Abstract

This study examines the effectiveness of CEO compensation monitoring depending on the extent of family involvement in the firm. Considering the contradictory evidence on the effects of family involvement on CEO compensation reported by the literature to date, we adopt a procedural conception of CEO monitoring – that reflect processes and rules used in family firms for the alignment of CEO incentives structure to the firm interests –, to test four hypotheses derived from agency and socioemotional wealth (SEW) perspectives. Using a sample of 357 family and non-family Spanish companies, the results show that CEO compensation monitoring is inversely related to family status, and the relationship between CEO compensation monitoring and firm performance is stronger in firms where family influence is higher. In addition, we found that the presence of a family CEO negatively affects the implementation of economically instrumental monitoring mechanisms, decoupling CEO compensation from firm performance. Our research, aligned with recent socio-psychological literature on the study of processes of family firm’s management policies, thus contributes to a better understanding of the setting of CEO compensation in family firms as a result of a combination of common bonds and mutual expectations based on emotions and values with contractual and financial factors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Agency theory originally focuses on contractual relationships where the physical and emotional distance between principals and agents can lead managers to act in their own self-interest (Eisenhardt 1989; Jensen and Meckling 1976). The evidence suggests that opportunism on the part of managers (Devers et al. 2007; Murphy 2013) may be less where the parties are highly interdependent, as is the case of family firms (Gomez-Mejia et al. 2001). The presence of altruism between the CEO (as an agent) and the set of family owners of the firm (as principals) reduces information asymmetries and potential acts of self-interest, increasing feelings of loyalty and commitment (Gomez-Mejia et al. 2003; Schulze et al. 2003).

The potential for opportunism in family firms must also take into account the close relationship where the parties work closely together and are emotionally attached (Cruz et al. 2010; Jaskiewicz et al. 2017). The socioemotional wealth (SEW) perspective (Gomez-Mejia et al. 2007) argues that the affective endowment of family firms may explain the design of contracts and monitoring mechanisms for the CEO. Family owners may not always be economically instrumental when monitoring the CEO, if it means threatening the family influence and permanence in the business (Berrone et al. 2012). Family owners are likely to see potential gains in welfare as their primary frame of reference in firm management when they trust their CEO. They may neglect their own protection in their (explicit or implicit) contracts and monitoring mechanisms (Cruz et al. 2010).

Monitoring is the observation, measurement, assessment, and compensation of managerial behaviors and decisions, and is therefore a central concept in the contractual relationships between CEOs and company owners in consideration of their mutual expectations (Fama and Jensen 1983). Compensation monitoring is the extent of CEO supervision by means of the design of his/her payment structure, and is normally intended to align CEO with the family owners’ interests (Cruz et al. 2010; Tosi and Gomez-Mejia 1989). While affective compensation monitoring (oriented towards emotional incentives and considerations of CEO welfare) is expected to apply to CEOs of family firms and highly involved family firms, instrumental compensation monitoring (oriented towards CEO economic incentives and accountability for the firm’s outcomes) is expected to apply to CEOs of non-family firms or firms with limited family influence.

An abundant literature (Block 2011; Carrasco-Hernandez and Sánchez-Marín 2007; Cheng et al. 2015; Chrisman et al. 2009; Combs et al. 2010; Cruz et al. 2010; McConaughy 2000; Gomez-Mejia et al. 2003; He 2008; Jaskiewicz et al. 2017; Michiels et al. 2013; Schulze et al. 2001; Young and Tsai 2008) has failed to provide a consensus on the influence of the family in the mechanisms for monitoring compensation and their consequences. While Combs et al. (2010) and Gomez-Mejia et al. (2003) find that, when the family power increases, the level of CEO compensation decreases and pay-for-performance sensitivity grows (Michiels et al. 2013; Cheng et al. 2015; Jaskiewicz et al. 2017), Cruz et al. (2010) find that performance-related executive compensation is not affected by family involvement, except in cases of strong variable compensation (McConaughy 2000; Young and Tsai 2008).

These contradictory findings may be explained by the extensive use of objective pay-for-performance approaches in most of these studies. In the context of family firms, perceptions of justice may play a key role in the design of CEO compensation, as the family owners may wish it to appear that they set compensation in ways that are similar to non-family firms, including the equal treatment of family and non-family executives, when, in fact, they do not (Gomez-Mejia et al. 2003). Consequently, objective measures of pay-for-performance may not capture the essence of monitoring mechanisms, and it may be better to ask family owners in charge of pay policies what it is that they intend (Verbeke and Kano 2012). Asking family owners (or their management representatives) what is being controlled and assessed when setting CEO compensation may be better than relying on the proportion of incentives in total pay (Tosi and Gomez-Mejia 1994).

Trying to fill these gaps and using a procedural conception of CEO monitoring, the aim of this paper is to analyze the relationships between CEO compensation, family involvement and firm performance in a sample of 357 large Spanish companies with varying degrees of family ownership and influence. This paper contributes to the literature in several ways. First, we provide new evidence about the influence of family involvement in the design of CEO compensation policies and the consequences in terms of firm performance, combining explanations of agency theory with those from the SEW perspective, which may better fit the peculiarities of family firms (Jaskiewicz et al. 2017; Schulze and Kellermanns 2015). Second, we adopt a procedural approach to the analysis of CEO compensation, and the internal process of setting CEO compensation and incentive structure, in order to more properly reflect the intangible aspects of CEO effectiveness and his/her monitoring (Cruz et al. 2010; Tosi and Gomez-Mejia 1994). Third, we analyze the heterogeneity of family firms (Chua et al. 2012) in the setting of CEO compensation policies and the mechanisms of monitoring, considering different levels of family involvement – in ownership and management. We also consider the family status of the CEO (Alessandri et al. 2012). Fourth, we provide methodological validation of the CEO compensation monitoring scale (Tosi and Gomez-Mejia 1989, 1994), demonstrating its appropriateness for analyzing CEO compensation policies in the context of family firms.

The article is structured as follows. In the next section, we develop our theoretical framework, leading to the formulation of hypotheses about the effectiveness of CEO compensation and the extent of family involvement. We then develop the methodological aspects and explain the results obtained. We conclude with a discussion of results and the main implications of the study.

