Abstract

This paper examines the effects of energy consumption, economic growth, and financial development on carbon emissions in a panel of 122 countries. We employ both first-generation and second-generation cointegration and estimation procedures in order to address diverse economic and econometric issues such as heterogeneity, endogeneity, and cross-sectional dependence. We find a cointegration relationship between the variables. Energy consumption, economic growth, and financial development have detrimental effects on carbon emissions in the full sample. When the sample is split into different income groups, we reveal that economic growth and financial development mitigate carbon emissions in high-income group but have the opposite effects in low-income and middle-income groups. The implication of the findings is that energy consumption increases carbon emissions. While high levels of income and financial development decrease carbon emissions, low levels of income and financial development intensify it. Based on the findings, the paper makes some policy recommendations.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

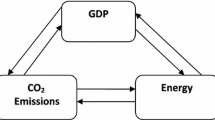

An insight into the relationship among carbon dioxide (CO2) emissions, energy consumption, economic growth, and financial development is fundamental for policy making in developed and developing countries. This is because policies that increase economic growth could raise energy consumption, and ultimately aggravate CO2 emissions. Similarly, the promotion of financial development has the capacity to spur economic growth, which in turn increases energy consumption and CO2 emissions. Therefore, the global increase in CO2 emissions has remained a grave concern to policy-makers especially due to the problems of climate change. For instance, global CO2 emissions increased from 4.19 metric tons per capita in 1990 to 4.97 metric tons per capita in 2014. This could be due to the increase in global energy consumption from 1660.93 kg of oil equivalent per capita in 1990 to 1919.38 kg of oil equivalent per capita in 2014. During this period, global real GDP per capita and financial development have also increased from USD7164.75 and 99.60% in 1990 to USD10,121.93 and 122.95% in 2014, respectively.Footnote 1

However, there is a wide variation in the level and growth rates of these variables among different income groups during the period. In 1990 for instance, CO2 emissions were 0.27, 0.99, 3.46, and 11.46 metric tons per capita in low-income, lower-middle-income, upper-middle-income, and high-income countries, respectively, compared to 0.25, 1.47, 6.59, and 10.98 metric tons per capita in 2014. This indicates that CO2 emissions experienced slight decline in low-income and high-income groups (but its level remains very high in the latter), while the middle-income groups recorded significant increase during the period. Furthermore, the corresponding energy consumption in 1990 were 371.51, 554.76, 1373.07, and 4595.39 kg of oil equivalent per capita compared to 395.86, 647.12, 2192.10, and 4756.23 kg of oil equivalent per capita in 2014 in low-income, lower-middle-income, upper-middle-income, and high-income groups.Footnote 2 It is obvious though that all the income groups experienced increase in energy consumption during the period, but the middle-income groups have the highest growth rate while the high-income group has the lowest growth rate.

Moreover, the levels of real GDP per capita in 1990 were USD460.47, USD964.84, USD3197.79, and USD29,426.42 compared to USD579.06, USD1965.71, USD7575.90, and USD41,016.44 in 2014 in low-income, lower-middle-income, upper-middle-income, and high-income groups, respectively. The corresponding financial development in 1990 were 14.11%, 26.47%, 44.85%, and 108.98% compared to 17.84%, 41.33%, 98.29%, and 143.50% in 2014 in low-income, lower-middle-income, upper-middle-income, and high-income groups.Footnote 3 Again, the middle-income groups experienced the highest growth rates in both real GDP per capita and financial development while the low-income group had the lowest. The wide variations in the levels and growth rates of CO2 emissions, energy consumption, real GDP per capita, and financial development among the different income groups could produce different relationships between the variables across the income groups.

Although the nexus between CO2 emissions and energy consumption has attracted the attention of scholars in the past three decades, there is no general consensus among the researchers. A strand of literature posited that energy consumption has detrimental effect on CO2 emissions (e.g., Alkhathlan and Javid 2013; Arouri et al. 2012; Mirza and Kanwal 2017; Omri 2013). They documented a positive impact of energy consumption on CO2 emissions, suggesting that CO2 emissions increase with a rise in energy consumption. Besides, a higher level of economic development can be achieved with higher level of energy consumption which in turn exacerbates CO2 emissions. Nonetheless, a greater level of energy consumption may not aggravate CO2 emissions if the fraction of clean and renewable energy in the energy mixture is large (see Hossain 2011).

Another strand of literature contended that CO2 emissions and economic growth have association. They posited that CO2 emissions rise as the country experiences economic growth at early stages of economic development but decline after a certain threshold level of economic growth is attained (see Apergis and Payne 2010; Arouri et al. 2012; Chen et al. 2016; Lean and Smyth 2010). However, Narayan and Narayan (2010) showed that CO2 emissions decline with a rise in economic growth in 15 countries, but the impact is heterogeneous in 28 countries. Similarly, Ozcan (2013) also found little support that CO2 emissions decline with a rise in real GDP per capita, but Zhang and Cheng (2009) provided empirical evidence to show that an increase in economic growthFootnote 4 has the capacity to increase energy consumption and ultimately aggravates CO2 emissions.

