Abstract

It is agreeable that the rapid progress of civilization throughout the years came at a great price for severe environmental damages. Currently, human civilization is facing the consequences of the environmental damages that have been made for centuries. As a result, taking measures that will take civilization forward yet not make any environmental damages has become a devoir. Taking these measures requires a profound knowledge of the effect of financial development and trade openness on carbon emissions. This paper inspects the association between economic development, financial development, trade openness, and energy usage on carbon emissions for an emerging nation, like Bangladesh. The paper is based on a total of 36 years of data (1980–2016). To ascertain the existence of both long-run and short-run relationships, the autoregressive distributed lag bounds testing method is applied. The outcomes expose that energy usage has a substantial influence on carbon emissions both in the short run and a long run. The influence of economic development is momentous in the long run; however, in the short run, it has no effect. The factors for trade openness and financial development are negative and immaterial equally in the short run and long run. The present study proposes that Bangladesh’s government should carry out the strategy to advance substitute energy bases that ought not to release a large amount of carbon emissions.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In the recent decade, to progress financially by protecting the environment has been burgeoning and is one of the leading concerns for the entire universe. The measures that are only beneficial for the economy but not for the environment are raising high controversies. Thus, in the world of research and development, the effect of economic development on the environment has become an imperative subject. While economic development is a result of multiple factors, among these factors, financial development (hereafter FD) and trade openness (hereafter TO) are prominent factors. The TO elucidates that different economies have opposed in accomplishing FD, economic growth, and TO-restrictive of equal witnessing an increase in carbon emissions (Ohlan 2015; Fernández-Amador et al. 2016; Hasanov et al. 2018). Numerous studies in the recent decade have examined the association among FD, economic development, TO, energy usage, and carbon emissions because the linkage between these variables has not been well explored in detail later (Shahbaz et al. 2011; Dogan and Turkekul 2016; Maji et al. 2017; Shoaib et al. 2020; Shujah-Ur-Rahman et al. 2019; Ahmad et al. 2020) Hence, this study emphasizes the bi-directional causation among these entirely variable groups.

Financial organizations are the most reliable source of investment for smoothly carrying out the government. As FD provides opportunities for capital and investment, it has become an indispensable part of an economy. That is additionally engaged in a fundamental character for improving the creation of merchandises and service industries. This guarantees that financial properties are distributed proficiently in progressing economic development. Moreover, FD enhances the consumption of energy that accelerates economic growth (Siddique and Majeed 2015). Thus, it can be demonstrated that FD is promoting production level and economic growth but together, it increases carbon emissions and influences the climate in harmful ways (Shahbaz et al. 2013a, b, c; Siddique et al. 2016, b).

Consequently, a series of prior studies have been conducted by research scholars about the influence of FD on carbon emissions with various methodologies, indexes, and samples. Conversely, some scholars advocate that FD could increase economic development and also in turn decrease environmental contamination. Romer and Frankel (1999) pointed out that the improved economic marketplace can boost the influx of FDI (foreign direct investment) and also augment the extent of economic development of the taking countries; FD acts as a channel for contemporary eco-friendly technology (Birdsall and Wheeler 1993). Furthermore, the established financial segment diminishes borrowing charge, increases usury in the energy-effective segment, and lowers energy discharges (Tamazian et al. 2009a, b; Shahbaz 2009; Shahbaz et al. 2010; Sadorsky 2010; Tamazian and Rao 2010). Predominantly, the state and local managements can receive the benefit of diminished borrowing cost to support environment-friendly schemes. Therefore, it can be said that the relevant research has not yet arrived at a reliable conclusion. Ascertaining environmental effects of TO has a fundamental task in assembling and development schemes of emerging nations that are presently endorsing a substantial rise in TO; nevertheless, very few works are attained to examine the environmental effects of TO.