Theoretical framework and hypotheses

Compensation monitoring in family and non-family firms

In agency theory, the owner or principal hires the agent (CEO) to perform, with hierarchical authority and autonomy, management services on their behalf (Jensen and Meckling 1976). Delegating power to the CEO increases both the risks of the company and its need for supervision, due to information asymmetries that create the potential for opportunistic behavior by agents, who are assumed to be risk averse (Dalton et al. 2007; Eisenhardt 1989). One solution to this potential divergence of interests is to offer the CEO a pay-for-performance system of compensation that encourages him/her to make decisions in line with the owners’ interests (Jensen and Murphy 1990; Murphy 2013). Although there are universal problems arising in situations where authority is delegated, the specific manifestation of CEO compensation in family firms may vary depending on the context of family influence, and where there may be damaging selfishness or altruistic behaviors (Fama and Jensen 1983; Gomez-Mejia et al. 2001).

According to the SEW perspective (Gomez-Mejia et al. 2007), family owners are less exposed to CEO opportunism than in non-family firms. Perceptions of benevolence and / or family ties lead family owners and CEO to have similar goals, even though some conflicts may still be present, where mutual social obligations create greater organizational commitment (Cruz et al. 2010). Trusting the CEO usually occurs in a context of altruism (Gomez-Mejia et al. 2001; Schulze et al. 2001). Altruism creates a sense of collective ownership among family members that reinforces generosity and engagement in the business, also emphasizing the alignment of interests and cooperation in the long term (Eddleston and Kellermanns 2007; Lubatkin et al. 2005; Verbeke and Kano 2012). The CEO and family share in the firm’s socioemotional wealth, and this gives them a more unified outlook (Berrone et al. 2012).

As a result, family owners who perceive opportunism to be less likely will feel compelled to reciprocate by designing caring contracts with stronger mechanisms to protect the CEO’s welfare (Gomez-Mejia et al. 2003). This affective monitoring will be less dependent on instrumental controls, such as quantitative performance indicators. When family owners are confident that the CEO executes his/her tasks in good faith and actively use his/her talents to achieve the strategy of the firm, family owners want to make him/her feel valued, well treated, and protected (Chrisman et al. 2009). In this situation, the perceived threat of CEO opportunism is lower, so that CEO compensation will be designed to monitor welfare and affective issues rather than instrumental aspects (Gomez-Mejia et al. 2003). The implementation of instrumental monitoring mechanisms based on economic incentives and quantitative indicators of performance are deemed unnecessary (Cruz et al. 2010), and may even harm the trust that both parties value as motivation of the CEO.

Although these affective contracts may emphasize the protection of CEO welfare as well as the SEW of the family, from the viewpoint of agency theory they could underestimate the potential for asymmetric altruism (Michiels et al. 2013; Schulze et al. 2001, 2003). While altruism serves to limit the CEO’s opportunistic behavior in family firms, asymmetric altruism – the firm owners’ tendency to be generous to the CEO (Chrisman et al. 2004; Lubatkin et al. 2005) – can interfere with the proper monitoring of the CEO (Chua et al. 2009). Family influence leads to biased judgments about the suitability of CEO decision-making, and underperformance may be attributed to exogenous forces rather than to the family-linked CEO. The emotions associated with family ties may reduce the effectiveness of CEO monitoring, distorting the economic instrumentality of the judgments (Gomez-Mejia et al. 2001).

In this context, the instrumental mechanisms of monitoring the CEO are more important to control for unexpected deviations in CEO behavior (Schulze et al. 2001; Lubatkin et al. 2005). Non-family firms, doubting the good faith of the CEO and perceiving greater risks of opportunistic behavior and agency costs, will intensify the monitoring effect of CEO compensation, based on economic incentives and accounting indicators of the firm’s outcomes, possibly even punishing poor performance, to ensure competent and responsible CEO behavior (Combs et al. 2010; Gomez-Mejia et al. 2003; Michiels et al. 2013). Pay-for-performance and associated accountability mechanisms are prevalent in non-family firms as a way to mitigate agency conflicts (Murphy 2013); ownership and control are completely separated. Considering all the above arguments, we expect instrumental monitoring mechanisms of CEO compensation to be applied more intensively in non-family than in family firms. This leads to our first hypothesis:

-

H1: CEO compensation monitoring is lower in family firms than in non-family firms.

According to SEW and agency principles, the linkage between CEO compensation monitoring and firm performance operates differently in family and non-family firms (Chrisman et al. 2009). While non-family firms design CEO compensation monitoring procedures on instrumental economic grounds, family firms share an affective alignment with their CEO. In family firms the payments to the CEO transcend economic rationality (Gomez-Mejia et al. 2011), and CEOs, because of their emotional attachment to the family firm, are willing to sacrifice their economic well-being by accepting lower compensation. As a result, in family firms, CEO compensation monitoring may be decoupled from firm performance (Combs et al. 2010; Cruz et al. 2010; Gomez-Mejia et al. 2003).

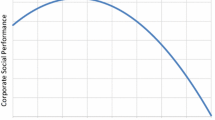

Combining these considerations with the findings of Tosi and Gomez-Mejia (1994), that there is a marginal and asymptotic positive relationship between CEO compensation and firm performance, we expect that, in family firms, an increase in the low level of CEO monitoring will be associated with greater improvements in firm performance. The lower level of CEO instrumental monitoring in family firms makes it possible to obtain greater improvement in firm performance as supervision of the CEO increases. In contrast, increasing the higher levels of CEO instrumental monitoring in non-family firms, which are already near optimal, will produce little improvement in firm performance. In other words, at low levels of compensation monitoring – as may be found in family firms – increases in instrumental CEO supervision significantly improves firm performance by preventing overly selfish and opportunistic behavior (Fama and Jensen 1983; Eisenhardt 1989). If instrumental compensation monitoring is high, the CEO achieves performance levels that approach the upper limits what is possible. At that level, an increase in monitoring of CEO compensation will not lead to further firm performance improvement. Considering all the above arguments, we formulate the second hypothesis in the following terms:

-

H2: CEO compensation monitoring is more strongly related to performance in family firms than in non-family firms.

