Abstract

This paper examines sustainable development, which employs an integrated approach to tackle environmental, social, and economic challenges. It provides a theoretical underpinning by examining sustainable development’s inception, fundamental tenets, and conceptual structures. This study highlights the interdependence of social equity, economic prosperity, and environmental conservation, emphasizing the need for a comprehensive approach. Quantitative methodology is utilized in this study, and the dependent variable is sustainable development. Financial risk, green growth, technological innovation, renewable energy, financial inclusion, and soft infrastructure are all independent variables. The analysis is predicated on secondary data from the Organization for Economic Cooperation and Development and World Development Indicators databases spanning 2004 to 2019. An entropy-weighted method used for the green growth index is a metric that enhances the precision of variable indicators. Cointegration, correlation, VIF, cross-sectional dependency, and stationarity tests are among the diagnostic tests that inform the selection of methods for the panel data set. It is determined that fully modified ordinary least squares is the suitable technique. The findings suggest statistically significant positive correlations among greenhouse gases, financial inclusion, and soft infrastructure. Conversely, significant negative correlations exist between financial risk, green growth, renewable energy, and technological innovation. An estimated 55% long-run variance is present. The study’s key finding is that financial risk has an adverse effect on sustainable development, while an impactful relationship where increased green growth is linked to decreased GHG emissions. This association is notably significant. Results show that renewable energy has a negative coefficient and significant negative impact on greenhouse gases, showing an active relation to enhancing sustainable development. In contrast, financial inclusion has a significant positive effect on sustainable development. The implications imply that providing incentives to institutions engaged in alternative energy, precisely renewable sources, could positively impact the environment. Government policies and funding regulations oriented toward sustainable development are indispensable for environmental sustainability. Government policies and incentives are pivotal in advancing an environmentally conscious and sustainable future. This study’s contribution lies in elucidating the positive correlation between government interventions and promoting renewable energy adoption, thereby paving the way for a greener tomorrow.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Global climate change is human beings’ most significant problem in the twentieth century. United Nations Framework on environmental degradation describes the “climate system” as “the entirety of the atmosphere, hydrosphere, biosphere, and geosphere and their interactions.” Numerous studies identified that the effects of ED are an increase in the sea level, the rise of temperature, extreme weather, low levels of agriculture, production, and environmental degraof the most alarming findings of AR6dation, which are severe threats to human health as well as social stability and suitability (Cui et al. 2023; Meghji et al. 2021; Zao et al. 2021).

Since the industrial revolution, fossil fuel usage has sharply raised CO2 emissions and other harmful greenhouse gases (GHGs), posing a severe environmental threat. Global CO2 emissions rose from 25,715.7 to 33,890.8 Mt between 2003 and 2018, a 31.79% increase, significantly driving global warming. This escalation of the greenhouse effect triggers issues like rising sea levels, desertification, and glacier melt, with potentially catastrophic impacts on society’s history (Ahmad et al. 2018). International in scope, environmental degradation is evident in Pakistan through occurrences of extreme weather events. As an agrarian developing nation, Pakistan relies on energy to drive economic growth and fulfill the needs of its expanding population (Khan et al. 2018).

These greenhouse gases (GHGs) are responsible for climate change and environmental deterioration. Industrialization has led to numerous social and climate changes and other ecological concerns that boost economic growth. The consequences of climate change on the environment and the survival of living species are adverse. Recent research indicates that an increase of 1.09 °C occurred at the earth’s surface between 2011 and 2020 compared to 1850 and 1900. Global warming will result in a 1.50 °C average temperature increase over the next two decades. These adverse climate change effects have the same global reach (Irfan et al. 2022).

Increasingly hot weather worldwide increases the likelihood of reaching hazardous climate system tipping points, which, once crossed over, can activate self-reinforcing loops that amplify climate change, including the thawing of glaciers or the death of vast expanses of forests. Initiating such reinforcing feedback can also result in other significant, abrupt, and irreversible alterations to the climate system. One of the most alarming findings of AR6 (Cook 2023) is that there are already more pervasive and severe adverse effects on ED than anticipated. Half of the world’s human beings experience extreme water shortages for at least 1 month per year, and rising temperatures are facilitating vector-borne disease transmission like malaria, West Nile virus, and Lyme disease, which are a grave concern. Since 1961, climate change has delayed crop productivity increases in Africa by one-third. Since 2008, severe flooding and cyclones have displaced more than 20 million people yearly (Arogyaswamy 2023).

Addressing the pressing environmental risks requires substantially reducing carbon emissions and greenhouse gases during production to safeguard a desirable quality of life. Climate change’s health implications are intertwined with global development policies and equitable health concerns. Those with limited access to resources, who have contributed the least to the issue, bear the brunt of its effects. Climate change should drive the attainment of MDG targets and hasten development in the world’s most impoverished nations. Moreover, it underscores intergenerational fairness. Inaction will compound health disparities via socioeconomic impacts on vulnerable populations. The disparity, where the affluent drive the problem and the marginalized face the majority of consequences, will be a regrettable legacy of our era (Nations 2022).

Green growth presents an ecologically and socially responsible form of economic advancement, embodying the “triple bottom line” principle that advances economic, environmental, and social sustainability. Through the lens of growth-oriented finance theory, this study asserts that green growth is pivotal in ensuring financial stability. It recognizes ecological risks and social disparities as significant factors alongside economic expansion. Green growth operates as a business strategy to achieve this aim. Furthermore, it prioritizes economic progress by directing public and private investments toward enhanced sustainable practices within the workplace (Jadoon et al. 2021).

Globalization, population development, and the rapid expansion of economic activity have all contributed to increased CO2 and other greenhouse gas emissions, putting the ecosystem in grave danger (Kirikkaleli et al. 2021). Due to the enormous energy demand, the continued growth of the world economy, which averages 3 to 4% annually, poses a serious threat to environmental sustainability. When industry increases, CO2 emissions are positively impacted by financial development, and money is created by increasing risk diversification, which influences CO2 emissions; economic expansion is negatively affected by environmental deterioration (Sadorsky 2010). These elements contribute to a 4–6 °C increase in temperature. The earth’s temperature has risen by 1.9 °C over the past 50 years due to the total CO2 particle concentration reaching 413 parts per million in the air (Greicius 2022). The rapid expansion of the global economy, population growth, and globalization have led to a significant increase in CO2 and other greenhouse gas emissions, posing a severe environmental peril. Critical factors like income, industrialization, international trade, urbanization, deforestation, population, and energy use contribute to ecological decline.

Regrettably, the emphasis on financial considerations often sidelines greenhouse gas emissions. This oversight has resulted in various environmental and societal issues, including rising sea levels, desertification, and melting glaciers, stemming from the intensifying greenhouse effect, potentially devastating human society. The United Nations recommends a shift to renewable energy as a superior solution for reducing carbon dioxide emissions. RQ1: How do financial risk and global greenhouse gas emissions affect each other? RQ2: How can green growth change greenhouse gas emissions? RQ3: How can renewable energy minimize global greenhouse gas emissions? RQ4: How can technological innovation change greenhouse gas emissions? Assess the impact of increasing global temperatures and greenhouse gas levels on extreme weather events, focusing on regions particularly susceptible to such phenomena. Investigate the progress and challenges of international initiatives like COP and SDGs in achieving net-zero emissions and promoting innovative green technology. Evaluate the effectiveness of green growth approaches in achieving economic, environmental, and social sustainability in the face of climate change.

“The factors identified by the researchers that can contribute to or mitigate the issue of climate change and energy are yet to be explored in a scientific manner through data. This study particularly addresses the issue of country-level financial risk and sustainable development. As mentioned, climate change affects humans, livestock, and the natural habitat; this study presents the issue of climate change with special reference to greenhouse gas emissions.”

In 2020, global greenhouse gas concentrations reached a record high, resulting in a 1.1 °C rise in temperature. Extreme weather events surged, impacting diverse regions. The global mean temperature approaches dangerous levels, affecting around 3.3 to 3.6 billion people in vulnerable countries. Initiatives like COP and SDGs aim to address climate change, but achieving net-zero emissions requires innovative green technology. Climate change affects health, development, and inequality, necessitating comprehensive financial development for sustainability. RO1 Green growth is crucial, focusing on economic, environmental, and social aspects. Although fossil fuels dominate emissions, RO2 renewable energy advancements can combat climate change. RO3 Financing renewable energy is vital for transitioning away from fossil fuels. SDG-13 targets climate change measures and promotes renewable energy investment for economic growth. A study on green growth’s impact on emissions and financial risk can offer policy recommendations for sustainable development goals, urging governments to foster economic growth and alternative energy consumption. The study examines the link between greenhouse gas emissions, financial risk, and factors like green growth, technology innovation, renewable energy, financial inclusion, and soft infrastructure.

