Abstract

The nexus among real income, energy consumption, financial development, and carbon emission has broadly conferred area in energy and environmental literature. However, there is no study in the literature which investigates the moderating role of financial development between real income, energy consumption, and CO2 emission in Pakistan. This study reveals the role of financial development as a moderator in the conventional environmental Kuznets curve (EKC). To achieve the objectives of this study, two approaches are employed, (i) with main effects and (ii) with interaction variables, using autoregressive distributed lag (ARDL) bounds testing approach in the case of Pakistan covering the period 1970 to 2016. Findings of the empirical analysis confirm the EKC hypothesis in the first case (without interaction effect) and our second estimations (with interaction effect) show that financial development significantly moderates the association of real output with CO2 emission (both for the long run and short run). The negative effect of financial development on carbon emission reveals to efficacious energy management with effective environmental performance. More precisely, the results of second estimations reveal that all three interaction variables are statistically significant but the EKC curve is no more. Thus, the current study proposes that the moderating effect of the financial sectors may be the possible reason which has been ignored by prior researchers and they found mix results regarding the existence of EKC in Pakistan. In addition, the Granger causality test confirms the feedback effect between real income and carbon emission and one-way causality from all the three interaction variables and financial development to CO2 emission. Lastly, this study posits some important policy inferences in the perspective of new economic policy formation in Pakistan.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

A dream of a developed economy cannot achieve without apt growth and development of industries in a country. Energy and its resources act as a spirit in the industrial and economic development of the state. Pakistan is struggling to shift from the agriculture economy to industrial economy, and this struggle requires sufficient energy resources to meet continuously increasing demand of energy. The increasing trend of energy utilization in traditional ways is the fundamental cause of high environmental pollution index in Pakistan. It is a common phenomenon that high energy consumption causes carbon emission, which affects the climate adversely. Global Climate Risk Index reported that in the list of the countries which are adversely affected by climate change, Pakistan is at the number seven (GCR-Index 2018). The evidence of worst climate change has been experienced in Karachi (Pakistan, summer 2015) in the form of 1200 deaths due to heatwaves (Cheema 2015). Through the National Environmental Policy (NEP), Pakistan has undertaken policy reforms and implemented them to control environmental degradation in 2015. Even though Pakistan is contributing around 0.4% carbon emission in the world’s total pollution which is growing up gradually (Shahzad et al. 2017). On the other hand, the economic growth of Pakistan has adversely affected by the energy crisis which is still going on. In this scenario, the role of financial and stock markets in the economic development of Pakistan cannot be ignored (Komal and Abbas 2015). According to Bloomberg, Pakistan’s financial sectors are showing promising signs to maintain its growth and small equity markets in the coming few yearsFootnote 1.

Although a plethora of empirical work focuses on the nexus of growth-energy-greenhouse gases (GHGs) emissions, however, still their results are inconclusive (Wolde-Rufael 2009; Alshehry and Belloumi 2015; Hao et al. 2016; Amri 2018; Naz et al. 2019; Ganda 2019). Several scholars have explored nexus between real income, economic growth, and energy consumption in EKC framework (Bello et al. 2018; Dong et al. 2018; Seetanah et al. 2019; Chen et al. 2019). Many scholars, for example Saud et al. (2019), Sarkodie (2018), Jula et al. (2015), Haseeb et al. (2018), and Hanif et al. (2019), confirm the hypothesis of EKC between real income and GHGs emissions while some other studies do not confirm it (Al-mulali et al. 2015; Dong et al. 2016; Abid 2017; Saidi and Ben 2017; Liu et al. 2017).

Many latest studies have exposed that environmental pollution is significantly associated with financial development. Adams and Klobodu (2018) postulate that financial development is an important indicator of environmental degradation. Guo et al. (2019) posit that stock trading volume and financial development efficiency accelerate to carbon emission and Esmaeilpour Moghadam and Dehbashi (2018) propose that financial development significantly contributes to environmental degradation. However, De Gregorio and Guidotti (1995) advocate that financial development affect economic growth negatively as in their investigation in Latin America, financial development significantly reduce economic growth. Similarly, Zafar et al. (2019) also found a negative association between financial development and CO2 emission. They advocate that financial development enhances environmental quality by encouraging investments in environmental projects (Tamazian et al. 2009; Jalil and Feridun 2011). In addition, a study on 129 countries, Al-mulali et al. (2015) conclude that (in the short run and long run) financial development enhances the environmental quality in the cases when (1) providing loans, (2) projects related to energy saving are encouraged, and (3) projects of renewable energy are appreciated. In contrast to the above discussion, Ganda (2019) and Hao et al. (2016) found mix findings between financial development and environmental quality.

