Abstract

Environment-economic growth nexus is one of the main concerns of the researchers in the modern era. Although there are several studies in this field, discussions are far from being reached a consensus. The main purpose of this study is to investigate the role of economic growth, renewable and non-renewable energy consumption, oil prices, and trade openness on CO2 emissions in 25 Organization for Economic Co-operation and Development (OECD) countries over the period 1990–2014. We provide a comparative panel data evidence using both the first- and second-generation estimation methods. The Fully Modified Ordinary Least Squares (FMOLS) and Dynamic Ordinary Least Squares (DOLS) estimations indicate that the Environmental Kuznets Curve (EKC) hypothesis is valid in OECD countries. However, the Augmented Mean Group (AMG) estimator revealed that the EKC hypothesis is invalid. The AMG estimator is a second-generation estimator and provides robust results under cross-sectional dependence compared to the first-generation methods; therefore, the EKC hypothesis is invalid. Our additional findings show that rising renewable energy consumption and oil prices mitigate CO2 emissions while non-renewable energy consumption increases it according to all estimators. No significant relationship is found between trade openness and CO2 emissions.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

As a result of human actions, especially in the last century, the planet has faced serious environmental problems such as climate change and global warming under the growing footprints on nature. It is claimed that global warming about 2 °C will lead to long-term and irreversible changes, such as the destruction of some ecosystems (Ulucak et al. 2019). With the increasing awareness that environmental problems threaten the whole world, steps have been taken to save nature. In order to reduce human footprints in areas such as forests, water resources, living diversity, agricultural lands, and food resources, a struggle has been initiated by governments, international organizations, and civil society at the global and local levels. In this struggle, one of the important areas where urgent measures should be taken is to reduce energy use based on fossil resources. The global energy sector is responsible for the major part of greenhouse gas emissions (World Wildlife Fund (WWF) 2011). In addition, production in fossil energy such as oil and gas reserves will fall by 40–60% by 2030 (Energy Information Administration (EIA) 2009). If dependency on fossil fuels continues, oil and gas scarcity would increase and energy costs would rise further and become more volatile. This will cause us to turn to unusual resources that harm the environment. The most important way to prevent both the economic and environmental troubles of fossil energy is to reduce the share of fossil fuels in economic activities and to substitute with renewable energy sources (Socolow 1991, Inglesi-Lotz and Dogan 2018).

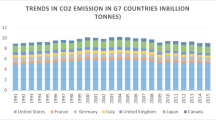

Rapid economic growth, increasing population, increasing living standards, and increasing infrastructure investments strongly affect world energy consumption (Iram et al. 2019). In the last three-decade, rapid industrialization of the countries has increased world energy demand. In this process, according to the World Development Indicators database of the World Bank (2019), the total energy consumption of the world increased by approximately 60%. Eighty-two percent of the world’s total energy consumption is met by fossil fuels. OECD countries are responsible for about 38% of the total global energy consumption by 2014. In OECD countries, nearly 88% of this energy supply comes from traditional non-renewable energy sources such as oil, natural gas, and coal. As a result, CO2 emissions, considered to be responsible for greenhouse gas emissions, have increased significantly. In the last three decades, global CO2 emissions have increased by about 63%, and OECD countries account for one-third of global carbon emissions. These emissions are seen as the main source of serious environmental problems such as global warming and climate change threatening the entire planet (Jebli et al. 2016). As a result of these global environmental disasters, countries are imposed on serious political and social pressure to reduce carbon emissions. In addition, most OECD countries have signed the Kyoto Protocol, committed to reducing the total of greenhouse gas emissions by 5% below the 1990 level in 2008–2012. Thus, the most important way for OECD countries to combat and overcome global environmental problems is to turn to renewable energy sources. International Energy Agency forecasts that production in fossil energy resources will fall by nearly 50% by 2030. This situation may lead to some serious problems such as the rise in oil prices and threatening energy security in OECD countries accounted for nearly 63% of the global GDP in 2014. Also, increasing renewables energy resources is the most crucial way to overcome these economic problems.

