Abstract

Purpose

The purpose of this work was to develop an indicator framework for the environmental sustainability benchmarking of products produced by the metallurgical industry. Sustainability differentiation has become an important issue for companies throughout the value chain. Differentiation is sometimes not attainable, due to the use of average data, lack of comparative data, certain issues being overshadowed by others, and a very narrow palette of indicators dominating the current sustainability assessments. There is a need for detailed and credible analyses, which show the current status and point out where improvements can be made. The indicator framework is developed to give a comprehensive picture of eco-efficiency, to provide methods that enable relevant comparisons as well as the tools for communicating the results. In this way, the methodology presented in this study aims to make differentiation easier and thus aid companies in driving the development toward more sustainable solutions.

Methods

The framework is based on the existing indicator framework Gaia Biorefiner, which is primarily intended for bio-based products. In this work, the framework was further developed for application in the metallurgical industry. The indicator framework is built by first looking at the issues, which are critical to the environment and global challenges seen today and which the activities of the metallurgical industry may have an impact on. Based on these issues, suitable indicators are chosen if they exist and built if they do not. The idea is that all indicators in a group form a whole, showing areas of innovation while refraining from aggregating and weighting, which often compromise a comprehensive and objective view. Both qualitative and quantitative indicators are included. The indicators are constructed following the criteria set by the EU and OECD for building indicators. Each indicator further has a benchmark. The rules for building the benchmark are connected to the indicators. Suitable data sources and criteria for the benchmark and the indicators are gathered from literature, publicly available databases, and commercial LCA software. The use of simulation tools for attaining more reliable data is also studied.

Results and discussion

The result is a visual framework consisting of ten indicator groups with one to five indicators each, totaling up to 31 indicators. These are visualized in a sustainability indicator “flower.” The flower can be further opened up to study each indicator and the reasons behind the results. The sustainability benchmark follows a methodology that is based on utilization of baseline data and sustainability criteria or limits. A simulation approach was included in the methodology to address the problem with data scarcity and data reliability. The status of the environment, current production technologies, location-specific issues, and process-specific issues all affect the result, and the aim of finding relevant comparisons that will support sustainability differentiation is answered by a scalable scoping system.

Conclusions

A new framework and its concise visualization has been built for assessing the eco-efficiency of products from the metallurgical industry, in a way that aims to answer the needs of the industry. Since there is a baseline, against which each indicator can be benchmarked, a sustainability indicator “flower” can be derived, one of the key innovations of this methodology. This approach goes beyond the usual quantification, as it is also scalable and linked to technology and its fundamental parameters. In part 2, a case study “A case study from the copper industry” tests and illustrates the methodology.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Companies in the metallurgical industry and generally are competing with several assets, one being sustainability differentiation. Customers throughout the value chain, from business to business and business to customer, are seeking better and more advanced means to differentiate, as well as more detailed and credible analyses. They wish to communicate why their product is more sustainable than that of their competitor and learn which sustainability aspects need more attention and development in order to perform better. In addition, investors and stakeholders need analysis of sustainability facts, e.g., in the case of considering funding and investments. Current sustainability assessment methods are not always very well suited for these practical needs, where industry-relevant sustainability benchmarking is the focus. This is due to several facts, e.g., limited availability of other than average data, lack of comparative data, and a rather narrow palette of sustainability indicators dominating the current sustainability assessments.

The purpose of this work was to develop a comprehensive industry-relevant indicator framework for the environmental sustainability benchmarking of products produced by the metallurgical industry. This study focuses on environmental sustainability issues, while future studies will respectively analyze the other two main areas of sustainability: economic and social. While focusing on environmental sustainability issues, the main emphasis of the proposed indicator framework is in eco-efficiency. Eco-efficiency, as a term, was introduced by the Rio Earth Summit and the World Business Council of Sustainable Development in the 1990s to highlight the business-relevant aspects of sustainability: the importance of using fewer resources and causing less environmental burden per unit of produced goods and services (Schmidheiny 1992). The seven eco-efficiency guidelines introduced by DeSimone and Popof (1997) are still valid and they have guided the development of the practical indicator framework we have developed for measuring eco-efficiency in the metallurgical industry. These were reducing the material intensity of goods and services, reducing the energy intensity of goods and services, reducing toxic dispersion, enhancing material recyclability, maximizing sustainable use of renewable resources, extending product durability, and increasing the service intensity of products. Later, Derwall et al. (2005) highlighted the importance of measuring and developing eco-efficiency by performing an analysis on the effect of eco-efficiency on investment portfolio performance, showing superior performance for the eco-efficient companies. In addition, industry-relevant resource efficiency metrics and indicators and case examples are increasingly called for, e.g., in the Flagship Initiative under the Europe 2020 strategy on resource-efficient Europe (European Commission 2011). However, measuring and especially benchmarking eco-efficiency is not always straightforward, and development of industry-relevant practical frameworks is still needed.

One of the concerns raised in a review of sustainability assessment methodologies by Singh et al. (2012) is that sustainability indicators should be selected, revisited, and refined based on the appropriate communities of interest so that suitable parameters can be chosen. The issues that are important for each industry differ. In the focus industry of this work, the metallurgical industry, where limited primary resources are utilized and require resource-intensive processing, resource depletion and resource efficiency are key issues. In addition, for metallurgical products, it is very important to emphasize how to reuse, recycle, and repurpose materials efficiently as national metal recycling targets are being raised. Mineral resources are also becoming scarce, leading to increased energy requirements of mining operations due to utilization of lower grade reserves (Schlesinger et al. 2011). Although all this highlights the importance of recycled raw materials, primary raw materials are still needed as well, because there is a demand for them and recycling can only be applied to a certain extent due to techno-economic constraints. From a sustainability point of view, it is therefore important to compare the resource usage and impacts for production of primary raw material and recycled raw material, often called the geological mine and urban mine, respectively. In order to compare these very different value chains, a flexible sustainability assessment and benchmarking framework is needed. For this purpose, it is also important that the scope of the analysis is scalable.

There are several methods, tools, and frameworks available, which aim for a comprehensive view and include selected sustainability and eco-efficiency indicators following the life cycle assessment (LCA) methodologies (ISO 14040 principles). Existing sustainability assessment methods and tools to support decision-making in the process industries are currently being evaluated by the SAMT project (“Sustainability assessment methods and tools to support decision-making in the process industries”) funded by the European Commission. The evaluation encompasses 51 methods and 38 tools, largely building on LCA approaches. In addition, Singh et al. (2012) have provided a recent review on sustainability indicator frameworks. The existing frameworks and the gaps that our developed framework aims to address are discussed in more detail in Section 2. With this background, it can be concluded that a lot of sustainability indicator methods and tools exist, yet they are not sufficient to cover the specific need of companies to differentiate and to build sustainable businesses.

