Abstract

The rapid rise in climate and ecological challenges have allowed policymakers to introduce stringent environmental policies. In addition, financial limitations may pose challenges for countries looking to green energy investments as energy transition is associated with geopolitical risks that could create uncertainty and dissuade green energy investments. The current study uses PTR and PSTR as econometric strategy to investigate how geopolitical risks and financial development indicators influence energy transition in selected industrial economies. Our findings indicate a non-linear DCPB-RE relationship with a threshold equal to 39.361 in PTR model and 35.605 and 122.35 in PSTR model. Additionally, when the threshold was estimated above, financial development indicators and geopolitical risk positively impacts renewable energy. This confirms that these economies operate within a geopolitical context, with the objective of investing more in clean energy. We report novel policy suggestion to encourage policymakers promoting energy transition and advance the sustainable financing development and ecological sustainability.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Due to immense pressure to overcome ecological and environmental challenges, policymakers have given priority to adopt energy transition and protect environmental quality (Jiang et al. 2024). In order to create global environmental consensus, UN adopted sustainable development goals to spur technological innovation, mitigate climate externalities, and strengthen technological developments (Anton and Nucu 2020; Ma et al. 2022). Recently, COP28 held in Dubai extended efforts for global consensus to increase the share of renewable energy usage within industrial and residential sectors. These efforts aim to balance socioeconomic and policy goals to focus on environmental sustainability. According to UN, the environmental sustainability is directly associated with using renewable energy to decarbonize the energy industry. However, according to IEA (IEA 2023) and IRWNA (IRENA 2023), renewable energy investments must quadruple to $1.3 trillion by 2030 in order to expand deployment and increase access, enhancing energy security, limiting temperature rise to 1.5 °C, and achieving zero carbon. The G20’s decision to agree supports this goal and to invest more than $4 trillion year through 2030 and emphasize the need to treble renewable energy capacity (World Bank 2023).

The role of financial institutions in ecological sustainability is critical as using energy transition to replace traditional energy requires large financial expenditures. However, the financial development (FD) and the consumption of renewable energy (REC) link is complicated and undefined. According to several research studies, financial development increases fossil energy consumption to help achieve economic transformation (Mukhtarov et al. 2022), while another research has established that banking and financial institutions can help increase the RE share within energy mix (Ma et al. 2023a). Emerging economies continue to contribute significantly to global greenhouse gas (GHG) emissions despite established countries’ efforts to achieve zero emissions of carbon dioxide (CO2) (Chen et al. 2020).

In addition, geopolitical risk (GRP) is another indicator which affects emerging nations’ energy transformation process. According to Caldara and Iacoviello (2022), the GRP indicator include the dangers posed by armed conflicts, terrorism, and wars that have an impact on regular and diplomatic level international affairs. Besides, the main participants in economic activity think that geopolitical risk concerns alter the dynamism of the financial market’s dynamics and slow investors’ decision-making (Caldara and Iacoviello 2022). Recently, several studies have demonstrated that the functions of GPR in the transition to clean energy and green finance have implications for environmental management (Ma et al. 2023b; Zhang et al. 2023).

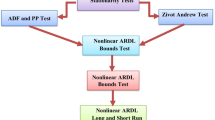

Rapid changes in trade and investment flows make industrial countries more vulnerable (Cheng and Chiu 2018; Alsagr and Hemmen 2021). Thus, by examining the FD and GPR effects of on energy transition within selected emerging economies over a period between 1985 and 2021, we use the Dynamic Panel Threshold Model as part of our empirical approach, and by constituting GPR and its role in economic and financial sectors, we provide novel addition to the environmental literature. For current study, we evaluate FD subset proxies and the geopolitical risk.

Our theoretical and empirical approach allows us to propose novel policy repercussions reshape energy mix and climate change approach. For this, we investigate following research question: To what extend geopolitical risks and financial development energy transition and ecological sustainability? In order to answer the above question, this study aims to give useful insights into the political process, decision-makers, and the investors (Charfeddine and Kahia 2019). The current study extends academic debate in following ways. Firstly, this study documents the association among financial development, geopolitical risk, and renewable energy using the PTR and PSTR techniques. Linear models have been used in the past for the investigation of this relationship. Second, this is the first study to look at this relationship in the context of industrialized economies that have highest energy alternative consumption. Thirdly, this study examines the different facets of financial development (banking and the stock market) impact energy transition. Lastly, our research provides insightful information to the government and to the decision-makers.

The remaining sections of the essay are structured to help us reach our objective as follows: both theoretically and practically, the “Literature review, theoretical framework, and hypothesis development” section describes theoretically the FD and GRP effects on the REC relationship. The primary panel regime-switching models are presented in the “Methodology” section. The non-linear impact of FD is empirically explored in the “Empirical results and discussion” section. The conclusion of the report, which discusses the main findings, is covered in the “Conclusion and policy implications” section.

