Abstract

Water leakage in the urban water cycle involves relevant economic, social, and environmental negative impacts. Thus, reducing water leakage is a key challenge for both water regulators and water companies. This study estimated the evolution (2007–2015) of the marginal cost of improving the quality of service in terms of water leakage in the Chilean water industry, which involves full private, concessionary, and public water companies. In water companies, management skills and efforts play an important role in meeting water leakage targets. Thus, this study employed a cost frontier model where it was assumed that unobserved management ability interacts with output and water leakage factors. The results reveal high levels of cost efficiency for the average water company. Management increases outputs and reduces water leakage and, thus, has a positive impact on costs and efficiency. The marginal cost of reducing water leakage is higher for the public water company than for private and concessionary water companies. The average estimated marginal cost of reducing water leakage was 0.349 €/m3, which means that a water company has to spend an extra 0.349 € in operating costs to avoid a cubic meter of water leakage. Some policy implications were discussed based on the results of this study.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Access to drinking water and sanitation were recognized by the United Nations (UN) as human rights as they are basic services whose lack involves notable consequences for the realization of other human rights (UN 2010). Moreover, by 2030, achieving access to safe drinking water and sanitation for all is part of the targets established by the Sustainable Development Goals (UN 2015). In this context, water supply and sanitation systems consist of complex organized networks and facilities whose sustainability and efficiency are vital for the continuation of safe, acceptable, and affordable water and sanitation services for the end users (Romano et al. 2017). Given the importance of this topic, several studies have been conducted to better understand the features of water and sanitation infrastructure and evaluate its efficiency and sustainability from an engineering, environmental, and economic perspective (see for instance, Marques and Monteiro 2003; Makropoulos and Butler 2010; Xu et al. 2014; Li et al. 2015; Molinos-Senante et al. 2016a; Pérez et al. 2019; Salleh et al. 2019).

One of the main challenges that water companies need to deal with in their networks is how to reduce water leakage (D’Inverno et al. 2020). Leakages have a negative economic, environmental, and social impact and water regulators and water companies need to work together to tackle this issue (Hernández-Sancho et al. 2012). Reducing water leakage is on the top of water companies’ agenda (Ardakanian and Martin-Bordes 2008; Ofwat 2019). Moreover, according to the International Water Association, the reduction of water leakage is a necessary step in the transition towards the circular economy (IWA 2016). Cutting water leakage will lead to an improvement in service quality which is a significant attribute of water distribution for household and non-household customers (Lombardi et al. 2019). Under regulated regimes, incentive schemes that encourage water companies to improve their quality of service can lead to cost savings. For instance, in England and Wales, the water regulator rewards or penalizes companies when they outperform or do not meet their service quality targets. In contrast, in Chile, the water regulator defined as the maximum percentage leakage for an “efficient water company” to be at the level of 15% and this is the reference value to set water tariffs. However, the water regulator does not penalize companies if they exceed the 15% percentage threshold and so the companies may not have any incentives to improve their service quality to customers (Molinos-Senante et al. 2019).

Given the importance of reducing water leakage in the urban water cycle, the main aim of this study is to estimate the marginal cost of improving the quality of service in terms of water leakage using stochastic frontier analysis (SFA) techniques. An empirical application focused on the Chilean water companies over the period 2007–2015 as the level of water leakage has remained almost constant in this country (SISS 2020). Moreover, the Chilean water industry involves full private water companies (FPWCs), concessionary water companies (CWCs), and a public water company (PWC). Hence, this study sheds light about the potential effects of the ownership on the marginal cost of improving the quality of service of the water companies. Previous studies on this topic employed distance functions with linear programming techniques or econometric techniques to estimate a shadow price for water leakage (Molinos-Senante et al. 2016a, 2016b, 2019). However, their analysis did not take into account the interaction between unobserved management and quality of service which influences water companies’ costs and efficiency (Marques et al. 2014). Moreover, the above studies estimated a shadow price (implicit cost) of water leakage, while this study uses a cost function to calculate the marginal cost of improving water leakages in the network.

