Abstract

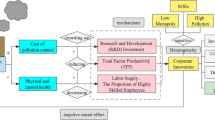

We analyze the real effects of the environmental regulation on technological innovation using an air pollution reduction governance policy promulgated in China under the 12th Plan in 2012. We treat the Air Pollution Prevention Policy as a quasi-natural experiment that is plausibly exogenous to the firms’ innovation policy and thus use the difference in difference (DID) as an identification strategy in our analysis. We provide evidence that environmental regulation substantially promotes innovation productivity. Our findings reveal that this impact is more pronounced for state-owned firms, pollution-intensive industries, and high-tech-intensive industries. We uncover three possible underlying economic mechanisms through which the air pollution reduction policy impacts innovation. We show that government financing, external governance from the capital market, and R&D intensity are three underlying economic channels through which environmental regulation promotes technological innovation. Collectively this study’s policy implication is that industrial policies that promote greener environments can enhance economic performance.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Since 1978, the Chinese government has implemented several policies to drive economic growth. The Chinese economy experienced miraculous growth for three decades in response to these policies. However, the Chinese economy’s stellar growth also contributed to extreme pollution levels (Dong et al. 2020a) to the extent that several Chinese cities are ranked as the most polluted cities in the world (Su et al. 2011). In recent years, the Chinese government committed to sustainable innovation-led growth and implemented several environmental policies to reduce air pollution (Chen et al. 2019; Zhang et al. 2019) and to mitigate pollution-related effects on the society and human health (Gu et al. 2019, 2020a, b; Elahi et al. 2020). While it is clear that environmental policies benefit the society, researchers are still grappling with whether environmental policies promote or inhibit growth at micro and macro levels. Various studies have recently focused on pollution emissions and environmental policies (Chang et al. 2018; Bu et al. 2020; Dong et al. 2019; Hu and PanX 2020; Rexhäuser and Rammer 2014; Zhang et al. 2019). However, there are limited studies with mixed evidence that explain the impact of environmental regulation on technological innovation using quasi-natural experiments in China. Therefore, this study fills this void by examining how firm innovation policies respond to a mandatory environmental regulation that is plausibly exogenous to the firm environment.

Some studies argue that environmental policies reduce negative external costs to the society but at high private costs (Ambec et al. 2013; Shi et al. 2018; Blackman et al. 2010). Environment regulations may impose substantial compliance costs on firms, which could reduce the firms’ financial capacities to invest in new technological products. Thus, environmental policy can depress firm productivity and innovation activities in financially constrained firms with limited internal resources and low access to external finance. In contrast, some studies use the Porter hypothesis to show that environmental regulation increases firm creativity and performance (Porter and van der Linde 1995; Rexhäuser and Rammer 2014; Van Leeuwen and Mohnen 2017; Hu and PanX 2020). Thus, the implications of environmental regulation on firm performance are not clear in the literature.

To answer this question, we analyze the real effects of environmental regulations on technological innovation using an air pollution reduction governance policy, which was officially promulgated in China under the 12th Five Year Plan in October 2012 by the State Council. The Air Pollution Prevention Policy (APPP) in the 12th Five Year Plan targeted key regions classified as air quality control zones and set some targets for air pollution reduction in these policy regionsFootnote 1. One peculiarity of these targeted regions is that they have high economic activity and account for China’s highest pollution levels. The APPP policy zone covers Beijing, Tianjin, Hebei, the Yangtze River Delta Area, the Pearl River Delta Area, and 10 urban clusters, involving 117 cities and 19 provinces in totalFootnote 2. The policy outlined some specific measures to reduce SO2, NOx, PM2.5, and other emissions like eliminating outdated and high pollution-intensive furnaces, installing pollution reduction equipment, using cleaner fuels, and several control measures to mitigate pollution levels. The policy period was characterized by intensive monitoring by both local and central leaders to enforce compliance and assist firms in the targeted regions to meet the set targets. Thus, this kind of policy has the potential to affect the operating strategy and innovation ability of firms, as firms in targeted regions are likely to switch to technology products and cleaner energy to meet regulation requirements.

Taking advantage of the APPP regulation, we assemble a sample of Chinese A-shares listed firms and divide it into two groups to examine the causal impact of this environmental policy on firms’ ability to innovate. Firms in the affected areas are used as the treatment group and those in unaffected areas as the control group. Since the APPP policy could have been triggered by excessive pollution levels and targeted at air pollution reduction other than technological innovation, it thus constitutes a quasi-natural experiment that is plausibly exogenous to the firms’ innovation policy. Furthermore, since the APPP policy is mandatory for some regions, it allows us to compare the policy effects on innovation variation for firms in targeted regions and those in non-policy areas. Also, the APPP regulation is one of the most comprehensive and strict environmental regulations implemented by the Chinese authorities as they declared “war” against excessive pollution. Therefore, we employ the difference in difference (DID) as an identification strategy in our analysis. The policy setup minimizes the omitted variable bias or reverses causality concerns that emanate from unobservable firm and location characteristics.

We isolate the causal effect of environmental regulation on technological innovation by comparing the post-APPP innovation productivity of firms in policy regions (treatment group) and innovation output for firms in non-policy regions (control group). We provide evidence that firms in policy regions substantially increased their innovation productivity after the implementation of the APPP. Our study results continue to hold after controlling for several variables, year fixed effects, industry fixed effects, province fixed effects, and firm fixed effects. We carry a host of tests that mitigate the concern that our results could be explained by pre-existing trends, reverse causality, or other confounding factors. We mitigate confounding selection issues between the treatment and control groups using the Heckman two-stage correction and propensity score-matched samples.

We uncover three potential underlying economic channels through which environment regulation influences firm innovation policy. We identify government support, external governance/monitoring, and R&D intensity as three plausible mechanisms that strengthen the positive impact of environmental policy on innovation. We first show that environmental regulation promotes innovation through R&D subsidies. This evidence is consistent with the “helping hand” hypothesis and the conjecture that less financially constrained firms respond better to climatic shocks by innovating more. We also observe that the impact of APPP on innovation is more pronounced for state-owned firms.

Next, we examine our second mechanism, which we call the external governance/monitoring channel. We provide evidence that firms in policy regions are followed by more financial analysis around the policy implementation. We also show that external governance(monitoring) proxied by the number of financial analysts is another plausible channel through which environmental regulation promotes innovation output. This evidence is consistent with the idea that increased information disclosure and extensive pressure from financial analysts induce firms to respond to environmental policies by investing more in sustainable projects with social outcomes. Additionally, we also provide evidence that the APPP regulation promoted innovation through investment in R&D projects.