The literature also depicts the evidence of investigations on the joint effect of energy consumption and financial development on the environment (Jalil and Feridun 2011; Ozturk and Acaravci 2013; Shahbaz et al. 2013; Destek and Sarkodie 2019; Zafar et al. 2019). In the case of China, Jalil and Feridun (2011) investigate the causes of environmental pollution by taking a joint impact on energy consumption, economic growth, and financial development on pollution. Their findings confirm the hypothesis of EKC and reveal that real income, energy consumption, and trade openness mediate the relationship between financial development and environmental quality. In addition, they argue that financial development decreases environmental pollution. Another study advocates that long-run relationship exists among energy consumption, economic growth, financial development, trade openness, and CO2 emissions in the context of Indonesia (Shahbaz et al. 2013). On the other hand, Ozturk and Acaravci (2013) do not find evidence that financial development influences the carbon emission in the long run in the case of Turkey. To measure the financial development, they used domestic credits (% age of GDP) provided to the private sector. According to Zafar et al. (2019), financial development and globalization enhance the environmental quality while energy consumption accelerates to environmental degradation through high carbon emission in OECD countries.

From above-mentioned literature, it is clear that the financial sector’s development augments the demand for energy. It is beyond discussion that financial development is possible without increasing energy demand. Therefore, probing the empirical nexuses (with available data, variables, and contemporary econometric approaches) between financial development, energy consumption, and GHGs emissions is an attracting area of interest for the researchers nowadays. The findings of the present empirical analysis can be precious for the practitioners and policymakers to make better decisions. So, it is clear that the financial sector’s development leads to high energy demand which ultimately generates high GHGs emission through fossil fuels combustion. Thus, presently, it is the dire need that the scholars should give more attention to this sector and explore new methodologies/techniques to enhance energy efficiency with the help of financial sectors. Various proxies have been used to measure the financial development as given below (see composite financial index section). It is necessary that there should be an econometric model based on all possible aspects of financial development in a country because one aspect (as previous studies have been undertaken) cannot cover the real role of the financial sector in an economy. Following Shahbaz et al. (2016), Katircioğlu and Taşpinar (2017), and Ang (2009), the current study tries to include all possible aspects of financial development and generate a “composite financial development index” to measure the financial development.

In the case of Pakistan, Javid and Sharif (2016) and Shahzad et al. (2017) argue that environmental Kuznets curve (EKC) exists while some other scholars do not find evidence for its existence in Pakistan (Baloch et al. 2018; Naz et al. 2019). Nasir and Rehman (2011) also do not support the EKC hypothesis for a short run in Pakistan. These mix findings reveal that the existence of the environmental Kuznets curve still requires more investigation on the bases of sub-segments of the economy. The present study focuses on a sector of the economy (financial sector) and investigates the nexus between carbon emission and energy consumption by taking financial sector as sub-segment. This study tries to fill the gap by including segment (sector) because it has been widely ignored in the previous studies.

The objective of this study is to explore the moderating role of financial development between real income, energy consumption, and carbon emission in the EKC framework. This is one of the very first studies which explore the “moderating role of financial development in conventional environmental Kuznets curve in the case of Pakistan.” In this way, this study also tries to give the answer to a common question, why previous studies have mix results regarding the existence of EKC in Pakistan. According to statistical theory, “when collaboration between two variables also depends on a third variable, it is called moderation and that third variable is called moderator” (Baron and Kenny 1986). To investigate the moderating role of financial development, this study employs two-step estimations, first without interaction term (moderator) and second with interaction variables. Secondly, the present study does not use a conventional proxy to measure financial development in Pakistan. This study constructs a “composite financial development index” with the help of five indicators of the financial sector (see Table 2). Third, to confirm the relationship among involving variables (i.e., real income, energy use, finical development, and carbon emission), the current study employs a famous econometric approach “Autoregressive Distributed Lag (ARDL)” for estimations. Lastly, we plot CUSUM and CUSUMsq to check the consistency of our econometric model and then confirm the causal impact between variables through “Granger Causality/Block Exogeneity Wald test.”

The rest of the paper is set out as: the “Literature Review” section includes all detail of related studies. The “Data source and Econometric Methodology” section of this study include all the details related to the data sources, variables descriptions, and formation of the index. The “Results and discussion” section provides all the tables of findings and estimations with their discussion. At the “Conclusion and policy implication” section conclude the whole study with some suggestions for policymakers.

Literature review

Literature includes many studies which explore the relationship (long-run and short-run) between energy use, CO2 emission, and financial development. According to one school of thought, financial development improves environmental quality by reducing energy consumption and carbon emission. Saud et al. (2019) explore the impact of financial development, economic growth, energy use, and trade openness on carbon emission in 59-BRI countries covering the period 1980–2016. They propose that energy consumption and economic growth contribute to environmental degradation while trade openness and financial development enhance environmental quality through mitigating carbon emission. Similarly, Zafar et al. (2019) investigate the impact of financial development and globalization on carbon emission in OECD countries and suggest that financial development and globalization significantly improve the environmental quality by reducing carbon emission. Kahouli (2017) explores growth-energy-financial development nexus in 6-SMCs covering period 1995–2015. He confirms long-run cointegration between variables and suggests that financial development is the main factor which can use to enhance energy efficiency. Under structural breaks and employing “Residual Augmented Least Square,” Farhani and Solarin (2017) investigate the relationship between financial development, energy consumption, economic growth, capital, trade, and FDI in USA. They advocate the economic growth and financial development diminution of the energy demand for the long run. Greater financial development promotes energy-efficient techniques due to which energy demand decreases (Islam et al. 2013). Alam et al. (2015) investigate energy-financial development nexus by using different indicators of financial development in SAARC member countries. They found that financial development has a larger impact on energy consumption and they suggest that energy demand can reduce through a tradeoff between economic growth and energy consumption.

