Abstract

This study investigates sustainable finance along with sustainable economic factors on both carbon emissions and ecological footprints in China. A novel Dynamic Autoregressive Distributed Lag technique is applied; results revealed sustainable finance exerts positive/negative influence on carbon emissions in the long and short run, respectively. Results are robust with ecological footprints that sustainable finance placed a lucrative cause to preserve the environment. Sustainable economic factors show a positive impact on carbon emissions in the long run, whilst economic growth, energy consumption and exports improve environmental quality. Conversely, in the short run, urbanisation supports the environment whilst economic development, energy use and exports exert a positive impact. In addition, this study suggests useful policy implications for the stakeholders.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Environmental degradation is a foremost challenge for both developed and developing economies across the globe. In particular, the crucial question facing businesses, environmental activists, academics, managers and regulators is how to cut greenhouse gases (GHG) and ecological footprint (sustainable environment) whilst generating wealth (sustainable finance) for society. Answering this crucial policy question and preserving the environment are arguably the most demanding task for policymakers (Collins and Zheng 2015; Bekun et al. 2019a, b).

Environmental degradationFootnote 1 is triggered by a flood, fire and GHG emissions. Within the context of the obligations imposed by the Paris Agreement in 2015, these have major implications, especially in emerging economies. Meanwhile, China, as the largest emerging economy is the leading energy consumer and carbon (hereafter CO2) emitterFootnote 2 in the world (Lahiani 2020). In this regard, it is essential to achieve sustainable economic growth whilst maintaining a sustainable environment by curtailing GHG emissions. This study contends that the answer to these questions is committing to sustainable finance through managing stock market capitalisation. Therefore, the purpose of this study is to investigate the influence of sustainable finance (market capitalisation) and the economy on environmental degradation with the help of CO2 emissions and ecological footprint over 38 years in China. Furthermore, other sustainable economic factors, such as energy use, economic growth, exports and urbanisation, are taken as additional predictors in this research.

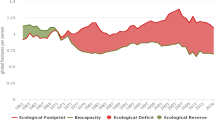

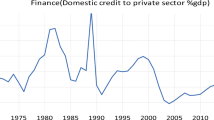

Apart from CO2 emissions, the ecological footprint has been proposed by Rees (1992) as a cumulative factor for environmental quality (Charfeddine 2017; Fakher 2019; Destek and Sinha 2020: Rehman et al. 2022). It is indicated that these were the consequences of financial and non-financial activities (Nathaniel and Khan 2020). China is considered the leading country in terms of ecological footprint globally (Ulucak and Lin 2017). Sustainable finance, i.e. market capitalisation is a substantial indicator of the size of firms and is corroborated by the finance literature. It contains additional elements for which the balance sheet is silent, such as company reputation, growth and management expertise (Adom et al. 2020). Bougatef (2017) claimed that market capitalisation is a way to enhance profitability. Figure 1 illustrates CO2 emissions (metric tons per capita) and ecological consumption (per capita) in China from 1970 to 2017. It is evident from both graphs that environmental degradation is progressively increasing and making ChinaFootnote 3 the world’s largest polluter in the world. The point emanated from the figure that environmental contamination is continually increasing and needs to be declined for a healthier future.

Overview of macroeconomic variables

Overall, this study probes the impact of sustainable growth on key macroeconomic variables: CO2 emission, ecological footprint, market capitalisation, GDP, energy usage, urbanisation and exports. CO2 emissions and ecological footprint are considered the main source of global warming and environmental deterioration. Market capitalisation and GDP are measured as leading pillars of economic growth. The role of energy consumption in the uplift of the economy and growth is certain. In a similar way, urbanisation and exports pertain to their roles in explaining economic growth and are also assumed to be a major determinant of CO2 emissions. The rapid industrialisation to gain higher exports has led to ecological pollution. Since the energy sector is the main contributing factor related to the industrialisation of the country and the eradication of poverty, therefore, this study considers important variables for the investigation.

To the best of our understanding, this research is unique in exploring the role of sustainable finance by examining the possible effects of market capitalisation on two different proxies of environmental deterioration. Thus, based on the review of prior research related to financial indicators and the environment, this study contributes to environmental finance literature from several angles. First and foremost, a plethora of research in the Environmental Kuznets Curve (EKC) perspective has been done on ecological degradation with financial development (Nosheen et al. 2019; Lahiani 2020; Rahman et al. 2020), financial inclusion (Fareed et al. 2022; Rehman et al. 2022), economic growth (Lau et al. 2014; Acquaye et al. 2017; Dogan et al. 2019; Khan et al. 2019a; Lahiani 2020), energy consumption (Boluk and Mert 2014; Wang et al. 2016a; Bhattacharya et al. 2017; Sarkodie and Strezov 2019), non-renewable energy consumption (Dogan et al. 2019; Sarkodie and Strezov 2019) and urbanisation (Zhang and Lin 2012; Erdogan 2013), but the literature is silent to uncover the sustainable finance considering the rapid increases in the market capitalisation of listed companies in emerging economies.

Secondly, the existing research enormously utilised autoregressive distributive lag (ARDL) (Pesaran et al. 1999, 2001), nonlinear ARDL (NARDL) (Shin et al. 2014) and quantile ARDL (QARDL) (Cho et al. 2015) for time-series studies, whilst in this study we have applied novel dynamic ARDL (DARDL) simulations as proposed by Jordan and Philips (2018) to consider the dynamic shocks of the variables. DARDL model is robust to plot positive and negative simulations. Thirdly, the study examines the influence of sustainable finance using market capitalisation and sustainable economic factors with energy consumption, economic growth, urbanisation and exports on environmental pollution (both CO2 emissions and ecological footprint) to obtain robust results. Lastly, this research contributes to the Chinese Economy perspective, which is the leading manufacturer worldwide and, hence, exporting products around the globe. It seeks to consume traditional energy sources based on fossil fuels (Lahiani 2020). In doing so, this study scrutinises the relationships amongst sustainable environment, finance and energy by applying dynamic modelling using CO2 emissions and ecological footprint.

