Abstract

This study investigates the role of energy consumption in environmental degradation and checks the validity of the environmental Kuznets curve (EKC) and pollution haven hypothesis (PHH) for the South Asian economies. The model is also controlled for population growth. The dynamic panel data model is estimated through Fully Modified Ordinary Least Square (FMOLS) rigorously. The results reject the possibility of the existence of EKC but ensure the prevalence of PHH. The study suggests that the South Asian countries should focus on attracting clean foreign investment, whereas the renewable energy production is critical for climate change mitigation. The study also stresses the financial institutions’ active role in providing easy loans for promoting research and development in environmentally friendly production practices.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Environment, energy, and economic growth are imperative components for the development of a country, wherein the role of foreign direct investment (FDI) is critical in developing economies. However, the phenomenon of shifting production from developed to developing countries due to the availability of cheap labor, abundant natural resources, and flexible environmental laws has raised serious concerns about climate change. According to IEA (2017), energy is a golden thread that connects equity, economic growth, and sustainability. It also highlights the importance of access to energy for achieving Sustainable Development Goals (SDGs). The FDI host countries predominantly rely on thermal energy for production. So, the idea of cleaner production is compromised at the cost of environmental degradation. In this perspective, the environmental Kuznets curve (EKC) and pollution haven hypothesis (PHH) have remained a matter of concern among international development practitioners, academicians, and policymakers.

Since the seminal work by Walter and Ugelow (1979) on PHH, many researchers such as Conrad (2005); Kheder and Zugravu (2008); Al-mulali and Tang (2013); Tang (2015); Zhang (2015) have devoted their efforts to look into its theoretical and empirical underpinning and triumphed effective results. Given that climate change and global warming are the most important issues for the environment and cleaner production, there is a need to deeply look into the environmental aspects of FDI and Gross Domestic Production (GDP). The relocation of China’s industry through its Belt and Roads initiative (BRI) makes the South Asian countries important to focus on which are already vulnerable to environmental degradation and climate change.

For instance, fossil fuel consumption stands at 73.8% in Bangladesh, 73.6% in India, 61.6% in Pakistan, and 50.5% in Sri Lanka that has risen significantly since 1991. On the other hand, CO2 emissions from electricity and manufacturing are also increased substantially during the same period. It is 69.2% in Bangladesh, 80% in India, 57.5% in Pakistan, and 46.7% in Sri Lanka (World Bank 2019). Furthermore, both the indicators are also strongly correlated with more than 87% correlation in each country. Basic understanding of data makes the South Asian countries an interesting case to look into greater detail. Climate change is now a bigger challenge for the region, whereas these countries are also the signatory of the Paris agreement. The evidence on the influx of FDI on CO2 emissions has not transpired accord. Keeping in view the gap in the literature, this study aims to investigate the validity of EKC and PHH for South Asian countries through vigorously handing data and methodology aspects. Based on findings, this study emphasizes the need to strengthen environmental laws, sustainable energy solutions, and cleaner production practices.

Sustainable economic growth and preserving the environment are at the core international development agenda. Environmental deterioration increases apprehensions about global warming and climate change (Salahuddin et al. 2019; Kasman and Duman 2015). The term ‘sustainable growth’ was used in the Brundtland Report developed by the World Commission on Environment and Development in 1987. It indicates a process of development that puts efforts into optimum use of available resources without harming future generations’ resources. It undertakes environmental concerns and growth (WCED 1987). Economic growth significantly contributes to environmental degradation, whereas the prime source of capital financing is FDI. It stimulates the growth process by providing advanced technology and spillover effects. FDI also generates productivity gains and introduces new managerial skills (Lee 2013). The past two decades’ rapid increase of FDI inflows poses some questions on its cost and related benefits for both academicians and policymakers. Technological improvement may have dual effects, simultaneously affect economic growth and environmental quality.

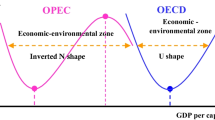

Environmental quality is treated as a normal good, so its demand rises with the buildup in earnings. Only a negligible amount is used to spend on environmental goods at the early stage of development. After the industrialization process has fastened, the demand for environmental goods and budget allocation is increased. When GDP grows continuously and reaches some threshold level, its typical outcome is a pollution reduction. The combined effect of this improvement in growth carries an inverted U-shaped relationship with pollution, referred to as EKC. CO2 emissions are positively related to the GDP and other growth factors before reaching a threshold level. However, in the context of the EKC framework, it is also important to take into consideration the theoretical underpinning for developing the model. Otherwise, it gives a spurious understanding of the inverted U-shaped relationship between environmental degradation and GDP.

Followed by the trade liberalization policy in the 1970s, the last four decades witnessed a drastic increase in FDI net inflows that remained a key element for economic development (Te-Velde and Bezemer 2006). In early 1980, worldwide per capita FDI was US$ 7.74, and during 1996–2000 it increases up to US$ 126.37. This increase has a significant effect on the growth of host countries. However, during the financial crises (2006–2010), annual FDI goes down. Overall, the net FDI inflows are increased from 10.17 billion USD in 1970 to 1.95 trillion USD in 2017 (World Bank 2019). From 1976 to 2011, the per capita energy use is increased from 1547.50 to 1917.98 kg of oil equivalent per capita (IEA 2017).

