Abstract

The focus areas for COP-27 include fast-tracking our worldwide evolution to decarbonization in the energy industry and clean energy as the stockholder’s effort to restrict global warming to 1.5 °C (2.7 °F) above the levels of pre-industrial. After this COP-27 summit, most of the developing countries will provoke challenges in accomplishing their targets of a carbon neutrality and sustainable economy with the minimum possible greenhouse gas (GHG) emissions. In this regard, the G-7 countries, despite prosperous cautiously, have not prospered in certifying ecological welfare in tandem. Nevertheless, these economies cannot endure their green growth attainments without instantaneously safeguarding their ecological features. To do this, green technologies and environmental taxes are vital apparatuses that can assist in accomplishing carbon neutrality objectives. Consequently, the current study investigates the influence of green technologies, environmental taxes, natural resources, renewable, and fossil fuel energy on GHG emissions in G-7 nations from 1994 to 2020. After confirming the cross-sectional dependency issue, this study uses a battery of second-generation panel methods to estimate the empirical findings. The estimated evidences discovered that green technologies, environmental taxes, and renewable protect environmental quality in the long run. However, natural resources and fossil fuel energy increase the GHG emissions levels. Furthermore, this study suggests that G-7 economies should be more focus on green technologies, imposing environmental taxes eco-innovation related developments, and promote renewable energy projects through the sustainable alteration of their consumption and production processes.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Green approaches can be a treatment for a polluted atmosphere. Green methods depend on nature-oriented cleaner energy resources, therefore rising obtaining sustainable development goals (SDGs) (Khan et al. 2018; Usman and Balsalobre-Lorente 2022). Owing to continuing issue of ecological dilapidation, environmentalists strain that economies have reconditioned their outdated business processes with green technologies, environmental taxes. and protected the world from the mist of environmental pollution (Sharif et al. 2023). Reasonably, the elements elaborated in the procedures of technology expansion and the mechanisms complicated in green technology have scarcer undesirable influence on the atmosphere. Rendering to the novel study of Liu et al. (2022), features arriving with green technology and environmental taxes alleviate carbon emissions (CO2) emissions and predominantly decrease environmental that unfavorably influence human life and natural resources. In this regard, research and development (R&D) sections demonstrate that revolution in green technology offers ultra-modern structures that are fewer emission-intensive and avoids consumptions in the raw ingredients form, gases, and water. These attachments upsurge the productivity and effectiveness level of individual firms (Balsalobre-Lorente et al. 2023; Huang et al. 2023). Nevertheless, prodigies of green technology and environmental taxes not solitary promise to upper-level practical developments but protection the commercial and domestic level occupational business to sustain their particular technologies. This philosophy has been flawlessly comprised by advanced economies, for instance G-7Footnote 1 economies (Hao et al. 2021) that encourage socially reasonable applications, which devour the slightest probable energy and develop the uppermost ecological expertise exporters.

The European Green Deal (EGD) covers whole subdivisions of the existing economies, particularly buildings, energy, transport, industries, and agriculture, for example, steel, ICT, cement, chemicals, and textiles. To customary into legislature the radical determination of being the world’s primary environmental neutrality continent by 2050, the directive will contemporary within first hundred days “European Climate Law.” To influence our ecological and climate determination, the directive will also explore the biodiversity approach for the years 2030, the novel Industrial Strategy and Circular Economy Action Plan (ISCEAP) especially linked with G-7 economies because many of the economies are from European Union (EU), and this proposals for carbon-free Europe. Conference the major purposes of the EGD will necessitate momentous investment. Accomplishing the existing 2030 energy and climate goals is projected to need €260 billion of extra yearly investment, on behalf of about 1.5% of 2018 economic growth. Particularly, in this, investment will essential the deployment of the private and public sectors. The main commission will contemporary in early 2020 a Sustainable Europe Investment Plan (SEIP) to support encounter investment requirements. As a minimum of the 25% of the EU’s long-run economical budget should be enthusiastic to the European Investment Bank, European climate action, Europe’s climate bank, will deliver additional sustenance. For the private division to subsidise and supporting the green evolution, the central commission will discover a Green Financing plan during the year of 2020 (Saqib and Usman 2023). The universal challenges of ecological deprivation and climate change necessitate a worldwide response. In this circumstance, the EU community will continue to endorse its ecological standards and targets in the United Nation’s biodiversity and environmental conventions and support its green international relations. The G-7, bilateral relationships, and universal agreements will be used to encourage others to increase their works. Moreover, the EU will also practise trade policy to confirm sustainability and it will shape corporations with its neighbours in the Africa and Balkans to support them with their individual evolutions (Wang et al. 2023a).

A similar method, for example an environmental tax, is carried frontward with socioeconomic designers on high-consuming power apparatus to boost the accrued prices of production (Safi et al. 2021) but concurrently increase the green technological development (Wang et al. 2023a). Likewise, economic growth reduces due to financial responsibilities on tax increases (Sharif et al. 2023). Although blockades to ecological taxes reduce trading activities and tourism development in the short term, constructive developments are certain in the long term. Numerous studies affirm that countries levy environmental taxes on non-renewable energy with the assistance of a down-top demand for energy model if they are economically stable and proactive to embellishment green economic actions and events (Trencher et al. 2021; Doğan et al. 2022; Saqib and Usman 2023). Therefore, applying these taxes diminish an adverse atmospheric issues externality (Sharif et al. 2023) and encourages the well-organized and effectual green energies production in the course of nature-friendly and carbon-free technologies (Usman and Radulescu 2022).

Particularly to the G-7 countries, Canada is rich in natural resources, including oil, natural gas, minerals, and forests and France has limited natural resources, but it has significant reserves of uranium, which is used to fuel its nuclear power plants. Moreover, Germany has significant reserves of lignite coal, which has been a major source of energy for the country. Besides, Italy has limited natural resources, but it has significant reserves of natural gas, which is used to fuel its electricity generation and similarly; Japan has also limited natural resources and relies heavily on imports for its energy needs, including oil, natural gas, and coal. Moreover, the UK has significant reserves of oil and natural gas in the North Sea, which have been a major source of energy for the country and the US is also rich in natural resources, including oil, natural gas, coal, minerals, and forests. It is one of the world’s largest producers of oil and natural gas.