Theoretical literature posited that financial development could intensify or mitigate CO2 emissions. The environmental effect of financial development stems from the fact that expansion in financial services, products, intermediaries, and institutions could engender higher energy demand, thereby increasing energy consumption which ultimately aggravates CO2 emissions. Katircioglu and Taşpinar (2017) noted that as the financial sector develops, it will start to rely on energy which could intensify CO2 emissions. Farhani and Solarin (2017) also noted that financial development stimulates energy use in the short run albeit it could reduce it in the long run. Besides, financial development causes higher economic activity (via credit expansion and investments) which in turn increases energy consumption (Shahbaz and Lean 2013). An efficient financial system may offer a conducive atmosphere for consumers to acquire greater loans that allow them to increase their demands for items that produce CO2 emissions (e.g., automobiles, refrigerators, air conditioners, washing machines, etc.), thereby aggravating CO2 emissions (Jalil and Feridun 2011). Moreover, Salahuddin et al. (2015) noted that an economy that has a well-developed financial system tends to attract greater investment, and thus enhances greater industrialization which engenders higher energy consumption, and ultimately leads to greater CO2 emissions.

Conversely, financial development could mitigate CO2 emissions if it encourages investment in environmental projects, and empowers firms to adopt and use advanced, energy-saving, and cleaner technologies or renewable energy projects which are environmentally friendly. It could boost the funding of environmental projects at reduced costs and increases foreign direct investment which in turn stimulates technological improvement and accentuates greater level of research and development that engender high environmental quality (see Tamazian et al. 2009). A well-developed and functioning financial system provides the mechanism for carbon trading which offers incentives for the mitigation of CO2 emissions (Claessens and Feijen 2007). A more developed and sound financial system also helps economies to enforce environment-friendly regulations as well as influences firms and households’ economic activities thereby lessening CO2 emissions (Omri et al. 2015; Yuxiang and Chen 2010).

Empirically, Farhani and Ozturk (2015) showed that financial development has a harmful effect on CO2 emissions, implying that financial development takes place at the expense of environmental degradation in Tunisia. Although this viewpoint is consistent with some empirical studies (e.g., Al-mulali and Sab 2012b; Boutabba 2014; Yuxiang and Chen 2010), Ozturk and Acaravci (2013) reported that financial development has no significant long-run effect on CO2 emissions in Turkey. Conversely, Salahuddin et al. (2015) documented that financial development reduces CO2 emissions in GCC countries, and similar findings have been reported by Jalil and Feridun (2011) in China, Shahbaz et al. (2013c) for Malaysia, Al-Mulali et al. (2016a) for Kenya, and Tamazian et al. (2009) in BRIC countries. Moreover, Al-mulali et al. (2016b) showed that financial development has a mitigating effect on CO2 emissions in Western Europe, but it aggravates CO2 emissions in Central and Eastern Europe, East Asia and the Pacific, South Asia, and sub-Sahara Africa. However, the effect is insignificant in America and Middle East and North Africa.

Thus, the differences in the empirical outcomes in some previous studies on the impact of energy consumption, economic growth, and financial development on CO2 emissions could be attributed to failure to account for differences in the level of income among the countries. It could also be due to differences in the methodologies employed as well as the inability to account for some economic and econometric issues such as heterogeneity, endogeneity, and cross-sectional dependence.

The specific objective of this study is to examine the impact of energy consumption, economic growth, and financial development on CO2 emissions in a panel of 122 countries. First, the study examines the impact of these variables on CO2 emissions in the full panel of 122 countries regardless of their income group. Second, the study categorizes the countries into four income groups based on World Bank (2017) classification of countries according to their income levels, namely, low income ($1005 and below), lower middle income ($1006–$3955), upper middle income ($3956–$12,235), and high income ($12,236 and above). The classification enables us to determine whether the empirical outcomes differ among the various income groups.

This study differs from previous studies because it represents the first attempt to examine the impact of economic growth, energy consumption, and financial development on carbon emissions from a global perspective comprising a global panel of 122 countries. This is important because CO2 emission is a global pollutant whose impact is uncertain, spatially and temporarily diverse. The growing CO2 emissions and its concentration engender global warming which is deleterious to the global economy. This issue is accorded greater attention due to the potential dangers of such emissions on climate change and global warming which can disrupt the functioning of the ecosystems that may undermine the requisite conditions for human welfare. Hence, it may be necessary to analyze the causes of carbon emissions from a global perspective rather than individual-specific country or a small group of countries.

Second, many previous studies (e.g., Alkhathlan and Javid 2013; Esso and Keho 2016; Mirza and Kanwal 2017) have examined the relationship between CO2 emissions, energy consumption, and economic growth without incorporating financial development in a single framework. Even those studies that have attempted it focused on time series data of individual-specific countries, namely, Jalil and Feridun (2011) for China, Katircioglu and Taşpinar (2017) for Turkey, Shahbaz et al. (2013c) for Malaysia, Shahbaz et al. (2013a) for Indonesia. Some studies have also used panel data of a group of countries such as Hafeez et al. (2018) for Belt and Road Initiative countries; Salahuddin et al. (2015) for Gulf Cooperation Council countries; Al-mulali and Sab (2012a) for sub-Saharan African countries; and Al-mulali and Sab (2012a) for 19 selected countries. However, none of these panel data studies has considered differences in the income level of the countries. We fill this gap by categorizing the global panel into four panels, with each panel having countries of similar income level. This approach enables us to juxtapose the results of the global panel with those of the different income groups. This is important because some studies have argued that the pooling of countries with different income levels into the same panel could lead to inappropriate estimation of the determinants of CO2 emissions (Sirag et al. 2018).