Reports of World Commission on Environment and Development (1987) and Club of Rome (Meadows et al. 1972) underline that today’s economic growth is not economically, socially, and environmentally sustainable. These reports also highlighted a potential correlation between the current economic path and global environmental problems. It is emphasized in the Brundtland Report (1987) that economic activities accounted for 13 trillion US$ world GDP in those years consumed finite natural resources in a dangerous way. According to World Bank (2019) data, the total GDP of OECD countries has risen dramatically from 29.27 trillion US dollars (constant 2010 US$) in 1990 to 47.72 trillion US dollars (constant 2010 US$). This level of production, accounting for about 63% of world production alone, shows that most of the limited resources of the world are used by OECD countries. OECD economies continued to grow by 2.05% in 2014, still meet a major proportion of the increasing energy demand from fossil fuels. The CO2 emission from the combustion of fossil fuels is the major contributor to environmental problems. Therefore, the effect of income growth on environmental pollution has been examined extensively in the literature. One of the most popular theories examining the economic growth-environment nexus, called the EKC, claims that there is an inverted U-shaped relationship between income growth and environmental degradation. The hypothesis assumes that environmental pollution increases with the increase of economic growth in the first phase, and economic growth decreases environmental pollution after a certain point is based on the assumption that it is caused by three effects such as scale, composition, and technique effects (Dinda 2004). The scale effect refers to environmental degradation resulting from the increase in the size of the economic activity without changing its quality. With this increase in the size of the economic activity, more natural resources will be used which makes it more harmful to the environment. The composition effect refers to a positive impact on the environment as a result of structural changes in the economy along with economic development. With economic development, environmental degradations will decrease as production methods will be transformed from energy-intensive production to information-intensive production and service sector which is cleaner than former production methods. The technique effect refers to the positive impact of new technological progress on the environment, accompanied by economic development. In societies with high welfare levels, cleaner production methods will be needed with increasing social demand for a cleaner environment. In these countries, the transition to clean technology is faster because research and development expenditures and information-intensive production are higher than in less-developed countries.

Based on the above reasons, this study aims to examine the relationship between renewable energy, economic growth, non-renewable energy, oil prices, trade openness, and the environment in OECD countries for the period of 1990–2014 in the context of EKC hypothesis modeling. The main contributions of this manuscript to the EKC literature are as follows: (i) to the best of our knowledge, this is the first study to test the impact of renewable energy consumption, non-renewable energy consumption, and oil prices on CO2 emission for OECD countries alongside common variables, (ii) standard panel data techniques assume cross-section independence; however, this assumption is hard to satisfy due to high degree of socioeconomic integration among countries; therefore, this work utilizes second-generation econometric approaches assuming cross-section dependence, (iii) although there are many studies, using either first- or second-generation panel data methods, there is a limited number of studies, using both methods. This study aims to provide a comparative and comprehensive empirical contribution to the existing literature.

Literature review

There are several studies investigating the EKC hypothesis empirically. However, the results obtained from those studies vary depending on the method and sample used. Following the seminal studies of Grossman and Krueger (1991), Panayotou (1993), and Selden and Song (1994), the EKC hypothesis was tested in plenty of studies in the literature, and the different control variables included in the EKC models in order to explain economic growth-environmental pollution nexus may also lead to vary the results. A summarize of those studies is given in Table 1.

There are a small number of studies in the literature analyzing the EKC hypothesis in the OECD sample. Cho et al. (2014), Dogan and Seker (2016), Bilgili et al. (2016), Jebli et al. (2016), and Churchill et al. (2018) come with the conclusion that the EKC hypothesis is valid in the OECD countries. Although these results are similar to each other, it is seen that there are methodological weaknesses in one part of the studies. Several studies in the EKC literature are based on the estimations that assume cross-sectional independence. However, the increase in economic, political, and cultural integrations among countries today makes the assumption that there is independence between the cross-sections unrealistic. The estimations without considering cross-sectional dependency lead to biased and inconsistent results (De Hoyos and Sarafidis 2006). Such results also may lead to incorrect inferences (Chudik and Pesaran 2013). Moreover, there are two studies examining the EKC hypothesis in the OECD sample, using second-generation estimation methods. Dogan and Seker (2016) examined the role of economic growth, financial development, trade openness, and energy consumption on CO2 and concluded that the EKC hypothesis is valid in OECD countries. Another study that considers cross-sectional dependency in the OECD sample is proposed by Churchill et al. (2018) investigating the relationship between economic growth, energy consumption, trade openness, population, financial development, and CO2. They reported that the EKC hypothesis is valid. In addition to the existing literature on the OECD sample, we distinctively include renewable and non-renewable energy consumption and oil prices to our model alongside economic growth and trade openness. This paper also provides a comparative analysis utilizing both first- and second-panel data methods.

