Abstract

The countries in the Middle East and North Africa (MENA) region have the greatest potential for renewable energy consumption in the world and is likely to be the most vulnerable to the horrendous effects of climate change. Unfortunately, only a few of the countries have tapped into this potential, as non-renewable energy still dominates the total energy mix of these countries. This study explores the effect of renewable and non-renewable energy consumption on the environment in MENA countries from 1990 to 2016 by applying the Augmented Mean Group algorithm while accounting for urbanization, financial development, and economic growth. The panel result suggests that financial development, economic growth, and urbanization add to environmental degradation. Also, findings reveal that renewable energy does not contribute meaningfully to environmental quality, while non-renewable energy consumption significantly adds to environmental degradation. A uni-directional causality flows from urbanization, economic growth, and energy use to environmental degradation. One way to abate this damage is for countries in this region to embrace and promote the consumption of clean energy sources.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The challenges facing the world are hydra-headed. The two core challenges relate to environmental preservation and sustainable growth/development (Dogan et al. 2019). Of the two, matters relating to environmental preservation have captured the interest of the world’s economies in recent times due to an increase in global mean temperature which informed both the Kyoto Protocol of 1997 and the Paris Agreement of 2015. The importance of nature to man calls for the protection of the biodiversity (Nathaniel and Iheonu 2019). One sure way to protect the biodiversity is to reduce greenhouse gas emissions (GHGs), of which CO2 emissions are a major contributor to it (Bekun et al. 2019a). The desire to reduce global warming has necessitated the ubiquitous call for the adoption of renewable energy (Khan et al. 2020; Destek and Okumuş 2019; Alola et al. 2019a, b; Sarkodie 2018; Sarkodie and Adams 2018; Sarkodie and Strezov 2018) because they are clean (Nathaniel et al. 2019; Baloch et al. 2019b) and low in emissions (Nguyen and Kakinaka 2019).

The role and importance of energy consumption in growth, poverty eradication, and development of a country cannot be overemphasized as it affects every sector of the economy. This is because the energy sector is a major contributor to industrial and economic accomplishments, as well as, a pre-requisite for providing basic human needs. Energy is consumed in various forms and recently, its consumption has increased globally (BP 2017). This could, however, be traced to the rapid increase in economic growth and urbanization in various countries of the world (Wu et al. 2019; Ahmad et al. 2019). The global energy consumption is dominated by fossil-fuels (Sinha et al. 2017). These conventional energy sources are finite and polluting thereby damaging economic activities, human life, the environment (Hanif et al. 2019; Ali 2018), and ultimately contributing to climate change and global warming.

The link between environmental quality and energy consumption is well established in the literature. Kahia et al. (2019) opined that in recent times, the meager consumption of renewable energy (RE) is responsible for the changes in the climate. The ever increasing deterioration in environmental quality has constituted a challenge to the quality of life across the world. As a result of these environmental challenges, the need for safe and clean energy becomes imperative. Researchers and policymakers have recognized the benefits of shifting from non-RE consumption to RE consumption. RE resources are capable of regenerating themselves within a relatively short period of time. Examples include wind, tides, solar, hydropower, and geothermal energy (Nathaniel 2019).

The MENA region is made up of approximately 22 countries. The region is by no means a homogenous region, but despite the differences between countries, they still face some common challenges. These include a young population with a high rate of unemployment, weak research capabilities, increased demand for electricity, and limited investments in energy (Saidi et al. 2018). The region has been on the radar because it has the greatest potential for RE in the world and is likely to be the most vulnerable to climate change (Gorus and Aslan 2019; Saidi et al. 2018). As noted by Kahia et al. (2019), despite its enormous potentials, the region has greatly suffered from poor environmental quality due to the massive use of non-RE. One of the objectives of government and policymakers in this region has been to achieve sustainable development through sustainable energy. This is because energy, sustainable development, and the environment are highly interconnected. Achieving sustainable development entails utilizing environment-friendly energy sources and higher efficiency process leads to less resource utilization and pollution.

There is a dire need to investigate the role of RE and non-RE on the ecological footprint (EF), our proxy for environmental degradation, in this particular region because of its rich oil wealth which has the tendency of deteriorating the environment by adding significantly to climate change. Another importance of this study hinges on the fact that sustainable development is needed for all MENA countries (Alshehry and Belloumi 2017), and though the use of energy can add to economic and social development, it can also promote environmental degradation on a global scale. Environmental degradation, on the other hand, inhibits growth, through different avenues like reducing agricultural productivity, contributing to ill-health, and making government policies erratic.

This study is plausible in the following ways: (i) Previous studies that considered the MENA region used CO2 emissions to capture environmental degradation. We used EF for the same purpose. EF is a better proxy for environmental degradation since the negative effects of human activities are not limited to the atmosphere (Charfeddine 2017; Nathaniel et al. 2019; Bello et al. 2018). (ii) In order to avoid biased estimates and estimator inefficiency which could result from ignoring cross-sectional dependence (CD) among the countries, we used both first and second-generation unit root and cointegration tests, and estimation techniques that are robust for CD. (iii) We also used the Augmented Mean Group (AMG) estimation technique which accounts for CD and country-specific heterogeneity in order to avoid being trapped in the guise of overgeneralization that marred previous studies.

The remainder of the study takes the following formats. After examining the issues relating to energy, trade, and urbanization in MENA, “Literature review” presents the literature review. “Methodology and model specification” addresses the methodology. “Presentation and discussion of results” involves the presentation and discussion of results. “Conclusion and policy direction” concludes with policy directions.

