Abstract

As a bridge between economy and ecology, green finance is vital in improving environmental quality and promoting sustainable development. Based on the building of an environmental pollution index system, this paper constructs the \({\text{STIRPAT}}-\mathrm{EKC}\) model to deeply explore the specific impact of green finance on environmental pollution using China’s provincial panel data from 2007 to 2020. This paper constructs an intermediary model to test the impact mechanism of green finance on reducing environmental pollution and discusses the regional heterogeneity of green finance in reducing environmental pollution. The results show that (1) green finance can significantly reduce environmental pollution, among which green credit has a pronounced effect on reducing environmental pollution, green investment has a relatively small effect, and green securities have not significant effect. (2) Green finance has the best inhibitory effect on solid pollution, less inhibitory effect on air pollution, and no significant improvement effect on water pollution. (3) Green technology innovation, industrial structure upgrading, and environmental regulation play an intermediary role in the process of green finance reducing environmental pollution and improving environmental quality. (4) The effect of green finance in the eastern and carbon emission pilot areas is significantly better than in the central and western regions and non-carbon emission pilot areas respectively. According to the research results of this paper, suggestions are put forward to promote the development of green finance, which is of great significance to reducing environmental pollution and achieving sustainable development goals.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Since the reform and opening up, China’s economic development has made remarkable achievements. However, the rapid economic growth is accompanied by severe environmental pollution and resource consumption (Chen 2015; Mohsin et al. 2021a, b, c). With the continuous acceleration of urbanization and industrialization, water, air, and soil have been polluted to varying degrees (Qiu 2023), and environmental pollution is becoming increasingly severe (Fang et al. 2022; Yin and Xu 2022), seriously impacting residents’ health and public life (Ma and Xue 2023; Yang et al. 2023). To reduce pollution and improve environmental quality, people continue to reduce energy consumption, find alternative clean energy (Chang et al. 2023), and explore experiences and methods to achieve sustainable green development goals. In this context, people pay more and more attention to the role of financial instruments in environmental governance (Xiang et al. 2023), and green finance came into being.

Green finance introduces ecological concepts into the financial field. It is a new financial instrument that links green development and finance, making financial instruments serve the real economy and sustainable development (Zhou et al. 2020). Green finance guides funds to flow to green fields such as ecological and environmental protection, solves the paradox of economic growth and environmental pollution, and shoulders the two missions of economic growth and environmental protection (Huang 2022). Green finance emphasizes environmental protection and coordinated development and guides financial resources from high-polluting and high-energy-consuming industries to low-polluting and low-energy-consuming industries (Zhang et al. 2022a, b, c, d). Green finance provides financial support for improving resource utilization efficiency and reducing greenhouse gas emissions (He et al. 2019). It becomes an effective financial way to reduce environmental pollution (An et al. 2021).

Green finance is an innovation and change in the financial field. In order to promote the development of green finance and achieve the goal of sustainable development, the central level has issued a series of policies and measures to plan and deploy as a whole (Yang et al. 2023). In 2012, the China Banking Regulatory Commission issued the “Green Credit Guidelines,” which specified the scope of green credit, requiring financial institutions to actively develop green credit, effectively prevent environmental risks, and achieve green development transformation (Hu et al. 2023)Footnote 1 In August 2016, the People’s Bank of China and seven other ministries and commissions jointly issued the “Guiding Opinions on Building a Green Financial System”Footnote 2 For the first time, this document’s concept of green finance was put forward in official documents. This document pointed out the construction of China’s green financial system. China has become the world’s first country with a relatively complete green financial policy system, and green finance has risen to the national strategic level. The 2022 “Green Finance Guidelines for Banking and Insurance Industry” emphasizes strengthening pre-loan assessment and credit investigation for customers with significant environmental, social, and governance risks and improving post-loan and post-investment management,Footnote 3 which is conducive to green finance to help the fight against pollution better and establish a sustainable development model. Upholding the ecological concept that green water and green mountains are invaluable assets, the report of the 20th National Congress of the Communist Party of China once again emphasized the need to accelerate the green transformation of the development mode, improve the fiscal and taxation financial system that supports green development, promote green and low-carbon production and lifestyle,Footnote 4 and further promote the development of green finance.

With the introduction of a series of green finance-related policies and the improvement of the market mechanism, the development level of China’s green finance is increasing (Muganyi et al. 2021). According to the data of the People’s Bank of China, by 2022, the green credit balance is as high as 20.6 trillion yuan, the green bond is as high as 1140.9 billion yuan, and eight carbon emission trading pilot zones (Zhou et al. 2020) and ten green financial reform and innovation experimental zones have been set up. Does the development of green finance help reduce environmental pollution and improve environmental quality? According to China’s Ministry of Ecology and Environment data, by the end of 2022, the water quality continued to improve, the air quality was stable and good, and the soil pollution was initially curbed. The section of inferior V water decreased by 0.5% compared with 2021, and the concentration of urban delicate particulate matter decreased by 3.3% compared with 2021Footnote 5 Although statistics show that China’s environmental governance has achieved apparent results (Yang et al. 2023), which is inseparable from the measures taken by the Party Central Committee to continuously strengthen comprehensive environmental politics and increase investment in energy conservation and environmental protection, is the development of green finance one of the reasons for reducing environmental pollution and improving environmental quality?

In the context of China’s remarkable achievements in environmental governance, there are still 126 cities with air quality exceeding the standard, accounting for 37.2%. The number of days with good air quality in 339 cities accounts for 86.5%, down one percentage point from 2021. More than 1700 plots are included in the list of soil pollution remediation for construction landFootnote 6 The battle for environmental pollution prevention is still challenging. Can green finance become a new driving force to comprehensively reduce environmental pollution?

In addition to answering whether green finance can reduce environmental pollution, there are the following questions to be solved: If green finance can reduce environmental pollution, what is the impact mechanism? Is there a difference in the impact of green finance on environmental pollution in different regions? Therefore, based on the measurement of the environmental pollution index, this study examines the effect of green finance on environmental pollution and analyzes its transmission mechanism and heterogeneity. This paper overcomes the shortcomings of incomplete construction of environmental pollution index system in the past, makes up for the one-sided drawbacks of the research on the impact of green finance on environmental pollution, enriches the research results in the field of green finance, and solves the paradox of economic growth and environmental pollution in China. It is of great theoretical and practical value to promote the coordinated development of green finance, improve environmental quality, and achieve sustainable development goals.

This paper has the following contributions. (1) The existing research on constructing environmental pollution index systems needs further improvement. It is mainly limited to a particular pollution dimension or industrial pollution level. The index system still needs to be improved. Based on predecessors, this paper selects pollution indicators from the three dimensions of water, air, and solid, including industry, agriculture, and life, and constructs an environmental pollution index system. Accurately describe the current environmental pollution situation and provide a basis for comprehensively measuring the pollution effect of green finance. (2) The existing research on the environmental pollution effect of green finance is mainly carried out on the level of air pollution, and there are few studies on the overall situation of environmental pollution. The relationship between green finance and environmental pollution needs to be further studied. Therefore, this paper directly discusses the impact of green finance on environmental pollution because of the constructed environmental pollution index and accurately judges the role of green finance in reducing environmental pollution. (3) Previous studies have focused on the transmission mechanism of green finance on environmental pollution from the perspectives of green technology innovation and industrial structure upgrading, ignoring the role of environmental regulation. This paper describes the transmission mechanism of green finance on environmental pollution from the perspectives of green technology innovation, industrial structure upgrading, and environmental regulation. (4) At the level of heterogeneity analysis, the study not only focuses on the impact of regional location differences but also further considers whether the impact of carbon emission pilots on green finance reduces environmental pollution, which helps to provide more accurate policy recommendations for green finance development.

The rest of this article is structured as follows. The “Literature review” section reviews the relevant literature and points out the innovation of this study. The “Theoretical analysis and research hypothesis” section puts forward the theoretical mechanism and research hypothesis of the impact of green finance on environmental pollution. The “Empirical research design” section introduces the index calculation, regression methods, and data. The “Empirical results and analysis” section analyzes the regression results. The “Conclusions and policy implications” section summarizes and makes policy recommendations.

