Abstract

The environmental consequences of economic policy uncertainty (EPU) and oil price changes have attracted much attention in recent years, but few studies have estimated the asymmetric impact. This research investigates the symmetric and asymmetric effects of EPU and oil prices on carbon emissions in the USA and China. Based on monthly data from 1995:1 to 2019:12, we address this issue by applying the ARDL and non-linear ARDL cointegration methodology. The symmetric results show that the change in EPU has no evident impact on carbon emissions in the short and long run for the USA and China, and oil prices have a lag effect in this regard. The non-linear ARDL estimation documents significant asymmetric effects of EPU and oil prices. Specifically, the negative change in EPU facilitates emissions in the USA in the long and short run, and a unit increase in EPU increases emissions by 2.24% and 4.95%, respectively, whereas its positive change does not produce any significant effect. Carbon emissions in China are significantly and positively affected by the positive change in EPU only over the long run, and an increase in EPU increases emissions by 0.04%. Furthermore, the positive shock of oil prices significantly and positively influences emissions in the long run, and a unit increase in this factor increases emissions by 15.73% and 0.44% in the USA and China, respectively. Moreover, the short-term effect of the negative shock of oil prices exhibits a lag effect. The empirical results provide a practical reference for the USA and China to craft robust policies on emission cutting.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Excessive carbon emissions and global warming caused by human activities have become a serious challenge facing human society and have aroused worldwide concern (Lin and Jia 2019). To slow climate change, substantially reducing carbon emissions is not an alternative to ensure sustainable development (Lee and Chong 2016). As the world’s two largest greenhouse gas emitters, the USA and China are expected to become global leaders in tackling climate change and assisting in carbon emission mitigation (Anasis et al. 2019). In 2019, the energy-related carbon emissions of the USA and China reached approximately 47.66 billion tons and 98.09 billion tons, respectively (IEA 2020). To prevent climate change from getting out of control, the USA has proposed reducing its carbon emissions by approximately 26–28% by 2025 compared with 2005 (Anasis et al. 2019). As one of the pioneers in signing the Paris Agreement, the past few years have witnessed China’s extraordinary efforts to control carbon emissions. For example, China has set a goal of responding to a changing climate: to reach the peak of carbon emissions by 2030 and achieve carbon neutrality by 2060 (Chen et al. 2021). However, the road to achieving this carbon peak and carbon neutrality in China is expected to face a greater challenge due to its large population, low energy consumption efficiency, and high energy consumption base (Wang et al. 2014). Since the USA and China play a prominent role in coping with global climate change and cutting emissions, a critical question subsequently emerged: what are the driving factors behind the surge in carbon emissions to meet their respective emissions pledges?

For the past several decades, EPU has fluctuated continuously around the world, which has generated much interest (Zhang et al. 2019; Bakas and Triantafyllou 2020). Al-Thaqeb and Algharabali (2019) argued that policy uncertainty associated with economic decision-making is of great importance in a more liberalized world economy. Indeed, the International Monetary Fund (IMF) reported that EPU is one of the fundamental causes for the lackluster growth of the economy. Numerous investigations have demonstrated that EPU is closely related to different economic indicators (Hailemariam et al. 2019; Abid 2020). It is noteworthy that in addition to the economic effect, EPU also has an environmental effect that is equally important (Ulucak and Khan, 2020). In theory, in times of EPU rise, the deterring impact of EPU over the adoption of green technologies results in producers adopting traditional and environmentally unfriendly production methods, which will lead to a sharp rise in energy consumption and carbon emissions accordingly (Romano and Fumagalli 2018). Meanwhile, it is difficult for enterprises to form reasonable expectations for the future. Enterprises or other economic entities tend to make prudent decisions to delay or change investment, consumption, or savings (Gulen and Ion, 2016). This view is in line with the real options theory. Since the carbon emissions behavior of economic entities is tightly bound to their production decisions, it can be predicted that the upward trend of EPU will inevitably impact pollutant emissions (Jiang et al. 2019). Additionally, the relatively high EPU will weaken the government’s determination of environmental governance and thus affect the effectiveness of environmental policy implementation (Jiang et al. 2019). In low-EPU periods, however, enterprises can afford cleaner fuels than traditional fossil fuels, and the government is more concerned with environmental sustainability (Ahmed et al. 2021). Hence, the reduction in EPU can make way for the mitigation of emissions. In this case, presumably, the upward and downward trends of EPU may affect carbon emissions in an asymmetric fashion. According to Rehman et al. (2020), macroeconomic variables can be asymmetrically affected by factors such as the business cycle and international trade. Earlier studies on the environmental effects of EPU changes were based on the assumption that EPU emissions have a linear pattern (e.g., Ulucak and Khan 2020; Anser et al. 2021), and the potential asymmetric response of carbon emissions to changes in EPU is less of a focus.

Crude oil, the most basic energy and chemical raw material, occupies a vital position in modern economic development (Behmiri and Manso 2013; Mo et al. 2019). In seminal research by Hamilton (1983), rising oil prices were shown to be the chief culprit in the US economic recession. The function of crude oil in the national economy has prompted scholars to further inquire into its environmental impact. Researchers have stated that energy prices are an efficient instrument for determining resource allocation, achieving energy savings, and controlling greenhouse gas emissions (Yuan et al. 2010; Dong et al. 2017). Generally, the impact mechanism of oil prices on carbon emissions can be summarized into two channels. On the one hand, when oil prices rise sharply, high energy prices reflect the scarcity of energy, which will encourage consumers to shift their interest to other alternative energy sources. In addition, the increase in investment and oil consumption costs induced by the rise of oil prices also promotes investment orientation transformation and lifestyle changes, further facilitating the development and use of new energy (Liu et al. 2017). As proposed by Oberndorfer (2009), the rise in oil prices is one of the ideal opportunities that stimulate the investment and development of new energy. Accordingly, rising oil prices can be one of the decisive factors to mitigate carbon emissions. On the other hand, in the case of low or falling oil prices, the crude oil demand increases, and industrial enterprises would rather consume more energy than pursue technological innovations. Economic growth will maintain a relatively extensive development model, further driving up energy consumption and inducing pollutant emissions. For this reason, the influence of rising and falling oil prices may be asymmetric. In other words, if an oil price plunge induces an increase in emissions, the rise in oil prices may be assumed to have the opposite effect. Since the impact mechanism of the upward and downward trends in oil prices on carbon emissions may be inconsistent, the role of oil prices in environmental degradation deserves to be reconsidered.