Bangladesh has witnessed tremendous economic growth along with rapid development both in the finance sector and in the labor sector over the last two decades (Hossain and Chen 2020). Besides, economic development has also been associated with the growing spending of fuel and, in this way, rising carbon emissions (Hossain et al. 2020a). A dynamic function is performed by TO in developing the nation’s economy. Although this development has carried numerous socio-economic advantages, its effect on environmental degeneration has been the core point of increasing dispute during the ongoing ages (Hossain et al. 2020b). For example, the yearly progress rate of carbon emissions has risen by 36% from the year 2000 to 2010 in Bangladesh (WDI 2010). While the influence of FD has raised global concern in Bangladesh, it has not drawn considerable interest for Bangladesh. As the quickest emergent nation in the Asian state, Bangladesh could be a pretty and engaging case study since this not only wants to build up the growing augmenting aspects to sustain consistent development but also bring the environmental contamination under the regulator. Hence, it is imperative to examine the way of connecting relationships between these variables for strategy purposes also. Bearing in mind this divergence, the current study attempts to survey the association between FD, TO, energy consumption, and economic development on carbon emissions from Bangladesh’s point of view.

The purpose of the present paper is to examine the bidirectional linkage among FD, TO, energy consumption, and economic development on carbon emissions. To attain this objective, this paper scrutinizes the relationship among FD, TO, energy consumption, and economic development on carbon emissions using the autoregressive distributed lag (ARDL) model. By using the ARDL model, this paper estimates this causality from a country-specific dataset of Bangladesh from the period of 1980 to 2016. The ARDL method is suitable to fulfill our desired objectives.

Our present study generates some novel achievements in the current literature and policy-making. First, the present study contributes new empirical evidence by using the ARDL model, as a new econometric approach, to investigate the causal association among FD, TO, economic development, and energy usage on carbon emissions. Second, as per our information, this research is a new endeavor that explores the associations among FD, TO, economic development, and energy consumption on carbon emissions in the Bangladesh framework. Third, this research extends the literature on energy economics through a better understanding of several determinants for the consumption of carbon emissions and their effect on environments as well as provides initiative to take actions and strategies regarding sustainable development.

The rest of the parts of the paper are constructed as follows: Section 2 reviews the relevant literature. Section 3 designates the methodology of this study. Results and discussion parts are explained in Section 4. Conclusion together with policy suggestions are illustrated in Section 5.

Literature review

Drawing from numerous literature reviews for antecedent variables of carbon emissions, we have partitioned our main research contents into three phases. The first phase demonstrates the relation between FD and its effect on carbon emissions; the second phase manifests the relation between trade openness and carbon emissions; the latest phase is expiated the mixed influence of FD and TO on carbon emissions by using the autoregressive distributed lag model in Bangladesh.

The relation between FD and its effect on carbon emissions

The inescapable association between FD and economic development was first studied by Schumpeter (1911). According to him, the financial system has a vital influence on assembling savings and designating them effective activities. This same belief is shared by King and Levine (1993), McKinnon (1973), and Goldsmith (1969) as well. Their studies alluded that a thorough financial system stimulates economic development, as the financial structure can reallocate surplus funds from the excess expenditure part to the shortage expenditure part of a financial system. The excess resources can be gathered from domestic and government funds. Moreover, there are uncertainties regarding cash while transactions are decreased if the financial system is smooth. Thus, the financial structure supports in decreasing business costs, information costs, as well as monitoring costs of organizations and increases efficiency (Shahbaz 2013).

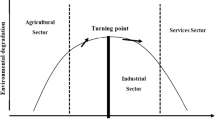

There are other theories in favor of a sound financial system. According to Claessens and Feijen (2006), FD and good governance enhance the superiority of the environment. This theory was also examined by Tamazian et al. (2009a, b). Their data were collected from Brazil, Russia, India, and China during the time from 1992 to 2004. According to them, trade receptivity and FD decrease carbon emissions. Tamazian and Rao (2010) used the generalized method of moments (GMM) method to find the influence of FD, economic and institutional, on carbon emissions for the temporary markets. They revealed that these elements support the decrease in carbon emissions. They too elucidated approval in favor of the environmental Kuznets curve (EKC). Applying panel data exploration, a set of experiments demonstrates that FD reduces carbon emissions.

