Abstract

The establishment of green finance reform and innovation pilot zones is an important practical exploration to achieve carbon emission reduction goals through green finance in China. Based on the panel data of 282 Chinese prefecture-level cities from 2006 to 2019, this paper examines the mechanism of China’s green financial reform and innovation pilot zone policy (GFRI) on urban carbon emissions (CE) and carbon emission efficiency(CEE) using difference-in-differences model. The study shows that GFRI has a significant carbon emission reduction effect, which is reflected in the significant reduction of urban CE and the improvement of urban CEE. GFRI achieves carbon emission reduction by promoting urban green innovation, while the mediating effect of financial agglomeration has not been verified. The results of heterogeneity analysis show that GFRI has more significant effects on carbon emission reduction in non-resource-based cities, large-scale cities and cities with strict environmental regulation. Financial development and digital infrastructure play a positive moderating role on the carbon emission reduction effect of GFRI. This study provides empirical evidence and policy insights from the Chinese city level for deepening the green finance policy and promoting urban low-carbon development.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Global warming is a serious threat to sustainable human development. Changing the way of economic development and green low-carbon transition have become an inevitable choice for countries around the world, and carbon peaking and carbon neutrality targets have been proposed and established (Cai et al. 2023; Flammer 2020; Hussain and Lee 2022; Zhang et al. 2022c). By the end of December 2021, 136 countries, 115 regions, 235 major cities and 682 of the top 2,000 companies worldwide had set carbon neutrality targets.Footnote 1 As the world’s second largest economy and the most significant carbon emitter, China has always taken the issue of climate change very seriously. In September 2020, China first proposed to work toward peak carbon by 2030 and carbon neutrality by 2060. To implement the carbon peaking and carbon neutrality targets, carbon reduction is the major point, and energy transition is the challenging point (Kong et al 2022). To this end, China is aggressively implementing various policies and measures to promote energy conservation and emission reduction, as well as the green and low-carbon transformation of the economy and society. In order to achieve the “double carbon” goal, a huge amount of financial support is needed, but the government’s funds are limited. Therefore, it is urgent to rely on the financial system to bring in social capital to support green investment and financing activities (Zhang and Chen 2023). Green finance is a crucial tool for promoting the green and low-carbon transformation of the economic structure in China. It can provide financial services for green and low-carbon projects, such as green production and green consumption, and promote the flow of resources, such as capital or technology, to green and environmental areas, thus promoting the ecological structure of industries and assisting in the achievement of carbon neutrality goal (Rasoulinezhad and Taghizadeh-Hesary 2022).

In August 2016, the People’s Bank of China and seven other ministries and commissions issued the “Guidance on Building a Green Financial System”. Immediately afterward, in June 2017, China conducted GFRI in eight places across five provinces, to highlight the beneficial impact of green finance in adjusting the structure and transforming the way, and explore pilot cities’ experiences that can be replicated and promoted. Compared with the Western developed countries, China’s green finance construction started late, but developed faster. By the end of 2022, the balance of green loans exceeded 0.2203 million yuan, an increase of 38.5% year-on-year. Since the introduction of GFRI in 2017, The pilot policy has been developed in China for nearly six years. Has GFRI become an effective tool to tackle carbon emissions in China? Further, what are its impact mechanisms? These are the questions that deserve to be answered.

Existing literature has mainly verified that GFRI has a catalytic effect on carbon emission reduction at the enterprise micro and provincial macro levels. However, pieces of evidence from the city level are relatively scarce and systematic studies are lacking. In fact, cities are crucial to achieving the carbon neutrality goal as the specific carrier and observation object of pilot policy implementation and the main source of carbon emissions (Huovila et al. 2022; Shen et al. 2022). Therefore, it is necessary to study the emission reduction effect of GFRI at the city level. However, existing literature mainly focuses on assessing its impact on carbon emissions and intensity, but ignores carbon emission efficiency. Compared with carbon emissions and intensity, carbon emission efficiency is a more comprehensive measure, which includes economic development factors and can reflect the synergistic effect of economic growth and carbon emission reduction. In view of this, this paper attempts to evaluate the impact of GFRI on reducing carbon emissions at the city level and pinpoint the inherent relationship between GFRI and reducing carbon emissions from two dimensions: per capita carbon emission (CE) and carbon emission efficiency(CEE).

The marginal contributions of this paper can be summarized into the following three aspects.

First, this paper investigates the impact of GFRI on CEE. Most of the existing literature measures green finance by indicators such as green credit, green bond or composite index, and then studies the impact of green finance on carbon emissions. The research on the carbon emission reduction effect of GFRI focuses more on carbon emissions and intensity, while the research on CEE is rarely concerned. This paper enriches and expands the existing research by studying the impact of GFRI on CEE. Second, this paper studies how GFRI affects carbon emission reduction from the urban perspective. Although there has been a lot of literature analyzing the impact of GFRI on carbon emission, most of them have verified the relationship between the two from the enterprise and provincial levels, and there is less literature from the city level. This paper uses data from 282 prefecture-level cities in China to expand and deepen the impact of GFRI, and provide documentary evidence at the city level. Third, this paper examines the moderating effect of financial development and digital infrastructure on the carbon emission reduction effect of GFRI. The existing literature mainly follows the path of “GFRI → carbon emission reduction” to study the relationship between the two, but ignores the external incentive role of financial development and digital infrastructure.

Literature review

Research on carbon reduction

To cope with climate deterioration, countries around the world have adopted various forms of carbon emission reduction policy measures. A growing body of literature focuses on carbon emission reduction and explores how to achieve it (Mo et al. 2018; Wang et al. 2013). In terms of CE, most of the early literature argues that technological progress and efficiency improvements are crucial in reducing carbon emissions (Ang 2009; Mizobuchi 2008; Okushima and Tamura 2010). Subsequently, some scholars have also found that urbanization, industrial structure, transportation infrastructure, fiscal expenditure and energy efficiency contribute to the reduction of carbon emissions (Li et al. 2022; Wang and Li 2019; Xie et al. 2017; Yao et al. 2018; Zheng et al. 2020). In addition, population clustering in large cities can aggravate urban carbon emissions (Yi et al. 2022). With the further advancement of the study, the role of environmental regulation policies in reducing carbon emissions is gradually gaining attention. Some scholars have found that carbon emissions trading policy has achieved carbon emission reduction targets in the process of stimulating carbon finance and allocating carbon allowances (Guo et al. 2022b; Shi et al. 2022a). Low carbon pilot policy is also an effective measure to curb carbon emissions (Fu et al. 2021). In terms of CEE, Dong et al. (2022b) provided evidence for developed countries to achieve carbon emission reduction and carbon neutrality targets. They found that most developed countries are still at a low level of CEE, green technology innovation has a considerable contribution to improving CEE in developed countries, and financial development has a beneficial moderating effect on it. Xie et al. (2021) based on cross-country data including developed countries, emerging economies and less developed countries, verified the role of technological progress in promoting CEE in each country. Among the evidence from China, Wang et al. (2019) find that resource endowments are not conducive to CEE. Fan et al. (2022) also reached a consistent conclusion. There is an inverted U-shaped relationship between urbanization and CEE (Sun and Huang 2020). Some scholars have also verified that environmental regulatory policies such as low-carbon pilot policy and new energy demonstration policy are favorable to fostering CEE (Chai et al. 2023; Du et al. 2022).

