Abstract

Over the past three decades, industrial innovations and technological advancements have changed business dynamics, adversely devastating the overall environment. As a result, our oceans have been severely affected due to climate change and global warming. To address this issue, this study investigates the factors that cause ocean CO2 using a sample of 44 countries over 2012–2021 and explores a dynamic and causal relationship between economic growth, ocean carbon dioxide emissions, energy consumption, and control variables relating to the ocean industry. This study finds that increasing economic activity tends to increase ocean carbon emissions. The results support the evidence of the environmental Kuznets curve (EKC) hypothesis suggesting an inverted U-shaped association between ocean emissions and real income for the sample countries. Moreover, this study reports that ocean health index, maritime container transport, trade of fishery and ocean species, aquaculture production and marine species, and employment rate in the fishery processing sector are the significant factors of ocean CO2. Region-wise analyses suggest that real income positively influences ocean emissions and confirm the evidence of the EKC hypothesis in European sample countries but these relationships have an insignificant effect in Asia and the Pacific and the American regions. Furthermore, a short-run unidirectional panel causality flows from the production of aquaculture and other species to RD&D, from OHI and GDP to trade of fishery and other species, and from OHI to employment rate in the fishery sector. Likewise, bidirectional causality runs from energy consumption and maritime transport to ocean CO2 in the long term. Regarding the long-run causal association, the results determine that all of the estimated coefficients of the lagged error correction terms are statistically significant which explains that they are crucial in the adjustment process as they deviate from the long-run equilibrium.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Greenhouse gas (GHG) emissions are the key factors influencing climate change and increasing global warming, enhancing the ocean temperature through the mix of CO2. Ocean acidification results from a surge in CO2 emissions — an important component of climate change. Tarakanov (2022) argued that increased CO2 emissions in 200 years are the consequences of human actions. The ocean absorbs 26% of all human-induced CO2, causing acute risk to marine life, ecosystem health, and people whose livelihoods are associated with the ocean (Tarakanov 2022).

The oceanic interest in anthropogenic CO2 tends to reduce seawater pH, thereby decreasing the seawater state for carbon minerals. In another study, Zeebe et al. (2008) argued that “the oceans have taken up ~40% of the anthropogenic CO2 emissions over the past 200 years.” Bhargava (2020) studied the dynamic interrelatedness between CO2 emissions and environmental effects, ambient temperatures, and ocean acidification and deoxygenation. Using the sample of 163 countries from 1985 to 2018, he found that economic activities and population were interlinked with increased CO2 emissions.

Over the last three decades, an increase in GHG emissions from energy consumption has adversely affected the overall environment. The decline in environmental quality has touched the terrifying conditions owing to global warming and climate change. As a result, our oceans are severely affected due to higher CO2 emissions. Tarakanov (2022) forecast that roughly three billion people who rely on marine and coastal biodiversity for their livelihoods could be affected by acidification. According to the Sustainable Development Goals Report (2022), “continuing ocean acidification and rising temperatures threaten marine species and negatively impact ecosystem services.” This implies that ocean emissions negatively affect marine species and threaten the lives of humans associated with the oceans. SDG 14 (life below water) envisages “conserving and sustainably using the oceans, seas, and marine resources” because healthy oceans and seas are critical for life on earth and human survival.

The ocean plays a critical role in regulating the amount of CO2 in the atmosphere. As the CO2 level increases, the ocean absorbs more carbon dioxide. According to the Intergovernmental Panel on Climate Change (2013), oceans have absorbed roughly 28% of the CO2 produced by human activities over the past 250 years. Though the ocean absorbs CO2 to safeguard atmospheric levels from rising even higher, mounting levels of CO2 dispersed in the oceans can harm some marine life. When CO2 interacts with seawater, it generates carbonic acid, which inflates the acidity level and imbalances the minerals in the water. To determine how much carbon dioxide is absorbed by the ocean sink, scientists have formulated various methods (e.g., atmosphere-ocean flux and geochemical or statistical procedures) to present the ocean’s role in the anthropogenically influenced carbon cycle (World Ocean Review 2021). To overcome ocean-based CO2, Ocean VisionsFootnote 1 proposed a few solutions covering (a) restoring living blue carbon, (b) deep sea storage, (c) electrochemical ocean CO2 removal, (d) microalgae cultivation, and (e) ocean alkalinity enhancement. The ocean economy encompasses ocean-based industries covering shipping, fishery, offshore wind, marine biotechnology, and tourism. These industries are contributing toward a blue economy; however, countries can explore untapped avenues by developing ocean policies and facilitating firms.