The second school of thought support to the common phenomenon and they posit that during financial development, the energy demand increases which affects the climate adversely due to high carbon emission. Guo et al. (2019) investigate the impact of financial development on carbon emission by using provincial data of China from 1997 to 2015. By employing extended STIRPAT model, they confirm that stock trading volume and efficiency of financial development accelerate to carbon emission. Similarly, Esmaeilpour Moghadam and Dehbashi (2018) also explore the association between financial development, trade, and environmental quality in Iran. Their empirical analysis does not confirm the hypothesis of EKC for Iran and they reveal financial development enhances environmental degradation. Mahalik et al. (2017) investigate the nexus between financial development and energy demand by using some addition determinants, i.e., urbanization, economic growth, and capital for Saudi Arabia covering period 1971–2011. They conclude that financial development upsurges to energy demand in the long run and behind it, capital and urbanization are the main factors. In addition, their empirical evidence confirms the non-linear (inverted U-shaped) link between financial development and energy consumption. There is a significant and positive association between financial development and energy consumption (Sadorsky 2010). He measures financial development by stock market, (1) stock market capitalization to GDP and (2) stock market turnover. In this way, he provides very strong evidence that financial development reduces environmental quality by exciting energy demand. Through direct growth-energy nexus, Haseeb and Azam (2015) confirm that energy from renewable energy sources (as compared to fossil fuel) is very helpful to enhance environmental quality because it reduces carbon emission in Pakistan. In addition, they also conduct an indirect nexus between CO2 and energy demand by emphasizing that how can a country achieve sustainable development. Similarly, Shahbaz et al. (2013) explore how economic growth incorporate on energy-financial development nexus in a multivariate framework in China covering period 1975Q1–2011Q4. They conclude that certain economic growth and financial development are necessary but they affect the environment adversely by enhancing the energy demand and GHGs emission.

Hanif et al. (2019) explore the growth-energy-FDI-environment nexus in 15 Asian countries by covering period from 1990 to 2013. By employing ARDL econometric approach, they propose that the endeavor to stimulate growth level enhances fossil fuel consumption in these countries eventually and degrades the environment. In addition, they corroborate the hypothesis of EKC for these countries. Baloch and Danish 2019investigate the non-linear association among economic growth, energy demand, and financial development through panel regression of “Driscoll-Kraay standard error.” They confirm the inverted U-shaped association between financial development and energy demand, economic growth, and energy demand for OECD countries. In addition, they found feedback causal effect between growth and energy consumption. Similarly, Ahmad et al. (2017) study the association between financial development and energy demand in EKC framework using data 1992Q1 to 2011Q1 for Croatia. They employ ARDL and then VECM econometric approaches and confirm the existence of EKC (inverted U-shaped) between economic growth and CO2 emission for the long run. Gill et al. (2018) do not found the EKC curve in the case of Malaysia; they confirm a monotonic increasing nexus between CO2 emissions and GDP per capita. They also support to sustainable energy agenda in the country because they found renewable energy consumption substantially decline air pollution. Ganda (2019) explores the impact of financial development on the environmental quality of OECD economies by employing system GMM analysis. Their empirical analysis reveals mix findings regarding the impact of financial development on the environment in OECD.

Mirza and Kanwal (2017) explore the nexus between GDP, air pollution, and energy consumption in Pakistan. Their empirical estimations confirm feedback causal effect between economic growth and energy use, energy use and carbon emission, and between economic growth and CO2 emission. In addition, to make a healthy country, they propose certain suggestions related to sustainable development policies in Pakistan. Khan et al. (2018) explore the nexus between renewable energy and GHG emissions in Pakistan. They employ “Toda and Yamamoto approach” and confirm a negative and significant impact of energy on GHGs emissions, covering the period 1981–2015. Also, they found that renewable energy consumption substantially reduces GHGs emissions in Pakistan. Bakhsh et al. (2017) report a negative and statistically significant association between stock capital and carbon emissions while a positive relationship between income and stock capital. In addition, they confirm that FDI has a significant and negative impact on carbon emissions in the case of Pakistan. Shahbaz et al. (2016) investigate the influence of financial development on the environment and they postulate that inefficient energy consumption contributes to environmental degradation in Pakistan. They propose that for a sustainable environment, energy-efficient technologies should be adopted because the latest technologies are supportive to rally environmental quality.