The association between carbon emissions and FD was re-examined by Zhang (2011) based on the China market and analyzed the conclusions by applying the vector error correction technique (VECM) as well as the variance decomposition method. However, this analysis concluded contradictory results to the abovementioned studies. The observation elicits that financial growth unquestionably causes an increase in environmental catastrophes. A similar study was conducted by Siddique et al. (2016a, b). They reviewed the effect of fuel usage and FD on carbon emissions in South Asia from the year 1983 to 2013. Their outcomes indicated that FD and energy usage are contaminating the atmosphere by raising carbon emissions. According to the observations, there are two-way contingencies between carbon emissions and energy usage in the long period as well as the short period. Several contingencies were discovered between carbon emissions and FD in the long period whereas there are no contingencies at all in the short period. There are many reviews regarding the link between FD and carbon emissions and many controversies about these reviews. For instance, Onanuga (2017) scrutinized the relationship between FD and carbon emissions for Sub-Saharan Africa. According to him, the carbon emissions is decreased by FD in high-medium-income nations and increased in low-medium-income and low-income nations. Further, according to Tsaurai (2019), FD increases carbon emissions which depend on West African countries.

The relation between trade openness and carbon emissions

In the late 1970s, trade analysis started including environmental conditions (Jayadevappa Ravishankar and Chhatre Sumedha 2000). As stated before, academics emphasize the relations between environmental quality and trade from three standpoints: intra-realm, inter-realm, and worldwide environmental crises. However, there have been contradictions among researchers about concluding trade openness effects on the environment. The studies of World Bank (Lucas et al. 1992; Birdsall and Wheeler, 1993) about environment and trade have discovered lesser emissions intensity for nations that follow open business strategies. Conversely, most of the researchers do not agree with World Bank’s research. According to Rock (1996), open trade policies are more catastrophic toward the environment rather than inward trade policies. Thus, it can be said that there are environmental externalities. Managi et al. (2009) applied the instrumental variables method to appraise the total influence of TO on ecological superiority. The outcomes exhibited that TO raises pollution in non-progressive countries, with an inconsistent response in progressive countries: this upsurge was recognized to the scales and conformation influences of TO. Jayanthakumaran et al. (2012) scrutinized the association between income, TO, and carbon emissions approving that TO reduces GHG (greenhouse gas) emissions through enhancing income and stimulating a total rise in consumer spending on environment-friendly products.

Furthermore, using the simultaneous equation model, Omri (2013) studied the effect of carbon emissions on TO for 14 Middle Eastern and North American (MENA) countries from the year 1990 to 2011. The result revealed that the influence of TO on emissions in these countries was inversed and statistically insignificant. Al-mulali and Sheau-Ting (2014) measured imports and exports distinctly through scrutinizing numerous bi-variate relations. They utilized the Panel fully modified ordinary least squares model (PFMOLS) to investigate bi-directional long-period relations among energy consumption, exports, imports, and TO on carbon emissions for 189 nations from the year 1990 to 2011. Their inquiry determined that there is a long-period progressive connection among the TO and energy usage on carbon emissions. Sohag et al. (2017) studied the effects of energy usage, population, real income, and TO on carbon emissions applying information from 82 emerging countries from the year 1980 to 2012 through several mean group (MG) methods. The outcomes revealed that a percentage rise in TO decreases carbon emissions by 0.3%. In the meantime, the outcomes were indecisive for entire sample nations, middle income and low income.

The mixed influence of FD and TO on carbon emissions

In Indonesia, Shahbaz et al. (2013a, b, c) studied the association among FD, TO, energy consumption, economic development, and carbon emissions. The outcome indicated that energy consumption and economic development increase carbon emissions. There is a bidirectional causation between economic development and carbon emissions, energy usage and carbon emissions, and unidirectional causation from FD to carbon emissions. Omri et al. (2015) considered the long-period association among energy consumption, FD, urbanization, TO, economic development, and carbon emissions for 12 MENA nations applying data between 1990 and 2011. By using the GMM method, they establish statistically inconsequential TO coefficients for 9 out of 12 nations.

In sum, Bangladesh has gotten little devotion from academics investigating related factors applying the ARDL method. Our study improves nuanced insights into the existing works by integrating FD and TO together with additional factors in the ARDL method to discover its influence on carbon emissions, particularly from Bangladesh’s point of view. Alom et al. (2017) for Bangladesh showed that FD reduces carbon emissions. To the best of our understanding, no previous papers have conducted the relationship among FD, TO, and the carbon emissions in the setting of Bangladesh. To shed light on this research gap, we empirically investigate the effects of carbon emissions on FD, TO, economic development, and energy usage for Bangladesh over the period 1980–2016.

