Abstract

This research observes the impact of environmental corporate social responsibility (CSR) and green supply chain management (GSCM) on green competitive advantage in Chinese manufacturing SMEs. Top management commitment is used as a mediator between environmental CSR, GSCM, and green competitive advantage. Moreover, a pro-environmental business strategy is used as a moderator between top management commitment and green competitive advantage. A simple random sampling technique was used, and 331 questionnaires were part of the final analysis. PLS-SEM is used for hypothesis testing. The results reveal that environmental CSR does not influence green competitive advantage. GSCM, top management commitment, and pro-environmental business strategy significantly measure green competitive advantage. Top management commitment significantly mediates between environmental CSR, GSCM, and green competitive advantage. Finally, a pro-environmental business strategy significantly moderates between top management commitment and green competitive advantage. This study strives to provide insightful information for strategic managers of Chinese manufacturing SMEs to optimize green competitive advantage, including environmental CSR, GSCM, top management commitment, and pro-environmental business strategy in decision-making. This study adds value to the body of knowledge by concentrating on factors that determine green competitive advantage. This initial research integrates environmental CSR, GSCM, top management commitment, pro-environmental business strategy, and green competitive advantage in a single framework using natural resource-based view (RBV). Furthermore, the study would present various implications for managers and lines for future directions.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The manufacturing sector is the most significant source of climate change, water pollution, air pollution, and waste (Rehman et al. 2021a). The stakeholders put substantial pressure on firms to decrease environmental impact because of production actions (Yu et al. 2017). The year 2018 was the hottest because of environmental issues (Ma et al. 2020). Few researchers recognized that customers need environmentally friendly products, and firms should focus on the environment (Bhatti et al. 2022a; Faishal 2022; Karamaşa et al. 2021; Loi 2022a, b; Phuoc et al. 2022). Firm objectives are to focus on sustainable factors due to rapid environmental changes (Mamani et al. 2022). Moreover, researchers found that ecological decline has become a worldwide issue (Kraus et al. 2020). The success or failure of firms depends on the environmental activities (Al-Tamimi 2022; Arsu & Ayçin 2021; Badi et al. 2022; Castillo-Acobo et al. 2022; Lubis & Pratama 2022). Any organization aims to attain a lasting competitive advantage (Astuty et al. 2022; Widajanti et al. 2022). The researchers increasingly change their focus from general deliberation to variables like environmental corporate social responsibility — CSR (Alam & Islam 2021), green intellectual capital (Asiaei et al. 2022), green innovation (Rehman et al. 2021a), green supply chain management or GSCM (Nureen et al. 2023), and environmental business strategy (Aftab et al. 2022). The trends are rapidly changing due to the competitive environment in the whole world. This research covers environmental CSR, GSCM, top management commitment (TMC), and pro-environmental business strategy to attain a green competitive advantage.

The organizations are gradually identifying strategic benefits that curtail the incorporation of environmental concerns in CSR undertakings (Alam & Islam 2021). Academicians tend to concentrate on the CSR phenomenon (Wu & Kung 2020). Xiang et al. (2021) state that CSR is a crucial business practice worldwide. Over 8000 organizations in 160-plus countries spend at least four trillion US dollars on CSR (Kraus et al. 2020). In the past, firms’ primary objective was to earn money, but now organizations focus on producing environment-friendly products (Kraus et al. 2018). From an environmental CSR viewpoint, using economic resources for keeping activities and environmental awareness has become eminent among firms (Yadav et al. 2018). Environmental CSR is a matter of marvelous consideration in the eyes of academicians and industry (Kraus et al. 2020; Rehman et al. 2022). Environmental CSR assists firms in attaining sustainable competitiveness in their operations (Chuang & Huang 2018). Moreover, environmental CSR is likely to add value to a firm’s sustainability distinctly (Chang et al. 2020).

Manufacturing organizations should provide environmentally friendly products to customers (Appolloni et al. 2022). The firms that are the base of environmental issues must change their supply chains and production processes to follow requirements and respect the government (Yildiz Çankaya & Sezen 2019). The firms comprehensively adopted the practices attached to the environmental problems in their supply chain (Rehman et al. 2023a). GSCM is an important initiative from the organizations’ side to improve the ecological benefits and sustainability (Naseer et al. 2023). GSCM emerged due to environmental thinking in SCM (Rehman et al. 2023a). Few researchers have suggested that implementing GSCM organizations can get benefits in terms of operating performance (Cousins et al. 2019), and firm performance (Khanal et al. 2023). Hence, based on these studies, GSCM is essential for organizations, and researchers overlooked the influence of GSCM on green competitive advantage (Dzikriansyah et al. 2023).

Environment-friendly organizations highly rely on TMC, which is eventually responsible for attaining a competitive advantage (Yang Spencer et al. 2013). TMC is a crucial factor in an organization’s strategies and objectives, and a manager’s dedication is necessary to attain the firms progress (Solovida & Latan 2017). Few researchers reveal that TMC improves the green performance of Indonesian organizations (Latan et al. 2018). Environment-friendly firms tend to depend mainly on TMC, which ultimately assists in improving green performance (Bresciani et al. 2023). Finally, test a pro-environmental business strategy as a moderator between TMC and green competitive advantage. Academicians and practitioners pay much attention to environmental strategies (Adomako & Tran 2022; Kraus et al. 2020). Environmental strategy (e.g., eco-efficient practices and innovative preventive practices) positively affects firms’ performance (Fousteris et al. 2018). The researchers suggested that environmental strategy can moderate TMC and green performance (Akram et al. 2023). Prior scholars overlooked the moderating role of pro-environmental business strategy between TMC and green competitive advantage (Kraus et al. 2020; Rehman et al. 2021a). Hence, this study covers this gap.

This study adds value to environmental CSR, GSCM, TMC, pro-environmental business strategy, and green competitive advantage literature. This research initially incorporated environmental CSR, GSCM, TMC, pro-environmental business strategy, and green competitive advantage that prior researchers overlooked (Kraus et al. 2020; Latan et al. 2018; Rehman et al. 2023a, 2021a; Waiyawuththanapoom et al. 2022). This study also determines the mediating role of TMC between environmental CSR, GSCM, and green competitive advantage. Moreover, a pro-environmental business strategy is also used as a moderator between TMC and green competitive advantage. Natural RBV theory is used to explain the research framework. Proposed questions and objectives are listed below.

Research questions:

-

Does environmental CSR affect green competitive advantage?

-

Does GSCM affect green competitive advantage?

-

Does TMC significantly mediate between environmental CSR, GSCM, and green competitive advantage?

-

Does pro-environmental business strategy significantly moderate between TMC and green competitive advantage?

Research objectives:

-

To identify the association between environmental CSR and green competitive advantage.

-

To identify the association between GSCM and green competitive advantage.

-

To identify whether TMC mediates between environmental CSR, GSCM, and green competitive advantage.

-

To identify whether pro-environmental business strategy moderates between TMC and green competitive advantage.

This study has theoretical, managerial, and contextual contributions. From a theoretical perspective, this used natural RBV to determine green competitive advantage. Natural RBV postulated that natural resources and capabilities (i.e., environmental CSR, GSCM, TMC regarding the environment, and pro-environmental business strategy) assist in attaining a green competitive advantage (Hart 1995). This study avoids using RBV because RBV omits natural resources and capabilities to measure sustainable performance and green competitive advantage (Hart 1995). Management of Chinese manufacturing SMEs can get an edge over competitors if they concentrate on environmental CSR, GSCM, TMC, and pro-environmental business strategy. Contextually, this study conducted in China and prior researchers studied environmental CSR, GSCM, TMC, pro-environmental business strategy, and green competitive advantage in countries other than China (Kraus et al. 2020; Rehman et al. 2021b, 2022, 2023a, 2023b, 2021a).

The remaining article is outlined as follows. “Literature review and hypotheses development” are presented immediately to the next. “Methodology” covers measurements, pre-tests, population and sampling, and proposed analysis techniques. In “Results,” this study covers the common method bias, model estimation, and regression model test. The final section includes the “Discussion and conclusion,” “Implications,” and “Limitations and future recommendations.”