Data, methodology, and empirical results

Data

Owing to the lack of measurement, the data employed in this paper range from 1990 to 2014 in 25 OECD countries. Considering the scale, technique, and composition effects of the EKC hypothesis, it is important to include the sample consisting of countries with similar development levels (Erdogan and Acaravci 2019); accordingly, OECD countries have been included. Following linear-logarithmic model has been employed to investigate the existence of the EKC hypothesis and determinants of carbon emission:

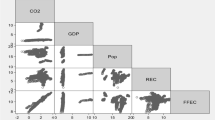

where i = 1,2,..25 and t = 1,2,…25, CO2 is carbon emissions (metric tons per capita), GDP is the real income per capita (constant 2010 US$), GDP2 is square of GDP, OILP is oil price (spot crude oil prices on West Texas Intermediate (WTI)), REN is renewable energy consumption (% of total final energy consumption), NREN is non-renewable energy consumption (fossil fuel energy consumption (% of total)), and TRis trade openness level (trade (% of GDP)). The GDP and GDP2 are mostly used regressors in existing EKC literature; thus, they are employed in this paper. Non-renewable energy consumption is one of the major causes of carbon emission, and renewable energy consumption is a substitute energy source of non-renewable one, suggested for empowering emission abatement policies. In that case, it could be said that there is a trade-off between renewable energy and non-renewable energy use. There are two main causes of these trade-offs: non-renewable energy prices and rising environmental concerns. It could be expected that provided that environmental concerns increase, governments are more tends to promote renewable energy consumption. Moreover, it is obvious that consumers tend to substitute renewable energy with non-renewable energy while non-renewable energy prices mounting up (Salim and Rafiq 2012). Thus, it could be said that trade-off between renewable and non-renewable energy occurs through price mechanism; hence, the oil price has been included as a proxy indicator for price mechanism, and trade openness is used as a control variable. The GDP per capita, renewable and fossil fuel energy consumption, and trade openness have been obtained from World Bank (World Development Indicators), while oil prices have been obtained from the British Petroleum (2019).

Methodology

It is generally accepted in the empirical literature that ignoring possible cross-section dependency, which frequently occurs in panel data analysis, could cause biased estimations and hypothesis tests (Chudik and Pesaran 2013; Erdogan et al. 2020). Therefore, initial analyses are required before implementing stationarity and cointegration analysis; therefore, cross-section dependence (Pesaran et al. 2008) and slope homogeneity testsFootnote 1 (Pesaran and Yamagata 2008) have been implemented.

It is well known that many of cointegration estimators such as FMOLS and DOLS are sensitive to the integrational level of variables. Hence, integrational levels of variables must be determined before implementing cointegration methods. This paper has employed Smith et al. (2004) bootstrap-based panel unit root test in order to determine the stationarity properties of those variables. Smith et al. propose a unit root for panel data which performs well for a relatively short time dimension (T) and tests the null of non-stationarity hypothesis against the alternative of stationarity. They adopt the methodology of Im et al. (2003) and consider cross-section dependency by using the bootstrap methodology. Smith bootstrap unit root approach is greatly based on the initial application of standard unit root tests to individual panel members; moreover, they propose five test statics as such as \( {\overline{\mathrm{LM}}}_s,{\overline{\mathrm{WS}}}_s,{\overline{t}}_s,{\overline{\operatorname{Max}}}_s,{\overline{\operatorname{Min}}}_s \). They emphasize that \( {\overline{\mathrm{LM}}}_s \) and \( {\overline{\operatorname{Min}}}_s \) statics perform weak compared to other static; whereas \( {\overline{\operatorname{Max}}}_s \)method-modified version of Leybourne (1995) relatively performs well; therefore, \( {\overline{\operatorname{Max}}}_s \)approach has been employed in this study in order to investigate stationarity properties of series, and could be obtained by the following specification:

Durbin-Hausman (DH) cointegration method developed by Westerlund (2008) has been implemented to test the long-run relationship between variables. The DH approach permits to obtain heterogeneous slope coefficients and considers cross-section dependence. Moreover, the DH approach employs the null hypothesis of no cointegration for the whole panel (H0 : ϕi = 1 for all i) against the alternative hypothesis of cointegration (\( {H}_1^g:{\phi}_i<1 \)) for at least some i. Besides, the DH approach is feasible in case of the stationarity of the regressor(s). This method proposes two statistics that group statistics are estimated under slope heterogeneity, and panel statistics are estimated under slope homogeneity. The existence of slope heterogeneity requires to use the group statistics instead of panel one, and test specification could be defined by the following equation:

In order to estimate long-run parameters, this paper employs various estimation procedures such as FMOLS, DOLS, and AMG estimator proposed by Pedroni (2000), Pedroni (2001), Eberhardt and Bond (2009), Eberhardt and Teal (2011), respectively. Both of the FMOLS and DOLS approaches fail to address with cross-section dependence. The AMG method considers cross-section dependence and allows to heterogeneity across cross-sections. In that case, it could be said that the AMG method is able to give country-specific coefficient estimations. The panel FMOLS estimation procedure could be implemented as \( {\hat{\beta}}_{\mathrm{GFMOLS}}={N}^{-1}{\sum}_{i=1}^N{\beta}_{\mathrm{FMOLSi}} \), where βFMOLSi is obtained by using individual FMOLS estimation of Eq. (1), and related t ratio could be estimated as \( {t}_{\beta_{\mathrm{GFMOLS}}}={N}^{-1/2}{\sum}_{i=1}^N{t}_{\beta_{\mathrm{FMOLSi}}} \). In order to estimate long-run coefficients with DOLS, the specification written in Eq. (1) could be expanded as follows:

where Kiand −Ki indicate lags and leads, respectively. Based on FMOLS specification, the DOLS estimation procedure could be implemented as \( {\hat{\beta}}_{\mathrm{GDOLS}}={N}^{-1}{\sum}_{i=1}^N{\beta}_{\mathrm{DOLSi}} \), where βDOLSi is captured from OLS estimation of Eq. (4) for each of the cross-sections; moreover, related t ratio could be estimated as \( {t}_{\beta_{\mathrm{GDOLS}}}={N}^{-1/2}{\sum}_{i=1}^N{t}_{\beta_{\mathrm{DOLSi}}} \). The AMG method allows to have variables, which have different stationarity level, and address with cross-section dependence. Furthermore, the AMG approach allows to slope heterogeneity, and the AMG approach gives robust results under even lack of cointegration relationship between variables. Ultimately, AMG methods perform well under possible endogeneity. The first ordered standard least-squares are containing dummy variables at the time T − 1 as follows:

where Δxit is set of first differenced regressors; ΔDt is first differenced T-1 period dummies; ςtis coefficients of dummies. In the second phase of the estimation procedure, estimated ςt coefficients are replaced with a common dynamic process (φt) as follows:

Ultimately, the general form of parameter estimation procedure could be introduced as\( {\tau}_{1,\mathrm{AMG}}={N}^{-1}{\sum}_{\dot{I}=1}^N{\tau}_{1,i} \) .

Empirical results

The results in Table 2 shows that the alternative hypothesis of cross-section dependence is strongly accepted; therefore, it could be said that possible shock in any of those countries may affect others. Moreover, the null hypothesis of slope homogeneity is strongly rejected for both \( \tilde{\varDelta} \) and \( {\tilde{\varDelta}}_{\mathrm{adj}} \) tests.

After unveiling cross-section dependency and slope heterogeneity, this paper has employed Smith et al. (2004) bootstrap-based unit root approach in order to investigate the stationarity properties of variables. As it is shown in Table 3, the null hypothesis of unit root is overwhelmingly accepted for both models with constant and trend and constant in level except for oil prices, and those variables have been exhibiting stationary processes in first differenced form. The oil price is stationary for the model with constant, whereas non-stationary for the model with trend and constant at the level. On the other hand, the oil price has become stationary for the model with trend and constant at its first difference. In that case, it could be inferred that those variables have a similar integrational level (I(1)), and any possible shock has a persistent effect on those variable and those could not revert back its state of balance without exogenous intervention.

Afterward determining the integrational level of variables, the DH panel cointegration test has been employed in order to detect possible cointegration relationships between variables. DH result (Table 4) indicates that the alternative hypothesis of cointegration has strongly accepted; in that case, there exist long-run relationships among variables.