Besides, the incorporation of financial development into the model provides useful insights and findings for policy-makers on how financial development is related to CO2 emissions in different income groups. Therefore, these countries will be provided with policy options that suit their levels of income. Finally, unlike previous studies, this study controls for diverse economic and econometric issues (e.g., heterogeneity, endogeneity, cross-sectional dependence, etc.) using diverse empirical strategies, thereby producing reliable and robust results for policy formulations.

In doing the analysis, this study employs both the first- and second-generation panel unit root tests, cointegration tests, and estimation techniques in order to address diverse economic and econometric issues such as integration, cointegration, heterogeneity, endogeneity, and cross-sectional dependence. Besides the conventional cointegration and estimation procedures, we also employ the panel cointegration tests developed by Westerlund (2007), the common correlated effect (CCE) estimation procedure developed by Pesaran (2006), and the dynamic CCE estimator proposed by Chidik and Pesaran (2015). These diverse procedures enable us to examine the effects of the three variables on CO2 emissions within static and dynamic specifications with a view to obtaining robust outcomes.

Interestingly, the paper finds that energy consumption, economic growth, and financial development have positive impact on CO2 emissions in the full sample of countries regardless of income groups. But when the countries were split into various income groups, it shows that high levels of income and financial development reduce CO2 emissions while low levels of income and financial development intensify it. This paper shows that energy consumption has taken place at the expense of CO2 emissions in all the income groups. Hence, the adoption of energy consumption policies that do not exacerbate CO2 emissions should be a fundamental agenda in the development policies of countries. Moreover, low-income countries should develop their financial system with a view to reducing CO2 emissions.

Apart from this introduction, the paper is divided into three sections. “Methodology and data” section presents the methodology and data. “Empirical results” section contains the empirical results, while “Discussion and policy implications” section concludes the study with some policy recommendations.

Methodology and data

Empirical techniques

This study employs the following baseline model to determine the impact of energy consumption, economic growth, and financial development on CO2 emissions in panel data analysisFootnote 5 (see Bekhet et al. 2017; Salahuddin et al. 2015):

where CO2 = carbon dioxide emissions (in metric ton per capita); ENC = energy consumption (in kg of oil equivalent per capita); GDP = real GDP per capita (at constant price 2010 = US$100); FDE = financial development (proxy by domestic credit to private sector as a ratio of GDP),Footnote 6 and ε = error term. All the variables are transformed into natural logarithm before analysis.

The estimation techniques used in this study are as follows: first, the study examines the order of integration of the variables in the model using panel unit root tests developed by Breitung (2000), Levin et al. (2002), and Im et al. (2003). The use of these multiple tests enables us to account for individuals and common unit root processes as well as small sample size. However, these traditional panel unit root tests (Breitung, LLC and IPS) assume cross-sectional independence. To account for cross-sectional dependence, we employ Pesaran (2007) panel unit root test.

Second, the study determines the cointegration relationship of the variables using the cointegration tests developed by Pedroni (1999), Kao (1999), and Westerlund (2007). The Kao test imposes homogeneous cointegrating vectors and coefficients, while the Pedroni cointegration test enables us to account for country size and heterogeneity which permit multiple regressors of the cointegration vector to vary across various panel sections. We employ the four error-correction-based panel cointegration tests developed by Westerlund (2007) which accommodates unit-specific short-run dynamics, unit-specific trend, slope parameters, and cross-sectional dependence. It seeks to test the null hypothesis of no cointegration by determining whether the error-correction term in a conditional panel error correction model is equal to zero. Two of the tests (i.e., panel tests) are made to test the alternative hypothesis that the whole panel is cointegrated, whereas the other two tests (i.e., group tests) are designed to test the alternative hypothesis that at least one unit is cointegrated (see Persyn and Westerlund 2008).Footnote 7

Third, the study estimates the impact of energy consumption, economic growth, and financial development on CO2 emissions using estimators that are appropriate for cointegrated panels, namely, dynamic ordinary least squares (DOLS) proposed by Stock and Watson (1993) and fully modified ordinary least squares (FMOLS) developed by Pedroni (2000). The DOLS is applied because the conventional OLS is inappropriate for cointegrated panels because it will produce spurious results. Hence, DOLS is considered to provide better results for panels that have cointegration relationships, albeit is does not account for cross sectional heterogeneity. The Stock–Watson DOLS model employed in this study is specified as follows:

where α = cointegrating vectors (long-run cumulative multipliers) and l, m, n = the lengths of the lags and leads of the regressors.

The study also uses FMOLS to estimate the long-run parameters because it accounts for cross-sectional heterogeneity (heterogeneous long-run coefficients), serial correlation, and endogeneity problems. FMOLS estimator also provides consistent estimates even in small sample (see Pedroni 2000; Salahuddin et al. 2015). The panel FMOLS estimator employed to estimate the coefficients of the variables is given as follows:

where \( {\varepsilon}_{it}^{\ast }={\varepsilon}_{it}-\frac{{\hat{L}}_{21i}}{{\hat{L}}_{22i}}\Delta {x}_{it} \); \( \hat{\gamma_i}={\hat{\Gamma}}_{21i}+{\hat{\Omega}}_{22i}^o-\frac{{\hat{L}}_{21i}}{{\hat{L}}_{22i}}\left({\hat{\Gamma}}_{22i}+{\hat{\Omega}}_{22i}^o\right) \)

x = the independent variables (such as energy consumption, real GDP per capita and financial development) and \( \overline{x} \) = the individual specific means. And the t-statistic is computed using the following:

To complement the static (model) specifications, we employ the dynamic panel generalized method of moments (GMM) estimator developed by Arellano and Bond (1991) to estimate the impact of energy consumption, economic growth, and financial development on CO2 emissions in a dynamic framework. We use this estimation procedure since it can control for country-specific effect, endogeneity,Footnote 8 and autocorrelation because the addition of the lagged dependent variable in the model causes autocorrelation concerns. The GMM estimation procedure uses the difference equation as instruments in estimating the parameters. We verify the consistency of the GMM estimator with the Sargan test of overidentifying restriction (used to test the joint validity of the instruments) and the Arellano and Bond test for autocorrelation (used to test for the presence of first-order and second-order serial correlation). The dynamic model is given as follows:

Furthermore, Pesaran (2006) posited that parameter estimates could be considerably bias, and their sizes distorted if cross-sectional dependence is overlooked. Consequently, we employ the common correlated coefficient (CCE) estimation procedure proposed by Pesaran (2006) and the dynamic common correlated coefficient (DCCE) estimator developed by Chidik and Pesaran (2015) which are capable of addressing cross-sectional dependence in the estimation. The CCE estimator can consistently estimate the parameters of a model with unobserved common factor and a heterogeneous factor loading. The heterogeneous coefficients are randomly distributed around a common mean with unobserved common factor and a heterogeneous factor loading. The CCE estimation procedure can also account for unobserved dependencies between countries in the panel. This is necessary since most economic models require heterogeneous coefficients, while most panel data are cross-sectionally dependent. According to Pesaran (2006), the model can be consistently estimated by approximating the unobserved common factor with cross-sectional means of the dependent and independent variables under strict exogeneity. The CCE estimated equation is given as follows:

where yi, t represents the dependent variable (CO2i, t) and xi, t represents the regressors (ENCi, t, GDPi, t, FDEi, t). The coefficients δi and ηi represent the elasticity estimates of yi, twith respect to the cross-sectional averages of the dependent variables and the observed regressors, respectively.

However, in dynamic specification, the lagged dependent variable is not strictly exogenous, and its inclusion in the model could make the CCE estimator to become inconsistent. Therefore, Chudik and Pesaran (2015) developed the DCCE estimator which is appropriate for dynamic models. They revealed that the estimator gains consistency provided the appropriate lag is selected for the cross-sectional means. The DCCE allows for slope heterogeneous coefficients. It also computes the cross-sectional dependence test (with the null hypothesis that the error terms are weakly cross-sectional dependent). It allows for endogenous regressors, supports both balanced and unbalanced panels, and can be used in small sample time series since it has small sample bias correction. The DCCE is based on autoregressive distributed lagged (ARDL) panel data model with cross-sectionally augmented unit-specific regressions as follows:

where\( {\overline{z}}_t=\frac{1}{N}\sum \limits_{i=1}^N{z}_{it}=\left({\overline{y}}_t,{\overline{x}}_t,{\overline{g}}_t\right) \). Thus, yi, t represents the dependent variable (CO2i, t), while xi, t represents the regressors (ENCi, t, GDPi, t, FDEi, t) and \( {\overline{g}}_t \) represents the covariates. Hence, the dynamic CCE mean group estimation of the coefficientsϕandαocan be obtained by taking the arithmetic averages of the least squares estimates of ϕi and αoi.Footnote 9

Finally, prior to using Westerlund cointegration tests, CEE and DCCE estimation techniques, we conducted cross-sectional dependence tests to ascertain the presence of cross-sectional dependence using four tests, namely, Lagrange multiplier (LM) test developed by Breusch and Pagan (1980), the scaled CDLM and general CD tests proposed by Pesaran (2004), and the bias-adjusted LM test proposed by Pesaran et al. (2008). After estimation, we conduct postestimation test using Pesaran (2015) test to ascertain whether the errors are weakly cross-sectional dependent.

Data

This study uses panel data of 122 countries for the 1990–2014 periodFootnote 10 obtained from World Development Indicators (2017) of the World Bank. The countries are grouped into four categories based on World Bank (2017) classification of countries according to their income levels, namely, low income ($1005 and below), lower middle income ($1006–$3955), upper middle income ($3956–$12,235), and high income ($12,236 and above). The study comprises 45 high-income countries, 32 upper-middle-income countries, 32 lower-middle-income countries, and 13 low-income countries. Unavailability of data on energy consumption limited the number of low-income countries included in the study. The countries included in the study are listed in Appendix Table 11.

Empirical results

Descriptive statistics and correlation analysis

Table 1 presents the descriptive statistics of the variables included in the model. It shows wide variations among the variables in the different income groups. It also reveals that CO2 emissions and energy consumption are larger in high-income countries compared to low-income countries. It is also obvious that the level of financial development is higher in high-income countries relative to low-income countries. Hence, as countries move from low-income to high-income group, there is a rise in CO2 emissions, energy consumption, and financial development.

The correlation analysis presented in Table 2 reveals that CO2 emissions and energy consumption, as well as CO2 emissions and economic growth are positively and significantly correlated. Moreover, CO2 emissions and financial development as well as energy consumption and financial development have negative correlation in high-income group, but positive relationship in other income groups. Finally, the analysis shows that energy consumption and economic growth as well as financial development and economic growth have positive correlations.

Panel unit root tests

The results presented in Table 3 show that all the variables are integrated of order one at 1% significant level in the whole panel as well as in different income groups. Hence, it is necessary to determine the cointegration between the variables using different cointegration tests.