Issues relating to energy, trade, and urbanization in MENA

MENA is a region with lots of natural gas and petroleum reserves (World Bank 2015). As of 2018, about half of the OPEC members were from the MENA region. The Oil and Gas Journal had earlier stated in 2009 that MENA has 60% and 45% of the global oil and natural gas reserves, respectively. This amounts to 810.98 billion barrels and 2,868,886 billion cubic feet of oil and natural gas reserves, respectively (USDOE 2011). Source: Adapted from Zhang et al. (2017).

However, as of 2016, the region's oil reserve had reduced to about 51% as shown in Fig. 1, while its natural gas reserve depleted to 41%. In Egypt, Yemen and Morocco, subsidies on fuel are more than thrice larger than government spending on health (World Bank 2012). In 2007 alone, Iran pumped in 56 × 1012 USD into fuel subsidy which happened to be the largest in the world (IEA 2008). Over the years, petroleum products have also been under-priced in the MENA region. The gasoline price gaps between the price of gasoline in Algeria, Qatar, Libya, Kuwait, Iran, Saudi Arabia, Egypt, Bahrain and Yemen and the average world price of gasoline were 77%, 89%, 97%, 87%, 58%, 95%, 62%, 90%, and 81% per liter in 2008 (World Bank 2012). Kahia et al. (2019) attributed these discrepancies, which has cumulated into inefficient resource allocation, to a large amount of subsidies pumped into the energy sector in these countries.

Cheap energy inhibits the use of clean technology, as well as, energy-efficient means of transportation (Janaun and Ellis 2010). This explains why the IEA (2010) posited that the removal of subsidy is germane for climate change mitigation in the MENA region. In 2011, six MENA countries (Qatar, Kuwait, Oman, UAE, Saudi Arabia, and Bahrain) were ranked among the top 20 emitters of CO2 per capita in the world (CDIAC 2011). Countries in this region depend heavily on oil and gas, and energy-intensive industrial projects that increase the utilization of hydrocarbons, which in turn impacts on the region’s carbon footprint (World Bank 2016). The heavy dependence on oil has made MENA countries vulnerable to shocks in global oil price. In 2016, for instance, the global oil price averaged 43 USD, and no single MENA country was able to fiscally break even. However, as the global oil price slightly increased in 2018 (to around 65 USD), countries like Qatar, UAE, Algeria, Kuwait, and Iran were able to break even. The remaining countries in the region require a higher oil price to be able to ease the tension on their current accounts.

As of 1990, the region’s share in global trade was 3.5%. It increased to 4.8% in 2017. Merchandise trade in the region was 75.9% in 2017, 48% for developing countries, and 60% for advanced countries. Saudi Arabia and UAE were the leading exporters in the region. In terms of import, UAE was the 18th largest importer globally, in the same year. All these re-emphasizes the region’s openness to trade (OECD 2018; International Trade Centre 2017). Service trade, in terms of the global total, increases from 2.59% in 2005 to 3.5% in 2017 (WTO 2018). However, for greater integration into the global value chain, the region has to improve its technology, competitive wage, and improve its production efficiency (IMF 2016). FDI inflows into the region were meagre between 2009 and 2010 mainly due to regional turbulences, the “Arab Spring,” and financial crisis. It worsens in 2015 due to the fall in the global oil price which impedes energy investments. As a result, region FDI inflows were only 1.3% in 2017 (Saidi and Prasad 2018). The MENA region is made up of economies that are resource-poor but labor-abundant, and resource-rich and labor-abundance, with each displaying its own idiosyncrasies (Saidi and Prasad 2018). As a result, the urbanization rate in the region has been unprecedented. About one hundred and seventy million (170 million) of the region’s estimated population of three hundred million (300 million) resides in the urban areas. According to the UN projections, the region’s population is expected to hit four hundred and thirty million by 2020, of which two hundred and eighty million will inhabit the urban areas. This suggests a 65% increase in urban population, with its negative antecedents.

Literature review

The desire to maintain a stable growth/development have made developing countries to derail from the pathways of being a low carbon society (Ali et al. 2019b). The connectivity between energy, environmental quality, and growth is very strong. The efficient management of these variables is germane for human wellbeing, sustainable development and viable policy direction (Temiz Dinç and Akdoğan 2019). For this reason, the literature is not shut of studies that have examined the interconnectivity of the aforementioned variables, and the possible effect of RE on environmental sustainability. Previous studies have proxy environmental quality with CO2 emissions (see Azizalrahman 2019; Gokmenoglu and Sadeghieh 2019; Bekun et al. 2019b; Saint Akadiri et al. 2019; Li et al. 2019; Sarkodie et al. 2019; Wang et al. 2019; Fan and Zhou 2019; Salahuddin et al. 2019; Saud et al. 2019; Cheng et al. 2019a, b; Chen et al. 2019a; Hanif et al. 2019; Ho and Iyke 2019; Destek and Okumuş 2019; Nkengfack and Fotio 2019; Alola 2019a, b; Salahuddin et al. 2018; Ali et al. 2017a, b; Chen et al. 2019b; Cheng et al. 2018), deforestation (Nathaniel and Bekun 2019; Maji et al. 2017; Faria and Almeida 2016), and most recently, EF (Alola et al. 2019b; Hassan et al. 2019).

