Abstract

Under the constraints of the “dual-carbon” objectives, how China can sustain economic development while concurrently achieving carbon emission reduction has become a pressing issue. With the rapid expansion of China’s outward foreign direct investment (OFDI), elucidating its impact on carbon emission efficiency (CEE) assumes pronounced significance. Employing the systematic generalized method of moments (GMM) approach, based on panel data spanning the years 2006 to 2019 for China, this study primarily delves into the influence of OFDI on China’s CEE. Furthermore, it probes into the mechanisms and asymmetries underpinning the relationship between OFDI and CEE. The principal findings are as follows: (1) augmentation of OFDI exerts a constructive effect on domestic carbon emission reduction, concomitantly yielding a discernible enhancement in CEE. A 1% increase in the magnitude of OFDI flow gives rise to a 0.009% improvement in CEE. (2) Mechanism verification reveals that heightened levels of OFDI operate through elevating green total factor productivity (GTFP), fostering optimal industrial structural adjustments, and invigorating green technological innovation, thereby elevating the CEE of the home country. (3) Asymmetry characterizes the impact of OFDI on domestic CEE, signifying a significant enhancement in regions with lower CEE while exhibiting less conspicuous effects in areas with higher CEE. This study furnishes policymakers with insights into leveraging OFDI to enhance CEE, thereby facilitating the attainment of the “dual-carbon” objectives.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Outward foreign direct investment (OFDI) refers to the economic activity wherein domestic investors of one country acquire foreign enterprises through cash, tangible assets, intangible assets, and similar means, with a central focus on obtaining operational and managerial control over said enterprises abroad. OFDI is generally understood as the economic conduct through which a country’s investors deploy capital, equipment, technology, and managerial expertise as intangible assets to acquire effective control over the management of foreign enterprises (Knoerich 2017). In recent years, the Chinese government has steadfastly pursued policies aimed at enhancing openness to the outside world, consistently bolstering its support for OFDI. The 19th National Congress of the Communist Party of China highlights the objectives of promoting high-level opening up to the world, elevating the quality and level of trade and investment cooperation, actively participating in global industrial division and cooperation, and upholding a diverse and stable international economic framework as well as economic and trade relations.Footnote 1 With the implementation and advancement of the “Going Global” strategy and the “Belt and Road” Initiative, China’s OFDI has undergone rapid development (Jalil et al. 2021). By the end of 2021, Chinese domestic investors have established approximately 46,000 overseas enterprises in 190 countries (regions), with the flow of OFDI reaching 1.7 trillion USD, accounting for 10.5% of the global flow for that year and ranking as the second largest in the world.Footnote 2 However, as China’s OFDI has experienced rapid growth, carbon emissions have also surged, leading to climate-related challenges that present severe implications for the nation’s economic progress (Song et al. 2021; Zhou et al. 2018). Particularly, with China’s announcement of the dual carbon objectives to peak carbon emissions before 2030 and achieve carbon neutrality by 2060, the imperative to balance economic development with climate change mitigation has become a pressing concern. In this context, clarifying the relationship between OFDI and China’s emissions reduction holds considerable pragmatic significance.

The reduction of emissions necessitates not only a focus on quantitative reduction but also a delicate equilibrium between the dual roles of economic and environmental considerations. Consequently, the assessment of carbon emission efficiency (CEE) assumes heightened significance (Wang et al. 2022b). It is generally posited that OFDI exerts its impact on the CEE of the home country through two underlying mechanisms. On the one hand, OFDI manifests reverse technology spillover effects (Fahad et al. 2022; Pan et al. 2020). During the process of outward investment, Chinese enterprises bring advanced managerial experience and green technologies back to the domestic arena, thereby positively influencing the enhancement of domestic CEE (Hao et al. 2020). Moreover, OFDI engenders structural adjustment effects (Huang 2021), promoting the optimization of domestic industrial structure and the elimination of outdated production capacities, thereby contributing to carbon reduction and efficiency enhancement (You et al. 2022). Additionally, OFDI has synergistic effects (Hao et al. 2020); through OFDI, enterprises can expand their scale and business domains, engage in investments spanning the entire industry chain, and undertake industrial integration. This aids in optimizing resource allocation and reducing energy consumption and resource wastage, ultimately bolstering green total factor productivity (GTFP) and CEE (Ren et al. 2022). On the other hand, the presence of energy rebound effects means that OFDI could potentially diminish a nation’s CEE (Wang et al. 2022c, 2023c). Energy rebound effects could result in a rapid escalation in domestic energy consumption, heightening the use of fossil fuels, thereby leading to substantial carbon emissions and a reduction in CEE (Chen et al. 2021). Consequently, a more comprehensive study is warranted to unravel the intricate impact of OFDI on China’s CEE.

In previous research endeavors, numerous scholars have undertaken discussions on the influence of OFDI on carbon emissions. The prevailing viewpoint among most scholars is that OFDI tends to lower a nation’s carbon emissions (Ge et al. 2022; Zhou et al. 2019). Additionally, certain scholars have explored the impact of OFDI on energy efficiency, proposing that OFDI has the potential to enhance China’s energy efficiency (Liu et al. 2022; Pan et al. 2022; Zhou et al. 2021). However, there remains a significant dearth of research focused specifically on the impact of OFDI on CEE, signifying a considerable research gap. To address this, building upon the foundation laid by previous research, this study employs the system generalized method of moments (SYS-GMM) approach. Drawing on panel data from 30 provinces in China spanning the years 2006 to 2019, the study primarily investigates the influence of OFDI on China’s CEE. Furthermore, the study delves into the mechanisms and asymmetries that underpin this relationship. The principal contributions of this study are as follows: First, diverging from the conventional emphasis on carbon emissions alone, this study focuses on estimating the impact of OFDI on CEE in China and enriches the research on the impact of OFDI on carbon emission reduction from the efficiency level. This efficiency-focused perspective not only enriches the existing research landscape but also provides a more diversified angle for the Chinese government’s carbon reduction endeavors. Second, the study offers an in-depth analysis of the mechanisms through which OFDI affects CEE. By addressing this research gap, it furnishes theoretical underpinnings and policy references for China’s utilization of OFDI to achieve carbon reduction and efficiency enhancement. Third, the study also examines the asymmetry of OFDI’s impact across regions with differing carbon emission efficiencies. This facet of the research delivers vital insights for local Chinese governments in tailoring their utilization of outward foreign investment to achieve the dual carbon objectives based on specific regional circumstances.

The structure of the remaining sections of this study is as follows: In the “Literature review,” an examination and synthesis of pertinent research literature is undertaken. “Method and data” elucidates the research methodology, encompassing the delineation of employed methods, variables, and data sources. The focal point of “Empirical results and discussion,” constituting the core of the research endeavor, involves the presentation and analysis of empirical findings pertaining to the impact of OFDI on CEE. This section also expounds upon the outcomes of the mechanism examination. “Further discussion” engages in a comprehensive discussion regarding the asymmetrical influence of OFDI on CEE. Finally, “Conclusions and policy implications” encapsulate the research conclusions and proffer policy recommendations grounded in the study’s findings.