Literature review and hypothesis development

Natural RBV

Resource-based view (RBV) postulated that a firm’s resources and capabilities determine a firm’s performance (Barney 1991). Organizational capabilities are significant for effective business management (Charutawephonnukoon et al. 2022). Natural resources are one of any country most significant economic resources (Alghazali et al. 2022). RBV omits natural resources, and this issue covers natural RBV (Hart 1995). This emission was reasonable, but firms should think about natural factors in attaining sustainable performance (Kraus et al. 2020). Hart (1995) extended RBV and focused on environmental factors in measuring sustainable competitive advantage. The researchers suggested following natural RBV to determine organizational performance by focusing on environmental CSR (Menguc & Ozanne 2005). The researchers can focus on attaining a green competitive advantage through environmental CSR, GHRM, TMC, and pro-environmental business strategy through the lens of natural RBV. Hence, environmental CSR (i.e., environmental philanthropy, environmental customer wellbeing, and environmental community involvement), GHRM (i.e., cooperation with customers, internal environmental management, eco-design, and green purchasing), TMC, and pro-environmental business strategy in attaining green competitive advantage through natural RBV.

CSR and green competitive advantage

The researchers focus shifted to CSR specifically because customer trends change rapidly, and they need more environmentally friendly products (Kraus et al. 2020). In recent decades, CSR has been deemed a vital practice worldwide (Xiang et al. 2021). Environmental CSR refers to the organizations’ responsibility to incorporate ecological concerns in the products, operations, recycling, waste management, and reducing practices that would distress the country future generation and world (Mazurkiewicz 2004). From an environmental CSR perspective, the use of economic resources for keeping activities and awareness regarding the environment has become prominent among organizations (Yadav et al. 2018). Moreover, environmental CSR has a stunning focus in industrialists’ and scholars’ eyes (Kraus et al. 2020; Rehman et al. 2022). Sustainable competitiveness in operations can be attained if environmental CSR is effectively implemented and measured (Chuang & Huang 2018). The literature stated that environmental CSR will likely contribute value to organizational sustainability (Chang et al. 2020). Hence, organizations are gradually focusing on green initiatives to achieve business competitiveness (Chuang & Huang 2015). CSR which has no exact CSR definition is available (Kraus et al. 2020). Hence, scholars needed help conducting a CSR study (Orlitzky et al. 2011). CSR means the organizations’ obligation to follow those strategies, make decisions, and pursue those lines of action that develop value for society (Bowen 2013). The researchers identified three dimensions: environmental philanthropy, environmental customer wellbeing, and environmental community involvement (Rashid et al. 2015). This study uses these dimensions to measure environmental CSR.

Organizational philanthropic contribution is a noticeable characteristic of environmental CSR (Brammer & Millington 2008). The researchers recognized that organizations are magnanimously encouraged by environmental philanthropy, where they are an essential element of the general public (Jhawar & Gupta 2017). The organizations enhance their societal image by focusing on philanthropic activities (Liu et al. 2017). Kim et al. (2020) stated that environmental philanthropy raises the image of organizations in the eyes of the public. Moreover, researchers suggested that organizations cannot ignore environmental philanthropy to attain a green competitive advantage (Alam & Islam 2021). Organization community developing actions through CSR contribute considerably toward making a sense of identity and customer loyalty (Statista 2023). Timely organizational efforts are significant predictors that build the base for stakeholders’ trust (Baik & Park 2019). Organizational community involvement is essential, and management cannot be missed for an organization’s success (Rahman 2011). When organizations provide environment-friendly products to customers and ensure that their primary purpose is to serve customers properly, this helps the organization gain a competitive advantage (Han et al. 2019). GCA refers to a situation in which an organization inhabits a specific position regarding environmental management that competitors find difficult to imitate, and the organization can thus attain the benefits of successful environmental strategies (Astuti & Datrini 2021). Natural RBV postulated that natural resources like environmental CSR determine green competitive advantage (Hart 1995). Organizations cannot overlook environmental customer wellbeing if they aim to attain a green competitive advantage in the marketplace (Alam & Islam 2021). The hypothesis is as below:

-

H1: Environmental CSR is positively related to green competitive advantage.

GSCM and green competitive advantage

GSCM refers to a supply chain-wide management approach for environmental management, including strategic positioning and environmental practices to enhance organizational environmental goals (Zhu et al. 2008). The term GSCM covers environmental elements to handle the supply chain (Al-Ghwayeen & Abdallah 2018). The GSCM concept emerged due to environmental thinking in supply chain management (Rehman et al. 2023a). Nowadays, practitioners and academicians highly concentrate on GSCM because this can be helpful for organizations in measuring performance and competitive advantage (Astawa et al. 2021). GSCM is an important initiative to enhance a firm’s sustainability and ecological benefits (Dzikriansyah et al. 2023). GSCM incorporates ethical and inclusive parts of the supply chain plus environmental reflections (Laari et al. 2016). This study measures GSCM through green purchasing, eco-design, customer cooperation, and internal environmental management (Zhu et al. 2010).

Green purchasing and customer cooperation increase performance (Zhu et al. 2013). Eco-design and internal environmental management are essential for firms success (Shang et al. 2010). GSCM is a strategic organizational resource (Rehman et al. 2023a). Natural RBV favors the relationship between natural resources such as GSCM and green competitive advantage (Hart 1995; Hart & Dowell 2011). Prior researchers recommended implementing GSCM in organizations, and due to this, organizations can benefit from increasing operating performance (Cousins et al. 2019), and organizational performance (Khanal et al. 2023). Few studies show GSCM impact on competitive advantage (Das et al. 2023; Naseer et al. 2023). Following is the hypothesis:

-

H2: GSCM is positively related to green competitive advantage.

TMC and green competitive advantage

From an ecological perspective, TMC refers to the employees’ appraisal of an organization commitment to environmentally friendly initiatives and green activities in motivating its employees to exhibit pro-environmental behavior and assist the organization in achieving environmental sustainability objectives (Haldorai et al. 2022). Organizations that depend on the environment rely on TMC, which is eventually responsible for attaining a competitive advantage (Yang Spencer et al. 2013). TMC is essential in organizations’ strategies and objectives, and a manager’s dedication is necessary for the attainment of the firms progress (Solovida & Latan 2017). Literature elucidated that TMC improves the green performance of Indonesian organizations (Latan et al. 2018). Environment-friendly firms tend to depend mainly on TMC, which ultimately assists in improving green performance (Bresciani et al. 2023). TMC is vital to promote organizational effectiveness (Hoejmose et al. 2012). TMC significantly increased green performance, and natural RBV supported this relationship (Latan et al. 2018). The researchers overlooked the impact of TMC on green competitive advantage (Nureen et al. 2023). The hypothesis is below:

-

H3: TMC is positively related to green competitive advantage.

TMC as a mediator

Prior researchers confirmed that if organizations effectively implemented environmental CSR practices, sustainable operations competitiveness could be attained (Chuang & Huang 2018). Moreover, environmental CSR adds value to firms’ sustainability (Chang et al. 2020). Environmental CSR cannot be ignored because academicians and industry pay much attention to this (Kraus et al. 2020; Rehman et al. 2022). Few researchers reveal that environmental CSR is significantly related to the green competitive advantage of apparel factories in Bangladesh (Yadav et al. 2018). Conversely, CSR is not important for green performance (Kraus et al. 2020; Rehman et al. 2022). GSCM improves firms’ performance (Khanal et al. 2023) and operating performance (Cousins et al. 2019). Conversely, GSCM is not essential for environmental performance (Rehman et al. 2023a) and firms’ performance (Nureen et al. 2023). Environmental CSR, GSCM, and a firm’s performance relationship are unclear. TMC is used as a mediator to explain the relationship.