Literature review, theoretical framework, and hypothesis development

Financial development and renewable energy consumption

While many economies have witnessed rapid economic growth and technological advancement over the past few years, a number of critical issues, i.e., energy development and climate change, have also received major focus. According to researchers studying environmental problems, come from excessive natural resource dependence. The environmental assumption from the environmental economic approach is the acquisition of equitable prices by assigning a precise value to natural capital (Bina and La Camera 2011).

Other researchers (Çoban and Topcu 2013; Chiu and Lee 2020) put up alternative theoretical stances that financial development could lower energy usage. They made note of the fact that businesses frequently increase energy efficiency or cut back on energy use to lower production costs. The availability of finance from financial institutions and markets may assist enterprises in overcoming financial challenges and upgrading factories and implementing technologies that conserve energy, consequently reducing their energy consumption. A number of literary works have investigated how financial developments affect industrial and residential energy consumption. Some studies (Mukhtarov et al. 2018) discovered evidence that banking sectors has bidirectional causality with energy usage, while others (Gómez and Rodriguez 2019) found evidence that banking development may even lead energy use to drop.

Furthermore, the actual findings of certain studies illustrate that the association between energy transition and economic growth is intricate. Yue et al. (2019), for example, used PSTR approach to report insignificant association between financial development and energy transition, whereas financial openness and financial intermediation are key determinants of industrial energy consumption. For G20 countries, Wang and Dong (2021) use panel data from 2005 to 2018 to discover that FD has large non-linear effects on renewable energy use. That is, FD can greatly boost REC only if technology, affluence, and population exceed a specific threshold amount; below that barrier, it has the reverse effect. In the same data case, Appiah-Otoo et al. (2023) used FGLS to report that financial institutions aid RE development as financial structure accelerates RE developments by setting various economic growth criteria based on the sample group. Moreover, Chang et al. (2022) and Topcu & Payne (2017) researched the association between financial stability, industrial transformation, and energy costs to determine that financial and regulatory stability are key to long-term energy transition.

-

H1: Domestic credit to private sector by banks is nonlinear impacting the renewable energy.

Geopolitical risk and energy transition

The geopolitical risks are those posed by conflicts of any kind (such as those between nations, armed battles, disasters, militarized societies, wars, and terrorist attacks), or political tensions that impact international or regional relations (Astvansh et al. 2021; Caldara and Iacoviello 2022). The GPR and related risks affect not just politics and security but also the economy and the environment. Moreover, the GPR ultimately leads to hazards and uncertainties around investment, domestic and international collaboration and policy, and a significant negative influence on the world economy (Dogan et al. 2021). For the other hand, the negative effects of uncertainty for fresh investment have long been a topic of discussion. Additionally, such conditions generate capital outflows since investors move their money to other wealthy and politically stable nations that provide safe returns on investments when violence is prevalent in emerging economies. In a similar vein, the study by Cheng and Chiu (2018) has demonstrated that ambiguous conditions and a terrible state of peace reduce total consumption and infrastructure investment in developing nations. As a result of these conflicts and unclear economic predictions, the renewable energy consumption, which necessitates consistent investment planning and financial development, falls.

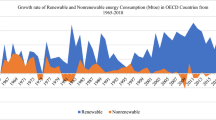

Recently, Zhao et al. (2021) adopted NARDL as empirical approach to study the interconnectedness between association between green energy developments and GPR in BRICS economies. As a result, they discovered that India, Brazil, and China’s long-term energy consumption are negatively impacted by changes in geopolitical risk, both positive and negative. More recently, Astvansh et al. (2021) reviewed the influence of geopolitical risk on environmental sustainability using nonlinear and linear autoregressive distributed lag simulations. The empirical findings revealed a substantial association between geopolitical risk and environmental sustainability, highlighting geopolitical risk’s asymmetric influence on the environment. As a result, in accordance with recent research and theoretical rationale, we claim that consumption of renewable energy falls precipitously during periods of increasing political and social turmoil (i.e., geopolitical risks), which have a detrimental influence on all commercial activity (Fig. 1).

In order to evaluate the following hypothesis, the present research compares renewable energy usage in developing nations to a newly constructed geopolitical risk indicator:

-

H2: Geopolitical risk is positively impacting the renewable energy.

Methodology

Data variables and model specification

Variables description

This study employs renewable energy consumption (the percentage share of RE consumption within primary energy) as the dependent variable, spanning the period 1985–2021 for 10 industrial economies. The subsets of financial development are represented through stock market turnover ratio and credit availability through private bank, and the deposit credit by bank represents the threshold variable. GPR index established by Caldara and Iacoviello (2022) and include in the modelling approach. FDI net inflow (% of GDP), inflation (inflation rate %) and GDP per capita growth (at year in %), as explanatory variables. Table 1 shows a summary of the measurement, acronyms, and sources for the study variables.

