Abstract

This study examines the relationship between FDI and CO2 emissions in a nonlinear framework using data from countries along the “One Belt, One Road” from 1979 to 2017 as the sample. First, the linear analysis method was used to examine the stability of FDI and CO2 emissions in countries along the “One Belt, One Road.” In addition, the BDS (Brock-Dechert-Scheinkman test) method and nonlinear Granger causality test are used to investigate the nonlinear relationship between variables. Finally, a threshold vector autoregressive model (TVAR) is used to analyze the dynamic change mechanism between China’s FDI and CO2 emissions, and a threshold vector error correction model (TVECM) is used to test how the variables respond to deviations from equilibrium. Then, the Markov switching model is used to test the robustness of the results. The research results show that China, India, South Africa, and other countries all have a nonlinear causal relationship between FDI and CO2 emissions. At the same time, the comovement of FDI and CO2 emissions in China has obvious structural break features, which are relevant for the underlying regime. Furthermore, the results also show that the adjustment process of the FDI toward equilibrium is highly persistent in the first regime, and CO2 emissions will adjust to an equilibrium state at a faster speed in the second regime. Therefore, this paper puts forward different policy suggestions for different countries. For China, we should pay attention to the long-term benefits of FDI and introduce high-tech green FDI.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Since China’s President Xi Jinping proposed the “Silk Road Economic Belt” and the “21st Century Maritime Silk Road” (referred to as “the Belt and Road Initiative”) cooperation initiative during his visit to central and southeast Asian countries in September and October 2013, construction related to the “Belt and Road Initiative” has rapidly developed. This initiative created a new region for economic and trade cooperation and development integrating production and has greatly promoted the degree of investment facilitation in the region, and FDI has increased significantly (Yaseen and Anwar 2016). The 2019 “Belt and Road Initiative” Index Report also pointed out that the countries along the “Belt and Road Initiative” have become gathering places of FDI in the world by relaxing their policies for FDI. On the other hand, the concentration of FDI will promote rapid economic development to all countries and affect the environmental pollution level of all countries to a certain extent, especially CO2, accounting for approximately 82% of total greenhouse gas emissions (Mahadevan and Sun 2020). Under this background, it is of great practical significance for this paper to study the relationship between FDI and CO2 emissions in the countries along the “Belt and Road Initiative.” In fact, the relationship between FDI and CO2 emissions has attracted broad attention in academic circles, especially under the background of advocating for construction related to “the Belt and Road Initiative” to boost high-quality economic development at this stage. Understanding how to realize the improvement of environmental quality in the process of deepening globalization has attracted great attention from relevant policy makers and economists. Therefore, a systematic understanding of the dynamic change between FDI and CO2 emissions can effectively provide a reference for political decision-making.

At present, research on the relationship between FDI and CO2 emissions mainly employs linear analysis, and the two prevailing viewpoints are the “pollution paradise” hypothesis (Hanif et al. 2019) and the “pollution halo” hypothesis (Rafindadi et al. 2018). Among them, the “pollution paradise” hypothesis, also known as the “pollution shelter” hypothesis, was first proposed by Walter and Ugelow (1979) and confirmed by Baumol and Oates (1988), which made it a relatively perfect theory. The core idea of this theory is that to reduce the cost of environmental regulation, enterprises in developed countries will transfer some sunset industries to developing countries with relatively low environmental regulation through international direct investment (Chichilnisky 1994), which deteriorates the environment of host countries and makes developing countries become a “pollution paradise.” The “pollution halo” hypothesis holds that FDI inflows do not worsen the host country’s environment but are beneficial for reducing environmental pollution, mainly because multinational enterprises have effective cleaner production technology, which in turn will improve the host country’s environment through technology spillovers.

However, it should be noted that the relationship between FDI and CO2 emissions is not static, and there may be a significant nonlinear relationship between them (Haug and Ucal 2019) under the impact of economic events such as economic cycle fluctuations, macropolicy control, financial crises and other factors, as well as technological progress and industrial structure adjustments. Therefore, we ask the following question: What is the relationship between FDI and CO2 emissions for the countries along the “Belt and Road Initiative”? Is this relationship linear or nonlinear? Whether this relationship is different in different countries deserves our attention. In this paper, first, the residual after VAR filtering is tested by BDS to examine whether there is nonlinearity among the variables, and then, the nonlinear Granger causality test is used to measure nonlinear causality among the variables. At the same time, to examine the relationship between FDI and CO2 emissions in China, which has the most CO2 emissions, a threshold vector autoregressive model (TVAR) and threshold vector error correction model (TVECM) are used to analyze the nonlinear relationship between these variables. Finally, a Markov switching model is used to test the robustness of the results. As an extension of the linear VAR model, the TVAR model changes the model parameters when there is a change in the threshold variable, FDI. This model quantifies the relationship between the variables under different regimes and captures the regime characteristics of the threshold variable FDI through internal identification. We examine the cointegration relationship between FDI and CO2 emissions in China and introduced the TVECM model (Hansen and Seo 2002) as an extension of the VECM model because it can capture the nonlinear characteristics of the system in the process of adjustment to long-term equilibrium. Therefore, the application of these models has many advantages suitable for this study. In fact, these models have been widely applied in studies on market price transmission (Ganneval 2016; Cheng and Cao 2019), macroeconomics (Pragidis et al. 2018), and finance (Li et al. 2016). This research is an effective extension of the existing research fields.