The previous literature in the existing literature reports vague results concerning the role of environmental technologies and environmental taxes (Doğan et al. 2022; Sun et al. 2023; Uddin et al. 2023; Zeraibi et al. 2023). These studies overlook the diminishing character of environmental technologies and environmental taxes in the energy mix transition with the presence of natural resources. Consequently, it is important to examine these aspects and postulate environment based economic and environmental policy proposals to diminish the overall level of environmental pollution without hurting the pace of economic growth trajectory for the G-7 nations. A conclusive policy approach is essential to support the G-7 economies to decrease the level of GHG emissions by implementing carbon taxation. Nevertheless, there are considerable dissimilarities across nations in examining strategies on the apparatuses of carbon taxes. Discovering the influence of the environmental tax is an indispensable condition to accomplishing a reliable standard of the influence on GHG emissions. According to the (Doğan et al. 2022) there are extensive differences in carbon pricing and environmental taxes across nations, prominent in the differences in tasks across nations to accomplish the targets of Paris Agreement summit. In this regard, the observed and estimated analysis of this study explores that the implementation of ecological taxes and green environmental technologies can augment climate wellbeing and substitute technical complexity and the utilization of energy from renewable and alternative sources, and its conclusions can argument to appropriate policy inferences for sustainable environmental expansion.

The contribution and novelty of this study to the literature of environmental economics is mainly three-fold. Initially, to the authors imperfect knowledge, none of the single studies examines the role of green technologies and environmental taxes in greenhouse gas (GHG) emissions. This research employed the up-to-date and developed available data (1994–2020) from G-7 nations and examined whether patents on environmental technologies has slightly role in nourishing GHG emissions. Moreover, the G-7 nations requires high level of eco-innovation, innovation, renewable, and fossil fuel energy use fulfil this need without emitting GHG emission and ecological taxes also confine the societies and institutions to produce elevated GHG emissions level. Consequently, a required pragmatic study also synthesizes the role of environment taxes, natural resources, renewable and fossil fuel energy utilization, and expansion of green technologies in amplification GHG emissions and it would be a valuable accumulation to the present literature body. Third, the present research increases the consideration of how environmental green technologies and natural resource diminish GHG emissions and subsequent ecological contamination in G-7 nations. Fourth, this study investigates what the role of renewable energy and environment-related taxes in dipping carbon emissions, offering a basis for G-7 nations to regulate the efficiency of their system of environmental tax and make obligatory modifications. Fifth, in order to address the issue of possible slope heterogeneity and cross-sectional dependency, this research employed the most lasted panel data approach (AMG and CCEMG) to accomplish the above-mentioned objectives. These approaches have the distinguishing of reliable that produced robust estimated evidences. Inclusively, the present study offers an empirical basis for redesigning actual planning for strategies of climate change and global warming, thus allowing the G-7 countries to accomplish their ecological sustainability targets. Following are the basic research questions of this study:

-

1)

Does green technology help in GHG emission reduction in G-7 countries?

-

2)

Do environmental taxes and assistance in GHG emission reduction in G-7 countries?

-

3)

Does renewable energy support in GHG emission reduction in G-7 countries?

-

4)

Do natural resources and fossil fuel energy increase the GHG emission levels in G-7 countries?

Literature review

The rising age of technologies transmutes the economies completely, and modern living standards ways arouse adversities and flexibility. The same materializes when technological expansion increase, ecological decay boost, and natural resources decreases appear apparent. Consequently, Shan et al. (2021) elevated this worldwide issue by stirring an adverse association of green technology with ecological damages. Similarly, Danish and Ulucak (2020) examined a system in the course of that environmental technologies influences the pace of green growth in BRICS economies. The empirical evidences show the carbon intensive resources use include direction over renewable and fossil fuel energy reduction. These findings encourage that green technologies contribute toward the increase of green growth, renewable/cleaner energy grounds a significant growth in green growth and, despite the fact fossil fuel energy, have a harmful influence. Likewise, Kilic and Cankaya (2020) unswerve a comparable influence that G-7 and BRICS bloc are prerequisite to invent innovations and techniques in their alternative and clean energy sector to increase the carbon-free environment. Even though it is remarkable that advanced green technologies definitely combat the adverse consequences of the environment, few studies second this element (Sharif et al. 2023; Ke et al. 2022; Wang et al. 2023a). In addition, Du and Li (2019) performed a research to regulate the singularity in the course of which modernizations in green technology influences the productivity of carbon and disclose an alteration between innovations and development in the pace of green technology. Conversely, Hao et al. (2021) discourse that the low emissions and green revolution owing to carbon emissions in G-7 nations. This emphasizes on the role of green development in ratifying sustainable environments by by means of robust approaches. The outcomes reveal that carbon emissions could be alleviated by symmetric and asymmetric relations of green development. Furthermore, it is acknowledged that cleaner energy, human capital, and environmental tax assist to recover the atmosphere, similar parades signified in the studies by Sharma et al. (2021). Moreover, Doğan et al. (2022) examined the influence of an environmental-related taxes on carbon pollution in the G-7 countries. Correspondingly, this study elucidates the association between characteristics, for example, economic complexity and natural resources that source environmental pollution. The findings also discovered that environmental tax and their governing function control energy deployment and environmental pollution. Nevertheless, the findings validate how these types of taxes can effectively increase the protection of environment and shown as a carbon-free economy.

In the same way, In the case of Pakistan, Khan et al. (2019) discovered the impact of several economic factors, globalization, and energy use on environmental degradation over the span from 1971–2016. The findings indicated that economic globalization, economic growth, energy use, significantly upsurges the pollution level in Pakistan. Furthermore, Muhammad (2019) showed that real output expansion with enhanced energy consumption in developing countries despite the fact that a decrease in MENA countries carbon emissions rise in all countries. Energy utilization increases in all countries but real income growth ascends in all economies with the exclusion of MENA consequently the increase in overall pollution level. Moreover, Waheed et al. (2019) explored that energy use and real income growth are measured as considerable sources of environmental pollution levels, and also, in emerging countries, high deployment of energy resources consequences in a boost in real GDP growth whereas in developed countries pivots a smaller amount on energy use for sustainable economic growth. In the case of the United States, Pata (2021) showed the influence of energy utilization and economic complexity on ecological footprint and observed an encouraging link with ecological contamination. This study’s finding shows that the effect of economic complexity was more important as compared to trade openness with the purpose of the achievement of sustainable growth and can assist in accomplishing the targets of long-term growth.