The remainder of the study is structured as follows. Section 2 presents the literature review, whereas Section 3 outlines the material and methods. Furthermore, Section 4 reports and interprets the findings, whilst Section 5 concludes the paper by outlining the indispensable policy implications.

Literature review

The ample literature explores the significant role of energy consumption and environmental quality. Countries’ economic performance depends on energy, but the excessive usage of traditional energy sources may result in global warming (Apergis and Garćıa 2019). Energy use and the environment have a significant relationship, and the results suggest that more use of non-renewable energy plays a key role in the deterioration of the environment (Katircioglu and Taşpinar 2017; Baloch et al. 2019). In addition, the excessive use of traditional energy leads to environmental and ecological degradation in both developing and developed nations (Ahmed et al. 2020). Zhang et al. (2017) reported that utilisation of sustainable energy improves environmental conditions, whereas non-renewable energy consumption deteriorates the environment. Renewable energy and energy efficiency play their role in mitigating GHG emissions (Akram et al. 2020; Rehman et al. 2021). Economic complexity and non-renewable energy consumption become a cause to the detriment of the ecological footprint (Shahzad et al. 2021). Similarly, the non-availability of public finance is also considered the main hurdle in improving environmental quality. The investment in new energy-efficient projects to reduce CO2 emissions requires the availability of finance. According to Setyowati (2020), the limited availability of public money requires the active participation of investors and corporate sectors to invest heavily in eco-friendly projects to ensure the availability of finance to support the projects. The active participation of financial institutions will lead to the development of infrastructure to promote a healthy environment. Thus, we believe that the availability of finances and contribution of the financial sector is imminent to accelerate the transition of the economy from the usage of traditional energy resources to low carbon emission and environmentally friendly energy resources.

Economic growth and ecological footprint nexus

The literature mainly discusses GHG emissions as a proxy for environmental deterioration. On occasions, however, the research discusses the possible effects on ecological footprint. The prior literature highlights the prominent role of energy consumption in the country’s economic growth. However, various studies have also mentioned its impact on environmental degradation. In response, global efforts are underway to balance energy consumption to restrict its negative impact on the environment (Khan et al. 2019b). In a similar vein, Arminen and Menegaki (2019) linked financial development and energy usage with environmental degradation. Empirically, literature shows a positive influence of sustainable economic factors such as economic growth on GHG emissions in developing economies. For instance, Nazir et al. (2018) examined that per capita income is positively significant with energy emissions in Kyoto Annex countries. As the economic growth of an economy increases, environmental pollution also increases (Katircioglu and Taşpinar 2017; Dogan et al. 2019; Rahman et al. 2020). The relationship between environmental quality and economic growth was analysed using the nonlinear ARDL model in China. The examined results of the asymmetric relationship showed that positive and negative change in GDP brings significantly positive and negative impacts on ecological quality, respectively (Lahiani 2020). In addition, Fareed et al. (2018) analysed the association between tourism, economic growth and terrorism. Their results revealed statistically significant and asymmetric behaviour. The impact of non-renewable energy and economic growth is positive on the ecological footprint.

Economic growth and CO2 emissions nexus

Moving ahead, many studies examined the link between economic growth and CO2 emissions in the context of developed and developing economies. Saidi and Omri (2020) mentioned that increase in human activity and more usage of energy increase the CO2 emissions. Similarly, Zhang et al. (2017) studied the relationship of renewable and non-renewable energy with CO2 emissions. Their outcomes disclose that sustainable energy impedes environmental degradation, whereas non-sustainable energy consumption deteriorates the environment. The relationship between renewable energy use, GDP and CO2 emissions is asymmetric in both the long and short-run in Saudi Arabia (Toumi and Toumi 2019). Similarly, the outcomes of non-sustainable energy and economic growth embrace a statistically significant impact on the ecological footprint (Sharif et al. 2020; Ullah et al. 2022). Dogan et al. (2019) examined the influence of non-renewable energy use on CO2 emissions, whilst Sharif et al. (2020) on ecological footprint. Both studies revealed that non-sustainable energy consumption leads to the environmental degradation.

Moreover, Hashmi et al. (2021) studied the influence of urbanisation on CO2 emissions. They found that urban agglomeration has a direct and significant effect on environmental degradation in the top ten urban agglomerated countries. Urbanisation holds a positively significant impact on the ecological footprint (Godil et al. 2021). What is more, Sadorsky (2010) reported that urbanisation has a significant positive effect on CO2 emissions in panel data of emerging economics. The association between urbanisation and carbon emissions is significant, leading to the deterioration of the environment (Pata 2018; Dogan et al. 2019).

Mahmood et al. (2019) analysed trade’s nonlinear or asymmetric impact on CO2 emissions. The results have shown that the immediate change in trade significantly augments CO2 emissions, whilst the negative change improves the environmental quality. In addition, there is a nonlinear impression of FDI and trade on CO2 emissions in Turkey (Haug and Ucal 2019). Godil et al. (2021) analysed the influence of financial development and transportation on ecological footprint using quantile ARDL. The outcomes of their study exposed that both transportation and financial development present reasons to preserve the environment.

Overall, from the literature as mentioned earlier, it is evident that much work has been done to explore the sustainable environment (CO2 emissions or ecological footprint) with financial indicators (financial development and economic growth) and non-financial indicators (transportation, energy consumption and urbanisation). In contrast, the literature is silent on uncovering the impact of sustainable finance on the environment.