Lastly, we employ a within-industry variation to examine the real effects of environmental regulation on firm innovation. We identify industries according to their pollution intensiveness and high tech-intensiveness. The APPP regulation’s main target was to reduce air pollution emissions and thus had a huge impact on pollution-intensive industries, which account for a greater proportion of emissions. Therefore, if the policy increased the firms’ ability to innovate, we expect the impact to be more pronounced for policy firms in pollution-intensive industries. Since high-intensive firms invest more resources into innovation projects, we expect to observe a jump in innovation output for high-tech industries in policy regions after the policy if environmental air pollution regulation promotes technological innovation. We carry our analyses and in consistent with our expectations, we find that firms in high-pollution intensive industries and high-tech intensive industries innovate more than their peers during the policy period.

This study contributes to the green policy and innovation literature in various ways. Our study fills the gap in this literature and provides a new research direction for studying China’s emission reduction policies. First, we show that environment regulation promotes innovation productivity using novel empirical analysis. We exploit a difference in difference analysis conditioned by a quasi-natural experiment to isolate the direction of causality. Thus, we extend the literature by providing causal evidence in support for the use of emissions reduction policies that address serious environmental problems and induce firms to invest in new technologies.

Second, this study uncovers three mechanisms through which air pollution reduction policy impacts innovation. This paper is among the first to elucidate the real effects of government funding in promoting compliance and technological innovation. Unlike other papers, we present a clear path that regulators need to take to promote a win-win outcome. We show that government financing strengthens the positive effect of environmental regulation on technological innovation. In this context, environmental policies supported by funding from the government can promote a cleaner environment and innovation-led economic growth.

Third, our study contributes to a set of corporate behavioral finance literature that examines how capital market players encourage environmental compliance and influence a firms’ commitment to sustainable investments (Starks et al. 2017; Kim et al. 2019; Tao et al. 2020; Mbanyele 2021c). Our study uncovers a novel contribution to the literature on the governance effects of external information demand and monitoring pressure. In related studies, Johnson (2020) indicates that information revelation of violators promotes compliance by other players, while Chu et al. (2021) show that shaming and information disclosure of violators enhance firms’ environmental innovation abilities. In contrast to these studies that focus on general stakeholders, this study specifically highlights the role played by key capital market players through external governance/monitoring from the capital market in promoting high-impact innovation. We show that external monitoring/governance from the capital market is another plausible channel through which environmental regulation encourages innovationFootnote 3.

Lastly, our study findings have policy implications to regulators that can be implemented in China and other countries facing similar environmental problems. We show that sustainable policies do not inhibit growth but rather can stimulate economic growth through technological transfer. This paper also shows that the government and the capital market are both essential in promoting environmental policy compliance and firm performance.

We proceed as follows: the “Related literature and economic theory” section discusses the literature and theory, the “Methodology” section explains the data and methodology, the “Empirical results” section presents the results, and the “Conclusion and policy implications” section concludes and provides recommendations.

Related literature and economic theory

Extant literature is divided on the real effects of environmental regulation on firm innovation productivity. According to Porter (1991), the benefits of environmental regulations depend on how they are implemented. The Porter hypothesis reveals that environmental regulations can help firms to become more competitive and innovative (Porter and van der Linde 1995). Thus, from this perspective, environmental policies benefit society and positively influence firm innovation performance (Ambec and Barla 2006). However, the success of environmental policies like other economic policies has some conditions to be met for them to be successful (According to Porter and van der Linde 1995).

Firstly, a policy needs to be properly designed and executed for it to be successful. According to Williamson (1999), effective public policies should be market-oriented but moderated with some administrative control mechanisms. Thus, regulators need to enforce flexible policies coupled with incentives to motivate regulated firms to adopt the policies (Majumdar 2001). Flexible policies help firms to meet the regulatory requirements using their own creative strategies. For instance, if the regulator sets an emission cap, firms may search for alternative ways to meet the emissions cap by redesigning their production systems or invent new equipment to meet the regulatory requirements. Thus, in this context, a flexible environment regulation with clear goals can promote firm innovation. In contrast, a rigid environmental regulation with strict requirements may impose excessive compliance costs on firms and results in more resources being channeled towards pollution emissions reduction while reducing the resources that could have been used for innovation (Ambec et al. 2013). This caveat possibly explains mixed results in environmental regulation research evaluating different policies in different regions.

Secondly, according to the Porter hypothesis, a policy’s effectiveness depends on how regulatory firms respond to the regulations. Firms may choose to be passive and continue their business operations as usual while complying with regulations through the payment of regulatory taxes. Depending on the nature of the policy, some firms may comply with the regulations by buying expensive equipment to meet regulatory thresholds. A passive response to the environmental policy could increase operating costs, reduce profitability, and crowd out limited financial resources for innovation activities. Thus, sustainable policies are likely to harm firms with limited dynamic capabilities to adjust to evolving social expectations. However, creative firms can respond to environmental regulation by reconfiguring their systems to align with the dynamic environment. In a flexible regulation, firms invest their resources and use their innovation capabilities to comply with regulatory requirements at little cost. Thus, proactive firms can perform better and become more competitive after an environmental policy regulation while meeting the regulatory requirements towards sustainability (Wu et al. 2012; Christmann 2000). Therefore, heterogeneous firm characteristics may also influence environmental policy outcomes. For instance, some firms may respond to air pollution reduction regulations by innovating more while other firms may choose to reduce the pollution levels by reducing output or just pay taxes for producing more than required quantities.

From a policy and governance perspective, firms that are responsible for heavy pollution emissions could be forced to comply with the regulatory requirements to avoid receiving negative media coverage and huge penalties for emissions violations (Johnson 2020). Thus, these penalties and negative information disclosure could motivate responsible firms to change their behavior and encourage other non-violators to change their operating systems to avoid costly negative attention and penalties. Thus, in response to strict environmental regulations, firms could reallocate more of their valuable financial resources to produce more green products. Therefore, environmental pollution regulation with strict monitoring can induce firms to innovate more, especially in green products.

Several studies have been done across the world to understand the impact of environmental regulations on firm performance and innovation. However, the empirical literature offers mixed results, possibly due to the reasons provided in previous sections. One strand of literature provides evidence that environmental regulations induce firm innovation productivity. In their study for firms in Germany, Rexhäuser and Rammer (2014) reveal that firms innovate more in response to policy regulations than through voluntary environmental commitments. Additionally, using a firm-level survey for Chinese firms, Bu, Qiao, and Liu (2020) show that voluntary environmental regulation is positively related to corporate innovation. They document that the effect of voluntary environmental commitment contributes to more innovation than mandatory regulation from the government. In support of this positive link, Hu and PanX (2020) find that the carbon emission trading system (CETS) pilot project in China contributes to an increase in firm-level innovation productivity. Additionally, Franco and Marin (2017) analyze a sample of European countries and find that environmental policies improve firm-level innovation productivity. Several studies from other countries also support that environmental regulation can induce firms to invest in technological innovation (Jaffe and Palmer 1997; Lee et al. 2011; Acemoglu et al. 2012; Nesta et al. 2014; Chakraborty and Chatterjee 2017).

