Abstract

This study analyzed the determinants that impact innovation on offshore wind energy (OSW) for a select group of countries, applying mixed-method approaches for a period between 2011 and 2021. The OSW sector witnessed cost reductions in recent years; therefore, this study analyzed how these factors impact technological innovation in the OSW sector. The fixed effects results proved trademark, carbon emissions, offshore wind capacity, and electricity from renewable energy, technical and scientific journals are significant and impact innovation regarding offshore wind energy. The maximum likelihood (MLE) coefficients are more robust than the restricted maximum likelihood (MREL) and better explained the significance of the variables in spurring OSW innovation. Ultimately, the interaction term “cross” came out significant in the analysis. It signified the importance of the interaction variables in scaling innovation. Similarly, the study forecasted OSW capacity additions to grow to more than 28GW by 2036, at a 48.8% growth rate, from the current over 55 G.W. capacity. Additionally, the infrastructure development of the OSW sector via a fitted line between total global offshore capacity and the development projects observed a negative relationship among these dual factors evaluated in the OSW, showing a decreasing trend of capacity additions among countries, as well as the fitted line relationship between total country OSW capacity and operational projects showed that China leads the globe with operational OSW projects. At the same time, Brazil is the new leader in the world regarding OSW capacity. The general analysis of the parameters of the OSW infrastructure plan showed the sector is declining regarding secured projects, development projects, operational projects, and capacities additions in some countries. However, global total capacity additions are on a steady path, declining a bit. This is attributable to the pandemic that slowed the global economy. This study will serve as a reference document for policy formulators regarding scaling up innovation for offshore wind energy.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Energy innovation strategy is vital for fighting the menace of climate change, and ensuring energy security and access, especially in the emerging countries where electrification is at its lowest levels yet (Alemzero et al. 2021). This study seeks to empirically determine what factors will influence innovation within offshore wind energy (OSW). The energy sector emits nearly 80% of carbon dioxide emissions that cause climate change (IRENA 2021a). Offshore wind is the panacea to abating climate change and delivering cost-effective electricity to the populace. However, this important aim can only be achieved based on sound technological innovation in offshore wind energy deployment and other negative emission technologies at scale.

Similarly, whereas innovation is cumbersome to estimate, other parts correlated to important keys-ins and outputs can still be measured (Vidican-Sgouridis et al. 2011). Hence, estimating innovation is vital for a nascent sector such as the offshore wind sector, which attracts huge expenditure across the private and public sectors for commercial upscaling (Vidican-Sgouridis et al. 2011). Recently, research has focused on data mining as the key-in to the innovation process. Not much has been done to measure the outcomes and productivity of renewable energy innovation. Thus, this study applies variables such as patent data from the study units, gross domestic product (GDP), foreign investment (FDI), the capacity factor (C.F.), trademark, carbon emissions, trade flows, offshore capacity, installation costs, offshore wind installations, and science and technical journals to analyze innovation for offshore wind energy. These indicators would make room for a thorough relative assessment of technological innovation performance (Vidican-Sgouridis et al. 2011).

Furthermore, renewable energy innovation, such as offshore wind energy, research, development, and demonstration, plays a key role. This will act to spur on the global energy transition. Since the transition is gathering momentum and there are renewed commitments from governments, these place innovation at the heart of the debate. Overall, these steps result in promoting innovation activities. Aside, these support mechanisms are considered key-ins in the innovation procedure, which will result in outputs, such as improved negative emissions technologies and transformations of the energy systems.

Nevertheless, innovation entails time differences and vagueness in producing knowledge, beating down costs, and scaling up the deployment of these technologies. In view of this, coupling the effects of the key-ins of the innovation advancement on RE innovation and comprehension could be cumbersome. Nonetheless, grasping these impacts are necessary for learning from the past years’ innovation policies and measures in scaling up funding, in addition to underpinning future policy crafting process on offshore wind deployment (Green and Vasilakos 2020; IRENA 2021a; Vidican-Sgouridis et al. 2011).

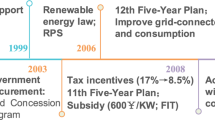

More so, several empirical studies have been done on the offshore wind energy sector, such as (Odam and Vries 2020) utilized a panel qualitative approach to model 15 small-scale and medium (SMEs) enterprises of wind farms and discovered opportunities and obstacles for partnerships between SMEs and big firms on innovation and cost competitiveness within the offshore wind energy sector. In this same vein, Doblinger et al. (2022) evaluated the post-2012 when the Chinese wind energy market developed, innovation increased by 80.7% alongside European suppliers working with non-European OEMs and by 67.2% with Chinese distributors working with non-Chinese. Similarly, via innovation support, technical innovation within the offshore wind energy sector integrates various approaches such as RD&D investment from public and private sources, market policies, and regulatory policies (IRENA 2021a; Jamasb and Köhler 2007). Additionally, Odam and Vries (2020) assessed the overall development circumstances and innovation opportunities in offshore wind turbines foundation using patent analysis within the offshore wind energy sector and suggested that Chinese policy regulators enact policies to transform theoretical knowledge from academia to practical knowledge. However, these studies did not use a mixed-methods approach in their analysis, thus making this study unique since it uses mixed methods and panel fixed effects to analyze the technological drivers of innovation within the OSW sector.

The novelty of this research is that it applies mixed methods approaches to empirically analyze the impact of innovation within the offshore sector on the drivers of offshore wind capacity in the world. The analysis proved that the interaction of patent, R&D, and installation costs would encourage offshore wind energy innovation. Also, the study forecasted the global offshore wind energy capacity additions to increase to more than 28GW by 2036, growing at a 48.8 rate from the current 55GW. Furthermore, the study demonstrated that scientific publications, trademarks, and carbon emissions are meaningful in scaling up innovation. The dual relationship between total global offshore wind energy capacity and development projects revealed Brazil as the new global leader in the offshore wind energy sector, but a decreasing trend of global capacity additions among some countries, which is attributable to the pandemic and country-specific circumstances. Ultimately, the study applied the Pesaran cross-section (CD) test to analyze the heterogeneity econometrically and obtained significant and robust results. This adds to the growing literature on innovation in the offshore sector.

The rest of the paper is structured as follows: “Literature review” reviews literature concerning innovation in the offshore sector. “Methodology” deals with the methodology used in the research analysis, and “Results and discussions” presents results and discussions. While “Conclusion” wraps up with the conclusion.

Literature review

Offshore wind presents an opportunity for countries to scale up sustainable energy consumption as it emits zero carbon emissions. The increase in the growth of offshore wind energy will reduce carbon intensity greatly. Reaching the deployment of 30GW by 2030 in the UK will significantly reduce the system carbon intensity as the additional wind energy displaces the future of combined cycle gas turbines (CCGTs) (Aurora 2018). The World Bank energy sector management program together (ESMAP) with the international finance corporation (IFC) has committed $5 million to unlock finances of 20 million pounds from the UK government to help emerging markets scale-up projects on the development and deployment of offshore wind energy (Alemzero et al. 2021). The sector has seen 23 GW of energy installed since 2018, representing $26 billion of investment or 8% of total global investment in clean energy. The sector is projected to spend over $500 billion by 2030 (Green and Vasilakos 2020; SEforAL 2020). The key areas of focus for the World Bank and its Energy sector Management program are knowledge generation, destination, and information exchange in scaling up and adopting offshore wind energy.