In China, Sarwar et al. (2019) observed that the industrialization process and deployment of non-renewable energy resources considerably augment the carbon emissions in the long run. Afterward, for a global panel, Ozturk et al. (2016) scrutinized the influence of real income, renewable energy, tourism, urbanization, and trade openness on the ecological footprint from 1988 to 2008 in the EKC hypothesis structure. This study’s outcomes revealed that fossil fuel energy use exceeds about to augments the ecological footprint. In recent, Appiah-Otoo (2021) scrutinized the influence of economic policy uncertainty and the deployment of renewable energy in 20 economies. The estimated evidence explored that there is the absence of any causal relationship between renewable energy growth and economic policy uncertainty. In addition, Sadiq et al. (2023) also investigated that nuclear and renewable energy deployment reduces ecological footprints in the top nuclear energy consumer economies. Moreover, Khan et al. (2018) investigated that renewable energy deployment reduces the pollution level in the case of Pakistan. Their findings advised that the policymakers and central authorities should boost the consumption of alternative and cleaner energy to decrease the GHGs emissions in the long run.

Research gap

The present study develops the existing literature on the following fronts: initially, this research includes environmental taxes, green technology, natural resources, and renewable and fossil fuel energy in simultaneous framework for the first time for G-7 economies. This research variable model is motivated and magnets strength from the agenda of SDGs targets that is scarcely for the investigated area of research. Furthermore, the present study advances the existent scope of literature in G-7 economies. In recollection, it is discovered in the current literature that green technologies and environmental taxes swiftly renovate consumer actions toward pollution-intensive goods. Likewise, the invention cost of energy-interrelated commodities increases owing to the pragmatic mitigation of GHG emissions. Hereafter, the noteworthy influence between green technologies, environmental taxes, and GHG emissions authenticates the discoveries of Sharif et al. (2023), but still, nations vacillate to levy taxes on tourism, exports, and carbon-intensive commodities because these technologies transform and taxes expressively lessening the GDP growth. After examining the link between a green technology, environmental taxes, and ecological pollution by examining the last scraps of indication, it is found that lacking transformation or adaptation towards environmental patent technology, and environmental taxes, it is not possible to eliminate the consequences of environmental contamination (Sharif et al. 2023; Ramzan et al. 2023; Usman and Hammar (2021); Yang and Usman (2021); Zhengxia et al. 2023; Wang et al. 2023b). Nevertheless, studies are undecided and not clear about the exterior integrated economies operations that use trading industries and banquet dangerous significances of carbon pollution. Additionally, the gap recognized is that rarely studies enlighten the green and cleaner environmental activities for high-income countries considering their alliances with emerging nations. Henceforth, the GHG circle relics reliable due to low stringent strategies followed worldwide to alleviate environmental pollution. Nevertheless, the requirement for applied solutions and ideologies is important to uplift sustainability through adapting complex and novel methods to green technology. Consequently, practical methods must be anticipated to execute environmental taxes and green technologies transformation without hurting green environmental growth to fulfill this gap.

Theoretical framework

The life elegance of human contest has considerably enhanced by the swift pace of technological innovations, energy transition, and economic growth; nevertheless, on the other side, there are innumerable adverse externalities connected with this development. For example, the current energy consumption and demand is considerably higher than it was few previous decades. Maximum power sources are immobile reliant on the non-renewables, subsequent in undesirable externalities from energy consumption and production. Consequently, global organizations and leading economies are nowadays focused to attain sustainable development without lacerating environmental quality. To this end, numerous tools and strategies are recommended and realized to diminish these harmful externalities, precisely carbon emissions. In this regard, environmental technology and taxes play an important role in plummeting ecological contamination, particularly through the renewable and alternative electricity use. Nevertheless, many aspects like natural resources and a nonexistence of suitable environmental tax policies can make the operation and adoption of such technologies more problematic. In this detection, environmental technology and renewable energy can offer sustainable resolutions to discourse the ecological effluence challenge, but such technologies can be excessively affluent or necessitate substantial mechanical expertise. Therefore, it may take time for such technologies to be espoused and combined into the prevailing systems, and the adoption and implementation cost may be a substantial fence. The countries with more differentiated economic actions are more expected to adapt and adopt these green technological innovations since their economies are improved fortified to fascinate the expenses of investments in ecological technology than those with less multifaceted economies. The degree to which renewable and alternative energy is espoused is inclined by economic factors, for example, the accessibility and cost of renewable sources of energy in addition to policy encouragements like taxes and subsidies credits. Besides, the policies related to environmental tax are perilous to encouraging the implementation of ecologically developed technologies. Environmental taxes can perform as inducements to endorse the espousal of renewable and alternative sources of energy by making ecologically destructive actions, such as non-renewable energy exploitation, less desirable or more expensive. The environmental taxes can also assist to lessen the adverse influences of ecological contamination and inspire an alteration toward more maintainable applies. The environmental tax level is resolute by the administration and is archetypally based on the pollution quantity produced by an economy. The profits engendered from the ecological taxes can be applied to endowment investments in environmental technology or to offer inducements for economies to implement renewable production. Altogether, the incorporation of environmental technology, natural resources, environmental taxes, and energy consumption is a multifaceted procedure that necessitates a multi-faceted tactic. Nevertheless, the efficiency of these apparatuses is predisposed by economic factors like the economic growth trajectory level and the accessibility and cost of alternative and renewable energy sources. Policymakers and environmentalists must prudently balance these indicators in order to redesign operative policies for plummeting environmental degradation.

Data and empirical methodology

Data and descriptive statistics

This research employs secondary panel data set from 1994 to 2020 for G-7 countries, comprising Germany, Canada, Japan, Italy, France, the United States, and the United Kingdom. The selection of the time period depends on the availability of data. This study explores the long-run influences of greenhouse gas emission patents on environmental technologies (used as proxy of green technologies) and environmental taxes on greenhouse gas (GHG) emissions, at the same time as controlling total natural resources, renewable energy use, and fossil fuel energy use as other imperative drivers of GHG emissions, the model specification in Eq. 1 as follows:

To avoid the issue of autocorrelation, data sharpness, scale equivalence, and heteroscedasticity, all the candidate variables are transformed into the natural logarithmic algorithms (ln). The adapted form of Eq. 1 can be stated in the form of Eq. 2 as follows:

where i and t shows the country and time, \(\mathrm{ln}(\mathrm{GHG}),\) \(\mathrm{ln}\left(\mathrm{GTECH}\right),\) \(\mathrm{ln}\left(\mathrm{ETX}\right),\) \(\mathrm{ln}(\mathrm{NRR}),\) \(\mathrm{ln}(\mathrm{REC}),\) and \(\mathrm{ln}\left(\mathrm{FFEC}\right)\) denote the logarithm of greenhouse gas emissions, patents on environmental technologies, environmental taxes, total natural resources, renewable energy use, and fossil fuel energy use. Further, \({\delta }_{0}\) denotes the intercept, and \({\delta }_{1}\to {\delta }_{5}\) presents the slope parameters of candidate series. The term \({\mathcal{E}}_{\mathrm{it}}\) explores the stochastic error term. Table 1 shows the description of variables, measurement unit, and data sources.

