Abstract

Present transport system of conventional vehicle in India has faced challenges due to enormous amount of air pollution, health hazards to human, rising oil price, insufficient indigenous fossil fuel reserve, heavy expenditure on oil import, energy insecurity, etc. Electrical vehicle (EV) is considered to be alternatives of conventional vehicles that can overcome these shortcomings. The aim of the study is to get an overview of the electric vehicle policies of government of India and its state governments to find out their relevance and impact on EV adoption in India. Exploratory research is used in present case to carry out the study. Currently, the EV industry in India is in preliminary condition and in growing stage. Government of India has framed policies such as “NEMMP 2020,” “FAME-I,” “FAME-II,” and Vehicle Scrappage policy. Seventeen of its state governments have framed EV policy. These policies facilitated various types of incentives, infrastructure development, fund allocation, research and development, production, and sales. This will have strong impact on EV demand generation, conversion of conventional vehicles to e-vehicle resulting E-mobility transformation and EV hub in the region that is at par with other EV-developed countries in the world. However, lack of policy and technology availability in the domain of disposal and reprocessing of Li-ion battery is found to be a future limitation of EV prospect in Indian context which needs to be looked into.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The immense increase in the number of motor vehicles in the modern urban transport system has posed significant threats to the air quality of India’s cities. Pollutants emitted by traditional vehicles depend on their burning efficiency and the type of fuel used. The main pollutants in petrol and diesel vehicles are hydrocarbons, carbon monoxide, nitrogen oxides, and particulates. Exhaust emissions due to the immense increase of automobiles increase the levels of carbon oxide (CO2, CO), nitrogen oxide (NO, NO2, NO5), sulfur oxide (SO2), hydrocarbon (HC), and particulate matter (PM); phototoxic components produced by solar action on nitrogen oxides and active hydrocarbons such as ozone (O3), hydrogen peroxide (H2O2), and peroxyacetyl nitrate (PAN); and various airborne toxins such as benzene (C4H6) and lead (Bhandarkar 2013; Greenbaum 2013; Mazza et al. 2020; Sharma et al. 2020). According to World Economic Forum reports, India has six of the ten most polluted cities in the world. New Delhi is ranked at the top of the world’s most polluted capital city list, according to the World Air Quality Report (WEF 2020). Air pollution including PM, NOx, CO, and O3 often exceed National Ambient Air Quality Standards (NAAQS) in many Indian cities. The reported annual concentration of PM10 nationwide suggests that no areas or cities in northern India comply with WHO (20 Mg/m3) and NAAQS (60 Mg/m3) standard limits (Arunkumar and Dhanakumar 2019). Traffic emissions are the main contributing sources \((62-85\mathrm{\%})\) of air pollution in India. Tailpipe exhaust from vehicles causes serious health effects such as carcinogenicity, mutagenicity, heart death, and respiratory death (Kosankar and Khandar 2014). A large number of deaths occur annually in India due to adverse health effects due to air pollution (ICCT 2019, Alam and Khan 2020). According to the World Resource Institutional team, climate change is happening due to increased CO2 emissions, and their impact is being felt around the world. According to climate scientists, at least 72% (at the 2010 level) of greenhouse gas emissions must be reduced by 2050 to limit global rising temperatures to 2 degrees Celsius above pre-trade levels (Emissions gap report 2020). Humans and ecosystems are particularly susceptible to the immediate, unexpected, and devastating effects of global warming on all levels of global warming. Therefore, it is urgently needed to increase our efforts to prevent GHG emissions (IPCC 2018). India’s greenhouse gas emissions have reached third place in the world. According to the Copenhagen Accord 2010, India is committed to reducing its GHG emissions by \(20-25\mathrm{\%}\)(2005 level) by 2020. Exhausts from the agricultural sector are excluded for this purpose. India has pledged in Paris climate change agreement in 2015 to reduce GHG emissions by \(33 -35\mathrm{\%}\), improve unconventional power generation by 40%, and include a reduction of \(2.5-3.0\) billion tons of carbon dioxide per year by increasing forest cover, all by 2030.

Today’s major challenges are the certainty of oil supply, its availability now and in the future, with increasing oil prices and environmental emissions, etc. These challenges can be addressed by incorporating government policies with a vision, market power, the development of fuel-efficient automotive technologies, modern transportation systems, and the use of alternative energy that will reduce emissions, achieve energy security, and provide greater energy savings. 16.67% of the world’s total population lives in India but accounts for only 0.4% of the proven estimated global hydrocarbon reserve. Given the current growth of the Indian transport sector, it is clear that India is becoming increasingly dependent on imported crude oil supply.

The basic factors of India’s energy insecurity are very low local oil production, low non-renewable fuel sources, and increasing demand and use of oil. Given the fast-growing economy and the subsequent demand for crude oil, India is at risk of being hit by the global and territorial oil supply crisis and in the realm of political instability. Domestic oil production in India can meet only 25% of its demand and import balance oil. With oil imports, India is just behind China and the USA (Babajide 2018). According to a January 2014 estimate, there are only 1.642 trillion barrels of oil available worldwide. The earth can survive only 50 years with this reserve because daily oil consumption is about 90.5 million barrels (Festus 2018). India’s oil reserves are neglected compared to other countries in the world. The problem the nation will face from the current transport system is emissions from a vehicle which include the addition of air pollution. Urban cities face health risks due to exhausts from vehicles, climate change and global warming due to greenhouse gas (GHG), energy security and reliance on imported oil, limited fossil fuel reserves stored in the world, and heavy spending of Forex reserves on oil imports.