This paper adds to prior research in the following three ways: First, different from previous papers using different methods that rely on panel data for the analysis, this paper mainly uses time series analysis to analyze the relationship between FDI and CO2 emissions in each country along the “the Belt and Road initiative” line one by one, which effectively addresses the bias caused by the premise that panel data endogenously reflect that the economic growth trajectory of each country or region is the same (Yang 2010). For different countries or regions, the level of economic development, technological level, and resource endowments are quite different, and these heterogeneous conditions will have different impacts on the FDI-CO2 relationship. Bruyn et al. (1996) and Lindmark (2002) believe that using time series to study a single country is more helpful for analyzing the dynamic relationship between the economy and environment. Second, considering the possible nonlinear relationship between FDI and CO2 emissions, this paper investigates whether there is a nonlinear trend between FDI and CO2 emissions in countries along the “Belt and Road Initiative” by combining various nonlinear analysis methods, such as neural networks, and studies the possible two-way causal relationship between FDI and CO2 emissions by using the nonlinear Granger causality test, which can effectively reveal heterogeneous characteristics and the dynamic change trends of FDI and CO2 emissions in various countries. Third, to further analyze the relationship between FDI and CO2 emissions in China, which is the largest developing country in terms of CO2 emissions, this paper uses TVAR and TVECM models for testing. Using the traditional NARDL (nonlinear autoregressive distributed lag) model would lead to contradicting results due to the use of different regional and time samples (Cheng and Cao 2019). The TVAR and TVECM models can effectively separate the impact of different stages of FDI on CO2 emissions, which is of great significance when predicting the impact of FDI on CO2 emissions and formulating corresponding policies.

The structure of this paper is as follows: the second part provides a literature review, the third part presents the method and describes the data, the fourth part discusses the empirical analysis, and the fifth part presents the conclusion of this paper.

Literature review

At this stage, research on the relationship between FDI and CO2 emissions has been relatively rich and mainly presents the following viewpoints:

First, FDI will lead to a significant increase in CO2 emissions, and the “pollution paradise” effect is significant. Shahbaz et al. (2015) studied the relationship between FDI and CO2 emissions in high-income, middle-income, and low-income countries; these scholars believed that the inflow of FDI would significantly aggravate regional CO2 emissions and that the “paradise of pollution” effect existed. Jungho (2016) studied the relationship between FDI, energy consumption, and CO2 emissions in ASEAN countries and found that the inflow of FDI will significantly promote an increase in CO2 emissions. Abdouli and Hammami (2017) studied the relationship between FDI and environmental pollution in 17 Middle East and north African countries and found that FDI can promote an increase in CO2 emissions, thus proving the “pollution paradise” effect of FDI. Bakhsh et al. (2017) used Pakistani data from 1980 to 2014 to measure the impact of FDI on environmental pollution and economic growth. The results showed that FDI has a significant positive correlation with CO2 emissions. Hanif et al. (2019) examined the effects of fossil fuels, FDI and economic growth on CO2 emissions in 15 Asian developing countries. The results showed that FDI significantly promotes CO2 emissions in developing countries, and the phenomenon of a “pollution paradise” exists. Malik et al. (2020) also proved the existence of a “pollution paradise” by analyzing the FDI and CO2 emissions data for Pakistan from 1971 to 2014.

Second, FDI will promote a decline in regional CO2 emissions; that is, the “pollution halo” effect is significant. Zhang and Zhou (2016) analyzed the relationship between FDI and CO2 emissions by using China’s provincial panel data from 1995 to 2010. It was found that the “pollution halo” effect was significant in the eastern, central, and western regions of China. Huang et al. (2017) studied the impact of FDI on China’s environment and economic growth by using a spatial econometric model and found that FDI can reduce environmental pollution in the region and promote economic growth, and the findings supported the “pollution halo” hypothesis. Rafindadi et al. (2018) studied the effects of FDI and energy consumption on CO2 emissions in GCC countries and found that an increase in FDI will significantly inhibit CO2 emissions. Cheng et al. (2019), using data from BRIICS countries, found that FDI is beneficial for reducing CO2 emissions per capita, which proves the “pollution halo” hypothesis to some extent.