Literature review

Global warming has become a significant global issue (Yang et al. 2019). Temperatures at the Earth’s surface and in the ambient air are reaching higher and more intense levels more frequently than in the past (Lebkowski 2019). GHG is the primary cause of global warming and air pollution. Increasing conveyance volumes have a more significant detrimental effect on the quality of the environment. One of these effects is the air pollution problem induced by the combustion of fossil fuels, agricultural activities, industrial and factory exhaust, and other activities (Knez et al. 2014). They are emitted by numerous human activities, such as industrial and transportation activities (Sinha et al. 2020).

After an evident decrease in CH4 emissions during the 1990s, anthropogenic CH4 emissions have risen again (Bousquet et al. 2006). Between 1979 and 2004, the N2O concentration increased linearly (Kandel et al. 2019). Additionally, livestock contributes to the increase in GHG emissions. Although the dynamic contrast of climate interactions is not fully understood, there is widespread scientific agreement that human activities contribute to global climate change, 2001, Houghton et al. Since the UN’s MDGs were established in 2000, economies have focused on regulating GHG emissions regardless of their development status. Because industrialized nations and countries with an industrial orientation impact the environment, they must control their emissions. Subsequently, the inauguration of SDGs 2015, however, world-leading agencies and UN member states observed a concentrated and attentive approach to environmental purification and protection (Schaeffer et al. 2015; Skrúcanỳ et al. 2019). They have analyzed the diverse policy implications and their impacts on European nations. They demonstrated that prudent sustainability requires policies regardless of the state’s level of development.

Other research (Sinha et al. 2020) assessed technology’s influence and government initiatives on GHGs in the environment of a minor sample of Asian and African economies. They determined that nations have focused more on their sustainability and SDG achievement policy mechanisms. Since the inauguration of the SDGs, academics have evaluated the state policy implications of a concentrated approach and suggested various policy implications for achieving all SDGs through optimal state resource utilization (Pezzagno et al. 2020). Global climate change’s predicted and observed effects include rising sea levels (Shepherd & Wingham 2007), rainfall distribution changes, and storm intensification. Theoretically, because of the information asymmetry it creates, financial instability can reduce environmental quality because it makes it difficult for financial institutions to fund renewable energy projects. Similarly, FDI flows are harmed by financial sector instability (FDI), which impedes the introduction of environmental innovations into the economy, thereby degrading environmental quality (Baloch et al. 2022; Yang et al. 2022).

Explore the numerous facets of financial risk and its implications for businesses, governments, markets, and people. Financial stability is vital for economic development and impacts environmental quality (Lee et al. 2013; Shahbaz et al. 2022). First, a more secure financial environment supported by robust financial institutions may entice more FDI, resulting in higher economic growth and increased energy consumption (Lee et al. 2013; Shahbaz et al. 2022).

To begin with, green structural transformation necessitates substantial expenditures in high-capital-cost areas like innovation and clean power (Lindenberg 2014). These industries are very susceptible to uncertainty and risk. Low-carbon energy sources, such as renewables, would require investment if green transition scenarios are to be met quadrupled, creating a “green finance gap” (Bui 2020). On the other hand, the study uses long-term equilibrium to examine the connection between carbon emissions, economic growth, and energy use. The study found that rising GDP directly increases CO2 emissions and energy demand, worsening India’s already poor climate. (Boutabba 2014). In other words, insufficient financial resources for green investments threaten the financial system’s stability. Moreover, investing practices, accounting systems, and financial regulatory regimes are being shown to have an intrinsic “carbon bias” (Campiglio 2016). Besides, this study showed that FR does not affect emissions (Ozturk & Acaravci 2016). Studies have revealed that climate-improvement efforts may have an unanticipated effect on the financial system’s stability (Battiston et al. 2017; Dietz et al. 2016; D’Orazio & Popoyan 2019). Examined the non-linear impact of financial Risk on CO2 emissions using the penal smooth transition regression model, and the results showed a negative effect between financial risk and CO2 emissions. Furthermore, the studies found the same results (Shahbaz et al. 2017; Abbasi & Riaz 2016; Zaidi et al. 2019). Boutabba’s finding was revised and confirmed by Bui (2020) and Fang et al. (2020).

Financial development considerably reduces both long- and short-term carbon emissions, according to an analysis of panel data covering APEC nations from 1990 to 2016 (Zaidi et al. 2019). Meanwhile, the Umar study discovered a persistent inverse relationship between CO2 emissions and China’s economic growth (Umar et al. 2020). Mberak testified that financial development adversely influences carbon emissions over the long run, showing that economic growth reduces environmental damage (Kais & Ben Mbarek 2017). Previous study findings were consistent with those (Kirikkaleli & Adebayo 2021). Report negative interrelationship between financial risk and carbon dioxide emission. On the other side, other studies showed that FR worsened CO2 emissions, for example, the study by Zhao et al., (2021) and Acosta et al. (2020).

As opposed to sustainability, green growth promotes ecologically sustainable growth without lowering the fiscal growth rate. As a result, green growth is regarded as a successful low-carbon framework and a viable road toward sustainable development (G20 2019; UNESCAP et al. 2012). Because green growth comprises both short-term economic growth and long-term environmental sustainability, multi-sectoral activities require consolidating new resources through investment and innovation while stimulating economic growth (Huang & Quibria 2013; OECD 2022). To that aim, green growth, defined as an alternative growth route requiring policy instruments such as fiscal and monetary policies, has emerged as a critical issue for the international community, spurring significant research into its causes (Hickel and Kallis 2022; Kim et al. 2014; Zhao et al. 2022). The need to find the best technique and resources to solve ecological problems without sacrificing economic growth is pressing in light of their increase. A shift from a resource-based to a renewable energy-based economic growth model is necessary. Two goals are possible means of doing this: achieving macroeconomic stability is critical for economic growth, and green development requires minimizing environmental damage and increasing resource use efficiency (Y. Chen et al. 2023a, b).

In addition, technological advancements, an increase in the financial risk index, and craft contribute to China’s economic expansion. We also discover that investment and technological innovation improvement can significantly impact a nation’s economic performance. Finally, we observe a negative correlation between financial risk and China’s economic performance (Xu & Zhao 2023). The results show that environment-related technologies contribute to green growth in BRICS nations, confirming the high optimism of long-term forecasts of environmental inventions and patents. Green growth in the BRICS nations is expected to expand as financial globalization develops (R. Chen et al. 2023a, b).

A rise in global temperature and a slew of unfavorable environmental conditions are directly attributable to the growing rate of industrialization worldwide and the overexploitation of non-renewable energy sources (Mohsin et al. 2021). In addition, worldwide emissions of greenhouse gases are anticipated to increase by 50% by 2050, primarily due to CO2 emissions from non-renewable energy sources (Spirito et al. 2014). The average atmospheric CO2 concentration and surface and ocean temperatures worldwide will continue to rise unless effective policies and technologies are implemented to cut or manage CO2 emissions. The rising global temperature has already caused significant damage to the human living environment due to these greenhouse gases. This includes the possible extinction of some species, the loss of biodiversity, droughts, floods, forest fires, acidification of the oceans, the melting of the south and north pole glaciers (NSPG), and sea-level rise (Jahangir et al. 2022), the effects of pollution by providing subsidized loans to businesses and industries that adhere to environmental regulations. This practice separates economic growth and CO2 emissions, facilitating the deployment of renewable energy projects (Baloch et al. 2022; Bo et al. 2022; Juyal et al. 2010).