To enable differentiation, a comprehensive sustainability picture is needed. In a simplified view, comprehensive sustainability assessment can be seen to focus on two major issues: the efficiency of the production process or use stage itself (meaning the use of resources), and the impact that the production or use has at the specific location or globally. Impacts on the environment depend on the vulnerability of the environment, which can be local or global, and the pressure put on it. In line with the LCA principles, sustainability issues, resource usage, and impacts need to be assessed at all stages of the value chain. Both resource usage and the environmental burden can be affected directly or indirectly. Indirect resource usage comes from cascading effects such as the substitution of resources in other value chains due to resource usage in the analyzed value chain. As a result, also indirect environmental impacts occur. The indicator framework developed here aims to build a comprehensive picture by including both resource use and impacts, and both in the direct system and in the broader system (Fig. 1).

The product value chain and comprehensive sustainability assessment of the metallurgical industry is focused on two major issues: resource use and impacts on the environment. Each product cycle is connected to other product cycles. They might add to the environmental burdens and depletion of resources or decrease the burdens by providing raw material, water, or energy to other cycles

Differentiation further requires a baseline (Reuter et al. 2015a, b). From an industry point of view, as described earlier, the usage of resources can be calculated, and the effluents can be measured, but evaluating what the values mean and what to compare against is difficult. Comparison could be made in a similar way as electricity, heat and water use, and waste production are monitored for private persons, and mean values have been collected for the purpose of comparing high usage and savings achieved with improved insulation, home appliances, faucets, and waste sorting. Comparing the process to other processes or to value chains of similar products makes this possible. This is the approach we have chosen to apply so as to solve the comparability problem. In order to improve comparability, system scoping must be transparent, scalable, and fully aligned with the indicator framework and the value chain in question. The developed method provides a proposed solution to this question. The fact that everything is compared to a baseline reveals truly what is techno-economically achievable and what not, hence making it possible to drive innovation where it really has an impact.

In addition, differentiation is complicated due to the use of average data in calculations and lack of data on for example waste formation, emissions, and water use. Here, simulation models provide an interesting opportunity to give more reliable and comprehensive data, building on an earlier work of Reuter et al. (2015a, b).

The eco-efficiency framework and assessment methodology developed to meet these needs of the metallurgical industry are described in this paper.

2 Discussion of other sustainability assessment methods

Environmental performance and sustainability reports for the whole plant or company have become part of the normal procedure for most companies; 93 % of the world’s largest 250 companies report on their sustainability according to the Global Reporting Initiative (GRI). Some companies also report product-specific data. The most established reporting format is the GRI, with 18,000 reports recorded in their database. In Europe, another sustainability reporting format, Environmental Product Declarations, EPDs, has raised interest, for example within the construction industry. The EPD database contains 450 publicly accessible reports.

However, these approaches are quite general. In order to understand sustainability in a more comprehensive manner, including benchmarking to relevant competing products and methods with a wider scope of sustainability aspects is needed. The sustainability reports typically follow standardized LCA methodologies. The problems with LCA relate to differences in scoping, which makes benchmarking difficult, and to the difficulty of accessing reliable data. Comparison of values thereby becomes difficult, due to the absence of values to which the results can be compared. There is a strong need for increased data collection and methods for benchmarking. Although many databases currently provide LCI data, in many cases, weaknesses in data integrity and reference value scoping mismatches make benchmarking impossible without significant collection of primary data. Both EPD and GRI and the LCI databases show that systematic collecting of data is possible in principle. EPD initiatives also show that standardized methods for modeling are needed, as emphasis is placed on product-specific rules, PSR, and product category rules, PCR, which are attempts to standardize scoping and modeling in relation to specific products or product categories. The work presented here relates to the PCR methodology, looking at the specific needs for the metallurgical industry and the products produced in the sector. In addition to the problems of these methods related to data availability, integrity, and scoping, these quantitative methods lack a qualitative and risk-based approach to sustainability. Not all important sustainability aspects can be turned into numeric values.

A comprehensive review by Singh et al. (2012) lists 41 sustainability indicator frameworks in 12 categories of different indicator types: innovation, knowledge, and technology indices; development indices; market- and economy-based indices; ecosystem-based indices; composite sustainability performance indices for industries; product-based sustainability index; sustainability indices for cities; environmental indices for policies, nations, and regions; environment indices for industries; social- and quality-of-life-based indices; energy-based indices; and ratings. Of these, the following three categories can be seen as relevant for processing industries. Of the indicators listed in the review, the following can also be seen to possess certain similarities to the developed framework.

Environment indices for industries

Singh et al. (2012) list several environment indices for industries, three of which take a similar approach as the framework developed here. The environment assessment for cleaner production technologies made by Fizal (2007) enables quantitative analysis of the environmental impact of implemented, modernized, and modified technological processes and products, allowing comparative analyses of alternative technologies. Eco-points from the PRé Consultants tool are primarily based on a “distance to target” methodology. It evaluates the processes and products to cover all life cycle stages (Goedkoop and Spriensma 2004). The Eco-compass by Fussler and James (1996) is a simplified visual tool developed by Dow Chemical for representing the summary of life cycle assessment data, based on the indicators of eco-efficiency developed by the World Business Council for Sustainable Development (WBCSD), with some minor amendments. The three methodologies provide general indicators, but the specific industrial sectors and products require tailored indicators.

All three methodologies approach benchmarking, which points out the need for this in the industry. The approaches differ in the type of benchmark used: alternative technologies, target, and scores. Our approach aims at including the possibility for flexible benchmark, where either targets or alternative technologies can be the benchmark.

Product-based sustainability indices

Singh et al. (2012) list two product-based sustainability indices. Both include social and economic aspects in addition to the environmental aspects, but neither is wide in environmental scope. The Life Cycle Index (LInX) by Khan et al. (2004) includes these three and an additional fourth aspect: technology. It is a composite index developed to support decision-making, in assessing the various design and technological considerations of processes and products. Ford of Europe’s Product Sustainability Index (PSI) is a sustainability management tool for car manufacturers. PSI looks at eight indicators reflecting environmental (life cycle global warming potential, life cycle air quality potential, sustainable materials, restricted substances, drive-by-exterior-noise), social (mobility capability, safety), and economic (life cycle cost of ownership) vehicle attributes. Both methodologies follow the recommendations of Singh et al. (2012), that indices should be tailored for the appropriate communities of interest. While the first methodology is directed to industry in general, it has a clear purpose of supporting decision makers. The second methodology is developed for the car industry and contains information that is interesting for the end consumer.

A similar sustainability assessment framework is the BASF Eco-Efficiency Analysis (Saling et al. 2002). With the Eco-Efficiency Analysis, selected indicators on energy consumption, emissions, toxicity potential, risk potential, and materials consumption are summarized in an environmental fingerprint. The method uses weighting and normalizing in order to compare results between value chains. However, with this method, the difficulty lies in weighting. As value chains differ a lot from each other, finding the proper weighting factors is complicated and objectivity and the transparency of the process are crucial. Nevertheless, study-specific weighting factors make it difficult to compare studies and develop a common data basis. Therefore, consistent scoping and system comparability still remain challenges for this type of approach. Further developed scoping and comparability, focus on metallurgical industry, and width of indicator set are the main differences to our approach.