By the end of 2020, global cumulative installed offshore wind energy capacity was above 34 GW, an increment of 6GW from the previous year and nearly 11 times within 2010, when the capacity was just 3 GW (IRENA 2021b). In addition, more than 70% of newly installed additions were located in Europe, and in 2020, China added over 3 GW of new capacity additions, more than any country (Green and Vasilakos 2020; IRENA 2021b).

Junginger et al. (2004), using the learning curve methodology in his work, concluded that investment costs and the cost of electricity from offshore wind are likely to be lowered by 39% in 2020. This assertion was based on the fast pace of the development of technologies and the attractiveness of offshore wind energy over conventional forms of energy. It is not exhaustible, too.

There is this debate regarding the transition to a low-carbon economy by technology development and mass development of technology for offshore wind development in the UK. They believe that it is not the mass deployment of technologies that matters in transiting to a low carbon future but that the market is already mature and may not drive down costs in the renewable energy sector. They contend there is a need to develop innovative technologies (Helm 2010; IRENA 2021b). According to Lee and Zhao (2021), global wind installations add up to an aggregate of 93 GW, with the offshore wind making up 86.9 GW, a 59% increase relative to 2019 installations.

A divergent view is being held by (Alemzero et al. 2021) argue that there is historical antecedence regarding the pattern of learning by doing and R&D in related technologies. The difference is well noticeable regarding the latter. A work done in the UK by Crown Estate (2012) contends that a 40% reduction in the levelised cost of electricity from offshore wind is achievable by 2020 through learning by doing in the supply chain. The cynics have said they are overly optimistic by the industry’s prospects in meeting this target against other forms of renewable energies.

A paper that reviewed the economics of offshore wind energy in Europe by (Green and Vasilakos 2020) concludes that offshore wind energy is associated with high installation and connections costs, making governments’ support essential. They say government policy drivers such as feed-in tariffs in certain European are key to reducing costs and promoting offshore wind energy development. The siting up of interconnections of transmission infrastructure among European countries will drive down costs.

For instance, offshore wind could generate 28 GW in the USA from 2021 to 2022, thanks to the Bureau of Ocean Energy Management (BOEM) leases, generating about 1.2 billion in treasury earnings (Zhang 2020). The technical offshore wind energy potential of the USA is 2450 GW; China is 2240 GW (IRENA 2021a). Also, auctions in lease territories within the Gulf Maine and parts of California in 2022 possibly could generate an extra $800 million in earrings to the United States Treasury (Vanegas-Cantarero et al. 2022; Zhang 2020). Furthermore, significant financing would be invested in the economy of the USA to back offshore wind energy projects. The cumulative investments will be around $17 billion by 2025, $108 billion by 2030, and $166 billion by 2035 (Zhang 2020). Also, Birol (2022) documented in their study that RES, grid investment, and storage solutions currently form more than 80% of new electricity investments. And that the tide is shifting in favor of offshore wind energy investments, with 2021 being the best year delivering about 20GW, and investments worth $40B were invested in OSW, which was hitherto dominated by onshore wind energy (Birol 2022). India, for instance, increased its RE investments to $14,397B in 2021/22 after the pandemic reduced investments in the sector in 2019, growing at 125% post- pandemic levels (Vibhuti Garg 2022). Indeed, it is projected that jobs from the offshore sector will reach around 19.0000–45,0000 in 2025 and 45,000–80,000 in 2030 (AWEA 2020). The multiplier effect of the offshore sector on the US economy is forecasted between $5.5B and 14.2 billion by 2025 and $45B and $ 83B by 2030 (AWEA 2020).

Furthermore, global total installation costs plummeted by 28% from 2015 to 2019; nonetheless, cost rigidity persists in the immature markets, coupled with LCOE plummeting to 32% from around USD 0.169/ kilowatts per hour in 2010 to USD 0.115 kilowatts per hour in 2019. The drivers of these reductions were research and development, learning by doing, and the scale of economies (IRENA 2021a; Jafari et al. 2020). Additionally, the capacity grew by 18%, attaining 44% in 2019 (Alemzero et al. 2021; Doblinger et al. 2022; IRENA 2021a). Similarly, Vietnam has the potential to generate about 30% of it is electricity from offshore wind by 2050 (Enslow 2020). Additionally, Chile is another country in South America with a good potential for offshore wind generation, with a fixed offshore Wind technical potential of 131 GW and a floating offshore wind potential of 826, cumulatively making 937 GW technical of offshore wind energy (SEforALL Sustainable Energy for All 2020). Interestingly, the G-20 members account for about 99.3% of offshore wind installed generation capacity and about all installed generation capacity (IRENA 2021b).

In a nutshell, after combing empirical literature, it is clear that there is an overwhelming consensus on the need to scale up innovation within the offshore wind energy sector, considering the imperative to transition to a lowcarbon future. This study will therefore apply mixed methods approaches to econometrically analyze the drivers that impact innovation among some of the key drivers of the OSW sector.

Methodology

Data and variables

This study analyses the impact of innovation on renewables deployment with a focus on offshore wind energy. That is, the study empirically analyses the drivers of innovation in offshore wind energy. The data was derived from the International Renewable Energy Agency (IRENA) and the World Bank development indicators (WDI) for 2011–2021. The study applies the mixed methods approaches and panel fixed effects in the analysis. In all, the study utilized ten countries with the potential for offshore wind energy and currently drive offshore capacities worldwide. These are Brazil, China, Chile, Denmark, the Philippines, India, South Africa, the USA, the UK, and Vietnam. The patent variable is the explained variable used for innovation. The rationale for selecting the variables for the empirical analysis is discussed below.

Innovation

Here, innovation, the explained variable measured by patent (Ahmad 2021), is one of the main instruments of the energy transition. Technological innovation is key at the heart of these; there are other innovations too. There is a need for innovation in market design, policies, as well as innovative financing models. Innovation indicators that serve as key-ins are research demonstration and development. Market formation and commercial diffusion would contribute to knowledge, strengthen partnerships, and advance technological performances at the different stages of the innovation cycles (IRENA 2021a; Jafari et al. 2020; Jenkins 2022). A patent application has been growing for these countries across all the technology types. Patents are very important for evaluating technological variations due to the granularity of information they provide via innovation, invention, country, and the location the patent is registered (Jafari et al. 2020; Vidican-Sgouridis et al. 2011), which is vital for country crosswise analysis.

Foreign direct investment

There has been a plethora of research on foreign direct investment (FDI) and innovation. This variable would shed light on its relevance in technological developments. A study by Amendolagine et al. (2021) found that green foreign direct investment attains a meaningful effect on green patent development such as offshore wind technology. On the other hand, Amendolagine et al. (2021) discovered FDI to have a negative impact on renewable development. Thus, this study will delve into the veracity of this claim. According to the Birol (2022), financing in the energy sector will increase to about 8% in 2022 despite economic setbacks from the global energy disaster. However, 2021 saw $1.7 T investment in debt issuances, alongside significant amount going to finance low carbon infrastructure projects and RES (Birol 2022).This signifies the importance of finance in whatever form to scale up offshore wind energy deployment.