This study contributes to the literature in two main different directions. First, from a methodological point of view, we employ a cost frontier model that allowed us to calculate the marginal cost of reducing water leakage in Chile. Second, we explore the role of unobserved time-invariant (fixed) managerial ability in the water industry and more particularly in Chile using a slightly modified version of Alvarez et al.’s (2004) frontier model. We estimate a cost frontier instead of a production frontier model as we assume that water companies are cost minimizers. We also discuss how unobserved management and service quality impacts companies’ costs and inefficiency (Marques et al. 2014). The estimated marginal cost values for reducing water leakage are compared and discussed by ownership type. We finally discuss some policy implications that arise from the analysis of our results. Chile presents an interesting case study within the context of this research since has been by far the most successful case of water and wastewater services coverage in Latin America (IBNET 2021). Moreover, because most of the Latin American water utilities present moderate and larger levels of leakage (larger than Chilean ones) (IBNET 2021), water managers and authorities in other Latin American countries can learn relevant lessons from the Chilean case.

Methodology

This section discusses the methodology employed to take into account managerial inefficiency in the estimation of the marginal cost of improving quality of service in terms of water leakage. A cost frontier model is estimated instead of a production frontier as it was assumed that water companies are cost minimizers. This methodological approach was chosen for the following reasons. First, management is of great importance in the production process of water companies as it influences how inputs are used to produce a given level of output. In particular, in the water industry, efficient managerial decisions allow the water company to reduce its costs and meet quality targets like water leakage. Thus, in this paper, it is argued that unobserved managerial efforts and skills are part of the production process and, thus, interrelated with observed output and water leakage factors. Performing better than other water companies in the industry and sharing their best practices with less performing companies may lead to financial and reputational awards. Omitting, thus, management effect from the estimation may lead to biased inefficiency estimates (Alvarez et al. 2004; Marques and Barros 2010).

Moreover, the use of the frontier model allowed us to model unobserved heterogeneity as the water industry consists of heterogeneous water companies and managerial practices to reduce costs differ among companies. Greene (2004, 2005a, 2005b) developed panel data SF models where unobserved firm-specific heterogeneity is treated separately from inefficiency. If heterogeneity is correlated with explanatory factors, then it is considered as fixed and therefore the “true” fixed effect (TFE) model is estimated. If it is uncorrelated with explanatory factors, then it is treated as random and thus, the “true” random effects (TRE) model is estimated. The limitation of the above models is that these unobserved factors are separated from the production process (Cullmann et al. 2012). Alvarez et al.’s (2004) frontier model shows how unobserved managerial heterogeneity interacts with production process. For this reason, our study adopted Alvarez et al.’s (2004) model.

Furthermore, we chose a SFA approach instead of other techniques such as data envelopment analysis, index numbers, or partial frontier parametric techniques to analyze the efficiency of the Chilean water companies as it mainly allowed us the specification of a production technology and the decomposition of the error term into random noise and inefficiency (for more details, please see Molinos-Senante et al. 2019).

Managerial skills are of great significance in the production process and influences companies’ costs and inefficiency. This is evident for water companies where they need to operate their facilities and improve the quality of service to the customers so that they can provide these services at an affordable price (Marques et al. 2014). Thus, as Alvarez et al. (2004) suggested, this should be taken into account when evaluating the performance of a firm. Ignoring unobserved managerial efforts, it may lead to biased inefficiency estimates (Marques and Barros 2010). Thus, this study employed Alvarez et al. (2004) model where managerial inefficiency was treated as a fixed (time-invariant) input that affects the production process. Based on this methodological approach, production function model takes the following form for any water company i at any given time t:

where y denotes the single output and x is a vector of inputs n = (1, 2, …, N) to produce a given level of output, i.e., the time varying variable input; m denotes the managerial ability which is treated as time-invariant, i.e., fixed input, and interacts with the input x; and ɛ is the random error which is assumed to have a zero mean. The production function model (Eq. 1) was then transformed into a frontier model by assuming that the maximum level of output, y∗, for a given level of inputs is obtained with the maximum level of management, m∗ (Barros et al. 2014). Thus, it takes the following form:

where ui, t denotes the inefficiency of any water company i at any given time t and follows a half-normal distribution, whereas the technical efficiency of a water company (TEi, t) was calculated as TEi, t = exp(−ui, t). The link between inefficiency and management was defined as follows (Alvarez et al. 2004):

In Eq. (3), the inefficiency consists of two components, the time-invariant management and the interaction of management with the inputs.

Equation (2) was estimated by treating the unobservable management effect, m∗as a “random effect” in a panel context. Thus, Eq. (2) was rewritten as follows:

In Eq. (4), the unobservable management effect is part of the constant term and takes a quadratic form, and the coefficients of the first-order terms of inputs become random coefficients with a common random effect, whereas the coefficients of the second-order terms of inputs are fixed (Cullmann et al. 2012). The above model is called the random coefficients stochastic production frontier model and is estimated using the maximum simulated stochastic frontier techniques (for more details, please see Alvarez et al. 2004; Greene 2007; Marques and Barros 2010; Cullmann et al. 2012).