Shahzad et al. (2017) employ ARDL bound test for cointegration procedure and their empirical evidence confirms the inverted U-shaped EKC curve. According to their findings, the economy is operating below the threshold level and they expect that carbon emission will gradually increase until the threshold level achieved. Javid and Sharif (2016) also support the EKC hypothesis for the long-term and short-term. They found a significant positive association among CO2 and financial development which divulge that for financial development they have to compromise on environmental quality. Similarly, using time series data from 1980 to 2013, Zaidi (2017) also confirms the inverted U-shaped EKC hypothesis between “income and carbon emission” and “between income and energy use” in Pakistan. His results reveal that energy efficiency in a controlled environment is a very good gauge to examine the strength of energy in an economy. In contrast, Naz et al. (2019) did find environmental Kuznets curve, they support to “pollution haven hypothesis,” and Nasir and Rehman (2011) also did not find EKC curve in the short run in the case of Pakistan.

Data source and econometric methodology

Data source

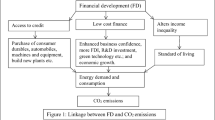

This study includes annual data covering the period of 1970 to 2016 from the World Bank and Pakistan Stock Exchange. The dependent variable is carbon dioxide emission (CO2) and measures as (metric tons) per capita. Gross domestic production (GDP) or real income measures as GDP per capita (constant $ 2010), square of real income (GDP2), energy consumption (EC) measure as the use of energy (kg of oil equivalent) per capita, and Financial Development (FD) measure as a composite financial index are the regressors. Trend in variables (i.e., CO2, GDP, EC, and FD) stated in Fig. 1 and Table 1 contains all the detail regarding to description of variables and data sources.

Composite financial index

In the literature, numerous proxies have been used to measure financial development. For example, many studies have calculated financial development through “M2” and “liquid liabilities” but according to Jalil and Feridun (2011), M2 did not capture exactly the development of the financial sector. They advocate that a large portion of M2 measures consistency of currency, so we can say that it represents to monetization instead to measure financial development exactly. Similarly, liquid liabilities also do not measure financial development completely because it only reflects the size of the financial sector (Creane et al. 2007). Domestic credits to the private sector (loans, non-equity security purchase, accounts receivables, and trade credits, etc.) also used a proxy of financial development (Boutabba 2014) but according to Shahbaz et al. (2017), domestic credit to the private sector is a good proxy to measure the productive investments endeavors. It is a major problem in empirical economics literature to find out a proper proxy for financial development which can cover its full efficiency (Ang 2009). In the presence of a number of financial systems that exist in different economies, it is obligatory for the researcher to construct measures that can reflect its real impact (Levine et al. 2000). In 1999, Beck et al. (1999) built a comprehensive proxy for financial development by combining various indicators which are very useful for researchers. From the above discussion and keeping in mind the importance of the financial sector for an economy, the current study constructs a composite index and tries to capture all the aspects of financial development. Following prior literature (i.e., Ang 2009; Shahbaz et al. 2016; Katircioğlu and Taşpinar 2017), current study constructs an index for financial development with the help of five different indicators of the financial sector: (a) domestic credits by banking sector (% of GDP); (b) domestic credits provided to private sector; (c) M2 (broad money supply which is % of GDP); (d) ratio of commercial banks assets to central bank assets plus commercial assets; (e) M3 (liquid liabilities, % age of GDP). And the functional relationship of the above five indicators can present as:

The variables a, b, and c obtained from “World Development Indicator” while the variables d and e obtained from “Pakistan Stock Exchange.” According to King and Levine (1993), the commercial banks take better decisions to allocate their funds as compared to central banks. Similarly, according to Ang (2009) commercial banks identify opportunities for profitable investment more actively as compared to central banks. So, we include commercial bank asset to construct the composite index. To measure financial intermediation, many researchers use the size of the financial sector but according to Levine et al. (2000), it is a simple proxy and they suggest that private credit is an effective proxy. Ang (2009) also states that credit to the private sector is a better proxy to measure financial development because private sectors take better decisions to allocate their funds as compared to the public sector. Following Jenkıns and Katırcıoglu (2010) and Beck et al. (1999), we include liquid liabilities, banking sector providing the credit, and broad money into our index construction process.

We construct a “Composite Financial Development Index” by using a famous statistical method known as “principal component factor analysis.” By using this method, we can convert a large number of variables (correlated) into a few variables (uncorrelated) without losing original variability in the data (Feridun and Sezgin 2008; Jalil et al. 2010). Principal component factor analysis is used by Chen and Myagmarsuren (2013) and Ang (2009) to construct financial performance indices. The current study also constructs an index through principal component factor analysis using the five indicators from the financial sector (as above discussed). Thumb rule is that financial indicators are assumed to be significant when they hold eigen value greater than 1 or at least equal to 1 (eigen value ≥1) and the factor loadings are greater than 0.5 (Hair 2006).

Using the following formula, we constructed a composite index for financial development with the help of factors extracted from factor analysis.

where “FD_Index” is our required index for financial development and “FSi” is the corresponding factor score of each factor (financial indicator). “wi” is the weight (ratio of variation explained by each indicator to the variation described by all other variables) and calculate as:

“wi” is the weight of the corresponding factor which is the ratio of variation due to that particular variable (vi) to the variance explained by all other variables (factors) and “n” denotes to total number of variables (Chen 2010).

