Abstract

The Yellow River Economic Belt (YREB) is a fundamental ecological protection barrier for China. Its carbon pollution issues are currently severe owing to the extensive energy consumption and unsatisfactory industrial constructions. In this context, this paper estimates carbon emission efficiency (CEE) based on the panel data from 56 cities in the YREB during the period 2006–2019 and analyzes its spatial distribution characteristics. Additionally, the spatial Durbin model (SDM) is utilized to examine the effect of technological innovation (TI) on CEE as a result of the moderating effects of government support (GS) and marketization (MA), respectively. The results indicated that (i) in the YREB, CEE exhibited significant spatial autocorrelation characteristics; (ii) TI negatively affected local CEE; (iii) the moderating effect of local GS on the relationship between TI and CEE in the local area was negative, but its spatial spillover effect was still not significant; (iv) the moderating effect of local MA on the relationship between TI and CEE in the local area was also negative, but positive in the surrounding areas. Based on the empirical analysis, a series of policy suggestions are proposed to improve the YREB’s CEE.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Significant issues relating to greenhouse gas emissions in China have resulted from increased energy consumption, which has caused widespread public concern (Tong et al. 2021). In contrast with developed countries, China’s energy generation is less efficient, resulting in international pressure on China to reduce CO2 emissions. In accordance with the framework of the Paris Agreement, the Chinese government announced plans to reduce carbon emission intensity by about 60–65% by 2030 (compared with 2005 levels) and to peak its CO2 emissions, creating a significant and challenging objective (Anderson et al. 2020; Rogelj et al. 2019). In response to the double challenge of domestic carbon pollution and international climate commitments, the Chinese government has issued various policies to reduce CO2 emissions. For instance, in January 2017, the National Development and Reform Commission announced their intention to construct the third batch of low-carbon pilots. In addition, in June 2017, China’s carbon emission trading market was officially launched (Chen et al. 2021). Subsequently, the Ministry of Ecology and Environment of the People’s Republic of China issued the Procedures for the Administration of Carbon Emissions Trading (for Trial Implementation) in December 2020 (Zhang et al. 2022d).

Indisputably, the government should not only focus on limiting the quantity of CO2 emissions but also consider its effect on economic growth. Therefore, this paper selected carbon emission efficiency (CEE), a combination of these two issues, as a reasonable evaluation indicator. Existing literature has indicated that improving carbon emission efficiency is a more efficient way for China to reduce carbon pollution (Sun and Huang 2020; Zhang et al. 2022a, b, c). The calculation of CEE is therefore of primary concern, and there are two methods: the single-indicator method and the multi-indicator method. The former is usually defined as the CO2 emissions per unit of GDP or the CO2 emissions per unit of energy consumption, which isolates the integrated relationship between CO2 emissions, GDP, and energy consumption. The multi-indicator method, however, is well designed by considering the undesirable output of CO2 emissions and the desired output of GDP, both of which are generated by specific inputs of capital, labor, and energy (Zhou et al. 2019). In addition to the estimation of CEE, previous studies have also focused on the factors that influence it. Specifically, numerous studies have applied panel data and spatial econometric models to explore the effects of various factors on CEE, among which the level of urbanization, foreign direct investment, economic level, and industrial structure are widely investigated factors (Liu et al. 2019). The effect of technological innovation (TI) on CEE has attracted considerable discussion with the application of TI to carbon reduction. A significant quantity of research has identified TI as an essential factor affecting CO2 emissions (Dong et al. 2022; Zhang and Liu 2022).

Previous studies have examined the relationship between technological innovation (TI) and CO2 emissions in relation to alternative regional scales (Li et al. 2021a, b; Xie et al. 2021; Zhang et al. 2017), and there is currently no consensus on the effect of TI on CEE so far. On the one hand, TI is considered an essential way to develop a low-carbon economy. For instance, the quantity of patents granted can significantly reduce the regional CO2 intensity by providing alternative energy sources to reduce dependence on fossil fuels. The renowned environmental Kuznets curve (EKC) demonstrates that environmental pollution has an inverse U-shaped relationship with economic growth, with pollution decreasing once the development of the economy reaches a certain threshold as a result of TI (Grossman and Krueger 1995). TI enhances CEE in numerous ways, such as cleaner production, less energy consumption, and higher-quality economic development. Specifically, the increased level of urban innovation enhances efficient production methods and facilitates high-tech carbon collection and treatment methods, thereby contributing to enhanced CEE (Zhang et al. 2017). On the other hand, however, not all TI scenarios contribute to CO2 reduction. For instance, innovation activities in fossil energy technologies are less efficient in reducing CO2 emissions (Wang et al. 2012). In addition, Yii and Geetha (2017) used the Granger causality test to demonstrate that the effect of TI on enhancing environmental quality is only effective in the short term but not in the long term. While TI promotes economic growth, it can also trigger a “rebound effect” (Yang and Li 2017). That is, energy efficiency gained from TI would lower production budgets, promote economic expansion, and consume additional fossil fuels, thus decreasing CEE (Huang et al. 2021; Han 2021).

Furthermore, marketization (MA) as well as government support (GS) are regarded as facilitators of innovative activities in a few studies for their significant effects on resource integration and factor circulation (Wang 2018). GS can significantly enhance firms’ efforts in low-carbon innovation, which has attracted widespread attention from academics. Yang and Xu (2019) proposed that government subsidies can provide financial support for businesses’ TI investments and contribute to their carbon reduction innovation. Guo et al. (2020) proposed that the green technology bank database (developed by the Chinese government) has significantly reduced the barriers to corporate utilization of green TI as well as providing an alternative to dependence on traditional “dirty” TI. Similarly, Du and Li (2019) found that the effect of TI on carbon mitigation is greater in developed economies compared with developing economies owing to their enhanced GS. On the other hand, regions with a higher level of MA have a more sophisticated institutional system, which facilitates the transfer of factors and products and creates a competitive and structured environment for innovative activities (Zhao and Yu 2014). Several studies have found that MA can facilitate the greening transformation of TI (Varadarajan 2020). Especially for developed countries, customer demand is an essential source of clean innovation, contributing to the development of environmentally friendly materials and the reduction of energy consumption and CO2 emissions (Veugelers 2012). This suggests that as economic and MA levels increase, the public becomes more aware of environmental conservation and they will increase their purchase of green products (Albort-Morant et al. 2016). Market demand can also enhance the expected returns of clean products, creating an intrinsic incentive for green TI and thus reducing CO2 emissions. The previous literature provides an important reference for the study of the moderating effect of government and market on the relationship between TI and CEE.

The YREB is both a political and cultural center and an important economic belt within China. The region is rich in fossil fuels and has strategic responsibility for ensuring national energy security (Jiang et al. 2021). This has also resulted in the economic development of the region relying primarily on energy-intensive industries and being the primary area for generating carbon emissions in China (Ji and Zhang 2021). In 2019, the YREB accounted for 40.5% of the total national emissions (Song et al. 2022). In response to this, the Chinese government proposed the Outline of a Plan for Ecological Protection and High-quality Development of the Yellow River Basin, a significant national strategy announcement in 2021, which emphasized the importance of promoting low-carbon development in the YREB by enhancing TI. However, this region has obvious shortcomings in TI. According to 2020 statistics, the number of invention patents granted in the YREB only accounted for 15.62% of the national total. Therefore, reducing CO2 emissions by utilizing innovative approaches has become critical and requires significant focus by both the government and the market. However, there are few systematic and comprehensive studies on the YREB, and few have investigated the moderating effects of GS and MA on the relationship between TI and CEE in the YREB from a spatial perspective (Zhang and Xu 2022; Guo et al. 2022). This paper therefore selected the YREB as the research object to investigate how TI affected CEE. Moreover, given the complexity of the development and conservation issues of the YREB and that carbon pollution is a synthetic result of combined factors (Jiang et al. 2021), the aforementioned multi-indicator approach, which combines low energy consumption, low CO2 emissions, and high economic growth to calculate CEE, is appropriate for a comprehensive exploration of CO2 emissions issues in the YREB holistically.

To resolve the deficiencies in previous studies, this paper focused on calculating CEE by utilizing a super-efficiency slacks-based measure (super-SBM) on the basis of the panel data of 56 cities in the YREB from 2006 to 2019. It then investigated the spatial distribution features of CEE in the YREB combined with global Moran’s I and local Moran’s I. Furthermore, the direct and indirect effects of TI on CEE were investigated through a spatial econometric approach. Finally, based on a dualistic perspective, this paper investigated the moderating effect of GS and MA on the relationship between TI and CEE, respectively.

