Abstract

This paper investigates the relationship between CO2 emissions, energy consumption, economic growth, and foreign direct investment for a sample of Asia-Pacific Economic Cooperation Countries (APEC) countries from 1981:Q1 to 2021:Q1 employing panel data methodology. We identify cross-sectional dependence and hence utilize the cross-sectional augmented Dickey-Fuller panel unit root test for appropriate estimation. The cointegration test developed by Westerlund (2008) reveals a long-run equilibrium between CO2 emissions, energy consumption, economic growth, and foreign direct investment. Long-run parameter estimates based on Common Correlated Effect Mean Group indicate that an increase in FDI inflows has a negative impact on air quality, supporting the pollution haven hypothesis. The cointegration test results also show that the impact of Gross Domestic Product (GDP) on CO2 emissions varies by country in the estimation sample. In contrast to the mixed evidence on the effects of other variables, the increase in energy consumption is positively and significantly affecting CO2 emissions in all APEC countries. Emirmahmutoglu and Kose Econ Model 28:870-876, (2011)’s panel causality test results show a bidirectional relationship between FDI and CO2 emissions in Japan. Furthermore, there is a bidirectional causal relationship between GDP and energy consumption in Australia, China, Japan, and Singapore. Overall, empirical evidence suggests that APEC countries should adhere to strict regulations and invest in environmental-friendly clean technologies to attract foreign direct investment.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In recent years and decades, there has been a great deal of interest in the connection between economic activity and environmental degradation. In most cases, rising economic activity is followed by rising energy consumption, and rising energy demand is frequently linked to environmental quality. Although the connection between economic development, energy, and the environment has long been a focus of study, the relationship between the environment and foreign direct investments (FDI) has received less attention over the same period. Capital flow mobility has increased rapidly as a result of the globalization process. The eventual rise in demand in manufacturing and service-driven sectors around the world has resulted in nations achieving high growth rates and rising trade activities with other countries, which eventually leads to higher capital movements. However, higher growth puts a strain on developing countries in terms of energy use and environmental protection because the expansion of production contributes to increased energy demand, which is one of the major sources of pollutant emissions (Shahbaz et al. 2015). As a result, the existing literature mainly suggests that FDI inflows might damage the environment (Shahbaz et al. 2019). According to Moosa (2002), FDI has three important effects on the host country: economic, political, and social. The economic effects of FDI are categorized as micro and macro effects. The provision of capital, output growth, employment and wages, balance of payment, and trade flows are some of the main macroeconomic effects of FDI. On the other hand, the microeconomic effects of FDI are concerned with structural changes in economic organization and are associated with productivity level, technology transfer, local people training, and market structure. However, the context of the environment is largely neglected, and the environment is only recently recognized as an important component of FDI (Pazienza 2014).

The Asia-Pacific Economic Cooperation (APEC), which currently comprises 21 member nations, was founded in 1989 with the purpose of eliminating trade and investment obstacles and boosting economic cooperation among members. According to an APEC Report (APEC 2020), 38% of the global population inhabits in the APEC region in 2019. APEC countries also account for 61% of global nominal Gross Domestic Product (GDP) and 47% of international trade in goods and commercial services in the same year, highlighting the critical role of the region in the global economy. According to APERC (2019) survey, APEC is responsible for 57% of global energy demand, and APEC countries are recognized as the world’s top five energy consumers. Increasing energy demand may indicate increased trade activity, which could lead to further environmental problems. As a result, the question of whether APEC can boost economic growth by consuming more energy without harming the environment becomes critical, making those countries an interesting case study for examining the role of FDI in the nexus of economic growth, energy, and environment.

Although FDI helps host countries’ economic development, it can also lead to environmental degradation by spreading industrial activity and encouraging the use of polluting industrial goods. The literature indicates three impacts of FDI on the environment: scale, technique, and structure (composition) effects (Grossman and Krueger 1991; Copeland and Taylor 1994; Pazienza 2014; Bakhsh et al. 2017). The scale effect emphasizes the role of increased market access on the path of economic growth of host countries. On the other hand, the structure effect associates the environmental impacts with the transformation of economic structure. According to this effect, a country with a steady stream of pollution-intensive industries would eventually have significant environmental pollution (Hao et al. 2020). Finally, the technique effect is linked to the spillover effect of local firms due to technological transfers, leading to a lower emission level due to more effective use of resources. Numerous empirical studies (Suri and Chapman 1998; Antweiler et al. 2001; Cole and Elliott 2003; Hansen and Rand 2006; He 2006; Bao et al. 2011; Bakhsh et al. 2017) have been conducted on these effects, but the findings are mostly inconclusive. Hence, the role of the FDIs still deserves special attention. The relationship between FDI and the environmental standards of the host country has spawned a slew of associated hypotheses, including pollution havens and pollution halos.

The pollution haven hypothesis contends that multinational corporations relocate their environmental-polluting activities to less regulated countries if the relevant regulations in the country of origin are stringent and costly (Kisswani and Zaitouni 2021). According to the pollution haven hypothesis, increasing FDI flows has a detrimental effect on the ecosystem of host countries where the regulatory regimes are less stringent or non-existent, as supported by several empirical studies (Gray 2002; Xing and Kolstad 2002; Mihci et al. 2005; He 2006; Wagner and Timmins 2009; Tang 2015; Solarin et al. 2017). The opposing views assume that openness leads to a cleaner industry (Birdsall and Wheeler 1993), while a few other studies suppose that there is no or limited evidence for pollution havens (Jaffe et al. 1995; Cole 2004; Elliott and Shimamoto 2008). On the other hand, the pollution halo theory argues that host countries adopt tighter environmental regulations and that FDI inflows have a beneficial effect on environmental sustainability. This hypothesis contends that multinational corporations in developed countries contribute to lower carbon emissions in host countries by acquiring more environmentally friendly technologies (Mert and Caglar 2020). However, the existing empirical literature is unable to provide systematic evidence to support the existence of this hypothesis (Pazienza 2014).

Given the above background, the main objective of this article is to comprehend the relationship between economic growth, carbon dioxide (CO2) emissions, energy consumption, and FDI for APEC countries. The study also seeks to ascertain the impact of FDIs on the environmental quality of host countries. This study contributes to the extant literature in several respects. First, the overview of the previous studies reveals that there are a limited number of studies concentrating on the energy consumption-CO2 emissions-FDI relationship for the APEC case. Second, as opposed to previous studies utilizing data with annual frequency, we utilize a unique quarterly dataset covering the period from 1981:Q1 to 2021:Q1 enabling us to draw more reliable statistical inferences regarding the relationship between economic growth, CO2, energy consumption, and FDI. Finally, the presence of causality among the variables under consideration has been investigated with the recently developed panel causality test by Emirmahmutoglu and Kose (2011) that can be employed for mixed panels involving stationary, non-stationary, cointegrated, and non-cointegrated series, as well as panels with cross-sectional dependence.

The organization of the paper is structured as follows. The next section contains a brief literature review on the energy consumption-CO2 emissions-FDI relationship. The third section introduces the model, and Sect. 4 presents the methodologies utilized in the paper. Section 5 presents the results of cointegration and causality analysis on the relationship between economic growth, CO2 emissions, energy consumption, and FDI. Finally, the last section concludes the paper and derives policy recommendations based on the empirical findings of the study.

Literature review

The relationship between environmental degradation, energy consumption, foreign direct investment, and economic growth has been investigated extensively in the literature in different countries utilizing different methodologies.