In contrast, another strand of literature argues that environmental policies help to reduce negative external costs to society but at high private costs (Blackman et al. 2010). For instance, environmental regulation compliance costs could increase firms’ cost burden and reduce firm profitability (Shi et al. 2018). Thus, an environmental policy could harm financially constrained firms with limited internal resources and low access to external finance (Ambec et al. 2013). Therefore, financially constrained firms could respond negatively to climatic shocks to the extent that they reduce their innovation capabilities. Stucki et al. (2018) providence evidence that environmental regulation discourages innovation by crowding out resources for innovation investments.

In a study of Chinese firms, Li et al. (2019) reveal that command and control environmental regulations impede technological innovation. However, in cross-sectional analyses, they show that the command-and-control regulation promotes innovation in the Western region and discourages innovation in the Eastern region. In a related but different setting, Dong et al. (2020b) find that the environmental regulatory efficiency of haze control varies from one region to another. Thus, it can be argued that the efficiency and success of environmental regulations vary with regional institutional dynamics (Dong et al. 2019).

Methodology

Data

This study uses a sample of Chinese A-listed firms from 2008 to 2016. We collect all firm-level data from CSMAR and WIND databases. Since the Air Pollution Prevention Policy came into effect in 2012, we allow for a window period of 4 years before the policy and 4 years after the policy year so that we can observe the policy effects. We make several restrictions on our sample. Firstly, we drop all financial firms and utility companies that are heavily regulated from the sample. Next, we drop all firms that could have different factory plants in different regions. Since the APPP policy is region-specific, our identification may suffer from measurement errors if the sample includes firms with multiple plants in different regions.Footnote 4 We also removed all firms with missing information. Our final sample is an unbalanced panel with 16906 firm-year observations. To eliminate skewness bias, we follow prior literature and winsorize all the continuous variables at 1% and 99% cut-off (Mbanyele 2021b; Mbanyele and Wang 2021).

Data description

Innovation

Some studies use R&D expenditure as a measure of innovation (Mbanyele 2021a); however, this measure only explains the innovation intensity or input but does not reveal its success (Aghion et al. 2013). Firstly R&D expenditures are insufficient in explaining the depth and length of innovative firms’ observable and non-observable strategies. Secondly, R&D expenditure suffers from accounting treatment problems; some firms capitalize on R&D expenses while some treat them as an expense for strategic purposes, thus weakening the use of R&D as a measure of corporate innovation.

Patents have been linked to firm performance, and many studies have been using them as an innovation output following pioneer works of Schmookler (1966), Scherer (1982), and Griliches (1984). A major advantage of patent data is that it is available for a universe of both public and private firms. However, one setback for patent counts is that some companies keep their inventions as a competitive secret and do not apply for patents (Kleinknecht et al. 2002; Arundel and Kable 1998). Patent counts have less association with the firm’s performance; thus, citation counts per patent have been used in literature as a complementary measure for patents as they measure the quality of innovation like generality, originality, and relevance (He and Tian 2013). The use of patent citations helps to evaluate the quality of inventions and economic significance (Hsu et al. 2014). Patent citations are an effective measure of the firm’s productivity as they have a significant relationship with the firm’s market value.

Although there is still debate on the best measures for firm innovation, this study uses patents as the main measure of innovation and uses R&D expenditure for robustness checks. In China, patents are classified into three classes, which are utility models, inventions, and designs. Of the three patent classes, invention patents have higher quality than utility patents and design patents (Tan et al. 2020). Therefore, we use two measures of innovation, the total number of patents and the number of patent inventions, to capture the quality of firm innovation. We normalize all our innovation measures using natural logarithms to reduce skewness bias.

Control variables

The study controls several control variables that have been found to influence innovation in prior studies (Tan et al. 2020; Mbanyele 2021a; Wang et al. 2020) (Table 12 of the Appendix). The study measures firm age as the difference between fiscal year t minus the year the firm was established and uses it to control for the firm life cycle. The natural logarithm of the book value of total assets is used to capture firm size. Leverage is calculated as the book value of total debts divided by the book value of total assets. Given that in China, the state is a dominant player, we control for state ownership. A firm’s profitability may influence the magnitude and depth of firm innovation policy; thus, we include return on assets as a control variable. We also control for asset tangibility using the firm’s expenditure on capital expenditure over total assets. We control for a firm’s growth opportunities using the Tobin Q. This study also controls for several governance variables that impact innovation like board independence and institutional ownership. We use the Herfindahl Hirschman Index (HHI) to control for product market competition. Aghion et al. (2005) show that competition influences a firm’s innovation abilities. We provide detailed explanation of our variables in Table 12 in the Appendix

Identification strategy

Studying the real effects of environmental sustainability on firm performance is challenging due to endogenous problems. To deal with this challenging task, we exploit a quasi-natural experiment to establish the direction of causality. We treat the APPP regulation implemented in 2012 as a plausible exogenous event and employ the difference in difference estimation as the identification strategy. This helps us to observe the patenting behavior of firms before and after the policy implementation in 2012. The APPP is a regional policy that targeted certain key regions and thus satisfies the conditions of implementing a difference in difference analysis comparing the firms in the policy areas and firms not affected by the policy. All firms in policy areas are classified as the treatment group, and those outside the targeted regions are classified as the control group. Since China is a big country with many provinces and cities, our results may be confounded by differences in how different regions implement the national policies in their jurisdictions. Thus, our study may suffer from omitted variable bias. To mitigate this problem, we control for province-fixed effects. In addition, we control for year fixed effects, industry fixed effects, and firm fixed effects to capture changes in business policies with time and changes in industry dynamics. The following model is used in our regressions:

where Innovation represents the natural logarithm of one plus the number of total patents (patent) and the natural logarithm of one plus the number of patent inventions (invention). Post is the year of policy implementation-2012. APPP is a dummy variable that equals 1 for all firms in the policy areas and zero otherwise. Controls represents firm age, firm size, leverage, state ownership, return on assets (ROA), Tobin Q, Capex, board independence, Herfindahl Hirschman Index (HHI), and institutional ownership. δ represents year fixed effects, firm fixed effects, province fixed effects, and industry fixed effects. All standard errors are clustered at the firm level.

Descriptive statistics

Table 1 reports descriptive statistics for the main variables used in this study. Patenting data shows average values of 29.044 and 14.363 for total patents and invention patents, respectively. This suggests that more than half of the inventions in our sample are utility and design patents, which are symbols of low-quality innovation. On average, firms spend 108 million RMB on R&D expenditure. About 75% of the firms in our study sample are in the APPP targeted regions.

Validity tests

We first need to test whether the APPP regulation is a plausibly exogenous shock to the firm’s innovation environment. Our DID identification strategy has to meet certain assumptions for it to be valid. The treatment group and the control group must meet the parallel trend test before the shock; that is, they should show some similar trends in their innovation productivity, which enable us to compare the differences for firm innovation output after the environment policy is implemented. We use graphs in Fig. 1 a and b to show the average innovation output trends before and after the environmental regulation for the treatment group (APPP=1) and the control group (APPP=0).

