Abstract

In the context of green finance, whether listed companies in heavily polluting industries can convert the external pressure of environmental information disclosure into internal motivation is critical to achieving environmental governance goals. This paper selects 946 listed companies of 16 heavily polluting industries in the Shanghai and Shenzhen stock markets as samples to explore whether environmental information disclosure can help companies increase bank credit support and reduce debt financing costs to transform their external pressures into internal motivation. The empirical results show that there is a significant positive correlation between environmental information disclosure and bank credit decisions. From the perspective of financing scale, heavily polluting companies have the inherent motivation to disclose environmental information actively and proactively to obtain more credit support. There is no significant relationship between the corporate debt financing cost and environmental information disclosure. This paper puts forward some critical policy suggestions for government decision makers, heavily polluting enterprises, and financial institutions.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In recent years, the issue of the ecological environment has received great attention from governments worldwide. The report of the 19th National Congress of the Communist Party of China puts forward the requirements of “adhering to the harmonious development of man and nature and focusing on environmental pollution” and “coordinated promotion of high-quality development and ecological environmental protection.” China has promoted ecological civilization and green development to the level of national development strategy. Especially after the outbreak of the epidemic, President Xi Jinping announced at the 75th United Nations General Assembly on September 22, 2020 that China will adopt more powerful policies and measures to achieve the goal of “carbon peak and carbon neutrality” and promote a “green economy” after epidemic recovery and sustainable development.

To achieve this goal, the Central Economic Work Conference of China listed “strengthening pollution prevention and control and improving the quality of the ecological environment” as an important task for the government in 2021. China’s seven ministries and commissions issued the “Guiding Principles on Establishing a Green Financial System” as early as 2016, promoting the gradual establishment and continuous improvement of a mandatory environmental information disclosure system for listed companies and bond-issuing companies. Banks must control the amount of loans granted to polluting companies and reduce the cost of corporate debt financing. The “Thirteenth Five-Year Plan for Ecological Environmental Protection” adopted by the State Council once again proposed the task of building a green financial system.

High-polluting companies are environmentally sensitive companies, and the public is particularly concerned about their environmental activities (Jiang et al. 2021). Enterprises are an important subject of social production and environmental consumption, and their environmental behavior shows great importance (Tzouvanas et al. 2020). In the past few years, the economic impact of corporate environmental responsibility has been greatly considered, not only company stakeholders, including investors, managers, suppliers, and employees, but also researchers (Zhang 2017). Moreover, the disclosure of environmental information is critical to shape the future of regulators’ actions (Qiu et al. 2016). In particular, the European Parliament emphasized the importance of corporate environmental disclosure for identifying sustainability risks and helping to increase the trust of investors and consumers.

Enterprises must undertake certain environmental responsibilities while ensuring that they obtain economic benefits, and environmental information disclosure is an important way for companies to convey the performance of environmental protection responsibilities and has attracted great attention from the government and society. Reporting transparent environmental information cannot only alleviate information asymmetry but also help build an information network within society, which is essential to combat climate change (Aggarwal and Dow 2012). To strengthen administrative supervision and social supervision, the Ministry of Ecology and Environment of the People’s Republic of China issued the “Environmental Information Disclosure System Reform Plan” on May 24, 2021. It requires key pollutants and companies that implement mandatory clean production audits to disclose their environmental information in accordance with the law.

However, in the face of external pressure from the government and society, whether companies have the internal motivation to disclose their environmental information in a timely and complete manner has become a question worth pondering. When companies actively disclose high-quality information to external stakeholders, their “green image” and “environmental label” can improve corporate reputation, increase bank credit support, and reduce financing risks (Zhu et al. 2019). This enhances the internal motivation of enterprises to disclose high-quality environmental information. Wang et al. (2013) found that external pressure will to some extent encourage companies to disclose their environmental information to obtain debt financing at a lower cost.

If the external pressure of information disclosure can be transformed into internal motivation, the quality of environmental information disclosure will be greatly improved, and the goal of environmental governance will be achieved as soon as possible. In the case of information asymmetry, the intrinsic motivation of companies disclosing their environmental information is very important. In particular, the environmental management level of listed companies in China’s heavy pollution industries is relatively weak. Will the environmental management signals sent to the market affect bank credit support and debt financing costs?

To examine the internal driving force of corporate environmental information disclosure, this paper chooses the empirical data of 946 listed companies in 16 heavily polluting industries in China’s Shanghai and Shenzhen stock markets to explore whether environmental information disclosure can increase bank credit support and reduce debt financing costs for enterprises. Based on the conclusions of empirical analysis, this study puts forward relevant suggestions to provide a theoretical basis and decision support for the government and enterprises to build an environmental governance system.