Evaluation of GFRI

Since the introduction of GFRI in 2017, scholars have conducted in-depth studies on the impact of the policy and explored its macro, meso and micro mechanisms and effects at the provincial, city and enterprise levels. Among them, the evidence from the provincial and enterprise levels is early. Specifically, at the province level, scholars find that GFRI has significantly boosted green technology innovation capacity and optimized industrial structure in the pilot provinces (Irfan et al. 2022). Zhang et al. (2022b) studied the impact of GFRI on environmental pollution and found that the policy only reduced SO2, NO2 and PM2.5, but failed to significantly suppress CO, O3 and PM10. Digital finance and green technology innovation are effective paths for GFRI to improve environmental quality (Hou et al. 2022). At the firm level, scholars find that GFRI promotes firm investment efficiency and innovation, especially green innovation (Sun et al. 2023; Yan et al. 2022). Moreover, GFRI has a differential impact on the total factor productivity of green and polluting firms, which promotes innovation and long-term value of green firms, but reduces the productivity of polluting firms (Hu et al. 2021). However, some scholars have found that GFRI can force heavy polluters to fulfill their social responsibility and reduce their debt-financing costs (Shen and Liao 2020; Shi et al. 2022b). Recently, scholars began to evaluate the effects of GFRI at the city level, and found that the policy has a positive impact on curbing urban haze pollution, enhancing urban green finance development, improving urban environmental quality, and promoting urban green total factor productivity (Li et al.2023; Zhang and Chen 2023; Zhang et al.2023).

Impact of green finance on carbon emission reduction

“Green finance” is also known as “climate finance”, and the relationship between green finance and carbon emission reduction has been a hot topic in academic circles. From the dimension of green financial instruments, scholars have studied the impact of green financial instruments such as green credit, green bonds and green venture capital on carbon emissions (Jiang et al. 2020). Green bonds and green credits are conducive to reducing CE and improving CEE (Liu et al. 2023b; Mamun et al. 2022; Rasoulinezhad and Taghizadeh-Hesary 2022; Saeed Meo and Karim 2022). Some scholars build green finance development index based on green credit, securities, etc., and verify that it has significant carbon emission reduction effect, and this effect is spillover (Li and Fan 2022; Lin et al. 2023; Mngumi et al. 2022; Ran et al. 2023). Wang et al. (2021b) found that the effect of green financial instruments with debt nature on carbon emission reduction is better than that of equity nature. Furthermore, green money does not reduce CO2 under stricter environmental rules. Additionally, combining green finance with green innovation makes it easier to reduce carbon emissions (Umar and Safi 2023). From the green finance policy dimension, more research has been done on the effect of green credit policy on carbon emissions and finds that green credit policy reduces carbon emissions of enterprises, especially the heavy polluters (Xu et al. 2023; Zhang et al. 2022a). Nenavath (2022) found that green finance policies significantly reduced industrial CO2 emissions based on data from India from 2010–2020. The relationship between GFRI and carbon emissions has also been gaining attention with the introduction of GFRI in China in 2017. Researchers have examined the connection between the two at the province, city, and enterprise levels, and they argued that GFRI is a useful strategy for reducing carbon emissions(Gao and Shen 2022; Tan et al. 2023).

Most of the current literature measures green finance by indicators such as green credit, green bonds or composite index, and then studies the impact of green finance on carbon emissions. Meanwhile. When scholars focus on the carbon emission reduction effect of GFRI, they concentrate more on carbon emissions and intensity and rarely consider carbon emission efficiency. Furthermore, most of the scholars study the policy effect of GFRI from the enterprise and provincial level, and the literature on the carbon emission reduction effect of GRIP from the city level is less and the research depth needs to be further explored. Therefore, this paper uses city-level data to highlight the effects of GFRI on CE and CEE. In addition, there is no literature yet to examine the role played by external factors in the impact of GFRI on CE and CEE.

Theoretical analysis and research hypothesis

GFRI and carbon emission reduction

First, the green technology innovation effect. Due to financial resources being concentrated in key and popular industries with high capital requirements, high energy consumption, and high output values, China’s current allocation of financial resources does not support green innovation or environmental protection, which encourages the growth of these industries and exacerbates resource waste and ecological harm(Wen and Liu 2019). At the same time, without the pressure of external regulation, enterprises lack the motivation to independently develop green innovation technologies to maximize profits, making it difficult to achieve low-carbon transformation and sustainable development. Therefore, GFRI is necessary. GFRI can promote the innovation of green technology in the following three aspects, and then promote carbon emission reduction. On the one hand, GFRI implements different capital credit policies for green enterprises and polluting enterprises. Green enterprises can benefit from preferential measures such as low-interest-rate loans, bond issuance and listing facilitation, while polluting enterprises are subject to punitive measures such as high-interest-rate loans, loan rejection and listing hindrance. This can alleviate the financing difficulties of green enterprises and limit the financing channels of polluting enterprises, thus fostering the growth of green businesses and requiring the reform and modernization of polluting businesses (Wang et al. 2021a). On the other hand, GFRI can improve the allocation efficiency of financial resources between the environmental and economic sectors. Although the pilot policy may increase the short-term cost of R&D technology, it can increase enterprises’ investment in technological innovation and produce the “innovation compensation effect” in the long run, thus gaining excess returns and improving the total factor productivity of enterprises (Alpay et al. 2002; Porter and Linde 1995; Wang and Liu 2014). In addition, since the positive externalities of many green innovation projects are not fully internalized and their rates of return are below market levels, social capital may lack the interest to enter. Due to the existence of GFRI, special measures are made available, such as subsidized interest rates and guarantees, to reduce the financing costs of enterprises, increase the profitability of projects, and promote the research and development of green innovative technologies, which in turn achieve carbon emission reduction.

Second, the financial agglomeration effect. GFRI is proposed to mobilize and stimulate more social capital to invest in green industry and establish a stable green financial system. GFRI makes financial institutions and financial talent continue to gather, and the pilot cities gradually expand the scale of finance, resulting in agglomeration effect. Further, financial agglomeration enhances urban carbon reduction through the following aspects. Firstly, financial agglomeration drives the concentration of financial institutions, financial talents and other financial resources, which can provide enterprises with more green financial products and services such as green credit, green bonds and green equity, help enterprises reduce costs and risks in carbon emissions, energy conservation and emission reduction, energy efficiency improvement, transformation and upgrading, and enhance their green competitiveness and sustainable development (Qian et al. 2022; Yan et al. 2022). Secondly, financial agglomeration can reduce the information cost of investment and financing, accelerate the liquidity of capital factors, improve the efficiency of financial resource allocation, facilitate the financing of green enterprises, and thus provide support for their low-carbon transformation (Yuan et al. 2019). Thirdly, financial agglomeration can provide more financial support for green technology innovation and market expansion, which is conducive to promoting the establishment and expansion of green markets, as well as the extension and improvement of green industrial chains, thus creating a favorable market environment for carbon emission reduction (Feng 2022). Finally, the financial agglomeration has generated more innovative financing tools and incentive and restraint mechanisms to meet the investment and financing needs of green industry development, which is conducive to accelerating the growth of emerging industries and the elimination of obsolete industries, reducing the dependence on fossil energy for urban development, and achieving urban carbon emission reduction (Qu et al. 2020).