Electric vehicles (EV) can be an alternative to conventional transport in India in reducing emissions from vehicles and improving energy security which will lead to a reduction in oil imports and cost savings. Zero tailpipe exhaust, low power consumption, energy efficiency, quiet and smooth operation, renewable energy growth, and low maintenance are factors that can be solutions to the current problems of the standard transport model. Presently Indian automobile industry is experiencing a dilemma of expecting new openings of business, growth, and opportunities with EV adoption and concerned about its shortcomings. The industry is concerned about acceptance of EV in automotive sector. The EV industry aims to launch various products in the coming years. However, the success of electric cars is still not promised. Costs, range, battery, and charging issues are the biggest challenge. The EV four-wheeler sales per year are still in few thousands, whereas globally more than 2.6 million EVs are sold. EV two-wheeler sales have gathered momentum, but sales figure in other segments of EV are not very satisfactory.

Against this backdrop, this study examines national and regional EV policies adopted in India apart from their impact on electric mobility adoption. This study is a first attempt to provide a detailed summary of EV policies and their impact on EV adoption in India. Exploratory research design is used in the present study to obtain an understanding of electrical vehicle acceptance in India. Policy documents related to electrical vehicles framed by various state governments and the central government of India are extracted from ministry websites of each state. This review of policy drafts explores the various issues and challenges of EV adoption in India. India is one of the largest contributors of GHG, and a transition towards green and clean transportation will contribute significantly towards their reduction (Fig. 1).

The current present EV scenario

Global landscape

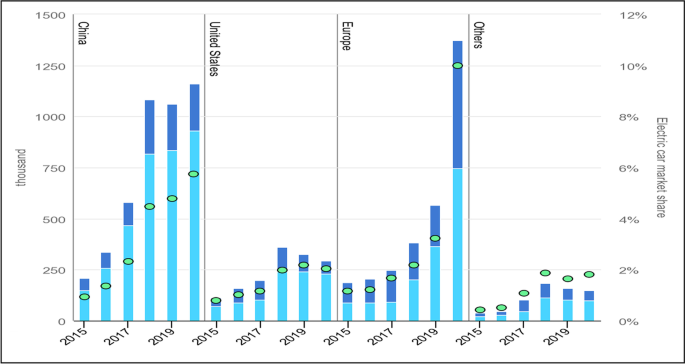

Significant growth in the production and sale of electric vehicles has been observed worldwide. The volume of the world’s electric car has crossed 10 million units by 2020. This is 43% more than the 2019 figure. By 2020, 67% of new electric vehicle registrations are electric vehicle batteries (BEVs). China has the largest fleet (4.5 million), and Europe has the highest number of electric vehicles per year to reach 3.2 million marks. Norway has the largest per capita EV owners in the world. Germany, the UK, France, Norway, Italy, Switzerland, the Netherlands, and Sweden are a major EV market. Some countries such as Australia, Austria, Canada, Spain, Italy, New Zealand, and Japan use good numbers of electric vehicles. The increase is happening very fast in the electric field of two/three wheels, buses, and trucks due to rapid technological advances.

The estimated number of new electric vehicles registered in 2020 is 3 million. This is the first time that 1.4 million new registrations have taken place in Europe. China took second place with 1.2 million registrations, and 295,000 new electric vehicles were registered in the USA. Registration for new electric vehicles in Germany and France is 395,000 and 185,000, respectively. The UK has 176,000 new EV registrations. The electric car sales share in Norway achieved a record high of 75% from the 2019 figure. Sales of electric vehicles in Ireland, Sweden, and the Netherlands increased by 50%, 30%, and 25%, respectively, from the previous sales (Figs. 2 and 3).

EV scenario in India

Currently, the EV industry in India is in preliminary condition and is growing day by day. Electric types of cars, buses, vans, heavy trucks, small tractors, tractor trucks, rickshaws, car cycles, motorcycles, solar boats, etc. are now available in the Indian market. Car manufacturers with brands like Tata, Maruti, Mahindra, Hyundai, Mercedes Benz, Bajaj, TVS, Hero, and Ather have already entered the categories of electric vehicles in India. Many of the above companies have already established EV production centers in India. The public charging system is rapidly evolving. Rapid DC chargers and AC chargers’ complete applications are included in the form of public access, workplace charging, car charging, residential properties, supermarket charging, highway charging, cinema halls, etc. Leading Li-ion battery (EV) manufacturing brands which include Tesla and Amperex Technology Company Ltd have planned to set up battery production plants in different parts of India. Presently around 5 lakh electric two-wheeler vehicles and a few thousand electric cars and buses are running on Indian roads. The EV sales in India are growing day by day. 1.52 lakh two-wheeler units, 3400 units of cars, and 600 bus units are sold in India in 2020. India’s EV sales figures for the past 5 years are shown in Fig. 4.

E-rickshaws are still considered part of the informal sector. Therefore, its sales of 90,000 units are not considered here. According to SMEV, the two-wheeled electric sector has played a major role in the growth of EV sales in India.

Government initiative on EV

Government of India has taken several initiatives for smooth electric mobility adoption. These are highlighted below:

-

“National Electric Mobility Mission Plan 2020 (NEMMP)”: Department of Heavy Industry has introduced the plan in 2013 for long-term plan targeting rapid manufacture and EV acceptance in India.

-

“Faster Adoption and Manufacturing of Hybrid and Electric Vehicles in India Phase-I (FAME-I)”: It was launched in April 2015. Demand generation, technology base, experimental projects, and basic facilities of charging system were focused to promote EV. Incentive for reduced purchase price was one of the highlights of “FAME-I.”