Panel cointegration tests

Table 4 shows the outcomes of Pedroni cointegration tests (individual intercept, no trend). The variables have cointegration relationship in all income groups, albeit that of low-income group is relatively weak. We also estimate with individual intercept and individual trends (results available upon request), and found similar results. In order to further check the robustness of the cointegration test results, the study employs Kao cointegration test, and the results reported in the lower panel of Table 4 indicate that the variables are cointegrated in all the income groups.

Long-run estimation using DOLS and FMOLS

The DOLS results presented in Table 5 reveal that energy consumption has a positive and significant impact on CO2 emissions in all income groups. This implies that an increase in energy consumption would increase CO2 emissions regardless of the income group. We also find that economic growth has positive impact on CO2 emissions in low-income and middle-income countries but negative impact in high-income countries. This suggests that an increase in economic growth increases CO2 emissions in low-income and middle-income countries but reduces CO2 emissions in high-income countries. In other words, at lower level of income, an increase in income increases CO2 emissions, but at higher level of income, a rise in income reduces CO2 emissions. Furthermore, the study shows that financial development has negative impact on CO2 emissions in high-income and upper-middle-income countries, whereas the impact is positive in low-income and lower-middle-income countries. This implies that high level of financial development reduces CO2 emissions, whereas low level of financial development aggravates it. Put differently, at lower level of financial development, an increase in financial development increases CO2 emissions, but at higher level of financial development, an increase in financial development decreases CO2 emissions.

The results of FMOLS reported in Table 6 find similar outcomes as DOLS in terms of signs and statistical significance of the coefficients (except the magnitudes that slightly differ). Thus, energy consumption has positive impact on CO2 emissions in all the panels. Similarly, economic growth has positive impact on CO2 emissions in all the income groups except high-income groups (where the impact is negative). Moreover, financial development has negative impact on CO2 emissions in high-income groups whereas the impact is positive in lower-middle-income and low-income groups. In both DOLS and FMOLS, changes in the regressors explain reasonable proportion of changes in the dependent variables as indicated by the coefficient of determination (R-squared).

Furthermore, Table 7 shows the results of the dynamic specification of the impact of energy consumption, economic growth, and financial development on CO2 emissions using the two-step GMM estimation procedure. The GMM estimation results corroborated the earlier results obtained with DOLS and FMOLS. Expectedly, the lagged dependent variable enters with a positive and significant coefficient in all the income groups, an indication of persistence in CO2 emissions.

The issue of cross-sectional dependence and robustness test

In order to address the issue of cross-sectional dependence and robustness check of our estimation results, we employ estimation procedures that are capable of addressing cross-sectional dependence (e.g., CCEMG, dynamic CCEMG). Before estimation, we confirm the existence of cross-sectional dependence in the panels by conducting cross-sectional dependence tests. The results reported in Table 8 confirmed the presence of cross-sectional dependence in all the panels.

Next, we employ Westerlund (2007) error-correction-based panel cointegration tests. The results presented in Table 9 reject the null hypothesis of no cointegration, implying the existence of cointegration in the panels.Footnote 11

Since, cointegration exists in the panels, we estimate the long-run coefficients using both CCE mean group and dynamic CCEMG. First, the results of CCEMG presented in Table 10 show that energy consumption enters with a positive and significant coefficient in all the income groups, suggesting its detrimental impact on CO2 emissions. The impact of GDP on CO2 emissions is also positive and significant in low- and lower-middle-income groups but insignificant in upper-middle-income and high-income groups. Financial development intensifies CO2 emissions in low-income and lower-middle-income countries, whereas the impact is insignificant in high-income and upper-middle-income countries.Footnote 12 These results are similar to the DOLS and FMOLS estimation results.

Second, the results of the dynamic specification of the impact of energy consumption, economic growth, and financial development on CO2 emissions using dynamic CCEMG are shown in the lower part of Table 10. Expectedly, the lagged dependent variable enters with a positive and significant coefficient, suggesting that past CO2 emissions aggravates current CO2 emissions. Energy consumption continues to enter with a positive and significant coefficient in all the income groups, while the coefficient of financial development is positive and significant in low-income countries, but insignificant in high-income countries. This corroborates earlier results that financial development has harmful effect on CO2 emissions in low-income countries. The Jackknife bias correction procedureFootnote 13 was used to correct for small sample time series bias in dynamic CCEMG estimator. Finally, the postestimation test using Pesaran (2015) test rejects the null hypothesis that the errors are weakly cross-sectional dependent in most of the panels.

Discussion and policy implications

The positive impact of energy consumption on CO2 emissions in all the income groups found in this study is consistent with Alkhathlan and Javid (2013), Arouri et al. (2012), Esso and Keho (2016), and Mirza and Kanwal (2017) who reported a detrimental effect of energy consumption on CO2 emissions. This implies that energy consumption has taken place at the expense of CO2 emissions in all the income groups. The harmful effect of energy consumption on CO2 emissions in all the income groups is not surprising because all the income groups experienced remarkable increase in energy consumption during the period under review. In this regard, it might be necessary to adopt energy consumption policies that do not exacerbate CO2 emissions. Therefore, the government of most countries should pay attention to building resources that would guarantee sufficient supply of energy by steadily increasing the proportion of renewable energy resources in the entire energy supplies. This is because an increase in energy production from renewable resources is considered to diminish CO2 emissions. Moreover, policies and activities that reduce CO2 emission should be vigorously pursued, and made a fundamental agenda in energy and environmental policies of countries with a view to lessening the harms connected with CO2 emissions.