Methodology

Data

For this study, annual time series data is collected from China over 1970–2017. The data for carbon dioxide emissions (CO2), economic growth (GDP), energy use (EC), exports (EXP), the market capitalisation of listed companies (MCAP), and urban population (URB) is collected from World Bank (World Development Indicators). At the same time, the data on the ecological footprint (EF) and non-renewable energy (NREC) is gathered from Global Footprint Network (GFPN) and BP Statistics, respectively. All the variables of the study are taken and transformed into their natural logarithmic form to draw better results, and their further description is presented in Table 1.

Methodology

In order to test the hypotheses, the model was developed using variables consistent with the prior literature. Our dependent variable, carbon dioxide emissions, is selected as a proxy for environmental degradation as it is considered the main source of pollution and a major contribution to the GHG emissions (Nasreen et al. 2017); ecological footprint is considered a source of environmental degradation (Khan et al. 2019a); market capitalisation, GDP and exports are associated with economic growth (Nathaniel and Khan (2020); energy usage and non-renewable energy are likely to be the most vulnerable to climate change; and finally, urbanisation is associated with higher energy consumption (Sinha et al. 2017). For the selection of variables, this research follows the prior studies. The relationship between GDP (Katircioglu and Taşpinar 2017; Pata 2018; Lahiani 2020), energy consumption (Katircioglu and Taşpinar 2017; Nosheen et al. 2019), non-renewable energy (Dogan et al. 2019), urbanisation (Dogan et al. 2019) and trade (Nosheen et al. 2019) is examined with GHG emissions.

In line with existing literature, the variables such as market capitalisation, exports, economic growth, energy use and urbanisation are selected to examine their impact on the sustainable environment in China for 48 years, taking from 1970 to 2017. The model of this study is presented as follows.

Along with CO2 emissions, this study also considered the ecological footprint as another proxy for the environment. Sharif et al. (2020) examined the influence of GDP and energy consumption (renewable and non-renewable) on ecological footprint, whilst Godil et al. (2021) explored urbanisation, transport and financial development with the ecological footprint. Hence, the second model for this study can be as follow.

ARDL bound testing

ARDL bounds test results are utilised to demonstrate the long-run association amongst the study variables, and the value of f-statistics indicates the long-run relationship. If the f-value is higher than the upper limit at a 5% significance level, long-term cointegration amongst variables is assumed (Pesaran et al. 2001). Nevertheless, if the f-value is smaller than the lower critical limit, then the long-run relationship is absent. Cointegration is considered un-decidable if the f-value lies between the lower and upper limit. The following hypothesis is assumed for checking long-run relationships amongst variables.

The bounds testing approach equation is presented below.

In the equation mentioned above, ∆ shows the change operator whilst t–i indicates optimal lag selection based on SBIC and HQIC as shown in Table 5. δ1 to δ7 and β1 to β6 are coefficients that will be estimated. In addition to CO2 emissions, the ecological footprint is also examined with predictor variables to robust the results. Following is the bound testing approach equation for ecological footprint.

Dynamic ARDL simulations

ARDL model was proposed by Pesaran et al. (1999) and (2001). It presents numerous benefits over other cointegration techniques (Duasa 2007). First of all, ARDL can be applied with different lag lengths of the variables as some model demands identical lags (Engle and Granger 1987; Johansen and Juselius 1990). Secondly, this model can be utilised if the data is stationary at I (0) or I (1) or a combination of both orders. Lastly, the ARDL model is favourable when the sample size is small (Narayan 2004).

After developing the ARDL technique, Shin et al. (2014) introduced the N-ARDL model to satisfy the asymmetric effects amongst variables. Later on, Cho et al. (2015) enhanced this model and presented the Q-ARDL technique. In addition, Jordan and Philips (2018) proposed dynamic ARDL with dynamic simulations to consider the effects of variables’ long and short-run association. The dynamic ARDL model is superior to ARDL for various reasons. First, it eliminates the problem of short-run and long-run multifarious model specifications found in old ARDL. Second, the new dynamic simulated ARDL model can stimulate, estimate and robotically plot the forecast of counterfactual alterations in one regressor whilst holding the remaining independent variables constant. Finally, the newly developed model is competent enough to automatically plot positive and negative simulations (Khan et al. 2019b). Hence, the following models of this study are proposed for a sustainable environment using dynamic ARDL. Equation (6) is used to determine the effects of a sustainable environment on carbon emission, whereas Eq. (7) is used to determine their effects on environmental footprint.

Results and discussion

Table 2 displays the descriptive statistics of all the variables of this study. Variables have positive mean values, and it is shown that economic growth has the highest mean of 3.044, followed by energy consumption, which is 2.964. Similarly, GDP is more volatile than the rest of the variables. On the other hand, ecological footprint and urbanisation have a minimum standard deviation. GDP has a larger range value, which is 1.507. Skewness values show that almost all the variables are moderately skewed because given values lie between 0 and 0.5. In contrast, kurtosis values are less than 3, and hence, kurtosis has a somewhat thin tail. In addition, Fig. 2 illustrates the correlational relationship amongst variables, and it is evident that the variables of this study have a strong association that further allows applying short and long-term econometric techniques to draw the outcomes.

Represents the binary-relation graph amongst ecological footprint, CO2 emissions, economic growth, energy consumption, non-renewable energy, urbanisation, exports and market capitalisation. The diagonal shows the distribution histograms of each variable; the upper triangular position indicates correlation coefficients along with significance level, whilst the lower triangular position represents two-way scatter plots

Table 3 reveals the unit root tests of study variables using ADF and ZA (Zivot and Andrews 2002). More so, the structural break is found by using the ZA unit root test, as shown in the table. These tests represent that variables are non-stationary at I (0), whereas all of them become stationary at first difference. Hence, both the unit root tests reject the null hypothesis when applied at I (1), representing the accomplishment of the condition for ARDL (Pesaran et al. 1999, 2001). Even so, Table 4 discloses the findings of PP and KPSS unit root tests for further clarification. Both are evidence that the variables of this study are stationary. Table 5 shows lag selection based on Vector Auto-Regressive (VAR) model (Khan et al. 2019a). It presents the results of LR, FPE, AIC, SBIC and HQIC criteria. As per the SBIC and HQIC, the first lag is appropriate, whilst AIC indicates that the second lag is satisfactory. Hence, SBIC and HQIC are used with lag one for the model selection.