Literature review

Research on OFDI and carbon emission

There is a substantial body of research dedicated to investigating the relationship between OFDI and carbon emissions. For instance, scholars have explored the impact of OFDI on carbon emissions in host countries. A portion of these investigations aligns with the “pollution heaven hypothesis” (Walter and Ugelow 1979), positing that during the process of OFDI, the home country tends to relocate pollution-intensive industries to host countries, thereby augmenting the carbon emissions in these locales. For example, Wang et al. (2023b) examine the influence of Chinese OFDI on the carbon intensity of countries along the “Belt and Road” initiative from 2005 to 2018, revealing that China’s outward investment might lead to an increase of 5.63% and 1.80% in carbon intensity in Vietnam and Malaysia, respectively. However, a predominant stance among scholars underscores the pollution halo effect of OFDI (Zarsky 1999), suggesting that as foreign capital flows into a host country, it brings along advanced management techniques and philosophies, thereby contributing to a reduction in pollution and emissions. For instance, Ge et al. (2022) study the carbon emission effects of Chinese OFDI on 42 countries along the “Belt and Road” initiative from 2003 to 2020, revealing a significant negative direct impact of OFDI on carbon emissions in these countries. Although OFDI may raise carbon emissions in these countries through effects associated with economic scale and industrial structure, the inhibitory effects of production technology on carbon emissions are more pronounced. Shinwari et al. (2022) investigate the influence of Chinese OFDI on carbon emissions in 35 countries participating in the “Belt and Road” initiative from 2000 to 2019. Their findings substantiate the pollution halo effect of China’s foreign investment, rather than investments undertaken as a refuge for carbon emission avoidance.

Numerous scholars have also examined the impact of OFDI on carbon emissions in the home country. Wu (2023) shows that the carbon emissions of overseas subsidiaries of US multinationals account for 9.8% of CO2 emissions within the US and 1.5% of global emissions in 2016. Yang et al. (2021), employing panel data from 30 Chinese provinces spanning the years 2003 to 2017, find a positive correlation between OFDI and domestic carbon dioxide emissions, primarily attributed to economic scale effects. In other words, carbon emissions are a byproduct of economic production activities, and as the scale of OFDI expands, carbon emissions increase accordingly. However, some scholars contend that OFDI can have a dampening effect on domestic carbon emissions. For instance, Hao et al. (2020), utilizing panel data from 29 Chinese provinces over the period 2003 to 2016, empirically investigate the impact of China’s outward foreign direct investment (OFDI) on domestic carbon dioxide emissions. The results indicated that for every 1% increase in OFDI, carbon intensity decreases by 0.082%, implying a negative impact of China’s OFDI on carbon emission intensity. Zhou et al. (2019) posit that China’s OFDI could engender green spillover effects domestically, fostering economic growth and lowering carbon emissions through the enhancement of GTFP. Currently, scholars have not reached a consensus on the impact of OFDI on carbon emissions, with substantial disparities prevailing. This discrepancy may stem from variations in the scope of data used and the regions under examination across different studies.

The nexus of OFDI and CEE

Compared to research on carbon emissions, the investigation into the impact of outward foreign direct investment (OFDI) on CEE has received relatively less attention from scholars. However, in contrast to emissions-focused research, studying the influence of OFDI on CEE is more illustrative of the comprehensive decarbonization trends and holds more practical significance. In comparison, several scholars have delved into the relationship between OFDI and energy efficiency. For instance, Liu et al. (2022), employing panel data from 29 Chinese provinces from 2003 to 2017, find that the technological spillover effects of OFDI positively impact total factor energy efficiency. Nevertheless, the current effect is relatively modest and exhibits lag. Zhou et al. (2021), utilizing data from 57 countries along the “Belt and Road” initiative for the years 2003 to 2016, highlight that the reverse spillover effects of OFDI contribute to improved energy efficiency in China. Pan et al. (2022), based on data from 30 Chinese provinces spanning 2006 to 2017, explore the non-linear impact of OFDI on China’s overall factor energy efficiency. The results demonstrat that an increase in China’s OFDI can enhance energy efficiency, but this relationship is non-linear and influenced significantly by factors such as openness, industrial structure, and human capital, which exert pivotal threshold effects.

However, with China’s energy strategy gradually transitioning from a focus on dual control of energy consumption to dual control of carbon emissions, confining attention merely to the impact of OFDI on energy efficiency is insufficient. Regarding research on the influence of OFDI on CEE, currently, only Cheng et al. (2022) have preliminarily investigated the effect of OFDI on China’s CEE using panel data from 30 Chinese provinces for the years 2004 to 2019. The outcomes indicated that OFDI significantly enhances China’s CEE. However, this study lacks a comprehensive exploration of the underlying mechanisms and heterogeneity. Presently, substantial gaps persist in the research on the impact of OFDI on CEE.

Research gaps

Based on the aforementioned literature review, numerous scholars have examined the impact of OFDI on carbon emissions in both the home and host countries (“Research on OFDI and carbon emission”). Additionally, some scholars have undertaken preliminary explorations into the influence of OFDI on CEE in host countries (“The nexus of OFDI and CEE”). However, we contend that these studies exhibit three notable shortcomings: First, prevailing research on OFDI and carbon emission reduction has predominantly focused on investigating carbon emission impacts, yet consensus on the research findings has not yet been reached. Second, the majority of extant studies have exclusively discussed the influence of OFDI on energy efficiency, with a significant dearth of research concerning CEE. Third, within the limited body of research, the study of OFDI’s impact on CEE has been lacking in both mechanistic analysis and heterogeneity examination, thereby leaving a knowledge gap regarding the underlying mechanisms and inherent reasons for the influence of OFDI on CEE.

Method and data

Model specification

Based on the above analysis, it is evident that a latent econometric relationship exists between OFDI and both carbon emissions and CEE. To further ascertain the nature of these relationships, this study has selected four variables, namely, economic growth \((\mathrm{PGDP})\), industrial structure \((\mathrm{IND})\), urbanization level \((\mathrm{URB})\), and energy consumption \((\mathrm{EC})\), which have potential influences on carbon emissions and CEE, to be employed as control variables (Wen et al. 2022; Zhang and Liu 2022). The foundational empirical framework is as follows:

where \(f\left(\bullet \right)\) is a function, \(i\) and \(t\) represent the province and year. \(\mathrm{CE}\) and \(\mathrm{CEE}\) represent carbon emission and CEE, respectively. \(\mathrm{OFDI}\) represents the outward foreign direct investment.

