Abstract

The core purpose of the study is to examine the asymmetric effect of foreign direct investment (FDI) and population health (measured by life expectancy index). The study takes time series data for 1980–2020. The non-linear autoregressive distributed lag (NARDL) bound testing to cointegration approach is applied to scrutinize an asymmetric association among foreign direct investment, government expenditures, trade openness, public debt, and population health. The study also used an asymmetric causality test to investigate the causal association between the measured variables. The findings affirm that cointegration exists between the variables in the occurrence of asymmetries. The asymmetric causality outcomes confirm that only positive changes in FDI have bidirectional causality to life expectancy while negative shocks have unidirectional that runs from FDI to life expectancy. The government expenditure and foreign direct investment also provided evidence of social sector health welfare in Pakistan. The output shows that increasing government expenditure can cause an increase in life expectancy while decreasing government expenditure can cause a decrease in life expectancy. The study found that investment in health care medical services is paramount to better results as far as government assistance (welfare) gains. The outcomes of the study have given numerous policy suggestions to boost life expectancy in the general public of Pakistan.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The part of foreign direct investment in monetary and human improvement has been scrutinized in an assortment of settings going over development and innovation or technology move to income discrimination and environmental and ecological pollution. “Health by means of an essential portion of development” (Chudnovsky, & Lopez, 1999; Worster, 1993; UNDP, 2018). As per these features can interrupt access to health care, predominantly in lower middle-income countries wherever collaboration to care is powerfully reliant on ability to pay, it may be the case that FDI is constructively accompanying through population health (Verma, 2021; Burns et al., 2017; Alsan et al., 2006). Moreover, foreign direct investment can provide financial assistance to increase health environment in the host countries but foreign organizations do not individually compensate healthier incomes than the native businesses resulting in providing their labors with better public facilities and safe workspaces (Burns et al., 2017; Nagel et al. 2015; Herzer & Nunnenkamp, 2012). When there is a non-linear effect of foreign direct investment with health population, FDI remains connected by negligible life expectancy used for a smaller sample of advanced host nations (Herzer & Nunnenkamp, 2012).

As these components could impact of medical care administrations or services, especially in low and middle-income country wherever collaboration to mind is seriously dependent upon ability to pay, it may be the paradigm that FDI is accommodatingly associated with population health. However, foreign direct investment possibly will help with increment health infirmities in the host nations but foreign associations not simply paid better wages than the nearby firms yet furthermore outfitted their representatives with better amicable social offices and safe workplaces (Herzer & Nunnenkamp, 2012; Azemar, & Desbordes, 2009). In their study, Herzer and Nunnenkamp (2012) and Nagel et al. (2015) exhibited the non-linear influence of foreign direct investment and health.

FDI is connected with more terrible life expectancy for a little illustration of 14 profoundly created (progressed) nations (Herzer & Nunnenkamp, 2012). In particular, we anticipate that FDI should have more constructive outcomes on health in developing nations, contrasting the adverse consequences in the profoundly progressed nations (Benach et al., 2007 and Giammanco, & Gitto, 2019). In the study of Immurana (2020), he confirmed that the health-debilitating impacts of foreign direct investment are more than equipoise slightly population health as well as intensifying impacts of FDI fluctuating greatest in relations of normal employee wages. Moreover, in the previous literature, the mostly ignored area of the study is a non-linear/asymmetric impact of FDI on population health. To the best of the creator’s information, there are lacking/inadequate investigations which try to empirically evaluate the non-linear effect of FDI on health in setting of Pakistan.

Health sector issues in Pakistan

From the period of independence, the Pakistan’s health sector has ignored. The area of health shows vital position in the social welfare along with amassing efficiency of labor force, diminishing the poverty (Economy Survey of Pakistan, 2019–2020). Investment in health sector is observed as a fundamental part of the régime’s poverty mitigation. Here, it has perceptible development in various factors in health sector; however, Pakistan ranks weakly preceding this description. Generally, in Pakistan, the life expectancy index persists smaller than several in his aristocrat group, whereas mortality rates of newborn are maximum (Hassan et al., 2017; Economic Survey of Pakistan, 2018–2019; UNDP, 2017).

The health sector in Pakistan is effectual. The health care has faced several disadvantages, low quality and inefficiency in health structure, deficiency to scrutinizing the policy of health area, planning, shortage of skilled employees, and corruption in health system (Abdullah et al., 2014; Kurji et al., 2016; Hassan et al., 2017; Khalid, & Abbasi, 2018). Moreover, there is a great deal of debasement in medical care framework because of bureaucrat force of individuals associated with strategy making. Subsequently, people do not have comparable way to deal with clinical consideration administrations and medical service assets or resources are not similarly disseminated (Ejaz et al., 2011; Kurji et al., 2016). Therefore, in Pakistan, the health sector has a worsening situation during the earlier 50 years due to the abovementioned limitations. One generous macroeconomic factor of health may be foreign direct investment, and is extensively perceived to help development and improvement and extensions in remuneration and overall chipped away at working conditions in low-income and focus-income nations (Blouin et al., 2009; Giammanco, & Gitto, 2019; Gökmenoğlu et al., 2018).

Since the most recent few years, the circumstance in health area and correlated factors in Pakistan has revealed a different pattern. In Pakistan, the life expectancy proportion is exceptionally low, with a more critical degree of mortality as well. At birth, the life expectancy has verified from 55 to 65 years which is astoundingly low when appeared differently in relation to other created and creating economies in predominant world. Moreover, the proportion of mortality rate under five is in scope of 78–112 since the last many years. This figure clarifies that expressed rate of 77.5 exists extremely above average, moderately to the established United Nations International Children’s Emergency Fund before finish of 2017 which stands 25 demises for each 1000 (UNCEF, 2019).

Pakistan is challenging the mortality rate which is multiple points upper than another region like South Asia. The condition of newborn child mortality in Pakistan is not good. Since 2001 to 2017, infant mortality rate (IMR) has additionally knowledgeable rate of about 64.9 in 2017 which is still at sketchy position. In other adjacent nations similarly Maldives, Bangladesh, India, Bhutan, Nepal, and Sri Lanka, this percentage is registered as per 9, 33, 41, 30, 32, and 8 respectively (Statista, 2018). So as contrast with these nations, in South Asian region, Pakistan is as yet facing a most elevated ratio of IMR.

Furthermore, Pakistan is facing health problems like weight of tuberculosis, and endemic polio, the event of neonatal, lack of healthy sustenance (malnutrition), diarrhea, and intense respiratory disease. Moreover, according to the discoveries of the United Nations International Children’s Emergency Fund, in Pakistan, under 5 years, 45% of the kids are out of hindered, which occurs as the 3rd highest percentage in the world (United Nations Children’s Fund, 2018). It is additionally described that the problem about taking care of kids is as yet a continuous issue as just 39% of kids are breastfed which is absolute at the first 6th months of childbirth. However, younger than five, 54% of the kids are confronting the lack in vitamin A (UNICEF, 2018). Moreover, just 55% of the kids are gaining vaccinations for the period of 11–22 months, whereas 88 obtainable of 1000 are conceived alive and die prior to arriving at 5th year birth. Practically, the HIV-positive patients have 26.9% of the total populace in which they utilize the medications and their other family members such as spouse and children face high risk (United Nations Children's Fund, 2018).

