Abstract

This paper explores spatial and temporal contexts for entrepreneurship at both the regional and country level in Spain during three different periods from 2002 to 2018. Using institutional data, we find significant differences in the conditions influencing new firm formation rates by regions. Such variations in firm formation rates are mainly explained by unemployment and economic stagnation in the presence of high population density before and during the economic crisis periods. However, human capital greatly determines entrepreneurship starting in 2015. This study illustrates how a contextualized view of entrepreneurship contributes to our understanding of this phenomenon. As a result, our work enriches our understanding of the dynamic socioeconomic drivers motivating entrepreneurial action.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Entrepreneurship liberalizes the economy, promotes foreign investment, infuses new technology, and increases the standards of living (Zahra et al., 2000). As a key driver of economic dynamism, entrepreneurship markedly influences the economic growth of countries and regions (Acs and Armington, 2004). Entrepreneurship can be better understood within its historical, temporal, institutional, spatial, and social contexts. That is, context is important for understanding when, how, and why entrepreneurship occurs (Welter, 2011). The emergence of new businesses is a development process at both the individual and regional levels. However, individuals’ decisions to run a new business are shaped by region-specific factors (Fritsch and Storey, 2014). Entrepreneurs act in response to their environments, which can be considered munificent or sparse (Dubini, 1989). The existence of highly supportive regional entrepreneurial environments can actually create entrepreneurs (Gartner, 1985; Fischer and Nijkamp, 2019). Entrepreneurial activities are not evenly distributed across space and place (Parker, 2005; Sternberg, 2009); i.e., entrepreneurship processes are somewhat region-specific (Guesnier, 1994) and eventually considered urban events (Bosma and Sternberg, 2014).

Previous studies have focused on the environmental factors that may play a role in developing entrepreneurship in a country or region (e.g., Gartner, 1985; Manning et al., 1989; Navarro et al., 2017; Armington and Acs, 2002). However, few studies have examined the institutional environment for new business creation in different periods at a regional and country level under three different economic conditions in Spain's recent economic cycle: before, during and after the crisis of 2008. Therefore, this article’s purpose is to improve our understanding of the theoretical conditions and policy implications of entrepreneurship. We accomplish this objective by examining the role of regional context in stimulating such activity in different substantive periods. Then, the research question is framed as follows: What are the main contributing factors to entrepreneurship in the precrisis, during and postcrisis periods in Spain?

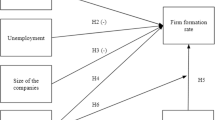

In this paper, entrepreneurship means new firm formation (Gartner, 1988). Thus, we carefully focused on the annual firm formation rate in each region. Our data were extracted from institutional secondary sources such as the INE,Footnote 1 DIRCE,Footnote 2 and MECD,Footnote 3 and the dataset includes the 18 Spanish regions and the periods of 2002–2008, 2009–2014, and 2015–2018. We applied fuzzy-set qualitative comparative analysis (fsQCA) to assess the contributing factors to the annual new firm formation rates in three different periods. Of the various determinants of entrepreneurial efficiency, we considered economic growth (Minniti, 2009), unemployment (Thurik and Verheul, 2002), population density (Delfmann et al., 2014), R&D investment (Roig-Tierno et al., 2015; Dvouletý, 2017b), and human capital (Krueger and Brazeal, 1994).

Our results show that entrepreneurship occurs in intertwined social and geographical contexts that can change over time, and we identify the potential socioeconomic conditions for entrepreneurship across different Spanish regions. Thus, our study complements the findings of other studies on entrepreneurship’s potential socioeconomic factors (e.g., Skica et al., 2019; Pejic Bach et al., 2018; Novejarque-Civera et al., 2020; Aragon-Mendoza et al., 2016) with the ultimate intention of offering better evidence-based recommendations to regional policy-makers.

The rest of the paper is structured as follows. The next section presents the conceptual framework and outlines the specific research questions. The third section describes the methodology for the data collection, data analyses and results. The paper concludes with a discussion of the results and implications for entrepreneurship research, practice, and public policy.

Theoretical framework

Business activity can be considered one of the key factors of economic development (Schumpeter, 1934). Entrepreneurship has a positive effect on the economy, creating new jobs and bringing innovation (Thurik, 2009). However, the effect of entrepreneurship can also be zero or negative (Baumol, 1996; Fritsch and Mueller, 2004; Fritsch, 2008). Thus, the sign of the effect of entrepreneurship on economic development is uncertain because there is no consensus among entrepreneurship academics.

Factors contributing to entrepreneurship can vary between countries and over time (Koellinger and Roy Thurik, 2012). Therefore, analyzing the causal relationship between entrepreneurial activity and economic cycles over time is valuable (Llopis et al., 2015). Several works study this causal relationship (e.g., Thurik et al., 2008; Koellinger and Roy Thurik, 2012; Congregado et al., 2012; Parker et al., 2012; Faria, 2015). There is also no consensus on whether the venture is pro- or countercyclical.

Entrepreneurship and economic growth

Some studies support the pro-cyclical relationship of entrepreneurial activity and cycles with GDP growth (e.g., Koellinger and Roy Thurik, 2012; Fritsch et al., 2015; Acs et al., 2016; Albulescu and Tămăşilă, 2016; Dvouletý and Mareš, 2016). For example, a positive relationship between new regional business activity and economic growth was found in Czech regions during the period 2003–2015 (Dvouletý, 2017a). In the same vein, another study showed similar results in the Nordic countries during the period 2004–2013 (Dvouletý, 2017b). Another similar study, conducted by Klapper et al. (2015), analyzed the period 2002–2012 in more than 100 countries and found that the relationship between an improved business climate (GDP growth) and entrepreneurship is positive over time.