In summary, previous research relies heavily on symmetric methods to evaluate the symmetry (linear) effects of EPU and oil prices on carbon emissions, and the asymmetries in the influences of EPU and oil prices have not received much attention (Ahmed et al. 2021; Mujtaba and Jena 2021). The results obtained have limited our understanding of the true influence of positive and negative changes in EPU and oil prices on emissions, and further research is needed to quantify their potential asymmetry in environmental effects. From a policy perspective, distinguishing the effects of the rise and fall of EPU and oil prices on carbon emissions will be beneficial in formulating differentiated mitigation policies. In this context, the research presented here empirically investigates the impacts that the shocks of EPU and oil prices have on carbon emissions, and further exploration has been conducted to determine whether there are short-run or long-run asymmetric (non-linear) correlations between them. Specifically, the ARDL approach was therefore adopted for examining the symmetric relationships, and a non-linear ARDL approach was also used to determine the potential asymmetric relationships. The application of the non-linear ARDL technique allows quantification of the short- and long-term nonlinearities simultaneously through positive and negative partial sum decompositions of EPU and oil prices. Meanwhile, the short- and long-term effects of changes in EPU and oil prices on carbon emissions can also be captured from asymmetric dynamic multipliers.

This paper adds to the existing literature from the following three aspects. First, we perform a time series analysis of the association between carbon emissions, EPU, and oil prices. To our knowledge, although some scholars have assessed the environmental effect of EPU and oil prices respectively (Adedoyin and Zakari 2020; Mujtaba and Jena 2021; Adedoyin et al. 2021c), there are little to no studies that address the effects of EPU and oil prices on carbon emissions in the context of the determinants of emissions and apply them to the USA and China. Hence, the current study is warranted to clarify the previous findings. Second, in this study, the effects of EPU and oil prices on carbon emissions are explored from an asymmetric perspective rather than focusing merely on causal links or correlations, which represents a significant divergence from previous research. Many previous related studies assumed asymmetric impacts of EPU and oil prices on carbon emissions, without much consideration of the hidden asymmetrical impact (Pirgaip and Dinçergök 2020). Third, this paper mainly focuses on the world’s two largest carbon emitters, namely the USA and China. These two countries are more representative than others, and lessons from this work can also offer new insights for other high-carbon emitters. Simultaneously, from the method adopted, we present evidence of the non-linear properties of the effects of EPU and oil prices on carbon emissions rather than linear properties. This finding advances understanding of the existing work, and several targeted implications based on the results are therefore provided for the USA and China to formulate scientific emission abatement policies.

This article is divided into five sections. In addition to the first section, the second section presents a literature review concerning the connections between EPU and carbon emissions, energy prices, and carbon emissions. The third section introduces the empirical methodology and our data, followed by the main findings and detailed discussion presented in section four. The fifth section provides conclusions and corresponding policy recommendations.

Literature review

EPU and carbon emissions

As one of the critical issues of global concern, the constraint effect of EPU on economic development has been widely reported. Recently, some papers began to explore the environmental consequences of EPU shocks, and the conclusions were contradictory. Several scholars have proposed that a high level of EPU may cause severe environmental degradation. Jiang et al. (2019), for example, conducted a Granger causality test in quantiles analysis to demonstrate that there is unidirectional causality from EPU to the extreme level of carbon emissions in the US sector. Pirgaip and Dinçergök (2020) employed 1998–2018 datasets for G7 countries and introduced the bootstrap panel Granger causality test to detect the causal link between EPU, energy consumption, and carbon emissions. Their results show that EPU has a unidirectional effect on carbon emissions in three G7 countries, namely the USA, Germany, and Canada. Adams et al. (2020) utilized a PMG-ARDL model to detect the correlations among EPU, energy consumption, and carbon emissions for several countries with high geopolitical risk from 1996 to 2017. The study reports that there is a significant positive association between EPU and carbon emissions. Another study by Atsu and Adams (2021) based on the cross-sectionally augmented ARDL (CS-ARDL) and FMOLS techniques for the period 1984–2017 specified that EPU generates a significant and positive effect on carbon emissions in BRICS countries. Similar evidence has been documented by Ulucak and Khan (2020) when evaluating the role of EPU in the energy-emissions nexus by using a time series method from 1985 to 2017. Their findings point to EPU adversely affecting carbon emissions in the USA. Targeting the top ten carbon emitter countries, Anser et al. (2021) assessed the role of the world uncertainty index (WUI) in carbon emissions from 1990 to 2015 by applying the PMG-ARDL method. They illustrated that a 1% rise in WUI escalates emissions by 1% and 0.12% in the short and long run, respectively. Taking the regional heterogeneity into account, a recent study by Yu et al. (2021) constructed a new provincial EPU to determine how EPU influences the carbon emissions intensity of Chinese manufacturing firms, using a two-way fixed-effect model. The empirical results revealed that EPU is a significant contributor to the increase in carbon intensity levels of manufacturing firms.

Although the studies mentioned above confirmed that rapidly increasing carbon emissions are significantly affected due to EPU shock, evidence to the contrary does exist. For instance, some researchers have suggested that the environmental impact of EPU varies in the short and long run. In a recent work of Adedoyin and Zakari (2020), the ARDL bond test was used to identify how EPU impacts the energy-emissions linkage. They report that in the short run, EPU changes exert a significant inhibitory effect on the increase of carbon emissions in the UK, while the effect becomes positive in the long run. Alternatively, Abbasi and Adedoyin (2021) do not detect a significant effect of EPU on pollutant emissions in China when using a dynamic ARDL simulation model to assess the impact of EPU, energy use, and economic development on carbon emissions covering the period 1970–2018. The above research presents some gaps that necessitate a critical step forward for a more effective carbon abatement policy. On the one hand, the existing work has not reached a consistent conclusion on the role of EPU in carbon emissions. On the flip side, most of the previous studies concerning the impact of EPU on carbon emissions assumed that they are linearly related, with the exception of recent work by Ahmed et al. (2021) that measured the asymmetric impacts of positive and negative fluctuations of EPU. The authors also suggested that future surveys should consider the potential asymmetric effect of EPU. In this context, the present study applies the non-linear ARDL model to analyze further whether the effect of EPU on carbon emissions varies with the change direction of the EPU trend.

Energy price and carbon emissions

A wealth of literature has documented the significant influence of oil price changes on carbon emissions. The impact of oil price changes on energy-saving emission reduction can be explained by factor substitution and technological innovation. Assuming that the prices of other factors remain unchanged in the short term, the rise of oil prices will directly lead to an increased unit cost of production. To maintain or even expand the production scale, enterprises are encouraged to search for alternative energy production factors or improve production technology to advance production efficiency and ensure enterprise profits. Therefore, with the rise of oil prices, unit energy consumption and carbon emissions will be significantly reduced. In addition, rising oil prices can also influence the level of carbon emissions by lowering consumption demand and adjusting the energy consumption structure (Wong et al. 2013; Mensah et al. 2019). This point agrees with neoclassical economics theory; if the price of a commodity increases relative to the substitutes’ price, the consumption demand for it will descend. Nevertheless, other scholars have advocated that energy prices are a significant factor in explaining the decline in carbon emissions. Indicatively, Saboori et al. (2016) employed the ARDL and Toda–Yamamoto–Dolado–Lütkepohl (TYDL) approaches to test the EKC hypothesis for 10 of the OECD countries. They concluded that oil prices enhance the quality of the environment by negatively influencing the ecological footprint. Considering the potential spatial correlations in carbon emissions, Li et al. (2020) applied spatial panel data models to evaluate the spatial impacts of energy prices on the carbon emissions of 30 Chinese provinces. The findings demonstrated that energy prices could directly or indirectly affect the level of emissions. However, a considerable portion of the literature detected divergent results regarding the role of oil prices. Using Johansen multivariate cointegration, Alshehry and Belloumi (2015) found that an upward trend in oil prices will push oil consumption and aggravate environmental pollution by releasing more carbon emissions in Saudi Arabia. By dividing 22 African countries into oil-exporting and non-oil-exporting countries, Mensah et al. (2019) introduced the panel ARDL model to discuss the causal linkages amid economic growth, fossil fuel consumption, carbon emissions, and oil prices for the 1990–2015 period. The examined results demonstrated a unilateral cause-and-effect nexus from oil prices to emissions in both the long and short run for all panels. In a country-specific study, Mujtaba and Jena (2021) investigated the determinants of carbon emissions, including economic growth, energy use, FDI, and oil prices, by combining the non-linear ARDL model with an asymmetric causality test for the period 1986–2014. The empirical results revealed that both the increase and decrease in oil prices significantly increased the pressure of environmental pollution.

