Abstract

Green finance is one of the most important ways to help companies achieve green transformation and development. We construct a quasi-natural experiment with the “Green Credit Guidelines” and establish a difference-in-differences model to empirically test the implementation effect of the green credit policy in China. The results show that after the implementation of China’s green credit policy, the debt financing scale of listed companies in heavily polluting industries has decreased significantly, the debt financing cost has increased significantly, and the debt financing maturity has been shortened significantly, indicating that the green credit policy has inhibited the debt financing of heavily polluting enterprises. We further find that this inhibition has also been affected by the nature of controlling shareholders, environmental information disclosure levels, regional environmental regulations and regional financial development levels. China’s green credit policy has played a role in guiding listed companies to go green through the redistribution of debt financing.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Under the guidance of national policies and social needs, going green has become the development strategy and goal of an increasing number of listed companies (Li et al. 2018). Green finance is one of the main ways to achieve this goal. In China, green credit policy has gradually been taken more seriously since it was first proposed in 2007. In 2012, the China Banking Regulatory Commission (CBRC) issued the “Green Credit Guides”, which clarified the standards and principles of green credit in the banking industry. Commercial banks have successively responded to policy requirements to develop green credit businesses. According to the “2019 China Banking Social Responsibility Report” issued by the China Banking Association, the green credit balance of China’s banking financial institutions exceeded 10 trillion yuan at the end of 2019. Green credit has become an important part of bank credit.

The massive increase in green finance and green credit practices has further promoted the research on corporate social responsibility, especially how environmental responsibility and performance impact corporate economic consequences (Lu et al. 2014). By constructing a stakeholder welfare score, Jiao (2010) emphasized the importance of non-shareholder stakeholder welfare in enhancing firm value. Ghoul et al. (2011) found that firms with better KLD CSR scores exhibited less costly equity financing. Wang et al. (2016) suggested that the relationship between corporate social performance and corporate finance could be illustrated effectively by a u-shaped. They used the MSCI ESG index to measure corporate social performance, and the results verified this u-shaped relationship. Li et al. (2020) constructed a set of green governance structure evaluation indicators to measure firms’ continuity and initiative in CSR activities and found that firms with better green governance structures faced lower financing constraints. Similarly, Liu et al. (2021) used content analysis methods to measure corporate environmental performance and found that firms with better corporate environmental performance experienced significantly fewer financing constraints. The inconsistency of these research conclusions may be due to different theoretical assumptions and different measurement methods. On the one hand, the inconsistency may result from the impacts produced by different hypotheses supported by different theories. The social impact hypothesis supports a positive impact (Freeman 1984), while the trade-off hypothesis and the management opportunism hypothesis support the negative impact (Aupperle et al. 1985; Williamson 1985). On the other hand, the inconsistency may also be caused by differing measures of corporate social responsibility in the literature (Esteban-Sanchez et al. 2017; Dragomir 2018). Corporate social responsibility performance is difficult to measure, and the selection of related indicators may lead to greater endogeneity, which also makes the research conclusions inconsistent and unreliable.

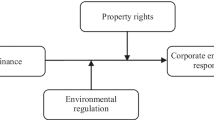

China’s green credit policy requires banks and other financial institutions to incorporate environmental risks into their credit decisions, reduce credit support for projects with high environmental risks, and increase credit support for projects that conform to the concept of sustainable development. As bank loans are an important source of corporate debt financing, changes in credit policies may have an impact on corporate debt financing. At the level of listed companies, listed companies in heavily polluting industries with numerous environmental risks are rather susceptible to the impact of the green credit policy and can therefore face severe financing constraints. Therefore, the implementation of China’s green credit policy provides an entry point for us to further explore how corporate environmental performance or environmental risks affect corporate debt financing. Analysing the changes in debt financing of companies with different environmental performances before and after the impact of this external shock can effectively prevent the endogeneity problems arising from the selection of indicators, making the conclusion of this empirical analysis of corporate environmental performance and economic consequences more robust.