-

“FAME-II”: It was introduced in 2019 for 3 years. Various incentives on the purchase price and development of changing infrastructure were the main focus of “FAME-II” [51].

-

Amendments of “FAME-II”: It was introduced on 11 Jan 2021 by the Department of Heavy Industry. The highlights are as follows:

-

Subsidy of electric two-wheeler linked with Battery size.

-

Subsidy of electric two-wheeler increased from Rs10,000/KWh to Rs15,000/kWh.

-

Eligibility criteria of minimums range of 80KM on single change and min top speed of 40 km/h have been fixed.

-

Electric top wheeler manufacture can give up to 40% discount to consumers on eligible E-2 wheelers.

-

A policy on changing infrastructure for faster EV adoption was issued by the Ministry of Power. The policy defined EVs changing as service, and no license is required to operate an EV charging station. Ministry of Road Transport and Highways has taken a policy decision. The policy says all battery electrical vehicles will be provided with green license plates, and these will be exempted from the commercial permit requirement. National Mission on Transformative Mobility and Battery Storage Plan has been approved. The plan will facilitate setting up large-scale plants for battery and cell manufacturing across. This will support localized production and indigenous electric vehicle supply chain.

EV policy of state governments

The actual realization of EV acceptance will be visible only when various state governments, union territories, and local bodies implement these policies and measures on the ground. Thus, state governments have framed their policies in addition to government of India’s policies for the promotion of EV adoption in their respective states. These will facilitate the states to become attractive destinations for manufacture, assembly, sales, and service hub. At the same time, the state will be benefitted from reduced emissions, employment to locals, fewer health issues, etc. As of now, sixteen states have issued either approved or draft EV policy mentioning plans, targets, subsidies, incentives, and other facilities to promote EV adoption. These policies are summarized below.

-

Andhra Pradesh (approved June 2018): 1,000,000 EVs are to be on the road by 2024. Refund of road tax and registration fee for the sale of EVs until 2024. E-buses are compulsory for public transport in four cities by 2024 and in all countries by 2030. One lakh (100,000) slow and quick charging stations by 2024. “Green days” will be celebrated for creating awareness among the public (Andhra Pradesh electric mobility policy 2018).

-

Bihar (drafted June 2019): To convert all cycle rickshaws to e-rickshaws by 2022. INR 12,000 ($ 163) subsidy for the end-user, as well as an additional INR 10,000 ($ 136) special subsidy, to encourage lithium-ion battery rickshaw. It promotes the production of e-rickshaws. Charging stations will be set up at every 50 km distance on state and national highways. Commercial and residential complexes will be facilitated with an EV charging system (Bihar electric vehicle policy 2019).

-

Gujarat (drafted September 2019): 100,000 EVs deployment on the road by 2022. The distribution of the EVS should be 80% 2-wheelers or scooters, 14% 3-wheelers, 4.5% personal cars, and 1.5% buses. 100% exemption from registration fee and 50% exemption from automobile tax. One hundred percent exemption from electricity tariff for EV charging stations. Additional aid at the state level to supplement the national accelerated hybrid adoption and production EV (FAME) II scheme. A separate policy for charging stations will be framed by the state government (Gujarat state electric vehicle policy 2021).

-

Himachal Pradesh (drafted Sep 2019): One hundred percent switch to EVs target by 2030. The use of hybrid EVs by state-owned enterprises during the transition. Dedicated charging infrastructure, development of the independent player model, and provision of charging facilities on commercial premises are encouraged (Himachal Pradesh electric vehicle policy 2019)

-

Karnataka (approved Sep 2017): One hundred percent e-transportability in auto-rickshaws, taxi aggregators, corporate transports, and school bus/vans implementation by 2030. Introducing 1,000 EV buses to the public transport system. A stimulus such as interest loans for EV production enterprises. Fund for a start-up for e-mobility, and the construction of an indirect market for batteries. One hundred twelve charging stations for EVs will be installed in Bangalore city (Karnataka electric vehicle and energy storage policy, 2017).

-

Kerala (approved March 2019): One million EV units on the road by 2022 and 6,000 public transport e-buses by 2025. Incentives such as state tax holidays, road tax exemptions, tax payments, free pilots permit, and free parking. Fund allocation for e-buses, EV-parts production, and government transports. Establishments for e-transportation exhibition venues in potential locations such as tourist centers, technology centers, and built-in metropolitan areas (The draft policy on electric vehicles for the state of Kerala 2018).

-

Madhya Pradesh (approved October 2019): One-fourth of all new public transport registrations will be the electric vehicle by 2026. Incentives such as waiver on the license fee, refund of toll, forgoing road tax/motor vehicle registration for 5 years, 100% free parking on any municipal company operating e-rickshaw parking area for 5 years. Stop registration for new conventional combustion engines vehicles in other cities. Setting up secure, reliable, and inexpensive infrastructure. Promotion of renewable energy use in charging infrastructure (Madhya Pradesh electric vehicle policy 2019).

-

Maharashtra (approved February 2018): EV target of 10% of new vehicle registration by 2025. To achieve 25% electricity-driven public transport in six identified city areas by 2025. Conversion of 25% state own bus to e-bus. To make Maharashtra the highest number of EV-producing states. To install 2375 charging stations in various city areas and national highways. The government will purchase the only EV from April 2022 onwards. Companies engaged with logistics, delivery, and e-commerce will have one-fourth of their complete fleet as EVs by 2025. Property tax rebates for charging facility installed by private owner. Financial incentives to the tune of INR 29,000/to INR 275,000 for various types of EVs. INR 10,000 and INR 500,000 incentives for slow and fast charging infrastructure (Maharashtra electric vehicle policy 2021).