Ratings

Singh et al. (2012) list several rating methods, one of which focuses on environmental performance instead of economic and social. The OEKOM Environment Rating process includes the definition of relevant ecological and industry-specific assessment criteria, which is followed by giving a grade for each criterion on a scale from A+ to D−. The rating areas are weighted according to the specific industry after which the separate grades are brought together to form the overall rating. Our approach significantly differs from this as we do not apply weighting but use industry reference data instead.

Indicators and frameworks have also been developed for specific sectors or themes; for example, a set of indicators was formulated by the Institution of Chemical Engineers (IChemE) to assess the sustainability performance of the process industry (IChemE 2002). The sustainability metrics cover three dimensions, i.e., environment, economic, and social. The environmental indicators focus on resource usage and effluents, emissions and wastes, which are the core of processing industry, but, with the exception of the chemical indicators, they do not deal with the impacts on the surrounding environment. This indicator set has a wider, more generic scope, whereas we focus on metallurgical industry and detailed analysis of the environmental sustainability aspects.

One indicator framework has been developed by Azapagic (2004) specifically for the mining and metals industry; for example, indicators connected to a decrease in metal ore grade (Vieira et al. 2012) have also been in focus. The comprehensive framework for the mining and minerals industry presented in Azapagic (2004), in addition to the indicators included in the GRI reporting guidelines, also included indicators adapted to reflect the sector characteristics and new indicators connected to company compliance with environmental legislation and voluntary activities, nuisance to neighboring residents and habitat, waste, emissions, closure and rehabilitation, land use, and mineral resources. Although Azapagic’s indicator framework is comprehensive, it is intended for sustainability reporting, not product group relevant sustainability benchmarking. The environmental sustainability issues presented in the framework are important also in our methodology. The indicators developed for a decrease in metal ore grade are connected to the issue of metal scarcity, which is a highly prioritized topic of the European Commission with ongoing studies on the criticality of raw materials. Mancini et al. (2015) highlight the fact that LCA is well positioned for providing information on resource-related issues of concern to business and governments such as the criticality of raw materials used in the supply chains. Issues such as criticality could be specifically addressed if highlighted during the goal and scope definition for certain product groups. If not, then the possibility is high for loss of relevant information due to, for example, cut-off criteria. Regarding the raw material criticality and recycling aspects of mining and the metals industry, Nelen et al. (2014) have developed a multidimensional indicator set to assess the benefits of WEEE material recycling, providing a good basis for further developing the recycling aspects of comprehensive sustainability indicator analysis. To summarize, earlier work on mining and metals sustainability indicator development has certain similarities with our approach and common goals, whereas the scope and approach we aim for differs.

Another relevant theme is resource efficiency, where indicators are being brought forward to respond to policies on resource efficiency. A systematized framework for resource efficiency indicators is sought by Huysman et al. (2015), as there is a need for structure and positioning of the indicators. They therefore developed a matrix that opens up the idea that there is a need to perform analyses from different perspectives to answer different needs, with the aim of supporting a meaningful application of indicators and giving a framework for the further structured development of indicators. In the matrix, indicators can be positioned according to the scale of the scope (assessment of specific processes and full supply chains, analyses at micro and macro scale) and the level of sustainability assessment (simple accounting of resource use and extraction and emissions or eco-efficiency indicators that include impact analysis). This approach is similar to our scalable scoping system, but we have implemented a similar approach specifically for the metallurgical industry and opted for a wider set of indicators.

Sustainability assessment has also been analyzed from an overall perspective by Sala et al. (2013). The outcome of their analysis is that mainstreaming LCA should be put on the agenda as a priority, that a holistic and system-wide approach is needed, that analyses should be transdisciplinary and multiscale, and that methods should be built together with stakeholders (Sala et al. 2013). Bringezu et al. (2003) also call for comprehensive approaches. They criticize material flow assessment (MFA)-based indicators, highlighting the need for the consideration of different impacts of material flows and different scales and perspectives of analysis, and distinguishing between turnover-based indicators of generic environmental pressure and impact-based indicators of specific environmental pressure. Reuter et al. (2015a) encourage the use of detailed data for sustainability analysis, as opposed to using average data for process steps, so that technological development can benefit more from sustainability analysis. Similar requests to those of Huysman et al. (2015) can be heard both on the industry level and on the national level. To conclude, current indicator frameworks lack comprehensiveness, scalability, and a connection between policy makers and companies.

As a result of the weaknesses related to the flexibility of scope and scalability, the comprehensiveness of indicators, and possibilities for benchmarking in other methods, we have aimed to develop a methodology which

-

Gives a more comprehensive sustainability picture in a well-communicated manner, summarized in a concluding visualization (Fig. 2)

Fig. 2 Example of concluding visualization on results of sustainability indicator analysis using the Gaia Biorefiner sustainability analysis tool (www.gaia.fi/biorefiner). To the picture, a hovering textbox has been added to visualize how the summarizing flower is opened to reveal detailed information for each indicator

-

Is scalable and flexible in terms of scope, i.e., indicators are scalable from technology and process efficiencies to differences between primary and secondary raw materials, so that innovation can be visualized and stimulated depending on the selected system scope (Reuter 1998)

-

Provides the possibility to benchmark within the preferred scale and scope, thus providing a baseline for technology and systems to drive innovation

The first mentioned point enables easier communication of sustainability advantages and risks to policy makers and other stakeholders, while the two latter mentioned points drive the development of baselines so that technologies can be compared objectively and innovation driven from a rigorous basis.

3 Methods

The framework described here is further developed from an eco-efficiency framework developed for the bio-based industry, Gaia Biorefiner. The framework, which was initially developed together with the Finnish Forest-Based Industry organization FIBIC, has in this study been further developed together with a representative from the metallurgical industry, the mining and metal technology company Outotec. A new addition is the connection to simulation.

3.1 Methods for setting the scope for scalable system analysis

The background for a scalable system analysis builds especially on earlier publications on systems view and simulation-based analysis of metals processing and recycling systems (Reuter 1998; Reuter et al. 2013, 2015a, b; Worrel and Reuter 2014). The authors have developed the HSC Sim software used in the previous studies further to facilitate analysis while linking to LCA methodology. In developing the methodology, we have followed the LCI and LCA principles and approached system scoping from an industrial relevance point of view.

3.2 Criteria for selecting environmental sustainability indicators

The selection and building of indicators generally follows the three basic criteria used in the OECD sustainability indicators development work (OECD 2003): policy relevance and utility for users, analytical soundness, and measurability.