Among others, oceans absorb a significant chunk of carbon dioxide. Besides, methane (CH4), nitrous oxide (NOx), and shipping also contribute to add-on ocean emissions. Figure 1 explains the country-wise position of the absorption of ocean CO2 across regions in 2012 and 2021. The results show that the ocean of every country has witnessed the soak up carbon dioxide; however, the magnitude of ocean emissions varies across countries. It can be determined that the USA is the leading contributor to ocean carbon emissions among all regions. Similarly, Belgium, Netherlands, Russia, and Spain absorbed higher ocean carbon emissions in Europe. Singapore and UAE mesmerized the highest ocean carbon emissions in Asia and Pacific and the Middle East and Arab States, respectively.

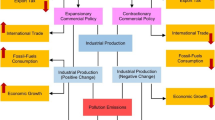

Researchers have widely explored the nexus between economic growth and GHG emissions. However, the evidence relating to economic growth and ocean emissions is limited. Badircea et al. (2021) studied the link between the blue economy and economic growth to climate change using the 28 European Union countries dataset from 2009 to 2018. They used the blue economy as the proxy of the gross added value contributing toward the ocean market and determined that the gross added value of the blue economy negatively influences GHG emissions. Moreover, they reported long-term cointegration among GHG emissions, the blue economy, and economic growth. They found a unidirectional causality flowing from GHG emissions to economic growth while bidirectional causality moving from economic growth to GHG emissions. Using a sample of fifteen countries, Kasman and Duman (2015) investigated the relationship between gross domestic product (GDP), CO2 emissions, and energy consumption between 1992 and 2010. Results found a short-run unidirectional causality flowing from energy consumption to CO2 emissions. They identified the estimated coefficients of lagged error correction terms (ECTs) in CO2 emissions, energy consumption, and economic growth are statistically significant in the long-run causal association. Their data support the environmental Kuznets curve (EKC) hypothesis, which asserts an inverted U-shaped link between environment and income.

This study addresses an important research question: what factors cause ocean CO2? The primary purpose of this paper is to investigate the relationship between ocean carbon dioxide emissions, economic growth, energy consumption, and control variables relating to the ocean industry for a panel of 44 countries across different regions over the period lasting from 2012 to 2021. This study identifies new evidence of the nexus between the ocean environment and economic growth. The contribution of this paper is fourfold: first, to examine the effect of economic growth on ocean CO2 which has not been tested earlier; second, to test the EKC hypothesis for sample countries. Most studies investigated the hypothesis between economic growth and the environment but did not consider ocean carbon emissions. Third, this study incorporates control variables relating to the ocean industry to identify the determinants that cause ocean CO2. Fourth, this study conducts region-wise analysis to determine the factors influencing ocean CO2 in different regions.

This study utilizes various panel unit root tests and finds mixed results. Applying different panel cointegration tests, this study reports that variables in the analysis are cointegrated. To test the relationship between ocean CO2 and economic growth, the system generalized method of momentum (GMM) technique is used and finds that an increase in real GDP per capita tends to produce more emissions, eventually inflating ocean carbon emissions. Moreover, this study finds an inverse relationship between squared real GDP per capita and ocean CO2 illustrating an inverted U-shaped curve — this evidence supports the typical EKC hypothesis. The quadratic relationship suggests that ocean CO2 increases at a certain point in the real GDP but then declines. In addition, this study finds that ocean health index (OHI), maritime container transport, trade of fishery and ocean species, aquaculture production and marine species, and employment rate in the fishery processing sector are the robust predictors of ocean CO2. Based on the region-wise analysis, this study finds mixed results. Results report that an increase in real GDP per capita positively influences ocean carbon emissions in the European region but has an insignificant effect in Asia and the Pacific and the American regions. Using the panel Granger causality test, the results report the bidirectional causality flowing from energy consumption to ocean CO2 in the long run but find no evidence of short- and long-term causality flowing from ocean carbon emissions to GDP and energy consumption to GDP.

The structure of this paper is as follows. “The model and econometric methodology” section explains the model and econometric methodology, “Data and empirical results” section describes the data and empirical results, and “Conclusion” section concludes the study.