TMC significantly plays a significant role in answering green issues (Ilyas et al. 2020). Moreover, TMC is an essential factor in firm strategies and objectives, and a manager’s dedication is necessary for the attainment of a firm’s progress (Solovida & Latan 2017). Hence, TMC is a mediator between environmental CSR, GSCM, and green competitive advantage. Hypotheses are below:

-

H4: TMC significantly mediates between environmental CSR and green competitive advantage.

-

H5: TMC significantly mediates between GSCM and green competitive advantage.

Pro-environmental business strategy as a moderator

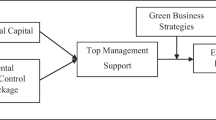

The environmental strategy of an organization’s long-term orientation regarding managing environmental practices and building environmental resources and capabilities is to fit stakeholders’ expectations well (Ortiz-de-Mandojana & Aragón-Correa 2016). Business practices and policies of organizations that fulfill stakeholders’ requirements regarding environmental issues (van Someren 1995). Environmental strategies are reflected in organizations’ expenditures to decrease waste pollution and safeguard the environment (Adomako & Tran 2022). The management focuses on natural issues that trigger the organizations’ aptitude to establish an environmental strategy (Hart & Dowell 2011). Natural RBV favored the relationship between environmental strategy and green performance (Kraus et al. 2020; Rehman et al. 2021a). Nowadays, practitioners and academicians focus on green strategies that improve environmental performance (Kraus et al. 2020). Moreover, environmental strategies improve financial performance (Fousteris et al. 2018). We used a pro-environmental business strategy between TMC and green competitive advantage. Environmental strategy can be a moderator between TMC and green performance (Akram et al. 2023). Moreover, prior researchers ignored to observe the moderating role of pro-environmental business strategy between TMC and green competitive advantage. Hypotheses are below; Fig. 1 depicts the research framework.

-

H6: Pro-environmental business strategy is positively related to green competitive advantage.

-

H7: Pro-environmental business strategy significantly moderates TMC and green competitive advantage.

Methodology

Measures

The items of all variables were adapted from previous studies. Environmental CSR includes EPH, ECI, and ECW. EPH has three items, ECI four items, and ECW has three items from Alam and Islam (2021). GSCM has four dimensions: eco-design, cooperation with customers, green purchasing, and internal environmental management. Eco-design includes four items and cooperation with customers and seven items from Zhu et al. (2013). Green purchasing and internal environmental management are five items each (Shang et al. 2010; Zhu et al. 2007). TMC’s five items are from Yang Spencer et al. (2013). Pro-environmental business strategy includes three items from Banerjee (2002). Finally, green competitive advantage’s four items are from Chen and Chang (2013) Table 1.

Population and sampling

The researchers collected data from Guangdong, China. China is the biggest exporter worldwide (Liu et al. 2009). In China, SMEs are > 93 million, and their contribution to employment and GDP is greater than 80% and 60%, respectively (Yang et al. 2020). Moreover, 41,490 SMEs are listed in Guangdong, China (Statista 2023). Before distributing the questionnaire, a pre-test was conducted. A total of 10 questionnaires were distributed, five to industry and five to academicians. The feedback was used to improve the content of the questionnaire. In SmartPLS, cross-loadings are used for pre-testing. Table 2 shows the cross-loadings. Population is known, and researchers used probability sampling for data collection. In probability sampling, this study used a simple random sampling technique to collect data because a simple random sampling technique offers an identical chance of selection to every member of the population (Sekaran & Bougie 2016). The researchers collected data through questionnaires and visited organizations personally. According to Comrey and Lee (1992), a sample size below 50 is weaker; sample sizes 51 to 100 are weak; sample sizes 101 to 200 are adequate; sample sizes 201 to 300 are good; sample size of 500 is very good; and sample size of 1000 is considered excellent. Thus, this study distributed a total of 2000 questionnaires to respondents randomly and only 335 questionnaires were received. Out of 335 questionnaires, 4 questionnaires were excluded due to misleading information. Hence, only 331 questionnaires were part of the final analysis. The Five-Likert scale was used. The Five-Likert scale approach is appropriate and followed by several prior researchers (Al Doghan & Malik 2022; Wiroonratch & Mungsakul 2022).

Table 1 highlights the demographic characteristics. From an industry perspective, textile organizations were 99 or 29.91%, food and beverage 92 or 27.79%, automotive and electronics 67 or 20.24%, and pharmaceuticals were 73 or 22.06%. From a supplier annual turnover perspective, less than 10 million Yuan turnover organizations were 85 or 25.68%; turnovers 10 to 25 million organizations were 46 or 13.90%; turnovers 26 to 50 million organizations were 53 or 16.01%; turnovers 51 to 75 million organizations were 35 or 10.57%; turnovers 76 to 100 million organizations were 47 or 14.20%; and organizations more than 100 million Yuan organizations were 65 or 19.64%. From a buyer annual turnover perspective, less than 10 million Yuan turnover organizations were 24 or 7.25%; turnovers 10 to 25 million organizations were 19 or 5.74%; turnovers 26 to 50 million organizations were 97 or 29.31%; turnovers 51 to 75 million organizations were 66 or 19.94%; turnovers 76 to 100 million organizations were 74 or 22.36%; and organizations more than 100 million Yuan organizations were 51 or 15.40%. In the type of buyer ownership perspective, state-owned organizations were 37 or 11.18%; state-shared-owned organizations were 53 or 16.01%; wholly foreign-owned organizations were 64 or 19.24%; privately owned organizations were 163 or 49.24%; and state and privately owned organizations were 14 or 4.23%.

Results

CMB.

Data was gathered using questionnaires simultaneously, and there is a possibility that common method bias (CMB) issues can happen. It was promised to respondents that their information will not be shared with someone without their consent. CMB is deemed a severe problem usually attached to self-survey (Podsakoff & Organ 1986). Statistically, variance inflation factor (VIF) or full-collinearity and Herman’s single factor are used for CMB. VIF is followed to assess the existence of collinearity in empirical data. WarpPLS 8.0 was used for full-collinearity. VIF or full-collinearity should be less than 3.3 (Kock 2015). Tables 4 and 6 show that the full-collinearity value is lesser than the standard value. Herman’s single factor is followed for CMB, and this study demonstrates that single-factor explains 41.23%, which is below 50%. Hence, both criteria are fulfilled, and empirical data is no CMB issue.

Correlation analysis

This study uses SPSS, WarpPLS, and SmartPLS for data analysis. The SPSS software was used for descriptive analysis. This study computes demographic results and correlation analysis in the descriptive analysis. Pearson’s correlation analysis technique was followed to compute interrelationships among variables/items. The researchers stated that the range of correlation is between − 1 and + 1 (Taylor 1990). The values near + 1 show high correlations and vice versa. Table 3 shows that green SCM is highly correlated with green competitive advantage (r = 0.789, p < 0.05). Table 3 reveals that the mean value of every variable is near to 4. Most respondents agree that green SCM, TMC, and pro-environmental business strategy measure green competitive advantage.

Model estimation

PLS is a soft modeling approach, so data distribution is unnecessary (Chidambaram et al. 2021). PLS-SEM technique is usually used to estimate hypotheses through SmartPLS software. The PLS-SEM is preferably adapted for exploratory research because this permits a complete evaluation of measurement and structural model (Yongliang & Sharon 2022). Several reasons are available for using PLS-SEM. For example, it is more reliable to execute mediation (Preacher & Hayes 2004). Moreover, it is appropriate for simple and complex models; data normality is not required, and smaller samples (Hair et al. 2014). PLS-SEM is widely accepted and followed by various researchers in diverse areas (Al-Muttar et al. 2022; Alfayad 2021; Almoussawi et al. 2022; Alyahya & Bhatti 2022; Ameer & Garg 2022; Anggusti 2022; Azizah 2021; Bhatti et al. 2022b; Chidambaram et al. 2021; Duong et al. 2022; Hossain et al. 2022; Khalil et al. 2022; Kuo et al. 2021; Olaleye et al. 2021; Ruan & Liu 2021; Satria et al. 2022; Van Loi 2022b, a; Wang et al. 2021). The sample is not big, hence, this study followed PLS-SEM for hypothesis testing. The research framework covers five reflective constructs. Environmental CSR and green SCM have various dimensions.