Trademark

A trademark is defined as a unique sign, which identifies particular goods and services like those provided by individuals or firms, according to the World Intellectual Property Organization (WIPO) (Marginson 2022; Mendonça et al. 2004; Tahir et al. 2022). Trademark equals patents regarding ease of access; however, patents provide more detailed information (Mendonça et al. 2004). Offshore wind energy has been acknowledged as a game-changer, boosting its deployment in the energy transition. From 2010 to 2015, the number of trademarks for offshore wind energy grew from 73 to 193, then plunged to 86 in 2019. Additionally, a respectable number of the holders of trademarks shows the sector is getting to maturity and scaling up. While few firms hold the trademark, the bigger firms are pursuing an amalgamation strategy (Alemzero et al. 2021; Hao et al. 2021; IRENA 2021a). In addition, trademark has not been widely applied as an indicator to estimate innovation, and so will empirical analysis demonstrate how it impacts innovation within the offshore sector.

GDP

The gross domestic product of any country determines the level of development the country has achieved. Thus, countries that have greater GDP can invest part of it to scale up innovation. Several studies tend to say that developed countries have the wherewithal to invest a part of their GDP in energy consumption, renewables in particular (Ehsanullah et al. 2021) (Petrović-Ranđelović et al. 2020). For instance, (Jacobson et al. 2019; Li and Leung 2021) found that renewable energy adds to a robust economic output. This study will empirically assess this narrative.

Carbon dioxide emission

Carbon dioxide pollution has become the major cause of climate change. Some of the study countries are the major emitters around the globe. Globally, the USA and China are leading emitters of CO2. Given the negative ramifications of climate change, there is the need for a transition to a low-carbon economy. Many studies believe that innovation and changes in the energy systems are some of the ways to abate pollution and therefore avoid the menace of climate (Munir Ahmad et al. 2020; Al-mulali 2011; Kang et al. 2019; Korkut Pata 2021; Mehmood et al. 2020; Wu et al. 2020).

Trade flows

The deployment of offshore wind energy to move to a greener economy has an economy-wide impact. The fast development of the offshore wind sector has increased trade in parts and equipment. There is significant growth in trade in wind turbines across the globe and gear and gearing boxes (IRENA 2021a). Trade figures from 2005 to 2015 have grown for both component types, particularly for gearing and gear, nearly double (IRENA 2021a). China, the USA, Germany, Japan, and Denmark are the leading blades manufacturers, while China, Germany, the USA, and Japan are the leading gears exporters (IRENA 2021a).

Capacity factor (C.P.)

The capacity factor explains the ratio of the mean produced power to the maximum potential output (Boccard 2009). The capacity factor is not static but increases as time goes on. For instance, in the UK, around 2010–2019 saw an increase in the capacity factor of 46%, and 2015–2019 grew by 22%. Denmark’s capacity factor grew between 2010 and 2019 equally grew by 12%, whereas the capacity factor of Japan and China did not experience any changes on their capacity factors in 2015–2019 (Adefarati and Obikoya 2019; Boccard 2009; IRENA 2021a).

Offshore wind capacity

Offshore wind capacity globally has been increasing. In 2019, 28 GW capacity was installed, of which nine-tenths were commissioned and operational in the North sea as well as the Atlantic; Denmark, Germany, and the UK are the pacesetters in the Offshore industry; however, China, America, and the Korea Republic are gradually taking their rightful place in the sector (IRENA 2021a; Lacal-Arántegui et al. 2018). According to the GWEC (2021), offshore wind has grown from 1% of global installations since 2009 to 10 per in 2019.

Installation costs

Installation costs have been falling among the renewable energy sources; however, this is due to the multifaceted nature of offshore wind technology, controlling project costs, and other logistical needs, impacting the sector’s costs (Lacal-Arántegui et al. 2018). Offshore wind is a mature market; nonetheless, it is still growing in some regions of the globe (Alemzero et al. 2021). Hence, the need to empirically estimate its growth patterns because of innovation. Again, Lacal-Arántegui et al. (2018) say installation costs of generating electricity from offshore wind can attain 75%, depending on the parameters taken into account by 2024 (Lacal-Arántegui et al. 2018). Generally, installation costs have plummeted across the geographies, with the weighted mean falling by 28% in 2015 and 2019, around USD 5 260 kWh to 3800/kWh (IRENA 2021a; Lacal-Arántegui et al. 2018). The study will empirically analyze costs’ correlation among the study countries.

Percentage of electricity from renewables

The proportion of electricity from renewables is growing in some of the countries. Wind-generated about 8.3% of cumulative electricity generation in the USA in 2020 (Alemzero 2022; Land-Based Wind Market Repot 2021; Yao et al. 2021) found when government grows the quantum of renewables generations in the power systems, costs fall, mirroring in the reductions in the prices of energy. Again, Ameyaw et al. (2021) demonstrated renewable energy generation in China and the USA will grow under the business as usual approach in 2030 and proffered policy incentives to boost generation levels.

Scientific and technical journals

With increased scientific publications on offshore wind energy, the knowledge from onshore wind energy technology was captured and spread. Between 2010 and 2019, over 12,300 technology-correlated papers were published, with the yearly figure growing from 756 in 2010 to 1777 in 2019. The published topics were varied and included technology, energy, engineering, and the material sciences (IRENA 2021a). This variable will scientifically be analyzed to determine the correlation to spur up innovation in the study countries.

Research and development (R&D)

Research and development form the bedrock of innovation. This forms the foundation for the diffusion of knowledge across sectors and nations. The study will analyze the percentage of the gross domestic product that is spent on research development activities. Interestingly, Ragwitz and Miola (2005) found that public investment in RES sources attracts private investment, which ultimately increases research and a direct correlation between R&D and GDP growth.

Model

This study utilizes a panel data model to granularly evaluate the determinants of technological innovation within the offshore wind energy sector. The reason for using the fixed effects model is that it creates space for individual differences among the intercept terms of the parameters. More so, the model is chosen over cross-section because it comes in handy in testing for complex relationships and patterns by controlling for latent heterogeneity among individual countries. Additionally, it gives solid ground for the granular analyses of aggregate data (Farooq et al. 2022).

Panel data is used to test the hypothesis that technological innovation within the offshore wind energy sector is associated with unobserved and observed factors in scaling up technological innovation within the offshore wind energy development and deployment among the drivers of the sector. The unobserved variables are called fixed effects. Thus, panel data is used to derive consistent estimates of the coefficients of the parameters. Because of this, the country-level fixed effects are important to control for unobserved heterogeneity that also affects offshore wind energy advancement (Cheng et al. 2021; Eberhardt and Teal 2011; Odam and Vries 2020; Raghutla et al. 2021; Shahbaz et al. 2018, 2022; Uddin et al. 2021). As a result, the determinants of the relationship are formulated below:

In order to empirically estimate the relationships among the parameters, the model is further broken down as follows:

where i represent each country …1.2…10. The period of the study is depicted by \(t\).