Literature review

Environmental pollution measurement

There are three main representation methods of environmental pollution. Some scholars directly use a single indicator to indicate environmental pollution, and scholars generally use PM2.5 (Su et al. 2022a, b; Yu et al. 2022; Zhang et al. 2021a, b, c), carbon dioxide (Li et al. 2022a, b, c; Mohsin et al. 2023; Zhang et al. 2022a, b, c, d), sulfur dioxide (Yang et al. 2018), industrial sulfur dioxide (Muganyi et al. 2021; Wang et al. 2021a, b), and other single indicators to represent environmental pollution. However, environmental pollution is multifaceted. It is too one-sided to use only one indicator to measure environmental pollution, and it is not an actual response to the specific value of environmental pollution.

Some scholars use the government’s air quality index (AQI) to indicate environmental pollution (Sun et al. 2018; Viard and Fu 2015); compared with a single indicator, this index helps evaluate air pollution. However, it is limited to air pollution, ignoring water and solid pollution, and the environmental pollution measurement needs to be more comprehensive.

Some scholars use multiple indicators to construct an environmental pollution index, such as agricultural irrigation area and chemical fertilizer application amount, to measure environmental pollution from the level of agricultural pollution (Zhang et al. 2021a, b, c). Industrial waste gas, industrial wastewater, and industrial solid waste are selected as indicators to consider environmental pollution from the perspective of industrial pollution (Chen and Bai 2023; Zhang and Mei 2022); in the industrial pollution level, carbon dioxide emission intensity is added to measure environmental pollution (Zhou and Tang 2022). Since domestic sulfur dioxide emissions account for a large proportion of exhaust gas, taking domestic sulfur dioxide emissions into account, the total sulfur dioxide emissions, industrial smoke and dust, and industrial wastewater emissions are used to construct the environmental pollution index (Yang et al. 2023), or sulfur dioxide, industrial wastewater emissions, and industrial solid waste emissions are used to construct the environmental pollution index (Wang et al. 2021a, b).

Green finance and environmental pollution

The existing research on the impact of green finance on environmental pollution mainly focuses on the impact of green finance on air pollution. Some scholars have studied the impact of green finance on carbon dioxide emissions, and the research conclusions generally confirm that green finance significantly reduces carbon dioxide emissions (Musah et al. 2022; Zhou et al. 2020). Regardless of whether using the ordinary panel model (Zakari et al. 2022) or the quantile regression model to study the BRICS countries (Mngumi et al. 2022) and the G-20 economies (Zhang et al. 2022a, b, c, d), green finance significantly reduces carbon dioxide emissions. Considering the scale of green finance development, carbon dioxide emissions will also respond differently. Further, using the QQR method to regress the quantiles of dependent and independent variables, the study found that the relationship between green finance and carbon dioxide may differ in different quantiles. However, in general, green finance still inhibits carbon dioxide emissions (Saeed Meo and Karim 2022).

Some scholars have confirmed that green finance can reduce PM2.5 concentration. Using the panel model (Zhang et al. 2021a, b, c) and Bootstrap rolling window test method (Su et al. 2022a, b), it is found that green credit significantly reduces PM2.5 concentration. Considering that this effect may have a spatial spillover effect, a dynamic spatial Durbin model is constructed for research. It is found that green finance helps reduce local PM2.5 concentration and has an inhibitory effect on adjacent areas (Zhang et al. 2023a, b).

Some scholars have demonstrated the impact of green finance on sulfur dioxide. Using the difference-in-differences model (Zhang et al. 2022a, b, c, d) and the semi-parametric difference-in-differences (SDID) model (Muganyi et al. 2021), it has been confirmed that green financial policies can significantly inhibit sulfur dioxide emissions.

Another part of the scholars analyzed the impact of green finance on AQI. Using a panel threshold model, scholars found that green finance could significantly improve air quality (Xiang et al. 2023). Further research on green finance policies using difference-in-differences model shows that establishing green finance pilots can dramatically reduce air pollution (Xu et al. 2023; Zhang et al. 2022a, b, c, d).

Combined with the existing literature, it can be found that the existing research on the construction of environmental pollution index systems still needs to be improved. The selection of indicators mainly focuses on air or industrial pollution, ignoring other dimensions of environmental pollution. The construction of the environmental pollution index system is not perfect; the description of environmental pollution needs to be more comprehensive, and the environmental pollution situation cannot be fully reflected. At the same time, although the existing literature has studied the environmental pollution effect of green finance, it is regrettable that it mainly focuses on the impact of green finance on air pollution. There are few studies on the overall environmental pollution of green finance, and the analysis of its transmission mechanism and heterogeneity needs to be more involved. There is still much room for improvement in the research of green finance to reduce environmental pollution. Therefore, this study improves the construction of the environmental pollution index system by selecting pollution indicators from three dimensions of water, air, and solid, including three levels of industry, agriculture, and life, and makes up for the shortcomings of existing research. This paper directly discusses the overall impact of green finance on environmental pollution, comprehensively and perfectly measures the role of green finance in reducing environmental pollution, and fills in the existing research.

Theoretical analysis and research hypothesis

Green finance and environmental pollution

The resource allocation attribute of finance has a direct impact on the environment. Excessive allocation of resources by finance to highly polluting industries will reduce environmental quality. When the idea of sustainable development is introduced into the financial field, when finance tilts the allocation of resources to the energy-saving and environmental protection industry, it helps to reduce environmental pollution. Green finance promotes the development of environmentally friendly projects by optimizing the allocation efficiency of financial resources (Zhang et al. 2022a, b, c, d), enhances the awareness of environmental protection of enterprises and residents, and guides them to transform into green production and lifestyle (Yang et al. 2022), reduces pollution emissions, promotes the improvement of environmental quality, and achieves sustainable development goals.

First, green finance optimizes the efficiency of financial resource allocation, guides financial institutions to flow funds to environmental protection projects, and promotes the development of environmental protection industries and technologies (Chen et al. 2022). In addition to the financial institutions’ funds, it will also issue green bonds (Mohsin and Jamaani 2023a, b), which are mainly used to finance environmentally friendly projects and sustainable development projects and accumulate a large amount of funds to invest in environmental protection projects (Zhao et al. 2022), resulting in clear environmental benefits, such as reducing dependence on high-carbon energy (Mohsin and Jamaani 2023a, b), reducing carbon emissions (Musah et al. 2022), and improving energy efficiency (Jiang et al. 2020). Green finance effectively reduces pollutant emissions and improves environmental quality.

Secondly, green finance enhances the environmental awareness of enterprises and residents, actively introduces environmental liability insurance, and improves the public and enterprises’ awareness and awareness of environmental protection (Wang et al. 2017a, b). By purchasing green insurance, individuals and enterprises will pay more attention to environmental issues, take active measures to reduce environmental risks, provide risk protection for environmental protection projects, support the development of environmental projects, and thus promote the improvement of environmental quality. By participating in green insurance, enterprises provide protection for themselves and actively participate in environmental protection and sustainable development, strengthen their sense of environmental responsibility, and promote the transformation of enterprises towards green development.

Finally, green finance guides enterprises and residents to transform into a green production and lifestyle. Through preferential and convenient financial resources, enterprises are encouraged to take the initiative to transform production technology, reduce dependence on traditional energy, and transform to green production mode (Jiang et al. 2022a, b; Xu and Dong 2023). At the same time, green finance strengthens residents’ sense of environmental protection, encourages them to give up the original consumption mode of environmental pollution, spontaneously choose a green consumption mode and become dependent on this mode, such as choosing green buildings, energy-saving and environmental protection decoration materials and energy-saving household appliances compared with ordinary buildings, choosing new energy vehicles, or taking public transportation compared with the original high-emission cars. Gradually realize the transition to green production and lifestyle, reduce pollution emissions, and improve environmental quality.

Through the above analysis, the first research hypothesis of this paper is proposed:

-

Hypothesis 1: Green finance helps to reduce environmental pollution.

Green finance, green technology innovation, and environmental pollution

Green technology innovation is conducive to reducing dependence on traditional energy, improving resource use efficiency (Wang et al. 2017a, b), reducing energy consumption (Jiang et al. 2020), and realizing clean energy production, thus reducing pollution emissions and improving environmental quality. Green finance can improve the efficiency of resource allocation (Liu et al. 2019; Zhang et al. 2022a, b, c, d), influencing the financing cost of enterprises and motivating managers’ attitudes towards green innovation (Jiang et al. 2022a, b) to improve the level of green technology innovation, improve environmental quality, and achieve sustainable development goals.