Results of principal factor analysis are presented in Table 2. The only first component has eigen value greater than 1 (4.8349). This component is better because it explains about 98.45% of the standardized variance. So, only one component is extracted from this analysis. We construct an index for financial development following Ang (2009) and take factor scores as weights (given in the second part of Table 2).

Theoretical framework

In the energy economic literature, environmental Kuznets curve (EKC) has been tested broadly in recent years. In the conventional model of EKC, GDP and its square use as regressors (in the literature some studies also include GDP3), as presented below in Eq. (1):

where “CO2” denotes to carbon dioxide emission and “GDP” is real income per capita. In the current study, we include “Energy Consumption (EC)” to check the association between energy consumption and CO2 emission, as presented in Eq. (2):

In linear equation form, Eq. (2) can be written as:

where “β0” denotes to intercept and “β1,” “β2,” and “β3” are the coefficients of the regressors and “ϵt” shows to possible errors.

To capture the growth effect of regressors on CO2 emission, following Katircioğlu (2010), we can rewrite Eq. (3) in logarithmic form as:

This study proposes that “Financial Development (FD)” might have a moderating role with its direct impact on EKC in the case of Pakistan. So, focusing on it, this study tries to explore the moderating role of “FD” on the association between GDP, GDP2, EC, and CO2 emission. In this context, Cohen et al. (2014) have been introduced interaction variables to check the moderating effect. Following Chen and Myagmarsuren (2013), we also make two models to check the moderating effects, as they have advised in their literature. First, to estimate the main effect, we added a proxy of financial development (lnFD) in Eq. (4) as presented below:

In the second model, we add interaction variables in Eq. (5) and get a new Eq. (6) to estimate the moderating effect of financial development.

According to Cohen et al. (2014), moderating effect will be confirmed when the interaction variables will show a statistically significant relationship. So, we also expect that the coefficients (i.e., β5, β6, and β7) will be statistically significant which will confirm the moderating role of financial development in our case. In this way, the FD may affect the direct relationship between CO2 emission and regressors (i.e., GDP, GDP2, and EC) and according to statistical methodology, it is called moderating role of that variable (Cohen et al. 2014).

Econometric strategy

In literature, a number of econometric approaches have been used for short-run and long-run estimations such as an approach based on residuals by Engle and Granger (1987) and a technique of maximum likelihood by Johansen and Juselius (1990). But in recent studies, a famous econometric approach known as the autoregressive distributed lag (ARDL) by Pesaran et al. (2001) is using for the bound test. The current study employs the ARDL approach as its estimations are unbiased and even in the case of small sample size, it provides consistent results. Second, it can apply in all three cases whether the variables are stationary at I(0) or stationary at I(1) even there is a mixture of both. Third, if cointegration confirms among variables, then it is a useful approach for both short-run and long-run dynamics. Fourth, this is the only approach which provides us with some explicit tests through which we can explore that exclusive cointegration exists or not instead of assuming vector existence. Lastly, Pesaran and Shin (1997) suggest that in ARDL methodology, appropriate lag selection is very helpful to deal with endogeneity issues and to control serial correlation problems.

We expressed the ARDL approach as (using Eq. (6))

where ∆ indicates first difference operator, the summation sign in the first part of the above equation denotes to the dynamics of error correction while the second part (which is without summation) representing to the relationship for the long run. Detail of all the variables (CO2, GDP, EC, and FD) is already provided in Table 1.

Before the estimation of short-run dynamics or long-run dynamics, it is necessary to confirm the integration level among variables because any variable with the order (2) restrict us to use ARDL approach. To check the cointegration among variables, F statistics is a useful technique because we can apply it irrespectively; the series is integrated at the order I(1) or I(0). The null hypothesis of no cointegration in Eq. (7) is (H0: β9= β10= β11= β12= β13= β14= β15= β16= 0) against the alternative hypothesis (Ha: β9 ≠ β10 ≠ β11≠ β12≠ β13 ≠ β14 ≠ β15 ≠ β16≠ 0). To confirm cointegration, we follow critical values of F statistics given by Narayan (2005) and Pesaran et al. (2001). According to them, if F value lies below the lower bound value, it is the indication toward the acceptance of null hypothesis, it means there is no cointegration while when F value exceed the upper bound value, we will reject null hypothesis the of no cointegration. But results remain inconclusive when F value fall between lower bound and the upper bound values. After confirmation of cointegration, we can apply ARDL and then the error correction term which is a useful way for establishing cointegration (Kremers et al. 1992; Banerjee et al. 1998; Boutabba 2014). Before the final decision, we have to ensure that our data is normally distributed, there is no autocorrelation and our data is homoscedastic. We can apply a number of diagnostic tests to deal with all these issues.