The results of descriptive information are presented in Table 2. These findings show that, on average, the G-7 economies illustrate 2.5123 tonnes per capita as GHG emissions over the approximately previous three decades. However, the highest GHG is reported as 3.2569 tonnes per capita while lowest is 1.7801. Also, the average value of LGTECH, LETX, LFFE, LNRR, and LREC pragmatic during the study period was 2.2633, 0.5863, 4.3439, − 1.6366, and 2.0145 with a minimum value of 1.6272, − 0.4155, 3.7559, − 4.5394, and − 0.162519 and maximum values of 2.7638, 1.2809, 4.5819, 1.6109, and 3.1219, respectively.

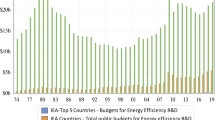

The bivariate analysis of correlation of the series is explored in Table 3. The outcomes report that there is a high and adverse correlation exists between LGTECH and LETX with LGHG emissions. Conversely, it is found a positive and significant correlation exists between LFFE, LNRR, and LREC with LGHG emissions. Furthermore, Fig. 1 presents the trend analysis of selected variables mean in G-7 countries (1994–2020).

Empirical methodology

Cross-sectional dependence tests

In the analysis of panel data, cross-sectional dependency (CD) refers to the situation where there is a correlation or interdependence between the observations of different units (such as individuals, firms, or countries etc.,) at a particular point in time. To address this issue, this study will use second-generation spatial econometric techniques developed by Pesaran (2004; 2006), and Breusch and Pagan (1980) that explicitly account for the correlation between observations. These models allow for the estimation of the effects of time-varying and time-invariant factors on the dependent variable, while controlling for the potential CD issue. The mathematical expression of Pesaran CD test can be reported as follows:

The term \({\widehat{\beta }}_{ik}^{2}\) denotes the bivariate pairwise cross-correlation of sample estimates which is estimated through the OLS regression method.

Panel unit root tests

After confirming the CD, it is vital to implement panel second-generation stationarity tests. These tests are statistical tests that are used to determine whether a panel dataset exhibits unit root behavior or not. A unit root is a statistical property of a time series where the series has a root that is equal to one, representing that the variables are not following the stationary process and has a stochastic trend (Usman and Makhdum 2021). The cross-sectional Im, Pesaran, and Shin (CIPS), and the cross-sectional augmented Dickey–Fuller (CADF) are the second-generation unit root tests, which has ability to tackle the issue of CD and slope heterogeneity. In this regard, Pesaran (2007) proposed CIPS and CADF methods to tackle the CD across panels. The CADF statistic can be computed as follows:

Here, \(\Delta\) presents the first difference operator and \({\varepsilon }_{it}\) and \({\mathrm{S}}_{it}\) denote the error term and selected variables applied in this research. However, incorporating the one lag (previous values) in the above equation, the findings can be presented in the below equation as follows:

where \({\pounds}_{i}\) explores the constant, \({\overline{s} }_{t-j}\) and \(\Delta {s}_{i,t-j}\) presents the average and the operators of first difference at the lagged level of each G-7 nations. CIPS test can be reported as follows:

where the term \({\beta }_{i}\left(N,T\right)\) term illustrates the coefficient of previous estimate (CADF) test that can be substituted with the contemporary term, and this can be presented as follows:

Westerlund cointegration test

The Westerlund cointegration approach is a statistical test used to determine whether a set of variables are cointegrated in a panel data context. Cointegration is a statistical property of a set of time series data, which indicates that the variables are related in a way that allows for the estimation of a long-run equilibrium association between them. The Westerlund (2007) approach is a second-generation stationary approach that accounts for CD in panel datasets. It is based on the estimation of a common factor model, which allows for a common stochastic trend among the variables (Wang et al. 2023b). The mathematical form of the Westerlund test can be written as follows:

AMG and CCEMG estimators

For addressing the issue of CD in the estimation of long-run elasticity, this study uses augmented mean group (AMG) and common corelated effect mean group (CCEMG) estimators. The AMG estimator is an extension of the mean group estimator, which assumes that the coefficients of the independent variables are different across individuals or groups within the panel. The AMG estimator, on the other hand, allows for some degree of heterogeneity across groups while imposing a structure on the coefficients. The AMG estimator is useful when there is some degree of heterogeneity among individuals or groups, but the researcher still wants to impose some structure on the coefficients. For example, if a researcher believes that some variables affect all individuals in the panel, while others affect only a subset of individuals, the AMG estimator can be used to estimate the relationship between the variables and the dependent variable while considering this CD and heterogeneity. The heterogeneous panel AMG estimator developed by Eberhardt and Teal (2010) and Eberhardt and Bond (2009) were utilized in this research as following the appearance below:

AMG (first stage):

AMG (second stage):

where \({\pi }_{i}\) shows the intercept, \({X}_{it}\) and \({S}_{it}\) illustrate selected variables, \({H}_{\mathrm{t}}\) denotes the in observed common dynamic with individual heterogeneous segments, \({\widehat{\upbeta }}_{\mathrm{AMG}}\) explores the mean-group (MG) of AMG estimators, and finally, \({\varepsilon }_{it}\) shows the random error term. This estimator is calculated by first estimating the coefficients of each individual or group in the panel separately using ordinary least squares (OLS) regression. Then, the individual estimates are combined using a weighted average, where the weights are calculated based on the variance of each individual estimate. The weights ensure that individuals with more precise estimates contribute more to the overall estimate.