FDI inflows have been increased in the last two decades in developing countries. FDI may generate positive externalities by introducing advanced technology along with negative externalities (Bosworth et al. 1999; Alfaro 2003; Bustos 2007; Ndikumana and Verick 2008). Developed countries prefer to invest in developing economies to benefit from weak environmental laws, economies of scale, known as the “industrial flight hypothesis”, and foreign companies install up-to-date technology and provide better management services. According to the pollution halo hypothesis, FDI that originated from developed to developing countries hurts environmental quality. Another argument is the installation of outdated technology, according to PHH.

Two channels, economic growth and technological progress, are critically important through which FDI can impact CO2 emissions (Sun et al. 2017). FDI, if accompanied by technology, influences the environment through the scale and structure of the host country. In the case of China, significant evidence is available which shows that FDI inflows are significant contributors to economic growth (Wei and Liu 2001; Yao and Wei 2007; Whalley and Xian 2010). For developing countries, FDI inflows are vital for triumphing growth in the short run. Capital accumulation can bring clean technology, spillovers, productivity gains, and new managerial skills (Lee 2013). According to Jaffe et al. (2002), technological progress can sway CO2 emissions either positively or negatively. Therefore, empirical verification of the PHH needs to include both of these channels. It also requires investigating the theoretical relationship between CO2 emissions and the economy that is well characterized in EKC.

The impact of technological progress in a country is dependent on the path, i.e., it depends on whether FDI comes with the clean technology and follows the same path or otherwise (Acemoglu et al. 2012; Omri et al. 2014) whereas it is still inconclusive for the South Asian region. If FDI brings pollution-intensive technologies or focuses on natural resource extraction without compensation, then it causes environmental degradation and compromises cleaner production. The reliance of developing countries on fossil fuels to produce electricity is one major source of CO2 emissions that resulted in climate change (Callan et al. 2009; Wu and Chen 2017; Shao et al. 2019). Therefore, a much deeper understanding is required that cannot be noticed by investigating the nexus among environment, FDI, energy consumption, and economy.

The literature mostly employs spatial econometric models, input-output models, or granger causality (Dietzenbacher and Mukhopadhyay 2007; Apergis and Payne 2009; Lu et al. 2017). Furthermore, it is hard to find any concrete insight while working in a single country because environmental degradation, energy consumption, and climate change are appropriate to study at the regional level. It is also important to highlight that focusing on CO2 emissions, economic growth, and FDI without controlling for energy consumption can only give spurious results without any representative implications. Therefore, this study’s contributions are twofold; first, the study focuses on a panel of South Asian countries, whereas a rigorous econometric estimation procedure is adopted. For instance, all the variables are checked for the order of integration, and then the panel cointegration test is employed. Afterward, the study used the Fully Modified Ordinary Least Square (FMOLS) method. By doing so, the study gets lead over the literature by appropriately handling the problem of serial correlation and endogeneity, i.e., it includes heterogenous cointegration (Phillips and Hansen 1990; Pedroni 2000; Hamit-Haggar 2012; Ozcan 2013). Second, the study provides evidence (employing data for the period 1990 to 2018) on the nexus among environmental degradation, economy, FDI, and energy consumption within the same model by focusing on the very neighboring region of China (four South Asian countries; Pakistan, India, Bangladesh, and Sri Lanka). It is worth considering given BRI and the already increasing environmental degradation.

Following the introduction, the requisite details about the empirical model, research methodology, and data description are given in the “Research methodology“ section. The results are analyzed in the “Research methodology “ section, whereas the “Conclusion” section concludes the study by sharing policy recommendations.

Research methodology

This section provides a detailed description of the empirical model in the light of literature for underpinning the theoretical basis. Then, all the steps followed for estimating the model starting from unit root test, Cointegration test, and FMOLS estimation with their justification and description.

Empirical model

Three constituents in the literature emphasize the relationship between FDI, economic growth, and the environment. The first strand emphasizes the soundness of the non-linear relation between environmental degradation and economic growth. This hypothesis forecasts economic development as an explanation for environmental issues without policy involvement (Grossman and Krueger 1991). According to Reibstein (2008), the sustainomics green growth hypothesis is key for objective economic growth with low pollution. Munasinghe (2010) explained how the tunnel effect contributes to developing nations reaching a target growth rate by maintaining low pollution. However, empirical outcomes are questionable. For instance, Selden and Song (1994) and Grossman and Krueger (1995) find EKC to be valid, whereas the results of Holtz-Eakin and Selden (1995) contradict this finding. Friedl and Getzner (2003) find an “N-shaped curve”, and Saboori et al. (2012) examined causal links between income and CO2 emissions and found mixed results. Second, strand examines the relationship between economic growth and FDI inflows by Hermes and Lensink (2003), Ekanayake et al. (2003), Nguyen (2007), Batten and Vo (2009), Tsang and Yip (2007), Anwar and Nguyen (2010). Few of them found a causal relationship between GDP and FDI, whereas others found no causal relationship. The third strand aims to investigate the link between FDI inflows and CO2 emissions. Many studies, including Smarzynska and Wei (2001), Xing and Kolstad (2002), Eskeland and Harrison (2003), Pao and Tsai (2010), and Zhang (2011) find evidence in favor of the pollution haven hypothesis.