Data and methodology

In the literature review described above, this study uses per-capita energy usage, FD index, per-capita gross domestic product (in constant 2010 US dollars), TO, and per-capita carbon emissions. We measure the per-capita energy usage by kilograms of oil equivalent; FD index is the proxy for FD, GDP per capita (in constant 2010 US dollars) is the proxy for the economic development, and trade as a percentage of GDP is the proxy for TO.

The data set per-capita energy usage, GDP (in constant 2010 US dollars), trade as a percentage of GDP, and per-capita carbon emissions was collected from the World Development Indicators (WDI). Financial development index was collected from the International Monetary Fund (IMF). We utilize yearly time-series statistics from the year 1980 to 2016 for Bangladesh. Log-linear measurement yields a superior outcome in comparison to the linear operational method. Consequently, the entire figures are converted to natural logarithmic.

We have employed carbon emissions as a dependent variable and FD, TO, economic development, and energy usage as independent variables.

The operational look of the model with natural logarithm is as follows:

where CO2 is carbon emissions, FD stands for financial development, EU signifies energy usage, GDP indicates economic development, and TO represents trade openness. Also, t is for the time between the year 1980 and 2016, a0 is intercept, a1 is the elasticity of FD, a2 is the elasticity of TO, a3 is the elasticity of energy usage, a4 is the economic development elasticity, a5 is the square of economic development elasticity of carbon emissions, and 𝜇 is the error term.

To examine the long-term and short-term association among FD, TO, economic development, and energy usage on carbon emissions, we have used several analyses and procedures. Since it is a time-series method and the figures are yearly, so earliest we have used the unit root examination to inspect the stationarity of the variables. We have exercised the Augmented Dickey–Fuller (ADF) and the Phillips–Perron (PP) assessment to test the stationarity of the variables, and the measurement for the ADF test is as follows:

The ADF assessment comprises lagged difference as a crucial component to pledge autocorrelation. The ideal amount of lags is utilized using Schwartz selection benchmarks. Once the variables are stationary at the level at that time ordinary least squares (OLS) is used, and if the variables are stationary at the first difference, we have exercised the Johansen co-integration method. If selected variables are stationary at the level and residual at the first difference, the ARDL bounds testing co-integration assessment is appropriate and relevant. For this situation, several variables are stationary at the first difference and the rest are at level; therefore, we have utilized the ARDL co-integration method. We have also applied the Lagrange multiplier (LM) assessment of the remaining heteroscedasticity test, serial correlation, and Ramsey reset assessment to examine the operational arrangement of our method. Cumulative sum (CUSUM) and cumulative sum of squares (CUSUMSQ) examinations will be utilized to scrutinize the constancy of long-period and short-period parameters. We will also draw the scatterplot matrix of variables.

Results and discussion

The descriptive indicators are presented in Table 1.

The unit root assessments

We used the ARDL bound assessment method to scrutinize the long period association among FD, TO, economic development, energy usage, and carbon emissions of Bangladesh. The benefit of bounds assessment is that it is adaptable considering the order of integration of the sequences. This necessitates that the variables should be integrated at I(0) or I(1) or I(0)/I(1). The standard Augmented Dickey–Fuller (ADF) assessment (Dickey and Fuller 1981) as well as the Phillips–Perron (PP) assessment (Phillips and Perron 1988) have been accompanied to distinguish the presence of unit roots and to recognize the order for every variable. In Table 2, ADF and PP unit root assessment exhibits that all variables act to enclose a unit root in their levels but are stationary in their first differences. This proposes that all sequences are integrated of order one or I(1). So, we have employed the ARDL bounds assessment co-integration method.

Criteria lag length selection

Before using the ARDL bounds assessment, there is a necessity to select the suitable lag order of the variables to calculate the ARDL F-statistic and to investigate whether co-integration occurs between the variables or not. The calculation of the F test is so much difficult to the choice of lag length. To ascertain the optimum lag interval in the analysis, a Vector Auto-Regressive (VAR) method was primarily identified containing the endogenous variables of FD, TO, GDP, GDP2, EU, and CO2 with a randomly designated lag interval together with a determination test of the lag interval was used to the residuals. The particulars of this assessment are shown in Table 3. Both lag selection measures and lag segregation assessments indicators suggest that a lag of order three is optimum in this analysis since four distinctive measures specify this feature.

