Abstract

Outward foreign direct investment (OFDI) in an open economy has gradually become an important source of green innovation (GI). With the rapid development of China’s OFDI, this research studies the impact of OFDI on the country’s GI, employing panel data of 30 provinces from 2006 to 2017. We first use the Super-SBM model to measure GI performance and then test the impact of OFDI on GI with the system GMM model. Evidence finds that the negative impact of OFDI on GI is not significant on the whole, but the results of regional regression show that impact of OFDI on GI exhibits obvious regional differences. We then utilize the dynamic threshold panel model to determine the non-linear relationship between OFDI and GI through the perspective of environmental regulation in order to avoid the bias caused by ignoring the impact of institutional factors and time dynamic change. After dividing environmental regulations into command control environmental regulation and market incentive environmental regulation, the research results show that the double threshold effects of both environmental regulations are significant. Command control environmental regulation does not play a role in promoting the effect of OFDI on GI. When the intensity of market incentive environmental regulation is low, OFDI negatively affects GI. Moreover, only when the market incentive regulation shows high intensity can OFDI significantly promote GI. With the continuous growth of China’s OFDI, it is therefore necessary to determine the appropriate environmental regulation to improve the reverse spillover effect of OFDI enterprises on the country’s GI.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

With the new round of scientific revolution and industrial transformation, the pattern of international division of labor is being reshaped. In order to adapt to changes in the economic environment at home and abroad, China is speeding up the transformation of its economic mode and promoting high-quality economic development (Jiang et al. 2021; Wen et al. 2021). Therefore, in the face of the country’s tight resource constraints and serious environmental pollution, green innovation (GI), which emphasizes innovation driven, energy savings, and emission reduction, has attracted much attention. As a combination of green development and innovation driven development, the essence of GI is to reduce environmental burden while improving economic efficiency. Under the background of the obvious slowdown of the global economy and the increasingly prominent resource and environmental problems, GI will play a more important role than ever before. With the implementation of the “Going Out” strategy, “The Belt and Road Initiative” and so on, China’s outward foreign direct investment (OFDI) is in the stage of rapid development. Can the rapid growth of OFDI promote China’s economy to achieve GI through reverse spillover? Is this reverse spillover effect influenced by other factors? Based on the perspective of environmental regulation, this paper discusses the impact of OFDI on the home country’s GI, which has very important research value. When discussing the relationship between OFDI and GI, the existing literature often ignored the role of institutional factors such as environmental regulation and the possible nonlinear characteristics of the impact of OFDI on GI, which may lead to biased conclusions. Therefore, taking environmental regulation as the threshold variable, this paper uses the dynamic threshold panel model to test the threshold effect of OFDI on GI on the basis of a comprehensive analysis of the theoretical mechanism, exploring the role of environmental regulation in the impact of OFDI on GI.

Often referred to as “sustainable innovation,” “ecological innovation,” or “environmental innovation,” GI is a broad expression without any current unified concept among academic scholars. Generally, an innovation that has novelty, value, and can achieve resource conservation or environmental improvement may be called GI (Li 2015). The main difference between GI and general innovation resides in “double externalities”—that is, the R&D spillover effect and environmental spillover effect. Like general innovation, GI also has an R&D spillover effect. The positive knowledge spillover effect from innovative enterprises benefits other enterprises, while inhibiting the enthusiasm of innovative enterprises to invest in R&D to some extent. However, unlike general innovation, GI has a special environmental spillover effect. The environmental benefits of GI arising from efficiency improvement of resource utilization or consumption reduction of resources are shared by society, which makes the enterprise gains of innovative enterprises less than the social gains. If the prices of green products are insufficient to cover the gap between the enterprise gains and social gains, then the enterprise’s enthusiasm for GI may be greatly reduced. Therefore, how to improve GI is an important issue in China.

In an open economy, apart from domestic independent R&D, international technology spillover has gradually become an important source of GI. Scholars have pointed out that the main channels of international technology spillover include international trade, FDI, and OFDI (Lichtenberg 1998; Chen and Lee 2020), among which OFDI is one of the key channels. OFDI not only broadens the international market, but also breaks the technical barriers of the host country to obtain technology spillovers, which have a further impact on the home country’s GI. With the implementation of Chinese enterprises’ “Going Out” strategy, OFDI in China has entered a stage of rapid development. According to the “2019 Statistical Bulletin of China’s Outward Foreign Direct Investment” jointly issued by the Ministry of Commerce, the National Bureau of Statistics, and the State Administration of Foreign Exchange, China’s OFDI flow was US$136.91 billion in 2019, ranking second in the world. By the end of 2019, 27500 domestic investors in China had established overseas enterprises for a total of 44000, which are distributed in 188 countries (regions) around the world. The OFDI stock has hit US$2.2 trillion, ranking third in the world after the USA and the Netherlands. According to the “World Investment Report 2020” published by UNCTAD, global OFDI flow was US$1.31 trillion in 2019, and the year-end OFDI stock was US$34.57 trillion. Based on this, China’s global share of OFDI flow and stock were 10.4% and 6.4% in 2019, respectively. The rapid development of OFDI has become an important source to improve the level of GI in China. Therefore, it is of great significance to study the impact of OFDI on China’s GI.

Can OFDI conclusively promote GI? Obviously, the answer is uncertain. Many studies have come to different conclusions about this (Zhang and Li 2020; Li et al. 2016a; Luo and Liang 2017). The reason is that the reverse spillover effect of OFDI on the home country’s GI may be restricted by many factors. As an important policy means to restrict the pollution behavior of enterprises, environmental regulation is one of the important constraints. Ever since the “Directive on Accelerating the Construction of Ecological Civilization released by the State Council” and the “Overall Plan for the Reform of Ecological Civilization System” were put forward in 2015, China has successively revised and issued some environmental regulations and policies such as the “Environmental Protection Law” and “Environmental Protection Tax Law”, further strengthening the environmental governance responsibility of enterprises. In this way, can the continuous improvement of environmental regulations further promote the reverse spillover effect of OFDI on GI? The answer to this question is very important for enhancing China’s GI level. Therefore, it is necessary to examine the effect of OFDI on GI from the perspective of environmental regulation.