The remainder of this paper is organized as follows. “Literature and hypotheses” section introduces the literature and hypotheses. “Data and empirical model” section describes the data and methodology. “Empirical results” section presents the main empirical results. Conclusions and policy implications are offered in “Conclusions and policy implications” section.

Literature and hypotheses

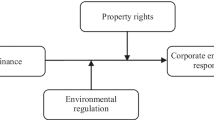

Environmental information disclosure and bank credit decision-making

Since 2007, a series of policy documents in China have been issued to encourage financial institutions to carry out green credit. It refers to loans invested in green projects and supporting environmental improvement, which is the main component of green finance in China (Liu et al. 2021). In March 2016, the 13th Five-Year Plan clearly proposed “establishing a green financial system and developing green credit and green securities.” As a result, the green financial system has become a national strategy (Luo et al. 2019). In August, the People’s Bank of China led seven ministries and commissions to compile and issue the Guiding Opinions on Building a Green Financial System and established the strategy and top-level design of China’s green financial system, including the development of green credit and environmental information disclosure. This is the first time that China has systematically put forward the definition of green finance, which has become a programmatic document for the development of green finance.

Green finance refers to investment and financing activities that support environmental improvement, cope with climate change, and improve resource utilization efficiency, while the green financial system is an institutional arrangement that guides economic green transformation through bank loans, issuing bonds and stocks, carbon finance, and other tools (Wan and Wasiuzzaman 2021). With the strong support of various policies, China’s green finance practice has made some progress, especially the development of green credit and green bonds, which is at the forefront of the world. In 2020, the balance of green loans of 21 major banks in China exceeded RMB 12 trillion, while the total scale of green and ESG loans in major European countries will be approximately RMB 700 billion. With the expansion of scale, green credit has released ecological dividends (Zhu and Lai 2020). However, in practice, China’s financial institutions still lack sufficient enterprise environmental information sharing data, which leads to higher credit risks in credit decision-making.

Stakeholder theory believes that pressure from stakeholders is the main factor that motivates corporate environmental activities (Buysse and Verbeke 2003; Cooper et al. 2018). Some studies extend this theory and show that companies can also obtain many resources from stakeholders by meeting their needs (Brammer and Millington 2008; El-Kassar and Singh 2019). When China implements green credit policy, banks are the most important stakeholders of enterprises because banks not only directly control the source of loan funds but also have the power to issue loans to eco-friendly enterprises. Therefore, companies with more environmental information or a higher degree of eco-friendliness can obtain more financial support from banks. However, since stakeholder theory only provides a broad concept, the influence of external factors and internal factors on stakeholders needs to be further explored. First, we discussed the relationship between environmental information disclosure and bank loans. We believe that the quality of environmental information disclosure and bank loan acquisition can alleviate the problem of information asymmetry. The theory of information asymptoticity believes that the distribution of information between buyers and sellers is unbalanced. A party with more private information can gain benefits in the transaction, but it may harm the interests of its parties (Strausz 2017). This situation creates the problem of adverse selection; that is, the party with missing information cannot make the correct decision (Akerlof 1970).

In the financial field, many studies have found that due to information asymmetry, investees face serious capital rationality or higher costs of capital adverse selection (Biais et al. 2015; Dell'Ariccia et al. 2017). A better information disclosure policy can increase the level of investor information disclosure and reduce the negative impact of adverse selection (Roychowdhury et al. 2019). Therefore, as an important part of nonfinancial disclosure, environmental disclosure can provide banks with more information related to environmental protection (Cui et al. 2018; Schiemann and Sakhel 2019). In short, effective environmental information disclosure is an important way for banks to collect more corporate environmental information and make correct credit decisions.

For financial institutions, the information asymmetry between borrowers and lenders is the main reason for the increase in credit risk and the mismatch of funds, especially the high concealment and professionalism of environmental responsibility information, which leads to the aggravation of information asymmetry between enterprises and creditors (Xing et al. 2021). Creditors will understand the lack of environmental information as an environmental risk, and the value of disclosing environmental information beforehand lies in reducing this “misunderstanding.” Based on the theory of information asymmetry, if enterprises do not disclose their environmental information truthfully and completely, it is difficult for financial institutions to correctly assess the environmental risks of green projects. Under this circumstance, it is easy to make adverse choices because of their lack of full awareness of the environmental risks of enterprises, thus increasing the probability of corporate debt default. In contrast, high-quality environmental information disclosure will enable financial institutions to fully understand the performance of the environmental responsibilities of enterprises, reduce the information asymmetry between financial institutions and enterprises, effectively avoid enterprises from missing financing opportunities due to adverse selection, and improve the operability of both parties in the implementation of bank credit decisions (Wang 2021). In summary, the following assumptions can be put forward:

-

Hypothesis 1 Environmental information disclosure is positively correlated with bank credit decisions; that is, environmental information disclosure is beneficial for enterprises to obtain more bank credit support.