Bounds test

ARDL Bounds Test

Date: 10/26/20

Time: 14:02

Sample: 1981–2016

Included observations: 36

Null hypothesis: No long-run relationships exist

Test statistic | Value | k | ||

F-statistic | 5.217137 | 5 | ||

Critical value bounds | ||||

Significance | I0 bound | I1 bound | ||

10% | 2.08 | 3 | ||

5% | 2.39 | 3.38 | ||

2.5% | 2.7 | 3.73 | ||

1% | 3.06 | 4.15 | ||

The outcomes of the ARDL bounds F test co-integration method are presented in Table 4. The second column of the table describes the lag order of the variables. The lag length of carbon emissions is 1, 0 for FD, TO, energy usage GDP, and GDP2. The value of F-stat is 5.217137 which is larger than the critical values at one percentage, five percentages, and ten percentages for both 0 and 1 bounds. The larger value of F-stat demonstrates the co-integration associations among FD, TO, energy usage, economic development, and carbon emissions in Bangladesh.

Long- and short-period analysis

ARDL co-integrating and long-run form

Dependent variable: CO2

Selected model: ARDL(1, 0, 0, 0, 0, 0)

Date: 10/26/20

Time: 14:08

Sample: 1980–2016

Included observations: 36

Cointegrating form | ||||

Variable | Coefficient | SE | t-Statistic | P value |

D(GDP) | 4.320837 | 1.897988 | 2.276536 | 0.0304 |

D(GDP2) | −0.335838 | 0.146419 | −2.293667 | 0.0292 |

D(EU) | 1.527187 | 0.251153 | 6.080695 | 0.0000 |

D(FD) | −0.047053 | 0.029178 | −1.612641 | 0.1177 |

D(TO) | −0.136206 | 0.072152 | −1.887767 | 0.0691 |

CointEq(−1) | −0.571562 | 0.151619 | −3.769739 | 0.0007 |

Long-run coefficients | ||||

|---|---|---|---|---|

Variable | Coefficient | SE | t-Statistic | Probability |

GDP | 5.044900 | 1.163980 | 4.334180 | 0.0002 |

GDP2 | −0.401470 | 0.082440 | −4.869842 | 0.0000 |

EU | 2.429165 | 0.479067 | 5.070620 | 0.0000 |

FD | −0.026211 | 0.034043 | −0.769946 | 0.4476 |

TO | −0.229550 | 0.105815 | −2.169344 | 0.0384 |

C | −21.461608 | 3.444022 | −6.231554 | 0.0000 |

The long period and short period co-integration are come across after the validation of co-integration by bounds F-stat assessment. The outcomes are described in Table 5.

The long-period outcomes demonstrate that GDP and energy consumption are the growing elements of carbon emissions. The coefficient of FD and TO are negative that shows the immaterial influence on carbon emissions. The coefficient of energy usage is 2.42 that shows that a 1% growth in energy usage produces a 2.42% rise in carbon releases. The coefficient of GDP is 5.044 that reveals that a 1% rise in GDP produces a 5.044% increase in carbon emissions. The p value of LM assessment is larger than 0.1 which reveals no serial correlation, and the p value of heteroscedasticity assessment is larger than 0.1 that involves no issue of heteroscedasticity. The p value of Ramsey reset assessment is likewise larger than 0.1 that involves no problem in the operational procedure of the method. Our experimental outcomes are stable with the previous research (Shahbaz et al., 2013a, b, c; Siddique et al., 2016, b).

The short-period outcomes demonstrate that energy usage has a significant influence on carbon emissions, GDP has a positive impact and significant at 5% level, FD has a negative impact on carbon emissions but insignificant, and TO has also negative impact on carbon emissions but significant at ten percentage points.