-

New Delhi (approved August 2020): One-fourth of the total new vehicles registered in the city will be EVs by 2024. At least 50% of all new stage buses for a city under purchase plan will be e-buses. Deployment of 1,000 e-buses by 2020. Purchase incentive for INR 10,000 ($ 136) per kWh of battery size provision for 4-wheelers electric (motor) vehicles. INR 5,000 financial help ($ 68) per kWh of battery size will be provided for the purchase of two-wheeled vehicles and is subject to a maximum incentive of INR 30,000 ($ 409) per vehicle. Encouragement to discard and re-register old conventional two-tire motor vehicles. INR 30,000 ($409) incentives for the purchase of each e-auto, e-rickshaw, and e-van (Delhi electric vehicle policy 2020).

-

Punjab (drafted November 2019, awaiting approval): One-fourth of total vehicle registration will be EVs for the next 5 years. Growth of two-wheeled electricity-driven vehicle share to 25% of new sales. Twenty-five percent of the Department of Transport’s buses to become e-buses and increasing the share of e-taxis to 25%. One hundred percent automotive vehicle tax exemption on private EVs for 5 years. Free registration and license for commercial vehicles for 5 years (Punjab electric vehicle policy 2019).

-

Tamil Nadu (approved September 2019): Five percent of buses to convert e-buses annually by 2030. Converting shared vehicles, institutional vehicles, and e-commerce delivery and transport vehicles into EVs by 2030. All auto-rickshaws in six major cities will be converted into electric vehicles in about 10 years. Business start-up funding and business incubation services to be established to encourage the start of EV. All employees working in EV production units will receive a skills renewal grant. One hundred percent exemption from electricity tariffs by 2025 for EV-related and charging infrastructure production units (Tamil Nadu electric vehicle policy 2019).

-

Telangana (approved August 2020): Target of EV sales as 80% of all two- and three-wheel segment, 70% all range commercial vehicles segment, 40% buses, 30% personal vehicles, and 15% electrification of all vehicles by 2025. Job creation of 20,000 numbers by 2025 in EVs and shared travel, infrastructure development for charging, and EV production activities. To attract $ 3.0 billion funding for infrastructure growth for charges. Production of lithium batteries for high mileage EVs will be encouraged with the policy framework and financial incentives (Telangana electric vehicle policy 2017).

-

Uttar Pradesh (approved August 2019): Target of one million EVs roll out in all segments of vehicles by 2024. One thousand electric buses will be deployed on road. Seventy percent of EV public transport will be operated on ear-marked green routes in ten cities by 2030. Conventional commercial fleets and logistics vehicles to phase out and achieve 50% EV mobility in goods transportation in identified ten EV cities by 2024 and all cities by 2030. Single-window approval system for EVs and battery manufacturing units. EV charging infrastructure provision will be encouraged for all new apartments, high-rise buildings, and technology parks. Establishment of research and development hub for EVs and next-generation battery management systems. To promote more research and development in e-mobility in universities and colleges (Uttar Pradesh electric vehicles manufacturing policy 2018).

-

Uttarakhand (approved Dec 2019): One hundred percent electricity duty exemption, subsidy for a bank loan, and EPF reimbursement for skilled/semiskilled labor for 5 years for EV manufacturing. Concession of land cost in SIIDCUL. Facilities such as SGST reimbursement, stamp duty exemption, environment protection, skill development, and EV mobility incentives. Incentives for the development of EV charging. Development of green highways. No motor vehicle tax for the first 100,000 customers. Special concession for EV battery manufacturing, development, and charging and swapping infrastructure (Uttarakhand electric vehicle policy 2019).

-

West Bengal (approved June 2021): Target to achieve one million EVs in all sectors in 5 years. To develop 100,000 charging stations in 5 years. Intercity corridor for EV with charging station in every 25 km. Set up of green zone e-mobility cities (West Bengal electric vehicle policy 2021).

-

Odisha (approved Feb 2021): Twenty percent EV adoption target by 2025. Subsidy on purchase of E-vehicles. Subsidized parking zones for EV. Facilities such as an interest-free loan for EV purchase exemption on road tax and registration fees. Reimbursement of 100% state GST on sale and manufacturing of EV. Capital subsidy for charger installation. Financial benefits for scrapping old vehicles. All types of business on EVs and their parts will be encouraged (Odisha electric vehicle policy 2021).

-

Meghalaya (Approved 2021): 15% EV adoption by 2025. Purchase subsidy for purchase of EV. Setting up charging infrastructure at government own buildings and commercial buildings (Meghalaya Electric Vehicle Policy 2021).

Findings

The rapid and steady growth of EV adoption is observed globally. China is leading in EV adoption in terms of production, sales, and registration. There is stiff competition between China and Europe in terms of EV adoption. The remarkable growth in EV adoption is also found in the USA. Many other countries are also found to be adopting EVs. Some growth of EVs adoption was observed in India also. Only 5 lac EVs stock was found in India against 10 million global EVs stock.