Using a sample of 19,384 firm-year observations from 2008 to 2016 of Chinese listed companies, we study the impact of the external shock of the implementation of a green credit policy on the debt financing of listed companies in heavily polluting industries and empirically test the effectiveness of a green credit policy from the aspects of debt financing scale, cost and maturity. We find that after the implementation of a green credit policy, listed companies in heavily polluted industries face smaller debt financing scales, higher debt financing costs and shorter debt financing maturities; that is, listed companies in industries with greater environmental risks face more serious financing constraints after implementing a green credit policy. The robustness test and placebo test further show the robustness of our conclusion. Moreover, we also analyse the impact of corporate governance factors at the company level and of legal and financial environmental factors at the macrolevel on policy effects. We find that state-controlled listed companies are more significantly affected by China’s green credit policy; the debt financing cost and maturity of listed companies with a low level of environmental information disclosure are more significantly affected by the policy; the debt financing scale and maturity of listed companies in regions with strict environmental regulation and low-level financial development are more significantly affected by the policy, while listed companies in regions with weak environmental regulation and high-level financial development may face higher debt financing cost growth due to the policy.

Our research supports the credit penalty effect of the green credit policy on heavily polluting companies. Through the adjustment and control of credit scale, cost and maturity, the green credit policy can encourage companies to improve their environmental performance by strengthening information disclosure, technological innovation, and through other means. On the one hand, the green credit policy facilitates the initial governance of environmental pollution through the redistribution of credit resources. Due to the constraints of credit resources, heavily polluting companies face higher financing thresholds and higher financing costs, which may prompt these companies to focus more on environmental performance. On the other hand, the policy fosters the full-cycle governance of environmental pollution by guiding the green transformation of heavily polluting enterprises. From the perspective of long-term development, it is only through green transformation that heavily polluting companies facing punitive credit constraints can effectively mitigate environmental risks, improve their company’s environmental performance, reduce the impact of punitive credit constraints, and ultimately achieve green development.

Our study contributes to the existing literature in several ways. First, our study enriches the research on the relationship between corporate environmental performance and economic consequences. Taking the external shock of the implementation of a green credit policy as an entry point, we establish a difference-in-differences model to empirically test the impact of environmental risks and pressures on the scale, cost and maturity of corporate debt financing and reduce endogenous issues to make our empirical results more robust. Second, our study also enriches the research on the relationship between the macro environment and the micro behaviour of an enterprise to a certain extent. We elaborate the impact of corporate governance factors at the company level and of macrolevel legal and financial environmental factors on the implementation of the green credit policy. Finally, our study provides a certain empirical reference concerning the necessity of green transformation and the importance of green financial instruments (such as green credit) in practice. Our study reaffirms the important role of green finance in a company’s green transformation, and our research on China’s green credit practice also provides some evidence for the development and practice of green finance around the world.

The remainder of the paper is arranged as follows: the “Green credit policy and corporate debt financing” section briefly reviews the relevant literature on green credit policy and corporate performance and proposes the main research hypotheses of this paper. The “Research design” section presents the research design of the paper, describes our sample and discusses the regression variables. The “Empirical results” section presents the empirical results and further analyses the impact of macroenvironmental factors and micro governance factors on our results. The “Conclusion and discussion” section provides some conclusions and discussions.

Green credit policy and corporate debt financing

Before the implementation of the “Green Credit Guidelines”, some scholars paid attention to the green credit policy implemented by China at the national and provincial levels (Zhang et al. 2011). Zhang et al. (2011) suggested that ambiguous policy details, unclear implementation standards, and insufficient environmental information led to an insufficient implementation of a green credit policy. With the improvement of China’s green credit policy in recent years, scholars have gradually begun to analyse the implementation effect of a green credit policy at the enterprise level (Liu et al. 2017; Zhou et al. 2018; Su and Lian 2018; Chang et al. 2019; He et al. 2019; Liu et al. 2019; Luo et al. 2019; Hu et al. 2020). Zhou et al. (2018) focused on the impact of carbon risk on debt financing in high-carbon companies and explored the moderation effect of media attention. Chang et al. (2019) investigated the influences of credit policy and financial constraints on the tangible and on the research and development (R&D) investments of companies in renewable energy industries. He et al. (2019) found that green financial development has a negative impact on renewable energy companies’ access to bank loans and inhibits investment efficiency. Luo et al. (2019) found that the quality of environmental information disclosure among heavily polluting listed companies has significantly reduced the cost of debt financing.