Overall, this study provides additional contributions compared with existing literature. Firstly, in contrast to most previous studies, which have taken industry or “hot regions” as the research sample, this study investigated CEE based on the panel data of the YREB and analyzed its spatial autocorrelation characteristics simultaneously. This provided an empirical reference for the government to control carbon pollution according to local conditions in the YREB. Secondly, in comparison with other studies that consider several factors simultaneously, this study focused on the direct and indirect effects of TI on CEE in the YREB. Its results identified the negative impact of TI on CEE, in contrast with previous research, which indicated that TI is beneficial to CEE. Thirdly, this study focused on the effect of TI in the context of the moderation role of GS and MA separately, which could contribute to developing a favorable government approach and market environment for TI activities.

The rest of our study is structured as follows: In the “Literature review and research hypotheses” section, we recap previous studies and propose research hypotheses. The “Data and methods” section introduces the research methodology and data sources. In the “Empirical analysis and results” section, the empirical results of the spatial econometrics approach are presented and the interactive effects are analyzed. And finally, in the “Conclusion and policy implications” section, we draw conclusions and provide a basis for relevant policy development.

Literature review and research hypotheses

This section first reviews and summarizes the literature relating to the implications of CEE and TI and the descriptive analysis of CEE. Then it analyzes the effect of TI on CEE and the moderating mechanisms of GS and MA, respectively, as well as the relevant findings and discussions relating to this issue. It concludes with research hypotheses in corresponding subsections.

Literature review

CEE, as an essential aspect of the assessment of environmental performance assessment, has attracted extensive attention in academia (Chen et al. 2022). Previous studies on CEE primarily focused on its assessment, spillover effect, and relevant factors (Xu et al. 2022a, b). The reasonable calculation of CEE is an important process in setting emission mitigation policies, which has primarily been undertaken by utilizing “single-factor” index or “total factor” performance evaluation methods (Zhang et al. 2022a, b, c). The former is easy to access data and simple to operate, but it separates the intrinsic link between economy, energy, and CO2 emissions (Luan et al. 2019). The latter, in comparison, consider into account input indicators, such as capital investment, labor, and energy consumption, desired output indicators of GDP, and undesired output indicators of CO2 emissions, thereby improving the accuracy of the assessment of CEE (Fang et al. 2022). In general, methods for measuring CEE consist of the data envelopment analysis (DEA) approach, fuzzy Delphi-ANP approach, and cross-efficiency model based on Malmquist productivity index (CE-MPI) (Lin and Zhou 2021). Among them, the DEA approaches and its modified form are the most widely applied to calculate CEE (Gong et al. 2022). In contrast with other DEA approaches, the advantages of the Super-SBM model include considering CO2 emissions as undesirable outputs and the reinforcement of radial and non-radial possibilities in the procedure, thus providing more objective performance assessments (Gao et al. 2021). For example, Xie et al. (2021) utilized the Super-SBM model to evaluate the CEE of 59 countries during the period 1998–2016 and found a steady increase in CEE in the sample countries. Gao et al. (2021) utilized the Super-SBM model to estimate the CEE of 28 industrial sectors in China as affected by both explicit and implicit carbon emission scenarios.

Besides the estimation of CEE, studies have extensively focused on the descriptive analysis of CEE. The relevant researches have primarily utilized the Markov chain model (Wu et al. 2023), Thiel index (Du et al. 2022a, b), Gini coefficient (Kong et al. 2019; Zhang et al. 2022a, b, c) and Moran’s I index (Wang et al. 2019a, b) to explore it, among which only the Moran’s I index considered the spatial location of samples. It is significant that geographical factors are an important factor in CO2 emission issues (Wu et al. 2016), owing to the fact that carbon emissions dispersed directly into the atmosphere can be readily transferred from one region to adjacent regions. In recent years, the discussions on the spillover effect of CEE have slowly developed into a focus (Fang et al. 2022; Xu et al. 2022a, b; Lin and Zhou 2021). Du et al. (2022a, b) investigated the spatial distribution aspect of CEE in the construction industry in China, and found that CEE in the construction industry showed obvious spatial spillover effects. For the power sector, Yan et al. (2017) found that there was also a significant spatial correlation of CEE in different regions, and CEE of the eastern region was higher, and it had a spillover effect on the surrounding areas. Wang et al. (2019a, b) explored the spatial distribution of CEE in China, and they found that CEE progressively declined in the east, central, and west, and that the high CEE spatial clusters were mainly concentrated in coastal regions. These findings corroborate the spatial autocorrelation of CEE, which is the foremost attribute of geography (Tobler 1970). Nevertheless, rarely have researches accounted for geographical factors in discussing the CEE of the YREB. As a result, this paper utilized geospatial data and Moran’s I index to characterize the spatial distribution of CEE in the YREB.

According to previous studies, TI is regarded as a significant factor in enhancing CEE. Its fundamental function is to enhance economic flexibility, promote energy efficiency, and decrease the costs of carbon abatement (Du et al. 2022a, b). In general, existing studies on TI primarily consist of three types, that is, the influencing factors, its performance, and its impact on CO2 emission mitigation. Firstly, scholars have broadly categorized the influencing factors of TI into three aspects (i.e., enterprise factors, MA, and GS). Wu et al. (2022) explored the impact of government subsidy policies and businesses’ decisions relating to low-carbon TI in the carbon market trading system. Secondly, in terms of performance, previous studies primarily focused on business performance and energy efficiency performance. For example, Cai and Li (2018) investigated the relationship between eco-innovation and business performance based on 442 Chinese firms. Sun et al. (2021) investigated the spillover effect of TI on energy efficiency in 24 innovative countries. Thirdly, numerous emerging studies have focused on the impact of TI on CO2 emissions abatement (Shahbaz et al. 2020). With the advent of the knowledge-based economy, many academics have begun to recognize the significance of TI in reducing carbon emissions and improving environmental performance (Liu et al. 2022). The effect of TI on CEE can be calculated by utilizing analytical methods, including the quadratic assignment procedure (QAP) regression (Wang and Yao 2022), the Tobit model (Zhu et al. 2021), the panel two-way fixed-effects model (Xu et al. 2021), and the spatial economic model (Sun et al. 2021). For instance, Lin and Ma (2022) utilized the fixed-effects model with Driscoll–Kraay standard errors (Driscoll and Kraay 1998) to address the issue of cross-sectional correlation and then explored the impact of different channels of TI on CO2 emissions. Awaworyi Churchill et al. (2019) applied nonparametric panel data models to investigate the effect of R&D intensity on CO2 emissions and found that R&D can curb CO2 emissions. Other researchers applied the spatial Durbin model to estimate the spatial effect of TI on carbon intensity and verified the technological diffusion effect (Gu et al. 2020).

However, there is no agreement in the existing literature concerning the relationship between TI and CEE. On the one hand, the positive view holds that TI has spawned numerous patents and high-tech products, which contribute to higher output per unit of energy consumption and enhance natural resource utilization, thus lowering energy consumption and enhancing environmental performance (Zhang et al. 2017). Some academics found that the decrease in CO2 emissions intensity in an area could have been caused by the promotion of green TI in neighboring cities; that is, there is an obvious spatial spillover of the carbon reduction effect of TI (Liu et al. 2022). It appears that TI has enhanced clean production and improved the effectiveness of carbon handling, thereby lowering CO2 levels (Liu et al. 2022; Xu et al. 2021). On the other hand, TI does not only contribute to improving energy efficiency and reducing carbon pollution, but it can also expand economic scale, resulting in additional energy consumption and pollution discharge (Acemoglu et al. 2012). The negative view indicates that TI activities may deviate from the purpose of energy conservation and low-carbon development and instead be a profit-driven behavior in the short term, thus increasing CO2 emissions (Yang and Li 2017). Similarly, some representative views hold that TI will trigger a “rebound effect” on CO2 emissions (Kang et al. 2018; Lin and Zhao 2016). Specifically, TI lowers the cost of fossil fuel extraction and increases energy efficiency, which encourages producers to substitute fossil fuels for capital and labor, resulting in serious carbon pollution (Yi et al. 2020). Li and Wang (2017) developed a decomposition model to investigate the dual effects of TI on CO2 emissions, including the intensity effect, which reduces carbon intensity, and the scale effect, which scales-up economy. They suggested that although TI contributes to the decrease in carbon intensity, the sprawl of economic scale it causes may produce additional CO2 emissions and reduce CEE. This is consistent with the findings of Weina et al. (2016), supporting the rebound effect of TI.