The dashed line shows the average number of patents produced by firms in the targeted policy regions (treatment). The solid line displays average patent output for non-policy firms (control). The pre-trend for patent output (total patents and invention patents) shows a clear parallel for the two groups leading up to the APPP environmental policy; thus, the parallel trend assumption of the DID identification is satisfied. However, the gaps between the treatment and the control groups widen after the policy year. There was a jump in patent output (total patents and invention patents) after the policy shock for the treatment group compared to a slow, stable rate for the control group. Overall, Fig. 1 a and b show that after the APPP environmental policy, firms in targeted regions increase their innovation productivity more than their counterparts in non-targeted regions.

Empirical results

Baseline results

In this section, we analyze the impact of the policy on firm innovation productivity. Table 2 presents baseline regression results using the Difference in Difference models. Tabulated results in Table 2 columns 1–2 show that our main variable Post*APPP is positive and significant at 1% levels across all measures of innovation. The results are robust to controlling for several firms and governance variables, industry fixed effects, province fixed effects, and year fixed effects. We also control for firm fixed effects in Table 2 for models 3–4 to control for time-invariant firm characteristics. Controlling for firm fixed effects helps us to observe the changes in innovation productivity following the policy change using a time series analysis. Our study results are also economically and statistically significant. The coefficients are slightly different from the results displayed in Table 3, columns 1–2. The slight variations may be possibly attributed to some variables that may have been omitted in our model that impact innovation. Collectively our findings support that the Chinese APPP policy launched in 2012 as part of the 12th national five-year plan contributed to a disproportionate increase in innovation for firms in pilot areas. Thus, the policy was successful in promoting innovation-led growth with minimal environmental externalities. Our findings are consistent with the Porter hypothesis and other empirical studies that established a positive link between environmental regulation and innovation (Bu et al. 2020; Hu and PanX 2020).

Regarding control variables, we observed that most of them display expected signs in line with prior studies. For instance, models 1–2 in Table 2 show positive significant coefficients for institutional owners, capital expenditure, return on assets (ROA), board independence, and firm size (Aghion et al. 2013). In contrast, debt and firm age are inversely related to innovation productivity.

Clustered standard errors at the firm level are shown in parenthesis. *, **, and *** represent significance at the 10%, 5%, and 1% statistical levels respectively

Endogeneity

We have tried to reduce endogeneity concerns in our study by exploiting a quasi-natural experiment that is plausibly exogenous to a firm’s innovation policy and using firm fixed effects in our regressions. However, there is a possibility that our findings are confounded with other endogenous issues. For instance, it is possible that the environmental regulation was evoked in response to high innovativeness in the policy regions. Thus, if the authorities targeted the firms in the policy regions due to their innovativeness, our results might be confounded by reverse causality bias. Therefore, to improve our analysis, we employ two econometric strategies to deal with possible endogeneity concerns. We first use the Heckman two-step correction method to minimize sample selection bias and then use the propensity score matching approach.

Heckman two-stage correction

The non-randomness of pilot selection of APPP cannot be ruled out. There are certain features that may have motivated the regulators to target certain regions, hence the room for selection bias. The APPP policy is mainly in provinces and cities with a representative degree of regional economic development. Generally, the higher the degree of economic development, the more attention will be paid to pollution emissions control. The decision for a firm to be located in a specific region may also not be random. Highly innovative firms are more likely to choose to be located in particular regions for economic reasons. As a result, these firms tend to be clustered in areas with high economic activity that happen to have heavy pollution emissions, and these areas are more likely to be selected as part of the APPP policy zones.

We therefore employ the Heckman two-stage correction model to mitigate endogenous problems caused by sample self-selection bias. We first estimate the probability of a firm being located in a policy region. However, for our tests to be valid, we need to identify some exclusion restrictions and include them in the first stage. The Heckman estimator requires variables that are correlated with the firm’s likelihood of being located in a policy region but not with the firm’s innovation policy. We use the city’s wind speed and total population density as potential exclusion restrictions in the first stage. These variables may influence the likelihood of a firm’s location to be in the targeted region but less likely to significantly affect an individual firm’s innovation ability. For instance, regions with low wind speed are likely to be in targeted areas for emissions reduction since pollution levels are mainly concentrated for a long time in the air when the wind speed is low. In contrast, dispersion of pollutants is faster in regions with high wind speed and thus these areas have better air quality and less likely to be policy targets. However, air flow is less likely to be correlated with an individual firm’s innovation policy. Additionally, areas with high population density are closely associated with high pollution levels but less likely to be associated with an individual firm’s innovation ability. We employ a non-linear probit model in the first stage and tabulate the results in Table 3 column 1. The first stage results displayed in Table 3 column 1 show that our exclusion restrictions enter the selection regression with significant coefficients supporting their selection as valid for identification. Next, we calculate the Inverse Mills ratio from the first stage estimation and use it in the second stage regression. We report the second stage results in Table 3.

Table 3 results indicate that the Inverse Mills ratio is significant in three of the four models, suggesting that our baseline sample has some selection issues. The coefficients for the Inverse Mills ratio are negative, implying that unobserved factors that influence the firm’s location to be selected as a policy area are negatively related to firm innovation. However, our main variable, Post*APPP, enters the second stage regressions with positive and significant coefficients at 1% statistical significance. Our coefficients in Table 3 after correcting for selection bias are different in magnitude from those shown in Table 2, suggesting that our main results are partially affected by selection issues. However, the coefficients remain economically significant in all our models supporting the evidence that the APPP regulation contributed to an increase in patenting productivity.

PSM-DID

Our study results may be biased if the differences in firm characteristics between the treatment and control groups are driving our main results. To minimize endogeneity concerns, we use the propensity score matching approach (PSM) to control for the observable differences between treatment and control groups. We use the firms’ characteristics before the policy to match the treatment firms and control firms. In addition to our control variables, we use patent growth to match our variables. We specifically use a one-to-one propensity score matching to match each firm in a policy region (treatment) with a peer firm in a non-policy region (control group). We use two diagnostic tests to evaluate our matching procedure.

First, we use a visual representation to evaluate our matching procedure using the Kernel density graphs before matching and after matching. We present our graphs in Fig. 2. The first graph in Fig. 2 shows meaningful observable differences between the treatment group (APPP=1) and the control group (APPP=0). In contrast, the other graph in Fig. 2 shows that the significant differences that existed before matching between the firms in policy regions and those in non-policy regions vanished after employing the propensity score matching.

Next, we use covariate balance tests to check whether our matching procedure is satisfactory. Table 4 presents covariate balance tests before and after matching. The t-statistics and visual observation of the covariates’ means in Table 4 show no significant differences between the matched treatment firms and the control firms. In addition, the results show a substantial percentage bias reduction after matching to the extent that the percentage bias for the mean differences dropped to less than ten percent. This means that our matching procedure removed all significant differences in pre-regulation characteristics between the treatment groups and control groups, thus meeting the parallel trend assumption. Overall, the satisfactory matching displayed in Fig. 2 and Table 4 increases our confidence that any observed differences in innovation productivity after the policy year between the two groups are caused by the APPP policy.