To mitigate the volatility of the data, logarithmic transformations are applied to all variables. Moreover, since the explanatory variable is related to the random error term, the lag term of the interpreted variable is also related to the random error term. It is plausible that the model could be subject to endogeneity issues arising from dynamic panel data (Ullah et al. 2018). Thus, to address this endogeneity concern, we have introduced first-order lagged terms for both carbon emissions and CEE into the model. The amended empirical model is as follows:

where \({\varepsilon }_{it}\) denotes random error term, \(X\) denotes a set of control variables, \({\alpha }_{0}\) and \({\beta }_{0}\) denote constant terms, and \({\alpha }_{1}\dots {\alpha }_{6}\) and \({\beta }_{1}\dots {\beta }_{6}\) denote estimated coefficients. In this contest, \({\alpha }_{2}\) represents the elasticity of OFDI with respect to carbon emissions. If \({\alpha }_{2}\) is both statistically significant and less than zero, it signifies that OFDI can significantly decrease carbon emissions within the home nation. On the other hand, \({\beta }_{2}\) signifies the elasticity of OFDI concerning CEE. Should \({\beta }_{2}\) be statistically significant and greater than zero, it implies that OFDI can notably enhance CEE within the home nation.

Mediating effect model

Further, we investigate the channels between OFDI and CEE. Referring to Baron and Kenny (1986), the mediating effect models are constructed as follows:

Herein, \(M\) represents the mediating variables, including GTFP (GTFP), industrial structure optimization (ISO), and green technology innovation (GTI) in this study. \({\gamma }_{0}\) and \({\delta }_{0}\) are the constant terms. \({\gamma }_{1},\cdots , {\gamma }_{6}\) and \({\delta }_{1},\cdots , {\delta }_{7}\) are the estimated coefficients. The mediating effects exist when \({\gamma }_{2}\) and \({\delta }_{3}\) are significant.

Variable description

Dependent variable

There are two dependent variables in this study, which are carbon emissions and CEE. Among them, carbon emissions primarily result from the combustion of fossil fuels. The CEE is mainly assessed using the Global Malmquist–Luenberger (GML) index method within the framework of data envelopment analysis (DEA).

First, we need to introduce a set of global production possibility sets. We take each province as a decision-making unit (DMU), using N inputs \(x=\left({x}_{1},{x}_{2},\cdots ,{x}_{n}\right)\in {R}_{N}^{+}\), producing M desirable outputs \({y}^{d}=\left({y}_{1}^{d},{y}_{2}^{d},\cdots ,{y}_{m}^{d}\right)\in {R}_{M}^{+}\) and S undesirable outputs \({y}^{u}=\left({y}_{1}^{u},{y}_{2}^{u},\cdots ,{y}_{s}^{u}\right)\in {R}_{S}^{+}\). The input–output quantity of the \(i\)-th DMU in period t can be denoted as \(\left({x}_{i,t},{y}_{i,t}^{d},{y}_{i,t}^{u}\right)\), and the production possibility set \({P}^{t}\left(x\right)\) in period t is

where \({\lambda }_{k,t}\) denotes the weight of each cross-section observation. Considering technological retrogression, we further adopt the global production possibility set \({P}^{G}\left(x\right)\) to represent the production frontier (Oh 2010). We assume \({P}^{G}\left(x\right)={P}^{1}\left({x}_{1}\right)\cup {P}^{2}\left({x}_{2}\right)\cup \cdots \cup {P}^{t}\left({x}_{t}\right)\), and let \({\text{g}}=\left({\text{g}}_{{y}^{d}},{\text{g}}_{{y}^{u}}\right)\) be a direction vector, where \({\text{g}}\in {R}_{M}^{+}\times {R}_{S}^{+}\). And the global slacks-based measure (SBM) directional distance function can be set as follows:

Herein, \(\beta\) denotes the value of the distance function to search for the direction of maximizing desirable output and minimizing undesired output. Therefore, according to the global production possibility set by Oh (2010), we calculate the GML index with reference to the SBM model:

Since the GML index represents the change in productivity in two periods, if \({\mathrm{GML}}_{t}^{t+1}>1\), it denotes that the productivity of time \(t+1\) increases compared to time \(t\), and vice versa. To accurately obtain the CEE in time \(t\), we calculate it through the following equation:

where \({\mathrm{CCE}}_{2006}=1\).

Herein, the input variables we employ are labor input (number of employed individuals), capital input (fixed asset investment and calculated using perpetual inventory method with the base year as 2003), and energy input (total energy consumption). The expected output is actual GDP (with the base year as 2006), while the non-expected output is carbon emissions.

Core independent variable

The core independent variable in this study is OFDI. OFDI data comprises both its flow and stock components. In benchmark regression, we employed both of these data types for comparative analysis. However, due to the temporal dimension inherent in OFDI flow, which signifies the volume of OFDI occurring within a year, and the non-temporal nature of OFDI stock, representing the cumulative total of OFDI at a specific time point, utilizing OFDI flow for research yields greater precision.

Control variables

This study incorporates four potential influencing variables as control factors for CEE.

-

(1)

Economic growth \((\mathrm{PGDP})\) is represented by GDP per capita. On the one hand, economic growth often accompanies technological innovations, enhanced energy efficiency, and diversification of energy sources, thereby favoring the elevation of CEE (Dagestani et al. 2022; Wang et al. 2022a). On the other hand, excessively rapid economic growth may engender substantial consumption of fossil fuels such as coal, contributing to a decline in CEE (Mohsin et al. 2021; Wang et al. 2021).

-

(2)

Industrial structure \((\mathrm{IND})\) is represented by the ratio of value added from the tertiary sector to that from the secondary sector. The tertiary sector, primarily composed of the service industry, is characterized by relatively lower material and energy consumption, making it comparatively cleaner. Consequently, the enhancement of industrial structure tends to augment CEE (Su et al. 2020).

-

(3)

Urbanization level \((\mathrm{URB})\), quantified by the proportion of the urban population, constitutes another variable under consideration. On the one hand, the augmentation of urbanization level can foster industrial agglomeration, enhance information dissemination, and optimize resource utilization efficiency, thereby conducive to the elevation of CEE (Wang et al. 2019). Conversely, the progression of urbanization level also engenders heightened energy consumption and expansion of infrastructure development (Dong et al. 2022; Zhao et al. 2020).

-

(4)

Energy consumption \((\mathrm{EC})\) is quantified using coal consumption volume. The combustion of coal leads to significant carbon dioxide emissions, serving as a primary contributor to climate-related issues. Consequently, the escalation in coal consumption is associated with a reduction in CEE (Tan and Wang 2021).

Mediating variables

To examine the mechanisms between OFDI and CEE, this study has opted for the following three mediating variables.

-

(1)

Green total factor productivity (GTFP) is measured by the GML index referring to Liu et al. (2023). The input variables are labor input, capital investment, and energy input; desirable output is real GDP; undesirable output is pollutants, including CO2, SO2, and chemical oxygen demand (COD) emissions.

