Abstract

The deteriorating global environment has attracted wide attention in various countries. How to curb environmental pollution and achieve sustainable economic growth has become an urgent problem that we must face. As an effective tool for pollution control, environmental tax has been implemented in many developed countries and has achieved good results. As the largest developing country in the world, China introduced the first environmental tax law in its history in December 2016, which is regarded as a major reform of the green tax system. To explore the implementation effect of environmental tax in China, this paper takes 3867 Chinese listed enterprises (2015–2020) in Shanghai and Shenzhen A shares as the research sample and explores the microeconomic effect of environmental tax reform using the difference in difference (DID) method. It is concluded that the environmental tax reform can produce a positive impact on the corporate profit margins while curbing the enterprise pollution behavior. This positive effect comes from the investment improvement effect and the cost-saving effect, and this effect is heterogeneous between different regions and property rights enterprises. Therefore, the design of the tax system must be implemented with different measures. Environmental taxes have achieved positive policy results in China, contributing to sustainable economic growth. This tax reform has an important reference value for the developing countries in the industrialization stage.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Sustainable development is the common goal of mankind and an inevitable requirement for realizing human well-being. However, the 2021 UN report states that the growing global population and unsustainable production patterns are having a devastating impact on the human living environment. Global per capita resource consumption increased by 40% between 2000 and 2017. The per capita consumption of natural resources has increased substantially in all countries except Europe, North America, and Australia and New Zealand. High consumption is usually accompanied by high emissions and high pollution. If no measures are taken, the rapid growth of natural resource consumption will have a negative impact on the global ecological environment. It is worth noting that the characteristics of natural resource consumption in developed countries and developing countries are different at the current stage. Developed countries account for a large proportion of global resource consumption, but the consumption rate has slowed down. Due to the development demand of industrialization, developing countries always consume at a faster speed, as they are in the stage of industrialization, and need to undertake the more resource-consuming part in the production chain of developed countries. Therefore, at the current stage, how to reduce resource consumption, curb environmental damage, and achieve sustainable and green economic growth has become a key issue for the whole world. To cope with environment-related problems caused by human activities, countries have taken a number of measures, such as taxes, green subsidies, administrative charges, emission permits, and emission trading (Tan et al. 2022). Compared with other tools, tax has become an effective tool for governing environmental problems because of its unique characteristics of compulsion and rule of law. This idea of internalization of environmental externalities can be traced back to the environmental tax theory proposed by Pigou (1920). In addition, the Organization for Economic Cooperation and Development (OECD) also proposed in 1972 that the polluter payment principle is an effective means to solve environmental problems, which also provides a theoretical and practical basis for developing countries to levy environmental taxes at the current stage.

As the largest developing country in the world, China has achieved considerable economic growth with high pollution, high emissions, and high energy consumption after the reform and opening up. However, this development mode has brought serious environmental problems and cannot adapt to the concept of green development practiced in China. Therefore, China has introduced a series of environmental governance policies for green and sustainable economic growth by exploring more effective environmental governance methods. Among the many environmental policies, the most concerned is the Environmental Protection Tax Law of the People’s Republic of China issued on December 15, 2016. This is the first environmental tax law in China’s history. It is the first time to raise pollution control to a strict legal level, which is of historic significance for China’s sustainable economic growth. Because China’s environmental tax has experienced a long reform process, China has established the administrative charge system for environmental pollution discharge as early as in 1979. However, this administrative charge system has the obvious disadvantages of the rigidity of law enforcement and lacks the ability to restrain the pollution behavior of enterprises. It is unable to drive sustainable economic growth at this stage. Therefore, China’s environmental tax is essentially a major reform of the traditional sewage fee system, aiming to use a stricter legal system to replace the administrative fee system, restrain the pollution behavior of enterprises, protect the ecological environment, and achieve sustainable economic growth. However, the implementation of any environmental governance policy is a challenging task at the expense of economic growth (Yamazaki 2022), especially for many developing countries with a heavy industrial structure that are in the stage of rapid industrialization. It has been 6 years since China’s environmental tax was introduced. Studies have shown that this tax reform does bring significant environmental benefits (Han and Li 2020), reducing the level of environmental pollution to a large extent. While reducing environmental pollution, can the environmental tax reform produce positive economic effects and promote the realization of sustainable economic growth? If so, then China’s environmental tax reform will be of important reference value for many developing countries living in rapid industrialization to achieve sustainable economic growth.