Of recent, the use of CO2 emissions to proxy environmental quality has been criticized on the ground that, it is not all-encompassing since the individual effect on the environment is not considered. Therefore, attention has been shifted to EF as a better proxy. There are quite a handful of studies that have explored the effect of RE and non-RE on EF (see, for instance, Destek and Sarkodie 2019; Baloch et al. 2019a; Dogan et al. 2019; Ozcan et al. 2018; Bello et al. 2018; Destek et al. 2018). All these studies discovered that RE consumption reduces EF thereby promoting environmental quality. The above-listed studies further discovered non-RE add to environmental deterioration and therefore called for the promotion and usage of clean energy sources if sustainable development is to be achieved.

Saidi et al. (2018) explored the link between the quality of institutions, RE and economic growth in MENA countries. Findings showed that RE and all institutional measures increase growth, except bureaucracy. A similar result was discovered by Abdouli and Hammami (2017) who explored the link between non-RE and economic growth in 17 MENA countries from 1990 to 2012. Findings suggest that energy consumption is important in raising economic growth.

Charfeddine and Kahia et al. (2019) investigated the effect of RE consumption on CO2 emissions in the MENA region from 1980 to 2015 using the panel VAR technique. Findings showed that RE has little influence on CO2 emissions. Also, in the same region, Gorus and Aslan (2019) assessed the determinants of environmental degradation in MENA from 1980 to 2013. It was revealed that non-RE adds to environmental degradation. Jin and Kim (2018) investigated the determinants of CO2 emissions in 30 countries from 1990 to 2014. The study discovered that unlike RE, nuclear energy adds to CO2 emissions. Thus, the development of RE is essential to prevent global warming. de Souza et al. (2018) explored the impact of RE, non-RE consumption and income on the environment in five MERCOSUR countries Findings showed the importance of RE in mitigating CO2 emissions. The study also showed that non-RE is culpable for CO2 emissions. A similar result was discovered by Kahia et al. (2019) for MENA.

Hassine and Harrathi (2017) explored the causal link between RE consumption, trade and economic growth in the GCC countries from 1980 to 2012. They concluded that RE, exports and financial development can actually trigger economic growth. Sinha et al. (2017) investigated the energy-environment nexus in the N-11 countries. Evidence from the GMM technique showed that RE reduces economic growth while the opposite was true for non-RE. They attributed their findings to the cost of implementing RE systems, as the N-11 nations depend on non-RE sources. In line with other similar studies, but for the case of 12 selected Commonwealth States, Rasoulinezhad and Saboori (2018) provided evidence, from both the FMOLS and DOLS results, that RE reduces CO2 emissions. Financial development also exacted the same impact on CO2 emissions.

Other studies in support of the inverse relationship between CO2 emissions and financial development include (Katircioğlu and Taşpinar 2017; Shahbaz et al. 2012; Boutabba 2014; Shahbaz et al. 2013) while (Al-Mulali et al. 2015; Pao et al. 2011; Pao and Tsai 2011; Farhani and Ozturk 2015) discovered a positive relationship between both. Zafar et al. (2019) disaggregated energy into its two major sources and examined how each has driven growth in Asia countries. The Continuously Updated FMOLS technique revealed that RE, R&D, and trade add to growth, but the same was not true for non-RE consumption. Nathaniel and Iheonu (2019) did a similar study like that of Zafar et al. (2019), but for the case of Africa omitting the R&D variable. They discovered that RE has contributed minimally to CO2 abatement in Africa.

For a single country case, Riti and Shu (2016) explored the interconnectedness between RE and energy efficiency for eco-friendly environment. Findings affirmed that RE enhances environmental quality in Nigeria. Lau et al. (2018) applied the ARDL cointegration approach to probe the factors affecting RE consumption in Malaysia from 1980 to 2015. Findings revealed that in Malaysia, the main drivers of RE consumption are economic growth and FDI. For Turkey, the result turns out the same, as reported in the studies of Temiz Dinç and Akdoğan (2019) were interested in establishing the direction of causality between RE production, growth and total energy consumption for Turkey from 1980 to 2016. A feedback causality was discovered between RE and growth, while a one-way causality flow from non-RE consumption to economic growth. Meanwhile, Khoshnevis Yazdi and Ghorchi Beygi (2018) had earlier investigated the contributions of RE to CO2 emissions in Africa. Findings suggest that both trade and RE promote environmental quality by reducing CO2 emissions. Ali et al. (2019a) assessed the awareness of variant urban communities of Xiamen to RE and energy conservation. They discovered a significant correlation between household size, income, and energy use. Ali et al. (2018) investigated the valuation and validation of carbon sources for the Bangkok metropolitan area. They discovered that more than 60% of the metropolitan area has been taken up by the urban area.

Methodology and model specification

Method

The study proceeds with the summary statistics of the variables. This will expose the basic characteristics of the data that would be used for the empirical analysis. We use various econometric procedures including the test for CD. This test was examined using three different approaches. The null hypothesis of the CD test is shown in Eq. 1 as;

The study also examines the unit root properties of the variables in order to avoid spurious regression. We performed both the first-generation unit root tests (which assumed no CD) and the second-generation tests (that accounts for CD). The Levin et al. (2002) test is specified as

The difference of yit is ∆yit for all ith country for the time period t = 1…T. This test assumes heterogeneity such that

The Cross-sectional augmented IPS (CIPS) test initiated by Pesaran (2007) is employed. Following Pesaran (2007), the Cross-sectionally Augmented Dickey-Fuller (CADF) regression is stated as

The introduction of a one-period lag into Eq. 3 results in Eq. 4.