Table 6 describes the ARDL bounds testing outcomes to demonstrate the long-term relationship amongst variables. The f-statistics value is 20.933 and is greater than the upper limit at a 1% p value (Pesaran et al. 2001). The model has sufficient evidence to accept the alternative hypothesis representing that the variables of this study embrace long-run cointegration and equilibrium. Moreover, the error correction term (ECT) is negative and significant, which is reported in Table 7 corroborating the cointegration (Kanjilal and Ghosh 2013).

Table 7 displays the results of dynamic ARDL simulations. The model outcomes indicate that market capitalisation has a significant association with carbon emissions in both the long and short run. China represents a 4 to 5% contribution of market capitalisation (percentage of GDP) towards the environment. The relationship indicates that market capitalisation behaves negatively and positively in the short and long run. This is because China is an emerging economy, and an increase in market capitalisation helps to save the environment. Then, in the long run, this impact becomes adverse and shifts to negative due to more investment and consumption of traditional sources of energy.

The outcomes of short-run economic growth show the positive and insignificant influence on CO2 emissions in China. The 1% increase in GDP influences the increase of 0.26% in environmental degradation per year. The positive effect of GDP on CO2 emissions shows that currently, China falls at the first stage of EKC and is moving towards industrial richness. On the other hand, in the long run, economic growth negatively impacts CO2 emissions in China because there will be a threshold point when CO2 emissions would start to decline even though GDP per capita is increasing (Grossman and Krueger 1991). These outcomes are consistent with the literature, which explains that economic growth might lead to environmental degradation (Sharma 2011; Acquaye et al. 2017; Pata 2018; Dogan et al. 2019; Lahiani 2020).

The results of dynamic ARDL simulations report a direct and significant association between energy use and carbon emissions in the short run. China is an emerging economy and the largest producer of manufactured goods globally. Hence, an increase of 1% in energy use pollutes the environment by 0.51% due to more traditional energy sources in the short run. On the other hand, this relationship shifts and becomes negatively insignificant in the long run. The coefficient is also decreased from 0.51 to 0.28 in the long run, which indicates that China tends towards more renewable energy use (Shahbaz et al. 2013; Wang et al. 2016a; Bhattacharya et al. 2017; Sarkodie and Strezov 2019). It is indicated that emerging countries are impatient for economic growth. These economies use traditional ways of energy sources based on fossil fuels and hence, causing the quality of the environment (Khan et al. 2019b).

The results of Table 7 show that between non-renewable energy use and GHG emissions, there exists a significantly positive and negative association in the short and long run, respectively, in China. This is due to the long-lasting effect of non-renewable energy use on the environment. Findings of urbanisation represent insignificant relation with carbon emissions. This relationship is direct in the long run, whereas inverse in the short run. The coefficient shows that urbanisation is more robust in the long run than in the short run in China. Wang et al. (2016b) studied the association of energy use and urbanisation with CO2 emissions, and the outcomes of the study presented that urbanisation is a key indicator of environmental degradation. Urbanisation has a direct impact on GHG emissions (Zhang and Lin 2012; Erdogan 2013). The outcomes of urbanisation are similar to those (Pata 2018; Dogan et al. 2019) but opposite to those (Khan et al. 2019a).

The results of dynamic ARDL simulations state a positive and significant relationship between exports and CO2 emissions in the short run. China is one of the leading manufacturers and exporters in the world. An increase of 1% in exports adds to environmental degradation by 0.06% in the short run. Whereas in the long run, this relationship is negatively insignificant. An increase of 1% in exports reduces GHG emissions by 0.003%. Trade has a bidirectional relationship with CO2 emissions (Mirza and Kanwal 2017; Chandia et al. 2018). In addition, developed countries shift their CO2 emissions-related technologies to emerging economies (Khan et al. 2019a).

ECT is negatively significant (−0.199), which states the speed of adjustment parameter aftershock. ECT narrates that the rate of adjustment to the preceding equilibrium exists at almost −20% in one year. R-squared value presents that the study’s independent variables explained 88% variation in CO2 emissions. For the ECT algorithm, this study utilised 5000 simulations for the variables vector as recommended (Sarkodie et al. 2019). The p value of the overall model is significant at a 1% level. Root mean square error (RMSE) and F-statistics values of the model are also favourable, which are 0.009 and 19.24, respectively. Further, as indicated in the table, when CO2 emissions are used as a dependent variable, the negative shocks of MCAP are observed; however, the cumulative effects of MCAP represent positive shocks on the dependent variable. The same pattern is observed in the case of URB. On the contrary, in the case of GDP, EC, NREC and EXP, the positive shocks were perceived at the first difference; however, the cumulative functions revealed negative shocks.

Table 8 shows the outcomes of dynamic ARDL simulations for a sustainable environment taking ecological footprint as a dependent variable. This indicates that market capitalisation has an insignificant relationship with ecological footprint for both the long and short run. The 1% increase in market capitalisation saves the environment by 0.01%. Sharif et al. (2020) presented a direct association of economic growth, whilst Godil et al. (2021) explored the negative relationship of financial development with the ecological footprint. In the short run, economic growth outcomes show a significant association with an ecological footprint in China. The 1% increase in GDP affects 0.38% of natural resources. In the long run, economic growth negatively influences ecological footprint similar to Sharif et al. (2020), whilst financial development leads to ignoring the environment (Godil et al. 2021).

