Abstract

Purpose

The concept of electro mobility is gaining importance and has become more dynamic in recent years, particularly in developed economies. Besides a significant reduction of mobility-related CO2 emissions, electro mobility is also expected to minimize the current dependence on oil, while maximizing energy conversion efficiency. However, the associated shift in resource requirements towards so-called strategic metals gives reason to suspect that trade-offs could threaten the desired merits of e-mobility with regard to sustainability. This study aims to give a more comprehensive understanding of the challenges—including the issue of uncertainties—which the broad implementation of e-mobility could place on resource availability and especially on a sustainable management of special metals for the high voltage traction batteries forming the heart of the electric powertrain.

Methods

Future metal flows for three possible cathode materials containing the special metals lithium and cobalt are estimated in this paper by means of a Material Flow Analysis. Using two scenarios (dominant and pluralistic) projecting the annual demand for electric vehicles until 2050 and the free software STAN in order to perform the calculation steps to build up the model for the analysis, the MFA considers the resource input requirements based on annual vehicle registrations and the consequent energy requirements.

Results and discussion

The results indicate continuously rising lithium requirements with a wide variation in absolute terms depending on the scenario, which can be considered symptomatic for the uncertainty regarding the development of e-mobility. In the case of cobalt, the projected demand trajectories differ even more drastically between the two scenarios. In comparison to lithium though, for both scenarios cobalt requirements in absolute terms are much less than lithium requirements. With a view to currently known reserves, the cumulative demand for battery technology projected in the dominant scenario will consume 74–248 % (for two different cases) of the lithium reserves and 50 % of the cobalt reserves by 2050.

Conclusions

Despite significant differences between the examined scenarios, it becomes clear that e-mobility will be an increased driver for cobalt and particularly lithium demand in the future. Exact increases in demand for both metals are difficult to predict, especially due to the necessity of numerous assumptions, such as recycling rates, as well as data availability and quality. The results of this study imply a shift from managing primary resources, resource uses, and waste separately, towards managing materials, i.e., resource flows and their implications over the entire life cycle.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Electric vehicles are considered to be a promising alternative to conventional combustion-engine-based vehicles in the transition to a more sustainable individual mobility. Their broad implementation is expected to substantially contribute to a necessary reduction of greenhouse gas emissions (GHG) from road transport, which are threatening Earth’s intake capacity and accelerating anthropogenic climate change. The transport sector is one of the largest contributors to global warming, mainly due to its carbon dioxide (CO2) emissions. Among the CO2 emissions from energy supply, industry, and transport, those from the transport sector constitute the fastest-growing share, driven by road transport in particular. Until 2030, CO2 emissions related to road transport are likely to increase by a factor of almost 1.5, based on 2007 levels, especially due to increased mobility and vehicle ownership in developing economies (IRP 2012; Bernstein et al. 2007; Mondal et al. 2011).

Not least in light of these developments, the concept of electro mobility (e-mobility) is gaining importance and has become more dynamic in recent years, particularly in developed economies. Besides a significant reduction of mobility-related CO2 emissions, e-mobility is also expected to minimize the current dependence on oil, while maximizing energy conversion efficiency. From a systems perspective, it is expected to offer promising options for sustainable systems integration related to and beyond mobility, e.g., by offering, respectively providing alternative energy storage devices (ESDs) for fluctuating renewable energies (Deutsche Bundesregierung 2009; Thielmann et al. 2010; NPE 2012; Buchert et al. 2009). In the current dynamics of the topic, economic and social considerations are becoming major drivers for ambitious targets that have been announced by numerous governments worldwide: if all of those targets were met, there would already be up to 1.5 million electric vehicle (EVFootnote 1) registrations in 2015 and up to 7 million registrations in 2020 (Thielmann et al. 2012, p. 5).

However, the associated shift in resource requirements towards so-called special, respectively technology metals gives reason to suspect that trade-offs could threaten the desired merits of e-mobility with regard to sustainability. While Earth’s intake capacity is increasingly jeopardized due to pollution—e.g., through emissions and increasing waste flows—its function as a source is threatened by an ever-increasing use of natural resources, in particular non-renewable resources such as metals. The United Nations International Resource Panel (IRP 2012 p. 7) asserts that “current patterns of [both] resource use and emissions are out of step with what the planet can sustain”. The availability of metals for high voltage traction batteries—the heart of the electric powertrain—has already been discussed by a number of researchers (e.g., Peters et al. 2013; Konietzko and Gernuks 2011; Angerer et al. 2009a, b; Buchert et al. 2009) in the past years.

However, results and particularly the conclusions derived from the results remain debatable as long as uncertainties cannot be eliminated. This study aims to give a more comprehensive understanding of the challenges—including the issue of uncertainties—that the broad implementation of e-mobility could place on resource availability and especially on a sustainable management of special metals for high-voltage traction batteries.

2 Traction batteries for mobile application

The battery is a key technology to an EV’s heart—its powertrain. As the energy source it provides the electric motor with electrical energy, which is then converted into mechanical energy (Buchert et al. 2011; Peters et al. 2013). Considering this sequence of energy conversion, it becomes evident that particularly the performance and potential of the energy source is critical to the overall performance of the electric powertrain. Other energy sources for EVs, such as fuel cells, exist; however, the rechargeable battery is the most prominent and established one. Also in the short and medium term, battery technology is considered to be the most promising technology for mobile application (Winter and Brodd 2004; Huggins 2009; Pollet et al. 2012; Tie and Tan 2013; Peters et al. 2013; Thielmann et al. 2010; Hawkins et al. 2012). As an electrochemical storage system, the battery stores and transports chemical energy and recalls it on demand, converting it into electrical energy based on a controlled chemical reaction. The common functional principle and technical architecture behind such an electrochemical conversion system is that of a galvanic cell. It consists of two chambers, in which electrochemical reactions take place at a respective electrode, whereas the electrodes are bridged through an electrolyte solution that transports ions between the electrodes, while electrically isolating them. As ions migrate from the anode to the cathode (during discharge), electrons are released from the anode and directed through an external circuit to create current before entering the cathode (Peters et al. 2013; Pollet et al. 2012; Hayner et al. 2012; Huggins 2009).