Through this literature review, we find that existing research on financing constraints is still limited to the level of scale, and research on the interaction between company-level and regional-level factors and a green credit policy is relatively lacking. Therefore, we choose to study the impact of a green credit policy on listed companies in heavily polluting industries from the aspects of debt financing scale, cost and maturity to comprehensively examine the effect of policy implementation while considering the interaction between company-level and regional-level factors.

The “Green Credit Guidelines” clearly require banks to refuse to grant credit to companies with noncompliant environmental and social performance and clarify the supervisory responsibilities of the China Securities Regulatory Commission (CSRC) and CBRC, making green credit practices both standardized and institutionalized. Under the requirements of this policy, if commercial banks strictly control credit in accordance with policy requirements, companies with high environmental risks will face debt financing dilemmas, and their debt financing scale, cost and maturity will be affected. Compared with other industries, listed companies in heavily polluting industries face higher environmental risks and are more likely to be directly affected by green credit. Commercial banks may adjust or even restrict the debt financing of listed companies in heavily polluting industries, based on policy requirements and environmental risk assessment results.

Specifically, the implementation of the Green Credit Guidelines may affect the debt financing of heavily polluting listed companies in the following ways:

First, financial markets and financial supply policies have different effects on the financing constraints of companies with different characteristics (Aghion et al. 2012; Goss and Roberts 2011). The traditional financial market gives more attention to the profitability of projects and relatively ignores environmental factors. The introduction of China’s green credit policy has strengthened financial development’s focus on environmental protection. Therefore, the implementation of this policy impacts the financing constraints of companies with different environmental performance characteristics. If commercial banks allocate credit resources in strict accordance with policy requirements and incorporate the environmental performance and potential environmental risks of enterprises into the credit management and assessment process, then heavily polluting enterprises with relatively poor environmental performance and relatively high potential environmental risks face more stringent credit audits, and their difficulty of financing increases.

Second, according to signal theory, the introduction of a green credit policy reflects the government and regulatory authorities and other policymakers’ concerns about corporate environmental performance and risks and sends a signal to the capital market to strengthen corporate environmental supervision. Correspondingly, investors in the capital market or creditors in the bond market focus more on the environmental performance of the company implementing a green credit policy (Li et al. 2020) to determine the willingness and price to provide capital based on the company’s environmental performance (Goss and Roberts 2011). After the implementation of a green credit policy, creditors such as banks may reduce their willingness to provide debt capital to companies with high environmental risks, and accordingly, this also increases the difficulty and cost of obtaining debt capital for heavily polluting companies.

Third, after the implementation of a green credit policy, heavily polluting companies will face greater institutional pressure, including compliance pressure, public opinion pressure, and moral condemnation, and may even face environmental litigation risks, triggering external creditors to withdraw funds or refuse loan extensions, thereby reducing companies’ level of debt financing (Su and Lian 2018). Heavily polluting companies are more likely to have potential environmental risks, which may affect their reputation in the capital market, increase transaction uncertainty and credit risk, and reduce the possibility of establishing trust relationships with creditors (Zak and Knack 2001; Li et al. 2020). Therefore, when banks and other creditors believe that heavily polluting companies have higher potential risks and uncertainties, banks will be more inclined to reduce loans, especially long-term loans.

Based on the above analysis, we propose the following hypotheses:

-

H1: After the implementation of China’s Green Credit Guidelines, compared with other enterprises, the scale of debt financing of heavily polluting enterprises has decreased significantly.

-

H2: After the implementation of China’s Green Credit Guidelines, compared with other enterprises, the cost of debt financing of heavily polluting enterprises has increased significantly.