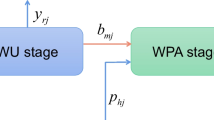

In this study, it was adopted the cost function approach as it was assumed that the water companies need to minimize their costs to produce a given level of output (water and sanitation services) (Marques et al. 2014). Following past evidence, a translog cost function was adopted (see, for instance, Coelli et al. 2005). Thus, in the absence of prices for inputs (Jamasb et al. 2012; Mydland et al. 2020), the random coefficient stochastic cost frontier model took the following form (Marques and Barros 2010; Barros et al. 2014, 2017):

where Ci, t denotes the total costs for any water company i; y is the vector of outputs; t denotes time; and χπ is a set of environmental variables that may influence costs and, therefore, inefficiency (Molinos-Senante et al. 2019). Moreover, as the objective of this study is to estimate the marginal cost of improving quality of service, following Jamasb et al.’s (2012) approach, a variable z was incorporated as an additional cost driver, which represents the quality of service in terms of water leakage.

The process of producing and delivering drinking water is organized around network structures (Cullmann et al. 2012). Since water leakage is the volume of water produced but lost in different parts of the urban water cycle such as connections, reservoirs, treatment water plants, and networks, it is part of production process and interacts with the outputs. Thus, the above model captures how the production process, outputs, and water leakage interact with water company management’s ability and efforts, m∗(Cullmann et al. 2012). The unobservable management effect enters in the model’s constant in a quadratic form, the first-order coefficients of outputs, y, and quality of service, z, are random coefficients with a common random effect, whereas the coefficients of the second terms are fixed (Cullmann et al. 2012). Finally, two components of interest were estimated from Eq. (5), namely, (i) economies of scale (ES) (Eq. 6) and (ii) marginal cost of quality improvements (Eq. 7).

If ES takes a value greater than 1, then a water company operates under increasing economies of scale, which means that cost savings increase more than proportionally with the scale of operations (Guerrini et al. 2018). If ES is less than 1, then the water company operates under diseconomies of scale. In our study, economies of scale measure the change in costs due to a proportional increase in the volumes of water delivered and number of customers occurred at the same time (Carvalho et al. 2012; Carvalho and Marques 2014).Footnote 1

The marginal cost of improving the quality of service was estimated econometrically from Eq. (5) (Jamasb et al. 2012). A marginal cost value for any water company i at any time t was calculated as follows:

where MCOSTit denotes the marginal cost of improving service quality (or reducing water leakage in our study); Cit is the total actual cost; and ELCOSTit presents the elasticity of cost regarding the cost driver z, which, in this study, denotes the quality of the service and is captured by water leakage.

Sample and data description

The empirical application conducted in this study focused on a sample of 23 Chilean water and sewerage companies (WaSCs) over the period 2007–2015. The sample consists of 12 FPWCs, 10 CPWCs, and 1 PWC. The data was collected from the “Management Report for Water and Sewerage Companies” in Chile, yearly published by the national water regulator (Superintendencia de Servicios Sanitarios, SISS) on its webpage. While the number of regulated WaSCs in Chile is 59, the 23 water companies analyzed in this study provide water and wastewater services to 98% of the total number of customers. Chilean WaSCs are regulated by the SISS which was created in 1990, i.e., before the privatization of the water industry which started on 1998 (SISS 2021). One of the main functions of the SISS is the setting of water tariffs for each WaSC each 5 years. The process is based on the definition and simulation of an efficient water company whose costs are compared with the ones of the real water company. Theoretically, the maximum tariff that the analyzed WaSC can charge to customers is the one that allows recovering the full costs, including investment, of the efficient WaSC. The SISS also monitors and audits the quality of service that Chilean WaSCs provide and has the power to impose sanctions in case of noncompliance (Molinos-Senante and Farias 2018).