Third, there is a more complicated mechanism for the impact of FDI on CO2 emissions in a host country. The ultimate impact is related not only to economic factors such as the economic development level and factor endowment of the host country but also the scale effect, structural effect and technological effect of FDI on CO2 emissions. Shahbaz et al. (2019) analyzed the impact of US energy consumption, FDI and trade liberalization on CO2 emissions and found that FDI would promote CO2 emissions increases through scale effects but inhibit CO2 emissions through technological effects. Liobikienė and Butkus (2019) use panel data of 147 countries from 1990 to 2012 to systematically analyze the effects of economic growth, FDI, urbanization and trade on CO2 emissions. The results showed that there is no evidence that FDI will affect CO2 emissions through scale and structural effects. Xie et al. (2020) believed that with an increase in FDI inflows, the effect of FDI on CO2 emissions is changed from positive to negative, thereby corroborating the pollution haven and pollution halo hypotheses.

Some studies have also examined the relationship between FDI and environmental pollution from the perspective of causality. Kivyiro and Arminen (2014) analyzed the causality relationships among CO2 emissions, energy consumption, economic growth, and FDI in sub-Saharan Africa and found that the causality relationships vary greatly between the countries, making it impossible to make any universal policy recommendations. Omri et al. (2014) analyzed panel data from 54 countries in the world from 1990 to 2011. The results showed that except in Europe and North Asia, there is a significant two-way causal relationship between FDI and CO2 emissions. Shahbaz et al. (2015) showed that there is a significant two-way Granger causality between FDI and CO2 emissions in high-income, middle-income and low-income countries. Appiah (2018) used Ghana’s data from 1960 to 2015 for an analysis and found that FDI is not the Granger cause of energy consumption, while energy consumption and CO2 emissions are mutually causal, indirectly proving that there is no one-way Granger causality between FDI and CO2. Malik et al. (2020) argued that there is a one-way causal relationship between FDI and CO2 emissions in Pakistan.

Fifth, there is a nonlinear relationship between FDI and CO2 emissions. Pazienza (2019) investigates the relationship between FDI and CO2 emissions by introducing the square term of FDI and considers that there is a “U”-shaped relationship between the two variables. Haug and Ucal (2019) use a nonlinear autoregressive distributed lag (NARDL) model for their analysis and conclude that there is a significant nonlinear relationship between FDI and CO2 emissions. Xie et al. (2020) examine the relationship between FDI and CO2 emissions in emerging countries. The results show that with an increase in FDI, its impact on CO2 emissions will change from positive to negative, and this transformation can only be realized when FDI reaches 24.34.

We find that current research on the impact of FDI on CO2 emissions has drawn many rich and meaningful conclusions, but due to the lack of a complete and systematic analysis framework, the conclusions drawn from the linear and nonlinear perspectives are different. In contrast to previous studies, this paper focuses not on the effect of FDI on CO2 emissions but on the linkage between the two. To systematically explore the specific relationship between FDI and CO2 emissions, this paper examines the nonlinear relationship between FDI and CO2 emissions in different countries along the “Belt and Road Initiative” by using a nonlinear Granger causality test and a new framework for the analysis, uses samples in China, investigates the nonlinear and asymmetric relationships between these variables by using TVAR and TVECM, and then verifies the robustness of the conclusion by using a Markov switching model.

Methods and data description

Introduction of methods

Nonlinear Granger causality test

To reveal the conduction regime between FDI and CO2 emissions, this paper uses TVAL proposed by Hiemstra and Jones (1994) and the Tn nonparametric test proposed by Diks and Panchenko (2006) to test the nonlinear Granger causality between variables. TVAL and Tn are briefly described, respectively.

For a given time series Xt and Yt, M represents the leading order of the Xt vector matrix, and Lx≥1 and Ly≥1 represent the corresponding lagging order. If the time series Yt is not the strict Granger cause of the time series Xt, the following relation holds:

This formula represents the joint density correlation integral calculated by Hiemstra and Jones (1994). At the same time, under the original assumption, for the given m, Lx≥1, Ly≥1, and e>0. The TVAL statistics obey the progressive normal distribution:

However, the TVAL method is prone to the problem of “excessive rejection.” Therefore, Diks and Panchenko (2006) constructed Tn statistics by following Hiemstra and Jones (1994):

where the estimate of the local density function is expressed, and the Tn statistics follow a normal distribution:

where Sn represents the asymptotic variance estimate of Tn(en).