Clustered standard errors at the firm level are shown in parenthesis. *, **, and *** represent significance at the 10%, 5%, and 1% statistical levels respectively

After matching our sample, we run our regressions using the DID procedure and report the results in Table 5. The PSM results in Table 5 show that the coefficient of Post*APPP is positive and significant at 5% in column 2 and 1% in columns 3–4. Our results using a propensity score–matched are comparatively similar to the baseline results using an unmatched sample and the coefficients remain economically sizeable. The changes in the coefficients' magnitude relative to the ones in baseline results suggest that our main results using the whole sample are partially being driven by some differences in firm characteristics between the treatment and control groups. However, the PSM-DID estimates are economically sizeable, providing evidence that treatment firms in policy regions experience a larger post-regulation increase in innovation output than their counterparts in non-policy areas. Collectively these results support that APPP environmental regulation enhanced firm innovation ability.

Clustered standard errors at the firm level are shown in parenthesis. *, **, and *** represent significance at the 10%, 5%, and 1% statistical levels respectively

Underlying economic mechanisms

We identify possible economic mechanisms that possibly explain the increase in innovation after the policy implementation using mediation analyses. There are three conditions that should be met to establish a mediation effect. First, in the first step, the independent variable (Post*APPP) should be significantly related to the dependent variable (Patent/Invention). Second, in the second step, the independent variable (Post*APPP) should be significantly associated with the mediator variable. Lastly, in the third step, the independent variable (Post*APPP) and the mediator variable are introduced into the same model. If there is a mediation effect, the mediator should be significant, and the significance of the independent variable (Post*APPP) should be reduced after adding the mediator variable in the model. The Sobel (1982) test is used to check the significance of the mediation effect. In our subsequent analyses, the baseline results in Table 2 serve as the first stage of the mediation analyses.

Government funding

One of the arguments against environmental regulation is the cost burden. The increased cost burden associated with environmental policies can severely reduce funds to invest in costly innovative projects (Ambec et al. 2013; Shi et al. 2018; Blackman et al. 2010). To the extent that firms with limited funds may have no incentive to comply with environmental regulation by investing in R&D projects. Thus, in this context, we argue that government financial assistance can increase the effectiveness of environmental policies in promoting innovation. We examine this mechanism using direct government funding towards innovation. The Chinese government motivates firms to invest in innovation projects by providing more productive firms with R&D subsidies. Thus, we expect firms that receive more financial assistance to allocate more resources towards innovation projects to meet the emissions targets. External funding from the government can alleviate financial constraints and provides sufficient funds needed to finance expensive innovation projects (Hall 2002). We identify the value of R&D subsidies allocated to various firms in the sample and analyze whether environmental regulation promotes innovation through government financing.

We first estimate the changes in R&D subsidies around the APPP regulation and report the second stage results for the mediation analyses in Table 6. Table 6 results in columns 1–2 show positive and significant coefficients for R&D subsidies. The coefficients are even stronger in magnitude for both models. These results suggest that firms in the policy areas received more R&D subsidies after the environmental regulation than their counterparts. Next, we add R&D subsidies in our baseline model and repeat our estimations. Third step mediation analysis results in Table 6 columns 3–6 reveal that our DID variable (Post*APPP) remains significant at 1 % levels. However, our coefficients in Table 6 columns 3–6 (third step) are less than the coefficients displayed in our baseline results in Table 2 columns 1–4 (first step). The results so far suggest that R&D subsidy is a potential channel through which environmental regulation promotes corporate innovation. We carry further analyses using the Sobel tests to validate our interpretation. We find that all the corresponding mediating factors are significant at 1% levels. Taken together, our results indicate that R&D subsidies mediate the relationship between environmental regulation and technological innovation.

Note that government financing partially mediates the relationship between APPP regulation and innovation since the coefficients of Post*APPP remain significant in the third step. We use the cross-section analysis results to illustrate the partial mediation effect on innovation. The total effect of APPP regulation on a patent is 0.454 (Table 2 column 1), and the direct effect is 0.390 (Table 6 column 3). The indirect effect, which equals the difference between the total effect and direct effect, is 0.064 (0.454–0.390). Thus, the mediation effect represents approximately 14% (0.064/0.454) of the total effect. Therefore, our findings uncover the importance of government funding in promoting the success of environmental regulations. We can infer from these results that environmental regulation promotes more innovation through the government funding channel.

Clustered standard errors at the firm level are shown in parenthesis. *, **, and *** represent significance at the 10%, 5%, and 1% statistical levels respectively

External governance

This section analyzes how external governance could strengthen the impact of environmental regulation on firm-level innovation. We use financial analyst coverage as a proxy variable that reflects the degree of external governance and monitoring. An increase in analyst coverage increases the firm’s visibility and attention from the capital market, which may force the firm to reduce pollution emissions by adopting greener technological systems. Financial analysts are external monitors that reduce information asymmetry between the business and investors and may pressure managers to reduce pollution emissions and increase sustainable investments. Financial analysts collect information about firm sustainable activities and provide this information to investors through analyst reports. Financial analyst reports expose firms by writing negative information about non-compliant firms. Given the increase in investor awareness on the costs of pollution and the importance of social outcomes to investors (Starks et al. 2017; Tao, Hui and Chen 2020; Kim et al. 2019), investors react to negative reports to the extent that non-compliant firms can lose market reputation and potential investors. Thus, in view of the stringent APPP regulation with set emissions targets, we expect financial analysts to play an external governance role that influences firms to adopt sustainable innovative approaches to meet the environmental regulation targets to the extent that firms with more analyst coverage comply with government environmental policy requirements through technological transfer.

To examine this potential channel, we first examine the effect of environmental regulation on financial analyst coverage. Firms in the policy regions are likely to attract more attention from the capital market after the regulation. We report our mediation analysis second stage results in Table 7 columns 1–2. We find a positive relationship between analyst coverage and environment regulation, suggesting that firms in targeted regions received more market attention from financial analysts following the APPP policy. These results satisfy the requirements for the second stage regressions for mediation analysis. Next, we incorporate analyst coverage in our baseline model and repeat our analysis. We tabulate our third step results in Table 7, columns 3–6. Our main variable (Post*APPP) in Table 7 columns 3–4 display positively significant and economically sizeable coefficients. However, these coefficients in the third step (Table 7, columns 3–4) are lower than those displayed in the first step (Table 2). We use the Sobel tests and find that this mediation effect is significant at 1% (p<0.01) suggesting that financial analyst coverage mediates the relationship between APPP environmental policy and technological innovation. The results support our view that external governance(monitoring) from the capital market is a plausible economic channel through which environmental regulations promote technological innovation. However, our results using within-firm variation in Table 7 columns 3–4 show negative weak coefficients for analyst coverage (Analysts) suggesting that the mediating effect for financial analyst coverage is only present in cross-section analysis.Footnote 5