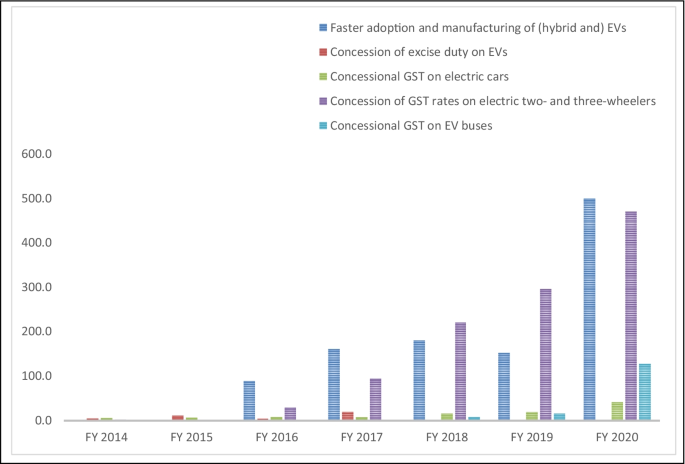

Government of India and various states/UTs of India have taken several initiatives in terms of policies, plan, and target for faster adoption of EVs in India. Incentives, subsidies, charging infrastructure development, and setting up manufacturing plants for EVs and its components have been observed. Special emphasis has been given in government planning on EVs battery and cell production. Research and development activities to facilitate growth of EV chain are also being taken care of in the long-term planning. Figures 5 and 6 present the support given by central government for the promotion of electric vehicle adoption in India. Subsidies on EVs have increased eighty times from 2 USD million in 2014 to 161 USD million representing a growth of 79.5%.

Concessional goods and services tax on electric vehicles have increased from mere INR 61 crore in 2014 to INR 41.7 crore in 2020. Similarly, concession on electric buses has shown a phenomenal growth from INR 0.6 crore in 2014 to INR 127.9 crore in 2020. Government of India’s support towards faster adoption and manufacturing of hybrid and electric vehicles has increased from INR 89.1 crore in FY 2016 to INR 500 crore in FY2020.

Similarly, initiatives from central and state government enhanced EV sales (e-2Ws and e-cars) by seven times in the last 5 years (2016–2020) and is expected to increase by 26% by 2023 and 30% by 2030 (Fig. 7). If EVs account for 30% of India’s car sales by 2030, there will be a host of benefits like 16 Mt CO2 of GHG emissions reduction; INR 1.1 lakh crore worth of savings with 15% reduction in crude oil import bill; INR 2.1 lakh crore of value added generated in EV powertrain, battery, and charger manufacturing sector; 1.2 lakh jobs created in EV powertrain, battery, and charger manufacturing and electricity generation sector; and 9 to 20% lower TCO for EV users compared to ICE vehicles in the case of 2 W, 3 W, 4 W, and buses (Soman et al. 2020).

Discussion

The automobile sector is a vital contributor to the Indian economy. It is a $93 billion industry. Seven percent of India’s GDP comes from the automobile sector. In India’s total automotive vehicle, sell were 23 million considering all segments. More than 4 million unit vehicles per year have been exported in the last 4 years. As per the India Infoline news service, India is the largest tractor manufacturer, second largest two-wheeler and bus manufacturer, fourth largest car manufacturer, and fifth largest heavy truck manufacturer in the world. India has proven capability of sales and export of automobile products in the world. So, the required basic infrastructure of manufacturing and sales of electric vehicles is already present in India. Indian government has taken all steps in terms of long-term planning, strategy, policy formulation, and infrastructure creation of a pollution-free mobility system which will faster speedy induction and growth of electric vehicle industry. Growing fuel price and insufficient domestic production of crude oil is a major issue in India that will compel Indian people to avoid using conventional vehicles and attract electric vehicles. The major barrier of the electric vehicle observed by researchers in the Indian context is the price of the vehicle, charging infrastructure such as charger density, charging time, range, and battery cost. Government of India has taken aggressive plans to neutralize the changing issues, technological development in the battery management system, raw materials, and rapid expansion of domestic production that will not only increase range but also reduce battery cost. Regular reduction per KWH battery cost is visible in the market. The growth and firm expansion plan in renewable energy production in India will reduce power costs and increase availability that will further increase electric vehicle usage in India.

The government of India has already placed a vehicle scrappage policy in 2021 to reduce vehicle-related pollution by declaring the end-of-life vehicle after use of stipulated life and mandatory requirements. Financial benefits will be provided for vehicle scrap, and additional taxes will have to be paid to retain aged vehicles. This policy facilitates a scrap value of 4 to 6% of ex-showroom price. The life of personal and commercial vehicles is fixed as 15 years and 20 years, respectively. A good amount of green tax will be imposed all over India for all conventional vehicles. It means a great number of vehicles will be scrapped in India every year. An accordingly equal number of additional vehicles or demands will be created in the automobile sector. Initially, this additional demand may go in favor of conventional vehicles due to the comparatively low purchase price and existing mindset of customers. These may again vary sector to sector. For example, additional demand in two- and three-wheeled vehicle sectors will go to electric version two and three wheelers due to purchase price competitiveness and low operation cost. However, in the long run, EV vehicles in all sectors will see benefits due to vehicle scrappage policy considering steady downfalls of the EV purchase price and battery price.

Conclusion and policy implications

The rapid and steady growth of EV adoption is observed globally. China, the USA, Germany, the UK, France, Norway, Italy, Switzerland, the Netherlands, Sweden, Australia, Austria, Canada, Spain, Italy, New Zealand, and Japan are the leading countries in EV acceptance. Major factors behind EV success in these countries are found to be a strong policy framework, financial and non-financial incentives, effective charging infrastructure, electricity availability with a proper mix, green lifestyle, consumer information, and awareness campaign and wide availability of EV model, etc. The volume of the world’s electric car has crossed over ten million units by 2020. Currently, the EV industry in India is in preliminary condition and a growing stage. The government of India and the majority of its state governments have taken strong initiatives in terms of strategy, policy formulation, infrastructure development, incentives, fund allocation, research and development, production, and sales at par with other EV-developed countries in the world.