The nexus between environmental pollution and economic growth

The ongoing debates about the relationship between economic development and environmental quality remain unresolved. Higher levels of economic activity necessitate increased exploitation of natural resources, resulting in environmental degradation (Ehrlich and Holdren 1971). However, it is also assumed that there is a direct connection between economic growth and environmental quality and that higher economic growth contributes to better environmental quality (Beckerman 1992). While the relationship between economic growth and environmental quality is still debated, the Environmental Kuznets Curve (EKC), which suggests that environmental quality deteriorates until a critical stage, has resulted in a large number of empirical studies. Beyond this point, increased economic development triggers a decrease in environmental degradation, assuming an inverted-U-shaped relationship between environmental degradation and income (Grossman and Krueger 1991). Acaravci and Ozturk (2010) examined the validity of the EKC hypothesis for 19 European countries, Ren et al. (2014) for China, Boluk and Mert (2015) for Turkey, Tang and Tan (2015) for Vietnam, Shahbaz et al. (2018) for India, Waqih et al. (2019) for the South Asian region, Nasir et al. (2019) and Munir et al. (2020) for ASEAN-5 countries, Chenran et al. (2019) for Laos, Aydogan and Vardar (2020) for E7 countries. Relevant studies also show an N-shaped relationship between income and environmental degradation, implying that environmental degradation will resume once a certain level of income is reached (Grossman and Krueger 1995; Panayotou 1997; Moomaw and Unruh 1997). Bhattarai et al. (2009) for Latin American countries, Omay (2013) for Turkey, Zhang and Zhao (2014) and Liu et al. (2016) for China, Balsalobre-Lorente and Álvarez-Herranz (2016) for 17 OECD countries, Ozokcu and Ozdemir (2017) for 26 high-income OECD countries, and Allard et al. (2018) for 74 countries all support an N-shaped relationship. Many studies, however, find no support for an inverted-U or N-shaped EKC hypotheses, such as those conducted by Chandran and Tang (2013) for the ASEAN-5 economies, Al-Mulali et al. (2015) for Vietnam, Dogan and Turkekul (2016) for the USA, Mert and Bölük (2016) for the 21 Kyoto countries, and Mikayilov et al. (2018) for Azerbaijan. Shahbaz et al. (2019) and Sun et al. (2021) find an inverted-U and an N-shaped relationship between income and environmental degradation in MENA countries. For E-7 countries, Gyamfi et al. (2021) fails to confirm the existence of an N-shaped EKC but proves the existence of an inverted-U-shaped EKC. As can be seen, despite the fact that many studies have been conducted to investigate the relationship between environmental pollution and income, the results are still inconclusive due to differences between countries or the sample periods analyzed.

The nexus between energy consumption, environmental pollution, and economic growth

Environment, besides its potent findings with income, also has a strong connection with energy consumption. Following the Kyoto Protocol, the energy systems of the nations have played a major role in achieving their sustainable development goals, and the requirement of the integration of energy issues with environmental policies has become disputable (Hu and Kao 2007). The interrelated energy, environment, and income linkage is extensively investigated, and the need to consume more energy to support economic growth is widely agreed upon in literature (Magazzino 2017). However, rising energy consumption has negative environmental consequences, such as air pollution and land degradation (Hanif 2017). As a result, increased energy consumption is often cited as one of the primary reasons for increased environmental pollution (Omri et al. 2015; Asumadu-Sarkodie and Owusu 2016; Ssali et al. 2019). The vast majority of empirical studies on energy and the environment have discovered a causal relationship (Menyah and Wolde-Rufael 2010; Chandran and Tang 2013; Gokmenoglu and Taspinar 2016; Kocak and Sarkgunesi 2018; Bekun et al. 2019; Adebayo and Akinsola 2021). The relationship between economic growth and energy consumption is also one of the most contentious topics in economics. However, the debates on the causal relationship between these two variables are still controversial. Since the seminal work of Kraft and Kraft (1978) on economic growth and energy consumption, early-period studies have explored various forms of causality between economic growth and energy consumption (Akarca and Long 1980; Yu and Hwang 1984; Yu and Choi 1985; Erol and Yu 1987; Hwang and Gum 1991; Stern 1993)Footnote 1. According to Huang et al. (2008), the disparity in findings stems from the employment of different econometric methods in prior studies. The causal linkages among these factors produces four distinct hypotheses: growth, conservation, feedback, and neutrality (Apergis and Payne 2010; Balli et al. 2020). The growth hypothesis is based on the assumption of unidirectional causality, implying that energy consumption positively impacts economic growth. This hypothesis has significant empirical support (Sengul and Tuncer 2006; Mehrara 2007; Tang et al. 2016; Nyasha et al. 2018). Each of the following studies, which are accompanied by a carbon emission variable for an integrated framework, has an identical conclusion: Ang (2007) for France, Alam et al. (2012) for Bangladesh, Alshehry and Belloumi (2015) for Saudi Arabia, Magazzino (2016a) for Kuwait, Oman, and Qatar, Acheampong (2018) and Gorus and Aydin (2019) for the MENA countries, Shahbaz et al. (2020) for 38 renewable-energy consuming countries, Ummalla and Goyari (2021) for BRICS countries. Footnote 2 The conservation hypothesis, as a second viewpoint, adopts the opposite stance as the former hypothesis. This approach, which is supported by many studies, assumes that economic development positively impacts energy consumption. For instance, Zhang and Cheng (2009)’s study reveals a unidirectional causal relationship from growth to energy consumption for China. Some other studies also support the relevant hypothesis for various countries, such as Zamani (2007) for Iran, Magazzino (2015) for Israel, Bartleet and Gounder (2010) for New Zealand, Rahman and Velayutham (2020) for five South Asian countries. The feedback hypothesis implies an existence of a bidirectional causal relationship between these two variables. The empirical studies including Erdal et al. (2008) for Turkey, Apergis and Payne (2009) for CIS countries, Belloumi (2009) for Tunisia, Dagher and Yacoubian (2012) for Lebanon, Zhixin and Xin (2011) and Wang et al. (2016) for China, Magazzino (2016b) for Italy, Antonakakis et al. (2017) for 106 countries, and Rahman (2021) for BRICS and ASEAN countries confirm the bidirectional causal relationship. Finally, the neutrality hypothesis indicates that economic growth and energy consumption do not have a causal relationship. This hypothesis is also confirmed by several studies, including Payne (2009) for the USA, Halicioglu (2009) for Turkey, Rahman and Mamun (2016) for Australia, Destek (2016) for Brazil and Malaysia, Bhattacharya et al. (2016) for 11 countries, Magazzino (2017) for APEC countries, and Fazal et al. (2021) for Pakistan.

The nexus between environmental pollution, carbon emission, economic growth, and foreign direct investment

According to mainstream economic theory, increasing FDI flows to any host nation damages the environment, especially in regions where environmental laws are weak and pollution-intensive sectors are widespread (Shahbaz et al. 2019). This is known as the pollution haven hypothesis, and it has generated considerable discussion in the literature. It focuses on the detrimental impacts of FDI on the environment from diverse sources. Many studies, using various methodologies, have confirmed the presence of the pollution haven hypothesis for various countries. Bukhari et al. (2014) for Pakistan and Solarin et al. (2017) for Ghana have used the ARDL model. Mert et al. (2019) for 26 EU countries and Essandoh et al. (2020) for low-income countries have employed panel ARDL models. Ren et al. (2014) for China and Shahbaz et al. (2019) for MENA countries have applied the GMM model for their analyses. Other research also has supported the pollution haven hypothesis, including Shahbaz et al. (2015), by employing Pedroni cointegration and the FMOLS model for low-, middle-, and high-income countries; Behera and Dash (2017), by using Pedroni cointegration, FMOLS and DOLS models for South and Southeast Asia and Nasir et al. (2019), by utilizing DOLS and FMOLS approaches for ASEAN-5 economies. Several studies, however (Tamazian and Rao 2010; Kirkulak et al. 2011; Tang and Tan 2015; Zhu et al. 2016; Zhang and Zhou 2016; Sung et al. 2018; Jugurnath and Emrith 2018; Salehnia et al. 2020), reject the pollution haven hypothesis and argue that FDI inflows reduce carbon emissions and benefit host country economies. These results are commonly attributed to the well-known pollution halo hypothesis, which argues that the negative effects of FDI can be reversed by international companies employing low-carbon technology or operating in less resource-intensive industries that are conducive to a clean environment (Zhu et al. 2016). According to this viewpoint, FDI inflows are the primary sources of minimizing environmental degradation by importing advanced or environmentally friendly technologies (Kirkulak et al. 2011; Tang and Tan 2015). The relationship between FDI and energy can also be seen here, and these investments help to boost R&D spending in order to attain improved energy efficiency (Tamazian et al. 2009). Based on the analysis of related hypotheses, the results may be country-specific, and a few other studies indicate that FDI has no significant influence on carbon emissions (Hoffmann et al. 2005; Kim and Adilov 2012; Shaari et al. 2014; Kizilkaya 2017). Utilizing bootstrap-corrected panel causality test, Yildirim (2014) found evidence in favor of pollution halo hypothesis for India, Iceland, Panama, and Zambia.