Entrepreneurship and unemployment

Fritsch et al. (2015) showed that new business formation is countercyclical, i.e., new business formation is higher during recessions than in boom periods. Then, they found a positive relationship between unemployment rates and start-up activities in Germany. Notably, they showed that unemployment’s effect on new business formation was only significant when the unemployment level was below the trend. Similarly, Koellinger and Roy Thurik (2012) determined that entrepreneurial cycles are positively affected by national unemployment cycles. Congregado et al. (2012) also found evidence that cyclical fluctuations have persistent effects on the natural rate of entrepreneurship in Spain. Extensive empirical evidence indicates a countercyclical relationship between entrepreneurship and unemployment (Faria et al., 2009, 2010; Faria, 2013). However, in this situation entrepreneurship is usually necessity driven (Fairlie, 2011).

Entrepreneurship and R&D investment

Entrepreneurial activity is also positively related to investment in R&D (Roig-Tierno et al., 2015). Otherwise, a decline in technological innovation reduces the number of entrepreneurs (Faria, 2015). However, investments in R&D do not necessarily boost entrepreneurship (Fagerberg and Fosaas, 2014; Dvouletý, 2017b). For example, Beneito et al. (2015) showed that the behavior of R&D expenses is countercyclical due to existing credit restrictions in the market. However, this trend can be eased and even reversed in family-owned businesses and group-affiliated companies, because they are less dependent on the credit crunch in recession periods.

Entrepreneurship and education

Two forms of human capital can be distinguished within the entrepreneurial activity: general and specific. General human capital includes levels of education whereas specific human capital includes work experience and industry-specific experience (Brüderl et al., 1992). A positive relationship between the growth of the population with higher education and entrepreneurial activity cannot be confirmed (Dvouletý, 2017b). In contrast, Johannisson (2016) argues that there might be a negative relationship between them because the education system does not provide the necessary skills and capabilities for entrepreneurial activity.

However, previous studies support the positive relationship between entrepreneurship and higher education by stating that entrepreneurial activity is higher when there is a growth in the population with higher education (Karlsson et al., 1993; Coleman, 1988; Karlsson and Backman, 2011). This may occur because people acquire fundamental skills through formal education to learn about markets, technology and better recognize the opportunities of the environment (Shane, 2000). Individuals with formal education can acquire organizational skills and abilities (Grant, 1996). Thus, higher levels of education provide entrepreneurs with a greater capacity to solve problems and make decisions related to entrepreneurial activity (Baptista et al., 2014).

Entrepreneurship and population density

Population density is used as a proxy for the urban–rural dichotomy in regional studies on entrepreneurship. The OECD defines rural areas as those having a population density below 150 inhabitants/km2 (OECD, 2008). Regions with a high population density and well-educated workers may particularly strengthen local beliefs that entrepreneurship is appropriate and taken for granted, thus conditioning the influence of an individual’s start-up behavior in the region (Kibler et al., 2014). For example, new firm survival rates differed between agglomerations, moderately congested regions, and rural regions in Germany (Fritsch et al., 2006). In general, agglomeration is positively related with the rate of new firm formation (Armington and Acs, 2002; Audretsch and Fritsch, 1994; Bosma et al., 2008). However, a limited set of studies argues that rurality has a positive effect on firm formation (see Pettersson et al., 2010). Urbanization increases the likelihood a more skilled workforce’s presence and facilitates a freer flow and exchange of ideas and knowledge. Moreover, the risk of starting a business in urban areas is considered relatively low due to the rich employment opportunities that function as a safety net in case the new firm fails (Stam, 2009). Otherwise, a higher degree of urbanization can lead to the pursuit of economies of scale, which enables firms to serve their clients more efficiently and leaves fewer opportunities for small firms (Verheul et al., 2001). Other negative effects of agglomeration include excessive competition, possibly resulting in increased wages and elevated input prices, thus discouraging entry (Nyström, 2007; Van Stel and Suddle, 2008). Although empirical results appear to confirm the importance of urbanization for entrepreneurship (Sternberg, 2011), urbanization’s influence on new firm formation is not universally agreed upon.

Conditions and method

Data and conditions

The rates of entrepreneurship, economic growth and employment have become key variables in open and developed economies for the elaboration a region’s economic policies.

In the last decade, national and community public institutions have implemented a set of measures aimed at removing obstacles to the creation of companies and relaunching the entrepreneurial spirit in Europe. SMEs are a dynamic agent of employment and growth in a region and, in the long term, entrepreneurial activity will reduce unemployment rates (Thurik and Verheul, 2002) and increase the GDP per capita of regions (Audretsch and Fritsch, 2002).

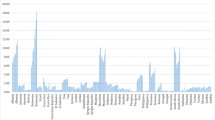

This paper studies the evolution and demographic behavior of Spanish companies and their relationship with economic growth from a regional perspective in three different periods: 2002–2008, 2009–20,014, and 2015–2018. The choice of the periods corresponds to the behavior and trend of the business creation ratio in Spain (see Fig. 1).

The sample used in this study includes all Spanish regions. However, the regions of Ceuta and Melilla appear together due to data availability issues. Therefore, we have 18 regions in total. The period includes the years from 2002 to 2018.

The conditions and sources used in the study are as follows:

-

Business Creation Rate (BCR). (Active companies n – Active companiesn-1)/(Active companiesn-1). Source: INE.Footnote 4 DIRCE.Footnote 5

-

Unemployment rate (TL). Number of unemployed/total number of people in the workforce. This condition is positively related to the creation of companies. The greater the number of unemployed people is, the greater the availability of resources for the creation of companies. Source: INE. EFPA.Footnote 6 EPA.

-

GDP per capita (GDP). Indicates the relationship between the total value of all goods and final services that are generated during a year by a regional economy and its number of inhabitants in that year. GDP per capita is a good indicator of the quality of life in a region. This variable is associated with a region’s economic growth. GDP is widely used as an indicator to measure the economic growth of a region. Source: INE. CREFootnote 7

-

Population density (D). Number of people/land area. The surface area is expressed in square kilometers. It is necessary to control the potential effect that the region’s density has on decisions to create a company. Source: INE. Information source of the data of “Territorial extension”. INE. Population Register.Footnote 8

-

Graduates (EDU). Gross rate of graduates. Indicates the percentage of the population that has completed superior education. The educational level of the population is a variable related to human capital. The educational level attained by people is related to entrepreneurial capacity, decreasing the intellectual costs of creating a company. Source: MECD. Education statistics in Spain University education (1st and 2nd cycle).