Although India has entered the electric vehicle sector a little bit late with slow growth in four-wheeled vehicle segments, good progress was observed in two-wheeled segments. Electric types of cars, buses, vans, heavy trucks, small tractors, tractor trucks, rickshaws, scooters, cycles, motorcycles, solar boats, etc. are now available in the Indian market. Car manufacturers with brands like Tata, Maruti, Mahindra, Hyundai, Mercedes Benz, Bajaj, TVS, Hero, and Ather have already entered the categories of electric vehicles in India. Many of the above companies have already established EV production centers in India. This is the result of initiatives taken by the government of India. However, India should act more vigorously towards charging infrastructure creation and broad credit policy such as an easy and low-interest loan from a bank and financial institution and create awareness about benefits of e-mobility, government subsidies, incentives, etc. People will be forced to adopt E-mobility considering its benefits. Government must convince automobile sellers and producers to act towards EV expansion. All state governments should take concrete steps to ensure electricity availability everywhere round the clock. Very soon, India will dominate the EV sector like conventional vehicle production, sales, and export business provided the plan and strategies initiated by central government and state governments are implemented and executed in reality.

Extraction and production of raw materials like graphite powder, lithium, cobalt, and nickel which are required for Li-ion batteries for electric vehicles are extremely detrimental to the environment. These activities are adding problems like air pollution, groundwater depletion, ecology damage, soil contamination, and acidification of water sources. Moreover, the majority of the present reserve of the above raw materials is located in very few countries such as Congo, Australia, Brazil, Turkey, China, South Africa, and Ukraine. A massive number of EV batteries will be dumped per year due to their end life, and it will be colossal damage to our environment unless we have a systematic battery disposal process. It may create tremendous health hazards to human beings. Reprocessing of used EV battery is one of the solutions of end-use battery disposal system, but it is in the very primitive stage in terms of policy, infrastructure, technology, and operation.

The motive behind discarding conventional fossil fuel-fired vehicles in our transportation system is to reduce environmental pollution in the form of tailpipe emissions and to avoid the use of fossil fuels considering its growing price, limited stock, and endanger energy security. An electric vehicle will certainly fulfill the above requirements during its use stage, but extraction of battery materials and their after-use disposal are a matter of concern for our environment. Our energy security will be endangered unless found out sufficient mines for battery materials in our country or indigenously produced materials are used for EV battery production. These are the limitations of the present study, and more work in these aspects will certainly be beneficial to prospects of the EV industry.

Data availability

The datasets generated during and/or analyzed during the current study are not publicly available but are available from the corresponding author on reasonable request.

Abbreviations

- NEMMP:

-

National Electric Mobility Mission Plan

- FAME:

-

Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India

- \({CO}_{2}\) :

-

Carbon dioxide

- NAAQS:

-

National Ambient Air Quality Standards

- WHO:

-

World Health Organization

- GHG:

-

Greenhouse gas

- WDI:

-

World Development Indicators

- IEA:

-

International Energy Agency

- SMEV:

-

Society of Manufacturers of Electric Vehicles

References

Aasness MA, Odeck J (2015) The increase of electric vehicle usage in Norway—incentives and adverse effects. Eur Transp Res Rev 7(4):1–8

Abhyankar N, Gopal AR, Sheppard C, Park WY, & Phadke AA (2017). All electric passenger vehicle sales in India by 2030: value proposition to electric utilities, government, and vehicle owners.

Abotalebi, E., Mahmoud, M., Ferguson, M., & Kanaroglou, P. S. (2015). Utilizing stated preference in electric vehicle research; evidence from the literature. In Proceedings of the 50th Annual Canadian Transport Research Forum Conference, Montreal (pp. 1–19).

Ahn J, Jeong G, Kim Y (2008) A forecast of household ownership and use of alternative fuel vehicles: a multiple discrete-continuous choice approach. Energy Economics 30(5):2091–2104

Alam MS, & Khan A (2020) The Impact Study Of Vehicular Pollution On Environment. http//: article%20observation/manuscrip%20ref/oil%20researve.pdf

Andhra Pradesh electric mobility policy 2018. https://apedb.gov.in/dowloads.html#:~:text=The%20Govt%20of%20Andhra%20Pradesh,10%20lakh%20EVs%20by%202024.

Araújo K, Boucher JL, Aphale O (2019) A clean energy assessment of early adopters in electric vehicle and solar photovoltaic technology: geospatial, political and socio-demographic trends in New York. J Clean Prod 216:99–116

Arunkumar M, Dhanakumar S (2019) Vehicular pollution and its implications. Pollut Res 38(3):634–647

Babajide N (2018) Indian energy security status: what are the economic and environmental implications? In IAEE Energy Forum (pp. 47–51).

Bagul TR, Kumar R, & Kumar R (2021) Real-world emission and impact of three wheeler electric auto-rickshaw in India. Environ Sci Pollut Res 1–24

Bak DB, Bak JS, Kim SY (2018) Strategies for implementing public service electric bus lines by charging type in Daegu Metropolitan City, South Korea. Sustainability 10(10):3386

Bhandarkar, S. (2013). Vehicular pollution, their effect on human health and mitigation measures. VE, 1(2), 3340.

Bihar electric vehicle policy 2019 (draft). http://www.investbihar.co.in/Download/Draft_for_e_vechile.pdf

Bockarjova M, Rietveld P, & Knockaert J (2013) Adoption of electric vehicle in the Netherlands-a stated choice experiment.