Moreover, the positive effects of economic growth on CO2 emissions found mostly in full sample and low-income groups of this study agreed with some studies (see Lean and Smyth 2010; Narayan and Smyth 2008; Salahuddin and Gow 2014; Tamazian and Rao 2010) who documented a significant positive effects of economic growth on CO2 emissions. This implies that economic growth has taken place to the detriment of CO2 emissions. Nevertheless, there is evidence that economic growth could reduce CO2 emissions in high-income group in this study. This is consistent with the postulation that CO2 emissions rise as the country experiences economic growth at early stages of economic development, but decline after a certain threshold level of economic growth is attained. Perhaps, the high-income group has reached income level where further increase in economic growth does not aggravate CO2 emissions, whereas the low-income group is yet to attain such threshold level. This is consistent with Narayan and Narayan (2010) and Jaunky (2011). As countries move from low-income to high-income group, the repugnant effects of economic growth on CO2 emissions decline. The policy implication of these findings is that low-income groups should prioritize policies and programs that would accelerate their level of income with a view to moving them to high-income groups if they desire to reduce CO2 emissions and its obnoxious effects.

Furthermore, the finding of this study regarding the positive impact of financial development on CO2 emissions in the full sample and low-income groups are consistent with some empirical studies (e.g., Al-mulali and Sab 2012b; Boutabba 2014; Farhani and Ozturk 2015; Zhang 2011). They argued that financial development increases CO2 emissions. However, the negative impact of financial development on CO2 emissions unveiled in high-income groups in this study is consistent with some studies (e.g., Jalil and Feridun 2011; Salahuddin et al. 2015; Shahbaz et al. 2013b). The differences in the impact of financial development on CO2 emissions across the income groups could be attributed to the differences in their levels of financial development. Thus, Yuxiang and Chen (2010) also posited that a country with more developed and sound financial system provides opportunity to industries for the adoption and utilization of advanced state-of-the-art technologies which produces less CO2 emissions. They also contended that the development of the financial sector enhances the enforcement of regulations that are environmentally friendly. The policy implication is that low-income countries should strive to develop their financial sector in order to mitigate CO2 emissions.

Conclusion

This paper examines the effects of energy consumption, economic growth, and financial development on CO2 emissions in heterogeneous panels of 122 countries divided into high-income, upper-middle-income, lower-middle-income, and low-income countries. We employ both first-generation and second-generation panel unit root tests, panel cointegration tests, and panel estimation procedures in order to address the issue of cross-sectional dependence. The study finds that cointegration exists between the variables regardless of income group. Energy consumption has positive impact on CO2 emissions in all the income groups. However, the impact of economic growth and financial development on CO2 emissions differ among the income groups. Specifically, there are evidences that economic growth and financial development mitigate CO2 emissions in high-income countries, while their effects are detrimental in middle-income and low-income countries.

The implication of this paper is that energy consumption increases CO2 emissions. But high levels of income and financial development decrease CO2 emissions, while low levels of income and financial development increase it. This implies that energy consumption has taken place at the expense of CO2emissions in all the income groups. Hence, the adoption of energy consumption policies that do not exacerbate CO2 emissions is fundamental. Therefore, the countries should increase the proportion of renewable energy resources in the entire energy supplies in order to diminish CO2 emissions. Additionally, the countries should formulate policies and activities that reduce CO2 emission, and make them fundamental agenda in their energy and environmental policies in order to lessen CO2 emissions and its detrimental effects.

Moreover, as countries move from low-income to high-income group, the adverse effects of economic growth on CO2 emissions declines. Therefore, low-income groups should prioritize policies and programs that would move them to high-income groups if they desire to reduce CO2 emissions. Since high level of financial development has the capacity to reduce CO2 emissions, the development of financial system should be prioritized by low-income countries. It appears that a sound financial system provides opportunity for the industries to adopt and use advanced state-of-the-art technologies which produces less CO2 emissions, as well as enhances the enforcement of environmentally friendly regulations.

This paper has succeeded in unfolding the differential impact of energy consumption, economic growth, and financial development on CO2 emissions in different income groups. Nevertheless, it is recommended that future researches should examine the threshold levels beyond which economic growth and financial development begin to reduce CO2 emissions because this would be fundamental for policy formulations.

Notes

All data are obtained from World Development Indicators (2018) of the World Bank.

All the data are obtained from World Development Indicators (2018) of the World Bank.

All the data are obtained from World Development Indicators (2018) of the World Bank.

Economic growth and real GDP per capita are used interchangeably in this study.

Baltagi (2008) highlighted the motivation of using panel data as follows: first, panel data are better able to identify and measure effects that are simply not detectable in pure time series data. Second, panel data give more informative data, more variability, less collinearity among the variables, more degrees of freedom and more efficiency. With additional more informative data, one can produce more reliable parameter estimates. Third, panel data control for individual heterogeneity. Panel data can control for country- and time-invariant variables while time series study cannot. Fourth, panel data are better able to study the dynamics of adjustment, thereby shedding light on the speed of adjustments to economic policy changes. Finally, panel data models allow us to construct and test more complicated behavioral models compared to purely time series models.