Drinking water survive a lot of critical in health outcomes. Pakistan faced endless health problems which provide evidence in most recent times because arsenic drinking explicitly affected a highly populated area of Punjab and other different areas (Daud et al., 2017; Khan et al., 2017; Bhowmik et al., 2015; Azizullah et al., 2011). In Pakistan, 80% of the people used polluted toxic drinking water, while only 20% of the population have used pure water (Daud et al., 2017).

Moreover, drugs and clinical gear stand non-replenished on an ordinary base (Pakistan Bureau of Statistics, 2019). The explanation follows that amount of unskillfulness clinical specialists is exercised with no conventional permit or degrees. The issue of ladies has an exceptionally low admittance to medical service facilities and primarily they rely upon their men. Culture and tradition factor does not allow women to move alone without the consent of their men.

The situation is likewise tracked down that in popular various rural regions, 43% of the clinical exhibits that there is no female clinical consultant, even though repose of the focuses has just a single female specialist doctor. Top to bottom examination of tehsil central quarters clarifies the way that out of 279 absolute emergency clinics, 205 are with no clinical expert, particularly a gynecologist (DHS, 2019).

Even though the health-associated issues are focusing on the general economy, a few endeavors have been built in government supervision. The issue is a typical wonder that government or administration authority is clearly liable to giving health services. In Pakistan, the medical service offices are extending with the progression of time, though the speed is moderate. As of now, there are 1165 public emergency clinics and care focuses, 5695 health units as dispensaries with 5459, and 729 mother and child care focuses having clinical experts as specialists’ doctors, drug specialists, and nurses (PBS, 2019). Before the finish of 2016, according to the findings of PBS, one specialist doctor for every 1039 people, one bed for each 1614 patients, and one dental specialist for every 11,512 people are obviously giving the proof that health area is suffering from the low-level services and facilities in Pakistan which is a prerequisite genuine consideration from the régime. In particular, the administration is consuming just 0.69% of GDP-arranged medical care which is extremely small when contrasted with the WHO suggestion of 5%. It is affirmed that right around 71% population relies on private sector however, receiving the medical health care facilities among just 22% depending upon public administrations. They suggest that medical care of 62% people is being met through private financing. Families are compelled to utilize the preserve assets to reimbursement for medical care. These are supposed cash-based uses. Furthermore, the private offices identified with health care are generally given in metropolitan regions and consequently making a gap in administrations in the individuals who are inhabiting in available rural regions (Pakistan Bureau of Statistics 2017).

Specifically in South Asia, foreign direct investment has a crucial role in the development and population health outcomes but then inconsistency in findings affirms that there is still a gap needed to be filled. Due to the significance of FDI in the context of population health, a conventional literature on this area is available. These studies focus on asymmetric effect of public debt, trade openness, foreign direct investment, and government expenditure on health population. Results show the mixed picture in different developing countries. To fill this gap, it is inevitable to check non-linear effect of FDI, government expenditure, and health from the evidence of Pakistan.

Foreign direct investment and population health (a review)

The present part is dealing with the review of literature, the effect of the foreign direct investment on the health for the social sector. In addition, various studies which include foreign direct investment and public investment (government expenditures) as a major explanatory variable have also been considered. While this writing “appears to have arrived behind schedule of steam,” the impacts of FDI on significant dimensions of the quality of life, for example, health situations are among the wide exhibit of neglected issues (Nagel et al., 2015; Blonigen & O'fallon, 2011). The connection among FDI and health is tended to by posting a sound labor force among the factors of area decisions in foreign stockholders (Hassan et al., 2017; Azemar & Desbordes, 2009; Alsan et al. 2006). Olayiwola et al. (2019) explored the relationship between the human capital, FDI, and health population. The study showed a panel random impact of the Economic Community of West African States from 1980 to 2018. The findings proposed that FDI have insignificant and positive effect with population health.

Beşe and Kalaycith (2021) investigated the non-linear relations between foreign direct investment and trade openness on the life expectancy used for the time span 1974–2017. In the long run, non-linear ARDL model is also used to analyze the non-linear relationships between the variables. The outcomes of asymmetric causality affirmed that FDI and trade openness to life expectancy are running the unidirectional causality. The findings of this study also confirmed that long run positively and significantly and association exist between foreign direct investment and life expectancy in Turkey.

There are a couple of studies accessible that analyze the influence of foreign direct investment and public population health and human development (Rodrik et al., 2004; Kaulihowa, & Adjasi, 2019) is one of the prior investigations which asserted that FDI expands business openings and further develops working conditions that decidedly influence life expectancy of workers. In their study, Kaulihowa and Adjasi (2018) investigated the non-linear effect of FDI on welfare. The study employed a panel of the twenty African states from the span 2000–2013. Applying the panel data analysis, cross‐sectional dependency and heterogeneity were applied. The outcomes of the study revealed that foreign direct investment had improved welfare, the non-linear impact on welfare. In the multifactor factor, the rise in the non-linear effect is lower than the linear part. Furthermore, the findings confirmed that foreign direct investment is eventually welfare amplifying; on the other hand, a nonmonetary factor is applied.

Nagel et al. (2015) analyzed the asymmetric impact of foreign direct investment on life expectancy such as health population, applying a panel of 179 countries over the time span of 1980–2011. The core findings of the study indicated that the non-linear associations exist between FDI and health which also depend upon income: the positive change in FDI on health with low income, but the impact decline with rise level of income, so this fluctuation converts gradually negative sign with larger income. Outreville (2007) analyzed the effect of foreign direct investment and health over amplification of health care sectors in developing economics.

Theoretically, it will in general be contended that there are different networks by which FDI might impact health. In any case, there is a wide extent of writing (Borensztein et al., 1998; Yanikkaya, 2003) which contends that public investment, foreign direct investment, and trade openness have boosted up growth. If FDI, government investment, and trade openness have positively identified on economic growth, the issue will be significantly aimed at life expectancy as higher pay helps with bearing the expense of better food and sustenance, clinical medical service therapy, and interest in better living and working conditions that essentially upgrade. Thus, there is a non-linear effect of FDI and public private investment on life expectancy index and human development index (Beşe & Kalayci, 2021; Kaulihowa, & Adjasi, 2019). The concentrate is the innovation and technology transmission move. Numerous previous studies (Papageorgiou et al., 2007; Ciruelos & Wang, 2005; Xu & Wang, 2000) have found that the FDI and trade openness are the method for innovation or technology diffusion, overall health.

Moreover, the foreign direct investment raises income and expansion in pay prompts an increment in consumptions (both local and public) on products that further develop populace health, like food, clean water and disinfection, and clinical consideration; then, at that point, a rise in FDI ought to further develop health population. The development improving impacts of FDI is robust in lesser than more extravagant countries (Smarzynska Javorcik (2004) and Blonigen & Wang (2004)). Yet, an expanding portion of income is frequently spent on medical care and quality food sources (like meat, vegetables, lean, fish, natural products, and bananas) as pay rises, the well-being capacity does not really have decreasing returns (Zarsky, 1999; Herzer & Nunnenkamp, 2012). The study explicitly performs that “medical services is conceivably a prevalent decent (Waldmann, 1992; X. Xu & Sylwester, 2016; Papageorgiou et al., 2007).”