The role of family involvement and CEO family status

The relationships between CEO compensation monitoring and firm performance may also depend, among family firms, on the extent of family involvement and on the CEO’s blood ties with the owning family, which may affect the principal’s perception of opportunism. Applying the logic of SEW, when the influence of the family in the ownership and management of the company is strong, and when the CEO belongs to the family, they share an altruistic, emotional alignment that transcends economic rationality, and they share SEW (Eddleston and Kellermanns 2007; Gomez-Mejia et al. 2011). The family thinks CEO opportunism is unlikely, making it unnecessary to invest in instrumental or economic monitoring mechanisms that transfer risk to the CEO (Eisenhardt 1989; Gomez-Mejia et al. 2001). In these contexts, according to Gomez-Mejia et al. (2007), CEOs are willing to behave in the family’s best interests, to avoid losses of their own socioemotional wealth. The regulation of these relationships altruism and trust require the family owners to implement an (explicit or implicit) contract that prioritizes and assures the protection of the family SEW and the welfare of the CEO (Gomez-Mejia et al. 2003; Verbeke and Kano 2012), through mechanisms of affective monitoring strongly oriented towards support, understanding and consideration of CEO welfare, and in which pay-for-performance policies are practically absent since they can be counterproductive and have a negative impact on the CEO’s intrinsic motivation (Cruz et al. 2010; Gomez-Mejia et al. 2011).

Conversely, significant agency cost are expected to prevail (Lubatkin et al. 2005) in family firms when family control declines in terms of ownership or management – including the case where the CEO is not a family member. Investment in instrumental economic monitoring mechanisms – based on extrinsic and quantitative indicators – is more likely to occur and fruitful from the viewpoint of the CEO and owners’ wealth, as the family loses control of the company (both in terms of ownership and management) or disperses its voting or management rights (Combs et al. 2010; McConaughy 2000; Cheng et al. 2015). If the family’s influence in the firm is limited, the family may have less power to appoint a trusted CEO. The CEO – usually not a family member and with no ownership, whose personal wealth is neither essentially nor emotionally tied to the interests of the family firm – may be thought disloyal by the family and not trusted (Gomez-Mejia et al. 2011; Michiels et al. 2013). Family owners bear increasing risk as family influence decreases, which in turn intensifies their perceptions of exposure to CEO opportunism, reducing their willingness to trust the CEO (Schulze et al. 2001). In order to face this increased risk, family owners will therefore try to ensure that the CEO makes effort to maximize family firm value through performance-based pay and, specifically by means of instrumental mechanisms of compensation monitoring based mainly on pay-for-performance alignment and quantitative indicators of the firm’s outcomes (Combs et al. 2010; He 2008; McConaughy 2000; Gomez-Mejia et al. 2003).

Non-family CEOs may be more prone to performance-related pay policies because they typically focus on a shorter term than family CEOs, as they need to achieve a successful track record of strong performance (Block 2011; Michiels et al. 2013). Several studies (Combs et al. 2010; He 2008; McConaughy 2000) find that non-family CEOs incentives are more closely linked to firm performance (and firm risk) than those for family CEOs. They posit that family CEOs have superior intrinsic motivation because of their position and, therefore, require less compensation as well as a more limited pay-for-performance mechanism to align their interests with the firm than do non-family CEOs (Gomez-Mejia et al. 2003).

Thus, it is expected that the intensity of CEO compensation monitoring decreases as the influence/involvement of the family in the firm is greater, both in ownership and management –including the family status of the CEO. We formulate the third hypothesis as follows:

-

H3: Family involvement – both in terms of ownership and management – and CEO family status are negatively related to CEO compensation monitoring.

In addition, considering the arguments presented in Hypothesis 2, we expect CEO compensation monitoring to be more effective in family firms with higher levels of family influence. To protect the family SEW, these firms tend to apply for more protective mechanisms of CEO compensation monitoring, so that an increase of instrumental mechanisms of compensation in this context stimulates higher levels of CEO performance and firm performance – an effect that is not available to family firms with low family involvement. Thus we propose the following hypothesis:

-

H4: CEO compensation monitoring is more strongly related to performance as family involvement in the firm increases.

Methodology

Population, sample and data collection

The population of Spanish non-listed firms was selected from the OSIRIS database (Bureau van Dijk 2008). OSIRIS database provides access to a broad cross-section of firms, and includes precise and complete economic and financial information. From this database we obtained information on industry classification, firm size and age, firm profitability, and business risk. The initial population consisted of 3032 firms with 250 or more employees from service and manufacturing industries. Only large firms were selected because monitoring mechanisms are more defined and formalized than in small and medium firms, allowing for a better analysis of the family involvement effects on CEO compensation. From this initial population, following the procedure of family firm identification of Cabrera-Suárez et al. (2014), we manually inspected and selected all the firms whose boards and/or management team include a minimum of two individuals with the same two surnames (in Spain, people whose two surnames are identical are very likely to be siblings). From these selected firms, we choose the level of 20% family stock ownership recommended by La Porta et al. (1999) as the cutoff point to define a firm as family owned, obtaining 1232 family firms (40.63%) out of total population of 3032 firms.

A telephone survey addressed to the human resource manager of the company was conducted between May and June 2016, asking about the CEO compensation monitoring process, the CEO individual characteristics and, if any, the degree of family involvement, obtaining valid information from 357 firms (response rate of 11.77%). Of these respondents, 153 are family firms, representing a response rate of 12.41%, relatively high and similar to other studies oriented to top managers of Spanish family firms, compared with the 11% rate obtained by Cruz et al. (2010). Regarding the information about family involvement, the survey results (firms’ self-classification) were cross-checked with the OSIRIS data gathered for each firm, obtaining almost a total agreement between the two sources of data.