The contributions of this paper are threefold. First, this paper proposes an analysis mechanism among OFDI, GI, and environmental regulation, which makes it clearer to understand how OFDI influences GI directly and indirectly, providing a rational basis for empirical analysis. Second, we utilize the dynamic threshold panel model to determine the non-linear relationship between OFDI and GI through the perspective of environmental regulation, which can avoid the bias caused by ignoring the impact of institutional factors and time dynamic change. Existing studies mostly use linear relationships to judge the impact of OFDI on GI, while ignoring the impact of environmental regulation. Third, this empirical study divides environmental regulation into market incentive environmental regulation and command control environmental regulation and compares the empirical results thoroughly to explore how these two policies differ in the threshold effect, making the conclusions more realistic.

To fulfill the research objectives, the rest of the paper runs as follows. Section 2 reviews relevant studies at home and abroad. Section 3 presents the analysis mechanism and proposes the hypothesis, which analyzes the main channels of OFDI influencing GI and the threshold role of environmental regulation and puts forward corresponding assumption. Section 4 sets up the models, variable selection, and data source. Section 5 includes the empirical test and result analysis, including national and regional system generalized method of moments (GMM) and threshold estimation. Section 6 offers a conclusion and suggestions.

Literature review

OFDI is an important channel for enterprises to obtain external R&D resources and has attracted the attention of academic circles for many years. Kogut and Chang (1991) first confirmed the important assumption of OFDI’s technology spillover to the home country, finding that Japan’s OFDI in the USA was mainly concentrated in R&D expenditure intensive industries, with the purpose of absorbing advanced technology from the USA. Based on the international R&D spillover model established by Coe and Helpman (1995), the reverse technology spillover effect of OFDI has been proved by many scholars (Li et al. 2016b; Mao and Xu 2014; Liu and Liu 2017; Piperopoulos et al. 2017; Yuan et al. 2020). However, there are scant researches studying the impact of OFDI on GI of the home country.

Present research findings about the impacts of OFDI on GI can be divided into three categories. First, some scholars believed that OFDI can significantly improve the level of GI in home countries. Han and Wang (2016) used the dynamic GMM model to investigate the relationship between OFDI and energy efficiency in China. The results showed that OFDI improves energy efficiency to a certain extent through reverse technology spillover. Gong et al. (2017) measured the efficiency of China’s industrial green innovation by using the Super-SBM model and concluded that OFDI plays a significant role in promoting the efficiency of industrial green innovation through the structural optimization effect, scale effect, and resource allocation effect. According to the nature of host countries, Jia et al. (2017) divided OFDI into two kinds: one is OFDI invested in developed countries, and the other is OFDI invested in developing countries. They found that these two kinds of OFDI could effectively promote the GI level of home countries whether invested in developed host countries or developing host countries. Using data of 11 provinces and cities in China’s Yangtze River Economic Belt, Kong et al. (2019) investigated the impact of OFDI on regional green technology innovation, with the results showing that the reverse technology spillover of OFDI by Chinese enterprises could significantly improve green technology innovation, but market segmentation indirectly hinders the improvement of green technology innovation level by distorting the transaction cost of the local market. Zhu et al. (2019) believed that OFDI not only could promote the growth of green total factor productivity in a local area, but also can significantly improve the green total factor productivity of neighboring provinces through the spatial spillover mechanism. Using the PVAR model, Yang and Wang (2019) also believed that OFDI and GI have the function of mutual promotion.

Secondly, some other scholars noted that OFDI has no significant impact on the promotion of the home country’s GI level or even has a negative impact. Based on the measurement of green technology innovation efficiency by the DEA method, Luo and Liang (2017) constructed a spatial econometric model using the non-linear CH pattern, indicating that the R&D capital of OFDI has a crowding-out effect on domestic investment, which impedes the upgrading of green technology innovation efficiency. Zheng and Ran (2018) first calculated the green total factor productivity and then found that OFDI plays a “stumbling block” role in China’s green innovation through the test of the dynamic panel model.

The third category supported the “uncertainty theory” and held that OFDI has a non-linear effect on GI. Hu et al. (2016) empirically investigated the long-term and short-term effects of OFDI on green total factor productivity, with a result showing that there is a certain heterogeneity in the long-term and short-term effects. OFDI promotes the green total factor productivity of most provinces, but also causes obvious negative effects on some provinces. Based on China’s provincial-level data, Yang et al. (2017) found that the impact of OFDI on green total factor productivity presents nonlinearity, and also exhibits significant regional differences.

The reverse spillover effect of OFDI on GI of the home country is constrained by multiple factors, which not only affect the size of the effect, but also may change its direction. Many scholars have studied these factors from different angles (Wang et al. 2017; Liu and Gong 2018), and some have tried to analyze the interaction among OFDI, environmental regulation, and GI. Li et al. (2016a) believed with the continuous strengthening of environmental regulation that OFDI significantly improves a home country’s GI, but this effect is not obvious when environmental regulation is weak. The conclusion by Wang et al. (2020) is similar, but they believed that OFDI reduces China’s green economic efficiency when environmental regulation intensity is low. Zhang and Li (2020) used panel data to test whether there is a threshold effect of environmental regulation in the impact of OFDI on green total factor productivity. The results showed a significant single threshold effect. Under the threshold condition of environmental regulation, OFDI’s impact on green total factor productivity presents nonlinearity. Nie and Wu (2020) also took environmental regulation as a threshold variable to explore the possible non-linear relationship between OFDI and regional green technology innovation capability, finding a significant single threshold effect.

The above literature has expounded upon the impact of OFDI on GI from different perspectives, but research strand on the impact of OFDI on GI is relatively small. Due to differences in research perspectives and research methods, there is no consistent conclusion. Many studies failed to fully consider the non-linear relationship between variables and ignored the impact of institutional factors on the spillover effect, and so the estimation results may be biased. Additionally, the existing literature rarely discusses in-depth the impact mechanism of OFDI on GI and the main channels of enterprises’ GI through OFDI, which are the basis for a more accurate analysis of the reverse spillover effect of OFDI. Finally, few scholars have studied the impact of OFDI on GI from the perspective of environmental regulation. As an important institutional element referring to GI, environmental regulation is likely to be one of the important reasons for the different conclusions between OFDI and GI, which makes it necessary to be further explored.

Mechanism analysis and hypothesis

Among the many driving factors of GI, OFDI is an important one that cannot be ignored. With the continuous implementation of China’s “Going Out” strategy, more and more Chinese enterprises are searching out opportunities for OFDI in foreign countries. Only by clarifying the relationship between OFDI and GI can we give full play to the reverse spillover effect of OFDI in this new situation and offer a pathway for China’s economy to achieve the goal of green development.