The above-related literature illustrates that FDI is necessary for economic growth, and in return, FDI may have negative impacts on environmental quality. The environment–FDI–growth relationship is investigated for the feedback hypothesis, the unidirectional hypothesis, and the neutrality hypothesis. According to Lee (2013), Ang (2008), and Jaunky (2011) the relation between CO2 emissions and economic growth is unidirectional. Tsai (1994), Halicioglu (2009), and Soytas and Sari (2009), while examining the feedback hypothesis, witnessed a bidirectional relation. Richmond and Kaufmann (2006) fail to find any relation among FDI, economic growth, and CO2 emissions. Coondoo and Dinda (2002) and Apergis and Payne (2009) show mixed results causal relationship between income and CO2. FDI has been originated in both polluted and non-polluted sectors and contributes to boosting growth but with certain compromise on the environmental quality.

Many studies have empirically investigated the impact of per capita GDP, FDI, per capita energy consumption (PCEC) on environmental degradation (e.g., Omri et al. 2014; Beak and Koo 2009; Pao and Tsai 2010). These studies have taken the following algebraic form of an empirical model.

Where FDI represents foreign direct investment inflow, economic growth is measured by a change in real GDP. However, some studies have used per capita real GDP instead of GDP in their empirical studies because per capita GDP gives the true representation of the individual behavior towards emission (e,g., Agarwal 2012; Choe 2003; Li and Liu 2005). The literature terms the non-linear relation between environmental degradation and per capita GDP as EKC that can be captured by introducing the square of per capita GDP into the empirical model. As an interesting fact, it is critical for developing a model that is rigorous both theoretically and empirically to yield valid results. The study has taken the lead over the literature to capture the PHH by introducing the square of FDI as an independent variable. By doing so, both the linear and non-linear relationship between environmental degradation and FDI is captured efficiently. The third important aspect is to complement the model by including per capita energy consumption for understanding the individual behavior and the significance of fuel mix to deal with environmental degradation. Furthermore, investigating the PHH without complementing it with per capita energy consumption can be misleading because of the regression equation’s spurious nature.

PCEC, along with FDI and per capita GDP, is used by Linh and Lin (2014), Khan et al. (2014), and Tamazian and Rao (2010), whereas Liu et al. 2015 have used total population in the model. In some studies, it is found that the immediate impact of FDI is to degrade the environment in the initial phase of economic growth, but once per capita GDP reaches the threshold level, the effects on the environment start falling (Badri and Parvizkhanlu 2014; Aliyu 2005; Levinson and Taylor 2008; Eskeland and Harrison 2003). Following Javid and Sharif (2016), Nasir and Rehman (2011) and Nasir et al. (2019) along with others, this non-linear relationship between per capita GDP and pollution is named EKC that is captured by introducing the squared term of per capita GDP.

where β's shows regression estimators. Following Badri and Parvizkhanlu (2014), the validity of the existence of the non-linear relationship of EKC is checked by including both FDI and its square. Energy consumption is included in the model because energy consumption may harm environmental quality. So the expected signs of β’s are, β2 > 0, β3 > 0, β4 < 0, β5 > 0 and β6 > 0.

Panel unit root and co-integration test

The panel unit root tests are applied to examine the stationarity of variables, where the null hypothesis is that there is a unit root. When there is a panel, it is essential to check the cross-sectional dependency before applying the unit root test (Ulucak and Khan 2020). Otherwise, the results are not reliable (Pesaran 2004). Three cross-sectional dependency tests are Friedman Chi-square, Pearson CD Normal, and Pearson LM Normal. The selection of unit root test(s) depends on the presence or absence of cross-sectional dependency, wherein the Covariate Augmented Dicky Fuller test (CADF) is one among the candidate tests.

Based on unit root results, the Johnsen Cointegration test is used to check the cointegration in panel series. According to Maddala and Wu (1999), advance panel cointegration tests are more useful than the traditional Pedroni (1997, 1999, 2004), and these techniques are developed to investigate the long-run relationship between series. In the present study, Pedroni and Kao residual co-integration tests are used. Both of the tests are built on the residual-based two-step cointegration tests proposed by Engle and Granger (1987). If cointegration exists among the variables, then FMOLS is the most appropriate technique for efficient estimators instead of OLS.