Chakraborty A, Kumar RR, Bhaskar K (2021) A game-theoretic approach for electric vehicle adoption and policy decisions under different market structures. J Oper Res Soc 72(3):594–611

Choi H, Shin J, Woo J (2018) Effect of electricity generation mix on battery electric vehicle adoption and its environmental impact. Energy Policy 121:13–24

Delhi electric vehicle policy – 2020. https://transport.delhi.gov.in/sites/default/files/All-PDF/Delhi_Electric_Vehicles_Policy_2020.pdf

Dhar S, Pathak M, Shukla PR (2017) Electric vehicles and India’s low carbon passenger transport: a long-term co-benefits assessment. J Clean Prod 146:139–148

Dixit A (2019) Electric vehicle infrastructure market sustainable growth in Indian scenario, needs and suggestions. International Journal of Innovative Technology and Exploring Engineering, ISSN: 2278–3075, Volume-8, Issue-11S

Faisal F (2017) An analysis of electric vehicle trends in developed nations: a sustainable solution for India. J Undergrad Res 9(1–5):1–8

Festus IO (2018) Fossil fuels and the current fuel reserve in developed and developing countries. Sci Technol Public Policy 2(1):5–10. https://doi.org/10.11648/j.stpp.20180201.12

Figenbaum E (2017) Perspectives on Norway’s supercharged electric vehicle policy. Environ Innov Soc Trans 25:14–34

Foley A, Gallachoir BO, Leahy P, & McKeogh E (2009) Electric vehicles and energy storage—a case study on Ireland. In 2009 IEEE Vehicle Power and Propulsion Conference (pp. 524–530). IEEE.

Greenbaum DS (2013) Sources of air pollution: gasoline and diesel engines. Air Pollution and Cancer, 49–62.

Gujarat state electric vehicle policy – 2021. https://pnt.gujarat.gov.in/Downloads/2021-06-23-GR-GujaratE-VehiclePolicy-2021.pdf

Haddadian G, Khodayar M, Shahidehpour M (2015) Accelerating the global adoption of electric vehicles: barriers and drivers. Electr J 28(10):53–68

Han L, Wang S, Zhao D, Li J (2017) The intention to adopt electric vehicles: driven by functional and non-functional values. Transp Res Part a: Policy Pract 103:185–197

Hidrue MK, Parsons GR, Kempton W, Gardner MP (2011) Willingness to pay for electric vehicles and their attributes. Resource and Energy Economics 33(3):686–705

Himachal Pradesh electric vehicle policy – 2019. http://himachalpr.gov.in/OnePressRelease.aspx?Language=1&ID=14445

Hove A, & Sandalow D (2019) Electric vehicle charging in China and the United States. Center on Global Energy Policy. https://theicct.org/sites/default/files/ICCT_factsheet_health_impact_airpollution_Delhi_20190705.pdf

ICCT (2019) Health impacts of air pollution from transportation sources in Delhi. https://theicct.org/sites/default/files/ICCT_factsheet_health_impact_airpollution_Delhi_20190705.pdf

IPCC (2018) Climate change 2014: synthesis report. https://www.ipcc.ch/site/assets/uploads/2018/05/SYR_AR5_FINAL_full_wcover.pdf

Jabeen F, & Australia W (2016) The adoption of electric vehicles: behavioural and technological factors (Doctoral dissertation, Tesis de Ph. D).

Jing W, Yan Y, Kim I, Sarvi M (2016) Electric vehicles: a review of network modelling and future research needs. Adv Mech Eng 8(1):1687814015627981

Karnataka electric vehicle and energy storage policy – 2017. https://kum.karnataka.gov.in/KUM/PDFS/KEVESPPolicyInsidepagesfinal.pdf

Kester J, Noel L, de Rubens GZ, Sovacool BK (2018) Policy mechanisms to accelerate electric vehicle adoption: a qualitative review from the Nordic region. Renew Sustain Energy Rev 94:719–731

Khan NA, Fatmi MR, Habib MA (2017) Type choice behavior of alternative fuel vehicles: a latent class model approach. Transportation Research Procedia 25:3299–3313

Khurana A, Kumar VR, Sidhpuria M (2020) A study on the adoption of electric vehicles in India: the mediating role of attitude. Vision 24(1):23–34

Kieckhäfer K, Wachter K, Spengler TS (2017) Analyzing manufacturers’ impact on green products’ market diffusion–the case of electric vehicles. J Clean Prod 162:S11–S25

Kosankar S, Khandar C (2014) A review of vehicular pollution in urban India and its effects on human health. J Adv Lab Res Biol 5(3):54–61

Lee H, & Clark A (2018) Charging the future: challenges and opportunities for electric vehicle adoption.

Li W, Long R, Chen H, Geng J (2017) A review of factors influencing consumer intentions to adopt battery electric vehicles. Renew Sustain Energy Rev 78:318–328

Li W, Yang M, Sandu S (2018) Electric vehicles in China: a review of current policies. Energy & Environment 29(8):1512–1524

Liao F, Molin E, van Wee B (2017) Consumer preferences for electric vehicles: a literature review. Transp Rev 37(3):252–275

Madhya Pradesh electric vehicle policy – 2019. http://mpurban.gov.in/Uploaded%20Document/guidelines/1-MPEVP2019.pdf

Maharashtra electric vehicle policy – 2021. https://evreporter.com/wp-content/uploads/2021/07/MH-EV-Policy-2021.pdf

Majumdar D, Majhi BK, Dutta A, Mandal R, Jash T (2015) Study on possible economic and environmental impacts of electric vehicle infrastructure in public road transport in Kolkata. Clean Technol Environ Policy 17(4):1093–1101

Malmgren I (2016) Quantifying the societal benefits of electric vehicles. World Electric Vehicle Journal 8(4):996–1007

Mazza S, Aiello D, Macario A, De Luca P (2020) Vehicular emission: estimate of air pollutants to guide local political choices A case study. Environments 7(5):37

Meghalaya Electric Vehicle Policy- 2021. https://www.meghalaya.gov.in/sites/default/files/documents/Meghalaya_Electric_vehicle_policy_2021.pdf

Meyer G, Dokic J, Jürgens H, & Stagle S (2015) Hybrid and electric vehicles: the electric drive delivers. Annual Report IEA IA-HEV Implementing Agreement for Co-operation on Hybrid and Electric Vehicle Technologies and Programmes.