Moreover, the results show a significantly positive association between energy consumption and ecological footprint in the short run. An increase of 1% in energy consumption influences the expansion of environmental degradation by about 0.75%. On the other hand, this relationship is negatively insignificant in the long run. Sharif et al. (2020) examined the negatively significant relationship between the environment and renewable energy. In addition, it is found that emerging countries look keen to use traditional ways of energy production based on fossil fuels, irrespective of the environment, to fulfil their energy demand (Khan et al. 2019b).

The results of Table 8 display that between non-renewable energy and ecological footprint, there is an insignificantly negative and positive association in the short and long run, respectively. An escalation in non-renewable energy use leads to polluting the environment (Bhattacharya et al. 2017). Non-renewable energy shows a positively significant effect on natural resources (Sharif et al. 2020). The results of urbanisation represent insignificant relation between environmental degradation and urbanisation. This affiliation is direct in the short run whereas inverse in the long run. The coefficients show that the influence of urbanisation is stronger in the long run in China. Similarly, the results of dynamic ARDL simulations show a positive and insignificant connection between exports and ecological footprint. The 1% increase in exports causes the environment to spoil by 0.01% in the short run and 0.04% in the long run. There is a bidirectional relationship between trade and environmental degradation (Shahzad et al. 2017; Chandia et al. 2018).

Besides, ECT is negatively significant (−0.756). In this model, ECT narrates that the speed of adjustment to the preceding equilibrium is almost 76% in 1 year. R-squared value presents that the independent variables explain 76% variation in ecological footprint. The p value of the overall model is significant at 1%. F-statistics and RMSE values are 8.31 and 0.007, respectively. In terms of shocks, when we use ecological footprint as a dependent variable, we observe negative shock in the case of MCAP and the cumulative effect of MCAP. In the case of GDP, EC and URB, we observe positive shock initially; however, the cumulative effect revealed negative shocks. What is more, NREC shows negative shock, whereas, its cumulative effect shows positive shocks. Finally, in the case of EXP, positive shocks were observed in both cases.

4.1 Graphs of dynamic ARDL simulations

Figure 3 presents positive and negative 10% changes in market capitalisation and its impact on CO2 emissions in China for 1970–2017. A 10% increase in market capitalisation saves the environment in a shorter period but deteriorates in the long run; on the opposite, the decrease in urbanisation assets has a negative influence on environmental quality. Figure 4 shows positive and negative 10% changes in economic growth and its impact on CO2 emissions in China for the period 1970–2017. The 10% rise in GDP has positive and negative effects on CO2 emissions in the long and short run, respectively A decrease in GDP helps save the environment in China.

Market capitalisation and carbon dioxide emissions. The paired graphs represent ± 10% change in market capitalisation and its impact on environmental degradation. Dots display ordinary forecasts, whereas the blue lines indicate a 95% confidence interval, which decreases to 90% and 75% confidence interval as the line becomes thin in two stages

Economic growth and carbon dioxide emissions. The paired graphs represent ± 10% change in growth (GDP per capita) and its impact on environmental degradation. Dots display ordinary forecasts, whereas the blue lines indicate a 95% confidence interval, which decreases to 90% and 75% confidence interval as the line becomes thin in two stages

Figure 5 reports positive and negative 10% changes in energy use and its impact on CO2 emissions. Escalation in energy consumption makes the environment deteriorate both in the long and short run. However, a 10% decrease in energy use helps to support the environment. Figure 6 shows positive and negative 10% changes in non-renewable energy and its impact on CO2 emission in China for 1970–2017. It is shown that the rise in non-renewable energy directly influences CO2 emissions in the short run. Still, an inverse impact in the long run as non-renewable sources saves the environment. Moreover, a 10% decrease in non-renewable energy use supports the environment.

Energy use and carbon dioxide emissions. The paired graphs represent ± 10% change in energy use and its impact on environmental degradation. Dots display ordinary forecasts, whereas the blue lines indicate a 95% confidence interval, which decreases to 90% and 75% confidence interval as the line becomes thin in two stages

Figure 7 shows positive and negative 10% changes in urbanisation and its impact on CO2 emissions in China. The rise in urbanisation has a positive influence on CO2 emissions. On the other hand, a 10% decrease in urbanisation helps to minimise environmental degradation in the short run than in the long run. Figure 8 reports positive and negative 10% changes in exports of products and their impact on CO2 emissions in China over 1970–2017. A rise in exports has a direct effect on carbon dioxide emissions. In contrast, a 10% decrease in exports negatively influences CO2 emissions.

Urbanisation and carbon dioxide emissions. The paired graphs represent ± 10% change in urbanisation and its impact on environmental degradation. Dots display ordinary forecasts, whereas the blue lines indicate 95% confidence interval, which decreases to 90% and 75% confidence interval as the line becomes thin in two stages

Exports and carbon dioxide emissions. The paired graphs represent ± 10% change in exports and their impact on environmental degradation. Dots display ordinary forecasts, whereas the blue lines indicate 95% confidence interval, which decreases to 90% and 75% confidence interval as the line becomes thin in two stages

Figure 9 indicates CUSUM (cumulative sum) and CUSUM squares graphs at a 5% significance level. These two graphs are utilised to know the reliability of the coefficient. The graphs represent the upper and lower boundary lines, and residual values are shown between these limits. These residual values are between the boundaries and prove that the examined DARDL model is stable and reliable at a 5% significance level.

