Abstract

The study mainly focuses on identifying the links between corporate social responsibility disclosure activities and green bond investment performance utilizing GDP growth as a moderating variable in Morocco. The research is based on a unique technique combining a thorough literature review, market data analysis, and interviews with a vast spectrum of green bond market players. The data from 2015 to 2019 for the 450 Moroccan enterprises has been utilized to produce CSR and GDP growth rates based on a serial criterion. The data demonstrate that the more firms publicly disclose their CSR initiatives, and the better the financial outcomes. The relationship between CSR disclosure and green bond investment seems to be tempered by GDP considerably, while the effect of CSR on green bond investment Tobin’s Q is dramatically lowered. As a consequence of the benefits that the business stands to get from CSR disclosure, legislators are moving in the direction of ensuring a long-term market. Overall, the issue of green bonds has a good influence on firms, may contribute to environmental development, encourages CSR and value creation, and helps to attract investors to some level. The research provided light on a strategy to measure CSR disclosure indices for emerging markets like Morocco. The results recommend that the business’s management pay more attention to CSR disclosure activities owing to the positive advantage their firm may gain and suggest policymakers maintain a stable economic background for a sustainable market.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Corporate social responsibilities and sustainable development are the general terms that concern economists, entrepreneurs, and economic-related policymakers worldwide. However, most countries are using innovative ways to adaptable the current economic conditions and investment attraction by issuing green bonds. At the same time, some countries focus on central and local government bonds, others use corporate bonds, and a few countries combine government and corporate green bonds. Corporate social responsibility (CSR) lowers loan costs by decreasing information asymmetry and business risk, and green credit growth improves CSR’s importance in this regard (Li et al. 2022). Many institutional factors may impede the development of the green investing sector, and ecologically conscious countries have larger green bond markets. The UNFCCC’s Paris 2015 obligations on climate change are one reason for the need for green bonds (Tolliver et al. 2020). Along with the rapid development of the global economy, problems relating to the environment have become increasingly prominent all over the world, and economic growth and sustainable development have become hot topics attracting the attention of most countries (Cuaresma et al. 2013). Sustainable development promotes sustainable finance, and the paper examines the practice of financing sustainable development green bonds. Consequently, there has been more and more research into sustainable development (Kudratova et al. 2018). The issuing of green bonds has a good influence on enterprises, may contribute to environmental action, encourages CSR and value creation, and helps to attract investors to a certain degree (Zhou and Cui 2019). Moroccan Agency of Sustainable Energy S.A. (MASEN), a state-owned public limited company, issued Morocco’s first green bond in November 2016 amounted to 1.15 billion Dirham (USD 117mn) (MASEN 2017). Environment-friendly CSR initiatives favour the company’s bottom line (Guang-Wen and Siddik 2022). The financing is expected to help save 938,000 tons on average of CO2 emissions equivalent per year, as well as the equivalent of 17.36 million tons of CO2 in greenhouse gas savings over the remaining lifetimes of the projects being financed (IFC 2017). The CSR, green investment, green credit, and the return on assets of chosen industries show a substantial and favourable correlation (Li et al. 2021). In Morocco, green bonds and other financing instruments with an environmental component might be essential for the country to reach its renewable energy goals. Current government plans aim to have 52% of electricity capacity from renewable sources.

Furthermore, the kingdom plans to reduce its carbon emissions by 32% (OBG 2019). The danger of greenwashing is concentrated in the green bond market compared to other securities like transition bonds and sustainability-linked instruments. It encourages investments in emerging economies, which might be a significant source of issuance (Deschryver and De Mariz 2020). Green bonds are generally issued to promote green industry projects and environmental improvement projects aiming to mitigate climate change effects, save resources, and control pollution. According to research, CSR activities have been demonstrated to improve financial performance (Johnson and Greening 1999). Green bonds are fixed-income products with profits designated solely for environmental initiatives (Syzdykov and Masse 2019). In terms of environmental preservation and sustainable development, green bond issuance is more than just a kind of “virtue signalling” (Wang and Wang 2022). Morocco has been keen to show its commitment to and leadership in climate finance. Environmental-friendly initiatives include renewable energy, water conservation, energy-efficient, bioenergy, and low carbon transportation of green bonds (Campiglio 2016). CSR is a crucial supporter in the fight to preserve the environment, and many businesses are using CSR initiatives to help advance a country’s socioeconomic context (MASEN 2017). According to the study, green bonds have a positive influence on a company’s brand image as well as its ability to expand sustainably. To examine the green bond market, the authors have chosen Morocco because of the country’s rapid growth in Africa and the effectiveness with which it has taken steps to promote investors in the green bond market. It is not just investors who are interested in green bonds’ impact on firms’ financial health and social responsibilities. The event study technique was used to conduct a robustness test to examine the influence of green bonds on CSR.