Using ARDL cointegration approach, we can confirm whether long-run and short-run cointegration exists or not. But this approach does not guide us about the causal relationship (direction) among the variables. There are two possibilities: (i) if we found cointegration, then we can apply Granger causality with error correction term but (ii) if the evidence detects that there is no cointegration, then Granger causality with vector autoregression (VAR) can apply to check causality (Engle and Granger 1987; Granger 1988). So, the augmented Granger causality test with error correction term presented as:

where ∆ denotes the difference operator and ECT(t-1) is the lagged error correction term derived from long-run equilibrium model. For long-run and short-run causation, ECT(t-1) for causality test should be statistically significant. φ is representing the speed of adjustments and its value shows the degree to which disequilibrium will be corrected within one period and ε1t − ε8t represents to stochastic error term (serially independent random errors, mean = 0 and finite covariance matrix).

Results and discussion

While using time series data, we have to confirm that our variables are stationary. Because estimations on the bases of non-stationary data can mislead. So, before long-run estimations (via ARDL), we apply the unit root test to confirm the level of stationery among involving variables. Following Ng and Perron (2001), we apply the unit root test and results are presented in Table 3. Due to the small sample size, Ng-Perron unit root test is more reliable as compared to ADF or PP unit root test. Results of our unit root test demonstrate that we are unable to reject the null hypothesis at level but findings with first difference reveal that we can reject the null hypothesis (i.e., H0 = data is not stationary) which shows that our variables are not stationary at level but all variables become stationary at first difference level. Following Zivot and Andrews (2002), we apply unit root which includes structural breaks and its outcomes also suggest that our all variables are integrated at first difference (see Table 4).

After confirmation of the level of stationarity among variables, we calculate F statistic with the help of the bound testing approach. The outcomes demonstrate that the F statistic in both cases (without interaction and with interaction variables) is higher than the appropriate critical value of the upper bound (see table 5). So, we reject the null hypothesis of no cointegration among the variables. More specifically, from these findings, it is clear that long-run relationship exists among CO2, GDP, GDP2, EC, and FD (also when interaction variables are included).

Table 6 includes the findings of short-run and long-run estimations by using ARDL approach. In panel (a) which is without interaction effect, carbon emission (CO2) is positively and statistically significantly associated with real income and energy consumption while negatively and statistically significant with the square of real income (GDP2) and financial development. The coefficient of income in the short run is 0.0034 while in the long run is 0.0067 which shows that 1% increase in income will lead to rising carbon emission per capita by 0.0034% in the short run and 0.0067% in the long run. Similarly, a 1% increase in energy consumption in Pakistan will contribute to 0.0284% in carbon emission (per capita) in the long run. Fascinatingly, the significant positive coefficient of income (GDP) and a significant negative coefficient of the square of income (GDP2) with carbon emission (CO2) demonstrate that there is non-linear inverted U-shaped relationship exists between income and carbon emission. More specifically, our empirical findings validate “the hypothesis of environmental Kuznets curve (EKC)” for Pakistan and our findings are in line of some recent studies, i.e., Saud et al. (2019) for 59-BRI countries, Shahzad et al. (2017) for Pakistan, Hanif et al. (2019) for 15 developing Asian countries, Katircioğlu and Taşpinar (2017) for Turkey, and Haseeb et al. (2018) for BRICS countries have validated the hypothesis of EKC between real income and GHGs emission.

The coefficient of FD (composite index for financial development) is statistically significant and its sign is negative (β = − 0.036, p < 0.05) which posits that 1% increase in financial development will diminish carbon emission by 0.036% for the long run. It demonstrates that development in the financial sector significantly improves the environmental quality in the case of Pakistan. This is the signal for the successful implementation of policies and energy management. Some recent studies for example Zafar et al. (2019), Katircioğlu and Taşpinar (2017), and Saud et al. (2019) also confirm the negative association between financial development and carbon emission.

On the other side, Table 6 also includes the results of the estimations with interaction variables (see panel b of Table 6). After including interaction variables, all the variables are still significant except energy consumption. The coefficient of GDP is significant but its sign is negative (β = − 0.1125, p < 0.05) and coefficient of GDP square (GDP2) is also significant but its sign is positive (β = 0.0007, p < 0.1). More interestingly, when we add interaction terms (variables), the impact of GDP and GDP2 on carbon emission is stronger as compared to before. But one thing is very important, in model (b), inverted U-shaped relationship is no more while the interaction variables (lnGDP × FD and lnGDP2 × FD) are statistically significant. This is the indication that as a moderator, financial development has a significant impact on the relationship between GDP, GDP2, and CO2. In addition, this moderator role of financial development also destroys the inverted U-shaped relationship between income and carbon emission in the case of Pakistan. This result is similar to the findings of some recent studies; Nasir and Rehman (2011) reported that EKC hypothesis does not exists and Naz et al. (2019) also did not find inverted U-shaped EKC in the case of Pakistan. Similarly, Gill et al. (2018) also confirm the increasing relationship (absence of EKC) between CO2 and GPD in the case of Malaysia. Overall, the long-run results of Table 6 suggest that as moderator, financial development has a significant impact and it also affects the EKC curve in the long-run period.