Main channels and effects of OFDI on GI

-

a.

Learning effect. OFDI’s investment motives can generally be divided into market seeking, technology seeking, natural resource seeking, and strategic resource seeking (Dunning and Lundan 2008). OFDI’s investment motives have decisive impacts on the promotion of a home country’s GI. Previous studies have shown that over 20% of an OFDI’s motives in China are technology seeking (Li and Su 2014). The “Learning—Imitation—Innovation” mode has always been an important mode of innovation for Chinese enterprises. Therefore, technology seeking enterprises generally choose developed countries as their host country, which have advanced technologies, talents, information, scientific research, and so on. Through learning from enterprises of developed countries in all these aspects, Chinese enterprises can obtain advanced technology and management experience from the host countries, produce a knowledge spillover effect, improve the GI level of themselves, and thus promote the GI level of parent companies and home country.

-

b.

Competition effect. OFDI enterprises and local enterprises in host countries are essentially competitive. On the one hand, OFDI enterprises entering the foreign market face the fierce competition from local enterprises. In order to gain market share, OFDI enterprises are obliged to reduce costs and improve product quality, accelerating their GI ability. On the other hand, OFDI enterprises do not exist independently and often have upstream and downstream relationships with their parent companies. If OFDI firms are in the downstream, then in order to beat the competition in the host market, the parent companies, which are in the upstream, have to upgrade their R&D, improve the quality of raw materials and intermediate products, and eventually enhance the level of GI. If the OFDI firms are in the upstream, then the intermediate products they provide are certainly of high quality under the fierce competition in host countries, which can also promote the efficiency of home countries’ GI.

-

c.

Industrial structure effect. The industrial selection of OFDI is the key to the influence of OFDI on the industrial structure of the home country. Natural resource seeking OFDI and strategic resource seeking OFDI usually enter the foreign market to solve the problems of increasing costs and scarce resources in the domestic market. Many labor-intensive industries and pollution industries have gradually transferred to overseas, because of the ever-rising costs of labor and other factors in China, along with its continuously increasing requirements for green development. The transfer of backward industries and production capacity to foreign countries is beneficial to the optimization of the country’s industrial structure and helps improve the overall GI efficiency of domestic industries. However, if OFDI’s investment selection is towards the high-tech industries or service industries, then it will certainly not have a positive impact on the industrial structure of the home country, and the overall GI efficiency of industries at home may decline.

-

d.

Resource allocation effect. The resources of a firm are limited, including human capital, financial resources, management resources, information resources, and so on (Lee and Wang 2021). When a firm chooses to execute OFDI, its resource allocation may change greatly. If the firm moves the low-end production links overseas, then more domestic resources of the firm can be allocated into the R&D link, improving the GI efficiency of both the parent company and home country. However, if the firm shifts its core production links overseas, then OFDI may “crowd out” domestic investment and other resources to a large extent, which will largely reduce the domestic input in research funding, human capital, and other resources, thus hindering domestic GI.

The influences of environmental regulation

The extent to which OFDI can affect the home country’s GI is affected by multiple factors, such as domestic institutional environment, current technology conditions, and enterprises’ absorptive capacity. Environmental regulation, an important institutional element, represents the extent to which a country encourages green development domestically. Different intensities of environmental regulation will bring about different conclusions on how OFDI affects GI.

From the perspectives of environmental regulation in the home country, relatively low intensity indicates that the environmental supervision of the host country is relatively strict. In this case, it is difficult for the pollution industries and energy consumption industries in the home country to transfer to the host country, and so the main investment direction of OFDI will be environment-friendly industries. In order to survive within international market competition, OFDI enterprises will leave production links with high pollution emissions at home and only set up R&D institutions or sales departments abroad. Owing to the cluster of pollution-intensive industries, the industrial structure of the home country deteriorates, which will bring a negative impact of OFDI on its GI. For China as a home country, due to fiscal decentralization, the idea of “growth only” of provincial governments may further reduce environmental regulation intensity and then may even expand the negative impact of OFDI on GI.

When the intensity of environmental regulation in the home country is relatively high, it means the environmental supervision in the host country is relatively loose for OFDI enterprises. Loose environmental regulation provides a favorable opportunity for OFDI enterprises to reduce production costs. Many pollution-intensive and resource-consuming industries choose to seek “pollution heaven” overseas due to their inability to meet the increasingly stringent environmental standards of their home countries, leaving high-tech industries and light industries in their home countries (Walter and Ugelow 1979). The home country will form a cluster of high-tech, slightly polluting industries that is advantageous to the upgrading of its domestic industrial structure, thus enhancing the level of its GI.

Based on the above analysis, OFDI promotes GI of the home country through learning effect and competition effect, and promotes or inhibits GI of the home country through industrial structure effect and resource allocation effect. The impact of OFDI on GI is affected by the heterogeneity of environmental regulation intensity. The hypothesis is proposed as follows:

Hypothesis: The impact of OFDI on GI is non-linear, and there is a threshold effect of environmental regulation.

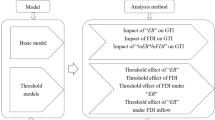

As shown in Fig. 1, the aggregate influence of OFDI on GI is ambiguous, which may be caused by the heterogeneity of environmental regulation intensity. The system GMM model is used to test the linear impact of OFDI on GI, and the threshold model is used to examine the non-linear relationship and the influence of environmental regulation.

Methodology

Model

In this paper, we first use the system GMM model constructed by Blundell and Bond (1998) to explore the impact of OFDI on GI of the home country. The advantage of the system GMM model is that the estimation efficiency is improved (Lee et al. 2020), and even if there are endogenous variables in the explanatory variables, the use of instrumental variables will make the estimation of coefficients more consistent. Considering the time lag and continuity of innovation, this paper uses a dynamic panel model as follows:

where i and t denote province and year, GIit is green innovation in province i and year t, GIi, t − 1 is the 1-year lag value of green innovation (that is, green innovation in province i and year t − 1), OFDIit is outward foreign direct investment, \( {X}_{it}^{\prime } \) denotes the control variables, including R&D, human capital, urbanization level, financial support, opening-up level, and degree of marketization, μi is the individual difference of each province that does not change with time, and εit is the error term.