The remainder of the study is organized as follows: The “Literature review” section describes the literature review to prove the significance of the study. The “Research methods” section determined the research methodology and econometrical research design, and the “Results and discussions” section explained the results and analysis of the survey with a table and graphs. The “Conclusion” section determined the conclusions of the study.

Literature review

Corporate social responsibility and Green Bonds

According to Weder et al. (2019), global energy businesses of all sizes and market positions have varying perspectives on corporate social responsibility. Investing in green bonds may command a higher premium from investors than conventional bonds to encourage project owners to issue green bonds to satisfy their financing needs at lower capital costs (Nanayakkara and Colombage 2019). There is also evidence that CSR is extensively accepted and applied by energy sector enterprises and energy-related industries worldwide (Weder et al. 2019). Andronie et al. (2019) described that corporate social responsibility is a means for firms to deliberately incorporate social and environmental responsibility into the business plan and the connection with societal stakeholders. Corporations are required to handle resources correctly and without causing harm to the environment or other stakeholders. The enormous energy supply companies operating on a global scale MASEN observations of CSR are based on their views and its effect on strategic CSR activities (RWE 2018). Various organizations and governments can issue green bonds to raise money from the general public to support projects that assist the globe’s progress toward a low-carbon, climate-resilient economy (Inderst et al. 2012). Investors in traditional assets can diversify their portfolios with green bonds in market turmoil (Cicchiello et al. 2022). Only by enhancing the quality and expanding the amount of green financing fuelled by scientific and technological advancements can we achieve long-term sustainable green development (Bai et al. 2022). According to Lloyd (2018), businesses play a unique role in addressing social expectations since they consume most of the available resources. By issuing our redeeming bonds, financing or refinancing can accomplish various tasks (Weber and Feltmate 2016).

Development of green bonds market

According to Kreivi (2017), a green bond’s principles are included in four components that earnings from green bonds are used rigorously by sustainability standards. GBP helps investors to improve the information availability needed to know the effect of green bonds on the environment. ICMA (2018) determined that the GBP design strives to develop a comprehensive and standardized market by offering advice on the four essential components needed to launch a credible green bond. Its size also influences the company’s financial systems. Low- and medium-value firms are more affected by corporate sustainability initiatives that are both positive and detrimental than high-value enterprises (Lin et al. 2021). International Development Association (IDA) and European Investment Bank (EIB) released the first-ever green bonds in 2007, with IBRD following suit in 2008 (Stoian and Iorgulescu 2019). Sustainable economic activity is a primary goal for green bonds, which impact how businesses approach environmental issues (Maltais and Nykvist 2020). According to research, many institutional factors may impede the growth of the green investing sector, and ecologically conscious countries have larger green bond markets. China is the leading issuer of developing market green bonds in 2019, with issuance rising by 21% to $52 billion (Amundi 2020).