Similarly, considering CD and slope heterogeneity issues, Pesaran (2006) proposed the CCEMG test that generates robust and reliable results. The CCEMG test allows the slope heterogeneous parameter crossways of each G-7 countries by origination the mean elasticity of each economy. The evaluation procedure of the CCEMG test can be explored as follows:

The augmented explanation with mean of all entities (i) of all variables (dependent and independent) can be reported as follows:

Results and discussion

In the present research, the authors applied the four dissimilar CD tests, for instance Pesaran scaled LM, Pesaran CD, Breusch–Pagan LM, and bias-corrected scaled LM, to investigate the CD issue properties of the candidate variables. In this regard, Table 4 explores the findings of CD tests, which suggest that all statistic is rejected the null hypothesis of no CD at 1% level of significance. This confirms that there is significant CD issue exists in the data set.

In the very next step, this study applied the second-generation unit tests. Table 5 shows the outcomes of second-generation unit root tests (i.e., CIPS and CADF). The variables LGTECH are stationary at level I (0) in both tests, while all other indicators such as LGHG, LETX, LNRR, LREC, and LFFEC are not following the stationary process at level I (0). However, all the variables are following the stationarity property after taking their first integration order I (1).

Based on the findings of the long-run cointegration test as explored in Table 6, there seems to be a significant link between the variable of interests that lasts for a long term. The group and panel statistics that Westerlund put together show that this is accurate. The findings show that there is a long-term cointegration exists within the variables.

The long-run estimated coefficients from the analysis of MG, AMG, and CCEMG estimators are reported in Table 7. In this context, the findings explore that the coefficient of green technology (GTECH) is significantly negative. This depicts that that GTECH adversely influences the GHG emissions, a 1% positive change in GTECH will reduce the GHG emissions by 0.2654%, 0.2311%, and 0.2506% according to MG, AMG, and CCEMG regression in the long run in G-7 nations. There are many reasons that why G-7 countries might choose to protect the environment through GTECH. These countries recognize the need to reduce GHGs emissions in order to combat the harmful effects of climate change, such as rising sea levels, increased frequency of extreme weather events, and loss of biodiversity. Moreover, GTECH sources can help G-7 countries to reduce their reliance on imported fossil fuels, which can enhance their energy security. Reducing pollution and improving air and water quality can have significant health benefits for the population, including reducing the incidence of respiratory diseases and improving overall quality of life (Usman and Radulescu 2022; Usman et al. 2022; Kamal et al. 2021). Furthermore, G-7 countries reveal their commitment to environmental protection and sustainable development by leading the way in the development and adoption of green technologies. Overall, these are the major reasons behind the negative role of GTECH for G-7 countries in the long run.

In context to the role of environmental taxes (ETX), the coefficient of ETX is also negative and significant in G-7 region. Particularly, a 1% augmentation in ETX will diminish the level of GHG emissions by 0.6822%, 0.6788%, and 0.5124% according to MG, AMG, and CCEMG regression in the long run in G-7 nations. The ETX are a policy tool used by G-7 countries to incentivize environmentally friendly behavior and discourage activities that harm the environment. The possible reason behind the environmental taxes that can be imposed on activities that generate pollution, such as emissions from factories or vehicles. By increasing the cost of these activities, ETX encourage individuals and companies to reduce their pollution levels. Moreover, taxes on environmental resources, such as oil or coal, can encourage conservation and the use of alternative, and renewable resources. This can help to reduce the depletion of natural resources and promote sustainable development. Another possible reason behind the negative effect of environmental taxes on GHG emissions is that it can provide an incentive for companies to invest in research and development of cleaner technologies, such as renewable energy sources or more efficient manufacturing processes. Moreover, ETX can generate revenue for governments, which can be used to fund environmental protection programs or other public goods. By increasing the cost of environmentally harmful activities and products, environmental taxes can encourage individuals to make more eco-friendly choices. For example, a tax on plastic bags can encourage people to bring their own reusable bags when shopping.

In context to the role of natural resources (NRR), the coefficient of NRR is positive and significant in the G-7 region. Particularly, a 1% augmentation in NRR will boost the level of GHG emissions by 0.1981%, 0.1684%, and 0.1987% according to MG, AMG, and CCEMG regression in the long run in G-7 nations. In this regard, it is observed that natural resource degradation is a significant environmental challenge in G-7 countries, as the exploitation of natural resources can have negative impacts on the environment. The positive coefficient of natural resources is that the clearing of forests for timber, agriculture, or other uses can lead to habitat loss, soil erosion, and biodiversity loss. Deforestation also contributes to climate change by releasing CO2 into the atmosphere. Moreover, mining for minerals and other resources can lead to soil and water pollution, habitat destruction, and the release of toxic chemicals into the environment. Another reason is that the extraction of oil and gas can lead to habitat destruction, air and water pollution, and the release of greenhouse gases into the atmosphere, contributing to climate change (Usman and Makhdum 2021). Moreover, the exploitation of natural resources in G-7 countries can have significant negative impacts on the environment (increase GHG emissions), including loss of biodiversity, soil and water pollution, habitat destruction, and climate change. The conceivable reason is that it is important for G-7 countries to adopt sustainable practices that balance the need for resource use with the need to protect the environment and promote sustainable environment. This can include measures such as sustainable forestry practices, responsible mining, renewable energy development, and sustainable water management.

In context to the role of renewable energy (REC), REC and fossil fuels energy sources have significant impacts on the environment of G-7 countries. Specifically, the coefficient of REC is also negative and significant in G-7 region. Particularly, a 1% augmentation in REC will diminish the level of environmental pollution by 0.6947%, 0.6516%, and 0.6194% according to MG, AMG, and CCEMG regression in the long run in G-7 nations. These findings in line with the conclusion of (Usman and Makhdum 2021; Usman et al. 2021; Pata 2021; Ibrahim et al. 2022; Usman et al. 2023; Jahanger et al. 2023). In recent years, these countries have been making efforts to reduce their dependence on nonrenewable energy sources and shift towards renewable energy sources to address the challenges of climate change and energy security. Renewable energy sources generate fewer greenhouse gas emissions than nonrenewable sources. Renewable energy sources like wind, solar, and hydropower can help mitigate climate change by reducing the carbon emissions (Saqib et al. 2022; Ayad et al. 2023). Renewable energy sources enhance energy security, reduce dependence on imported fossil fuels, and minimize the risks of supply disruptions, thereby improving energy security for G-7 countries. Renewable energy sources have a low impact on the environment since they do not produce waste products or emit harmful pollutants (Jahanger and Usman 2023).