Econometric methodology

When the integration of the variables is exclusively ordered, the OLS estimator does not give useful estimates. In this case, FMOLS developed by Pedroni (2001) sort out this problem and calculate the values of long-run estimates. The FMOLS technique provides estimates consistently. The panel FMOLS estimate Eq. (2) and yit = yi,t − 1 + eit. The innovating vector ωit = (μit, eit)′ is I(0) with asymptotic long-run covariance vector Ω is defined as follows:

The auto covariances vector, Γi, and xit = (yit, zit) is I(1) and yit, zit are cointegrated. The panel FMOLS estimators for the coefficient β are defined as follows:

where, \( {z}_{it}^{\ast }=\left({z}_{it}-\overline{z}\right)-\frac{{\hat{L}}_{21i}}{{\hat{L}}_{22i}}\ \Delta {\mathrm{y}}_{it},\kern0.5em {\acute{\upeta}}_i\equiv {\acute{\Gamma}}_{21i}+{\hat{\Omega}}_{21i}^0-\kern0.5em \frac{{\hat{L}}_{21i}}{{\hat{L}}_{22i}}\ \left(\ {\acute{\Gamma}}_{22i}+{\hat{\Omega}}_{22i}^0\right) \)

and \( {\hat{L}}_i \) is a lower triangular decomposition of \( {\hat{\varOmega}}_i^0. \)

Data and variable description

In the present study, we use CO2 as the dependent variable, whereas FDI, per capita energy consumption, per capita GDP, and population are used as independent variables. The data is taken from the World Development Indicators database of the World Bank from 1990 to 2017 for all four countries: Bangladesh, India, Pakistan, and Sri Lanka.

Results and discussion

This section offers the empirical analysis of PHH and EKC for four major South Asian economies. As a first step, this section tests the cross-sectional dependence for selected South Asian countries that is a preliminary step to decide the appropriate unit root test. Then, after discussing the results of the unit root test, Pedroni and Kao residual co-integration test is applied and analyzed. The results reveal that the data set used in the study has cross-sectional independence, all the variables are found integrated of order one, and there exists a long-run relationship among the variables. After evaluating the preliminary tests, FMOLS results are analyzed to provide insight into the long-run elasticity wherein CO2 emissions conform to the dependent variable.

Given the fact that working on environmental degradation wherein energy is taken as a source, limits the research to preferably focusing on panel data to study the regional outlook. The panel data approach allows for inclusive econometric analysis for small data sets. Furthermore, it is beneficial because of having less collinearity, more degree of freedom, controlling heterogeneity, the adjustment speed to changes in economic policy, identification efficiency, and measuring the economic issues (Baltagi 2005). However, it is important for panel data studies to reconnoiter the cross-sectional dependence at the first stage so that the estimation procedure is planned accordingly. Among the candidate tests, Pesaran (2004) scaled LM test, Pesaran (2004) CD test, and Friedman (1937), Chi-square test is employed. Pesaran (2004) LM test is best suited for large time and cross-sectional settings, whereas the Pesaran (2004) CD test is appropriate for small-time series and cross-sections. Results in Table 1 reveals that cross-sectional dependence does not exist. Therefore, the estimation can be proceeded, keeping in view the independence of cross-section.

Keeping the cross-sectional independence, CADF, suggested by Hansen (1995), is applied to test for the panel unit root. The CADF test is selected for three reasons. First, it is feasible for power gains in case of inferior size performances, as simulations reported by Elliott and Jansson (2003). Second, due to the familiarity of its framework with that of the ADF test, the computational burden relevant to P-values is simple. Third, it presumes that economic phenomena are not univariate in the real world and that the use of appropriate information leads to precise and efficient results. Moreover, the unit root test is required to check the order of integration of the variables, so that decision on whether to move for the Cointegration test or not is made. The results in Table 2 do not reject the unit root in all variables at a level, whereas all the variables become stationary at the first difference even at 1% level of significance. Therefore, it is established that all the variables are integrated of order one, that is, I(1), and the Conintegration test can be applied. In case Cointegration exists, then long-run relation can be modeled through employing FMOLS.

For the purpose to check the cointegration, Pedroni (2004) and Kao (1999) tests are used because of their suitability in the presence of cross-sectional independence. Otherwise, Westerlund (2007) could have been preferred. The results of the Pedroni test, in Table 3, confirm the existence of cointegration in two out of four panels at a 1% level of significance. Further, two out of three group tests also indorse the aura of panel cointegration at a 1% significance level. On the other hand, the Kao test also confirms the existence of panel cointegration at a 1% significance level. Therefore, the estimation can be pursued without transforming the variables into the first difference. There is no chance of a spurious relationship identified by estimating the long-run elasticities by employing FMOLS.

OLS estimators failed to provide efficient estimators in the presence of co-integration among variables. In that case, FMOLS is the most appropriate technique for acquiring efficient estimators. It is also helpful to remove the problem of heterogeneity and endogeneity. Two variants of the model are estimated, with and without GDP per capita square. In both models in Table 4, per capita GDP, FDI inflows, per capita energy consumption, and population significantly impact carbon emissions, leading to implications for climate change. A rise of 1% in each of per capita GDP, FDI inflows, per capita energy consumption, and population leads to 0.486%, 0.982%, 0.0023%, and 0.982% increase in CO2 emissions, respectively. Acharyya (2009), Shahbaz et al. (2015), Zakarya et al. (2015), Kivyiro and Arminen (2014), and Behera and Dash (2017) also found similar results. Lau et al. (2014) who worked for China and Malaysia, respectively, found positive impact of FDI on environmental degradation. Few panel data studies for developing countries such as Bhattacharya et al. (2016) and Shahbaz et al. (2013) and for European countries also witnessed positive impact of FDI on environmental degradation. However, few studies including Pao and Tsai (2010), Zhang and Zhou (2016), Nasir et al. (2019) witnessed the negative impact of FDI on environmental degradation. After inclusion of per capita GDP square in the model, the CO2 emissions are now more elastic to changes in per capita GDP and increased from 0.486 to 1.729, whereas it is still significant at 5% level of significance. The coefficients of other variables do not change much when per capita GDP square is included in the model.