In studies concerning the relationship between TI and CEE, the moderating role of GS and MA cannot be negligible. Government subsidies can offset environmental costs of firms and encourage them to undertake TI activities to achieve environmental goals (Xie et al. 2019). It acts as a significant factor in resolving market failures and usually plays a signal effect in guiding companies to improve environmental performance and increase CEE by utilizing TI (Fischer et al. 2017; Dimos and Pugh 2016). As a result of the “race to the top,” local government behavior may affect surrounding governments (Xu et al. 2022a, b; Feng et al. 2021). Yet few studies have been conducted to investigate the spillover effect of the interactive term of GS and TI. Liang et al. (2022) analyzed the moderating role of government subsidies on the relationship between TI and environmental performance; the spatial spillover, nevertheless, was not considered. In contrast, the spillover effect of MA has been discussed by Shao et al. (2022), and they proposed that the “ripple effect,” caused by infrastructure development and increased factor mobility, can enhance TI in neighboring regions (Zhu and Lee 2021; Dong et al. 2020), hence there is positive spatial spillover of the interactive item of MA and TI on CEE. Other literature on the impact of MA on the relationship between TI and CEE has primarily considered the carbon trading market or supply chain perspectives. Zhang et al. (2022a, b, c) suggested that although the carbon trading market squeezed out corporate green TI inputs, it reduced carbon emissions. Wei and Wang (2023) applied game theory to explore alternative approaches to promote green TI, and they found that information sharing of market demand can facilitate green TI. Nevertheless, the previous literature is devoid of an explicit and comprehensive discussion on the moderating role of GS and MA on the nexus between TI and CEE.

While many studies have examined the effect of TI on environmental performance, the impact of TI on CEE moderated by GS and MA has rarely been considered, particularly in the YREB. This study investigated in further detail the relationship between TI and CEE of the YREB as affected by the moderating role of GS and MA from a spatial perspective.

Technological innovation on carbon emission efficiency

According to the classical Schumpeterian innovation theory, TI creates a mechanism of “creative destruction” for economic development (Schumpeter 1942). The impact of TI on CEE differs among regions with different levels of economic development. Owing to the different demands at different stages of economic development, some studies have demonstrated that TI can curb CO2 emissions in developed economies but increase them in developing economies (Ibrahim and Vo 2021; Kumar and Managi 2009). Especially in Northwest China, given its significant energy resources, the supply chain of “dirty” energy hinders the transition from traditional technology to clean technology. Moreover, energy-based economic development consumes significant quantities of fossil fuels, offsetting the reductions in pollution emissions achieved by clean fuels (Ghoddusi and Roy 2017). The YREB, as a significant underdeveloped economic belt, has experienced massive energy resource exploitation. While TI has enhanced the efficient utilization of energy for economic development in the YREB, it has resulted in environmental deterioration and lower CEE (Mushtaq et al. 2020).

Increasingly, scholars have analyzed the spatial effects of TI on CEE from the perspective of regional heterogeneity (Wang and Zhu 2020). To be specific, the ability of different regions to absorb and transform TI outcomes into low-carbon products is different, resulting in different spillover effects of TI on CEE across regions (Luan et al. 2019; Huang et al. 2018). For underdeveloped regions, the mobility of information and communication technology (ICT) is limited by infrastructure, and therefore the externalities of TI may not be meaningful for these regions (Yang et al. 2021; Jiao et al. 2018). Particularly, these regions are constrained by the inertia development model; their TI is initially in a phase of superior profit orientation and inferior environmental objectives. Mobility barriers inhibit the low level of TI’s capability to generate spatial spillover effects on the CEE in neighboring regions (Jin et al. 2022; Nie et al. 2021; Du and Li 2019). Compared with other developed economic belts in China, the TI capacity of the YREB has not developed sufficiently to enter the technological diffusion period. It is currently insufficient to exert spillover effects. Accordingly, we proposed the following hypothesis:

-

H1: TI reduces local CEE, but it has no spatial spillover effect on the CEE of surrounding areas.

Moderating role of government support

Externalities from TI activities may lead to a reduction in businesses’ incentives to innovate when profitability objectives are contrary to environmental targets (Wang 2018; Zhang et al. 2017). Government fiscal spending is generally regarded as the principal way to increase businesses’ motivation to utilize low-carbon technologies and to enhance the sustainability of regional development, with the key factor being to address the high R&D (research and development) costs due to insufficient private investment and externalities (Wu and Hu 2020). The government is therefore one of the primary factors affecting TI capacity, according to the national innovation system theory (Wei and Wang 2023). Numerous studies have investigated the government’s influence on innovation, highlighting the interactive effects of GS and TI on CEE. For example, Bellucci et al. (2019) determined that GS is crucial for businesses to study and develop innovative techniques. Yang and Xu (2019) identified that GS can facilitate businesses’ objectives to invest in TI in the recycling industry supply and encourage them to enhance their innovation procedures in relation to carbon emission reduction. In recent years, with respect to the dual carbon target, government financial support has enhanced its focus on innovations that align with national development targets, such as renewable energy, energy-saving, and emission-reducing technologies (Yuan et al. 2021). These innovation projects, however, require long periods, while their profits barely cover the costs of the business. As a result, with a high level of GS, the inhibiting effect of TI on CEE will be minimized.

The Chinese government’s role is fundamental in the post-adoption stage of emerging TI. Particularly for underdeveloped economic belts, sufficient government financial support can encourage firms to utilize technology to enhance innovation (Wang et al. 2019a, b), in particular for areas (including the YREB) where there is a shortage of skills and technological advantages. Nevertheless, compared with other developed economic belts, the fiscal expenditure of the YREB accounts for a lower share of the general national public budget expenditure, which restricts the spillover effect of its GS on the relationship between TI and CEE in neighboring cities. Consequently, Hypothesis 2 was proposed as follows:

-

H2: Local GS negatively moderates the relationship between TI and CEE in the local area of the YREB, but the interaction of GS and TI has no spatial spillover effect.

Moderating role of marketization

Market development is critical, as it drives economic growth and creates a favorable environment for TI (Shankar and Narang 2020). Resolving environmental problems necessitates focusing policies on the market (Doganova and Karnoe 2015). In the MA process, the market scale and price effect are significant factors. The scale effect facilitates the transfer of innovation resources to larger sectors (Gong et al. 2019), which is conducive to the advantages of agglomeration. On the other hand, the price effect guides the transfer of innovation resources to low-cost sectors, resulting in price competition between businesses that causes the financing cost of TI to be lowered, thus enhancing TI. As the market distributes innovation factors proportionately, it facilitates the combination of economic and environmental benefits (Yu and Liu 2020; Li et al. 2019a, b), allowing for enhanced social outcomes in terms of TI, which is also a new market-oriented model (Yuan et al. 2021; Xiao 2016). Accordingly, under the moderating effect of MA, the level of TI will rapidly reach the inflection point of a U-shaped curve, thus boosting CEE.

The potential market space of the YREB is relatively huge, and MA is a significant and fundamental factor in resource allocation (Li et al. 2021a, b). On the one hand, local businesses will be motivated by the market competition mechanism and thus enhance their innovation efforts. On the other hand, the government adapts its environmental policies according to the requirements of the market environment in order to mitigate negative externalities resulting from carbon pollution, which significantly enhances the flexibility of businesses to invest in carbon-reducing innovations. It also facilitates the transfer of low-carbon resources between cities. Therefore, both its direct and spillover effects are conducive to CEE in the YREB (Yuan et al. 2021). Based on the above, this paper proposed the following hypothesis:

-

H3: Local MA negatively moderates the relationship between TI and CEE in the local area of the YREB, and neighboring MA positively moderates the relationship; that is, both the direct and indirect effects of the interaction between MA and TI contribute to CEE.

Research gaps

Here we identify the research gaps that our study would try to fill. Firstly, following a review of the literature, numerous academics have investigated the spatial spillover of CEE. They have found a clear spatial correlation with CEE. However, these studies have primarily focused on a particular industry, national level, or developed regions (Wang et al. 2023; Fan et al. 2022; Liu 2022; Gao et al. 2021), but failed to investigate the spillover of CEE in the YREB (Gong et al. 2022; Zhou et al. 2022). Secondly, there is no agreement on examining the spatial effect of TI on CEE (Yang et al. 2023; Xu et al. 2021). In the particular context of the YREB, an underdeveloped economic belt, the role of TI on CEE requires in-depth discussion, which is rare in extant studies. Thirdly, the literature on the moderating effect of GS and MA on the relationship between TI and CEE is relatively lacking at present. In the background of the organic combination of government and market, it is necessary to investigate the moderating role of GS and MA within the TI-CEE relationship.

Therefore, to deal with these gaps, this is the first study to explore the direct and spatial effects of TI on CEE in the YREB and to consider the implications for the development of low-carbon transformation in the YREB and other underdeveloped economic belts. In particular, we attempt to introduce the moderating effects of GS and MA for further discussion of the double effects, respectively. Based on the above analysis, Fig. 1 demonstrates the research gaps and the influencing mechanisms of TI affecting CEE.