Due to the large monopoly on energy prices in China, the energy pricing system has not been entirely under market rules. One practical instance is that the actual price of energy is clearly lower than the market-clearing price. There appears to be a subset of literature focusing on the environmental consequence of energy price distortion. For instance, Ju et al. (2017) quantified the impact of energy price regulations on GDP growth and carbon emissions in China by carrying out path analysis and simulation analysis. The authors proposed that energy price distortions induced by energy price regulations have a specific inhibitory influence on emissions. Wang et al. (2019) constructed a dynamic translog function model to analyze the correlation between oil price distortion and Chinese transport sector emissions. The authors believe that eliminating oil price distortion can significantly diminish carbon emissions in the transport sector. Given this background, the most recent research by Li et al. (2019) and Malik et al. (2020) showed that rising energy prices are a significant driver of carbon emissions declines, while decreasing energy prices exacerbate emissions. The major drawback of these studies is that they assumed the asymmetric impact of energy prices on carbon emissions and neglected the possibility of an asymmetric effect. Motivated by the established research, this study provides a more comprehensive analysis of the effect of oil prices on carbon emissions within the USA and China by using the ARDL and non-linear ARDL methods.

Methodology and data

Methodology

This study concentrates on detecting the symmetric and asymmetric impacts of EPU and oil prices on carbon emissions in the case of the USA and China. Based on the existing literature, EPU and oil prices alone may fail to explain changes in carbon emissions. Prior environmental research has validated that economic activities and uncontrolled fossil fuel consumption are vital sources of increasing pollutant emissions (Ozturk et al. 2019; Le and Ozturk 2020). For instance, taking 27 selected European Union economies as an example, Adedoyin et al. (2021b) proposed that economic development puts tremendous pressure on environment quality and accelerates growth in carbon emissions. As a fundamental element in economic growth, energy consumption is extremely beneficial to the development of most economies (Adedoyin et al. 2020b). However, it is worth noting that overreliance on energy has had undeniable detrimental environmental effects (Adedoyin et al. (2021c)). In this light, economic growth (GDP) and energy consumption (EC) are incorporated into our model as control variables to avoid omitting the essential variables. The linkage between the variables can be expressed in the following equation:

where CO2 is the carbon emissions per capita in metric tons, EPU reflects the economic policy uncertainty index, WTI represents crude oil prices per barrel, GDP denotes real GDP per capita calculated by 2010 US$ prices, and EC denotes energy consumption per capita in kilograms of oil equivalent. All variables concerned are converted into logarithmic form to eliminate heteroscedasticity. Then, Eq. (1) can be transformed to the following:

where \({\beta_0}\) is the constant term and \(\varepsilon\) is the error term.

The linear ARDL model was initially applied to examine the symmetric effect of EPU and oil prices on carbon emissions. The advantage of the ARDL model is that it is flexible, as it can be used regardless of whether the integration order of the variables in the model is I(0) or I(1); thus, the statistical inferences of long-run estimates can be obtained (Katrakilidis and Trachanas 2012). Equation (2) can be transformed into the symmetric ARDL model as follows:

where \(\Delta \ln C{O_2}\), \(\Delta \ln EPU\), \(\Delta \ln WTI\), \(\Delta \ln GDP\), and \(\Delta \ln EC\) represent their respective different values. \({\beta_1}\) to \({\beta_5}\) indicate short-term dynamic relationships, and \({\lambda_1}\) to \({\lambda_5}\) represent long-term dynamic relationships. Following Pesaran et al. (2001), the null hypothesis of the F-joint significance test for ARDL bound tests indicates that the cointegration relationship is not present. Specifically, if the F-statistic obtained is higher than the upper bound of the boundary value, then cointegration exists between variables. In contrast, no cointegration exists. Then, we estimated the short- and long-term coefficients and performed diagnostic tests to ensure the stability of the model. The short-term models can be written in:

where \({\theta_i}\) refers to the speed of adjustment from short-term to long-term equilibrium.

The ARDL model helps to determine “whether EPU and oil prices affect carbon emissions symmetrically.” As argued by Falk (1986), most macroeconomic variables incorporate non-linear properties. This means that EPU and oil prices are possible candidates for causing asymmetric influences on carbon emissions. To capture the potential asymmetric relationship, the non-linear ARDL technique advanced by Shin et al. (2014) is used to answer another critical question: “does there exist heterogeneity in the influence of the positive and negative changes of EPU and oil prices on carbon emissions?” Then, the non-linear ARDL model can be constructed as follows:

where \(\ln EPU_t^+\), \(\ln WTI_t^+\) \(\ln EPU_t^-\), and \(\ln WTI_t^-\) represent the positive and negative partial sum process variations in EPU and oil prices, respectively, and they can be calculated by Eq. (6) and Eq. (7):

Then, the non-linear ARDL model can be extended in the following form:

where \(\sum\nolimits_i^p {\delta_i^+ }\) and \(\sum\nolimits_i^p {\delta_i^- }\) represent the short-term positive and negative impacts of EPU and oil prices on carbon emissions, respectively, \(\lambda_i^+\) and \(\lambda_i^-\) capture the long-term effect. The error correction model is established by Eq. (9):

where \({\theta_i}\) shows the long-term equilibrium adjustment speed after the short-term shock and \(\delta_i^+\) \(\delta_i^-\) indicates the short-term asymmetric coefficients.

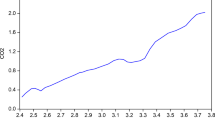

Figure 1 shows the procedure of the current empirical research. Traditional unit root tests and the unit root test accounting for structural breaks are first used to examine the stationarity properties of the variables concerned with the aim of avoiding spurious model results. Then, the ARDL bound test is conducted to determine whether long-term equilibrium relationships exist between related variables. Finally, ARDL and non-linear ARDL techniques are adopted to capture the symmetric and asymmetric impacts of EPU and oil prices on carbon emissions.