The substantial assortment of research is the effect of environmental pollution with health outcomes. The elective interpretation stands that foreign direct investment increases environmental expectations (determined in innovative enhancements) and makes the purported contamination aureole impact of exchange harmless to the ecosystem innovation and skill overseas (Haibo et al., 2019; Liu et al., 2018; Zarsky, 1999). The presumption behind this view is that in developed countries, FDI is intrinsically cleanser than local firm. As needs be, a more elevated FDI can prompt longer government/public investment on health outcomes. The public administration facilities expand to good health. The expression of (Rodrik, 1998) “public spending is utilized social protection in contradiction of outside hazard.”

Also, foreign direct investment has further developed health population results as even or market looking for health area FDI construct supplementary clinical goods and services (medical tool and pharmaceuticals) accessible on minor costs than previously (Idrees, & Bakar, 2019a, 2019b). Despite the fact that the incidence of international businesses delivering strength elevating items can add to better health, foreign direct investment can harm health if FDI is in areas producing health-harming items like unhealthy foods, tobacco, and alcohol.

It is additionally examined that FDI is an inspirational factor to advance monetary development, working on occupied ailment in local market, giving improved incomes in low-income countries. These indicators can impact the admittance of medical care measures, and in all the extra explicitly center pay nations somewhere, medical care is absolutely relying on compensable limits of the people. Under such circumstance, local firms will give better friendly and medical facilities to workers (Lai & Sarkar, 2017; X. Xu & Sylwester, 2016; Moran, 2005; Feenstra & Hanson, 1997a, 1997b).

Alsan et al. (2006) used methodological implication of fixed effect, endogeneity, and correlation. The study affirmed that foreign direct investment is helpful to the health indicator like life expectancy. The outcomes of the study demonstrated significant and positive influence of FDI on overall health (age mortality); however, no relationship exists in child mortality. Stevens et al. (2013) have analyzed the nexus of the trade openness’s and health outcomes. The study used panel data from the time span 1970 to 2005. The findings revealed that trade openness has positive effect of infant mortality (IM) rate in under-one and the under-five infant mortality rate. Stevens et al. (2013) and Owen and Wu (2007) affirmed that the non-linear relationship exists between trade openness’s and health outcomes. Qadir and Majeed (2018) examined the effect of trade openness and life expectancy from spanning period 1975 to 2016. The findings exhibited that openness has a negative association among life expectancy and openness of trade in Pakistan. Alsan et al. (2006) affirmed a positive relation between the foreign direct investment and life expectancy index.

Data and methodology

This section is explaining data and methodology. The explanation that we have picked to examine Pakistan, just as its significant investment and health factors, will likewise be introduced in the information data section.

Data and variables

Pakistan is scrutinized as a fascinating contextual investigation as the nation state has appreciated critical advancement in accomplishing life expectancy. As per the World Bank (2020), the life expectancy partakes enhanced altogether over 52 years in 1973 and to 66 years in 2020. Moreover, enduring different local and global conflicts, huge political insecurity, and ascent of various radical troops, Pakistan has figured out how to get a lot of FDI of 1309 million US$ in 2019 which is multiple stages of further 1972. The ideas inspire to investigate the effect of foreign direct investment on life expectancy in Pakistan. The World Development Indicators (2020) have collected the data on FDI (in % of GDP), public debt (in % of GDP), government/public expenditures on health (in % of gross domestic product), and trade openness. Various proxies of population health are utilized by different economists, as shown in our previous studies above. Population health can be measured by life expectancy index, used by the UNDP to measure the population health.

The non-linear ARDL approach

In the literature, the relationship between foreign direct investment and population health has been examined using several time series techniques, such as cointegration, error correction modeling, and Granger causality. The foremost weaknesses of these methods contain the postulates of asymmetric association between variables and the linearity, and the time-varying independence behavior. Innovative examination in this arena has involved higher magnitude of non-linear and asymmetric association among the variables. Several connections among macroeconomic factors will in general follow a non-linear way instead of the more normal linear assumptions. The speed at which macroeconomic factors interchange the descending way is frequently not equivalent to that of the upward side, consequently proposing non-linear conduct. Thus, the data content installed in linear relationships might be improper in making solid inference (Shin et al., 2014). Subsequently, we decide to utilize the non-linear ARDL bound test to cointegration approach produced through (Shin et al., 2014). Also, dissimilar to the model’s error correction somewhere, the order of integration is measured, time series ought to be something similar, and the non-linear ARDL paradigm loosens up this limitation and takes into consideration a blend of various incorporation instructions. The adaptability has a vital role, as per displayed by Hoang et al. (2016). Lastly, the technique likewise tackles the multicollinearity issue by picking the suitable slack order factors. The asymmetric/non-linear autoregressive distributed lags technique suggested in Shin et al. (2014) addresses the error correction term (ECT) asymmetric as observed:

In Eq. (1), \({\lambda }_{i}\) symbolizes the long-term coefficients, although \({\theta }_{i}\) designates the short-term coefficients through \(i=1..\dots .k.\) They evoke that a short-term result is proposed to evaluate the direct effects of exogenic variable fluctuations to the predict variable. By difference, a long-term study is developed to estimate the response of time with rapidity adjustment regarding a symmetry level. The study also employs the Wald test to establish the long-term asymmetry \(\lambda {= \lambda }^{+}={\lambda }^{-}\) and short-term asymmetry \({\theta = \theta }^{+}={\theta }^{-}\). Akaike information criterion (AIC) has determined optimal lags P (response variable (LEI)) and q which are represented by measured variables (FDI, DEBT, GOV, and TOPN).

Decomposition of the explanatory variables in negative and positive changes of partial sums for rises and declines is as follows:

with \({x}_{t}\) representing FDI, DEBT, GOV, and TOPN.

To assess the occurrence of an asymmetric long-run cointegration, Shin et al. (2014) represent the bounds cointegration, and it is a joint trial of the multitude of lagged levels of regressand. They utilized the t-statistic and the F-statistic test (Banerjee et al. (1998) and Pesaran et al. (2001)). The t-statistic tests the null hypothesis \(\theta =0\) beside the alternative hypothesis \(\theta <0\). The F-statistic tests the null hypothesis \({\theta }_{k}={\theta }^{+}={\theta }^{-}=0\). Therefore, the null hypothesis is rejected; then, no cointegration exists in the long run among the variables.

Finally, in step 4, we use the asymmetric ARDL model (1) to develop the asymmetric cumulative dynamic multiplier impacts of a unit change in \({x}_{t}^{+}\), \({x}_{t}^{-}\) respectively, \({on x}_{t}\):

Note that as h → ∞, then \({m}_{h}^{+}\)→\({\beta }^{+}\) and \({m}_{h}^{-}\)→\({\beta }^{-},\) where \({\beta }^{+}\) and \({\beta }^{-}\) are the asymmetric long-run coefficients calculated as \({\beta }^{+}\) = \(\frac{-{\theta }^{+}}{\rho }\) and \({\beta }^{-}\) = \(\frac{-{\theta }^{-}}{\rho }\) respectively.