Even though FMOLS and DOLS do not cope with cross-section dependence, those methods have widely used in EKC literature in order to estimate long-run coefficients, and such an approach may cause suspicion about the consistency of results and hypothesis tests obtained by means of those. Therefore, this paper has used FMOLS and DOLS estimators, additionally with the AMG method to make a comparative analysis and to discuss existing literature as well. As it is shown in Table 5, real income per capita has a positive and statistically significant coefficient, whereas the square of real income per capita has negative and statistically significant coefficients in terms of FMOLS and DOLS estimation results. Those findings strongly indicate that the EKC hypothesis is valid, and it might be accepted that there exists an inverted U-shaped relationship between economic growth and environmental degradation in OECD countries in related period of time. On the contrary, even having consistent parameter signs with former estimations, real income per capita and its square of real income per capita are statistically insignificant in AMG estimations; thus, it could be clearly inferred that the EKC hypothesis is not valid in related sample and timespan. This finding is consistent with the results of Liddle (2015), Destek et al. (2018), and partially Acaravci and Akalin (2017); while in contrast with the results of Arouri et al. (2012), Apergis (2016), Dogan and Seker (2016), Ulucak and Bilgili (2018), Dong et al. (2018), Churchill et al. (2018), and Destek and Sarkodie (2019).

Furthermore; oil prices have negative and statistically significant coefficients with different significance levels in all estimations. Omri and Nguyen (2014) state that an increase in oil prices will stimulate the economic agents to reduce their oil consumption levels, and adopt more eco-friendly consumption behaviors. In that case, any increase in oil prices reduces the consumption of pollutant resources and causes to substitute with renewable energy sources, thus contributes to diminishing emissions level. Non-renewable energy consumption has positive and statistically significant parameters, as expected, and confirms consensus on literature that the use of non-renewable energy is one of the main causes of emission levels. On the other hand, renewable energy consumption has a negative and statistically significant parameter in FMOLS and AMG estimations, whereas negative but statistically insignificant in DOLS estimations. If it is considered that the AMG approach has good test size and power because of addressing with cross-section dependence, it will be more rational to consider AMG findings. Thus, renewable energy consumption promotes to diminish carbon emission levels. Pata (2018a, b) stated that utilizing renewable energy sources may be a strategy for reducing environmental degradation and foreign energy dependency. Moreover, the widespread use of renewable energy may contribute to hinder undesirable consequences of oil price volatility in energy-dependent countries. Bilgili and Ulucak (2018) emphasized that utilizing renewable energy sources may be an efficient tool for supporting emission abatement policies and ensuring environmental sustainability. Ultimately, trade openness has a positive, but statistically insignificant parameter in all estimation results.

Conclusion

In this study, we investigated the role of economic growth, renewable energy, non-renewable energy, oil prices, and trade openness on carbon emissions in 25 OECD countries with annual data in the period from 1990 to 2014. We utilized different types of estimation methods assuming cross-section dependence and cross-section independence. According to results obtained from FMOLS and DOLS estimators that do not consider dependency between cross-sections, the EKC hypothesis is valid in OECD countries. In addition, rising oil prices and renewable energy consumption decrease environmental degradation while non-renewable energy consumption increases. However, no significant relationship was found between trade openness and CO2 emission. On the other hand, we performed the AMG estimator allowing cross-section dependence. The results of the AMG estimator show that results obtained in the case of cross-sectional dependence may vary.

Given the above results, it could be inferred that even the panel data estimation methods, which do not deal with cross-section dependence, might give a signal on the sign of parameters; however, they may cause biased hypothesis tests. Such a fact could cause unintended results such as accepting the validity of the EKC hypothesis instead of invalidity and might be resulted in irreversible environmental deterioration. In that case, using the tests performing well under cross-section dependency is vital to hinder biased hypothesis tests and construct precise policy proposals for sustaining environmental quality.