Data and methods

Spatial autocorrelation test

Moran’s I is an effective indicator to identify whether the particular observation is exceptionally correlated with the observation of its neighboring locations. It is primarily categorized into global Moran’s I and local Moran’s I, which are applied to analyze spatial autocorrelation and spatial distribution model separately. The global Moran’s I can be set as follows:

where n is the number of sample cities. xi is the CEE in city i, \(\overline{x }=\frac{1}{n}\sum\limits_{i=1}^{n}{x}_{i}\),Wij is the 0–1 adjacency weight matrix as follows:

The global Moran’s I is a total indicator that represents the heterogeneous level throughout the entire study area. In contrast, the local indicator of spatial association (LISA) chart can precisely visualize the spatial distribution characteristic and the changing trend of each observation point. The index can be calculated as follows:

There are five types of agglomeration in the LISA chart, such as low-low cluster (L-L), high-low cluster (H–L), low–high cluster (L–H), high-high cluster (H–H), and insignificant areas. H–H and L-L clusters indicate that the CEE of a local city correlates positively with that of neighboring cities. In contrast, the H–L and L–H clusters indicate that CEE of a local city correlates negatively with that of surrounding cities.

Model specification

Traditional regression models do not take spatial factors into account. Based on the agglomeration theory, the spatial concentration of economic resources leads to a spatial deviation of CEE from uniform diffusion (Wang and Zhu 2020). Many scholars have proven that CEE is spatially clustered and dependent (Li et al. 2019a, b; Chuai and Feng 2019). In exploring regional CEE, ignoring spatial spillover effect may lead to biased estimates (Hong et al. 2020). Our study, therefore, assumed that there was a spatial effect of CEE. After a series of tests, such as the Hausman test, the LM test, the robust LM test, and the combined LR test, we developed the spatial Durbin model (SDM) under the individual and time-fixed effect to confirm Hypotheses 1, as shown in Eq. (4).

where i denotes the city, t denotes the year. LnTIit represents the TI index. LnGSit refers to the level of GS. LnMAit denotes the MA degree. β is the coefficient of direct effect, Θ is the coefficient of indirect effect. μi and λt denote the time-fixed effect and space-fixed effect respectively. εit denotes the model error item. W denotes the 0–1 adjacency weight matrix as Eq. (2).

In addition, this paper investigated the moderating effects of GS and MA, i.e., tests H2 and H3, respectively. To address the multicollinearity problem, we deducted their respective means from the moderating variables, i.e., decentering process. The spatial moderation model, including the interaction terms of the core explanatory variable and decentered moderating variables, is presented as follows:

where c_LnGSit and c_LnMAit represent the decentered moderating variables. LnTIit × c_LnGSit and LnTIit × c_LnMAit denote the interactive items of the moderating effects of GS and MA on the relationship between TI and CEE, respectively. The other parameters are in accordance with the above.

Nevertheless, it is difficult to precisely determine the marginal effect of TI on CEE simply by regression coefficients. Consequently, the decomposition model is highlighted. Based on the study of Elhorst (2010), the total spatial spillover effect can be decomposed into direct and indirect effects by utilizing calculus to avoid the bias caused by point estimation methods. After differentiating the independent variables of the above equations, the decomposition equation is as follows:

where Yit denotes a dependent variable and Xit denotes independent variables. The remaining variables have the same meaning as in the above equations. The bias matrix is then derived from the partial derivatives of the independent variables as follows:

where the average of diagonal components denotes a direct effect, while the average of non-diagonal components denotes an indirect effect.

Variables selection

Explained variable

The super-SBM with undesirable outputs model (Tone 2001) is utilized to estimate CEE. In essence, the super-SBM-undesirable model is an evaluation system of multi-inputs for the production of desirable outputs and undesirable outputs, as defined below:

where Φ* refers to the value of CEE that can be larger than 1. For a specific assessment unit, when Φ* ≥ 1, the assessed unit is efficient. When Φ* < 1, however, the assessed unit is inefficient, implying that the input–output should be enhanced. xik, ypkd, and yqku are input factors, desirable outputs, and undesirable outputs, respectively. λj stands for a weight vector.

As per previous studies, the input factors included capital stock (fixed assessment investment calculated by perpetual inventory method), labor force (the number of urban employees at the end of the year), and energy consumption (primary energy consumption). The desirable output factor was GDP (real GDP at constant 2006 price). The undesirable output factor was CO2 emissions, which was measured by the top-down computation method proposed by Chen et al. (2020). In reality, the provincial CO2 emissions data was estimated based on the carbon conversion coefficient (IPCC 2006) by Formula (10) first, and then the prefecture-level CO2 emissions were calculated according to the nighttime light data. Table 1 displays the indicators employed to estimate CEE.

where i denotes the index of energy, i = 1, 2, ….n; Ei represents the consumption of energy i; Fi represents the carbon emissions coefficient of energy i; 44/12 is the mass rate applied to transform carbon into an identical quantity of CO2.

Core explanatory variables

TI can enhance economic outputs and enhance energy efficiency, hence affecting CEE. TI indicators can be classified into two types: input indicators and output indicators. The former denotes inputs in the innovation process, such as research and development (R&D) spending. They have been extensively applied as surrogate variables to evaluate the innovation efforts in previous research. This data, however, failed to propose any specific correlation with innovation outcomes. However, output indicators (e.g., patents), which focus on the results of TI, have become accepted as an indicator of TI in mainstream research. Therefore, this paper utilized the patent value calculated by applying the patent renewal model as TI indicator (Kou and Liu 2020).

Moderating variables

GS is one of the factors affecting TI outcomes and is fundamental in the financial support of knowledge production. Consequently, this paper utilized the ratio of government financial expenditure to total GDP in order to calculate the degree of GS. MA is another significant factor affecting private R&D and demand-oriented CEE. As previous studies have concluded, the ratio of the number of private and self-employed individuals in the area to the number of employed individuals indicated the level of MA. Furthermore, to avoid the estimation bias resulting from multicollinearity, the moderating variables were decentered before calculating interaction items.

Control variables

In addition to the moderating and core explanatory variables, a number of other factors that may have a significant impact on the research variables were considered in this study, including economic development (PGDP), population (P), urbanization (UR), and foreign direct investment (FDI), which were calculated by per capita GDP, the total population at the end of the year, the ratio of urban population to total population, and the ratio of real foreign direct investment to local GDP.

Data source

The study area for this paper included the 66 prefecture-level cities of the YREB (as defined in the Encyclopedia of Yellow River Culture) (Li 2000). As data is deficient for some states and cities, this paper utilized data relating to 56 prefecture-level cities in the YREB scanning for the period from 2006 to 2018. The socioeconomic data was sourced from the following books: China Regional Statistical Yearbook, China Urban Construction Statistical Yearbook, and China Energy Statistical Yearbook. In particular, the nighttime light data was sourced from the National Geophysical Data Center (NGDC), a division of the National Oceanic and Atmospheric Administration (NOAA) (https://www.ngdc.noaa.gov/eog/download.html). In addition, the carbon emission coefficients were sourced from the Intergovernmental Panel on Climate Change (IPCC). The descriptive statistics of variables are presented in Table 2.

Empirical analysis and results

Spatial autocorrelation analysis

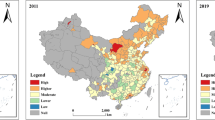

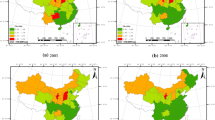

The global Moran’s I of LnCEE is 0.114 and under the 1% significance level, indicating the existence of significant spatial autocorrelation characteristic of CEE in the YREB in the period 2006 to 2019. Furthermore, this paper applied Geoda to map the LISA cluster chart (Fig. 2), clarifying the spatial autocorrelation distribution of CEE under the 5% significance in the YREB. In summary, H–H-type clusters displayed a lock-in effect, while L-L-type clusters displayed a spillover effect. The former is primarily concentrated in Yan’an, Linfen, and Yulin, and later transferred to other small areas such as Heze, Kaifeng, and Jiaozuo, where the overall spatial pattern was relatively solid. Conversely, the latter is primarily centered on the western areas, including Wuwei, Xining, and Baiyin, gradually expanding to wider regions such as Changzhi, Ordos, Baotou, Wuzhong, Yinchuan, and Shizuishan. In summary, the overall range of H–H type and L-L type clusters is expanded during the sample period, indicating an enhanced spatial autocorrelation of CEE in the YREB. Both H–L-type spatial clusters and L–H-type spatial clusters represent negative spatial correlation. The spatial pattern of CEE demonstrated gradient distribution and the Matthew effect. The L-L agglomeration was significant in enhancing the spatial evolution of CEE but did not entirely alter the unevenness of CEE, similar to the findings of Zhang et al. (2022a, b, c) concerning the Yangtze River Economic Belt.