Data description

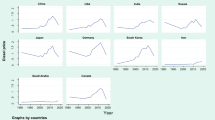

Our estimations are conducted by selecting monthly observations of EPU, WTI oil prices, economic growth, energy consumption, and carbon emissions for the USA and China. Based on the availability of the data, the study spans 1995:M1–2019:M12. Data for the EPU index can be found at http://www.policyuncertainty.com. WTI crude oil prices are gathered from the US Energy Information Administration (www.eia.gov). The remaining data are collected from World Development Indicators (World Bank 2020). The definitions and sources of all variables are shown in Table 1, and the detailed descriptive statistics after transforming all the variables into logarithm form are displayed in Table 2. In addition, we graphically illustrate the monthly time series of the EPU, oil prices, and carbon emissions for the USA (Fig. 2a) and China (Fig. 2b) from January 1995 to December 2019. EPU maintains a relatively consistent dynamic with the carbon emissions in both the USA and China, but the oil-emissions linkage is more ambiguous.

Empirical results and discussion

Unit root test and cointegration test

Prior to modeling the time series data, the ADF test, PP test, KPSS test, and ERS test were performed to examine the order of integration of variables. As presented in Table 3, all series are nonstationary in level form but become stationary in the first difference form. Thus, it can be inferred that they are integrated of order one, I(1). According to Perron (1989), traditional unit root tests ignore structural breaks in the time series and may yield biased results. For this purpose, the ADF unit root test containing an unknown structural break introduced by Kim and Perron (2009) is used. The results presented in Table 4 show that all the variables at first difference have the same integration order I(1). Furthermore, the ARDL bound test is conducted to assess whether there is a long-run equilibrium relationship among the variables concerned. According to the results reported in Table 5, the F-statistics value is statistically significant at the 1% level and exceeds the critical value of the upper bound of Narayan’s (2005) table under constant and no trend. It can be concluded that there is a long-term cointegrating relationship between EPU, oil prices, and carbon emissions in the sample period.

The linear ARDL analysis

To facilitate comparison, the ARDL and ARDL-ECM techniques are utilized to estimate the long-term and short-term correlations between variables in the USA and China, and the detailed estimations are summarized in Table 6 and Table 7. Following Ullah et al. (2021), this study applied the Akaike information criteria (AIC) and used a maximum of four lags for the data of the model. In the case of long-run correlation, we observe that the coefficients of EPU are insignificant under the symmetrical framework in both the USA and China, which suggests that there is no evidence of any meaningful relationship between EPU and carbon emissions. Furthermore, the same is true when we consider the environmental impact of EPU in the short run. In other words, the environmental effect of EPU is negligible, whether in the long run or short run. Our result coincides with the work of Abbasi and Adedoyin (2021), who revealed that EPU has a statistically insignificant influence on variations in carbon emissions.

For oil prices, the results reveal that oil prices have insignificant positive coefficients in the current period. The lagged oil price measures (WTIt-1 in the USA and WTIt-2 in China) significantly and negatively affect carbon emissions in the long run. It is reasonable to believe that oil price changes exert a beneficial influence on carbon emissions over time, and they could be an effective regulatory tool for emission mitigation in the USA and China in the near future. This evidence is confirmed by and consistent with analysis work by Saboori et al. (2016) in some OECD countries’ cases. The reason for this phenomenon may be that the fall in oil prices has garnered the attention of policy-makers regarding the sustainable diversification of energy structures rather than cheap energy policies, which restrains pollution emissions. Likewise, in the short run, the coefficients of oil prices are insignificant in the current period, but the first lag of oil prices (∆WTIt-1) is significant and has different signs in the USA and China. In the USA, the first lag of oil prices brings a negative effect, while it is positively correlated with emissions in China. A 1% increase in oil prices is associated with an 11.99% decrease in carbon emissions in the USA and a 1.11% increase in emissions in China. In addition, the error correlation terms (ECT) are significantly negative in Table 7, which signifies that any deviation from the long-run equilibrium has been corrected, and the speed of adjustment is 41.97% for the USA and 7.50% for China. It is worth noting that the ARDL model assumes the increase and decrease in EPU and oil prices have symmetric effects on carbon emissions. In the presence of potential asymmetry, the ARDL technique may not be suitable and could provide misleading evidence. To this end, applying the non-linear ARDL technique to take further steps to highlight the hidden asymmetric relationship is advised.

The non-linear ARDL analysis

In this subsection, we apply Wald tests for short- and long-run asymmetry to determine the most suitable model specification. As shown in Table 8, the non-linear ARDL with long-run asymmetry is selected for EPU in China and oil prices in both the USA and China, and the non-linear ARDL with short-run asymmetry and long-run asymmetry is selected for EPU in the USA. This highlights the effectiveness of considering asymmetries in modeling the associations between EPU, oil prices, and carbon emissions, and the results from linear models may not be comprehensive and authoritative. We then use the non-linear ARDL technique to capture the possible asymmetric correlations between variables. The Akaike information criteria (AIC) is used as the lag selection criterion. The results reported in Table 9 and Table 10 reveal that the response of carbon emissions to positive or negative changes in EPU and oil prices differs significantly in the long and short run. In the long run, the positive shock in EPU (EPU-P) has an insignificant positive impact in the US. In contrast, the negative change in EPU (EPU-N) in relation to carbon emissions exerts a significant positive effect (with 0.0224 at 5% significance). The positive sign illustrates that the negative change in EPU is responsible for environmental deterioration through the promotion of carbon emissions. It can be concluded that carbon emissions of the USA are more vulnerable to the lower level of EPU, whereas a high level of EPU does not notably influence carbon emissions. A possible explanation for this result is that, in theory, a higher level of EPU is one of the fundamental forces driving macroeconomic volatility (Pastor and Veronesi 2012, 2013). Under such circumstances, enterprises tend to reduce investment and production activities due to unclear expectations about the future. The government’s attention to environmental governance is also be distracted, which inevitably negatively impacts the implementation and supervision of environmental policies (Jiang et al. 2019). Accordingly, increased EPU will not cause an increase in carbon emissions in the USA. When the EPU level decreases, enterprises resume investment and production, and the willingness to consume and demand of consumers rise, which facilitates the consumption of energy and stimulates carbon emissions. According to the short-run estimations presented in Table 10, the positive shock in EPU (EPU-P) does not affect carbon emissions, and the negative shock (EPU-N) has a significantly positive impact, with a coefficient of 0.0495 at 10% level of significance. Thus, in the short run, carbon emissions in the USA are less responsive to the increase of EPU than that its decrease.

In China, it can be observed that the effect of a long-run positive shock to EPU (EPU-P) on carbon emissions is significantly positive, with a coefficient of 0.0004 at a 5% level of significance, while a negative shock of EPU (EPU-N) is insignificantly positive. This information validates that the increase in EPU exacerbates environmental quality, while the decrease in EPU seems to be negligible. This may occur because EPU increases and stagnation in research and development (R&D) and innovation is not conducive to the sustainable development and utilization of renewable energy, thereby causing a rapid increase in emissions. As another potential cause, the increased EPU makes it difficult for regulated enterprises to form clear expectations for the government’s environmental policies and future behavior. The inherent impetus of enterprises in energy conservation and emission abatement has been seriously diminished. Enterprises prefer to adopt high energy consumption and low-cost production modes, which dramatically stimulate carbon emissions. Our findings support Adams et al. (2020) in that there exists a significant long-run association between EPU and carbon emissions. The short-run estimations show that the positive or negative shock in EPU could not influence Chinese carbon emissions.