Environmental information disclosure and corporate debt financing costs

Under the green credit policy, companies voluntarily improve the quality of environmental information disclosure and actively transmit their positive signals to financial institutions in terms of green innovation, clean production, and environmental governance (Jin et al. 2021). This makes financial institutions have a high degree of recognition of their environmental risks and tend to choose relatively favorable interest rate policies and loose agreement terms in the process of signing bank credit contracts, thereby reducing financing costs (Liu et al., 2020). Under normal circumstances, enterprises that dare to disclose environmental information truly and completely are less likely to hide “bad information” and can usually fulfill their environmental protection and governance responsibilities well, and the probability of moral hazard is low (Fonseka et al. 2019). Based on signal transmission theory, enterprises accurately and fully disclose their green governance and environmental responsibility performance (Eichholtz et al. 2019). They send a more positive signal to external stakeholders so that creditors can demand a lower risk premium and tend to formulate relatively favorable interest rate policies and loose agreement terms in the process of bank credit decision-making, thus reducing the debt financing cost of enterprises (Li et al. 2019).

Better corporate social responsibility helps companies establish more stable relationships with consumers, employees, and operators, thereby reducing business risks and bankruptcy risks (Brooks and Oikonomou 2018). Creditors demand lower debt interest on companies with better social responsibilities. Relevant studies have shown that when other conditions are the same, corporate social responsibility and loan interest rates are negatively correlated (Wu and Shen 2013; Rosa et al. 2018); a reduction in capital costs will also affect or restrict the motivation, level, and quality of corporate social responsibility information disclosure (Meng 2010). In terms of environmental information disclosure, there is a serious information asymmetry problem between listed companies and stakeholders, and information asymmetry can easily lead to adverse selection by creditors.

The higher the degree of information asymmetry, the higher the risk premium required by creditors, and the higher the cost of corporate debt financing. Signal transmission theory is fundamentally concerned with reducing the information asymmetry between the two parties (Spence 2002; Bergh et al. 2014). Insiders receive positive and negative private information, and they must decide whether to communicate this information to outsiders. Signal transmission theory mainly focuses on the deliberate dissemination of positive information in an effort to convey the attributes of part-of-speech organization (Certo 2003; Connelly et al. 2011). Franco et al. (2015) found that compared with disclosing low-quality segment information, diversified companies have lower debt financing costs when disclosing high-quality segment information. Banks mainly rely on informal channels to reduce information asymmetry, thereby reducing public disclosure costs (Alvis 2013). In addition, environmental information disclosure also facilitates corporate financing by affecting corporate reputation and its impact mechanism is as follows. In a market economy, reputation plays an extremely important role in providing incentives. Kreps et al. (1982) first conducted a more in-depth study on the reputation problem and demonstrated that the reputation mechanism has an irreplaceable role in reducing information asymmetry and providing incentives. Through environmental information disclosure, those companies that actively implement environmental protection convey a strong sense of social responsibility to the outside world. It will help enterprises establish a good image to improve their reputation and attract more creditors and investors, thereby reducing the financing cost of enterprises.

Companies that disclose environmental information can obtain high bank loans at relatively low debt financing costs (Dejean and Martinez 2009). The “green credit” economic policy proposed by the Ministry of Environmental Protection of China encourages creditors to fully evaluate and review the company’s environmental information before making a lending decision. If the company does not disclose environmental information or the quality of information disclosure is low, it will produce adverse selection by creditors, making it impossible for the company to implement green economic policies. If the company discloses high-quality environmental information, the needs of creditors will be met, and their cost of finding information will be reduced. Therefore, debt financing is easier for the company. In the absence of environmental problems, companies will naturally improve the quality of environmental information disclosure to maintain their existing reputation and obtain lower loan interest rates.

Stakeholder theory also provides a reasonable explanation for the intrinsic motivation of enterprises to obtain more favorable credit support by disclosing environmental information. Under the background that China’s environmental governance issues have attracted much attention, external information users require enterprises to provide relevant information, such as the performance of environmental governance responsibilities, environmental performance, and economic consequences, to help them accurately assess the environmental risks of enterprises and make scientific and reasonable investment and management decisions accordingly.