As the Chilean WaSCs are in charge of providing both water and wastewater services, following past evidence (Molinos-Senante et al. 2016b, 2018; Pinto et al. 2017), two outputs were defined: (i) volume of drinking water delivered to customers expressed in thousands of cubic meters per year and (ii) the number of water and sewerage customers per year. The dependent variable in the econometric specification was proxied by the operating costs of the WaSCs expressed in Chilean pesos annually and deflated by the consumer prices index taken from national statistics (Molinos-Senante et al. 2019). The volume of water leakage measured in thousands of cubic meters annually was used as a cost driver as the aim of the study was to estimate the marginal cost of reducing water leakage. Finally, a set of environmental variables were included in the assessment as they may have an impact on water companies’ costs and efficiency. These variables were selected based on the previous study on the water industry and data availability (Saal and Parker 2000; Berg and Marques 2011; Carvalho and Marques 2011; Marques et al. 2014; D’Inverno et al. 2020). These included the following: (i) type of water resources, i.e., surface, groundwater, or mixed sources; (ii) ownership of WaSCs, i.e., FPWCs, CWCs, and PWC; (iii) drinking water quality; and (iv) wastewater treatment quality. Both quality variables were measured based on two composite indicators, reported by the national water regulator, which take a value between zero and one. A value of one implies that the WaSC has met all standards with respect to drinking water and wastewater treatment quality (SISS 2015). The descriptive statistics of the variables used in the study are reported in Table 1.

Results and discussion

Stochastic frontier model estimation

Table 2 shows the results from the estimation of the stochastic frontier model (Eq. 5). The first-order coefficients of the outputs (means for random parameters) are positive and statistically significant from zero. This is satisfied for all observations in the sample. On average, a 1% increase in the volume of drinking water delivered and the number of customers will increase costs by 0.454 and 0.461%, respectively. The inverse of the sum of the outputs is greater than 1 which implies the presence of increasing economies of scale for the average WaSC.

The first-order coefficient of water leakage is negative and statistically significant from zero implying a positive marginal cost. The cost of producing and delivering more drinking water increases the cost of reducing water leakage and vice versa as shown by the interaction term between water delivered and water leakage. Cost complementarities may exist between network and water leakage as shown by the negative and statistically significant coefficient of the interaction term between these two variables.

The costs increase with most of the square terms. This is evident, for instance, with the volume of drinking water delivered and the number of water and sewerage customers. However, it seems that both these outputs when are interacted can lead to a reduction in costs. Their interaction term is negative and statistically significant which implies cost complementarities between these outputs. The variable time is positive and statistically significant which implies that average costs for the Chilean WaSC increases over time. The rate of technical regress however reduces as shown by its square term.

The coefficients of the unobserved fixed management are all statistically significant from zero, which provides evidence that management efforts impact on the efficiency of WaSCs is correct. An increase in management increases the volumes of water delivered, connected properties, and reduces water leakage. The statistically significant positive sign of the variable management and the statistically significant negative sign of its squared term suggest that eventually management reduces costs and inefficiency. The variable type of water resource is positive and statistically significant which means that groundwater and mix water resources (surface and groundwater) increase costs and inefficiency of the Chilean WaSCs evaluated. Finally, the parameter lambda is statistically significant from zero which implies the presence of cost inefficiencies in the model (Molinos-Senante and Maziotis 2018).

Cost efficiency and economies of scale estimation

The evolution of cost efficiency by WaSC ownership type is shown in Fig. 1. It is illustrated that on average the Chilean water and sewerage industry is 0.915 cost-efficient. This means that average WaSC can improve its efficiency by reducing costs by 8.5%. The three types of water companies, i.e., FPWCs, CWCs, and the PWC, reported similar and high levels of cost efficiency. This implies that ownership type does not have an impact on efficiency, a finding that is confirmed from the econometric results in Table 2 where the variable ownership did not have a statistically significant impact on water companies’ efficiency. It should be noted that although our assessment only involves one PWC, it does not have any impact on results as Table 2 illustrates that efficiency differences among FPWCs and CWCs were not significant from a statistically point of view. High levels of cost efficiency for the Chilean water and sewerage industry were also found by Ferro and Mercadier (2016), Molinos-Senante et al. (2018, 2019), and Molinos-Senante and Maziotis (2019).

On average, all WaSCs demonstrated a similar trend in their efficiency. It appears that the water industry improved its efficiency over the years 2007–2010 whereas a downward trend in its efficiency is shown for the subsequent years. Since 2010, a mega-drought has been affecting the central and north area of Chile. It is characterized by a notable reduction in the accumulation of snow in the Andes, in the volumes of reservoirs and in the levels of groundwater (Garreaud et al. 2019). As in Chile, the access to water by all water users (including water companies) is regulated through a water market where there is no priority in the use of water and WaSCs have had to buy water rights at a higher cost, which might have led to a reduction in their efficiency.