Test of asymmetric causality

To examine the asymmetric/non-linear associations among the dependent and explanatory variables, this study claims the non-linear causality approach suggested by Hatemi-J (2012). The study investigates the asymmetric causal relationship among the estimated integrated variables; for instance, \({Z}_{1t}\) and \({Z}_{2t}\) variables can be expressed as following the arbitrary method as:

where \({Z}_{10}\) and \({Z}_{2o}\) coexist the constants, and \({\vartheta }_{1i}\) and \({\vartheta }_{1i}\) are the error terms that must be white noise. Both the positive and negative shocks can be written as \({\vartheta }_{1t}^{+}=\mathrm{max }({\vartheta }_{1i}, 0)\) and \({\vartheta }_{2t}^{+}=\mathrm{max }({\vartheta }_{2i}, 0)\), \({\vartheta }_{1t}^{-}=\mathrm{min }({\vartheta }_{1i}, 0)\) and \({\vartheta }_{2t}^{-}=\mathrm{min }({\vartheta }_{2i}, 0)\). Therefore, the residuals derived will be the sum of positive and negative shocks as \({\vartheta }_{1i=}{\vartheta }_{1t}^{+}+{\vartheta }_{1t}^{-}\) and \({\vartheta }_{1i=}{\vartheta }_{1t}^{+}+{\vartheta }_{1t}^{-}\). After decomposing into positive and negative shocks, then \({Z}_{1t}\) and \({Z}_{2t}\) can be written as

Finally, both the positive and negative shocks of each variable can be written as.

\({Z}_{1t=}^{+}{\sum }_{i=1}^{t}{\vartheta }_{1i}^{+}\) and \({Z}_{1t=}^{-}{\sum }_{i=1}^{t}{\vartheta }_{1i}^{-}\), and \({Z}_{2t=}^{+}{\sum }_{i=1}^{t}{\vartheta }_{2i}^{+}\) and \({Z}_{2t=}^{-}{\sum }_{i=1}^{t}{\vartheta }_{2i}^{-}\).

After identifying the negative and positive changes in separate variables, the next step is to estimate the causal relationship between the positive cumulative shocks and negative cumulative shocks. Let us assume that \({\vartheta }_{t}^{+}={\vartheta }_{1}^{+}+{\vartheta }_{2}^{+}\); in order to analyze the causality among the variables, the resulting VAR (vector autoregressive) technique to order q can be written as:

where \({Z}_{t}^{+}\) is the 2 × 1 vector of variables, while v is the 2 × 1 vector of intercepts, and \({\mu }^{+}\) is the vector of residual term.

Conclusions and explanations

The research of study initially introduces descriptive analysis and outcomes of the unit root (ADF, PP, and Zivot and Andrews) test. In this subsequent subcategory, firstly, the study investigates the findings of the asymmetric/non-linear ARDL cointegration approach (Shin et al. 2014). Secondly, the study also examines the asymmetric causality technique, which is developed by Hatemi-J (2012).

Descriptive statistics and correction

Tables 1 and 2 present the findings of the descriptive statistics and correlations. The mean of the GOV and LEI are lesser than FDI, DEBT, and TOPN. The Jarque–Bera test provides evidence of data normality since the probability magnitudes of all considered variables are greater than 1% level of significance (0.822, 0.567, 0.816, 0.115, and 0.338 > 0.01) for standard performance, LEI, FDI, DEBT GOV, and TOPN respectively from Table 1, and the standard deviations are highest for FDI and the lowest to TOPN and LEI indicating the magnitude differed from the mean value. This characteristic of the series shows that the inevitability depends on asymmetric procedures.

In the pair-wise correlation, there exists positive correlation between foreign direct investment (FDI) and life expectancy (LEI). Government expenditure (GOV) is positively correlated with LEI. A positive correlation is also found between DEBT and LEI. Moreover, the highest value in this correlation matrix is 0.890 which shows that FDI and LEI are highly correlated.

The subsequent phase is to be located to analyze the factors of stationarity properties, which confirm that no one is incorporated in the second order I (2). These criteria should achieve in light of the fact that the non-linear ARDL approach of Shin et al. (2014) comprises that the factors be coordinated at level I (0) or first order I (1) to analyze the cointegration which occurs among the dynamics. In support of this reason, the study employed augmented Dickey-Fuller (1979), Zivot and Andrews (1992), and Phillips-Perron (PP, 1988) unit root tests. The consequences of ADF and Phillips-Perron tests are displayed in Table 3. It was found that all the variables (LEI, DEBT, GOV, and TOPN) except FDI are found to be non-stationary on (intercept + trend) level. But this stationary developed by taking the first difference. The tests of PP and Zivot and Andrews make equivalent pragmatic suggestion.

Perron (1990) noticed that the stationary test for unit root issue of series possibly will cause underlying deviations, and investigators ought to recall that conventional unit root tests may give one-sided (biased) observational outcomes. The testaments of unit root might acknowledge a false null hypothesis by expressing those cycles as stationary; however, the structural break can happen. The capability of bias increases the problem of fostering unit root analysis and structural breaks toward accomplished solid exact outcomes. Moreover, Kim and Perron (2009) claimed that conventional tests of unit root give questionable outcomes because low instructive force and helpless magnitude circulation, in place of primary breaks occurring, are dealt with asymmetrically non-individual null hypothesis, nevertheless similarly accessible alternative assumption. This gap is addressed through using unit root practice which includes a single unidentified structural break (Zivot & Andrews, 1992). Moreover, this experiment obliges a primary break point in the example work with an obscure date in both the null and alternative hypotheses. The test outcomes are demonstrated in Table 4.

The results confirmed that none of the variable is not stationary at second order 1 (2). From now, the study established non-linear bound test to cointegration approach.

Cointegration results

This section of study is aimed to examine the long-run asymmetrical relationship between life expectancy index, LEI, and positive and negative shocks of explanatory variables FDI, DEBT, GOV, and TOPN. A detailed description of analysis and the major findings are what will follow in subsequent sections.

Bound test of linear and non-linear cointegration: life expectancy index

The results of linear and non-linear cointegration based on bound testing cointegration approach are demonstrated in Table 5. The outcomes of model have F-test values for symmetric and asymmetric cointegration.

For symmetric cointegration (linear ARDL), the calculated F-statistics value (2.734) is less than the lower bound value 3.41 at 1% level of significance. However, the F-test value for the asymmetric cointegration exceeds the upper bound value (9.397) that confirm presence of non-linear cointegration/hidden cointegration among the life expectancy index and explanatory variables of FDI, DEBT, GOV, and TOPN. The presence of cointegration among the purposed variables motivates to move forward for the short-term and long-term association among dependent and explanatory variables for this model.

Dynamic non-linear estimation of model, life expectancy index

First, we check some of the diagnostic dimension’s similar Ramsey’s reset, heteroscedasticity, normality, and serial correlation for analyzing the appropriateness of dynamical specifications. As presented in Table 6, anticipated models of life expectancy index developed such tests for the reason that heteroscedasticity, functional form, lagged correlation or serial correlation, and not-normality continue to exist absent with 5% significance. The \({R}^{2}\) value is about 0.871, which shows high power of independent variables in explaining the changes of the dependent variable and value of F-statistics indicating the better fit exhibited by the estimated model. Thus, the study can move forward to discuss short-run asymmetric dynamics as presented in Table 6. Regarding the short-run equation of the life expectancy index, the speed of adjustment shown by the coefficient of LEI (− 1) happens negative and significant emphasizing the persistence of long-run association among regressand and regressor variables for this model.