We can obtain the CADF statistics from both Eq. 3 and Eq. 4, but the CIPS statistic would be derived from the simple average of the former. We employed three cointegration techniques proposed by (Pedroni 1999, 2004; Maddala and Wu 1999; Westerlund 2007) to ascertain the cointegrating relationship among the variables. The first two tests assume no CD while the Westerlund (2007) deals with CD using robust critical values through bootstrapping. To explore the impact of RE and non-RE on EF, we employ the AMG algorithm of Bond and Eberhardt (2013). The AMG is capable of handling CD, and it is also very flexible even in the presence of non-stationary variable(s) (Destek and Sarkodie 2019; Baloch et al. 2019b). Since the issue of causality is necessary for drawing relevant policy recommendation(s), and since the AMG technique does not account for causality, the Dumitrescu and Hurlin (2012) test is used for this purpose. This test accommodates CD and heterogeneity which are one of the weaknesses of the VECM causality test.

The model for the test is presented in Eq. 5 as;

\( {\vartheta}_i^{(p)} \) and \( {\lambda}_i^{(p)} \) are the regression coefficient across countries and the autoregressive parameters, respectively. x and y are underlying variables for n cross-section in t time. The two hypotheses associated with the test are;

\( {H}_1:\Big\{{}_{\beta_i\ne 0}^{\beta_i=0} \) ∀i = 1,2...N and ∀i = N + 1, N + 2…N

Data and model specification

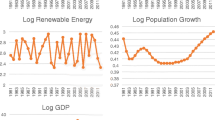

A set of annual data for thirteen (13) MENA countries are used in this study. The data extends from 1990 to 2016. The choice for the time period is consistent with the availability of data. All data were obtained from the World Development Indicator (WDI) (2019). However, data on EF was derived from the Global Footprint Network (2019). The econometric model for the study takes the form;

Here, EF is ecological footprint (global hectares per capita), RE is renewable energy (% of total energy consumption), non-RE is non-renewable energy (kg of oil equivalent), URB is urbanization (percentage of total population), GDP is GDP per capita (constant 2010 US$), FDV is financial development (% of GDP). The principal component analysis was used to create an index for FDV. The variables that were used to create this index include: domestic credit to the private sector, domestic credit to the private sector by banks, and foreign direct investments.

Presentation and discussion of results

This section proceeds with the features of some selected variables, in the selected MENA countries. Source: Author’s Computation from WDI (2019).

From Fig. 2, all the countries in the region consume more of non-RE than Sudan. However, the consumption of non-RE appears to be increasing gradually in Sudan, but relatively constant in the remaining countries. The UAE, Algeria, Bahrain, Iran, Jordan, and Yemen are among the top consumers of non-RE. Source: Author’s Computation from WDI (2019).

From Fig. 3, the top three urbanized countries are Bahrain, Lebanon, and the UAE. Urbanization is also increasing rapidly in Tunisia, Iran, Algeria, Jordan, and Oman. However, Yemen and Sudan are still less urbanized. Source: Author’s Computation from WDI (2019).

Figure 4 shows that few of the countries in the region are financially developed. These countries include: Lebanon, Jordan, Israel, Bahrain, Tunisia, and the UAE. Yemen and Sudan are among the least financially developed countries in the region. Source: Author’s Computation from WDI (2019).

From Fig. 5, the UAE, Israel, and Bahrain have the highest GDP in the region, while Sudan, Yemen, Egypt, and Morocco are the countries with low GDP. GDP has grown dramatically over the last few decades in Israel.

The EF accounts for how much water and land area is needed to produce all the goods consumed. Simply put, it denotes the bioproductive area required to sustain a population. Source: Author’s Computation from WDI (2019).

In this study, EF was used to proxy environmental degradation. As shown in Fig. 6, environmental degradation appears to be on the increase in almost all the countries over the last few decades. The situation is more devastating in Algeria, Egypt, Iran, and the UAE (Tables 1, 2, 3, and 4).

The correlation result reveals that non-RE and RE are positively associated with EF, while urbanization, GDP and financial development are negatively correlated with EF. GDP is positively correlated with urbanization. Non-RE and financial development are inversely associated with RE and positively associated with GDP. On the other hand, RE is negatively linked with both urbanization and GDP.

The Westerlund (2007) test is robust amidst CD. Therefore, from the results of the Westerlund (2007) test, there is a long-run relationship among the variables.

For a country-specific case, it was revealed that RE does not contribute meaningfully to environmental quality in Sudan, Tunisia, UAE, Oman, Morocco, Lebanon, Iran, Egypt, Bahrain, Algeria, and Yemen. This accounts for about 84% of the countries sampled for the study. The energy mix of the aforementioned countries is dominated by fossil fuels. This finding is in tandem with that of Nathaniel and Iheonu (2019) who used the same estimation technique (AMG) and discovered that RE has no significant impact on environmental quality in Morocco, Tunisia, Egypt, Sudan, and Algeria.

Though Morocco has invested heavily in RE by housing one of the world’s largest solar power plant in Noor-Ouarzazate, this investment is yet to yield any meaningful impact on the environment. In Algeria, fossil fuels contributed about 93% of the country’s total energy mix in 2010. This explains why RE still does not exact a meaning impact on the environment in Algeria. As a result, Algeria has set a target to generate 22,000 MW of power from RE sources between 2011 and 2030. The same for Bahrain that hopes to generate 5% of electricity from RE sources in 2030. Iran currently produces only 0.2% of its energy from RE sources compared to Israel and Jordan with 2.6% and 11%, respectively. We also discovered that energy consumption (non-RE) promotes environmental degradation in Oman, Yemen, Algeria, Iran, Tunisia and, the UAE, while economic growth is not environmentally friendly in Iran, Jordan, Lebanon, Oman, and the UAE. Urbanization also appeared to be a serious problem in the MENA region. It adds significantly to environmental degradation in about 56% of the countries sampled, with a more devastating impact in Oman.