Green bonds and CSR

It is possible to harvest both financial and social advantages through CSR initiatives, according to Cho et al. (2013), the organizations with high levels of CSR reap both economic and social benefits. Wang and Zhi (2016) studied the link between green financing and environmental protection to develop a method that would allow funding green to safeguard the environment better. Corporate green bonds are becoming more common in environmentally concerned industries, notably China, the USA, and Europe (Flammer 2021). According to Chiang et al. (2017), there is a relationship between the degree of CSR activity and bond ratings and CSR in China serves as a reference point for relevant firms. CSR is a multifaceted approach for long-term growth that has garnered substantial attention in recent years. The business must fulfil society’s current economic, legal, ethical, and discretionary expectations, as defined by Carroll (1979). It is a voluntary guideline for developing the green bond market that recommends transparency and disclosure and promotes integrity in the growth of the green bond market (ICMA 2016). According to Zerbib (2019), one-third of all green bonds have been issued in US dollars or Euros. Gong et al. (2018) described that Chinese companies with better CSR disclosure quality have lower bond costs; it is also found that there is a negative link with more pronounced in companies with poor corporate governance. ESG, on the other hand, has a long-term negative impact on the stock returns of the majority of firms (Feng et al. 2022). State-owned firms’ bond credit rating has been discovered to negatively affect CSR and the cost of bonds (Huang et al. 2018). Industrial and heavily polluting businesses have a higher impact on corporate green innovation due to the concentration of consumers (Huang et al. 2022). Bauer et al. (2019) in the Netherlands found that investors are interested in sustainable investments, especially pension assets on the table to encourage sustainable investments. For companies that pollute a great deal and are publicly listed, environmental disclosure has increased financing channels, boosted product sales, and heightened media coverage (Xiang et al. 2020). There is a positive connection between CSR, the environment, and society. A rule addresses the CSR issue regarding green bonds (CSRC 2017). According to He and Jin (2010), even while both debt and corporate ratings impact bond rates, the debt rating counts more than volatility as an indicator of the bond issuance atmosphere and bond market stability. Companies are obligated to all their stakeholders to contribute to the general growth of the economy and societal well-being (Clarkson 1995).

Research methodology

Data collection

The Casablanca Stock Exchange (https://www.casablanca-bourse.com) has 555 companies listed; World’s Bank database (https://data.worldbank.org.com) and data related to green bond investment are collected from the Moroccan Agency of Sustainable Energy S.A. (MASEN) (https://www.climatebonds.net.com). The CSR reporting positively affects financial performance, independent of the company’s stock market listing. There are more rules and regulations in place at MASEN than at CSE, which is the smaller and younger stock market. Accordingly, the companies listed on MASEN are expected to benefit less than those listed on CSE if CSR disclosure levels are the same. The study found that the effect is much less pronounced for ROA and TBQ in MASEN than in CSE.

Research design

The following equation is used to determine the effect of CSR on GBI:

GBI i is a measure of green bond investment’s market performance in the year “t” and λi, t is firm-yearly fixed effects that control all firm-specific factors. Yi, t is a matrix of controlled variables that captures the impact of firm-specific factors like financial leverages, and εi, t is an error term in a time-specific factor. Additionally, the study explores how different facets of CSR affect society and the requirements of critical stakeholders for GBI, in the same way, that prior empirical studies in developing countries have done so. As a result, four equations are used to quantify the impact of CSR components on GBI.

where (i = 1,…, 4) and GBIj,i,t corresponds to the ith category of CSR as environmental control (CSR_ENV), Workers control (CSR_WOR), Public control (CSR_PUB), and Production control (CSR_PROD). The following regression model is used to evaluate the moderating influence of economic policy uncertainty (GDP) factors:

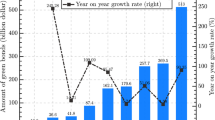

GDP t represents the gross domestic product factors during one-year “t”. There is because GDP is a macroeconomics variable, which means there is some value for all observations in a year. Additionally, the regression examines the influence of GDP on GBI and how these factors influence the CSR-to-CPF link (through the coefficient of cross-product) Fig. 1.

Corporate social responsibility

The CSR index can be measured in a variety of ways. The reputation index, Milton Moskowitz, and the Fortune reputation index are the first to be considered. Secondly, there is a company grading system like the KLD, the Global Initiative Reporting Indicator (GRI), and the Domini 400 Social Index (DSI). The third instance uses a survey to gather information on social responsibility. The last option is to look at the details of the secondary data itself. CSR operations in public businesses, particularly in their reporting divisions, have been studied extensively using this strategy.

Control variables

Financial leverage vs social responsibility disclosure is a hot-button issue. Many variables influence this nexus, including the size and age of the company. According to Kumar et al. (2014), stakeholders perceive that large corporations participate more successfully in social activities than smaller ones. Regarding environmental regulations, size matters, and larger companies care more about their public image. As a result, even little mistakes in managerial conduct can significantly impact product quality, emissions, employment, and more. The study employs several control factors, such as (1) leverage, (2) firm size, (3) financial risk, (4) firm age, and (5) SOE, to enhance the estimated likelihood of the association between social responsibility and CBI.

Results and discussions

Descriptive statistics

The study makes use of Stata version 11 and R software. Samples from Morocco’s publicly traded firms’ financial, annual, and sustainability reports are used in the investigation. Companies between 2015 and 2019 reported a total of 450 CSR-related concerns. The following are some descriptive statistics for the factors that are examined (Table 1).