Following theoretical discussion in the “Literature review, theoretical framework, and hypothesis development” sections, the function of energy transition through RE is given as FDI, INF, and GDP per capita (Eq. 1). Our model is presented and investigated according to Alsagr and Hemmen (2021). So, the estimated model is specified and written symbolically as follows:

Model specification

PTR model

In the first phase, we use Hansen’s (1999) model to assess the presence of a nonlinear link between RE and private credit. The following is the model’s definition:

The explanatory variables Yit and \({\varphi }_{it}\) are scalar, the threshold variable \({\varphi }_{it}\), and the regressor is \({Z}_{it}\), a k-item vector, as previously stated. I(.) is a transitional regime indicator function, and \(\varepsilon\)it is a random disturbance item. Hansen (1999) provides us with the following threshold equation:

In this case, the panel data set is separated into two regimes based on whether the true value of the threshold variable \({\varphi }_{it}\) is more or less than the predicted threshold. The computed regression slopes, \({\alpha }_{1}\) and \({\alpha }_{2}\), distinguish these two regimes. The random variable \({\varepsilon }_{it}\) has a normal distribution (i.i.d).

As a result, the double threshold model is defined as follows:

The novel aspect of this modelling (Eq. 3) is the exposure of a panel to a variety of regimes, each defined by a linear dynamic. Because at any given time, unit can go from one plan to another, there is a sudden transition in this instance. The first stage is evaluating the linearity. As a result, the linearity test entails determining if various regime parameters are equivalent. The following hypothesis (Eq. 4) indicates the absence of a threshold effect in Eq. 2:

To carry out this linearity test, its statistics must be evaluated and assumed to be equal to its anticipated value:

with \({S}_{1}\left({\widehat{c}}_{1}\right)\) and \({S}_{0}\) represent each model’s sum of residual squares (linear and nonlinear), whereas chi-square distribution is determined through F1(\(\widehat{c}\)) (Eq. 5).

PSTR model

Current study follows González et al. (2005) in using PSTR which is effective incise panel is linear or non-linear alike. The technique solves non-linear heterogeneity problem by incorporating fixed effects and exogenous regressors. The fundamental PSTR function can be shown as:

If i = 1…. N and t = 1…. T, time and cross-sections are represented through T and N. \({Y}_{it}\), \({\mu }_{i}\), and \({x}_{it}\) indicate explanatory variables, individual effect, and control variable vectors. The transition function, \(g\left({q}_{it},\gamma ,c\right)\), is affected by threshold variable (\({q}_{it}\)), threshold parameter (c), and transition functions’ slope (\(\gamma\)). The comparison of the status of a \({q}_{it}\) (transition factor) in association with threshold value is required for the transition from one regime to another. Outside of the STAR model, no new hypothesis concerning the selection of this transition variable appears to exist. As a result, Eq. 6 can be rewritten in the following way:

The novel aspect of Eq. 7 is the panel’s exposure to various regimes, each of which is defined by a linear dynamic. Because a unit can go from one plan to another at any time, there is a sudden transition in this instance. The first stage is evaluating the linearity. As a result, the linearity test entails determining if various regimes’ parameter are equivalent. The following hypothesis (Eq. 8) indicates the absence of threshold effect in Eq. 7:

In order to conduct this linearity test, its statistics must be evaluated and assumed to be equal to its anticipated value:

\({S}_{1}\left({\widehat{c}}_{1}\right)\) and \({S}_{0}\) are models’ residual sum of squares, respectively. F1(\(\widehat{c}\)) has a non-standard asymptotic distribution that precisely follows the chi-square distribution, as represented in (Eq. 9). Before proceeding to PSTR model estimation, linearity test is necessary to determine regime change’s statistical significance. González et al. (2017) developed an econometric strategy to test the null hypothesis (\({H}_{0}:{\beta }_{1}^{\prime}=0\), equivalent to \({H}_{0}:\gamma =0\)) against a PSTR model:

where \({{\text{RSS}}}_{0}\) and RSS_1 are used to showcase linear and nonlinear model’s sum of squares with two regimes. The \({\text{LR}}\) statistics and Wald \({{\text{LM}}}_{{\text{w}}}\) are used to follow independent variables’ chi-square distribution where degree of freedom is shown by K, while \({{\text{LM}}}_{{\text{F}}}\) illustrate chi-square distribution for two degrees of freedom.

Empirical results and discussion

Descriptive analysis

Before addressing the economic and empirical analysis of the CSD, unit root stationary, and cointegration relationship for data variables, we detail descriptive statistics to shed light on basic data properties in Table 2.

Our econometric analysis begins with descriptive statistics (Table 2), where we can observe that most of data variables possess leptokurtic and asymmetric shape. In addition, we also decline the existence of normality in data series through Jarque–Bera. Lastly, we use Born and Breitung (2016) to determine that data series suffer from issues related to autocorrelation (Jarque and Bera 1987).

The CSD test (Table 3) is used in the first step of our analysis to determine if CSD exists within empirical dataset. The data projections reported in Table 3 consistently supports CSD and reject null hypothesis. This allows us to proceed to second generation unit root tests. As per Table 4, data indicators are mostly significant at first difference meaning we proceed to testing cointegration properties.