As mentioned in Section 3, under different environmental regulation intensities, the impact of OFDI on GI is non-linear. To test this, we use the threshold effect model constructed by Seo and Shin (2016) to explore the role of environmental regulation in the impact of OFDI on a home country’s GI. According to the mechanism analysis in Section 3.2, as an important institutional factor, environmental regulation will affect the reverse spillover effect of OFDI on GI. When the intensity of environmental regulation is different, the impact of OFDI on GI will also have significant differences. The essence of threshold model is to divide the sample into several groups by the threshold value of environmental regulation, and test the differences of estimated parameters of different groups. The threshold number and threshold value are determined endogenously by the sample data, which avoids the disadvantage of manual grouping in traditional analysis (Chiu and Lee 2020). The manual grouping method may have some subjectivity in the grouping standard, and cannot estimate the threshold value specifically and conduct the significance test for differences of different groups’ estimates. The threshold model can endogenously divide the environmental regulation intensity’s range through repeated bootstrapping, which makes the research results more reliable. Hansen’s (1999) panel threshold model has been widely used in empirical research, but the model is static and requires the covariates to be strong exogenous variables. However, in regression, the strong exogeneity is limited, and the explanatory variables of the model may contain the lag term of the dependent variable. Innovation is a gradual process. Therefore, we apply the model of Seo and Shin (2016) to introduce the dynamic threshold panel model. The biggest feature of this model is that it includes the lag term of dependent variable in explanatory variables, which can fully consider the continuity of GI. The equation goes as follows:

Equation (2) represents the single panel threshold model; i and t denote indices of the individual (province) and time (year) respectively; ER is the environmental regulation, the threshold variable; I(·) is the indicator function, with a value of 1 when the condition in brackets is true and 0 otherwise; γ is the threshold value to be estimated; and other variables are the same as in Eq. (1). The data are separated into two regimes, whereby the threshold variable, ER, is less than or greater than the threshold value γ.

The threshold model has been extended to be more than one threshold, because in some applications, there may be multiple thresholds. Equation (3) is the double-threshold model. The data are separated into three regimes, where γ1 < γ2. Higher-order threshold models are not discussed here due to space limitation.

Dependent variable

GI is the dependent variable, which is commonly measured with the input-output method. Compared with general innovation, GI needs to consider the resource input and undesirable environmental pollution output. This paper uses the Super-SBM model to measure GI, which is an extension of the data envelopment analysis (DEA) model. The traditional DEA model is mainly based on the perspective of a desirable output, neglecting the input or output slack, resulting in a better conclusion, but an error in the evaluation of the performance of decision-making units may occur. The Super-SBM model proposed by Tone (2001) adds the indices of undesirable output and also uses non-radial and non-angular functions to avoid the deviation caused by radial and angular functions and puts the slack variable directly into the objective function to solve the problem of input-output slackness, which is more conducive to measurement and result analysis. Based on the Super-SBM model, the measurement of GI is set as Eq. (4).

In the above formula, ρ in the objective function is the efficiency of GI of each decision-making unit (DMU), which is treated as a surrogate variable for GI performance; xij is the ith input in the jth decision-making unit; yrj is the rth output in the jth decision-making unit; there are a total of m inputs and q outputs; λ is the weight vector; and s is the slack variable. When ρ < 1, the DMU is relatively ineffective—that is, there is factor redundancy in DMU, and the efficiency can be improved by optimizing the allocation of input, desirable output, or undesirable output. When ρ ≥ 1, the DMU is relatively effective and located on the optimal production frontier. The greater the value of ρ is, the better is GI performance.

According to the nature of GI, we include capital investment, personnel investment, and energy input in the input indicators. We then divide the output indices into desirable and undesirable outputs. The details can be seen in Table 1.

Figure 2 is the kernel density distribution curve, from which we can see the dynamic evolution effect of GI. The curves are all characterized by double peaks and right long-tailed in 2006, 2010, and 2016. The right peak values in 2010 and 2016 are significantly higher than that in 2006, indicating that China’s overall GI efficiency is on an upward trend.

Independent variable

The independent variable is OFDI, expressed by the ratio of OFDI stock data to the real GDP of each province. The “Statistical Bulletin of China’s Outward Foreign Direct Investment” releases both the flow and stock data of OFDI. Compared with the flow data that fluctuate greatly, OFDI stock data are much more stable and can better reflect the long-term trend of OFDI. Therefore, this paper uses the stock data. Since the OFDI stock data in the Statistical Bulletin are in US dollars, we use the RMB exchange rate of the corresponding year published by the National Bureau of Statistics to convert the US dollars into RMB.

Threshold variable

Drawing on the research of Xie et al. (2017), we divide environmental regulation into market incentive policy and command control policy. The market incentive policy mainly includes emission trading system, pollution discharge levy system, and voluntary pollution control investment. The command control policy mainly refers to environmental standards, including emission standards, technical standards, and so on. According to their characteristics, different indicators are set up to measure the intensities of these two environmental regulations respectively.

-

(1)

Market incentive environmental regulation (ER1): expressed by the proportion of environmental governance investment in GDP. The greater the proportion is, the greater is the intensity of environmental regulation. When enterprises are faced with stricter environmental regulations, the polluters, which need to find technologies and methods to reduce pollution emissions in order to meet the stringent requirements, will spend more expenses on pollution control. Therefore, environmental governance investment will be larger than before.

-

(2)

Command control environmental regulation (ER2): expressed by the comprehensive index system consisting of a variety of pollutants such as wastewater and sulfur dioxide to present the policy effects. The larger the comprehensive index is, the greater are the emissions of each pollutant, and then the weaker is the intensity of environmental regulation. Based on the severity of various pollutant emissions and data availability in China, this paper selects wastewater, sulfur dioxide, and solid waste as the pollutants and borrows the method from Fu and Li (2010) to measure the comprehensive index.

Each index is first standardized through mathematical transformation (Eq. (5)), namely non-dimension treatment, in order to eliminate the non-commensurability and contradiction between indicators.

where UEij is the original value of province i and pollutant j; max(UEj) and min(UEj) are the maximum and minimum values of pollutant j in all regions, respectively; and \( {UE}_{ij}^s \) is the standardized value.

The adjustment coefficient of each index (namely, the weight of each index) is calculated according to:

where Wj is the ratio of the proportion of regional emissions to total emissions and the proportion of regional output value to total output value. Finally, using the standardized value and weight of each index, the comprehensive index of environmental regulation in each province is measured according to:

where Si is the comprehensive index of environmental regulation in province i.