We proxy financial development with credit to private sector relative to GDP which is the most commonly used proxy that measure the credit that goes to the private sector (see Al-Mulali et al. 2016b; Jalil and Feridun 2011; Shahbaz et al., 2013a, b, c; Hafeez et al. 2018; Salahuddin et al. 2015). Although we attempted to use another proxy of financial development (e.g., liquid liabilities relative to GDP) that measures financial depth, or stock market development indicators (e.g., market capitalization relative to GDP), but we could not get complete data for the 122 countries for the 1990–2014 period. When data become readily available, we suggest that future research should consider this possibility for comparison.

Our panel data of 122 countries covering 1990–2014 period are appropriate (not too small) for Westerlund’s (2007) error correction model–based panel cointegration test because this cointegration test produces reliable results even in small sample size. Westerlund (2007, p. 709) said “Our simulation results suggest that the tests have good small-sample properties with small size distortions and high-power relative to other popular residual-based panel cointegration tests.” In his empirical application, Westerlund (2007, p.733–736) presented empirical evidence to show that international healthcare expenditures and GDP are cointegrated in a small sample size using annual panel data of 20 OECD countries for 1970–2001 period. Moreover, some studies have also used the Westerlund’s (2007) error correction model–based panel cointegration test for similar sample size (e.g., Persyn and Westerlund 2008).

This study controls for endogeneity by using the GMM developed by Arellano and Bond (1991) which is renowned for controlling for endogeneity and autocorrelation.

Our data characteristics determine the panel estimation techniques we employ in this study. First, since our variables are integrated of order one and cointegrated, we employ the estimation techniques which are appropriate for cointegrated panels such as DOLS and FMOLS. Thereafter, we test for cross-sectional dependence, and the results show the existence of cross-sectional dependence. To account for this, we employ the estimation techniques that can account for cross-sectional dependence, and also appropriate for cointegrated panels such as CCE and DCCE. Moreover, autocorrelation is potentially common to all time series or long span panel data (such as our 25-year data span). Similarly, endogeneity is a potential common concern in many economic variables. Thus, we employ GMM to control for potential autocorrelation and endogeneity in the model.

Our original intention was to include all countries in the world that have data on carbon emissions, economic growth, energy consumption, and financial development for a minimum of three decades. Unfortunately, after intensive search, we only able to find data for 122 countries for 1990–2014 period. Hence, unavailability of data limited the scope of this study.

We also conducted another cointegration test using the Lagrange multiplier-based cointegration tests proposed by Westerlund and Edgerton (2007) that allow for heteroskedastic and serially correlated errors as well as structural breaks in the intercept and slope. The results (not reported for want of space, but available upon request) reject the null hypothesis of no cointegration, implying that cointegration relationship exists among the variables in all the panels.

We thank the anonymous reviewer for this comment. Although the focus of this study is panel data analysis rather than time series analysis, our empirical strategy enables us to obtain the estimation results of individual-specific country through the CCE estimator. The results are not reported for lack of space, but available upon request. A summary of the results shows that economic growth, energy consumption and financial development are significant determinants of CO2 emissions in most of the countries. However, we do not give much attention to the individual-specific country estimation results because the sample size is too short for time series analysis.

References

Alkhathlan K, Javid M (2013) Energy consumption, carbon emissions and economic growth in Saudi Arabia: an aggregate and disaggregate analysis. Energy Policy 62:1525–1532

Al-mulali U, Sab CN (2012a) The impact of energy consumption and CO2 emission on the economic growth and financial development in the sub Saharan African countries. Energy 39(1):180–186

Al-mulali U, Sab CN (2012b) The impact of energy consumption and CO2 emission on the economic and financial development in 19 selected countries. Renew Sust Energ Rev 16(7):4365–4369

Al-Mulali U, Solarin SA, Ozturk I (2016a) Investigating the presence of the environmental Kuznets curve (EKC) hypothesis in Kenya: an autoregressive distributed lag (ARDL) approach. Nat Hazards 80(3):1729–1747

Al-Mulali U, Ozturk I, Solarin SA (2016b) Investigating the environmental Kuznets curve hypothesis in seven regions: The role of renewable energy. Ecol Indic 67:267–282

Apergis N, Payne JE (2010) The emissions, energy consumption, and growth nexus: evidence from the commonwealth of independent states. Energy Policy 38(1):650–655

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arouri ME, Youssef AB, M'henni H, Rault C (2012) Energy consumption, economic growth and CO2 emissions in Middle East and North African countries. Energy Policy 45:342–349

Baltagi BH (2008) Econometric analysis of panel data. 4th Ed. John Wiley and Sons Ltd. United Kingdom

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth and financial development in GCC countries: dynamic simultaneous equation models. Renew Sust Energ Rev 70:117–132

Boutabba MA (2014) The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model 40:33–41

Breitung J (2000) The local power of some unit root tests for panel data. Adv Econ 15:161–177

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47(1):239–253

Chen PY, Chen ST, Hsu CS, Chen CC (2016) Modeling the global relationships among economic growth, energy consumption and CO2 emissions. Renew Sust Energ Rev 65:420–431

Chudik A, Pesaran MH (2015) Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors. J Econ 188(2):393–420

Claessens S & Feijen E (2007) Financial sector development and the millennium development goals. World Bank Publication

Dhaene G, Jochmans K (2015) Split-panel jackknife estimation of fixed-effect models. Rev Econ Stud 82(3):991–1030