First, green finance improves the allocation efficiency of financial resources, provides more convenient financial resources for green enterprises with limited R&D funds at a lower threshold, and reduces the financing cost of R&D projects of green enterprises (Xu and Li 2020). Green finance can not only provide sufficient financial support for enterprises’ R&D projects (Chen et al. 2022), eliminate backward production capacity, improve resource use efficiency (Wang et al. 2017a, b), and enhance enterprises’ green technology innovation level (He et al. 2021). It can also reduce the R&D cost of enterprises, expand the profit margin of enterprises (Li et al. 2022a, b, c), attract more enterprises to carry out green technology innovation activities actively, form a green demonstration effect (Zhang et al. 2021a, b, c), further deepen the level of green technology innovation, and achieve pollution reduction.

Secondly, green finance increases the financing cost of polluting enterprises. It requires them to have higher credit thresholds and transaction costs (Amore et al. 2013), which makes polluting enterprises face high environmental charges and brings financial pressure to polluting enterprises. Once an enterprise violates environmental regulations in polluting emissions, it may face the risk of withdrawal of financial institutions or even interruption of production, and the operation and reputation of the enterprise will be affected (Chen et al. 2022). To reduce the negative impact of environmental pollution on commercial activities (Brunnermeier and Cohen 2003), polluting enterprises take the initiative to carry out green technology innovation (Yang et al. 2022) to reduce the environmental cost of enterprises, thus helping to improve the level of green technology innovation and realize green production.

Finally, green finance provides abundant financial resources and preferential policies for enterprises that carry out green innovation projects (Ren et al. 2020), which helps reduce enterprises’ production costs and broaden their profit margins (Guo et al. 2018). Encourage managers to firmly adhere to enterprise green technology innovation (Yang et al. 2022), guide managers to change from extensive production to energy conservation and environmental protection, and actively participate in green technology innovation projects. At the same time, corporate performance and environmental responsibility have a positive relationship. When enterprises improve the level of green technology innovation and actively fulfill environmental responsibility, corporate performance will also be enhanced (Yang et al. 2022), which will further strengthen the determination of managers to improve the level of green technology innovation, actively assume environmental responsibility, and reduce pollution emissions.

The second research hypothesis of this paper is proposed:

-

Hypothesis 2: Green finance reduces environmental pollution by improving the level of green technology innovation.

Green finance, industrial structure upgrading, and environmental pollution

The upgrading of industrial structure means that capital-intensive industries replace labor-intensive industries, the transformation from the secondary industry with high pollution and high emission to the tertiary industry represented by high-tech industries, and the transformation from the original high energy consumption and high emission production mode to the green production mode to alleviate environmental pressure. By improving resource allocation efficiency and strengthening environmental information disclosure (Wang et al. 2019), green finance guides financial resources from high-pollution and energy-consuming industries to low-pollution and low-energy-consuming industries and from inefficient sectors to high-efficiency sectors to promote the development of energy conservation and environmental protection industries. Achieve clean energy production (Wang and Wang 2021), promote industrial structure upgrading, reduce environmental pollution (Chang et al. 2022), and achieve sustainable development (Zhang et al. 2021a, b, c).

First of all, green finance can improve the efficiency of resource allocation, guide financial resources to the energy conservation and environmental protection industry, provide sufficient and large amounts of financial resources for the energy conservation and environmental protection industry with preferential policies, and improve the development level of tertiary industry (Wang and Wang 2021). When green finance provides a large number of preferential funds for the upgrading of industrial structure, it can also encourage enterprises to expand the scale of green industry development (Hu et al. 2020), increase investment in energy conservation and environmental protection projects, guide the industrial structure to develop in the direction of energy conservation and environmental protection, and realize the upgrading of industrial structure. At the same time, many financial resources are concentrated in the energy-saving and environmental protection industry. The production factors continue to accumulate, which helps to form space accumulation and synergistic effect (Hu et al. 2020), reduce the cost of production factors, attract more enterprises to join the energy-saving and environmental protection industry, expand the development scale of the green industry, and deepen the development level of the green industry. We will improve the development of energy conservation and environmental protection industries and upgrade the industrial structure.

Secondly, green finance requires financial institutions to rectify the flow of funds, restrict investment in projects with high pollution and energy consumption, shorten the loan time limit and increase the corresponding loan cost for industries with high pollution and energy consumption, and even directly refuse to provide financial resources to them (Gao et al. 2023; Zhou et al. 2022), reducing the flow of funds. It is difficult for heavily polluting industries to maintain normal production processes only by relying on their funds. To secure access to financial resources for regular production, polluting industries take the initiative to adopt mergers and reorganizations to carry out internal transformation and industrial structure upgrading (Liu et al. 2019). Transition to the direction of green development (Hu et al. 2020), from high-polluting and energy-consuming industries to clean and environmental protection industries, reduce pollution emissions, and improve environmental quality.

Finally, green finance requires enterprises to strengthen the ability of environmental information disclosure, implement information sharing mechanisms, reduce investor information asymmetry, and improve investors’ awareness of green enterprises (Liu et al. 2023). Investors can effectively choose green industries for investment according to the development prospects of enterprises. It will help solve the financing problem of green enterprises (Zeng et al. 2023), promote the development of green enterprises, and realize the upgrading of industrial structures. To obtain sufficient external financing and establish a green image, other enterprises continue to make internal adjustments to the development of the green environmental protection industry. At the same time, it also helps attract new enterprises to position themselves in the green environmental protection industry at the beginning of their establishment, establish a green image, ensure the external financing necessary for the survival and development of enterprises, and promote the upgrading of industrial structures.

The third research hypothesis of this paper is proposed:

-

Hypothesis 3: Green finance reduces environmental pollution by promoting upgrading industrial structures.

Green finance, environmental regulation, and environmental pollution

A strict environmental supervision system raises the market access threshold of polluting industries, encourages energy-saving and environmental protection industries to enter the market, and changes the market structure and behavior, thereby reducing pollution emissions and improving environmental quality (Zhang et al. 2017). By releasing environmental protection signals and strengthening the environmental information disclosure system, green finance fully considers the impact of enterprises on the environment, improves environmental regulation policies, strengthens social supervision, reduces pollution emissions, and improves environmental quality.

On the one hand, green finance releases environmental protection signals to the market, guides the market to respond accordingly, and strengthens the level of environmental regulation. Financial institutions actively respond to the call, prudently assess the environmental responsibility of financing entities when providing financial resources, fully consider corporate environmental responsibility (Zhang et al. 2023a, b), incorporate corporate environmental costs into production costs, and regulate the behavior of market entities by reducing the financial support of polluting enterprises and raising the cost of using funds. Internalize enterprise environmental costs. The stronger the environmental regulation, the more perfect the environmental governance requirements for enterprises, and the more conducive to reducing pollution emissions and improving environmental quality. Under strict environmental regulations, the higher the environmental cost that polluters bear, the more difficult it is to survive (Peng et al. 2020). To survive in the market, they must transform to green and clean energy (Xu and Dong 2023) to reduce environmental pollution.

On the other hand, green finance requires enterprises to fully disclose environmental information and improve the environmental information disclosure system, which is conducive to improving the environmental regulation system, strengthening the intensity of environmental regulations, reducing the probability of “Greenwashing” events (Gu et al. 2021), and enabling the green industry to obtain financial resources support. By improving the environmental information disclosure system, banks and other financial institutions can better invest in the environmental governance of enterprises. Financial institutions can effectively match the capital demand side so that green projects and energy conservation and environmental protection industries can effectively receive financial resources support (Jiang et al. 2022a, b). At the same time, under the strict environmental regulation system, a sound social disclosure system can help strengthen the public’s supervision of enterprises and exert the supervision effect of public social groups. Once an enterprise’s illegal emission behavior is found, the public can expose it through media, the Internet, and other channels, and the enterprise may be faced with a suspension of business at any time—damaging corporate reputation and social image (He et al. 2022). To reduce environmental costs, polluting enterprises actively fulfill their environmental responsibilities, while energy-saving and environmental protection enterprises can further improve their corporate reputation by disclosing environmental information, promoting the long-term development of enterprises, and reducing pollution emissions.