R&D expenditure

So far, we have provided evidence that shows that the air pollution environment regulation promotes firm innovation productivity. Since patent productivity results from firms’ spending on R&D investments, we conjecture that environmental regulation promotes innovation output by encouraging firms to invest in R&D projects. We scale R&D expenditure by total firm assets and estimate the real effects of environmental regulation on corporate R&D activities. We report the second step mediation analysis results in Table 8. Table 8 results show that the APPP policy is positively associated with an increase in R&D investments. These results show that the APPP encouraged firms to engage in more R&D projects. Next, we control for R&D expenditure in our baseline model. Table 8 results in columns 3–6 (third step) display positive and economically significant coefficients for Post*APPP, indicating that innovation output is increasing as R&D expenditure is increasing. We find that the coefficients for our mediating factor are significant at 1% levels, and the coefficients for Post*APPP in the third step (Table 2) are smaller than those in the third step (Table 8 columns 3–6). These results satisfy the requirements for the second stage and third stage regressions for mediation analysis. Using Sobel tests, we find that the mediator is significant at p < 0.01. Taken together, these findings indicate that R&D expenditure mediates the relationship between APPP regulation and technological innovation. Thus, the evidence supports our conjecture that environmental regulation promotes innovation through R&D expenditure.

Clustered standard errors at the firm level are shown in parenthesis. *, **, and *** represent significance at the 10%, 5%, and 1% statistical levels respectively

Clustered standard errors at the firm level are shown in parenthesis. *, **, and *** represent significance at the 10%, 5%, and 1% statistical levels respectively

Heterogeneity analysis

Pollution intensiveness

Since the APPP policy was mainly targeted at lowering air pollution, it is important to examine how the policy impacted innovation productivity in pollution-intensive industries in the policy zones. Targeted firms in pollution-intensive industries have been given more targets for emissions reductions and retooling their operating systems; thus, these firms are impacted more by this policy than their counterparts. Thus, if the environment policy promotes technological innovation, we expect to observe a more pronounced increase in innovation productivity for firms in pollution-intensive industries than those in less pollution-intensive industries. To examine this effect, we introduce a dummy variable that equals one if an industry is classified as a heavy pollution industry using Chinese Industrial Classification and zero otherwise (Pollution). Additionally, to compare the effects of the policy on pollution and non-pollution intensive industries, we also create another dummy variable for firms in non-pollution industries (Npollution). Next, we interact our two dummy variables with the post-policy year dummy variable (Post) and run our regressions. Our main variables of interest are Pollution*Post and Npollution*Post. We report the results in Table 9.

Clustered standard errors at the firm level are shown in parenthesis. *, **, and *** represent significance at the 10%, 5%, and 1% statistical levels respectively

The results in Table 9 show that the coefficients for our variables of interest, Pollution*Post and NPollution*Post are positive and significant at 1 % and 5% respectively. These results suggest that the policy promoted an increase in innovation for both pollution and non-pollution intensive firms. However, if we compare the economic significance, we can observe that the coefficients for Pollution*Post are larger than for Npollution*Post, suggesting that the impact of APPP regulation on innovation is more pronounced for targeted firms in pollution-intensive industries. This evidence supports our conjecture that environmental regulations induce more innovation for pollution-intensive firms than for non-pollution-intensive firms.

High-tech intensiveness

Next, we use high-tech intensiveness as another industry economic dimension to explain the positive relationship between APPP and innovation. High tech-intensive industries are naturally innovative industries that invest extensive resources in research and development expenditure. Since we intend to evaluate the implications of APPP on innovation productivity, an analysis of how the policy impacts high-tech intensive industries and low-tech intensive industries helps us gain deeper insights on the real effects of environmental regulation on firm innovation policy. We expect to observe a jump in innovation productivity for high-tech industries in policy regions in response to the environmental air pollution regulation. We identify high-tech intensive industries using the amount spent by firms on R&D expenditures following prior literature (Hsu et al. 2014). All the industries with R&D values below the industry-level median are classified as low-tech industries, and those with values above the industry median are classified as high-tech industries. We create two dummy variables for high-tech intensive industries (High-Tech) and low-tech intensive industries (Low-Tech). Next, we interact our dummy variables with post-policy dummy variable (Post) and carry our estimations reported in Table 10. The interaction effect results in Table 10 show that the coefficients for High-Tech*Post and Low-Tech*Post are all positive suggesting that the environmental regulation promoted innovation for both high-tech and low-tech firms. However, when we consider the magnitude of the coefficients, we observe that the coefficients for High-Tech*Post are economically large in all models. The large variations in patenting productivity for naturally innovative industries (High-Tech) around the APPP regulation indicate that the impact of APPP is more pronounced for high-intensive industries located in targeted policy regions. Overall, these findings suggest that the air pollution emissions reduction regulation induced high-tech-intensive firms in policy zones to innovate more than their counterparts.

Clustered standard errors at the firm level are shown in parenthesis. *, **, and *** represent significance at the 10%, 5%, and 1% statistical levels respectively

State ownership

In our previous findings, we find that firms that receive government financial support responded better to the air pollution regulation by producing more innovative output. In this section, we examine whether state-owned firms respond to environmental regulation better than non-state-owned firms. This caveat is very important, considering the high proportion of state-owned firms in China. In terms of financial support, state firms benefit more than private firms; also, state-owned enterprises are closely monitored in the implementation of government economic policies. Thus, we expect the APPP regulation to encourage more innovation in state-owned firms than private firms.

Clustered standard errors at the firm level are shown in parenthesis. *, **, and *** represent significance at the 10%, 5%, and 1% statistical levels respectively

We divide our sample into two sub-samples of state-owned firms and private firms and then create two dummy variables. Next, we interact our dummy variables with post-policy dummy variable and carry our cross-sectional analysis. Our main variables of interest are SOE*Post, and Private*Post. We report the results in Table 11. Table 11 results show that the coefficients for our main variables of interest are positive and significant in all models. However, the coefficients for SOE*Post are economically larger than for Private*Post indicating that the impact of the policy in driving innovation is more pronounced for state-owned firms. This evidence suggests that patenting productivity increased more for state-owned firms than for private firms in policy areas after the APPP regulation. This caveat uncovers the importance of government-controlled firms in driving industrial policies and sustainable economic growth. Our study findings corroborate with Pan et al. (2021), who also find that state-owned firms respond more positively to environmental regulation.

Placebo tests

We conduct some tests to mitigate the concern that our study results may be driven by other overlapping policies in other years and regions. On top of the visual validity tests that we provide in Fig. 1 a and b, which show that innovation changes jumped after the policy year, we provide further evidence that our results are not being driven by pre-trend or other policies that could have launched before or after the APPP policy year. We exploit placebo tests to do counterfactual tests. We run 500 loops that randomly set the APPP dummy variable on each time, and we present a visual representation for our placebo tests in Fig. 3. The distribution in Fig. 3 is bell-shaped, showing a normal distribution, which shows that none of the counterfactuals can explain our study results. Collectively, we find no evidence that suggests that our results are driven by other policies in the policy period or policy regions. Thus, we conclude that the APPP policy promoted an increase in innovation in policy areas.