-

Investment in R&D over GDP (R&D). Percentage of R&D expenses divided by GDP at market prices. Source: INE. CRE.

For all described conditions, the variation for each period is calculated as the variation rate between the first and the final year of each period. This rate of variation is applied to all conditions as well as the outcome.

Fuzzy set Qualitative Comparative Analysis (fsQCA)

QCA is a comparative analysis tool that analyzes the causal relationships between certain variables as specified in the context or situation. It constitutes an optimal tool for analyzing complex causality relationships in contexts in which researchers work with “medium or small samples”.

The development of the analysis offers three alternative results: the complex, the parsimonious and the intermediate solution. In our study, the intermediate solution is analyzed. It represents an alternative of intermediate complexity that assumes that only some of the possible causal configurations that do not include real cases would have derived in the analyzed result (Ragin and Sonnett, 2005).

We want to analyze those settings that are favorable for the increase in the creation rates of regional companies.

Table 1 shows the definition of the outcome and the different conditions selected including two economic attributes, one technological attribute, and one educational attribute.

The correct use of the fsQCA is based on correct transformation of the continuous variables into fuzzy variables or diffuse categories. This methodology requires not only measuring the variables but also calibrating them based on external standards.

The first step in fsQCA is calibration, which enables assessment of whether a particular region belongs to the set of regions where the outcome or conditions are present or absent. As indicated by Ragin (2008), calibration consists of transforming raw data into values that belong to the set. The direct method of calibration proposed by Ragin was used to define three thresholds: fully inside the set (0.95), fully outside the set (0.05), and the point of maximum ambiguity (0.5).

The criteria used to calibrate the variables should reflect the field of study’s standards and be outside the measure of the variable itself.

Next, the process followed in this study for the calibration of the selected continuous variables will be explained.

To transform a quantitative variable into a diffuse set, the case study group must first be established, because this determines the values for the calibration of the conditions. In our work, the study group is made up of the 18 regions of Spain (Ceuta and Melilla are presented together).

Our first objective is to identify which region has a high variation in the rate of variation used. Calibration is employed to determine which regions are totally outside this category and which have different degrees of integration.

To identify the determining points of the GDP per capita category, we considered the forecasts made by the OECD regarding the GDP growth for the periods 2002–2008, 2009–2014, and 2015–2018.

For the period 2002–2008, the forecasts for GDP growth rates for Spain made by the OECD were set at 21%. During this period, all regions presented variation rates higher than that forecast. Thus, the value of 21% is established as a low limit; any region that has a variation of less than 21% in its GDP growth rates is assumed to have low growth. Those regions whose variations in GDP growth rates exceed 30% are considered regions with full economic development in the period studied. Variations that remain approximately 25.7% are excluded from the category. For the periods 2009–2014 and 2015–2018, the OECD forecasts for the GDP growth rates for Spain were set at -4% and 10%, respectively. The economic crisis in Spain produced negative rates in GDP growth. After the crisis period, the GDP in the regions of Spain rebounded with positive growth rates.

For the period 2002–2008, the OECD shows a positive variation in the growth rate related to investment in R&D. The forecasts are positive with an investment variation rate of 30%.

The upper limit is 37.2%. Those regions whose variation in R&D investment rates exceeds the percentage are considered regions with efficient investment. The lower limit was set to 30%. Any community that presents a variation less than 30% in its growth rates of investment in R&D is considered a region with insufficient investment. Variations that remain approximately 33.6% are excluded from the category. The periods 2009–2014 and 2015–2018 show a positive variation in the growth rate related to investment in R&D. The forecasts are positive with an investment variation rate of 30%. For the periods 2009–2014 and 2015–2018, the forecasts on the R&D growth rates for Spain made by the OECD were set at -8.59% and -1%, respectively. In the period that explains the economic crisis and in subsequent periods, investment in R&D has negative growth rates in the regions of our country.

In the period 2002–08, according to OECD data, the variation in unemployment rates in Spain was -1.7%. From 2002 to 2008, the regions in Spain have positive and negative variations in unemployment rates.

The lower limit corresponds to positive variations in the unemployment rate of 2%. Any region that presents a positive variation in its unemployment rates has not met the objective set by the OECD. No variation in unemployment rates is in the center.

Those regions whose variation in unemployment growth rates are -1.7% are considered communities with full economic development. In the subsequent study periods, there are positive and negative unemployment rates. The OECD for the 2009–2014 period shows increases in the unemployment rate of 36.88%, and for the 2015–2018 period, the increases are -22.47%. Spain had high unemployment rates during the period of economic crisis. Once the crisis was over, unemployment rates begin to decrease.

In education, for the period 2002–08, the OECD shows positive variation rates in the percentage of people with higher education, which is 23% in Spain. The percentage of people with higher education in Spain increased by 23% from 2002 to 2008. The upper limit is located at 23%, and those regions whose variation in the percentage of people with higher education surpasses 23% are regions with a correct development in human capital. The lower limit is 15%, so that any region that presents a variation under 15% has an insufficient level of training among its inhabitants. Variations that remain approximately 19% are excluded from the category. For the periods 2009–2014 and 2015–2018, the OECD reveals positive variation rates in the percentage of people with higher education, the values of which are of 21% and 8%, respectively. For the three periods, there is an increase in the percentage of people with higher education.

For the period 2002–08, for the variations in density, the upper limit is set at 10%. Those regions whose variations in density rates exceed 10% have adequate density for the study objective. The lower limit corresponds to positive variations of less than 7%. Any region that presents a variation of less than 7% has a degree of density that is not adequate in the period studied for the output. Variations that remain approximately 8.5% are excluded from the category.