In order to meet the high energy requirements for automotive application, traction batteries usually consist of a large number of cells that are connected in series. Even though there is no theoretical limit to the amount of connected cells, their accumulated weight and volume pose practical limits. Hence, the number of cells required and with it their weight and volume, depend on the specific characteristics and performance of the cell chemistry and the vehicle concept the battery pack is designed for, i.e., in terms of hybridization (Fig. 1) (Brandl et al. 2012; Gaines and Cuenca 2000). Thereby, the battery characteristics and cell performance is largely a function of the materials used, both in terms of quantity, quality, and properties (Wagner et al. 2013; Huggins 2009; Majeau-Bettez et al. 2011).

Consequently, material development is the major driver for research and development (R&D), which is why this field is highly dynamic. Patent applications for battery technologies have risen continuously between 1994 and 2008, and even accelerated their upward trend since 2009. Former studies have given reliable indication that battery technology will significantly depend on the so-called technology metals (Angerer et al. 2009a, b; Konietzko and Gernuks 2011; Kesler et al. 2012; Peters et al. 2013; Vikström et al. 2013). Technology metals are a functional sub-group of minor metals (special and precious metals) that—in addition to their geological scarcity as non-renewable resources—typically suffer from structural, technical, and economical scarcities, as well as from suboptimal utilization cycles. Substitution or decoupling their use from economic growth has been difficult so far, due to the specific properties of this group of metals. In most cases, substitution fails its original purpose by replacing elements within the same group (Hagelüken and Meskers 2010).

According to those special metal requirements, the traction battery in an EV furthermore constitutes a significant cost factor, with a share of up to 40 % of the vehicle’s total production costs (Peters et al. 2013; Hayner et al. 2012; Tie and Tan 2013).

Besides their mobile use in EVs, rechargeable batteries are being used in a broad array of applications with each application or segment having its own performance requirements. In recent years, however, requirements for traction batteries have been one of the greatest drivers for R&D, since current technologies are facing various limitations, particularly regarding the specific energy (energy-to-weight ration, in Wh/kg) and costs (Gerssen-Gondelach and Faaij 2012; Huggins 2009). The high rate of R&D activities has already led to important technological changes. Improvements are not always of incremental nature in known areas, but there are also new materials, concepts, and approaches (Huggins 2009). The battery chemistries that have been discussed most for the field of e-mobility are lithium-ion (Li-ion), lithium-polymer (Li-poly), nickel-metal-hydride (NiMH), lead-acid (PbA), zinc air, and sodium-nickel-chloride (ZEBRA) (Hawkins et al. 2012; Gerssen-Gondelach and Faaij 2012; Tie and Tan 2013).

Among these, Li-ion technology in general is particularly convincing with regard to energy and power density, reaching higher performances compared to most other currently known, respectively established battery technologies (Hayner et al. 2012). Accordingly, Li-ion technology is currently considered the best available technology. They are regarded as most promising forerunner technology that will pave the way for a widespread implementation of EVs, in particular BEVs and PHEVs, in the short- and medium term. Already today, most new EVs make use of this battery type. In 2020, application of Li-ion for e-mobility could make up 50–70 % of all applications (Thielmann et al. 2012; Majeau-Bettez et al. 2011; Notter et al. 2010; Peters et al. 2013; Brandl et al. 2012; Konietzko and Gernuks 2011). Peter Birke of Continental Batteriesysteme (in: Thielmann et al. 2010, p. 18) states that it will be difficult to find serious alternatives for Li-ion technology until 2020 since the Li-ion electrochemical system is too distinguished in its position.

At the same time, Li-ion technology has still not reached a comparable level of technological maturity as for example the lead-acid technology, which is why there is still potential (and in fact the necessity) for important technological enhancements (Peters et al. 2013; Majeau-Bettez et al. 2011). According to Scrosati and Garche (2010, p. 2429), this disposition to innovation “(…) will place it in top position as the battery of the future”. Reinhard Mörtel from the Fraunhofer Institut für Siliziumtechnologie (in: Thielmann et al. 2010, p. 5) also expects numerous technological developments after 2015–2025 that could establish the Li-ion battery as standard energy storage technology.

Clearly, there is still the need to enhance or develop battery technologies, especially in order to make BEVs and PHEVs price and performance competitive. A systematic sequence of development paths for material combinations of cell components cannot be identified so far. Instead, technological development currently appears to be rather open in terms of a two-way-strategy including Li-ion- and post-lithium-ion-technologies. Battery technologies such as high voltage Li-ion cells (5 V), lithium-air, lithium-sulfur and lithium-metal-polymer are promising but they still face considerable challenges. Most of them will thus not be relevant before 2020–2030. Batteries other than lithium-based ones are also not expected to appear as competition before 2030 (Thielmann et al. 2010, 2012; Scrosati and Garche 2010; Gerssen-Gondelach and Faaij 2012; Huggins 2009; Peters et al. 2013).

Li-ion batteries show the highest combination of energy and power densities among rechargeable batteries. This is particularly owed to the favorable characteristics of lithium, which as the lightest of all metals, allows the greatest electrochemical potential. Additionally, they show relative advantages in terms of cost, recharge rate, weight, maintenance, self-discharge and cycling life. Also, Li-ion batteries do not suffer from a memory-effect. Since their introduction in 1991, Li-ion batteries have been primarily used for consumer electronics. More recently, their development has focused on meeting the requirements established by the automotive industry (Hayner et al. 2012; Angerer et al. 2009a; Notter et al. 2010; Scrosati and Garche 2010). In general, Li-ion technology still leaves a wide range of possibilities for the choice of materials, as it—in contrast to most other electrochemical systems—permits to vary the interplay of different materials for the active cell components: the anode, the cathode and the electrolyte (Brandl et al. 2012). The choice of material for these three main components and their combination are decisive for the overall performance of the Li-ion battery. So far, innovations have usually been based on one component at a time with no simultaneous changes of the other components, thus keeping the conventional Li-ion structure. Considerations with regard to material availability are in fact already among the aspects that influence R&D (Hayner et al. 2012; Wagner et al. 2013; Scrosati and Garche 2010). Which Li-system will ultimately be dominant with a view on applications in the field of traction is not clearly foreseeable yet (Angerer et al. 2009a).