-

(2)

Industrial structure optimization (ISO) is calculated by Zhao et al. (2022a), where the Theil index is employed to assess the level of balanced industrial growth. The calculation formula is as follows:

$$\mathrm{ISO}=\sum\nolimits_{i=1}^{3}(\frac{{Y}_{i}}{Y})\mathrm{ln}(\frac{{Y}_{i}}{{L}_{i}}/\frac{Y}{L})$$(11)where \(i\) represents the i-th industry, \(Y\) denotes GDP, \(L\) represents the total employment. \({Y}_{i}\) signifies the output of the i-th industry, and \({L}_{i}\) indicates the employment level in the i-th industry. A higher ISO index indicates a greater degree of imbalance among industries.

-

(3)

Green technology innovation (GTI) is measured following the approach presented by Wang et al. (2023a), using the number of green patents granted in the respective year.

Data sources

This study is grounded in balanced panel data from 30 Chinese provinces spanning from 2006 to 2019. The primary methodology employed is the SYS-GMM technique, aimed at investigating the impact of OFDI on CEE. The OFDI stock and flow data are sourced from the China Outward Foreign Direct Investment Statistical Bulletin.Footnote 3 The carbon emission data for calculating CEE are procured from Carbon Emission Accounts and Datasets (CEADs) (Guan et al. 2021; Shan et al. 2018, 2020). The green patent authorization data are extracted from the CNOpenData database.Footnote 4 Other pertinent data are derived from China Statistical Yearbooks and China Energy Statistical Yearbooks (NBS 2020, 2022). The statistical description of all variables is listed in Table 1.

Empirical results and discussion

Characteristics of OFDI and CEE

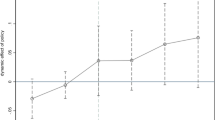

This study offers an analysis of the spatial distribution and temporal dynamics of China’s OFDI and CEE, as illustrated in Fig. 1. Over time, the overall trend of China’s OFDI flow exhibits a rapid ascension. From 2006 to 2019, the OFDI flow surged from $17.634 billion to $116.958 billion, translating to an annual growth rate of 15.67%. Regionally, the eastern areas notably outperform their western counterparts, particularly the coastal regions in the eastern and southeastern parts, where OFDI flow commands a leading position nationwide. This can be attributed to the rapid economic development and favorable geographical locations in these regions, which provide both economic and environmental foundations for engaging in OFDI (Duan et al. 2020). At the provincial level, Guangdong province and Shanghai municipality stand out as the highest OFDI flow contributors, with 2019 OFDI flows reaching $16.699 billion and $10.492 billion, respectively. Notably, within Guangdong province, Shenzhen’s OFDI stock attains $9.359 billion, accounting for 56.05%. This is predominantly attributed to the fact that Shenzhen, as an early window to China’s opening-up policies, and Shanghai, as a financial center, offer unique opportunities and facilitative conditions for enterprises to expand overseas (He 2019). In contrast, China’s provinces with lower OFDI flow in 2019 are Guizhou (14.34 million dollars), Qinghai (50.31 million dollars), and Shanxi (63.33 million dollars). These areas are all inland areas, which do not have location advantages in the OFDI process.

The CEE, overall, demonstrates a conspicuous upward trajectory. In 2007, nearly all provinces in China exhibit CEE values below 1.2. However, by 2019, a majority of provinces report CEE values surpassing 1.6. This phenomenon stems primarily from two interrelated factors. On the one hand, the application of new technologies has elevated enterprise production efficiency and energy utilization efficacy (Liao and Ren 2020). On the other hand, the Chinese government has actively undertaken measures to phase out energy-intensive industries and outdated capacities while vigorously promoting the development of clean energy and environmentally friendly industries (Hou et al. 2011). More specifically, in 2019, Beijing (2.26), Tianjin (2.44), Hunan (2.84), and Sichuan (2.71) emerge as the regions with the highest CEE in China. Beijing and Tianjin are both direct-administered municipalities that hold prominent economic positions and a lesser presence of high-energy-consuming industries, thus contributing to their elevated CEE. Hunan and Sichuan owe their high CEE to their robust utilization of renewable energy resources, exemplified by the establishment of the Three Gorges Dam and the Wuqiangxi Hydropower Station. These two provinces have significantly boosted CEE by continuously augmenting the proportion of renewable energy within their energy structures.

Benchmark regression

Furthermore, this study conducts an analysis of the impact of OFDI on carbon emissions and CEE. Table 2 presents the benchmark regression results. In particular, columns (1) and (3) display the regression outcomes utilizing OFDI flow data, while columns (2) and (4) depict the regression results using OFDI stock data. The test results reveal that the p values for the AR(1) statistics across all regression results are below 0.1. Moreover, the p values for both the AR(2) and Hansen tests are above 0.1. This attests to the effectiveness of the chosen instrumental variables, affirming the reliability of the SYS-GMM model. Additionally, the coefficients of the lagged terms for \(\mathrm{lnCE}\) and \(\mathrm{lnCEE}\) are significantly positive at the 1% level, indicating that carbon emissions and CEE exhibit inertia. This signifies that the carbon emissions and emission efficiency of the previous period significantly influence the carbon emissions and emission efficiency of the current period.

In column (1), the coefficient for \(\mathrm{lnOFDI}\) is significantly negative at the 1% level, with a value of − 0.030. This suggests that a 1% increase in China’s OFDI flow is associated with a 0.030% decrease in carbon emissions. Consistently, column (2) results using OFDI stock data also yield similar findings. This also aligns with the conclusions of Zhou et al. (2019). It is mainly because the structural and technological effects of OFDI can promote the high-quality transformation of industries in the home country, thereby promoting the transformation of the industrial model from high energy consumption and high emissions to low energy consumption and emissions. The negative impact of OFDI on China’s carbon emissions also highlights the constructive role of China’s “Going Global” strategy in facilitating domestic carbon reduction efforts and advancing the attainment of dual carbon objectives.

In both columns (3) and (4), the coefficient for \(\mathrm{lnOFDI}\) is statistically significant and positive, implying that OFDI has the capacity to enhance China’s CEE. A 1% increase in OFDI flow corresponds to a 0.009% improvement in CEE. This finding aligns with the outcomes of Cheng et al. (2022). The principal reasons behind this phenomenon can be delineated as follows. First, OFDI can generate economies of scale (Hao et al. 2020). Through mechanisms such as mergers, acquisitions, and joint ventures during the process of foreign direct investment, companies can expand their market share and resource base, thereby augmenting production capacity and efficiency. This optimization of production scale can lead to reduced production costs and carbon emission intensity, ultimately enhancing CEE. Second, OFDI is associated with reverse technology spillover effects (Fahad et al. 2022; Pan et al. 2020). Throughout the process of foreign direct investment, firms can learn and adopt advanced environmental protection technologies and management expertise from overseas (Hao et al. 2020). The introduction of these technologies and practices can aid in refining production processes and elevating energy utilization efficiency, subsequently bolstering CEE in the home country (Bai et al. 2020). Lastly, OFDI also encompasses structural adjustment effects (Huang 2021). Within the foreign direct investment framework, companies can choose to invest in environmentally friendly sectors like renewable energy and energy conservation, thereby facilitating the transition of the domestic energy structure towards low-carbon and green directions, leading to emissions reduction and heightened CEE (Dai et al. 2021).