Control variables

R&D investment and R&D personnel are the foundation of GI, so R&D and human capital are included in the control variables of the model. To reduce the impact of other factors on GI and combined with previous research on GI performance, this paper takes some other control variables. Borrowing from Gong et al. (2017), financial support and opening-up level are also added into the model. The use of urbanization level and degree of marketization is drawn on the research of Zhang and Li (2020). The details are as follows.

-

(1)

Research and development (R&D): the proportion of R&D expenditure in local GDP.

-

(2)

Human capital (HUM): refers to the common practice of existing literature (Zhang and Li 2020), where the average length of schooling is used to describe the level of regional human capital:

Among them, primit, midit, highit, and uniit represent the proportion of the educated population with primary school, middle school, high school, and university or higher degree in the population over 6 years old, respectively.

-

(3)

Urbanization level (URB): the proportion of urban population in the total population. Areas with a higher level of urbanization have a strong agglomeration effect on high-quality production resources and human capital, which is conducive to the allocation of innovation resources, and thus the improvement of GI level.

-

(4)

Financial support (FIN): the proportion of financial institutions’ loan balances in GDP. The agglomeration of existing innovation resources is inseparable from the flow of financial capital, and the high-level financial support can provide necessary financial capital for the improvement of GI efficiency.

-

(5)

Opening-up level (OPEN): the proportion of total imports and exports in GDP. Economic openness means increased opportunities for the exchange of talents, technologies, ideas and so on, which could be the driving factors of GI.

-

(6)

Degree of marketization (MAR): the proportion of fixed asset investment of the non-state-owned economy in the fixed asset investment of the whole society. High degree of marketization is conducive to reducing the government intervention in the market and stimulating the market vitality of market entities. In addition, it will reduce the investment uncertainty risks and transaction costs, encouraging more enterprises to carry out GI actively.

Data source

This paper uses balanced panel data from 30 provinces in China from 2006 to 2017 as samples. Tibet is deleted, because it has a lot of missing data. The original data come from the China Statistical Yearbook, the China Environmental Statistical Yearbook, the China Energy Statistical Yearbook, and the China Statistical Yearbook of Science and Technology. Table 2 gives descriptive statistics of the main variables.

Empirical test and result analysis

Estimating the GI impacts of OFDI

Regression on national level

Before any regression, the main variables in the model are tested by multiple collinearity, and we find that the variance expansion factor value is much less than 10, indicating that the problem of multiple collinearity among variables is within the controllable range. We use the GMM method to estimate the dynamic panel model. The Sargan test results of one-step system GMM (Model 3) and two-step system GMM (Model 4) show no over-identification in the model, making IV effective. There is also no autocorrelation problem according to the AR (2) test result, solving the endogeneity problem of the model. As shown in Table 3, the coefficients of the GI-lag are significantly positive, meaning GI has the characteristics of accumulation and sustainability and further explains that it is necessary to build a dynamic panel model for analysis. We add other control variables in Model 5 and Model 6, and control time fixed effect and individual fixed effect respectively. OLS regression (Model 1) and fixed effect regression (Model 2) estimates are also listed in Table 3.

As for the core explanatory variables, the results in the table show that the coefficients of OFDI are negative, but not significant, ranging from − 0.474 to − 0.017, indicating that China’s OFDI does not exhibit a reverse spillover effect and may hinder GI improvement in China instead. The possible reasons for this can be many, including different OFDI destination countries, various investment industries, or other factors that may constrain the reverse spillover effect of OFDI on GI of the home country. As mentioned in Section 3.1, OFDI can affect GI through different channels. Some of the effects are positive (Gong et al. 2017; Zhu et al. 2019), such as learning effect and competition effect, while others may produce negative effects (Luo and Liang 2017; Zheng and Ran 2018), such as industrial structure effect and resource allocation effect. Therefore, the total impact may not be significant. The estimated coefficient of R&D is 5.981, indicating that the increase of R&D expenditure significantly promotes GI performance. Similar results are also shown for human capital, opening-up level, urbanization level, and degree of marketization, but with smaller estimated coefficients. However, the estimated coefficient of financial support is significantly negative, which is not in line with expectations. The possible reason maybe that more loans that an enterprise receives indicate a serious shortage of funds, and so the funds that can be used for GI are very limited.

Regional sample regression

The overall effect of OFDI on GI is not obvious, which may be caused by regional differences, and so, we explore the effect of OFDI on GI using regional samples. According to the geographical location of each province, the whole sample is divided into three regions: East, Central, and West. The eastern region includes Beijing, Hebei, Tianjin, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan. The central region includes Shanxi, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, and Hunan. The western region includes Inner Mongolia, Chongqing, Guizhou, Sichuan, Yunnan, Shaanxi, Gansu, Ningxia, Qinghai, Guangxi, and Xinjiang. The system GMM estimation results are in Table 4.

We see from Table 4 that there are obvious regional differences in the impact of OFDI on GI. OFDI significantly promotes GI in the eastern region, while it has no significant impact in the central region, and in the western region, OFDI actually significantly hinders GI. Due to the great differences in the level of economic development, technology, and resource endowment among regions in China, the channels through which OFDI affect GI can be very distinct. The eastern region is endowed with higher levels of economic development, technology, institutional quality, and large-scale powerful companies, which are helpful at producing learning and competitive effects. With the transfer of some domestic industries to the central and western regions, the infrastructure conditions and institutional quality have been improved, but there is still a gap in the quantity and quality of OFDI compared with the eastern region, which makes the reverse spillover effect of OFDI not obvious or even negative.

The effect of OFDI on GI is more likely closely related to the intensity of regional environmental regulation. There are great spatial differences in environmental regulation in China. Different regions have different levels of economic development, and so, there are great differences in the emphasis and investment in environmental protection. Generally, economically developed regions have higher requirements for environmental quality. In addition, the difference in the industrial structure of each province is also one of the reasons for the different intensity of environmental regulation. Therefore, it is necessary to further test the impact of OFDI on GI when environmental regulation is in a different range of intensity.

Robustness test

In order to test the robustness of the estimation results in Tables 3 and 4, we use the quantile regression model. Traditional regression methods mainly focus on the influence of explanatory variables on the conditional expectation of the explained variables and cannot fully describe the influence of explanatory variables on the whole conditional distribution of the explained variables. We conclude that the effect of OFDI on GI is different through theoretical analysis and empirical regression. In order to test this effect more comprehensively, we use the generalized quantile regression and select four representative quantiles (0.25, 0.50, 0.75, and 0.90) to explore the conditional distribution characteristics of OFDI on GI.