Under the pressure of external stakeholders and strict resource constraints, enterprises improve resource utilization efficiency and reduce energy consumption through green innovation, which brings good external reputation to enterprises. For example, the disclosure of environmental management system certification information by enterprises can reflect the importance of environmental protection, help enterprises win the trust of various stakeholders, and create a good external environment for enterprise financing (Zhang et al. 2019). When making bank credit decisions, financial institutions as stakeholders analyze their potential environmental risks according to the quality of enterprise environmental information disclosure and take environmental impact as an important basis for bank credit decision-making to reduce the debt financing cost of green enterprises and increase the debt financing cost of “two high” enterprises. In summary, the following assumptions can be put forward:

-

Hypothesis 2 Environmental information disclosure is negatively correlated with debt financing costs; that is, environmental information disclosure is beneficial to reduce debt financing costs.

Data and empirical model

Sample selection and data description

This paper focuses on heavy pollution industries that have a greater impact on the environment, such as thermal power generation, steel, cement, electrolytic aluminum, and mineral development, considering China’s national environmental supervision system and the latest release of the “Environmental Information Disclosure System Reform Plan.” The targets of supervision mainly involve listed companies in heavily polluting industries, and the focus of green credit policy is also concentrated in this type of industry. The China Securities Regulatory Commission issued the “Guidelines for Industry Classification of Listed Companies,” which was revised in 2012. In September 2010, the Ministry of Environmental Protection announced the “Guidelines for Environmental Information Disclosure of Listed Companies” and “List of Industry Classification Management Lists for Listed Companies’ Environmental Inspections.” These policy documents define the criteria for the classification of 16 heavily polluting industries.

Based on these standards, we selected all listed companies in the heavily polluting industries on the Shanghai and Shenzhen stock markets as samples. After excluding ST and PT companies and companies with incomplete data, we finally obtained 4636 data points from 946 companies. The industry classification, year, and market distribution of these companies are shown in Table 1. The environmental information disclosure data of all sample companies from 2014 to 2018 were obtained by consulting the annual reports, social responsibility reports, and environmental reports of listed companies. The financial data were mainly obtained from the CSMAR and Wind databases. This study performed 1% winsorized tailing processing on the variables of the outliers, and the statistical analysis was completed with Stata 16 software.

Definition of main variables

The motivation of this study is to examine the regression relationship of bank credit decisions, debt financing costs, and corporate environmental information disclosure. The specific definitions of all variables involved are shown in Table 2.

Explained variables

Bank credit decision (CLoan) refers to bank credit support obtained by heavily polluting enterprises. To quantify this variable, this paper takes the logarithm of the data to eliminate the nonstationary phenomenon caused by the difference in volume between different enterprises. The debt financing cost (DCost) is expressed by the normalized value of the natural logarithm processing of the interest expense.

Explanatory variable

Environmental information disclosure (EID) is the core explanatory variable of this study and a dummy variable, which is mainly used to observe whether each enterprise disclosed environmental information in the current year. It is 1 if the company has disclosed environmental information; otherwise, it is 0.

Control variables

This study adopts the nature of the company and the form of shares, as well as the company’s assets, liabilities, and earnings, as control variables. It is divided into state-owned enterprises or private enterprises, the proportion of the top five shareholders, the number of independent directors, the total assets, the scale of assets and liabilities, and the average return on assets.

Drawing lessons from Bradley et al. (2011), this study selects the nature of equity, the degree of equity concentration, the number of independent directors, and whether the two positions are integrated as part of the control variables to measure the level of corporate governance. In addition, the company’s liabilities, profitability, and other factors will also have an impact on bank credit decisions and debt financing costs. Learning from Minnis (2011), we select asset scale, financial leverage, and return on assets as other control variables.

Model specification

To verify whether hypothesis 1 is valid, that is, whether environmental information disclosure is positively correlated with bank credit decisions, model 1 is constructed as follows.

To verify whether hypothesis 2 is valid, that is, whether there is a negative correlation between environmental information disclosure and debt financing costs, model 2 is given by

where i is the number of each enterprise, t is the term, αi and βi are the coefficients of influence factor, and εi, t indicates the error term.

Empirical results

Descriptive statistics

From the descriptive statistical results of each variable in Table 3, we can see that the average value of credit support obtained by the sample companies from the banks is 16.113, while the average value of interest expenses over the same period is 15.043. This shows that although listed companies in heavily polluting industries can obtain more loans, the corresponding debt financing costs are also higher.

The average value of the degree of environmental information disclosure of the sample companies is 0.292, and the standard deviation is 0.455, which indicates that the degree of environmental information disclosure of listed companies in heavily polluting industries is low and that the disclosure situation among enterprises is quite different. The average asset-liability ratio of the sample companies is 40.2%, and the average value of return on assets is 4.9%, which shows that the financial risks of listed companies in heavily polluting industries are high, but the profitability of assets is not high. These data characteristics are basically consistent with the current situation of listed companies in heavy pollution industries in China.