A literature review has shown that for the negative electrode (anode), despite the development and introduction of alternative materials, graphite is still the material of choice. It is likely that graphite will eventually lose importance within the next years, while the importance of silicon, metal alloys, and graphene will increase. In the near future, however, experts agree that graphite will remain the most relevant anode-material of choice. Graphite is abundant in nature, it is easy to handle, and as anode material it offers good cycling stability and safety characteristics. Furthermore, it is of light weight, non-toxic and environmentally sound (Gaines and Cuenca 2000; Scrosati and Garche 2010; Scrosati 2000; Wagner et al. 2013; Hayner et al. 2012; Ziemann et al. 2014).

With regard to the positive electrode (cathode) the range of possible materials is much broader. Cathode materials have generally been recognized to be the limiting factor to batteries’ overall performance. Compared to most anode materials, cathode materials have rather low storage capacities, but higher costs (Hayner et al. 2012). This drives R&D activities, which is why there are various types of cathode materials with different properties being used and developed for mobile application (Notter et al. 2010; Gerssen-Gondelach and Faaij 2012; Brandl et al. 2012). Two major categories can be identified: layered compounds and materials with more open structures. Layered compounds are well-suited as cathode materials due to their structure that favors rapid ion intercalation processes. Among the layered compounds, NMC-systems of the Li (Ni x Co y M z ) O2 type (with M = manganese (Mn) or aluminum (Al)) are already successfully being used and showed annual patent growth rates of 46 % between 2006 and 2010 (Wagner et al. 2013; Scrosati and Garche 2010; Hayner et al. 2012). An equally promising compound is the three-dimensional spinel prototype lithium manganese oxide (LiMnO4; LMO). For EV application this is particularly attractive due to its relatively easy and low cost production, and most of all due to its good safety properties (thermal stability (cf. Notter et al. 2010; Scrosati and Garche 2010).

Most commercially available Li-ion batteries use mixtures of a liquid component—e.g., dimethyl carbonate (DMC), diethyl carbonate (DEC), or ethylene carbonate (EC)—as electrolyte with the Li salt containing the li-ions, typically lithium hexafluorophosphate (LiPF6). Liquid organic electrolytes as well as polymer, gel and other solid electrolytes are being explored and will be essential for new generations of anode and cathode materials. Nevertheless, further R&D activities will be required before new electrolytes will dominate the market (Wagner et al. 2013; Hayner et al. 2012; Scrosati and Garche 2010; Gaines and Cuenca 2000; Peters et al. 2013).

3 Battery-related metal flows for the transition to e-mobility

Future battery (active material) -related metal flows in the field of e-mobility were estimated, considering three possible cathode material compounds (Table 1). As reasoned earlier, positive electrode (cathode) materials offer numerous possibilities and due to the high R&D dynamics it is not foreseeable which chemistry will be dominant. In addition, the positive electrode is (currently) withal the component with the greatest share of metal use and thus with the greatest impact on metal flows. Consequently, it has been found reasonable to consider more than one positive electrode compound for future scenarios, while the previously mentioned most common anode and electrolyte materials were assumed to be equal for all three resulting battery cells:

-

(1)

The phospho-olivine compound lithium-iron-phosphate with an open structure (LFP, LiFePO4)

-

(2)

An NMC-material system with layered structure (LiNi0.4Co0.2Mn0.4O2)

-

(3)

The three-dimensional spinel prototype lithium-manganese-oxide (LMO, LiMnO4)

While the anode material, as assumed to be made of graphite, was excluded from estimations, the special metals containing electrolyte was assumed to be equal for all three battery types. The special metals under consideration were lithium and cobalt.

3.1 Method and approach

Future metal flows were estimated by means of a material flow analysis (MFA)—a feasible method to describe and explore a material-based system defined in space and time. This method allows to systematically assess (all) relevant material flows and stocks, connecting sources with pathways and sinks. Thereby, the quantitative assessment is primarily based on the law of conservation of matter, which means that all inputs, stocks and outputs of the defined system have to be balanced. With regard to this function, MFA cannot only be used as an independent analytical method, it also constitutes the basis (material inventory) for almost all commonly known environmental impact assessment methods, as for example LCA and eco-balancing (Brunner and Rechberger 2004). Therefore, the results from an MFA must first be interpreted and evaluated.

In order to perform the MFA, the software tool STAN (short for subSTance flow ANalysis) was used. STAN is a freeware, developed by the Institute for Quality, Resources and Waste Management at the Vienna University of Technology in cooperation with INKA software in 2004. STAN supports MFA by integrating all necessary components to define and depict a metabolic model, the management of data, calculation and the graphical handling of results (Cencic and Rechberger 2008).

The calculation steps to build up the model for the analysis were based on a top-down approach (Fig. 2). The model parted from the projected demand for different electric vehicle concepts (ratio of new vehicle registrations), based on two scenarios that were developed for a similar study by the Fraunhofer ISI in 2009 (Angerer et al. 2009b). The demand-ratios were given in annual terms and at a global scale (system boundary in space). They were transferred into absolute numbers based on 2013 passenger vehicle registrations and on the annual growth rate. With a view to the system boundaries in time, the Fraunhofer ISI scenarios project the annual demand until 2050. Hence, flows were analyzed over a period of 36 years, from the present (2014) to 2050.

In a next procedural step, the demand for each considered vehicle concept was transferred from the absolute number of vehicles to the respective annual energy requirements (in kWh/a), by means of the particular energy requirements per vehicle concept.

Subsequently, the annual energy requirements were transformed into the respective battery mass requirements (in kg/a), by means of the material intensity I B (kg/kWh) for each battery based on a particular cathode type. Therefore, due to differing performances, different market penetrations for each cathode type and vehicle concept under consideration are assumed.

In order to obtain resource input requirements, inventories from different LCA studies on the three cathode types were used to reconstruct the respective production chain and material flows. Production processes and flows shared among the cathode types were integrated. With the objective to quantify recycling potentials at certain points in time, respectively material stocks in the anthroposphere, assumptions regarding the useful life of traction batteries and collection efficiency were adopted.