As apparent from Table 5, there are significant differences in the estimation coefficients of OFDI under different quantiles, indicating that the estimation results of Table 3 and Table 4 are robust. It can be seen from the regression results that the estimated coefficient is significantly negative at the 25% and 50% quantiles, not significant at the 75% quantile, and significantly positive at the 90% quantile. When the level of regional GI is low, OFDI has a negative impact on GI; when the regional GI level is high, OFDI promotes the improvement of GI, mainly because the enterprises’ learning effect through OFDI depends on their own learning ability. The enterprises located in provinces with a higher GI level have stronger learning, imitation, and innovation abilities, which make it easy for them to realize the reverse spillover of OFDI, thus greatly improving the level of GI in the home country. However, in provinces with a low level of GI, the competitive effect and learning effect through OFDI need to be improved, and the industrial structure effect may be negative, because of the cluster of pollution intensive industries. Hence, OFDI will have a negative impact on the GI of the home country.

In order to compare the results of regional differences more clearly, the average GI levels of different regions are listed in Table 6. It can be seen that the average GI levels in the eastern, central, and western regions are 0.962, 0.733, and 0.666 respectively, with the eastern region getting the highest GI level. According to the quantile regression results, when the regional GI level is high, OFDI promotes GI significantly. Therefore, OFDI can promote the GI of the eastern region, which is consistent with the regional regression results (Table 4), indicating that the regression results are robust.

Threshold effect test

In the previous part, we analyze the overall impact and regional differences of OFDI on GI from a linear perspective. The impact of OFDI on GI is affected by multiple factors and may have non-linear characteristics. The Hypothesis in Section 3 supposes that the impact of OFDI on GI is non-linear, and there is a threshold effect of environmental regulation. Therefore, we take environmental regulation as the threshold variable to further analyze the non-linear impact of OFDI on GI.

Test for threshold effect

Before estimating the threshold effect, it is necessary to determine the threshold type of environmental regulation in the impact of OFDI on GI—namely, the test under the assumption of a single threshold, double threshold, and triple threshold. We complete the test by Stata 16.0 on balanced panel data of N = 330, T = 12. Due to the different roles of market incentive environmental regulation and command control environmental regulation, we investigate their threshold effect respectively. The results show that the threshold effects of both environmental regulations are significant, corroborating the Hypothesis. We see from Table 7 for market incentive environmental regulation that the single threshold hypothesis passes the test at a 10% significance, the double threshold hypothesis passes the test at a 5% significance, but the triple threshold hypothesis fails. As for the command control environmental regulation, the single threshold hypothesis passes the test at a 5% significance, the double threshold hypothesis passes the test at a 1% significance, while the triple threshold hypothesis also fails to pass the test at a 10% significance level. Therefore, for both environmental regulations, the double threshold model should be used for estimation.

After determining the threshold type, we then estimate the threshold value of each environmental regulation. Table 8 reports the threshold values and 95% confidence intervals for both environmental regulations.

Analysis of the threshold model regression

According to the threshold effect test, both the market incentive environmental regulation and the command control environmental regulation pass the double threshold test. Table 9 and Table 10 show the results of the threshold regressions based on the double threshold. The OFDI-1, OFDI-2, and OFDI-3 in the following tables (including Tables 9, 10, 12, and 13) denote OFDI · I(ER ≤ γ1), OFDI · I(γ1 < ER ≤ γ2) and OFDI · I(ER > γ2) respectively.

The larger the index value of market incentive environmental regulation is, the stronger is the environmental regulation. The regression result of Table 9 shows that when environmental regulation is weak, the coefficient of OFDI is − 0.519 and passes the test at the 10% significance level. With the improvement of environmental regulation intensity, the estimated coefficient becomes positive, but not significant. When the value of market incentive environmental regulation is higher than 1.75, the estimated coefficient of OFDI is significantly positive, with quite a large coefficient (15.570), which indicates that high-intensity market incentive environmental regulation can greatly promote the reverse spillover effect of OFDI.

Unlike the market incentive environmental regulation, the relationship between the index value and intensity of command control environmental regulation is negatively related. Therefore, the three coefficients of OFDI from up to down in Table 10 show the change of OFDI’s effect when the command control environmental regulation changes from strong to weak. It can be found that when the command control environmental regulation is lower than 0.013, the estimated coefficient of OFDI is − 1.765 and passes the significance test at the 10% level, indicating that when the intensity of command control environmental regulation is very high, OFDI significantly hinders GI. When the command control environmental regulation is in the middle, the OFDI’s coefficient changes from negative to positive, but is not significant. When the command control environmental regulation is higher than 0.436 (namely, low level intensity), the impact of OFDI on GI is still negative at the 10% significance level. Therefore, command control environmental regulation does not play a role in promoting the effect of OFDI on GI, but instead hinders the effect.

Only high-intensity market incentive environmental regulation can promote the effect of OFDI on GI, while none of the other types of environmental regulations work, or they affect in the opposite way. The different influences of command control environmental regulation and market incentive environmental regulation, to a certain extent, explain why OFDI in China has no significant effect on GI. Command control environmental regulation, which is mainly issued by government departments, is a mandatory act or directive, putting enterprises in a passive position. The market incentive environmental regulation mainly relies on environmental economic means, through the effective allocation of pollution emissions among polluters, in order to achieve the purpose of reducing pollution, which will more likely produce sustained effects among enterprises. In China, command control environmental regulation is widely used by local governments, because administrative control can achieve quick results and easy operations, but it lacks the effect at stimulating OFDI’s spillover.

Regional distribution analysis

According to the regression results of the threshold effect, the market incentive environmental regulation is divided into three intervals: low environmental regulation interval (ER1≤1.685), medium environmental regulation interval (1.685 <ER1 ≤ 1.750), and high environmental regulation interval (ER1>1.750). The changes in the number of provinces in the three intervals are as follows.