Upon examining the outcomes of the control variables, it becomes evident that the coefficients for \(\mathrm{lnPGDP}\) and \(\mathrm{lnIND}\) are both statistically significant and positive. This observation suggests that an increase in per capita GDP and a higher proportion of the tertiary sector can significantly enhance CEE (Sun et al. 2022; Wang et al. 2012; Yu et al. 2020). This phenomenon is predominantly attributed to the concurrent expansion of businesses with economic growth, leading to the adoption of novel equipment and specialized division of labor. These dynamics ultimately contribute to heightened production and energy utilization efficiency, consequently augmenting CEE. Furthermore, the dominance of the tertiary sector by service industries implies lower energy consumption while generating increased economic output. As the proportion of the tertiary sector advances, the corresponding improvement in CEE within the region becomes significant. The coefficient for \(\mathrm{lnURB}\) is significantly negative at the 1% level, indicating that an increase in the urbanization rate diminishes CEE (Li et al. 2022; Sun and Huang 2020). In recent years, China’s urbanization rate has rapidly escalated, surging from 43.9% in 2006 to 60.6% in 2019. The augmentation in urban population has escalated energy demands, leading to a substantial rise in fossil fuel consumption. Additionally, heightened urbanization rates accelerate infrastructure construction in urban areas (Liu et al. 2015), further exacerbating fossil fuel usage and inducing an escalation in pollution and emissions. Consequently, the surge in urbanization rates results in substantial fossil fuel consumption lowering CEE.

Robustness checks

To validate the robustness of the benchmark regression outcomes, this study undertakes three approaches for robustness testing. First, drawing from the research by Wang et al. (2022b), we employ the super-efficiency SBM model to compute CEE, subsequently re-conducting the regression as depicted in column (1) of Table 3. Second, we replace the estimation method by substituting the SYS-GMM technique with the difference-generalized method of moments (DIFF-GMM) technique for re-estimation, as put forth by Zhao et al. (2022b). The results are presented in column (2) of Table 3. Lastly, we employ a technique of control variable substitution for robustness testing. We utilize the proportion of value added from the tertiary sector to represent industrial structure and conduct the estimation, as showcased in column (3) of Table 3.

Upon scrutiny of the regression outcomes, it becomes evident that irrespective of the employed methodologies, the coefficient for \(\mathrm{lnOFDI}\) consistently remains significantly positive at the 1% level, corroborating the benchmark regression results. This consistent finding across different methodologies affirms the robustness of the benchmark regression results.

Mediating mechanism tests

Furthermore, we delve into the mechanisms through which OFDI influences CEE. This study explores three potential pathways: GTFP, industrial structure optimization, and green technology innovation.

First, the mechanism effect of GTFP is discussed in columns (1) and (2) of Table 4. In column (1), the coefficient for \(\mathrm{lnOFDI}\) is significantly positive (0.007), indicating that an increase in OFDI promotes the enhancement of domestic GTFP. This aligns with similar findings by Liu et al. (2022). In column (2), the coefficient for \(\mathrm{lnGTFP}\) is also significantly positive (0.439), suggesting that a 1% increase in GTFP results in a 0.439% improvement in CEE. These outcomes collectively underscore the crucial mediating role of GTFP in the process through which OFDI affects CEE. This phenomenon is attributed to various factors. First, through OFDI, companies can introduce advanced technologies and management expertise domestically, thereby elevating resource utilization efficiency and environmental management levels, consequently driving the enhancement of GTFP (Hao et al. 2021; Zhao et al. 2022c). Second, given the stringent environmental regulations in some host countries, Chinese firms might intensify their investments in green production during the OFDI process to comply with local environmental standards (Feng et al. 2018), consequently boosting GTFP. An increase in GTFP implies companies adopting cleaner energy sources, employing low-carbon environmental technologies, and formulating sustainable development strategies (Tao et al. 2023). These affirmative measures also contribute to elevating a company’s CEE.

Subsequently, columns (3) and (4) of Table 4 investigate the mechanism effect of industrial structure optimization. In column (3), the coefficient for \(\mathrm{lnOFDI}\) is significantly negative (− 0.027), indicating that an increase in OFDI is conducive to optimizing the domestic industrial structure. This concurs with the findings of Hao et al. (2020). In column (4), the coefficient for \(\mathrm{lnISO}\) is significantly negative (− 0.046), signifying that a 1% decrease in the industrial structure optimization index results in a 0.046% increase in the CEE of the home country. Similar conclusions are drawn by Guo et al. (2022). These outcomes collectively reveal the mediating role of industrial structure optimization in the process through which OFDI influences CEE. This phenomenon is attributed to several factors. In recent years, Chinese companies have engaged in the global value chain through OFDI, seeking optimal resource allocation and market layouts on a global scale. This engagement forms complementary advantages with foreign enterprises, consequently further optimizing the domestic industrial structure. The optimization of industrial structure not only favors the development of clean industries and resource recycling but also signifies the application of more advanced and efficient production equipment, along with stricter pollution and emission control measures (Zhang et al. 2019). Thus, industrial structure optimization contributes to enhancing CEE.

Lastly, columns (5) and (6) of Table 4 examine the mechanism effect of green technology innovation. In column (5), the coefficient for \(\mathrm{lnOFDI}\) is significantly positive (0.041), indicating that OFDI can foster the elevation of technological innovation levels. This concurs with the findings of Ren et al. (2022). In column (6), the coefficient for \(\mathrm{lnGTI}\) is significantly positive at the 1% level (0.046), signifying that a 1% increase in green technology innovation levels leads to a 0.046% improvement in CEE. These results collectively establish the mediating effect of green technology innovation in the process through which OFDI influences CEE. Similar conclusions are drawn in the research by Zhang et al. (2023b). In recent years, China’s enterprises have undertaken extensive outward direct investments through the “Going Global” strategy, collaborating with numerous foreign enterprises to engage in green technology innovation research. This collaboration has facilitated the introduction of advanced green technologies domestically, promoting innovation and application of domestic green technologies (Zhang et al. 2023a). Green technology innovation is instrumental in fostering the substitution of clean energy sources, enhancing energy utilization efficiency, and optimizing low-carbon production processes (Dagestani 2022), thereby contributing to elevating CEE.