Moreover, in context to the role of fossil fuel energy (FFEC), the coefficient of FFEC is positive and significant in G-7 region. Particularly, a 1% augmentation in FFEC will boost the level of GHG emissions by 1.7043%, 0.7675%, and 0.7497% following to the estimation of MG, AMG, and CCEMG analysis in the long run in G-7 nations. These findings corroborated with the conclusion of (Jahanger et al. 2023). The use of FFEC sources has significant environmental impacts, including air and water pollution, habitat destruction, and climate change (Makhdum et al. 2022; Jahanger et al. 2023; Saqib et al. 2023). The dependence on nonrenewable energy sources from politically unstable regions poses risks for energy security. Though FFEC sources are readily available and have been used as a primary energy source, this energy sources provide a reliable source of energy for transportation, industry, and homes for decades. The price volatility of nonrenewable energy sources affects the economic and national security of these countries. In conclusion, these countries are making efforts to reduce their dependence on nonrenewable energy sources and shift towards REC sources. The transition to REC has significant economic, environmental, and security impacts. These impacts should be considered while developing energy policies and strategies for the G-7 countries. In conclusion, both types of energies have significant environmental impacts in these economies. The environmental impacts of both types of energy sources should be considered while developing energy policies and strategies for the transition to sustainable energy systems (Fig. 2).

Conclusion and policy implications

This study investigates the influences of green technologies, environmental taxes, natural resources, renewable energy, and fossil fuels energy use on GHG emissions of the G-7 economies between 1994 and 2020. After confirming the issue of cross-sectional dependency, this study applied the second-generation procedure for econometric estimation. The estimated evidences from the analysis of regression revealed that green technologies, environmental taxes, and renewable energy diminishes the GHG emissions in the region, while natural resources and fossil fuel energy deteriorates the eminence of environment in the long run.

Based on such estimated evidences, well-nigh sustainable strategies are proposed to improve the green environmental scheme in G-7 economies. Principally, the green technology variable portrays the undesirable influence on GHG emissions. Therefore, investors and policymakers enhance their processes by communicating green strategical tactics universally through the means of exports and imports, foreign investments, and authorizing from high-income to low-income countries. By executing this, rough market constancy diminishes, and sustainability upsurges largely. Likewise, in the course of growth-oriented financial policies, per capita income boosts. Based on this, G-7 economies pledge instructive programs and capability/skill knowledge programs to produce eco-friendly technological innovations that will advantage in extenuating GHG emissions. By doing so, they can help mitigate the impacts of climate change, enhance their energy security, create new economic opportunities, improve public health, and demonstrate their commitment to sustainable development. Correspondingly, researchers strain the consequence of ecological taxes in invigorating the unadorned significances of ecological contamination. Estimated findings reveal that central authorities must levy high taxes on carbon-containing goods and abandon private administrations for startup productions that exploit fossil fuel/non-renewable energies. Additionally, with the support of tax assortments, carbon-free consciousness agendas, contributions, and knowledge must be uniform.

Likewise, the energy and industrial sector of G-7 economies is a prodigious contributor to GHG emissions. Therefore, a prearranged tax outline will execute to diminish the extraction of fossil fuels/nonrenewable energy and encourage low-emission equipment. By doing so, G-7 bloc can accomplish the arranged goal with developed economies to upsurge the market share of biofuels. In general, environmental taxes can help to protect the environment in G-7 countries by incentivizing sustainable behavior, promoting innovation, and generating revenue for environmental protection programs. However, it is important to design these taxes carefully to avoid unintended consequences, such as disproportionately impacting low-income individuals or businesses, or incentivizing environmentally harmful activities in other countries with weaker environmental regulations.

Lastly, there are some caveats of this investigation that should be addressed in upcoming studies. This research only investigated the G-7 economies. Consequently, comparison between developed and emerging economies were left out. Upcoming studies aimed at a larger sample of developed and developing countries might enhance to a more inclusive information of the current nexus. Data limitation/unavailability is another limitation of this study. Additionally, this research only investigated the linear role of green technologies, and environmental taxes but not included the social macroeconomic indicators such as (rule of law, corruption, regulatory authority, etc.). Future studies should investigate this nexus within the STIRPAT framework in G-7 economies.

Data availability

The datasets used and/or analyzed during the current study are variability from the first author on reasonable request.

Notes

Germany, Canada, Japan, Italy, France, United Kingdom, and the United States.

References

Appiah-Otoo I (2021) Impact of economic policy uncertainty on renewable energy growth. Energy Res Lett 2:1–5. https://doi.org/10.46557/001c.19444

Ayad H, Sari-Hassoun SE, Usman M, Ahmad P (2023) The impact of economic uncertainty, economic growth and energy consumption on environmental degradation in MENA countries: fresh insights from multiple thresholds NARDL approach. Environ Sci Pollut Res 30(1):1806–1824. https://doi.org/10.1007/s11356-022-22256-w

Balsalobre-Lorente D, Luzon LI, Usman M, Jahanger A (2023) The relevance of international tourism and natural resource rents in economic growth: fresh evidence from MINT countries in the digital era. Environ Sci Pollut Res 1–18. https://doi.org/10.1007/s11356-022-25022-0

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47(1):239–253. https://doi.org/10.2307/2297111

Danish, Ulucak R (2020) How do environmental technologies affect green growth? Evidence from BRICS economies. Sci Total Environ 712:136504. https://doi.org/10.1016/j.scitotenv.2020.136504

Doğan B, Chu LK, Ghosh S, Truong HHD, Balsalobre-Lorente D (2022) How environmental taxes and carbon emissions are related in the G7 economies? Renew Energy 187:645–656. https://doi.org/10.1016/j.renene.2022.01.077

Du K, Li J (2019) Towards a green world: How do green technology innovations affect total-factor carbon productivity. Energy Policy 131:240–250. https://doi.org/10.1016/j.enpol.2019.04.033

Eberhardt M, Bond S (2009) Cross-section dependence in nonstationary panel models: a novel estimator. Munich Personal RePEc Archive. http://mpra.ub.uni-muenchen.de/17692/

Eberhardt M, Teal F (2010) Productivity analysis in global manufacturing production. Discussion Paper 515, Department of Economics, University of Oxford. http://www.economics.ox.ac.uk/research/WP/pdf/paper515.pdf