The effect of technological advancement on economic growth. According to a study, the quantity and quality of innovative activity are related to economic development (Hasan & Tucci 2010). Additional research affirms that growth relies on accessible energy, with a strong correlation between energy consumption and output. Progress in technology and better fuel options have overcome previous constraints on economic productivity due to inadequate energy resources. Nonetheless, the significance of energy remains unchanged. In developed and select developing countries, advancements in technology and a shift from coal to superior fuels, especially electricity, have reduced energy use per unit of economic output (Simmons 2011). According to research by Yang and Usman (2021) that analyzed the economies from 1990 to 2016, the countries included in this analysis are Brazil, India, China, and South Africa. Technology has a minimal impact on ecological footprints in major emerging market countries, according to research by Destek and Manga (2021). Sun et al. (2022) elaborate on this point by noting that countries with more developed economies, better technology, and more efficient energy use see a more considerable influence from innovation (Khattak et al. 2022; Kihombo et al. 2021; Liguo et al. 2022). All looked at the impact of innovations on reducing emissions in distinct locations. It has also been helpful in the United States (Liguo et al. 2022). Technology improvement mitigates environmental degradation by decreasing carbon emissions in key nuclear consumer countries, according to recent research by (Sadiq et al. 2023). However, more research is needed to understand how technological development affects the ecological footprint of economically sophisticated nations.

Fourthly, to combat the issue of financial exclusion (Andrianaivo & Kpodar 2011), policymakers in several nations continue to commit substantial resources to boost the amount of financial inclusion in their respective countries. Access to essential banking services in the formal economy is critical to financial inclusion, especially for impoverished people (Allen 2016). Policymakers and researchers have paid close attention to financial inclusion for four main reasons. Financial inclusion is essential to realize the United Nations’ sustainable development objectives (Demirgüç-Kunt & Singer 2017). There has been a plethora of research on several dimensions of financial inclusion, including its role in fostering development (Claessens et al. 2013), its impact on financial stability (Cull et al. 2012), its connection to economic expansion (D.-W. Kim et al. 2018a, b), and the practices of individual nations in this area (Kabakova & Plaksenkov 2018). Increasing the poor’s access to financial services is widely recognized as a practical strategy for combating budgets for studies (Beck et al. 2007). Demirgüç-Kunt and Singer (2017) note, however, that most evidence on the connection between financial inclusion and growth resides at the individual and micro levels. The link underlying financial inclusion and broad economic growth remains poorly documented. At least in theory, it is possible to show a connection between financial inclusion, macroeconomic development, and inequality. However, the World Bank points out that this correlation is not black and white. According to the literature, entrepreneurial endeavor is a function of capacity and not parental wealth (Beck et al. 2009).

Financial inclusion has garnered a lot of focus in recent times. Policymakers and academics have emphasized financial inclusion for numerous reasons (Ozili 2021). These are typical instances in which the availability of reasonably priced financial services and products fosters the use of renewable energies. The implementation of environmental protection services, which decrease CO2 emissions by reducing fossil fuel consumption (Le et al. 2020) analyzed the effects of foreign direct investment, urban sprawl, energy consumption, and industrialization in 31 different nations. The study found an upward trend in financial inclusion and carbon dioxide emissions. The effect of financial inclusion on greenhouse gas emissions was evaluated (Renzhi & Baek 2020) for 103 countries. The research showed that financial inclusion lowers CO2 emissions using the GMM technique and data collected annually between 2004 and 2014. Financial inclusion could lessen the negative consequences of economic development by raising public awareness of environmental issues (Zafar et al. 2021).

Therefore, financial inclusion mitigates ecological degradation. Environmental quality can be improved by investing in renewable energy sources; lower finance costs, streamlined procurement procedures, and less oil pollution are all results of a well-developed financial sector (Kirikkaleli & Adebayo 2021). This study illustrated the existence of long-run cointegration among an economic development index, the proportion of tourism in exports, energy consumption, renewable energy, trade, and per capita greenhouse gas (GHG) emissions across 34 high-income countries spanning Asia, Europe, and America (Khan et al. 2019). To improve environmental quality and support development that is both low-carbon and energy-efficient Sustainable Development Goals (SDGs), economic actors should be given access to green growth-oriented financial services (Ahmad & Satrovic 2023).

With the advancement of science and technology, broadband infrastructure is recognized as a critical element for enhancing industrial competitiveness. Countries worldwide are proactively seizing the opportunity presented by the implementing plans and policies to expand the availability of their lightning-fast broadband networks, which are the foundation of the “information superhighway” of the future. This development of the Internet and information and communication technology (ICT) significantly impacts the scale and structure of energy consumption, posing challenges to energy sustainability (A. Lee et al. 2021; Wu et al. 2021).

Investigating the relationship between Broadband Internet access and energy conservation is essential. High-speed broadband plays a crucial role in the infrastructure of information and communication technology (ICT) and is considered a strategic asset for fostering the growth of the digital economy (DeStefano et al. 2018; Lee et al. 2022). The significance of this extends to influencing social and economic activities, impacting energy and environmental sustainability. The current reliance on fossil fuels leads to high emissions, and while transitioning to cleaner energy sources can reduce this, it may affect total factor energy efficiency (TFEE). In China, advanced coal technologies exist, but renewable energy efficiency needs to catch up, posing a challenge in comparing emission reduction and TFEE improvement. Scholars propose green total factor energy efficiency (GTFEE) integrating pollutant emissions. Additionally, the development of information and communication technology, including broadband infrastructure, has implications for energy consumption, sector productivity, and energy structure (Appiah-Otoo & Song 2021; Wu et al. 2021).

It encourages the use of digital technologies, reduces the price of transactions, and speeds up data dissemination. Massive volumes of high-frequency data are transmitted to facilitate intelligent energy management, greatly facilitated by a robust broadband network. Broadband infrastructure and information and communication technology also aid in the conscious revamping of power infrastructure, reduce the risks associated with renewable energy, and speed up the shift to a more sustainable energy system. A great deal of risk and uncertainty is associated with the energy transition process, from price swings in energy to questions about how well it can improve efficiency (Zhang et al. 2022), which can have ripple effects on economic and monetary structures. Digital infrastructure, however, can lessen the blow of such unknowns (Lee et al. 2022).

Expanding the ICT sector, driven by broadband infrastructure, increases energy consumption by enabling economic activity. Consequently, there are advantages and disadvantages to implementing a broadband infrastructure to achieve energy sustainability. Adopting digital infrastructure, particularly broadband networks, can foster regional innovation in green technologies, improve energy conservation, reduce pollution emissions, and promote environmental sustainability (Ma et al. 2021). Integrating technology for sharing information and making connections, the shift to digital may help the environment and advance green, sustainable energy (Wu et al. 2021). As the fourth wave of industrialization, digitalization is a game-changer with far-reaching economic and social consequences because of manufacturing innovation, distribution, circulation, and consumption. Some research has found that the connection between digitization and energy sustainability is complex and ambiguous (Lee et al. 2022; Sun et al. 2022; Wang et al. 2022; Wu et al. 2021). Broadband infrastructure, as a component of the digital economic and social revolution, improves the speed and accuracy of information sharing while lowering transaction prices. Analyzing the role of broadband infrastructure can provide insights into how the mechanisms of digital transformation influence sustainable development, particularly in information transmission, leading to lower transaction and data expenses. By studying the impact of broadband infrastructure on financial stability, we can better understand the connection between digital transformation and environmental and economic sustainability, shedding light on the intricate dynamics at play in the digital era.

Theoretical background

Environmental Kuznets curve (EKC)

This study is built upon the framework of the environmental Kuznets curve (EKC) theory, which posits that as economies progress, initial environmental degradation gives way to improving environmental quality. We aim to examine the relationship between green growth, financial stability, and other economic aspects to enhance ecological well-being.

Beyond conventional economic growth, our research highlights the necessity of integrating sustainable practices into economic advancement. We contend that prioritizing green growth, characterized by eco-friendly approaches and technologies, can yield better environmental outcomes. We seek insights into their positive impact on environmental quality by investigating the interplay between green growth and financial stability.

Furthermore, our study adopts a holistic approach, encompassing diverse economic factors affecting the environment, including resource efficiency, adoption of renewable energy, pollution control measures, and sustainable production and consumption practices. By analyzing these elements alongside green growth and financial stability, we aim to identify effective strategies for enhancing environmental quality.

Methodology

Existing research has predominantly focused on calculating the green growth index for OECD countries using the entropy-weighted method. Extending this analysis to a broader spectrum of countries, such as both OECD and non-OECD nations, is a research gap. This study will use financial risk as an independent variable, previously used as a mediator. The entropy weight method, initially applied by the OECD, has been extended globally. This approach utilizes a systematic process to assign weights to various indicators, enhancing the representation of variables in diverse datasets and facilitating a comprehensive analysis of global phenomena.