Furthermore, we have illustrated Fig. 2 to provide a more intuitive depiction of the mechanisms through which OFDI influences CEE.

Further discussion

In this section, the analysis of the asymmetry in the impact of OFDI on CEE is conducted using the panel quantile regression method. The methodology of panel quantile regression is elucidated in “Quantile regression for panel data (QRPD)”. Subsequently, “Results of asymmetric checks” presents the findings regarding the asymmetrical effects of OFDI on CEE.

Quantile regression for panel data (QRPD)

Koenker and Bassett (1978) introduce quantile regression, primarily used to examine the asymmetrical characteristics of the distribution of outcome variables. Powell (2022) refines this approach and introduces quantile regression for panel data (QRPD) with non-additive fixed effects. In comparison to other methods of heterogeneity analysis, utilizing panel quantile regression helps mitigate biases arising from evident peaks or fat tails in the data, rendering the estimation results more robust. The model for panel quantile regression is as follows:

where \({\eta }_{0\uptau }\) is the constant term; \({\eta }_{1\uptau }\cdots {\eta }_{5\uptau }\) represent the estimated coefficients; \(X\) denotes a set of control variables; \({\sigma }_{i}\) indicates individual fixed effects; \({\mu }_{t}\) denotes time fixed effects. This model employs the Markov Chain Monte Carlo (MCMC) optimization method for estimation (Powell 2022).

Results of asymmetric checks

This study employs the aforementioned panel quantile method to explore the asymmetry in the impact of OFDI on CEE. Results from Table 5 indicate that at the 20th, 40th, and 60th quantiles, OFDI has a significant positive impact on CEE, while its effect on CEE is not significant at the 80th quantile. This suggests that the role of OFDI in enhancing CEE is more pronounced in regions with lower CEE, while its ability to promote efficiency in areas with already high CEE is limited. Provinces in China with lower CEE include Ningxia, Jilin, Qinghai, Shanxi, and Inner Mongolia. These areas often rely on heavy industries and resource extraction. Foreign direct investment can bring advanced technologies, facilitate industrial restructuring, and enhance total factor productivity, thus contributing to improving CEE (Gao et al. 2021). In contrast, provinces with higher CEE are usually economically developed areas, such as Hunan and Sichuan. On the one hand, these regions have better trade and services, so their carbon emissions are relatively low (Razzaq et al. 2023; Shen et al. 2023). On the other hand, these regions have paid attention to environmental and climate issues early on and have already made a lot of contributions to reducing emissions (Cao et al. 2023; Tao and Goh 2022). Therefore, further increases in OFDI may not significantly enhance CEE in these provinces.

Conclusions and policy implications

This study employs the SYS-GMM method based on panel data from China spanning 2006 to 2019 to primarily investigate the influence of OFDI on the CEE of the home country. Additionally, it explores the mechanisms behind OFDI’s impact on CEE and examines potential asymmetry. The key conclusions are as follows: (1) China’s OFDI exhibits an overall increasing trend over time, with higher OFDI flows observed in the eastern and southeastern coastal regions and relatively lower flows in the western regions. (2) The increase in OFDI has a positive effect on domestic carbon reduction efforts and significantly enhances CEE. (3) Mechanism analysis reveals that the increase in OFDI contributes to improving the home country’s CEE through mechanisms like elevating GTFP, promoting industrial structure optimization, and boosting green technology innovation. (4) The impact of OFDI on the home country’s CEE displays asymmetry, with a notable enhancement in areas with lower CEE, whereas the effect is less pronounced in regions with higher CEE.

Based on the aforementioned findings, this paper proposes the following policy recommendations.

First, considering the effective role of OFDI in promoting carbon emission reduction and enhancing CEE, the Chinese government should persistently advance the “Going Global” strategy. By facilitating the introduction of new technologies and management practices, the government can enhance CEE and contribute to the timely realization of the dual-carbon goals. On the one hand, the government should implement a series of supportive measures, including offering tax incentives, export credits, and export credit insurance, while establishing dedicated support funds. On the other hand, the government should leverage the informational advantage of diplomatic missions abroad, providing domestic enterprises with vital investment information about foreign countries’ legal frameworks, tax policies, market conditions, and corporate credit, thereby furnishing essential information support for Chinese enterprises’ overseas endeavors. Furthermore, there should be incentives to encourage enterprises to selectively invest in low-carbon industries such as renewable energy, energy conservation, and environmental protection, thereby accumulating experiences for the development of relevant industries in China.

Furthermore, based on the mediating roles of GTFP, industrial structure optimization, and green technological innovation, the Chinese government can establish a green enterprise evaluation system to assess and certify enterprises’ levels of green production. Through the disclosure of evaluation results and the implementation of reward and penalty mechanisms, enterprises can be incentivized to actively enhance their GTFP. Additionally, the government should formulate industrial policies that encourage the optimization of industrial structure by reducing the proportion of high-carbon industries and increasing investments in clean energy and environmental protection sectors. Concurrently, stringent emissions control measures should be imposed on high-carbon industries, fostering their transition towards green transformation to improve CEE. Moreover, the government should intensify financial support for green technological innovation by establishing dedicated funds to promote research and application of green technologies. Facilitating technology transfer and knowledge sharing can facilitate the active absorption and application of advanced green technologies by domestic enterprises.

Lastly, due to the asymmetric impact of OFDI on domestic CEE, the government should take regional disparities into full consideration when formulating policy measures. For regions with lower CEE, the government should actively encourage enterprises to engage in OFDI, relax entry conditions, and enhance policy support. By leveraging OFDI, these regions can adjust their industries and energy structures, contributing to achieving carbon peak and carbon neutrality. In contrast, for regions with higher CEE, the government can urge them to undergo a more profound green transformation. This entails further increasing the proportion of renewable energy in the energy mix, introducing stricter environmental regulations and carbon emission control measures, thus expediting the attainment of carbon peak and carbon neutrality objectives.

Data Availability

The data that support the findings of this study are available from the corresponding author upon reasonable request.