Esso LJ, Keho Y (2016) Energy consumption, economic growth and carbon emissions: Cointegration and causality evidence from selected African countries. Energy 114:492–497

Farhani S, Ozturk I (2015) Causal relationship between CO2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environ Sci Pollut Res 22(20):15663–15676

Farhani S, Solarin SA (2017) Financial development and energy demand in the United States: new evidence from combined cointegration and asymmetric causality tests. Energy 134:1029–1037

Hafeez M, Chunhui Y, Strohmaier D, Ahmed M, Jie L (2018) Does finance affect environmental degradation: evidence from One Belt and One Road Initiative region? Environ Sci Pollut Res 25(10):9579–9592

Hossain MS (2011) Panel estimation for CO2 emissions, energy consumption, economic growth, trade openness and urbanization of newly industrialized countries. Energy Policy 39(11):6991–6999

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econ 115(1):53–74

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33(2):284–291

Jaunky VC (2011) The CO2 emissions-income nexus: evidence from rich countries. Energy Policy 39(3):1228–1240

Kao C (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econ 90:1–44

Katircioglu ST, Taşpinar N (2017) Testing the moderating role of financial development in an environmental Kuznets curve: empirical evidence from Turkey. Renew Sust Energ Rev 68:572–586

Lean HH, Smyth R (2010) CO2 emissions, electricity consumption and output in ASEAN. Appl Energy 87(6):1858–1864

Levin A, Lin CF, Chu CS (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econ 108(1):1–24

Mirza FM, Kanwal A (2017) Energy consumption, carbon emissions and economic growth in Pakistan: dynamic causality analysis. Renew Sust Energ Rev 72:1233–1240

Narayan PK, Narayan S (2010) Carbon dioxide emissions and economic growth: panel data evidence from developing countries. Energy Policy 38:661–666

Narayan PK, Smyth R (2008) Energy consumption and real GDP in G7 countries: new evidence from panel cointegration with structural breaks. Energy Econ 30:2331–2341

Omri A (2013) CO2 emissions, energy consumption and economic growth nexus in MENA countries: evidence from simultaneous equations models. Energy Econ 40:657–664

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries? Energy Econ 48:242–252

Ozcan B (2013) The nexus between carbon emissions, energy consumption and economic growth in Middle East countries: a panel data analysis. Energy Policy 62:1138–1147

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267

Pedroni P (1999) Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf Bull Econ Stat 61:653–678

Pedroni P (2000) Fully modified OLS for heterogeneous cointegrated panels. Adv Econ 15:93–130

Persyn D, Westerlund J (2008) Error-correction-based cointegration tests for panel data. Stata J 8(2):232–241

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels. CESifo Working paper series No.1229, IZA Discussion Paper No 1240

Pesaran MH (2006) Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74(4):967–1012

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22(2):265–312

Pesaran MH (2015) Testing weak cross-sectional dependence in large panels. Econ Rev 34(6–10):1089–1117

Pesaran MH, Ullah A, Yamagata T (2008) A bias-adjusted LM test of error cross-section independence. Econ J 11(1):105–127

Salahuddin M, Gow J (2014) Economic growth, energy consumption, C02 emissions in gulf cooperation council countries. Energy 73:44–58

Salahuddin M, Gow J, Ozturk I (2015) Is the long-run relationship between economic growth, electricity consumption, carbon dioxide emissions and financial development in Gulf Cooperation Council Countries robust? Renew Sust Energ Rev 51:317–326

Shahbaz M, Lean HH (2013) Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy Policy 40:473–479

Shahbaz M, Hye QMA, Tiwari AK, Leitao NC (2013a) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sust Energ Rev 25:109–121

Shahbaz M, Tiwari AK, Nasir M (2013b) The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 61:1452–1459

Shahbaz M, Solarin SA, Mahmood H, Arouri M (2013c) Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Econ Model 35:145–152

Sirag A, Matemilola BT, Law SH, Bany-Ariffin AN (2018) Does environmental Kuznets curve hypothesis exist? Evidence from dynamic panel threshold. J Environ Econ Policy 7(2):145–165

Stock JH, Watson MW (1993) A simple estimator of cointegrating vectors in higher order integrated systems. Econometrica 61:783–820

Tamazian A, Rao BB (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ 32:137–145

Tamazian A, Chousa JP, Vadlamannati CK (2009) Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy 37(1):246–253

Westerlund J (2007) Testing for error correction in panel data. Oxf Bull Econ Stat 69(6):709–748

Westerlund J, Edgerton DL (2007) New improved tests for cointegration with structural breaks. J Time Ser Anal 28(2):188–224

World Bank (2017) “New country classifications by income level: 2017-2018” Available on: https://blogs.worldbank.org/opendata/new-country-classifications-income-level-2017-2018

World Development Indicators (2017) of the World Bank

World Development Indicators (2018) of the World Bank

Yuxiang K, Chen Z (2010) Financial development and environmental performance: evidence from China. Environ Dev Econ 16(1):93–111

Zhang Y (2011) The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy 39(4):2197–2203

Zhang XP, Cheng XM (2009) Energy consumption, carbon emissions and economic growth in China. Ecol Econ 68(10):2706–2712

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Philippe Garrigues

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Ehigiamusoe, K.U., Lean, H.H. Effects of energy consumption, economic growth, and financial development on carbon emissions: evidence from heterogeneous income groups. Environ Sci Pollut Res 26, 22611–22624 (2019). https://doi.org/10.1007/s11356-019-05309-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-019-05309-5