The fourth research hypothesis of this paper is proposed:

-

Hypothesis 4: Green finance reduces environmental pollution by improving environmental regulation.

Empirical research design

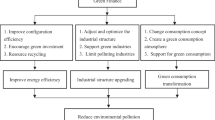

In this study, we measured the environmental pollution and green finance indexes, constructed the extended \({\text{STIRPAT}}-\mathrm{EKC}\) and intermediary models to verify the above hypotheses, and conducted dimension analysis and robustness tests. Finally, we also studied the heterogeneity. The article structure diagram is shown in Fig. 1.

Methodology

Entropy value method

According to the degree of dispersion among indicators, the entropy method uses information entropy to assign weight to each indicator objectively. When the degree of dispersion of an indicator is larger, it means that the indicator provides more information and assigns more weight to it; otherwise, it means that the information provided is smaller and the weight assigned to it is smaller. The entropy method assigns weight to each index, which helps avoid the influence of subjective factors.

\(X_{ij,t}\) is the i object j index in the t period. The specific steps of the entropy method are shown as follows:

-

1) The raw data is first standardized to eliminate the impact of magnitude and magnitude differences. Among them, the positive dimension is treated as formula (1), and the negative dimension is treated as formula (2):

$${y}_{ij,t}=\frac{{x}_{ij,t}-min\text{(}{x}_{ij,t}\text{)}}{max\text{(}{x}_{ij,t}\text{)}-min\text{(}{x}_{ij,t}\text{)}}\;\;(1\le i\le m,1\le j\le n\text{)}$$(1)$${y}_{ij,t}=\frac{\mathrm{max}\text{(}{x}_{ij,t}\text{)}-{x}_{ij,t}}{max\text{(}{x}_{ij,t}\text{)}-min\text{(}{x}_{ij,t}\text{)}}\;\;(1\le i\le m,1\le j\le n\text{)}$$(2) -

2) Second, we calculate the proportion of each index information by formula (3):

$${p}_{ij,t}={y}_{ij,t}/\sum_{i=1}^{m}{y}_{ij,t}$$(3) -

3) Third, we calculate the entropy of indicator by formula (4):

$${e}_{j,t}=-\frac{1}{\mathrm{ln}m}\sum_{i=1}^{m}({p}_{ij,t}\times \mathrm{ln}{p}_{ij,t})$$(4) -

4) Fourth, we calculate the weight of indicator by formula (5):

$${w}_{j,t}=\text{(}1-{e}_{j,t}\text{)}/\sum_{j=1}^{n}\text{(}1-{e}_{j,t}\text{)}$$(5) -

5) Finally, we calculate the score of indicator by formula (6):

$$s_{i,t}=\sum_{j=1}^{n}(y_{ij,t}\times w_{j,t})$$(6)

Benchmark model

The traditional \({\text{STIRPAT}}\) model is improved from the \({\text{IPAT}}\) model, which can effectively avoid the disadvantages of the limited number of \({\text{IPAT}}\) models, and is mostly used to study the impact of economic development on environmental quality. The basic model is formula (7):

To stabilize the data and reduce the heteroscedasticity, by formula (8):

where I represents the environment, P, A, and T indicate the population size, affluence, and technical level, respectively, a is the model coefficient, b, c, and d are the variable index, respectively, and \(\varepsilon\) indicates the error term. According to the existing research, green finance (\(GF\)), financial development level (\(FI\)), and regional openness (\(\it {\text{Open}}\)) will all have an impact on environmental pollution. Therefore, these three factors are included in the model, and the environmental pollution index (\(EP\)), urbanization level (\(\it {\text{Urban}}\)), economic development level (\(GDP\)), and research and development level (\(R\&D\)) represent I, P, A, and T, respectively. However, it is different from previous studies that only consider the linear term of economic development level (Ren et al. 2021; Zhang et al. 2022a, b, c, d). This paper introduces the environmental Kuznets curve and adds the first and second terms of economic development level to the model at the same time. The traditional model is extended to the formula (9):

\(\it \text EP_{it}\) represents the environmental pollution level in the t period in i province, \(\alpha_{0}\) is the intercept term, \({\textit GF_{it}}\) represents the development level of green finance in the t period in i province, \(\alpha_{1}\) is the green finance coefficient, and \(\alpha_{2}-\alpha_{6}\) is the coefficient of the other control variables, \(\zeta_{i}\) represents the fixed individual, \(\vartheta_{t}\) represents the fixed time, and \(\upsilon_{it}\) represents the random error term.

Mechanism model

To avoid the endogenous estimation bias in the traditional intermediary model stepwise regression test method, this paper constructs a formula (10) based on the intermediary test proposed by Jiang Ting (Jiang 2022) to study the relationship between green finance and intermediary variable M. On the premise that α1 is significant, if β1 is significant, it indicates that green finance reduces environmental pollution through intermediary variable M. Mit indicates that green technology innovation (\(GTI\)), industrial structure upgrading (\(Str\)), and environmental regulation (\(ER\)) in the t period in i province, \(\beta_{0}\) is the intercepted item, \(\beta_{1}\) is the green finance coefficient, \(\beta_{2}-\beta_{6}\) is the coefficient of other control variables, and the rest of the indicators have the same meaning as formula (9).

Variable definition

Explained variable

Environmental pollution (\(EP\)): this paper selects 14 pollution discharge indicators from three pollution dimensions of water, air, and solid, including industry, life, and agriculture, to build an \(EP\) index system to ensure the comprehensive and reasonable construction of the index system, as shown in Table 1. At the same time, selecting the relative emission intensity of the pollution index instead of the absolute quantity can strengthen regional comparability and avoid the disadvantage of ignoring regional differences. The entropy method is used to assign weights to each index, making the measurement results more realistic and objective and effectively reflecting the regional \(EP\) situation. The larger the value, the more serious the \(EP\) and the worse the environmental quality in the region; the smaller the value, the smaller the \(EP\) and the better the environmental quality in the region.

According to the measurement results of the entropy method, the distribution map of the regional \(EP\) in individual years is drawn, as shown in Fig. 2. From the time dimension, from 2007 to 2020, the \(EP\) in China’s provinces has decreased significantly, showing a trend of improvement year by year, and the environmental quality has improved significantly. From the spatial dimension, the \(EP\) in the southern and eastern regions is generally less than that in the northern and western regions, and the environmental quality in the southern and eastern regions is better.

Explanatory variable

Green finance (\(GF\)): Due to the late development of China’s green bond and green insurance market, data statistics are incomplete (Jiang et al. 2022a, b). Therefore, three dimensions of green credit (\(GC\)), green securities (\(GS\)), and green investment (\(GI\)) are selected (Zhang et al. 2022a, b, c, d), and the entropy method is used to measure the \(GF\) index, as shown in Table 2. The higher the index, the better the development level of \(GF\) in the region; the lower the index, the lower the development level of \(GF\).

Controll variables

Urbanization rate (\(\it {\text{Urban}}\)): it is expressed by the urban population/resident population (Xie and Liu 2019); the higher the level of urbanization, the stronger the residents’ awareness of environmental protection, the higher the requirements for environmental quality, but the greater the demand for energy, resulting in higher pollution emissions. The impact of urbanization on \(EP\) depends on the combination of these two functions.

The level of economic development (\(GDP\)) and the second term (\(GDP2\)): it is represented by per capita gross domestic product. The environmental Kuznets curve indicates that economic growth is at the expense of the environment in the early stage of economic development. However, when economic growth reaches a certain level, people pay attention to environmental quality, and investment in environmental protection research and development is also increasing. There is an inverted U-shaped relationship between economic growth and \(EP\), and studies show that China’s economic development and \(EP\) also conform to this law (Kijima et al. 2010; Lee and Oh 2015). Therefore, the level of \(GDP\) and the quadratic term \(GDP2\) are added to the analysis in this paper.