Figure 2 portrays the measurement model in lower order. Loading should be > 0.50 (Hair et al. 2014). Table 4 confirms no issue regarding loadings. For the reliability test, Cronbach’s alpha and CR were used (Alnaim 2022; Susilawati et al. 2022; Tarrad et al. 2022). Cronbach’s alpha and CR value should be 0.70 or more (Hair et al. 2019). Table 4 shows no issue regarding this. Convergent validity was computed through average variance extracted (AVE), and researchers suggested that AVE should be > 0.50 (Hair et al. 2014). Table 4 shows no issue regarding this.

Researchers use heterotrait-monotrait (HTMT) because traditional metrics are outdated (Henseler et al. 2015). The HTMT value should be 0.85 for latent variables (LVs) conceptually different and 0.90 for the same. Table 5 shows that all the values are within the range at first order, and the discriminant validity criterion was achieved.

Tables 6 and 7 demonstrate that all the criteria like factor loadings, CR, AVE, full-collinearity, and HTMT are fulfilled in second order because these criteria are more than standardized values, as mentioned. Figure 3 portrays the measurement model in second order.

Regression model test

Table 8 highlights hypothesis results. Environmental CSR is not important for green competitive advantage (β = 0.037 and t-value = 0.391), and H1 is not accepted. Green SCM (β = 0.591 and t-value = 5.476) and TMC (β = 0.193 and t-value = 2.929) increase green competitive advantage and accept H2 and H3 (Fig. 4). TMC significantly mediates between environmental CSR (β = 0.096 and t-value = 2.727), green SCM (β = 0.056 and t-value = 1.988), and green competitive advantage and accepted H4 and H5. Pro-environmental business strategy enhances green competitive advantage (β = 0.097 and t-value = 2.644), and H6 is accepted. Finally, a pro-environmental business strategy strengthens TMC and green competitive advantage (β = 0.055 and t-value = 2.120) and supports H7. Figure 5 portrays this relationship.

The f2 displays if an external variable influences an endogenous variable (Ningning & Mengze 2022). According to Cohen (1988), f2 is categorized into smaller (f2 = 0.02), medium (f2 = 0.15), and high effect (f2 = 0.35). Table 8 demonstrates that environmental CSR has none, but TMC and pro-environmental business strategy are smaller, and green SCM has a medium effect on green competitive advantage. Environmental CSR has a medium, and GSCM has a smaller effect on TMC. For predictive relevance, Q2 and the explanatory power of research model R2 are used. R2 refers to the variance explained by collectively exogenous variables (Abdulnabi et al. 2022; Prasetyo et al. 2022; Serrano-Díaz et al. 2022; Taddeo et al. 2022; Wachs et al. 2022; Waty et al. 2022). The R2 categories are weak (R2 = 0.02 – 0.13), moderate (R2 = 0.13 – 0.26), and substantial (R2 = more than 0.26). Table 9 highlights that R2 of TMC is 57.6% and green competitive advantage is 66.7%. Hence, the R2 value of TMC and green competitive advantage fall under substantial. The literature stated that Q2 should be > 0 (Chin 1998). The blindfolding technique is followed for Q2. Table 9 reveals that the Q2 value of TMC and green competitive advantage is above zero. Hence, both criteria were achieved.

Discussion and conclusion

This research objective is to contribute to natural RBV by determining the association between environmental CSR, green SCM, and green competitive advantage with the mediating role of TMC. A pro-environmental business strategy is followed as a moderator.

Environmental CSR is not important for green competitive advantage, and H1 is not accepted. Prior researchers found that CSR does not significantly determine environmental performance (Kraus et al. 2020). The results are not in favor of natural RBV (Hart 1995). GSCM attained a green competitive advantage, and H2 supported. Prior researchers reveal that GSCM influences green performance (Cousins et al. 2019). The natural RBV supported this relationship (Hart 1995).

TMC attains a green competitive advantage and supports H3. TMC significantly improves the environmental performance of Indonesian organizations (Latan et al. 2018). Literature confirmed that environment-friendly firms tend to rely on TMC, which eventually assists in enhancing green performance (Bresciani et al. 2023). TMC explains the difference environmental CSR, GSCM, and green competitive advantage and supports H4 and H5. TMC is helpful in boosting the relationship between natural resources and organizational performance (Nureen et al. 2023). Without a managerial role, the organizations cannot get maximum benefits in terms of green competitive advantage through natural resources like environmental CSR and green SCM (Hart 1995). TMC assists in attaining a green competitive advantage and supports H5.

A pro-environmental business strategy significantly and positively determines green competitive advantage and supports H6. Prior researchers elucidated that environmental strategy improves green performance (Kraus et al. 2020). Organizations that concentrate on environmental strategies get more benefits in terms of improved green performance, and organizations that lack environmental strategies cannot get this benefit (Solovida & Latan 2017). Natural RBV supports that environmental strategies are vital in measuring green competitive advantage (Hart 1995). Finally, the pro-environmental business strategy strengthens TMC and green competitive advantage and supports H7. This research suggests that even the TMC environmental CSR and GSCM organizations cannot ignore the pro-environmental business strategy to attain a green competitive advantage. Prior researchers supported this argument that environmental strategies cannot be overlooked in measuring green performance (Rehman et al. 2021a).

Theoretical implications

This research has several theoretical implications. In literature, the influence of environmental CSR, GSCM, TMC, and pro-environmental business strategy on green competitive advantage have rarely been discussed together (Kraus et al. 2020; Latan et al. 2018; Rehman et al. 2023a, 2021a). This study extends those of Nureen et al. (2023), who found GSCM on green culture and TMC leading firms’ performance. This study adds environmental CSR and pro-environmental business strategy to measure green competitive advantage. Prior studies overlooked the influence of environmental CSR, green GSCM, TMC, and pro-environmental business strategy on green competitive advantage (Bresciani et al. 2023; Kraus et al. 2020; Latan et al. 2018; Rehman et al. 2022). Hence, this research covers this gap.

Environmental CSR is used to attain a green competitive advantage through natural RBV and supports this relationship. Few researchers used stakeholder theory for CSR and economic performance (Hernández et al. 2020) and financial performance (Yang et al. 2020). The researchers suggested that natural RBV can be used to determine green competitive advantage through CSR (Menguc & Ozanne 2005). Environmental CSR and green competitive advantage are not explored well particularly in SMEs (Kraus et al. 2020). Hence, we use natural RBV for environmental CSR and green competitive advantage. GSCM positively related to green competitive advantage through natural RBV. Few of the researchers used different theories on GSCM, for instance, stakeholder theory (Ahmed et al. 2020) and institutional theory (Saeed et al. 2018). GSCM measures environmental performance (Cousins et al. 2019). Green competitive advantage through GSCM is explored little (Rehman et al. 2023a). Hence, this research uses natural RBV for GSCM and green competitive advantage.

TMC is a valuable factor in attaining a green competitive advantage. TMC measures firms’ performance (Nureen et al. 2023) and environmental or green performance (Latan et al. 2018). Few researchers recommended that TMC in organizations can improve organizational green performance (Rehman et al. 2021a). The knowledge-based view is followed for TMC and environmental performance (Bresciani et al. 2023). The scholars recommended using natural RBV between TMC and firms’ performance (Nureen et al. 2023). Hence, this study uses natural RBV for TMC and green competitive advantage. Finally, a pro-environmental business strategy measures green competitive advantage and gets superior results. Contingency theory is used for environmental strategy and performance (Rötzel et al. 2019). Natural RBV can be followed for pro-environmental business strategy and green performance (Kraus et al. 2020; Rehman et al. 2021a). Thus, we see the impact of a pro-environmental business strategy on green competitive advantage by using natural RBV.