Testing for non-response bias, we split the sample into first-wave (70%) and second-wave responding firms, finding no significant differences (Armstrong and Overton 1977). In addition, regarding common method bias, although data was already collected from two sources (OSIRIS database and telephone survey), we checked it through a confirmatory factor analysis (CFA) (Podsakoff et al. 2003). The poor fit of the single factor measurement model suggests no threat of common method variance (χ2 = 3172.32; RMSEA = 0.22; NFI = 0.6; NNFI = 0.6; CFI = 0.6). Finally, testing for differences between population and final sample regarding industry, firm size, firm age and family status, we checked that the samples of 357 firms and 153 family firms represented reasonably well the population of large family businesses in Spain (results of comparisons are available from the authors upon request).

Variables measurement

CEO compensation monitoring

The measurement of the CEO compensation monitoring reflects the potential agency problems that emerge as a result of the delegation of power from the owners to the CEO (Dalton et al. 2007; Werner and Tosi 1995). To address this aspect, Tosi and Gomez-Mejia (1989, 1994) develop a measurement scale that reflects the effectiveness of CEO compensation setting in the alignment of interests through the introduction of diverse mechanisms and structures of economic incentives (Zajac and Westphal 1995). We adopt this original scale, which is defined as a single construct consisting of 16 items on a 5-point Likert scale structured in two blocks of questions (as shown in Table 1): (1) the importance given to factors influencing the setting of CEO compensation; and (2) the intensity of supervision regarding CEO compensation through pay-for-performance alignment. The whole scale assesses the CEO compensation setting process and the contingencies associated with CEO payment, including those related to the several stakeholders involved in this procedure.

A confirmatory factor analysis (CFA) was conducted to test the psychometric properties of the CEO compensation monitoring scale. As shown in Table 1, indicators fall within recommended values and the measurement model fits satisfactorily (χ2 = 340.41; RMSEA = 0.08; NFI = 0.96; NNFI = 0.97; CFI = 0.97; IFI = 0.97,) (Anderson and Gerbing 1988; Hoyle and Panter 1995). The scale shows both very high levels of reliability – well above the recommended cut-off (Straub 1989) – and dimensionality – with all factor loadings significant and converging to one single factor (Bagozzi and Yi 1988). In addition, the average variance extracted (AVE) is above the recommended 0.5 necessary to confirm convergent validity of the scale (Fornell and Larcker 1981) and greater values of the square root of the AVE than the correlation among variables off-diagonal elements of Table 2 confirm discriminant validity.

Firm performance

We assess firm performance using a quantitative indicator based on average vale of return on assets (ROA) for three years (from 2014 to 2016). ROA is a widely accepted measure for examining effectiveness of HR practices, including those regarding compensation policies (Sánchez-Marín et al. 2019; Zattoni et al. 2015), and is usually preferred over other measures such as return on sales (ROS) or return on equity (ROE) (Dekker et al. 2015). We calculate ROA as the yearly net income divided by average total assets for the year. To reduce the skewness (Hair et al. 2006), we calculate the natural logarithm for ROA adding 1 to all values to avoid negative terms in logarithmic transformations.

Family involvement

We measure the family involvement in the firm through the two main dimensions of family influence in the business usually considered by the literature (Corbetta and Salvato 2004; Westhead and Howorth 2006), family ownership and family management. First, family ownership represents the voting rights of the family in the firm, and is measured by the proportion of shares held by the family over total shares, which in our sample ranges from 0 (non-family owned firms) to 100 (totally owned family firms). This measure indicates the capacity of the family to control the board (Wu 2013). And second, family management represents the ability of the family to influence the day-to-day management of the firm, and is measured through the proportion of family members on a firm’s management team (Sciascia and Mazzola 2008). Similarly, this variable ranges in the sample from 0 (non-family managed firms) to 100 (totally managed family firms) showing a variety of degrees of family management influence.

CEO family status

Since CEO is directly involved in compensation decisions, his/her family status is likely to influence the type and intensity of the compensation monitoring (Combs et al. 2010). Each CEO was asked to report his/her personal family relationship to the firm owners to create a CEO family status dummy variable (“1” in case of family CEO and 0 otherwise).

Control variables

Five firm/industry variables and four individual variables, that characterize the CEO and TMT, have been selected as control variable. (1) The industry in which a business operates was measured as a dummy variable indicating whether firm is involved in manufacturing (value “1”) or in services (value “0”) industry, based on NACE coding (NACE Rev. 2 2008). (2) Firm size was operationalized as the average number of employees during the period 2016–2018, taken as a natural logarithm (Miller et al. 2000; Wasserman 2006). (3) Firm age was measured as the difference between year 2016 (when the survey was administered) and the year the company was founded (Sánchez-Marín et al. 2019). (4) Ownership concentration was operationalized on the basis of the independence indicators reported in OSIRIS database, namely A qualification – companies with no shareholder over 24.99% of ownership, B qualification – with shareholders between 25% and 49.99% of ownership, and C qualification – with shareholders over 49.99% (Baixauli-Soler and Sanchez-Marin 2011). We construct a variable from less to more concentration where A is coded as “1”, B as “2” and C as “3” (Baixauli-Soler and Sanchez-Marin 2015). (5) Business risk was measured as the coefficient of variation of ROA in each industry sector over five years (2012–2016) (Gomez-Mejia et al. 2007). (6) CEO ownership was measured by the proportion of shares held by the CEO to total shares outstanding (Arosa et al. 2010). (7) CEO tenure was operationalized as self-reported number of years that the CEO has held this position in the firm (Tsai et al. 2006). (8) Top management team (TMT) tenure was measured as the average number of years that top managers had held their positions in the firm, as reported by the CEO (Cruz et al. 2010). (9) CEO duality was operationalized as a dichotomous variable, taking the value of 1 when the roles of CEO and chairperson are occupied by distinct persons and the value of 0 when these two roles are held by the same person (Lam and Lee 2008).

Results

Table 2 shows descriptive statistics and correlations. As expected, some interesting correlations between variables reflect the sense of the formulated hypotheses. For example, CEO compensation monitoring is significantly correlated with firm size (positively), CEO duality (negatively), CEO ownership (negatively), CEO tenure (positively), business risk (negatively), family ownership (negatively), family management (negatively), CEO family status (negatively) and ROA (positively). ROA is significantly correlated with firm size (positively), CEO duality (negatively), CEO tenure (positively) and CEO family status (negatively).