Hao LN, Umar M, Khan Z, Ali W (2021) Green growth and low carbon emission in G7 countries: how critical the network of environmental taxes, renewable energy and human capital is? Sci Total Environ 752:141853. https://doi.org/10.1016/j.scitotenv.2020.141853

Huang Y, Raza SMF, Usman M (2023) Asymmetric role of natural resources dependence, industrialization, and foreign direct investment in China’s economic growth. Resour Policy 85:103932. https://doi.org/10.1016/j.resourpol.2023.103932

Ibrahim RL, Ajide KB, Usman M, Kousar R (2022) Heterogeneous effects of renewable energy and structural change on environmental pollution in Africa: do natural resources and environmental technologies reduce pressure on the environment? Renew Energy 200:244–256. https://doi.org/10.1016/j.renene.2022.09.134

Jahanger A, Usman M (2023) Investigating the role of information and communication technologies, economic growth, and foreign direct investment in the mitigation of ecological damages for achieving sustainable development goals. Eval Rev 47(4):653–679. https://doi.org/10.1177/0193841X221135673

Jahanger A, Hossain MR, Usman M, Onwe JC (2023) Recent scenario and nexus between natural resource dependence, energy use and pollution cycles in BRICS region: does the mediating role of human capital exist? Resour Policy 81:103382. https://doi.org/10.1016/j.resourpol.2023.103382

Kamal M, Usman M, Jahanger A, Balsalobre-Lorente D (2021) Revisiting the role of fiscal policy, financial development, and foreign direct investment in reducing environmental pollution during globalization mode: evidence from linear and nonlinear panel data approaches. Energies 14(21):6968. https://doi.org/10.3390/en14216968

Ke J, Jahanger A, Yang B, Usman M, Ren F (2022) Digitalization, financial development, trade, and carbon emissions; implication of pollution haven hypothesis during globalization mode. Front Env Sci 10:211. https://doi.org/10.3389/fenvs.2022.873880

Khan MTI, Ali Q, Ashfaq M (2018) The nexus between greenhouse gas emission, electricity production, renewable energy and agriculture in Pakistan. Renew Energy 118:437–451. https://doi.org/10.1016/j.renene.2017.11.043

Khan MK, Teng JZ, Khan MI, Khan MO (2019) Impact of globalization, economic factors and energy consumption on CO2 emissions in Pakistan. Sci Total Environ 688:424–436. https://doi.org/10.1016/j.scitotenv.2019.06.065

Kilic E, Cankaya S (2020) Oil prices and economic activity in BRICS and G7 countries. CEJOR 28:1315–1342. https://doi.org/10.1007/s10100-019-00647-8

Liu Q, Zhu Y, Yang W, Wang X (2022) Research on the impact of environmental regulation on green technology innovation from the perspective of regional differences: a quasi-natural experiment based on China’s new environmental protection law. Sustainability 14(3):1714. https://doi.org/10.3390/su14031714

Makhdum MSA, Usman M, Kousar R, Cifuentes-Faura J, Radulescu M, Balsalobre-Lorente D (2022) How do institutional quality, natural resources, renewable energy, and financial development reduce ecological footprint without hindering economic growth trajectory? Evidence from China. Sustainability 14(21):13910. https://doi.org/10.3390/su142113910

Muhammad B (2019) Energy consumption, CO2 emissions and economic growth in developed, emerging and Middle East and North Africa countries. Energy 179:232–245. https://doi.org/10.1016/j.energy.2019.03.126

OECD (2022) Environmental tax (indicator). https://doi.org/10.1787/5a287eac-en. Accessed on 26 March 2023

Ozturk I, Al-Mulali U, Saboori B (2016) Investigating the environmental Kuznets curve hypothesis: the role of tourism and ecological footprint. Environ Sci Pollut Res 23(2):1916–1928. https://doi.org/10.1007/s11356-015-5447-x

Pata UK (2021) Renewable and non-renewable energy consumption, economic complexity, CO2 emissions, and ecological footprint in the USA: testing the EKC hypothesis with a structural break. Environ Sci Pollut Res 28(1):846–861. https://doi.org/10.1007/s11356-020-10446-3

Pesaran MH (2006) Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74(4):967–1012. https://doi.org/10.1111/j.1468-0262.2006.00692.x

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Economet 22(2):265–312. https://doi.org/10.1002/jae.951

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels (Working Paper). Faculty Econ. https://doi.org/10.17863/CAM.5113

Ramzan M, Razi U, Usman M, Sarwar S, Talan A, Mundi HS (2023) Role of nuclear energy, geothermal energy, agriculture, and urbanization in environmental stewardship. Gondwana Res 1–19. https://doi.org/10.1016/j.gr.2023.08.006

Sadiq M, Shinwari R, Wen F, Usman M, Hassan ST, Taghizadeh-Hesary F (2023) Do globalization and nuclear energy intensify the environmental costs in top nuclear energy-consuming countries? Prog Nucl Energy 156:104533. https://doi.org/10.1016/j.pnucene.2022.104533

Safi A, Chen Y, Wahab S, Zheng L, Rjoub H (2021) Does environmental taxes achieve the carbon neutrality target of G7 economies? Evaluating the importance of environmental R&D. J Environ Manag 293:112908. https://doi.org/10.1016/j.jenvman.2021.112908

Saqib N, Usman M (2023) Are technological innovations and green energy prosperity swiftly reduce environmental deficit in China and United States? Learning from two sides of environmental sustainability. Energy Rep 10:1672–1687. https://doi.org/10.1016/j.egyr.2023.08.022

Saqib N, Ozturk I, Usman M, Sharif A, Razzaq A (2022) Pollution Haven or Halo? How European countries leverage FDI, energy, and human capital to alleviate their ecological footprint. Gondwana Res 116:136–148. https://doi.org/10.1016/j.gr.2022.12.018

Saqib N, Ozturk I, Usman M (2023) Investigating the implications of technological innovations, financial inclusion, and renewable energy in diminishing ecological footprints levels in emerging economies. Geosci Front 14(6):101667. https://doi.org/10.1016/j.gsf.2023.101667

Sarwar S, Shahzad U, Chang D, Tang B (2019) Economic and non-economic sector reforms in carbon mitigation: empirical evidence from Chinese provinces. Struct Chang Econ Dyn 49:146–154. https://doi.org/10.1016/j.strueco.2019.01.003