We conclude that initially, GDP has positive while its square has a negative relationship with the CO2 emission, which confirms the hypothesis of EKC and financial development has a negative impact on carbon emission in Pakistan. So, we propose that all the policies related to energy protection are magnificently adopted by Pakistan but more important thing is that by ignoring the moderating role of financial development, economic growth is successfully driven by financial development through the financial sectors. On the other side, when we undertake the moderating role of financial development, the EKC curve was no more. It shows that financial sectors are not only enhancing environmental quality but also playing an important role as moderator in Pakistan. So, this is the major contribution of the current study because the moderating role of financial development has been ignored by prior researchers that is why Shahzad et al. (2017), Javid and Sharif (2016), and Shahbaz et al. (2012) confirm the EKC curve but Nasir and Rehman (2011) do not confirm for the short run and Naz et al. (2019) do not find any evidence for the existence of the EKC curve in the case of Pakistan.

The second portion of Table 6 includes the short-run estimations for both cases, i.e., the main effect (without interaction terms) and the main effect with interaction or moderating effects. The error correction terms have negative coefficient and statistically significant at 1% level. Prior literature suggests that the ECM(t-1) should be negative and its value should be between 0 to − 2 (Narayan and Smyth 2006; Boutabba 2014; Samargandi et al. 2015). So, these results of error correction terms (ECT) divulge that carbon emission (CO2) in Pakistan significantly responds to the path of long-term equilibrium with 100% speed of adjustment in both panels (i.e., with and without the moderating role of the financial development).

Lastly, we also apply some robust analysis and the findings of the diagnostic test are also reported at the bottom of Table 6. “Jarque-Bera test” posits that residuals are normally distributed, “LM test” demonstrates that there is no serial correlation, “D-Watson test” reveals that there is no autocorrelation, “Ramsey’s RESET test” confirm that there is no multicollinearity, and lastly, “Breush Pagan Godfrey test” finalizes that data is homoscedastic in the given model. In the end, to ensure long-run parameter’s stability, we employ recursive residuals, cumulative sum (CUSUM), and cumulative sum of square (CUSUMsq) tests and their graphical representation is given in Figs. 2 and 3. In Fig. 2, CUSUM does not cross the 5% level of significance while in Fig. 3, CUSUM square also almost stable. Because most of the time, CUSUM square within critical bounds at 5% level, it must be significant at 10% level of significance (Khan et al. 2018). So, we can say that our model is stable and the results are reliable for the purpose of policymaking.

ARDL estimation provides long-run and short-run cointegration among variables. For causality relationship (direction) among interested variables, we apply Granger Causality (Block Exogeneity Wald) test and outcomes of causal relationship are reported in Table 7. For comprehensive policy suggestions, it is necessary for the policymakers to know the direction of the relationship. Results of Granger Causality test confirm the feedback effect (bidirectional) between real income and carbon emission while one-way causality from financial development to CO2 emissions but energy consumption does not show a causal relationship with carbon emission. Most important thing is that all the three interaction terms/variables (GDP × FD, GDP2 × FD, and EC× FD) show one-way causality toward CO2 emissions.

Conclusion and policy implications

This study explores the direct and moderating role of financial development on the relationship between carbon emission (CO2), real income (GDP), and energy consumption (EC) in the case of Pakistan. In addition, the current study also reveals the influence of the financial sector as a moderator on the environmental Kuznets curve in Pakistan. To achieve the study objectives, we employed “the Autoregressive Distributed Lag (ARDL)” econometric approach for long-run and short-run cointegration dynamics. We included time series annual data which cover the period from 1970 to 2016. We also applied some robust analysis and graphical representation of recursive residuals show that our model is stable and suitable for policymaking. Lastly, to check the causal association among the variables, we exploited the Granger Causality test.

Empirical findings of this study suggest that GDP has positive while its square has a negative impact on CO2 emission, which confirms the existence of the EKC curve in Pakistan. Financial development significantly improves environmental quality by reducing carbon emission. On the other side, when we undertake financial development as moderator and add interaction terms/variables in the main model, the EKC curve was no more. It shows that financial sector is not only enhancing environmental quality but also playing an important role as a moderator and affect the EKC curve in Pakistan. Hence, this is the key contribution of the current study to the literature on income, energy, and environment. Moreover, results of Granger Causality test confirm the feedback effect (bidirectional) between real income and carbon emission while one-way causality from financial development to CO2 emissions but energy consumption does not show a causal relationship with carbon emission. A country can achieve environmental sustainability by undertaking newly sustainable reforms with successful implementation. This study proposes to policymakers that they should realize the role of financial development and try to balance the economic and financial policies to control CO2 emissions without affecting economic and financial development.