The model and econometric methodology

The model

This study follows the methodology of Alaganthiran and Anaba (2022), Kasman and Duman (2015), Arouri et al. (2012), and Apergis and Payne (2009, 2010) to investigate the association between ocean CO2, real income, and energy consumption, which is a mix of the EKC and growth in energy consumption. Hence, the following model is proposed to test the relationship:

where Ocean CO2 is measured in thousand tons, and GDP is the per capita real GDP. EC indicates the per capita energy consumption. The coefficients β1, β2, and β3 represent the long-run elasticities of ocean carbon dioxide emissions relating to GDP, GDP2, and per capita energy consumption. The subscripts i and t show country and time, respectively. All variables are taken in the form of a natural logarithm. For testing the EKC hypothesis, it is assumed that β1 > 0 and β2 < 0. This refers to an inverted U-shaped pattern indicating that a surge in income level reduces ocean emissions. Moreover, β3 > 0 predicts that rising energy consumption leads to increased ocean emissions.

As the nomenclature of ocean CO2 emissions differs from CO2 emissions, this study employs ocean-related variables to estimate their impact on ocean CO2. Earlier studies used various proxies [e.g., trade openness (Farhani et al. 2014; Lau et al. 2014), urbanization (Kasman and Duman 2015), gross savings (Onofrei et al. 2022), and tourism (Alaganthiran and Anaba 2022; Dogan and Aslan 2017)] to examine their effect on CO2 emissions. For the extension of model 1, this study specifies the quadratic EKC model as follows:

where OHI refers to the score of the OHI. The expected sign of coefficient β4 is negative, which directs that a higher level of OHI means a country is putting its best effort into overcoming ocean emissions. MT is total maritime container transport in a million tons. It is expected that coefficient (β5) be positive, which shows that higher maritime transport activities will emit higher pollution, thereby increasing ocean emissions. RD&D is total energy research, development, and deployment in millions of US$. β6 is expected to be negative. In the wake of higher RD&D activities, the magnitude of ocean emissions would be lower. MA is a total marine protected area measured in square kilometers. FT is the total trade of fisheries and other species in US$ million. AP refers to total aquaculture production and marine species in millions of US$. ER shows people employed in the fishery processing sector by occupation rate (thousands). The coefficients β5, β6, β7, β8, and β9 are measured in the form of a natural logarithm.

Econometric methodology

This study investigates the causal association between ocean CO2, national income, energy consumption, OHI, maritime container transport, total energy research, development, and deployment (RD&D), total marine protected area, fisheries trade, aquaculture production, and people employed in fishery processing. The testing methods comprise the following phases. First, this study analyzes the stationarity of the data by using different panel unit root tests. In the absence of stationarity, the second phase investigates whether a cointegrating association exists between the series through suitable panel cointegration approaches. The long-term elasticities are estimated using the system GMM technique if the parameters are cointegrated. Lastly, this study applies panel error correction models to determine the relationship between the short- and long-run dynamics of the series.

Panel unit root tests

Various tests are utilized to test the stationarity of data. Levin, Lin, and Chu—LLC (2002) propose a panel unit root test as follows:

where ∅it comprises unique deterministic factors, ρ shows the autoregressive coefficient, and n is the lag order. Nonetheless, the LLC method presumes ρ consistency across panels which may bear the loss of power (Breitung 2001). Im, Pesaran, and Shin — IPS (2003) suggest that ρ fluctuates across panels to extend the LLC method.

To determine the stationarity of panel data, Breitung (2001) specifies the following model:

The null hypothesis of Eq. (5) states the procedure is difference stationary, \({H}_0:\sum_{k=1}^{p+1}{\beta}_{ik}-1=0\), and \({H}_0:\sum_{k=1}^{p+1}{\beta}_{ik}-1<0\kern0.5em \forall i\). Breitung (2001) employs the transformed trajectories to develop test statistic as follows:

where λB refers to the Breitung (2001) t-statistics indicating a standard normal distribution.

Im et al. (2003) suggested the t-bar test which argued that all cross-sectional units move to the equilibrium value at unlike paces relating to the alternative hypothesis.

where N refers to the panel size, and tα is the average ADF t-statistics. \({\mathcal{K}}_t\) and νt compute the mean and variance of every tαi statistic.

Choi (2001) proposes the Fisher tests (ADF and Phillips-Perron) for time series and panel data. The tests integrate every series to get a p-value from unit root testing rather than averaging a single test statistic as Im et al. (2003) suggested, which is the most unique characteristic. Hadri (2000) suggests a method to examine the stationarity of the series. Its structure is similar to KPSS for time series which is expressed as follows:

where rit represents random work indicating as rit = rit − 1 + νit, where νit is white noise. Model (8) predicts testing the stationarity where \({H}_0:{\sigma}_{\nu}^2=0,\) and \({H}_1:{\sigma}_{\nu}^2>0\).