From Fig. 3, we see that the number of provinces with the low market incentive environmental regulation is the largest, the number of high environmental regulation provinces ranks second, and only very few provinces have the middle-intensity market incentive environmental regulation. It means that the intensity of market incentive environmental regulation in most provinces is relatively low, which fails to promote the impact of OFDI on GI at the national level. From Table 11, we can see the specific provinces located in different intervals. In 2017, only 6 provinces (20% of sample size) were endowed with high intensity of market incentive environmental regulation, including Beijing, Hebei, Inner Mongolia, Shanxi, Shanghai, and Guangdong, which means the market incentive environmental regulation intensity in most provinces of China is in the range of too low or in the middle, making it hard to play the beneficial role in promoting the GI effect of OFDI.

We map the annual market incentive environmental regulation data to provide a visualization of the time and spatial distribution trends of provinces in China. In Fig. 4, we observe the specific provinces with different intensities of market incentive environmental regulation through the color map. Despite the change over time, most provinces have low intensity of market incentive environmental regulation. The regulation gap between the eastern, central, and western regions is also distinct, which might be the main reason for the difference in the effect of OFDI on GI, further verifying the rationality of our regression results.

Robustness test

-

a.

Re-measure GI performance. The previous section uses the Super-SBM model to measure the GI performance. We employ industrial wastewater emissions, industrial waste gas emissions, and industrial solid waste emissions as undesirable outputs. Since the reuse rate of solid waste is very high, and the industrial solid waste emissions in most provinces are much lower than that of wastewater and waste gas, we remove industrial solid waste emissions from the undesirable outputs and recalculate the value of GI. The regression results are in Table 12. We see that the double threshold effects of both market incentive environmental regulation and command control environmental regulation are significant. The estimated coefficients of OFDI indicate that only high-intensity market incentive environmental regulation can significantly promote the effect of OFDI on GI, while none of the other types of environmental regulations work, or they affect in the opposite way, which is basically consistent with the main results in Table 9 and Table 10. This suggests that the core conclusions of this paper are robust.

-

b.

Change the time range. In order to reduce the influence caused by sample time selection, after excluding the samples of 2006 and 2017, we reestimate the threshold effects using data from 2007 to 2016. From Table 13, we see that the double threshold effects are still robust. In light of the estimated coefficients of OFDI, we find the conclusion that command control environmental regulation does not play a positive role in the impact of OFDI on GI, but the high-intensity market incentive environmental regulation is beneficial for OFDI to promote GI of the home country, indicating the robustness of our main conclusions.

Conclusions

Based on how OFDI affects GI of the home country, this research constructs an analysis mechanism, suggesting that the impact of OFDI on GI is non-linear due to different effects, and that there is a threshold effect of environmental regulation. Employing panel data of 30 provinces in China from 2006 to 2017, we utilize the system GMM and threshold models to reveal that the empirical results are in line with the analysis.

The results of this paper are the following. (1) The negative impact of OFDI on GI is not significant on the whole, but the results of regional regression show that the impact of OFDI on GI has obvious regional differences. OFDI significantly promotes GI in the eastern region, has no significant impact in the central region, and has a negative impact in the western region. (2) The double threshold effects of both environmental regulations are significant. When the intensity of market incentive environmental regulation is low, OFDI negatively affects GI. With the improvement of market incentive environmental regulation intensity, the estimated coefficient of OFDI turns positive, but not significant. Only when the market incentive regulation shows high intensity can OFDI significantly promote GI. (3) When the intensity of command control environmental regulation is very low or very high, OFDI significantly hinders GI. When the command control environmental regulation is in the middle range, OFDI’s coefficient is not significant. Hence, command control environmental regulation does not play a role at promoting the effect of OFDI on GI.

Our findings suggest some policy implications. First, as OFDI has not yet produced a reverse spillover effect on China’s overall GI, the government should fully encourage enterprises to increase the amount of technology seeking oriented OFDI in the process of investing abroad, and to actively learn and introduce foreign advanced ideas and technologies, so as to achieve the purpose of promoting domestic GI through OFDI. At the same time, due to the obvious regional differences in the GI impacts of OFDI, the government should adopt differentiated regional policies according to local conditions. Second, because the impact of OFDI on GI has significant threshold effect of environmental regulation, full attention should be paid to take advantage of environmental regulation to induce the GI impacts of OFDI. The empirical results showed that the impact of OFDI on GI is significantly different under different intensity of environmental regulation. Therefore, the government should attach importance to the coordination of environmental regulation and investment strategies, and give full play to the threshold role of environmental regulation in the GI impacts of OFDI. Third, market incentive environmental regulation should be placed a high value. The results of this paper showed that OFDI can significantly promote GI only when the intensity of market incentive environmental regulation is high, which has been well verified in some provinces of China. Therefore, when formulating environmental regulation policies, the government should actively learn the advanced experience from Beijing, Hebei, Shanghai, and other high-intensity environmental regulation provinces, fully strengthen market incentive environmental regulation, and gradually reduce the use of command control environmental regulation tools. Only in this way can OFDI realize reverse spillover.

In this paper, the samples were provincial panel data of China, which were relatively mature. However, compared with provincial panel data, different industries may face different environmental constraints, so the impact of OFDI on GI may vary greatly among different industries. Therefore, in future research, we will take industry panel data as samples to test the impact of OFDI on GI. We will also continue to study the threshold role of environmental regulation. In addition, it is of great significance to take full account of the heterogeneity of OFDI destination countries, and study whether there are significant differences in the impact of OFDI on GI between investing in developed countries and investing in developing countries, so as to provide more policy implications for promoting the reverse spillover of OFDI in the future.

Data availability

Data are available from the authors upon request.

References

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87:115–143

Chen Y, Lee CC (2020) Does technological innovation reduce CO2 emissions? Cross-country evidence. J Clean Prod 263:121550

Chiu YB, Lee CC (2020) Effects of financial development on energy consumption: the role of country risks. Energy Econ 90:104833

Coe DT, Helpman E (1995) International R&D spillovers. Eur Econ Rev 39:859–887

Dunning JH, Lundan SM (2008) Institutions and the OLI paradigm of the multinational enterprise. Asia Pac J Manag 25:573–593

Fu JY, Li LS (2010) Empirical study on environmental regulation, factor endowment and industrial international competitiveness—based on panel data of China's manufacturing industry. Manag World 10:87–98+187

Gong XS, Li MJ, Zhang HZ (2017) Has OFDI promoted the industrial enterprises’ green innovation efficiency in China—evidence based on agglomeration economic effect. J Int Trade 11:127–137

Han YJ, Wang L (2016) The effect of OFDI reverse technology spillover on China energy efficiency. On Econ Probl 3:95–101