Nian V, Hari MP, Yuan J (2019) A new business model for encouraging the adoption of electric vehicles in the absence of policy support. Appl Energy 235:1106–1117

Odisha electric vehicle policy – 2021. https://ct.odisha.gov.in/news/odisha-electric-vehicle-policy2021

Priessner A, Sposato R, Hampl N (2018) Predictors of electric vehicle adoption: an analysis of potential electric vehicle drivers in Austria. Energy Policy 122:701–714

Punjab electric vehicle policy – 2019. https://www.transportpolicy.net/wp-content/uploads/2019/12/Punjab_Draft_EV_Policy_20191115.pdf

Sajjad A, Asmi F, Chu J, & Anwar MA (2020) Environmental concerns and switching toward electric vehicles: geographic and institutional perspectives. Environ Sci Pollut Res 27(32).

Sang YN, & Bekhet HA (2015) Exploring factors influencing electric vehicle usage intention: an empirical study in Malaysia. Int J Bus Soc 16(1)

Schmid A (2017) An analysis of the environmental impact of electric vehicle, Missouri S&T’s Peer to Peer, vol1, issue 2.

Shalender K, Sharma N (2021) Using extended theory of planned behaviour (TPB) to predict adoption intention of electric vehicles in India. Environ Dev Sustain 23(1):665–681

Shankar A, & Kumari P (2019) Exploring the enablers and inhibitors of electric vehicle adoption intention from sellers’ perspective in India: a view of the dual-factor model. Int J Nonprofit Volunt Sector Marketing, 24(4), e1662

Sharma R, Kumar R, Singh PK, Raboaca MS, Felseghi RA (2020) A systematic study on the analysis of the emission of CO, CO2 and HC for four-wheelers and its impact on the sustainable ecosystem. Sustainability 12(17):6707

Soman A, Harsimran K, Himani J, Karthik G (2020) India’s electric vehicle transition: can electric mobility support India’s sustainable economic recovery post COVID-19? Council on Energy, Environment and Water, New Delhi

Tamil Nadu electric vehicle policy 2019. https://powermin.gov.in/sites/default/files/uploads/EV/Tamilnadu.pdf

Tatari O (2017) Socio-economic implications of large-scale electric vehicle systems (No. FSEC-CR-2073–17). University of Central Florida. Electric Vehicle Transportation Center (EVTC).

Telangana electric vehicle policy – 2017(draft). https://www.transportpolicy.net/wp-content/uploads/2019/10/Telangana_EV_Policy_20170927.pdf

The draft policy on electric vehicles for the state of Kerala – 2018. https://anert.gov.in/sites/default/files/inline-files/go20190310_Trans-24-Ms_e_vehicle_policy_.pdf

UNEP U (2020) Emissions gap report 2020. UN Environment Programme.

Uttar Pradesh electric vehicles manufacturing policy – 2018. https://electricvehicles.in/wp-content/uploads/2019/08/Uttar-Pradesh-Electric-Vehicle-Policy-2019.pdf

Uttarakhand electric vehicle policy – 2019. https://evreporter.com/wp-content/uploads/2020/07/electric1576487934.pdf

Van Mierlo J, Lebeau K, Messagie M, & Macharis C (2013) Electric vehicles: environmental friendly and affordable? Rev. E Tijdschr. jaargang/129ème année–n, 4.

Vidhi R, Shrivastava P (2018) A review of electric vehicle lifecycle emissions and policy recommendations to increase EV penetration in India. Energies 11(3):483

VISION 2050: A strategy to decarbonize the global transport sector by mid-century, icct

Wang N, Tang L, Pan H (2019) A global comparison and assessment of incentive policy on electric vehicle promotion. Sustain Cities Soc 44:597–603

West Bengal electric vehicle policy – 2021. https://wbpower.gov.in/wp-content/uploads/Electric%20Vehicle%20Policy%202021%20(Kolkata%20Gazette%20Notification).pdf

World Economic Forum (2020). 6 of the world’s 10 most polluted cities are in India https://www.weforum.org/agenda/2020/03/6-of-the-world-s-10-most-polluted-cities-are-in-india/

Xu G, Wang S, Li J, Zhao D (2020) Moving towards sustainable purchase behavior: examining the determinants of consumers’ intentions to adopt electric vehicles. Environ Sci Pollut Res 27(18):22535–22546

Author information

Authors and Affiliations

Contributions

Pabitra Kumar Das: Conceptualization, writing-original draft preparation, and methodology.

Mohammad Younus Bhat: Software, methodology, data curation, validation, and investigation.

Corresponding author

Ethics declarations

Ethics approval

All ethical principles have been followed while preparing this manuscript.

Consent to participate

NA

Consent for publication

NA

Competing interests

The authors declare no competing interests.

Additional information

Communicated by Philippe Garrigues.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Das, P.K., Bhat, M.Y. Global electric vehicle adoption: implementation and policy implications for India. Environ Sci Pollut Res 29, 40612–40622 (2022). https://doi.org/10.1007/s11356-021-18211-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-18211-w