Regarding the four components that make up total carbon sequestration, CSR_ENV has the lowest average value, indicating that much more investment is required in Morocco to renew energy production sources to reduce environmental pollution. CSR_WOR has the highest average value among the CSR criteria. It confirms that companies can provide more detailed information about the employees because the CSR_WOR is the only indication with a value smaller than 0. And the measurement of GBI has been done through ROA and TBQ, which has an average value respectively for firms. ROA indicates that, on average, the companies in the sample had a return on assets of more than 7% throughout the research period. TBQ’s average value means the business’s value creation is more than its expenditure. ROA’s highest and minimum values with a standard deviation indicate a significant variance of profitability index in assets with TBQ. Some other control factors, such as RISK, SIZE (LEV), SOE, and AGE, provide fascinating findings that are worth further investigation. In other words, if a company borrows more money than its total assets are worth, it will not be able to pay it back. Most enterprises in the sample are not owned by the government, which is why the average SOE value is 0.311. Morocco is progressively converting its previous state-owned corporations into familiar joint-stock firms. The Casablanca stock market is still in its infancy, as evidenced by the fact that AGE has a range of values ranging from 20 years to barely 2 years, with an average value of 9.001.

Comparison of ROA and TBQ

The study is interested in determining how CSR affects a company’s financial system. The regression coefficients for CSR and TBQ are significantly higher than CSR and ROA. Tables 2 and 3 summarise the efficient correlation between CSR and CSR is positively connected with ROA and TBQ at a 1% significance level. These findings support the “advocating CSR” of CSR (Schreck 2011). Samples are also divided into subgroups, such as stock market and operational characteristics, to test CSR impacts more thoroughly. Regression findings for ROA and TBQ are shown in columns 2, 3, 4, and 5 in both Tables 2 and 3, respectively, based on the CSR values of different subsamples. That CSR reporting has a statistically significant beneficial influence on financial performance is evident, independent of whatever stock exchange companies are listed. As a result, the more these firms publicize their CSR information, the easier it is for them to receive investment flows and other advantages from the government and other investors. It also looks at how CFP is affected by CSR components.

Table 3 shows the regression findings of TBQ and ROA on CSR for different subsamples. The CSR results show a significant positive effect on gross domestic product (GDP) and investments in the green bonds market in Morocco. Accordingly, the companies listed on MASEN are expected to benefit less than those listed on CSE if CSR disclosure levels are the same.

The study found that the effect is much less pronounced for ROA and TBQ in MASEN than in CSE. According to statistical results, manufacturing organizations are more likely than non-manufacturing organizations to increase their CSR disclosures. The robustness of CSR impacts is further investigated by dividing the study sample into subgroups such as the stock market and the operational aspect of the company. The government authorizes surveys in Morocco indicating that the manufacturing industries play a more significant role in changing the environmental conditions, so the authorities are paying attention to collecting more and more information related to manufacturing industries causing increased ecological changes in the country. The companies that make CSR efforts more widely compared to others are more likely to get government funding and assistance for green energy production resources and examine the impact of CSR components on GBI in further detail. Table 4 shows the results of regressions. As expected, the overall CSR index shows that these factors have almost identical effects on GBI.

CSR_ENV, which focuses on environmental actions, is first discussed in depth. According to Endrikat et al. (2014), the positive and statistically significant coefficients of the variable, enterprises that engaged more in environmental activities are more likely to be profitable, and ecological activism is comparable. In addition to CSR_ENV, CSR_WOR, CSR_PUB, and CSR_PROD all have effects that are pretty similar to the GBI. Companies that are more conscious of the workers’ concerns and the communities’ needs are more likely to reap financial rewards (Kang et al. 2010). These results demonstrate the relevance of CSR in all aspects of business operations.

Controlling effects of GDP

The study focused on the financial impact of CSR on companies’ performance to get investments in green bonds, considering GDP growth as a moderating variable. Table 5 shows the results of the variables in the regressions to check the strong relation between CSR effects on companies’ financial performance and GBI relationships.

Table 6 also shows the results of the variables in the regressions to check the strong relation between CSR effects on companies’ financial performance and GBI relationships. The results demonstrate corporate social responsibility (CSR)’s critical role across the board. It focused only on CSR’s impact on a company’s financial success without considering the GBI factor’s moderating impacts. Our regression has included a new element in determining if it affects the CSR_GDP nexus in this section.