The findings of the studies on the causal relationship between FDI and CO2 emissions are diverse, and these studies used a wide range of methodologies. The bulk of these studies discovered bidirectional causality between FDI and CO2 emissions by employing Granger causality based on the VECM (Pao and Tsai 2011; Mutafoglu 2012; Al-Mulali and Tang 2013; Chandran and Tang 2013; Balibey 2015; Ozturk and Oz 2016), Hacker and Hatemi-J (2012) bootstrap test for causality (Kocak and Sarkgunesi 2018), Dumitrescu and Hurlin (2012) panel causality (Shahbaz et al. 2015), VAR model (Abdouli and Hammami 2017). Ozturk and Oz (2016) discovered a bidirectional causal relationship between economic development and FDI. Abdouli and Hammami (2018) discovered a bidirectional causal association between economic growth, FDI, and CO2 emissions. Using the Toda-Yomamota causality test, Gokmenoglu and Taspinar (2016) discover a bidirectional causal relationship between CO2 emissions, FDI, and energy consumption. However, none of the studies examined employed the causality test suggested by Emirmahmutoglu and Kose (2011). Several studies have also discovered a unidirectional causal association between relevant variables. Feridun and Sissoko (2011), Mutafoglu (2012), Olusanya (2013), Gokmenoglu and Taspinar (2016), and Abdouli and Omri (2021) reveal a unidirectional causality running from economic growth to FDI. Many other studies (Azlina and Mustapha 2012; Lee 2013; Abdouli and Hammami 2017) have explored a unidirectional causality running from FDI to economic growth. Finally, using the panel Granger causality test, Shaari et al. (2014) conclude that FDI has no long-run causal effect on CO2 emissions.

Model and data

The main objective of this article is to examine the long-run relationship among CO2 emissions, energy consumption, economic growth, and foreign direct investment in APEC countries, namely, Australia, Canada, China, Indonesia, Japan, Malaysia, Mexico, Philippines, Singapore, Thailand, and the USA. As previously stated, in contrast to previous studies that used annual time series, this paper utilizes quarterly data from the Refinitiv Eikon Datastream database on CO2 emissions, primary energy consumption, economic growth, and foreign direct investment from 1981:Q1 to 2021:Q1 (Refinitiv Eikon Datastream 2021). Following Pao and Tsai (2011), Gokmenoglu and Taspinar (2016), and Shahbaz et al. (2019), the model utilized in the paper is formulated using the equation below:

where lnGDPit represents the natural log of gross domestic product per capita; lnECit denotes the natural log of total primary energy consumption per capita defined in terms of million tonnes of oil equivalent (mtoe). lnCO2it represents the natural log of CO2 emissions per capita (in short tonnes) employed as a proxy for the air pollution of the countries. FDIit is defined as the ratio of net foreign direct investment inflows to GDP.

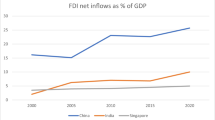

The pooled and cross-sectional descriptive statistics of the variables are presented in Table 1. The mean of CO2 emissions is highest for the USA, followed by China and Japan. Singapore has the lowest average CO2 emissions among the selected APEC countries. The mean value of the energy consumption variable is highest for the USA, followed by China and Japan. Singapore seems to have the lowest average energy consumption among the selected APEC countries. It is also noteworthy that the highest mean value of FDIit is recorded for Singapore with 14.322%.

Methodology

Cross-sectional dependence and homogeneity tests

This paper applies appropriate panel data methodologies to examine cross-sectional dependence and variable heterogeneity in the first step of the panel time series analysis. Breusch and Pagan (1980) proposed the following LM test statistic for cross-sectional dependence:

The LM test yields inconsistent results when N is large. As a solution to this problem, for (N, T) → ∞, the existence of cross-sectional dependence among the variables of APEC countries is examined with cross-sectional dependence (CD) test proposed by Pesaran (2004). The CD statistic testing the null hypothesis of zero dependence across the panel unit is computed as follows:

where N and T denote the number of cross-sections and the estimation period, respectively. The null hypothesis indicates that there is no cross-sectional dependence. The test statistics \({\hat{\rho}}_{ij}^2\) is the estimated pair-wise correlation coefficient of the residuals obtained through simple regressions using OLS. Along with CD test, Pesaran and Yamagata (2008)’s method based on Swamy (1970) is applied to evaluate homogeneity of slope coefficients by computing the delta (\(\overset{\sim }{\varDelta }\)) and the adjusted delta (\({\overset{\sim }{\varDelta}}_{adj}\)) statistics. \(\overset{\sim }{\varDelta }\) statistic is a modified version of Swamy (1970) test (\(\overset{\sim }{S}\)) computed as follows:

Under the null hypothesis with (N, T) → ∞, error terms are normally distributed, and \(\overset{\sim }{\Delta }\)test is written as below:

Adjusted \(\overset{\sim }{\Delta }\) test is developed for the small sample is given as

Panel unit root test

This article utilizes cross-sectional augmented Dickey-Fuller (CADF) panel unit root tests to analyze the unit root properties of the variables under cross-sectional dependence. The regression model used to derive the CADF test is written as follows:

where αi , \({\bar{Z}}_{t-1}\) ti(N, T) denote deterministic term, \(\left(\frac{1}{N}\right){\sum}_{i=1}^N{Z}_{i,t-1}\), and the t-statistics for estimation ρi in the equation used for computing the individual ADF statistics, respectively. Finally, CIPS statistic is computed by taking the average of individual CADF statistics based on the following formula:

Panel cointegration test and panel long-run estimator

After determining the cross-sectional dependence and order of integration of variables, we used Westerlund (2008) cointegration technique to determine the long-run relationship between variables under the cross-sectional dependence. This test is built on the notion of rejecting the null hypothesis of no cointegration. The following data-generation procedure is assumed:

where dt denotes the deterministic components, and Xit represents the matrix of independent variables, i.e., lnGDPit, lnECit, and FDIit. \({\lambda}_i=-{\alpha}_i{\beta}_i^{\prime }\) and αi denote the adjustment parameter measuring the speed at which the system corrects back to equilibrium after a sudden shock.

The test generates four test statistics (Ga, Gt, Pa, and Pt) to assess the long-run association between variables based on estimates of αi . These statistics are produced using the least squares estimator. Ga and Gt test cointegration relationship for the panel, whereas Pa and Pt test cointegration relationship for individual panel members.

After determining the cointegrating relationship among variables, we utilized Common Correlated Effect Mean Group (CCE-MG) estimate of Pesaran (2007). The specification of the equation based on CCE-MG is written as follows:

where the coefficient ϕi represents the elasticity of lnCO2it with respect to the cross-sectional averages of the dependent variables and φi is the elasticity of lnCO2itwith respect to the cross-sectional averages of the observed regressors.

Mean group (MG) and pooled mean group (PMG) estimators

In addition to the Westerlund (2008) test, the MG and PMG estimators are used to further explore the short- and long-run linkages between CO2 emissions, energy consumption, economic growth, and foreign direct investment. Pesaran and Smith (1995) devised mean group (MG) estimates, which estimate long-term parameters by averaging the long-term coefficients of each cross section. Pesaran et al. (1999) proposed a panel ARDL model that incorporates pooling and averaging. The pooled mean group (PMG) estimator allows for short-term coefficients and differs in error variances across groups as in MG estimators. The PMG estimator, in contrast to the MG estimator, imposes a homogeneity constraint on the long-run relationship between variables, allowing intercepts, short-run coefficients, and error variances to fluctuate freely across groups while keeping long-run coefficients constant. The PMG estimator can be specified using the panel ARDL(p,q) model as below:

where Xit is the matrix containing the explanatory variables, Xit = [lnGDPit lnECit FDIit]. To explore short- and long-run dynamic relationship, panel ARDL(p,q) model in Eq. (11) is converted into the following error correction model (ECM):

The equation above is further redefined by combining the error correction of the variables, yielding the following equation:

In Eq. (13), \(-\frac{\delta_i}{\phi_i}\) represents the long-run linkages between the explained and explanatory variables, and, ρij and λij are the short-term parameters. Furthermore, ϕi is the error correction coefficient, which shows the speed of adjustment to the equilibrium level. The presence of cointegration is evidenced in case φi is negative. The Hausman (1978) test may be used to compare the MG and PMG models based on the homogeneity constraints imposed by the PMG estimator.