Baltagi et al. (2001) comprehensively developed the MLE model approximation approach explained in the model below. Model (3) below is an unbalanced nested error component model. It seeks to estimate the unbalanced natural panel of groups such as individual countries or entities. Its unbalanced panel econometric form is presented below:

Here, \({\mathrm{Patent}}_{\mathrm{it}}\) depicts the explained variable of the \(i\mathrm{th}\) country, for the \(\mathrm{tth}\) time frame. \({X}^{^{\prime}}\) explains the vector of K non-stochastic variables. The noise within the model is presented below:

where \({u}_{i}\) represents the \({i\mathrm{th}}\) country-specific effects that are presumed to be independently identity distributed\(\left(0,{\sigma }_{u}^{2}\right)\), \({v}_{\mathrm{it},}\) depicts the nested effect of each country which is said to be identically and independently distributed\(\left(0,{\sigma }_{u}^{2}\right)\). While \({\varepsilon }_{\mathrm{it}}\) portrays the residual stochastic term, which is presumed to be also identically and identically distribute (i.i.d)\(\left(0,{\sigma }_{u}^{2}\right)\). Thus, \({u}_{\mathrm{it} },{v}_{\mathrm{it},}{\varepsilon }_{\mathrm{it}}\) is self-reliant on one another and between themselves (Baltagi et al. 2001). This is a nested grouping in that every single part of the stochastic term is nested or embedded to the prior component of the parameter (Farooq et al. 2022). This approach ensures the observation of different time horizons among individual countries.

Cross-section dependence analysis

Peasaran advanced the idea of a unique method to tackling cross-sectional dependence. He considered a single factor with varied loading factors regarding residuals, as presented in Philip and others (Hurlin and Mignon 2007). This is done to ensure that factors that impact technological offshore wind energy innovation among countries are not spilled to another country and that country-specific factors impact offshore wind energy deployment. Therefore, Breusch and Pagan (1980) mooted the idea of the L.M. statistic, and Hurlin and Mignon (2007) proffered the idea of cross-sectional dependence (CD) that could be used for different panel models comprising of panels without units and unit root panels evolving with heterogeneity alongside short T and big N. The proposed model was fixed on the OLS approach mean pairwise association coefficients of the residual from each parameter estimation instead of the squares of the panels as it pertains in Breusch Pagan LM analysis (Hurlin and Mignon 2007; Pindyck and Rubinfeld 1997; Vidican-Sgouridis et al. 2011). The linear model below is used for the empirical test for CD in the panels.

On the equation above, the cross-sectional time and times aspects ae \(i\) and \(t\), and \({a}_{i}\) and \({\beta }_{i}\) depicts the individual intercept and slope coefficient varying between panels in time intervals. While \({x}_{\mathrm{it}}\) portrays the exploratory variables, Pesaran (2021) documented the augmented Dickey-Fuller estimation alongside the cross-section of the mean of past values levels and first differenced of the series individually, which is an improvement of what was proffered by Breusch Pagan above. Thus, when the residuals are not continually associated, the \(j\mathrm{th}\) term estimation of a country is estimated below:

Here, \({\widehat{y}}_{t-1}=\left(\frac{1}{N}\right) \sum_{i=1}^{N}{y}_{i, t-1}\) and \(\Delta {\widehat{y}}_{t =}\left(\frac{1}{N}\right)\sum_{i=1}^{N}\Delta {\widehat{y}}_{t}\). The \(T\) statistic of the ordinary least square estimator is \({\rho }_{i}\) when it is denoted as \({t}_{i}=\left(N,T\right)\); hence, Pesaran’s test is grounded on the augmented ADF, individually correctionally statistic called CADF.

The empirical model is otherwise ordinarily stated below, which seeks to account for cross-sectional dependencies for offshore wind energy development drivers.

where \(\widehat{\rho ij={\sum }_{t=1}^{T}{e}_{\mathrm{it}}{e}_{\mathrm{jt}}/\left(\sum_{t=1}^{T}{e}_{\mathrm{it}}^{2}\right)}{ }^{1/2}\left(\sum_{t=1}^{T}{{e}_{\mathrm{it}}}^{2}\right){ }^{1/2}\), alongside \({e}_{\mathrm{it}}\) depicting the OLS residual centered on T observations according to every \(i=1,\dots ,N.\) On the null hypothesis of cross-section independence \(\mathrm{CD}\sim N\left(\mathrm{0,1}\right)\), thus the Monte Carlo experiments depict that the normal Breusch Pagan LM analyses performs below par for regarding \(N>T\) panels, in which Pesaran’s CD does extra better concerning small \(T\) and big \(N\) panels.

Results and discussions

Table 1 depicts the descriptive statistics of the regressors. Carbon emissions have the highest mean figure of 1,498,000. This explains the need to innovate on negative emissions technologies in these economies. Trademark derives the next strong mean value of 152,090, which is very important for technological innovation and diffusion. Trademark equally has a high mean figure of 152,090, explaining the business sector of the offshore wind energy sectors growing around the work, with increased manufacturers of turbines, the supply chains (OEMs) (Alemzero et al. 2021). Carbon dioxide emissions have a high mean value among the regressors; this is no surprise because both the first and the second emitters of carbon dioxide globally are China and the USA (Li and Leung 2021). Another noticeable variable that attains a strong mean figure is scientific and technical journals. Recently, more scholarly works have been published in energy and material mining, and China and the USA lead the world regarding academic publications (Marginson 2022).

Of course, the variable with the least means value is a shore wind energy capacity factor. This variable has been growing but at a reduced rate due to technological advancements and good wind resources in some areas. Indeed, some countries have experienced reduced or stagnated OSW energy capacity additions (RCG 2020). The USA has a significant offshore wind capacity factor than China (GWEC 2021). Conspicuously, the percent of GDP spent on research and development equally has the least mean value. This explains that these countries don’t spend much of their GDP on R&D, which is vital to accelerate innovation globally. Installation costs have the least mean, explaining costs are falling but not at a faster rate relative to onshore wind energy.

From the correlation matrix, the overall variables correlate strongly. A correlation typically shows the association between two variables. The range of figures is between zero and one. One depicts a stronger correlation between the two variables. It is clear from Table 2 that the association between patents and scientific and technical journals is strong. These two variables correlate strongly together with the majority of the regressors. This elucidates the significance of these variables in influencing innovation in the offshore wind energy sector. As these variables keep increasing, the better for the offshore wind sector to grow faster. The subsequent variables that correlate strongly are carbon emissions and patents. The big elephant in the room, the log of carbon dioxide emissions, obtained the strongest correlation alongside the log of the trademark with a value of 0.50. Carbon emissions pollute the global economy causing climate change; hence, the imperative to innovate for negative emissions technologies such as offshore wind energy to abate emissions and transition the global economy to a lowcarbon future that is just and equitable. Interestingly, the log of trade flows correlates feebly with most of the regressors; this explains the limited trade activities taking place within the global economy concerning offshore wind energy supply chain products. As it is known, offshore wind energy trade activity is limited to China, the USA, Germany, Japan, and a few others (AWEA 2020; IEA 2019). For the sector to be a global market that permeates all aspects of the global economy, it must enjoy economies of scale.

Table 3 presents the individual fixed effects of the panel, as well as the maximum likelihood effects (MLE) and the restricted maximum likelihood effects (REML). Only three variables are significant within the fixed effects analysis (FE). These are trademark, carbon emissions, electricity from renewable sources, and scientific and technical journals. However, they exhibit varied correlations. Trademark is significant and attains a direct correct with a patent which is the proxy variable for innovation. This result is in line with (Mendonça et al. 2004), which corroborated that trademark is vital for encapsulating vital parts of innovation phenomena and the process of industrial transformation. As was expected, carbon emissions are significant and indirectly correlate to patent. This is rightly so because an increase in carbon emissions increases global economy temperature and its consequences. Hence, the need to innovate to abate emissions from the sector. So, the more innovation in the offshore sector, the more the world can reduce CO2 emissions levels (Korkut Pata 2021; Sun et al. 2020). Equally significant from the analysis is offshore wind capacity. The past decade has seen an increase in offshore wind capacity. This implies that the world needs more patents on the offshore sector to abate the issue of pollution and generate clean electricity from the sector. For instance, in 2010, offshore wind capacity was 3GW and quickly grew to 23GW in 2018, giving a 30% per year increment more than any other source, except for solar P.V. (Energy and Special 2019; Lindman and Söderholm 2012).