Managerial implications

This research concentrates on environmental CSR, GSCM, TMC, and pro-environmental business strategy to attain a green competitive advantage. If Chinese SMEs want an edge over competitors, then there is a need to focus on these predictors. Even environmental CSR does not directly measure green competitive advantage. SMEs cannot disregard the significance of environmental CSR for organizations’ success. For instance, prior researchers found that CSR significantly enhances organizational performance (Naseem et al. 2020). This study suggests that even the findings of environmental CSR are not in favor, but management cannot ignore attaining green competitive advantage based on prior studies. The management should contribute to future generations and support non-government agencies operating in troublesome areas. The organizations take initiatives to promote and improve the natural environment and sustainable growth for future generations, inspire workers to take part in social activities, operationalize distinct schemes for reducing ecological effects, show respect for customers rights, and consider customer satisfaction on the priority list.

GSCM is an important indicator of green competitive advantage. For example, firms should liaise with suppliers for green objectives, supplier ISO 14000 certification, audit for supplier internal management, establish an environmental protection index of recycling gaseous reduction and energy conversation, and support for environmental practices from upper and middle management. Moreover, cooperation is fostered with the customers for eco-design, green packaging, adoption, and third-party logistics. This study recommends that TMC is crucial for improving green performance (Latan et al. 2018). If organizations want a green competitive advantage, TMC regarding environmental activities is essential. For instance, top managers continue to emphasize green competitive advantage, put extra effort into meeting green competitive advantage, and provide accurate information on firms’ green competitive advantage, and their work has contributed to green competitive advantage. Finally, this research suggests that a pro-environmental business strategy significantly impacts green competitive advantage. If organizations need to get an edge over competitors, they need to concentrate on a pro-environmental business strategy. For instance, organizations should emphasize the environmental aspects of products in ads, make marketing strategies for products/services, and product-market decisions that are always influenced by environmental concerns.

Limitations and future recommendations

A cross-sectional approach is used, and upcoming scholars can use longitudinal research to see whether the results have changed. This research comprehensively sees the impact of environmental CSR, GSCM, TMC, and pro-environmental business strategy on green competitive advantage in Chinese manufacturing SMEs. The location and sample size might be a limitation. However, this study may enhance its scope in the future by considering the following directions. The sample size is small, and upcoming scholars can raise this to support the generalizability of outcomes. Researchers collected data from SMEs in Guangdong, China.

Nevertheless, considering the budget and time situation, some other industries might be targeted for data collection. Other countries might be focused on getting data and validating the results on a larger sample. This study might add other variables like environmental management control systems, environmental knowledge, and green innovation concerns to determine green competitive advantage.

Data availability

Data are available from the corresponding author on request.

Change history

10 February 2024

A Correction to this paper has been published: https://doi.org/10.1007/s11356-024-32411-0

References

Abdulnabi SM, Almoussawi ZA, Hatem A, Ahmed MD, Hasan AA, Sabti AA, Alhani I (2022) The effect of drivers and barriers on the adoption of green supply chain management in construction of Iraq: a crosssectional study. Int J Construction Supply Chain Manag 12(1):167–182

Adomako S, Tran MD (2022) Sustainable environmental strategy, firm competitiveness, and financial performance: evidence from the mining industry. Resour Policy 75:102515

Aftab J, Abid N, Sarwar H, Veneziani M (2022) Environmental ethics, green innovation, and sustainable performance: exploring the role of environmental leadership and environmental strategy. J Clean Prod 378:134639

Ahmed W, Najmi A, Khan F (2020) Examining the impact of institutional pressures and green supply chain management practices on firm performance. Manag Environ Qual: Int J 31(5):1261–1283

Akram HI, Samad S, Nguyen NT, Rehman SU, Rehman HI, Iqbal Y (2023) Environmental MCS package and green intellectual capital influence environmental performance: a mediated-moderated perspective. Environ Sci Pollut Res 30:103339–103357

Al Doghan M, Malik N (2022) Gauging the effect of job burnout and stress on job satisfaction. Social Space 22(1):383–403

Alam S, Islam K (2021) Examining the role of environmental corporate social responsibility in building green corporate image and green competitive advantage. Int J Corp Soc Responsib 6(1):1–16

Alfayad FS (2021) The impact of bank performance towards technology and marketing strategy on omni-channel adoption in Saudi banking sector. Cuadernos De Economía 44(124):33–41

Alghazali T, Al-Sudani AQAS, Alabass HSH, Hawash MK, Talib S G, Ali MH, . . . Al-Muttar MYO. (2022). The impact of knowledge-based economy on the economic growth of Middle Eastern Countries. Cuadernos de Econ 45(127): 163-170

Al-Ghwayeen WS, Abdallah AB (2018) Green supply chain management and export performance: the mediating role of environmental performance. J Manuf Technol Manag 29(7):1233–1252

Almoussawi ZA, Sarhed JN, Obay Saeed M, Ali MH, Wafqan HM, Abd Alhasan SA (2022) Moderating the role of green trust in the relationship of green brand positioning, green marketing, green production, and green consumer value on green purchase intention of university students in Iraq. Trans Market J 10(3):738–750

Al-Muttar MYO, Basheer ZM, Sahib AA, Wafqan HM, Ali MH, Abd Al Mahdi R, Hasan HQ (2022) Moderating effect of international relations among information capital, supplier trade integration and performance: an evidence from international trade business in Iraq. Croatian Int Relat Rev 28(90):193–213

Alnaim AF (2022) Effects of individual (perceived identity theft, cognitive trust, and attitude) and situational (website quality, perceived reputation, social presence) factors on online purchase intention: moderating role of cyber security. Int J Cyber Criminol 16(2):131–148

Al-Tamimi SA (2022) Towards integrated management accounting system for measuring environmental performance. AgBioforum 24(2):149–161

Alyahya M, Bhatti MA (2022) Role of teachers’ ability and students’ facilities in educational sustainability during the COVID-19 pandemic: empirical evidence from Saudi Arabia. Eurasian J Educ Res 97(97):132–153

Ameer R, Garg P (2022) Factors impacting adoption of human resource analytics among HR professionals in India. Trans Market J 10(3):623–635

Anggusti M (2022) Cybercrime change consumers’ purchase intention in Indonesia: a moderating role of corporate social responsibility and business law. Int J Cyber Criminol 16(1):20–39

Appolloni A, Jabbour CJC, D’Adamo I, Gastaldi M, Settembre-Blundo D (2022) Green recovery in the mature manufacturing industry: the role of the green-circular premium and sustainability certification in innovative efforts. Ecol Econ 193:107311

Arsu T, Ayçin E (2021) Evaluation of OCED countries with multicriteria decision-making methods in terms of economic, social, and environmental aspects. Operational Res Eng Sci: Theory Appl 4(2):55–78

Asiaei K, Bontis N, Alizadeh R, Yaghoubi M (2022) Green intellectual capital and environmental management accounting: natural resource orchestration in favor of environmental performance. Bus Strateg Environ 31(1):76–93

Astawa IP, Astara I, Mudana IG, Dwiatmadja C (2021) Managing sustainable microfinance institutions in the Covid-19 situation through revitalizing balinese cultural identity. Quality-Access Success 22(184):131–137

Astuti P, Datrini L (2021) Green competitive advantage: examining the role of environmental consciousness and green intellectual capital. Manag Sci Lett 11(4):1141–1152

Astuty W, Habibie A, Pasaribu F, Pratama I, Rahayu S (2022) Utilization of accounting information and budget participation as antecedent of managerial performance: exploring the moderating role of organizational commitment, leadership style, environmental uncertainty and business strategy in Indonesia. J Modern Project Manag 10(1):189–201

Azizah SN (2021) A criminal perspective of the COVID-19 pandemic’s impact on the distribution of Halal food. Int J Crim Justice Sci 16(1):278–295

Badi I, Muhammad LJ, Abubakar M, Bakır M (2022) Measuring sustainability performance indicators using Fucom-Marcos method. Operational Res Eng Sci: Theory Appl 5(2):99–116

Baik Y, Park Y-R (2019) Managing legitimacy through corporate community involvement: The effects of subsidiary ownership and host country experience in China. Asia Pacific J Manag 36:971–993