The empirical estimates reported in Table 5 helps us determine cointegration properties to confirm cointegration properties for our proposed econometric model. Such determination allows us to proceed toward main econometric analysis.

PTR and PSTR results

We begin by utilizing the PTR model to estimate the association between FD and RE. The linearity test is used to determine the existence of the non-linear relationship once the model has been estimated to reject null hypothesis as threshold (i.e., DCPB = 39.361) in the confidence range between 27.062 and 46.817, as shown in Table 6. Furthermore, the RSS and residual variance values are 10696.656 and 29.713, respectively.

The confirmation of non-linear association is between the DCPB and REC variables. These results support the work of Kemmler and Spreng (2007), Yue et al. (2019), Raza et al. (2020), and Chang et al. (2022). We now investigate the relationship between the DCPB and the REC in the PTR model’s various DCPB regimes. The PTR model results are shown in Table 7. In the first regime (DCPB 39.361), the variables FDI, INF, and TOR negatively impact energy transition through RE consumption. GPR, on the other hand, has a positive and considerable impact on RE, whereas DCPB has a negative but minor impact. Statistically, each 1% increase in FDI, INF, and TOR reduces RE by 0.284%, 0.005%, and 0.152%, respectively, while a 1% increment in GPR increases RE by 0.074%. All variables have a favorable and significant association with RE in the second regime (DCPB > 39.361). Statistically, an increase in the INF, FDI, GPR, DCPB, and TOR variables boosts renewable energy consumption by 0.002, 0.189, 0.183, 0.161, and 0.667, respectively.

Financial development, according to Wang and Dong (2021), has distinct effects on renewable energy use at different threshold intervals. Banking and financial adversely impact RE at a low level, but positive shifts have positive impact with long-term RE developments in emerging economies. The findings are consistent with Mahalik et al.’s (2017) study for Saudi Arabia and Agbanike et al.’s (2019) study for Nigeria. We also argue that a stable and mature financial framework strengthens economic outcomes which positively correlate with RE advancement within energy mix. Furthermore, as banking intermediation grows, so does the demand of renewable energy (Raza et al. 2020). Furthermore, stock market development is important in reducing CO2 emissions through RE consumption. Listed firms that operate under stock market rules use sustainable energy resources, latest technologies to mitigate pollutant emissions and climate protective production processes to ensure environmental protection (Lanoie et al. 1998).

Additionally, improvements in the banking and stock markets are critical for increasing renewable energy use. According to Sadorsky (2010) and Alsaleh and Abdul-Rahim (2019), developments in financial platforms and banking sector can promote the production of green energy, back RE energy investments, and constitute financial reliability to sustain RE developments. Likewise, when financial development reaches the anticipated threshold, the association between RE and GPR stays favorable for two reasons. First, large oil-producing countries face increased geopolitical risk. To lower traditional energy dependency whose sources can become soft targets for terrorist attacks, major oil states must invest regularly in RE resources rather than increasing investment in non-renewable energy resources. As a result, energy insecurity, emerging countries are transitioning toward producing and consuming more renewable energy in order to ensure energy security (Alsagr and Hemmen 2021).

The finding also shows a positive relationship between GDP and RE, which supports Tiwari et al.’s (2022) findings that economic growth rates benefit renewable energy usage. Indeed, economic growth is vital to maintaining and strengthening the country’s renewable technology industry since it provides adequate money for infrastructure and promotes renewable energy. In economies with a high level of financial growth, FDI benefits renewable energy utilization. Green spillover can help to spread clear technologies, increase RE consumption, and deliver improved environmental performance (Samour et al. 2023).

After estimating the PTR model, we proceed to estimating the PSTR model. First, we do the linearity test to identify the number of thresholds. Indeed, the LM, LMF, LR tests’ p values reveal the existence of two thresholds with 10% probability for a logistic PSTR model (m = 1) and (r = 2). Thus, in industrial economies, the relationship between domestic bank loans to the private sector and renewable energy is not linear (see Table 8).

Table 9 shows that the estimated thresholds r1 and r2 are 35.605 and 122.35, respectively, whereas the transition parameters 1 and 2 are 0.721 and 0.269. Furthermore, the RSS, AIC, and BIC minimum values are attained with values of 6368.529, 3.095, and 3.413, respectively.

The findings from PSTR document the existence of three distinct regimes. The threshold values for the DCPB variable are 35.605 and 122.35, as shown in Table 10. From a statistical standpoint, the first regime demonstrates that the GPR and DCPB have a negative and considerable impact on RE (− 0.435 and − 0.619, respectively), while the remaining variables have a minimal impact on RE. The variables FDI, GPR, and DCPB have a positive and considerable impact on the consumption of RE sources in the second regime. INF and TOR factors have little effect, but a 1% rise in these variables can statistically boost renewable energy usage by 0.675%, 0.387%, and 0.387%, respectively. In the third system, all variables exert significant and positive effect on RE. In other words, increasing the INF, FDI, GPR, DCPB, and TOR by 1% can increase the consumption of RE by 0.008%, 1.228%, 0.317%, 0.785%, and 0.251%, respectively.