Conclusion

This study has sought to extend the extant literature on sustainable environment, energy and finance by applying a dynamic model to evaluate the effects of sustainable finance and other economic factors on the environmental performance in China. The main findings are as follows: first, the results indicate that the study’s variables are stationary in the first order, leading to long-run cointegration and equilibrium. Second, empirical outcomes of this study show that the novel measure of sustainable finance (market capitalisation) exerts a negative and positive influence on carbon emissions in the short and long run, respectively. More so, these results in the short run are robust with ecological footprint through which it is evident that sustainable finance placed a reasonable cause to preserve the ecological quality. On the contrary, sustainable finance leads to the degradation of the environment in the long run. This might be due to more non-renewable energy production sources in China. In the long run, other sustainable economic factors, such as urbanisation, positively impact CO2 emissions, whilst economic growth, energy use and exports are worthy indicators to improve environmental quality. Finally, these findings have adverse effects in the short run. Urbanisation negatively impacts the environment, whilst economic growth, energy consumption and exports positively impact CO2 emissions.

The study supports the overall efforts of governments to use clean energy and balance the use of energy to reduce environmental degradation. Overall, our results have important implications for regulators. We urge the policymakers to develop more environmentally friendly policies by supporting the investment in advanced technologies. Substantial efforts in this scenario are required to implement eco-friendly economic strategies. What is more, the implementation of renewable energy targets is required to decrease the usage of traditional energy sources that increases GHG emissions. Further, the rural areas should be provided basic amenities to restrict the flow of population to urban areas. The settlement of people in urban areas increases urbanisation, which leads to more energy consumption. Finally, efforts should be made to introduce subsidies on sustainable energy resources to achieve the sustainable development objectives.

In addition, the findings of this study provide various implications for investors and other stakeholders. First, our findings will be of interest to investors, especially Chinese investors, as they are required to attain an optimal level of sustainable finance in order to achieve sustainable economic growth. Second, since economic growth has a negative influence on GHG emissions, in the long run, it seems appropriate to work towards increasing GDP so that maximum economic growth along with a sustainable environment can be accomplished that might lead to fulfilling the target of net-zero GHG emissions by 2060. Third, in the short run, energy consumption adds to pollute the environment by emitting more carbon emissions. Therefore, it is pertinent to replace the conventional energy production techniques with renewable and cleaner energy consumption methods. Hence, policymakers in China and other leading CO2 emitters’ economies can accomplish sustainable economic growth by providing subsidies on low carbon-emitting technologies and the availability of smart energy-efficient methods by imposing a ban on the use of fossil fuels in order to improve the community’s lifestyle.

Like other studies, this article is not without limitations. However, these limitations may serve as an interesting research ground for further research. First, this study examined the relationship in the case of China. Since the overall culture of China differs significantly from other Asian countries, we urge future researchers to apply the same set of variables to examine this nexus in other leading GHG emitter Asian countries to explore further the role of sustainable growth in sustainable growth persevering the environmental quality. Second, the inclusion of social and demographic factors associated with energy consumption can also be included. Lastly, we consider only CO2 emission as a proxy for GHG emissions. Using other proxies such as SO2 and CH4 may also provide interesting results in this context.

Data availability

The data will be provided upon a reasonable request to the corresponding author.

Notes

These events can disrupt the natural resources, infrastructure, agricultural land and, most importantly, human lives.

China’s CO2 emissions have increased from 0.94 in 1970 to 7.18 metric tons per capita in 2016, representing an almost seven times increase (World Bank 2018).

The reason behind this is twofold. Firstly, China is the largest populated country, and this massive population demands more natural resources and energy consumption. Secondly, it is the largest manufacturer and exporter worldwide.

References

Acquaye A, Feng K, Oppon E, Salhi S, Ibn-Mohammed T, Genovese A, Hubacek K (2017) Measuring the environmental sustainability performance of global supply chains: a multi-regional input-output analysis for carbon, sulfur oxide, and water footprints. J Environ Manag 187:571–585

Adom PK, Amuakwa-Mensah F, Amuakwa-Mensah S (2020) Degree of financialization and energy efficiency in Sub-Saharan Africa: do institutions matter? Financ Innov 6:1–22

Ahmed Z, Asghar MM, Malik MN, Nawaz K (2020) Moving towards a sustainable environment: the dynamic linkage between natural resources, human capital, urbanization, economic growth, and ecological footprint in China. Res Policy 67:101677

Akram R, Majeed MT, Fareed Z, Khalid F, Ye C (2020) Asymmetric effects of energy efficiency and renewable energy on carbon emissions of BRICS economies: evidence from nonlinear panel autoregressive distributed lag model. Environ Sci Pollut Res 27(15):18254–18268

Apergis N, Garćıa C (2019) Environmentalism in the EU-28 context: the impact of governance quality on environmental energy efficiency. Environ Sci Pollut Res 26:37012–37025

Arminen H, Menegaki AN (2019) Corruption, climate and the energy-environment-growth nexus. Energy Econ 80:621–634

Baloch MA, Mahmood N, Zhang JW (2019) Effect of natural resources, renewable energy and economic development on CO2 emissions in BRICS countries. Sci Total Environ 678:632–638

Bekun FV, Emir F, Sarkodie SA (2019a) Another look at the relationship between energy consumption, carbon dioxide emissions and economic growth in South Africa. Sci Total Environ 655:759–765

Bekun FV, Alola AA, Sarkodie SA (2019b) Toward sustainable environment: nexus between CO2 emissions, resource rent, renewable and non-renewable energy in 16-EU countries. Sci Total Environ 657:1023–1029

Bhattacharya M, Churchill SA, Paramati SR (2017) The dynamic impact of renewable energy and institutions on economic output and CO2 emissions across regions. Renew Energy 111:157–167

Boluk G, Mert M (2014) Fossil & renewable energy consumption, GHGs (greenhouse gases) and economic growth: evidence from a panel of EU (European Union) countries. Energy 74:439–446