Banerjee SB (2002) Corporate environmentalism: the construct and its measurement. J Bus Res 55(3):177–191

Barney J (1991) Firm resources and sustained competitive advantage. J Manag 17(1):99–120

Bhatti MA, Alyahya M, Alshiha AA, Aldossary M, Juhari AS, Saat SAM (2022a) SME’s sustainability and success performance: the role of green management practices, technology innovation, human capital and value proposition. Int J eBusiness eGovernment Stud 14(2):112–125

Bhatti MA, Alyahya M, Juhari AS, Alshiha AA (2022b) Green HRM practices and employee satisfaction in the hotel industry of Saudi Arabia. Int J Operations Quantitative Manag 28(1):100–120

Bowen HR (2013) Social responsibilities of the businessman. University of Iowa Press

Brammer S, Millington A (2008) Does it pay to be different? An analysis of the relationship between corporate social and financial performance. Strateg Manag J 29(12):1325–1343

Bresciani S, Rehman SU, Giovando G, Alam GM (2023) The role of environmental management accounting and environmental knowledge management practices influence on environmental performance: mediated-moderated model. J Knowl Manag 27(4):896–918

Castillo-Acobo RY, Cano YDPYF, Paricahua AKP, Íñiguez-Ayón YP, León CRR, Mohamed MMH, . . . Preciado MAC. (2022) The role of innovation adoption and circular economy readiness on the environmental sustainability: moderating impact of organizational support. AgBioForum 24(2): 226-235

Chang T-W, Yeh Y-L, Li H-X (2020) How to shape an organization’s sustainable green management performance: the mediation effect of environmental corporate social responsibility. Sustainability 12(21):9198

Charutawephonnukoon P, Sriyakul T, Jermsittiparsert K, Pinyokul K (2022) Information technology governance role on the business capabilities and management in public sector organizations in Thailand. Int J eBusiness and eGovernment Stud 14(1):89–105

Chen Y-S, Chang C-H (2013) The determinants of green product development performance: green dynamic capabilities, green transformational leadership, and green creativity. J Bus Ethics 116(1):107–119

Chidambaram V, Shanmugam K, Sivamani B (2021) Effect of project team integration on the performance of Indian construction project: SMART PLS Structural Equation Approach. Int J Construction Supply Chain Manag 11(1):1–20

Chin WW (1998) Commentary: issues and opinion on structural equation modeling. MIS Q 22(1):7–16

Chuang S-P, Huang S-J (2015) Effects of business greening and green IT capital on business competitiveness. J Bus Ethics 128:221–231

Chuang S-P, Huang S-J (2018) The effect of environmental corporate social responsibility on environmental performance and business competitiveness: the mediation of green information technology capital. J Bus Ethics 150:991–1009

Cohen J (1988) tatistical power analysis for the behavioral sciences, 2nd edn. Hillsdale, NJ: erlbaum

Comrey AL, Lee HB (1992) first course in factor analysis. Psychology press.

Cousins PD, Lawson B, Petersen KJ, Fugate B (2019) Investigating green supply chain management practices and performance: the moderating roles of supply chain ecocentricity and traceability. Int J Oper Prod Manag 39(5):767–786

Das G, Li S, Tunio RA, Jamali RH, Ullah I, Fernando KWTM (2023) The implementation of green supply chain management (GSCM) and environmental management system (EMS) practices and its impact on market competitiveness during COVID-19. Environ Sci Pollut Res 30:68387–68402

Duong KD, Thanh Hai Thi, T. (2022) The role of corporate social responsibilities and personnel risk management in business management in Vietnam. Int Construction Supply Chain Manag 12(1):114–126

Dzikriansyah MA, Masudin I, Zulfikarijah F, Jihadi M, Jatmiko RD (2023) The role of green supply chain management practices on environmental performance: a case of Indonesian small and medium enterprises. Clean Logistics Supply Chain 6:100100

Faishal A (2022) Laws and regulations regarding food waste management as a function of environmental protection in a developing nation. Int J Criminal Justice Sci 17(2):223–237

Fousteris AE, Didaskalou EA, Tsogas M-MH, Georgakellos DA (2018) The environmental strategy of businesses as an option under recession in Greece. Sustainability 10(12):4399

Hair JF, Hult GTM, Ringle C, Sarstedt M (2014) A primer on partial least squares structural equation modeling (PLS-SEM). Sage Publications, Thousand Oaks

Hair JF, Risher JJ, Sarstedt M, Ringle CM (2019) When to use and how to report the results of PLS-SEM. Eur Bus Rev 31(1):2–24

Haldorai K, Kim WG, Garcia RF (2022) Top management green commitment and green intellectual capital as enablers of hotel environmental performance: the mediating role of green human resource management. Tour Manage 88:104431

Han H, Yu J, Kim W (2019) Environmental corporate social responsibility and the strategy to boost the airline’s image and customer loyalty intentions. J Travel Tour Mark 36(3):371–383

Hart SL (1995) A natural-resource-based view of the firm. Acad Manag Rev 20(4):986–1014. https://doi.org/10.5465/amr.1995.9512280033

Hart SL, Dowell G (2011) Invited editorial: a natural-resource-based view of the firm: fifteen years after. J Manag 37(5):1464–1479

Henseler J, Ringle CM, Sarstedt M (2015) A new criterion for assessing discriminant validity in variance-based structural equation modeling. J Acad Mark Sci 43(1):115–135

Hernández JPS-I, Yañez-Araque B, Moreno-García J (2020) Moderating effect of firm size on the influence of corporate social responsibility in the economic performance of micro-, small-and medium-sized enterprises. Technol Forecast Soc Chang 151:119774

Hoejmose S, Brammer S, Millington A (2012) “Green” supply chain management: The role of trust and top management in B2B and B2C markets. Ind Mark Manage 41(4):609–620

Hossain A, Hasan S, Begum S, Sarker MAH (2022) Consumers’ online buying behaviour during COVID-19 pandemic using structural equation modeling. Trans Market J 10(2):311–334

Ilyas S, Hu Z, Wiwattanakornwong K (2020) Unleashing the role of top management and government support in green supply chain management and sustainable development goals. Environ Sci Pollut Res 27:8210–8223

Jhawar N, Gupta S (2017) Understanding CSR-its history and the recent developments. J Bus Manag 19(5):105–109

Karamaşa Ç, Ergün M, Gülcan B, Korucuk S, Memiş S, Vojinović D (2021) Ranking value-creating green approach practices and choosing ideal green marketing strategy for logistics companies. Operational Res Eng Sci: Theory Appl 4(3):21–38. https://doi.org/10.1515/erj-2017-0014

Khalil MI, Haque R, Senathirajah Bin S, A. R., Chowdhury, B., & Ahmed, S. (2022) Modeling factors affecting SME performance in Malaysia. Int J Operartions Quantitative Manag 28(2):506–524

Khanal G, Shrestha R, Devkota N, Sakhakarmy M, Mahato S, Paudel UR, . . . Khanal CK (2023). An investigation of green supply chain management practices on organizational performance using multivariate statistical analysis. Supply Chain Anal 3: 100034

Kim M, Yin X, Lee G (2020) The effect of CSR on corporate image, customer citizenship behaviors, and customers’ long-term relationship orientation. Int J Hosp Manag 88:102520

Kock N (2015) Common method bias in PLS-SEM: a full collinearity assessment approach. Int J E-Collaboration (ijec) 11(4):1–10

Kraus S, Burtscher J, Vallaster C, Angerer M (2018) Sustainable entrepreneurship orientation: a reflection on status-quo research on factors facilitating responsible managerial practices. Sustainability 10(2):444

Kraus S, Rehman SU, García FJS (2020) Corporate social responsibility and environmental performance: the mediating role of environmental strategy and green innovation. Technol Forecast Soc Chang 160:120262

Kuo Y-K, Shen W-T, Kuo Y-L, Islam MM, Ramirez-Asis E (2021) Nexus between organizational behavior and managerial skill of sports clubs in olympic games. Revista De Psicología Del Deporte (journal of Sport Psychology) 30(4):105–115

Laari S, Töyli J, Solakivi T, Ojala L (2016) Firm performance and customer-driven green supply chain management. J Clean Prod 112:1960–1970

Latan H, Jabbour CJC, de Sousa Jabbour ABL, Wamba SF, Shahbaz M (2018) Effects of environmental strategy, environmental uncertainty and top management’s commitment on corporate environmental performance: the role of environmental management accounting. J Clean Prod 180:297–306

Liu Y, Luo Y, Liu T (2009) Governing buyer–supplier relationships through transactional and relational mechanisms: evidence from China. J Oper Manag 27(4):294–309

Liu W, Wei Q, Huang S-Q, Tsai S-B (2017) Doing good again? A multilevel institutional perspective on corporate environmental responsibility and philanthropic strategy. Int J Environ Res Public Health 14(10):1283

Loi, L. V. (2022). The role of international religious relations, intrinsic & extrinsic religiosity in developing the pro-environmental behavior of individuals among diverse religious backgrounds with mediating effect of proenvironmental intention. Croatian Int Relat Rev XXVIII: 150–170.