Sensitivity test and stability assessment

The investigative assessments such as normality of residual terms, LM for serial correlation, the specification for the short-period method, and heteroscedasticity are described in Table 6. The outcomes propose that the short period method permits all investigative assessments. We discover no indication of white heteroscedasticity, autoregressive conditional heteroscedasticity, and serial correlation. The operational procedure of the model seems well identified as well as the residual terms are typically disseminated. Cumulative sum (CUSUM) and cumulative sum of squares (CUSUMSQ) assessments have been engaged to scrutinize the stability of long- and short-period parameters. Pesaran et al. (2000, 2001) recommend that the stability of long- and short-period estimation be confirmed by applying the CUSUM and CUSUMSQ assessments. Figures 1 and 2 specify the outlines for CUSUM and CUSUMSQ. These are between the critical bounds at the five percentage points, hence are steady. The scatterplot matrix of variables is shown in Fig. 3.

Conclusion and policy implications

This paper examined the effect of FD, TO, energy consumption, and economic development on carbon emissions in Bangladesh from the year 1980 to 2016. The ARDL bounds testing co-integration method has been applied for the study. The ARDL bound F-stat specifies that energy consumption and economic development have a long-run association with carbon emissions in Bangladesh. The impact of FD and TO is trivial on carbon emissions. The short-run outcomes demonstrate that energy consumption has a positive and significant influence on carbon emissions, GDP has a positive impact and significant at 5% level, FD has a negative impact on carbon emissions but insignificant, and TO has also a negative impact on carbon emissions but significant at 10% level. According to pragmatic attestation, energy consumption and economic development are the prime contributors to carbon emissions. On the other hand, the progress of the financial sector and trade liberalization helps to shrink toxic waste from energy consumption. Relying on these findings, this factual study will recommend a few guidelines.

The outcomes indicate that progress in financial condition can play an important part in recovering the environmental situation. The manifestation of the stated outcome is the guidelines of financial progress and its effect. A government policy should be started to encourage and scrutinize financial progress. This measure will increase the influx of FDI, relocation of innovative skill and manufacture, and altogether it will also help the country to make fewer carbon emissions. The policy should also focus on economic progress that helps in conserving natural resources. As a result, greater welfare will be achieved. Hence, an advanced level of financial development, with superior trade liberalization, will lead to technological progress, either by purchasing in low-carbon machinery from aboard or by rising expenditure on energy preservation R&D. This will increase energy efficiency and, therefore, reduces CO2 emissions.

Second, the government can put a label on coal consumption. High charges should be imposed if an organization consumes more than a certain amount of coal. This will hopefully decrease dependency on coal and inspire organizations to take eco-friendly measures. Besides, the government should make sure that eco-friendly measures are cheaper.

Third, the ready-made garments (RMG) manufacturing industry will be the most benefited from trade liberalization in Bangladesh. The country’s trade is heavily dominated by this business, as this industry is the source of 82% of aggregate export earnings of the nation. Generally, the role of the country in the supply chain of RMG involves CMT (Cut, Make, Trim) activities, as the country has one of the cheapest labors in the world. Bangladesh imports raw materials run CMT operation and then exports the final product. Since the CMT operations are extremely labor oriented, Bangladesh’s RMG segment comparatively hygienic. Hence, Bangladesh’s government endeavor for trade divergence should be focused on hygienic productions which would not release too much carbon emissions.

The current research can be amplified for the upcoming study by examining the association among economic growth, renewable fuel usage, non-renewable energy usage, and carbon emissions. Furthermore, an investigation can be done by relating other significant factors of carbon emissions such as trade balance and worldwide value chain.

References

Ahmad M, Jiang P, Majeed A, Raza MY (2020) Does financial development and foreign direct investment improve environmental quality? Evidence from belt and road countries. Environ Sci Pollut Res Int 27(19):23586–23601. https://doi.org/10.1007/s11356-020-08748-7

Al-mulali, Sheau-Ting (2014) Econometric analysis of trade, exports, imports, energy consumption and CO2 emission in six regions. Renew Sust Energ Rev 33:484–498. https://doi.org/10.1016/j.rser.2014.02.010

Alom K, Uddin ANM, Islam N (2017) Energy consumption, CO2 emissions, urbanization and financial development in Bangladesh: vector error correction model. J Glob Econ Manag Bus Res 9(4):178–189

Birdsall N, Wheeler D (1993) Trade policy and industrial pollution in Latin America: where are the pollution havens? J Environ Dev 2(1):137–149. https://doi.org/10.1177/107049659300200107