Bougatef K (2017) Determinants of bank profitability in Tunisia: does corruption matter? J Money Laund Control

Chandia KE, Gul I, Aziz S, Sarwar B, Zulfiqar S (2018) An analysis of the association among carbon dioxide emissions, energy consumption and economic performance: an econometric model. Carbon Manag 9:227–241

Charfeddine L (2017) The impact of energy consumption and economic development on ecological footprint and CO2 emissions: evidence from a Markov switching equilibrium correction model. Energy Econ 65:355–374

Cho JS, Kim TH, Shin Y (2015) Quantile cointegration in the autoregressive distributed lag modelling framework. J Econ 188:281–300

Collins D, Zheng C (2015) Managing the poverty–CO2 reductions paradox: the case of China and the EU. Organ Environ 28:355–373

Destek MA, Sinha A (2020) Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: evidence from the organisation for economic co-operation and Development countries. J Clean Prod 242:118537

Dogan E, Taspinar N, Gokmenoglu KK (2019) Determinants of ecological footprint in MINT countries. Energy & Environ 30:1065–1086

Duasa J (2007) Determinants of Malaysian trade balance: an ARDL bounds testing approach. Glob Econ Rev 36:89–102

Engle RF, Granger CW (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica: Journal of Econometric Society:251–276

Erdogan S (2013) Econometric analysis of the impact of urbanization on CO2 emissions and energy use of Turkey

Fakher HA (2019) Investigating the determinant factors of environmental quality (based on ecological carbon footprint index). Environ Sci Pollut Res 26:10276–10291

Fareed Z, Meo MS, Zulfiqar B, Shahzad F, Wang N (2018) Nexus of tourism, terrorism, and economic growth in Thailand: new evidence from asymmetric ARDL cointegration approach. Asia Pac J Tour Res 23:1129–1141

Fareed Z, Rehman MA, Adebayo TS, Wang Y, Ahmad M, Shahzad F (2022) Financial inclusion and the environmental deterioration in Eurozone: the moderating role of innovation activity. Technol Soc 69:101961

Godil DI, Ahmad P, Ashraf MS, Sarwat S, Sharif A, Shabib-ul-Hasan S, Jermsittiparsert K (2021) The step towards environmental mitigation in Pakistan: do transportation services, urbanization, and financial development matter? Environ Sci Pollut Res 28(17):21486–21498

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free-trade agreement

Hashmi SH, Fan H, Fareed Z, Shahzad F (2021) Asymmetric nexus between urban agglomerations and environmental pollution in top ten urban agglomerated countries using quantile methods. Environ Sci Pollut Res 28:13404–13424

Haug AA, Ucal M (2019) The role of trade and FDI for CO2 emissions in Turkey: nonlinear relationships. Energy Econ 81:297–307

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration—with applications to the demand for money. Oxf Bull Econ Stat 52:169–210

Jordan S, Philips AQ (2018) Cointegration testing and dynamic simulations of autoregressive distributed lag models. Stata J 18:902–923

Kanjilal K, Ghosh S (2013) Environmental Kuznets curve for India: evidence from tests for cointegration with unknown structural breaks. Energy Policy 56:509–515

Katircioglu ST, Taşpinar N (2017) Testing the moderating role of financial development in an environmental Kuznets curve: empirical evidence from Turkey. Renew Sust Energ Rev 68:572–586

Khan A, Chenggang Y, Hussain J, Bano S (2019a) Does energy consumption, financial development, and investment contribute to ecological footprints in BRI regions? Environ Sci Pollut Res 26:36952–36966

Khan MK, Teng JZ, Khan MI, Khan MO (2019b) Impact of globalisation, economic factors and energy consumption on CO2 emissions in Pakistan. Sci Total Environ 688:424–436

Lahiani A (2020) Is financial development good for the environment? An asymmetric analysis with CO 2 emissions in China. Environ Sci Pollut Res 27:7901–7909

Lau LS, Choong CK, Eng YK (2014) Investigation of the environmental Kuznets curve for carbon emissions in Malaysia: do foreign direct investment and trade matter? Energy Policy 68:490–497

Mahmood H, Maalel N, Zarrad O (2019) Trade openness and CO2 emissions: evidence from Tunisia. Sustainability 11:3295

Mirza FM, Kanwal A (2017) Energy consumption, carbon emissions and economic growth in Pakistan: dynamic causality analysis. Renew Sust Energ Rev 72:1233–1240

Narayan P (2004) Reformulating critical values for the bounds F-statistics approach to cointegration: an application to the tourism demand model for Fiji, 2, 04 edn. Monash University, Australia

Nasreen S, Anwar S, Ozturk I (2017) Financial stability, energy consumption and environmental quality: evidence from South Asian economies. Renew Sustain Energy Rev 67:1105–1122

Nathaniel S, Khan SAR (2020) The nexus between urbanization, renewable energy, trade, and ecological footprint in ASEAN countries. J Clean Prod 272:122709

Nazir MR, Nazir MI, Hashmi SH, Fareed Z (2018) Financial development, income, trade, and urbanization on CO2 emissions: new evidence from Kyoto annex countries. J Innov Sustain RISUS 9:17–37

Nosheen M, Iqbal J, Hassan SA (2019) Economic growth, financial development, and trade in nexuses of CO 2 emissions for Southeast Asia. Environ Sci Pollut Res 26:36274–36286

Pata UK (2018) Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: testing EKC hypothesis with structural breaks. J Clean Prod 187:770–779

Pesaran MH, Shin Y, Smith RP (1999) Pooled mean group estimation of dynamic heterogeneous panels. J Am Stat Assoc 94:621–634

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16:289–326

Rahman HU, Ghazali A, Bhatti GA, Khan SU (2020) Role of economic growth, financial development, trade, energy and FDI in environmental Kuznets curve for Lithuania: evidence from ARDL bounds testing approach. Eng Econ 31:39–49