We used hierarchical regression analyses to test the hypothesized direct and moderating effects regarding CEO compensation monitoring, family involvement and firm performance, applying White’s correction for robust standard errors that correct for potential heteroscedasticity (White 1980). In addition, to minimize the effects of multicollinearity, each of the independent and moderating variables were mean-centered before they were used in regression analyses (Aiken and West 1991).

Table 3 reports the results of the regression analysis with CEO compensation monitoring as the dependent variable. Models 1 and 2 include 357 firms (all firms of the sample) and models 3 and 4 include 153 firms (only family firms). Model 1 contains only the control variables, showing that higher business risk, CEO ownership and TMT tenure together with lower CEO tenure reduce CEO compensation monitoring. In Model 2 we added family ownership to differentiate family and non-family firms, showing a significant increase in R2, from 0.06 to 0.19 (p < 0.001), and negative and significant coefficients of family ownership (β = −0.22, P < 0.01), which means that CEO compensation monitoring decreases (from non-family to family firm) as the family involvement in the ownership increases, supporting Hypothesis 1. Analyzing only family firms, Model 4 shows adds the family involvement in ownership and management and the CEO family status over the set of control variables in Model 3, showing a significant increase in R2, from 0.09 to 0.12 (p < 0.1). The coefficient of CEO family status is negative and significant (β = −0.18, p < 0.1) indicating lower CEO compensation monitoring when the CEO belongs to the family. Regarding family involvement, the intensity of CEO compensation monitoring decreases as the proportion of family managers increases (β = −0.17, P < 0.1). However, no significant influence was found for family ownership, which might be expected considering that levels of family ownership among family owned firms are highly homogeneous, and there was little variation on this dimension. All these results support Hypothesis 3.

Figure 1 graphically shows the effect of family involvement (considering both family and. Non-family firms and degree of family influence among family firms) on CEO compensation monitoring tested in Hypotheses 1 and 3. While CEO compensation monitoring is lower in family firms in which the CEO and most of managers share family ties, it is higher in non-family firms and in family firms with a non-family CEO and with a minority of family members in the TMT.

Table 4 shows the results from the regression analyses with firm performance as a dependent variable and CEO compensation monitoring as an independent variable. As with the models described above, Models 5 and 6 include all firms of the sample and Models 7 and 8 only include family firms. In Models 5 and 7, control variables and main effects were entered first, then adding multiplicative terms in Models 6 and 8 to examine the hypothesized moderations. Model 5 shows that greater firm size and higher CEO compensation monitoring increase firm performance. Adding interactions in Model 6, a significant increase in R2 can be seen, from 0.05 to 0.15 (p < 0.001) and a positive and significant coefficient for the interaction of family management and CEO compensation monitoring (β = 0.32, P < 0.001), but not for interaction with family ownership, which indicate that the relationship between CEO compensation monitoring and firm performance is stronger as the proportion of family managers in the company increases, partially supporting Hypothesis 2.

To test Hypothesis 4, analyzing these relationships only among family firms, we ran Models 7 and 8. Model 7 includes control variables and main effects, where again we can observe that CEO compensation monitoring is significant and positively related to firm performance (monitoring (β = 0.35, p < 0.001). Model 8 shows a significant increase in R2 compared to Model 7, from 0.17 to 0.38 (p < 0.001), together with positive and significant coefficients for the multiplicative terms of family management and CEO family status with CEO compensation monitoring (β = 0.23, p < 0.05; β = 0.29, p < 0.01), which indicate that firm performance increases greatly when CEO compensation monitoring increases in family firms with a high proportion of family managers and a family CEO. As expected, family ownership again has no influence in these relationships because of its low variability among family owned firms. These results provide support for Hypothesis 4.

Figure 2 graphically represents the effectiveness of the monitoring of CEO compensation based on the firm’s level of family involvement. As shown, the increase of firm performance is higher in family firms, where instrumental CEO compensation monitoring is lower in comparison with non-family firms. CEO’s lower level of compensation monitoring in highly involved family firms – regarding family managers and a family CEO – provides a greater distance to reach the upper limit of CEO monitoring effectiveness which, in turn, provides more potential for improving firm performance.

Discussion and conclusions

This paper examines the effectiveness of CEO compensation monitoring in relation to the extent of family involvement in the firm. Adopting a procedural approach based on the internal process of setting CEO compensation – based on the established procedures and rules reflecting the alignment of CEO incentives structure to the firm interests (Tosi and Gomez-Mejia 1994) – we shed light on the influence of family governance and control in the design of mechanisms of CEO compensation and its consequences for performance. To explain these relationships we combine agency and SEW theories, which are empirically tested on a sample of 357 large Spanish family and non-family companies. Our findings show a negative effect of family involvement –both comparing family with non-family firms, and among family firms with different levels of family involvement in management – on CEO compensation monitoring as well as a stronger relationships between CEO compensation and firm performance as the family influence is higher in terms of family managers and family CEOs.

Specifically, our results indicate that the intensity of economically instrumental CEO compensation monitoring (oriented towards economic incentives and accountability for the firm’s outcomes) is higher in non-family firms than in family firms. In addition, among family firms CEO compensation monitoring decreases with increasing family involvement. In line with Cruz et al. (2010), our results indicate that family owners opt for a more affective supervision (oriented to the preservation of their – both the family owners’ and the CEO’s – socioemotional wealth and welfare) decreasing the intensity of CEO compensation monitoring (Gomez-Mejia et al. 2011). In addition, among family firms, the family ownership dimension is no longer important, which is expected considering that, once the firm is under family control, family management is the main determining factor of governance (Daily and Dollinger 1992). In that vein, CEO compensation monitoring is lower when the management team is dominated by the family and, more importantly, when the CEO belongs to the family (Cruz et al. 2010). In this case, family owners perceive a low risk of opportunism, and design affective contracts with stronger CEO protection mechanisms, and less compensation monitoring based on extrinsic economic controls (Gomez-Mejia et al. 2003).