Panel causality test

To control heterogeneity and cross-sectional dependence in a panel model, Emirmahmutoglu and Kose (2011) developed a panel Granger causality test. This test is useful since it may be used on panels with stationary, non-stationary, cointegrated, and non-cointegrated series, as well as panels with cross-sectional dependency. It is also beneficial for countries dealing with turbulent periods (Seyoum et al. 2015). The Fisher (1932) test is used in this method to expand the probability values of Toda and Yamamoto (1995). Fisher test statistics, \(\lambda =-2{\sum}_{i=1}^N{\ln}\left({p}_i\right)\), pi is the p value for Wald statistics of each unit, is not applicable in the case of dependence across cross-sectional units. As a result, Emirmahmutoglu and Kose (2011) used the bootstrap methodology to calculate the empirical distribution of the Fisher (1932) test statistics.

To examine the causality relationship among the variables, this approach utilizes an augmented bivariate VAR model with ki + dmaxi lags in heterogeneous mixed panels:

where dmaxi represents the maximal order of integration for each unit. In the first step of the test, the Augmented Dickey-Fuller (ADF) unit root test is used to determine the optimal order integration of variable for each country i (dmaxi) in order to test the causality from X to Y represented in Eq. (14).Footnote 3 Secondly, using the selected ki and dmaxi, Eq. (14) is re-estimated by OLS; the residuals for each unit are obtained. These residuals are centered with a method proposed by Stine (1987), and the bootstrap sample of Yit (\({Y}_{it}^{\ast }\)) is generated in a recursive way using the bootstrap residuals. Finally, Eq. (11) is re-estimated without imposing any parameter restrictions by substituting \({Y}_{it}^{\ast }\) for Yit, and the individual Wald statistics are computed to test the null hypothesis of non-causality for each unit. These procedures may be performed for Eq. (15) to verify causality flowing from Y to X.

Empirical results and discussion

Before the assessment of the stationary features of the variables, the existence of cross-sectional dependence for APEC countries is explored using the CD test developed by Pesaran (2004). Table 2 shows evidence to reject the null hypothesis of cross-sectional dependence at the 1% level of significance for CO2, GDP, EC, and FDI variables, indicating that the variables are cross-sectionally dependent. This finding implies that a shock in one of the APEC member nations may be propagated to the rest of the sample. The Pesaran and Yamagata (2008) homogeneity test is also used to evaluate the homogeneity of the slope coefficients, and the results are shown in Table 2. The test findings reveal indications of heterogeneity among APEC member nations.

After checking the presence of heterogeneity and cross-sectional dependency among APEC countries, we utilized CADF panel unit root test of Pesaran (2007) to identify the order of the integration of variables. Table 3 displays the results of the CADF panel unit root test. According to the results of the unit root test, all variables are integrated of order one, i.e., I (1).

Given that all variables have the same order of integration, we proceed to investigate the long-run relationship using the panel cointegration test proposed by Westerlund 2008 accounting for cross-sectional dependence. The cointegration test results illustrated in Table 4 indicate that the long-run relationship between GDP, CO2, EC, and FDI for APEC countries is confirmed by all statistics at 1% level of significance.

Following verification of the order of integration and long-run relationship between the variables, the CCE-MG methodology is used to estimate the long-run coefficients of Eq. (1). Table 5 displays the results of the Pesaran (2007) CCE-MG estimates for the model. The results, in general, indicate the significance of the majority of the estimated coefficients. For instance, a 1% increase in FDI results in a 0.0008% rise in CO2 emissions, indicating that higher FDI inflows may cause environmental degradation in APEC nations. This evidence supports the pollution haven hypothesis. As for the polluting effects of economic activity, the sign and the significance of the parameters vary across the member countries. In Australia, Canada, China, Malaysia, and Thailand, the elasticity of GDP with respect to CO2 emissions is positive, indicating that increased GDP per capita increases the CO2 emissions in these countries. This evidence aligns with Destek and Okumus (2019) for China and Thailand and Niu et al. (2011) for Australia, China, and Thailand. On the other hand, the evidence of negative and significant GDP coefficients for Indonesia and the Philippines reveals that a rise in economic activity reduces environmental degradation in both countries. This finding is consistent with the results of Salman et al. (2019) for these countries as the authors stated that this conclusion could be explained by institutional qualities as well as by the length of the various data periods, variables, and econometric methods. Moreover, for all countries, including Indonesia and the Philippines, the elasticity of energy consumption to CO2 emissions is positive, indicating that increasing energy consumption contributes to CO2 emissions. Among countries, China is the highest contributor of energy consumption to CO2 emissions. Additionally, the elasticity of CO2 emissions to FDI is positive in Canada, China, Malaysia, and the USA. This evidence is consistent with the findings of Ren et al. (2014) for China, indicating that FDI increases CO2 emissions. Additionally, the findings show that energy consumption has a positive and substantial effect on CO2 emissions; a 1% increase in energy consumption leads to a 0.802% increase in the APEC nations’ CO2 emissions. The evidence for the long-run positive impact of energy consumption on APEC is consistent with that of Zaidi et al. (2019).

Following the application of Westerlund (2008) cointegration test, the short- and long-run relationship between CO2 emissions, energy consumption, economic growth, and foreign direct investment is investigated using the MG and PMG estimators based on the estimation of the VECM form of the panel ARDL equation in Eq. (13). Table 6 displays the parameter estimates. The findings of the Hausman (1978) specification test for choosing between two estimators are also shown in Table 7. The null hypothesis of homogeneity restriction cannot be rejected based on the test statistics suggesting that the PMG estimator is a preferable alternative for estimating the link between CO2 emissions, energy consumption, economic growth, and FDI. The error correction terms are statistically significant at the 1% level, indicating the existence of a cointegration relationship between the variables, as shown earlier by Westerlund (2008) cointegration test. The PMG findings indicate that, with the exception of foreign direct investment, all variables have a positive and significant impact on CO2 emissions in both the long and short run. A 1% increase in energy consumption results in a 0.883% rise in CO2 emissions in the long term. This conclusion is consistent with the CCE-MG estimator’s findings. According to short-run estimates, a 1% increase in energy consumption and GDP increases CO2 emissions by 0.355 and 0.409%, respectively.

The heterogeneous causality test proposed by Emirmahmutoglu and Kose (2011) is employed in the final stage of the empirical research to evaluate the direction of causation between GDP and CO2, FDI and CO2 emissions, and energy consumption and GDP. The results of bootstrap Granger causality between GDP and CO2 emissions for 11 APEC nations are reported in Table 8. For Canada, China, Malaysia, and Mexico, the data reveal a bidirectional association between GDP and CO2 emissions. Furthermore, a unidirectional relationship running from GDP to CO2 emissions is evidenced for the Philippines, Singapore, Japan, and Thailand, indicating that a rise in GDP may increase CO2 emissions in these countries. The findings are consistent with Rahman and Vu (2020) for Canada, Bekhet and Othman (2017) for Malaysia, and Munir et al. (2020) for the Philippines, Singapore, and Thailand. However, the results are inconsistent with the findings of Wang et al. (2011) for China and Munir et al. (2020) for Malaysia which find a unidirectional causality running from economic growth to CO2 emissions and Lee and Yoo (2016) for Mexico which find a unidirectional causality running from CO2 emissions to economic growth.

The findings of the bootstrap Granger test between FDI and CO2 emissions using the bootstrap approach are presented in Table 9. Overall, the results reveal that foreign direct investment leads to an increase in CO2 emissions in APEC countries. There are several studies concerning different countries supporting pollution haven hypothesis (Solarin et al. 2017; Nasir et al. 2019; Shahbaz et al. 2019). The findings back up the pollution haven theory by showing a bidirectional connection between FDI and CO2 emissions but only for Japan. This finding is consistent with Pao and Tsai’s (2011) research of BRIC countries. Furthermore, a unidirectional relationship from CO2 to FDI is observed for Mexico.