-

H3: After the implementation of China’s Green Credit Guidelines, compared with other enterprises, the maturity of debt financing of heavily polluting enterprises has been significantly shortened.

Research design

Sample and data

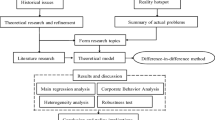

Given that the regulatory requirements issued by the regulatory authorities are exogenous and unpredictable for listed companies, we can construct a quasi-natural experiment based on the promulgation of the “Green Credit Guidelines” and divide the experimental and control groups according to time and industry. The listed companies in the industries affected by China’s green credit policy are the experimental group samples, and the remaining listed companies are the control group samples. We choose the sample period as 4 years before and after the implementation of the policy, that is, from 2008 to 2016. In addition, we exclude listed companies in the financial industry and ST/PT listed companies; therefore, the final sample contains 19,384 observations. The debt financial data and other financial or governance data were obtained from the WIND database.

Variables and research model

We establish a difference-in-differences model to examine the different impacts of green credit policy implementation on the debt financing (including the scale, cost and maturity of debt financing) of listed companies in heavily polluting industries, thus providing empirical evidence for how green credit policies eliminate backward production capacity and promote green transformation.

In Model 1, with reference to existing research (Chang et al. 2019; Liu et al. 2019), we use the scale of debt financing, the cost of debt financing, and the maturity of debt financing to measure corporate debt financing. The policy-affected DID variable is the cross-product of Dum_pollution and Dum_year, where 1 is the experimental group and 0 is the control group. Dum_pollution is a grouped dummy variable for heavy pollution industries; 1 is for heavily polluting industries, and 0 is for others. Dum_year is a time dummy variable; 1 is after the policy implementation, and 0 is before the policy implementation. Control indicates other control variables that may be influential at the company level.

Regarding the determination of heavily polluting industries, we refer to the existing research (Xu et al. 2020) and choose to determine the heavily polluting industries according to the “List of Classified Management of Environmental Protection Industry of Listed Companies” issued by the Ministry of Environmental Protection in 2008. However, this industry directory is inconsistent with the general classification of the Guideline for Industrial Classification of Listed Companies of the China Securities Regulatory Commission. Finally, we match the directory with the CITIC industry classification of the WIND database to identify listed companies in heavily polluting industries. The main variables are described in Table 1.

Descriptive statistics

Table 2 shows the descriptive statistics of the main variables. The mean of Dum_pollution is 0.27, which means 27% of the sample enterprises are heavily polluting enterprises. The mean of DF_sacle is 0.07, which shows that long-term liabilities account for an average of 7% of the total assets of the sample enterprises. The mean of DF_maturity is 0.25, which shows that the long-term loans account for an average of 25% of the total loans of the sample enterprises. For the debt financing cost, the mean DF_cost is 134.72 million yuan.

Empirical results

Empirical impact of a green credit policy on corporate debt financing

Our empirical research tests the impact of implementing China’s green credit policy on the debt financing of heavily polluting enterprises. Table 3 presents the results of our baseline tests. The dependent variables of debt financing in the estimated firm-year regression models are scale, cost, and maturity. All regression models include control variables for time-varying firm characteristics and fixed effects for year and industry.

In columns (1) and (3), the DID coefficients are both significantly negative at the 1% significance level, which shows that the scale and maturity of debt financing of heavily polluting enterprises are significantly reduced after the implementation of the green credit policy. In column (2), the DID coefficient is significantly positive at the 1% significance level, which means that the cost of debt financing of heavily polluting enterprises significantly increases after the implementation of the green credit policy. The results support the hypothesis in our paper.

Robustness test

To ensure the robustness of the empirical results, we use the method of substitution variables to perform the robustness test. We use new dummy year variables (change the value of Dum_year in 2012 to 0) and new dummy polluting enterprise variables (reclassified according to the “Announcement on the Implementation of Special Emission Limits of Air Pollutants” issued by the Ministry of Environmental Protection) to generate DID2 and DID3 as proxy variables for DID. Table 4 shows the results of robustness test. Consistent with our baseline results, both DID2 and DID3 in Table 4 indicate that the debt financing scale of listed companies in heavily polluting industries decreases significantly, the cost increases significantly, and the maturity is significantly shortened after the implementation of China’s green credit policy. The results of the robustness test further verify the robustness of the main regression results.