Baseline regression analysis and spillover effect decomposition

According to the results of the “Spatial autocorrelation analysis” section, CEE exhibited significant spatial correlation, but the influencing effect of TI and the existence of its spatial spillover effect cannot be accurately determined. This study, therefore, conducted baseline regression to investigate the specific impact mechanisms of TI on CEE. For the purpose of determining the suitable regression model, this study first performed a Hausman test to identify whether to select a fixed-effect model or a random-effect model. The original hypothesis was that there was no individual effect associated with the regression variables, but the Hausman test results rejected this original hypothesis and satisfied the significance test, and as a result, the fixed-effect model was utilized. In addition, the combined LM tests of LM-lag, robust LM-lag, LM-error, and robust LM-error in all models were for the residuals according to the OLS regression that was conducted, which indicated that spatial econometric analysis ought to be preferred. Finally, the likelihood ratio (LR) tests were undertaken to validate whether SLM or SEM was nested in the SDM and whether the time-fixed model or individual-fixed model was nested in the double-fixed model, and the results indicated that the SDM model under the individual and time fixed effect was more appropriate to this study.

Model 1 in Table 3 was applied to validate H1. The estimated coefficient of LnTI was −0.063 and significant at 5% level, indicating TI exerted a significant negative effect on local CEE. The coefficient of W*LnTI was 0.003 but insignificant, suggesting that TI in surrounding cities had no influence on the local city. Therefore, the enhancement of TI lowered CEE of the local area but did not affect CEE of surrounding areas in the YREB. H1 is therefore supported.

In addition, this paper separated the effects of explanatory variables on CEE into direct, indirect, and total effects. The direct effect of LnTI on LnCEE is −0.062 and at 5% significance level, which means that the higher the TI, the lower the local CEE. This outcome was consistent with the observation that TI had a negative effect on CEE (Lin and Ma 2022). The indirect effect of W*LnTI on LnCEE was insignificant, indicating that the TI of the neighboring cities had no spatial spillover effect on the CEE in a local city. Considering the present condition of the YREB, these results can be explained as follows: Firstly, in contrast to developed economic belts, the YREB is economically backward. Enterprises in the YREB do not focus sufficiently on low-carbon innovation, and their TI is too low and insufficient to generate spillover effects. Secondly, production activities in the YREB are significantly influenced by its abundant energy resources, and TI is conducive to reducing energy costs and enhancing economic progress, thus raising energy consumption and generating a “rebound effect.” This finding has been mentioned elsewhere (Behera and Dash 2017; Yang and Li 2017; Lin and Zhao 2016). However, these studies focused on developed regions, and this paper was the first to focus on the rebound effect of TI in the YREB. At the same time, TI activity itself also generates a certain amount of carbon emissions, which results in a decrease in CEE. In previous studies by Acemoglu et al. (2012), TI was classified as clean and dirty technology that had a path-dependent effect. The economic development of the YREB required and was dependent on fossil fuels, resulting in an energy-intensive industrial system (Lin and Ma 2022). It relied on high-carbon TI for manufacturing development. Numerous regions in the YREB are therefore likely to be highly reliant on their current high-carbon TI systems, resulting in lower CEE. On the other hand, the results of this study in connection with TI spillover differ from other studies (Yang et al. 2023; Lu et al. 2018; Li et al. 2021a, b). The spillover effect of TI on CEE in the YREB was found to be insignificant, which can also be inferred from the study by Luan et al. (2019). In particular, it could be caused by the fact that the investment intensity and intellectual property protection capacity in the YREB have not yet developed sufficiently, resulting in a limited ability to absorb TI from neighboring regions is limited (Yang et al. 2021; Hao et al. 2021), thereby determining an absence of spillover effect of TI on CEE in the YREB. These findings further validate H1.

Furthermore, GS in a local city has a significant positive direct effect on local CEE. However, its indirect effect on CEE is insignificant. This indicates that government financial support is beneficial to the increase of local CEE but has no spillover effect. Unlike GS, both the direct and indirect effects of MA on CEE are significantly positive, indicating that the enhanced MA of a particular city can improve CEE not only of its own, but also of neighboring cities.

Analysis of the moderation effect

The effects of TI, GS, and MA on CEE can be identified separately in the empirical analysis of the previous section. In contrast to Table 3, the interactive terms are added to analyze whether or not there exist moderating effects of GS and MA, respectively. Specific results are exhibited in Tables 4 and 5.

Whether or not TI still had an increasing effect on CEE as a result of the influence of GS, the results in Table 4 indicated the absence of this effect. The interactive effect of local GS and TI is significantly positive, indicating that the negative effect of TI on CEE is inhibited by the moderating effect of GS in a local city. This result is in line with the previous study by Chen and Hu (2018), which found that government subsidies can provide incentives for manufacturers to improve their TI for carbon reduction but inconsistent with the conclusions by Shahbaz et al. (2020) that GS results in increased CO2 emissions. When considering the surrounding situation, nevertheless, the interaction between GS and TI had no indirect effect on CEE. Therefore, there is no effect caused by the interaction between surrounding GS and TI on local CEE. This result had not been discussed in the previous literature. In addition, the interaction between GS and TI had a total effect on the CEE of the YREB, but it was weaker than its direct effect, as the positive direct effect was partially offset by an insignificant indirect effect. This was inconsistent with the comparison between the direct effect of GS and its total effect. The indirect effect of GS was insignificantly positive, and its total effect was greater than its direct effect, indicating that GS had a greater impact on CEE of the entire YREB compared with the city in which it is located. These findings verified H2.

Table 5 demonstrates how MA affected the enhancement effect of TI on CEE. The direct effect of the interaction between TI and MA was significantly positive, indicating that the inhibitory effect of TI on CEE was negatively affected by MA in the local city. This was inconsistent with the finding of Sha et al. (2022) that market opening was conducive to green innovation, thus enhancing environmental performance. Similarly, the indirect effect of the interaction between TI and MA was also significantly positive, indicating that there was a significant synergy between neighbor MA and TI to enhance local CEE. This result was similar to the study by Shao et al. (2022), which indicated that the market demand for local green TI had positive spillover in surrounding areas. By comparison, the indirect effect of the interaction between TI and MA was greater than its direct effect, owing to MA enhancing the liquidity of innovation factors, resulting in them transferring to regions with utilization advantages (Yuan et al. 2021; Zhu and Lee 2021; Tang et al. 2021). Therefore, TI can play a more significant effect in CEE in surrounding cities. In addition, the total effect of the interaction between MA and TI was positive, and the total effect of the interaction was greater than the direct or indirect effects, indicating that MA has the greatest inhibitory role on the negative effect of TI on CEE in the entire YREB. These findings verified H3.

Conclusion and policy implications

As a result of the dual carbon target, the Chinese government has attached increasing importance to the contribution of TI (Lin and Ma 2022). To explore the impact of TI on CEE in the YREB, this paper employed a spatial analysis method and utilized data from 56 cities for the period 2006 to 2019. In particular, this paper focused on the moderating effects of GS and MA from a spatial perspective. This research was the first to explore the interactions by which TI can contribute to solving carbon pollution issues in underdeveloped economic belts. In particular, under the dual role of government and market, the moderating effects of GS and MA on the relationship between TI and CEE and their spatial effects were analyzed, and this perspective had not previously been extensively studied in the YREB. This study analyzed the impact of TI on CEE in one underdeveloped region, providing an empirical reference to guide government and market in encouraging the green transformation of TI. Furthermore, it also considered the moderating effect from a spatial perspective, enriching the study of moderating mechanisms in spatial economics theory.

This paper’s conclusions indicated that (1) CEE of the YREB had a positive spatial autocorrelation characteristic. High-high clusters exhibited a lock-in effect, while low-low clusters exhibited a spillover effect. In summary, the total area of high-high clusters and low-low clusters expanded from 2006 to 2019. (2) When the moderation effect was excluded, local TI had a negative effect on CEE. However, neighboring TI had no significant effect on local CEE. (3) When considering the effect of GS, this converted into a positive effect. Nevertheless, this effect remained insignificant for neighboring cities. (4) For both the local city and the surrounding cities, the moderation role of MA had an inhibitory effect on the negative impact of TI on CEE, and the interactive effect of MA and TI was significantly positive on CEE. Based on the findings of this study, the following policy recommendations have been provided for the YREB to tackle carbon pollution and encourage low-carbon TI, thereby promoting CEE:

Firstly, it is important to further encourage TI activities which focus on clean production in the YREB, as well as enhance the promotion and application of patented products, thus gradually replacing “dirty” technology (Xie et al. 2021). Simultaneously, cities with a high level of CEE should utilize the spillover effect to encourage low-carbon development in neighboring cities, while cities with a low level of CEE should undertake green TI activities to prevent carbon diffusion.