The short-run results of this model provide evidence for the presence of asymmetry as well. The positive signs of coefficients of positive and negative shocks of FDI and GOV are found to have positive and significant impact on life expectancy index of Pakistan. A positive change in DEBT has positive influence on life expectancy index while the negative change in DEBT has a negative impact with life expectancy index, and negative and positive changes of DEBT are statistically significant. The coefficients of TOPN which have positive and negative changes are negatively correlated to life expectancy index of Pakistan.

From the estimated results in Table 6, the long-run equation for this model is calculated from the cointegration equation and demonstrated in Table 7.

The asymmetric long-run findings confirmed that foreign direct investment and government expenditures on health have the long-run asymmetric relationship with life expectancy index of Pakistan at 5% level of significance. It is clear from the results that 1% increase in foreign direct investment leads to increase in life expectancy index by 0.064% in the long run. However, the study also finds direct relationship between negative change in foreign direct investment and life expectancy index. It means 1% decrease in foreign direct investment leads to decrease life expectancy index by 0.249% in the long run. These results are supported by the previous research by Idrees and Bakar (2019a, 2019b); Gökmenoğlu et al. (2018); Burns et al. (2017); Alam, Shahbaz, and Abbas (2016); and Reiter and Steensma (2010). As numerous previous studies (for example Ciruelos & Wang, 2005 and Xu & Wang, 2000) have affirmed FDI, the method for innovation, technology diffusion, and general health can be worked over the amplified contact toward innovative technologies for pharmaceuticals, medical treatment, and water sanitation.

In the long run, also for GOV, positive and negative shocks are positively and significantly linked to life expectancy index. These results are supported by the previous studies (Kim & Lane, 2013; Fadilah et al., 2018; Ahmad, & Hasan, 2016; van den Heuvel, & Olaroiu, 2017; Railaitė, & Čiutienė, 2020). For TOPN, both positive and negative shocks are negatively related to life expectancy index in the long run but positive component of TOPN is significant while a negative component is insignificant. There are some assessments which reason that the rise of trade openness has negative effect on public health outcomes. The open economy may endure the quicker spread of contagious infections, for example, H5N1 and HIV avian flu infection with the genuine danger to populace health (McInnes and Lee, 2012; Kawachi et al., 2006; Kimball, 2016). Trade openness and health can be likewise be negatively related through the impact of income inequality (Bergh & Nilsson, 2008; Farooq et al., 2019; Dreher & Gaston, 2008; McInnes and Lee, 2012). For DEBT, positive and negative shocks have found to be negative impact on life expectancy index, but both positive and negative changes of DEBT are significant. That is to say that, the upper a country’s responsibility, the further probable the nation stands to practice financial difficulty while an outcome of the issue liability provision compulsions and the arduous government to tackle monetarist capitals are designed for societal expenditure (Gohou & Soumare, 2012). The higher a nation’s obligation, the more probable the country is to practice monetary misery because of its obligation debt servicing, and the inflexible it is for the government to get to monetary assets for social expenditure (Kawachi et al., 2006; Gohou & Soumare, 2012; Anetor et al., 2020). It is important to conclude the long-run and short-run analysis of life expectancy index that the coefficient values of negative and positive shocks of explanatory variables, FDI, GOV, TOPN, and DEBT in model are not same, which provides evidence of the existence of asymmetric relationship between dependent and independent variables in both the long run and short run in Pakistan. The empirical findings also suggest positive shocks of FDI making greater change in life expectancy index of Pakistan than negative shocks in both the long run and short run.

In calm to confirm the applicability of Wald test of an asymmetric model, it has been applied for both short-run (WSR) and long-run (WLR) symmetries, as demonstrated in Table 8. The results for life expectancy index confirm that all macroeconomic variables perform asymmetrically in long term. More specifically, the magnitude of FDI positive and negative shocks of the Wald test is found 6.593 (p-value = 0.030), while for the GOV positive and negative shocks, it is found 39.14 (p-value = 0.000) in the long run. Moreover, the short-run symmetric hypothesis is also tested. In the short run, all the other variables reject the null hypothesis of symmetric relationship in the short run except for TOPN which shows a symmetric relationship to life expectancy index in the short run. More specifically, the short-run coefficients of FDI and GOV are positive and statistically significant at 5% level of significance.

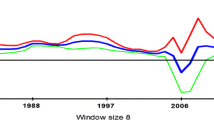

In case of long-run dynamic multipliers of life expectancy index, which are depicted in Fig. 1, the upper dotted line represents the cumulative dynamics of explanatory variables, FDI, DEBT, GOV, and TOPN with respect to a 1% increase in explanatory variables while the lower dotted line denotes the impact of 1% negative shocks of explanatory variables on life expectancy index. The blue thick line between the 95% confidence intervals presents the change between positive and negative responses. The overall impression is that responses of life expectancy index to negative and positive shocks of FDI, DEBT, GOV, and TOPN have been identified by the quick reaction for the first year. But response to the positive and negative change is captivated after around 2 years to acquire an equilibrium state. Moreover, for this model, an overall positive link exists among variables because positive shocks in FDI, DEBT, GOV, and TOPN have dominating positive effects on life expectancy index, LEI.

The asymmetric causality results of life expectancy index

The study investigated the linkages between variables by employing a recent approach of Granger causality developed by Hatemi-J (2012), which is asymmetric or non-linear means that it explains the impact of positive or negative shocks of one variable on the other. In the decision phase, modified WALD test statistics is compared to critical values in different significance levels. If MWALD test statistics value is greater than the critical value at any significance level, it means that there is causation link between shocks and alternative hypothesis is accepted. Whereas most of the literature in the study context uses these approaches based on positive shock only, the present study contributes to the literature by analyzing the impact of both the positive and negative shocks of one variable on the other. For model life expectancy index measured by health population, the results from asymmetric Granger-causality analysis are presented in Table 9. The results clearly indicated the evidence of existence of asymmetric Granger causality between dependent variable life expectancy index (LEI) and explanatory variables FDI, DEBT, GOV, and TOPN.

The results of model LEI also based on the Wald test statistic that is used for positive and negative shocks of the null hypothesis for non-Granger causality are rejected at the 5% and 10% level of significance in all cases. There is unidirectional causality among variables of this model that runs from positive FDI shock to positive LEI shock, positive GOV shock to positive LEI shock, negative LEI shock to negative GOV shock, negative TOPN shocks to negative LEI shock, and negative DEBT shock to positive LEI shock.

The outcomes evidently revealed that the asymmetric Granger-causality evidence exists between dependent and independent variables. More specifically, this outcome suggests also that increasing the FDI can cause an increase in LEI which will enhance the social welfare in Pakistan. Government expenditure (GOV) also provided the evidence for social welfare in Pakistan as both decreasing and increasing shocks can cause LEI and its welfare indicators. The output shows that increasing GOV can cause increase in LEI while a decreasing GOV can cause a decrease in LEI. These findings are aligning with the previous studies of Mandal and Madheswaran (2012) partly supporting to use asymmetric causality test. This finding indicates that the FDI encouraging policies are recommended that can improve the population health (life expectancy index) in Pakistan. These findings of the study highlighted the significance of the asymmetric causal relationship among dependent and independent variables of the model of the study.