To solve the possible problem of sample selectivity, we use a propensity score matching (PSM) method with 1:1 pairing to find a control group similar to the experimental group. Table 5 shows the regression results, which are consistent with the main regression results and verify our hypothesis.

Placebo test

To further ensure the accuracy of the policy analysis, we also perform a placebo test. Assuming the green credit policy was implemented in 2010, we construct a new policy impact variable DID4 to test the effect of policy implementation from 2008 to 2011. Table 6 reports the results of the placebo test. We find that this hypothetical policy does not have a significant impact on the debt financing of heavily polluting companies, further enhancing the credibility of our research.

Further analysis

Our evidence thus far shows that the implementation of China’s green credit policy has indeed increased the debt financing constraints of heavily polluting enterprises. In this section, we shift our focus to whether different corporate governance characteristics and regional legal and financial factors affect the implementation of the green credit policy.

We select the nature of the controlling shareholder and the level of environmental information disclosure at the company level and the level of environmental regulation and financial development at the regional level as grouping variables for further research to group test the baseline regression.

The nature of the controlling shareholder is divided into a state-controlled group and a non-state-controlled group according to the actual controller of the listed company. The level of environmental information disclosure is divided into a high-level group and a low-level group based on the number of pages of listed companies' social responsibility reports. Regional environmental regulation is represented by the number of local laws and regulations in each province disclosed in the China Environmental Yearbook and is divided into two groups: a strict group and a weak group. The regional financial development level is represented by the total assets of the banking outlets in each province disclosed in the “Regional Financial Operation Report of China”, which is issued by the People’s Bank of China each year, and is divided into two groups: a high-level group and a low-level group. Table 7 presents the results of the group test.

The results in Panel A of Table 7 show the different effects of implementing the green credit policy on state-controlled and non-state-controlled groups. In columns (1), (3), and (5), the DID coefficients are all significant at the 1% significance level, while in columns (2), (4), and (6), none of the DID coefficients are significant. The results show that state-controlled listed companies are more significantly affected by implementing the green credit policy.

The results in Panel B of Table 7 show the different effects of implementing the green credit policy on high-level and low-level environmental information disclosure groups. In columns (1) and (2), neither DID coefficient is significant, which shows that the level of environmental information disclosure does not affect the impact of implementing the green credit policy on the debt financing scale. In columns (3) and (5), neither DID coefficient is significant, while the DID coefficients in columns (4) and (6) are both significant. The results show that companies with a low level of environmental information disclosure face more severe financing pressure (cost and maturity).

The results in Panel C of Table 7 show the different effects of implementing the green credit policy on strict and weak regional environmental regulation groups. The DID coefficient in column (1) is significant at the 1% significance level, while that in column (2) is significant at the 5% significance level. The DID coefficients in columns (3) and (4) are both significantly positive at the 1% significance level, and the DID coefficient in column (4) is larger than that in column (3). The DID coefficient in column (5) is significant, while that in column (6) is not significant. The results show that the debt financing scale and maturity of listed companies in regions with strict environmental regulations are more significantly affected by implementing the policy, while listed companies in regions with weak environmental regulations may face higher debt financing cost growth.

The results in Panel D of Table 7 show the different effects of implementing the green credit policy on high-level and low-level regional financial development groups. The DID coefficient in column (2) is significant, while that in column (1) is not significant. The DID coefficients in columns (3) and (4) are both significantly positive at the 1% significance level, and the DID coefficient in column (3) is larger than that in column (4). The DID coefficients in columns (5) and (6) are both significantly negative, and the DID coefficient in column (5) is larger than that in column (6). The results show that the debt financing scale and maturity of listed companies in regions with low-level financial development are more significantly affected by implementing the policy, while listed companies in regions with high-level financial development may face higher debt financing cost growth.