In terms of firm performance, our results indicate that lower levels of CEO monitoring in family firms are associated, in comparison with non-family firms, with stronger firm performance improvements in response to increases of CEO compensation procedure oriented towards a better alignment of economic incentives to firm outcomes (Gomez-Mejia et al. 2011). In addition, among family firms, the strength of the relationship between CEO compensation monitoring and firm performance increases as the family involvement increases. Again, the effectiveness of CEO compensation monitoring leading to further improvements of firm performance is determined by the presence of family managers in the management team. The initial lower level of instrumental CEO monitoring in family owned companies implies, as anticipated, that an improvement of monitoring leads to a greater firm performance in firms with a family CEO than in firms with an external, non-family CEO (Cruz et al. 2010). In family firms with a family CEO, as there is a protective supervision over the family CEO, an increase in the level of economic alignment of CEO incentive structure generates more room for firm performance improvement. In contrast, in family firms with non-family CEO, the low confidence in this external CEO causes an initial higher level of CEO compensation monitoring closer to the optimal for firm performance.

Overall, these findings contribute to the literature in the compensation and family business fields. First, this study aligns with the recent literature on the study of the process and consequences of CEO compensation in family firms that has evolved from a classic agency approach towards a socio-psychological perspectives (Jaskiewicz et al. 2017). The adoption of the SEW perspective makes it possible to explain firm owners’ perceptions of CEO opportunism through the lens of family ties, leading them to supervise and compensate CEOs depending on the commitment and goals they share (Gomez-Mejia et al. 2011). Second, we contribute to the contradictory evidence on the effects of family involvement on CEO compensation (i.e. Combs et al. 2010; Cruz et al. 2010), which may be produced by the use of objective pay-for-performance measures (based on agency view of optimal contracting) that indirectly operationalize the concept of monitoring since family firms are more reluctant to use explicit compensation arrangements (Verbeke and Kano 2012). Third, by adopting this procedural approach to the analysis of CEO compensation, based on the internal monitoring of CEO’s incentive structure, we methodologically provide a more direct, alternative, perspective – following the seminal works of Tosi and Gomez-Mejia (1989, 1994) – to the study of CEO compensation and its consequences in the context of family firms. In that regard, the CEO compensation monitoring scale is shown to be appropriate for analyzing this important topic. And finally, this study is in line with those analyzing effectiveness of the management of family firms, combining common bonds and mutual expectations based on emotions, feelings and values grounded in psychology with contractual and financial factors grounded in the economy (Chrisman et al. 2004, 2009; Chua et al. 2009; Gomez-Mejia et al. 2007; Lubatkin et al. 2005; Schulze and Kellermanns 2015). Our paper confirms the important role of family involvement in the implementation of mechanisms of CEO monitoring and the effects of affective affiliations in the decoupling of CEO compensation from firm performance.

This work also has important implications for practitioners. Our results suggest, first, that family companies, even in the absence of agency conflicts, should maintain appropriate mechanisms of CEO supervision based on the structure of economic incentives (Verbeke and Kano 2012). Whatever the degree of family involvement and CEO family status, an appropriate setting of CEO compensation based on the alignment of CEO behavior with the firm’s financial and non-financial interests can be a prudent measure to avoid opportunistic or asymmetrical altruistic behaviors, balancing potential goal dichotomies. Human resource managers in family firms should consider the design of mechanisms of CEO compensation monitoring driven by a balance between the desire to preserve and enhance the family’s socioemotional wealth and the pragmatic approach based on economic and financial aspects.

Finally, we also acknowledge the limitations of our study, which may provide some fruitful directions for future research. First, the paper employs a widely-accepted measure of family involvement in the firm based on the influence of the family in both ownership and the management of the company. Further studies should consider, however, the inclusion of explicit socioemotional wealth dimensions of the owning family, in order to analyze their effects on CEO supervision effectiveness explicitly (Berrone et al. 2012; Debicki et al. 2016). Second, and related to the above, although our analysis focuses on a widely-accepted measure of firm financial performance, namely ROA, future studies should consider other performance indicators related to non-financial outcomes, such as family reputation and family cohesion, that could appropriately represent the socioemotional goals of the family firm (Zellweger et al. 2013). Third, our paper focuses on the structure of CEO compensation as the prevalent mechanism of supervision. Although compensation mechanism represents one of the most powerful and common instruments of CEO monitoring, future studies should extend this analysis by examining the influence of other governance mechanisms, such as the type of majority shareholder or the proportion of independent directors on the board (Chrisman et al. 2018). Finally, this paper analyzes family businesses based on a widely accepted and well known definition. Future research should complemented and enriched these studies by considering additional aspects of family culture and values (Habbershon and Williams 1999; Rau et al. 2018) in order to have a more comprehensive view of the CEO monitoring function in the context of the total role of the family in the business.

References

Aiken, L. S., & West, S. G. (1991). Multiple regressions: Testing and interpreting interactions. Newsbury Park: SAGE.

Alessandri, T., Tong, T. W., & Reuer, J. (2012). Firm heterogeneity in growth option value: The role of managerial incentives. Strategic Management Journal, 33(13), 1557–1566.

Anderson, J. C., & Gerbing, D. W. (1988). Structural equation modeling in practice: A review and recommended two-step approach. Psychological Bulletin, 103(3), 411–423.

Armstrong, J. S., & Overton, T. S. (1977). Estimating nonresponse bias in mail survey. Journal of Marketing Research, 14(3), 396–402.

Arosa, B., Iturralde, T., & Maseda, A. (2010). Ownership structure and firm performance in non-listed firms: Evidence from Spain. Journal of Family Business Strategy, 1(2), 88–96.

Bagozzi, R. P., & Yi, Y. (1988). On the evaluation of structural equation models. Journal of the Academy of Marketing Science, 16(1), 74–94.

Baixauli-Soler, J. S., & Sanchez-Marin, G. (2011). Organizational governance and TMT pay level adjustment. Journal of Business Research, 64(8), 862–870.