Structural stability tests

Brown et al. (1975) recommended CUSUM (cumulative sum) and CUSUMSQ (the cumulative sum of squares) tests to validate long-run coefficient’s stability. Figure 2 depicts those plots of CUSUM and CUSUMSQ statistics are inside the critical bounds at 5% significance of level. This concludes that all estimated coefficients are stable.

Contribution of the study

This study contributes in present works in the accompanying four different ways. Firstly is the long time series data to explore the dynamic association between government expenditure, foreign direct investment, public debt, trade openness, and life expectancy (health population). Secondly, the study uses both traditional unit root (ADF and PP) tests and structural break for investigating the stationary of variables. Thirdly, very limited studies have examined the effects of FDI, government expenditure, and life expectancy in Pakistan. Furthermore, none of the studies scrutinized asymmetry relation. Different studies exhibited the time series and panel of states (Kaulihowa and Adjasi, 2018; Gökmenoğlu et al., 2018; Burns et al., 2017; Nagel et al., 2015; Railaitė and Čiutienė, 2020).

In any case, as contended in Boutabba (2014), any potential induction obtained from this cross country contemplates is broadly perceived to give just an overall comprehension of the linkage among the factors; accordingly, itemized policy suggestions for every country cannot be drawn from such studies (Ang 2008; Lindmark 2002; Stern et al. 1996). At last, the non-asymmetric causality was applied as suggested in Hatemi-J (2012). For this load of reasons, we chose to examine the instance of Pakistan in this investigation.

Conclusion and policy implication

Although a capacious volume of literature is accessible to classify the various determining factors of life expectancy, not any study has been established that examines the non-linear effects of foreign direct investment on Pakistan’s health (measured by life expectancy index). Additionally, there is insufficient information resulting to dynamic relations among FDI, government expenditure, and life expectancy by applying time series approaches. In this research, we have focused to investigate the dynamic asymmetric short run and long-term relationships among FDI, trade openness, public debt, government expenditures, and life expectancy (population health) in evidence of Pakistan over the time span 1980–2020. Empirical outcomes of the study contribute to prior literature by utilizing a non-linear ARDL approach recently established by Shin et al. (2014). The empirical outcomes propose strong anticipation for the existence of an asymmetric cointegration relationship among the variables below the study. Positive and negative changes/shocks of FDI have positive and significant influence on life expectancy in the long term and short run. The asymmetric causal associations among the variables were examined through Hatemi-J (2012).

Findings provided from this review have some significant critical policy suggestions. The main results of the study affirm that FDI contribute to life expectancy positively in Pakistan. Subsequently, Pakistan’s government must utilize FDI, trade openness, and public investment as per fiscal instruments not on individual basis but improving national production as well as intensifying health issue of the enormous population. Hence, the study suggests that the policy designers would present further foreign direct investment amicable strategies which confirm the deep economic and public profits. The study also recommends that social advantages of foreign direct investment will be extra prominent; however, the policy makers will be able to certify better foreign direct investment especially in the health sector.

Therefore, most foreign partners should participate in medical clinic (hospital) and pharmaceutical areas in getting contemporary skills and innovation from their host nations which drive amenably advantage to the community health.

In addition, there is a need to maintain the government policies that helped to maximize the positive impacts and minimize the detrimental effects of FDI to social sector development in Pakistan, and such policies are local content requirements, local resource development requirements, local partner requirements for some sectors, export requirement, and minimum wage requirement. While those requirements have been improved recently in accordance with the development of the local economy and the changes in the international market, they are still needed. Moreover, the government of Pakistan should use FDI as economic tools not only for enhancing domestic production but also for improving health and education of its huge population. Therefore, the study recommends that policy makers should introduce more trade liberalization and foreign investment friendly policies that will ensure the maximum economic and social benefits, and also suggested that the social benefits of FDI and DPI will be more potent if the policy makers can ensure greater domestic public and foreign investment particularly in the health and education sectors of Pakistan. Moreover, foreign partners and government of Pakistan should largely invest in hospital, pharmaceutical sectors, and educational institutions, by bringing modern know-how and technology from their host countries which will directly benefit to the public health and education of the host country of Pakistan.

It is also appeared that the positive effect of FDI on economic growth and infrastructure creations in host countries contributes toward the enhancement of human well-being. This then implied that open economic policy with increasing efforts toward integration of national economies into the global marketplace is a necessary condition for social sector development. TNCs through FDI also intended to capitalize on the quality of human capital (health and education) in host countries. Countries with higher levels of achievements in social sectors attract more FDI. The low-income country such as Pakistan’s case showed that it is in fact the achievements in population health and educational development that are significantly important to foreign investors. Thus, host countries should continue to invest more in improving the elements of social sectors (skills, education, health status, and overall worker productivity) of their populations at large. Nonetheless, policy makers need to carefully examine the issue of efficiency of FDI from the viewpoint of national economic development priorities and be selective in terms of its sectoral composition. National governments also need to develop their bargaining power and negotiation skills in relation to their dealings with TNCs to attract a desirable type of FDI. The attainment of high-income level is also of grave importance for Pakistan in order to further increase school enrollment ultimately motivating human capital. Consequently, more rigorous human capital will widely be contributed into the social welfare.

Availability of data and materials

The datasets used in this study are available from the corresponding author on reasonable.

Change history

01 April 2024

This article has been retracted. Please see the Retraction Notice for more detail: https://doi.org/10.1007/s11356-024-33139-7

References

Abdullah MA, Mukhtar F, Wazir S, Gilani I, Gorar Z, Shaikh BT (2014) The health workforce crisis in Pakistan: a critical review and the way forward. World Health Popul 15(3):4–12

Ahmad R, Hasan J (2016) Public health expenditure, governance and health outcomes in Malaysia. Jurnal Ekonomi Malaysia 50(1):29–40

Anetor FO, Esho E, Verhoef G (2020) The impact of foreign direct investment, foreign aid and trade on poverty reduction: evidence from Sub-Saharan African countries. Cogent Economics & Finance 8(1):1737347

Ang JB (2008) Determinants of foreign direct investment in Malaysia. Journal of Policy Modeling 30(1):185–189

Alam MS, Raza SA, Shahbaz M, Abbas Q (2016) Accounting for contribution of trade openness and foreign direct investment in life expectancy: the long-run and short-run analysis in Pakistan. Soc Indic Res 129(3):1155–1170

Alsan M, Bloom DE, Canning D (2006) The effect of population health on foreign direct investment inflows to low-and middle-income countries. World Dev 34(4):613–630

Azemar C, Desbordes R (2009) Public governance, health and foreign direct investment in Sub-Saharan Africa. J Afr Econ 18(4):667–709

Azizullah A, Khattak MNK, Richter P, Häder D-P (2011) Water pollution in Pakistan and its impact on public health—a review. Environ Int 37(2):479–497

Banerjee A, Dolado J, Mestre R (1998) Error‐correction mechanism tests for cointegration in a single‐equation framework. Journal of time series analysis 19(3):267–283

Bayer C, Hanck C (2013) Combining non-cointegration tests. J Time Ser Anal 34(1):83–95

Bergh A, Nilsson T (2008) Do economic liberalization and globalization increase income inequality? In Annual Meeting of the American Public Choice Society, San Antonio, March 6 9:2008

Bergh A, Nilsson T (2010) Good for living? On the relationship between globalization and life expectancy. World Dev 38(9):1191–1203