Correlation analysis

To preliminarily estimate whether there is correlation between the variables in the model and whether there is multicollinearity between the explanatory variables, it is necessary to perform a Pearson correlation test on all variables in both model 1 and model 2. The Pearson correlation coefficient, also known as the simple correlation coefficient, is often used to roughly estimate the linear correlation between two variables. Its value is between −1 and 1, where 1 means a complete positive correlation, 0 means nothing, and −1 means a completely negative correlation. In practical statistical analysis, these three extreme cases do not exist but always exist between them.

From the correlation analysis results of the whole sample variables in Table 4, some conclusions are drawn as follows. First, there is no serious multicollinearity problem between the explanatory variables of both model 1 and model 2, so the regression results will not be distorted. Second, the correlation coefficient between environmental information disclosure and bank credit decisions is 0.07 at the 1% significance level. We can preliminarily judge that there may be a certain positive correlation between them, and hypothesis 1 may be true. The correlation coefficient between environmental information disclosure and debt financing cost is 0.036 at the 5% significance level. It is preliminarily judged that there may be a certain positive correlation between them, and hypothesis 2 may not be true.

However, the Pearson correlation coefficient has some limitations and requires data to meet several basic conditions. First, there is a linear relationship between the two variables. Second, the variables are continuous variables. Third, the variables are in accordance with a normal distribution. Fourth, the two variables are independent. In practice, this is not always the case. Therefore, there are drawbacks in judging whether there is correlation or uncorrelation between variables only by the Pearson correlation coefficient. Whether environmental information disclosure affects bank credit decisions and debt financing costs still needs further analysis. Next, we performed multiple regression on each variable.

Regression result analysis

By collecting 4636 sample data of 946 companies from 2014 to 2018, this paper needs to establish a panel model for regression. Since there are three common models for panel data analysis, including mixed estimation model, fixed effect model, and random effect model, it is necessary to test the above effects to select an appropriate regression model. According to the difference between the three types of models, the random effects model and the fixed effects model consider that the estimated results of the regression equation are different in terms of the intercept and slope terms, while the mixed effects model is the opposite, representing the intercept and slope terms of the estimated equations for each section all the same. Moreover, the difference between random effects and fixed effects models is that the fixed effects model considers the error term and explanatory variables to be correlated, while the random effects model considers the error term and explanatory variables to be uncorrelated. To set the model category for this study, a Hausman test was performed on the sample data. Through the F test and Hausman test, the fixed effect model was finally selected for regression, and the test results are shown in Table 5.

This study constructs regression models to examine whether hypothesis 1 and hypothesis 2 are acceptable. Table 6 shows the results of model 1 and model 2.

Regression result of model 1 for hypothesis 1

The regression coefficient between environmental information disclosure (EID) and bank credit decision-making (CLoan) in model 1 is 0.464 with a statistical significance level of 10%, indicating that there is a significant positive correlation between environmental information disclosure and bank credit decision-making. Therefore, the higher the environmental information disclosure level of listed companies in heavily polluting industries, the more bank credit support they receive from financial institutions, which proves the validity of hypothesis 1. Consistent with this result, Ni and Kong (2016) believe that the company’s disclosure of high-quality environmental information will help it obtain more bank loans. In other words, companies with better environmental information disclosure can obtain more loan support in the long term (Shen and Ma 2014).

For listed companies in heavily polluting industries, the communication channels of environmental protection information between financial institutions and enterprises are not smooth, and the degree of information asymmetry is high, which affects the enthusiasm of financial institutions for bank credit support. Although green finance has developed rapidly in China in recent years, the risk of lending by financial institutions cannot be ignored. Green credit policy requires financial institutions to pay more attention to assessing the potential risks caused by environmental problems in addition to comprehensively checking the basic financial information such as solvency, operational ability, and profitability of enterprises. It is very important for enterprises to disclose their environmental responsibility information in a timely, accurate, and complete manner, which is very important for them to obtain more bank credit support. Imperfect disclosure of environmental information will interfere with the bank credit decisions of financial institutions to a great extent.

Therefore, to obtain more bank credit support, enterprises have internal motivation to actively disclose environmental information, which is manifested in two aspects. On the one hand, enterprises with good environmental management quality send positive signals to stakeholders, especially creditors, by actively disclosing their good environmental information. On the other hand, under the dual pressure of government supervision and media attention, companies with poor environmental management are eager to improve the attitudes of stakeholders, especially creditors, and are eager to convert external pressures into internal motivation and actively release relevant information that is beneficial to them. This is a challenging task for financial institutions to accurately identify the quality of environmental information disclosure and then make reasonable bank credit decisions.