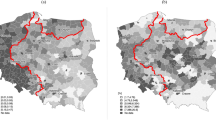

According to data from BBVA and IVIE Foundation, the average Spanish population growth rate from 2000 to 2018 is quantified at 11.45%, but growth is not homogeneous in all regions. Spain has regions with high and moderate growth and even regions with negative growth in the period studied. Reynolds (1997) and Garofoli (1994) show that the increase in the number of inhabitants has an intense impact on levels of business creation and self-employment. The most affected region by depopulation is Castilla-León, where the European index falls to 26.1 people per square kilometer. For later periods, more modest increases in density are used due to the population behavior in regions in Spain.

The variation in the business creation rate is positive in the 2000–2008 period. The OECD determines a positive variation of 26.3%. The value of 20% is established as a low limit. Any region that presents a variation of less than 20% in its business creation rates has little entrepreneurial dynamism. Those regions whose variation exceeds 26.3% are considered regions with full development entrepreneurs. Variations that remain approximately 23.1% are excluded from the category. The variation in the business creation rate is positive in the period analyzed. For the 2009–2014 period, the OECD presents negative increases for Spain in the business creation rate, -9.20%. From 2015–2018, it shows newly positive increases with a value of 5.20%. Although Spain grew again, it failed to reach the growth rate identified before the economic crisis in the 2000–2008 period.

Table 2 shows the calibrated values of the change rate (for fully inside the set, fully outside the set, and the point of maximum ambiguity) and descriptive statistics for each condition.

Findings

First, we analyzed the necessary conditions for high changes in business creation rates. Table 3 shows results of the analysis of necessary conditions for the three periods. In the period 2002–2008, there is a single necessary condition for the high business creation rate, as shown by the consistency level of 0.91. As expected, all regions that experienced a high business creation rate feature high population density variation rates (fsTD). The coverage of high population density variation rates as the only necessary condition of high business creation rates lies at 0.71. This means that 71% of the cases that exhibit high population density variation rates experienced high business creation rates in the first period. However, the high increase in unemployment rates (fsTL) appears as the necessary condition in the period 2009–2014. The opposite solution is found in the third period (2015–2018), where the condition of moderate or nonincrease in the unemployment rate (~ fsTL) appears necessary. There is also one further necessary condition in the third period: high population density variation rates (fsTD). Therefore, our results suggest that economic and demographic conditions are necessary for the high variation in the rate of business creation.

Possible causal configurations for the growth in entrepreneurship in all periods are explained in Table 4.

The presence of high growth in unemployment rates combined with high growth rates in the region’s density, together with moderate or low growth in R&D investments (condition 1a), accounts for 25.5% of the cases with high growth in business creation rates (raw coverage 0.255) in the first period. Moreover, cases sharing this combination of conditions strongly agree in displaying the outcome (consistency 0.986). This configuration also has a unique coverage of 0.125. The output is explained exclusively by this combination in 12.5% of the regions in Spain. The raw coverage index of a configuration indicates the total proportion of positive cases explained by such configuration: in our case, high growth rates in company creation. The consistency index indicates the proportion of cases with a certain configuration that is positive (Ragin, 2006). Canarias and Madrid are regions explained by this configuration. A second causal configuration (1b) emerges as the most relevant because it explains 27.4% of the high growth in business creation rates. This configuration presents high growth rates in unemployment and density, together with a moderate or zero growth in GDP per capita. The high growth in business creation rates is explained exclusively by this combination in 14% of the regions. This configuration has a high consistency (99.1%). The cases that explain this configuration are those of the islands: Baleares and Canarias. In addition, high growth in business creation rates occurs with high rates of GDP per capita, slight or zero growth in the unemployment rate, high-density rates and high growth in the percentage of people with higher education (1c). This configuration shows the lowest raw (0.124) and unique (0.121) coverage. This is the case in Andalucía. In sum, the whole set of the three causal configurations (1a, 1b, and 1c) have a set relation that is highly consistent (98.8%) and relevant (coverage 52%). That is, high variations in the rates of company creation in the first period (2002–2008) may result from these three different combinations of conditions, which explain 52% of the outcome.

In the second period (2009–2014), our results suggest that a high increase in unemployment rates along with a moderate or zero increase in GDP per capita (2c) explains 46.8% of the cases with high increase in the business creation rate. In this period, entrepreneurship seems to be necessity-driven rather than opportunity-driven. This causal combination uniquely explains 11% of the high growth business creation rates. The set of the four causal configurations (2a, 2b, 2c, and 2d) has a coverage of 94% and a consistency of 99.9%.

In the last analyzed period, 2015–2018, the relevant solution indicates that the following conditions lead to a high increase in the creation of companies: moderate or nongrowth in GDP per capita but also in R&D investment, together with a high increase in density along and nongrowth unemployment rates (3a). This configuration explains 34.1% of the outcome. Density is again decisive in this period as a factor that enhances entrepreneurship. A new condition appears as relevant, population with a high rate of graduate students (3b). Although entrepreneurship by necessity seemed to be the trigger in the previous period, in this period, the variation in new company creation is characterized by qualified entrepreneurs with superior education. This condition did not appear in any of the previous periods. The set of the two causal configurations has a coverage of 60.8% and a consistency of 93.7%. Therefore, human capital together with economic improvement functions as a relevant condition for the high growth in business creation rates in the postcrisis period.

Discussion

Our purpose was to enhance understanding of the conditions and policy implications for entrepreneurship. Then, we examined the role of regional context in stimulating such activity in different substantive periods.

In the period 2002–2008 but also during the economic crisis 2009–2014, we found a countercyclical relationship between business activity and GDP growth. The absence of GDP per capita growth appears as a sufficient condition to foster entrepreneurship in the Spanish regions. The result verifies results obtained by Fritsch et al. (2015), which established an inverse relationship between business activity and the economic cycle. In other words, entrepreneurship is contagious. Our findings contradict results obtained by Klapper et al. (2015), Koellinger and Roy Thurik, (2012), Fritsch et al. (2015), Acs et al. (2016), Albulescu and Tămăşilă (2016), Dvouletý and Mareš (2016), and Dvouletý (2017a) that defend the positive relationship between GDP growth and entrepreneurship.