Literature review and research hypothesis

With the theory of sustainable development being widely recognized by the international community, environmental protection has been valued by governments of all countries. As an important tool and means for the governments to adjust social economic life, tax revenue plays an important role in environmental protection. It is generally believed that the idea of environmental tax originated from the book of Welfare Economics by Pigou (1920). In his opinion, the inconsistency between private cost and social cost would lead to market failure, while the government could effectively correct the private cost of economic parties and restrain private behavior through taxation. This idea has been widely applied in environmental governance. Collecting the environmental tax has become an effective measure to correct the market failure. After a long period of development, environmental tax has evolved into a mature legal system in the world. In the context of the global environmental crisis, environmental tax, as a powerful tool to restrain corporate pollution behavior (Xiao et al. 2022; Wolde-Rufael and Mulat-Weldemeskel 2022; Xue et al. 2022), plays an important role in protecting the environment and promoting sustainable development. In particular, it can be viewed from two aspects: On the one hand, environmental taxes curb pollution and protect the ecological environment (Piciu and Trică 2012; Esen et al. 2021), which has produced good environmental benefits. Studies have found that environmental tax reforms can reduce greenhouse gas emissions by reducing primary energy consumption (Niu et al. 2018; Xie and Jamaani 2022; Li et al. 2022a, b). Compared with the emission administrative charge system, the environmental tax system can also have a more positive impact on the emission reduction of air pollutants (Li et al. 2021; Chien et al. 2021). This effect also shows some geographical characteristics (Han and Li 2020); on the other hand, environmental taxes have had a not-negligible impact on economic development. At the macroeconomic level, existing studies have found that the collection of environmental taxes may have a negative impact on economic growth in the short term but may have a positive impact in the long term (Oueslati 2014; Abdullah and Morley 2014; Hassan et al. 2020; Zhang et al. 2022). At the micro level, few studies focus on the family level (Ekins et al. 2011; Rausch and Schwarz 2016) and the individual level (Kallbekken and Sælen 2011; Cherry et al. 2014; Ercolano and Gaeta 2014). Most studies focus more on the enterprise level. Since environmental tax is mainly levied on enterprises with pollution behaviors, most studies focus on enterprises in heavy pollution industries. A series of micro empirical studies have confirmed that any strict environmental regulation policy, whether environmental tax or environmental administrative charge system, will increase the financial costs of enterprises in heavily polluting industries (Blackman et al. 2010; Filbeck and Gorman 2004; Gray and Shadbegian 2003) and have a negative impact on the performance of enterprises in heavily polluting industries. Many studies have reconfirmed the Porter hypothesis, that is, reasonable environmental regulations (especially market-based environmental taxes, pollution emission licensing and trading mechanisms, and other means) can stimulate innovation and improve product quality, partially or even completely offset the costs caused by complying with environmental regulations, making manufacturers more competitive in the international market, which may also improve enterprise performance (Porter and Linde 1995; Ramanathan et al. 2017; Albrizio et al. 2017; Wang et al. 2019). From the practical experience, the environmental tax system has achieved a positive microeconomic effect in many developed countries (Yamazaki 2022; Doğan et al. 2022). However, there are relatively few studies on the reform and effectiveness of environmental tax system in developing countries. As the largest developing country in the world, China’s environmental tax reform is not only of great significance to its own country but also has an important reference value for the green tax system design of other developing countries in the world. Studies have found that China’s environmental tax reform can promote R&D and innovation of enterprises in heavily polluting industries by raising financing constraints (Liu et al. 2022a, b). China’s environmental tax is a tax system design that combines constraints and incentives. It not only puts forward strict constraints on pollution behaviors but also provides tax relief and financial subsidies to enterprises in heavy pollution industries that are actively carrying out green transformation, saving costs for enterprises. This tax system design caters to the idea of Porter’s hypothesis. Accordingly, the first hypothesis is proposed:

-

H1: China’s environmental tax reform will have a positive impact on the performance of enterprises in heavily polluting industries.

In the existing studies, there are different choices for measuring enterprise performance according to different research purposes. As an important indicator of enterprise finance, profit margin includes the cost determined by productivity and the price determined by market forces. It is a comprehensive reflection of the performance of enterprises participating in market competition. It is a widely accepted key indicator to measure enterprise performance. The higher the profit margin, the better the performance of enterprises (Nguyen et al. 2020). Existing research holds that the corporate profit margin will be affected by both external factors and internal factors. From the external factors, the national laws and regulations will often have a key impact on the level of corporate profit margin (Cherchye and Verriest 2016). From the perspective of institutional theory and resource-based view, the environmental tax system in this research, as a strict legal system, will cause external legitimacy pressure on its tax object (enterprises in heavily polluting industries). This legitimacy pressure often forces the enterprises in the heavy pollution industry to adjust investment orientation (Liu et al. 2022a, b), inject the money into the green technology innovation and green product innovation or application, reduce the environmental negative externalities to meet the requirement of legitimacy, and balance the profitability of enterprises and environmental responsibility (Li et al. 2017) for a sustainable development. We define the phenomenon of improving investment orientation and application to meet the pressure of legality for green innovation and application as the investment improvement effect. From the perspective of internal factors, the profit margin level of the enterprise will be constrained by the management cost to different degrees. According to the changes in the economic situation, managers will timely adjust and optimize the internal cost distribution, which will be of great significance to maintain the profitability of enterprises (Maryska and Doucek 2015). Therefore, facing the pressure impact of environmental tax burden, the polluting enterprises should optimize the internal management mode and reduce the management cost to hedge the cost increase brought by the tax burden and maintain the existing profit margin level. In addition to the management cost, the reduction of production cost caused by the increase of internal productivity cannot be ignored. There is a virtuous cycle between higher productivity gains and higher profit margins (Yu et al. 2017). Generally speaking, the impact of enterprise internal factors on the level of profit margin mainly comes from the reduction of various costs. We define this phenomenon as a cost-saving effect. Accordingly, this paper proposed the second research hypothesis:

-

H2: The positive impact of environmental tax reform on the corporate profit margin of the heavy pollution industry mainly comes from the investment improvement effect and the cost-saving effect.

According to the above content, this paper will examine whether the research hypothesis is true through empirical strategies.