Claessens S, Feijen E (2006) Financial sector development and the millennium development goals. World Bank Working Paper No. 89. Washington, DC: World Bank. © World Bank. https://openknowledge.worldbank.org/handle/10986/7145 License: CC BY 3.0 IGO

Dickey D, Fuller W (1981) Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49(4):1057–1072. https://doi.org/10.2307/1912517

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23:1203–1213. https://doi.org/10.1007/s11356-015-5323-8

Fernández-Amador, Francois JF, Tomberger P (2016) Carbon dioxide emissions and international trade at the turn of the millennium. Ecol Econ 125:14–26. https://doi.org/10.1016/j.ecolecon.2016.01.005

Goldsmith RW (1969) Financial structure and development. Yale University Press, New Haven

Hasanov FJ, Liddle B, Mikayilov JI (2018) The impact of international trade on CO2 emissions in oil-exporting countries: territory vs consumption emissions accounting. Energy Econ, Elsevier 74(C):343–350. https://doi.org/10.1016/j.eneco.2018.06.004

Hossain MA, Chen S (2020) Decoupling of energy-related CO2 emissions from economic growth: a case study of Bangladesh. Environ Sci Pollut Res 27:20844–20860. https://doi.org/10.1007/s11356-020-08541-6

Hossain MA, Chen S, Khan AG (2020a) Decomposition study of energy-related CO2 emissions from Bangladesh’s transport sector development. Environ Sci Pollut Res 28:4676–4690. https://doi.org/10.1007/s11356-020-10846-5

Hossain MA, Engo J, Chen S (2020b) The main factors behind Cameroon’s CO2 emissions before, during and after the economic crisis of the 1980. Environ Dev Sustain 23:4500–4520. https://doi.org/10.1007/s10668-020-00785-z

Jayadevappa Ravishankar, Chhatre Sumedha (2000) International trade and environmental quality: a survey. Ecol Econ 32:175–194

Jayanthakumaran, Verma R, Liu Y (2012) CO2 emissions, energy consumption, trade and income: a comparative analysis of China and India. Energy Policy 42:450–460. https://doi.org/10.1016/j.enpol.2011.12.010

King RG, Levine R (1993) Finance, entrepreneurship, and growth: theory and evidence. J Monet Econ 32:513–542

Lucas EBR, Wheeler D, Hettige H (1992) Economic development, environmental regulation and international migration of toxic industries. In: Editior A (ed) International Trade and the Env. World Bank Discussion Papers, World Bank, Washington, DC, p 159

Maji IK, Habibullah MS, Saari MY (2017) Financial development and sectoral CO2 emissions in Malaysia. Environ Sci Pollut Res 24:7160–7176. https://doi.org/10.1007/s11356-016-8326-1

Managi S, Hibiki A, Tsurumi T (2009) Does trade openness improve environmental quality? J Environ Econ Manag, Elsevier 58(3):346–363 November

MCkinnon RI (1973). Money and capital in economic development. The Brookings institutions, Washington, D.C, vol. 2(3), pages 87-88, World Development, Elsevier, March.

Ohlan R (2015) The impact of population density, energy consumption, economic growth and trade openness on CO2 emissions in India. Nat Hazards 79:1409–1428. https://doi.org/10.1007/s11069-015-1898-0

Omri A (2013) CO2 emissions, energy consumption and economic growth nexus in MENA countries: evidence from simultaneous equations models. Energy Econ, Elsevier 40(C):657–664. https://doi.org/10.1016/j.eneco.2013.09.003

Omri SD, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Econ 48:242–252, ISSN 0140-9883. https://doi.org/10.1016/j.eneco.2015.01.008

Onanuga OT (2017) The impact of economic and financial development on carbon emissions: evidence from Sub-Saharan Africa, University of South Africa, Pretoria. http://hdl.handle.net/10500/23220

Pesaran MH, Shin Y, Smith RJ (2000) Structural analysis of vector error correction models with exogenous I(1) variables. J Econ 97:293–343

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16:289–326

Phillips PCB, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346. https://doi.org/10.1093/biomet/75.2.335

Rock MT (1996) Pollution intensity of GDP and trade policy: can the World Bank be wrong? World Dev, Elsevier 24(3):471–479 March

Romer DH, Frankel JA (1999) Does trade cause growth? Am Econ Rev, American Economic Association 89(3):379–399