According to the study results, for the period 2002–2014, high unemployment rates lead to an increase in business creation rates. Our results are in line with work by Fristch et al. (2015), Faria (2015) and Fairlie (2011), wherein they argue that the relationship between new company formation in periods of high unemployment (periods of economic recession) is greater than in boom periods. There is a positive relationship between unemployment and business creation. Unemployment stimulates entrepreneurship. Entrepreneurship out of necessity is based on people’s need to be self-employed in order to obtain economic income because they cannot find employment given the current situation. Opposite results are found in the last period analyzed (2015–2018), where the opportunity effect appears. The results obtained in this period are consistent with those obtained by Schumpeter (1942), Audretsch (1995) and Audretsch and Thurik (2000), in which an inverse relationship between unemployment and company creation is detected. Inverse causality is also analyzed between the variables treated at work: an increase in the creation of companies reduces unemployment levels.

R&D investment appears relevant in the last analyzed period, 2015–2018. Our results show a negative relationship between R&D and entrepreneurship in contrast to Roig-Tierno et al. (2015), who support a positive relationship. A decline in technological innovation reduces entrepreneurial activity (Faria, 2015). Our results are in line with those of Fagerberg and Fosaas (2014), Amorós et al. (2019), and Dvouletý (2017b), who showed that investments in R&D do not necessarily boost entrepreneurship and R&D transfer increases the flow of information and market competitiveness. There is a reduction in the advantages of economy of scale that allows new ventures to enter. Some R&D mechanisms could be conditioned to the availability of educational institutions to transfer information and apply it to the market. The role of universities in terms of specific training for new generations of entrepreneurs is very important. Universities train in better technical and managerial skills, which could be relevant for creating better conditions for more dynamic new companies and making them more competitive.

Notably, human capital appears as an important condition for entrepreneurship after 2015. However, Dvouletý (2017b) showed that a positive relationship between population growth with higher education and business activity cannot be confirmed. Johannisson (2016), on the contrary, found a negative relationship between them. One possible explanation is that the education system does not provide the necessary skills and abilities for entrepreneurial activity. In Spain, we determined that the relationship between human capital and entrepreneurship begins after the economic crisis. Our results reinforce the work of Karlsson et al. (1993) and Coleman (1988), who argue that business activity is greater when there is a population growth with superior education. According to the latest data from the NECI (National Entrepreneurship Context Index), education in entrepreneurship is insufficient both at school and university levels. Regardless of the educational model applied to enhance entrepreneurship, throughout the educational process the individual must be provided with theoretical and practical tools and skills to be an entrepreneur. Thus, at all the stages of the Spanish educational model, young people should experience a "push towards entrepreneurial culture".

According to the latest data published by the Spanish Federation of Municipalities and Provinces (FEMP, 2017), Spain is the most depopulated country in the south of the European Union. An extreme case is exemplified by the region of Castilla-León. We found that before the crisis, a high positive variation in population density was necessary for entrepreneurship. Although a growing population is clearly positively related to new firm formation (Armington and Acs, 2002), this relationship differs with the intensity of population change and across regional contexts (Delfmann et al., 2014). Both urban and rural contexts have potential for generating both opportunity-driven and necessity-driven entrepreneurship, but rural entrepreneurship is typically seen as necessity-driven because of limited employment opportunities. However, rural entrepreneurs mix an intimate knowledge of and concern for the place with strategically built nonlocal networks, i.e., the best of two worlds, thus providing a source of opportunities and allowing access to resources otherwise not available (Korsgaard et al., 2015). Therefore, Spain should develop rural development policies that prioritize provision of basic services to the country’s most exiled regions to solve the problem of rural depopulation. Politicians from economically less privileged but politically overrepresented regions may claim that poor, depopulated, and rural areas deserve to have more population density and human capital, thus fostering entrepreneurship in their regions. However, regions depopulated by deaths and migration in times of famine will not recover earlier population densities in the short term.

Our results explain that a bad economic situation drove self-employment in Spain from 2002 to 2014. Therefore, we can see a change in the conditions for creating companies in Spain at the regional level. Before and during the crisis, entrepreneurship was driven by necessity. However, after 2015, entrepreneurship seems to respond to opportunity rather than necessity issues.

This study has several limitations. First, the data come from secondary sources that do not always provide it accurately or are aggregated in a way that restricts the use of different units of analysis (e.g., municipality level). Second, the after-crisis period is too short, spanning only four years, because of data available when we launched our study. Extending this last period may result in better conclusions.

Future studies may investigate the influences of additional contextual conditions such as political or gender issues and norms affecting the observed relationships. Moreover, our understanding of regional economic systems may be enhanced by considering entrepreneurs as economic agents actively interacting with their urban or regional systems. Future researchers may investigate this phenomenon in other countries with similar geographical, political, economic, and social characteristics (e.g., Portugal and Italy), thus favoring other comparative analysis. Furthermore, the regional setting and the intensity of population decline should be considered when determining the coping mechanisms needed for dealing with the consequences of decline (Delfmann et al., 2014). Future researchers may also approach the phenomenon from diverse theoretical viewpoints, including economic, social, and psychological, and use different levels of analysis, including the individual, group, firm, and/or population levels (Fritsch and Storey, 2014). For example, because the rural–urban difference is sizable and the impact factors would be very different, future studies could separate the rural and urban parts of each region. Future research should also pay attention to the market interest rate, especially the interest rate on investment loans and state actions taken in financial support for entrepreneurial initiatives. All things considered, there is potential for accumulating knowledge to develop a well-articulated underlying theory of entrepreneurship. We hope our work will inspire others to take deeper looks at this exciting research field on entrepreneurship.