3.2 Data and specific assumptions

The fundament for the analysis was given by the Fraunhofer ISI e-mobility scenarios (Angerer et al. 2009b), which were found to provide the most far-reaching horizon (until 2050) among the numerous scenarios that were published since 2007 and recently summarized by Peters et al. (2013, p. 63f). The Fraunhofer ISI global scenarios are an extended version of national (Germany) scenarios from 2008 and have been used before to assess future metal availability (Angerer et al. 2009b; Konietzko and Gernuks 2011). Both scenarios—a Pluralistic Scenario and a Dominant Scenario—consider three vehicle concept groups: City-BEVs including mainly passenger vehicles, but also motor scooters and small pick-up trucks (20 kWh), hybrid-electric passenger vehicles (1.4kWh) and battery-electric passenger vehicles/plug-in hybrid-electric passenger vehicles (20 kWh). An overview on both scenario concepts is given in Table 2.

In both scenarios, the city-BEVs group plays a minor role, which is why these vehicles were integrated into the group of BEVs and PHEVs. The pluralistic scenario is based on the assumption that e-mobility will develop as one of many options to enhance the efficiency of individual mobility. Many objectives with respect to technical, economical and safety issues will be achieved. However, PHEVs will only be used by a small share of consumers while BEVs will cover the majority of small inner-city vehicles but only partially position itself in the inner-city commercial transport sector. Figure 3 shows how—in the Pluralistic Scenario—the use of PHEVs and BEVs will evolve as a share of annual vehicle registrations between 2014 and 2050, while Fig. 4 shows their dissemination under the assumptions of the Dominant Scenario. Latter paints a much more optimistic picture of e-mobility development. It suggests that hybridization becomes widely established and that e-mobility will dominate individual mobility. According to this scenario, PHEVs and BEVs for urban uses become established from mid-2015, while the establishment of BEVs in general will follow from mid-2025. (Angerer et al. 2009b, p. 26ff)

Relative e-mobility market penetration as share (in %) of annual vehicle registrations along the projected time horizon (2014–2050): Dominant Scenario (based on Angerer et al. 2009b)

Relative e-mobility market penetration as share (in %) of annual vehicle registrations along the projected time horizon (2014–2050): Pluralistic Scenario (based on Angerer et al. 2009b)

The energy requirements for each vehicle group were basically adopted from Angerer et al. (2009b). However, in the case of HEVs, Tie and Tan (2013) presented several examples that suggested a higher average energy use for HEVs, which is why the figure was slightly raised (compare Table 3)

The Fraunhofer ISI scenarios forecast how e-mobility could evolve in the future as a ratio of total annual vehicle registrations. In order to calculate absolute numbers, a total number of 62,644,460 global passenger vehicle sales or registrations (OICA 2014) in 2013 and an annual growth rate of 2.18 % (Fulton and Eads 2004) were assumed. The latter, despite its disputable timeliness, has proven its prevailing accuracy so far: the adopted figure is only slightly lower than the one forecasted by Konietzko and Gernuks (2011) for 2013 based on this annual growth rate: 66,831,428 (a difference of approx. 4 Mio vehicles).

Furthermore, a differentiation of the (static) market penetration of the three considered cathode materials related to the vehicle concept groups was conducted (Table 4). The final assumptions were based on prior, comparable studies (Angerer et al. 2009b; Konietzko and Gernuks 2011), as well as on technical differences of the cathode materials and their state-of-the-art. As LFP provides relatively lower energy densities but higher power densities, it is the preferred cathode material for HEV concepts. Accordingly, its share for FHEV concepts was assumed to be much higher compared to NMC and LMO technologies. LMO was considered to be primarily competing with NMC, while the market share of LMO in general was assumed to be slightly lower than that of both other cathode materials.

In order to model the relevant material flows for each cathode type, an inventory of all relevant material inputs and outputs was gathered from the literature upon which the relevant production processes and flows were reproduced. Thereby, all three inventories were extracted from LCA studies on particular Li-ion technologies (Notter et al. 2010a, b; Majeau-Bettez et al. 2011a, b). For the LMO-based battery, the data stems from a study conducted by Notter et al. (2010a, 2010b). Inputs for particular production processes were either directly provided as percentage of the output or indirectly as mass ratios (kg input per 1 kg output), which allows calculating backwards; parting from a certain battery pack weight to the initial input masses.

The material flows of each cathode type were connected to the annual vehicle registrations, respectively the annual energy requirements via the material intensity—a critical factor when it comes to the comparison of different battery technologies. Since there was no available data, the material intensity was calculated based on an approach used by Andersson and Råde (2001) in a study on the resource intensity of different battery technologies (Table 5). Accordingly, the material intensity was calculated based on the theoretical specific capacity (mAh/g), the theoretical voltage (V) of the respective active material and utilization ratios for material use and average discharge voltage.

Data availability and quality only allowed for calculations (in the software STAN) at the goods layer. However, with the objective to reveal recycling potentials, substance flows for the second half of the model (battery flows in tons) were traced in EXCEL. Average concentrations per ton battery were calculated for lithium and cobalt, based on the chemical composition of the active electrode material and its respective mass shares in the batteries.

Note that the above-presented metal contents solely refer to the electrode materials, while the metal demand that was calculated in the MFA model includes lithium requirements for the electrode as well as for the electrolyte. However, the lithium used for the electrolyte makes up only 5–7 % of the total lithium content in the battery, as calculations showed. Neglecting the lithium contained in the electrolyte for the projection of recycling potentials was found to be acceptable since different recycling channels are likely. A comparison with other studies (Konietzko and Gernuks 2011; Angerer et al. 2009a; Kushnir and Sandén 2012; Andersson and Råde 2001) showed that the calculated lithium contents in g/kWh resulted slightly higher but still comparable.

Recycling potentials at certain points in time were based on the assumption that the useful life of a traction battery lies at around 10 years (Konietzko and Gernuks 2011; Brandl et al. 2012; Evans 2014; Abraham et al. 2007; Broussely et al. 2011). Even though the useful life of the vehicle might exceed that of the battery, replacement flows were not (explicitly) included in the model. Due to remaining uncertainties regarding second-life/reuse options for spent traction batteries, possible reuse flows were not deducted from the recycling potentials for the assessed time horizon. The collection efficiency was assumed to be optimistically high—with a global collection quota of 90 %—not necessarily to give the most accurate picture of reality but to give an idea of the maximum recycling potential. The risk of distorting primary metal requirements based on a too optimistic collection quota can be considered as irrelevant, since no secondary metal flows back into the supply chain were modeled.