The impact of per capita GDP square on CO2 emissions is insignificant even at a 10% level of significance. Hence, the results do not provide evidence in favor of the existence of EKC for four selected South Asian countries. It might be because these countries are at the initial stage of development. Furthermore, the role of technological innovations, environmental and economic policies could be the possible reasons that propagate the non-existence of EKC (Roca et al. 2001). However, the possibility of EKC cannot be rejected in the future if these countries take environmental quality as a priority to ensure sustainable economic growth. Dogan and Inglesi-Lotz (2020) and Dogan et al. (2017) give evidence in support of EKC hypothesis for the countries that are relying more on renewable energy. Looking into the significant and positive impact of FDI inflows on CO2 emissions reveals the prevalence of PHH, whereas a square of FDI inflows reveals the negative impact on CO2 emissions. However, the impact of FDI and its square ranges from 0.682 to 0.717 and −0.017 to −0.0285, respectively. Therefore, it is evident that the relationship between FDI and CO2 emissions in selected South Asian countries is inverted U-shaped.

The results reveal that selected South Asian countries are at compromising stage in view of economic growth to be sustainable, that is, FDI is a source of environmental degradation. If these countries do not target clean FDI then they will be prone to the negative implications of climate change. Kasman and Duman (2015) suggest to focus on environmental quality and sustainable economic growth to avoid climate change consequences. As a natural candidate, these countries require more energy for industry oriented growth but the lack of focus on renewable energy sources should not be an option. Therefore, FDI can be used as a source to enhance productivity, as advocated by Lee (2013). But at the same time, technological advancement for energy production, and to decrease the share of fossil fuels is a much needed area to attract FDI.

Conclusion

Countries around the globe are more interested to achieve sustainable development by attracting environmental friendly FDI and improving technological capabilities. However, it does not seem true in case of developing countries, especially the South Asian countries, where the CO2 emissions are at record level. Therefore, this study offers an investigation about the unique determinants of CO2 emissions for the South Asian countries. Following a rigorous estimation process, this study provides evidence about the non-existance of EKC or the inverted U-shaped relationship between per capita GDP and CO2 emissions. The PHH is not rejected but there exists a U-shaped relationship between FDI and CO2 emissions. It points out that CO2 emissions will decrease with the increase in FDI inflows after a threshold point is achieved in these countries. It is true that energy consumption cannot be avoided for development but environmental friendly energy policy can be beneficial for long-run sustainability. Therefore, strong regulatory regime with more focus on renewables should be a matter of understanding.

From a policy point of view, this study has important implications. First, it is important to look into the prevailing fuel mix in all the selected countries that are dominated by fossil fuels with a strong correlation with CO2 emissions. Accordingly, the results uncover that energy use positively contributes to carbon emissions in the long run. Therefore, the policymakers of these countries, being signatories of the Paris Agreement, should change their respective energy policies to shift their focus on renewable energy resources so that long-run sustainability can be achieved. All these countries are rich in hydel, wind, and solar resources, which can be harvested through micro and macro policy perspective. It will not only ensure climate change mitigation through less CO2 emissions, but it will also indirectly deal with the energy inequalities. Second, there is a need to focus on a balance between environmental degradation and economic growth. The unfortunate reality is that the South Asian countries that share common features of mounting environmental degradation, and lax regulatory environment, rely on FDI inflows for economic growth and high population growth. Therefore, policymakers should pursue clean FDI with vigorous environmental management so that sustainable development can be ensured. It can be made realistic by incentivizing clean FDI, whereas financial institutions’ role can also be important for providing financial support to the high-tech industry.

Third, FDI in power development infrastructure has primarily been focused on producing electricity through fossil fuels that damage the environment and lead to high costs for the consumers. So, it results in two-edge sword; damaging effect for the environment and loss of competitiveness due to the high cost of electricity. Therefore, the governments of the sample countries should emphasize attracting FDI for clean energy production. Fourth, energy security and off-grid renewable-based solutions for high energy demanding areas such as industrial clusters or Special Economic Zones, transport and energy poor localities can be an important policy initiative to deal with the environmental degradation. Fifth, benchmarking of environmental standards for manufacuring plants and equipments is necessary to promote green technologies and reducing CO2 emissions. Lastly, a rigorous awareness campaign is necessary to educate people about the environmental consequences of their social, economic, and environmental practices and prevailing policies.

Data availability

Data is available from the authors on request.