Regarding oil prices, as far as the long-run relationship is concerned, the coefficient of oil prices (WTI-P) has a significantly positive sign in the USA, which confirms that the rise in oil prices obviously promotes carbon emissions, and as oil prices increase by 1% following an increase in emissions by approximately 15.73%. Nevertheless, the coefficient of the first-order lag of positive shock to oil prices (WTI-Pt-1) is significantly negative, supporting the cumulative role of rising oil prices in lowering carbon emissions, noting the lag effect. This outcome implies that the rise in oil prices directly drives carbon emissions in the current period and facilitates the decline of emissions in the later period. The reason may be that industrial enterprises will seek alternative energy in cases of rising oil prices. If the chosen alternative energy source is not energy saving, carbon emissions will increase as oil prices rise. When industrial enterprises later reduce the risk of increased costs caused by rising oil prices through technological innovation, rising oil prices will be conducive to the reduction of emissions. This may be the reason for the lag effect of oil prices on emission reduction. In addition, a long-run negative shock to oil prices exerts a significant positive effect at lag 2 (WTI-Nt-2) with a statistically significant coefficient of 0.1868. The positive correlation indicates that falling oil prices positively influence emissions but with a lag effect in the USA. This situation may occur because when oil prices are at a low level, the motivation for technological innovation of enterprises is insufficient, and economic growth is driven by high input and high consumption, which intensifies pollution emissions. This is consistent with the evidence presented by Alshehry and Belloumi (2015) and Mensah et al. (2019).

The coefficient of the increase in oil prices (WTI-P) in China is significantly positive at a 10% level of significance in the long run. Every 1% increase is predicted to elevate carbon emissions by 0.44%. This result may be attributed to the increased reliance on nonrenewable energy such as coal or natural gas with the rise of oil prices, resulting in increased emissions. It is essential to note that the positive impact of rising oil prices in China is far lower than that in the USA. The reason may lie in the low efficiency of the Chinese energy market due to strict government regulation. This result is similar to Li et al. (2020), who claimed that the elasticity of energy prices to carbon emissions in China is relatively small. In the short run, carbon emissions in the USA and China are not significantly affected by the increase or decrease in oil prices (WTI-P or WTI-N) in the current period, suggesting that oil price volatility is not the key driving force behind the growth of carbon emissions over the short run. One possible explanation is that rising oil prices urge policy-makers to focus on short-term energy security rather than long-term strategies to prevent pollution (Apergis and Gangopadhyay 2020). Thus, the environmental damage caused by the oil price increase is not expected to be obvious. However, the negative change in oil prices at the first-order lag (WTI-Nt-1) has a significant negative impact in the USA and China, with coefficients of − 0.0973 and − 0.0265, respectively. In other words, the decline in oil prices exerts an adverse effect on emissions in the short run, but there exists a lag effect. The evidence confirms the notion of Li et al. (2020) that the environmental consequence of energy prices has a lag effect. In summary, the asymmetric ARDL results present a completely separate picture from the symmetric ARDL, and assuming the symmetric effect of EPU and oil prices can lead to unreliable inferences and unconvincing results. Therefore, applying a more flexible non-linear ARDL model that accounts for the asymmetric features of EPU and oil price shocks is suggested.

Concerning the other variables, the coefficients of economic growth are positive and present a significant effect on carbon emissions in the USA and China over the long run. The results postulate that every 1% increase in economic growth will result in 97.31% and 99.14% increases in carbon emissions in the USA and China, respectively. This result indicates that the economic development of the USA and China is accomplished by environmental degradation, which is consistent with our expectations because carbon emissions will be increasingly severe for the large consumption of energy with the speed of economic development (Adedoyin et al. 2021a, d). The short-run effect of economic growth is positive and insignificant in the USA, while it is significant in China. This finding may be due to the difference in the level of economic development and economic structure between these two countries. In the USA, the scale effect of economic development may be offset by the technical and structure effect, while the extensive growth method in China delays the development of a low-carbon economy and emission mitigation (Huang et al. 2020). Shittu et al. (2021) also confirmed that the environmental quality of Asian countries, including China, deteriorates with rapid economic growth. Regarding energy consumption, it can be noted that the long-term coefficients in the USA and China are positive but nonsignificant in the current period. In contrast, energy consumption exerts a significant positive impact on carbon emissions in the short run. An increase in energy consumption by 1% led to carbon emission increases of 114.76% and 6.04% in the USA and China, respectively. This result echoes the findings of Adedoyin et al. (2020a), who also reported that growth in fossil fuel energy consumption is one of the determinants that hinders carbon emissions abatement. Consequently, the transformation of economic growth and energy consumption in both the USA and China to a more ecological pattern requires urgent solutions.

Robustness checks

To confirm the validity of our results, several statistical tests were performed on the dataset. The cumulative sum (CUSUM) and cumulative sum of squares (CUSUMSQ) stability tests were utilized first to ensure the structural ability of the models. As shown in Fig. 3 and Fig. 4, in addition to the CUSUMQ for the USA from 2008 to 2016 and China from 2000 to 2008 being out of the critical bound, the estimated parameters are stable for most of the cases, showing that the model coefficients calculated are basically structurally stable. We infer that the instability of the estimated parameters during 2008–2016 and 2000–2008 may be due to structural breaks of carbon emissions in the USA and China in the short term.

Furthermore, multiplier dynamic adjustments are applied to examine the asymmetries due to the EPU and oil price decomposition, as plotted in Fig. 5 and Fig. 6. The solid black lines and the black dotted lines refer to the non-linear adjustment of EPU and oil prices in response to positive shocks and negative shocks, respectively. The asymmetric pattern shown by the red dotted line is the difference between negative and positive shocks. The cumulative dynamic multiplier effect fully reflects the adjustment of carbon emissions from the original equilibrium to the new equilibrium after a unit of the negative or positive shock of EPU and oil prices. Specifically, the criteria in the symmetrical or asymmetrical adjustment of carbon emissions are to observe the directions and degrees in the adjustment of carbon emissions are consistent after a unit of the positive and negative shock of EPU or oil prices. It could be called symmetry only when the degree of the adjustment is the same and the direction is opposite. Otherwise, it is called asymmetric.