TVAR model

The TVAR model is an extension of the VAR model. Compared with the common VAR model, the TVAR model incorporates the following improvements. First, the model partially addresses the requirement for coefficient linearization in the VAR model and allows the variable coefficients to change with the threshold value by introducing a threshold value. Second, the threshold variables of the model can be arbitrarily chosen from the selected variables, and the optimal threshold is extracted through a grid search, which not only avoids the problem of setting due to subjective determination of threshold points but also improves the defect of single equilibrium of the original VAR model. This paper uses a TVAR model to analyze FDI as an endogenous variable. The specific TVAR model is as follows:

where Yt is the explanatory variable, I is the indicator function, when St ≤ γ, define I(St ≤ γ) = 1 and I(St > γ) = 0, when St > γ, define I(St > γ) = 1 and I(St ≤ γ) = 0. St is the threshold variable, and γ is the threshold determined by a grid search. It is concluded here that when the threshold variable is greater than the optimal threshold, the set parameter of the model is (α2, ϕ2). In contrast, the set parameter of the model becomes (α1, ϕ1), and one or more conditions may exist in the optimal threshold determined by searching.

TVECM model

Assuming that Xt is a p-dimensional first-order monointegral time series and Xt has a P×1-dimensional cointegration vector β, and Wt = β′Xt is a stationary error correction term,Xt − 1(β) = [1, Wt − 1(β), ΔXt − 1, ΔXt − 2, ⋯ΔXt − n]′. Then, the double-regime linear vector error correction model with lag order L+1 is:

where A1 and A2 are dynamic coefficient matrices and threshold values. In the above model, the vector error correction model is divided into two regimes according to the size. In different regimes, the terms have different coefficients, reflecting the nonlinear characteristics of the system in the process of adjustment to long-term equilibrium.

Data description

At present, China is strongly advocating for the construction of “the Belt and Road initiative.” To effectively compare the relationship between FDI and CO2 emissions between China and “the Belt and Road initiative” countries and ensure the integrity and consistency of the data, data on China, India, South Africa, Brazil, Malaysia, Turkey, Greece, Poland, Malta, and nine other countries are selected for analysis. The sample time span of each country is 1979–2017. FDI data were obtained from the UNCTAD database, and CO2 emissions data for the various countries were obtained from the International Energy Agency’s “CO2 Highlights 2019.” To ensure the comparability of the data, in this paper, the logarithmic form of all data are used. The descriptive statistics of the data are presented in the following table (Table 1).

Inspection results and analysis

Unit root inspection

To investigate the single integer order of the variables, this paper uses the ADF test method to test the unit root of FDI and CO2 emissions data for various economies. The test results are shown in Table 2. It can be found that the original hypothesis of the “unit root” cannot be rejected when testing the FDI and CO2 emissions values for various economies. The first-order difference sequence of FDI and CO2 emissions of various economies shows that the original hypothesis of the “unit root” is rejected with least at a significance level of 5%. Therefore, it is believed that the FDI and CO2 emissions variables for each economy represent nonstationary I(1) processes.

Nonlinear Granger causality test

Existing research shows that there is often a significant trend of nonlinear changes between different economic variables (Lee et al. 1993; Cheng and Cao 2019); therefore, when examining the relationship between FDI and CO2 emissions, it is necessary to test the nonlinear relationship to determine whether there is a nonlinear change trend. In the inspection process, referring to the methods proposed by Asimakopoulos et al. (2000), first, the optimal VAR model is used to estimate the relationship between FDI and CO2 emissions to eliminate the linear dependency between them, and then, BDS nonlinear inspection is carried out on the residual after VAR filtering. The inspection results are shown in Table 3. When the embedding dimension m=2, 3, 4, 5, or 6, there is a significant nonlinear dynamic change trend for FDI and CO2 emissions after linear filtering by optimal VAR. Therefore, it is believed that due to the impact of economic cycle fluctuations, financial crises, and other events, there is a significant nonlinear dynamic change trend for FDI and CO2 emissions in various countries, which means that traditional linear analysis will have an impact on the estimation results when analyzing the relationship between these two variables.

To further verify whether there is a nonlinear relationship between FDI and CO2 emissions in various countries, this paper studies the nonlinear Granger causality of the variables by using the TVAL method proposed by Hiemstra and Jones (1994) and the Tn nonparametric test method proposed by Diks and Panchenko (2006) to reveal the nonlinear conduction regime between FDI and CO2 emissions. The residual filtered by the VAR model is tested, and the test results based on common lag order (Lx=Ly) are reported to ensure that strict nonlinear Granger causality between variables can be accurately verified. The results are shown in Tables 4 and 5.