Shan S, Genç SY, Kamran HW, Dinca G (2021) Role of green technology innovation and renewable energy in carbon neutrality: a sustainable investigation from Turkey. J Environ Manag 294:113004. https://doi.org/10.1016/j.jenvman.2021.113004

Sharif A, Kartal MT, Bekun FV, Pata UK, Foon CL, Depren SK (2023) Role of green technology, environmental taxes, and green energy towards sustainable environment: insights from sovereign Nordic countries by CS-ARDL approach. Gondwana Res 117:194–206. https://doi.org/10.1016/j.gr.2023.01.009

Sharma A, Surana K, George M (2021) Do clean energy trade duties generate employment benefits? Renew Sustain Energy Rev 159:112104. https://doi.org/10.1016/j.rser.2022.112104

Sun Y, Usman M, Radulescu M, Pata UK, Balsalobre-Lorente D (2023) New insights from the STIPART model on how environmental-related technologies, natural resources and the use of the renewable energy influence load capacity factor. Gondwana Res 1–19. https://doi.org/10.1016/j.gr.2023.05.018

Trencher G, Truong N, Temocin P, Duygan M (2021) Top-down sustainability transitions in action: how do incumbent actors drive electric mobility diffusion in China, Japan, and California? Energy Res Soc Sci 79:102184. https://doi.org/10.1016/j.erss.2021.102184

Uddin I, Usman M, Saqib N, Makhdum MSA (2023) The impact of geopolitical risk, governance, technological innovations, energy use, and foreign direct investment on CO2 emissions in the BRICS region. Environ Sci Pollut Res 1–16. https://doi.org/10.1007/s11356-023-27466-4

Usman M, Balsalobre-Lorente D (2022) Environmental concern in the era of industrialization: can financial development, renewable energy and natural resources alleviate some load? Energy Policy 162:112780. https://doi.org/10.1016/j.enpol.2022.112780

Usman M, Hammar N (2021) Dynamic relationship between technological innovations, financial development, renewable energy, and ecological footprint: fresh insights based on the STIRPAT model for Asia Pacific Economic Cooperation countries. Environ Sci Pollut Res 28(12):15519–15536. https://doi.org/10.1007/s11356-020-11640-z

Usman M, Makhdum MSA (2021) What abates ecological footprint in BRICS-T region? Exploring the influence of renewable energy, non-renewable energy, agriculture, forest area and financial development. Renew Energy 179:12–28. https://doi.org/10.1016/j.renene.2021.07.014

Usman M, Radulescu M (2022) Examining the role of nuclear and renewable energy in reducing carbon footprint: does the role of technological innovation really create some difference? Sci Total Environ 841:156662. https://doi.org/10.1016/j.scitotenv.2022.156662

Usman M, Khalid K, Mehdi MA (2021) What determines environmental deficit in Asia? Embossing the role of renewable and non-renewable energy utilization. Renew Energy 168:1165–1176. https://doi.org/10.1016/j.renene.2021.01.012

Usman M, Jahanger A, Makhdum MSA, Radulescu M, Balsalobre-Lorente D, Jianu E (2022) An empirical investigation of ecological footprint using nuclear energy, industrialization, fossil fuels and foreign direct investment. Energies15(17):6442. https://doi.org/10.3390/en15176442

Usman M, Balsalobre-Lorente D, Jahanger A, Ahmad P (2023) Are Mercosur economies going green or going away? An empirical investigation of the association between technological innovations, energy use, natural resources and GHG emissions. Gondwana Res 113:53–70. https://doi.org/10.1016/j.gr.2022.10.018

Waheed R, Sarwar S, Wei C (2019) The survey of economic growth, energy consumption and carbon emission. Energy Rep 5:1103–1115. https://doi.org/10.1016/j.egyr.2019.07.006

Wang R, Usman M, Radulescu M, Cifuentes-Faura J, Balsalobre-Lorente D (2023a) Achieving ecological sustainability through technological innovations, financial development, foreign direct investment, and energy consumption in developing European countries. Gondwana Res 119:138–152. https://doi.org/10.1016/j.gr.2023.02.023

Wang J, Usman M, Saqib N, Shahbaz M, Hossain MR (2023b) Asymmetric environmental performance under economic complexity, globalization and energy consumption: evidence from the world’s largest economically complex economy. Energy 128050. https://doi.org/10.1016/j.energy.2023.128050

WDI (World development indicators) (2022) World Bank Database. https://www.databank.worldbank.org/indicator/NY.GDP.PCAP.CD/1ff4a498/PopularIndicators. Accessed date: 02 March 2023

Westerlund J (2007) Testing for error correction in panel data. Oxford Bull Econ Stat 69(6):709–748. https://doi.org/10.1111/j.1468-0084.2007.00477.x

Yang B, Usman M (2021) Do industrialization, economic growth and globalization processes influence the ecological footprint and healthcare expenditures? Fresh insights based on the STIRPAT model for countries with the highest healthcare expenditures. Sustain Prod Cons 28:893–910. https://doi.org/10.1016/j.spc.2021.07.020

Zeraibi A, Jahanger A, Usman M, Balsalobre-Lorente D, Adebayo TS, Kamal M (2023) The role of fiscal decentralization and technological innovations in curbing sulfur dioxide emissions: formulating SDGs policies for China. Environ Dev Sustain 1–26. https://doi.org/10.1007/s10668-023-03431-6

Zhengxia T, Haseeb M, Usman M, Shuaib M, Kamal M, Khan MF (2023) The role of monetary and fiscal policies in determining environmental pollution: revisiting the N-shaped EKC hypothesis for China. Environ Sci Pollut Res 1–14. https://doi.org/10.1007/s11356-023-28672-w

Funding

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Author information

Authors and Affiliations

Contributions

M. M.: conceptualization, introduction, writing—original draft preparation, and review and editing. X. H.: supervision, formal analysis, writing—original draft preparation, and review and editing. M. A. H.: visualization, methodology, and writing original draft and preparation.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

This is not applicable.

Consent for publication

This is not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Manjang, M., Hao, X. & Husnain, M.A. Examining the impact of environmental technologies, environmental taxes, energy consumption, and natural resources on GHG emissions in G-7 economies. Environ Sci Pollut Res 30, 106611–106624 (2023). https://doi.org/10.1007/s11356-023-29885-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-29885-9