3.3 Results

Based on an assumed lithium content of 6.7 % in concentrated lithium brineFootnote 2 (Notter et al. 2010, p. 7), results indicate a continuously increasing lithium demand. Between 2014 and 2050 the estimated annual lithium demand for e-mobility lies between 42,000 t and 370,000 t in the Pluralistic Scenario and between 61,000 and 2 Mt in the Dominant Scenario (1st case, Fig. 5).

MFA results—annual lithium (elemental) requirements 2014–2050 in tons (Albach 2014)

For comparison: current annual lithium production in 2013 is approx. 35,000 t/a (Menzie et al. 2013). Thereby, the lithium demand for batteries, with a share of 29 % in 2013 (Evans 2014, p. 238f; Jaskula 2014, p. 94f), only accounts for around one third of the total annual demand. The estimated figures thus appear dubiously high. An examination of the figures revealed that 70 % of the elemental lithium input is lost in the first beneficiation process of the lithium brine. This loss rests on the input-output ratio provided by Notter et al. (2010b, p. 8), who indicate that 9.38 kg concentrated lithium with a content of 6.7 % lithium are required to produce 1 kg lithium carbonate with a content of 18,787 % (deduced from the atomic mass shares of the elements). This information could not be confirmed, since lithium carbonate generally serves as equivalent to determine lithium inputs. Meshram et al. (2014) give a comprehensive review on lithium extraction and a conclusion remains that extraction of lithium from its minerals and clays is fraught with high mining costs and involves high energy, while extraction from brine needs a long time for evaporation. Hence, these processes need to be adequately modified to yield efficiency and better economic returns. The efficiency and the improved economic returns depend on the mine and the location and varies (Meshram et al., 2014). Consequently, this information is afflicted by high uncertainties. Nevertheless, such losses are conceivable since low(er) extraction efficiencies are commonly accepted, generally owed to economic factors (von Gleich 2006). Since lithium mining is quite a new market with fast gain in knowledge in mining and processing. Therefore, lithium mining in the future might be more efficient and losses are decreasing. Taken into account the annual lithium consumption from 2014, the USGS forecast that the world has enough known reserves for about 365 years of current global production of about 37,000 t per year (US Geological Survey 2015). This forecast does consider a growth rate of lithium need in the future. Assessing a high growth rate of EVs due to a high demand in the growing countries like India and China we will soon decrease the reserves for lithium. In addition, we can reasonably expect that lithium reserves and resources will increase as market demand grows. In addition, lithium can be substitute and as soon as the price rises there is a higher motivation for replacing lithium with other substitutes as calcium, magnesium, mercury, and zinc as anode material in primary batteries (US Geological Survey 2015).

If in fact the reason for this 70 % loss was the result of poor extraction efficiencies, then the real lithium requirements are those that can be calculated from the required lithium carbonate. In this case (second case), the lithium demand would lie between approx. 13,000 and 112,000 t (Pluralistic Scenario), respectively 18,000 t to 622,000 t (Dominant Scenario). Regardless of the perspective, the results show that there is a significant difference in required amounts between the two scenarios. In the second case, the lithium demand in the Dominant Scenario is more than five times the lithium demand in the Pluralistic Scenario 2050. This wide range of possible lithium requirements can be considered as symptomatic for the uncertainty regarding the development of e-mobility and the consequent resource requirements. Uncertainty in general in this paper is either related to missing data or incorrect data. Incorrect data maybe based on losses during mining and processing of lithium or even the unknown battery composition due to company secrets. Assessing the correct uncertainty remains impossible in this case and only assumptions can be made at this time.

When contrasting the demand trajectories with today’s known lithium reserves of approximately 12.1 Mt (Vikström et al. 2013; Kesler et al. 2012; USGS/ Jaskula 2014; Evans 2014), the results indicate that in the 2nd case, between 17 and 74 % of the reserves would be consumed by 2050. In the 1st case, the consumption would even lie between 57 and 248 %.

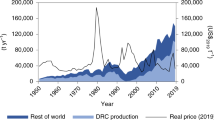

In the case of cobalt, the projected demand trajectories differ drastically between the two scenarios. As Fig. 6 shows, the required quantities of cobalt in the Pluralistic Scenario in fact almost disappear against the quantities required in the Dominant Scenario. In comparison to lithium though, for both scenarios cobalt requirements are—in absolute terms—much less than lithium requirements. This is not surprising with a view to the considered battery chemistries (only NMC-chemistry contains cobalt) and the fact that lithium is not only contained in the electrodes, but also in the electrolyte. Hence—according to the calculations—cobalt requirements would lie between almost 6000 t (Pluralistic Scenario) and 246,000 t (Dominant Scenario) in 2050. In comparison, current cobalt production reached levels of 103,000 t in 2012, and an estimated 120,000 t in 2013 (USGS/Shedd, 2014).

MFA results—annual cobalt requirements 2014–2050 in tons (Albach 2014)

With regard to currently known cobalt reserves of approximately 7.2 Mt (Shedd 2014, p. 47), the cumulative cobalt demand for battery technology in the Dominant Scenario will have consumed almost 50 % of the reserves by 2050. A comparison of annual recycling potentials for both metals and their respective annual demand is shown in Figs. 7 and 8. Note that the scales have been chosen differently for each scenario in order to better highlight the comparison between the respective metal demand and the corresponding secondary supply potential. Figure 8 indicates that in the case of lithium, even with a 100 % technical recycling quota and 100 % closed loop recycling, secondary supply could only cover a small fraction of the annually required quantities—a maximum of around 30 % for both second case scenarios in 2050. In the case of cobalt, secondary supply based on a 100 % technical recycling quota and 100 % closed loop recycling could cover up to 48 % (2050) in the Dominant Scenario and up to 65 % (2050) in the Pluralistic Scenario.

MFA results—annual (2014–2050) elemental lithium demand in tons against the respective annual lithium recycling potential, second case (Albach 2014)

MFA results—annual (2014–2050) cobalt demand in tons against the respective annual recycling potential (Albach 2014)

4 Discussion

The case study in this paper shows the importance of assessing the uncertain data availability and the composition ranges. Metals will always continue to exist based on the law of conservation of matter, still forming part of the non-renewable resources group due to their replenishment rate and their usefulness (von Gleich 2006; Kesler et al. 2012; Hagelüken and Meskers 2010). Consumption and losses thus do not occur in their original, rather finite sense, but in terms of a debasement or even annihilation of usability, i.e., metals can (and most likely will) be used up, i.e., they can be devalued under thermodynamic aspects (von Gleich 2006, p. 18). The dimensions of these factors, however, underlie anthropogenic processes within the technosphere and are in theory, compared to the geological processes, both influenceable and controllable—a core task for a sustainable metals management.