-

With respect to policy relevance and utility for users, an environmental indicator should:

-

Provide a representative picture of environmental conditions, pressures on the environment or society’s responses

-

Be simple, easy to interpret, and able to show trends over time

-

Be responsive to changes in the environment and related human activities

-

Provide a basis for international comparisons

-

Be either national in scope or applicable to regional environmental issues of national significance

-

Have a threshold or reference value against which to compare it, so that users can assess the significance of the values associated with it

-

-

With respect to analytical soundness, an environmental indicator should:

-

Be theoretically well founded in technical and scientific terms

-

Be based on international standards and international consensus about its validity

-

Lend itself to being linked to economic models, forecasting, and information systems

-

-

With respect to measurability, an environmental indicator should be:

-

Readily available or made available at a reasonable cost/benefit ratio

-

Adequately documented and of known quality

-

Updated at regular intervals in accordance with reliable procedures

-

As mentioned earlier, the indicator selection further builds on the eco-efficiency perspective and the seven eco-efficiency guidelines (DeSimone and Popof 1997). These still summarize many relevant environmental sustainability aspects for the resource-intensive industries like metallurgy. In addition, in order to be relevant for the metallurgical industry, the indicators must correspond to the critical environmental issues and global challenges that can be seen today in the operating environment. This leads to a comprehensive environmental sustainability assessment. Additional relevant aspects for the metallurgical industry include the environmental risk aspect, which is highlighted from business perspective in the Global Risk Report by the World Economic Forum. Failure of climate change mitigation and adaptation, major biodiversity loss and ecosystem collapse, and water crises were all listed in top 10 risks in terms of impact in the wide stakeholder study of Global Risk Report 2016 (WEF 2016). In addition, environmental degradation, i.e., deterioration in the quality of air, soil, and water from ambient concentrations of pollutants and other activities and processes, was listed as a long-term trend affecting the risk that could contribute to amplifying global risks and/or altering the relationship between them.

Building on all these, and taking into account the specific activities along the value chains of the metallurgical industry and their impacts, a matrix of all aspects relevant for the indicator framework was compiled, and the proposed indicator framework was identified and established so that all relevant aspects were covered but no redundant indicators were included within the scope. The indicators were chosen and defined to be informative, in a way that drives development toward more sustainable solutions in an intuitive manner. Indicator-specific reasoning for selection and the respective literature references are discussed in detail in Section 4.2. Together with indicator selection and definition, the type of indicator was also defined, including benchmarking type and required reference data. This process is described in more detail in Section 3.3.

Following the abovementioned process, an indicator framework was established so that the following design criteria can be met:

-

It provides a basis for technological comparison.

-

It provides a basis for comparison of geographical locations of the value chain.

-

It is applicable to complex systems that include multiple production locations, multiple raw materials and processing methods, multiple energy and water sources, and multiple products and repurposing at different stages of the product life cycle.

-

All of the policy and relevance criteria of OECD.

3.3 Basis for building the benchmark

The indicators define the type of benchmark that is suitable, and the benchmark aims to fulfill the policy and relevance criteria mentioned earlier of having a threshold or reference value against which to compare it, so that users can assess the significance of the values associated with it.

As described earlier, many sustainability indicators such as the usage of resources can be calculated, but evaluating what the values mean and what to compare against is difficult. Interpretation is generally highly value chain or product category specific. Therefore, comparison could be made so that value chains are compared to value chains of similar products within a product category.

It is unlikely that one product would have all the best qualities with respect to all sustainability aspects or all the average qualities. Therefore, the quantitative or qualitative results of the indicators are not compared to the values originating from one product, but each issue is looked at separately to find the specific thresholds and reference values relevant for (1) that issue (indicator) and (2) the scope of the study. This method of addressing each issue separately makes it possible to avoid generic weighting methods that often lack the necessary transparency and objectivity.

Data availability may narrow down the possibilities for reliable and meaningful benchmarking. To approach this problem, methods for data gathering are looked at.

Industries are dependent on policies, regulations, and customer demand. Together with the state of the environment and technological development, these are issues that are constantly changing. Similarly, the benchmark, to which the system is compared, must change. The benchmark therefore reflects

-

The sustainability goals set by nations and various institutions

-

The development and innovation of technology in the product group in question, and

-

The urgency of change due to critical environmental impacts

3.4 Methods used to define the suitable type of data sources

In the first instance, data is collected from the actual processing steps that are part of the value chain. In addition, other data sources are needed for when this type of primary data is not available. For data gathering, the method uses primarily HSC Sim software for collecting primary data via process simulation (see Section 4.4), LCI databases for LCI data, as well as other complementing sources of value chain data. For LCI data, GaBi (www.thinkstep.com) and SimaPro (www.pre-sustainability.com) are used.

In addition, data is needed for the benchmarks. Generally, data for the benchmark is similar to that for the value chain being assessed. Suitable data sources were searched from commercial LCI databases, publications, and statistical databases. These are presented in connection with the results from building the indicators (Section 4.2) and forming the benchmark (Section 4.3). Simulation tools were included as an additional tool for building the benchmark and this is described in Section 4.4.

4 Results

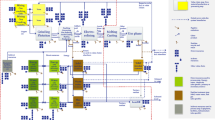

The developed eco-efficiency indicator framework, given the name Gaia Refiner, consists of four main parts. The first part is defining the system or scope to be analyzed. Every analysis needs to have a clearly defined scope and the width of the system should reflect the purpose of the analysis. Defining the scope defines what the analysis will focus on. At the core of the framework is the second part, the indicators. The indicators define what it is relevant to measure or evaluate and how this should be performed, reflecting the selected system scope. The third part is the benchmark, which, defined by the system scope of the analysis, shows the position of the value chain with respect to others. The last part is the backbone of the analysis, the gathering of data, which ultimately defines whether the analysis can be performed. The different parts of the framework, their connections, and the use of the results from the assessments performed with the framework are shown in Fig. 3. The development and the results of the four parts of the framework are described in detail in the following.

4.1 Building a framework that allows for scalable scoping

4.1.1 Scale and focus of analysis

The design principles of system scoping were described in Section 3.1, emphasizing alignment with LCI and LCA principles together with industrially relevant flexible scoping in order to see the differences between comparable value chains in question. The first assumption is that products will be produced as long as there is a demand for them. The demand comes from the fact that the product fulfills a function. The analysis question that the sustainability assessment answers is thus how sustainable the system is for producing a product which fulfills a specific function. The comparable value chains fulfill the same purpose. The system scope always includes the geographical locations, processes, and raw materials involved as well as the surrounding environment. Generally, as described below, the system scope includes the whole value chain, but in certain cases, the scope can be narrowed down to allow more focused analyses, for example, if variation in certain parts is too significant to allow seeing clear differences between the comparable value chains in question. In those cases, narrowing down of the wide system scope is an iterative process, reflecting targets of the analysis, indicators, benchmark, and available data. This is important as narrowing down, e.g., can increase accuracy of quantitative indicators in the focused scope but can lead to some system level indicators being obsolete in the specific case. In order to enable rigorous analysis, scoping is therefore aligned with all steps of the study and iteratively updated if so needed.

4.1.2 System boundaries

The general system boundary of the developed framework encompasses production phases from extraction of raw material to product’s end of life. The system includes raw material production steps, pretreatment steps, processing steps, refining steps, product design steps, use phase, and end of life as presented in Fig. 4. Direct resource (energy, water, and chemicals) use, indirect resource use, direct emissions, indirect emissions, direct infrastructure, and indirect infrastructure are included for each separate step, and transportation requirements between all the steps within the system boundaries are included.