-

H1: GFRI has a significant carbon emission reduction effect.

-

H2: GFRI achieves carbon emission reduction effect by promoting green innovation and financial agglomeration.

Moderating effects of financial development

GFRI was launched to explore the establishment of a regional green financial service system. The successful implementation of the policy needs to rely on the financial infrastructure and financial service system of each region. Therefore, the carbon emission reduction effect of GFRI may be influenced by financial development. It has been found that financial development has a non-negligible impact on environmental quality, especially carbon emissions (Acheampong 2019). Some scholars argue that an increase in financial development can drive economic expansion and promote a sharp increase in energy consumption, making it a major driver of carbon emissions (Zhang 2011). However, as global awareness of carbon reduction increases, financial development has become an accepted solution to climate and environmental problems (Tao et al. 2023). The higher the level of financial development, the more beneficial to carbon emission reduction (Jia et al. 2021). Specifically, green technology innovation is characterized by high risk and long-term periods, which require the guidance of financial development. A high level of financial development means that more capital support can be provided for green technology innovation, which is conducive to mitigating the investment risk of enterprises and motivating them to carry out green technology innovation activities, thus promoting cleaner production and achieving carbon emission reduction (Liu et al. 2023a; Zaidi et al. 2019). In addition, the higher the level of financial development, the more developed the capital market is. To obtain better financing, companies are inclined to adopt environmental protection and emission reduction measures to build a good identity, which also contributes to achieving carbon emission reduction (Shahbaz et al. 2013). In the case of China, the financial development has been gradually greened with the support of policies and innovative development of the industry. Therefore, this paper speculates that financial development can help GFRI to better achieve the carbon emission reduction effect (Guo et al. 2019).

-

H3: Financial development has a positive moderating influence on the carbon emission reduction effect of GFRI.

Moderating effects of digital infrastructure

With the advent of the digital economy, digital infrastructure has also been widely used in the field of financial reform. Good digital infrastructure provides many conveniences for building a digital platform for green finance, which is conducive to solving the difficulties in green finance reform, and thus realizing the carbon emission reduction effect of GFRI. Therefore, the carbon emission reduction effect of GFRI may be affected by the level of regional digital infrastructure. Digital infrastructure development has become an essential tool to reduce carbon emissions by releasing “digital dividends” (Guo et al. 2022a). Specifically, digital infrastructure construction broadens the channels of information dissemination and accelerates the efficiency of information flow, which can effectively alleviate the problem of information asymmetry, improve the efficiency of resource allocation, and thus realize the improvement of carbon emission performance (Dong et al. 2022a). In addition, digital infrastructure also effectively promotes green innovation and digital transformation of enterprises, thus achieving energy saving and emission reduction, and providing incentives for urban economic green development (Hao et al. 2023). In general, the higher the level of digital infrastructure, the more beneficial the carbon reduction effect of GFRI is (Wei and Ullah 2022).

-

H4: Digital infrastructure positively moderates the carbon emission reduction effect of GFRI.

Research design

Model setting

This paper uses the difference in differences method (DID) to evaluate the effect of GFRI on the pilot cities (experimental group) and the non-pilot cities (control group) before and after the introduction of the policy, and eliminate the confounding factors that do not change over time and cannot be observed, so as to identify the net effect of GFRI on urban carbon emissions. The benchmark model is constructed as follows.

In Eq. (1), i, t and j replace prefecture-level cities, years and provinces, respectively. Y is the explained variables, including urban CE and CEE. treat × post is a dummy variable for GFRI. control is a set of control variables. γ is a time fixed effect, θ is a city fixed effect and Province × Year is province and time fixed effects. \({\varepsilon }_{it}\) denotes the random error term.

Variable selection

Explained variables

CE is chosen to be measured as urban carbon emissions per capita, which is the ratio of urban carbon emissions to resident population. Referring to Gao and Shen (2022) and considering the availability of data, this paper classifies carbon emission sources into three categories: natural gas and LPG, thermal energy and electric energy. The specific calculation formula is as follows.

In Eq. (2), CO2i is the carbon emission of city i. Cni, Cei, and Chi are the carbon emissions from natural gas and LPG, heat, and electricity, respectively. Eni, Eei, and Ehi are the consumption of natural gas and LPG, heat, and electricity. δ and η are the relevant conversion factors provided by IPCC2006. μgt denotes the baseline emission factor for the grid g in year t.

The indicators of CEE are selected with reference to Yu and Zhang (2021), where fixed capital stock (Zhang et al. 2004), employment at the end of the year, and total electricity consumption are used as input variables, GDP is the desired output, and carbon dioxide emission is regarded as the undesired output. Further, this paper adopts the DEA-SBM model to measure CEE (Tone 2002). The measurement formula is as follows.

In Eq. (3), ρ is the value of urban CEE, which ranges between 0 and 1. N, M and I represent the number of input variables, desired output variables and undesired output variables, respectively. The vectors \({s}_{n}^{x}\) and \({s}_{m}^{y}\) represent the redundancy of inputs and desired outputs, respectively, and \({s}_{i}^{b}\) represents the deficiency of undesired outputs. \({\lambda }_{k}^{t}\) is the weight variable of each decision unit.

Explanatory variables

The explanatory variable is GFRI, which is mainly measured by constructing a difference-in-differences variable. Among them, post is a dummy variable for the time of the policy pilot. If it is a pilot period (after 2017), it takes the value of 1, and if it is a non-pilot period (before 2017), it takes the value of 0. treat is a dummy variable for the policy pilot city, which takes the value of 1 if it is a pilot city and 0 if it is a non-pilot city.

Mechanism variables

Based on the above theoretical mechanism analysis, two mediating variables, green innovation and financial aggregation, are selected in this paper. Green innovation is measured by the number of green invention patent applications per capita. Financial agglomeration is examined by constructing three indicators to examine the financial agglomeration effect (Yuan et al. 2022). The specific measures are as follows. (1) FA1 = (number of urban employed persons in the financial sector / number of urban employed persons) / (number of urban employed persons in the financial sector nationwide / number of urban employed persons nationwide). (2) FA2 = (loan balance of urban financial institutions / urban GDP) / (loan balance of national financial institutions / national GDP). (3) FA3 = (deposit and loan balance of urban financial institutions / urban GDP) / (national financial institution deposit and loan balance / national GDP).

Control variables

CE and CEE are closely related to economic development. It is necessary to control for the heterogeneity characteristics of economic development in the treatment and control groups. The control variables selected to measure the characteristics of regional economic development include the following. The level of economic development (lnpgdp) is the logarithm of real gross domestic product per capita. The degree of economic agglomeration (lnpd) is the logarithmic value of population per square kilometer. Government intervention (gov) is the ratio of local fiscal expenditures to GDP. Innovation intensity (te) is the share of science and technology expenditures to GDP. Road accessibility (rod) is the logarithm of road area per capita.

Moderating variables

Financial development (fd) is expressed by using the ratio of loan and deposit balances of financial institutions to GDP at the end of the year (Zhang and Chen 2023). Digital infrastructure (dig) is measured by using a dummy variable for the broadband China pilot policy. If a city i is established as a broadband China pilot city in year t, it takes the value of 1, while a non-pilot city takes the value of 0 (Wang et al. 2022).