According to the estimation results presented in Tables 4 and 5, first, in China, South Africa, Malaysia, Greece, Poland, and other countries, FDI Granger causes CO2 emissions in a nonlinear fashion. As FDI Granger causes CO2 emissions only in a nonlinear fashion, it is believed that these countries, inevitably, introducing FDI will have a significant impact on regional CO2 emissions, but it will not have a significant impact on FDI in the process of implementing energy saving and emission reduction policies. Second, CO2 emissions Granger causes FDI in a nonlinear fashion in India. Therefore, it is believed that in India, the process of implementing energy conservation and emission reduction policies will have an impact on regional FDI in, but the introduction of FDI has no influence on India’s CO2 emissions. Therefore, it is believed that FDI will not have a “pollution paradise” effect to India. Third, there is a significant two-way nonlinear Granger causality between FDI and CO2 emissions in Brazil and Turkey. Therefore, it is believed that in these two countries, the process of FDI introduction will significantly affect regional CO2 emissions, and the process of implementing energy conservation and emission reduction policies will have an impact and influence on regional FDI. Finally, there is no nonlinear causal relationship between FDI and CO2 emissions in Malta.

Nonlinearity analysis of China data

The previous analysis shows that there is a significant nonlinear relationship between FDI and CO2 emissions. To further investigate what kind of nonlinear relationship exists between FDI and CO2 emissions in different sample periods, it is important to determine the degree of the interaction between these two variables. This paper further analyzes China, a developing country with the largest amount of total CO2 emissions, and uses TVAR and TVECM to analyze the nonlinear dynamic relationship between FDI and CO2 emissions from the long-term and short-term perspectives.

The LR test method proposed by Hansen (1999) is used to test the nonlinear relationship between FDI and CO2 emissions. China is taken as the research object to measure whether there is a threshold effect on CO2 emissions during the rapid growth of FDI in China. The econometric analysis software used for this analysis is R software. The test results are shown in Table 6. At the significance level of 1%, the original assumption of linear VAR can be rejected, proving that there is a significant threshold relationship between FDI and CO2 emissions. On this basis, the optimal threshold is determined by the 2vs3 method using TVAR.LRtest. The result shows that there is an optimal threshold between FDI and CO2 emissions.

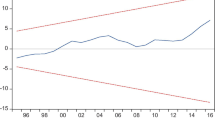

To find the optimal threshold node, the TVAR(1) model is used to investigate the long-term nonlinear relationship between FDI and CO2 emissions and determine the threshold year. Considering the principle of minimum AIC and BIC, the best lag period of the system formed by each sequence is selected as phase 1, while the value of nthresh is selected as 1, and FDI is used as the threshold variable for the TVAR test. The threshold regression diagram is shown in Fig. 1. The figure consists of three parts. The first part shows that China’s FDI is increasing year by year. The second part shows the optimal threshold by removing 10% of the maximum and minimum FDI variables. This paper employs FDI as the threshold variable, and the reasonable threshold value is determined to be 8.1568, which appeared in 1990. One possible reason for this result is that in the early 1990s, China experienced a new upsurge in economic development. To promote rapid economic development, various regions have vigorously attracted foreign investment, thus promoting a rapid increase in the IFDI scale. The third part indicates that the threshold value is determined by the grid search. The specific regression results are shown in Table 7. The relationship between FDI and CO2 emissions can be divided into two regimes. One regime is when FDI is ≤ 8.1568, i.e., the low FDI regime, with 31.6% of the samples located in this interval. The other regime is when FDI is > 8.1568, i.e., the high FDI regime, with 68.4% of the samples located in this interval.

First, in the low FDI regime, the impact of FDI lagging behind the first stage in the current period reaches 0.9443, and for every 1% increase in FDI lagging behind, the first stage will significantly promote an increase in current CO2 emissions levels by 0.3151%. This result is significant at the 1% level. In the regime of high FDI, the positive impact of FDI lagging behind the first stage on FDI and CO2 emissions in the current period increased. At this time, for every 1% increase in FDI lagging behind the first stage, the current FDI will increase by 0.9820%, and CO2 emissions in the current period will increase by 0.4785%, which indicates that an increase in FDI will aggravate China’s “pollution paradise” effect.

Second, in the low FDI regime, CO2 emissions lagging behind the first stage has no significant impact on FDI in the current period, but it will promote an increase in CO2 emissions in the current period. This result is significant at the 1% level. In the regime of high FDI, the impact of CO2 emissions lagging behind the first phase on FDI in the current period is still nonsignificant, but for every 1% increase in CO2 emissions lagging behind the first phase, there will be an increase of 0.4978% in CO2 in the current period. This result is significant at the 1% level. To a certain extent, this result confirms the results of the nonlinear Granger test, which shows that in the process of implementing carbon emission reduction, China will not see much influence on FDI.