The results reveal that about 5% of the CSR variable’s coefficients are positive and statistically significant, indicating that CSR positively impacts ROA and TBQ. However, in the face of ambiguity, the connection has little influence; when the economy of a developing country like Morocco becomes less stable, and corporations have to prioritize other operations above CSR, the value of CSR diminishes. The study found no direct connection between GDP and GBI; economic shocks devalue CSR activity to a certain degree. The betas of the cross-product between GDP and CSR are explicitly negative in columns 6 to 10 and indistinctly in columns 1 to 5. There should be little impact on internal financial ability in the short term because only GDP is affected. CSR and TBQ show a negative correlation when the research sample is separated by the location of the firm’s stock market value. Investors underestimate manufacturing and non-manufacturing enterprises regarding economic shocks, regardless of the firm’s operational characteristics.

Endogeneity analysis

The study utilizes an endogeneity test for the OLS estimation to evaluate the endogeneity problem. To ensure the OLS is consistent, apply the Durbin-Wu-Hausman (DWH) test. The study can create a DWH test using the residuals of all exogenous variables as a function of endogenous right-hand-side variables in the original model (Davidson and MacKinnon 1993). A new exogenous variable, Award, is added as an additional exogenous variable to retrieve the residual CSR_RES, and then an enhanced regression is performed on the data (Table 7).

When ROA is the dependent variable, the coefficient of CSR RES is statistically insignificant. The OLS regression has no endogeneity bias. The instrumental variable does not apply. Even though CSR RES has an alpha of just 0.02 when considered the dependent variable, this suggests that CSR is an endogenous variable, and, therefore, OLS estimation is unreliable. The component may be responsible for the reported correlation between CSR and TBQ rather than an actual link between these variables. A list of awards given to companies in Casablanca measures corporate social responsibility. The goal is to impact a company’s corporate social responsibility. Companies that win yearly awards have demonstrated a commitment to corporate social responsibility. It reveals that CSR has a significant and favourable effect on TBQ. A two-stage reversal of the TBQ-CSR relationship is stable in an IV regression. The correlation between CSR and TBQ may not constitute a genuine relationship between the two variables. Table 8 shows the regression analysis findings for the TBQ-CSR association.

Dummy variables, such as the list of Morocco-listed business Awards, are used to measure corporate CSR. CSR has a considerable and beneficial influence on TBQ and the OLS estimates that are previously made. The study also considers the IV variable’s solid or weak level on the IV regression. According to the minimal eigenvalue statistic (11.97 > 10), the study IV variable is robust, and the estimation based on the IV estimator is accurate.

Discussions

The bond market and institutional investors must act to meet the magnitude of green bond investments necessary for a low-carbon economy. CSR helps to enhance green bond investment in Morocco, which has a good influence on increasing renewable energy sources and lowering CO2 emissions. The study’s findings are validated because CSR impacts sustainability (Andronie et al. 2019). The government of Morocco’s authorities’ surveys indicate that manufacturing industries play a more significant role in changing environmental conditions. As a result, the rules focus on collecting more data related to manufacturing industries, causing increased ecological changes in the country. The research (Weder et al. 2019) also strongly supports these relationships, indicating that social responsibility aids in achieving sustainable energy development goals. Suppose a company in the energy sector succeeds in implementing CSR. In that case, the results will stimulate the use of renewable energy resources as a cause-and-effect relationship, ensuring a sustainable energy supply and achieving sustainable energy development goals. As a result, enterprises who engage in more CSR activities than others are more likely to get government financing and help for green energy production resources and investigate the influence of CSR components on GBI in greater depth. Environmental activism and businesses participating in more environmental initiatives are more likely to succeed. Environmental activism is comparable, and CSR_ENV concentrates on environmental actions. The variable’s positive and statistically significant coefficients are first addressed in depth, and firms participating in more environmental activities are more likely to succeed. Khamis and Wan Ismail (2022) examine whether they are on the right side of the law from a social and environmental aspect when conducting commercial activities and making agreements with stakeholders. The study results show that the announcement of green bond issuance affects stock prices, financial performance, and CSR for corporations (Zhou and Cui 2019). CSR activities are devalued by economic shocks even if there is no clear correlation between GDP and GBI; the environmentally friendly company practices and resource conservation promoted by green investment programs boost sales significantly (Yannan et al. 2021). Investors undervalue manufacturing and non-manufacturing firms in times of economic difficulty because of CSR’s substantial positive impact on stock prices, regardless of their operational features (Flammer 2013). According to Cho et al. (2013), a direct link between the degree of information asymmetry and CSR-reduced information asymmetry might have a favourable impact on investor perceptions.