The level of economic development (\(GDP\)) and the second term (\(GDP2\)): it is represented by per capita gross domestic product. The environmental Kuznets curve indicates that economic growth is at the expense of the environment in the early stage of economic development. However, when economic growth reaches a certain level, people pay attention to environmental quality, and investment in environmental protection research and development is also increasing. There is an inverted U-shaped relationship between economic growth and \(EP\), and studies show that China’s economic development and \(EP\) also conform to this law (Kijima et al. 2010; Lee and Oh 2015). Therefore, the level of \(GDP\) and the quadratic term \(GDP2\) is added to the analysis in this paper.

Research and development level (\(R\&D\)): it is documented by the internal expenditure/expression of scientific research funds (Wang and Wang 2021); the improvement of the research and development level can promote technological innovation, improve energy utilization efficiency, and reduce pollution emissions.

Financial development level (\(FI\)): it is measured as the deposit and loan balance of financial institutions/GDP, and the improvement of \(FI\) can broaden the financing channels of enterprises, help polluting enterprises obtain credit financing, and expand production, which may increase pollution emissions; At the same time, the improvement of the \(FI\) will help guide funds to low-pollution and low-energy consumption industries, promote the development of energy-saving and environmental protection industries, and improve the level of green technology innovation, which will help alleviate \(EP\). The specific impact of financial development on \(EP\) depends on the combination of the two functions.

Regional openness (\(\it {\text{Open}}\)): it is expressed by the total amount of imports and exports/GDP (Mohsin et al. 2021a, b, c; Yang et al. 2022); the higher the degree of \(\it {\text{Open}}\), the greater the international trade, which may cause polluting enterprises to expand production, increase energy consumption, and exacerbate \(EP\). At the same time, improving \(\it {\text{Open}}\) is conducive to the diffusion of cleaner production technologies and reducing \(EP\). The total effect of \(\it {\text{Open}}\) on \(EP\) depends on the sum of two kinds of effects.

Intermediary variables

Green technology innovation (\(GTI\)): it is expressed by the number of green patents obtained per 10,000 people (Ma and Xue 2023; Zhao and Wang 2022); the higher the level of green technology innovation, the higher the efficiency of energy use and the less pollution emissions.

Industrial structure upgrading (\(Str\)): it is measured by the ratio of tertiary industry to secondary industry (Zhang et al. 2021a, b, c); upgrading the industrial structure will help promote the development of energy-saving and environmental protection industries, eliminate outdated production capacity, reduce pollution emissions, and improve environmental quality.

Environmental regulation (\(ER\)): it is expressed by investment in industrial pollution control (Lanoie et al. 2008); the stronger environmental regulation, the more conducive it is to encourage enterprises to strengthen terminal treatment and reduce pollution emission.

Data sources

In 2007, the Opinions on Implementing Environmental Protection Policies and Regulations to Prevent Credit Risks marked China’s in-depth development of green finance. Therefore, this paper selected the relevant data from 2007 to 2020, excluded Hong Kong, Macao, Taiwan, and Tibet, and selected the remaining 30 provinces as the research object to consider data availability and integrity. In this paper, the relevant data of the environmental pollution index are from China Environmental Statistical Yearbook, the \(\it CO_{2}\) data are calculated according to the methods provided by \({\text{IPCC}}\) (2006), the calculation data are from China Energy Statistical Yearbook, the green technology innovation data are from CNRDS, and the rest data are from China Statistical Yearbook and Wind database. Logarithmic processing was applied to all variables in this paper to stabilize the data and eliminate the influence of heteroskedasticity. The descriptive statistics of variables are shown in Table 3.

Empirical results and analysis

Benchmark regression results

To study whether \(GF\) can reduce \(EP\), this paper conducts regression on the \(EP\) from the three sub-dimensions of \(GF\), \(GC\), \(GS\), and \(GI\). The regression models are all time-individual double fixed effect models, and the empirical results are shown in Table 4.

It can be seen from column (1) of Table 4 that the regression coefficient of \(GF\) is significantly negative at the 1% level. For every 1% increase in \(GF\), \(EP\) is reduced by 0.36%; hypothesis 1 is tested, indicating that the improvement of \(GF\) level is conducive to reducing \(EP\) and improving environmental quality. Our research results are similar to existing research (Musah et al. 2022; Zhou et al. 2020). However, unlike previous studies, this paper focuses directly on the overall pollution situation, rather than only on the impact of green finance on air pollution. \(GF\) may reduce \(EP\) mainly because green finance endogenizes environmental externalities by improving resource allocation efficiency and releasing environmental protection signals, forcing high-pollution and energy-consuming industries to improve production technology, guiding financial resources to low-pollution and low-energy consumption sectors, promoting the development of energy-saving and environmental protection industries, and releasing environmental protection signals, strengthening the environmental protection awareness of residents and enterprises, and improving environmental quality.

The negative relationship between \(\it {\text{Urban}}\) and \(EP\) is not significant for the control variables; this may be because the improvement of \(\it {\text{Urban}}\) and the enhancement of residents’ environmental awareness will help reduce \(EP\). Still, the improvement of urbanization level is often accompanied by the increase of urban population density and the acceleration of transportation infrastructure. The energy demand may also be more significant, increasing \(EP\). The two have a specific canceling relationship, making this coefficient negative but insignificant.

\(GDP\) and \(EP\) are significantly positive, while \(GDP2\) and \(EP\) are significantly negative, indicating that there is an inverted U-shaped relationship between \(GDP\) and \(EP\), and the environmental Kuznets curve is confirmed (Shi et al. 2020). \(GDP\) and \(EP\) show an inverted U-shaped relationship because the initial stage of economic growth is at the expense of the environment. When economic development reaches a certain height, people pay attention to environmental quality, and production equipment and technology are more advanced. With the improvement of the economic growth level, environmental quality has gradually improved (Chang et al. 2023). In this paper, compared with the existing research (Ren et al. 2021), \(GDP2\) is added, and the environmental Kuznets curve is considered, which shows the impact of economic growth on environmental pollution more comprehensively.

Both \(R\&D\) and \(\it {\text{Open}}\) have a significant negative correlation with \(EP\) because the higher the regional \(R\&D\) level, the more conducive to improving the level of \(GTI\); the more advanced the environmental protection technology, the higher the energy utilization efficiency and the less pollution emission (Mohsin et al. 2021a, b, c; Zhang et al. 2021a, b, c). The higher the degree of openness, it will help introduce more advanced technologies, promote the in-depth development of energy-saving (Zafar et al. 2019) and environmental protection industries, and reduce pollution emissions.

There is a significant positive correlation between \(FI\) and \(EP\), which may be because the higher the \(FI\), the more financing channels for polluting enterprises, and the easier it is to obtain loans and expand production scale, thus aggravating \(EP\) and reducing environmental quality.

Compared with previous studies (Li et al. 2022a, b, c), this study further discusses the specific impact of various dimensions of \(GF\) on \(EP\) effects and conducts a more detailed analysis. The three sub-dimensions of green credit (\(GC\)), green securities (\(GS\)), and green investment (\(GI\)) are respectively used to regress \(EP\). The regression results are shown in columns (2)–(4) of Table 4. It can be seen from Table 4 in addition to the insignificant regression coefficient of \(GS\); the regression coefficient of \(GC\) and \(GI\) is both significantly negative, indicating that \(GF\) mainly relies on \(GC\) and \(GC\) plays a role in reducing \(EP\). \(GC\) has the best effect on reducing \(EP\), and every 1% increase in \(GC\) can reduce \(EP\) by 0.474%. The impact of \(GI\) is less, at 0.074%.

Dimension analysis

Compared with the existing research (Wang et al. 2021a, b), this study not only directly uses the \(EP\) to conduct research but also deeply studies the impact of \(GF\) on various sub-dimensions of \(EP\) and shows the impact of \(GF\) on \(EP\) from multiple perspectives. In order to further study which dimensions of \(EP\) are affected, this study further regresses the three sub-dimensions of water pollution (\(WP\)), air pollution (\(AP\)), and solid pollution (\(SP\)), and the regression results are shown in Table 5.