Conclusion and policy implications

This study contributes to the literature by analyzing the impact of air pollution reduction regulation in China using a sample of A-share listed firms. We exploit the Air Pollution Prevention Policy in China’s 12th Five-Year Plan. The difference in difference procedure, Heckman two-stage and the propensity score matching approach are employed to establish the direction of causality. Our findings reveal that the air pollution regulation contributed to a substantial increase in innovation for firms located in targeted policy areas. The study results continue to hold after a battery of tests.

Additionally, our paper contributes to the literature by uncovering possible underlying economic mechanisms that possibly explain the channels through which environmental policy promotes technological innovation. We find that R&D intensity and external governance mediate the relationship between environmental regulation and innovation. At the same time, our paper highlights the critical role played by R&D subsidies in strengthening the effect of environmental regulation on technological innovation. Furthermore, in our heterogeneity analysis, we find that state-owned firms, firms in pollution-intensive industries and high-tech intensive industries, innovate more than their counterparts after the air pollution reduction policy. In this way, this study enriches our understanding about how environmental regulation improves technological innovation.

We contribute to the literature and economic policy in various ways. In view of our study findings, the government should continue to fight against pollution to promote green cities since emissions reduction policies are associated with increased economic performance. The government can extend the emission reduction regulation to more regions to effectively reduce pollution emissions while also encouraging technological innovation. Since our study results show that government financing improves the firms’ responses to environmental regulation, we recommend regulators implement complementary financial measures that support environmental regulation. For instance, the government can allocate some funds to help financially constrained firms in policy regions so that they can positively respond to government policies. Incentives like subsidies, tax reductions, and other benefits can help to promote compliance with environmental policies. There is a need for the government, through its affiliates, to allocate more green finance as it can help lowering pollution emissions and encourage technological change. It is also important for regulators to enforce laws that reduce capital market frictions since key capital market players like financial analysts promote the effectiveness of government policies.

One limitation of this study is that we did not manage to examine whether environmental regulations encourage investment in dirty or clean technologies, due to restrictions regarding data availability. We thus encourage future studies to explore this fruitful area of research.

Notes

The thirteen covered regions include the Beijing-Tianjin-Hebei area, the Yangtze River Delta, the Pearl River Delta, central Liaoning, Shandong province, Wuhan and its surrounding area, Changsha-Zhuzhou-Xiangtan, Chengdu, Fujian province, north-central Shanxi, central Shaanxi, Gansu province and Ningxia Autonomous Region, and Urumqi.

We observe this effect in cross sectional analyses but the effect disappears in a time series analysis

Our study results are not altered if we include these firms in the sample

The disappearance of the mediation effect in time series analysis is possibly explained by time-invariant firm characteristics or problems associated with time series analysis for short sample periods.

References

Acemoglu A, Aghion P, Bursztyn L, Hemous D (2012) The environment and directed technical change. Am Econ Rev 102(2012):131–166

Aghion P, Bloom N, Blundell R, GriffithR, Howitt P (2005) Competition and innovation: an inverted U relationship? Q J Econ 120(2):701–6728

Aghion P, Van Reenen J, Zingales L (2013) Innovation and institutional ownership. Am Econ Rev 103(1):277–304

Ambec S, Barla P (2006) Can environmental regulations be good for business? an assessment of the Porter hypothesis. Energy Stud Rev 14:42–62

Ambec S, Cohen AM, Elgie S, Lanoie P (2013) The Porter hypothesis at 20: can environmental regulation enhance innovation and competitiveness. Rev Environ Econ Policy 7:2–22

Arundel A, Kable I (1998) What percentage of innovations are patented? Empirical estimates for European firms. Res Policy 27(2):611–624

Blackman A, Lahiri B, Pizer W, Planter MR, Pina CM (2010) Voluntary environmental regulation in developing countries: Mexico’s clean industry program. J Environ Econ Manag 60(3):182–119

Bu M, Qiao Z, Beibei LB (2020) Voluntary environmental regulation and firm innovation in China. Econ Model 89:10–18

Chakraborty P, Chatterjee C (2017) Does environmental regulation indirectly induce upstream innovation? New evidence from India. Res Policy 46:939

Chang C, Wen J, Dong M, Hao Y (2018) Does government ideology affect environmental pollutions? New evidence from instrumental variable quantile regression estimations, Energy Policy 113:386–400

Chen X, Chen YE, Chang CP (2019) The effects of environmental regulation and industrial structure on carbon dioxide emission: a non-linear investigation. Environ Sci Pollut Res 26:30252–30267

Christmann P (2000) Effects of 'best practices' of environmental management on cost advantage: the role of complementary assets. Acad Manag J 43(4):663–680

Chu Y, Liu Y, Tian X (2021) Environmental risk and green innovation: evidence from evacuation spills. Available at SSRN: https://ssrn.com/abstract=3740551; https://doi.org/10.2139/ssrn.3740551

Dong F, Zhang S, Long R, Zhang X, Sun Z (2019) Determinants of haze pollution: an analysis from the perspective of spatiotemporal heterogeneity. J Clean Prod 222:768–783

Dong F, Zhang S, Li Y, Li J, Xie S, Zhang J (2020a) Examining environmental regulation efficiency of haze control and driving mechanism: evidence from China. Environ Sci Pollut Res 27:29171–29190. https://doi.org/10.1007/s11356-020-09100-9

Dong F, Li J, Li K, Sun Z, Yu B, Wang Y, Zhang S (2020b) Causal chain of haze decoupling efforts and its action mechanism: evidence from 30 provinces in China. J Clean Prod:245, 118889

Elahi E, Khalid Z, Weijun C, Zhang H (2020) The public policy of agricultural land allotment to agrarians and its impact on crop productivity in Punjab province of Pakistan. Land Use Policy 90:104324. JLUP_104324. https://doi.org/10.1016/j.landusepol.2019.104324

Franco C, Marin G (2017) The effect of within-sector, upstream and downstream environmental taxes on innovation and productivity. Environ Resour Econ 66:261

Griliches Z (1984) R&D, patents, and productivity. The University of Chicago Press, Chicago, IL.