Research design

Data declaration

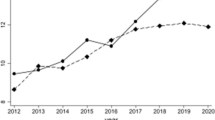

The sample period studied in this paper ranges from 2015 to 2020. The research sample is China’s A-share listed industrial enterprises in Shanghai and Shenzhen, with a total of 3,867 listed enterprises and a total of 18,972 observed values. According to the needs of the empirical research in this paper, all the samples are divided into two groups—the enterprises in the heavy pollution industry and the enterprises in the non-heavy pollution industry. The enterprises in the heavy pollution industry are included as the main objects of this paper, namely, the experimental group; the enterprises in the non-heavy pollution industry are included as the control group. Enterprises in heavy pollution industries are selected as the experimental group because these enterprises are the main subject of environmental tax in China, and enterprises in non-heavy pollution industries without pollution behavior are not taxed. Therefore, enterprises in heavy pollution industries are the research objects that can most directly reflect the microeconomic effect of environmental tax reform. Accordingly, the industries of the sample enterprises are classified in the following steps: (1) Determine the heavy pollution industries. Referring to the Catalogue of Environmental Protection Verification Industry Classification Management of Listed Companies issued by Ministry of Ecology and Environment, PRC in 2008 and the practices of Liu and Liu (2015) and Liu (2016), coal mining and washing, oil and gas mining, ferrous metal mining, non-ferrous metal mining, textile, leather, fur, feather and products and footwear, paper and paper products, petroleum processing, coking and nuclear fuel processing, chemical materials and chemical products manufacturing, chemical fiber manufacturing, rubber and plastic products, non-metal mineral products, ferrous metal smelting and mandering, ferrous metal smelting and mandering, and power and heat production and supply are the heavy pollution industries. (2) To ensure the stability and effectiveness of the sample, the following enterprise data are excluded: ST and ST* enterprises (enterprises that suffer consecutive losses are known as ST and ST* enterprises), delisting enterprises, and listed companies that issue both A shares and B shares. (3) The financial data of the sample enterprises selected in this paper are all from the GTA database. To alleviate the effect of the outliers on the empirical results, the continuous variables were curtailed by 1%.

Variable measurement

Explained variables: corporate profit margin

Corporate profit margin has a variety of forms, including sales profit rate, cost profit rate, output value profit rate, and capital profit rate. They all reflect the transformation of surplus value. Based on the research purpose and data availability, the total asset net profit margin (ROAit) is used as the explained variable. It is the ratio of the total net profit to the total amount of enterprise assets. It is an index that reflects the comprehensive utilization effect of enterprise assets and also an important index to measure the profits made by enterprises using the total creditors and owners’ equity.

Core independent variable: dummy variables of environmental tax policy

The independent variables include the group and time dummy variables and the interaction terms of the two. When estimating the impact of environmental fee-to-tax reform, set the dummy variable treatedit for whether it belongs to heavy pollution industry, and assign the value to each industry respectively. If a certain industry belongs to heavy pollution industry, treatedit = 1; otherwise, treatedit = 0. When estimating the temporal impact of the environment on corporate profit margins, set the dummy variable of time effect as T (T = 0–1 dummy variable). t = 1 indicates the year after the promulgation of the Environmental Protection Tax Law for an industry, and t = 0 indicates the year before the promulgation of the Environmental Protection Tax Law. The interaction term treatit*tit is the core independent variable.

Control variables

As the corporate profit margin is affected by many factors, the paper introduces a series of control variables referring to the existing research of the corporate profit margin determinants to improve the accuracy of the regression results.

The enterprise-level factors include the following: enterprise size (size): total assets of the enterprise with a natural logarithm; asset-liability ratio (lev) reflects the solvency of the enterprise, indicated by the proportion of the enterprise liabilities to the total assets of the enterprise; average wages (wage) reflects the wage level of employees, indicated by the natural logarithm of the average wage of employees; enterprise age (life) reflects the survival life of the enterprise, indicated by the logarithm of the survival life; bank credit (loan): the 0–1 dummy variable is used to indicate whether the interest expenditure occurs; and liquidity ratio (liquid) reflects the financial security situation of enterprises and the ability to resist risks, indicated by the ratio of the difference between total liquid assets and liquid liabilities and the total assets of the enterprise. Herfindahl–Hirschman Index (hhi) is used to control the impact of the overall competition degree of the urban industry on enterprises. Table 1 shows the descriptive statistics of each variable: the mean is mainly meant to reflect the general level of the data; the standard deviation reflects the dispersion of the data; the maximum and minimum values present the maxima and minimum values of the data, reflecting the range of the data.

Model setting

The difference in difference method was first introduced into economics by Ashenfelter (1978) and has since been widely used in empirical studies. This method was chosen for two reasons: First, this method has its own advantages. Compared with the traditional measurement method, the difference in difference method has obvious advantages in policy evaluation. It is studied using exogenous events as an explanatory variable. Its sample grouping and treatment variables are all independent of individual heterogeneity. At the same time, it controls the influence of the unobservable factors changing with time and avoids the endogenous problems of the explanatory variables to a great extent. Therefore, this method can get an unbiased estimation of the policy effect as an accurate policy evaluation method. Second, this method perfectly fits the problem to be studied in this paper. The idea of DID method is to find the appropriate control group, that is, the object that has not implemented the policy. As a counterfactual reference frame for the treatment group, the change of the control group not affected by the policy can be regarded as a pure time effect. Combining the difference between groups and the time difference, that is, subtracting the changes in the control group from the changes in the treatment group, we can get a more reliable estimation method for the policy treatment effect. After the introduction of the Environmental Protection Tax Law of the People’s Republic of China, the environmental tax law system has fully replaced the pollution discharge administrative charge system, putting forward stricter standards and requirements for the enterprise pollution behavior, and the pollution behavior will pay a higher cost price. Specifically, after the environmental tax reform, the change of the corporate profit margin of enterprises in heavy pollution industries mainly comes from two aspects: For one thing, there is the time effect. Even without the introduction of environmental tax policy, the corporate profit margin may change with time and there is a time difference before and after the reform; for another thing, it is the grouping effect. There is heterogeneity in the non-heavy pollution enterprises in the control group and the heavy pollution enterprises in the experimental group. The difference in difference method can effectively identify the policy treatment effect, namely, the policy net effect, and can effectively control the endogenous correlation between the environmental tax policy impact and the change of the corporate profit margin level.

The difference in difference method is a very important way to assess the effectiveness of a policy. If the implementation of the policy works only on one part of the economy and has no impact on another part, it can be regarded as an approximate scientific experiment to evaluate the impact of the policy on different parts of the economies. The difference in the final evaluation result is the implementation effect of the policy. Based on this, this paper intends to use the difference in difference method to examine the relationship between environmental tax policy and corporate profit margin (the research framework is shown in Fig. 1).