Panel cointegration tests

Earlier studies used various testing methods [e.g., Kao 1999; Pedroni (1999, 2004); Westerlund 2007; and Maddala and Wu (1999)] to analyze long-run equilibrium among the variables. This study uses Pedroni (1999, 2004), Kao (1999), and Westerlund (2007) tests to assess the cointegrating association between ocean CO2, GDP, and energy consumption (model 1). In model 2, the control variables are added along with the parameters in model 1. Pedroni (1999, 2004) suggests various measures that rely on the residuals of Engel and Granger’s (Engel and Granger 1987) cointegration equation. The estimated residuals obtained from the long-run equation are specified as follows:

where Y and X are supposed to be I(1) in levels. Residuals are described as \({\varepsilon}_{it}={\rho}_i{\varepsilon}_{it-1}+{\mathcal{U}}_{it}\). H0 : ρi = 1; ∀ i, and H1 : ρi < 1; ∀ i. These tests are normally distributed. To determine the cointegration, statistics are compared with appropriate critical values. When critical values are higher than statistics, this confirms the evidence of cointegration and the long-run association between the variables. Kao’s (1999) test is formulated on a similar foundation to Pedroni’s (1999, 2004) test; however, it identifies cross-sectional intercepts and homogenous coefficients on the first stage regression (Equation 9). Additionally, this study employs Westerlund’s (2007) panel cointegration test, which asserts that all cross sections are cointegrated in the panel. In this test, it is assumed that all variables are non-stationary and specifies Gτ, Gα, Pτ, and Pα test statistics. Westerlund (2007) test is expressed as follows:

where N and T represent the cross sections and observations. Moreover, dt comprises the deterministic factors.

System GMM estimator

This study employs the system GMM estimator proposed by Arellano and Bover (1995) and Blundell and Bond (1998) to reduce the possibility of endogeneity issues. Regular panel OLS and within-group estimations, which do not account for these two issues, lead to biased and inconsistent estimates, which is why system GMM is used in this study (Arellano and Bover 1995; Blundell and Bond 1998; Blundell et al. 2001; Bond et al. 2001; Hoeffler 2002). Moreover, OLS levels and within-groups estimates are unreliable as both methods ignore undetected country and time invariant effects (Hsiao 2014; Nickell 1981). On the other hand, the system GMM provides reliable and effective parameter estimates in an equation wherein independent variables are not stringently exogenous (Roodman 2009).

Panel Granger causality test

This study assesses the short-run error correction model after integrating the residuals on the model’s right side. The cointegrating association shows a causal relationship among the variables, at least in one direction. It does not, however, reveal the direction of causation. The panel ECM with dynamic corrective error used in this study looks at both the short- and long-term causal relationships between variables. Following Engel and Granger’s (Engel and Granger 1987) two-step method, the long-run factors are estimated using Eq. (1) and Eq. (2) through the system GMM technique.

The Granger causality test covering ECT is presented as under the following:

Model 1:

Model 2:

.

.

.

.

where ∆, ETC, and p represent the first difference of the variable, the ECT, and the lag length, respectively. Using Akaike’s information criterion, optimal lag length is identified. The causality runs from ∆GDP and ∆GDP2 to ∆Ocean CO2 (∆EC) if the joint null hypothesis α31ip = 0 ∀jp and α41ip = 0 ∀jp (α23ip = α24ip0 ∀jp) is rejected. The existence of two variables estimating GDP in the system which entails cross-equation restrictions to identify causality from ocean CO2, energy consumption, OHI, maritime container transport, total energy RD&D, total marine protected area, total trade of fisheries, aquaculture production and marine species, and people employed in the fishery processing sector to GDP using a likelihood ratio.

Data and empirical results

Data

The sample used in this study covers ocean CO2, per capita GDP, per capita energy consumption, OHI, total maritime container transport (MT), total energy RD&D, a total marine protected area (MA), total trade of fisheries (FT), total aquaculture production and marine species (AP), and people employed in the fishery processing sector (ER) from 44 countries over the period 2012–2021. Table 9 explains the definition of all variables used in this study and data sources. Sample countries include Argentina, Australia, Belgium, Brazil, Bulgaria, Canada, Chile, China, Colombia, Croatia, Denmark, Estonia, Finland, France, Germany, Greece, Iceland, India, Indonesia, Ireland, Israel, Italy, Japan, Latvia, Lithuania, Malaysia, Mexico, Netherlands, New Zealand, Norway, the Philippines, Poland, Portugal, Romania, Russia, Slovenia, Spain, South Korea, Sweden, Thailand, Turkey, UK, USA, and Vietnam.