References

Acemoglu D, Aghion P, Bursztyn L, Hemous D (2012) The environment and directed technical change. Am Econ Rev 102(1):131–166

Acharyya J (2009) FDI, growth and the environment: evidence from India on CO2 emission during the last two decades. J Econ Dev 34(1):43–58

Agarwal RN (2012) Economic globalization, growth and the environment-testing of environmental Kuznets curve hypothesis for Malaysia. J Bus Finance Affair 1(2):1–104

Alfaro L (2003) Foreign direct investment and growth: does the sector matter. Harv Bus School 2003:1–31

Aliyu MA (2005) Foreign direct investment and the environment: pollution haven hypothesis revisited. Retrived: gtap.agecon.purdue.edu. Accessed 7 Jul 2020

Al-Mulali U, Tang CF (2013) Investigating the validity of pollution haven hypothesis in the gulf cooperation council (GCC) countries. Energy Policy 60:813–819

Ang JB (2008) Economic development, pollutant emissions and energy consumption in Malaysia. J Policy Model 30(2):271–278

Anwar S, Nguyen LP (2010) Foreign direct investment and economic growth in Vietnam. Asia Pac Bus Rev 16(1-2):183–202

Apergis N, Payne JE (2009) CO2 emissions, energy usage, and output in Central America. Energy Policy 37(8):3282–3286

Badri AK, Parvizkhanlu KJ (2014) Foreign direct investment and environmental consequences of economic growth. Int J Mod Manag Foresight 1(1):1–12

Beak J, Koo WW (2009) A dynamic approach to FDI-environment nexus: The case of China and India. Journal of International Economic Studies 13: 1598-2769

Baltagi BH (2005) Econometric analysis of data panel. Wiley, Chichester

Batten JA, Vo XV (2009) An analysis of the relationship between foreign direct investment and economic growth. Appl Econ 41(13):1621–1641

Behera SR, Dash DP (2017) The effect of urbanization, energy consumption, and foreign direct investment on the carbon dioxide emission in the SSEA (South and Southeast Asian) region. Renew Sust Energ Rev 70:96–106

Bhattacharya M, Paramati SR, Ozturk I, Bhattacharya S (2016) The effect of renewable energy consumption on economic growth: evidence from top 38 countries. Appl Energy 162:733–741

Bosworth BP, Collins SM, Reinhart CM (1999) Capital flows to developing economies: implications for saving and investment. Brook Pap Econ Act 1999(1):143–180

Bustos P (2007) Multilateral trade liberalization, exports and technology upgrading: evidence on the impact of MERCOSUR on Argentinean firms. mimeo Universitat Pompeu Fabra

Callan T, Lyons S, Scott S, Tol RS, Verde S (2009) The distributional implications of a carbon tax in Ireland. Energy Policy 37(2):407–412

Choe JI (2003) Do foreign direct investment and gross domestic investment promote economic growth? Rev Dev Econ 7(1):44-57

Conrad K (2005) Locational competition under environmental regulation when input prices and productivity differ. Ann Reg Sci 39(2):273–295

Coondoo D, Dinda S (2002) Causality between income and emission: a country group-specific econometric analysis. Ecol Econ 40(3):351–367

Dietzenbacher E, Mukhopadhyay K (2007) An empirical examination of the pollution haven hypothesis for India: towards a green Leontief paradox? Environ Resour Econ 36(4):427–449

Dogan E, Inglesi-Lotz R (2020) The impact of economic structure to the environmental Kuznets curve (EKC) hypothesis: evidence from European countries. Environ Sci Pollut Res 2020(27):12717–12724

Dogan E, Seker F, Bulbul S (2017) Investigating the impacts of energy consumption, real GDP, tourism and trade on CO2 emissions by accounting for cross-sectional dependence: a panel study of OECD countries. Curr Issue Tour 20(16):1701–1719

Ekanayake EM, Vogel R, Veeramacheneni B (2003) Openness and economic growth: empirical evidence on the relationship between output, inward FDI, and trade. J Bus Strateg 20(1):59

Elliott G, Jansson M (2003) Testing for unit roots with stationary covariates. J Econ 115(1):75–89

Engle RF, Granger CW (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica:251–276

Eskeland GS, Harrison AE (2003) Moving to greener pastures? Multinationals and the pollution haven hypothesis. J Dev Econ 70(1):1–23

Friedl B, Getzner M (2003) Determinants of CO2 emissions in a small open economy. Ecol Econ 45(1):133–148

Friedman M (1937) The use of ranks to avoid the assumption of normality implicit in the analysis of variance. J Am Stat Assoc 32(200):675–701

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free trade agreement (No. w3914). National Bureau of economic research

Grossman GM, Krueger AB (1995) Economic growth and the environment. Q J Econ 110(2):353–377

Halicioglu F (2009) An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 37(3):1156–1164

Hamit-Haggar M (2012) Greenhouse gas emissions, energy consumption and economic growth: a panel cointegration analysis from Canadian industrial sector perspective. Energy Econ 34(1):358–364

Hansen BE (1995) Rethinking the univariate approach to unit root testing: using covariates to increase power. Econ Theory 11:1148–1171

Hermes N, Lensink R (2003) Foreign direct investment, financial development and economic growth. J Dev Stud 40(1):142–163

Holtz-Eakin D, Selden TM (1995) Stoking the fires? CO2 emissions and economic growth. J Public Econ 57:85–101

IEA 2017 CO2 Emission from fuels combustions: highlights. IEA statistics, International energy agency, OECD, Paris