According to Raza et al. (2020), countries with lower financial regulatory approach, the relationship between RE and private banking sector is negative and significant. Thus, in this system, private borrowing from banks contributes significantly correlate with higher energy consumption while not encouraging the use of renewable energy. The availability of low-interest-rate loans enables consumers to industrial equipment and manufacturing plants, leading to higher energy demand and lower environmental quality. Chang (2015) supports these estimates where the author that ease of financial credit is directly associated with traditional and fossil fuel demand. However, recent studies have proposed that this also enables firm to increase R&D spending (Hassine and Harrathi 2017; Eren et al. 2019) which helps firm develop energy alternatives and replace fossil fuels with RE and green energy resources. According to our results, funding from institutions such as stock markets is mainly channelled toward industrial growth; however, in order to ensure compliance with UN SDGs, it is imperative that policymakers use it to accelerate RE adoption (Paramati et al. 2017; Kutan et al. 2017).

Geopolitical risks can increase RE when the FD threshold is above 35.605, indicating greater governmental investments as it encourages private sector and crowd-out effects (Bilgin et al. 2020). Geopolitical issues such as Russia-Ukraine war impacts energy affordability also as such events generally increase energy prices and make RE investments more affordable (Song et al. 2019). Hence, this helps us conclude that GPR generally has positive implications for RE in the long run. FDI is another indicator which allows industries to gain capital access to help accelerate RE technological transfer especially for emerging economies. Higher FDI inflows allows investors to diversify investment decisions and help establish low-carbon industries and higher resource efficiency (Kutan et al. 2017). Can and Ahmed (2023) analyzed investor decisions in emerging economies to conclude that feasible regulations help divert energy investments from traditional to renewable energy sector and accelerate using economic complexity to reshape energy mix as well (Can and Gozgor 2017; Apergis et al. 2018).

When a specific threshold value is beached, the econometric association among data variables also changes according to a mathematical function called the transition function. As a result, especially in light of Fig. 2, it is considered that the projected values of the smoothing parameters, which is equal to (\(\widehat{\gamma }\) = 0.721) and (\(\widehat{\gamma }\) = 0.269), is low and indicates that the change toward second regime from the first is smooth. After testing our hypothesis, we discovered a non-linear impact among energy transition and financial development, as well as that geopolitical risk had a beneficial impact on energy transition. This signifies that the fixed hypotheses H1 and H2 have been validated.

Conclusion and policy implications

In light of recent ecological and climate change challenges, the role of financial and energy reforms has gained attention to preserve ecological sustainability. The current study extends academic debate by investigating the impact of GPR and FD on REC using panel data from ten industrial economies between 1985 and 2021 and conduct an extensive econometric investigation on the basis of literature and theoretical analysis. Both the banking industry and the stock market were used as FD proxies. The PTR and PSTR models’ results demonstrate a non-linear relationship between RE and FD. When the threshold is less than 39.361 and 35.605, respectively, financial development has negative association with RE; however, when the threshold is surpassed, the consumption of renewable energy increases, the impact remains positive.

For geopolitical risk, when financial development is higher, geopolitical risk is positive for renewable energy, incentivising the selected industrial economies to invest more in renewable energy. In fact, geopolitical risks add a layer of uncertainty to financial development, while financial development can provide a solid foundation for the renewable energy sector. The balance between the promotion of a favorable financial environment and the management of geopolitical challenges is critical element for the sustainable growth of green energy in highly developed financial contexts.

Policymakers in growing economies, whether they are energy producers or consumers, must consider the following factors: this study has significant policy ramifications. Primarily, policymakers should be integrated energy strategies that take into account both energy production and consumption. To improve energy security, cut greenhouse gas emissions, and advance sustainable development, these strategies should give priority to renewable energy sources. Secondly, emerging economies should invest in a variety of green energy resources, including geothermal, hydroelectricity, and solar to diversify their energy in the high-polluted sectors.

Leaders in politics in developing nations should use extreme caution while promoting energy transition dogmas. They ought to be aware of the significance of FD in the process of the energy transition. They should be, firstly, adopt initiatives to draw domestic and international capital to renewable energy projects. To attract both the public and private sectors to these investments, provide incentives like tax breaks, subsidies, and feed-in tariffs. Moreover, create a stable and transparent regulatory framework to support the growth of renewable energy sources. An encouraging environment for investing is created, and investor uncertainty is decreased through consistent policies and open regulations. By considering these policy effects, policymakers in emerging economies can encourage the use of renewable energy, advance the development of sustainable financing, and contribute to a more reliable and sustainable energy future.