Based on the theoretical model and existing studies, the benchmark regression model is as follows:

In the regression formula, didjt is the intersection term of the group dummy variable and the time dummy variable, indicating whether the heavy pollution industry is impacted by the environmental tax policy in the year t, whether the industry using the grouping dummy variable is a heavy pollution industry (assign a value of 1), and whether the time dummy variable is used after the policy is issued (that is, the assigned value in 2017–2020 is 1 and in 2015–2016 is 0). Subscripts i and t refer to the industry and year respectively, ωt refers to the unobserved factors related to the year, μi refers to the unobserved individual factors that do not change over time, Zijt is the introduced control variable, and ROAit refers to the enterprise’s total asset net profit rate, i.e., the explained variable selected in this paper.

Empirical analysis

Benchmark regression

To examine the impact of environmental tax reform on corporate profit margin, this paper used the test model formula (1) for regression analysis, and the specific results of the underlying regression are shown in Table 2. All regressions were performed at the enterprise level across different industries, allowing for possible sequence correlations. In column (1), only DID interaction term did of the environmental tax reform was added, controlling the fixed effect of the year and the enterprise fixed effect. The regression result is the estimated result without control variables, which is the direct effect of the environmental tax reform on the corporate profit margin of enterprises in the heavy pollution industries. The regression coefficient of the interaction term was positive and significant at the 1% level, indicating that the environmental tax reform has significantly improved the corporate profit margin level. In column (2) and column (3), the influencing factors of enterprise level (enterprise size, solvency, wage, average wage, enterprise age, liquidity ratio) and industry level (industry competition degree) were further controlled separately, and the interaction item coefficient was significantly positive in order. Column (4) added all the control variables, which was the most robust result. The coefficient of the interaction term “did” was still significantly positive at the 1% level, and the empirical results were further validated.

In all the four columns of the benchmark regression in Table 2, the coefficient of the DID interaction terms was significantly positive, and the coefficient ranged between 0.0211 and 0.0267, showing that the introduction of environmental tax reform can significantly improve the full profit margin of enterprises. This effect did not change significantly with the continuous addition of the covariates and showed some robustness. It shows that the environmental tax has a positive impact on the performance represented by the corporate profit margin, as demonstrated by hypothesis 1 (H1).

Robustness test

Parallel trend test

The important premise of DII analysis is that the parallel trend assumption must be satisfied between the treatment and control groups. If the policy shock does not exist, there should be no systematic difference in the temporal trend between the control and experimental groups and should be consistent. Therefore, parallel trends will be tested in this section.

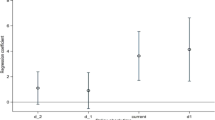

To avoid the subjectivity of intuitive judgment, this paper draws on the idea of Event Study Approach and further verifies the dynamic effect of parallel trend and environmental tax reform on corporate profit margins. First, the interaction term of the year dummy variable and the treatment group dummy variable is generated, and then, the interaction term is added to the model for regression. Then, the coefficient of the interaction term can better measure the difference between the treatment group and the control group. The equation is as follows:

M and N indicate the pre- and post-policy periods, respectively, and the coefficient δj of the interaction term treatedi × yearj measures the difference between the phase-j processing group, the control group, and the baseline group. If the coefficient of the interaction term between the dummy variable and the treatment group before the policy point is not significant, there is no time trend of heterogeneity in the treatment group and the control group before the policy point.

The parallel trend test results are obtained according to the existing theory (Table 3). The figure shows the significance of the annual regression coefficients within the 95% confidence intervals. Based on 2016, it can be seen that in the two periods before the introduction of the environmental tax reform, the regression coefficient was not significantly different from 0, indicating that no systematic difference was present between the treatment group and the control group before the policy impact. The regression coefficient of the current period (2017) and the following lag period is significantly different from 0, indicating that the policy effect is obvious in the current period, and after the policy impact, and the parallel trend is proved.

Replace dependent variable

The rate of return on total assets is selected as the dependent variable in this paper. The profit margin is a relative data. To verify the robustness of the conclusion, this paper further selects two absolute value indicators, namely, total profit (operating profit + non-operating income − non-operating expenditure) and net profit (total profit − income tax) to examine whether the conclusion that corporate profits are not reduced but improved under the impact of environmental tax policy is reliable. As shown in Table 4, through the investigation, it was found that both net profit and total profit were significantly positive at the level of 1%, which was consistent with the conclusion of corporate profit margin. It shows that the index representing the profit level of the enterprise, whether the relative value data or the absolute value data, always maintains strongly robust. That is, the impact of the environmental tax policy did not decline the corporate profit level; on the contrary, the overall profit level of enterprises in heavy pollution industries has been improved under the impact of the policy.

Replacement industry classification standard

Regarding the definition of heavy pollution industry, the existing literature does not have a unified and clear classification criteria. The classification criteria of different articles are partially different. Fifteen heavy pollution industries are defined in the Catalogue of Environmental Protection Verification Industry Classification Management of Listed Companies issued by Ministry of Ecology and Environment, PRC, in 2008. To avoid the contingency of the results, two other classification criteria are selected for the robustness test: In the first category, 18 heavy pollution industries are defined according to the Industry Classification Standards of Listed Companies revised by CSRC in 2012 and the Catalogue of Environmental Protection Verification Industry Classification Management of Listed Companies issued by Ministry of Ecology and Environment. In the second category, 14 heavy pollution industries published by Ministry of Ecology and Environment are included in the enterprise data of listed companies as the definition standard of heavy pollution industries. The results of the regression are shown in Table 5. The first column shows the classification method of the benchmark regression; the second column shows the second category; the third column shows the third classification method. The environmental tax reform has improved the corporate profit margin in heavy pollution industries at the significance level of 1%, and the results have a strong robustness.