References

Bai Y, Qian Q, Jiao J, Li L, Li F, Yang R (2020) Can environmental innovation benefit from outward foreign direct investment to developed countries? Evidence from Chinese manufacturing enterprises. Environ Sci Pollut Res 27:13790–13808

Baron RM, Kenny DA (1986) The moderator–mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J Pers Soc Psychol 51:1173

Cao J, Law SH, Wu D, Yang X (2023) Impact of local government competition and land finance on haze pollution: empirical evidence from China. Emerg Mark Finance Trade 59:3877–3899

Chen Z, Song P, Wang B (2021) Carbon emissions trading scheme, energy efficiency and rebound effect – evidence from China’s provincial data. Energy Policy 157:112507

Cheng P, Huan X, Choi B (2022) The comprehensive impact of outward foreign direct investment on China’s carbon emissions. Sustainability 14:16116

Dagestani AA (2022) An analysis of the impacts of COVID-19 and freight cost on trade of the economic belt and the maritime silk road. IUST 33:1–16

Dagestani AA, Qing L, Abou Houran M (2022) What remains unsolved in sub-African environmental exposure information disclosure: a review. J Risk Financ Manag 15:487

Dai L, Mu X, Lee C-C, Liu W (2021) The impact of outward foreign direct investment on green innovation: the threshold effect of environmental regulation. Environ Sci Pollut Res 28:34868–34884

Dong F, Li Y, Gao Y, Zhu J, Qin C, Zhang X (2022) Energy transition and carbon neutrality: exploring the non-linear impact of renewable energy development on carbon emission efficiency in developed countries. Resour Conserv Recycl 177:106002

Duan W, Zhu S, Lai M (2020) The impact of COVID-19 on China’s trade and outward FDI and related countermeasures. J Chin Econ Bus Stud 18:355–364

Fahad S, Bai D, Liu L, Dagar V (2022) Comprehending the environmental regulation, biased policies and OFDI reverse technology spillover effects: a contingent and dynamic perspective. Environ Sci Pollut Res 29:33167–33179

Feng Z, Zeng B, Ming Q (2018) Environmental regulation, two-way foreign direct investment, and green innovation efficiency in China’s manufacturing industry. Int J Environ Res Public Health 15:2292

Gao Y, Zhang M, Zheng J (2021) Accounting and determinants analysis of China’s provincial total factor productivity considering carbon emissions. China Econ Rev 65:101576

Ge G, Tang Y, Zhang Q, Li Z, Cheng X, Tang D, Boamah V (2022) The carbon emissions effect of China’s OFDI on countries along the “Belt and Road”. Sustainability 14:13609

Guan Y, Shan Y, Huang Q, Chen H, Wang D, Hubacek K (2021) Assessment to China’s recent emission pattern shifts. Earth’s Future 9:e2021EF002241

Guo X, Wang X, Wu X, Chen X, Li Y (2022) Carbon emission efficiency and low-carbon optimization in Shanxi Province under “Dual Carbon” background. Energies 15:2369

Hao Y, Guo Y, Guo Y, Wu H, Ren S (2020) Does outward foreign direct investment (OFDI) affect the home country’s environmental quality? The case of China. Struct Chang Econ Dyn 52:109–119

Hao Y, Ba N, Ren S, Wu H (2021) How does international technology spillover affect China’s carbon emissions? A new perspective through intellectual property protection. Sustain Prod Consum 25:577–590

He B (2019) The status and roles of special economic zones in China’s unbalanced development. Springer Singapore, Singapore, pp 69–103

Hou J, Zhang P, Tian Y, Yuan X, Yang Y (2011) Developing low-carbon economy: actions, challenges and solutions for energy savings in China. Renewable Energy 36:3037–3042

Huang W (2021) Research on the impact of investment efficiency of China’s commercial economy on industrial structure adjustment based on cloud computing. IEEE Sens J 21:25525–25531

Jalil A, Rauf A, Sikander W, Yonghong Z, Tiebang W (2021) Energy consumption, economic growth, and environmental sustainability challenges for Belt and Road countries: a fresh insight from “Chinese Going Global Strategy”. Environ Sci Pollut Res 28:65987–65999

Knoerich J (2017) How does outward foreign direct investment contribute to economic development in less advanced home countries? Oxf Dev Stud 45:443–459

Koenker R, Bassett Jr G (1978) Regression quantiles. Econometrica: J Econ Soc 33–50

Li R, Li L, Wang Q (2022) The impact of energy efficiency on carbon emissions: evidence from the transportation sector in Chinese 30 provinces. Sustain Cities Soc 82:103880

Liao M, Ren Y (2020) The ‘double-edged effect’ of progress in energy-biased technology on energy efficiency: a comparison between the manufacturing sector of China and Japan. J Environ Manage 270:110794

Liu Y, Luo T, Liu Z, Kong X, Li J, Tan R (2015) A comparative analysis of urban and rural construction land use change and driving forces: implications for urban–rural coordination development in Wuhan, Central China. Habitat Int 47:113–125

Liu H, Peng C, Chen L (2022) The impact of OFDI on the energy efficiency in Chinese provinces: based on PVAR model. Energy Rep 8:84–96

Liu Y, Wang J, Dong K, Taghizadeh-Hesary F (2023) How does natural resource abundance affect green total factor productivity in the era of green finance? Global evidence. Resour Policy 81:103315

Mohsin M, Kamran HW, Atif Nawaz M, SajjadHussain M, Dahri AS (2021) Assessing the impact of transition from nonrenewable to renewable energy consumption on economic growth-environmental nexus from developing Asian economies. J Environ Manage 284:111999

NBS (2020) China energy statistical yearbook. China Statistics Press, Beijing

NBS (2022) China statistical yearbook. China Statistics Press, Beijing

Oh D-H (2010) A global Malmquist-Luenberger productivity index. J Prod Anal 34:183–197

Pan X, Li M, Wang M, Chu J, Bo H (2020) The effects of outward foreign direct investment and reverse technology spillover on China’s carbon productivity. Energy Policy 145:111730

Pan X, Chu J, Tian M, Li M (2022) Non-linear effects of outward foreign direct investment on total factor energy efficiency in China. Energy 239:122293

Powell D (2022) Quantile regression with nonadditive fixed effects. Empirical Economics 63:2675–2691

Razzaq A, Sharif A, Ozturk I, Yang X (2023) Central inspections of environmental protection and transition for low-carbon Chinese cities: policy intervention and mechanism analysis. Energy Econ 124:106859

Ren S, Hao Y, Wu H (2022) The role of outward foreign direct investment (OFDI) on green total factor energy efficiency: does institutional quality matters? Evidence from China. Resour Policy 76:102587

Shan Y, Guan D, Zheng H, Ou J, Li Y, Meng J, Mi Z, Liu Z, Zhang Q (2018) China CO2 emission accounts 1997–2015. Sci Data 5:170201

Shan Y, Huang Q, Guan D, Hubacek K (2020) China CO2 emission accounts 2016–2017. Sci Data 7:54

Shen B, Yang X, Xu Y, Ge W, Liu G, Su X, Zhao S, Dagestani AA, Ran Q (2023) Can carbon emission trading pilot policy drive industrial structure low-carbon restructuring: new evidence from China. Environ Sci Pollut Res 30:41553–41569

Shinwari R, Wang Y, Maghyereh A, Awartani B (2022) Does Chinese foreign direct investment harm CO2 emissions in the Belt and Road Economies. Environ Sci Pollut Res 29:39528–39544

Song W, Mao H, Han X (2021) The two-sided effects of foreign direct investment on carbon emissions performance in China. Sci Total Environ 791:148331