The dynamic adjustment graph of carbon emissions in the USA presented in Fig. 5a shows both long-run and short-run asymmetry. The asymmetric curve shows that the dynamic multiplier effect on positive change in EPU is negative in the first 3 months and then becomes positive. The effect of the negative change in EPU is negative except that it is positive in the fifth month. Further observation shows that the influence of the negative change is stronger than that of a positive change in most cases, and the asymmetry curve is much closer to the negative shock. Similarly, Fig. 5b demonstrates that the dynamic adjustment to the positive and negative shocks of oil prices are also asymmetric in the long and short term, and the asymmetry is more evident in the short term. For the dynamic multipliers graph of China shown in Fig. 6a, the asymmetric curve illustrates that the dynamic multiplier effect on positive change in EPU is positive in the whole sample range, while the negative change effect becomes negative. However, it is worth noting that the asymmetry curve comes closer to the negative shock because the negative change in EPU has a more substantial impact than that of a positive change. In Fig. 6b, the dynamic multiplier effect on the positive change in oil prices is positive and reaches the maximum in the fifteenth period, and the negative change is negative and peaks in the ninth period. Overall, the results are highly consistent with the empirical results regarding the asymmetric effect of EPU and oil prices obtained in the previous sections.

Finally, we also use the alternative crude oil price (Brent) to further verify the robustness of our findings. This enables us to evaluate whether the results are robust to the choice of oil price selection. The non-linear short-run and long-run coefficients of the ARDL model estimates reported in the (Tables 11 and 12) largely support the asymmetric relationship between EPU, oil prices, and carbon emissions obtained when using WTI oil prices, suggesting that the above listed non-linear ARDL results are reliable and robust to different measures of energy prices.

Conclusions

Most early studies that examined the responses of EPU and oil prices to carbon emissions relied on the assumption that the increased and decreased EPU and oil prices behave symmetrically; however, the potential asymmetric effects have been overlooked. This study aimed to investigate both the symmetric and asymmetric effects of EPU and oil prices on carbon emissions in the USA and China over the period 1995:M1–2019:M12. The investigation of the environmental effect of EPU and oil price changes is addressed by first using the linear ARDL model and then adopting the non-linear ARDL approach. The empirical results of the linear ARDL model show that in both the USA and China, the changes in EPU do not affect carbon emissions in either the short or long run, and oil prices impose a lagged impact on carbon emissions. With the non-linear ARDL model, we disclose evidence of significant asymmetric effects of EPU and oil prices on carbon emissions over the short and long run. Specifically, the negative shock in EPU significantly escalates carbon emissions in the USA neither in the short run nor in the long run. In the case of China, the positive shocks in EPU contribute to increases in carbon emissions in the long run, and both of the positive and negative shocks in EPU exert a nonsignificant influence on emissions in the short run. In other words, the carbon emissions of the USA are mainly affected by the increase in EPU, and EPU changes have a significant impact on the carbon emissions of China only in the long run. Regarding oil prices, the increased oil prices generate a positive effect in both the USA and China in the long run, whereas this effect becomes nonsignificant in the short run, and the impact of the decreased oil prices has a lag effect. Not surprisingly, growing GDP and excessive energy consumption are the main bottlenecks of emission mitigation.

Based on the above findings, the policy implications of this work are straightforward. First, the research shows that the negative change in EPU causes carbon emissions in the USA. The main concern for policy-makers is how to develop diversified energy policies and apply advanced techniques extensively for environmentally sustainable development. For China, given that the positive change in EPU deteriorates environmental quality by emitting more carbon emissions over the long-run period, it is eminent for the relevant departments to make prudent decisions from a long-term perspective when formulating economic policies to avoid the institutional costs caused by frequent unnecessary changes in relevant economic policies. In addition, gradually improving the market information disclosure system and easing the information asymmetry or shortage in the market would prevent the rise of emissions due to the increased EPU. Second, a positive shock to oil prices is a major source of carbon emissions in the long run in both the USA and China. Efforts should be made to finetune fossil energy consumption by vigorously developing green and clean energy such as solar energy or hydroenergy and guiding these two countries toward energy resource diversification and low-carbon intensification. It is also recommended that the USA and China invest in low-carbon and carbon–neutral energy resources and adopt measures of energy efficiency. Although there is a lag effect, downward oil prices aggravate environmental pollution in China. The Chinese government should accelerate the market-oriented reform of energy prices, encourage the market’s leading role in the crude oil pricing mechanism, and strengthen the commodity attribute of crude oil. This is particularly effective in the short term, as it can diminish the increase in carbon emissions caused by the overconsumption of crude oil. Finally, our findings also reveal that economic development and energy consumption are detrimental to enhancing environmental quality in the USA and China. As a result, it is expected that minimizing carbon-intensive energy use, raising the proportion of renewable energy, and promoting the exploitation and utilization of new energy-saving environmental protection technologies, equipment, and products will be conducive to pollution emission mitigation. More importantly, it would be better to establish and improve the green low-carbon circular development economic system in the USA and China.

This article builds on the framework of EPU, oil prices, and carbon emissions by providing evidence of asymmetric effects, which contributes to clarifying the role of EPU and oil prices in environmental quality. Nevertheless, there is still much work to be done. Specifically, the EPU index refers to the uncertainty related to monetary, fiscal, and trade policies, and EPU in this study is used as a unified indicator. It would be interesting to distinguish the impacts of different types of EPU on carbon emissions in a comprehensive study for further exploration. In addition, the current analysis selects only the USA and China as the major subjects investigated. Since the characteristics of economic structure and emission levels can differ in other countries, the relationships between carbon emissions, EPU, and oil prices may be subject to heterogeneity, and the results obtained cannot be validated and applied to all countries. Consequently, future work on other countries is required to generalize the environmental consequences of EPU and oil prices to seek practical solutions to alleviate the pressure of carbon emissions growth for other countries.

Availability of data and materials

The datasets used or analyzed during the current study are available from the corresponding author on reasonable request.

References

Abbasi KR, Adedoyin FF (2021) Do energy use and economic policy uncertainty affect CO2 emissions in China? Empirical evidence from the dynamic ARDL simulation approach. Environ Sci Pollut Res 28(18):23323–23335. https://doi.org/10.1007/s11356-020-12217-6

Abid A (2020) Economic policy uncertainty and exchange rates in emerging markets: short and long runs evidence. Financ Res Lett 37:101378. https://doi.org/10.1016/j.frl.2019.101378

Adams S, Adedoyin F, Olaniran E, Bekun FV (2020) Energy consumption, economic policy uncertainty and carbon emissions; causality evidence from resource rich economies. Econ Anal Policy 68:179–190. https://doi.org/10.1016/j.eap.2020.09.012

Adedoyin FF, Zakari A (2020) Energy consumption, economic expansion, and CO2 emission in the UK: the role of economic policy uncertainty. Sci Total Environ 738:140014. https://doi.org/10.1016/j.scitotenv.2020.140014

Adedoyin FF, Alola AA, Bekun FV (2020a) An assessment of environmental sustainability corridor: the role of economic expansion and research and development in EU countries. Sci Total Environ 713:136726. https://doi.org/10.1016/j.scitotenv.2020.136726

Adedoyin FF, Gumede MI, Bekun FV, Etokakpan MU (2020b) Modelling coal rent, economic growth and CO2 emissions: does regulatory quality matter in BRICS economies? Sci Total Environ 710:136284. https://doi.org/10.1016/j.scitotenv.2019.136284