Table 10 illustrates bootstrap Granger causality between energy consumption and GDP. The data reveal a bidirectional causality between energy consumption and GDP in Australia, China, Japan, and Singapore, verifying the feedback hypothesis. The findings of the study indicate a unidirectional causality from GDP to energy consumption for Indonesia, Mexico, the Philippines, and Thailand, supporting the conservation hypothesis. Additionally, a unidirectional causality is discovered from energy consumption to GDP in Canada and the USA, providing evidence for the growth hypothesis. These findings are in accordance with Wang et al. (2011) for China, Mahadevan and Asafu-Adjaye (2007) for Australia, Munir et al. (2020) for Indonesia and Thailand, Lee and Yoo (2016) for Mexico, and Ajmi et al. (2015) for Canada. However, the findings differ from those of Zhang and Cheng (2009) for China and Fatai et al. (2004) for Australia, which find a unidirectional causality running from GDP to energy consumption, as well as Munir et al. (2020) for Singapore, which find a unidirectional causality running from energy consumption to GDP. The findings differ from those of Shahbaz et al. (2013), who find bidirectional causality between energy consumption and economic growth in Indonesia.

The main findings of the causality tests suggest a number of implications. Unidirectional causality flowing from energy consumption to economic growth in Canada and the USA implies that energy conservation may reduce economic growth, indicating that economic growth may be achieved by increasing energy consumption. If unidirectional causation flows in the opposite direction, as it does in Indonesia, Mexico, the Philippines, and Thailand, then policies enacting conservative energy measures have little or no negative effects on economic development (Mahadevan and Asafu-Adjaye 2007). As a result, governments in these nations may reduce energy-related spending by identifying other priority areas that would help economic growth in the long run, such as education (Munir et al. 2020). However, if there is a bidirectional causation between energy consumption and economic growth, as shown by the results for four countries, then energy consumption plays a key role in promoting economic growth, and economic growth boosts energy consumption. The findings of the causality between FDI and CO2 emissions support the pollution haven hypothesis for overall panel countries.

Conclusions

Using panel data methodology, this research explored the relationship between CO2 emissions, energy consumption, economic growth, and foreign direct investment for a sample of APEC countries from 1981:Q1 to 2021:Q1. Test results provide evidence of cross-sectional dependence and heterogeneity among APEC countries. Therefore, cross-sectional augmented Dickey-Fuller (CADF) unit root test among the second-generation unit root tests is employed to test the stationarity levels of variables. Furthermore, we investigated the long-run equilibrium relationship across the variables using the Westerlund (2008) panel cointegration test. The Common Correlated Effects Mean Group (CCE-MG) approach proposed by Pesaran (2007) is utilized to determine the relationship between independent and dependent variables. Furthermore, short- and long-run coefficient estimations were obtained utilizing PMG analysis. Finally, the panel causality approach developed by Emirmahmutoglu and Kose (2011) is employed to find the direction of causality between the variables. The panel cointegration test results indicate that the variables are cointegrated, and there exists a long-run relationship between the variables in APEC countries. The CCE-MG test results reveal that energy consumption and FDI lead to an increase in environmental degradation as a whole panel. Similarly, PMG results also show that energy consumption was found to have a positive and significant effect on CO2 emissions both in the long and short run. Due to the differences in the economic structures of APEC countries, the impacts of energy consumption, economic growth, and foreign direct investment on CO2 emissions differ in a cross-country analysis. Moreover, Emirmahmutoglu and Kose (2011) bootstrap panel Granger causality demonstrates that the feedback hypothesis is valid among energy consumption and GDP in Australia, China, Japan, and Singapore. Additionally, there is a bidirectional causal relationship between FDI and CO2 emissions in Japan. For Mexico, there is also evidence of unidirectional causality running from CO2 emissions to FDI. Furthermore, a bidirectional relationship between GDP and CO2 emissions has been confirmed for Canada, China, Malaysia, and Mexico.

The current trend of increasing CO2 emissions poses a significant issue for APEC countries. To meet this problem, a comprehensive range of economic, foreign direct investment, and energy policies that promote economic growth while protecting the environment should be implemented. In general, our findings indicate that foreign direct investment and energy consumption contribute to CO2 emissions in a subset of APEC nations. These findings highlight the importance of enacting environmentally friendly policies to reduce the impact of FDI and energy consumption on CO2 emissions. As a result, APEC nations can reduce CO2 emissions by implementing investment policies that encourage the use of ecologically friendly energy sources in order to attain a cleaner environment.

This study has several limitations in that we analyze the impact of primary energy consumption on environmental deterioration in the APEC nations’ model. Future research could incorporate renewable energy sources into the analysis to investigate the impact of various energy sources on CO2 emissions. Future study could investigate this connection further by employing the ecological footprint as an alternative environmental indicator.

Availability of data and materials

None

Notes

See Huang et al. (2008) for a detailed empirical literature review on causal relationship between economic growth and energy consumption.

Tiba and Omri (2017) conduct a detailed investigation into causal relationship between economic growth, energy consumption and carbon emissions.

The optimum number of lags ki is selected based on Akaike and Schwarz information criterions.

References

Abdouli M, Hammami S (2017) Investigating the causality links between environmental quality, foreign direct investment and economic growth in MENA countries. Int Bus Rev 26:264–278

Abdouli M, Hammami S (2018) The dynamic links between environmental quality foreign direct investment and economic growth in the Middle Eastern and North African countries (MENA region). J Knowl Econ 9:833–853

Abdouli M, Omri A (2021) Exploring the nexus among FDI inflows, environmental quality, human capital, and economic growth in the Mediterranean region. J Knowl Econ 12(2):788–810

Acaravci A, Ozturk I (2010) On the relationship between energy consumption, CO2 emissions and economic growth in Europe. Energy 35:5412–5420

Acheampong AO (2018) Economic growth, CO2 emissions and energy consumption: what causes what and where? Energy Econ 74:677–692

Adebayo TS, Akinsola GD (2021) Investigating the causal linkage among economic growth, energy consumption and CO 2 emissions in Thailand: an application of the wavelet coherence approach. Int J Renew Energy Dev 10(1):17–26

Ajmi AN, Hammoudeh S, Nguyen DK, Sato JR (2015) On the relationships between CO2 emissions, energy consumption and income: the importance of time variation. Energy Econ 49:629–638

Akalpler E, Hove S (2019) Carbon emissions, energy use, real GDP per capita and trade matrix in the Indian economy—an ARDL approach. Energy 168:1081–1093

Akarca AT, Long TV (1980) On the relationship between energy and GNP: a reexamination. J Energy Dev 5:326–331

Alam MJ, Begum IA, Buysse J, Van Huylenbroeck G (2012) Energy consumption, carbon emissions and economic growth nexus in Bangladesh: cointegration and dynamic causality analysis. Energy Policy 45:217–225

Allard A, Takman J, Uddin GS, Ahmed A (2018) The N-shaped environmental Kuznets curve: an empirical evaluation using a panel quantile regression approach. Environ Sci Pollut Res 25:5848–5861

Al-Mulali U, Tang CF (2013) Investigating the validity of pollution haven hypothesis in the gulf cooperation council (GCC) countries. Energy Policy 60:813–819

Al-Mulali U, Saboori B, Ozturk I (2015) Investigating the environmental Kuznets curve hypothesis in Vietnam. Energy Policy 76:123–131

Alshehry AS, Belloumi M (2015) Energy consumption, carbon dioxide emissions and economic growth: the case of Saudi Arabia. Renew Sust Energ Rev 41:237–247

Ang JB (2007) CO2 emissions, energy consumption, and output in France. Energy Policy 35:4772–4778

Antonakakis N, Chatziantoniou I, Filis G (2017) Energy consumption, CO2 emissions, and economic growth: an ethical dilemma. Renew Sust Energ Rev 68:808–824

Antweiler W, Copeland BR, Taylor MS (2001) Is free trade good for the environment? Am Econ Rev 91:877–908

APEC (2020) APEC in Charts 2020. Policy support unit: APEC

APERC (2019) APEC energy demand and supply outlook. In: Asia Pacific Energy Research Centre (APERC), 7th edition, 1 edn. The Institute of Energy Economics, Japan (IEEJ), Japan

Apergis N, Payne JE (2009) CO2 emissions, energy usage, and output in Central America. Energy Policy 37:3282–3286

Apergis N, Payne JE (2010) Renewable energy consumption and growth in Eurasia. Energy Econ 32:1392–1397