Addressing climate change as a worldwide concern, this study views the entire world as its population. While encompassing all nations, a sample of 111 countries was selected due to reliable and complete data availability. Esteemed sources like the World Bank and OECD contribute to this study’s credibility. Spanning 16 years from 2004 to 2019, this analysis period offers consistent and comprehensive data for critical variables. Recognizing data limitations, the study focuses on nations with available statistics, striving to provide pertinent insights into global population trends.

This research explores the interplay and impact of financial risk, technological innovation, green growth, soft infrastructure, renewable energy, and financial inclusion on sustainable development. It also investigates how greenhouse gas emissions are influenced by sustainable development, technology innovation, green growth, soft infrastructure, renewable energy, and financial inclusion. Employing quantitative techniques and secondary data, this study follows a similar methodology (Wang & Dong 2022). The entropy weighted method was used to better represent variables in calculating the green growth index to calculate the green growth index.

Entropy weighted method

Step 1: Assigning an entropy weight to each parameter.

To calculate the entropy value, we need to know how many samples there are (I = 1, 2, 3, z). Parameters j are scored on a scale from 1 to t for each sample. Therefore, the eigenvalue matrix X may be built using Eq. (1):

Step 1

Efficiency, cost, fixed, and interval feature indices are all possible classifications. Equation (2) provides the normalizing building function (Yij) for efficiency types:

Step 2

Yij is the normalization construction function for a parameter (j) in a specific sample (i). (Xij) min and (Xij) max represent each index’s minimal and maximum values in the initial quality analysis data. The initial matrix must be transformed before calculating the weights to eradicate the error caused by distinct dimensions and units. As shown in Eq. (3), the standard grade matrix Y can be acquired after transformation.

Step 3

Standardizing measurements (Docheshmeh Gorgij et al. 2017; Huang & Wei 2012): The ith index’s standard deviation in the jth sample is denoted by pij, and its calculation is as follows:

Step 4

In the EWM, the entropy value Ei of the ith index is defined as follows:

Step 5

In the EWM evaluation, PIJ, lnPij = 0 is typically set when pij = 0 for calculation convenience. The range of entropy value Ei is between 0 and 1. The greater the Ei, the greater the degree of differentiation of index I and the more data can be extracted. The index should, therefore, be accorded a greater weight. Therefore, the technique for calculating weight within the EWM is as follows (Amiri et al. 2014; Liu et al. 2010).

Step 6

Another study (Cao et al. 2022) used the cast-off entropy-weighted technique to calculate the green growth index, and its data was collected from the OECD and World Bank.

Variables

The dependent variable is sustainable development, while sustainable development is measured by different indicators, i.e., CO2 emission, greenhouse gas emission, ecological footprint, and carbon footprint, in various contexts (Afzal et al. 2022; Mohsin et al. 2021). The other variables for this study are green growth, financial inclusion, technological innovation, renewable energy consumption, and soft infrastructure used (Table 1) (Zafar et al. 2022).

Model specification

The conceptual framework serves as the project’s overall theoretical framework. It is a network of relationships among the variables determined to be pertinent to the issue scenario and found by procedures like observation, interviews, and literature surveys that have been rationally established, documented, and elaborated.

This model illustrates the interconnectedness between greenhouse gas emissions, considering the influences of financial risk, green growth, financial inclusion, renewable energy, and soft infrastructure. The model accounts for control variables denoted by the letters URB for urbanization, PG for population growth, IND for industrialization, and LL for literacy level. In this context, “I” represents individual nations, and “t” signifies eras. The term denoted as (µit) is an erroneous element. The vector β pertains to the dependent variable, where GHGs represent greenhouse gas emissions, and independent variables include FR for financial risk, GG for green growth, RE for renewable energy, TI for technological innovation, FI for financial inclusion, and ST for soft infrastructure. Additionally, the symbol “C” symbolizes the controlled variables in the model.

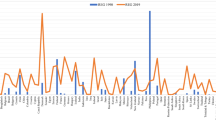

Descriptive statistics

Each variable included 1776 observations of a period ranging from 2004 to 2019 for 111 countries. The descriptive statistics of the dataset report the range mean and median of the data of the variables. The descriptive statistics result shows that the greenhouse gases have a mean value of 11.3, the range of greenhouse gases is 16.358, and the standard deviation is 1.32. The descriptive statistic of financial risk reports a mean of 16.65, the range is 97.937, and the standard deviation of economic risk is 12.006. The figures for green growth show a range of around 0.00256 with a mean value of 0.00285 and a standard deviation of 0.00323 (Table 2).

The descriptive statistics of renewable energy show a mean value of 2.763, a range of 4.427, and a divergence from the norm value of 1.168. The dataset reports an average value of 3.327, having a range of 5.996, and the standard deviation is 0.903 for technological innovation. The descriptive financial inclusion statistics show a mean value of 3.078, a range of 4.854, and a standard deviation of 1.002. Soft infrastructure has a mean of 13.126, with a standard deviation value of 2.785 and a range of 20.201.

Correlations

Upon examination of the correlation matrix, it is evident that technological innovation (TI), financial inclusion (FI), and soft infrastructure (SI) (0.228*, 0.076*, and 0.611*) have significant positive correlations with greenhouse gases (GHG) at P 0.01. This indicates a distinct positive relationship between these factors and greenhouse gas emissions. In other words, technological innovation, financial inclusion, and soft infrastructure will be associated with increased greenhouse gas emissions (Table 3).

There is a significant negative correlation (− 0.011, − 0.59*, − 0.29*, P 0.01) across greenhouse gases (GHG) with financial risk (FR), renewable energy (RE), and green growth, as shown by the correlation matrix. This indicates that greenhouse gas emissions decline as financial risk, green growth, and renewable energy increase. In this study, the VIF values of all variables in the regression model are less than 3, which is acceptable. This suggests that multicollinearity is insignificant in this model. In addition, the mean VIF value of 1.428 is below 2, supporting the conclusion that multicollinearity does not pose a significant problem for this regression model.

Cross-sectional dependency

All variables examined in the study had P-values of 0.00, indicating significant evidence of cross-sectional independence. This suggests that the observations in the panel data set exhibit a considerable degree of interdependence or relationship. The results indicate that changes or disruptions in one observation or unit will influence the remaining observations or units in the dataset. These results underscore the presence of cross-sectional dependence, emphasizing the independence or interrelationship of the investigated variables (Table 4).

Slope homogeneity test

The slope homogeneity is determined by analysis of covariance (ANCOVA) or a comparable technique. The “delta” and “adjusted” test statistics are correspondingly 20.45* and 28.91*. Both test results are highly significant, as indicated by extremely low P-values (“00”), indicating substantial evidence to reject the null hypothesis that no slope difference exists between groups or conditions. Therefore, the slopes differ substantially between the categories or conditions being compared (Table 5).

Panel unit root test

After analyzing the results of the CIPS and CADF tests, all panel variables are nonstationary, indicating that the null hypothesis is accepted at the I (0) level. The null hypothesis of nonstationary is rejected in favor of the alternative hypothesis of stationarity when the variables are differentiated once (I (1)). Consequently, according to the findings, the variables maintain a steady state when analyzed at the first difference (Table 6).

Pedroni cointegration

The panel cointegration test used the Pedroni test to fix whether the variables have a long-term affiliation. The results indicate that cointegration exists (Table 7).

The M Phillips Perron test produced a T statistic of 13.8343 with a significance level of 0.000. This strongly suggests co-integration, suggesting a long-term relationship between the variables. With a T statistic of − 9.1397 and a P-value of 0.000, the Phillips-Perron test also supported the presence of cointegration. These results support the notion that the variables have a long-term relationship. A Dickey-Fuller test demonstrated cointegration with a T statistic of − 8.0614 and a P-value of 0.000. This suggests that the variables are not entirely random and have a long-term relationship.

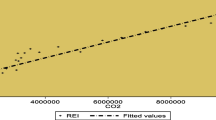

Fully modified ordinary least squares

The R-squared value (0.552689) gauges the degree to which predictor variables in a regression model explain the variance in the dependent variable. In this case, the independent variables account for around 55.27% of the variation in the dependent variable. The adjusted R-squared (0.550155) modifies to consider the number of independent variables, showing a slight difference from the R-squared value.