Conclusion

The study investigates the relationship between CSR disclosure efforts and green bond investment (GBI) performance in the Moroccan market under independent and GDP-moderating-effect scenarios. The study has used a variety of panel data analysis methodologies to address our study questions; a set of 450 firms’ observations from the Casablanca Stock Exchanges (MASEN and CSE) between 2015 and 2019 are subjected to multivariate regression analyses to account for missing data and individual variability. According to the findings of the research, CSR and GBI have a positive relationship in Morocco; empirical evidence shows that CSR, on its whole, has a positive impact on GBI. According to the research, the more CSR activities a company publicly discloses, the better the financial results. Several studies have indicated that building corporate social responsibility (CSR) frameworks for rising nations is necessary, and the analysis follows in the footsteps of Morocco’s publicly traded companies. Since socially responsible behaviours vary from country to country and culture to culture, researchers should also develop CSR frameworks that are compatible with national documents and norms. As an essential moderator for TBQ, the GDP may not be tied to the GDP-ROA relationship. Another OLS regression does not suffer from endogeneity bias, as shown by the pooled OLS regression findings for fixed and random factors. The last step is identifying and eliminating any endogenous events affecting the results. It would inspire politicians and business leaders to increase their corporate social responsibility efforts.

Limitations and recommendations

The scalability of the green bond market depends on a paradigm shift. Stakeholders today perceive the green bond market mainly as a communication tool with a relatively limited or unclear economic benefit. The study suggests distinguishing the green bond market from other instruments, such as transition bonds and sustainability-linked instruments, reducing the risk of greenwashing. Fourth, facilitating investments in emerging economies can become a relevant source of issuance. In terms of information disclosure, it should enhance the theoretical design of green bonds and related trading systems to enable external supervision and control of green bonds and ensure the smooth progress of green projects. CSR should guarantee the independence and integrity of third-party rating institutions and include more companies.

Future research suggestions

Due to data service challenges in Morocco, the study has had to rely on much human labour, so the authors seek to educate readers about the significance of CSR and its favourable influence on company success. Future research may establish a more diversified collection of CSR evaluation criteria, control variables, and GBI indicators.

Availability of data and materials

All data generated or analysed during this study are included in this published article.

Abbreviations

- CSR:

-

Corporate social responsibility

- GBI:

-

Green bond investment

- GDP:

-

Gross domestic product

- CSR_ENV:

-

Environmental control

- CSR_WOR:

-

Workers’ control

- CSR_PUB:

-

Public control

- CSR_PROD:

-

Production control

- CSE :

-

Casablanca Stock Exchange

- MASEN:

-

Moroccan Agency of Sustainable Energy S.A.

References

Amundi IFC. (2020). Emerging market green bond report. World Bank Group 202005-EM-Green-Bonds-Report-2019.pdf (ifc.org).

Andronie M, Simion V, Gurgu E, Dijmărescu A, Dijmărescu I (2019) Social responsibility of firms and the impact of bio-economy in the intelligent use of renewable energy sources. Anfiteatro Econ 21(52):520–535

Bai J, Chen Z, Yan X, Zhang Y (2022) Research on the impact of green finance on carbon emissions: evidence from China. Econ Res-Ekonomska Istraživanja:1–20

Bauer R, Ruof T, Smeets P (2019) Get real! Individuals prefer more sustainable investments. https://ssrn.com/abstract=3287430

Campiglio E (2016) Beyond carbon pricing: The role of banking and monetary policy in financing the transition to a low-carbon economy. Ecol Econ 121:220–230

Carroll AB (1979) A three-dimensional conceptual model of corporate performance. Acad Manag Rev 1979(4):497–505

Chiang WC, Shang J, Li S (2017) Broad bond rating change and irresponsible corporate social responsibility activities. Adv Account 2017(39):32–46

China Securities Regulatory Commission. (2017). Directive opinion on supporting green bonds development notice no.6. http://www.csrc.gov.cn.com

Cho SYY, Lee C, Pfeiffer RJ Jr (2013) Corporate social responsibility performance and information asymmetry. J Account Public Policy 2013(32):71–83