According to the test results of the TVAR model, FDI is employed as the threshold variable, and CO2 emissions is tested by the threshold vector autoregressive model. It is believed that the threshold value of FDI appeared in 1990. In the long run, there is a significant nonlinear relationship between FDI and CO2 emissions. To investigate the regime of the interaction between FDI and CO2 emissions in the short term, this paper further uses the TVECM model to measure whether there is a significant nonlinear relationship between FDI and CO2 emissions in the short-term dynamic change process and tests the interaction rules. First, the Sup-LM test method proposed by Hansen and Seo (2002) is used to measure whether there is a nonlinear cointegration relationship between FDI and CO2 emissions. The test results are shown in Table 8. It can be found that the original assumption of linear cointegration is rejected at the significance level of 5%. Therefore, it is considered that there is a nonlinear cointegration relationship between FDI and CO2 emissions. The cointegration relationship is Wt=lnCO2−1.1804×lnFDI, and the threshold value is −0.8658.

Based on threshold cointegration analysis, the TVECM model is further constructed to decompose the short-term relationship between FDI and CO2 emissions into two regimes. The first regime is Wt≤−0.8658; that is, CO2≤1.1804×FDI−0.8658. To clarify, when FDI is lower than equilibrium and deviates more than 0.8658, the regime contains 30.6% of the observed values. The second regime occurs when Wt>−0.8658, i.e., CO2 > 1.1804 × FDI−0.8658. That is, FDI is higher than equilibrium and deviates by more than 0.8658 in the second regime, which contains 69.4% of the observed values. From the regression results shown in Table 9, it can be seen that only the CO2 emissions error correction term coefficient was significant at the 1% level under the two regimes, and the absolute value of the CO2 emissions error correction term coefficient was significantly greater than the absolute value of the FDI error correction term coefficient, indicating that CO2 emissions will adjust to the equilibrium state at a faster speed when FDI and CO2 emissions deviate from the equilibrium state in both the first regime and the second regime. At the same time, it can be found that the absolute value of the FDI error correction term coefficient in the first regime is significantly greater than that in the second regime, while the absolute value of the CO2 emissions error correction term coefficient in the first regime is significantly smaller than that in the second regime, indicating that when the system deviates from the equilibrium state, FDI will be adjusted to the equilibrium state at a faster speed in the first regime, while CO2 emissions will be adjusted to the equilibrium state at a faster speed in the second regime. In summary, we find that there is a significant nonlinear asymmetric adjustment process between FDI and CO2 emissions.

To verify the robustness of the conclusions in this paper, a Markov switching model is used to test the structural impact of FDI on CO2 emissions in China under the different regimes. The results are shown in Table 10. It can be found that there is an obvious nonlinear relationship between FDI and CO2 emissions, and the “pollution paradise” effect is significant. This result verifies the robustness of the conclusions in this paper to a certain extent. It can also be seen from the transfer probability matrix that China is currently in a high FDI regime and will transfer to the first regime at only a probability of 0.0976. Therefore, understanding how to grasp the nonlinear characteristics of the relationship between FDI and CO2 emissions to formulate specific carbon emission reduction policies for China is the focus of this paper.

Conclusion and policy implications

By employing a nonlinear analysis framework, this paper conducts an in-depth analysis of FDI and CO2 emissions data for China, India, and other countries along the “Belt and Road Initiative” from 1979 to 2017. In this research, the nonlinear Granger causality test, TVAR model, TVECM, and Markov switching model are used to systematically investigate the nonlinear dynamic relationship between FDI and CO2 emissions. The results show that in the nine countries along the “Belt and Road Initiative” selected in this paper, the relationship between FDI and CO2 emissions has significant nonlinear characteristics. China, South Africa, Malaysia, Greece, Poland have nonlinear Granger causality of FDI to CO2. Brazil and Turkey have significant two-way nonlinear Granger causality between FDI and CO2. India has nonlinear Granger causality of CO2 to FDI, while Malta has no nonlinear causality between FDI and CO2. Third, judging from the estimation results obtained through TVAR, there is a breakpoint in the relationship between China’s FDI and CO2 emissions; this model decomposes the relationship between the two variables into two regimes. In the low FDI regime and high FDI regime, FDI that lags behind the first stage will significantly promote an increase in CO2 emissions, but the impact of CO2 emissions on FDI is not significant. At the same time, in the high FDI regime, the promotion effect of FDI on CO2 emissions is significantly greater than that of the low FDI regime. This is related to introduce FDI at the cost of environment to promote economic development in China. Fourth, judging from the estimation results of the TVECM model, the threshold value of −0.8658 decomposes the relationship between FDI and CO2 emissions into two regimes. In the first and second regimes, the coefficient of the error correction term is only significant in the CO2 emissions equation, indicating that when FDI and CO2 emissions deviate from the system equilibrium, the error correction effect can make FDI and CO2 emissions reach the cointegration state only in the CO2 emission equation. Fifth, the results of the Markov switching model further verify the robustness of the conclusion that China’s FDI has a “pollution paradise” effect.