If it is considered that estimations of panel data without considering cross-sectional dependency lead to biased and inconsistent results, it would be wise to consider estimations obtained by estimation techniques performing well under cross-sectional dependence. Therefore, in the policy implications, we consider the results of the AMG estimator. The invalidity of the EKC hypothesis indicates that argument, assuming environmental degradation diminishes after a threshold point of economic growth proposed by Grossman and Krueger (1991), may not occur, and there is no systematic and deterministic relationship, and predicted as an inverted U-shaped, among economic growth and environmental degradation. Therefore, policymakers should not rely on the implications of the EKC hypothesis. Thus, in order to deal with environmental pollution, more efficient policies such as encouraging the use of eco-friendly energy sources should be made by policymakers. Our results also supporting this idea. As it was stated in empirical findings, increasing renewable energy consumption diminishes environmental degradation whereas non-renewable energy consumption increases it. Therefore; promoting renewable energy sources such as wind, solar, wave, and biomass energy will be an effective way to combat environmental pollution. In addition to its benefits in the context of environmental quality, it may also reduce production costs and may create new job opportunities and contribute to economic growth (Lehr et al. 2012; Bhattacharya et al. 2016). However, if it is considered that energy consumption is highly correlated with any countries output levels and as well as economic growth rates (Erdoǧan et al. 2019), policy makers should also consider the welfare concerns of countries and show prudent actions.

Furthermore, it is well known that non-renewable energy sources are scarce. Due to this scarcity, it can be expected that non-renewable energy prices will increase. This situation may force countries to substitute non-renewable sources with renewable ones. Although this fact may cause an increase in production costs, it may lead to better environmental quality as we found a negative relationship between oil prices and CO2 emissions. The best way to deal with both economic (rising oil price) and environmental burden (rising greenhouse gases) of using non-renewable energy sources can also be promoting renewable energy production. Therefore, policymakers should design effective policies to support renewable energy use such as tax incentives for the renewable energy industry, improving renewable energy technologies, feed-in tariffs for energy generation from renewable energy sources, and subsidies to renewable energy investments and trading.

Notes

Due to being widely used and well-known tests in economic literature, those tests were not introduced one more again.

References

Abid M (2017) Does economic, financial and institutional developments matter for environmental quality? A comparative analysis of EU and MEA countries. J Environ Manag 188:183–194

Acaravci A, Akalin G (2017) Environment–economic growth nexus: a comparative analysis of developed and developing countries. Int J Energy Econ Policy 7(5):34–43

Ahmed A, Uddin GS, Sohag K (2016) Biomass energy, technological progress, and the environmental Kuznets curve: evidence from selected European countries. Biomass Bioenergy 90:202–208

Al-Mulali U, Tang CF, Ozturk I (2015a) Estimating the environment Kuznets curve hypothesis: evidence from Latin America and the Caribbean countries. Renew Sust Energ Rev 50:918–924

Al-Mulali U, Weng-Wai C, Sheau-Ting L, Mohammed AH (2015b) Investigating the environmental Kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecol Indic 48:315–323

Apergis N (2016) Environmental Kuznets curves: new evidence on both panel and country-level CO2 emissions. Energy Econ 54:263–271

Apergis N, Ozturk I (2015) Testing environmental Kuznets curve hypothesis in Asian countries. Ecol Indic 52:16–22

Arouri MEH, Youssef AB, M'henni H, Rault C (2012) Energy consumption, economic growth and CO2 emissions in Middle East and North African countries. Energy Policy 45:342–349

Baek J (2015) A panel cointegration analysis of CO2 emissions, nuclear energy and income in major nuclear generating countries. Appl Energy 145:133–138

Bakirtas I, Cetin MA (2017) Revisiting the environmental Kuznets curve and pollution haven hypotheses: MIKTA sample. Environ Sci Pollut Res 24(22):18273–18283

Bhattacharya M, Paramati S.R, Ozturk I, Bhattacharya S (2016) The effect of renewable energy consumption on economic growth: Evidence from top 38 countries. Applied Energy 162:733–741

Bilgili F, Ulucak R (2018) The nexus between biomass–footprint and sustainable development. Reference module in materials science and materials engineering. Elsevier, Amsterdam

Bilgili F, Koçak E, Bulut Ü (2016) The dynamic impact of renewable energy consumption on CO2 emissions: a revisited environmental Kuznets curve approach. Renew Sust Energ Rev 54:838–845

British Petroleum (2019) BP Statistical Review of World Energy June 2018. https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy/downloads.html. Data Accessed: 20.04.2019

Cho CH, Chu YP, Yang HY (2014) An environment Kuznets curve for GHG emissions: a panel cointegration analysis. Energy Sources, Part B: Econ, Plan, and Policy 9(2):120–129