Jaffe AB, Newell RG, Stavins RN (2002) Environmental policy and technological change. Environ Resour Econ 22(1-2):41–70

Jaunky VC (2011) The CO2 emissions-income nexus: evidence from rich countries. Energy Policy 39(3):1228–1240

Javid M, Sharif F (2016) Environmental Kuznets curve and financial development in Pakistan. Renew Sust Energ Rev 54:406–414

Kao C (1999) Spurious regression and residual-based tests for co-integration in panel data. J Econ 90(1):1–44

Kasman A, Duman YS (2015) CO2 emissions, economic growth, energy consumption, trade and urbanization in new EU member and candidate countries: a panel data analysis. Econ Model 44:97–103

Khan MA, Khan MZ, Zaman K, Arif M (2014) Global estimates of energy-growth nexus: application of seemingly unrelated regressions. Renew Sust Energ Rev 29:63–71

Kheder SB, Zugravu N (2008) The pollution haven hypothesis: a geographic economy model in a comparative study. CES working papers, p 83

Kivyiro P, Arminen H (2014) Carbon dioxide emissions, energy consumption, economic growth, and foreign direct investment: causality analysis for Sub-Saharan Africa. Energy 74:595–606

Lau L-S, Choong C-K, Eng Y-K (2014) Investigation of the environmental Kuznets curve for carbon emissions in Malaysia: do foreign direct investment and trade matter? Energy Policy 68:490–497

Lee JW (2013) The contribution of foreign direct investment to clean energy use, carbon emissions and economic growth. Energy Policy 55:483–489

Levinson A, Taylor MS (2008) Unmasking the pollution haven effect. Int Econ Rev 49(1):223–254

Li X, Liu X (2005) Foreign direct investment and economic growth: an increasingly endogenous relationship. World Dev 33(3):393–407

Linh DH, Lin SM (2014) CO2 emissions, energy consumption, economic growth and FDI in Vietnam. Manag Glob Transit Int Res J 12(3)

Liu Y, Zhou Y, Wu W (2015) Assessing the impact of population, income and technology on energy consumption and industrial pollutant emissions in China. Appl Energy 155:904–917

Lu S, Jiang H, Liu Y, Huang S (2017) Regional disparities and influencing factors of average CO2 emissions from transportation industry in Yangtze River economic belt. Transp Res Part D: Transp Environ 57:112–123

Maddala GS, Wu S (1999) A comparative study of unit root tests with panel data and a new simple test. Oxf Bull Econ Stat 61(S1):631–652

Munasinghe M (2010) Addressing the sustainable development and climate change challenges together: applying the sustainomics framework. Procedia Soc Behav Sci 2(5):6634–6640

Nasir M, Rehman FU (2011) Environmental Kuznets curve for carbon emissions in Pakistan: an empirical investigation. Energy Policy 39(3):1857–1864

Nasir MA, Duc Huynh TL, Xuan Tram HT (2019) Role of financial development, economic growth & foreign direct investment in driving climate change: a case of emerging ASEAN. J Environ Manag 242:131–141

Ndikumana L, Verick S (2008) The linkages between FDI and domestic investment: unravelling the developmental impact of foreign investment in Sub-Saharan Africa. Dev Policy Rev 26(6):713–726

Nguyen KQ (2007) Impacts of wind power generation and CO2 emission constraints on the future choice of fuels and technologies in the power sector of Vietnam. Energy Policy 35(4):2305–2312

Omri A, Nguyen DK, Rault C (2014) Causal interactions between CO2 emissions, FDI, and economic growth: evidence from dynamic simultaneous-equation models. Econ Model 42:382–389

Ozcan B (2013) The nexus between carbon emissions, energy consumption and economic growth in Middle East countries: a panel data analysis. Energy Policy 62:1138-1147

Pao HT, Tsai CM (2010) CO2 emissions, energy consumption and economic growth in BRIC countries. Energy Policy 38(12):7850–7860

Pedroni P (1997) Cross sectional dependence in cointegration tests of purchasing power parity in panels. WP Department of Economics, Indiana University

Pedroni P (1999) Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf Bull Econ Stat 61(S1):653–670

Pedroni P (2000) Fully modified OLS for heterogeneous cointegrated panels. Adv Econ 15:93–130

Pedroni P (2001) Purchasing power parity tests in cointegrated panels. Rev Econ Stat 83(4):727-731

Pedroni P (2004) Panel cointegration: asymptotic and finite sample properties of pooled time series test with an application to the PPP hypothesis. Econ Theory:597–625

Pesaran MH (2004) General Diagnostic Tests for Cross Section Dependence in Panels. Faculty of Economics, University of Cambridge, Cambridge

Phillips PC, Hansen BE (1990) Statistical inference in instrumental variables regression with I (1) processes. Rev Econ Stud 57(1):99–125

Reibstein R (2008) Making development more sustainable: sustainomics framework and practical applications, Mohan Munasinghe, Munasinghe Institute for Development, Colombo, Sri Lanka, 2007, 650 pp. Ecol Econ 67(3):515–516

Richmond AK, Kaufmann RK (2006) Is there a turning point in the relationship between income and energy use and/or carbon emissions? Ecol Econ 56(2):176–189