General system boundaries for all indicators. Each block (indicated in light blue) represents a step in the main processing chain. Each step has direct resource requirements, direct effluents and emissions, and direct infrastructure requirements. This has been opened up for step 2, and for the other steps, these four issues are indicated with symbols. The production of each direct resource requires the use of other resources (indirect resources) and results in effluents and emissions (indirect effluents and emissions), all indicated with the respective symbols in the example in step 2. The effluents and emissions require treatment, from which either deposit disposal, release to air and water, or recycle occurs. The dotted red line shows the steps that have been included in this specific case study

The system boundaries for some indicators may slightly differ from these general system boundaries. Any deviations from the general system boundaries will be presented case by case when the indicators are described in more detail in Section 4.2.

The developed calculation methodology follows the standards for LCA (ISO 2006a, b). All quantitative indicators are calculated per mass of main product(s) under examination and the allocation is done according guidelines in ISO 14044: 2006 (ISO 2006a). Either primary process data or secondary data from databases are used for all inputs and outputs and cut-off criteria of 1 % by mass is used in modeling. However, inputs, which are excluded from the LCI used in SimaPro modeling, are not necessarily excluded from data used to calculate all indicators. For example, all chemicals, even those that are under the cut-off criteria, should be included in the chemical risk indicators, because health and safety or environmental burdens are possible even though the chemical accounts for less than 1 % by mass of the system. Furthermore, as production value chains consist of process steps performed at multiple locations, the cut-off criteria of 5 % is used for indicators evaluating issues based on location-specific circumstances. This means that if over 5 wt% of the raw material used in the product originates from a specific location, then the circumstances connected to that location will be included in the evaluation.

4.1.3 Categorization of outputs and raw material

In the sustainability assessment, one of the most important issues is that the terms used in the assessment are clearly defined. This is specifically crucial when assigning product, co-product, and waste status to the outputs. Allocation is done based on the product/waste status of the output and it will have a major effect on the outcome of the sustainability assessment (ISO 2006a, b). Also, the rules for determining which status applies for each output need to be clearly defined to ensure consistency in all assessments. The Waste Framework Directive of the European Union (European Commission 2008) is applied for the terms connected to waste utilization and disposal. For the purpose of this work, the terms and definitions in Table S1 apply (see Electronic supplementary material).

The outputs are firstly categorized as either products or residues according to the criteria for classification as a product from the Waste Framework Directive (European Commission 2008):

-

The process is modified to produce the product.

-

The product has a market value.

-

The product has a usage internally = replaces purchase of other products.

-

The processing has a value = treatment is paid for.

-

The product has a usage externally = replaces purchase of other products.

In addition, there is a need to differentiate between different types of products and different types of residues, depending on their purpose for further utilization. The possible types of products are main product and co-product and the possible types of residues are waste and raw material for another step.

-

Main product: the output under inspection

-

Co-product: output that meets the criteria of a product but is not under inspection

-

Waste: output that does not meet the criteria of a product and is not under inspection

Similarly, raw material can be a product from a process or a waste, and the rules mentioned above are used to define whether resource usage and impacts should be allocated to the production of the raw material or not.

4.2 Defining the indicators for the framework

The Gaia Refiner framework is developed for screening the environmental sustainability of products and technologies and their entire value chains based on ten indicator groups. Indicators can be grouped in many different ways. The approach taken here is to group the indicators according to the issue, in a way that the name is familiar to a wide variety of readers and easily comprehensible. The result is that the indicator group contains indicators, which describe the resource usage as well as the impacts from it. Thus, each group describes how much of the resource is used and how critical the usage of the resources is.

The framework is a collection of already standardized and established indicators, together with some novel ones that address issues not yet covered by the established methods. The established indicators included are those that are found in LCA software and frequently reported in company sustainability reports, the most well known being the GRI reports and EPD reports mentioned earlier. These include the environmental impact indicators global warming potential (GWP), eutrophication potential (EP), and acidification potential (AP). The reporting of water use, energy use, and waste generation is also common, although several methods of reporting are applied, making comparison difficult.

The novel indicators, which have been developed in this work and included in the framework, are based on studies that describe environmental impacts from land use, and industrial activities, as well as sustainability development initiatives that focus on minimizing the use of resources and the generation of wastes. Some countermeasures for preventing the negative environmental impacts from resource usage are already in use, such as the sustainability criteria defined in the EU’s Renewable Energy Directive (European Commission 2009b) and Fuel Quality Directive (European Commission 2009a) concerning GHG emissions, biodiversity, and land use. These criteria have been incorporated in the indicators that pertain to the respective issues.

Resource efficiency has long been a focus for industries, because of the connection to economics, but it is now also a primary focus of, for example, the EU and UN, due to the environmental and social aspects. UNIDO and UNEP support Resource Efficient and Cleaner Production (RECP) methods, defined as follows:

-

Efficient use of natural resources, including materials, water, and energy

-

Minimization of wastes and emissions, including those discharged to water, air, or on land

-

Reduction of risks to humans and the environment from use of chemicals and disposal of chemicals used in industry

A similar view on what is needed for sustainable development is presented in the EU’s growth strategy, which includes a Resource Efficiency Roadmap as part of the Resource Efficiency Flagship initiative. The roadmap offers a vision of the EU economy in 2050, where the economy is competitive and inclusive and provides a high standard of living with much lower environmental impact. All resources are sustainably managed, climate change milestones are achieved, and biodiversity and ecosystem services have been both protected and restored.

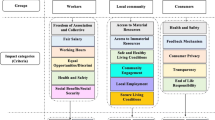

The sustainability issues mentioned in these initiatives are included in the Gaia Refiner indicator framework so that the use of key resources can be accessed from a life cycle and value chain perspective. The resulting indicator groups are presented in Fig. 5.

The aim of the assessment is to benchmark the value chain with respect to alternative value chains. The summarizing picture shown in Fig. 5 therefore only shows the result of each indicator. Each indicator can give three different results: green, indicating a possible competitive edge; red, indicating a possible alert; and yellow, being between these classes. The first part of the assessment is to analyze the value chain by calculating the values that the indicators need and listing the required criteria. In the quantitative indicators, the result is then screened against a reference group of comparable value chains and, in the qualitative indicators, against indicator-specific alert lists and sustainability criteria. The benchmarks in the qualitative indicators mainly reflect current sustainability goals and the urgency to change, due to critical environmental impacts, while the benchmarks for the quantitative indicator, such as the resource intensity indicators (water intensity, energy intensity, land use intensity, material efficiency, and fossil intensity) are linked to the development of technology.

The indicator framework is shown in Table 1. The importance or weight of each indicator is not evaluated and indicators are not equalized or combined in any way. Instead, each issue should be addressed separately. In the following, each indicator group is described along with its respective indicators.

4.2.1 Indicator group 1: climate change

As global warming is seen as one of the major challenges of our time (IPCC 2013), global warming potential is included in the indicator framework to address the value chains contribution to greenhouse gases. The indicators are based on the existing method for evaluation of global warming potential (GWP), published by IPCC (2013). However, in the indicator group (Table 2), GHG emissions from production and GHG emissions from transport are separated and reported as two separate indicators. The measures to improve the situation are different, and by this approach, process-related and transport-related improvement potential can be detected separately.