The results of the analysis described above have the following policy implications. First, in a period when there is a shortage of funds in developing countries, to make up for the funds needed for economic construction, developing countries tend to introduce FDI to promote rapid economic development. However, we need to be cautious about this because FDI has led to some undesirable effect in some industries (high pollution, high energy consumption, and high emission levels) in developing countries in the process of promoting economic development, making developing countries the pollution paradise of developed countries. To minimize the impact of FDI on environmental pollution in developing countries, developing countries such as South Africa and Malaysia should implement phased investment policies and dynamically adjust investment policies. In the initial stage of economic development, the economy should be developed by introducing FDI. When the economy reaches a certain stage, green FDI should be introduced by changing the investment structure and implementing a negative list policy, learning advanced foreign environmental technology, gradually changing from “Introducing FDI” to “Choosing FDI” and ultimately reducing regional CO2 emissions.

Second, as there is a nonlinear causal relationship such that “CO2→FDI” in India, Brazil, Turkey, and other countries; therefore, attention should be paid to its possible impact on FDI in the process of implementing “energy conservation and emission reduction,” and gradual emission reduction targets should be established, mainly through financial subsidies and other measures that attract green FDI. While reducing regional CO2 emissions, green FDI should be gradually increased to ultimately promote economic development.

Third, China should clearly recognize the gap between its resource carrying capacity and that of developed countries pay attention to the long-term benefits of introducing FDI, and not return China’s economy to the era of “gray economy” because of the short-term benefits. Therefore, the Chinese government should, on the premise of continuing to adhere to the concept of “bringing in,” gradually pay attention to the impact of FDI on the environment; accelerate the transformation of the previous investment model, which mainly focuses on demographic dividends and resource endowment advantages; cultivate professional markets to introduce high-tech green FDI; promote the improvement of environmental quality; and ultimately realize the high-quality development of China’s economy.

Although this study systematically explores the nonlinear relationship between FDI and CO2 emissions in nine countries of “the Belt and Road initiative,” it is limited by the availability of objective data. On the one hand, the sample number of countries selected in this study is small; on the other hand, this study analyzes the relationship between FDI flows and CO2 emissions in the nine countries of “the Belt and Road initiative.” However, these data are macro-overall data and cannot be broken down into a certain industry. For example, detailed data on the manufacturing industry cannot be obtained. In fact, an analysis of the manufacturing industry, as an industry with large FDI inflows and high pollution emissions, would be more targeted. If a breakthrough can be made in the screening and segmentation of FDI and CO2 emissions data in the future, this study can be used as a reference.

Data availability

The datasets used and analyzed during the current study are available from the corresponding author upon reasonable request.

References

Abdouli M, Hammami S (2017) Economic growth, FDI inflows and their impact on the environment: an empirical study for the MENA countries. Qual Quant 51(1):1–26

Appiah MO (2018) Investigating the multivariate Granger causality between energy consumption, economic growth and CO2 emissions in Ghana. Energy Policy 112:198–208

Asimakopoulos I, Ayling D, Mansor Mahmood W (2000) Non-linear Granger causality in the currency futures returns. Econ Lett 68:25–30

Bakhsh K, Rose S, Ali MF, Ahmad N, Shahbaz M (2017) Economic growth, CO2 emissions, renewable waste and FDI relation in Pakistan: New evidences from 3SLS. J Environ Manag 196:627–632

Baumol WJ, Oates WE (1988) The theory of environmental policy. Cambridge University Press, Cambridge

Bruyn SMD, Bergh JCJM, Opschoor JB (1996) Economic growth and patterns of emissions –reconsidering the empirical basis of environmental Kuznet Curves. Ecol Econ 25(2):161–175

Cheng S, Cao Y (2019) On the relation between global food and crude oil prices: an empirical investigation in a nonlinear framework. Energy Econ 81:422–432

Cheng C, Ren X, Wang Z, Cheng Y (2019) Heterogeneous impacts of renewable energy and environmental patents on CO2 emission-evidence from the BRIICS. Sci Total Environ 668:1328–1338

Chichilnisky G (1994) North-south trade and the global environment. Am Econ Rev 84(4):851–874

Diks C, Panchenko V (2006) A new statistic and practical guidelines for nonparametric Granger causality testing. J Econ Dyn Control 30:1647–1669

Ganneval S (2016) Spatial price transmission on agricultural commodity markets under different volatility regimes. Econ Model 52:173–185

Hanif I, Raza SMF, Gagodesantos P, Abbas Q (2019) Fossil fuels, foreign direct investment, and economic growth have triggered CO2 emissions in emerging Asian economies: some empirical evidence. Energy 171:493–501

Hansen BE (1999) Testing for linearity. J Econ Surv 13(5):551–576

Hansen BE, Seo B (2002) Testing for two-regime threshold cointegration in vector error-correction models. J Econ 110(2):293–318