Van Loi L. (2022). The impact of moral education and psychology in ancestor worship belief in Vietnam: mediating role of individual beliefs. Eurasian J Educ Res (EJER) (98): 101–115.

Lubis H, Pratama K (2022) HR related antecedes to sustainability reporting in Indonesian public listed firm: the mediating role of employee committeemen. Cuadernos De Economía 45(128):87–97

Ma X, Jiang P, Jiang Q (2020) Research and application of association rule algorithm and an optimized grey model in carbon emissions forecasting. Technol Forecast Soc Chang 158:120159

Mamani WC, Manrique GML, Madrid SDPC, Herrera EE, Acosta DB, Rivas-Diaz RR, . . . Ramos FSS. (2022) The role of entrepreneurship and green innovation intention on sustainable development: moderating impact of inclusive leadership. AgBioForum 24(1): 134-143

Mazurkiewicz P (2004) Corporate environmental responsibility: is a common CSR framework possible. World Bank 2(1):1–18

Menguc B, Ozanne LK (2005) Challenges of the “green imperative”: a natural resource-based approach to the environmental orientation–business performance relationship. J Bus Res 58(4):430–438

Naseem T, Shahzad F, Asim GA, Rehman IU, Nawaz F (2020) Corporate social responsibility engagement and firm performance in Asia Pacific: the role of enterprise risk management. Corp Soc Responsib Environ Manag 27(2):501–513

Naseer S, Song H, Adu-Gyamfi G, Abbass K, Naseer S (2023) Impact of green supply chain management and green human resource management practices on the sustainable performance of manufacturing firms in Pakistan. Environ Sci Pollut Res 30(16):48021–48035

Ningning M, Mengze Z (2022) Impact of technological orientation on sustainability financial inclusion and economic growth: role of environmental CSR strategy. International Journal of Economics and Finance Studies 14(4):19–44

Nureen N, Liu D, Irfan M, Sroufe R (2023) Greening the manufacturing firms: do green supply chain management and organizational citizenship behavior influence firm performance? Environ Sci Pollut Res 30:77246–77261

Olaleye BR, Ali-Momoh BO, Herzallah A, Sibanda N, Ahmed AF (2021) Dimensional context of total quality management practices and organizational performance of SMEs in Nigeria: evidence from mediating role of entrepreneurial orientation. Int J Operations Quantitative Manag 21(4):399–415

Orlitzky M, Siegel DS, Waldman DA (2011) Strategic corporate social responsibility and environmental sustainability. Bus Soc 50(1):6–27

Ortiz-de-Mandojana N, Aragón-Correa J (2016) Environmental strategy. The Palgrave Encyclopedia of Strategic Management. Palgrave Macmillan, London, pp 1–6

Phuoc VH, Thuan ND, Vu NPH, Tuyen LT (2022) How servant leadership impact the cohesion and burnout of female athlete and how self-identity intermediate the association between servant leadership, cohesion and burnout. Int J Econ Finance Stud 14(2):36–52

Podsakoff PM, Organ DW (1986) Self-reports in organizational research: problems and prospects. J Manag 12(4):531–544

Prasetyo A, Mursitama TN, Simatupang B, Furinto A (2022) Enhancing mega project resilience through capability development in Indonesia. Int J Econ Finance Stud 14(3):1–21

Preacher KJ, Hayes AF (2004) SPSS and SAS procedures for estimating indirect effects in simple mediation models. Behav Res Methods Instrum Comput 36(4):717–731

Rahman S (2011) Evaluation of definitions: ten dimensions of corporate social responsibility. World Rev Business Res 1(1):166–176

Rashid NRNA, Khalid SA, Rahman NIA (2015) Environmental corporate social responsibility (ECSR): exploring its influence on customer loyalty. Proc Econ Finance 31:705–713

Rehman SU, Bhatti A, Kraus S, Ferreira JJ (2021a) The role of environmental management control systems for ecological sustainability and sustainable performance. Manag Decis 59(9):2217–2237

Rehman SU, Kraus S, Shah SA, Khanin D, Mahto RV (2021b) Analyzing the relationship between green innovation and environmental performance in large manufacturing firms. Technol Forecast Soc Chang 163:120481

Rehman SU, Bresciani S, Yahiaoui D, Giacosa E (2022) Environmental sustainability orientation and corporate social responsibility influence on environmental performance of small and medium enterprises: the mediating effect of green capability. Corp Soc Responsib Environ Manag 29(6):1954–1967

Rehman SU, Elrehail H, Poulin M, Shamout MD, Alzoubi HM (2023a) Green managerial practices and green performance: a serial mediation model. Int J Innov Stud 7(3):196–207

Rehman SU, Giordino D, Zhang Q, Alam GM (2023) Twin transitions & industry 40: unpacking the relationship between digital and green factors to determine green competitive advantage. Technol Soc 73:102227

Rötzel PG, Stehle A, Pedell B, Hummel K (2019) Integrating environmental management control systems to translate environmental strategy into managerial performance. J Account Organ Chang 15(4):626–653

Ruan Z, Liu W (2021) Coach authentic leadership connected with performance satisfaction and psychological well-being of team: the mediating role of team cohesion and psychological capital. Revista De Psicología Del Deporte (journal of Sport Psychology) 30(1):189–203

Saeed A, Jun Y, Nubuor SA, Priyankara HPR, Jayasuriya MPF (2018) Institutional pressures, green supply chain management practices on environmental and economic performance: a two theory view. Sustainability 10(5):1517

Satria H, Amar S, Wardi Y (2022) Impact of Nagari financial management on the performance of sustainable development in West Sumatra Province. Croatian Int Relat Rev 28(90):288–310

Sekaran U, Bougie R (2016) Research methods for business: a skill building approach. John Wiley & Sons, New York, United States

Serrano-Díaz N, Aragón-Mendizábal E, Mérida-Serrano R (2022) Families’ perception of children’s academic performance during the COVID-19 lockdown. Comunicar 30(70):59–68

Shang K-C, Lu C-S, Li S (2010) A taxonomy of green supply chain management capability among electronics-related manufacturing firms in Taiwan. J Environ Manage 91(5):1218–1226

Solovida GT, Latan H (2017) Linking environmental strategy to environmental performance: mediation role of environmental management accounting. Sustain Account Manag Policy J 8(5):595–619

Statista (2023) Number of small and medium-sized industrial enterprises above designated size in China in 2017, by region. https://www.statista.com/statistics/778273/china-small-and-medium-sized-enterprises-number/

Susilawati E, Lubis H, Kesuma S, & Pratama I. (2022). Antecedents of student character in higher education: the role of the automated short essay scoring (ASES) digital technology-based assessment model. Eurasian J Educ Res (98): 203–220.