Data sources

The Chinese government approved GFRI in Quzhou, Huzhou, Huadu District, Gui'an New Area, Ganjiang New Area, Hami, Changji Hui Autonomous Prefecture, and Karamay in 2017. The policy aims to summarize the replicable experience of green financial development through multi-point efforts. Considering the far-reaching impact of COVID-19 on the whole society in 2020–2022, the period 2006–2019 is selected as the study interval. Meanwhile, due to the availability of city-level data in China, 282 cities in China were selected as the study sample. In this paper, eight cities are pilot cities,Footnote 2 and 274 cities were non-pilot cities. The data are obtained from the China City Statistical Yearbook, China Regional Statistical Yearbook, China Energy Statistical Yearbook, China Industrial Statistical Yearbook and the State Intellectual Property Office.

Analysis of empirical results

Baseline regression results

Table 1 presents the results of the baseline regressions, all of which control for year fixed effects, city fixed effects, and province-year fixed effects. Columns (1) and (3) of Table 1 do not add control variables, and control variables are added in columns (2) and (4). The results show that the regression coefficients of treat × post for CE are significantly negative with coefficient values of -0.3523 and -0.3508, respectively, regardless of whether the control variables are added or not. The regression coefficients of treat × post for CEE are significantly positive with coefficient values of 0.2179 and 0.2086, respectively. Therefore, GFRI decreases CE and improves CEE. H1 is confirmed.

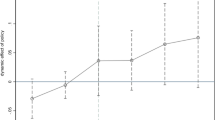

Parallel trend test

The key premise of DID model is the parallel trend assumption, i.e., before the implementation of GFRI, both CE and CEE of pilot and non-pilot cities maintained stable tendency of fluctuation. To avoid covariance, the previous period (2016) when the policy occurred is used as the base group and removed. Figure 1 illustrates the parallel trend test. The results show that the regression coefficients of CE and CEE before policy implementation are insignificant and fluctuate around 0, indicating that there is no significant difference between pilot and non-pilot cities before policy implementation, satisfying the parallel trend assumption. Further, from the dynamic effect of the parallel trend test, regression coefficients of CE decrease rapidly after the base year with a negative coefficient, indicating that GFRI suppresses CE. Regression coefficients of CEE increase rapidly after the base year with a positive coefficient, which indicates that GFRI improves CEE.

Placebo test

First, temporal placebo test. A temporal placebo test is conducted to avoid the differences in CE and CEE between the treatment and control groups caused by temporal changes. The implementation time of GFRI is advanced by 1 year and 2 years, respectively, to construct a spurious policy time. The test results show that the regression coefficients of the spurious policy time fail the significance test at the 10% level. This indicates that there is no systematic difference in the time trend between the treatment and control groups (Table 2).

Second, urban placebo test. To avoid the baseline regression results being affected by unobservable omitted variables and to ensure that the findings obtained are induced by GFRI, this paper draws on Cai et al. (2016) to conduct a placebo test by replacing cities in the treatment group. The placebo test provides robustness to the baseline regression results by randomly selecting a number of dummy experimental groups. Specifically, a sample of 1,000 times was conducted among all 282 prefecture-level cities, and 8 cities were randomly selected as the dummy experimental group in each sample. The kernel density distribution of the two explanatory variables shows that the t-values of the estimated coefficients are within 2 and the p-values are above 0.1, indicating that GFRI has no significant effect in these random samples of 1000 times (Fig. 2). Therefore, the conclusions obtained can pass the placebo test, and the carbon emission reduction effect of GFRI has little causal relationship with other unobservable factors.

Robustness tests

The baseline regression results indicate that GFRI reduces CE and improves CEE. However, a series of robustness tests are still needed to exclude the confounding factors.

Propensity score matching method

To avoid the endogeneity problem caused by the self-selection bias in the establishment of green finance pilot zones, this paper further uses the PSM-DID method to test the carbon emission reduction effect of GFRI. Specifically, the experimental group was matched with the control group using the nearest match method, so that they were not significantly different as possible before the policy shock of GFRI. And then, the DID method is used to identify the net impact of GFRI on CE and CEE. The estimated results are shown in Table 3, and the estimated coefficients of treat × post all pass the significance test at the 5% level. This further indicates that GFRI reduces CE and improves CEE.

Other policy interference is excluded

Other relevant policies in the same period may also affect the policy effects of GFRI. During our sample period, the low-carbon city pilot policy started in 2010 (Yu and Zhang 2021), carbon emission trading pilot policy and the energy conservation and emission reduction policy started in 2011(Gao et al. 2020; Xu et al. 2022). In order to remove the interference of these policies, this paper introduces dummy variables of the above policies for regression testing. The regression results in Table 4 show that after excluding these policies, the treat × post regression coefficients of CE are significantly negative at the 5% level, and the treat × post regression coefficients of CEE are significantly positive at the 1% level. Therefore, the baseline regression results are robust.

Urban peculiarities is considered

First, among the eight pilot cities, Guangzhou and Nanchang belong to provincial capitals, which may interfere with the identification of GFRI on CE and CEE. Second, the Heihe-Tengchong line divides China into two parts, the Southeast and the Northwest, with huge differences in population density between the two parts. Karamay is the only city located in the northwest of the Heihe-Tengchong line among the eight pilot cities, and its special characteristics may also affect the baseline regression results. Finally, Guiyang, Nanchang, and Guangzhou are environmentally friendly cities with stronger environmental regulations than others, which may affect the baseline regression results. The regression results in Table 5 show that the regression coefficient of CE is still significantly negative after introducing the dummy variables of the above city characteristics, and the regression coefficient of CEE is still significantly positive, which further verifies the robustness of the baseline regression results.

Further analysis

Mechanism test

Baseline regression results and a series of robustness tests confirm the carbon emission reduction effect of GFRI. Then how is this effect realized? This requires an in-depth exploration of the intrinsic impact mechanism. The second part has already concluded the theoretical hypothesis that GFRI can reduce CE and improve CEE through green innovation and financial agglomeration. To check hypothesis 2, the following mediating effect model is constructed.

In Eqs. (4) and (5), M is the mediating variable and is replaced by green innovation and financial agglomeration. The other variables are consistent with the previous section. If the coefficients φ and δ are significant, the mediating effect holds. Further, if λ is also significant and has the same sign as φ × δ, it means that M has a partial mediating effect and its contribution to the total effect is φ × δ/(φ× δ + λ).

The mediating effect of green innovation. Green innovation promotes the development of low-carbon technology in enterprises to reduce CE and improve CEE. The regression results are shown in Table 6, and two findings are summarized. First, the coefficients of the variables greeninno in columns (1) and (3) are significantly positive, indicating that the implementation of GFRI significantly improves the level of green innovation. Second, the coefficients of greeninno and treat × post in column (2) are both significantly negative, and the coefficients of greeninno and treat × post in column (3) are both significantly positive. It shows that green innovation has a partial mediating effect on CE and CEE, and the contribution of this effect to the total effect can be found to be about 25.21% and 17.06%, respectively. Accordingly, the green innovation effect of GFRI is verified.