The long-run variance of the dependent variable is 0.025573, reflecting its sustained variability over time and providing insights into stability and volatility. Analysis shows significant connections between variables and greenhouse gas (GHG) emissions. The coefficient of − 0.000143 indicates a statistically significant relationship between variable FR and GHG emissions. While moderately substantial at the 10% level (P-value = 0.0815), higher FR values seem linked to reduced GHG emissions.

Contrastingly, variable GG exhibits a statistically significant negative association, with a coefficient of − 5.695605. The findings highlight a meaningful relationship: increased green growth (GG) is associated with decreased greenhouse gas (GHG) emissions (P-value = 0.017), emphasizing GG’s pivotal role in fostering sustainable development by curbing GHG emissions.

The analysis underscores critical findings regarding the impact of variables on greenhouse gas emissions. Variable TI shows a significant negative correlation (coefficient − 0.030229, P-value 0.0201), indicating higher TI values relate to lower GHG emissions. Similarly, RE exhibits a substantial inverse relationship (coefficient − 0.132910, P-value 0.0001), where increased RE is associated with reduced GHG emissions. Conversely, FI reveals a noteworthy positive correlation (coefficient 0.057379, P-value 0.0005), signifying heightened FI links to higher GHG emissions. Likewise, SI demonstrates a significant positive connection (coefficient 0.029942, P-value 0.00001). Coefficient results show a positive direction of the relationship with GHG emissions. These results emphasize the significant roles of FR, GG, TI, RE, FI, and SI in influencing GHG emissions.

Robustness test

The R-squared value of 0.580229 indicates that approximately 58% of the variation in the dependent variable can be explained by the independent variables included in the regression model. The mean of the dependent variable, GHG, is 11.29986, representing the average amount of GHG emissions in the data set. The standard deviation of the dependent variable is 1.631627, which represents the variance or dispersion of GHG emissions around the mean. After that, the standard error of the regression (S.E. of regression) is 0.111450, representing the average difference between the actual GHG emissions and the values predicted by the regression model. The sum of squared residuals is 20.5568, meaning the total squared difference between actual GHG emissions and model-predicted values.

The outcomes of the robustness test are displayed in Table 9. According to the test results, all dimension variables passed the significance test. This demonstrates the stability of the impact of FR, RE, GG, TI, FI, and SI on greenhouse gas emissions.

Discussion

This research shows that lowering carbon emissions and minimizing financial risks are mutually exclusive. To reduce carbon emissions without jeopardizing national stability and economic growth, policymakers must keep financial risks within manageable bounds and implement effective measures to counteract the inverse relationship between these dangers and emissions. Stable and orderly economic growth and decreased carbon emissions may be attained through increased technological innovation and the use of renewable energy.

We have discovered a substantial positive relationship between carbon emissions and economic stability. Greenhouse gas emissions have a significant negative correlation with financial development. In contrast, countries with larger populations and higher urbanization rates experience increased carbon emissions (Afzal et al. 2022).

This study confirms in Tables 8 and 9 that financial risk is negatively correlated with greenhouse gas emissions. In the long run, financial risk has a minimal coefficient, which means that an increase in financial risk will increase greenhouse gases; ultimately, financial risk impacts renewable energy, green growth, and technological innovation, which increases greenhouse gas emissions. Controlling greenhouse gas emissions and, in the long run, financial risk has a positive relation. However, the long variance with other economic indicators has optimal results, meaning that more than controlling financial risk to greenhouse gases is required; other economic indicators, financial risk, and greenhouse gases both factors will control up somehow in the long run.

The global economy has expanded at the fastest rate in the twentieth century, with unprecedented development in virtually every sector, but this prosperity has been accompanied by pollution. In consequence, the environment and livelihoods of residents have been in jeopardy for the past three decades despite the expansion of industrial production. In addition to ensuring long-term financial stability, the government continues to exert significant efforts to clean up the environment and reduce environmental concerns.

The statistical findings demonstrate a negative correlation between environmental degradation and green growth. In the short and long term, a 1% change in GTRD results in a 0.35 and 0.48% decrease in environmental degradation at a 1% significance level (Wei et al. 2023). These results are consistent with this study. The coefficients of green growth are − 5.695605 and − 0.132910, respectively, indicating the cumulative effect of green growth on CO2 emissions and highlighting the efficacy of global advocacy for a green economy. Businesses’ green technological innovation processes have been sped up, and industrial optimization and upgrading have been hastened because of the worldwide economy’s green transformation and expansion.

As the green movement has gained popularity, people have become more concerned about improving their quality of life and using less energy, producing much pollution. The findings here are consistent with those of the research (Lee & Lee 2022); the discovery of a negative correlation between green growth and greenhouse gas emissions speeds up the emergence of green finance. The local government’s aggressive promotion and support of the green economy has prompted a widespread cultural shift in favor of sustainability, and green ideas are permeating every sector of society.

Renewable energy has a negative impact of 5% on CO2 emissions in both the short and long term. This suggests that renewable energy reduces carbon dioxide emissions. Recent research has found an adverse correlation between renewable energy and carbon dioxide emissions, with the former alluding to the fact that the latter makes it possible for the world’s top ten greenhouse gas emitters to reduce their carbon footprint (Tsimisaraka et al. 2023; Yu et al. 2022). Another study reveals a negative coefficient for renewable energy, indicating that it significantly decreases consumption-based CO2 emissions in BRI countries over time. Similar results are observed for renewable energy, suggesting that, like fossil fuels, renewable energy has a statistically significant and negative relationship with CO2 emissions in both short- and long-term models (Cai & Wei 2023).

Findings of the study are shown in Tables 8 and 9. In line with the above results, renewable energy has a negative coefficient and significant impact on greenhouse gases, showing an inverse relation to enhancing sustainable development; countries need to strengthen the use of renewable energy instead of fossil fuel. Renewable energy has a high coefficient in the FMOLS and DOLS models, showing its high inverse impact on sustainable development.

According to the results of this study, financial inclusion has a significant positive impact on sustainable development at the level of 5%. This result is consistent with the finding of Tsimisaraka et al. (2023); the study reveals that financial inclusion (FI) has a 5% positive long-term and short-term impact on CO2 emissions in the nations. This means that as financial inclusion increases, so do CO2 emissions. Increased credit availability led to consumer spending on electronics like refrigerators, air conditioners, and televisions in the nations under study. Widespread adoption of these products hastens the consumption of fossil fuels for domestic energy production, leading to increased CO2 emissions. It also shows how the countries distribute their money to get their desired results.

The short-term and long-term effects of the soft infrastructure development on carbon emissions are statistically significant and favorably trending. An increase in smooth infrastructure development results in a rise in energy demand, increasing carbon emissions. Investment in weak infrastructure and hardware production will invariably increase energy consumption in the region (energy rebound effect), resulting in increased carbon emissions. However, the hardware of soft infrastructure has a significant and positive impact on carbon emissions. The coefficient of the soft infrastructure is 0.029942 positive in the long run to examine the results FMOLS and DOLS conducted, and these results are aligned and confirm the study of Cui et al. (2023).

Conclusion

The idea of sustainability has significantly increased in popularity over the past 30 years and has taken center stage in international forums. It has become a matter of utmost importance, necessitating the creation of a thorough framework for society and the economy that can successfully combine economic viability, social inclusion, and environmental sustainability. To address the substantial problems that have arisen because of ecological deterioration and global warming caused by human activity, it is necessary to adopt financial processes that are socially and ecologically responsible. One such process is financial risk green growth, renewable energy, technological innovation, financial inclusion, and soft infrastructure. It is of the utmost importance to disentangle economic growth and development from the process of damaging environmental systems by implementing modifications to fundamental business practices. Because of the growing number of risks to the natural world, environmentally responsible investment is now necessary in the modern era to accomplish the goal of sustainable development. The idea of funding projects with green bonds became widespread in 2008 and has seen consistent expansion since then. Promoting environmentally sustainable growth is the most effective strategy for stopping global warming.