The results of the group test further show the different effects of company-level and regional-level factors on the implementation of green credit policies.

Conclusion and discussion

With the intensification of climate change, concepts such as sustainable development, inclusive development, and green development have gradually become popular. Governments around the world have introduced policies centred on the goal of sustainable development. In this context, China's green credit policy has emerged. Policymakers hope that banks and other financial institutions can differentiate their credit resources by identifying a company’s social and environmental risks, strictly controlling credit for high-polluting projects, and increasing support for green, environmentally friendly and sustainable projects, thereby promoting relevant enterprises to realize green transformation and sustainable development. We have focused on the debt financing of listed companies in the heavy pollution industry, which also displays the most direct impact of China’s green credit policy. Based on the empirical difference-in-differences model analysis, we have studied the impact of the implementation of the green credit policy on the debt financing of enterprises in heavy pollution industries, and the main conclusions are as follows: First, our research demonstrates whether the implementation of the green credit policy has a significant impact on the debt financing of enterprises in heavy pollution industries. We find that after the implementation of the green credit policy, compared with companies in non-heavy pollution industries, the scale of debt financing of listed companies in heavy pollution industries drops significantly, the cost of debt financing rises sharply, and the debt financing maturity is significantly shortened, indicating that China’s green credit policy restrains the debt financing of listed companies in heavy pollution industries. Second, our research finds that the impact of green credit policies on listed companies in heavily polluting industries varies depending on a company's characteristics. We find that after the implementation of China’s green credit policy, the debt financing of state-controlled listed companies is significantly negatively affected by the policy, while there is no significant impact on non-state-controlled listed companies. We also find that although listed companies with higher levels of environmental information disclosure are not “rewarded”, listed companies with lower levels of environmental information disclosure are “punished” and face higher debt financing costs and shorter debt financing maturities. Third, our research also finds that the impact of implementing the green credit policy on listed companies in heavily polluting industries varies in different regions. We find that after the implementation of the green credit policy, listed companies in regions with stricter environmental regulations and regions with lower levels of financial development face smaller debt financing scales and shorter debt financing maturities, while listed companies in regions with relatively weak environmental regulations and regions with higher levels of financial development may face higher debt financing costs. Our research results support that China’s green credit policy has played an active role in guiding listed companies in heavily polluting industries towards green development by restricting their access to credit resources.

Our empirical results have the following three policy implications: First, to comply with the requirements of the Green Credit Guidelines, banks have adjusted and controlled credit support for enterprises in heavily polluting industries. After the implementation of the policy, the scale of debt financing has declined, the cost of debt financing has increased, and the length of debt financing maturity has been shortened. This result indicates that China’s green credit policy has achieved the initial policy goal of the current phase; that is, “special credit guidelines shall be formulated for the restricted categories of national key regulation and industries with major environmental and social risks, and differentiated credit policies shall be implemented.” Policy differences have been used to restrain the development of enterprises in heavily polluting industries, such as “two high enterprises (high energy consumption and high pollution)”. Therefore, banks must continue to strictly implement differentiated credit support policies based on the environmental and social risk status of credit-granting enterprises and maintain the continuity and stability of China’s green credit policy. Second, from the perspective of specific implementation effects, the impact of implementing China’s green credit policy on the debt financing of different types of heavily polluting enterprises has been different. For example, the implementation of the green credit policy has had a depressing effect on the debt financing of state-controlled heavily polluting enterprises but has had no significant impact on non-state-owned enterprises, and the level of regional environmental regulations and financial development have also made differences in the effect of policy implementation. Therefore, policymakers must fully consider the differences between different types of heavily polluting companies, take into account the differences in the governance environment of different regions, and further improve and refine the specific implementation requirements of China’s green credit policy. Third, the managers of enterprises in heavily polluting industries should actively pay attention to and fully realize the impact of the green credit policy on the scale, cost and maturity of a company’s debt financing and make a strategic plan for their company’s future development by weighing the debt financing losses and transformation costs. In the short term, according to our empirical results, strengthening environmental information disclosure can to a certain extent alleviate the increase in financing costs and shorten the financing period caused by the implementation of China’s policy. Heavy polluting companies can increase environmental information disclosure by issuing social responsibility reports every year, which can appropriately alleviate financing pressure and provide additional time for a company’s green transformation. In the long term, heavily polluting enterprises should increase investment in environmental protection, accelerate the elimination of high-pollution and high-energy-consuming production models, promote the upgrades needed for environmentally friendly transformations, and adapt to the requirements of China’s green credit policy.