Haug AA, Ucal M (2019) The role of trade and FDI for CO2 emissions in Turkey: nonlinear relationships. Energy Econ 81:297–307

Hiemstra C, Jones JD (1994) Testing for linear and nonlinear granger causality in the stock price-volume relation. J Financ 49(5):1639–1664

Huang J, Chen X, Huang B, Yang X (2017) Economic and environmental impacts of foreign direct investment in China: a spatial spillover analysis. China Econ Rev 45:289–309

Jungho B (2016) A new look at the FDI–income–energy–environment nexus: dynamic panel data analysis of ASEAN. Energy Policy 91:22–27

Kivyiro P, Arminen H (2014) Carbon dioxide emissions, energy consumption, economic growth, and foreign direct investment: Causality analysis for Sub-Saharan Africa. Energy 74:595–606

Lee T, White H, Granger CW (1993) Testing for neglected nonlinearity in time series models: a comparison of neural network methods and alternative tests. essays in econometrics. Cambridge University Press, Cambridge

Li M, Zheng H, Chong TTL, Zhang Y (2016) The stock–bond comovements and cross-market trading. J Econ Dyn Control 73:417–438

Lindmark M (2002) An EKC-pattern in historical perspective: carbon dioxide emissions, technology, fuel prices and growth in Sweden 1870–1997. Ecol Econ 42(1):333–347

Liobikienė G, Butkus M (2019) Scale, composition, and technique effects through which the economic growth, foreign direct investment, urbanization, and trade affect greenhouse gas emissions. Renew Energy 132:1310–1322

Mahadevan R, Sun Y (2020) Effects of foreign direct investment on carbon emissions: evidence from China and its Belt and Road countries. J Environ Manag 276:111321

Malik MY, Latif K, Khan Z, Butt HD, Hussain M, Nadeem MA (2020) Symmetric and asymmetric impact of oil price, FDI and economic growth on carbon emission in Pakistan: Evidence from ARDL and non-linear ARDL approach. Sci Total Environ 726:138421

Omri A, Nguyen DK, Rault C (2014) Causal interactions between CO2 emissions, FDI, and economic growth: evidence from dynamic simultaneous-equation models. Econ Model 42:382–389

Pazienza P (2019) The impact of FDI in the OECD manufacturing sector on CO2 emission: evidence and policy issues. Environ Impact Assess Rev 77:60–68

Pragidis IC, Tsintzos P, Plakandaras B (2018) Asymmetric effects of government spending shocks during the financial cycle. Econ Model 68:372–387

Rafindadi AA, Muye IM, Kaita RA (2018) The effects of FDI and energy consumption on environmental pollution in predominantly resource-based economies of the GCC. Sustain. Energy Tech Assess 25:126–137

Shahbaz M, Nasreen S, Abbas F, Anis Q (2015) Does foreign direct investment impede environmental quality in high-, middle-, and low-income countries? Energy Econ 51:275–287

Shahbaz M, Gozgor G, Adom PK, Hammoudeh S (2019) The technical decomposition of carbon emissions and the concerns about FDI and trade openness effects in the United States. Int Econ 58:943–951

Walter I, Ugelow JL (1979) Environmental policies in developing countries. Ambio 8(23):102–109

Xie Q, Wang X, Cong X (2020) How does foreign direct investment affect CO2 emissions in emerging countries?New findings from a nonlinear panel analysis. J Clean Prod 249:119422

Yang ZH (2010) Nonlinear research on the relationship between “Economic Growth” and “CO2 emissions”: based on nonlinear Granger causality test in developing countries. J World Econ 10:139–160

Yaseen Anwar (2016) China-Pakistan economic corridor (CPEC). International Monetary Review 3(2):117–119

Zhang C, Zhou X (2016) Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renew. Sust Energ Rev 58:943–951

Funding

This work is supported by the Humanities and Social Sciences Foundation of the Chinese Ministry of Education (20YJC790031). The scientific research program was funded by the Hubei Provincial Education Department (Q20201513). Philosophy and Social Science Research Project of Hubei Provincial Education Department (20Y057).

Author information

Authors and Affiliations

Contributions

M.G. designed the study, analyzed the data, and wrote the manuscript. S.Z. collected the data and coordinated the data analysis. H.L. revised the manuscript. All authors have read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Ethical approval

Not applicable.

Consent to participate

Not applicable.

Consent to publish

Not applicable.

Additional information

Responsible Editor: Eyup Dogan

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Gong, M., Zhen, S. & Liu, H. Research on the nonlinear dynamic relationship between FDI and CO2 emissions in the “One Belt, One Road” countries. Environ Sci Pollut Res 28, 27942–27953 (2021). https://doi.org/10.1007/s11356-021-12532-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-12532-6