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38(5):2528–2535

Schumpeter JA (1911) The theory of economic development. Harvard University Press, Cambridge, MA

Shahbaz M (2009) A reassessment of finance-growth nexus for Pakistan: Under the investigation of FMOLS and DOLS techniques. The IUP Journal of Applied Economics VIII(1):65–80

Shahbaz M (2013) Does financial instability increase environmental degradation? Fresh evidence from Pakistan. Ecol Model 33:537–544

Shahbaz M, Shamim A, Naveed A (2010) Macroeconomic environment and financial sector’s performance: econometric evidence from three traditional approaches. IUP J Financial Econ 1:103–123

Shahbaz, Faridul I, Butt MS (2011) Financial development, energy consumption and CO2 emissions: evidence from ARDL approach for Pakistan, MPRA Paper 30138. University Library of Munich, Germany revised 07 Apr 2011

Shahbaz QMAH, Tiwari AK, Leitão NC (2013a) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sust Energ Rev 25:109–121, ISSN 1364 0321. https://doi.org/10.1016/j.rser.2013.04.009

Shahbaz M, Solarin SA, Mahmood H, Arouri M (2013c) Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Econ Modell, Elsevier 35(C):145–152. https://doi.org/10.1016/j.econmod.2013.06.037

Shoaib HM, Rafique MZ, Nadeem AM, Huang S (2020) Impact of financial development on CO2 emissions: a comparative analysis of developing countries (D8) and developed countries (G8). Environ Sci Pollut Res Int 27(11):12461–12475. https://doi.org/10.1007/s11356-019-06680-z

Shujah-Ur-Rahman CS, Saud S, Saleem N, Bari MW (2019) Nexus between financial development, energy consumption, income level, and ecological footprint in CEE countries: do human capital and biocapacity matter? Environ Sci Pollut Res Int 26(31):31856–31872. https://doi.org/10.1007/s11356-019-06343-z

Siddique HMA, Majeed MT (2015) Energy consumption, economic growth, trade and financial development nexus in South Asia. Pak J Commer Soc Sci 9(2):658–682

Siddique HMA, Majeed MT, Ahmad HK (2016) The impact of urbanization and energy consumption on CO2 emissions in South Asia. Res J South Asian Stud 31(2):745–757

Sohag K, Al Mamun M, Uddin GS, Ahmed AM (2017) Sectoral output, energy use, and CO2 emission in middle-income countries. Environ Sci Pollut Res 24:9754–9764. https://doi.org/10.1007/s11356-017-8599-z

Tamazian A, Rao BB (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ 32(1):137–145

Tamazian A, Chousa JP, Vadlamannati KC (2009a) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy, Elsevier 37(1):246–253

Tamazian A, Piñeiro J, Vadlamannati KC (2009b) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37(1):246–253

Tsaurai K (2019) The impact of financial development on carbon emissions in Africa. Int J Energy Econ Policy 9(3):144–153

WDI (2010) “World development indicators”, Data Bank. The World Bank. Available at: http://databank.worldbank.org/data/reports.aspx?source=world-developmentindicators#advancedDownloadOptions

Zhang Y-J (2011) The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy 39:2197–2203

Acknowledgments

The authors would like to thank their family members and their lab-mates who continuously support and inspire them to do this research work. In addition, the authors would like to thank the National Natural Sciences Foundation of China for its financial support for this work.

Availability of data and materials

The datasets generated during and/or analyzed during the current study are available from the corresponding author on reasonable request.

Funding

This work was financially supported by the National Natural Sciences Foundation of China (NSFC-71672009.71972011)

Author information

Authors and Affiliations

Contributions

Conceptualization: A.G.K.; methodology: A.G.K.; formal analysis and investigation: A.G.K.; writing—original draft preparation: Md.A.H.; writing—review and editing: Md.A.H.; funding acquisition: S.C.; resources: S.C.; supervision: S.C. All authors read and approved the final manuscript.

Corresponding authors

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Khan, A.G., Hossain, M.A. & Chen, S. Do financial development, trade openness, economic development, and energy consumption affect carbon emissions for an emerging country?. Environ Sci Pollut Res 28, 42150–42160 (2021). https://doi.org/10.1007/s11356-021-13339-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-13339-1