Gu H, Cao Y, Elahi E, Jha SK (2019) Human health damages related to air pollution in China. Environ Sci Pollut Res 26(13):13115–13125. https://doi.org/10.1007/s11356-019-04708-y

Gu H, Bian F, Elahi E (2020a) Effect of air pollution on female labor supply: an empirical analysis based on data of labor force dynamic survey of China. Social Work in Public Health 35(4). https://doi.org/10.1080/19371918.2020.1764433

Gu H, Yan W, Elahi E, Cao Y (2020b) Air pollution risks human mental health: an implication of two-stages least squares estimation of interaction effects. Environ Sci Pollut Res 27:2036–2043. https://doi.org/10.1007/s11356-019-06612-x

Hall BH (2002) The financing of research and development. Oxf Rev Econ Policy 18:35–51

He J, Tian X (2013) The dark side of analyst coverage: the case of innovation. J Financ Econ 109(3):856–878

Hsu P, Tian X, Xu Y (2014) Financial market development and innovation: cross-country evidence. J Financ Econ 112(1):116–135

Hu J, PanX HQ (2020) Quantity or quality? The impacts of environmental regulation on firms’ innovation–Quasi-natural experiment based on China’s carbon emissions trading pilot. Technol Forec Soc Chan 158:120122

Jaffe AB, Palmer K (1997) Environmental regulation and innovation: a panel data study. Rev Econ Stat 79(4):610–619

Johnson MS (2020) Regulation by shaming: deterrence effects of publicizing violations of workplace safety and health laws. Am Econ Rev 110(6):1866–1904

Kim I, Wan H, Wang B, Yang T (2019) Institutional investors and corporate environmental, social, and governance policies: evidence from toxics release data. Manag Sci 65(10):4901–4926

Kleinknecht A, Montfort VK, Brouwer E (2002) The non-trivial choice between innovation indicators. Econ Innov New Technol 11(2):109–121

Lee J, Veloso MF, Hounshell AD (2011) Linking induced technological change, and environmental regulation: evidence from patenting in the U.S. auto industry. Res Policy 40(9):1240–1252

Li W, Gu Y, Liu F (2019) The effect of command-and-control regulation on environmental technological innovation in China: a spatial econometric approach. Environ Sci Pollut Res 26:34789–34800

Majumdar KS, Marcus AA (2001) Rules versus discretion: the productivity consequences of flexible regulation. Acad Manag J 44:170–179

Mbanyele W (2021a) Staggered boards, unequal voting rights, poison pills and innovation intensity: new evidence from the Asian markets. Int Rev Law Econ 65:105970

Mbanyele W (2021b) Economic policy uncertainty and stock liquidity: the role of board networks in an emerging market. Int J Emerg Mark ahead-of-print. https://doi.org/10.1108/IJOEM-05-2020-0492

Mbanyele W (2021c) Firms’ innovation strategy under the shadow of corporate social responsibility disclosure: evidence from China. Manage Decis Econ:1– 17. https://doi.org/10.1002/mde.3386

Mbanyele, W. & Wang, F. (2021) Board Interlocks and Stock Liquidity: New Evidence from an Emerging Market, Emerging Markets Finance and Trade, doi:https://doi.org/10.1080/1540496X.2021.1882988

Nesta L, Vona F, Nicolli F (2014) Environmental policies, competition and innovation in renewable energy. J Environ Econ Manag 67(2014):396–411

Pan X, Cheng W, Gao Y et al (2021) Is environmental regulation effective in promoting the quantity and quality of green innovation?. Environ Sci Pollut Res 28:6232–6241. https://doi.org/10.1007/s11356-020-10984-w

Porter ME (1991) America’s green strategy. Sci Am 264(4):168

Porter ME, van der Linde C (1995) Toward a new conception of the environment–competitiveness relationship. J Econ Perspect 9(4):97–118

Ramanathan, R., He, Q, and Black, A, Ghobadian, A., and Gallear D.(2017). Environmental regulations, innovation and firm performance: a revisit of the porter hypothesis

Rexhäuser S, Rammer C (2014) Environmental innovations and firm profitability: unmasking the porter hypothesis. Environ Resour Econ 57:145–167

Scherer FM (1982) Inter-industry technology flows and productivity growth. Rev Econ Stat 64(4):627–634

Schmookler J (1966) Invention and Economic Growth, Harvard University Press, Cambridge, MA

Shi B, Feng C, Qiu M, Ekeland A (2018) Innovation suppression and migration effect: the unintentional consequences of environmental regulation. China Econ Rev 49:1–23

Sobel ME (1982) Asymptotic confidence intervals for indirect effects in structural equation models. Sociol Methodol:13290–13312

Starks, L. T., Venkat, P., Zhu, Q. 2017. Corporate ESG profiles and investor horizons. Unpublished manuscript.

Stucki T, Woerter M, Arvanitis S, Peneder M, Rammer C (2018) How different policy instruments affect green product innovation: a differentiated perspective. Energy Policy 114:245–61

Su S, Li B, Cui S, Tao S (2011) Sulfur dioxide emissions from combustion in China: from 1990 to 2007. Environ Sci Technol 45:8403–8410

Tao C, Hui D, Chen L (2020) Institutional shareholders and corporate social responsibility. J Financ Econ 135(2):483–2504

Tan Y, Tian X, Zhang X (2020) The real effects of privatization: evidence from China’s split share structure reform. J Corp Finan

Van Leeuwen G, Mohnen P (2017) Revisiting the porter hypothesis: an empirical analysis of green innovation for The Netherlands. Econ Innovat N Technol 26:63–77

Wang F, Li Y, Sun J (2020) The transformation effect of R&D subsidies on firm performance: an empirical study based on signal financing and innovation incentives. Chin Manag Stud 14:373–390. https://doi.org/10.1108/CMS-02-2019-0045

Williamson (1999) Public and private bureaucracies: a transaction cost economics perspectives. J Law Econ Org 15(1):306–342

Wu Q, He Q, Duan Y, O'Regan N (2012) Implementing dynamic capabilities for corporate strategic change towards sustainability. Strateg Chang 21(5/6):231–247

Wu Y, Zhu X, Groenewold N (2019) The determinants and effectiveness of industrial policy in China: a study based on Five-Year Plans. China Econ Rev 53(1):225–242

Zhang K, Xu D, Li S (2019) The impact of environmental regulation on environmental pollution in China: an empirical study based on the synergistic effects of industrial agglomeration. Environ Sci Pollut Res 26:25775–25788

Availability of data and materials

The data that support the findings of this study are available from the CSMAR database but restrictions apply to the availability of these data, which were used under license for the current study, and so are not publicly available. Data are however available from the authors upon reasonable request and with permission of CSMAR.

Funding

This work was supported by the National Natural Science Foundation of China (Grant Number: 71573159 and the China International Postdoctoral Exchange Program

Author information

Authors and Affiliations

Contributions

WM: conceptualization; data curation; formal analysis; investigation; methodology; visualization; writing—review and editing

FW: conceptualization; resources; supervision; validation; writing—review and editing

Corresponding author

Ethics declarations

Ethics approval

Not applicable

Consent for publication

Not applicable

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Baojing Gu

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Mbanyele, W., Wang, F. Environmental regulation and technological innovation: evidence from China. Environ Sci Pollut Res 29, 12890–12910 (2022). https://doi.org/10.1007/s11356-021-14975-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-14975-3