The metallurgical industry is typically very energy intensive. Selecting more energy-efficient process technology or utilizing renewable energy sources will lower the GHG emissions from processing, but in addition, resource efficiency is a key factor contributing to reduction of GHG emissions. When less raw materials and water are used, less energy is required to produce and process (pump, heat, cool) them. Also, less transportation is needed, lowering the net GHG emissions. In metal production industry, long transportation distances are also typical as the mineral ore deposits and production sites might be located in different countries or continents.

4.2.2 Indicator group 2: water

Water intensity describes the total water withdrawal needed from municipal, groundwater, surface waters, or seas to produce the product.Footnote 1 Water is used in different operations, for the production process itself and also for cooling, heating, and washing, for example. If the water used is not incorporated into the products, the usage should be minimized. To minimize water intensity, the most water-efficient and suitable raw materials need to be chosen and all processes need to be selected so that they use as little water as possible. Recycling, especially circular closed systems for cooling water, is also an effective way to minimize water intensity. Indicator 2.1 (Table 3) covers water intensity by calculating the water use (water withdrawal) within the general system boundaries. Metallurgical processes utilize significant amounts of water. For example, flotation processes are highly water intensive and closed circuits are crucial to decrease the amount of required water. Hydrometallurgical production processes are even more water intensive.

For the sustainable use of water, in addition to water intensity, water scarcity is also important. The water scarcity indicator covers the issue of regional water availability, describing the possible imbalance between availability and demand. Water overuse is damaging the environment in many regions (UNEP 2008) and water stress has consequences for security and human well-being (Ridoutt and Pfister 2010). This is especially important issue for extraction industries such as mineral extraction, as it is a location-specific industry. Therefore, if the water scarcity level is high, it is necessary to concentrate on efficient use of water. The water scarcity indicator used by Hoekstra et al. (2012) is based on a consumption-to-availability ratio (CTA) and is calculated as the fraction between consumed (blue water footprint) and available water. Indicator 2.2 covers water scarcity within the general system boundaries.

Both the water intensity indicator and the water scarcity indicator are based on existing methodologies (Hoekstra et al. 2012). However, both indicators are included in framework as they measure different aspects of water consumption. Indicators 2.1 evaluated how efficiently water is used by the operations and the second indicator (2.2) is location specific considering the scarcity of the water resources at the specific location.

However, precise data for evaluation is not necessarily easy to find out. Data for calculation can be found from LCI databases that are included in LCA software, such as SimaPro. In addition, country-specific water scarcity maps have been developed and published by different associations, such as WWF.

4.2.3 Indicator group 3: energy

Global energy demand is constantly growing, with adverse effects on availability of natural resources, climate change and the environment, caused by energy production and use. The first indicator (Table 4) describes the energy intensity of processing, while the second indicator evaluates the sustainability of the energy sources used to meet the requirements of processing. Both of these indicators are established earlier and have been used in several initiatives and indicator frameworks, for example in the EU’s resource efficiency scoreboard (European Union 2015). Within the metallurgical industry, significant amounts of energy are required in the different process steps, such as grinding and milling of ore, flotation of ore to concentrate, and also in pyrometallurgical and refining processes. Therefore, it is important to minimize energy consumption by using energy-efficient process technologies and utilizing renewable energy sources that decrease the environmental impacts caused by the energy production and consumption.

Although the indicator GHG emissions from processing reflects energy use, the technological advances could be overshadowed by the source of energy. The energy indicators are included to provide more detailed information on the solutions connected to the location of production and the ones connected to the energy source.

Available data about energy consumption by the metal production industries can be found from LCI databases, but reported data are also publicly available from Eurostat and BAT reference documents published by the European Commission. The main difficulties with data are to find information for similar system boundaries so that the values are comparable with each other.

4.2.4 Indicator group 4: land use

There is an increasing pressure to use land effectively. Land provides possibilities for food and feed production, but land is required also for the production of other primary raw materials. Furthermore, it provides crucial ecosystem services and carbon sinks. Extraction of minerals causes land transformation that involves changes in local ecosystems. In addition, mineral extraction processes include various risks that might have an impact on the surrounding environment; therefore, indicators related to risk management are also included. The land use indicator group (Table 5) comprises one quantitative and three qualitative indicators.

The quantitative component measured is land use intensity (4.1). Accounting for land use intensity is especially crucial for raw materials whose production does not allow synergistic use of the land for other purposes. If synergistic use of the land area is possible, then major land use requirements become less crucial. This is indicated by a separate qualitative indicator, 4.2 Land use synergies through ecosystem services. These synergistic uses balance the quantitative land use intensity, making certain quantitatively low-efficiency sources beneficial by taking into account the synergistic benefits provided. Both indicators serve the purpose of comparing the land use requirement of different raw materials (metals, fossil, bio-based), since often very different raw materials can be used to produce an end product that ultimately serves the same purpose to its user. These indicators describe the use of resources. Indicator 4.2 is based on the methodology developed by Bukhard (2009, 2014).

The two other qualitative indicators indicate the impacts of land use. These are 4.3 Land use impact and risk mitigation of mines and 4.4 Land use impact and risk mitigation of tailing ponds, which highlight the use of sustainable practices and their relevance in protecting the land required by the mining industry. Since land use cannot be avoided (except for recycled materials), the impacts must be minimized, mitigated, and if necessary, compensated. Mining operations have a major impact on the environment. If risk management is poorly handled, it might cause wide environmental disasters. Indicators 4.3 and 4.4 have been developed in this study to cover these specific characteristics of land use in the metallurgical value chain. For assessment, a sustainability criteria list is formed and operations are compared against these criteria.

These indicators are not often presented together with other typical sustainability indicators, although the importance of sustainable land use increases continuously and should be taken into consideration by all industries. It should also be noted that risks related to operations and their possibility to cause negative impacts on land use more widely are not considered in existing sustainability frameworks.

4.2.5 Indicator group 5: chemical risks

Chemicals are used in numerous ways during the product life cycle. The metallurgical industry utilizes chemicals in their production processes, and therefore, risks for environment and people exist. In addition to chemical consumption, some metallurgical processes produce also significant amounts of chemicals as by-products. This increases the potential risks for people and environment. Furthermore, the risks do not exist only at the production site, but also transportation and storage of chemicals comprises risks that might cause hazards outside the production facility. Minimization of chemical risks is therefore one aspect to take into account when benchmarking alternative processing technologies (Sala and Goralczyk 2013). Currently, chemical risks are included in transport and safety documents, but evaluation of risks are not connected to the overall assessment of the value chain. The use of environmentally friendly chemicals or safety measures taken for hazardous chemicals may affect resource use. Looking at resource use together with chemical risks will provide a better basis for sustainability comparison.

The indicator set, shown in Table 6, covers all three aspects separately, i.e., environment (indicator 5.2), health (indicator 5.3), and safety (indicator 5.4). The system boundaries cover only the chemicals used in in-house production, including waste treatment processes. The indicator group also includes a general evaluation of the total use of chemicals (indicator 5.1). These indicators are developed in this study as risks related to use of chemicals are typically present in metallurgical processes. Indicators are based on established hazard statements of chemicals.