Conclusions

Over the past three decades, there has been a growing recognition of the impact of both formal institutions and other soft factors such as social capital on entrepreneurship (Fritsch and Storey, 2014). In addition, a contextual approach seems to have strengthened its position considerably in recent times because historical, temporal, institutional, spatial, and social contexts provide individuals with opportunities and set boundaries for their actions (Welter, 2011). The conditions contributing to entrepreneurship vary between regions and over time. We can establish a relationship between entrepreneurship and economic cycles. Therefore, our purpose in this paper was to re-examine the contextual determinants of regional variation in firm birth rates in Spain with renewed data as well as recent works emphasizing the impact of human capital on entrepreneurship (Baptista et al., 2014). Entrepreneurs find real opportunities (Kirzner, 1973) when they rely on exogenous change to generate them (Vaughn, 1994). However, regional variations in firm birth rates usually depend on a set of regional determinants such as unemployment, population density, human capital, and R&D investment. Using longitudinal data from institutional sources, we collected annual data on firm births for the 18 Spanish regions (Ceuta and Melilla were grouped) from 2002–2018 but divided into three subperiods: 2002–2008 (before crisis), 2009–2014 (during crisis), and 2015–2018 (after the crisis). Our results show significant differences in the determinants of new firm formation rates among regions and periods. Such variations before the crisis are substantially explained by regional differences in population density growth. During the crisis, however, such differences are mainly explained by unemployment growth rates. Otherwise, the proclivity to start new firms is, after the crisis period, a function of local human capital, which spurs entrepreneurship and makes the region attractive for venture capitalists, migrants, and visitors.

Notes

INE: Instituto Nacional de Estadística.

DIRCE: Directorio Central de Empresas, INE.

MECD. Ministry of education and professional training. Provides indicators related to contextual factors that can influence the activity and education situation.

INE: The National Statistics Institute is a legally independent administrative Autonomous institution assigned to the Ministry of Economy and Business, via the Secretary of State for the Economy and Business Support.

DIRCE. Central directory of companies brings together in a unique information system all Spanish companies and their local units located in the national territory. It includes all economic activities except Agriculture and Fisheries, Public Administration, Defense and Compulsory Social Security, the activities of households that employ domestic personnel and Extraterritorial Organizations.

EFPA. The Economically Active Population Survey (EAPS) has been conducted since 1964. The current methodology has been used since 2005.This continuous and quarterly research is aimed at families, intended to collect data on the labor force and its various categories (employed, unemployed) as well as on the population outside the labor market (inactive). The initial sample is taken from about 65,000 families per quarter, equivalent to approximately 160,000.

CRE. The Spanish Regional Accounts (SRA) is a statistical operation that the INE has been carrying out conducted since 1980 and whose main objective is to provide a quantified, systematic and as complete a description as possible of the regional economic activity in Spain (Autonomous Communities and provinces), during the considered reference period. This information allows the analysis and evaluation of the structure and development of the regional economies and serves as a statistical base for the design, execution, and monitoring of regional policies. The regional accounts are a specification of the national accounts; that is, the Spanish National Accounts (SNA) are the conceptual and quantitative framework in which the SRA is integrated.

Population figures provide a quantitative measurement of the population resident in Spain, in each autonomous community. Population series since 1971, which is obtained from the intercensal estimates of the population, for the period 1971–2012, and from the operation Population figures itself, as of 2012. The Register of inhabitants of May 1, 1996 of the I.N.E. it is the source of information for the calculation of the indicators in table 1.1: Population density; Percentage of population from 0 to 29 years and territorial extension.

References

Ács, Z. J., Szerb, L., & Autio, E. (2016). Global entrepreneurship and development index 2015. Springer.

Acs, Z., & Armington, C. (2004). Employment growth and entrepreneurial activity in cities. Regional Studies, 38(8), 911–927.

Albulescu, C. T., & Tămăşilă, M. (2016). Exploring the role of FDI in enhancing the entrepreneurial activity in Europe: a panel data analysis. International Entrepreneurship and Management Journal, 12(3), 629–657.

Amorós, J. E., Poblete, C., & Mandakovic, V. (2019). R&D transfer, policy and innovative ambitious entrepreneurship: evidence from Latin American countries. The Journal of Technology Transfer, 44(5), 1396–1415.

Aragon-Mendoza, J., del Val, M. P., & Roig-Dobón, S. (2016). The influence of institutions development in venture creation decision: A cognitive view. Journal of Business Research, 69(11), 4941–4946.

Armington, C., & Acs, Z. (2002). The determinants of regional variation in new firm formation. Regional Studies, 36(1), 33–45.

Audretsch, D. B. (1995). Innovation and industry evolution. Mit Press.

Audretsch, D. B., & Fritsch, M. (1994). The geography of firm births in Germany. Regional Studies, 28(4), 359–365.

Audretsch, D. B., & Fritsch, M. (2002). Growth regimes over time and space. Regional Studies, 36(2), 113–124.

Audretsch, D. B., & Thurik, A. R. (2000). Capitalism and democracy in the 21st century: from the managed to the entrepreneurial economy. Journal of Evolutionary Economics, 10(1–2), 17–34.

Baptista, R., Karaöz, M., & Mendonça, J. (2014). The impact of human capital on the early success of necessity versus opportunity-based entrepreneurs. Small Business Economics, 42(4), 831–847.

Baumol, W. J. (1996). Entrepreneurship: productive, unproductive, and destructive. Journal of Business Venturing, 11(1), 3–22.

Beneito, P., Rochina-Barrachina, M. E., & Sanchis-Llopis, A. (2015). Ownership and the cyclicality of firms’ R&D investment. International Entrepreneurship and Management Journal, 11(2), 343–359.

Bosma, N., & Sternberg, R. (2014). Entrepreneurship as an urban event? Empirical evidence from European cities. Regional Studies, 48(6), 1016–1033.