Secondly, given that TI is not entirely conducive when it comes to improving CEE, this “rebound effect” issue can be prevented by applying government financial aid. Particularly for numerous energy-dependent and high-pollution businesses, governments in the YREB should focus on their financial support. This could be “green research subsidies” that are directed at TI activities for low-carbon patents and beneficial to relieving the pressure on these businesses. Moreover, the government should target capital configuration according to the local situation, in order that the capital can accurately be supplied to the green TI sector and transferred into the low-carbon development of the surrounding areas.

Thirdly, it is important to encourage MA and also to undertake market-oriented reform for low-carbon development. The YREB should utilize the experience from developed economic belts and permit the market to participate in the configuration of innovation resources. With respect to MA, the pricing system relating to innovation outputs and carbon emission rights should be optimized. Furthermore, for cities with low CEE, low-carbon innovation support should be encouraged to avoid a disproportionate focus on economic growth at the expense of the environment. This could be achieved by encouraging the market, improving the market pricing of innovation resources, and attracting superior innovation resources from neighboring regions.

While this paper has progressed the issue of examining the moderating effects of GS and MA on the relationship between TI and CEE, there remain certain limitations, which may also be an issue for future investigation. While this study was solely empirical, the existence of the theoretical mechanism of the negative relationship between TI and CEE in the YREB is equally significant. Hence, subsequent research could consider the development of theoretical models to explain the empirical results of this study. Furthermore, there is a significant transition period from patent launch to patent commercialization spillover, and the time lag of technology spillover has not been considered. Further significant results could be determined by including the time delay in technology spillover. Finally, owing to data availability constraints, this study utilized the patent value calculated by the patent renewal model as a TI indicator. In the future, a “green patent value” could be calculated to further explore its impact on CEE.

Data availability

The authors confirm that data will be made available upon reasonable request.

References

Acemoglu D, Aghion P, Bursztyn L, Hemous D (2012) The environment and directed technical change. Am Econ Rev 102(1):131–166. https://doi.org/10.1257/aer.102.1.131

Albort-Morant G, Leal-Millán A, Cepeda-Carrión G (2016) The antecedents of green innovation performance: a model of learning and capabilities. J Bus Res 69:4912–4917

Anderson K, Broderick JF, Stoddard I (2020) A factor of two: how the mitigation plans of ‘climate progressive’ nations fall far short of Paris-compliant pathways. Clim Pol 20(10):1290–1304. https://doi.org/10.1080/14693062.2020.1728209

Awaworyi Churchill S, Inekwe J, Smyth R, Zhang X (2019) R&D intensity and carbon emissions in the G7: 1870–2014. Energy Econ 80:30–37. https://doi.org/10.1016/j.eneco.2018.12.020

Behera SR, Dash DP (2017) The effect of urbanization, energy consumption, and foreign direct investment on the carbon dioxide emission in the SSEA (South and Southeast Asian) region. Renew Sustain Energy Rev 70:96–106. https://doi.org/10.1016/j.rser.2016.11.201

Bellucci A, Pennacchio L, Zazzaro A (2019) Public R&D subsidies: collaborative versus individual place-based programs for SMEs. Smal Bus Econ 52(1):213–240. https://doi.org/10.1007/s11187-018-0017-5

Chen WT, Hu ZH (2018) Using evolutionary game theory to study governments and manufacturers’ behavioral strategies under various carbon taxes and subsidies. JClean Prod 201:123–141. https://doi.org/10.1016/j.jclepro.2018.08.007

Cai WG, Li GP (2018) The drivers of eco-innovation and its impact on performance: evidence from China. J Clean Prod 176:110–118. https://doi.org/10.1016/j.jclepro.2017.12.109

Chen J, Gui WL, Huang YY (2022) The impact of the establishment of carbon emission trade exchange on carbon emission efficiency. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-23538-z

Chen JD, Gao M, Cheng SL, Hou WX, Song ML, Liu X, Liu Y, Shan YL (2020) County-level CO2 emissions and sequestration in China during 1997–2017. Sci Data 7(1):391. https://doi.org/10.1038/s41597-020-00736-3

Chen ZF, Zhang X, Chen FL (2021) Do carbon emission trading schemes stimulate green innovation in enterprises? Evidence from China. Technol Forecast Soc Change 168:120744. https://doi.org/10.1016/j.techfore.2021.120744

Chuai XW, Feng JX (2019) High resolution carbon emissions simulation and spatial heterogeneity analysis based on big data in Nanjing City, China. Sci Total Environ 686:828–837. https://doi.org/10.1016/j.scitotenv.2019.05.138

Dimos C, Pugh G (2016) The effectiveness of R&D subsidies: a meta-regression analysis of the evaluation literature. Res Policy 5(4):797–815. https://doi.org/10.1016/j.respol.2016.01.002

Doganova L, Karnoe P (2015) Building markets for clean technologies: controversies, environmental concerns and economic worth. Indust Mark Manag 44:22–31. https://doi.org/10.1016/j.indmarman.2014.10.004

Dong F, Zhu J, Li YF, Chen YH, Gao YJ, Hu MY, Qin C, Sun JJ (2022) How green technology innovation affects carbon emission efficiency: evidence from developed countries proposing carbon neutrality targets. Environ Sci Pollut Res 29(24):35780–35799. https://doi.org/10.1007/s11356-022-18581-9

Dong ZQ, He YD, Wang H, Wang LH (2020) Is there a ripple effect in environmental regulation in China?-Evidence from the local neighborhood green technology innovation perspective. Ecol Indic 118:106773. https://doi.org/10.1016/j.ecolind.2020.106773

Driscoll JC, Kraay AC (1998) Consistent covariance matrix estimation with spatially dependent panel data. Rev Econ Statist 80(4):549–560. https://doi.org/10.1162/003465398557825

Du K, Li J (2019) Towards a green world: How do green technology innovations affect total-factor carbon productivity. Energy Policy 131:240–250. https://doi.org/10.1016/j.enpol.2019.04.033

Du M, Zhou Q, Zhang Y, Li F (2022a) Towards sustainable development in China: how do green technology innovation and resource misallocation affect carbon emission performance? Front Psych 13:929125–929125. https://doi.org/10.3389/fpsyg.2022.929125

Du Q, Deng YG, Zhou J, Wu J, Pang QY (2022b) Spatial spillover effect of carbon emission efficiency in the construction industry of China. Environ Sci Pollut Res 29(2):2466–2479. https://doi.org/10.1007/s11356-021-15747-9

Elhorst JP (2010) Applied spatial econometrics: raising the bar. Spat Econ Anal 5(1):9–28

Fan MT, Li MX, Liu JH, Shao S (2022) Is high natural resource dependence doomed to low carbon emission efficiency? Evidence from 283 cities in China. Energy Econ 115:106328. https://doi.org/10.1016/j.eneco.2022.106328

Fang GG, Gao ZY, Tian LX, Fu M (2022) What drives urban carbon emission efficiency? - Spatial analysis based on nighttime light data. Appl Energy 312:118772. https://doi.org/10.1016/j.apenergy.2022.118772

Feng YC, Wang XH, Liang Z (2021) How does environmental information disclosure affect economic development and haze pollution in Chinese cities? The mediating role of green technology innovation. Sci Total Environ 775:145811. https://doi.org/10.1016/j.scitotenv.2021.145811

Fischer C, Greaker M, Rosendahl KE (2017) Robust technology policy against emission leakage: the case of upstream subsidies. J Environ Econ Manage 84:44–61. https://doi.org/10.1016/j.jeem.2017.02.001

Gao P, Yue S, Chen H (2021) Carbon emission efficiency of China’s industry sectors: from the perspective of embodied carbon emissions. J Clean Prod 283:124655. https://doi.org/10.1016/j.jclepro.2020.124655

Ghoddusi H, Roy M (2017) Supply elasticity matters for the rebound effect and its impact on policy comparisons. Energy Econ 67:111–120. https://doi.org/10.1016/j.eneco.2017.07.017

Gong MQ, Liu HY, Atif RM, Jiang X (2019) A study on the factor market distortion and the carbon emission scale effect of two-way FDI. China Pop Resour Environ 17(2):145–153. https://doi.org/10.1080/10042857.2019.1574487

Gong WF, Zhang HX, Wang CH, Wu B, Yuan YQ, Fan SJ (2022) Analysis of urban carbon emission efficiency and influencing factors in the Yellow River Basin. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-23065-x

Grossman GM, Krueger AB (1995) Economic growth and the environment. Nber Working Papers 110(2):353–377. https://doi.org/10.1016/B0-12-226865-2/00084-5

Gu W, Chu ZZ, Wang C (2020) How do different types of energy technological progress affect regional carbon intensity? A spatial panel approach. Environ Sci Pollut Res 27(35):44494–44509. https://doi.org/10.1007/s11356-020-10327-9