The mediating effect of financial agglomeration. According to the theoretical analysis in the previous section, GFRI may affect carbon emission reduction through the financial agglomeration effect. The regression results are shown in Tables 7 and 8. The coefficients of FA1, FA2 and FA3 are not significant for GFRI, indicating that the implementation of GFRI does not significantly affect the level of financial agglomeration, which means that the financial agglomeration effect does not work. This is different from the results of the previous theoretical analysis, which may be because there are fewer cities in GFRI, which can hardly promote financial agglomeration in a short period.

Heterogeneity analysis

Green financial reform pilot zones contain different types of cities, which have large differences in resource endowment, city size, and environmental regulation. By implementing GFRI for different types of cities, different experiences can be obtained, which can be easily learned and studied by other cities in the future. Therefore, the implementation of GFRI has different effect on different pilot cities. For this reason, this paper examines the heterogeneous effects of GFRI on urban carbon emission reduction in terms of resource endowment, city size, and environmental regulation.

First, the heterogeneity of resource endowment. Does GFRI show differentiated policy effects due to the resource endowment of cities? In this regard, this paper divides the sample cities into resource-based cities and non-resource-based cities according to the National Sustainable Development Plan for Resource-based Cities (2013–2020). The estimation results are shown in Table 9. Columns (1) and (2) show that GFRI can significantly reduce CE in all types of cities, but the coefficients and significance of non-resource-based cities are smaller than those of resource-based cities, which indicates that GFRI is more effective in reducing CE in non-resource-based cities. This may be due to the fact that the economic development of resource-based cities depends on their natural resources and have a strong path dependence on resources, which leads to slower advancement in the greening and restructuring of industries, weakening the effectiveness of the policy. Columns (3) and (4) show that the coefficients of resource-based cities and non-resource-based cities are opposite, with the coefficient of resource-based cities being significantly negative and that of non-resource-based cities being significantly positive. It indicates that GFRI has a suppressive effect on CEE of resource cities, while it has a promotional effect on CEE of non-resource cities. It is worth noting that for resource-based cities, the coefficients of CE and CEE are negative, indicating that GFRI suppresses CE and CEE in resource-based cities simultaneously. This may be due to the fact that GFRI raises the financing constraints and pollution treatment costs of resource-based cities, squeezes out the urban green innovation expenditures, and thus leading to a decrease in CEE, and causing the phenomena where CE and CEE decline at the same time.

Second, the heterogeneity of city size. City size is an important factor that leads to differences in carbon emissions between cities. Then, how does city size affect the carbon emission reduction effect of GFRI? The regression results are shown in Table 10. In terms of CE, GFRI only suppresses CE in large cities. It is noteworthy that GFRI has a catalytic effect on CE in mega-cities at the 10% significance level. In terms of CEE, GFRI has a positive effect on CEE in large cities, but the policy effect is not significant for mega-cities and small and medium-sized cities. This may be due to the fact that when the population size of cities is too large, it tends to produce congestion effects and cause problems such as traffic congestion. Therefore, it may be difficult to achieve carbon emission reduction in a short period (Ren et al. 2019). As for small and medium-sized cities, their green financial service system and efficiency still need to be improved, resulting in insufficient power for the carbon emission reduction effect of GFRI.

Third, the heterogeneity of environmental regulations. Appropriate environmental regulation prompts enterprises to engage in technological innovation and improve production processes and pollution control technologies. To examine whether the level of environmental regulation affects the carbon emission reduction effect of GFRI, this paper divides the sample cities into strong and weak environmental regulation according to the average PM2.5 values. Among them, cities with PM2.5 values above the average are those with weak environmental regulation, and the rest are those with strict environmental regulation. Table 11 shows the regression results of environmental regulation heterogeneity. GFRI has a significant reduction effect on CE in both types of cities. Meanwhile, GFIP significantly improves CEE in cities with strict environmental regulation, but its impact on cities with weak environmental regulation is less clear. Further, the comparison of regression coefficients reveals that the policy effect of GFRI is better in cities with strict environmental regulation. This may be because cities with strict environmental regulation have a high level of environmental regulation and environmental judicial efficiency, which enables GFRI to be implemented more smoothly and efficiently, leading to a higher marginal effect of GFRI. Cities with weak environmental regulation have relatively low implementation efficiency of policies, and the related urban industries are urgently required to perform technological transformation, equipment renewal, and green transformation with policy shocks. At this time, enterprises need to invest more costs, and it is difficult for the policy effect to be quickly transformed within a short time. Therefore, the impact of GFRI on CEE in cities with weak environmental regulation may have delayed effects.

Tests for moderating effects

According to the theoretical analysis in the previous section, financial development and digital infrastructure have moderating effects on the effect of GFRI on carbon emission reduction. Based on this, this paper uses the introduction of moderating variable (T) and its interaction term with GFRI to verify the moderating effect of financial development and digital infrastructure. The specific model is set as follows:

The regression results of the moderating effects of financial development and digital infrastructure are shown in Table 12. The interaction term of financial development and GFRI has a significant negative effect on CE and a significant positive effect on CEE. This indicates that there is a significant positive moderating effect of financial development in the carbon emission reduction effect of GFRI, i.e., the improvement of financial development level can promote the carbon emission reduction effect of GFRI, which verifies hypothesis 3. Further, The regression coefficients of the interaction term of digital infrastructure and GFRI on CE and CEE are significantly negative and positive, respectively. The digital infrastructure can positively moderate the carbon emission reduction effect of GFRI. That is, GFRI’s effect of reducing carbon emissions can be more easily achieved with increased levels of digital infrastructure. Hypothesis 4 is verified.

Conclusion and policy implications

GFRI is an important initiative to promote low-carbon urban transformation. This paper regards the implementation of GFRI as a “quasi-natural experiment” and assesses its impact on reducing urban carbon emissions using data from 282 Chinese cities from 2006 to 2019, and then conducts a series of robustness tests, impact mechanism tests, heterogeneity tests and moderating effect tests. GFRI has a significant urban carbon emission reduction effect. Compared with non-pilot cities, GFRI reduces CE and improves CEE of pilot cities. This conclusion still holds after a parallel trend test and a series of robustness tests such as placebo test, propensity score matching method, and excluding other policy interference. GFRI achieves urban carbon emission reduction by promoting urban green innovation. However, the policy has no significant effect on financial agglomeration, so the mediating effect of financial agglomeration is not verified. There is significant variability in GFRI on urban carbon emission reduction. Among the cities with different resource endowments, the promotion effect of GFRI on carbon emission reduction in non-resource-based cities is stronger than that in resource-based cities. Noteworthy, GFRI significantly reduces CEE in resource-based cities. under different city sizes, GFRI has a better enhancement effect on carbon emission reduction in large cities, but promotes CE in mega cities. under different environmental regulation levels, GFRI has a greater carbon emission reduction effect on cities with strict environmental regulation than weak environmental regulation. Financial development and digital infrastructure have a positive moderating effect on the carbon emission reduction effect of GFRI.

Based on the above findings, this paper offers the following policy implications:

First, the experiences of GFRI should be summarized and promoted. the findings of this paper show that the introduction of GFRI not only significantly reduces CE, but also improves CEE. Therefore, on the basis of summarizing and promoting the experiences of green finance pilot, the scope of GFRI can be further expanded. This will help promote green and low-carbon transformation and achieve the goal of carbon peaking and carbon neutrality.