As shown in Table 5, the coefficient of \(GF\) on \(WP\) is not significant, and the coefficient on \(AP\) and \(SP\) is significantly negative, indicating that \(GF\) mainly reduces \(EP\) and improves environmental quality by improving \(AP\) and \(SP\). Among them, the coefficient of \(GF\) on \(AP\) is −0.418%, and the coefficient on \(SP\) is −0.797%. This result shows that \(GF\) has the greatest inhibitory effect on \(SP\), less inhibitory effect on \(AP\), and no significant inhibitory effect on \(WP\), indicating that \(GF\) mainly reduces \(EP\) and improves environmental quality by reducing \(AP\) and \(SP\).

Mechanism analysis

\(GF\) Can reduce \(EP\) and improve environmental quality by improving \(GTI\), \(Str\), and \(ER\). To verify these three research hypotheses, this paper constructs an intermediary model to conduct regression on the three variables of \(GTI\), \(Str\), and \(ER\), respectively, and the regression results are shown in Table 6.

As can be seen from Table 6, on the premise that \(GF\) significantly reduces \(EP\), \(GF\) significantly promotes \(GTI\), \(Str\), and \(ER\) development, indicating that \(GTI\), \(Str\), and \(ER\) play an intermediary role in the environmental effect of \(GF\). \(GF\) reduces \(EP\) by promoting the development of these three variables. Hypothesis 2, 3, and 4 are tested. This is because the higher the development level of \(GF\), the more help to improve the efficiency of financial resource allocation, increase enterprise research and development investment, improve the level of \(GTI\), eliminate backward production capacity, improve the efficiency of resource use, guide new enterprises to develop into energy-saving and environmental protection industries, promote the original high-pollution and energy-consuming industries to transform into energy-saving and environmental protection tertiary industries, and promote the \(Str\). Change the original crude mode of production, and continue to release environmental signals to the market, strengthen the level of \(ER\), improve the level of financial institutions to assess the environmental responsibility of financing entities, strengthen the supervision of financial institutions on corporate environmental responsibility, give play to the supervision effect of public groups, guide residents and enterprises to transform to green life and production, and reduce pollution emissions.

This study confirms that \(GF\) mainly reduces \(EP\) by improving the level of \(GTI\), promoting \(Str\), and strengthening \(ER\). Many scholars have confirmed this conclusion, but unfortunately, the existing literature (Zeng et al. 2022; Zhang et al. 2022a, b, c, d) mainly discussed the transmission mechanism of \(GTI\) and \(Str\). The transmission mechanism of \(ER\) is less described. This study fills in this field.

Robustness test

To reduce the endogeneity problems caused by a lack of variables, measurement errors, and mutual causation and test the reliability of the results of \(GF\) in reducing \(EP\), this paper adopts the first-order lag term of \(GF\) as an instrumental variable and conducts an endogeneity test on it. Choose to replace the explained variables, change the number of samples, and tail reduction processing for the robustness test. The test results are shown in Table 7.

The results of the method listed as instrumental variable method (IV) column (1) in Table 7 are consistent with those of the benchmark regression model. \(GF\) can significantly inhibit \(EP\) at the 1% level, and the conclusion remains valid after controlling endogenous factors. Columns (2) and (3) are the results of replacing the explained variables, replacing \(EP\) with \(\it CO_{2}\) and \(PM2.5\), respectively. The results show that \(GF\) significantly reduces the concentrations of \(\it CO_{2}\) and \(PM2.5\) at the 1% level, which is conducive to improving environmental quality; (4) is the result of deleting the four municipalities directly under the central government of Beijing, Tianjin, Shanghai, and Chongqing; and (5) is the result of 1% tail processing for each variable. The results in both columns show that \(GF\) has a significant negative relationship with \(EP\). In summary, the five test results show that \(GF\) significantly reduces \(EP\), and the results are robust and credible.

Heterogeneity analysis

Due to the vast territory of China and the different levels of economic development and resource reserves among regions, the environmental effects of \(GF\) may also be different. To further analyze the environmental impacts of \(GF\), this paper conducts a heterogeneity analysis. According to the National Development and Reform Commission’s zoning standards for economic regions in 2000, 11 provinces, including Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan, are classified as eastern regions, and the rest as central and western regions. Meanwhile, Beijing, Tianjin, Shanghai, Chongqing, Hubei, Guangdong, Shenzhen, and Fujian, are carbon-emission pilot areas, and the rest are non-carbon-emission pilot areas. Since provincial panel data are used, Shenzhen belongs to Guangdong province, so this paper considers the Shenzhen pilot and Guangdong pilot as the same province, and the specific results are shown in Table 8.

As seen from Table 8, \(GF\) significantly inhibits \(EP\) in the eastern region. The direction of the \(EP\) coefficient in the central and western regions is negative but insignificant, indicating that \(GF\) is conducive to reducing \(EP\) in the eastern region, but has no obvious effect on reducing \(EP\) in the central and western regions. This may be because compared with the central and western regions, the eastern region has a more developed economy, a higher level of \(GF\), a more complete \(GF\) system (Wang and Wang 2021), more enterprises, greater financing needs, and stronger dependence on \(GF\). The impact of \(GF\) is also greater (Xu and Li 2020); at the same time, due to the higher economic level in the eastern region, residents pay more attention to high-quality life, higher requirements for environmental quality, stronger awareness of environmental protection, and more perfect supervision mechanism for polluting enterprises; \(GF\) has the best effect on reducing \(EP\) in the eastern region.

The carbon-emission pilot shows that \(GF\) increases by 1%, and the \(EP\) decreases by 0.815%; the results of the non-carbon-emission pilot show that \(GF\) increases by 1%, and the \(EP\) decreases by 0.176%. In other words, \(GF\) has higher inhibition on \(EP\) and better environmental improvement effect than the non-carbon-emission pilot areas. This may be because the establishment of the carbon-emission pilot transmits a more obvious signal of environmental protection to society, enhances the effect of \(ER\), increases the cost of pollution emission of enterprises, further improves the development system of \(GF\), and strengthens the impact of \(GF\) on \(EP\).

Previous studies have focused on regional location differences (Li et al. 2022a, b, c; Qiu 2023), ignoring whether it is a pilot city for carbon emissions. The establishment of carbon emission pilots is an important measure to promote the development of green finance. Based on the differences in carbon emission pilots, the heterogeneity of the impact of green finance on environmental pollution is discussed, which helps to adjust measures to local conditions according to regional differences, promote the development of green finance, and reduce environmental pollution.

Conclusions and policy implications

Green finance links ecology and finance and is regarded as a powerful weapon to solve the paradox between economic growth and environmental pollution and achieve sustainable development. However, so far, the existing research on the construction of an environmental pollution index system is not perfect, and the impact of green finance on environmental pollution is still less. Therefore, based on the panel data of 30 provinces in China from 2007 to 2020, this study first measures the environmental pollution index and then directly discusses the relationship between green finance and environmental pollution, subdivides the interaction between green finance and environmental pollution, and then analyzes the transmission mechanism of green finance to reduce environmental pollution. Finally, the heterogeneity of the environmental effects of green finance is discussed. The main conclusions are as follows:

First, based on the three perspectives of water, air, and solid pollution, the relative pollution emission indicators, including industry, agriculture, and life, are selected to measure the environmental pollution index. It is found that green finance significantly inhibits environmental pollution and improves environmental quality. Among them, green credit has a better inhibitory effect on environmental pollution, green investment has a smaller effect, and green securities have no obvious inhibitory effect on environmental pollution. At the same time, green finance has the best inhibitory effect on solid pollution, less inhibitory effect on air pollution, and no significant inhibitory effect on water pollution.

Secondly, it analyzes the transmission mechanism of green finance to environmental pollution. It finds that green finance inhibits environmental pollution and improves environmental quality by improving the level of green technology innovation, promoting the upgrading of industrial structure, and strengthening the level of environmental regulation.

Finally, the heterogeneity of green finance in reducing environmental pollution is discussed. It is found that the effect of green finance on environmental pollution in the eastern region and carbon emission pilot areas is better than that in the central and western regions and non-carbon emission pilot areas.

Accordingly, we propose the following policy recommendations.

First, improve the green finance system and vigorously develop green finance business. Improve the green financial system from the four levels of green financial institutions, financial support, infrastructure, and legal facilities, increase government subsidies, encourage financial institutions to vigorously develop green financial business, form a green financial policy system, give full play to green financial, environmental effects, reduce environmental pollution, and achieve sustainable development.