Asumadu-Sarkodie S, Owusu PA (2016) The relationship between carbon dioxide and agriculture in Ghana: a comparison of VECM and ARDL model. Environ Sci Pollut Res 23:10968–10982

Aydogan B, Vardar G (2020) Evaluating the role of renewable energy, economic growth and agriculture on CO2 emission in E7 countries. Int J Sustain Energy 39:335–348

Azlina AA, Mustapha NN (2012) Energy, economic growth and pollutant emissions nexus: the case of Malaysia. Procedia Soc Behav Sci 65:1–7

Bakhsh K, Rose S, Ali MF, Ahmad N, Shahbaz M (2017) Economic growth, CO2 emissions, renewable waste and FDI relation in Pakistan: new evidences from 3SLS. J Environ Manag 196:627–632

Balibey M (2015) Relationships among CO2 emissions, economic growth and foreign direct investment and the EKC hypothesis in Turkey. Int J Energy Econ Policy 5:1042–1049

Balli E, Nugent JB, Coskun N, Sigeze C (2020) The relationship between energy consumption CO2 emissions and economic growth in Turkey: evidence from Fourier approximation. Environ Sci Pollut Res 27:44148–44164

Balsalobre-Lorente D, Álvarez-Herranz A (2016) Economic growth and energy regulation in the environmental Kuznets curve. Environ Sci Pollut Res 23:16478–16494

Bao Q, Chen Y, Song L (2011) Foreign direct investment and environmental pollution in China: a simultaneous equations estimation. Environ Dev Econ 16:71–92

Bartleet M, Gounder R (2010) Energy consumption and economic growth in New Zealand: Results of trivariate and multivariate models. Energy Policy 38:3508–3517

Beckerman W (1992) Economic growth and the environment: whose growth? Whose environment? World Dev 20:481–496

Behera SR, Dash DP (2017) The effect of urbanization, energy consumption, and foreign direct investment on the carbon dioxide emission in the SSEA (South and Southeast Asian) region. Renew Sust Energ Rev 70:96–106

Bekhet HA, Othman NS (2017) Impact of urbanization growth on Malaysia CO2 emissions: evidence from the dynamic relationship. J Clean Prod 154:374–388

Bekun FV, Alola AA, Sarkodie SA (2019) Toward a sustainable environment: nexus between CO2 emissions, resource rent, renewable and nonrenewable energy in 16-EU countries. Sci Total Environ 657:1023–1029

Belloumi M (2009) Energy consumption and GDP in Tunisia: cointegration and causality analysis. Energy Policy 37:2745–2753

Bhattacharya M, Paramati SR, Ozturk I, Bhattacharya S (2016) The effect of renewable energy consumption on economic growth: evidence from top 38 countries. Appl Energy 162:733–741

Bhattarai K, Paudel KP, Poudel BN (2009) Searching for an environmental Kuznets curve in carbon dioxide pollutant in Latin American countries. J Agric Appl Econ 41:13–27

Birdsall N, Wheeler D (1993) Trade policy and industrial pollution in Latin America: where are the pollution havens? J Environ Dev 2:137–149

Boluk G, Mert M (2015) The renewable energy, growth and environmental Kuznets curve in Turkey: an ARDL approach. Renew Sust Energ Rev 52:587–595

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47:239–253

Bukhari N, Shahzadi K, Ahmad MS (2014) Consequence of FDI on CO2 emissions in case of Pakistan. Middle-East J Sci Res 20:1183–1189

Chandran VGR, Tang CF (2013) The impacts of transport energy consumption, foreign direct investment and income on CO2 emissions in ASEAN-5 economies. Renew Sust Energ Rev 24:445–453

Chenran X, Limao W, Chengjia Y, Qiushi Q, Ning X (2019) Measuring the effect of foreign direct investment on CO2 emissions in Laos. J Resources Ecol 10:685–691

Chontanawat J (2020) Relationship between energy consumption, CO2 emission and economic growth in ASEAN: cointegration and causality model. Energy Rep 6:660–665

Cole MA (2004) Trade, the pollution haven hypothesis and the environmental Kuznets curve: examining the linkages. Ecol Econ 48:71–81

Cole MA, Elliott RJ (2003) Determining the trade-environment composition effect: the role of capital, labor and environmental regulations. J Environ Econ Manag 46:363–383

Copeland BR, Taylor MS (1994) North-South trade and the environment. Q J Econ 109:755–787

Dagher L, Yacoubian T (2012) The causal relationship between energy consumption and economic growth in Lebanon. Energy Policy 50:795–801

Destek MA (2016) Renewable energy consumption and economic growth in newly industrialized countries: evidence from asymmetric causality test. Renew Energy 95:478–484

Destek MA, Okumus I (2019) Does pollution haven hypothesis hold in newly industrialized countries? Evidence from ecological footprint. Environ Sci Pollut Res 26:23689–23695

Dogan E, Turkekul B (2016) CO 2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23:1203–1213

Dumitrescu EI, Hurlin C (2012) Testing for Granger non-causality in heterogeneous panels. Econ Model 29:1450–1460

Ehrlich PR, Holdren JP (1971) Global ecology: readings toward a rational strategy for man. Harcourt Brace Jovanovich, New York

Elliott RJ, Shimamoto K (2008) Are ASEAN countries havens for Japanese pollution-intensive industry? World Econ 31:236–254

Emirmahmutoglu F, Kose N (2011) Testing for Granger causality in heterogeneous mixed panels. Econ Model 28:870–876

Erdal G, Erdal H, Esengün K (2008) The causality between energy consumption and economic growth in Turkey. Energy Policy 36:3838–3842

Erol U, Yu ES (1987) On the causal relationship between energy and income for industrialized countries. J Energy Dev 13:113–122

Essandoh OK, Islam M, Kakinaka M (2020) Linking international trade and foreign direct investment to CO2 emissions: any differences between developed and developing countries? Sci Total Environ 712:1–10

Fatai K, Oxley L, Scrimgeour FG (2004) Modelling the causal relationship between energy consumption and GDP in New Zealand, Australia, India, Indonesia, The Philippines and Thailand. Math Comput Simul 64(3-4):431–445

Fazal R, Rehman SAU, Rehman AU, Bhatti MI, Hussain A (2021) Energy-environment-economy causal nexus in Pakistan: a graph theoretic approach. Energy 214:118934

Feridun M, Sissoko Y (2011) Impact of FDI on economic development: a causality analysis for Singapore, 1976-2002. Int J Econ Sci Appl Res 4:7–17

Fisher RA (1932) Statistical methods for research workers. Oliver and Boyd, Edinburgh, p 1925

Gokmenoglu K, Taspinar N (2016) The relationship between CO2 emissions, energy consumption, economic growth and FDI: the case of Turkey. J Int Trade Econ Dev 25:706–723

Gorus MS, Aydin M (2019) The relationship between energy consumption, economic growth, and CO2 emission in MENA countries: causality analysis in the frequency domain. Energy 168:815–822

Gray KR (2002) Foreign direct investment and environmental impacts-Is the debate over. Rev Eur Comp & Int'l Envtl L 11:306–313

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free trade agreement No. w3914. National Bureau of economic research. https://www.nber.org/system/files/working_papers/w3914/w3914.pdf. Accessed 12 Dec 2020

Grossman GM, Krueger AB (1995) Economic growth and the environment. Q J Econ 110:353–377

Gyamfi BA, Adedoyin FF, Bein MA, Bekun FV (2021) Environmental implications of N-shaped environmental Kuznets curve for E7 countries. Environ Sci Pollut Res 28:33072–33308

Halicioglu F (2009) An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 37:1156–1164

Hanif I (2017) Economics-energy-environment nexus in Latin America and the Caribbean. Energy 141:170–178

Hansen H, Rand J (2006) On the causal links between FDI and growth in developing countries. World Econ 29:21–41

Hao Y, Guo Y, Guo Y, Wu H, Ren S (2020) Does outward foreign direct investment (OFDI) affect the home country’s environmental quality? The case of China. Struct Chang Econ Dyn 52:109–119

Hatemi-j A (2012) Asymmetric causality tests with an application. Empir Econ 43:447–456

Hausman JA (1978) Specification tests in econometrics. Econometrica: J Econ Soc 46:1251–1271