Bosma, N., Suddle, K., & Schutjens, V. A. J. M. (2008). Whither a flat landscape? Regional differences in Entrepreneurship in the Netherlands (No. H200805). EIM Business and Policy Research.

Brüderl, J., Preisendörfer, P., & Ziegler, R. (1992). Survival chances of newly founded business organizations. American Sociological Review, 57(2), 227–242.

Coleman J. S. (1988). Social capital in the creation of human capital. American Journal of Sociology, 94(Suppl.), 95–120.

Congregado, E., Golpe, A. A., & Parker, S. C. (2012). The dynamics of entrepreneurship: hysteresis, business cycles and government policy. Empirical Economics, 43(3), 1239–1261.

Delfmann, H., Koster, S., McCann, P., & Van Dijk, J. (2014). Population Change and New Firm Formation in Urban and Rural Regions. Regional Studies, 48(6), 1034–1050.

Dubini, P. (1989). The influence of motivations and environment on business start-ups: Some hints for public policies. Journal of Business Venturing, 4(1), 11–26.

Dvouletý, O., & Mareš, J. (2016). Determinants of regional entrepreneurial activity in the Czech Republic. Economic Studies & Analyses/Acta VSFS, 10(1), 31–46.

Dvouletý, O. (2017a). Can policy makers count with positive impact of entrepreneurship on economic development of the Czech regions?. Journal of Entrepreneurship in Emerging Economies.

Dvouletý, O. (2017b). Determinants of Nordic entrepreneurship. Journal of Small Business and Enterprise Development.

Fagerberg, J., & Fosaas, M. (2014). Innovation and innovation policy in the Nordic region. Center for Technology, Innovation and Culture (TIK), University of Oslo, P.O.Box 1108 Blindern, N-0317 Oslo, Norway. Online at https://mpra.ub.uni-muenchen.de/56114/ MPRA Paper No. 56114, posted 22 May 2014 13:17 UTC

Fairlie, R. W. (2011). Kauffman Index of Entrepreneurial Activity 1996–2010. Available at SSRN 1780284.

Faria, J. R. (2013). Entrepreneurship and unemployment cycles: a delay differential equation approach. Frontiers of Economics in China, 8, 288–292.

Faria, J. R. (2015). Entrepreneurship and business cycles: technological innovations and unemployment. International Entrepreneurship and Management Journal, 11(2), 253–265.

Faria, J. R., Cuestas, J. C., & Gil-Alana, L. (2009). Unemployment and entrepreneurship: a cyclical relation? Economics Letters, 105, 318–320.

Faria, J. R., Cuestas, J. C., & Mourelle, E. (2010). Entrepreneurship and unemployment: a nonlinear bidirectional causality? Economic Modelling, 27, 1282–1291.

FEMP. (2017). Documento de acción. Comisión de la despoblación. Listado de medidas para luchar contra la despoblación. http://www.femp.es/sites/default/files/multimedia/documento_de_accion_comision_de_despoblacion_9-05-17.pdf

Fischer, M. M., & Nijkamp, P. (2019). The nexus of entrepreneurship and regional development. In Handbook of Regional Growth and Development Theories: Edward Elgar Publishing.

Fritsch, M. (2008). How does new business formation affect regional development? Introduction to the special issue. Small Business Economics, 30(1), 1–14.

Fritsch, M., & Mueller, P. (2004). Effects of new business formation on regional development over time. Regional Studies, 38(8), 961–975.

Fritsch, M., & Storey, D. J. (2014). Entrepreneurship in a Regional Context: Historical Roots, Recent Developments and Future Challenges. Regional Studies, 48(6), 939–954.

Fritsch, M., Brixy, U., & Falck, O. (2006). The effect of industry, region, and time on new business survival–a multi-dimensional analysis. Review of Industrial Organization, 28(3), 285–306.

Fritsch, M., Kritikos, A., & Pijnenburg, K. (2015). Business cycles, unemployment and entrepreneurial entry – evidence from Germany. International Entrepreneurship and Management Journal, 11(2), 267–286.

Garofoli, G. (1994). New firm formation and regional development: the Italian case. Regional Studies, 28(4), 381–393.

Gartner, W. B. (1985). A conceptual framework for describing the phenomenon of new venture creation. Academy of Management Review, 10(4), 696–706.

Gartner, W. B. (1988). “Who is an entrepreneur?” is the wrong question. American Journal of Small Business, 12(4), 11–32.

Grant, R. (1996). Toward a knowledge-based theory of the firm. Strategic Management Journal, 17, 109–122.

Guesnier, B. (1994). Regional variations in new firm formation in France. Regional Studies, 28(4), 347–358.

Johannisson, B. (2016). Limits to and prospects of entrepreneurship education in the academic context. Entrepreneurship & Regional Development, 28(5–6), 403–423.

Karlsson, C., & Backman, M. (2011). Accessibility to human capital and new firm formation. International Journal of Foresight and Innovation Policy, 7(1–3), 7–22.

Karlsson, Ch., Johannisson, B., & Storey, D. (1993). Small Business Dynamics: International, National, and Regional Perspectives. New York: Routledge.

Kibler, E., Kautonen, T., & Fink, M. (2014). Regional Social Legitimacy of Entrepreneurship: Implications for Entrepreneurial Intention and Start-up Behaviour. Regional Studies, 48(6), 995–1015.

Kirzner, I. M. (1973). Competition and Entrepreneurship. University of Chicago Press.

Klapper, L., Love, I., & Randall, D. (2015). New firm registration and the business cycle. International Entrepreneurship and Management Journal, 11, 287–306.

Koellinger, P. D., & Roy Thurik, A. (2012). Entrepreneurship and the business cycle. Review of Economics and Statistics, 94(4), 1143–1156.

Korsgaard, S., Ferguson, R., & Gaddefors, J. (2015). The best of both worlds: how rural entrepreneurs use placial embeddedness and strategic networks to create opportunities. Entrepreneurship & Regional Development, 27(9–10), 574–598.