Table 10 presents the summary statistics of all the variables of each country for the period from 2012 to 2021. The data is divided into three regions: the Americas, Asia and Pacific, and Europe. The mean ocean CO2 is 7786 thousand tons with a standard deviation of 13,439. The minimum and maximum values of ocean CO2 are 12,450 and 83,506 thousand tons, respectively, showing the large dispersion among sample countries. In the Americas region, the USA emitted the highest ocean emissions of 65,793 thousand tons, followed by Brazil with about 11,551 thousand tons. In contrast, Chile produced the lowest ocean CO2 of 674 thousand tons. When analyzing the Asia and Pacific region, it is found that China (29,745 thousand tons) and South Korea (29,388 thousand tons) are the leading contributors to ocean emissions. However, Vietnam produced the lowest ocean emissions (645 thousand tons). Among European countries, the Netherlands and Russia emitted the highest ocean CO2 of 39,994 and 26,660 thousand tons respectively while Croatia is the lowest contributor to ocean CO2 (33 thousand tons). The mean value of per capita GDP is US$28,822 and ranges from US$1434 to US$102,913 indicating considerable variations in the sample. The data shows the highest per capita GDP obtained by the Netherlands (US$65,124) and the USA (US$57,760). In contrast, India has the lowest per capita GDP of US$1689. The mean per capita energy consumption is 3978 kg of oil equivalent. The mean score of the OHI is 68.589, with a standard deviation of 4.997. The sample shows that the Netherlands has the highest OHI score of 81.963 whereas Israel has the lowest OHI score of 59.891. On average, maritime container transport is US$56.133 million. Total energy RD&D is a crucial variable illustrating that a higher value of RD&D reduces the likelihood of ocean CO2 emissions. The mean values of RD&D and total marine protected area are US$517.877 million and 181,571 km2, respectively. On average, fisheries trade is US$5.383 billion, with a standard deviation of US$6.383 billion. The mean value of aquaculture production and marine species is US$2.240 billion. On average, people employed in fishery processing (thousands) are 366. The dispersion between minimum and maximum values shows a higher variation of people associated with fishery processing among sample countries.

Empirical results

Panel unit root tests

This study employs various tests to identify the stationarity of the variables (Table 1). The different panel unit root tests report mixed results. The LLC and Breitung tests do not reject the null hypothesis of the non-stationarity of ocean CO2; however, IPS, Fisher, and Hadri tests reject the null hypothesis. Results of GDP and GDP2 variables show non-stationarity of data in all tests except Fisher and Hadri z-statistics. Similarly, in a few instances, results report the non-stationarity of other variables. The results of all variables are stationary at the first difference.

Panel cointegration tests

This study examines the cointegration by applying the Pedroni (1999, 2004) cointegration tests of both models (Table 2). Most of the statistics are highly significant, thus confirming the evidence of no cointegration. In both models, the results suggest that variables are cointegrated. Table 3 exhibits the results of Kao’s (1999) cointegration test. Results show that variables are statistically cointegrated at a 1% level in both models.

Finally, this study employs Westerlund’s (2007) panel cointegration test (Table 4). This test only applies in model 1. This study rejects the null hypothesis that variables are not cointegrated, indicating the long-run relationship between the variables in all the cases except Gτ. Results verify the cointegration in the scenario of bootstrapped p-values and the null hypothesis of no cointegration is rejected (Gα, Pτ, and Pα).

Effect of ocean CO2 on economic growth

This section estimates the impact of ocean CO2 on the per capita real GDP using the system GMM estimator. Two models were estimated to test the hypothesis (Table 5). In model 1, the coefficient of lagged ocean CO2 is positive and statistically significant, illustrating that ocean carbon emissions follow previous trends. This study employs GDP2 to measure a probable non-linear linkage between ocean CO2 and GDP to test the EKC hypothesis. The result shows a direct association explaining that higher economic activities lead to higher ocean carbon emissions. This implies that in the wake of higher GDP, firms produce more and generate higher GHG emissions which ultimately surge in ocean emissions. The coefficient of GDP2 is negative and statistically significant, reporting a non-linear association between the real GDP and ocean CO2. This finding illustrates an inverted U-shaped relationship between two variables that is in line with the typical EKC hypothesis. This quadratic association shows that ocean CO2 rises at a certain level of the real GDP and begins to decline. These findings are consistent with Maalej and Cabagnols (2020), Kasman and Duman (2015), and Ahmed and Qazi (2014). On the other hand, Zoundi (2017) finds no evidence of EKC prediction between CO2 emissions and real income.