Taddeo G, De-Frutos-Torres B, Alvarado M-C (2022) Creators and spectators facing online information disorder. effects of digital content production on information skills. Comunicar 30(72):9–20

Tarrad KM, Al-Hareeri H, Alghazali T, Ahmed M, Al-Maeeni MKA, Kalaf GA, . . . Mezaal YS. (2022). Cybercrime challenges in Iraqi Academia: creating digital awareness for preventing cybercrimes. Int J Cyber Criminol 16 (2): 15–31–15–31.

Taylor R (1990) Interpretation of the correlation coefficient: a basic review. J Diagnostic Med Sonogrphy 6(1):35–39

van Someren TC (1995) Sustainable development and the firm: organizational innovations and environmental strategy. Bus Strateg Environ 4(1):23–33

Wachs S, Wettstein A, Bilz L, Gámez-Guadix M (2022) Adolescents’ motivations to perpetrate hate speech and links with social norms. Comunicar 30(71):9–20

Waiyawuththanapoom P, Vaiyavuth R, Tirastittam P, Shaharudin MR, Boonrattanakittibhumi C (2022) The relationship among the green supply chain management, collaborative capability and organizational performance. Social Space 22(2):137–161

Wang YS, Hu H-Q, Chen Z, Yang Y (2021) How servant leadership impact the cohesion and burnout of female athlete and how self-identity intermediate the association between servant leadership, cohesion and burnout. Revista De Psicología Del Deporte (journal of Sport Psychology) 30(1):204–217

Waty E, So IG, Indrajit RE, Abdinagoro SB (2022) Networking capabilities and digital adoption of business agility: the mediating role of business model innovation. Int J eBusiness eGovernment Stud 14(2):224–241

Widajanti E, Nugroho M, Riyadi S (2022) Sustainability of competitive advantage based on supply chain management, information technology capability, innovation, and culture on managers of small and medium culinary business in Surakarta. J Modern Project Manag 10(2):83–93

Wiroonratch B, Mungsakul O (2022) SMEs operational efficiency and adoption of management accounting information: evidence from Thailand. Soc Space 22(1):229–250

Wu T, Kung C-C (2020) Carbon emissions, technology upgradation and financing risk of the green supply chain competition. Technol Forecast Soc Chang 152:119884

Xiang C, Chen F, Jones P, Xia S (2021) The effect of institutional investors’ distraction on firms’ corporate social responsibility engagement: evidence from China. RMS 15:1645–1681

Yadav N, Gupta K, Rani L, Rawat D (2018) Drivers of sustainability practices and SMEs: a systematic literature review. Eur J Sustain Dev 7(4):531–531

Yang Y, Lau AK, Lee PK, Cheng T (2020) The performance implication of corporate social responsibility in matched Chinese small and medium-sized buyers and suppliers. Int J Prod Econ 230:107796

Yang Spencer S, Adams C, Yapa PW (2013) The mediating effects of the adoption of an environmental information system on top management’s commitment and environmental performance. Sustain Account Manag Policy J 4(1):75–102

Yildiz Çankaya S, Sezen B (2019) Effects of green supply chain management practices on sustainability performance. J Manuf Technol Manag 30(1):98–121

Yongliang S, Sharon CPY (2022) Exploring the impact of agile project management practices on supply chain resilience and sustainability: a case study of the manufacturing industry. J Modern Project Manag 10(1):75–90

Yu W, Ramanathan R, Nath P (2017) Environmental pressures and performance: an analysis of the roles of environmental innovation strategy and marketing capability. Technol Forecast Soc Chang 117:160–169

Zhu Q, Sarkis J, Lai K-H (2007) Initiatives and outcomes of green supply chain management implementation by Chinese manufacturers. J Environ Manage 85(1):179–189

Zhu Q, Sarkis J, Lai K-H (2008) Confirmation of a measurement model for green supply chain management practices implementation. Int J Prod Econ 111(2):261–273

Zhu Q, Geng Y, Fujita T, Hashimoto S (2010) Green supply chain management in leading manufacturers: case studies in Japanese large companies. Manag Res Rev 33(4):380–392

Zhu Q, Sarkis J, Lai K-H (2013) Institutional-based antecedents and performance outcomes of internal and external green supply chain management practices. J Purch Supply Manag 19(2):106–117

Acknowledgements

This work was supported by the Deanship of Scientific Research, Vice Presidency for Graduate Studies and Scientific Research, King Faisal University, Saudi Arabia [Grant No. *4367*].

Author information

Authors and Affiliations

Contributions

Conceptualization and original write up: SR, MPC, and AHA; methodology; SR and MYA; Analysis and discussion and conclusion: SR and AIAA; project administration: SR; review and editing: SR and AHA.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent to participate

No applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Arshian Sharif

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Environmental corporate social responsibility (Alam and Islam 2021).

Environmental philanthropy.

1. The firm contributes to the projects promoting the well-being of the society.

2. The firm invests into the projects for the future generations.

3. The firm contributes to support other non-governmental agencies working in troublesome areas.

Environmental community involvement.

1. The firm takes part in the initiatives for promoting and improving the natural environment.

2. The firm aims at sustainable growth of the society for future generations.

3. The firm inspires employees for participating in societal activities voluntarily.

4. The firm operationalizes distinct schemes for mitigating the negative effects upon ecology.

Environmental customer wellbeing.

1. The firm shows respects to the rights of customers and legal aspects.

2. The firm discloses complete and precise information regarding products for the customers.

3. The firm considers customer satisfaction as a very high priority.

Green supply cain management.

Green purchasing (Zhu et al. 2007).

1. Providing design specification to suppliers that include environmental requirements for purchased item.

2. Cooperation with suppliers for environmental objective.

3. Suppliers’ ISO14000 certification.

4. Environmental audit for suppliers’ internal management.

5. Choice of suppliers by environmental criteria. (Shang et al. 2010).

Internal environmental management (Shang et al. 2010).

1. Cross-functional cooperation for environmental improvements.

2. Established an environmental protection index of recycling, gaseous reduction and energy conservation.

3. Environmental management system exists.

4. The company’s efforts in relation to environmental matters have exceeded the requirements of the relevant regulations.

5. Support for environmental practices from senior managers and mid-level managers. (Zhu et al. 2007).

Eco-design (Zhu et al. 2013).

1. Design of products for reduced consumption of material/energy.

2. Design of products for reuse, recycle, recovery of material, component parts.

3. Design of products to avoid or reduce use of hazardous of products.

4. Design of processes for minimization of waste.

Cooperation with customers (Zhu et al. 2013).

1. Cooperation with customer for eco-design.

2. Cooperation with customers for cleaner production.

3. Cooperation with customers for green packaging.

4. Cooperation with customers for using less energy during product transportation.

5. Adopting third-party-logistics.

6. Cooperation with customers for product take back.

7. Cooperation with customers for reverse logistics relationships.

Top management commitment (Yang Spencer et al. 2013).

1. My own work has made a contribution to the green competitive advantage.

2. Continues to put an emphasis on green competitive advantage.

3. Extra effort to meet green competitive advantage.

4. Green competitive advantage is one of the most important targets to achieve.

5. Providing accurate information on company green competitive advantage.

Pro-environmental business strategy (Banerjee 2002).

1. We emphasize the environmental aspect of our products and the services in our ads.

2. Environmental concerns have influenced our marketing strategies for our products and services.

3. In our firm, product-market decisions are always influenced by environmental concerns.

Green competitive advantage (Chen and Chang 2013).

1. The company has the competitive advantage of low cost about environmental management compared to its major competitors.

2. The quality of the green products or services that the company offers is better than that of its major competitors.

3. The company is more capable of environmental R&D and green innovation than its major competitors.

4. The company is more capable of environmental management than its major competitors.

The original online version of this article was revised: Ahmed Hassan Abdou is affiliated to both affiliations 3 and 4.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Rehman, S.U., Chan, M.P., Almakhayitah, M.Y. et al. Going green! Factors influencing green competitive advantage of Chinese SMEs: a moderated-mediated perspective. Environ Sci Pollut Res 31, 15302–15320 (2024). https://doi.org/10.1007/s11356-024-32099-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-024-32099-2