In summary, this research analyzed how green financial indicators affect long-term prosperity and financial risk in 111 selected countries. The findings highlight the critical role of green growth, technological innovation, and renewable energy in promoting sustainable development and achieving carbon-neutrality targets and sustainable development goals. Recent research has demonstrated that financial inclusion is vital in promoting sustainable development, positively impacting various aspects. Additionally, soft infrastructure, including technological advancements, has been identified as contributing to positive outcomes. This implies that countries focusing on producing goods and services related to soft infrastructure and technological advancements may inadvertently contribute to higher greenhouse gas (GHG) emissions. Such elevated GHG emissions can significantly threaten environmental quality and sustainability. It is essential to carefully balance the benefits of financial inclusion and technological progress with the need for ecological preservation and mitigation of GHG emissions.

In conclusion, institutions should prioritize allocating budgets toward environmental improvement R&D and promoting green assets to ensure a sustainable future. Policymakers must provide fiscal and monetary incentives to encourage businesses and researchers to transition to a green economy and invest in renewable energy. In addition, governmental organizations and authorities should actively support the development of the circular economy and greener energy products. Environmental concerns, geopolitical tensions, and the requirement for increased energy security are pushing forward the shift toward renewable energy sources. Green bonds, climate change projects, and clean energy assets can all be included in an investor or fund manager’s portfolio if they adjust to have these types of investments.

Recommendations

A primary recommendation is to prioritize adopting green growth strategies in these nations. Governments can stimulate economic growth by facilitating incentives for investments in renewable energy and environmentally sustainable energy, alongside deploying advanced eco-friendly technologies to address environmental concerns. This involves formulating policies that incentivize financial institutions to back green projects and offering subsidies to attract private investments in renewables.

Policy recommendations

A key recommendation is to emphasize the adoption of green growth strategies in these countries. Governments should promote economic growth by encouraging investments in renewable energy and good government eco-friendly initiatives. This entails creating policies that incentivize financial institutions to support green projects and offering subsidies to attract private investments in renewables.

Green incentives and regulations

Governments should enact and enhance policies encouraging firms and people to pursue green practices. Incentives like tax breaks and subsidies may work as motivators toward using clean energy technologies and practicing sustainability.

Investment in clean energy technology

Promote research, development, and investment in green energy technologies. Governments must set aside money for innovation in renewable energy resources, energy-efficient technologies, and environmentally sound infrastructures to achieve sustainable growth while protecting the environment.

Eco-friendly governance

Governments should also focus on enforcing regulations that encourage environmental sustainability. Setting up efficient governance systems and emission monitoring systems, as well as elimination of the wastes and use of resources, will contribute toward a clean and healthy environment.

Theoretical implications

Various theoretical consequences of this research are interconnected, and thus, it adds to the existing empirical base on sustainable development. The study considers the intertwining relationship between social equity, economic growth, and environmental conservation. These ideas confirm that sustainable development must be pursued comprehensively. This gives us a better grasp of the intricate mechanisms that make sustainability possible in various branches and domains. The study’s findings also stimulate debates within the theoretical background around the nexus between the financial aspect and sustainable development. By illustrating the negative consequences of financial risk and the positive influence of financial inclusion on prolonging sustainability outcomes, this research deepens theoretical debates concerning the finance function in the context of economic sustainability.

Research implication

The research adds considerable knowledge to the subfield of sustainable development by applying a multidisciplinary model which brings together the social, environmental, and economic dimensions. Through applying quantitative methods and analyzing the interplay of the independent factors, the paper presents valuable evidence about the particularities of sustainable progress. This research article, however, states that financial risk is one of the critical aspects that may hamper sustainable development. This focused a spotlight on risk management practices that enable sustainable practices. Policymakers and other stakeholders can use these insights to develop interventions that target financial risks as a medium for the promotion of the comprehensive project’s success.

Limitations

Despite these limitations, this paper contributes significantly to existing literature and lays the groundwork for future explorations in this field.

Future research

However, this study offers avenues for future research. While presenting valuable insights within the chosen countries, it is crucial to acknowledge that the impact of green financial indicators can significantly differ across nations. Future researchers should replicate this study using a diverse range of countries to yield more comprehensive results. Comparative analyses among various regions, encompassing developed and developing nations, could provide additional valuable insights. Additionally, incorporating more current data would enhance the analysis.

Research design and methods

The research will employ a quantitative approach, utilizing both quantitative data collection methods. WDI and OECD website were used to gather data.

Environmental and community impact

Given the nature of sustainable development research, the project is committed to minimizing its own environmental footprint. Paper usage will be minimized, and data will be stored securely in digital formats. Additionally, the research team will engage with local communities when applicable, seeking input and respecting local knowledge in the research process.

Publication and dissemination

The research findings will be disseminated through academic publications, conferences, and educational workshops. The research team will ensure that the information shared accurately represents the collected data and is used to advance knowledge in the field of sustainable development.

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114. https://doi.org/10.1016/j.enpol.2015.12.017

Acosta LA, Maharjan P, Peyriere HM, Mamiit RJ (2020) Natural capital protection indicators: measuring performance in achieving the Sustainable Development Goals for green growth transition. Environ Sustain Indic 8:100069. https://doi.org/10.1016/j.indic.2020.100069

Afzal A, Rasoulinezhad E, Malik Z (2022) Green finance and sustainable development in Europe. Econ Res Ekon Istraž 35(1):5150–5163

Ahmad M, Khan Z, Ur Rahman Z, Khan S (2018) Does financial development asymmetrically affect CO2 emissions in China? An application of the nonlinear autoregressive distributed lag (NARDL) model. Carbon Manag 9(6):631–644. https://doi.org/10.1080/17583004.2018.1529998

Ahmad M, Satrovic E (2023) Relating fiscal decentralization and financial inclusion to environmental sustainability: criticality of natural resources. J Environ Manage 325:116633. https://doi.org/10.1016/j.jenvman.2022.116633

Allen RE (2016). Financial crises and recession in the global economy Edward Elgar Publishing

Amiri V, Rezaei M, & Sohrabi N (2014). Groundwater quality assessment using entropy... - Google Scholar. https://scholar.google.com/scholar_lookup?title=Groundwater%20quality%20assessment%20using%20entropy%20weighted%20water%20quality%20index%20(EWQI)%20in%20Lenjanat%2C%20Iran&author=V.%20Amiri&author=M.%20Rezaei&author=N.%20Sohrabi&publication_year=2014

Andrianaivo M, & Kpodar K (2011). ICT, financial inclusion, and growth: evidence from African countries

Arogyaswamy B (2023) Demand side mitigation and net zero emissions: technological, social, and cultural challenges. Sustainability Clim Change 16:102–114. https://doi.org/10.1089/scc.2022.0125

Appiah-Otoo I, Song N (2021) The impact of ICT on economic growth comparing rich and poor countries. Telecommunications Policy 45(2):102082

Baloch A, Shah SZ, Rasheed S, Rasheed B (2022) The impact of shadow economy on environmental degradation: empirical evidence from Pakistan. GeoJournal 87(3):1887–1912

Battiston S, Mandel A, Monasterolo I, Schütze F, Visentin G (2017) A climate stress test of the financial system. Nat Clim Change 7(4):4. https://doi.org/10.1038/nclimate3255

Beck T, Demirgüç-Kunt A, Levine R (2007) Finance, inequality and the poor. J Econ Growth 12:27–49

Beck T, Demirgüç-Kunt A, & Levine R (2009). Financial institutions and markets across countries and over time data and analysis. World Bank Policy Research Working Paper, 4943

Bo L, Yunbao X, Chengbo D, Chao T, Guangde Z, & Yameen T (2022). Green growth and carbon neutrality targets in BRICS: do ICT-trade and bank credit matter?