Model 2 looks at how different factors affect ocean CO2. In model 2, every variable utilized in model 1 is statistically significant, demonstrating the significance of each variable in estimating ocean carbon emissions. The OHI negatively influences ocean CO2, suggesting that a higher value of OHI means a country is taking necessary measures to make its ocean blue and emit fewer ocean emissions. The MT coefficient is positive and significant at a 1% level, indicating that increased maritime transport activities increase ocean carbon emissions. The result shows that a higher trade of fisheries and marine species may increase the probability of ocean emissions. This implies the presence of ocean species (e.g., fisheries and mangroves) make the ocean environment clean but a higher level of their exportation may inflate the ocean emissions. Aquaculture production is another significant predictor that negatively affects ocean emissions. This finding illustrates that the production of aquaculture and other species probably reduces the magnitude of ocean emissions as they purify ocean health. The coefficient of employment rate in fishery processing and marine species is positive and statistically significant. This evidence suggests that a higher employment rate associated with fishery pollutes higher ocean CO2; therefore, training fishermen to use the latest technology to help reduce ocean emissions is crucial. However, RD&D and marine protected areas are insignificant factors in the analysis.

Effect of ocean CO2 on economic growth: a region-wise analysis

Using the system GMM estimator, this section examines the impact of ocean CO2 on GDP in the Asia and Pacific, European, and Americas regions (Table 6). Ocean emissions in the Asia-Pacific region are considerably impacted by lagged ocean CO2 and energy consumption in model 1. This suggests that the likelihood of ocean emissions increases with greater energy usage. According to the outcomes of other covariates in model 2, a higher OHI indicates that a country is taking the necessary steps to reduce ocean carbon emissions. The coefficient of marine container transport is positive and significant at a 10% level implying that higher activities of maritime transport emit higher pollution and contribute to an increase in ocean CO2. The likelihood of producing ocean emissions is reduced when a country considers energy RD&D. A marine protected area is another covariate with a positive relationship with ocean CO2. This finding suggests that a larger marine area will increase the likelihood of ocean emissions. The coefficient of trade of fisheries and other species is positive and significantly influences ocean emissions. The surge in the outflow of marine species will enhance ocean carbon emissions suggesting that marine species protect ocean health. Aquaculture production and marine species and employment rate in fishery processing are insignificant factors in the analysis.

Models (3) and (4) report the results of the factors that cause ocean emissions in the European region. The results of model (3) show the significance of all variables. The result reports a positive relationship between real per capita GDP and ocean CO2, explaining that higher production activities of goods and services in a country increase the probability of ocean emissions. The squared per capita GDP is negative, which means that ocean emissions increase with an increase in GDP at a certain point but afterward, ocean emissions increase at a decreasing rate. In model (4), OHI is negative, meaning that a country’s lower emissions lead to improved ocean health. It is important to note that higher maritime transport activities tend to increase the magnitude of ocean emissions. Additionally, this study reports that the overall trade in fisheries and other species positively impacts ocean carbon emissions. This evidence shows that a surge in the outflow of marine species may increase the possibility of ocean emissions. However, the rest of the variables are insignificant.

Lastly, models (5) and (6) report the determinants of ocean CO2 in the Americas region. The sole reliable predictor in model (5) is lagged ocean carbon emissions, per capita GDP, and energy consumption are statistically insignificant. Model (6) indicates that marine protected areas, fishery and marine species trade, and aquaculture production and other species are statistically significant determinants. In a nutshell, it can be concluded that the factors that cause ocean emissions vary across the region owing to the size of marine and blue economy.

Panel Granger causality tests

This section applies Granger causality tests to investigate the short-run and long-run relationship. The results of causality tests are reported in Tables 7 and 8. The results of both models are the same; therefore, this study interprets the results of model 2. The results suggest bidirectional causality running from energy consumption and maritime transport to ocean CO2 in the long run. Moreover, this study finds bidirectional causality running from the OHI and the trade of fishery and ocean species to GDP in the long run. The result reports no evidence of short- and long-term causality from energy consumption to GDP, implying that strategic actions increasing energy efficiency are executed without threatening economic growth. Likewise, no evidence of causality is found running from ocean CO2 to GDP, suggesting that concerned organizations must formulate necessary measures for overcoming ocean emissions without affecting economic growth. The results of the Granger causality test indicate bidirectional causality running from total energy RD&D, marine protected area, and trade of fishery and ocean species to marine transport containers. Another bidirectional causality flows from marine protected areas and the trade of fishery and ocean species to RD&D. However, this study reports a short-run unidirectional panel causality running from the production of aquaculture and other species to RD&D, from OHI and GDP to trade of fishery and other species, from OHI to employment rate in the fishery sector. This study estimates every regression’s ECT to examine the long-run association. The statistical significance of the ECT coefficient describes the error-correction process emphasizing the variables’ long-term association. The ECT coefficient is statistically significant in all equations. As the system deviates from the long-run equilibrium, all parameters may be crucial to the adjustment process. In short, the findings show evidence of bidirectional Granger causation between these variables.