Cicchiello AF, Cotugno M, Monferrà S, & Perdichizzi S (2022). Credit spreads in the European green bond market: a daily analysis of the COVID-19 pandemic impact. J Int Financ Manag Account

Clarkson MBE (1995) A stakeholder framework for analyzing and evaluating corporate social performance. Acad Manag J 1995(20):92–118

Cuaresma JC, Palokangas T, Tarasyev A (2013) Green growth and sustainable development. Springer, Berlin/Heidelberg

Davidson R, MacKinnon JG (1993) Estimation and inference in econometrics, vol 63. Oxford, New York

Deschryver P, De Mariz F (2020) What future for the green bond market? How can policymakers, companies, and investors unlock the potential of the green bond market? J Risk Financ Manag 13(3):61

Endrikat J, Guenther E, Hoppe H (2014) Making sense of conflicting empirical findings: A meta analytic review of the relationship between corporate environmental and financial performance. Eur Manag J 32(5):735–751. https://doi.org/10.1016/j.emj.2013.12.004

Feng GF, Long H, Wang HJ, Chang CP (2022) Environmental, social and governance, corporate social responsibility, and stock returns: What are the short and long run relationships? Corporate Social Responsibility and Environmental Management.

Flammer C (2013) Corporate social responsibility and shareholder reaction: the environmental awareness of investors. Acad Manag J 2013(56):758–781

Flammer C (2021) Corporate green bonds. J Financ Econ 142(2):499–516

Gong G, Xu S, Gong X (2018) On the value of corporate social responsibility disclosure: an empirical investigation of corporate bond issues in China. J Bus Ethics 150(1):227–258. https://doi.org/10.1007/s10551-016-3193-8

Guang-Wen Z, Siddik AB (2022) Do corporate social responsibility and green financing help banking institutions to enhance their environmental performance? An Empirical Examination. Frontiers in Environmental. Science 2022:858

He P, Jin M (2010) Influence of credit ratings in China’s bond market (in Chinese). J Financ Res 358(4):15–28

Huang J, Wei H, Zhu G (2018) The effect of corporate social responsibility on cost of corporate bond: evidence from China. Emerg Mark Financ Trade 2018(54):255–268

Huang C, Chang X, Wang Y, & Li N (2022). Do major customers encourage innovative sustainable development? Empirical evidence from corporate green innovation in China. Bus Strategy Environ

ICMA. (2016). The green bonds principles are summarized in: https://www.icmagroup.org.com

ICMA. (2018). Green bond principles: voluntary process guidelines for issuing green bonds. https://www.icmagroup.org.com

IFC. (2017). IFC and Proparco invest in pioneering Moroccan green bond to boost renewable energy, Rabat Catherine Gozzard, IFC. Paris Florence Priolet, Proparco Telephone: Email: prioletf@proparco.fr.com [Accessed 12.04.2022]

Inderst, G, et al. (2012). Defining and measuring green investments: implications for institutional investors’ asset allocations 28. OECD Working Papers on Fin., Ins. & Priv. Pensions, Paper No. 24.

Johnson RA, Greening DW (1999) The effects of corporate governance and institutional ownership types on corporate social performance. Acad Manag J 1999(42):564–576

Kang KH, Lee S, Huh C (2010) Impacts of positive and negative corporate social responsibility activities on company performance in the hospitality industry. Int J Hosp Manag 29(1):72–82. https://doi.org/10.1016/j.ijhm.2009.05.006

Khamis NI, Wan Ismail WK (2022) The impact of corporate social responsibility on corporate image in the construction industry: a case of SMEs in Egypt. J Sustain Finance Invest 12(1):128–146

Kreivi E (2017) Green bond market development and EIB. European Investment Bank, Luxembourg

Kudratova S, Huang X, Zhou X (2018) Sustainable project selection: Optimal project selection considering sustainability under reinvestment strategy. J Clean Prod 2018(203):469–481

Kumar K, Boesso G, Michelon G (2014) How do strengths and weaknesses in corporate social performance across different stakeholder domains affect company performance? Bus Strategy Environ 25. https://doi.org/10.1002/bse.1874

Li Z, Wei SY, Chunyan L, N. Aldoseri MM, Qadus A, Hishan SS (2021). The impact of CSR and green investment on stock return of Chinese export industry. Econ Res-Ekonomska Istraživanja 1-17