Guo A, Yang C, Zhong F (2022) Influence mechanisms and spatial spillover effects of industrial agglomeration on carbon productivity in China’s Yellow River Basin. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-23121-6

Guo R, Lv S, Liao T, Xi F, Zhang J, Zuo X, Cao X, Feng Z, Zhang Y (2020) Classifying green technologies for sustainable innovation and investment. Resour Conserv Recycl 153:104580. https://doi.org/10.1016/j.resconrec.2019.104580

Han B (2021) Research on the influence of technological innovation on carbon productivity and countermeasures in China. Environ Sci Pollut Res 28(13):16880–16894. https://doi.org/10.1007/s11356-020-11890-x

Hao Y, Ba N, Ren SY, Wu HT (2021) How does international technology spillover affect China’s carbon emissions? A new perspective through intellectual property protection. Sustain Prod Consum 25:577–590. https://doi.org/10.1016/j.spc.2020.12.008

Hong JK, Gu JP, He RX, Wang XZ, Shen QP (2020) Unfolding the spatial spillover effects of urbanization on interregional energy connectivity: evidence from province-level data. Energy 196:116990. https://doi.org/10.1016/j.energy.2020.116990

Huang JB, Liu Q, Cai XC, Hao Y, Lei HY (2018) The effect of technological factors on China’s carbon intensity: new evidence from a panel threshold model. Energy Pol 115:32–42. https://doi.org/10.1016/j.enpol.2017.12.008

Huang JB, Li XH, Wang YJ, Lei HY (2021) The effect of energy patents on China’s carbon emissions: evidence from the STIRPAT model. Technol Forecast Soc Change 173:121110. https://doi.org/10.1016/j.techfore.2021.121110

Ibrahim M, Vo XV (2021) Exploring the relationships among innovation, financial sector development and environmental pollution in selected industrialized countries. J Environ Manag 284:112057. https://doi.org/10.1016/j.jenvman.2021.112057

IPCC (2006) https://www.ipccnggip.iges.or.jp/meeting/pdfifiles/Washington_Report.pdf

Ji YY, Zhang LJ (2021) Comparative analysis of spatial-temporal differences in sustainable development between the Yangtze River Economic Belt and the Yellow River Economic Belt. Environ Dev Sustain 25(1):979–994. https://doi.org/10.1007/s10668-021-02087-4

Jiang W, Gao WD, Gao XM, Ma MC, Zhou MM, Du K, Ma X (2021) Spatio-temporal heterogeneity of air pollution and its key influencing factors in the Yellow River Economic Belt of China from 2014 to 2019. J Environ Manag 296:113172. https://doi.org/10.1016/j.jenvman.2021.113172

Jiao JL, Jiang GL, Yang RR (2018) Impact of R&D technology spillovers on carbon emissions between China’s regions. Struct Change Econ Dynam 47:35–45. https://doi.org/10.1016/j.strueco.2018.07.002

Jin P, Mangla SK, Song M (2022) The power of innovation diffusion: how patent transfer affects urban innovation quality. J Bus Res 145:414–425. https://doi.org/10.1016/j.jbusres.2022.03.025

Kang ZY, Li K, Qu J (2018) The path of technological progress for China’s low-carbon development: evidence from three urban agglomerations. J Clean Prod 178:644–654. https://doi.org/10.1016/j.jclepro.2018.01.027

Kong YC, Zhao T, Yuan R, Chen C (2019) Allocation of carbon emission quotas in Chinese provinces based on equality and efficiency principles. J Clean Prod 211:222–232. https://doi.org/10.1016/j.jclepro.2018.11.178

Kou ZL, Liu XY (2020) On patenting behavior of Chinese firms: stylized facts and effects of innovation policy. Econ Res J 55(03):83–99

Kumar S, Managi S (2009) Energy price-induced and exogenous technological change: assessing the economic and environmental outcomes. Resour Energy Econ 31(4):334–353. https://doi.org/10.1016/j.reseneeco.2009.05.001

Li M (2000) Encyclopedia of Yellow River culture. Sichuan Dictionary Publishing House, Sichuan

Li MQ, Wang Q (2017) Will technology advances alleviate climate change? Dual effects of technology change on aggregate carbon dioxide emissions. Energy Sustain Dev 41:61–68. https://doi.org/10.1016/j.esd.2017.08.004

Li L, Hong XF, Peng K (2019a) A spatial panel analysis of carbon emissions, economic growth and high-technology industry in China. Struct Chang Econ Dyn 49:83–92. https://doi.org/10.1016/j.strueco.2018.09.010

Li HB, Zhang BB, Gu JY (2019b) Home market size and energy efficiency improvement in China: empirical research based on dynamic panel threshold regression model. China Pop Resour Environ 29(5):61–70

Li LS, Zhao HB, Guo FY, Wang Y (2021a) High-quality development spatio-temporal evolution of industry in urban agglomeration of the Yellow River Basin. Scientia Geo Sinica 41(10):1751–1762

Li WC, Xu J, Ostic D, Yang JL, Guan RD, Zhu L (2021b) Why low-carbon technological innovation hardly promote energy efficiency of China?-Based on spatial econometric method and machine learning. Comput Indust Engin 160:107566. https://doi.org/10.1016/j.cie.2021.107566

Liang T, Zhang YJ, Qiang W (2022) Does technological innovation benefit energy firms’ environmental performance? The moderating effect of government subsidies and media coverage. Technol Forecast Soc Change 180:121728. https://doi.org/10.1016/j.techfore.2022.121728

Lin BQ, Ma RY (2022) Towards carbon neutrality: the role of different paths of technological progress in mitigating China’s CO2 emissions. Sci Total Environ 813:152588. https://doi.org/10.1016/j.scitotenv.2021.152588

Lin BQ, Zhao HL (2016) Technological progress and energy rebound effect in China’ s textile industry: evidence and policy implications. Renew Sustain Energy Rev 60:173–181. https://doi.org/10.1016/j.rser.2016.01.069

Lin BQ, Zhou YC (2021) Does the internet development affect energy and carbon emission performance? Sustain Prod Consump 28:1–10. https://doi.org/10.1016/j.spc.2021.03.016

Liu D (2022) Convergence of energy carbon emission efficiency: evidence from manufacturing sub-sectors in China. Environ Sci Pollut Res 29(21):31133–31147. https://doi.org/10.1007/s11356-022-18503-9

Liu JL, Duan YX, Zhong S (2022) Does green innovation suppress carbon emission intensity? New evidence from China. Environ Sci Pollut Res 29(57):86722–86743. https://doi.org/10.1007/s11356-022-21621-z

Liu BQ, Shi JX, Wang H, Su XL, Zhou P (2019) Driving factors of carbon emissions in China: a joint decomposition approach based on meta-frontier. Appl Energy 256:113986. https://doi.org/10.1016/j.apenergy.2019.113986

Lu N, Wang WD, Wang M, Zhang CJ, Lu HL (2018) Breakthrough low-carbon technology innovation and carbon emissions: direct and spatial spillover effect. China Pop Resour Environ 29(5):30–39

Luan BJ, Huang JB, Zou H (2019) Domestic R&D, technology acquisition, technology assimilation and China’s industrial carbon intensity: evidence from a dynamic panel threshold model. Sci Total Environ 693:133436. https://doi.org/10.1016/j.scitotenv.2019.07.242

Mushtaq A, Chen Z, Din NU, Ahmad B, Zhang X (2020) Income inequality, innovation and carbon emission: perspectives on sustainable growth. Econ Research-Ekonomska Istrazivanja 33(1):769–787. https://doi.org/10.1080/1331677X.2020.1734855

Nie X, Wu JX, Zhang W, Zhang J, Wang WH, Wang YH, Luo YP, Wang H (2021) Can environmental regulation promote urban innovation in the underdeveloped coastal regions of western China? Mar Pol 133:104709. https://doi.org/10.1016/j.marpol.2021.104709

Rogelj J, Forster PM, Kriegler E, Smith CJ, Seferian R (2019) Estimating and tracking the remaining CO2 budget for stringent climate targets. Nature 571(7765):335–342. https://doi.org/10.1038/s41586-019-1368-z

Schumpeter JA (1942) Capitalism, socialism, and democracy. Am Econ Rev 3(4):594–602. https://doi.org/10.4324/9780203202050

Sha YZ, Zhang P, Wang YR, Xu YF (2022) Capital market opening and green innovation--evidence from Shanghai-Hong Kong stock connect and the Shenzhen-Hong Kong stock connect. Energy Econ 111:106048. https://doi.org/10.1016/j.eneco.2022.106048