Adedoyin FF, Agboola PO, Ozturk I, Bekun FV, Agboola MO (2021a) Environmental consequences of economic complexities in the EU amidst a booming tourism industry: accounting for the role of brexit and other crisis events. J Clean Prod 305:127117. https://doi.org/10.1016/j.jclepro.2021.127117

Adedoyin FF, Alola AA, Bekun FV (2021b) The alternative energy utilization and common regional trade outlook in EU-27: evidence from common correlated effects. Renew Sust Energy Rev 145:111092. https://doi.org/10.1016/j.rser.2021.111092

Adedoyin FF, Nathaniel S, Adeleye N (2021c) An investigation into the anthropogenic nexus among consumption of energy, tourism, and economic growth: do economic policy uncertainties matter? Environ Sci Pollut Res 28(3):2835–2847. https://doi.org/10.1007/s11356-020-10638-x

Adedoyin FF, Ozturk I, Bekun FV, Agboola PO, Agboola MO (2021d) Renewable and non-renewable energy policy simulations for abating emissions in a complex economy: evidence from the novel dynamic ARDL. Renew Energy 177:1408–1420. https://doi.org/10.1016/j.renene.2021.06.018

Ahmed Z, Cary M, Shahbaz M, Vo XV (2021) Asymmetric nexus between economic policy uncertainty, renewable energy technology budgets, and environmental sustainability: evidence from the United States. J Clean Prod 313:127723. https://doi.org/10.1016/j.jclepro.2021.127723

Alshehry AS, Belloumi M (2015) Energy consumption, carbon dioxide emissions and economic growth: the case of Saudi Arabia. Renew Sust Energy Rev 41:237–247. https://doi.org/10.1016/j.rser.2014.08.004

Al-Thaqeb SA, Algharabali BG (2019) Economic policy uncertainty: a literature review. J Econ Asymmetries 20:e00133. https://doi.org/10.1016/j.jeca.2019.e00133

Anasis JG, Khalil MAK, Butenhoff C, Butenhoff R, Lendaris GG (2019) Optimal energy resource mix for the US and China to meet emissions pledges. Appl Energy 238:92–100. https://doi.org/10.1016/j.apenergy.2019.01.072

Anser MK, Apergis N, Syed QR (2021) Impact of economic policy uncertainty on CO2 emissions: evidence from top ten carbon emitter countries. Environ Sci Pollut Res 1–10.https://doi.org/10.1007/s11356-021-12782-4

Apergis N, Gangopadhyay P (2020) The asymmetric relationships between pollution, energy use and oil prices in Vietnam: some behavioural implications for energy policy-making. Energy Policy 140:111430. https://doi.org/10.1016/j.enpol.2020.111430

Atsu F, Adams S (2021) Energy consumption, finance, and climate change: does policy uncertainty matter? Econ Anal Policy 70:490–501. https://doi.org/10.1016/j.eap.2021.03.013

Bakas D, Triantafyllou A (2020) Commodity price volatility and the economic uncertainty of pandemics. Econ Lett 193:109283. https://doi.org/10.1016/j.econlet.2020.109283

Behmiri NB, Manso JRP (2013) How crude oil consumption impacts on economic growth of Sub-Saharan Africa? Energy 54:74–83. https://doi.org/10.1016/j.energy.2013.02.052

Chen R, Zhang R, Han H (2021) Climate neutral in agricultural production system: a regional case from China. Environ Sci Pollut Res 28(25):33682–33697. https://doi.org/10.1007/s11356-021-13065-8

Dong F, Long R, Bian Z, Xu X, Yu B, Wang Y (2017) Applying a Ruggiero three-stage super-efficiency DEA model to gauge regional carbon emission efficiency: evidence from China. Nat Hazards 87(3):1453–1468. https://doi.org/10.1007/s11069-017-2826-2

Falk B (1986) Further evidence on the asymmetric behavior of economic time series over the business cycle. J Polit Econ 94(5):1096–1109. https://doi.org/10.1086/261423

Gulen H, Ion M (2016) Policy uncertainty and corporate investment. Rev Financ Stud 29(3):523–564. https://doi.org/10.1093/rfs/hhv050

Hailemariam A, Smyth R, Zhang X (2019) Oil prices and economic policy uncertainty: evidence from a nonparametric panel data model. Energy Econ 83:40–51. https://doi.org/10.1016/j.eneco.2019.06.010

Hamilton JD (1983) Oil and the macroeconomy since World War II. J Polit Econ 91(2):228–248. https://doi.org/10.1086/261140

Huang Y, Zhu H, Zhang Z (2020) The heterogeneous effect of driving factors on carbon emission intensity in the Chinese transport sector: evidence from dynamic panel quantile regression. Sci Total Environ 727:138578. https://doi.org/10.1016/j.scitotenv.2020.138578

IEA (2020) International energy agency. Available at: https://www.iea.org/. Accessed 17 Sept 2020

Jiang Y, Zhou Z, Liu C (2019) Does economic policy uncertainty matter for carbon emission? Evidence from US sector level data. Environ Sci Pollut Res 26(24):24380–24394. https://doi.org/10.1007/s11356-019-05627-8

Ju K, Su B, Zhou D, Wu J (2017) Does energy-price regulation benefit China’s economy and environment? Evidence from energy-price distortions. Energy Policy 105:108–119. https://doi.org/10.1016/j.enpol.2017.02.031

Katrakilidis C, Trachanas E (2012) What drives housing price dynamics in Greece: new evidence from asymmetric ARDL cointegration. Econ Model 29(4):1064–1069. https://doi.org/10.1016/j.econmod.2012.03.029

Kim D, Perron P (2009) Unit root tests allowing for a break in the trend function at an unknown time under both the null and alternative hypotheses. J Econ 148(1):1–13. https://doi.org/10.1016/j.jeconom.2008.08.019

Le HP, Ozturk I (2020) The impacts of globalization, financial development, government expenditures, and institutional quality on CO2 emissions in the presence of environmental Kuznets curve. Environ Sci Pollut Res 27(18):22680–22697. https://doi.org/10.1007/s11356-020-08812-2

Lee S, Chong WO (2016) Causal relationships of energy consumption, price, and CO2 emissions in the US building sector. Resour Conserv Recy 107:220–226. https://doi.org/10.1016/j.resconrec.2016.01.003

Li K, Fang L, He L (2019) How population and energy price affect China’s environmental pollution? Energy Policy 129:386–396. https://doi.org/10.1016/j.enpol.2019.02.020

Li K, Fang L, He L (2020) The impact of energy price on CO2 emissions in China: a spatial econometric analysis. Sci Total Environ 706:135942. https://doi.org/10.1016/j.scitotenv.2019.135942

Lin B, Jia Z (2019) Impacts of carbon price level in carbon emission trading market. Appl Energy 239:157–170. https://doi.org/10.1016/j.apenergy.2019.01.194

Liu Y, Xiao H, Lv Y, Zhang N (2017) The effect of new-type urbanization on energy consumption in China: a spatial econometric analysis. J Clean Prod 163:S299–S305. https://doi.org/10.1016/j.jclepro.2015.10.044