Roca R, Brogniez H, Picon L, Desbois M (2001) High resolution observations of free tropospheric humidity from METEOSAT over the Indian Ocean. In: MEGHATROPIQUES 2nd Scientific Workshop, vol 26

Saboori B, Sulaiman J, Mohd S (2012) Economic growth and CO2 emissions in Malaysia: a cointegration analysis of the environmental Kuznets curve. Energy policy 51:184-191

Salahuddin M, Gow J, Ali MI, Hossain MR, Al-Azami KS, Akbar D, Gedikli A (2019) Urbanization-globalization-CO2 emissions nexus revisited: empirical evidence from South Africa. Heliyon 5(6):e01974

Selden TM, Song D (1994) Environmental quality and development: is there a Kuznets curve for air pollution emissions? J Environ Econ Manag 27(2):147–162

Shahbaz M, Hye QMA, Tiwari AK, Leitão NC (2013) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sustain Energy Rev 25:109–121

Shahbaz M, Nasreen S, Abbas F, Anis O (2015) Does foreign direct investment impede environmental quality in high-, middle-, and low-income countries? Energy Econ 51:275–287

Shao Q, Wang X, Zhou Q, Balogh L (2019) Pollution haven hypothesis revisited: a comparison of the BRICS and MINT countries based on VECM approach. J Clean Prod 227:724–738

Smarzynska BK, Wei SJ. (2001). Pollution havens and foreign direct investment: dirty secret or popular myth? NBER Working Paper 8465

Soytas U, Sari R (2009) Energy consumption, economic growth, and carbon emissions: challenges faced by an EU candidate member. Ecol Econ 68(6):1667–1675

Sun C, Zhang F, Xu M (2017) Investigation of pollution haven hypothesis for China: an ARDL approach with breakpoint unit root tests. J Clean Prod 161:153–164

Tamazian A, Rao BB (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ 32(1):137–145

Tang JP (2015) Pollution havens and the trade in toxic chemicals: evidence from US trade flows. Ecol Econ 112:150–160

Te-Velde DW, Bezemer D (2006) Regional integration and foreign direct investment in developing countries. Transl Corp 15(2):41–70

Tsai PL (1994) Determinants of foreign direct investment and its impact on economic growth. J Econ Dev 19(1):137–163

Tsang EW, Yip PS (2007) Economic distance and the survival of foreign direct investments. Acad Manag J 50(5):1156–1168

Ulucak R, Khan SUD (2020) Determinants of the ecological footprint: role of renewable energy, natural resources, and urbanization. Sustain Cities Soc 54:101996

Walter, Ugelow J (1979) Environmental policies in developing countries. Ambio 8:102–109

WCED SWS (1987) World commission on environment and development. Our common future 17:1-91

Wei Y, Liu X (2001) Foreign direct investment in China: determinants and impact. Edward Elgar Publishing

Westerlund J (2007) Testing for error correction in panel data. Oxf Bull Econ Stat 69(6):709–748

Whalley J, Xian X (2010) China's FDI and non-FDI economies and the sustainability of future high Chinese growth. China Econ Rev 21(1):123–135

World Bank (2019) World development indicators Database [WWW Document]. http://data.worldbank.org/news/new-country-classifications. Accessed 11.8.19

Wu XF, Chen GQ (2017) Energy use by Chinese economy: a systems cross-scale input-output analysis. Energy Policy 108:81–90

Xing Y, Kolstad CD (2002) Do lax environmental regulations attract foreign investment? Environ Resour Econ 21(1):1–22

Yao S, Wei K (2007) Economic growth in the presence of FDI: the perspective of newly industrialising economies. J Comp Econ 35(1):211–234

Zakarya GY, Mostefa B, Abbes SM, Seghir GM (2015) Factors affecting CO2 emissions in the BRICS countries: a panel data analysis. Procedia Econ Finance 26:114–125

Zhang YJ (2011) The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy 39(4):2197–2203

Zhang YG (2015) China's regional trade patterns under the perspective of carbon emissions: pollution haven and factor endowment. China Ind Econ:5–19

Zhang C, Zhou X (2016) Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renew Sustain Energy Rev 58:943–951

Author information

Authors and Affiliations

Contributions

Conceptualization, Shahzad Alvi and Tanzila Akmal; methodology and software, Tanzila Akmal and Shahzad Alvi; validation, Shahzad Alvi and Shahzada M. Neam Nawaz; formal analysis, Shahzad Alvi and Tanzila Akmal and Shahzada M. Naeem Nawaz writing—original draft preparation, Shahzad Alvi, Shahzada M. Naeem Nawaz and Tanzila Akmal.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

All ethical standard has been followed in this research paper. No formal approval is required. The research is not on human and animal subjects.

Consent for publication

We are willing to publish the research paper in the Environmental Science and Pollution Research.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Nawaz, S.M.N., Alvi, S. & Akmal, T. The impasse of energy consumption coupling with pollution haven hypothesis and environmental Kuznets curve: a case study of South Asian economies. Environ Sci Pollut Res 28, 48799–48807 (2021). https://doi.org/10.1007/s11356-021-14164-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-14164-2