The material-intensity is thus the decisive link, and consequently determining factor, for the quantification of material flows to both ends—in terms of required input and recycling potential (output). However, no such data could be found in the literature. While the use of average values for Li/Co contents of certain cathode types, as for example used by Konietzko and Gernuks (2011), were found inadequate (not applicable) for the reconstruction of the battery production chains, average values for Li/Co contents of Li-ion batteries in general (e.g., in Angerer et al. 2009a, b) would have implied the outright negligence of different battery types. Hence, the ultimately chosen approach is, owing to numerous assumptions and the integration of data sets from different studies, highly afflicted with uncertainties, which are passed down to the results. In general, the comingling of data from different sources is highly questionable and inconsistencies can hardly be eliminated completely.

A further shortcoming has been the lack of adequate data, respectively data quality regarding (dissipative) life cycle losses of materials, especially on substance level. As it has been mentioned before, most similar, prior studies have been using average Li/Co contents to assess resource requirements and/or recycling potentials, whereby life-cycle losses are largely neglected. This is one of the major reasons why the battery production chains could not be reproduced on substance level: the number of unknown values exceeds that of known values, thus the mathematical equations cannot be solved.

Discussions on the recyclability of products abound and there are strong efforts to catch up with recycling technologies for all our booming high-tech products. What we are missing in the discussion is the view on mining efficiencies. There might be some undiscovered potential efficiencies in the very beginning of the product: in the mineral processing. There is a strong link between recycling technologies and mineral processing since they can sometimes be based on the same or similar technology. Mining has a long history and the learning curve had lots of time to improve, but we face the development of new established technologies that even make future mining waste worth processing again, as we can see at old gold mine waste in South Africa. Therefore, a high opportunity for mineral sustainability next to recycling is to mine as much as possible of each deposit rather than focusing on ores of the highest quality. With regard to the high losses during the first processing steps as identified in this paper, there is always a strong dependence of recycling rates and the primary mining efficiency. With a view to sustainable resource management both have to achieve high efficiency.

Despite significant differences between the examined scenarios it becomes clear that e-mobility will be an increasing driver for cobalt and particularly lithium demand in the future. Especially in the case of lithium increased quantities and high growth rates with regard to the demand can be expected from traction batteries, as shown in this paper. Exact increases in demand for both metals are difficult to predict, especially due to the necessity of numerous assumptions, which are seldomly consistent, and due to insufficient data availability and quality. However, it is important to identify trends and discuss underlying assumptions and major challenges.

An important assumption, particularly in the case of lithium, that has often lead to the overall optimistic appraisal of lithium availability in the future is that of possible recycling rates (cf. for example Kushnir and Sandén 2012; Gruber et al. 2011; Konietzko and Gernuks 2011; Kesler et al. 2012). However, optimistic recycling rates in the short- and medium term are questionable. The significance of the contribution of secondary lithium production through recycling to satisfy global lithium demands is still highly uncertain. Substantial delays in the build-up of recycling capacities are most likely. Results from the present study indicate that even high recycling rates cannot keep up with the growth rates in demand. This means that higher production of lithium in the future, under any scenario, will most certainly be required. In addition, both possible future production quantities and the quantities that will be demanded in the future are similarly afflicted by uncertainties (Kesler et al. 2012). Lithium supply from brines, greatest lithium source by far, suffers from slow response times to changes in lithium demand (Vikström et al. 2013). The modeled annual production volumes for 2050 (lithium) are likely to meet neither of the herein projected demands (considering that EV batteries only make up for a share of around 27 %).

Furthermore, there are other relevant factors that ultimately might even become more crucial than the size of the reserve or the resource base and thus should be considered as serious challenges. Among these challenges are social factors, for example, as well as legal frameworks and increasing environmental standards (cf. Kesler et al. 2012, p. 64, Vikström et al. 2013) Accordingly, aiming for sustainable resource management practices could directly affect resource availability.

Cobalt is in general losing its prior predominance in battery chemistries. Among the reasons for substitution are, in fact, environmental risks and availability concerns (Scrosati 2000; Wagner et al. 2013; Hayner et al. 2012; Peters et al. 2013; Roberts and Gunn 2014). There is a trend towards decreasing use of cobalt for traction batteries, which translates into a relief of the cobalt demand from this sector (while increasing the demand for the substitutes, as, e.g., manganese and nickel). Nevertheless, even the more conservative projection of the cobalt demand development in this study indicates an increasing demand.

However, as in the case of lithium, the demand for primary resources would still increase and translate into comparable challenges as the ones described before for lithium. A particular challenge for the case of cobalt, however, is its relatively low occurrence and consequently its nature of being a by-product in mining activities of other metals.

5 Conclusions

The sustainability of resource management is a major challenge especially with regard to the understanding of sustainability as preserving resources for the future. Based on this understanding, sustainable development aims to protect the planet and future societies from substantial system collapses. Thus, key concerns to this understanding of sustainability are the limitations set by Earth’s carrying capacity, which exist for all three dimensions of sustainability. The rather long-term orientation and global perspective of the defensive understanding grants the most attention to long-term and potentially irreversible effects of today’s and future sustainability deficits, as well as those deficits that tend to impact on a global scale.

The use and availability of resources is a typical example (other examples are the climate and biodiversity) for a rather long-term problem of global scale, which is additionally related to questions of carrying capacity in a multidimensional way. Sustainable Resource Management is not just a simple extension of traditional resource management. In the beginning it was rather a division between resource management (i.e., exploitation and upgrading), waste management and environmental management as a cross-divisional function along a linear economy. Nowadays, it is an integrated management approach that addresses the entire life cycle of resources including all related environmental, economic and social concerns, in their relation with the bio-geosphere, the anthroposphere and the technosphere (e.g., Allen et al. 2009; Dijkema et al. 2000; Brunner and Rechberger 2004; Stahel 2006).