Li Y, Chen R, & Xiang E (2022). Corporate social responsibility, green financial system guidelines, and cost of debt financing: evidence from pollution-intensive industries in China. Corp Soc Respons Environ Manag

Lin WL, Lee C, Law SH (2021) Asymmetric effects of corporate sustainability strategy on value creation among global automotive firms: a dynamic panel quantile regression approach. Bus Strateg Environ 30(2):931–954

Lloyd RA (2018) The impact of CSR efforts on firm performance in the energy sector. Rev Integr Bus Econ Res 7(3):25–65

Maltais A, & Nykvist B (2020). Understanding the role of green bonds in advancing sustainability. J Sustain Finance Invest 1-20

Moroccan Agency for Sustainable Energy. (2017). First Green Bond issuance on the Moroccan Market, @ 2012-2021 Green Finance Platform. https://www.greenfinanceplatform.org.com [Accessed 21.04.2022]

Nanayakkara M, Colombage S (2019) Do investors in green bond market pay a premium? Global evidence. Appl Econ 51(40):4425–4437

Oxford Business Group. (2019). Morocco’s green bonds supporting a switch to cleaner energy, https://oxfordbusinessgroup.com/. [Accessed 20.04.2022]

RWE (2018) A global scale MASEN observations of CSR. https://www.rwe.com

Schreck P (2011) Reviewing the business case for corporate social responsibility: new evidence and analysis. J Bus Ethics 103(2):167. https://doi.org/10.1007/s1055101108670

Stoian A, & Iorgulescu F (2019). Sustainable capital market. Z. M. (Eds.). In financing sustainable development: Key challenges and prospects, (pp. 193–226).

Syzdykov Y, & Masse, J-M (2019). Emerging market green bonds report 2019: momentum builds as nascent markets grow. Amundi Asset Management (Amundi) & International Finance Corporation (IFC). 202005-EMGreen-Bonds-Report-2019.pdf (ifc.org).

Tolliver C, Keeley AR, Managi S (2020) Drivers of green bond market growth: the importance of nationally determined contributions to the Paris Agreement and implications for sustainability. J Clean Prod 244:118643. https://doi.org/10.1016/j.jclepro.2019.118643

Wang S, Wang D (2022) Exploring the relationship between ESG performance and green bond issuance. Front Public Health 10:897577

Wang Y, Zhi Q (2016) The role of green finance in environmental protection: two aspects of market mechanism and policies. Energy Procedia 104:311–316

Weber O, Feltmate B (2016) Sustainable banking and finance: managing the social and environmental impact of financial institutions. On: University of Toronto Press, Toronto

Weder F, Koinig I, Voci D (2019) Antagonistic framing of sustainability by energy suppliers. Corp Commun 24(2):368–390

Xiang X, Liu C, Yang M, Zhao X (2020) Confession or justification: the effects of environmental disclosure on corporate green innovation in China. Corp Soc Responsib Environ Manag 27(6):2735–2750

Yannan D, Ahmed AA, Kuo TH, Malik HA, Nassani AA, Haffar M, Suksatan W, Iramofu DP (2021). Impact of CSR, innovation, and green investment on sales growth: new evidence from manufacturing industries of China and Saudi Arabia. Econ Res-Ekonomska Istraživanja, 1-20.

Zerbib OD (2019) The effect of pro-environmental preferences on bond prices: evidence from green bonds. J Bank Financ 98:39–60

Zhou X, Cui Y (2019) Green bonds, corporate performance, and corporate social responsibility. Sustainability 11(23):6881

Author information

Authors and Affiliations

Contributions

Saleem Ahmad: Visualization, investigation, software

Saleem Ahmad: Conceptualization, methodology, funding acquisition

Mokhchy Jihane: Data curation; writing, original draft preparation; formal analysis

Corresponding author

Ethics declarations

Ethics approval

Not applicable

Consent to participate

Not applicable

Consent for publication

Not applicable

Conflict of interest

The authors declare no competing interest.

Additional information

Responsible Editor: Arshian Sharif

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ahmad, S., Mokhchy, J. Corporate social responsibilities, sustainable investment, and the future of green bond market: evidence from renewable energy projects in Morocco. Environ Sci Pollut Res 30, 15186–15197 (2023). https://doi.org/10.1007/s11356-022-23080-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-23080-y