Regression result of model 2 for hypothesis 2

The regression coefficient between environmental information disclosure (EID) and debt financing cost (DCost) in model 2 is 0.135, which is not statistically significant, indicating that environmental information disclosure will not significantly affect debt financing cost, and hypothesis 2 has not been verified. Consistent with this result, Tang and Li (2008) show that there is no significant relationship between the quality of environmental information disclosure and corporate debt financing, which is mainly caused by creditors’ weak awareness of corporate environmental risks. Gao et al. (2018) believe that the quality of environmental information disclosure cannot significantly reduce the cost of debt financing. Lv et al. (2018) point out that financial liabilities such as short-term loans based on bank credit are not related to corporate environmental information disclosure.

The main reasons may come from two aspects. On the one hand, the environmental risks of listed companies in heavily polluting industries are higher than those of listed companies in other industries, and their environmental management level is relatively backward; otherwise, they will not be recognized as highly polluting enterprises. Enterprises disclose their environmental information in a timely, accurate, and complete manner. Although they may obtain more credit support, they cannot reduce the necessary rate of return required by stakeholders, so it is difficult to obtain interest rate concessions provided by creditors, and thus they cannot reduce their debt financing costs. On the other hand, the environmental information disclosure system in China is not perfect at present. Although the relevant departments of our government have issued a series of reform programs of environmental information disclosure system, the lack of verification of the quality of environmental information disclosure leads to the problems of environmental information disclosure of enterprises, such as disclosing good news but not bad, disclosing empty but not real, which makes it difficult to form the pressure of environmental information disclosure of enterprises.

Some findings of control variables

For each control variable, bank credit decisions are positively correlated with asset returns and enterprise development; that is, the regression coefficient between asset scale and asset return rate is positive, which indicates that large-scale enterprises and enterprises with good benefits more easily obtain financing support in various ways. In addition, the number of independent directors and the shareholding ratio of the top 5 directors are negatively correlated with interest expenses, indicating that the improvement of corporate governance can help enterprises obtain bank credit support.

Robustness test

To verify the reliability of the above empirical results, the following robustness tests are carried out.

Replacing the explained variable

Considering that the scale of enterprises receiving bank credit support may be affected by their own scale, this paper uses the ratio of bank credit funds to corporate assets instead of bank credit decision (CLoan) and re-substitutes it into model 1 for regression analysis. We found that there is no substantial difference in the main results of the regression after variable substitution, which is consistent with the previous conclusions.

To eliminate the impact of corporate heterogeneity on the analysis results, this paper uses the ratio of interest expenditure to average debt to replace debt financing costs (DCost) and re-substitutes it into model 2 for regression analysis. The main results are not substantially different from those obtained in the previous empirical experiments. The conclusion is consistent.

Eliminating endogeneity

Considering that there may be endogeneity problems in the constructed model, 2SLS regression is carried out by using the one-stage lag treatment method, and hypothesis 1 and hypothesis 2 are retested. The new empirical results show that it is basically consistent with the original regression conclusion, indicating that the research model in this paper is relatively robust and that the research conclusion has certain reliability.

Conclusions and policy implications

Conclusions

This paper takes all listed companies in heavily polluting industries in the Shanghai and Shenzhen stock markets as samples to investigate whether environmental information disclosure can realize the transformation from external pressure to internal power by increasing bank credit support and reducing debt financing costs for enterprises. The findings are as follows.

First, there is a significant positive correlation between environmental information disclosure and bank credit decision-making, and the disclosure of environmental information by heavily polluting enterprises can promote the growth of bank credit. From the perspective of financing scale, to obtain more credit support, heavily polluting enterprises have the internal motivation to actively disclose environmental information.

Second, there is no significant relationship between environmental information disclosure and corporate debt financing costs, and the disclosure of environmental information by heavily polluting enterprises will not reduce their debt financing costs. From the perspective of capital costs, heavily polluting enterprises cannot take reducing debt financing costs as their internal driving force to strengthen environmental information disclosure.

Policy implications

This paper puts forward the following policy suggestions for government policy makers, heavily polluting enterprises, and financial institutions.

For government policy makers, the relevant policy guidelines and evaluation mechanism of the environmental information disclosure system are customized from the top-level design to meet China’s national conditions. To achieve these goals, big data, artificial intelligence, and other technologies are used to promote the joint establishment of environmental information sharing mechanisms by various departments to enhance supervision ability.

For enterprises, the main responsibility for environmental information disclosure should be implemented as soon as possible. The external pressure from government supervision and social supervision should be transformed into internal power in two aspects. On the one hand, enterprises with good environmental management quality can send positive signals to creditors by actively disclosing good environmental protection information. In contrast, some companies with poor environmental management are under the influence of multiple external pressures and eager to release some relevant information that is as beneficial to them as possible. In the selection of actual production and investment projects, it is recommended to select green profitable projects that have been calculated by professional evaluation agencies, and combine green innovation technologies to achieve product upgrades and benefit transformation.