Chudik A, Pesaran MH (2013) Large panel data models with cross-sectional dependence: a survey. https://www.dallasfed.org/~/media/documents/institute/wpapers/2013/0153.pdf. Accessed 5 Mar 2019

Churchill SA, Inekwe J, Ivanovski K, Smyth R (2018) The environmental Kuznets curve in the OECD: 1870–2014. Energy Econ 75:389–399

Danish, Ulucak R, Khan SUD (2020) Determinants of the ecological footprint: role of renewable energy, natural resources, and urbanization. Sustain Cities Soc 54:101996

De Hoyos RE, Sarafidis V (2006) Testing for cross-sectional dependence in panel-data models. Stata J 6(4):482–496

Destek MA, Sarkodie SA (2019) Investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Sci Total Environ 650:2483–2489

Destek MA, Ulucak R, Dogan E (2018) Analyzing the environmental Kuznets curve for the EU countries: the role of ecological footprint. Environ Sci Pollut Res 25(29):29387–29396

Dinda S (2004) Environmental Kuznets curve hypothesis: a survey. Ecol Econ 49(4):431–455

Dogan E, Seker F (2016) An investigation on the determinants of carbon emissions for OECD countries: empirical evidence from panel models robust to heterogeneity and cross-sectional dependence. Environ Sci Pollut Res 23(14):14646–14655

Dong K, Sun R, Li H, Liao H (2018) Does natural gas consumption mitigate CO2 emissions: testing the environmental Kuznets curve hypothesis for 14 Asia-Pacific countries. Renew Sust Energ Rev 94:419–429

Eberhardt, M. & Bond, S. (2009). Cross-section dependence in nonstationary panel models: a novel estimator. https://mpra.ub.unimuenchen.de/17692/. Accessed 12/03/2019

Eberhardt M, Teal F (2011) Econometrics for grumblers: a new look at the literature on cross-country growth empirics. J Econ Surv 25(1):109–155

EIA (2009) World energy outlook 2009. International Energy Agency, Paris

Erdogan S, Acaravci A (2019) Revisiting the convergence of carbon emission phenomenon in OECD countries: new evidence from Fourier panel KPSS test. Environ Sci Pollut Res 26(24):24758–24771

Erdoǧan S, Gedikli A, Yılmaz AD, Haider A, Zafar MW (2019) Investigation of energy consumption–economic growth nexus: a note on MENA sample. Energy Rep 5:1281–1292

Erdogan S, Akalin G, Oypan O (2020) Are shocks to disaggregated energy consumption transitory or permanent in Turkey? New evidence from Fourier panel KPSS test. Energy:117174. https://doi.org/10.1016/j.energy.2020.117174

Farhani S, Mrizak S, Chaibi A, Rault C (2014) The environmental Kuznets curve and sustainability: a panel data analysis. Energy Policy 71:189–198

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free trade agreement (No. w3914). National Bureau of Economic Research, Cambridge

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogenius panels. J Econ 115:53–74

Inglesi-Lotz R, Dogan E (2018) The role of renewable versus non-renewable energy to the level of CO2 emissions a panel analysis of sub-Saharan Africa’s Βig 10 electricity generators. Renew Energy 123:36–43

Iram R, Zhang J, Erdogan S, Abbas Q, Mohsin M (2019) Economics of energy and environmental efficiency: evidence from OECD countries. Environ Sci Pollut Res:1–13

Jaunky VC (2011) The CO2 emissions-income nexus: evidence from rich countries. Energy Policy 39(3):1228–1240

Jebli BM, Ben Youssef S, Ozturk I (2015) The role of renewable energy consumption and trade: environmental kuznets curve analysis for sub‐saharan Africa countries Afr Dev Rev 27:288–300.

Jebli MB, Youssef SB, Ozturk I (2016) Testing environmental Kuznets curve hypothesis: the role of renewable and non-renewable energy consumption and trade in OECD countries. Ecol Indic 60:824–831

Lean HH, Smyth R (2010) CO2 emissions, electricity consumption and output in ASEAN. Appl Energy 87(6):1858–1864

Lehr U, Lutz C, Edler D (2012) Green jobs? Economic impacts of renewable energy in Germany. Energy Policy 47:358–364

Leybourne SJ (1995) Testing for unit roots using forward and reverse dickey–fuller regressions. Oxf Bull Econ Stat 57:559–571