Also, electricity from renewables source is significant but has an indirect correlation. This conforms with (Ahmad 2021; Manish et al. 2006) that renewable electricity generation has grown globally. Trademark is important to scaling up innovation in the offshore sector since sound manufacturing standards can bring about economies of scale and thus make supply chains competitive. For stance, China is a hub for innovation in the offshore and onshore sectors, producing cheaper turbines and parts than any country in the world. Tahir et al. (2022) found that enforcing intellectual property rights (IPR) in China can spur trademarks and promote innovation. Carbon emissions significance depicts the need to innovate to scale up the deployment of renewable energy sources (RES). The direction is direct, implying the need to increase OSW innovation as carbon emissions grow. OSW controls the environmental externalities that come with electricity generation (Runst and Höhle 2022). This finding was backed by Wen et al. (2022) who argued RES-boosted innovation.

Furthermore, electricity from renewable sources is significant. This is so given the current push for deploying RES electricity due to climate change concerns (Countries et al. 2021; Dutt and Ranjan 2022; Huang et al. 2022; IRENA 2021b; Poudineh 2021). Thus, the technological innovation within the OSW sector is in tandem with the global imperative for the world to transition to a low-carbon future and attain the Paris accord. In line with this goal, the future of offshore wind energy study (FOWS) (ARUP 2022) states that the UK needs to deploy about 140GW of OSW capacity by midcentury to achieve carbon neutrality goals. Also, the BOEM has committed 3B USD in capital debt to scale up offshore wind capacity of 30GW by 2030 via DOE’s loan program, under President Biden’s ambition for clean energy deployment (Alemzero 2022; Fellow 2022; Zhang 2020).

Similarly, technological advancements have enabled manufacturing turbines with more swept areas and greater sizes to produce electricity. The capacity factor is not static but evolves with time. The USA has an offshore wind capacity factor above 40% (IRENA 2021b). For instance, California’s capacity factor grew from 13% in 1985 to 24% in 2001 (Boccard 2009). Scientific and technical journals are significant in the fixed analysis and the MLE and REML models. Scientific research is important to unleash new ideas in innovation. This underpins innovations in the OSW sector in China and globally. Currently, China leads the world in the scientific and technical publications or STEM in the world, according to Marginson (2022). Judging from the MLE coefficients, an aspect of the mixed methods approach, they are more robust than the REML, signifying that the MLE approach is more accurate in estimating the factors that determine the technological innovation of the OSW sector.

From Table 4, the cross-section dependence test shows that the variables contain cross-section independence, thus causing the variable to be non-stationary. The suitable model for this test is the second-generation test based on the presumption that cross-section units within the panel are independent. Nonetheless, several studies have asserted that macroeconomic variables tend to co-movement in unionson among cross-sections in units, such as Hurlin and Mignon (2007), Pindyck and Rubinfeld (1997), and Vidican-Sgouridis et al. (2011). Therefore, the appropriate method to tackle the co-drifting of macroeconomic variables is the second-generation unit root tests formulated with the idea that there is cross-sectional dependence among unit root analyses. So from Table 4, all the series have CD dependence, so the Pesaran second units root test was deployed to analyze the CD with the trend and without trend in Table 5, and the lag lengths were specified. After the Pesaran second-generation unit test, the variables were stationary at first differenced. Thereby, the hypothesis that innovation in the offshore sector is cross-sectionally independent is accepted for some of the variables, except Patent, R&D, Relect, CPF, Reelect, and Stjornls, as shown in Fig. 5. On the other hand, there is sense of cross-section dependence on the CPF. This is due to the fact that CPF is not static but dynamic with time. Thus, as technology is developed in one country can spillover to another country. This is evident as more turbines are being developed with more swept areas are being exported to different countries for installation. Patent has a weak dependence since it is constrained to a particular region or country, before it is be diffused.

Interaction effect

An interaction term is performed to ascertain the impact of an independent parameter on the explained variable and relies on the scale of another independent variable (Ai and Norton 2003). The table presents the interaction effect of the variables. As shown in Table 5, trademarks, carbon emissions, offshore wind capacity, electricity from renewable sources, and scientific and technical journals are significant as in the previous models. Nevertheless, the “cross” variable of interest is an interaction of patent, research, and development percentage of gross domestic product and installation costs, which came out perfectly significant, as shown in Table 6. It equally has a direct magnitude. Meaning that a patent increases, the interaction term increases. A unit increase in the patent variable increases the “cross” by 50%. This signifies that when these variables are given the needed policy push, they can accelerate offshore wind energy deployment via innovation.

Figure 1 is the estimation of total global offshore wind energy capacity. According to IRENA (2021c), offshore wind energy capacity by 2021 was 55 678 MW or more than 55 GW. Globally, China installed about half, that is 26 390 MW, of the global offshore capacity due to policy incentives and a robust regulatory environment. However, this current installed capacity is forecasted to reach more than 28GW in 2036, growing at about 48.8%, as depicted in figure one.

Furthermore, Fig. 2 presents a fitted analysis of the relationship between total global offshore wind capacity and those in development within the offshore sector. As shown, Brazil is the new global leader within the offshore wind energy sector, with more development projects than any other country. Indeed, Brazil tops the countries with more offshore wind energy projects, with about 97 GW of offshore wind capacity (RCG 2020). It occupies the position at the end of the fitted line to the right. On the other, the global total offshore wind energy capacity drivers are China, the UK, Taiwan, Vietnam, etc. One noticeable relationship pattern is the decrease between total global shore wind energy capacity additions and development projects. This shows a trajectory of decreasing capacity installations going forward if nothing is done to change the trend. This trend is partly attributable to the covid that broke out in 2019 and stalled ongoing projects in development due to total economic shutdowns worldwide. Countries such as China, Taiwan, the USA, Japan, South Korea, and Poland had their capacity additions decreased by a factor of two or three (RCG 2020). Given this negative outlook, these countries need to ensure the right policy frameworks are put in place to entice private sector participation and political commitment to see that happen.

Similarly, Fig. 3 presents a dual-dimensional relationship between total country offshore wind energy capacity and operational OSW projects. Conspicuously, Brazil is missing from this analysis because it is a late comer to the offshore energy sector. All its projects are in the pipeline. The outlier countries are the UK and China, with operational OSW capacity and total installations. These are leaders when it comes to operational projects and capacity installed. For instance, the UK has 10.5GW functional and 9.8 GW secured, while China added about 8GW in 2021, surpassing the UK as the leader in operational OSW globally (RCG 2020). It is essential to notice that the relationship between these variables is direct, implying that these counties are growing their installation capacity additions. This is so as new countries like Finland, Australia, and Italy emerge among the global drivers of OSW capacity. They see offshore wind energy as the promising means to decarbonizing their economies. This will spike capacity additions, hence the direct relationship of these variables (Fig. 4).