The results indicate that in 2010, the efficiency of private and public companies reached its peak level, an efficient level of almost 0.928. In contrast, the last year of the sample, the efficiency of FPWCs and PWCs considerably reduced, at the level of 0.888 and 0.896, respectively, whereas the efficiency level of the CWCs remained almost the same. This finding reveals that WaSCs need to put more efforts to reduce their daily operational costs as their efficiency considerably reduced compared to the first years of our sample.

As far as the results of economies of scale are concerned, they are shown in Fig. 2. It was found that, on average, the Chilean water and sewerage industry operates under increasing economies of scale. This means that an increase in industry’s outputs by 1% may lead to an increase in operational costs by 0.919% (< 1%). In particular, FPWCs and PWCs may increase their costs by 0.904% if their outputs increase by 1%. A slightly higher increase in costs by 0.938% may occur for CWCs. Overall, the results indicate that the Chilean water industry may achieve further cost savings if the water companies continue to increase the volumes and scale of production.

Estimation of marginal cost of reducing water leakage

Figure 3 shows the average cost elasticity of water leakage for Chilean FPWCs, CWCs, and PWC. The results indicate that the average cost elasticity of water leakage decreases over time. This is evident for all types of Chilean WaSCs (FPWCs, CWCs, and PWC). It is also shown that the cost elasticity of water leakage is considerably higher for the PWC than FPWCs and CWCs. This implies a higher marginal cost for reducing water leakage for public companies than private (see Fig. 4).

On average, the marginal cost of reducing water leakage for the years 2007–2015 was 0.349 €/m3. This is equivalent to say that the water company has to spend an extra 0.349 € in operating costs to avoid a cubic meter of water leakage. Alternatively, it means that on average, the cost of losing 1 m3 from the water distribution system is 0.349 €. On average, there is a reduction of the marginal cost of water leakage from 0.449 €/m3 in 2007 to 0.292 €/m3 in 2015. The average marginal cost of reducing leakage increased the first 2 years of the sample followed by a downward trend in the next years. This downward trend was interrupted in 2015 where the marginal cost of reducing water leakage slightly increased.

The findings of this study are consistent with previous studies by Molinos-Senante et al. (2016b and 2019), who reported an implicit cost of reducing water leakage of 0.23 and 0.441 €/m3.These studies calculated a shadow price (implicit cost) for reducing water leakage using distance functions with linear programming techniques and econometric techniques, respectively. Our study differs from these approaches as our econometric model uses a cost function and calculates the marginal cost of reducing water leakage. Moreover, it takes into account the interaction of management with the production process and its influence on costs and efficiency.

As far as the ownership type is concerned, it is concluded that the marginal cost of reducing water leakage for CWCs is lower than FPWCs. In contrast, the marginal cost of reducing water leakage for the PWC is substantially higher than private companies. This is may be attributed to its high cost elasticity of water leakage. It is reported that, on average, the cost of losing 1 m3 from the water distribution system for CWCs and FPWCs is 0.297 and 0.359 €, respectively. For a PWC, the cost of improving the quality of service regarding water leakage is 0.745 €/m3. This finding is consistent with Molinos-Senante et al. (2019) who also reported that the implicit cost of reducing water leakage is considerable higher for public companies than private.

The marginal cost of reducing water leakage at the WaSC level and across years is reported in Table 3. There is a considerable variability in the marginal cost for each water company and over the years. For instance, the minimum marginal cost for reducing leakage takes a value which ranges from 0.001 to 0.024 €/m3, whereas the maximum marginal cost varies from 0.710 to 1.006 €/m3. This variability can be attributed to several factors such as the age and material of water networks and the water company-specific technologies used to predict and monitor leakage (Molinos-Senante et al. 2019).

Regarding ownership type, it is shown that for an average FPWC, the cost of losing 1 m3 of water decreased from 0.429 €/m3 in 2007 to 0.359 €/m3 in 2015. However, there are several water companies (WC1, WC5, WC8, WC10) that showed a substantial increase in the cost of reducing water leakage with WC1 showing the highest cost of leakage over time among all companies in the sample. The rest of the FPWCs showed a decline in their marginal cost values with WC7 showing the highest decrease in the marginal cost from 0.668 €/m3 in 2007 to 0.252 €/m3 in 2015. For an average CWC, the extra spend in operating costs to prevent 1 m3 of water leakage decreased from 0.435 €/m3 in 2007 to 0.211 €/m3 in 2015. All the CWCs, except for WC21 and WC22, showed a significant reduction in the marginal cost of water leakage. The values of marginal cost for WC21 and WC22, although increased, still remain the lowest in the industry. The empirical results for the PWC highlight the importance of reducing water leakages. Its marginal cost, although decreased over time, is the second highest among all water companies.