Second, green innovation should be taken as an important point of GFRI to increase urban green innovation and improve green innovation policies. The experience of China's GFRI has shown that the policy has promoted urban carbon emission reduction through green innovation. Therefore, cities should establish standards for defining green technologies, set up service platforms for technological innovation, broaden the scope of policy support, increase the intensity of policy support, improve the incentive mechanism for innovation, create a good environment for green innovation, guide financial resources to support the sustainable development of the economy and promote the development of low-carbon industries and the transformation of high-energy-consuming industries, which provide an inexhaustible impetus for urban carbon emission reduction.

Third, differentiated green finance measures are formulated according to the development characteristics of cities. Under different resource endowments, city scale and environmental regulation levels, there are differences in the urban carbon emission reduction effect of GFRI. Therefore, the "one-size-fits-all" model for different types of cities should be eliminated. Cities should formulate corresponding green financial objectives scientifically and reasonably according to their specific conditions, and truly perform the effect of GFRI. As resource-based cities have a strong path dependence on resources, the government should increase the promotion of policies when implementing policies, and develop corresponding financial products and service platforms according to the characteristics of urban industries, guiding the green transformation of industries in resource-based cities. As for megacities, the advantages of financial markets and financial institutions should be fully utilized to guide the low-carbon transformation of cities. Small and medium-sized cities should accelerate the improvement of their financial systems and enhance the efficiency of green financial services. Cities with strict environmental regulations should give full play to their environmental regulation level and environmental justice efficiency to promote sustainable development. Cities with weak environmental regulations can continuously improve their green financial products by considering their economic situation, thus promoting the low-carbon transformation of urban industries.

Fourth, the improvement of financial development and digital infrastructure can effectively enhance the carbon emission reduction effect of GFRI. Therefore, the development of green finance should be vigorously promoted, the green financial policy support system should be strengthened, the green financial products and market system should be optimized, and the supporting service facilities for green finance should be improved to promote the low-carbon transformation of cities. In addition, digital infrastructure such as big data and artificial intelligence can be used to enhance the service level and efficiency of green finance. At the same time, relying on advanced digital technology, a green financial information platform can be built to provide data support for green financial supervision, thus better realizing the carbon emission reduction effect of GFRI.

Data availability

The data is available on reasonable request.

Notes

Boao Forum for Asia Annual Report on Sustainable Development Asia and the World 2022.

Considering that GFRI was only introduced in Lanzhou New Area of Gansu Province on November 28, 2019, this paper does not put Lanzhou New Area into the pilot cities. In addition, due to the serious lack of data from Changji Prefecture and Hami City in Xinjiang Uygur Autonomous Region, eight cities, including Quzhou City, Huzhou City, Guangzhou City, Guiyang City, Anshun City, Nanchang City, Jiujiang City, and Karamay City, were finally identified as the experimental group.

References

Acheampong AO (2019) Modelling for insight: does financial development improve environmental quality? Energy Econ 83:156–179. https://doi.org/10.1016/j.eneco.2019.06.025

Alpay E, Buccola S, Kerkvliet J (2002) Productivity growth and environmental regulation in Mexican and US food manufacturing. Am J Agr Econ 84:887–901. https://doi.org/10.1111/1467-8276.00041

Ang JB (2009) CO2 emissions, research and technology transfer in China. Ecol Econ 68:2658–2665. https://doi.org/10.1016/j.ecolecon.2009.05.002

Cai X, Lu Y, Wu M, Yu L (2016) Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. J Dev Econ 123:73–85. https://doi.org/10.1016/j.jdeveco.2016.08.003

Cai J, Zheng H, Vardanyan M, Shen Z (2023) Achieving carbon neutrality through green technological progress: evidence from China. Energy Policy 173:113397. https://doi.org/10.1016/j.enpol.2022.113397

Chai J, Tian L, Jia R (2023) New energy demonstration city, spatial spillover and carbon emission efficiency: Evidence from China?s quasi-natural experiment. Energy Policy 173:113389. https://doi.org/10.1016/j.enpol.2022.113389

Dong F, Li Y, Qin C et al (2022a) Information infrastructure and greenhouse gas emission performance in urban China: a difference-in-differences analysis. J Environ Manage 316:115252. https://doi.org/10.1016/j.jenvman.2022.115252

Dong F, Zhu J, Li Y et al (2022b) How green technology innovation affects carbon emission efficiency: evidence from developed countries proposing carbon neutrality targets. Environ Sci Pollut Res 29:35780–35799. https://doi.org/10.1007/s11356-022-18581-9

Du M, Feng R, Chen Z (2022) Blue sky defense in low-carbon pilot cities: A spatial spillover perspective of carbon emission efficiency. Sci Total Environ. 846:157509. https://doi.org/10.1016/j.scitotenv.2022.157509

Fan M, Li M, Liu J, Shao S (2022) Is high natural resource dependence doomed to low carbon emission efficiency? Evidence from 283 cities in China. Energy Econ 115:106328. https://doi.org/10.1016/j.eneco.2022.106328

Feng R (2022) Financial agglomeration, green technology innovation and green economic efficiency. Econ Survey 39:150–160. https://doi.org/10.15931/j.cnki.1006-1096.2022.04.010

Flammer C (2020) Green bonds: Effectiveness and implications for public policy. Environ Energy Policy Econ 1:95–128. https://doi.org/10.1086/706794

Fu Y, He C, Luo L (2021) Does the low-carbon city policy make a difference? Empirical evidence of the pilot scheme in China with DEA and PSM-DID. Ecol Indic 122:107238. https://doi.org/10.1016/j.ecolind.2020.107238

Gao Y, Shen Z (2022) The role of green finance reform policy in carbon reduction. China Environ Sci 42:4849–4859. https://doi.org/10.19674/j.cnki.issn1000-6923.20220616.009

Gao Y, Li M, Xue J, Liu Y (2020) Evaluation of effectiveness of China’s carbon emissions trading scheme in carbon mitigation. Energy Econ 90:104872. https://doi.org/10.1016/j.eneco.2020.104872

Guo M, Hu Y, Yu J (2019) The role of financial development in the process of climate change: Evidence from different panel models in China. Atmos Pollut Res 10:1375–1382. https://doi.org/10.1016/j.apr.2019.03.006

Guo J, Wang L, Zhou W, Wei C (2022a) Powering green digitalization: Evidence from 5G network infrastructure in China. Resour Conserv Recycl 182:106286. https://doi.org/10.1016/j.resconrec.2022.106286

Guo Q, Su Z, Chiao C (2022b) Carbon emissions trading policy, carbon finance, and carbon emissions reduction: evidence from a quasi-natural experiment in China. Econ Change Restruct 55:1445–1480. https://doi.org/10.1007/s10644-021-09353-5

Hao X, Li Y, Ren S et al (2023) The role of digitalization on green economic growth: Does industrial structure optimization and green innovation matter? Environ Manag 325:116504. https://doi.org/10.1016/j.jenvman.2022.116504

Hou H, Zhu Y, Wang J, Zhang M (2022) Will green financial policy help improve China’s environmental quality? the role of digital finance and green technology innovation. Environ Sci Pollut Res 30:10527–10539. https://doi.org/10.1007/s11356-022-22887-z

Hu J, Li J, Li X et al (2021) Will Green Finance Contribute to a Green Recovery? Evidence From Green Financial Pilot Zone in China. Front Public Health 9:794195. https://doi.org/10.3389/fpubh.2021.794195