Conclusion

This study examined the association between ocean CO2, real income, energy consumption, and control variables of the ocean industry using the dataset of 44 countries across regions from 2012 to 2021. This study also tested the EKC hypothesis using panel unit and cointegration tests. This study reports a long-run cointegrated relationship between variables in the analysis. This study uses the system GMM estimator to test the hypothesis and finds a positive relationship between economic growth and ocean carbon dioxide emissions. This finding illustrates that higher economic activities produce higher emissions, ultimately affecting ocean CO2. The results also suggest the presence of an inverted U-shaped curve between real income and ocean carbon dioxide emissions, which supports the evidence of the EKC hypothesis. This finding illustrates that ocean CO2 increases with an increase in real income at a certain level and then decreases. Moreover, this study finds that OHI, maritime container transport, fishery and ocean species trade, aquaculture production and marine species, and employment rate in the fishery processing sector are robust predictors of ocean CO2. Regarding the region-wise analysis, real GDP per capita positively affects ocean CO2 in the European region but has no significant effect in the other regions.

This study employs a panel error correction model to identify short- and long-term causal relationships. The results indicate a short-run unidirectional panel causality running from the production of aquaculture and other species to RD&D, from OHI and GDP to trade of fishery and other species, and from OHI to employment rate in the fishery sector. Regarding the long-run causal association between the variables, the findings show that the lagged ECT in all the variables is significant at a 1% level explaining that all these predictors are critical in the adjustment process as the system departs from the long-run equilibrium. The study reports a bidirectional causality running from energy consumption and maritime transport to ocean CO2 in the long run. Moreover, this study finds bidirectional causality running from the OHI and the trade of fishery and ocean spices to GDP in the long run. However, no evidence of short- and long-term causality from energy consumption to GDP is found. The bidirectional causal relationship between energy consumption and ocean CO2 implies that ocean emissions will not decline in sample countries if energy consumption continues to increase soon. Hence, policymakers and concerned agencies must formulate policies for the ocean sector to reduce CO2, ensuring the survival of people associated with the ocean industry. Furthermore, the sample countries must follow the energy efficiency plan to emit lower emissions which helps achieve ocean sustainability.

References

Ahmed K, Qazi AQ (2014) Environmental Kuznets curve for CO2 emissions in Mongolia: an empirical analysis. Manag Environ Qual: An Int J 25(4):505–516

Alaganthiran JR, Anaba MI (2022) The effects of economic growth on carbon dioxide emissions in selected sub-Saharan African (SSA) countries. Heliyon 8:e11193

Apergis N, Payne J (2009) CO2 emissions, energy usage and output in Central America. Energy Policy 37:3282–3286

Apergis N, Payne J (2010) The emissions, energy consumption and growth nexus: evidence from the Commonwealth of Independent States. Energy Policy 38:650–655

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components model. J Econ 68(1):29e51

Arouri MH, Ben Youssef A, M’Henni H, Rault C (2012) Energy consumption, economic growth and CO2 emissions in Middle African countries. Energy Policy 45:342–349

Badircea RM, Manta AG, Florea NM, Puiu S, Manta LF, Doran MD (2021) Connecting blue economy and economic growth to climate change: evidence from European Countries. Energies 14:1–12

Bhargava A (2020) Econometric modelling of carbon dioxide emissions and concentrations, ambient temperatures and ocean deoxygenation. J R Stat Soc Series A 185:178–201

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87(1):115e14

Blundell R, Bond S, Windmeijer F (2001) Estimation in dynamic panel data models: improving on the performance of the standard GMM estimator. In: Baltagi BH, Fomby TB, Hill RC (eds) Nonstationary panels, panel cointegration, and dynamic panels, vol 15. Emerald Group Publishing Limited, pp 53–91

Bond S, Hoeffler A, Temple J (2001) GMM estimation of empirical growth models. Working Paper No. 2001-W21. Nuffield College, University of Oxford, UK