Second, deepen the depth and breadth of green finance development. Encourage financial institutions to actively develop diversified green financial products, establish green financial operation platforms, strengthen information communication between the government and financial institutions, reduce information asymmetry, and achieve effective docking of financial resources; at the same time, the development of diversified models in loan scale, interest rate and repayment form, promote the development of energy conservation and environmental protection industry, provide sufficient financial support for enterprises to carry out green technology innovation and industrial structure upgrading, transmit a strong signal of environmental protection to the market, improve the level of market regulation, and better play the role of green finance in curbing environmental pollution.

Third, we will regulate green finance policies according to local conditions. In the eastern region and carbon emission pilot areas, we will continue to explore new green financial service projects, strengthen problem-oriented, precise policies, and provide policy models that can be replicated and promoted. In the central and western regions and non-carbon emission pilot areas, focus on cultivating the concept of green development, promote the model of combined development of green financial instruments such as green credit, green securities, green insurance, and carbon emission pilot, expand the coverage of industries and enterprises affected by green finance, so that more enterprises can enjoy the dividends brought by green finance, and give full play to the environmental effects of green finance. Reduce environmental pollution.

This paper studies the impact of green finance on environmental pollution, but there are still some limitations due to data limitations. Due to the late development of green insurance in China and the lack of data statistics, the construction of green finance indicators could be better. In addition, this paper takes data at the provincial level as the research object and further expands the research results at the municipal level to be more convincing. In future research, it is necessary to further improve the construction of green finance index systems and further study based on the data at the municipal level.

Data availability

The datasets used and analyzed during the current study are available from the corresponding author on reasonable request.

Notes

Source:http://www.cbirc.gov.cn/cn/view/pages/ItemDetail.html? docId = 9636&itemId = 928&generaltype = 0.

References

Amore MD, Schneider C, Žaldokas A (2013) Credit supply and corporate innovation. J Financ Econ 109(3):835–855. https://doi.org/10.1016/j.jfineco.2013.04.006

An S, Li B, Song D, Chen X (2021) Green credit financing versus trade credit financing in a supply chain with carbon emission limits. Eur J Oper Res 292(1):125–142. https://doi.org/10.1016/j.ejor.2020.10.025

Brunnermeier SB, Cohen MA (2003) Determinants of environmental innovation in US manufacturing industries. J Environ Econ Manage 45(2):278–293. https://doi.org/10.1016/S0095-0696(02)00058-X

Chang L, Taghizadeh-Hesary F, Chen H, Mohsin M (2022) Do green bonds have environmental benefits? Energy Econ 115. https://doi.org/10.1016/j.eneco.2022.106356

Chang L, Taghizadeh-Hesary F, Mohsin M (2023) Role of artificial intelligence on green economic development: joint determinates of natural resources and green total factor productivity. Resour Policy 82. https://doi.org/10.1016/j.resourpol.2023.103508

Chen S (2015) Environmental pollution emissions, regional productivity growth and ecological economic development in China. China Econ Rev 35:171–182. https://doi.org/10.1016/j.chieco.2014.08.005

Chen S, Bai Y (2023) Green finance, the low-carbon energy transition, and environmental pollution: evidence from China. Environ Sci Pollut Res 83657–83677. https://doi.org/10.1007/s11356-023-28196-3

Chen Z, Zhang Y, Wang H, Ouyang X, Xie Y (2022) Can green credit policy promote low-carbon technology innovation? J Clean Prod 359:132061. https://doi.org/10.1016/j.jclepro.2022.132061

Fang Z, Razzaq A, Mohsin M, Irfan M (2022) Spatial spillovers and threshold effects of internet development and entrepreneurship on green innovation efficiency in China. Technol Soc 68. https://doi.org/10.1016/j.techsoc.2021.101844

Gao J, Wu D, Xiao Q, Randhawa A, Liu Q, Zhang T (2023) Green finance, environmental pollution and high-quality economic development-a study based on China’s provincial panel data. Environ Sci Pollut Res 30(11):31954–31976. https://doi.org/10.1007/s11356-022-24428-0

Gu B, Chen F, Zhang K (2021) The policy effect of green finance in promoting industrial transformation and upgrading efficiency in China: analysis from the perspective of government regulation and public environmental demands. Environ Sci Pollut Res 28(34):47474–47491. https://doi.org/10.1007/s11356-021-13944-0

Guo Y, Xia X, Zhang S, Zhang D (2018) Environmental regulation, government R&D funding and green technology innovation: evidence from China provincial data. Sustainability 10(4):940. https://doi.org/10.3390/su10040940

He L, Zhang L, Zhong Z, Wang D, Wang F (2019) Green credit, renewable energy investment and green economy development: empirical analysis based on 150 listed companies of China. J Clean Prod 208:363–372. https://doi.org/10.1016/j.jclepro.2018.10.119

He Y, Liao N, Rao J, Chen Z (2021) Energy conservation path of China iron and steel industry driven by relative policies. Energy Effic 14(1):14. https://doi.org/10.1007/s12053-020-09925-w

He L, Zhong T, Gan S (2022) Green finance and corporate environmental responsibility: evidence from heavily polluting listed enterprises in China. Environ Sci Pollut Res 29(49):74081–74096. https://doi.org/10.1007/s11356-022-21065-5

Hu Y, Jiang H, Zhong Z (2020) Impact of green credit on industrial structure in China: theoretical mechanism and empirical analysis. Environ Sci Pollut Res 27(10):10506–10519. https://doi.org/10.1007/s11356-020-07717-4

Hu H, Liu X, Pei H, Chen Y, Ye Z, Cui H, Xue C (2023) Will green credit promote corporate environmental protection investment? Environ Sci Pollut Res. https://doi.org/10.1007/s11356-023-25483-x

Huang D (2022) Green finance, environmental regulation, and regional economic growth: from the perspective of low-carbon technological progress. Environ Sci Pollut Res 29(22):33698–33712. https://doi.org/10.1007/s11356-022-18582-8

Jiang Z, Lyu P, Ye L, Yw Z (2020) Green innovation transformation, economic sustainability and energy consumption during China’s new normal stage. J Clean Prod 273:123044. https://doi.org/10.1016/j.jclepro.2020.123044

Jiang P, Jiang H, Wu J (2022a) Is inhibition of financialization the sub-effect of the green credit policy? Evidence from China. Financ Res Lett 47:102737. https://doi.org/10.1016/j.frl.2022.102737

Jiang S, Liu X, Liu Z, Shi H, Xu H (2022b) Does green finance promote enterprises’ green technology innovation in China? Front Environ Sci 10:1–18. https://doi.org/10.3389/fenvs.2022.981013

Jiang T (2022) Mediating effects and moderating effects in causal inference. China Industrial Economics 39(05):100–120. https://doi.org/10.19581/j.cnki.ciejournal.2022.05.005

Kijima M, Nishide K, Ohyama A (2010) Economic models for the environmental Kuznets curve: a survey. J Econ Dyn Control 34(7):1187–1201. https://doi.org/10.1016/j.jedc.2010.03.010

Lanoie P, Patry M, Lajeunesse R (2008) Environmental regulation and productivity: testing the porter hypothesis. J Prod Anal 30(2):121–128. https://doi.org/10.1007/s11123-008-0108-4

Lee S, Oh D-W (2015) Economic growth and the environment in China: empirical evidence using prefecture level data. China Econ Rev 36:73–85. https://doi.org/10.1016/j.chieco.2015.08.009

Li C, Chen Z, Wu Y, Zuo X, Jin H, Xu Y, Zeng B, Zhao G, Wan Y (2022a) Impact of green finance on China’s high-quality economic development, environmental pollution, and energy consumption. Front Environ Sci 10:1. https://doi.org/10.3389/fenvs.2022.1032586

Li C, Sampene AK, Agyeman FO, Brenya R, Wiredu J (2022b) The role of green finance and energy innovation in neutralizing environmental pollution: empirical evidence from the MINT economies. J Environ Manage 317:115500. https://doi.org/10.1016/j.jenvman.2022.115500