One factor that has influenced urbanization in Oman is civilization dated back to about 5000 years ago by the autochthone population (Benkari 2017). The centralization of facilities, decision making, and services in the capitals have encouraged de-population in villages and small towns. Urbanization in Oman increased from 30% to 50% between 1970 and 1980. As of 2017, it was 80%. It is expected to hit 85% by 2040 (Benkari 2017). Urbanization in MENA should be treated with utmost urgency as about 280 million of the region’s population is expected to be urban in 2020 according to the UN projection.

Conclusion and policy direction

The study examined the role of non-RE and RE on the environment in MENA while accounting for urbanization and financial development from 1990 to 2016. The presence of CD informed the use of estimation techniques (like the AMG, and the Westerlund cointegration test) that are robust amidst CD. Findings revealed that RE does not contribute meaningfully to environmental quality in about 84% of the countries sampled. On the other hand, non-RE consumption contributes about 17% of environmental deterioration in the region. Urbanization, economic growth, and financial development contribute to environmental degradation in the region, though insignificantly, while non-RE, economic growth and urbanization drive EF. One way to abate this damage is for countries in this region to embrace and promote the consumption of clean energy sources like tide, wind, solar, and hydropower (Tables 6, 7, 8, 9, and 10).

Policymakers can also initiate and support policies that enhance investment in new technologies, especially technologies that are environmentally friendly. The region further needs substantial changes in order to achieve an eco-friendly environment. There is a need for each of the countries to set mandatory RE targets that are feasible. Though these targets have been set by some MENA countries, only a few are on track to achieving it. The creation of a RE agency that will promote RE development and improve the transparency of the system will also be of help (Charfeddine and Kahia 2019). The discrepancies between the gasoline prices in MENA and the average world price of gasoline are enormous. This could be attributed to the inefficient resource allocation, and a large amount of subsidies pumped into the energy sector in MENA countries. Since cheap energy discourages the use of clean technology, the gradual removal of subsidies will ensure the growth of renewables. Urbanization arises mainly from discrepancies in development factors like access to amenities, household income, and provision of infrastructures. Therefore, the provision of the needed amenities and infrastructures in the rural areas will go a long way in curbing the upward surge in urbanization and the anomaly associated with it.

References

Abdouli M, Hammami S (2017) Exploring links between FDI inflows, energy consumption, and economic growth: further evidence from MENA countries. J Econ Dev 42(1):95–117

Ahmad M, Zhao ZY, Li H (2019) Revealing stylized empirical interactions among construction sector, urbanization, energy consumption, economic growth and CO2 emissions in China. Sci Total Environ 657:1085–1098

Ali G (2018) Climate change and associated spatial heterogeneity of Pakistan: empirical evidence using multidisciplinary approach. Sci Total Environ 634:95–108

Ali G, Pumijumnong N, Cui S (2017a) Decarbonization action plans using hybrid modeling for a low-carbon society: the case of Bangkok metropolitan area. J Clean Prod 168:940–951

Ali S, Anwar S, Nasreen S (2017b) Renewable and non-renewable energy and its impact on environmental quality in south Asian countries. Forman J Econ Stud 13:177–194 https://www.researchgate.net/publication/317588274

Ali G, Pumijumnong N, Cui S (2018) Valuation and validation of carbon sources and sinks through land cover/use change analysis: the case of Bangkok metropolitan area. Land Use Policy 70:471–478

Ali G, Yan N, Hussain J, Xu L, Huang Y, Xu S, Cui S (2019a) Quantitative assessment of energy conservation and renewable energy awareness among variant urban communities of Xiamen, China. Renew Sust Energ Rev 109:230–238

Ali G, Abbas S, Pan Y, Chen Z, Hussain J, Sajjad M, Ashraf A (2019b) Urban environment dynamics and low carbon society: multi-criteria decision analysis modeling for policy makers. Sustain Cities Soc 51:101763

Al-Mulali U, Ozturk I, Lean HH (2015) The influence of economic growth, urbanization, trade openness, financial development, and renewable energy on pollution in Europe. Nat Hazards 79(1):621–644

Alola AA (2019a) The trilemma of trade, monetary and immigration policies in the United States: accounting for environmental sustainability. Sci Total Environ 658:260–267

Alola AA (2019b) Carbon emissions and the trilemma of trade policy, migration policy and health care in the US. Carbon Management 10:209–218 1–10

Alola AA, Yalçiner K, Alola UV, Saint Akadiri S (2019a) The role of renewable energy, immigration and real income in environmental sustainability target. Evidence from Europe largest states. Sci Total Environ 674:307–315

Alola AA, Bekun FV, Sarkodie SA (2019b) Dynamic impact of trade policy, economic growth, fertility rate, renewable and non-renewable energy consumption on ecological footprint in Europe. Sci Total Environ 685:702–709

Alshehry AS, Belloumi M (2017) Study of the environmental Kuznets curve for transport carbon dioxide emissions in Saudi Arabia. Renew Sust Energ Rev 75:1339–1347

Azizalrahman H (2019) A model for urban sector drivers of carbon emissions. Sustain Cities Soc 44:46–55