Bousquet P, Ciais P, Miller JB, Dlugokencky EJ, Hauglustaine DA, Prigent C, Van der Werf GR, Peylin P, Brunke E-G, Carouge C (2006) Contribution of anthropogenic and natural sources to atmospheric methane variability. Nature 443(7110):439–443

Boutabba MA (2014) The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model 40:33–41. https://doi.org/10.1016/j.econmod.2014.03.005

Bui DT (2020) Transmission channels between financial development and CO2 emissions: a global perspective. Heliyon 6(11):e05509. https://doi.org/10.1016/j.heliyon.2020.e05509

Cai X, Wei C (2023) Does financial inclusion and renewable energy impede environmental quality: empirical evidence from BRI countries. Renew Energy 209:481–490. https://doi.org/10.1016/j.renene.2023.04.009

Campiglio E (2016) Beyond carbon pricing: the role of banking and monetary policy in financing the transition to a low-carbon economy. Ecol Econ 121:220–230. https://doi.org/10.1016/j.ecolecon.2015.03.020

Cao J, Law SH, Samad ARBA, Mohamad WNBW, Wang J, Yang X (2022) Effect of financial development and technological innovation on green growth—analysis based on spatial Durbin model. J Clean Prod 365:132865

Chen R, Ramzan M, Hafeez M, Ullah S (2023a) Green innovation-green growth nexus in BRICS: does financial globalization matter? J Innov Knowl 8(1):100286. https://doi.org/10.1016/j.jik.2022.100286

Chen Y, Lyulyov O, Pimonenko T, & Kwilinski A (2023). Green development of the country: role of macroeconomic stability Energy Environ https://doi.org/10.1177/0958305X231151679

Claessens S, Ghosh SR, Mihet R (2013) Macro-prudential policies to mitigate financial system vulnerabilities. J Int Money Financ 39:153–185

Cook LF (2023) The Latest IPCC Synthesis Report: What We Learned About Climate Science, and What We Learned About Ourselves. Environment: Science and Policy for Sustainable Development 65(5):19–25. https://doi.org/10.1080/00139157.2023.2225407

Cui H, Cao Y, Feng C, Zhang C (2023) Multiple effects of ICT investment on carbon emissions: evidence from China. Environ Sci Pollut Res 30(2):4399–4422. https://doi.org/10.1007/s11356-022-22160-3

Cull R, Demirgüç-Kunt A, & Lyman T (2012). Financial inclusion and stability: what does research show?

Demirgüç-Kunt A, & Singer D (2017) Financial inclusion and inclusive growth: a review of recent empirical evidence World Bank Policy Research Working Paper, 8040

DeStefano T, Kneller R, Timmis J (2018) Broadband infrastructure, ICT use and firm performance: evidence for UK firms. J Econ Behav Organ 155:110–139

Destek MA, Manga M (2021) Technological innovation, financialization, and ecological footprint: evidence from BEM economies. Environ Sci Pollut Res 28:21991–22001

Dietz S, Bowen A, Dixon C, Gradwell P (2016) Climate value at risk’ of global financial assets. Nat Clim Change 6(7):7. https://doi.org/10.1038/nclimate2972

Docheshmeh Gorgij A, Kisi O, & Asghari Moghaddam A (2017). Groundwater quality ranking for drinking Google Sholarhttps://scholar.google.com/scholar_lookup?title=Groundwater%20quality%20ranking%20for%20drinking%20purposes%2C%20using%20the%20entropy%20method%20and%20the%20spatial%20autocorrelation%20index&author=A.%20D.%20Gorgij&author=O.%20Kisi&author=A.%20A.%20Moghaddam&author=A.%20Taghipour&publication_year=2017

D’Orazio P, Popoyan L (2019) Fostering green investments and tackling climate-related financial risks: which role for macroprudential policies? Ecol Econ 160:25–37. https://doi.org/10.1016/j.ecolecon.2019.01.029

Fang Z, Gao X, Sun C (2020) Do financial development, urbanization and trade affect environmental quality? Evidence from China. J Clean Prod 259:120892. https://doi.org/10.1016/j.jclepro.2020.120892

Is green growth possible? (n.d.). Retrieved November 14, 2022, from https://www.tandfonline.com/doi/full/https://doi.org/10.1080/13563467.2019.1598964

Greicius, T. (2022, December 13). NASA sensors to help detect methane emitted by landfills [Text]. NASA. http://www.nasa.gov/feature/jpl/nasa-sensors-to-help-detect-methane-emitted-by-landfills

Hasan I, Tucci CL (2010) The innovation–economic growth nexus: global evidence. Res Policy 39(10):1264–1276

Huang Q, & Wei X (2012). Comprehensive entropy weight observability-controllab Google Sholarhttps://scholar.google.com/scholar_lookup?title=Comprehensive%20entropy%20weight%20observability-controllability%20risk%20analysis%20and%20its%20application%20to%20water%20resource%20decision-making&author=X.%20G.%20Li&author=X.%20Wei&author=Q.%20Huang&publication_year=2012

Huang Y, Quibria MG (2013). Green growth: theory and evidence (Working Paper 2013/056). WIDER Working Paper. https://www.econstor.eu/handle/10419/81020

Irfan M, Razzaq A, Sharif A, Yang X (2022) Influence mechanism between green finance and green innovation: exploring regional policy intervention effects in China. Technol Forecast Soc Chang 182:121882. https://doi.org/10.1016/j.techfore.2022.121882

Jadoon IA, Mumtaz R, Sheikh J, Ayub U, Tahir M (2021) The impact of green growth on financial stability. Journal of Financial Regulation and Compliance 29(5):533–560. https://doi.org/10.1108/JFRC-01-2021-0006

Jahanger A, Yang B, Huang WC, Murshed M, Usman M, Radulescu M (2022) Dynamic linkages between globalization, human capital, and carbon dioxide emissions: empirical evidence from developing economies. Environ Dev Sustain 25(9):9307–35

Jahangir MH, Montazeri M, Mousavi SA, Kargarzadeh A (2022) Reducing carbon emissions of industrial large livestock farms using hybrid renewable energy systems. 189:52–65. https://doi.org/10.1016/j.renene.2022.02.022

Juyal P, Yen AT, Rodgers RP, Allenson S, Wang J, Creek J (2010) Compositional variations between precipitated and organic solid deposition control (OSDC) asphaltenes and the effect of inhibitors on deposition by electrospray ionization Fourier transform ion cyclotron resonance (FT-ICR) mass spectrometry. Energy Fuels 24(4):2320–2326

Kabakova O, Plaksenkov E (2018) Analysis of factors affecting financial inclusion: ecosystem view. J Bus Res 89:198–205

Kandel TP, Lærke PE, Hoffmann CC, Elsgaard L (2019) Complete annual CO2, CH4, and N2O balance of a temperate riparian wetland 12 years after rewetting. Ecol Eng 127:527–535

Khan MTI, Ali Q, Ashfaq M (2018) The nexus between greenhouse gas emission, electricity production, renewable energy and agriculture in Pakistan. Renew Energy 118:437–451. https://doi.org/10.1016/j.renene.2017.11.043

Kais S, Ben Mbarek M (2017) Dynamic relationship between CO2 emissions, energy consumption and economic growth in three North African countries. Int J Sustainable Energy 36(9):840–854. https://doi.org/10.1080/14786451.2015.110291

Khan MTI, Yaseen MR, Ali Q (2019) Nexus between financial development, tourism, renewable energy, and greenhouse gas emission in high-income countries: a continent-wise analysis. Energy Econ 83:293–310. https://doi.org/10.1016/j.eneco.2019.07.018

Khattak SI, Ahmad M, Haq Z, Shaofu G, Hang J (2022) On the goals of sustainable production and the conditions of environmental sustainability: does cyclical innovation in green and sustainable technologies determine carbon dioxide emissions in G-7 economies. Sustain Prod Consumpt 29:406–420

Kihombo S, Ahmed Z, Chen S, Adebayo TS, Kirikkaleli D (2021) Linking financial development, economic growth, and ecological footprint: what is the role of technological innovation? Environ Sci Pollut Res 28(43):61235–61245

Kim D, Yu J, & Hassan M (2018). Growth: towards green growth. A summary for policy makers—Google Scholar. https://scholar.google.com/scholar_lookup?title=Towards%20Green%20Growth%3A%20A%20Summary%20for%20Policy%20Makers%2C%20May%202011&publication_year=2011&author=OECD

Kim D-W, Yu J-S, Hassan MK (2018b) Financial inclusion and economic growth in OIC countries. Res Int Bus Financ 43:1–14

Kim SE, Kim H, Chae Y (2014) A new approach to measuring green growth: application to the OECD and Korea. Futures 63:37–48. https://doi.org/10.1016/j.futures.2014.08.002

Kirikkaleli D, Adebayo TS (2021) Do renewable energy consumption and financial development matter for environmental sustainability? New Global Evidence. Sustain Dev 29(4):583–594. https://doi.org/10.1002/sd.2159