Hansen BE (1999) Threshold effects in non-dynamic panels: estimation, testing, and inference. J Econ 93:345–368

Hu YX, Qu XE, Dong MF (2016) The effect of green productivity growth of China’s FDI: an empirical analysis based on the perspective of spatiotemporal heterogeneity. Economist 12:61–68

Jia J, Wei JY, Wang Y (2017) Different impacts of environmental regulations of green technological innovation on Chinese OFDI—from the perspective of heterogeneity of host countries. R&D Manag 29:81–90

Jiang XC, Shen H, Lee CC, Cheng C (2021) Supply-side structural reform and dynamic capital structure adjustment: evidence from Chinese-listed firms. Pac Basin Financ J 65:101482

Kogut B, Chang SJ (1991) Technological capabilities and Japanese direct investment in the United States. Rev Econ Stat 73:401–413

Kong QX, Chen H, Ni YH (2019) How does OFDI reverse technology spillover of Chinese enterprises promote green technology innovation—based on empirical evidence of Yangtze River Economic Belt. J Guizhou Univ Finance Econ 4:100–111

Lee CC, Wang CW (2021) Firms’ cash reserve, financial constraint, and geopolitical risk. Pac Basin Financ J 65:101480

Lee CC, Wang CW, Ho SJ, Wu TP (2020) The impact of natural disaster on energy consumption: international evidence. Energy Econ 2020:105021, In press. https://doi.org/10.1016/j.eneco.2020.105021

Lichtenberg FR (1998) International R&D spillovers: a comment. Eur Econ Rev 42:1483–1491

Li GX, Zhang W, Wang YJ (2016a) OFDI, environmental regulation and green technology innovation in China. Sci Technol Manag Res 36:227–231+236

Li J, Roger S, Lu TN, Dylan S (2016b) Outward foreign direct investment and domestic innovation performance: evidence from China. Int Bus Rev 25:1010–1019

Li P, Su WZ (2014) Foreign direct investment and China’s technological innovation: from the perspective of heterogeneous investment host country. Int Bus 2:71–82

Li X (2015) Analysis and outlook of the related researches on green innovation. R&D Manag 27:1–11

Liu DL, Liu H (2017) Research on the impact of China’s Foreign Direct Investment on innovation ability—based on the perspective of the supply-side reform. Int Bus 6:98–108

Liu HY, Gong MQ (2018) Factor market distortion and scale effect of two-way FDI on carbon emissions. China Popul Res Environ 28:27–35

Luo LW, Liang SR (2017) The spatial effect of international R&D capital technology spillovers on the efficiency of China’s green technology innovation. Bus Manag J 39:21–33

Mao QL, Xu JY (2014) Does FDI of Chinese enterprises promote enterprise innovation? J World Econ 8:98–125

Nie H, Wu Q (2020) Does the reverse green technology spillover effect of FDI really exist? Modern Manag 40:7–11

Piperopoulos P, Wu J, Wang C (2017) Outward FDI, location choices and innovation performance of emerging market enterprises. Res Policy 47:232–240

Seo MH, Shin Y (2016) Dynamic panels with threshold effect and endogeneity. J Econ 195:169–186

Tone K (2001) A slacks-based measure of efficiency in data envelopment analysis. Eur J Oper Res 130:498–509

Walter I, Ugelow JL (1979) Environmental policies in developing countries. Technol Dev Environ Impact 8:102–109

Wang SL, Wang XL, Teng ZW (2017) The productivity effect of China’s two-way FDI: based on the perspective of resource and environment constraints. Int Bus 5:65–78

Wang ZJ, Wei J, Ren BP (2020) The impact of two-way FDI on green economic efficiency under the background of heterogeneous environmental regulation. Finance Trade Res 31:1–16

Wen H, Lee CC, Zhou F (2021) Green credit policy, credit allocation efficiency and upgrade of energy-intensive enterprises. Energy Econ 94:105099

Xie RH, Yuan YJ, Huang JJ (2017) Different types of environmental regulations and heterogeneous influence on “green” productivity: evidence from China. Ecol Econ 132:104–112

Yang SD, Han XF, Song WF (2017) Does OFDI affect China’s green total factor productivity. J Shanxi Univ Finance Econ 39:14–26

Yang ZJ, Wang DY (2019) Research on the interaction between outward direct investment, foreign direct investment and green innovation: based on PVAR model. Ecol Econ 35:55–63

Yuan H, Feng Y, Lee CC, Chen Y (2020) How does manufacturing agglomeration affect green economic efficiency? Energy Econ 92:104944

Zhang J, Li ZF (2020) Does OFDI promote green TFP growth in China—an empirical study based on dynamic system GMM estimation and threshold model. J Int Trade 7:159–174

Zheng Q, Ran GH (2018) Effects of two-way FDI on green productivity spillover in China: an empirical test based on dynamic panel model. Stat Inform Forum 33:54–61

Zhu WT, Lv CR, Gu NH (2019) Research on the influence of OFDI and reverse technology spillover on green total factor productivity. China Popul Res Environ 29:63–73

Acknowledgements

The authors are grateful to the Editor and two anonymous referees for helpful comments and suggestions.

Funding

This research has been financially supported by the Project of the National Social Science Fund of China (Grand No. 20BJL054), Shandong Social Science Planning Fund Program (Grant No. 18DJJJ02), and Natural Science Foundation of Shandong Province (Grant No. ZR2018BG010). Chien-Chiang Lee is grateful to the Jiangxi Humanities and Social Sciences Project of University (NO. JJ20125).

Author information

Authors and Affiliations

Contributions

Four authors provided critical feedback and helped shape the research, analysis, and manuscript. Lihua Dai—conceptualization, investigation, and writing of the original draft and analysis. Xiuru Mu—software, data curation, and corresponding author. Chien-Chiang Lee—visualization, reviewing and editing. Wei Liu—data curation and writing.

Corresponding author

Ethics declarations

Ethics approval

This is an original article that did not use other information that requires ethical approval.

Consent to participate

All authors participated in this article.

Consent for publication

All authors have given consent to the publication of this article.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Ilhan Ozturk

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Dai, L., Mu, X., Lee, CC. et al. The impact of outward foreign direct investment on green innovation: the threshold effect of environmental regulation. Environ Sci Pollut Res 28, 34868–34884 (2021). https://doi.org/10.1007/s11356-021-12930-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-12930-w