Mechanism analysis

The above empirical research results show that the environmental tax reform can promote the corporate profit margin in heavy pollution industries. What mechanism does the environmental tax reform implement to affect the profit margins of enterprises in heavy pollution industries? Generally speaking, environmental tax policy, as a rigid new regulatory standard, will bring greater cost pressure to enterprises. If enterprises want to avoid the long-term pressure of environmental policies, they may improve their investment choices, reduce the choice of polluting production departments, and turn to choose the production methods with higher investment cleanliness. At the same time, the enterprise will also change the internal organizational structure through management innovation, organizational optimization, and personnel adjustment, reduce the management costs, and keep the overall cost level of the enterprise stable.

Investment improvement effect

This section mainly verifies whether the environmental tax reform has improved the corporate profit margin by improving the investment level of enterprises in heavy pollution industries. To verify whether this mechanism is valid, this paper draws on the empirical ideas of existing research and establishes an investment sensitivity model, as follows:

Among them, investit represents the level of enterprise investment: enterprise investment level = (cash paid for purchase of fixed assets, intangible assets, and other long-term assets − cash recovered from disposal of fixed assets, intangible assets, and other long-term assets)/total assets at the end of the period. roa is the return on equity, which is used to measure the impact of environmental tax reform on the investment level of enterprises. To verify whether enterprises in heavy pollution industries have improved their investment strategies and turned to choose cleaner production methods, this paper further introduces proxy variables that can measure the output of green innovation (green innovation output = number of green innovation applications + green innovation authorization volume) and counts logarithmic processing to investigate whether enterprises in heavy pollution industries carry out green transformation under the pressure of environmental tax burden. Green production can be achieved by improving processes, improving design, and using alternative renewable energy sources. As can be seen from the regression results in Table 6, the investment level of enterprises in heavy pollution industries under the impact of environmental tax policy was improved significantly at the level of 5%, and the green innovation level was increased at 5%, indicating that enterprises in heavy pollution industries began to trend to green transformation under the pressure of environmental tax burden.

Cost-saving effect

Microeconomic theory and empirical evidence show that enterprise productivity is an important factor in determining its profit level. Companies with higher productivity can reduce production costs and make higher profits through economies of scale. There is a positive correlation between the two aspects. As a comprehensive index reflecting the economic effect of the whole production and operation activities of the enterprise, the corporate profit margin is a comprehensive reflection of the enterprise profitability. The product cost determined by the productivity and the management cost determined by the internal operation level are the key elements of whether the enterprise can make a profit. Under the impact of environmental tax reform, the profit margin of enterprises in heavy polluting industries has not been reduced but improved. The section mainly examines whether the enterprises in heavy pollution enterprises reduce their production cost and management cost under the environmental tax burden pressure, so as to obtain higher profit space and maintain the market performance, i.e., cost-saving effect of the environmental tax. To test whether this transmission mechanism is established, referring to the existing literature, this section takes the enterprise management fee as the proxy variable (take the logarithm) and replaces the dependent variable of type (1) for two-way fixed effect regression. Control variables are consistent with the benchmark regression, and standards are wrongly clustered to the industry level. The results are shown in Table 6. After the impact of environmental tax reform, the management cost of enterprises in heavy pollution industries is reduced instead, showing that under the stronger pressure of environmental regulations, enterprises will reduce their management cost by adjusting their internal operation methods, so as to offset the pressure brought by the environmental tax burden cost as far as possible. Further, this paper introduces the enterprise total factor productivity (LP method calculation) to replace the dependent variable of type (1) and investigates whether the environmental tax policy forces enterprises in heavy pollution industries to improve their production efficiency, so as to reduce the production cost and obtain more profit space. As can be seen from the regression results in Table 6, under the impact of environmental tax policies, the production efficiency of enterprises is significantly improved at 1%, and the management cost is significantly reduced at 1%. It shows that the environmental tax policy expands the profit space of enterprises in heavy pollution industries through the cost-saving effect.

According to the above findings, on the one hand, the environmental tax reform has improved the investment orientation of enterprises in heavy pollution industries and promoted the green innovation of enterprises; on the other hand, it has optimized the internal cost management of enterprises in heavy pollution industries and reduced the production cost by improving their own production efficiency, confirming the assumption of investment improvement effect and cost-saving effect. Environmental tax reform has boosted the peculiar profit margins of heavily polluting industries through investment-improvement and cost-saving effects; thus, hypothesis 2 (H2) is demonstrated.

Heterogeneity test

Although this paper has demonstrated the impact of environmental tax policies on the profit margins of enterprises in heavy pollution industries, the same policy has different effects in different regions due to a vast territory in China. In addition, for different properties of enterprises, the impact of changing institutional costs is not the same. To this end, this paper analyzes the heterogeneity of enterprises from different regions and with different properties:

Divide different regions for regression analysis: All provinces are classified into eastern region, central region, western region, and northeast region depending on the geographic location. It should be noted that this regression equation is consistent with the benchmark regression, using two-way fixed effect but sub-sample regression. The regression results in Table 7 showed that all regions were significantly positive, consistent with the benchmark regression. However, in the specific coefficient size shows a certain difference. The results showed that the corporate profit margins of heavy pollution industries in central region were most affected by the environmental tax reform, followed by northeast region. The main reason is that the central region is an important energy base in China, and the northeast region is China’s traditional industrial base. The industrial structure of the two regions is biased and sensitive to changes in the environmental regulations.

Divide enterprises with different property rights for regression analysis: Referring to the existing literature, the enterprises are divided into state-owned enterprises and non-state-owned enterprises for two-way fixed-effect regression, and the control variables are consistent with the benchmark regression. The results are shown in Table 7. Non-SOEs are more affected by the environmental tax reform as they need to assume full responsibility for its profits and losses. Under the impact of environmental tax burden, non-SOEs bear greater institutional costs, so they are highly affected by the profit margins.