Baixauli-Soler, J. S., & Sanchez-Marin, G. (2015). Executive compensation and corporate governance in Spanish listed firms: A principal-principal perspective. Review of Managerial Science, 9(1), 115–140.

Berrone, P., Cruz, C., & Gomez-Mejia, L. R. (2012). Socioemotional wealth in family firms: Theoretical dimensions, assessment approaches, and agenda for future research. Family Business Review, 25(3), 258–279.

Block, J. H. (2011). How to pay nonfamily managers in large family firms: A principal-agent model. Family Business Review, 24(1), 9–27.

Cabrera-Suárez, M. K., Déniz-Déniz, M. D. L. C., & Martín-Santana, J. D. (2014). The setting of non-financial goals in the family firm: The influence of family climate and identification. Journal of Family Business Strategy, 5(3), 289–299.

Carrasco-Hernandez, A., & Sánchez-Marín, G. (2007). The determinants of employees compensation in family firms: Empirical evidence. Family Business Review, 20(3), 215–228.

Cheng, M., Lin, B., & Wei, M. (2015). Executive compensation in family firms: The effect of multiple family members. Journal of Corporate Finance, 32(3), 238–257.

Chrisman, J. J., Chua, J. H., & Litz, R. (2004). Comparing the agency costs of family and non-family firms: Conceptual issues and exploratory evidence. Entrepreneurship Theory and Practice, 28(4), 335–354.

Chrisman, J. J., Chua, J. H., & Kellermanns, F. (2009). Priorities, resource stocks, and performance in family and nonfamily firms. Entrepreneurship Theory and Practice, 33(3), 739–760.

Chrisman, J. J., Chua, J. H., Le Breton-Miller, I., Miller, D., & Steier, L. P. (2018). Governance mechanisms and family firms. Entrepreneurship Theory and Practice, 42(2), 171–186.

Chua, J. H., Chrisman, J. J., & Bergiel, E. B. (2009). An agency theoretic analysis of the professionalized family-owned firm. Entrepreneurship Theory and Practice, 33(2), 355–372.

Chua, J. H., Chrisman, J. J., Steier, L. P., & Rau, S. B. (2012). Sources of heterogeneity in family firms: An introduction. Entrepreneurship Theory and Practice, 36(6), 1103–1113.

Combs, J. G., Penney, C. R., Crook, T. R., & Short, J. C. (2010). The impact of family representation on CEO compensation. Entrepreneurship Theory and Practice, 34(6), 1125–1144.

Corbetta, G., & Salvato, C. (2004). Self-serving or self-actualizing? Models of man and agency costs in different types of family firms: A commentary on “comparing the agency costs of family and non-family firms: Conceptual issues and exploratory evidence”. Entrepreneurship Theory and Practice, 28(4), 355–362.

Cruz, C. C., Gómez-Mejia, L. R., & Becerra, M. (2010). Perceptions of benevolence and the design of agency contracts: CEO-TMT relationships in family firms. Academy of Management Journal, 53(1), 69–89.

Daily, C. M., & Dollinger, M. J. (1992). An empirical examination of ownership structure in family and professionally managed firms. Family Business Review, 5(2), 117–136.

Dalton, D. R., Hitt, M. A., Certo, S. T., & Dalton, C. M. (2007). The fundamental agency problem and its mitigation. Academy of Management Annals, 1(1), 1–64.

Debicki, B. J., Kellermanns, F. W., Chrisman, J. J., Pearson, A. W., & Spencer, B. A. (2016). Development of a socioemotional wealth importance (SEWi) scale for family firm research. Journal of Family Business Strategy, 7(1), 47–57.

Dekker, J., Lybaert, N., Steijvers, T., & Depaire, B. (2015). The effect of family business professionalization as a multidimensional construct on firm performance. Journal of Small Business Management, 53(2), 516–538.

Devers, C. E., Cannella, A. A., Reilly, G. P., & Yoder, M. E. (2007). Executive compensation: A multidisciplinary review of recent developments. Journal of Management, 33(6), 1016–1072.

Eddleston, K. A., & Kellermanns, F. W. (2007). Destructive and productive family relationships: A stewardship theory perspective. Journal of Business Venturing, 22(4), 545–565.

Eisenhardt, K. M. (1989). Agency theory: An assessment and review. Academy of Management Review, 14(1), 57–74.

Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. Journal of Law and Economics, 26(2), 301–325.

Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18, 39–50.

Gomez-Mejia, L. R., Nunez-Nickel, M., & Gutierrez, I. (2001). The role of family ties in agency contracts. Academy of Management Journal, 44(1), 81–95.

Gomez-Mejia, L. R., Larraza-Kintana, M., & Makri, M. (2003). The determinants of executive compensation in family-controlled public corporations. Academy of Management Journal, 46(2), 226–237.

Gomez-Mejia, L. R., Haynes, K., Nuñez-Nickel, M., Jacobson, K. J. L., & Moyano-Fuentes, J. (2007). Socioemotional wealth and business risks in family-controlled firms: Evidence from Spanish olive oil mills. Administrative Science Quarterly, 52(1), 106–137.

Gomez-Mejia, L. R., Cruz, C., Berrone, P., & De Castro, J. (2011). The bind that ties: Socioemotional wealth preservation in family firms. Academy of Management Annals, 5(1), 653–707.

Habbershon, T. G., & Williams, M. L. (1999). A resource-based framework for assessing strategic advantages of family firms. Family Business Review, 12(1), 1–22.

Hair, J. F., Black, W. C., Babin, B. J., Anderson, R. E., & Tatham, R. L. (2006). Multivariate data analysis. Upper Saddle River: Pearson Prentice Hall.

He, L. (2008). Do founders matter? A study of executive compensation, governance structure and firm performance. Journal of Business Venturing, 23(3), 257–279.

Hoyle, R. H., & Panter, A. T. (1995). Writing about structural equation modeling. In R. H. Hoyle (Ed.), Structural equation modeling: Concepts, issues and applications (pp. 158–176). Thousand Oaks: Sage.

Jaskiewicz, P., Block, J. H., Combs, J. G., & Miller, D. (2017). The effects of founder and family ownership on hired CEOs’ incentives and firm performance. Entrepreneurship: Theory and Practice Theory, 41(1), 73–103.