Graph of OSW infrastructure development. Source (RCG 2020)

Ultimately, all these parameters are on a declining trajectory, even steeper around 2015, and went flat in 2019 and 2020 thanks to the pandemic that shipwrecked the global economy and the offshore wind energy sector, to be precise. Also, the percentage change in capacity additions in 2019/20 negatively or positively impacted drivers of global capacities. However, global total offshore wind energy capacity remains on a steady but decreased pathway post-2020. This shows the world is on track to growing total capacity additions if these pipeline projects are developed.

Figure 5 shows the cumulative global offshore wind capacity additions from the top movers of all ongoing projects. As shown in the pie chart, Brazil leads with current projects with 15%, the UK with 13%, China and Vietnam with 10%, and Finland with 2% as a newcomer. The pie chart depicts ongoing projects that are likely to come online.

Top movers of global offshore wind capacity. Source. Authors’ construct from (RCG 2020)

Conclusion

This study analyzed the drivers of innovation in the offshore wind energy sector, using a mixed-method approach of fixed effects, the maximum likelihood effects and REML between 2011 and 2021. This was done to deeply understand the variables that impact innovation in the offshore sectors by utilizing patent, trademark, capacity factor, installations costs, offshore wind capacity, percentage of GDP spent on research and development, electricity from renewable sources, trade flows, carbon emissions, scientific and technical journals, and FDI. The rationale is the current need to deploy negative emissions technologies, such as offshore wind energy, to transition the world to a low-carbon economy.

The findings revealed varied results. On the fixed effects analysis, trademark, carbon emissions, and electricity from renewable sources, technical and scientific journal is equally meaningful. China has witnessed a significant rise in this aspect, publishing more STEM papers, and the USA has committed more funding to the DOE to research new technologies. Their meaningfulness depicts their importance in incentivizing innovation within the offshore wind sector. This amply connotes the rising emissions in the world causing climate change, making the deployment of OSW relevant, hence, the significance of these variables. Judging from the MLE coefficients, an aspect of the mixed-methods approach, coefficients are more robust than the REML, implying their impact on offshore wind energy innovation and precise in estimating the factors that determine the technological innovation of the OSW sector.

Furthermore, the interaction term cross came out significant and had a direct correlation to further reinforcing the interplay of patent, R&D, and offshore wind energy capacity, underpinning technological innovation within the offshore wind energy sector. Thus, as offshore wind energy capacity increases, innovation increases too.

Furthermore, the study forecasted global offshore wind energy capacity additions to grasp the trend of capacity additions by 2036 and arrive at a growth rate of 48.8% by 2036, reaching a capacity of 28500GW, more than the current 55GW installed. Also, the study analyzed the infrastructure development of the OSW by drawing a dual relationship via a fitted line between total global offshore capacity and development projects and observed a negative relationship among the drivers of the OWS, showing a decreasing trend of capacity additions among countries, due to the pandemic in 2019. However, a new global leader in the sector has energy with the most developed OSW in Brazil.

Additionally, after analyzing the relationship between operational OSW projects and total capacity additions, China leads the world with overall capacity in operation, next to the UK. The analysis equally found Brazil does not have any operational OWS capacity yet. The general analysis of the parameters of the OSW infrastructure plan showed the sector is on the decline regarding secured projects, development projects, operational projects, and capacities additions in some countries. However, global total capacity additions are on a steady path, declining a bit. This is attributable to the pandemic that slowed the global economy.

Therefore, sustained policy backings in the form of economic, political, and environmental are key to de-risking, creating technological consciousness about the OSW, benchmarking from best practices in the mature markets, and modernizing the grid for the rapid uptake of the OSW sector.

Ultimately, the interaction effect produced interesting findings consistent with another analysis model, with trademark, carbon emissions, and scientific and technology journals significant. The interaction term “cross” is perfectly significant and has a direct magnitude. That means the interaction of patent, R&D, and installation is key in commercializing innovation.

Overall, offshore wind energy is one the fastest growing renewable sources that has achieved cost reductions and policy support. The findings reveal that more policy support is needed to scale up innovation in the sector considering the factors analyzed, such as increased emissions and the need to transition to a low-carbon economy.

The drawback of this study is that it focused on some counties in the OSW sector instead of all the countries with offshore OWS projects. Thus, future works can consider the entire OSW sector in their analysis.

Data availability

The data and Stata code that support the findings of this study are openly accessible on request.

References

Adefarati T, Obikoya GD (2019) Evaluation of wind resources potential and economic analysis of wind power generation in South Africa. Int J Eng Res Afr 44:150–181. https://doi.org/10.4028/www.scientific.net/JERA.44.150

Advantage-OW Framework RCG’s offshore wind technology and innovation (2020) Available at: https://thinkrcg.com/wp-content/uploads/2020/12/RCG20201130-AdvantageOW-White-Paper.pdf

Ahmad M (2021) Non-linear dynamics of innovation activities over the business cycles: empirical evidence from OECD economies. Technol Soc 67(April):101721. https://doi.org/10.1016/j.techsoc.2021.101721

Ahmad M, Li H, Anser MK, Rehman A, Fareed Z, Yan Q, Jabeen G (2020) Are the intensity of energy use, land agglomeration, CO2 emissions, and economic progress dynamically interlinked across development levels? Energy Environ. https://doi.org/10.1177/0958305X20949471

Ai C, Norton EC (2003) Interaction terms in logit and probit models. Econ Lett 80:123–129. Available at: https://doi.org/10.1016/S0165-1765(03)00032-6

Alemzero D (2022) A two-pronged evaluation of green efficiency of the BRICS economies. Available at SSRN 4129060: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4129060

Alemzero D, Acheampong T, Huaping S (2021) Prospects of wind energy deployment in Africa: technical and economic analysis. Renew Energy 179:652–666. https://doi.org/10.1016/j.renene.2021.07.021

Al-mulali U (2011) Oil consumption, CO2 emission and economic growth in MENA countries. Energy 36(10):6165–6171. https://doi.org/10.1016/j.energy.2011.07.048

Amendolagine V, Lema R, Rabellotti R (2021) Green foreign direct investments and the deepening of capabilities for sustainable innovation in multinationals: insights from renewable energy. J Clean Prod 310:127381. https://doi.org/10.1016/j.jclepro.2021.127381

Ameyaw B, Li Y, Ma Y, Agyeman JK, Appiah-Kubi J, Annan A (2021) Renewable electricity generation proposed pathways for the U.S. and China. Renew Energy 170:212–223. https://doi.org/10.1016/J.RENENE.2021.01.119

ARUP (2022) Future offshore wind scenarios: an assessment of deployment drivers. April, 1–11.Available at: https://www.futureoffshorewindscenarios.co.uk/

Aurora (2018) The new Economics of Offshore Wind energy. Available at: https://auroraer.com/country/europe/great-britain/the-new-economics-of-offshore-wind

AWEA (2020) U.S. offshore wind power economic impact assessment. March, 17. https://supportoffshorewind.org/wp-content/uploads/sites/6/2020/03/AWEA_Offshore-Wind-Economic-ImpactsV3.pdf

Baltagi BH, Song SH, Jung BC (2001) The unbalanced nested error component regression model. J Econom 101(2):357–381. https://doi.org/10.1016/S0304-4076(00)00089-0

Birol F (2022) World energy investment. 1–183.Available at: https://www.iea.org/reports/world-energy-investment-2022