Discussion and conclusion

With the increasing severity of global environmental pollution, more and more countries adopt environmental taxes to maintain the ecological environment. Compulsory taxation should be imposed on economic entities, especially enterprises, to curb environmental pollution and pursue sustainable economic growth. This study selected the data of 3,867 listed enterprises in China from 2015 to 2020, and empirically tested the impact of China’s environmental tax reform on the corporate profit margin of heavily polluting enterprises by establishing a difference in difference model (DID) and verified three valuable findings.

The first verified study suggested that China’s environmental tax reform has effectively improved the profit margins of companies in heavily polluting industries. After the environmental tax reform, the profit margins of companies in heavy polluting industries rose by 2.11%, which remained solid after replacing the dependent variables and industry standards. Profit margin is the comprehensive performance of market competition performance. The rising profit rate means the rising enterprise competitiveness. Environmental regulations can promote the market competitiveness, which is consistent with the Porter hypothesis mentioned above (Porter and Linde 1995). In a practical sense, the environmental regulations aim to reduce environmental pollution, maximize the sustainable benefits of the economy and society, and achieve sustainable economic growth (Ramanathan et al. 2017). Therefore, this finding has reference significance for the formulation of environmental regulations in various countries.

The second verified study indicated that the main mechanism of China’s environmental tax reform on enterprises in heavy pollution industries comes from the investment improvement effect and cost-saving effect: First, this paper constructs the investment sensitivity test equation and introduces green innovative proxy variables. It is found that after the environmental tax reform, the investment level of enterprises in heavy pollution industries has been significantly improved at 5%, and the level of green innovation has been significantly improved. It suggests that enterprises in heavy pollution industries have improved the efficiency of investment allocation and their investment strategies, turned to choosing cleaner production methods, and improved their market competitiveness and profitability through investment improvement and green innovation. This is in line with previous research that environmental tax reforms would increase environmental investment (Liu et al. 2022a, b). With the changes in the economic situation, the investment strategy is changed and the R&D expenditure is increased, allowing the enterprise to gain a long-term development (Hirschey et al. 2012). Second, this paper introduces enterprise management cost and uses LP method to measure total factor productivity. Under the pressure of the more stringent environmental tax system, the management cost of the enterprises in the heavy pollution industries is being reduced instead, indicating that the enterprises will reduce the management cost by adjusting their internal operation methods, so as to offset the pressure brought by the environmental tax burden cost as much as possible. Under the impact of environmental tax reform, the production efficiency of enterprises in heavy pollution industries has been significantly improved at 1%, which also verifies Porter’s hypothesis theory. It shows that the environmental tax reform is a relatively moderate environmental regulation policy, which can stimulate innovation, improve production efficiency, reduce production costs, and expand the profit space of enterprises in heavy polluting industries. In the long run, by reducing costs and improving cost-effectiveness, it will also help to improve the ability of enterprises to create profits (Carratù et al. 2020).

The third validated study concludes that the impact of environmental tax reform on the corporate profit margins of heavy pollution industries presents a heterogeneity: the corporate profit margins of heavy pollution industries in central region were most affected by the environmental tax reform, followed by northeast region. The main reason is that the central region is an important energy base in China, and the northeast region is China’s traditional industrial base. The industrial structure of the two regions is biased and sensitive to changes in the environmental regulations. Non-SOEs are more affected by the environmental tax reform as they need to assume full responsibility for their profits and losses. Under the impact of environmental tax burden, non-SOEs bear greater institutional costs, so they are more sensitive to the changes in the profit margins and highly affected by the profit margins.

Policy implications

From the literature review and the above research results, China’s environmental tax reform can effectively reduce environmental pollution (Li et al. 2022a, b) on the one hand; on the other hand, it can also produce positive microeconomic effects and promote sustainable economic growth. This is of important reference significance for the design of green tax revenue in many developing countries with rapid industrialization. Specifically speaking, the following policy implications can be obtained:

First, in terms of institutional design, we should also attach importance to the economic value and environmental protection value of environmental protection tax and the role of environmental tax on ecological protection, but also integrate this tax design into sustainable economic growth. In addition, we should pay attention to the coordinated implementation of other environmental protection measures such as carbon tax, unblock the connection between environmental supervision and administrative law enforcement units and the corresponding tax departments, and maintain the benign policy effect of environmental tax reform.

Second, for the purpose of reform, China’s environmental tax reform should focus on enterprises in heavy pollution industries. The purpose of China’s environmental tax reform is to control pollution and protect the ecology. According to the research of this paper, the environmental tax reform has a positive impact on the enterprise performance in heavy pollution industries. Therefore, with the deepening of environmental tax reform, environmental protection law enforcement departments should strengthen the supervision frequency and intensity of enterprises in heavy pollution.

Third, from the influence mechanism, China’s environmental tax reform has a positive impact on the enterprise performance in the heavy pollution enterprises, as the government encourages tax-paying enterprises to strengthen the environmental inputs and gives the financial subsidies and financial support. This greatly reduces the cost of enterprise innovation. From the empirical results, these measures have stimulated the level of green innovation, improved the traditional investment orientation of heavily polluting enterprises, and turned them to choose cleaner production methods. Therefore, the government departments should further improve and build a financial subsidy, financial support, and tax reduction policy system oriented by green technology innovation, alleviate the cost constraints of enterprises in introducing green technology or to carry out green innovation independently, and encourage high-quality green innovation activities.