Su K, Wei D-Z, Lin W-X (2020) Influencing factors and spatial patterns of energy-related carbon emissions at the city-scale in Fujian province, Southeastern China. J Clean Prod 244:118840

Sun W, Huang C (2020) How does urbanization affect carbon emission efficiency? Evidence from China. J Clean Prod 272:122828

Sun Y, Qian L, Liu Z (2022) The carbon emissions level of China’s service industry: an analysis of characteristics and influencing factors. Environ Dev Sustain 24:13557–13582

Tan J, Wang R (2021) Research on evaluation and influencing factors of regional ecological efficiency from the perspective of carbon neutrality. J Environ Manage 294:113030

Tao M, Dagestani AA, Goh LT, Zheng Y, Le W (2023) Do China’s anti-corruption efforts improve corporate productivity? A difference-in-difference exploration of Chinese listed enterprises. Socioecon Plann Sci 87:101594

Tao M, Goh LT (2022) Threshold effect of environmental regulation on eco-friendly productivity: empirical evidence from China. Asian Econ Lett 4

Ullah S, Akhtar P, Zaefarian G (2018) Dealing with endogeneity bias: the generalized method of moments (GMM) for panel data. Ind Mark Manage 71:69–78

Walter I, Ugelow JL (1979) Environmental policies in developing countries. Ambio 102–109

Wang Z, Yin F, Zhang Y, Zhang X (2012) An empirical research on the influencing factors of regional CO2 emissions: evidence from Beijing city, China. Appl Energy 100:277–284

Wang G, Deng X, Wang J, Zhang F, Liang S (2019) Carbon emission efficiency in China: a spatial panel data analysis. China Econ Rev 56:101313

Wang J, Dong X, Dong K (2021) How renewable energy reduces CO2 emissions? Decoupling and decomposition analysis for 25 countries along the Belt and Road. Appl Econ 53:4597–4613

Wang J, Dong K, Dong X, Taghizadeh-Hesary F (2022a) Assessing the digital economy and its carbon-mitigation effects: the case of China. Energy Econ 113:106198

Wang J, Dong K, Sha Y, Yan C (2022b) Envisaging the carbon emissions efficiency of digitalization: the case of the internet economy for China. Technol Forecast Soc Chang 184:121965

Wang Q, Zhao T, Wang R (2022c) Carbon neutrality ambitions and reinforcing energy efficiency through OFDI reverse technology spillover: evidence from China. Pol J Environ Stud 31:315–328

Wang J, Dong X, Dong K (2023a) Does renewable energy technological innovation matter for green total factor productivity? Empirical evidence from Chinese provinces. Sustainable Energy Technol Assess 55:102966

Wang M, Liu J, Rahman S, Sun X, Sriboonchitta S (2023b) The effect of China’s outward foreign direct investment on carbon intensity of Belt and Road Initiative countries: a double-edged sword. Economic Analysis and Policy 77:792–808

Wang Q, Wang R, Liu S (2023c) The reverse technology spillover effect of outward foreign direct investment, energy efficiency and carbon emissions. Environ Dev Sustain

Wen S, Jia Z, Chen X (2022) Can low-carbon city pilot policies significantly improve carbon emission efficiency? Empirical evidence from China. J Clean Prod 346:131131

Wu R (2023) The carbon footprint of Chinese multinationals’ foreign affiliates. Carbon Manag 14:2236068

Yang T, Dong Q, Du Q, Du M, Dong R, Chen M (2021) Carbon dioxide emissions and Chinese OFDI: from the perspective of carbon neutrality targets and environmental management of home country. J Environ Manage 295:113120

You J, Ding G, Zhang L (2022) Heterogeneous dynamic correlation research among industrial structure distortion, two-way FDI and carbon emission intensity in China. Sustainability 14:8988

Yu X, Wu Z, Zheng H, Li M, Tan T (2020) How urban agglomeration improve the emission efficiency? A spatial econometric analysis of the Yangtze River Delta urban agglomeration in China. J Environ Manage 260:110061

Zarsky L (1999) Havens, halos and spaghetti: untangling the evidence about foreign direct investment and the environment. Foreign Direct Investment and the Environment 13:47–74

Zhang M, Liu Y (2022) Influence of digital finance and green technology innovation on China’s carbon emission efficiency: empirical analysis based on spatial metrology. Sci Total Environ 838:156463

Zhang M, Liu X, Ding Y, Wang W (2019) How does environmental regulation affect haze pollution governance?—an empirical test based on Chinese provincial panel data. Sci Total Environ 695:133905

Zhang S, Shinwari R, Zhao S, Dagestani AA (2023a) Energy transition, geopolitical risk, and natural resources extraction: a novel perspective of energy transition and resources extraction. Resour Policy 83:103608

Zhang Z, Zhao Y, Cai H, Ajaz T (2023b) Influence of renewable energy infrastructure, Chinese outward FDI, and technical efficiency on ecological sustainability in belt and road node economies. Renewable Energy 205:608–616

Zhao H, Cao X, Ma T (2020) A spatial econometric empirical research on the impact of industrial agglomeration on haze pollution in China. Air Qual Atmos Health 13:1305–1312

Zhao J, Jiang Q, Dong X, Dong K, Jiang H (2022a) How does industrial structure adjustment reduce CO2 emissions? Spatial and mediation effects analysis for China. Energy Econ 105:105704

Zhao J, Wang J, Dong K (2022b) The role of green finance in eradicating energy poverty: ways to realize green economic recovery in the post-COVID-19 era. Econ Change Restruct

Zhao S, Tian W, Dagestani AA (2022c) How do R&D factors affect total factor productivity: based on stochastic frontier analysis method. Econ Anal Lett 1

Zhou Y, Fu J, Kong Y, Wu R (2018) How foreign direct investment influences carbon emissions, based on the empirical analysis of Chinese urban data. Sustainability 10:2163

Zhou Y, Jiang J, Ye B, Hou B (2019) Green spillovers of outward foreign direct investment on home countries: evidence from China’s province-level data. J Clean Prod 215:829–844

Zhou X, Guo Q, Zhang M (2021) Impacts of OFDI on host country energy consumption and home country energy efficiency based on a Belt and Road perspective. Energies 14:7343

Funding

The article is sponsored by “The Postgraduate Innovative Research Fund” of University of International Business and Economics (Grant No. 202316).

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation, data collection, and analysis were performed by S.Y. and H.G. The first draft of the manuscript was written by S.Y. and J.W., and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethical approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

The corresponding author on behalf of all co-authors agreed to publish in Environmental Science and Pollution Research.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: V.V.S.S. Sarma

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Yang, S., Gong, H. & Wang, J. The carbon reduction effect of “Going Global” strategy: an empirical perspective on the carbon emission efficiency of OFDI in China. Environ Sci Pollut Res 30, 117998–118012 (2023). https://doi.org/10.1007/s11356-023-30410-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-30410-1