Boccard N (2009) Capacity factor of wind power realized values vs. estimates. Energy Policy 37(7):2679–2688. https://doi.org/10.1016/j.enpol.2009.02.046

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47(1):239. https://doi.org/10.2307/2297111

Cheng G, Zhao C, Iqbal N, Gülmez Ö, Işik H, Kirikkaleli D (2021) Does energy productivity and public-private investment in energy achieve carbon neutrality target of China?. J Environ Manag 298(July). https://doi.org/10.1016/j.jenvman.2021.113464

Countries I, Fendoğlu E, Fendoğlu E (2021) The relationship between R & D expenditures and economic growth : panel data analysis in selected new Ar- Ge Harcamaları ile Ekonomik Büyüme Arasındaki İlişki : Seçilmiş Yeni Sanayileşen Ülkelerde Panel Veri Analizi. 3, 728–747

Doblinger C, Surana K, Li D, Hultman N, Anadón LD (2022) How do global manufacturing shifts affect long-term clean energy innovation? A study of wind energy suppliers. Res Policy 51(7):104558. https://doi.org/10.1016/j.respol.2022.104558

Dutt D, Ranjan A (2022) Towards a just energy transition in Delhi: addressing the bias in the rooftop solar market. Energy Policy 160(November 2021):112667. https://doi.org/10.1016/j.enpol.2021.112667

Eberhardt M, Teal F (2011) Econometrics for grumblers: a new look at the literature on cross-country growth empirics. J Econ Surv 25(1):109–155. https://doi.org/10.1111/j.1467-6419.2010.00624.x

Ehsanullah S, Tran QH, Sadiq M, Bashir S, Mohsin M, Iram R (2021) How energy insecurity leads to energy poverty? Do environmental consideration and climate change concerns matters. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-14415-2

Enslow R (2020) Offshore wind development, pp 2–3. Available at: https://thinkrcg.com/rcg-report-more-than-200-gw-of-global-offshore-wind-projects-have-entered-development-since-2020/

Farooq S, Ozturk I, Majeed MT, Akram R (2022) Globalization and CO2 emissions in the presence of EKC: a global panel data analysis. Gondwana Res 106:367–378

Fellow A (2022) The Biden administration’ s offshore wind fantasy Jonathan Lesser. February, 1–15. Available at: https://thinkrcg.com/rcg-report-more-than-200-gw-of-global-offshore-wind-projects-have-entered-development-since-2020/

Gobal wind report (GWEC) (2021) Global Wind Energy Council, 75. http://www.gwec.net/global-figures/wind-energy-global-status/

Green R, Vasilakos N (2020) The economics of offshore wind. Energy Policy 39(2):496–502. https://doi.org/10.1016/j.enpol.2010.10.011

Hao LN, Umar M, Khan Z, Ali W (2021) Green growth and low carbon emission in G7 countries: how critical the network of environmental taxes, renewable energy and human capital is? Sci Total Environ 752:141853. https://doi.org/10.1016/j.scitotenv.2020.141853

Helm D (2010) Government failure, rent-seeking, and capture: the design of climate change policy. Oxf Rev Econ Policy 26(2):182–196. Available at: https://ideas.repec.org/a/oup/oxford/v26y2010i2p182-196.html

Huang J, Xiang S, Wu P, Chen X (2022) How to control China’s energy consumption through technological progress: a spatial heterogeneous investigation. Energy 238:121965. https://doi.org/10.1016/j.energy.2021.121965

Hurlin C, Mignon V (2007) Second generation panel unit root tests to cite this version : HAL Id : halshs-00159842 Second Generation Panel Unit Root Tests. 1–25. https://halshs.archives-ouvertes.fr/halshs-00159842

IEA (2019) Offshore wind outlook 2019. Available at: https://www.iea.org/reports/offshore-wind-outlook-2019

IRENA (2021a) Tracking the impacts of innovation. Available at: https://www.irena.org/publications/2021/Jun/Impact-of-Innovation-Offshore-wind-casestudy

IRENA (2021b) OFFSHORE an action agenda for deployment.Available at: https://www.irena.org/publications/2021a/Jul/Offshore-Renewables-An-Action-Agenda-for-Deployment

IRENA (2021c) Renewable capacity statistiques De Capacité Estadísticas De Capacidad.Available at: https://www.irena.org/publications/2021b/March/Renewable-Capacity-Statistics-2021b

Jacobson MZ, Delucchi MA, Bauer ZAF, Wang J, Weiner E, Yachanin AS, Goodman SC, Chapman WE, Cameron MA, Bozonnat C, Chobadi L, Clonts HA, Enevoldsen P, Erwin JR, Fobi SN, Goldstrom OK, Hennessy EM, Liu J, Lo J, … Sontag MA (2019) 100% clean and renewable wind, water, and sunlight all-sector energy roadmaps for 139 countries of the world Joule 202https://doi.org/10.1016/j.joule.2017.07.005

Jafari M, Botterud A, Sakti A (2020) Estimating revenues from offshore wind-storage systems: the importance of advanced battery models. Appl Energy 276(July):115417. https://doi.org/10.1016/j.apenergy.2020.115417

Jamasb T, Köhler J (2007) Learning curves for energy technology and policy analysis: a critical assessment. Delivering a low carbon electricity system: Technologies, economics and policy, pp 314–332. https://www.repository.cam.ac.uk/bitstream/handle/1810/194736/0752&EPRG0723.pd?sequence=1

Jenkins KEH (2022) 72 sustainable development and energy justice: two agendas combined. In Delivering Energy Law and Policy in the E.U. and the U.S. https://doi.org/10.1515/9780748696802-076

Junginger M, Faaij A, Turkenburg WC (2004) Cost reduction prospects for offshore wind farms. Wind Eng 28(1):97–118. https://doi.org/10.1260/0309524041210847

Kang SH, Islam F, Kumar Tiwari A (2019) The dynamic relationships among CO2 emissions, renewable and non-renewable energy sources, and economic growth in India: evidence from time-varying Bayesian VAR model. Struct Chang Econ Dyn 50:90–101. https://doi.org/10.1016/j.strueco.2019.05.006

Korkut Pata U (2021) Linking renewable energy, globalization, agriculture, CO2 emissions and ecological footprint in BRIC countries: a sustainability perspective. https://doi.org/10.1016/j.renene.2021.03.125

Lacal-Arántegui R, Yusta JM, Domínguez-Navarro JA (2018) Offshore wind installation: analysing the evidence behind improvements in installation time. Renew Sustain Energy Rev 92(April):133–145. https://doi.org/10.1016/j.rser.2018.04.044

Land-Based Wind Market Report: 2021 Edition (2021) Available at: https://www.energy.gov/eere/wind/articles/land-based-wind-market-report-2021-edition-released

Li R, Leung GCK (2021) The relationship between energy prices, economic growth and renewable energy consumption: evidence from Europe. Energy Rep 7:1712–1719. https://doi.org/10.1016/j.egyr.2021.03.030

Lindman Å, Söderholm P (2012) Wind power learning rates: a conceptual review and meta-analysis ☆. Energy Econ 34(3):754–761. https://doi.org/10.1016/j.eneco.2011.05.007

Manish S, Pillai IR, Banerjee R (2006) Sustainability analysis of renewables for climate change mitigation. Energy Sustain Dev 10(4):25–36. https://doi.org/10.1016/S0973-0826(08)60553-0