There are also several research limitations that can be further improved in future studies. First, given the availability of data and referring to existing research, we divided the experimental group and the control group according to industry and did not refine the grouping basis at the enterprise level, which may have a certain impact on the evaluation of policy effects. Grouping the samples according to the environmental risks of listed companies is worthy of further study. Second, we only considered the impact of policy implementation on the debt financing of listed companies and did not consider the impact on other behaviours of listed companies (such as investment and R&D). In fact, considering the relatively weak development of China’s capital market, bank loans are one of the most important channels for listed companies to obtain financing. The impact of implementing China’s green credit policy on the debt financing of listed companies in heavily polluting industries makes a company’s cash flow insufficient, which may inhibit a company's investment and research and development activities and further impact a company’s performance. The subsequent impact of the debt financing shock brought about by the green credit policy deserves further attention and in-depth analysis. Third, we did not examine the dynamic changes that heavily polluting companies may adopt for their green transformation after the implementation of the policy. We only explored the impact of differences on environmental information disclosure in group comparisons and did not pay attention to whether heavily polluting companies facing more difficult debt financing have adopted green mergers and green innovations to release green transition signals to banks to ease companies’ financing constraints. Promoting the green transformation of enterprises in heavily polluting industries is also one of the ultimate goals of implementing China’s green credit policy. Therefore, the green behaviour and green development of enterprises after the implementation of the green credit policy may become the direction of future research.

Data availability

The datasets analysed during the current study are publicly available in the WIND database and are available from the corresponding author on reasonable request.

References

Aghion P, Askenazy P, Berman N, Cette G, Eymard L (2012) Credit constraints and the cyclicality of R&D investment: evidence from France. J Eur Econ Assoc 10(5):1001–1024. https://doi.org/10.1111/j.1542-4774.2012.01093.x

Aupperle KE, Carroll AB, Hatfield JD (1985) An empirical examination of the relationship between corporate social responsibility and profitability. Acad Manag J 28(2):446–463. https://doi.org/10.5465/256210

Chang K, Zeng Y, Wang W, Wu X (2019) The effects of credit policy and financial constraints on tangible and research & development investment: firm-level evidence from China's renewable energy industry. Energy Policy 130:438–447. https://doi.org/10.1016/j.enpol.2019.04.005

Dragomir VD (2018) How do we measure corporate environmental performance? A critical review. J Clean Prod 196:1124–1157. https://doi.org/10.1016/j.jclepro.2018.06.014

Esteban-Sanchez P, La Cuesta-Gonzalez MD, Paredes-Gazquez JD (2017) Corporate social performance and its relation with corporate financial performance: international evidence in the banking industry. J Clean Prod 162:1102–1110. https://doi.org/10.1016/j.jclepro.2017.06.127

Freeman RE (1984) Strategic Management: A Stakeholder Approach. Pitman, Boston

Ghoul SE, Guedhami O, Kwok CC, Mishra DR (2011) Does corporate social responsibility affect the cost of capital. J Bank Financ 35(9):2388–2406. https://doi.org/10.1016/j.jbankfin.2011.02.007

Goss A, Roberts GS (2011) The impact of corporate social responsibility on the cost of bank loans. J Bank Financ 35(7):1794–1810. https://doi.org/10.1016/j.jbankfin.2010.12.002

He L, Liu R, Zhong Z, Wang D, Xia Y (2019) Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renew Energy 143:974–984. https://doi.org/10.1016/j.renene.2019.05.059