Benach J, Muntaner C, & Santana V (2007) Employment conditions and health inequalities

Beşe E, Kalayci S (2021) Relationship between life expectancy, foreign direct investment and trade openness: evidence from Turkey. Montenegrin Journal of Economics 17(1):31–43

Bhowmik AK, Alamdar A, Katsoyiannis I, Shen H, Ali N, Ali SM, . . . Eqani SAMAS (2015) Mapping human health risks from exposure to trace metal contamination of drinking water sources in Pakistan. Science of the Total Environment, 538, 306-316

Blonigen B, & O'fallon C (2011). Foreign firms and local communities: National Bureau of Economic Research

Blonigen BA, & Wang M (2004) Inappropriate pooling of wealthy and poor countries in empirical FDI studies: National Bureau of Economic Research

Blouin C, Chopra M, van der Hoeven R (2009) Trade and social determinants of health. The Lancet 373(9662):502–507

Borensztein E, De Gregorio J, Lee J-W (1998) How does foreign direct investment affect economic growth? 1. J Int Econ 45(1):115–135

Boutabba MA (2014) The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model 40:33–41

Burns DK, Jones AP, Goryakin Y, Suhrcke M (2017) Is foreign direct investment good for health in low- and middle-income countries? An instrumental variable approach. Soc Sci Med 181:74–82

Brown RL, Durbin J, Evans JM (1975) Techniques for testing the constancy of regression relationships over time. J Roy Stat Soc: Ser B (methodol) 37(2):149–163

Chintrakarn P, Herzer D, Nunnenkamp P (2012) FDI and income inequality: evidence from a panel of US states. Econ Inq 50(3):788–801

Chudnovsky, D., & Lopez, A. (1999). Globalization and developing countries: foreign direct investment and growth and sustainable human development. UN

Ciruelos A, Wang M (2005) International technology diffusion: effects of trade and FDI. Atl Econ J 33(4):437–449

Daud M, Nafees M, Ali S, Rizwan M, Bajwa RA, Shakoor MB, . . . Murad W (2017) Drinking Water Quality Status and Contamination in Pakistan. BioMed Research International, 2017

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. Journal of the American statistical association 74(366a):427–431

DHS. (2019). Pakistan demographic and health survey 2018–19 (pp. 392). Pakistan

Dreher A, Gaston N (2008) Has globalization increased inequality?. Review of International Economics 16(3):516–536

Fadilah A, Ananda CF, Kaluge D (2018) A panel approach: how does government expenditure influence human development index? Jurnal Ekonomi Dan Studi Pembangunan 10(2):130–139

Farooq F, Yusop Z, Chaudhry IS (2019) How do trade openness and public expenditures affect health status in OIC member countries? An empirical analysis. Pakistan Journal of Commerce and Social Sciences (PJCSS) 13(4):1041–1056

Ejaz I, Shaikh BT, Rizvi N (2011) NGOs and government partnership for health systems strengthening: a qualitative study presenting viewpoints of government, NGOs and donors in Pakistan. BMC Health Serv Res 11(1):1–7

Feenstra RC, Hanson GH (1997a) Foreign direct investment and relative wages: evidence from Mexico’s maquiladoras. J Int Econ 42(3–4):371–393

Feenstra RC, & Hanson GH (1997b) Productivity measurement and the impact of trade and technology on wages: estimates for the US, 1972–1990: National Bureau of Economic Research

Giammanco MD, Gitto L (2019) Health expenditure and FDI in Europe. Economic Analysis and Policy 62:255–267

Gohou G, Soumare I (2012) Does foreign direct investment reduce poverty in Africa and are there regional differences? World Dev 40(1):75–95. https://doi.org/10.1016/j.worlddev.2011.05.014

Gökmenoğlu KK, Apinran MO, Taşpınar N (2018) Impact of foreign direct investment on human development index in Nigeria. Business and Economics Research Journal 9(1):1–14

Government of Pakistan (2018–19).Economic survey of Pakistan. Ministry of Finance Division, Economic Advisor’s Wing, Islamabad, Pakistan

Government of Pakistan (2019–20).Economic survey of Pakistan. Ministry of Finance Division, Economic Advisor’s Wing, Islamabad, Pakistan

Haibo C, Ayamba EC, Agyemang AO, Afriyie SO, Anaba AO (2019) Economic development and environmental sustainability—the case of foreign direct investment effect on environmental pollution in China. Environ Sci Pollut Res 26(7):7228–7242

Hassan A, Mahmood K, Bukhsh HA (2017) Healthcare System of Pakistan. IJARP 1(4):170–173

Hatemi-J A (2012) Asymmetric causality tests with an application. Empirical Economics 43(1):447–456

Hawkes C (2005) The role of foreign direct investment in the nutrition transition. Public Health Nutr 8(4):357–365

Herzer D, Nagel K (2015) The long-run and short-run effects of health aid on life expectancy. Appl Econ Lett 22(17):1430–1434

Herzer D, Nunnenkamp P (2012). FDI and health in developed economies: a panel cointegration analysis: Kiel Working Paper

Hoang TH, Guerich M, Yvonnet J (2016) Determining the size of RVE for nonlinear random composites in an incremental computational homogenization framework. J Eng Mech 142(5):04016018

Idrees S, Bakar NAA (2019a) Accounting for the contribution of foreign direct investment in population health: a case study of Pakistan. International Journal of Research in Social Sciences 9(5):14–35

Idrees S, Bakar A (2019b) Foreign direct investment and social sectors development: a review. Pakistan Journal of Humanities and Social Sciences 7(1):93–105

Immurana M (2020). Does population health influence FDI inflows into Ghana?. International Journal of Social Economics

Nagel K, Herzer D, Nunnenkamp P (2015) How does FDI affect health? Int Econ J 29(4):655–679

Kaulihowa T, Adjasi C (2018) FDI and welfare dynamics in Africa. Thunderbird International Business Review 60(3):313–328

Kaulihowa T, Adjasi C (2019) Non-linearity of FDI and human capital development in Africa. Transnational Corporations Review 11(2):133–142

Kawachi I, Wamala S (Eds.) (2006). Globalization and health. Oxford University Press

Khan K, Lu Y, Saeed MA, Bilal H, Sher H, Khan H, . . . Baninla Y (2017) Prevalent fecal contamination in drinking water resources and potential health risks in Swat, Pakistan. Journal of Environmental Sciences

Khan S, Shahnaz M, Jehan N, Rehman S, Shah MT, Din I (2013) Drinking water quality and human health risk in Charsadda district, Pakistan. J Clean Prod 60:93–101

Khalid F, & Abbasi AN (2018) Challenges faced by Pakistani healthcare system: clinician's perspective

Kimball AM (2016) Risky trade: infectious disease in the era of global trade. Routledge

Kim D, Perron P (2009) Unit root tests allowing for a break in the trend function at an unknown time under both the null and alternative hypotheses. Journal of Econometrics 148(1):1–13

Kim TK, Lane SR (2013) Government health expenditure and public health outcomes: a comparative study among 17 countries and implications for US health care reform. Am Int J Contemp Res 3(9):8–13

Kurji Z, Premani ZS, Mithani Y (2016) Analysis of the health care system of Pakistan: lessons learnt and way forward. J Ayub Med Coll Abbottabad 28(3):601