In addition to our empirical investigation, we also report several research limitations to be addressed by future studies. Firstly, an important limitation can be the reliability and accessibility of data on financial development, geopolitical risk, and renewable energy consumption. It may be difficult to undertake a thorough analysis since data may be erroneous, old, or inconsistent between nations. Secondly, the phenomenon where changes in one variable have an impact on other variables, may be present in the linkages between financial development, geopolitical risk, and renewable energy use. Endogeneity must be taken into account to prevent skewed estimates and false conclusions. Thirdly, using the PTR and PSTR models make the assumption that variables have nonlinear relationships, which may not necessarily be true in practice. The dynamics of finance development, geopolitical risk, and energy transition may be oversimplified by assuming a fixed threshold. Moreover, these models frequently represent static relationships and may not take time lags or dynamic impacts into consideration. Geopolitical risk and financial development changes could have a delayed effect on green energy developments. The results of threshold models may not be easily generalized to other settings or locations outside of the 10 industrial economies. The factors influencing renewable energy use may differ substantially among regions and economic sectors.

Data availability

The corresponding author is authorized to handle data and related inquiries.

References

Agbanike TF, Nwani C, Uwazie UI, Anochiwa LI, Enyoghasim MO (2019) Banking sector development and energy consumption in Nigeria: exploring the causal relationship and its implications. Afr Dev Rev 31(3):292–306. https://doi.org/10.1111/1467-8268.12390

Alsagr N, van Hemmen S (2021) The impact of financial development and geopolitical risk on renewable energy consumption: evidence from emerging markets. Environ Sci Pollut Res 28:25906–25919. https://doi.org/10.1007/s11356-021-12447-2

Alsaleh M, Abdul-Rahim AS (2019) Financial development and bioenergy consumption in the EU28 region: evidence from panel auto-regressive distributed lag bound approach. Resources 8(1):44. https://doi.org/10.3390/resources8010044

Anton SG, Nucu AEA (2020) The effect of financial development on renewable energy consumption. A panel data approach. Renew Energy 147:330–338. https://doi.org/10.1016/j.renene.2019.09.005

Apergis N, Can M, Gozgor G, Lau CKM (2018) Effects of export concentration on CO2 emissions in developed countries: an empirical analysis. Environ Sci Pollut Res 25(14):14106–14116. https://doi.org/10.1007/s11356-018-1634-x

Appiah-Otoo I, Chen X, Ampah JD (2023) Does financial structure affect renewable energy consumption? Evidence from G20 countries. Energy 272:127130. https://doi.org/10.1016/j.energy.2023.127130

Astvansh V, Deng W, Habib A (2021) Does geopolitical risk stifle technological innovation?. SSRN 4047207:1–21

Bilgin MH, Gozgor G, Karabulut G (2020) How do geopolitical risks affect government investment? An empirical investigation. Def Peace Econ 31(5):550–564. https://doi.org/10.1080/10242694.2018.1513620

Bina O, La Camera F (2011) Promise and shortcomings of a green turn in recent policy responses to the “double crisis.” Ecol Econ 70(12):2308–2316. https://doi.org/10.1016/j.ecolecon.2011.06.021

Born B, Breitung J (2016) Testing for serial correlation in fixed-effects panel data models. Economet Rev 35(7):1290–1316. https://doi.org/10.1080/07474938.2014.976524

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47(1):239–253. https://doi.org/10.2307/2297111

Caldara D, Iacoviello M (2022) Measuring geopolitical risk. Am Econ Rev 112(4):1194–1225. https://doi.org/10.1257/aer.20191823

Can M, Ahmed Z (2023) Towards sustainable development in the European Union countries: does economic complexity affect renewable and non-renewable energy consumption? Sustain Dev 31(1):439–451. https://doi.org/10.1002/sd.2402

Can M, Gozgor G (2017) The impact of economic complexity on carbon emissions: evidence from France. Environ Sci Pollut Res 24(19):16364–16370. https://doi.org/10.1007/s11356-017-9219-7

Chang SC (2015) Effects of financial developments and income on energy consumption. Int Rev Econ Financ 35:28–44. https://doi.org/10.1016/j.iref.2014.08.011

Chang L, Qian C, Dilanchiev A (2022) Nexus between financial development and renewable energy: empirical evidence from nonlinear autoregression distributed lag. Renew Energy 193:475–483. https://doi.org/10.1016/j.renene.2022.04.160

Charfeddine L, Kahia M (2019) Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: a panel vector autoregressive (PVAR) analysis. Renew Energy 139:198–213. https://doi.org/10.1016/j.renene.2019.01.010

Chen J, Li Z, Dong Y, Song M, Shahbaz M, Xie Q (2020) Coupling coordination between carbon emissions and the eco-environment in China. J Clean Prod 276:123848. https://doi.org/10.1016/j.jclepro.2020.123848

Cheng CHJ, Chiu CWJ (2018) How important are global geopolitical risks to emerging countries? Int Econ 156:305–325. https://doi.org/10.1016/j.inteco.2018.05.002

Chiu YB, Lee CC (2020) Effects of financial development on energy consumption: the role of country risks. Energy Econ 90:104833. https://doi.org/10.1016/j.eneco.2020.104833

Çoban S, Topcu M (2013) The nexus between financial development and energy consumption in the EU: a dynamic panel data analysis. Energy Econ 39:81–88. https://doi.org/10.1016/j.eneco.2013.04.001