Results on Table 3 illustrate that there are several water companies that showed a significant increase in the marginal cost of water leakage during the last year of the sample. In addition to this, the high variability in the marginal cost values over time suggests that, regardless the ownership type, the Chilean water regulator needs to provide appropriate incentives to the water companies to reduce water leakage.

Conclusions

One of the main global challenges that water companies face is to improve the quality of service by meeting several targets. In particular, reducing leakage from water distribution systems is essential, because of its economic, social, and environmental impacts. In this study, a cost frontier model was used to estimate the marginal cost of improving the quality of service in terms of water leakage in a sample of 23 Chilean water companies over the years 2007–2015. Moreover, in the econometric modeling, it was considered the interaction between management’s ability with output and water leakage factors. The model specification further allowed us to estimate cost efficiency and economies of scale for the Chilean water industry.

The results for the Chilean water industry provide the following primary conclusions:

-

i).

The industry shows high levels of cost efficiency implying that the performance of Chilean water companies is large. However, there is still room to reduce their daily operational costs.

-

ii).

The estimates of economies of scale exhibit that on average, the Chilean water companies operate under increasing economies of scale. This implies that they may achieve further cost savings if they continue to increase the volumes and scale of production.

-

iii).

The marginal cost of reducing water leakage is higher for the PWC than FPWCs and CWCs; this may be explained by the high cost elasticity of water leakage. The average marginal cost of reducing water leakage for the period of study reaches 0.349 €/m3.

-

iv).

As far as the management is concerned, it is concluded that it has a positive impact on costs and efficiency since it increases outputs and reduces water leakage.

From a policy perspective, the methodology and findings of this study are of great interest for both water companies’ managers and regulators. First, management ability has an impact on the production process and influences costs and inefficiency. Thus, efficiency analysis can benefit from controlling for management efforts. Second, the differences in the marginal cost values of reducing water leakage demonstrate that there are some companies who may not have sufficient incentives to reduce water leakage. Third, the water regulator may need to introduce additional policies such as rewards/penalties to incentive water companies to achieve water leakage targets. This is very relevant for countries where the presence of this type of performance incentives in the water industry has not been developed yet. In this context, some urban water regulators have defined mandatory targets to water companies. Nevertheless, the European Commission (European Commission 2015) recommends regulating leakage at the river basin or unconnected water resource zone level, rather than for a single water company. Moreover, leakage should be managed taking into account of all stakeholders’ views, i.e., water regulator, water and environmental authorities, customers, etc. From the water utilities’ perspective, the traditional and most employed criterion to determine the optimal level of leakage is the “economic level of leakage” which is defined as the level of leakage is equal to benefit gained from the marginal leakage reductions. By contrast, the English and Welsh water regulator (Ofwat) pioneered the concept of “sustainable economic level of leakage” which is the level of leakage of a water distribution network at which the unit cost of leakage control measures for the water service provider equals the unit cost of water, including the water service provider's costs and the environmental and resource costs that are external to the water service provider (PWC 2019). Given the advantages and holistic approach of this criteria, it is suggested to water regulators to follow it to define leakage targets for water companies.

Notes

Carvalho et al. (2012), Carvalho and Marques et al. (2014), and Guerrini et al. (2018) differentiate between economies of scale and customer density as follows. Economies of scale measure the reaction of costs to simultaneous changes in volumes of water delivered and number of customer. Economies of customer density measure how costs alter when volumes of water delivered and number of customers change keeping the area or network length constant.

References

Alvarez A, Arias C, Greene W (2004) Accounting for unobservables in production models: management and inefficiency, Working Paper No. 72, Centro de Estudios Andaluces.