Baloch MA, Zhang J, Iqbal K, Iqbal Z (2019a) The effect of financial development on ecological footprint in BRI countries: evidence from panel data estimation. Environ Sci Pollut Res 26(6):6199–6208

Baloch MA, Mahmood N, Zhang JW (2019b) Effect of natural resources, renewable energy and economic development on CO2 emissions in BRICS countries. Sci Total Environ 678:632–638

Bekun FV, Alola AA, Sarkodie SA (2019a) Toward a sustainable environment: Nexus between CO2 emissions, resource rent, renewable and nonrenewable energy in 16-EU countries. Sci Total Environ 657:1023–1029

Bekun FV, Emir F, Sarkodie SA (2019b) Another look at the relationship between energy consumption, carbon dioxide emissions, and economic growth in South Africa. Sci Total Environ 655:759–765

Bello MO, Solarin SA, Yen YY (2018) The impact of electricity consumption on CO2 emission, carbon footprint, water footprint and ecological footprint: the role of hydropower in an emerging economy. J Environ Manag 219:218–230

Benkari N (2017) Urban development in Oman: an overview. WIT Trans Ecol Environ 226:143–156

Bond S, Eberhardt M (2013) Accounting for unobserved heterogeneity in panel time series models. Nuffield College, University of Oxford, mimeo

Boutabba MA (2014) The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model 40:33–41

BP (2017) BP statistical review of world energy 2017. Available at: http://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy/downloads.html

Carbon Dioxide Information Analysis Center (CDIAC) (2011) Ranking of the world’s countries by 2011 per capita fossil-fuel CO2 emission rates. Research Institute for Environment, Energy and Economics. http://cdiac.ornl.gov/trends/emis/top2011.cap . Accessed Jan 2018

Charfeddine L (2017) The impact of energy consumption and economic development on ecological footprint and CO2 emissions: evidence from a Markov switching equilibrium correction model. Energy Econ 65:355–374

Charfeddine L, Kahia M (2019) Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: a panel vector autoregressive (PVAR) analysis. Renew Energy 139:198–213

Chen Y, Wang Z, Zhong Z (2019a) CO2 emissions, economic growth, renewable and non-renewable energy production and foreign trade in China. Renew Energy 131:208–216

Chen Y, Zhao J, Lai Z, Wang Z, Xia H (2019b) Exploring the effects of economic growth, and renewable and non-renewable energy consumption on China’s CO2 emissions: evidence from a regional panel analysis. Renew Energy 140:341–353

Cheng C, Ren X, Wang Z, Shi Y (2018) The impacts of non-fossil energy, economic growth, energy consumption, and oil price on carbon intensity: evidence from a panel quantile regression analysis of EU 28. Sustainability 10(11):4067

Cheng C, Ren X, Wang Z, Yan C (2019a) Heterogeneous impacts of renewable energy and environmental patents on CO2 emission-evidence from the BRIICS. Sci Total Environ

Cheng C, Ren X, Wang Z (2019b) The impact of renewable energy and innovation on carbon emission: an empirical analysis for OECD countries. Energy Procedia 158:3506–3512

de Souza ES, de Souza Freire F, Pires J (2018) Determinants of CO2 emissions in the MERCOSUR: the role of economic growth, and renewable and non-renewable energy. Environ Sci Pollut Res 25(21):20769–20781

Destek MA, Okumuş İ (2019) Biomass energy consumption, economic growth and CO2 emission in G-20 countries. J Soc Sci Mus Alparslan Univ 7(1):347–353

Destek MA, Sarkodie SA (2019) Investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Sci Total Environ 650:2483–2489

Destek MA, Ulucak R, Dogan E (2018) Analyzing the environmental Kuznets curve for the EU countries: the role of ecological footprint. Environ Sci Pollut Res 25(29):29387–29396

Dogan E, Taspinar N, Gokmenoglu KK (2019) Determinants of ecological footprint in MINT countries. Energy Environ 0958305X19834279

Dong K, Hochman G, Zhang Y, Sun R, Li H, Liao H (2018) CO2 emissions, economic and population growth, and renewable energy: empirical evidence across regions. Energy Econ 75:180–192

Dumitrescu EI, Hurlin C (2012) Testing for granger non-causality in heterogeneous panels. Econ Model 29(4):1450–1460

Fan JS, Zhou L (2019) Impact of urbanization and real estate investment on carbon emissions: evidence from China’s provincial regions. J Clean Prod 209:309–323

Farhani S, Ozturk I (2015) Causal relationship between CO2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environ Sci Pollut Res 22(20):15663–15676

Faria WR, Almeida AN (2016) Relationship between openness to trade and deforestation: empirical evidence from the Brazilian Amazon. Ecol Econ 121:85–97

Feron P, Cousins A, Jiang K, Zhai R, Thiruvenkatachari R, Burnard K (2019) Towards zero emissions from fossil fuel power stations. Int J Greenhouse Gas Control 87:188–202

Global Footprint Network (2019) Global Footprint Network. https://www.footprintnetwork.org/our-work/ecological-footprint/(2019), Accessed 1st May 2019

Gokmenoglu KK, Sadeghieh M (2019) Financial development, CO2 emissions, fossil fuel consumption and economic growth: the case of Turkey. Strateg Plan Energy Environ 38(4):7–28

Gorus MS, Aslan M (2019) Impacts of economic indicators on environmental degradation: evidence from MENA countries. Renew Sust Energ Rev 103:259–268