Dogan E, Majeed MT, Luni T (2021) Analyzing the impacts of geopolitical risk and economic uncertainty on natural resources rents. Resour Policy 72:102056. https://doi.org/10.1016/j.resourpol.2021.102056

Eren BM, Taspinar N, Gokmenoglu KK (2019) The impact of financial development and economic growth on renewable energy consumption: empirical analysis of India. Sci Total Environ 663:189–197. https://doi.org/10.1016/j.scitotenv.2019.01.323

Frees EW (1995) Assessing cross-sectional correlation in panel data. J Econom 69(2):393–414. https://doi.org/10.1016/0304-4076(94)01658-M

Frees EW (2004) Longitudinal and panel data: analysis and applications in the social sciences. Cambridge University Press, Cambridge. https://doi.org/10.1017/CBO9780511790928

Friedman M (1937) The use of ranks to avoid the assumption of normality implicit in the analysis of variance. J Am Stat Assoc 32(200):675–701. https://doi.org/10.1080/01621459.1937.10503522

Gómez M, Rodríguez JC (2019) Energy consumption and financial development in NAFTA countries, 1971–2015. Appl Sci 9(2):302. https://doi.org/10.3390/app9020302

González A, Teräsvirta T, Dijk DV (2005) Panel smooth transition regression models (No. 604). SSE/EFI Working Paper Series in Economics and Finance. https://swopec.hhs.se/hastef/papers/hastef0604.pdf

González A, Teräsvirta T, van Dijk D, Yang Y (2017) Panel smooth transition regression models (No. 2017–36). Department of Economics and Business Economics, Aarhus University, pp 1–17

Hansen BE (1999) Threshold effects in non-dynamic panels: estimation, testing, and inference. J Econom 93(2):345–368. https://doi.org/10.1016/S0304-4076(99)00025-1

Hassine MB, Harrathi N (2017) The causal links between economic growth, renewable energy, financial development and foreign trade in gulf cooperation council countries. Int J Energy Econ Policy 7(2):76–85. https://doi.org/10.3390/en12173289

IEA (2023) Tripling renewable power capacity by 2030 is vital to keep the 1.5°C goal within reach, IEA, Paris https://www.iea.org/commentaries/tripling-renewable-power-capacity-by-2030-is-vital-to-keep-the-150c-goal-within-reach, License: CC BY 4.0

IRENA (2023) Renewable energy statistics 2023, International Renewable Energy Agency, Abu Dhabi. https://mc-cd8320d4-36a1-40ac-83cc-3389-cdn-endpoint.azureedge.net/-/media/Files/IRENA/Agency/Publication/2023/Jul/IRENA_Renewable_energy_statistics_2023.pdf?rev=7b2f44c294b84cad9a27fc24949d2134

Jarque CM, Bera AK (1987) A test for normality of observations and regression residuals. Int Stat Rev/revue Internationale De Statistique 55(2):163–172. https://doi.org/10.2307/1403192

Jiang Y, Guo Y, Bashir MF, Shahbaz M (2024) Do renewable energy, environmental regulations and green innovation matter for China’s zero carbon transition: evidence from green total factor productivity. J Environ Manag 352:120030. https://doi.org/10.1016/j.jenvman.2024.120030

Kao C (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econom 90(1):1–44. https://doi.org/10.1016/S0304-4076(98)00023-2

Kemmler A, Spreng D (2007) Energy indicators for tracking sustainability in developing countries. Energy Policy 35(4):2466–2480. https://doi.org/10.1016/j.enpol.2006.09.006

Kutan AM, Paramati SR, Ummalla M, Zakari A (2017) Financing renewable energy projects in major emerging market economies: evidence in the perspective of sustainable economic development. Emerg Mark Financ Trade 54(8):1761–1777. https://doi.org/10.1080/1540496X.2017.1363036

Lanoie P, Laplante B, Roy M (1998) Can capital markets create incentives for pollution control? Ecol Econ 26(1):31–41. https://doi.org/10.1016/S0921-8009(97)00057-8

Ma B, Wang Y, Zhou Z et al (2022) Can controlling family involvement promote firms to fulfill environmental responsibilities? Evidence from China. Manag Decis Econ 43:569–592. https://doi.org/10.1002/mde.3403

Ma B, Bashir MF, Peng X et al (2023a) Analyzing research trends of universities’ carbon footprint: an integrated review. Gondwana Res 121:259–275. https://doi.org/10.1016/j.gr.2023.05.008

Ma B, Sharif A, Bashir M, Bashir MF (2023b) The dynamic influence of energy consumption, fiscal policy and green innovation on environmental degradation in BRICST economies. Energy Policy 183:113823. https://doi.org/10.1016/j.enpol.2023.113823

Mahalik MK, Babu MS, Loganathan N, Shahbaz M (2017) Does financial development intensify energy consumption in Saudi Arabia? Renew Sustain Energy Rev 75:1022–1034. https://doi.org/10.1016/j.rser.2016.11.081