Rees WE (1992) Ecological footprints and appropriated carrying capacity: what urban economics leaves out? Environ Urban 4:121–130

Rehman MA, Fareed Z, Salem S, Kanwal A, Pata UK (2021) Do diversified export, agriculture, and cleaner energy consumption induce atmospheric pollution in Asia? application of method of moments quantile regression. Frontiers in Environmental. Science 497

Rehman MA, Fareed Z, Shahzad F (2022) When would the dark clouds of financial inclusion be over, and the environment becomes clean? The role of national governance. Environ Sci Pollut Res 1–13

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38:2528–2535

Saidi K, Omri A (2020) The impact of renewable energy on carbon emissions and economic growth in 15 major renewable energy-consuming countries. Environ Res 186:109567

Sarkodie SA, Strezov V (2019) A review on environmental Kuznets curve hypothesis using bibliometric and meta-analysis. Sci Total Environ 649:128–145

Sarkodie SA, Strezov V, Weldekidan H, Asamoah EF, Owusu PA, Doyi INY (2019) Environmental sustainability assessment using dynamic autoregressive-distributed lag simulations—nexus between greenhouses gas emissions, biomass energy, food and economic growth. Sci Total Environ 668:318–332

Setyowati AB (2020) Governing sustainable finance: insights from Indonesia. Clim Policy 1-14

Shahbaz M, Hye QMA, Tiwari AK, Leitão NC (2013) Economic growth, energy consumption, financial development, international trade, and CO2 emissions in Indonesia. Renew Sust Energ Rev 25:109–121

Shahzad SJH, Kumar RR, Zakaria M, Hurr M (2017) Carbon emission, energy consumption, trade openness and financial development in Pakistan: a revisit. Renew Sust Energ Rev 70:185–192

Shahzad U, Fareed Z, Shahzad F, Shahzad K (2021) Investigating the nexus between economic complexity, energy consumption and ecological footprint for the United States: new insights from quantile methods. J Clean Prod 279:123806

Sharif A, Baris-Tuzemen O, Uzuner G, Ozturk I, Sinha A (2020) Revisiting the role of renewable and non-renewable energy consumption on Turkey’s ecological footprint: evidence from Quantile ARDL approach. Sustain Cit Soc 57:102138

Sharma SS (2011) Determinants of carbon dioxide emissions: empirical evidence from 69 countries. Appl Energy 88:376–382

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in Honor of Peter Schmidt. Springer, New York, pp 281–314

Sinha A, Shahbaz M, Balsalobre D (2017) Exploring the relationship between energy usage segregation and environmental degradation in N-11 countries. J Clean Prod 168:1217–1229

Toumi S, Toumi H (2019) Asymmetric causality among renewable energy consumption, CO 2 emissions, and economic growth in KSA: evidence from a nonlinear ARDL model. Environ Sci Pollut Res 26:16145–16156

Ullah I, Rehman A, Svobodova L, Akbar A, Shah MH, Zeeshan M, Rehman MA (2022) Investigating relationships between tourism, economic growth, and CO2 emissions in Brazil: an application of the nonlinear ARDL approach. Frontiers in Environmental. Science 2022, 52

Ulucak R, Lin D (2017) Persistence of policy shocks to ecological footprint of the USA. Ecol Indic 80:337–343

Wang S, Li Q, Fang C, Zhou C (2016a) The relationship between economic growth, energy consumption, and CO2 emissions: empirical evidence from China. Sci Total Environ 542:360–371

Wang Y, Chen L, Kubota J (2016b) The relationship between urbanization, energy use and carbon emissions: evidence from a panel of Association of Southeast Asian Nations (ASEAN) countries. J Clean Prod 112:1368–1374

World Bank (2018) Who Global Ambient Air Quality Database (update 2018).

Zhang C, Lin Y (2012) Panel estimation for urbanization, energy consumption and CO2 emissions: a regional analysis in China. Energy Policy 49:488–498

Zhang B, Wang B, Wang Z (2017) Role of renewable energy and non-renewable energy consumption on EKC: evidence from Pakistan. J Clean Prod 156:855–864

Zivot E, Andrews DWK (2002) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J Bus Econ Stat 20:25–44

Author information

Authors and Affiliations

Contributions

Conceptualization, R.A.; methodology, R.A., M.A.R., and R.U.R.; software M.A.R., and R.U.R.; validation, R.A., and C.G.N.; investigation, R.A., and M.A.R.; data curation, M.A.R.; writing—original draft, M.A.R., and R.A.; writing—review and editing, R.A., R.u.R., and C.G.N; project administration, M.U.R. All authors have read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Ethics approval

The manuscript does not report on or involve the use of any animal or human data, etc.

Consent to participate

Authors have agreed to authorship, read and approved the manuscript, and given consent for submission of the manuscript.

Consent for publication

The authors have given consent for subsequent publication of the manuscript.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Eyup Dogan

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Highlights

• Robust results explained that sustainable finance places a lucrative cause to preserve the environment.

• A novel Dynamic Autoregressive Distributed Lag (D-ARDL) technique is applied.

• Annual data is collected for China from 1970 to 2017.

• In the long run, sustainable economic factors positively impact CO2 emissions, whereas economic growth, energy consumption and exports improve the ecosystem.

• However, in the short run, urbanisation supports the environment whilst economic development, energy use and exports positively impact the environment.

Rights and permissions

About this article

Cite this article

Ali, R., Rehman, M.A., Rehman, R.U. et al. Sustainable environment, energy and finance in China: evidence from dynamic modelling using carbon emissions and ecological footprints. Environ Sci Pollut Res 29, 79095–79110 (2022). https://doi.org/10.1007/s11356-022-21337-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-21337-0