Huovila A, Siikavirta H, AntuñaRozado C et al (2022) Carbon-neutral cities: Critical review of theory and practice. J Clean Prod 341:130912. https://doi.org/10.1016/j.jclepro.2022.130912

Hussain J, Lee C-C (2022) A green path towards sustainable development: Optimal behavior of the duopoly game model with carbon neutrality instruments. Sustain Dev 30:1523–1541. https://doi.org/10.1002/sd.2325

Irfan M, Razzaq A, Sharif A, Yang X (2022) Influence mechanism between green finance and green innovation: Exploring regional policy intervention effects in China. Technol Forecast Soc Change 182:121882. https://doi.org/10.1016/j.techfore.2022.121882

Jia X, Liu B, Cui Y, Peng L (2021) Has Financial Development Improved Carbon Emission Efficiency? An Analysis Based on Super Efficiency Undesirable - Sbm Model and Multinational Panel Data. Environ Eng Manag J 20:1821–1832

Jiang H, Wang W, Wang L, Wu J (2020) The effects of the carbon emission reduction of China’s green finance: an analysis based on green credit and green venture investment. Financ Forum 25:39–48+80. https://doi.org/10.16529/j.cnki.11-4613/f.2020.11.006

Kong G, Wang S, Wang Y (2022) Fostering firm productivity through green finance: Evidence from a quasi-natural experiment in China. Econ Model 115:105979. https://doi.org/10.1016/j.econmod.2022.105979

Li W, Fan Y (2022) Influence of green finance on carbon emission intensity: empirical evidence from China based on spatial metrology. Environ Sci Pollut Res 30:20310–20326. https://doi.org/10.1007/s11356-022-23523-6

Li G, Wang L, Li Z, Guo Z (2023) Has pilot zones policy for green finance reform and innovations improved the level of green finance development and environmental quality? Environ Sci Pollut Res. https://doi.org/10.1007/s11356-023-27243-3

Li R, Li L, Wang Q (2022) The impact of energy efficiency on carbon emissions: Evidence from the transportation sector in Chinese 30 provinces. sustain Cities Soc 82. https://doi.org/10.1016/j.scs.2022.103880

Lin Z, Liao X, Yang Y (2023) China’s experience in developing green finance to reduce carbon emissions: from spatial econometric model evidence. Environ Sci Pollut Res 30:15531–15547. https://doi.org/10.1007/s11356-022-23246-8

Liu C, Xu J, Zhao J (2023a) How does financial development reduce carbon emissions: evidence from BRI countries. Environ Sci Pollut Res 30:27227–27240. https://doi.org/10.1007/s11356-022-24105-2

Liu Z, He S, Li W, Sun H (2023b) Does green credit reduce carbon emissions? Evidence from China. Environ Sci Pollut Res 30:26735–26751. https://doi.org/10.1007/s11356-022-24011-7

Mamun M, Boubaker S, Nguyen DK (2022) Green finance and decarbonization: Evidence from around the world. Finance Res Lett 46:102807. https://doi.org/10.1016/j.frl.2022.102807

Mizobuchi K (2008) An empirical study on the rebound effect considering capital costs. Energy Econ 30:2486–2516. https://doi.org/10.1016/j.eneco.2008.01.001

Mngumi F, Shaorong S, Shair F, Waqas M (2022) Does green finance mitigate the effects of climate variability: role of renewable energy investment and infrastructure. Environ Sci Pollut Res 29:59287–59299

Mo J, Duan H, Fan Y, Wang S (2018) China’s energy and climate targets in the Paris agreement: integrated assessment and policy options. Eco Res J 53:168–181. https://doi.org/10.16529/j.cnki.11-4613/f.2020.10.007

Nenavath S (2022) Impact of fintech and green finance on environmental quality protection in India: By applying the semi-parametric difference-in-differences (SDID). Renew Energy 193:913–919

Okushima S, Tamura M (2010) What causes the change in energy demand in the economy? The role of technological change. Energy Econ 32:S41–S46. https://doi.org/10.1016/j.eneco.2009.03.011

Porter ME, van der Linde C (1995) Toward a New Conception of the Environment-Competitiveness Relationship. J Econ Perspect 9:97–118. https://doi.org/10.1257/jep.9.4.97

Qian Y, Liu J, Forrest JY-L (2022) Impact of financial agglomeration on regional green economic growth: evidence from China. J Environ Plan Manag 65:1611–1636. https://doi.org/10.1080/09640568.2021.1941811

Qu C, Shao J, Shi Z (2020) Does financial agglomeration promote the increase of energy efficiency in China? Energy Policy 146:111810. https://doi.org/10.1016/j.enpol.2020.111810

Ran Q, Liu L, Razzaq A et al (2023) Does green finance improve carbon emission efficiency? Experimental evidence from China. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-023-25571-y

Rasoulinezhad E, Taghizadeh-Hesary F (2022) Role of green finance in improving energy efficiency and renewable energy development. Energy Effic 15:14. https://doi.org/10.1007/s12053-022-10021-4

Ren Y, Ren X, Hu J (2019) Driving factors of China’s city-level carbon emissions from the perspective of spatial spillover effect. Carbon Manag 10:551–566. https://doi.org/10.1080/17583004.2019.1676096

Saeed Meo M, Karim MZA (2022) The role of green finance in reducing CO2 emissions: An empirical analysis. Borsa Istanbul Rev 22:169–178. https://doi.org/10.1016/j.bir.2021.03.002

Shahbaz M, Tiwari AK, Nasir M (2013) The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 61:1452–1459. https://doi.org/10.1016/j.enpol.2013.07.006

Shen L, Liao X (2020) Reform and innovation of green finance and fulfillment of corporate social responsibility: Evidence from the Green Finance Pilot Zones. Financ Forum 25:69–80

Shen Y-S, Lin Y-C, Cheah W et al (2022) Influences and pathways of urban form and lifestyle on carbon emission reduction. Urban Clim 46:101325. https://doi.org/10.1016/j.uclim.2022.101325

Shi B, Li N, Gao Q, Li G (2022a) Market incentives, carbon quota allocation and carbon emission reduction: Evidence from China’s carbon trading pilot policy. trading pilot policy. J Environ Manag 319:115650. https://doi.org/10.1016/j.jenvman.2022.115650

Shi J, Yu C, Li Y, Wang T (2022b) Does green financial policy affect debt-financing cost of heavy-polluting enterprises? An empirical evidence based on Chinese pilot zones for green finance reform and innovations. Technol Forecast Soc Change 179:121678. https://doi.org/10.1016/j.techfore.2022.121678

Sun W, Huang C (2020) How does urbanization affect carbon emission efficiency? Evidence from China. J Clean Prod 272:1222828. https://doi.org/10.1016/j.jclepro.2020.1222828

Sun X, Zhang A, Zhu M (2023) Impact of Pilot Zones for Green Finance Reform and Innovations on green technology innovations: evidence from Chinese manufacturing corporates. Environ Sci Pollut Res 30:43901–43913. https://doi.org/10.1007/s11356-023-25371-4

Tan XC, Gao JX, Zeng A et al (2023) Impact of the “Pilot Zones for Green Finance Reform and Innovations” policy on carbon emissions. Clim Change Res 19:213–226