Liddle B (2015) What are the carbon emissions elasticities for income and population? Bridging STIRPAT and EKC via robust heterogeneous panel estimates. Glob Environ Chang 31:62–73

Meadows D.H, Meadows D.L, Randers J, Behrens III W.W (1972) The Limits to growth: a report for the Club of Rome’s project on the predicament of mankind. Washington: Potomac Associates Books

Omri A, Nguyen DK (2014) On the determinants of renewable energy consumption: international evidence. Energy 72:554–560

Osabuohien ES, Efobi UR, Gitau CMW (2014) Beyond the environmental Kuznets curve in Africa: evidence from panel cointegration. J Environ Policy Plan 16(4):517–538

Ozcan B, Apergis N, Shahbaz M (2018) A revisit of the environmental Kuznets curve hypothesis for Turkey: new evidence from bootstrap rolling window causality. Environ Sci Pollut Res 25(32):32381–32394

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267

Panayotou T (1993) Empirical tests and policy analysis of environmental degradation at different stages of economic development. In: Working Paper WP238. Technology and Employment Programme, International Labour Office, Geneva

Pata UK (2018a) The influence of coal and noncarbohydrate energy consumption on CO2 emissions: revisiting the environmental Kuznets curve hypothesis for Turkey. Energy 160:1115–1123

Pata UK (2018b) Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: testing EKC hypothesis with structural breaks. J Clean Prod 187:770–779

Pedroni P (2000) Fully modified OLS for heterogeneous cointegrated panels. Adv Econ 15:93–130

Pedroni P (2001) Purchasing power parity tests in cointegrated panels. Rev Econ Stat 83:727–731

Pesaran MH, Yamagata T (2008) Testing slope homogenity in large panels. J Econ 142:50–98

Pesaran MH, Ullah A, Yamagata T (2008) A bias-adjusted LM test for error cross-section independence. Econ J 11:105–127

Salim RA, Rafiq S (2012) Why do some emerging economies proactively accelerate the adoption of renewable energy? Energy Econ 34:1051–1057

Sarkodie SA, Strezov V (2019) Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci Total Environ 646:862–871

Selden TM, Song D (1994) Environmental quality and development: is there a Kuznets curve for air pollution emissions? J Environ Econ Manag 27(2):147–162

Shahbaz M, Solarin SA, Sbia R, Bibi S (2015) Does energy intensity contribute to CO2 emissions? A trivariate analysis in selected African countries. Ecol Indic 50:215–224

Shahbaz M, Solarin SA, Ozturk I (2016) Environmental Kuznets curve hypothesis and the role of globalization in selected African countries. Ecol Indic 67:623–636

Smith LV, Leybourne S, Kim T-H, Newbold P (2004) More powerful panel data unit root tests with an application to mean reversion in real exchange rates. J Appl Econ 19:147–170

Socolow R (1991) Environment-respectful global development of the energy system. Perspectives in Energy, 1(1), 121–126.

Tamazian A, Rao BB (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ 32(1):137–145

Ulucak R, Bilgili F (2018) A reinvestigation of EKC model by ecological footprint measurement for high, middle and low income countries. J Clean Prod 188:144–157

Ulucak R, Yücel AG, Koçak E (2019) The process of sustainability: from past to present. In: Environmental Kuznets Curve (EKC). Academic, p 37-53

Wang KM (2012) Modelling the nonlinear relationship between CO2 emissions from oil and economic growth. Econ Model 29(5):1537–1547

World Commission on Environment and Development (1987) Our common future. Oxford University Press, Oxford; New York

Westerlund J (2008) Panel cointegration tests of the fisher effects. J Appl Econ 23:193–233

World Bank (2019) World development indicators. https://databank.worldbank.org/data/source/world-development-indicators. Data Accessed: 20.04.2019

WWF (2011) The energy report: 100% renewable energy by 2050. Technical Report. World Wide Fund for Nature. http://wwf.panda.org/energyreport

Zhu H, Duan L, Guo Y, Yu K (2016) The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: evidence from panel quantile regression. Econ Model 58:237–248

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Erdogan, S., Okumus, I. & Guzel, A.E. Revisiting the Environmental Kuznets Curve hypothesis in OECD countries: the role of renewable, non-renewable energy, and oil prices. Environ Sci Pollut Res 27, 23655–23663 (2020). https://doi.org/10.1007/s11356-020-08520-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-08520-x