Jensen, M. C., & Meckling, W. F. (1976). Theory of the firm: Managerial behavior, agency costs, and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Jensen, M. C., & Murphy, K. (1990). Performance pay and top-management incentives. Journal of Political Economy, 98(2), 225–264.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. W. (1999). The quality of government. Journal of Law Economics and Organization, 15(1), 222–279.

Lam, T. Y., & Lee, S. K. (2008). CEO duality and firm performance: Evidence from Hong Kong. Corporate Governance, 8(3), 299–316.

Lubatkin, M., Schulze, W., Ling, Y., & Dino, R. (2005). The effects of parental altruism on the governance of family-managed firms. Journal of Organizational Behavior, 26(3), 313–330.

McConaughy, D. L. (2000). Family CEOs vs. nonfamily CEOs in the family-controlled firm: An examination of the level and sensitivity of pay to performance. Family Business Review, 13(2), 121–131.

Michiels, A., Voordeckers, W., Lybaert, N., & Steijvers, T. (2013). CEO compensation in private family firms: Pay-for-performance and the moderating role of ownership and management. Family Business Review, 26(2), 140–160.

Miller, N. J., Winter, M., Fitzgerald, M. A., & Paul, J. (2000). Family microenterprises: Strategies for coping with overlapping family and business demands. Journal of Developmental Entrepreneurship, 5(2), 87–113.

Murphy, K. J. (2013). Executive compensation: Where we are, and how we got there. In G. Constantinides, M. Harris, & R. Stulz (Eds.), Handbook of the economics of finance (pp. 211–356). New York: Elsevier Science North Holland.

NACE Rev. 2 (2008). Statistical classification of economic activities in the European Community. Luxembourg: Office for Official Publications of the European Communities [date accessed: December 15, 2013]. Available: <http://epp.eurostat.ec.europa.eu/cache/ITY_OFFPUB/KS-RA-07-015/EN/KS-RA-07-015-EN.PDF>.

Podsakoff, P. M., MacKenzie, S. B., Lee, J. Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879–903.

Rau, S. B., Astrachan, J. H., & Smyrnios, K. X. (2018). The F-PEC revisited: From the family business definition dilemma to foundation of theory. Family Business Review, 31(2), 200–213.

Sánchez-Marín, G., Meroño-Cerdán, A. L., & Carrasco-Hernández, A. J. (2019). Formalized HR practices and firm performance: An empirical comparison of family and non-family firms. International Journal of Human Resource Management, 30(7), 1084–1110.

Schulze, W. S., & Kellermanns, F. W. (2015). Reifying socioemotional wealth. Entrepreneurship Theory and Practice, 39(3), 447–459.

Schulze, W. S., Lubatkin, M. H., Dino, R. N., & Buchholtz, A. K. (2001). Agency relationships in family firms: Theory and evidence. Organizational Science, 12(2), 99–116.

Schulze, W. S., Lubatkin, M. H., & Dino, R. N. (2003). Exploring the agency consequences of ownership dispersion among the directors of private family firms. Academy of Management Journal, 46(2), 179–194.

Sciascia, S., & Mazzola, P. (2008). Family involvement in ownership and management: Exploring nonlinear effects on performance. Family Business Review, 21(4), 331–345.

Straub, D. (1989). Validating instruments in MIS research. MIS Quarterly, 13(2), 147–169.

Tosi, H. L., & Gomez-Mejia, L. R. (1989). The decoupling of CEO pay and performance: An agency theory perspective. Administrative Science Quarterly, 34(2), 169–189.

Tosi, H. L., & Gomez-Mejia, L. R. (1994). CEO compensation monitoring and firm performance. Academy of Management Journal, 37(4), 1002–1016.

Tsai, W. H., Hung, J. H., Kuo, Y. C., & Kuo, L. (2006). CEO tenure in Taiwanese family and nonfamily firms: An agency theory perspective. Family Business Review, 19(1), 11–28.

van Dijk, B. (2008). Osiris database. London: Bureau van Dijk Electronic Publishing.

Verbeke, A., & Kano, L. (2012). The transaction cost economics theory of the family firm: Family-based human asset specificity and the bifurcation bias. Entrepreneurship Theory and Practice, 36(6), 1183–1205.

Wasserman, N. (2006). Stewards, agents, and the founder discount: Executive compensation in new ventures. Academy of Management Journal, 49(5), 960–976.

Werner, S., & Tosi, H. L. (1995). Other people's money: The effects of ownership on compensation strategy and managerial pay. Academy of Management Journal, 38(6), 1672–1691.

Westhead, P., & Howorth, C. (2006). Ownership and management issues associated with familiy firm performance and company objectives. Familiy Business Review, 19(4), 301–316.

White, H. (1980). A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica, 48(4), 817–838.

Wu, C. H. (2013). Family ties, board compensation and firm performance. Journal of Multinational Financial Management, 23(4), 255–271.

Young, C. S., & Tsai, L. C. (2008). The sensitivity of compensation to social capital: Family CEOs vs. nonfamily CEOs in the family business groups. Journal of Business Research, 61(4), 363–374.

Zajac, E. J., & Westphal, J. D. (1995). Accounting for the explanations of CEO compensation: Substance and symbolism. Administrative Science Quarterly, 40(2), 283–308.

Zattoni, A., Gnan, L., & Huse, M. (2015). Does family involvement influence firm performance? Exploring the mediating effects of board processes and tasks. Journal of Management, 41(4), 1214–1243.

Zellweger, T. M., Nason, R. S., Nordqvist, M., & Brush, C. G. (2013). Why do family firms strive for nonfinancial goals? An organizational identity perspective. Entrepreneurship Theory and Practice, 37(2), 229–248.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Sánchez-Marín, G., Carrasco-Hernández, A.J. & Danvila-del-Valle, I. Effects of family involvement on the monitoring of CEO compensation. Int Entrep Manag J 16, 1347–1366 (2020). https://doi.org/10.1007/s11365-019-00617-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11365-019-00617-1