He J (2006) Pollution haven hypothesis and environmental impacts of foreign direct investment: the case of industrial emission of sulfur dioxide (SO2) in Chinese provinces. Ecol Econ 60:228–245

Hoffmann R, Lee CG, Ramasamy B, Yeung M (2005) FDI and pollution: a granger causality test using panel data. J Int Dev: J Dev Stud Assoc 17:311–317

Hu JL, Kao CH (2007) Efficient energy-saving targets for APEC economies. Energy Policy 35:373–382

Huang BN, Hwang MJ, Yang CW (2008) Causal relationship between energy consumption and GDP growth revisited: a dynamic panel data approach. Ecol Econ 67:41–54

Hwang DB, Gum B (1991) The causal relationship between energy and GNP: the case of Taiwan. J Energy Dev 16:219–226

Jaffe AB, Peterson SR, Portney PR, Stavins RN (1995) Environmental regulation and the competitiveness of US manufacturing: what does the evidence tell us? J Econ Lit 33:132–163

Jugurnath B, Emrith A (2018) Impact of foreign direct investment on environment degradation: evidence from SIDS countries. J Dev Areas 52:13–26

Kim MH, Adilov N (2012) The lesser of two evils: an empirical investigation of foreign direct investment-pollution tradeoff. Appl Econ 44:2597–2606

Kirkulak B, Qiu B, Yin W (2011) The impact of FDI on air quality: evidence from China. J Chin Econ Foreign Trade Stud 4:81–98

Kisswani KM, Zaitouni M (2021) Does FDI affect environmental degradation? Examining pollution haven and pollution halo hypotheses using ARDL modelling. J Asia Pac Econ:1–27

Kizilkaya O (2017) The impact of economic growth and foreign direct investment on CO2 emissions: the case of Turkey. Turk Econ Rev 4:106–118

Kocak E, Sarkgunesi A (2018) The impact of foreign direct investment on CO 2 emissions in Turkey: new evidence from cointegration and bootstrap causality analysis. Environ Sci Pollut Res 25:790–804

Kraft J, Kraft A (1978) On the relationship between energy and GNP. J Energy Dev 3:401–403

Lee JW (2013) The contribution of foreign direct investment to clean energy use, carbon emissions and economic growth. Energy Policy 55:483–489

Lee SJ, Yoo SH (2016) Energy consumption, CO2 emission, and economic growth: evidence from Mexico. Energy Sources, Part B: Econ Plann Policy 11(8):711–717

Linh DH, Lin SM (2014) CO 2 emissions, energy consumption, economic growth and FDI in Vietnam. Manag Global Trans: Int Res J 12(3):219–232

Liu Y, Yan B, Zhou Y (2016) Urbanization, economic growth, and carbon dioxide emissions in China: a panel cointegration and causality analysis. J Geogr Sci 26:131–152

Magazzino C (2015) Economic growth, CO2 emissions and energy use in Israel. Int J Sustain Dev World Ecol 22:89–97

Magazzino C (2016a) The relationship between real GDP, CO2 emissions, and energy use in the GCC countries: a time series approach. Cogent Econ Finance 4:1–20

Magazzino C (2016b) The relationship between CO2 emissions, energy consumption and economic growth in Italy. Int J Sustain Energy 35:844–857

Magazzino C (2017) The relationship among economic growth, CO2 emissions, and energy use in the APEC countries: a panel VAR approach. Environ Syst Dec 37:353–366

Mahadevan R, Asafu-Adjaye J (2007) Energy consumption, economic growth and prices: a reassessment using panel VECM for developed and developing countries. Energy Policy 35(4):2481–2490

Mehrara M (2007) Energy consumption and economic growth: the case of oil exporting countries. Energy Policy 35:2939–2945

Menyah K, Wolde-Rufael Y (2010) Energy consumption, pollutant emissions and economic growth in South Africa. Energy Econ 32:1374–1382

Mert M, Bölük G (2016) Do foreign direct investment and renewable energy consumption affect the CO2 emissions? New evidence from a panel ARDL approach to Kyoto Annex countries. Environ Sci Pollut Res 23:21669–21681

Mert M, Caglar AE (2020) Testing pollution haven and pollution halo hypotheses for Turkey: a new perspective. Environ Sci Pollut Res 27(26):32933–32943

Mert M, Bölük G, Caglar AE (2019) Interrelationships among foreign direct investments, renewable energy, and CO 2 emissions for different European country groups: a panel ARDL approach. Environ Sci Pollut Res 26:21495–21510

Mihci H, Cagatay S, Koska O (2005) The impact of environmental stringency on the foreign direct investments of the OECD countries. J Environ Assess Policy Manag 7:679–704

Mikayilov JI, Galeotti M, Hasanov FJ (2018) The impact of economic growth on CO2 emissions in Azerbaijan. J Clean Prod 197:1558–1572

Moomaw WR, Unruh GC (1997) Are environmental Kuznets curves misleading us? The case of CO2 emissions. Environ Dev Econ 2:451–463

Moosa I (2002) Foreign direct investment: theory, evidence and practice. Springer, Switzerland

Munir Q, Lean HH, Smyth R (2020) CO2 emissions, energy consumption and economic growth in the ASEAN-5 countries: a cross-sectional dependence approach. Energy Econ 85:1–10

Mutafoglu TH (2012) Foreign direct investment, pollution, and economic growth: evidence from Turkey. J Dev Soc 28:281–297

Nasir MA, Huynh TLD, Tram HTX (2019) Role of financial development, economic growth & foreign direct investment in driving climate change: a case of emerging ASEAN. J Environ Manag 242:131–141

Niu S, Ding Y, Niu Y, Li Y, Luo G (2011) Economic growth, energy conservation and emissions reduction: a comparative analysis based on panel data for 8 Asian-Pacific countries. Energy Policy 39(4):2121–2131

Nyasha S, Gwenhure Y, Odhiambo NM (2018) Energy consumption and economic growth in Ethiopia: a dynamic causal linkage. Energy Environ 29:1393–1412

Olusanya SO (2013) Impact of foreign direct investment inflow on economic growth in a pre and post deregulated Nigeria economy. A Granger causality test (1970-2010). Eur Sci J 9:335–356

Omay RE (2013) The relationship between environment and income: regression spline approach. Int J Energy Econ Policy 3:52–61

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Econ 48:242–252

Ozokcu S, Ozdemir O (2017) Economic growth, energy, and environmental Kuznets curve. Renew Sust Energ Rev 72:639–647

Ozturk Z, Oz D (2016) The relationship between energy consumption, income, foreign direct investment, and CO2 emissions: the case of Turkey. Cankiri Karatekin Univ J FEAS 6:269–288

Panayotou T (1997) Demystifying the environmental Kuznets curve: turning a black box into a policy tool. Environ Dev Econ 2:465–484

Pao HT, Tsai CM (2011) Multivariate Granger causality between CO2 emissions, energy consumption, FDI (foreign direct investment) and GDP (gross domestic product): evidence from a panel of BRIC (Brazil, Russian Federation, India, and China) countries. Energy 36:685–693

Payne JE (2009) On the dynamics of energy consumption and output in the US. Appl Energy 86:575–577

Pazienza P (2014) The relationship between FDI and the natural environment: facts, evidence and prospects. Springer Science & Business Media, Italy

Pesaran MH (2004) General diagnostic tests for cross-sectional dependence in panels. Cambridge Working Papers in Economics 0435, Faculty of Economics, University of Cambridge. https://ideas.repec.org/p/cam/camdae/0435.html. Accessed 21 Dec 2020

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22:265–312

Pesaran MH, Shin Y, Smith RP (1999) Pooled mean group estimation of dynamic heterogeneous panels. J Am Stat Assoc 94:621–634

Pesaran MH, Smith R (1995) Estimating long-run relationships from dynamic heterogeneous panels. J Econom 68(1):79–113

Pesaran MH, Yamagata T (2008) Testing slope homogeneity in large panels. J Econ 142:50–93

Rahman MM (2021) The dynamic nexus of energy consumption, international trade and economic growth in BRICS and ASEAN countries: a panel causality test. Energy 229:120679

Rahman MM, Mamun SAK (2016) Energy use, international trade and economic growth nexus in Australia: new evidence from an extended growth model. Renew Sust Energ Rev 64:806–816

Rahman MM, Velayutham E (2020) Renewable and non-renewable energy consumption-economic growth nexus: new evidence from South Asia. Renew Energy 147:399–408

Rahman MM, Vu XB (2020) The nexus between renewable energy, economic growth, trade, urbanisation and environmental quality: a comparative study for Australia and Canada. Renew Energy 155:617–627

Refinitiv Eikon Datastream, (2021). Refinitiv. Available. https://www.refinitiv.com/en/products/datastream-macroeconomic-analysis. (Accessed 21 April 2021).