It implies a shift from managing primary resources, resource uses and waste separately, towards managing materials. Waste is a subjective qualitative label for a resource, which triggers the motivation to be changed whenever possible by means of any transformation process.

Besides, the resource base of a non-renewable resource cannot just be taken as inventory; the matter is much more complicated. Countless deposits have not sufficiently, if at all, been evaluated yet. This applies especially to the supposedly known resources, whose conversion into actually recoverable reserves is, accordingly, still highly uncertain.

The obtained results and particularly the conclusions derived from the results remain still debatable as long as uncertainties in the overall assessment cannot be eliminated. This study is aimed at giving a more comprehensive understanding of challenges—including the issue of uncertainties—that the broad implementation of e-mobility could place on resource availability and especially on a sustainable management of special metals for high voltage traction batteries. Material Flow Assessment, especially for new technologies, can never be exact, since the battery technology distribution in vehicles is only an assumption. We are quite certain that NMC batteries will still be used in the near future due to their high energy density. Therefore, cobalt will still be under discussion as resource relevant for e-mobility.

Notes

Here only referring to Battery Electric Vehicles (BEV) and Plug-in Hybrid Electric Vehicles (PHEV).

As an explicit example. Note that lithium contents vary among different lithium sources.

References

Abraham D, Knuth J, Dees D, Bloom I, Christophersen J (2007) Degradation of high-power lithium-ion cells—electrochemistry of harvested electrodes. J Pow Sources 170(2):465–475

Albach S (2014) Sustainable Resource Management, Masterthesis at Carl von Ossietzky University, available online http://www.uni-oldenburg.de/cascadeuse

Allen F, Halloran P, Leith A, Clare Lindsay M (2009) Using material flow analysis for sustainable materials management. J Ind Ecol 13(5):662–665

Andersson B, Råde I (2001) Metal resource constraints for electric-vehicle batteries. Transp Res Part D: Transp Environ 6:297–324

Angerer G, Marscheider-Weidemann F, Lüllmann A, Erdmann L, Scharp M, Handke V et al. (2009a) Rohstoffe für Zukunftstechnologien. Fraunhofer Institut für System- und Innovationsforschung (ISI); Institut für Zukunftsstudien und Technologiebewertung (IZT). Stuttgart: Fraunhofer IRB Verlag

Angerer G, Marscheider-Weidemann F, Wendl M, Wietschel M (2009b) Lithium für Zukunftstechnologien - Nachfrage und Angebot unter besonderer Berücksichtigung der Elektromobilität. Fraunhofer ISI, Fraunhofer Systemforschung Elektromobilität (FSEM) & Innovationsallianz-Lithium-Ionen-Batterie (LIB2015), Karlsruhe

Bernstein L, Bosch P, Canziani O, Chen Z, Christ R, Davidson O et al (2007) Climate change 2007: synthesis report. IPCC, Valencia

Brandl M, Gall H, Wenger M, Lorentz V, Giegerich M, Baronti F et al. (2012) Batteries and battery management systems for electric vehicles. 2012 Design, Automation and Test in Europe Conf and Exhibition, pp 971–976

Broussely M, Herreyre S, Biensan P, Kasztejna P, Nechev K, Staniewicz R (2011) Aging mechanism in Li ion cells and calendar life predictions. J Pow Sources 97–98:13–21

Brunner P, Rechberger H (2004) Practical handbook of material flow analysis. Lewis Publishers, Boca Raton

Buchert M, Schüler D, Bleher D (2009) Critical metals for future sustainable technologies and their recycling potential. Öko-Institut e.V.; UNEP; United Nations University

Buchert M, Jenseit W, Dittrich S, Hacker F, Schüler-Hainsch E, Ruhland K et al. (2011) Ressourceneffizienz und ressourcenpolitische Aspekte des Systems Elektromobilität. Arbeitspaket 7 des Forschungsvorhabens OPTUM, Öko-Institut e.V.;Umicore; TU Clausthal; Daimler AG, Darmstadt

Bundesregierung D (2009) Nationaler Entwicklungsplan Elektromobilität der Bundesregierung. Germany, Berlin

Cencic O, Rechberger H (2008) Material flow analysis with software STAN. J Env Eng Manag 18(1):3–7

Dijkema G, Reuter M, Verhoef E (2000) A new paradigm in waste management. Waste Manag 20(8):633–638

Evans K (2014) Lithium. In: Gunn G (ed) Critical metals handbook, 1st edn. Wiley, Keyworth, Nottingham, UK, pp 230–260

Fulton L, Eads G (2004) IEA/SMP model documentation and reference case projection. WBCSD, WBCSD

Gaines L, Cuenca R (2000) Costs of lithium-ion batteries for vehicles. Argonne National Laboratory, Center for Transportation Research, Argonne, IL, USA

Gerssen-Gondelach S, Faaij A (2012) Performance of batteries for electric vehicles on short and longer term. J Pow Sources 212:111–129

Gruber P, Medina P, Keoleian G, Kesler SE, Wallington T (2011) Global lithium availability: a constraint for electric vehicles? J Ind Ecol 15:760–775

Hagelüken C, Meskers C (2010) Complex life cycles of precious and special metals. In: Graedel T, van der Voet E (eds) Linkages of sustainability. The MIT Press, Cambridge, pp 163–197

Hawkins TR, Singh B, Majeau-Bettez G, Hammer Stromman A (2012) Comparative environmental life cycle assessment of conventional and electric vehicles—supporting material. Retrieved March 19, 2014 from Wiley Online Library: http://onlinelibrary.wiley.com/store/10.1111/j.1530-9290.2012.00532.x/asset/supinfo/jiec532-sup-0001-S1.pdf?v=1&s=0ffcfad9015984dae69de3941a663e52dbe475f0

Hayner C, Zhao X, Kung H (2012) Materials for rechargeable lithium-ion batteries. Ann Rev Chem Biomolecu Eng 3:445–471

Huggins R (2009) Advanced batteries—material science aspects. Springer, New York

IRP (2012) Responsible resource management for a sustainable world: Findings from the International Resource Panel. United Nations Environment Programme

Jaskula B (2014, February) Mineral commodity summary: lithium. (USGS, Ed.) Retrieved May 20, 2014 from USGS: http://minerals.usgs.gov/minerals/pubs/commodity/lithium/mcs-2014-lithi.pdf