4.2.6 Indicator group 6: resource depletion

Resource depletion is a globally recognized challenge and the metallurgical industry is an intensive consumer of nonrenewable resources. This group of indicators is included in the framework to cover relevant issues regarding resource depletion as well as their availability and substitutability.

Methods describing the availability of resources are included in many LCA impact methodologies; for instance, the CML LCA methodology, developed by the Center of Environmental Science of Leiden University (https://www.universiteitleiden.nl/en), includes the traditionally used, abiotic depletion potential (ADP). The method is applied in some sustainability assessments, such as EPDs. The ADP method indicates the seriousness of resource depletion and it takes under consideration existing reserves of resources and extraction rates. It however combines all resources used and converts them to the reference resource, antimony, which, although giving a good picture of the overall impact, covers the details of where improvement is needed and where improvement is possible. In this study, a wider aspect, including more aspects and avoiding combining the information into one number, was chosen to evaluate resource depletion and availability and therefore existing methodologies that concentrate mainly on physical constraints were not utilized for minerals. The CML methodology also includes a method to determine abiotic depletion potential of fossil fuels, expressed in megajoules. This approach has been applied in the indicator group, although the unit of measurement chosen is kilogram, as the indicator includes the use of fossil sources as materials.

The first indicator (Table 7), fossil intensity, measures the amount of fossil feedstock required to produce the product. This comprises the fossil fuels consumed in the production and transportation phases, in secondary energy production as well as the fossil raw material present in the raw materials. The indicator poses some duplication of information as, the use of fossil fuels is seen in the climate change and energy indicator groups, as higher greenhouse gas emissions and lower share of renewable resources, respectively. The indicator is however added as it includes the viewpoint whether the material used for the production of the product is of fossil origin or not and the total effect this has on the use of fossil resources. Therefore, this indicator is included to show the total effect of these issues. It does not bring new viewpoints if only products from the metallurgical industry are looked at, but if multimaterial products are included then the indicator becomes important.

The second indicator (6.2) describes the availability of mineral resources. Mineral deposits are distributed unequally in the Earth’s crust and the scarcity of different minerals varies. Furthermore, declining ore grades and more troublesome locations of resources are challenges to overcome in order to utilize these resources. However, the physical constraints are not the only factors that have an impact on the availability of certain materials. Therefore, mineral availability describes not only the scarcity of the element concerned but also covers other issues that affect availability, such as the recycling rate and political stability of the producing countries. These aspects have been taken into account in relative supply risk index published by the British Geological Survey (BSG 2012), and therefore, this risk list is used as basis for the mineral availability indicator. However, there is no information how often this risk list will be updated, and therefore, it might contain outdated data in future studies.

The last indicator (6.3) of the group describes the substitutability of different materials. Especially, in emerging economies, people are dependent on the unique properties of metals and their compounds. In many applications, materials can be substituted by an alternative if necessary, as the general reason for using a certain material in an application is the cost of the material. However, in some applications, the unique properties of the material mean that there is no suitable replacement available. Therefore, the evaluation of the substitutability of different materials encompasses whether the material is substitutable or not, and how substitution impacts on the performance and price of the application. This indicator is based on substitutability scores published by the European Commission (2014a).

These indicators are developed for this particular assessment method, but both of them are based on announced sources of information (BSG 2012; European Commission 2014a).

4.2.7 Indicator group 7: material efficiency

As global resource usage rises and several resources are becoming scarce, material efficiency is a top priority. Material efficiency covers the efficient use of resources in the value chain. The more efficiently the resources can be utilized, the fewer primary resources are required in producing the product. Often material efficiency is also beneficial in minimizing adverse environmental impacts, such as waste generation. One of the European Union’s strategic goals is to improve the circular economy, where one mean is the efficient utilization of residues and another the recycling of materials. Another goal is the prevention of waste formation. To reach these goals, the industries need to be able to set targets and measure the progress. The material efficiency indicators serve this purpose.

Raw material efficiency can be improved by choosing the most suitable material, choosing the most suitable method of processing, and developing methods for utilizing all fractions of the material. One measure of how efficient the utilization of material is in the process is the generation of waste. However, further treatment options of the waste also play an important role. If the generated waste can be reused after treatment, this option is better from the overall material efficiency perspective, than if the waste is in such a form that it requires much treatment or large resources to transform into something usable. The material flow in a general system is shown in Fig. 6.

Typically, the metallurgical industry produces significant amounts of unavoidable gangue material due to low ore grades. However, in various production steps, there is also a possibility to produce co-products instead of creating waste streams. This lowers the environmental impacts caused by the industry. Furthermore, minimizing the loss of valuable materials in different process steps decreases the amount of raw material used per product and thus lowers the environmental impacts caused by extraction. In this framework, these special characteristics of the metallurgical industry are considered in the indicator development process.

These indicators are based on mass balance and typical composition of material in the metallurgical industry. Indicators take into account both the total material consumption and the efficiency by which specific metals are extracted. Metallurgical operations also involve phase changes and changes in the composition of material; therefore, exergy is included as an indicator. This is only possible to calculate if simulation programs are used. Otherwise, the exergy losses are too complicated and time-consuming to calculate for this kind of assessment.

Indicators 7.1 and 7.2 (Table 8) cover the mass balances of raw material to products: 7.1 with an overview and 7.2 specifically looking at efficient utilization of the metals in the raw material. The two other indicators, 7.3 and 7.4, deal with material efficiency from the waste minimization perspective. Indicator 7.5 evaluates the utilization of secondary raw material, which the circular economy aspect targets.

Important issues for material efficiency calculations are as follows:

-

Defining which outputs can be categorized as products

-

How the mass balance should be calculated if water acts as a reactant and is included in the product

-

The mass/volume of a product that should be used if the product is sellable, but contains both material suitable for the final product and unnecessary material, which will become waste when the material is further processed

4.2.8 Indicator group 8: unrecovered materials

The unrecovered materials indicators look at the discharges from the process. The indicators (Table 9) aim at describing how much is lost and to which phase, so that recovery could be improved.

Sustainability reports commonly contain information on total waste deposited to landfill, and in some cases, waste used for energy production is reported, but specific waste fractions are seldom reported in sustainability assessments. For innovation purposes and finding opportunities for utilization of waste streams, reporting the amount of generated waste streams, before waste treatment operations, could be advantageous. At the same time, this kind of information might be difficult to acquire. The metallurgical industry creates many side streams at different process phases. The side streams can be utilized by turning them into products, thus decreasing the amount of unrecovered material. Separate indicators were formed (indicators 8.1, 8.2, and 8.3) to report the waste that arises in aqueous, gaseous, and solid states, respectively, and the amount is reported before waste treatment operations.

In addition, fugitive gas emissions are recognized as a significant source of dust emissions in the metallurgical industry. Indicator 8.4, Fugitive emissions, describes measures taken to suppress fugitive emissions. Fugitive emissions are emissions escaping collection and thus not directly measurable. Material balances could be used to approximate the loss, but the input and output values are often too uncertain for calculating the part lost from the balance. A qualitative approach is therefore used in the indicator. The indicator is based on sustainability criteria formed from lists of best practices in the metallurgical industry (European Commission 2009a, b, 2014b), and operations are compared against these criteria. The indicator thereby describes how fugitive gas emissions are prevented for example by means of process equipment or operational practices.