Ren S, Yuan B, Ma X, Chen X (2014) International trade, FDI (foreign direct investment) and embodied CO2 emissions: a case study of Chinas industrial sectors. China Econ Rev 28:123–134

Salehnia N, Alavijeh NK, Salehnia N (2020) Testing Porter and pollution haven hypothesis via economic variables and CO 2 emissions: a cross-country review with panel quantile regression method. Environ Sci Pollut Res 27:31527–31542

Salman M, Long X, Dauda L, Mensah CN (2019) The impact of institutional quality on economic growth and carbon emissions: evidence from Indonesia, South Korea and Thailand. J Clean Prod 241:118331

Sengul S, Tuncer I (2006) Türkiye’de enerji tüketimi ve ekonomik büyüme: 1960-2000. İktisat İşletme ve Finans 21:69–80

Seyoum M, Wu R, Lin J (2015) Foreign direct investment and economic growth: the case of developing African economies. Soc Indic Res 122:45–64

Shaari MS, Hussain NE, Abdullah H, Kamil S (2014) Relationship among foreign direct investment, economic growth and CO2 emission: a panel data analysis. Int J Energy Econ Policy 4:706–715

Shahbaz M, Hye QMA, Tiwari AK, Leitão NC (2013) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sust Energ Rev 25:109–121

Shahbaz M, Nasreen S, Abbas F, Anis O (2015) Does foreign direct investment impede environmental quality in high-, middle-, and low-income countries? Energy Econ 51:275–287

Shahbaz M, Zakaria M, Shahzad SJH, Mahalik MK (2018) The energy consumption and economic growth nexus in top ten energy-consuming countries: fresh evidence from using the quantile-on-quantile approach. Energy Econ 71:282–301

Shahbaz M, Balsalobre-Lorente D, Sinha A (2019) Foreign direct investment–CO2 emissions nexus in Middle East and North African countries: importance of biomass energy consumption. J Clean Prod 217:603–614

Shahbaz M, Raghutla C, Chittedi KR, Jiao Z, Vo XV (2020) The effect of renewable energy consumption on economic growth: evidence from the renewable energy country attractive index. Energy 207:1–14

Solarin SA, Al-Mulali U, Musah I, Ozturk I (2017) Investigating the pollution haven hypothesis in Ghana: an empirical investigation. Energy 124:706–719

Ssali MW, Du J, Mensah IA, Hongo DO (2019) Investigating the nexus among environmental pollution, economic growth, energy use, and foreign direct investment in 6 selected sub-Saharan African countries. Environ Sci Pollut Res 26:11245–11260

Stern DI (1993) Energy and economic growth in the USA: a multivariate approach. Energy Econ 15:137–150

Stine RA (1987) Estimating properties of autoregressive forecasts. J Am Stat Assoc 82(400):1072–1078

Sun Y, Li M, Zhang M, Khan HSUD, Li J, Li Z, Sun H, Zhu Y, Anaba OA (2021) A study on China’s economic growth, green energy technology, and carbon emissions based on the Kuznets curve (EKC). Environ Sci Pollut Res 28(6):7200–7211

Sung B, Song WY, Park SD (2018) How foreign direct investment affects CO2 emission levels in the Chinese manufacturing industry: evidence from panel data. Econ Syst 42:320–331

Suri V, Chapman D (1998) Economic growth, trade and energy: implications for the environmental Kuznets curve. Ecol Econ 25:195–208

Swamy PA (1970) Efficient inference in a random coefficient regression model. Econometrica: J Econ Soc 38:311–323

Tamazian A, Rao BB (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ 32:137–145

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37:246–253

Tang J (2015) Testing the pollution haven effect: does the type of FDI matter? Environ Resour Econ 60:549–578

Tang CF, Tan BW (2015) The impact of energy consumption, income and foreign direct investment on carbon dioxide emissions in Vietnam. Energy 79:447–454

Tang CF, Tan BW, Ozturk I (2016) Energy consumption and economic growth in Vietnam. Renew Sust Energ Rev 54:1506–1514

Tiba S, Omri A (2017) Literature survey on the relationships between energy, environment and economic growth. Renew Sust Energ Rev 69:1129–1146

Toda HY, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econ 66:225–250

Ummalla M, Goyari P (2021) The impact of clean energy consumption on economic growth and CO2 emissions in BRICS countries: does the environmental Kuznets curve exist? J Public Aff 21:1–12

Wagner UJ, Timmins CD (2009) Agglomeration effects in foreign direct investment and the pollution haven hypothesis. Environ Resour Econ 43:231–256

Wang SS, Zhou DQ, Zhou P, Wang QW (2011) CO2 emissions, energy consumption and economic growth in China: a panel data analysis. Energy Policy 39(9):4870–4875

Wang S, Li Q, Fang C, Zhou C (2016) The relationship between economic growth, energy consumption, and CO2 emissions: empirical evidence from China. Sci Total Environ 542:360–371

Waqih MAU, Bhutto NA, Ghumro NH, Kumar S, Salam MA (2019) Rising environmental degradation and impact of foreign direct investment: an empirical evidence from SAARC region. J Environ Manag 243:472–480

Westerlund J (2008) Panel cointegration tests of the Fisher effect. J Appl Econ 23:193–233

Xing Y, Kolstad CD (2002) Do lax environmental regulations attract foreign investment? Environ Resour Econ 21:1–22

Yang Z, Zhao Y (2014) Energy consumption, carbon emissions, and economic growth in India: Evidence from directed acyclic graphs. Econ Model 38:533–540

Yildirim E (2014) Energy use, CO 2 emission and foreign direct investment: is there any inconsistence between causal relations? Front Energy 8:269–278

Yu ES, Choi JY (1985) The causal relationship between energy and GNP: an international comparison. J Energy Dev 10:249–272

Yu SHE, Hwang BK (1984) The relationship between energy and GNP: further results. Energy Econ 6:186–190

Zaidi SAH, Zafar MW, Shahbaz M, Hou F (2019) Dynamic linkages between globalization, financial development and carbon emissions: evidence from Asia Pacific Economic Cooperation countries. J Clean Prod 228:533–543

Zamani M (2007) Energy consumption and economic activities in Iran. Energy Econ 29:1135–1140

Zhang XP, Cheng XM (2009) Energy consumption, carbon emissions, and economic growth in China. Ecol Econ 68:2706–2712

Zhang C, Zhao W (2014) Panel estimation for income inequality and CO2 emissions: a regional analysis in China. Appl Energy 136:382–392

Zhang C, Zhou X (2016) Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renew Sust Energ Rev 58:943–951

Zhixin Z, Xin R (2011) Causal relationships between energy consumption and economic growth. Energy Procedia 5:2065–2071

Zhu H, Duan L, Guo Y, Yu K (2016) The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: evidence from panel quantile regression. Econ Model 58:237–248

Author information

Authors and Affiliations

Contributions

EB: data curation, estimation of unit root tests, interpretation of empirical results, editing of the manuscript; CS: review of literature, data curation, editing of the manuscript; MSU: review of literature, drafting the article, editing of the manuscript; ANC: data curation, estimation of the model, interpretation of empirical results, editing of the manuscript.

Corresponding author

Ethics declarations

Ethics approval

This article does not contain any studies with human participants performed by any of the authors.

Consent to participate

No human or animal subjects were used in the study, and no questionnaire was conducted.

Consent for publication

This study does not cover individual’s personal data.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Eyup Dogan

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Balli, E., Sigeze, C., Ugur, M.S. et al. The relationship between FDI, CO2 emissions, and energy consumption in Asia-Pacific economic cooperation countries. Environ Sci Pollut Res 30, 42845–42862 (2023). https://doi.org/10.1007/s11356-021-17494-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-17494-3