Kaiser O, Eickenbusch H, Grimm V, Zweck (2008) Zukunft des Autos. Zukünftige Technologien Consulting der VDI Technologiezentrum GmbH, Düsseldorf, Germany

Kesler S, Gruber P, Medina P, Keoleian G, Everson M, Wallington T (2012) Global lithium resources: relative importance of pegmatite, brine and other deposits. Ore Geolog Rev 48:55–69

Konietzko S, Gernuks M (2011) Ressourcenverfügbarkeit von sekundären Rohstoffen - Potenzialanalyse für Lithium und Kobalt. LiBRi; LithoRec

Kushnir D, Sandén B (2012) The time dimension and lithium resource constraints for electric vehicles. Res Pol 37(1):93–103

Majeau-Bettez G, Hawkins T, Hammer Stromman A (2011) Life cycle environmental assessment of lithium-ion and nickel metal hydride batteries for plug-in hybrid and battery electrical vehicles. Supporting information. Environ Sci Technol 45(10):4548–4553

Menzie D, Soto-Viruet Y, Bermúdez-Lugo O, Mobbs PM, Perez AA, Taib M, Wacaster S, and Staff (2013) Review of selected global mineral industries in 2011 and an outlook to 2017: U.S. Geological Survey Open-File Report 2013–1091, 33 p., http://pubs.usgs.gov/of/2013/1091, accessed June 19th, 2015

Meshram P, Pandey BD, Mankhand TR (2014) Extraction of lithium from primary and secondary sources by pre-treatment, leaching and separation. A Comprehen Rev Hydrometallurgy 150(IF-2.12):192–208

Mondal P, Kumar A, Agarval V, Sharma N, Vijay P, Bhangale U et al (2011) Critical review of trends in GHG emissions from global automotive sector. Brit J Env Climate Change 1(1):1–12

Notter D, Gauch M, Widmer R, Wäger P, Stamp A, Zah R et al (2010) Contribution of Li-ion batteries to the environmental impact of electric vehicles. Supporting information. Environ Sci Technol 44(17):6550–6556

NPE (2012) Fortschrittsbericht der Nationalen Plattform für Elektromobilität (Dritter Bericht). NPE & GGEMO. Berlin, Germany: BMVBS

OICA (2014) New PC registrations or sales 2005–2013. Retrieved April 27, 2014 from International Organization of Motor Vehicle Manufacturers: http://www.oica.net/wp-content/uploads//pc-sales-2013.pdf

Peters A, Doll C, Plötz P, Sauer A, Schade W, Thielmann A et al. (2013) Konzepte der Elektromobilität - Ihre Bedeutung für Wirtschaft, Gesellschaft und Umwelt. (B. f. (TAB), Ed.) Berlin: edition sigma

Pollet B, Staffell I, Shang J (2012) Current status of hybrid, battery and fuel cell electric vehicles: From electrochemistry to market prospects. Electroch Acta 84:235–249

Roberts S, Gunn G (2014) Cobalt. In Gunn, G (ed) Critical metals handbook, 1st edn. John Wiley & Sons, Keyworth, Nottingham, UK, pp 122–147

Scrosati B (2000) Recent advances in lithium ion battery materials. Electroch Acta 45:2461–2466

Scrosati B, Garche J (2010) Lithium batteries: status, prospects and future. J Pow Sources 195:2419–2430

Shedd K (2014) Mineral commodity summary: cobalt. Retrieved May 21, 2014 from USGS: http://minerals.usgs.gov/minerals/pubs/commodity/cobalt/mcs-2014-cobal.pdf

Stahel W (2006) The role of metals for designing products and solutions in the context of a sustainable society. In von Gleich A, Ayres R, Gößling-Reisemann S (eds) Sustainable metals management. Springer, Dordrecht, pp 593–607

Thielmann A, Isenmann R, Wietschel M (2010) Technologie-Roadmap Lithium-Ionen-Batterien 2030. Fraunhofer-Institut für System- und Innovationsforschung (ISI). Karlsruhe, Germany: Fraunhofer Verlag

Thielmann A, Sauer A, Isenmann R, Wietschel M (2012) Technologie-Roadmap Energiespeicher für die Elektromobilität. Fraunhofer-Institut für System- und Innovationsforschung, Karlsruhe, Germany

Tie S, Tan C (2013) A review of energy sources and energy management system in electric vehicles. Renew Sust Energy Rev 20:82–102

U.S. Geological Survey (2015) Mineral commodity summaries 2015: U.S. Geological Survey, 10.3133/70140094, accessed June 19th, 2015

Vikström H, Davidsson S, Höök M (2013) Lithium availability and future production outlooks. Appl Energy 110:252–266

von Gleich A (2006) Outlines of Sustainable Metals Industry. In: von Gleich A, Ayres R, Gößling-Reisemann S (eds) Sustainable metals management. Springer, Dordrecht, pp 4–40

Wagner R, Preschitschek N, Passerini S, Leker J, Winter M (2013) Current research trends and prospects among the various materials and designs used in lithium-based batteries. J Appl Electrochem 43:481–496

Winter M, Brodd R (2004) What are batteries, fuel cells, and supercapacitors? Chem Rev 104:4245–4269

Ziemann S, Mueller D, Grunwald A, Schebek L, Weil M (2014) Rohstoffverfügbarkeit für ein zukünftiges Mobilitäts- und Energiesystem - Was können Untersuchungen der Rohstoffkreisläufe beitragen? In: Teipel U, Reller A (eds) 3. Symp Rohstoffeffizienz und Rohstoffinnovationen. Stuttgart: Fraunhofer Verlag, pp 405–417

Acknowledgments

Part of the research was made possible through founding the research group “Cascade Use” at Oldenburg University, funded by the German Federal Ministry of Education and Research (No: 01LN1310A).

Compliance with Ethical Standards

ᅟ

Conflicts of interest

The author(s) declare that they have no competing interests

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Ming Chen

Rights and permissions

About this article

Cite this article

Pehlken, A., Albach, S. & Vogt, T. Is there a resource constraint related to lithium ion batteries in cars?. Int J Life Cycle Assess 22, 40–53 (2017). https://doi.org/10.1007/s11367-015-0925-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11367-015-0925-4