Ardakanian R, Martin-Bordes JL (2008) Proceedings of International Workshop on Drinking Water Loss Reduction: Developing Capacity for Applying Solutions. UNW-DPC Publication Series. Available at: https://www.ais.unwater.org/ais/pluginfile.php/56/course/section/26/Proceedings_DWLR.pdf

Barros CP, Scafarto V, Samagaio A (2014) Cost performance of Italian football clubs: analysing the role of marketing and sponsorship. Int J Sports Mark Spons 15(4):59–77

Barros CP, Wanke P, Nwaogbe OR, Azad K, Md A (2017) Efficiency in Nigerian airports. Case Studies on Transport Policy 5(4):573–579

Berg S, Marques RC (2011) Quantitative studies of water and sanitation utilities: A benchmarking literature survey. Water Policy 13(5):591–606

Carvalho P, Marques RC (2011) The influence of the operational environment on the efficiency of water utilities. J Environ Manag 92(10):2698–2707

Carvalho P, Marques RC (2014) Computing economies of vertical integration, economies of scope and economies of scale using partial frontier nonparametric methods. Eur J Oper Res 234(1):292–307

Carvalho P, Marques RC, Berg S (2012) A meta-regression analysis of benchmarking studies on water utilities market structure. Utilities Policy 21:40–49

Coelli TJ, Prasada Rao DS, O’Donnell CJ, Battese GE (2005) An Introduction to Efficiency and Productivity Analysis, 2nd edn. Springer, New York

Cullmann A, Farsi M, Filippini M (2012) Unobserved heterogeneity and efficiency measurement in public transport. Journal of Transport Economics and Policy 46(1):51–66

D’Inverno G, Carosi L, Romano G (2020) Environmental sustainability and service quality beyond economic and financial indicators: a performance evaluation of Italian water utilities. Socio Econ Plan Sci, In Press:100852

European Commission (2015) EU Reference document Good Practices on Leakage Management WFD CIS WG PoM. Available at: https://circabc.europa.eu/sd/a/1ddfba34-e1ce-4888-b031-6c559cb28e47/Good%20Practices%20on%20Leakage%20Management%20-%20Main%20Report_Final.pdf

Ferro G, Mercadier AC (2016) Technical efficiency in Chile’s water and sanitation provides. Utilities Policy 43(Part A):97–106

Garreaud RD, Boisier JP, Rondanelli R, Montecinos A, Sepúlveda HH, Veloso-Aguila D (2019) The Central Chile Mega Drought (2010–2018): A climate dynamics perspective. Int J Climatol 40(1):421–439

Greene W (2004) Interpreting Estimated Parameters and Measuring Individual Heterogeneity in Random Coefficient Models, Department of Economics, Stern School of Business, Working Paper No. 04-08, New York University.

Greene W (2005a) Reconsidering Heterogeneity in Panel Data Estimators of the Stochastic Frontier Model. J Econ 126(2):269–303

Greene W (2005b) Fixed and Random Effects in Stochastic Frontier Models. J Prod Anal 23:7–32

Greene W (2007) LIMDEP 9.0, Econometric Modeling Guide, Volume 2, Econometric Software, Inc., 2007, Plainview, NY, USA.

Guerrini A, Romano G, Leardini C (2018) Economies of scale and density in the Italian water industry: A stochastic frontier approach. Util Policy 52:103–111

Hernández-Sancho F, Molinos-Senante M, Sala-Garrido R, Del Saz-Salazar S (2012) Tariffs and efficient performance by water suppliers: an empirical approach. Water Policy 14(5):854–864

IBNET (2021) The International Benchmarking Network. Available at: https://www.ib-net.org/

IWA (2016) Water utility pathways in a circular economy. Available at: https://www.iwa-network.org/wp-content/uploads/2016/07/IWA_Circular_Economy_screen.pdf

Jamasb T, Orea L, Pollitt M (2012) Estimating the marginal cost of quality improvements: The case of the UK electricity distribution companies. Energy Econ 34:1498–1506

Li R, Huang H, Xin K, Tao T (2015) A review of methods for burst/leakage detection and location in water distribution systems. Water Sci Technol Water Supply 15(3):429–441

Lombardi G, Stefani G, Paci A, Becagli C, Miliacca M, Gastaldi M, Giannetti B, Almeida C (2019) The sustainability of the Italian water sector: An empirical analysis by DEA. J Clean Prod 227:1035–1043

Makropoulos CK, Butler D (2010) Distributed water infrastructure for sustainable communities. Water Resour Manag 24(11):2795–2816

Marques RC, Barros CP (2010) Performance of European airports: regulation, ownership and managerial efficiency. Appl Econ Lett 18(1):29–37

Marques R, Monteiro AJ (2003) Application of performance indicators to control losses— results from the Portuguese water sector. Water Science & Technol: Water Supply 3(1–2):127–133

Marques RC, Berg S, Yane S (2014) Nonparametric benchmarking of Japanese water utilities: institutional and environmental factors affecting efficiency. J Water Resour Manag Plann 140(5):562–571