Hu Y, Jiang H, Zhong Z (2020) Impact of green credit on industrial structure in China: theoretical mechanism and empirical analysis. Environ Sci Pollut Res 27:10506–10519. https://doi.org/10.1007/s11356-020-07717-4

Jiao Y (2010) Stakeholder welfare and firm value. J Bank Financ 34(10):2549–2561. https://doi.org/10.1016/j.jbankfin.2010.04.013

Li W, Xu J, Zheng M (2018) Green governance: new perspective from open innovation. Sustainability 10(11):3845–3864. https://doi.org/10.3390/su10113845

Li W, Zheng M, Zhang Y, Cui G (2020) Green governance structure, ownership characteristics, and corporate financing constrains. J Clean Prod 260:121008. https://doi.org/10.1016/j.jclepro.2020.121008

Liu JY, Xia Y, Fan Y, Lin SM, Wu J (2017) Assessment of a green credit policy aimed at energy-intensive industries in China based on a financial CGE model. J Clean Prod 163:293–302. https://doi.org/10.1016/j.jclepro.2015.10.111

Liu X, Wang E, Cai D (2019) Green credit policy, property rights and debt financing: quasi-natural experimental evidence from China. Financ Res Lett 29:129–135. https://doi.org/10.1016/j.frl.2019.03.014

Liu Z, Li W, Hao C, Liu H (2021) Corporate environmental performance and financing constraints: an empirical study in the Chinese context. Corp Soc Responsib Environ Manag 28(2):616–629. https://doi.org/10.1002/csr.2073

Lu W, Chau KW, Wang H, Pan W (2014) A decade’s debate on the nexus between corporate social and corporate financial performance: a critical review of empirical studies 2002-2011. J Clean Prod 79:195–206. https://doi.org/10.1016/j.jclepro.2014.04.072

Luo W, Guo X, Zhong S, Wang J (2019) Environmental information disclosure quality, media attention and debt financing costs: evidence from Chinese heavy polluting listed companies. J Clean Prod 231:268–277. https://doi.org/10.1016/j.jclepro.2019.05.237

Su D, Lian L (2018) Does green credit policy affect corporate financing and investment? Evidence from publicly listed firms in pollution-intensive industries. Financ Res 12:123–137

Wang H, Lu W, Ye M, Chau KW, Zhang X (2016) The curvilinear relationship between corporate social performance and corporate financial performance: evidence from the international construction industry. J Clean Prod 137:1313–1322. https://doi.org/10.1016/j.jclepro.2016.07.184

Williamson OE (1985) The Economic Institutions of Capitalism. Free Press, New York

Xu F, Yang M, Li Q, Yang X (2020) Long-term economic consequences of corporate environmental responsibility: evidence from heavily polluting listed companies in China. Bus Strateg Environ 29(6):2251–2264. https://doi.org/10.1002/bse.2500

Zak PJ, Knack S (2001) Trust and growth. Econ J 111(470):295–321. https://doi.org/10.1111/1468-0297.00609

Zhang B, Yang Y, Bi J (2011) Tracking the implementation of green credit policy in China: top-down perspective and bottom-up reform. J Environ Manag 92(4):1321–1327. https://doi.org/10.1016/j.jenvman.2010.12.019

Zhou Z, Zhang T, Wen K, Zeng H, Chen X (2018) Carbon risk, cost of debt financing and the moderation effect of media attention: Evidence from Chinese companies operating in high-carbon industries. Bus Strateg Environ 27(8):1131–1144. https://doi.org/10.1002/bse.2056

Funding

This research is funded by the Key Program of National Natural Science Foundation of China (71533002).

Author information

Authors and Affiliations

Contributions

Weian Li and Guangyao Cui contributed to the study conception and design. Data collection and analysis were performed by Guangyao Cui and Minna Zheng. The first draft of the manuscript was written by Guangyao Cui and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Li, ., Cui, G. & Zheng, M. Does green credit policy affect corporate debt financing? Evidence from China. Environ Sci Pollut Res 29, 5162–5171 (2022). https://doi.org/10.1007/s11356-021-16051-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-16051-2