For relevant financial institutions, the construction of a green financial system with the Central Bank of China as the core and various commercial banks as the main participants should be strengthened. In addition, environmental and social factors should also be incorporated into the whole process of bank risk control to guide the rational flow of capital based on the “green” concept and promote the green innovation of enterprises.

Data availability

The data used to support the findings of this study are available from the corresponding author upon request.

Change history

25 February 2022

Ruili 2021 was removed as it was a duplicate of the reference Wang 2021.

References

Aggarwal R, Dow S (2012) Corporate governance and business strategies for climate change and environmental mitigation. Eur J Financ 18:311–331

Akerlof GA (1970) The market for “lemons”: quality uncertainty and the market mechanism. Q J Econ 84:488–500

Alvis KL (2013) Do declines in bank health affect borrowers’ voluntary disclosures? Evidence from international propagation of banking shocks. J Account Res 52:541–581

Bergh DD, Connelly BL Jr, Ketchen DJ Jr, Lu MS (2014) Signaling theory and equilibrium in strategic management research: an assessment and a research agenda. J Manag Stud 51:1334–1360

Biais B, Foucault T, Moinas S (2015) Equilibrium fast trading. J Financ Econ 116:292–313

Bradley SW, Shepherd DA, Wiklund J (2011) The importance of slack for new organizations facing ‘tough’ environments. J Manag Stud 48:1071–1097

Brammer S, Millington A (2008) Does it pay to be different? An analysis of the relationship between corporate social and financial performance. Strateg Manag J 29:1325–1343

Brooks C, Oikonomou I (2018) The effects of environmental, social and governance disclosures and performance on firm value: a review of the literature in accounting and finance. Br Account Rev 50:1–15

Buysse K, Verbeke A (2003) Proactive environmental strategies: a stakeholder management perspective. Strateg Manag J 24:453–470

Certo ST (2003) Influencing initial public offering investors with prestige: signaling with board structures. Acad Manag Rev 28:432–446

Connelly BL, Certo ST, Ireland RD, Reutzel CR (2011) Signaling theory: a review and assessment. J Manag 37:39–67

Cooper SA, Raman KK, Yin J (2018) Halo effect or fallen angel effect? Firm value consequences of greenhouse gas emissions and reputation for corporate social responsibility. J Account Public Policy 37:226–240

Cui J, Jo H, Na H (2018) Does corporate social responsibility affect information asymmetry? J Bus Ethics 148:549–572

Dejean F, Martinez I (2009) Environmental disclosure and the cost of equity: the French case. Account Eur 6:57–80

Dell'Ariccia G, Laeven L, Suarez GA (2017) Bank leverage and monetary policy’s risk-taking channel: evidence from the United States. J Financ 72:613–654

Eichholtz P, Holtermans R, Kok N, Yonder E (2019) Environmental performance and the cost of debt: evidence from commercial mortgages and REIT bonds. J Bank Financ 102:19–32

El-Kassar A, Singh SK (2019) Green innovation and organizational performance: the influence of big data and the moderating role of management commitment and HR practices. Technol Forecast Soc Changes 144:483–498

Fonseka M, Rajapakse T, Richardson G (2019) The effect of environmental information disclosure and energy product type on the cost of debt: evidence from energy firms in China. Pac Basin Financ J 54:159–182

Franco F, Urcan O, Vasvari FP (2015) Corporate diversification and the cost of debt: the role of segment disclosures. Account Rev 91:1139–1165

Gao H, Zhu H, Meng F (2018) Does the quality of environmental information disclosure affect the cost of debt financing? Empirical evidence from listed companies in environmentally sensitive industries in China. J Nanjing Audit Univ 15:20–28

Jiang C, Zhang F, Wu C (2021) Environmental information disclosure, political connections and innovation in high-polluting enterprises. Sci Total Environ 764:144248

Jin Y, Gao X, Wang M (2021) The financing efficiency of listed energy conservation and environmental protection firms: evidence and implications for green finance in China. Energy Policy 153:112254

Kreps DM, Paul M, John R, Robert W (1982) Rational cooperation in the finitely repeated prisoners’ dilemma. J Econ Theory 27:245–252

Li W, Zhang Y, Zheng M et al (2019) Research on green governance and evaluation of Chinese listed companies. Manag World 35:126–133

Liu S, Liu C, Yang M (2021) The effects of national environmental information disclosure program on the upgradation of regional industrial structure: evidence from 286 prefecture-level cities in China. Struct Chang Econ Dyn 58:556–561

Luo W, Guo X, Zhong S, Wang J (2019) Environmental information disclosure quality, media attention and debt financing costs: evidence from Chinese heavy polluting listed companies. J Clean Prod 231:268–277