Tao M, Sheng MS, Wen L (2023) How does financial development influence carbon emission intensity in the OECD countries: some insights from the information and communication technology perspective. J Environ Manag 335:117553. https://doi.org/10.1016/j.jenvman.2023.117553

Tone K (2002) A slacks-based measure of super-efficiency in data envelopment analysis. Eur J Oper Res 143:32–41. https://doi.org/10.1016/S0377-2217(01)00324-1

Umar M, Safi A (2023) Do green finance and innovation matter for environmental protection? A case of OECD economies. Energy Econ 119:106560. https://doi.org/10.1016/j.eneco.2023.106560

Wang J, Li H (2019) The mystery of local fiscal expenditure and carbon emission growth in China. Environ Sci Pollut Res 26:12335–12345. https://doi.org/10.1007/s11356-019-04591-7

Wang J, Liu B (2014) Environmental regulation and enterprise’s TFP: An empirical analysis based on China’s industrial enterprise data. Chin Ind Econ 3:44–56. https://doi.org/10.19581/j.cnki.ciejournal.2014.03.004

Wang F, Feng G, Wu L (2013) Regional contribution to the decline of national carbon intensity in China’s economic growth. Eco Res J 48:143–155

Wang K, Wu M, Sun Y et al (2019) Resource abundance, industrial structure, and regional carbon emissions efficiency in China. Resour Policy 60:203–214. https://doi.org/10.1016/j.resourpol.2019.01.001

Wang F, Cai W, Elahi E (2021a) Do Green Finance and Environmental Regulation Play a Crucial Role in the Reduction of CO2 Emissions? An Empirical Analysis of 126 Chinese Cities. Sustainability 13:13014. https://doi.org/10.3390/su132313014

Wang X, Liu J, Zhao Y (2021b) Effectiveness Measurement of Green Financial Reform and Innovation Pilot Zone. J Quant Tech Econ 38:107–127. https://doi.org/10.13653/j.cnki.jqte.2021.10.006

Wang Q, Hu A, Tian Z (2022) Digital transformation and electricity consumption: Evidence from the Broadband China pilot policy. Energy Econ 115:106346. https://doi.org/10.1016/j.eneco.2022.106346

Wei L, Ullah S (2022) International tourism, digital infrastructure, and CO2 emissions: fresh evidence from panel quantile regression approach. Environ Sci Pollut Res 29:36273–36280. https://doi.org/10.1007/s11356-021-18138-2

Wen S, Liu X (2019) Financial misallocation, pollution and sustainable growth. Res Econ Manag 40:3–20. https://doi.org/10.13502/j.cnki.issn1000-7636.2019.03.001

Xie R, Fang J, Liu C (2017) The effects of transportation infrastructure on urban carbon emissions. Appl Energy 196:199–207. https://doi.org/10.1016/j.apenergy.2017.01.020

Xie Z, Wu R, Wang S (2021) How technological progress affects the carbon emission efficiency? Evidence from national panel quantile regression. J Clean Prod 307:127133. https://doi.org/10.1016/j.jclepro.2021.127133

Xu T, Kang C, Zhang H (2022) China’s efforts towards carbon neutrality: does energy-saving and emission-reduction policy mitigate carbon emissions? J Environ Manage 316:115286. https://doi.org/10.1016/j.jenvman.2022.115286

Xu P, Ye P, Jahanger A, et al (2023) Can green credit policy reduce corporate carbon emission intensity: Evidence from China's listed firms. Corp Soc Responsib Environ Manag 1–16. https://doi.org/10.1002/csr.2506

Yan C, Mao Z, Ho K-C (2022) Effect of green financial reform and innovation pilot zones on corporate investment efficiency. Energy Econ 113:106185. https://doi.org/10.1016/j.eneco.2022.106185

Yao X, Kou D, Shao S et al (2018) Can urbanization process and carbon emission abatement be harmonious? New evidence from China. Environ Impact Assess Rev 71:70–83. https://doi.org/10.1016/j.eiar.2018.04.005

Yi Y, Qi J, Chen D (2022) Impact of population agglomeration in big cities on carbon emissions. Environ Sci Pollut Res 29:86692–86706. https://doi.org/10.1007/s11356-022-21722-9

Yu Y, Zhang N (2021) Low-carbon city pilot and carbon emission efficiency: Quasi-experimental evidence from China. Energy Econ 96:105125. https://doi.org/10.1016/j.eneco.2021.105125

Yuan H, Zhang T, Feng Y et al (2019) Does financial agglomeration promote the green development in China? A spatial spillover perspective. J Clean Prod 237:117808. https://doi.org/10.1016/j.jclepro.2019.117808

Yuan H, Zhang T, Hu K et al (2022) Influences and transmission mechanisms of financial agglomeration on environmental pollution. J Environ Manage 303:114136. https://doi.org/10.1016/j.jenvman.2021.114136

Zaidi S, Zafar M, Shahbaz M, Hou F (2019) Dynamic linkages between globalization, financial development and carbon emissions: Evidence from Asia Pacific Economic Cooperation countries. J Clean Prod 228:533–543. https://doi.org/10.1016/j.jclepro.2019.04.210

Zhang Y-J (2011) The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 39:2197–2203. https://doi.org/10.1016/j.enpol.2011.02.026

Zhang H, Chen Z (2023) Financial reform and haze pollution: A quasi-natural experiment of the financial reform pilot zones in China. J Environ Manag 330:117196. https://doi.org/10.1016/j.jenvman.2022.117196

Zhang J, Wu G, Zhang J (2004) The estimation of China’s provincial capital stock: 1952–2004. Eco Res J 10:35–44

Zhang A, Deng R, Wu Y (2022a) Does the green credit policy reduce the carbon emission intensity of heavily polluting industries? -Evidence from China’s industrial sectors. J Environ Manag 311:114815. https://doi.org/10.1016/j.jenvman.2022.114815

Zhang A, Wang S, Liu B (2022b) How to control air pollution with economic means? Exploration of China’s green finance policy. J Clean Prod 353:131664. https://doi.org/10.1016/j.jclepro.2022.131664

Zhang Z, Hu G, Mu X, Kong L (2022c) From low carbon to carbon neutrality: A bibliometric analysis of the status, evolution and development trend. J Environ Manag 322:116087. https://doi.org/10.1016/j.jenvman.2022.116087

Zhang H, Wang Y, Li R et al (2023) Can green finance promote urban green development? Evidence from green finance reform and innovation pilot zone in China. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-22886-0

Zheng X, Wang R, Du Q (2020) How does industrial restructuring influence carbon emissions: City-level evidence from China. J Environ Manag 276:111093. https://doi.org/10.1016/j.jenvman.2020.111093

Funding

This paper was supported by the Key Project of Humanities and Social Sciences in Anhui Universities (SK2021A0229); Anhui Ecological and Economic Development Research Center Project (AHST2019016).

Author information

Authors and Affiliations

Contributions

Qiang Xie: Conceptualization, methodology, draft writing. Xianxian Fan: Data collection, review and revisions.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Xie, Q., Fan, X. Carbon emission reduction effects of green finance reform and innovation pilot zones policy: evidence from the prefecture-level city in China. Environ Sci Pollut Res 30, 102624–102640 (2023). https://doi.org/10.1007/s11356-023-29505-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-29505-6