Marginson S (2022) ‘All things are in flux’: China in global science. High Educ 83(4):881–910. https://doi.org/10.1007/s10734-021-00712-9

Mehmood K, Iftikhar Y, Chen S, Amin S, Manzoor A, Pan J (2020) Analysis of Inter-temporal change in the energy and CO2 emissions efficiency of economies: a two divisional network DEA approach. Energies. https://doi.org/10.3390/en13133300

Mendonça S, Pereira TS, Godinho MM (2004) Trademarks as an indicator of innovation and industrial change. Res Policy 33(9):1385–1404. https://doi.org/10.1016/j.respol.2004.09.005

Odam N, De Vries FP (2020) Innovation modelling and multi-factor learning in wind energy technology. Energy Econ 85:104594. https://doi.org/10.1016/j.eneco.2019.104594

Pesaran MH (2021) General diagnostic tests for cross-sectional dependence in panels. Empir Econ 60(1):13–50. https://doi.org/10.1007/s00181-020-01875-7

Petrović-Ranđelović M, Mitić P, Zdravković A, Cvetanović D, Cvetanović S (2020) Economic growth and carbon emissions: evidence from CIVETS countries. Appl Econ 52(16):1806–1815. https://doi.org/10.1080/00036846.2019.1679343

Pindyck R, Rubinfeld D (1997) Econometric models and economic forecasts. 1–634. Available at: https://www.amazon.com/Econometric-Models-Economic-Forecasts-Pindyck/dp/0079132928

Poudineh R (2021) A critical assessment of learning curves for solar and wind power technologies. Available at: https://www.oxfordenergy.org/publications/a-critical-assessment-of-learning-curves-for-solar-and-wind-power-technologies/

Raghutla C, Shahbaz M, Chittedi KR, Jiao Z (2021) Financing clean energy projects: new empirical evidence from major investment countries. Renew Energy 169:231–241. https://doi.org/10.1016/j.renene.2021.01.019

Ragwitz M, Miola A (2005) Evidence from RD&D spending for renewable energy sources in the E.U. Renew Energy 30(11):1635–1647. https://doi.org/10.1016/J.RENENE.2004.12.001

Renewables Consulting Group (2020) Global offshore wind: annual market report 2020. p 130. Available at: https://thinkrcg.com/rcg-report-more-than-200-gw-of-global-offshore-wind-projects-have-entered-development-since-2020/

Runst P, Höhle D (2022) The German eco tax and its impact on CO2 emissions. Energy Policy 160(April 2021) https://doi.org/10.1016/j.enpol.2021.112655

SEforALL Sustainable Energy for All. (2020). The recover better with sustainable energy guide for african countries. United Nations Publications, 53(9), 21https://doi.org/10.1017/CBO9781107415324.004

Shahbaz M, Lahiani A, Abosedra S, Hammoudeh S (2018) The role of globalization in energy consumption: a quantile cointegrating regression approach. Energy Econ 71:161–170. https://doi.org/10.1016/j.eneco.2018.02.009

Shahbaz M, Song M, Ahmad S, Vo XV (2022) Does economic growth stimulate energy consumption? The role of human capital and R&D expenditures in China. Energy Econ 105:105662. https://doi.org/10.1016/J.ENECO.2021.105662

Sun H, Khan AR, Bashir A, Alemzero DA, Abbas Q, Abudu H (2020) Energy insecurity, pollution mitigation, and renewable energy integration: prospective of wind energy in Ghana. Available at: https://www.researchgate.net/profile/publication/342691879_Energy_insecurity_pollution_mitigation_and_renewable_energy_integration_prospective_of_wind_energy_in_Ghana/links/5f091ff9299bf18816127d35/Energy-insecurity-pollution-mitigation-and-renewable-energy-integration-prospective-of-wind-energy-in-Ghana.pdf

Tahir M, Gen LL, Ali M, Asif M (2022) Analyzing the trademark protection index of China and Pakistan: a comparative study. Int J Law Politics Stud 4(1):27–31. https://doi.org/10.32996/ijlps.2022.4.1.4

Uddin R, Khan HR, Arfeen A, Shirazi MA, Rashid A, Khan US (2021) Energy storage for energy security and reliability through renewable energy technologies: a new paradigm for energy policies in Turkey and Pakistan. Sustainability (switzerland) 13(5):1–18. https://doi.org/10.3390/su13052823

Vanegas-Cantarero MM, Pennock S, Bloise-Thomaz T, Jeffrey H, Dickson MJ (2022) Beyond LCOE: a multi-criteria evaluation framework for offshore renewable energy projects Renew Sustain Energy Rev 161https://doi.org/10.1016/j.rser.2022.112307

Vibhuti Garg (2022) Renewable energy investment surges in India investment will need to more than double to meet 2030 goals. pp 1–11. Available at: https://ieefa.org/sites/default/files/2022-06/Renewables%20Investment%20Trends%20in%20India-June_2022.pdf

Vidican-Sgouridis G, Woon WL, Madnick SE (2011) Measuring innovation using bibliometric techniques: the case of solar photovoltaic industry. SSRN Electron J. https://doi.org/10.2139/ssrn.1388222

Wen J, Okolo CV, Ugwuoke IC, Kolani K (2022) Research on influencing factors of renewable energy, energy efficiency, on technological innovation. Does trade, investment and human capital development matter? Energy Policy 160:112718

Wu Z, Hou G, Xin B (2020) The causality between participation in GVCs, renewable energy consumption and CO2 emissions. Sustainability (Switzerland), 12(3). https://doi.org/10.3390/su12031237

Yao J, Xiao E, Jian X, Shu L (2021) Service quality and the share of renewable energy in electricity generation. Utilities Policy 69:101164. https://doi.org/10.1016/J.JUP.2020.101164

Zhang F (2020) Economic impact study of new offshore wind lease. Available at: https://tethys.pnnl.gov/sites/default/files/publications/Offshore-wind-economic-impact-analysis.pdf

Funding

This research was supported by National Natural Science Fund of China (Grant number: 72102090), Humanities and Social Sciences Project of Ministry of Education (Grant number: 21YJC630112), Philosophy and Social Science Research Fund of Jiangsu (Grant number: 2021SJA2070) and the Philosophy and Social Science Excellent Innovation Team Construction Foundation of Jiangsu Province(SJSZ2020-20). The usual disclaimers apply.

Author information

Authors and Affiliations

Contributions

Junguo Shi: conceptualization, funding, methodology, writing—original draft, software: visualization, and taking the lead in this project; Xuhua Hu: methodology and discussion; Shanshan Dou: data curation, discussion and editing; David Alemzero: conceptualization, methodology, writing and revision, software-data analysis, and language improvement; Elvis Adam Alhassan: discussion and editing.

Corresponding author

Ethics declarations

Ethical approval and consent to participate

The authors declare that they have no known competing interests or personal relationships that could have appeared to influence the work reported in this paper. We declare that we don't have human participants, human data or human issue.

Consent for publication

They do not have any individual person’s data in any form.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Philippe Garrigues

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Shi, J., Hu, X., Dou, S. et al. Evaluating technological innovation impact: an empirical analysis of the offshore wind sector. Environ Sci Pollut Res 30, 20105–20120 (2023). https://doi.org/10.1007/s11356-022-23521-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-23521-8