Kirikkaleli D, Adebayo TS, Khan Z, Ali S (2021) Does globalization matter for ecological footprint in Turkey? Evidence from dual adjustment approach. Environ Sci Pollut Res 28(11):14009–14017

Knez Ž, Markočič E, Leitgeb M, Primožič M, Hrnčič MK, Škerget M (2014) Industrial applications of supercritical fluids: a review. Energy 77:235–243

Le T-H, Le H-C, Taghizadeh-Hesary F (2020) Does financial inclusion impact CO2 emissions? Evidence from Asia. Fin Res Lett 34:101451. https://doi.org/10.1016/j.frl.2020.101451

Lebkowski A (2019) Studies of energy consumption by a city bus powered by a hybrid energy storage system in variable road conditions. Energies 12(5):951

Lee A, Gong H, Duquenne PA, Schwenk H, Chen PJ, Wang C, Popuri S, Adi Y, Pino J, & Gu J (2021). Textless speech-to-speech translation on real data. arXiv Preprint arXiv:2112.08352

Lee C-C, Lee C-C (2022) How does green finance affect green total factor productivity? Evidence from China. Energy Econ 107:105863

Lee C-C, Yuan Z, Wang Q (2022) How does information and communication technology affect energy security? Int Evidence Energy Econ 109:105969

Lee CC, Chiu YB, Chang CH Insurance demand and country risks: a nonlinear... - Google Scholar. Retrieved November 13, 2022, from https://scholar.google.com/scholar_lookup?title=Insurance%20demand%20and%20country%20risks%3A%20a%20nonlinear%20panel%20data%20analysis&publication_year=2013&author=C.-C.%20Lee&author=Y.-B.%20Chiu&author=C.-H.%20Chang

Liguo X, Ahmad M, Khattak SI (2022) Impact of innovation in marine energy generation, distribution, or transmission-related technologies on carbon dioxide emissions in the United States. Renew Sustain Energy Rev 159:112225

Lindenberg N (2014). Public instruments to leverage private capital for green investments in developing countries. German Development Institute/Deutsches Institut Für Entwicklungspolitik (DIE) Discussion Paper, 4

Liu L, Zhou BJ, An X, & Zhang Y 2010 Using fuzzy theory and information entropy for... - Google Scholar. https://scholar.google.com/scholar_lookup?title=Using%20fuzzy%20theory%20and%20information%20entropy%20for%20water%20quality%20assessment%20in%20Three%20Gorges%20region%2C%20China&author=L.%20Liu&author=J.%20Zhou&author=X.%20An&author=Y.%20Zhang&author=L.%20Yang&publication_year=2010

Ma J, Li Y, Grundish NS, Goodenough JB, Chen Y, Guo L, Peng Z, Qi X, Yang F, Qie L (2021) The 2021 battery technology roadmap. J Phys D Appl Phys 54(18):183001

Mohsin M, Kamran HW, Nawaz MA, Hussain MS, Dahri AS (2021) Assessing the impact of transition from nonrenewable to renewable energy consumption on economic growth-environmental nexus from developing Asian economies. J Environ Manage 284:111999

Meghji J, Mortimer K, Agusti A, Allwood BW, Asher I, Bateman ED, Bissell K, Bolton CE, Bush A, Celli B, Chiang CY, Cruz AA, Dinh-Xuan AT, El Sony A, Fong KM, Fujiwara PI, Gaga M, Garcia-Marcos L, Halpin DMG, Hurst JR, Jayasooriya S, Kumar A, Lopez-Varela MV, Masekela R, Mbatchou Ngahane BH, Montes de Oca M, Pearce N, Reddel HK, Salvi S, Singh SJ, Varghese C, Vogelmeier CF, Walker P, Zar HJ, Marks GB (2021) Improving lung health in low-income and middle-income countries: from challenges to solutions. Lancet 397(10277):928–940. https://doi.org/10.1016/S0140-6736(21)00458-X

Nations, U. (2022). Human development report 2021–22. In Human Development Reports. United Nations. https://hdr.undp.org/content/human-development-report-2021-22

Wang X, Shao Q (2019) Non-linear effects of heterogeneous environmental regulations on green growth in G20 countries: evidence from panel threshold regression. Sci Total Environ 660:1346–1354. https://doi.org/10.1016/j.scitotenv.2019.01.094

OECD Green growth strategy synthesis report—Google Scholar. (n.d.). Retrieved November 14, 2022, from https://scholar.google.com/scholar_lookup?title=Towards%20Green%20Growth%2C%20Green%20Growth%20Strategy%20Synthesis%20Report&publication_year=2011&author=OECD

Ozili PK (2021) Financial inclusion research around the world: a review. Forum Soc Econ 50(4):457–479

Ozturk I, Acaravci A (2016) Energy consumption, CO2 emissions, economic growth, and foreign trade relationship in Cyprus and Malta. Energy Sources Part B 11(4):321–327. https://doi.org/10.1080/15567249.2011.617353

Pezzagno M, Richiedei A, Tira M (2020) Spatial planning policy for sustainability: analysis connecting land use and GHG emission in rural areas. Sustainability 12(3):947

Renzhi N, Baek YJ (2020) Can financial inclusion be an effective mitigation measure? Evidence from panel data analysis of the environmental Kuznets curve. Financ Res Lett 37:101725

Sadiq M, Ou JP, Duong KD, Van L, Xuan Bui T (2023) The influence of economic factors on the sustainable energy consumption: evidence from China. Econ Res Ekon Istraž 36(1):1751–1773

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38(5):2528–2535

Schaeffer DA, Polizos G, Smith DB, Lee DF, Hunter SR, Datskos PG (2015) Optically transparent and environmentally durable superhydrophobic coating based on functionalized SiO2 nanoparticles. Nanotechnology 26(5):055602

Shahbaz M, Nasir MA, Roubaud D Environmental degradation in France: the... - Google Scholar (n.d.). Retrieved November 13, 2022, from https://scholar.google.com/scholar_lookup?title=Environmental%20degradation%20in%20France%3A%20the%20effects%20of%20FDI%2C%20financial%20development%2C%20and%20energy%20innovations&publication_year=2018&author=M.%20Shahbaz&author=M.A.%20Nasir&author=D.%20Roubaud

Shahbaz M, Shafiullah M, Papavassiliou VG, Hammoudeh S (2017) The CO2–growth nexus revisited: a nonparametric analysis for the G7 economies over nearly two centuries. Energy Econ 65:183–193. https://doi.org/10.1016/j.eneco.2017.05.007

Shepherd A, Wingham D (2007) Recent sea-level contributions of the antarctic and greenland ice sheets. Science 315(5818):1529–1532. https://doi.org/10.1126/science.1136776

Simmons, O. E. (2011). Book review: essentials of accessible grounded theory (Stern & Porr, 2011). The Grounded Theory Review, 10(3), 67–85

Sinha A, Sengupta T, Saha T (2020) Technology policy and environmental quality at crossroads: designing SDG policies for select Asia Pacific countries. Technol Forecast Soc Chang 161:120317

Skrúcanỳ T, Kendra M, Stopka O, Milojević S, Figlus T, Csiszár C (2019) Impact of the electric mobility implementation on the greenhouse gases production in central European countries. Sustainability 11(18):4948

Spirito CM, Richter H, Rabaey K, Stams AJ, Angenent LT (2014) Chain elongation in anaerobic reactor microbiomes to recover resources from waste. Curr Opin Biotechnol 27:115–122

Sun Y, Guan W, Razzaq A, Shahzad M, An NB (2022) Transition towards ecological sustainability through fiscal decentralization, renewable energy and green investment in OECD countries. Renew Energy 190:385–395

Saidi K, Mbarek MB The impact of income, trade, urbanization, and financial development on CO2 emissions in 19 emerging economies | SpringerLink. (n.d.). Retrieved November 10, 2022, from https://springerlink.bibliotecabuap.elogim.com/article/https://doi.org/10.1007/s11356-016-6303-3

Tsimisaraka RSM, Xiang L, Andrianarivo ARNA, Josoa EZ, Khan N, Hanif MS, Khurshid A, Limongi R (2023) Impact of financial inclusion, globalization, renewable energy, ICT, and economic growth on CO2 emission in OBOR countries. Sustainability 15(8):8. https://doi.org/10.3390/su15086534