Shahbaz M, Raghutla C, Song ML, Zameer H, Jiao ZL (2020) Public-private partnerships investment in energy as new determinant of CO2 emissions: the role of technological innovations in China. Energy Econ 86:104664. https://doi.org/10.1016/j.eneco.2020.104664

Shankar V, Narang U (2020) Emerging market innovations: unique and differential drivers, practitioner implications, and research agenda. J Acad Mark Sci 48(5):1030–1052. https://doi.org/10.1007/s11747-019-00685-3

Shao XY, Liu S, Ran RP, Liu YQ (2022) Environmental regulation, market demand, and green innovation: spatial perspective evidence from China. Environ Sci Pollut Res 29(42):63859–63885. https://doi.org/10.1007/s11356-022-20313-y

Song HH, Gu LY, Li YF, Zhang X, Song Y (2022) Research on carbon emission efficiency space relations and network structure of the Yellow River Basin City cluster. Int J Env Res Public Health 19(19):12235. https://doi.org/10.3390/ijerph191912235

Sun W, Huang CC (2020) How does urbanization affect carbon emission efficiency? Evidence from China. J Clean Prod 272:122828. https://doi.org/10.1016/j.jclepro.2020.122828

Sun H, Edziah BK, Kporsu AK, Sarkodie SA, Taghizadeh-Hesary F (2021) Energy efficiency: the role of technological innovation and knowledge spillover. Technol Forecast Soc Change 167:120659. https://doi.org/10.1016/j.techfore.2021.120659

Tang C, Xu YY, Hao Y, Wu HT, Xue Y (2021) What is the role of telecommunications infrastructure construction in green technology innovation? A firm-level analysis for China. Energy Econ 103:105576. https://doi.org/10.1016/j.eneco.2021.105576

Tobler WR (1970) A computer model simulation of urban growth in the Detroit region. Econ Geo 46(2):234–240

Tone K (2001) A slacks-based measure of efficiency in data envelopment analysis. Eur J Oper Res 130(3):498–509. https://doi.org/10.1016/S0377-2217(99)00407-5

Tong ZM, Cheng, ZW, Tong SG (2021) A review on the development of compressed air energy storage in China: technical and economic challenges to commercialization. Renew Sustain Energy Rev 135:110178. https://doi.org/10.1016/j.rser.2020.110178

Varadarajan R (2020) Customer information resources advantage, marketing strategy and business performance: a market resources based view. Ind Mark Manage 89:89–97. https://doi.org/10.1016/j.indmarman.2020.03.003

Veugelers R (2012) Which policy instruments to induce clean innovating? Res Pol 41(10):1770–1778. https://doi.org/10.1016/j.respol.2012.06.012

Wang J (2018) Innovation and government intervention: a comparison of Singapore and Hong Kong. Res Pol 47(2):399–412. https://doi.org/10.1016/j.respol.2017.12.008

Wang YF, Yao JM (2022) Complex network analysis of carbon emission transfers under global value chains. Environ Sci Pollut Res 29(31):47673–47695. https://doi.org/10.1007/s11356-022-19215-w

Wang ZH, Yin FC, Zhang YX, Zhang X (2012) An empirical research on the influencing factors of regional CO2 emissions: evidence from Beijing City, China. Appl Energy 100:227–284. https://doi.org/10.1016/j.apenergy.2012.05.038

Wang N, Xue Y, Liang H, Wang Z, Ge S (2019b) The dual roles of the government in cloud computing assimilation: an empirical study in China. Inform Technol Peop 32(1):147–170. https://doi.org/10.1108/ITP-01-2018-0047

Wang Q, Li LJ, Li RR (2023) Uncovering the impact of income inequality and population aging on carbon emission efficiency: an empirical analysis of 139 countries. Sci Total Environ 857(2):159508–159508. https://doi.org/10.1016/j.scitotenv.2022.159508

Wang ZL, Zhu YF (2020) Do energy technology innovations contribute to CO2 emissions abatement? A spatial perspective. Sci Total Environ 726:138574. https://doi.org/10.1016/j.scitotenv.2020.138574

Wang G, Deng X, Wang J, Zhang F, Liang S (2019a) Carbon emission efficiency in China: a spatial panel data analysis. China Econ Rev 56:101313. https://doi.org/10.1016/j.chieco.2019.101313

Wei JY, Wang CX (2023) A differential game analysis on green technology innovation in a supply chain with information sharing of dynamic demand. Kyb 52(1):362–400. https://doi.org/10.1108/K-04-2021-0296

Weina D, Gilli M, Mazzanti M, Nicolli F (2016) Green inventions and greenhouse gas emission dynamics: a close examination of provincial Italian data. Environ Econ Pol Study 18:247–263. https://doi.org/10.1007/s10018-015-0126-1

Wu JX, Wu YR, Guo XM, Cheong TS (2016) Convergence of carbon dioxide emissions in Chinese cities: a continuous dynamic distribution approach. Energy Pol 91:207–219. https://doi.org/10.1016/j.enpol.2015.12.028

Wu QL, Xu XX, Tian Y (2022) Research on enterprises emission reduction technology innovation strategies with government subsidy and carbon trading mechanism. Managerial Dec Econ 43(6):2083–2097. https://doi.org/10.1002/mde.3510

Wu J, Zhao RZ, Sun JS (2023) State transition of carbon emission efficiency in China: empirical analysis based on three-stage SBM and Markov chain models. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-24885-7

Wu H, Hu S (2020) The impact of synergy effect between government subsidies and slack resources on green technology innovation. J Clean Prod 274:122682. https://doi.org/10.1016/j.jclepro.2020.122682

Xiao Z (2016) Market mechanism, government regulation and city development. China Pop Resour Environ 26(4):40–47

Xie XM, Huo JG, Zou HL (2019) Green process innovation, green product innovation, and corporate financial performance: a content analysis method. J Bus Res 101:697–706. https://doi.org/10.1016/j.jbusres.2019.01.010

Xie ZH, Wu R, Wang SJ (2021) How technological progress affects the carbon emission efficiency? Evidence from national panel quantile regression. J Clean Prod 307:127133. https://doi.org/10.1016/j.jclepro.2021.127133

Xu Y, Ge WF, Liu GL, Su XF, Zhu JN, Yang CY, Yang XD, Ran QY (2022b) The impact of local government competition and green technology innovation on economic low-carbon transition: new insights from China. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-23857-1

Xu L, Fan MT, Yang LL, Shao S (2021) Heterogeneous green innovations and carbon emission performance: evidence at China’s city level. Energy Econ 99:105269. https://doi.org/10.1016/j.eneco.2021.105269

Xu Q, Zhong MR, Cao MY (2022a) Does digital investment affect carbon efficiency? Spatial effect and mechanism discussion. Sci Total Environ 827:154321. https://doi.org/10.1016/j.scitotenv.2022.154321

Yan D, Lei YL, Li L, Song W (2017) Carbon emission efficiency and spatial clustering analyses in China’s thermal power industry: evidence from the provincial level. J Clean Prod 156:518–527. https://doi.org/10.1016/j.jclepro.2017.04.063

Yang L, Li Z (2017) Technology advance and the carbon dioxide emission in China–empirical research based on the rebound effect. Energy Pol 101:150–161. https://doi.org/10.1016/j.enpol.2016.11.020

Yang Y, Xu X (2019) A differential game model for closed-loop supply chain participants under carbon emission permits. Comput Ind Eng 135:1077–1090. https://doi.org/10.1016/j.cie.2019.03.049

Yang X, Yang Z, Jia Z (2021) Effects of technology spillover on CO2 emissions in China: a threshold analysis. Energy Rep 7:2233–2244. https://doi.org/10.1016/j.egyr.2021.04.028

Yang XH, Jia Z, Yang ZM (2023) Spatial impact mechanism of Chinese technology diffusion on CO2 emissions in the countries along the Belt and Road Initiative. Environ Sci Pollut Res 30:21368–21383. https://doi.org/10.1007/s11356-022-23719-w

Yi M, Wang Y, Sheng M, Sharp B, Zhang Y (2020) Effects of heterogeneous technological progress on haze pollution: evidence from China. Ecol Econ 169:106533. https://doi.org/10.1016/j.ecolecon.2019.106533

Yii KJ, Geetha C (2017) The Nexus between technology innovation and CO2 emissions in Malaysia: evidence from granger causality test. Energy Procedia 105:3118–3124. https://doi.org/10.1016/j.egypro.2017.03.654

Yu P, Liu JX (2020) Research on the effects of carbon trading market size on environment and economic growth. China Soft Sci 352(4):46–55

Yuan B, Li C, Xiong X (2021) Innovation and environmental total factor productivity in China: the moderating roles of economic policy uncertainty and marketization process. Environ Sci Pollut Res 28(8):9558–9581. https://doi.org/10.1007/s11356-020-11426-3