Mukhtarov S, Mikayilov JI, Mammadov J, Mammadov E (2018) The impact of financial development on energy consumption: evidence from an oil-rich economy. Energies 11(6):1536. https://doi.org/10.3390/en11061536

Mukhtarov S, Yüksel S, Dinçer H (2022) The impact of financial development on renewable energy consumption: evidence from Turkey. Renew Energy 187:169–176. https://doi.org/10.1016/j.renene.2022.01.061

Paramati SR, Mo D, Gupta R (2017) The effects of stock market growth and renewable energy use on CO2 emissions: evidence from G20 countries. Energy Econ 66:360–371. https://doi.org/10.1016/j.eneco.2017.06.025

Pedroni P (2004) Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Economet Theor 20(3):597–625. https://doi.org/10.1017/S0266466604203073

Pesaran MH (2006) Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74(4):967–1012. https://doi.org/10.1111/j.1468-0262.2006.00692.x

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Economet 22(2):265–312. https://doi.org/10.1002/jae.951

Pesaran MH, Ullah A, Yamagata T (2008) A bias-adjusted LM test of error cross-section independence. Economet J 11(1):105–127. https://doi.org/10.1111/j.1368-423X.2007.00227.x

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels. Cambridge Working Papers in Economics No. 435, University of Cambridge, and CESifo Working Paper Series No. 1229. https://doi.org/10.17863/CAM.5113

Raza SA, Shah N, Qureshi MA, Qaiser S, Ali R, Ahmed F (2020) Non-linear threshold effect of financial development on renewable energy consumption: evidence from panel smooth transition regression approach. Environ Sci Pollut Res Int 27(25):32034–32047. https://doi.org/10.1007/s11356-020-09520-7

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38(5):2528–2535. https://doi.org/10.1016/j.enpol.2009.12.048

Samour A, Ali M, Abdullah H, Moyo D, Tursoy T (2023) Testing the effects of banking development, economic growth and foreign direct investment on renewable energy in South Africa. OPEC Energy Rev. https://doi.org/10.1111/opec.12289

Song Y, Ji Q, Du YJ, Geng JB (2019) The dynamic dependence of fossil energy, investor sentiment and renewable energy stock markets. Energy Econ 84:104564. https://doi.org/10.1016/j.eneco.2019.104564

Tiwari AK, Nasreen S, Anwar MA (2022) Impact of equity market development on renewable energy consumption: do the role of FDI, trade openness and economic growth matter in Asian economies? J Clean Prod 334:130244. https://doi.org/10.1016/j.jclepro.2021.130244

Topcu M, Payne JE (2017) The financial development–energy consumption nexus revisited. Energy Sources Part B 12(9):822–830. https://doi.org/10.1080/15567249.2017.1300959

Wang Q, Dong Z (2021) Does financial development promote renewable energy? Evidence of G20 economies. Environ Sci Pollut Res 28(45):64461–64474. https://doi.org/10.1007/s11356-021-15597-5

Westerlund J (2007) Testing for error correction in panel data. Oxford Bull Econ Stat 69(6):709–748. https://doi.org/10.1111/j.1468-0084.2007.00477.x

World Bank (2023) Catalyzing private investments and climate finance to turn energy transition ambitions to reality. https://projects.worldbank.org/en/results/2023/08/04/catalyzing-private-investments-and-climate-finance-to-turn-energy-transition-ambitions-to-reality

Yue S, Lu R, Shen Y, Chen H (2019) How does financial development affect energy consumption? Evidence from 21 transitional countries. Energy Policy 130:253–262. https://doi.org/10.1016/j.enpol.2019.03.029

Zhang D, Chen XH, Lau CKM, Cai Y (2023) The causal relationship between green finance and geopolitical risk: implications for environmental management. J Environ Manag 327:116949. https://doi.org/10.1016/j.jenvman.2022.116949

Zhao W, Zhong R, Sohail S, Majeed MT, Ullah S (2021) Geopolitical risks, energy consumption, and CO2 emissions in BRICS: an asymmetric analysis. Environ Sci Pollut Res 28(29):39668–39679. https://doi.org/10.1007/s11356-021-13505-5

Author information

Authors and Affiliations

Contributions

Amal Ben Abdallah: conceptualization and methodology; Hamdi Becha: data curation, writing draft, methodology, and data analysis; Arshian Sharif: writing draft, methodology, and revision: Muhammad Farhan Bashir: revision, methodology, data curation, writing draft, methodology, and data analysis.

Corresponding author

Ethics declarations

Ethical approval

N/A.

Consent to participate

N/A.

Consent for publication

N/A.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Ilhan Ozturk

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ben Abdallah, A., Becha, H., Sharif, A. et al. Geopolitical risk, financial development, and renewable energy consumption: empirical evidence from selected industrial economies. Environ Sci Pollut Res 31, 21935–21946 (2024). https://doi.org/10.1007/s11356-024-32565-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-024-32565-x