These indicators are specifically developed for this indicator framework. Indicator 8.4 regarding fugitive gas emissions is specifically important for the metallurgical industry, with impacts on for example air quality, health of employers, and process economics.

4.2.9 Indicator group 9: impacts from emissions

For this study, two main environmental impact assessment methods, eutrophication and acidification potentials (Table 10), were chosen as indicators. Acidification and eutrophication potentials are important indicators because the environmental burdens related to these may not only be due to the energy use during the production process but also other factors typical of mining and the metal industry, e.g., the disposal of sulfidic tailings and other emissions or pollutants to air, soil, and water may have a significant effect. In this work, existing methods for calculating eutrophication and acidification are employed. Both of the indicators cover the general system boundaries.

4.2.10 Indicator group 10: end use and end of life

The end use and end of life indicators (Table 11) cover the last part of the value chain. These indicators describe how well a product or material serves in its intended function as well as after its use phase.

Different materials can be used for the same purposes. However, the performance of the materials varies. For instance, in electronics, the material is required to have good electrical conductivity or cooking equipment should be able to conduct heat effectively. The properties of materials have an impact on how a well-chosen material delivers its function in a product (10.1). Therefore, the first indicator of the group compares the functionality and/or material properties to other comparable products or materials.

The second indicator describes the safety of a product. It gives information about the potential hazards of the materials used in a product based on material safety data sheets (MSDSs), which describes the material’s capability to cause safety hazards. This indicator gives information about the stability, flammability, and possible health hazards of the material.

From the resource efficiency point of view, the recyclability of a product gives information about how efficiently materials can be reused. In order to recover materials effectively, the recyclability of a product has to be considered at the design phase of a product. Therefore, the design for recycling indicator describes how the issues that have an impact on recyclability are covered. The evaluation incorporates the reusability of a product, recycling infrastructure for a product, and also the possible contamination and material losses in the recycling phase. Sustainability criteria are derived from published research papers regarding the factors that have influence on the product’s recyclability (Reuter et al. 2013, 2015a; Van Schaik and Reuter 2014).

These indicators are specifically developed for this indicator framework to evaluate how eco-efficiency aspects have been considered in terms of usability, safety, and recyclability of a product. Many indicator frameworks concentrate on the production processes and produced materials but do not cover sustainability issues of products. This is an especially important factor in the metallurgical industry, because for example, metals can be recycled and reused if the products have been designed in a way that enables the separation of different materials and contamination with other materials has been avoided.

Alternatively, these issues could be covered by widening the borders of the assessment and including the end use phase and end of life phase. The indicator helps to simplify the analysis in cases where this is not possible.

4.3 Building the benchmark for the indicators

In the framework, the benchmark is connected to the scope of the analysis. Forming a tight connection between benchmarking and the aim of the analysis makes it possible for a company to differentiate from others. As the benchmark follows the scope, the companies can choose this baseline, which allows for comparison within scopes ranging from specific narrow scopes to a system-wide scope, depending on where their sustainability advantages and risks lie.

The methodology is described here with a concrete example, comparing two alternative system scopes for benchmarking a case as shown in Fig. 7. The first system scope is called “technology benchmarking.” It studies a narrower system scope with locked and normalized parameters, thereby allowing higher accuracy for highlighting differences in technological processing efficiencies and identifying concrete improvement areas within the processing steps. It can also prove useful as a basis for forming BAT specifications. With this approach, however, only a limited amount of indicators is relevant, as many broader system-wide indicators become nonrelevant due to the narrower system scope and locked and normalized parameters. The second system scope is called system benchmarking. It looks at a wider system and allows the comparison of varying value chains fulfilling the same end user need. A wider amount of indicators is relevant in this scope alternative, but only significant differences are shown, as the wider system scope masks the smaller differences. These concrete examples show how selecting the system scope is crucial for carrying out an analysis and benchmark that is industrially relevant and meaningful. The usefulness of the results for various purposes directly reflects the choices made in system scoping. Therefore, flexible and scalable scoping is a key to useful analysis.

The two different system scopes: technology and system benchmarking. Both aspects are relevant and thus depending on the situation, there is a need to look at the system from the narrow perspective to the wide perspective. The Gaia Refiner methodology aims at harmonizing the way of analyzing systems of different scopes and widths

The benchmark is set differently depending on the type of indicator. The indicators included in the framework describe either intensity, output, and efficiency or qualitative issues, requiring three different types of benchmarks: reference groups, sustainability limits, and sustainability criteria. These three benchmark types are described in the following.

4.3.1 Reference groups

Intensity indicators would preferably be compared against a reference group of several different processes to produce a similar product. In the absence of reference values for the whole value chain, the reference values can be built up from the different technologies applicable at each process step. The type of indicators connected to this type of benchmark are GHG emissions from processing (1.1), GHG emissions from transport (1.2), water intensity (2.1), energy intensity (3.1), land use intensity (4.1), fossil intensity (6.1), freshwater eutrophication potential (9.1), and terrestrial acidification potential (9.2).

The analysis is relative to a certain product category, so that product category-specific reference groups and classification criteria can be utilized. Each product category has subcategories and each subcategory is connected to a specific reference group. Issues such as energy intensity, water intensity, fossil intensity, and raw material intensity increase with the degree of refinement and value-adding steps. By comparing products that belong to a certain product subcategory, it can be ensured that the products are benchmarked to relevant alternative products and value chains.

If the scope is made even more narrow, the reference group must follow. As an example, one of the main issues affecting the energy intensity of milling is the ore grade, i.e., the concentration of desired metal in the ore. From an environmental sustainability point of view, there are many reasons to prioritize one raw material over another. These are mainly connected to land use issues and resource depletion but also to resource efficiency. It may be much more resource-efficient to produce metal from an ore with a high concentration of the desired metal. A similar effect can be difficult to achieve with technology improvements, and thus, these achievements are easily hidden behind the parameters that affect the results more. To ensure technological development toward sustainable solutions for the metallurgical industry, a more narrow scope is needed in many cases. A narrow scope can here mean for example locking certain parameters for better comparison.

For the metallurgical industry, the product category is defined as metals and the subcategories can be narrowed down to the categorization found in the Eurostat NACE.

-

Base metals

-

Iron, steel, and ferro-alloys

-

Basic precious metals and nonferrous metals

-

Copper

-

Aluminum

-

Precious metals

-

Lead, zinc, and tin

-

Other nonferrous metals

-

-

Similarly, EU BREF documents can be found for nonferrous metals industries (European Commission 2014b) and iron and steel production (Remus et al. 2013). Other BREF documents relating to the metallurgical industry are ferrous metals processing industry, management of tailings, and waste rock in mining activities. Many of the techniques and individual stages of production processes are common for most of the nonferrous metals produced. Energy management, air emissions, and waste handling are similar for many metal production processes.