Fourth, from the perspective of the heterogeneity results, the effect of environmental tax reform in different regions and among enterprises in heavy polluting industries with property rights is not feasible. Therefore, the policy implementation process should be adjusted according to local conditions and differentiated implementation. Due to China’s vast territory and abundant resources, different regions have different industrial layout characteristics. More preferential policies and financial support should be given to areas with more enterprises in heavy pollution industries to accelerate the speed of green transformation and upgrading. In addition, we should strengthen the tax supervision of state-owned enterprises. In China, compared with non-state-owned enterprises, state-owned enterprises lack the market competition incentive affected by political factors and are less affected by policy implementation. Therefore, regulation and administrative intervention must be strengthened to urge enterprises in heavy polluting industries with different property rights to speed up green transformation and upgrading.

Limitations

There are still some deficiencies in the research, mainly reflected in: First, the research objects of this paper are Chinese listed enterprises. Due to the lack of corresponding data and the insufficient research and attention of unlisted small and micro enterprises, it is unable to identify the problems of micro-level enterprises. Second, it is the exploration of influencing mechanism. This paper mainly excavates the mechanism from the investment improvement effect and the cost-saving effect. Due to the limitation of research perspective, there may be other impact mechanisms, thus failing to show the impact of environmental tax reform on corporate profit margins. This will also be one of the research directions in the future.

Data availability

All data used in this paper are from China Stock Market & Accounting Research Database (CSMAR) (https://www.gtarsc.com).

References

Abdullah S, Morley B (2014) Environmental taxes and economic growth: evidence from panel causality tests. Energy Econ 42:27–33. https://doi.org/10.1016/j.eneco.2013.11.013

Albrizio S, Kozluk T, Zipperer V (2017) Environmental policies and productivity growth: evidence across industries and firms. J Environ Econ Manag 81:209–226. https://doi.org/10.1016/j.jeem.2016.06.002

Ashenfelter O (1978) Estimating the effect of training programs on earnings. Rev Econ Stat 60(1):47–57. https://doi.org/10.2307/1924332

Blackman A, Lahiri B, Pizer W, Planter MR, Piña CM (2010) Voluntary environmental regulation in developing countries: Mexico’s Clean Industry Program. J Environ Econ Manag 60(3):182–192. https://doi.org/10.1016/j.jeem.2010.05.006

Carratù M, Chiarini B, Piselli P (2020) Effects of European emission unit allowance auctions on corporate profitability. Energy Policy 144:111584. https://doi.org/10.1016/j.enpol.2020.111584

Cherchye L, Verriest A (2016) The impact of home-country institutions and competition on firm profitability. Int Bus Rev 25(4):831–846. https://doi.org/10.1016/j.ibusrev.2015.10.005

Cherry TL, Kallbekken S, Kroll S (2014) The impact of trial runs on the acceptability of environmental taxes: experimental evidence. Resour Energy Econ 38:84–95. https://doi.org/10.1016/j.reseneeco.2014.06.005

Chien F, Sadiq M, Nawaz MA, Hussain MS, Tran TD, Thanh TL (2021) A step toward reducing air pollution in top Asian economies: the role of green energy, eco-innovation, and environmental taxes. J Environ Manage 297:113420. https://doi.org/10.1016/j.jenvman.2021.113420

Doğan B, Chu LK, Ghosh S, Truong HHD, Balsalobre-Lorente D (2022) How environmental taxes and carbon emissions are related in the G7 economies? Renew Energy 187:645–656. https://doi.org/10.1016/j.renene.2022.01.077

Ekins P, Pollitt H, Barton J, Blobel D (2011) The implications for households of environmental tax reform (ETR) in Europe. Ecol Econ 70(12):2472–2485. https://doi.org/10.1016/j.ecolecon.2011.08.004

Ercolano S, Gaeta GL (2014) Romano O (2014) Environmental tax reform and individual preferences: an empirical analysis on European micro data. J Behav Exp Econ 51:1–11. https://doi.org/10.1016/j.socec.2014.02.008

Esen Ö, Yıldırım DÇ, Yıldırım S (2021) Pollute less or tax more? Asymmetries in the EU environmental taxes–ecological balance nexus. Environ Impact Assess Rev 91:106662. https://doi.org/10.1016/j.eiar.2021.106662

Filbeck G, Gorman RF (2004) The relationship between the environmental and financial performance of public utilities. Environ Resource Econ 29(2):137–157. https://doi.org/10.1023/B:EARE.0000044602.86367

Gray WB, Shadbegian RJ (2003) Plant vintage, technology, and environmental regulation. J Environ Econ Manag 46(3):384–402. https://doi.org/10.1016/S0095-0696(03)00031-7

Han F, Li J (2020) Assessing impacts and determinants of China’s environmental protection tax on improving air quality at provincial level based on Bayesian statistics. J Environ Manage 271:111017. https://doi.org/10.1016/j.jenvman.2020.111017

Hassan M, Oueslati W, Rousselière D (2020) Environmental taxes, reforms and economic growth: an empirical analysis of panel data. Econ Syst 44(3):100806. https://doi.org/10.1016/j.ecosys.2020.100806

Hirschey M, Skiba H, Wintoki MB (2012) The size, concentration and evolution of corporate R&D spending in US firms from 1976 to 2010: evidence and implications. J Corp Finan 18(3):496–518. https://doi.org/10.1016/j.jcorpfin.2012.02.002

Kallbekken S, Sælen H (2011) Public acceptance for environmental taxes: self-interest, environmental and distributional concerns. Energy Policy 39(5):2966–2973. https://doi.org/10.1016/j.enpol.2011.03.006

Li D, Zheng M, Cao C, Chen X, Ren S, Huang M (2017) The impact of legitimacy pressure and corporate profitability on green innovation: evidence from China top 100. J Clean Prod 141:41–49. https://doi.org/10.1016/j.jclepro.2016.08.123

Li P, Lin Z, Du H, Feng T, Zuo J (2021) Do environmental taxes reduce air pollution? Evidence from fossil-fuel power plants in China. J Environ Manage 295:113112. https://doi.org/10.1016/j.jenvman.2021.113112