Malik MY, Latif K, Khan Z, Butt HD, Hussain M, Nadeem MA (2020) Symmetric and asymmetric impact of oil price, FDI and economic growth on carbon emission in Pakistan: evidence from ARDL and non-linear ARDL approach. Sci Total Environ 726:138421. https://doi.org/10.1016/j.scitotenv.2020.138421

Mensah IA, Sun M, Gao C, Omari-Sasu AY, Zhu D, Ampimah BC, Quarcoo A (2019) Analysis on the nexus of economic growth, fossil fuel energy consumption, CO2 emissions and oil price in Africa based on a PMG panel ARDL approach. J Clean Prod 228:161–174. https://doi.org/10.1016/j.jclepro.2019.04.281

Mo B, Chen C, Nie H, Jiang Y (2019) Visiting effects of crude oil price on economic growth in BRICS countries: fresh evidence from wavelet-based quantile-on-quantile tests. Energy 178:234–251. https://doi.org/10.1016/j.energy.2019.04.162

Mujtaba A, Jena PK (2021) Analyzing asymmetric impact of economic growth, energy use, FDI inflows, and oil prices on CO2 emissions through NARDL approach. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-12660-z

Narayan PK (2005) The saving and investment nexus for China: evidence from cointegration tests. Appl Econ 37(17):1979–1990. https://doi.org/10.1080/00036840500278103

Oberndorfer U (2009) Energy prices, volatility, and the stock market: evidence from the Eurozone. Energy Policy 37(12):5787–5795. https://doi.org/10.1016/j.enpol.2009.08.043

Ozturk I, Al-Mulali U, Solarin SA (2019) The control of corruption and energy efficiency relationship: an empirical note. Environ Sci Pollut Res 26(17):17277–17283. https://doi.org/10.1007/s11356-019-05016-1

Pastor L, Veronesi P (2012) Uncertainty about government policy and stock prices. J Financ 67(4):1219–1264. https://doi.org/10.1111/j.1540-6261.2012.01746.x

Pastor L, Veronesi P (2013) Political uncertainty and risk premia. J Financ Econ 110(3):520–545. https://doi.org/10.1016/j.jfineco.2013.08.007

Perron P (1989) The great crash, the oil price shock, and the unit root hypothesis. Econometrica J Econ Soc 57:1361–1401. https://doi.org/10.2307/1913712

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326. https://doi.org/10.1002/jae.616

Pirgaip B, Dinçergök B (2020) Economic policy uncertainty, energy consumption and carbon emissions in G7 countries: evidence from a panel Granger causality analysis. Environ Sci Pollut Res 27(24):30050–30066. https://doi.org/10.1007/s11356-020-08642-2

Rehman MU, Ali S, Shahzad SJH (2020) Asymmetric non-linear impact of oil prices and inflation on residential property prices: a case of US, UK and Canada. J Real Estate Financ Econ 61(1):39–54. https://doi.org/10.1007/s11146-019-09706-y

Romano T, Fumagalli E (2018) Greening the power generation sector: understanding the role of uncertainty. Renew Sust Energ Rev 91:272–286. https://doi.org/10.1016/j.rser.2018.03.098

Saboori B, Al-Mulali U, Bin Baba M, Mohammed AH (2016) Oil-induced environmental Kuznets curve in organization of petroleum exporting countries (OPEC). Int J Green Energy 13(4):408–416. https://doi.org/10.1080/15435075.2014.961468

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in a non-linear ARDL framework. In: Horrace WC, Sickles RC (eds) Festschrift in honor of Peter Schmidt. Springer Science and Business Media, New York

Shittu W, Adedoyin FF, Shah MI, Musibau HO (2021) An investigation of the nexus between natural resources, environmental performance, energy security and environmental degradation: evidence from Asia. Resou Policy 73:102227. https://doi.org/10.1016/j.resourpol.2021.102227

Ullah S, Andlib Z, Majeed MT, Sohail S, Chishti MZ (2021) Asymmetric effects of militarization on economic growth and environmental degradation: fresh evidence from Pakistan and India. Environ Sci Pollut Res 28(8):9484–9497. https://doi.org/10.1007/s11356-020-11142-y

Ulucak R, Khan SUD (2020) Relationship between energy intensity and CO2 emissions: does economic policy matter? Sustain Dev 28(5):1457–1464. https://doi.org/10.1002/sd.2098

Wang SJ, Fang CL, Guan XL, Guan XL, Pang B, Ma HT (2014) Urbanisation, energy consumption, and carbon dioxide emissions in China: a panel data analysis of China’s provinces. Appl Energy 136:738–749. https://doi.org/10.1016/j.apenergy.2014.09.059

Wang X, Bai M, Xie C (2019) Investigating CO2 mitigation potentials and the impact of oil price distortion in China’s transport sector. Energy Policy 130:320–327. https://doi.org/10.1016/j.enpol.2019.04.003

Wong SL, Chia WM, Chang Y (2013) Energy consumption and energy R&D in OECD: perspectives from oil prices and economic growth. Energy Policy 62:1581–1590. https://doi.org/10.1016/j.enpol.2013.07.025

World Bank (2020) World development indicators. Available at: http://www.worldbank.org. Accessed 25 Feb 2020

Yu J, Shi X, Guo D, Yang L (2021) Economic policy uncertainty (EPU) and firm carbon emissions: evidence using a China provincial EPU index. Energy Econ 94:105071. https://doi.org/10.1016/j.eneco.2020.105071

Yuan C, Liu S, Wu J (2010) The relationship among energy prices and energy consumption in China. Energy Policy 38(1):197–207. https://doi.org/10.1016/j.enpol.2009.09.006

Zhang SF, Hu TT, Li JB, Cheng C, Song ML, Xu B, Baležentis T (2019) The effects of energy price, technology, and disaster shocks on China’s Energy-Environment-Economy system. J Clean Prod 207:204–213. https://doi.org/10.1016/j.jclepro.2018.09.256

Acknowledgements

We would like to express our sincere gratitude to the editor, Professor Roula Inglesi-Lotz, and the anonymous referee for their constructive comments and suggestions, which are helpful to improve the quality of this paper greatly. Of course, any remaining errors are our own.

Funding

This research is partly supported by the Open Fund Project of Key Research Institute of Philosophies and Social Sciences in Hunan Universities (20FEFMZ3).

Author information

Authors and Affiliations

Contributions

ZWH: conceptualization, formal analysis, visualization, writing-original draft; HY: conceptualization, writing-review and editing, investigation; WH: data curation, methodology, software, supervision. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

This study did not use any kind of human participants or human data, which require any kind of approval.

Consent for publication

This study did not use any kind of individual data such as video and images.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Zhang, W., Huang, Y. & Wu, H. The symmetric and asymmetric effects of economic policy uncertainty and oil prices on carbon emissions in the USA and China: evidence from the ARDL and non-linear ARDL approaches. Environ Sci Pollut Res 29, 26465–26482 (2022). https://doi.org/10.1007/s11356-021-17839-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-17839-y