Hanif I, Raza SMF, Gago-de-Santos P, Abbas Q (2019) Fossil fuels, foreign direct investment, and economic growth have triggered CO2 emissions in emerging Asian economies: some empirical evidence. Energy 171:493–501

Hassan ST, Xia E, Khan NH, Shah SMA (2019) Economic growth, natural resources, and ecological footprints: evidence from Pakistan. Environ Sci Pollut Res 26(3):2929–2938

Hassine MB, Harrathi N (2017) The causal links between economic growth, renewable energy, financial development and foreign trade in gulf cooperation council countries. Int J Energy Econ Policy 7(2):76–85

Ho SY, Iyke BN (2019) Trade openness and carbon emissions: evidence from central and eastern European countries. Rev Econ 70(1):41–67

IEA (Internatianal Energy Agency) (2008) World energy outlook 2008rjr (IEA). OECD, Paris

IEA (International Energy Agency) (2010) World energy outlook 2010. OECD/IEA, Paris

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econ 115(1):53–74

IMF (2016) “Economic diversification in oil-exporting Arab countries”, report prepared for the Annual Meeting of Arab Ministers of Finance, Apr. https://www.imf.org/external/np/pp/eng/2016/042916.pdf

International Trade Centre (2017) What did the Middle East and North Africa trade in 2017?. http://www.intracen.org/news/What-did-the-Middle-East-and-North-Africa-trade-in-2017/

Janaun J, Ellis N (2010) Perspectives on biodiesel as a sustainable fuel. Renew Sust Energ Rev 14(4):1312–1320

Jin T, Kim J (2018) What is better for mitigating carbon emissions–renewable energy or nuclear energy? A panel data analysis. Renew Sust Energ Rev 91:464–471

Kahia M, Jebli MB, Belloumi M (2019) Analysis of the impact of renewable energy consumption and economic growth on carbon dioxide emissions in 12 MENA countries. Clean Techn Environ Policy 21(4):871–885

Katircioğlu ST, Taşpinar N (2017) Testing the moderating role of financial development in an environmental Kuznets curve: empirical evidence from Turkey. Renew Sust Energ Rev 68:572–586

Khan SAR, Zhang Y, Nathaniel S (2020) Green supply chain performance and environmental sustainability: a panel study. LogForum 16(1):141–159

Khoshnevis Yazdi S, Ghorchi Beygi E (2018) The dynamic impact of renewable energy consumption and financial development on CO2 emissions: for selected African countries. Energy Sources Part B: Economics Planning, and Policy 13(1):13–20

Lau LS, Yii KJ, Lee CY, Chong YL, Lee EH (2018) Investigating the determinants of renewable energy consumption in Malaysia: an ARDL approach. Int J Bus Soc 19(3):886–903

Levin A, Lin CF, Chu CSJ (2002) Unit root tests in panel data: asymptotic and finite sample properties. J Econ 108(1):1–24

Li S, Zhou C, Wang S (2019) Does modernization affect carbon dioxide emissions? A panel data analysis. Sci Total Environ 663:426–435

Maddala GS, Wu S (1999) A comparative study of unit root tests with panel data and a new simple test. Oxf Bull Econ Stat 61(S1):631–652

Maji IK, Abdul-Rahim AS, Ndawayo AB, Ofozor CA, Basiru HA, Bin Mubarak SM (2017) The relationship between income, energy consumption, population and deforestation for environmental quality in Nigeria. Int J Green Econ 11(3/4):204–216

Nathaniel SP (2019) Modelling urbanization, trade flow, economic growth and energy consumption with regards to the environment in Nigeria. GeoJournal, 1–15

Nathaniel SP, Bekun FV (2019) Environmental management amidst energy use, urbanization, trade openness, and deforestation: the Nigerian experience. J Public Affairs

Nathaniel SP, Iheonu CI (2019) Carbon dioxide abatement in Africa: the role of renewable and non-renewable energy consumption. Sci Total Environ 679:337–345

Nathaniel S, Nwodo O, Adediran A, Sharma G, Shah M, Adeleye N (2019) Ecological footprint, urbanization, and energy consumption in South Africa: including the excluded. Environ Sci Pollut Res:1–12

Nguyen KH, Kakinaka M (2019) Renewable energy consumption, carbon emissions, and development stages: some evidence from panel cointegration analysis. Renew Energy 132:1049–1057

Nkengfack H, Fotio HK (2019) Energy consumption, economic growth and carbon emissions: evidence from the top three emitters in Africa. Mod Econ 10:52–71

OECD (2018) Trade facilitation and the global economy. https://doi.org/10.1787/9789264277571-en

Ozcan B, Apergis N, Shahbaz M (2018) A revisit of the environmental Kuznets curve hypothesis for Turkey: new evidence from bootstrap rolling window causality. Environ Sci Pollut Res 25(32):32381–32394

Pao HT, Tsai CM (2011) Multivariate granger causality between CO2 emissions, energy consumption, FDI (foreign direct investment) and GDP (gross domestic product): evidence from a panel of BRIC (Brazil, Russian Federation, India, and China) countries. Energy 36(1):685–693

Pao HT, Yu HC, Yang YH (2011) Modeling the CO2 emissions, energy use, and economic growth in Russia. Energy 36(8):5094–5100

Pedroni P (1999) Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf Bull Econ Stat 61(S1):653–670

Pedroni P (2004) Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econometric theory 20(3):597–625

Pesaran M (2004) General diagnostic tests for cross section dependence in panels (no. 1240). Institute for the Study of labor (IZA)