Li Z, Zheng C, Liu A, Yang Y, Yuan X (2022a) Environmental taxes, green subsidies, and cleaner production willingness: evidence from China’s publicly traded companies. Technol Forecast Soc Chang 183:121906. https://doi.org/10.1016/j.techfore.2022.121906

Li S, Jia N, Chen Z, Du H, Zhang Z, Bian B (2022b) Multi-objective optimization of environmental tax for mitigating air pollution and greenhouse gas. J Manuf Sci Eng 3(7):473–488. https://doi.org/10.1016/j.jmse.2022.02.001

Liu G, Yang Z, Zhang F, Zhang N (2022a) Environmental tax reform and environmental investment: a quasi-natural experiment based on China’s Environmental Protection Tax Law. Energy Econ 109:106000. https://doi.org/10.1016/j.eneco.2022.106000

Liu G, Zhang L, Xie Z (2022b) Environmental taxes and corporate cash holdings: evidence from China. Pac Basin Financ J 76:101888. https://doi.org/10.1016/j.pacfin.2022.101888

Maryska M, Doucek P (2015) Reference model of cost allocation and profitability for efficient management of corporate ICT. Procedia Econ Financ 23:1009–1016. https://doi.org/10.1016/S2212-5671(15)00324-X

Nguyen SK, Vo XV, Vo TMT (2020) Innovative strategies and corporate profitability: the positive resources dependence from political network. Heliyon 6(4):e03788. https://doi.org/10.1016/j.heliyon.2020.e03788

Niu T, Yao X, Shao S, Li D, Wang W (2018) Environmental tax shocks and carbon emissions: an estimated DSGE model. Struct Chang Econ Dyn 47:9–17. https://doi.org/10.1016/j.strueco.2018.06.005

Oueslati W (2014) Environmental tax reform: short-term versus long-term macroeconomic effects. J Macroecon 2014(40):190–201. https://doi.org/10.1016/j.jmacro.2014.02.004

Piciu GC, Trică CL (2012) Assessing the impact and effectiveness of environmental taxes. Procedia Econ Finance 3:728–733. https://doi.org/10.1016/S2212-5671(12)00221-3

Pigou, (ed) (1920) The economics of welfare. Palgrave MacMillan, New York

Porter ME, Van der Linde C (1995) Toward a new conception of the environment-competitiveness relationship. J Econ Perspect 9(4):97–118. https://doi.org/10.1257/jep.9.4.97

Ramanathan R, He Q, Black A, Ghobadian A, Gallear D (2017) Environmental regulations, innovation and firm performance: a revisit of the Porter hypothesis. J Clean Prod 155:79–92. https://doi.org/10.1016/j.jclepro.2016.08.116

Rausch S, Schwarz GA (2016) Household heterogeneity, aggregation, and the distributional impacts of environmental taxes. J Public Econ 138:43–57. https://doi.org/10.1016/j.jpubeco.2016.04.004

Tan Z, Wu Y, Gu Y, Liu T, Wang W, Liu X (2022) An overview on implementation of environmental tax and related economic instruments in typical countries. J Clean Prod 330:129688. https://doi.org/10.1016/j.jclepro.2021.129688

Wang Y, Sun X, Guo X (2019) Environmental regulation and green productivity growth: empirical evidence on the Porter hypothesis from OECD industrial sectors. Energy Policy 132:611–619. https://doi.org/10.1016/j.enpol.2019.06.016

Wolde-Rufael Y, Mulat-Weldemeskel E (2022) The moderating role of environmental tax and renewable energy in CO2 emissions in Latin America and Caribbean countries: evidence from method of moments quantile regression. Environ Chall 6:100412. https://doi.org/10.1016/j.envc.2021.100412

Xiao B, Fan Y, Guo X, Xiang L (2022) Re-evaluating environmental tax: an intergenerational perspective on health, education and retirement. Energy Econ 110:105999. https://doi.org/10.1016/j.eneco.2022.105999

Xie P, Jamaani F (2022) Does green innovation, energy productivity and environmental taxes limit carbon emissions in developed economies: implications for sustainable development. Struct Chang Econ Dyn 63:66–78. https://doi.org/10.1016/j.strueco.2022.09.002

Xue J, Zhu D, Zhao L, Li L (2022) Designing tax levy scenarios for environmental taxes in China. J Clean Prod 332:130036. https://doi.org/10.1016/j.jclepro.2021.130036

Yamazaki A (2022) Environmental taxes and productivity: lessons from Canadian manufacturing. J Public Econ 205:104560. https://doi.org/10.1016/j.jpubeco.2021.104560

Yu X, Dosi G, Grazzi M, Lei J (2017) Inside the virtuous circle between productivity, profitability, investment and corporate growth: an anatomy of Chinese industrialization. Res Policy 46(5):1020–1038. https://doi.org/10.1016/j.respol.2017.03.006

Zhang J, Liu Y, Zhou M, Chen B, Liu Y, Cheng B, Xue J, Zhang W (2022) Regulatory effect of improving environmental information disclosure under environmental tax in China: from the perspectives of temporal and industrial heterogeneity. Energy Policy 164:112760. https://doi.org/10.1016/j.enpol.2021.112760

Author information

Authors and Affiliations

Contributions

The authors’ contributions are as follows: conceptualization, XH and QLJ; methodology, XH; formal analysis, QLJ; data curation, XH; writing—original draft preparation, XH and QLJ; and writing—review and editing, XH and QLJ. All authors have read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Xu He and Qinlei Jing are the main authors of this paper, who conducted data processing, empirical analysis, manuscript writing and revision.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

He, X., Jing, Q. The influence of environmental tax reform on corporate profit margins—based on the empirical research of the enterprises in the heavy pollution industries. Environ Sci Pollut Res 30, 36337–36349 (2023). https://doi.org/10.1007/s11356-022-24893-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-24893-7