Molinos-Senante M, Farias R (2018) Evaluation of the influence of economic groups on the efficiency and quality of service of water companies: an empirical approach for Chile. Environ Sci Pollut Res 25:23251–23260

Molinos-Senante M, Maziotis A (2018) Assessing the influence of exogenous and quality of service variables on water companies’ performance using a true-fixed stochastic frontier approach. Urban Water J 15(7):682–691

Molinos-Senante M, Maziotis A (2019) Productivity growth and its drivers in the Chilean water and sewerage industry: a comparison of alternative benchmarking techniques. Urban Water J 16(5):353–364

Molinos-Senante M, Mocholi-Arce M, Sala-Garrido R (2016a) Estimating the environmental and resource costs of leakage in water distribution systems: a shadow price approach. Sci Total Environ 568:180–188

Molinos-Senante M, Maziotis A, Sala-Garrido R (2016b) Estimating the cost of improving service quality in water supply: a shadow price approach for England and Wales. Sci Total Environ 539:470–477

Molinos-Senante M, Villegas A, Maziotis A (2019) Are water tariffs sufficient incentives to reduce water leakages? An empirical approach for Chile. Util Policy 61(100971):100971

Molinos-Senante M, Donoso G, Sala-Garrido R, Villegas A (2018) Benchmarking the efficiency of the Chilean water and sewerage companies: a double-bootstrap approach. Environ Sci Pollut Res 25(9):8432–8440

Mydland O, Kumbhakar SC, Lien G, Amundsveen R, Marit Kvile H (2020) Economies of scope and scale in the Norwegian electricity industry. Econ Model 88:39–46

Ofwat (2019) PR19 final determinations – overview of companies’ final determinations. The Water Services Regulation Authority. Birmingham. UK.

Pérez F, Delgado-Antequera L, Gómez T (2019) A two-phase method to assess the sustainability of water companies. Energies 12(13):2638

Pinto FS, Simoes P, Marques RC (2017) Water services performance: do operational environment and quality factors count? Urban Water J 14(8):773–781

PWC (2019) Funding approaches for leakage reduction. Available at: https://www.ofwat.gov.uk/wp-content/uploads/2019/12/PwC-%E2%80%93-Funding-approaches-for-leakage-reduction.pdf

Romano G, Guerrini A, Marques RC (2017) European Water Utility Management: Promoting Efficiency, Innovation and Knowledge in the Water Industry. Water Resour Manag 31(8):2349–2353

Saal DS, Parker D (2000) The impact of privatization and regulation on the water and sewerage industry in England and Wales: a translog cost function model. Manag Decis Econ 21:253–268

Salleh A, Yusof SM, Othman N (2019) An importance-performance analysis of sustainable service quality in water and sewerage companies. Industrial Eng Manag Syst 18(1):89–103

SISS (2015) Water and Sanitation Management Report for Chile. Available at: https://www.siss.gob.cl/586/articles-16141_recurso_1.pdf

SISS (2020) Non-revenue Water Report for Chile. Available at: https://www.siss.gob.cl/586/articles-17553_Recurso_1.pdf

SISS (2021) History of the Superintendencia de Servicios Sanitarios. Available at: https://www.siss.gob.cl/586/w3-propertyvalue-6316.html

UN (2010) Human Rights to Water and Sanitation. Available at: https://www.unwater.org/water-facts/human-rights/

UN (2015) Sustainable Development Goals. Available at: https://www.un.org/sustainabledevelopment/sustainable-development-goals/

Xu Q, Liu R, Chen Q, Li R (2014) Review on water leakage control in distribution networks and the associated environmental benefits. J Environ Sci (China) 26(5):955–961

Availability of data and materials

The datasets generated and/or analyzed during the current study are not publicly available due to that they were developed from the primary sources of data but are available from the corresponding author on reasonable request.

Author information

Authors and Affiliations

Contributions

AM—conceptualization; data curation; validation; writing (original draft).

AV—formal analysis; methodology; software.

MMS—project administration; resources; writing (review and editing).

Corresponding author

Ethics declarations

Ethical approval

This manuscript has been developed in compliance with ethical standards.

Competing interests

The authors declare that they have no competing interests.

Additional information

Responsible Editor: Philippe Garrigues

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Molinos-Senante, M., Villegas, A. & Maziotis, A. Measuring the marginal costs of reducing water leakage: the case of water and sewerage utilities in Chile. Environ Sci Pollut Res 28, 32733–32743 (2021). https://doi.org/10.1007/s11356-021-13048-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-13048-9