Krueger, N. F., Jr., & Brazeal, D. V. (1994). Entrepreneurial potential and potential entrepreneurs. Entrepreneurship Theory and Practice, 18(3), 91–104.

Llopis, J. A. S., Millán, J. M., Baptista, R., Burke, A., Parker, S. C., & Thurik, R. (2015). Good times, bad times: entrepreneurship and the business cycle. International Entrepreneurship and Management Journal, 11(2), 243–251.

Manning, K., Birley, S., & Norburn, D. (1989). Developing a new ventures strategy. Entrepreneurship Theory and Practice, 14(1), 67–76.

Minniti, M. (2009). Gender issues in entrepreneurship. Foundations and Trends® in Entrepreneurship, 5(7–8), 497–621.

Navarro, T. M., Durán, F. M., & Santos, J. L. (2017). Un índice de competitividad regional para España. Revista de Estudios Regionales, 109, 67–94.

Novejarque-Civera, J., Pisá-Bó, M., & López-Muñoz, J. F. (2020). Do contextual factors influence entrepreneurship? Spain’s regional evidences. International Entrepreneurship and Management Journal, 1–25.

Nyström, K. (2007). An industry disaggregated analysis of the determinants of regional entry and exit. The Annals of Regional Science, 41(4), 877–896.

OECD. (2008). OECD factbook 2008: Economic, environmental and social statistics. Publications de l'OCDE.

Parker, S. C. (2005). Explaining regional variations in entrepreneurship as multiple occupational equilibria. Journal of Regional Science, 45(4), 829–850.

Parker, S. C., Congregado, E., & Golpe, A. A. (2012). Is entrepreneurship a leading or lagging indicator of the business cycle? Evidence from UK self-employment data. International Small Business Journal, 30(7), 736–753.

Pejic Bach, M., Aleksic, A., & Merkac-Skok, M. (2018). Examining determinants of entrepreneurial intentions in Slovenia: applying the theory of planned behaviour and an innovative cognitive style. Economic research-Ekonomska istraživanja, 31(1), 1453–1471.

Pettersson, L., Sjölander, P., & Widell, L. M. (2010). Firm formation in rural and urban regions explained by demographical structure, 50th Congress of the European Regional Science Association: “Sustainable Regional Growth and Development in the Creative Knowledge Economy”, 19–23 August 2010. Sweden, European Regional Science Association (ERSA), Louvain-la-Neuve: Jönköping.

Ragin, C. C. (2006). Set relations in social research: Evaluating their consistency and coverage. Political Analysis, 14(3), 291–310.

Ragin, C. C. (2008). Measurement versus calibration: A set‐theoretic approach. In The Oxford handbook of political methodology.

Ragin, C. C., & Sonnett, J. (2005). Between complexity and parsimony: Limited diversity, counterfactual cases, and comparative analysis. In Vergleichen in der Politikwissenschaft (pp. 180–197). VS Verlag für Sozialwissenschaften.

Reynolds, P. D. (1997). Who Starts New Firms? Preliminary Explorations of Firms-in-Gestation. Small Business Economics, 9(3), 449–462.

Roig-Tierno, N., Alcázar, J. N., & Ribeiro-Navarrete, S. (2015). Use of infrastructures to support innovative entrepreneurship and business growth. Journal of Business Research, 68(11), 2290–2294.

Schumpeter, J. A. (1934). The theory of economic development. Cambridge: Harvard University Press.

Schumpeter, J. A. (1942). Capitalism, socialism and democracy. New York: Harpers.

Shane, S. (2000). Prior knowledge and the discovery of entrepreneurial opportunities. Organization Science, 11, 448–469.

Skica, T., Mroczek, T., & Leśniowska-Gontarz, M. (2019). The impact of selected factors on new business formation in the private healthcare sector. International Entrepreneurship and Management Journal, 15(1), 307–320.

Stam, E. (2009). Entrepreneurship, evolution and geography (No. 0907). Papers on economics and evolution.

Sternberg, R. (2009). Regional Dimensions of Entrepreneurship. Now Publishers.

Sternberg, R. (2011). Regional determinants of entrepreneurial activities–theories and empirical evidence (pp. 33–57). Handbook of Research on Entrepreneurship and Regional Development, Cheltenham: Elgar.

Thurik, A. R. (2009). Entreprenomics: entrepreneurship, economic growth and policy (pp. 219–249). Entrepreneurship: Growth and Public Policy.

Thurik, A. R., Carree, M. A., Van Stel, A., & Audretsch, D. B. (2008). Does self-employment reduce unemployment? Journal of Business Venturing, 23(6), 673–686.

Thurik, R., & Verheul, I. (2002). The relationship between entrepreneurship and unemployment: the case of Spain. Centre for Advanced Small Business Economics: Faculty of Economics, Erasmus University, Rotterdam.

Van Stel, A., & Suddle, K. (2008). The impact of new firm formation on regional development in the Netherlands. Small Business Economics, 30(1), 31–47.

Vaughn, K. I. (1994). Austrian Economics in America: The Migration of a Tradition. Cambridge University Press.

Verheul, I., Wennekers, S., Audretsch, D., & Thurik, R. (2001). An eclectic theory of entrepreneurship: policies, institutions and culture (No. 01–030/3). Tinbergen Institute Discussion Paper.

Welter, F. (2011). Contextualizing Entrepreneurship-Conceptual Challenges and Ways Forward. Entrepreneurship Theory and Practice, 35(1), 165–184.

Zahra, S. A., Ireland, R. D., Gutierrez, I., & Hitt, M. A. (2000). Privatization and entrepreneurial transformation: Emerging issues and a future research agenda. Academy of Management Review, 25(3), 509–524.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Pisá-Bó, M., López-Muñoz, J.F. & Novejarque-Civera, J. The ever-changing socioeconomic conditions for entrepreneurship. Int Entrep Manag J 17, 1335–1355 (2021). https://doi.org/10.1007/s11365-020-00737-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11365-020-00737-z