Lai Y-C, Sarkar S (2017) Do high FDI Indian firms pay low wages & have higher output? Indian Journal of Industrial Relations 52(3):432–443

Liu Q, Wang S, Zhang W, Zhan D, Li J (2018) Does foreign direct investment affect environmental pollution in China’s cities? A spatial econometric perspective. Sci Total Environ 613:521–529

Lindmark M (2002) An EKC-pattern in historical perspective: carbon dioxide emissions, technology, fuel prices and growth in Sweden 1870–1997. Ecol Econ 42(1–2):333–347

Mandal SK, Madheswaran S (2012) Productivity growth in Indian cement industry: A panel estimation of stochastic production frontier. The Journal of Developing Areas 287-303

McInnes C, Lee K (2012) Global health and international relations. Polity

Moran TH (2005). How does FDI affect host country development? Using industry case studies to make reliable generalizations. Does foreign direct investment promote development, 281–313

Olayiwola SO, Adedokun AS, & Oloruntuyi AO (2019) Population health and foreign direct investment inflows: the case of ECOWAS countries. Journal of Economics Studies, 2(1)

Outreville JF (2007) Foreign direct investment in the health care sector and most-favoured locations in developing countries. Eur J Health Econ 8(4):305–312

Owen AL, Wu S (2007) Is trade good for your health? Rev Int Econ 15(4):660–682

Papageorgiou C, Savvides A, Zachariadis M (2007) International medical technology diffusion. J Int Econ 72(2):409–427

PBS. (2018). Population Welfare Statistics Section. Retrieved 20 December, 2017, 2017, from http://www.pbs.gov.pk/content/population-welfare-statistics-section

PBS. (2019). Population Welfare Statistics Section. Retrieved 20 December, 2017, 2017, from http://www.pbs.gov.pk/content/population-welfare-statistics-section

Reiter SL, Steensma HK (2010) Human development and foreign direct investment in developing countries: the influence of FDI policy and corruption. World Dev 38(12):1678–1691

Perron, P. (1989). The great crash, the oil price shock, and the unit root hypothesis. Econometrica: journal of the Econometric Society, 1361–1401

Perron P (1990) Testing for a unit root in a time series with a changing mean. J Business & Econ Stat 8(2):153–162

Perron P (1997) Further evidence on breaking trend functions in macroeconomic variables. J Econ 80(2):355–385

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. Journal of applied econometrics 16(3):289–326

Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346

Qadir N, Majeed MT (2018) The impact of trade liberalization on health: Evidence from Pakistan. Empirical Economic Review 1(1):71–108

Railaitė R, Čiutienė R (2020) The impact of public health expenditure on health component of human capital. Inžinerinė Ekonomika 31(3):371–379

Reiter SL, Steensma HK (2010) Human development and foreign direct investment in developing countries: the influence of FDI policy and corruption. World development 38(12):1678–1691

Rodrik D (1998) Why do more open economies have bigger governments? J Polit Econ 106(5):997–1032

Rodrik D, Subramanian A, Trebbi F (2004) Institutions rule: the primacy of institutions over geography and integration in economic development. J Econ Growth 9(2):131–165

Shahbaz M, Van Hoang TH, Mahalik MK, Roubaud D (2017) Energy consumption, financial development and economic growth in India: new evidence from a nonlinear and asymmetric analysis. Energy Econ 63:199–212

Shin Y, Yu B, & Greenwood-Nimmo M (2014). Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework Festschrift in honor of Peter Schmidt (pp. 281–314): Springer

SmarzynskaJavorcik B (2004) Does foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward linkages. Am Econ Rev 94(3):605–627

Statista. (2018). Infant mortality rates in South Asian countries between 2010 and 2015. Retrieved 15 January 2018, from https://www.statista.com/statistics/590050/infant-mortality-rates-in-south-asia/

Statistics P. B. O (2017) Pakistan bureau of statistics. Ministry of Population, Islamabad

Statistics P. B. O (2019) Pakistan bureau of statistics. Ministry of Population, Islamabad

Stern DI, Common MS, Barbier EB (1996) Economic growth and environmental degradation: the environmental Kuznets curve and sustainable development. World Dev 24(7):1151–1160

Stevens P, Urbach J, Wills G (2013) Healthy trade: the relationship between open trade and health. Foreign Trade Rev 48(1):125–135

Verma, R. (2021). FDI and Health expenditure dynamics in ASEAN

UNCEF. (2019). A newborn baby dying within the first month of life is a tragedy. Retrieved 20 December 2019, from http://www.unicefrosa-progressreport.org/savenewborns.html

UNICEF. (2018). Pakistan Annual Report 2018 (pp. 1–66). Pakistan

United Nations Development Programme. (2015a). Human development data. Retrieved from http://hdr.undp.org/en/data

UNDP (2017). United Nations Development Programme. In Human Development Report 2016. http://hdr.undp.org/sites/default/files/2016_human_development_report.pdf. Accessed December 05, 2018

UNDP (2018). United Nations Development Programme. In Human Development Data (1990–2017). http://hdr.undp.org/en/data

Waldmann RJ (1992) Income distribution and infant mortality. Q J Econ 107(4):1283–1302

Worster D (1993) The wealth of nature: environmental history and the ecological imagination. Oxford University Press on Demand

van den Heuvel WJ, Olaroiu M (2017) How important are health care expenditures for life expectancy? A comparative, European analysis. J Am Med Dir Assoc 18(3):276-e9

Xu B, & Wang J (2000) Trade, FDI, and international technology diffusion. J Econ Integr, 585–601

Xu X, Sylwester K (2016) The effects of foreign direct investment on emigration: the roles of FDI source country, education, and gender. Econ Model 55:401–409

Yanikkaya H (2003) Trade openness and economic growth: a cross-country empirical investigation. J Dev Econ 72(1):57–89

Zarsky L (1999) Havens, halos and spaghetti: untangling the evidence about foreign direct investment and the environment. Foreign Direct Investment and the Environment 13(8):47–74

Zivot E, Andrews DWK (1992) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. Journal of Business & Economic Statistics 20(1):25–44

Funding

Saif ur Rahman acknowledges that this paper has been supported by the Superior University and significant portion of this paper is extracted from his PhD thesis in Economics from School of Economics, Finance, and Business, Universiti Utara, Malaysia. Muhammad Saeed Meo acknowledges that this paper has been supported by the RUDN University Strategic Leadership Program.

Author information

Authors and Affiliations

Contributions

Saif ur Rahman: conceptualization, data analysis, writing—original draft.

Imran Sharif Chaudhary: writing—methodology and description of asymmetric findings.

Muhammad Saeed Meo: review, writing—original draft.

Salman Maqsood Sheikh: writing—methodology and supervision.

Sadia Idrees: explanation of results, proofreading.

Corresponding author

Ethics declarations

Ethical approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This article has been retracted. Please see the retraction notice for more detail: https://doi.org/10.1007/s11356-024-33139-7

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Rahman, S.u., Chaudhry, I.S., Meo, M.S. et al. RETRACTED ARTICLE: Asymmetric effect of FDI and public expenditure on population health: new evidence from Pakistan based on non-linear ARDL. Environ Sci Pollut Res 29, 23871–23886 (2022). https://doi.org/10.1007/s11356-021-17525-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-17525-z