Lv M, Xu G, Shen Y et al (2018) Heterogeneous debt governance, contract incompleteness and environmental information disclosure. Account Res 5:67–74

Meng X (2010) Interactive relation between corporate social responsibility disclosure and the cost of capital: an analysis framework based on asymmetric information. Account Res 22:25–29

Minnis M (2011) The value of financial statement verification in debt financing: evidence from Finland. Int J Audit 2:88–108

Ni J, Kong L (2016) Environmental information disclosure, bank credit decisions and debt financing costs—empirical evidence from China’s Shanghai and Shenzhen A-share listed companies in heavily polluting industries. Econ Rev 1:147–156

Niu H, Zang X, Zhang P (2020) Institutional changes and effect evaluation of China’s green finance policy: taking the empirical research of green credit as an example. Manag Rev 32:3–12

Qiu Y, Shaukat A, Tharyan R (2016) Environmental and social disclosures: link with corporate financial performance. Br Account Rev 48:102–116

Rosa FL, Liberatore G, Mazzi F, Terzani S (2018) The impact of corporate social performance on the cost of debt and access to debt financing for listed European non-financial firms. Eur Manag J 36:519–529

Roychowdhury S, Shroff N, Verdi RS (2019) The effects of financial reporting and disclosure on corporate investment: a review. J Account Econ 68:101246

Schiemann F, Sakhel A (2019) Carbon disclosure, contextual factors, and information asymmetry: the case of physical risk reporting. Eur Account Rev 28:791–818

Shen H, Ma Z (2014) Regional economic development pressure, corporate environmental performance and debt financing. Financ Res 2:153–166

Spence M (2002) Signaling in retrospect and the informational structure of markets. Am Econ Rev 92:434–459

Strausz R (2017) A theory of crowdfunding: a mechanism design approach with demand uncertainty and moral hazard. Am Econ Rev 107:1430–1476

Tang J, Li P (2008) An empirical study on environmental information disclosure: evidences from the chemical industry in China’s securities market. China Popul Res Environ 5:112–117

Tzouvanas P, Kizys R, Chatziantoniou I, Sagitova R (2020) Environmental disclosure and idiosyncratic risk in the European manufacturing sector. Energy Econ 87:104715

Wan M, Wasiuzzaman S (2021) Environmental, social and governance (ESG) disclosure, competitive advantage and performance of firms in Malaysia. Clean Environ Syst 2:100015

Wang R (2021) Management governance, environmental accounting information disclosure and financing constraints. Accounting Newsletter 3:73–76

Wang X, Xu X, Wang C (2013) Public pressure, social reputation, internal governance and corporate environmental information disclosure: evidence from listed companies in China’s manufacturing industry. Nankai Manag Rev 2:82–91

Wu MW, Shen CH (2013) Corporate social responsibility in the banking industry: motives and financial performance. J Bank Financ 37:3529–3547

Xing C, Zhang Y, Tripe D (2021) Green credit policy and corporate access to bank loans in China: the role of environmental disclosure and green innovation. Int Rev Financ Anal 12:101838

Zhang C (2017) Political connections and corporate environmental responsibility: adopting or escaping? Energy Econ 68:539–547

Zhang Z, Zhang C, Cao D (2019) Is the certification of enterprise environmental management system effective? Nankai Manag Rev 22:123–134

Zhu N, Lai X (2020) Research on China’s green credit efficiency evaluation and improvement path. Financ Superv Res:41–58

Zhu W, Sun Y, Tang Q (2019) Substantial or selective disclosure: the impact of corporate environmental performance on the quality of environmental information disclosure. Account Res 3:10–17

Acknowledgements

The authors would like to express their sincere gratitude to the anonymous reviewers and the editors for their truly valuable comments.

Funding

This work was supported by the National Natural Science Foundation of China (No. 71704098, 72001191, 72003110), Key Research Project of Financial Application in Shandong Province (No. 2021-JRZZ-25), and Key Project of Philosophy and Social Science Foundation of Jinan City (No. JNSK21B18).

Author information

Authors and Affiliations

Contributions

Mo Du: conceptualization, writing—original draft, writing—review and editing. Shanglei Chai: funding acquisition, formal analysis, writing—original draft. Wei Wei: funding acquisition, writing—review and editing. Shuqi Wang: methodology. Zhilong Li: data curation.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Du, M., Chai, S., Wei, W. et al. Will environmental information disclosure affect bank credit decisions and corporate debt financing costs? Evidence from China’s heavily polluting industries. Environ Sci Pollut Res 29, 47661–47672 (2022). https://doi.org/10.1007/s11356-022-19229-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-19229-4