Li J, Dong K, Taghizadeh-Hesary F, Wang K (2022c) 3G in China: how green economic growth and green finance promote green energy? Renew Energy 200:1327–1337. https://doi.org/10.1016/j.renene.2022.10.052

Liu X, Wang E, Cai D (2019) Green credit policy, property rights and debt financing: quasi-natural experimental evidence from China. Financ Res Lett 29:129–135. https://doi.org/10.1016/j.frl.2019.03.014

Liu C, Dai C, Chen S, Zhong J (2023) How does green finance affect the innovation performance of enterprises? Evidence from China. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-023-28063-1

Ma X, Xue Y (2023) How does carbon emission trading scheme affect enterprise green technology innovation: evidence from China’s A-share non-financial listed companies. Environ Sci Pollut Res 30(13):35588–35601. https://doi.org/10.1007/s11356-022-24768-x

Mngumi F, Shaorong S, Shair F, Waqas M (2022) Does green finance mitigate the effects of climate variability: role of renewable energy investment and infrastructure. Environ Sci Pollut Res 29(39):59287–59299. https://doi.org/10.1007/s11356-022-19839-y

Mohsin M, Jamaani F (2023a) Green finance and the socio-politico-economic factors’ impact on the future oil prices: evidence from machine learning. Resour Policy 85:103780. https://doi.org/10.1016/j.resourpol.2023.103780

Mohsin M, Jamaani F (2023b) A novel deep-learning technique for forecasting oil price volatility using historical prices of five precious metals in context of green financing – a comparison of deep learning, machine learning, and statistical models. Resour Policy 86:104216. https://doi.org/10.1016/j.resourpol.2023.104216

Mohsin M, Hanif I, Taghizadeh-Hesary F, Abbas Q, Iqbal W (2021a) Nexus between energy efficiency and electricity reforms: a DEA-Based way forward for clean power development. Energy Policy 149:112052. https://doi.org/10.1016/j.enpol.2020.112052

Mohsin M, Taghizadeh-Hesary F, Panthamit N, Anwar S, Abbas Q, Vo XV (2021b) Developing low carbon finance index: evidence from developed and developing economies. Financ Res Lett 43:101520. https://doi.org/10.1016/j.frl.2020.101520

Mohsin M, Ullah H, Iqbal N, Iqbal W, Taghizadeh-Hesary F (2021c) How external debt led to economic growth in South Asia: a policy perspective analysis from quantile regression. Econ Anal Policy 72:423–437. https://doi.org/10.1016/j.eap.2021.09.012

Mohsin M, Orynbassarov D, Anser MK, Oskenbayev Y (2023) Does hydropower energy help to reduce CO2 emissions in European Union countries? Evidence from quantile estimation. Environ Dev 45:100794. https://doi.org/10.1016/j.envdev.2022.100794

Muganyi T, Yan L, Sun HP (2021) Green finance, fintech and environmental protection: evidence from China. Environ Sci Ecotechnol 7:100107. https://doi.org/10.1016/j.ese.2021.100107

Musah M, Owusu-Akomeah M, Kumah EA, Mensah IA, Nyeadi JD, Murshed M, Alfred M (2022) Green investments, financial development, and environmental quality in Ghana: evidence from the novel dynamic ARDL simulations approach. Environ Sci Pollut Res 29(21):31972–32001. https://doi.org/10.1007/s11356-021-17685-y

Peng Z, Wu Q, Li M (2020) Spatial characteristics and influencing factors of carbon emissions from energy consumption in China’s transport sector: an empirical analysis based on provincial panel data. Pol J Environ Stud 29(1):217–232. https://doi.org/10.15244/pjoes/102369

Qiu Q (2023) Exploring industrial agglomeration and green finance impact on regional environmental pollution in China based on system-GMM model. Environ Sci Pollut Res 30(16):46766–46778. https://doi.org/10.1007/s11356-023-25632-2

Ren X, Shao Q, Zhong R (2020) Nexus between green finance, non-fossil energy use, and carbon intensity: empirical evidence from China based on a vector error correction model. J Clean Prod 277:122844. https://doi.org/10.1016/j.jclepro.2020.122844

Ren S, Hao Y, Wu H (2021) How does green investment affect environmental pollution? Evidence from China. Environ Resource Econ 81(1):25–51. https://doi.org/10.1007/s10640-021-00615-4

Saeed Meo M, Karim MZA (2022) The role of green finance in reducing CO2 emissions: an empirical analysis. Borsa Istanb Rev 22(1):169–178. https://doi.org/10.1016/j.bir.2021.03.002

Shi T, Yang S, Zhang W, Zhou Q (2020) Coupling coordination degree measurement and spatiotemporal heterogeneity between economic development and ecological environment ––empirical evidence from tropical and subtropical regions of China. J Clean Prod 244:118739. https://doi.org/10.1016/j.jclepro.2019.118739

Su C-W, Li W, Umar M, Lobonţ O-R (2022a) Can green credit reduce the emissions of pollutants? Econ Anal Policy 74:205–219. https://doi.org/10.1016/j.eap.2022.01.016

Su CW, Umar M, Gao R (2022b) Save the environment, get financing! How China is protecting the environment with green credit policies? J Environ Manage 323:116178. https://doi.org/10.1016/j.jenvman.2022.116178

Sun C, Luo Y, Li J (2018) Urban traffic infrastructure investment and air pollution: evidence from the 83 cities in China. J Clean Prod 172:488–496. https://doi.org/10.1016/j.jclepro.2017.10.194

Viard VB, Fu S (2015) The effect of Beijing’s driving restrictions on pollution and economic activity. J Public Econ 125:98–115. https://doi.org/10.1016/j.jpubeco.2015.02.003

Wang X, Wang Q (2021) Research on the impact of green finance on the upgrading of China’s regional industrial structure from the perspective of sustainable development. Resour Policy 74:102436. https://doi.org/10.1016/j.resourpol.2021.102436

Wang C, Nie P-y, Peng D-h, Li Z-h (2017a) Green insurance subsidy for promoting clean production innovation. J Clean Prod 148:111–117. https://doi.org/10.1016/j.jclepro.2017.01.145

Wang W, Yu B, Yan X, Yao X, Liu Y (2017b) Estimation of innovation’s green performance: a range-adjusted measure approach to assess the unified efficiency of China’s manufacturing industry. J Clean Prod 149:919–924. https://doi.org/10.1016/j.jclepro.2017.02.174

Wang F, Yang S, Reisner A, Liu N (2019) Does green credit policy work in China? The correlation between green credit and corporate environmental information disclosure quality. Sustainability 11(3):733. https://doi.org/10.3390/su11030733

Wang F, Wang R, He Z (2021a) The impact of environmental pollution and green finance on the high-quality development of energy based on spatial Dubin model. Resour Policy 74:102451. https://doi.org/10.1016/j.resourpol.2021.102451

Wang T, Peng J, Wu L (2021b) Heterogeneous effects of environmental regulation on air pollution: evidence from China’s prefecture-level cities. Environ Sci Pollut Res Int 28(20):25782–25797. https://doi.org/10.1007/s11356-021-12434-7

Xiang W, Qi Q, Gan L (2023) Non-linear effects of green finance on air quality in China: new evidence from a panel threshold model. Front Ecol Evol 11:1162137. https://doi.org/10.3389/fevo.2023.1162137

Xie Q, Liu J (2019) Combined nonlinear effects of economic growth and urbanization on CO2 emissions in China: evidence from a panel data partially linear additive model. Energy 186:115868. https://doi.org/10.1016/j.energy.2019.115868

Xu S, Dong H (2023) Green finance, industrial structure upgrading, and high-quality economic development-intermediation model based on the regulatory role of environmental regulation. Int J Environ Res Public Health 20(2):1–23. https://doi.org/10.3390/ijerph20021420

Xu X, Li J (2020) Asymmetric impacts of the policy and development of green credit on the debt financing cost and maturity of different types of enterprises in China. J Clean Prod 264:121574. https://doi.org/10.1016/j.jclepro.2020.121574

Xu X, Xie Y, Obobisa ES, Sun H (2023) Has the establishment of green finance reform and innovation pilot zones improved air quality? Evidence from China. Hum Soc Sci Commun 10(1):1–14. https://doi.org/10.1057/s41599-023-01773-0