Breitung J (2001) The local power of some unit root tests for panel data. In: Baltagi BH, Fomby TB, Hill RC (eds) Nonstationary panels, panel cointegration, and dynamic panels. Advances in Econometrics, vol 15. Emerald Group Publishing Limited, United Kingdom, pp 161–177

Choi I (2001) Unit root tests for panel data. J Int Money Financ 20:249–272

Dogan E, Aslan A (2017) Exploring the relationship among CO2 emissions, real GDP, energy consumption and tourism in the EU and candidate countries: evidence from panel model robust to heterogeneity and cross-sectional dependence. Renew Sust Energ Rev 77:239–245

Engel RF, Granger CWJ (1987) Cointegration and error correction: representation, estimation and testing. Econometrica 55:251–276l

Farhani S, Mrizak S, Chaibi A, Rault C (2014) The environmental Kuznets curve and sustainability: a panel data analysis. Energy Policy 71:189–198

Hadri K (2000) Testing for stationarity in heterogeneous panel data. Econ J 3:148–161

Hoeffler A (2002) The augmented Solow model and the African growth debate. Oxf Bull Econ Stat 64(2):135–158

Hsiao C (2014) Analysis of panel data, vol 54. Cambridge University Press

Im K-S, Pesaran H, Shin Y (2003) Testing for unit roots in heterogenous panels. J Econ 115:53–74

Intergovernmental Panel on Climate Change (2013) Climate change 2013: the physical science basis. Working Group I contribution to the IPCC Fifth Assessment Report. Cambridge University Press, Cambridge, United Kingdom www.ipcc.ch/report/ar5/wg1

Kao C (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econ 90:1–44

Kasman A, Duman YS (2015) CO2 emissions, economic growth, energy consumption, trade and urbanization in new EU member and candidate countries. A panel data analysis. Econ Model 44:97–103

Lau L-S, Choong C-K, Eng Y-K (2014) Investigation of the environmental Kuznets curve for carbon emissions in Malaysia: do foreign direct investment and trade matter? Energy Policy 68:490–497

Levin A, Lin CF, Chu CSJ (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econom 108:1–24

Maalej A, Cabagnols A (2020) CO2 emissions and growth. J Energy Dev 46(1/2):1–24

Maddala GS, Wu S (1999) A comparative study of unit root tests with panel data and a new simple test. Oxf Bull Econ Stat 61(S1):631–652

Nickell S (1981) Biases in dynamic models with fixed effects. Econometrica 49(6):1417–1426

Onofrei M, Vatamanu F, Cigu E (2022) The relationship between economic growth and CO2 emissions in EU countries: a cointegration analysis. Front Environ Sci 10:934885

Pedronni P (1999) Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf Bull Econ Stat 61:653–670

Pedronni P (2004) Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econ Theory 20:597–625

Roodman D (2009) A note on the theme of too many instruments. Oxf Bull Econ Stat 71(1):135–158

Tarakanov V (2022) How carbon emissions acidify our ocean? International Atomic Energy Agency (IAEA) Bulletin, 63–4. https://www.iaea.org/bulletin/how-carbon-emissions-acidify-ourocean

The Sustainable Development Goals Report (2022) United Nations. https://unstats.un.org/sdgs/report/2022/The-Sustainable-Development-Goals-Report-2022.pdf

Westerlund J (2007) Testing for error correction in panel data. Oxf Bull Econ Stat 69:0305–9049

World Ocean Review (2021) The ocean guarantor of life — sustainable use, effective protection. Published jointly by Maribus, International Ocean Institute, and German Marine Research Consortium, Germany

Zeebe RE, Zachos JC, Caldeira K, Toby T (2008) Oceans Carbon emissions and acidification Science. American Association for the Advancement of Science 321(5885):51–52. https://www.science.org/doi/10.1126/science.1159124

Zoundi Z (2017) CO2 emissions, renewable energy and the environmental Kuznets curve, a panel cointegration approach. Renew Sustain Energy Rev 72:1067–1075

Author information

Authors and Affiliations

Contributions

Conceptualization, data curation, writing the paper, review, and editing — MZM.

Corresponding author

Ethics declarations

Ethical approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The author declares no competing interests.

Additional information

Responsible Editor: V.V.S.S. Sarma

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Mumtaz, M.Z. What factors cause ocean CO2? A panel data analysis. Environ Sci Pollut Res 30, 123111–123125 (2023). https://doi.org/10.1007/s11356-023-30880-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-30880-3