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22(2):265–312

Rasoulinezhad E, Saboori B (2018) Panel estimation for renewable and non-renewable energy consumption, economic growth, CO2 emissions, the composite trade intensity, and financial openness of the commonwealth of independent states. Environ Sci Pollut Res 25(18):17354–17370

Riti JS, Shu Y (2016) Renewable energy, energy efficiency, and eco-friendly environment (R-E5) in Nigeria. Energy Sustain Soc 1(6):1–16

Saidi N, Prasad A (2018) Trends in trade and investment policies in the MENA region

Saidi H, El Montasser G, Ajmi N (2018) Renewable energy, quality of Institutions and Economic growth in MENA countries: a panel cointegration approach, Munich Personal RePEc Archive, 84055

Saint Akadiri S, Alkawfi MM, Uğural S, Akadiri AC (2019) Towards achieving environmental sustainability target in Italy. The role of energy, real income and globalization. Sci Total Environ 671:1293–1301

Salahuddin M, Alam K, Ozturk I, Sohag K (2018) The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew Sust Energ Rev 81:2002–2010

Salahuddin M, Ali MI, Vink N, Gow J (2019) The effects of urbanization and globalization on CO2 emissions: evidence from the sub-Saharan Africa (SSA) countries. Environ Sci Pollut Res 26(3):2699–2709

Sarkodie SA (2018) The invisible hand and EKC hypothesis: what are the drivers of environmental degradation and pollution in Africa? Environ Sci Pollut Res 25(22):21993–22022

Sarkodie SA, Adams S (2018) Renewable energy, nuclear energy, and environmental pollution: accounting for political institutional quality in South Africa. Sci Total Environ 643:1590–1601

Sarkodie SA, Strezov V (2018) Assessment of contribution of Australia's energy production to CO2 emissions and environmental degradation using statistical dynamic approach. Sci Total Environ 639:888–899

Sarkodie SA, Strezov V, Weldekidan H, Asamoah EF, Owusu PA, Doyi INY (2019) Environmental sustainability assessment using dynamic autoregressive-distributed lag simulations—Nexus between greenhouse gas emissions, biomass energy, food and economic growth. Sci Total Environ

Saud S, Chen S, Haseeb A (2019) Impact of financial development and economic growth on environmental quality: an empirical analysis from belt and road initiative (BRI) countries. Environ Sci Pollut Res 26(3):2253–2269

Shahbaz M, Mutascu M, Tiwari AK (2012) Revisiting the relationship between electricity consumption, capital and economic growth: cointegration and causality analysis in Romania. Rom J Econ Forecast 3:97–120

Shahbaz M, Hye QMA, Tiwari AK, Leitão NC (2013) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sust Energ Rev 25:109–121

Sinha A, Shahbaz M, Balsalobre D (2017) Exploring the relationship between energy usage segregation and environmental degradation in N-11 countries. J Clean Prod 168:1217–1229

Temiz Dinç D, Akdoğan EC (2019) Renewable energy production, energy consumption and sustainable economic growth in Turkey: a VECM approach. Sustainability 11(5):1273

United States Department of Energy (2011) International reserves. Archived from the original on 2011-05-13. Retrieved 2011-05-13

Wang J, Dong K (2019) What drives environmental degradation? Evidence from 14 sub-Saharan African countries. Sci Total Environ 656:165–173

Wang S, Wang J, Li S, Fang C, Feng K (2019) Socioeconomic driving forces and scenario simulation of CO2 emissions for a fast-developing region in China. J Clean Prod 216:217–229

Waterbury J (2017) Water and water supply in the MENA: less of the same. Water Energy Food Sustain Middle East, 57

Westerlund J (2007) Testing for error correction in panel data. Oxf Bull Econ Stat 69(6):709–748

World Bank (2012) Word development indicators online database. World Bank, Washington

World Bank (2015) The Middle East and North Africa. http://www.worldbank.org/en/region/mena

World Bank (2016) World Bank Annual Report. http://worldbank.org/annualreport

World Development Indicator (WDI) (2019) World Bank Development Indicators database (online) available at https://data.worldbank.org/ Accessed date 24.10.2019

WTO (2018) World Trade Report 2018, “The future of world trade: how digital technologies are transforming global commerce.” https://www.wto.org/english/res_e/publications_trade_report18_e.pdf

Wu Y, Shen L, Zhang Y, Shuai C, Yan H, Lou Y, Ye G (2019) A new panel for analyzing the impact factors on carbon emission: a regional perspective in China. Ecol Indic 97:260–268

Zafar MW, Shahbaz M, Hou F, Sinha A (2019) From nonrenewable to renewable energy and its impact on economic growth: the role of research & development expenditures in Asia-Pacific economic cooperation countries. J Clean Prod 212:1166–1178

Zhang XP, Mingyu OU, Yanmin SONG, Xiaolu LI (2017) Review of Middle East energy interconnection development. J Modern Power Syst Clean Energy 5(6):917–935

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Eyup Dogan

List of countries

Sudan, Tunisia, UAE, Oman, Morocco, Lebanon, Iran, Egypt, Bahrain, Algeria, Yemen, Jordan, and Israel.

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Nathaniel, S., Anyanwu, O. & Shah, M. Renewable energy, urbanization, and ecological footprint in the Middle East and North Africa region. Environ Sci Pollut Res 27, 14601–14613 (2020). https://doi.org/10.1007/s11356-020-08017-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-08017-7