Empirical results of this study have very important implications in the perspective of economic policy formation in Pakistan. Environmental degradation has become a global issue, and Pakistan is also facing it in the form of extreme weather proceedings. To meet the increasing demand for energy, high consumption of fossil fuels is becoming the main cause of environmental pollution in Pakistan. The current study contributes to the existing literature by revealing the moderating role of financial development. For continuous economic growth, this study suggests that the government of Pakistan should take caution of imprudent expansion of the financial sector. Because this study reveals that financial development has a dual role, on one side, it has a direct effect on carbon emission and on the other side, it is playing a vital role as moderator. So, where policymakers are trying to improve the efficiency of the financial sector at the same time, they should undertake some necessary reforms to avoid its adverse impact on the economy.

In brief, using a new approach, this study introduces the moderating role of financial development with its direct effect on the EKC in the case of Pakistan. Actually, from this dimension, it is very important and interesting to understand the role of financial development and for future research, it is also the new direction. Policymakers may advice to the government of Pakistan for more investment in R & D to explore the true figure of the financial sector with environmental and economic policies reforms to reduce high carbon emissions. More specifically, they should keep in mind the moderating role of financial development on pollution with existing environmental and energy portfolio to control carbon emission in Pakistan.

References

Abid M (2017) Does economic, financial and institutional developments matter for environmental quality? A comparative analysis of EU and MEA countries. J Environ Manage 188:183–194. https://doi.org/10.1016/j.jenvman.2016.12.007

Adams S, Klobodu EKM (2018) Financial development and environmental degradation: does political regime matter? J Clean Prod 197:1472–1479. https://doi.org/10.1016/j.jclepro.2018.06.252

Ahmad N, Du L, Lu J et al (2017) Modelling the CO 2 emissions and economic growth in Croatia: is there any environmental Kuznets curve? Energy 123:164–172. https://doi.org/10.1016/j.energy.2016.12.106

Alam A, Malik IA, Bin AA et al (2015) Does financial development contribute to SAARC’S energy demand? From energy crisis to energy reforms. Renew Sustain Energy Rev 41:818–829. https://doi.org/10.1016/j.rser.2014.08.071

Al-mulali U, Tang CF, Ozturk I (2015) Does financial development reduce environmental degradation? Evidence from a panel study of 129 countries. Environ Sci Pollut Res 22:14891–14900. https://doi.org/10.1007/s11356-015-4726-x

Alshehry AS, Belloumi M (2015) Energy consumption, carbon dioxide emissions and economic growth: the case of Saudi Arabia. Renew Sustain Energy Rev 41:237–247. https://doi.org/10.1016/j.rser.2014.08.004

Amri F (2018) Carbon dioxide emissions, total factor productivity, ICT, trade, financial development, and energy consumption: testing environmental Kuznets curve hypothesis for Tunisia. Environ Sci Pollut Res 25:33691–33701. https://doi.org/10.1007/s11356-018-3331-1

Ang JB (2009) CO2 emissions, research and technology transfer in China. Ecol Econ 68:2658–2665. https://doi.org/10.1016/j.ecolecon.2009.05.002

Bakhsh K, Rose S, Ali MF et al (2017) Economic growth, CO 2 emissions, renewable waste and FDI relation in Pakistan: new evidences from 3SLS. J Environ Manage 196:627–632. https://doi.org/10.1016/j.jenvman.2017.03.029

Baloch MA, Danish MF (2019) Modeling the non-linear relationship between financial development and energy consumption: statistical experience from OECD countries. Environ Sci Pollut Res 26:8838–8846. https://doi.org/10.1007/s11356-019-04317-9

Baloch A, Shah SZ, Noor ZM, Magsi HB (2018) The nexus between income inequality, economic growth and environmental degradation in Pakistan. Geo J 83:207–222. https://doi.org/10.1007/s10708-016-9766-3

Banerjee A, Dolado JJ, Mestre R (1998) Error-correction mechanism tests for cointegration in a single-equation framework. J Time Ser Anal 19:267–283. https://doi.org/10.1111/1467-9892.00091

Baron RM, Kenny DA (1986) The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J Pers Soc Psychol 51:1173–1182. https://doi.org/10.1037/0022-3514.51.6.1173

Beck T, Demirguc-Kunt A, Levine RE (1999) A new database on financial development and structure.

Bello MO, Solarin SA, Yen YY (2018) The impact of electricity consumption on CO2 emission, carbon footprint, water footprint and ecological footprint: the role of hydropower in an emerging economy. J Environ Manage 219:218–230. https://doi.org/10.1016/j.jenvman.2018.04.101

BloomBerg What’s next for Asia’s best-performing stock market? - Bloomberg. https://www.bloomberg.com/news/articles/2016-10-20/what-s-next-for-asia-s-best-performing-stock-market. Accessed 16 Apr 2019

Boutabba MA (2014) The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model 40:33–41. https://doi.org/10.1016/j.econmod.2014.03.005

Cheema AR (2015) Social impacts of science metrics. Nature 524:35–35

Chen M-H (2010) The economy, tourism growth and corporate performance in the Taiwanese hotel industry. Tour Manag 31:665–675. https://doi.org/10.1016/j.tourman.2009.07.011

Chen C-F, Myagmarsuren O (2013) Exploring the moderating effects of value offerings between market orientation and performance in tourism industry. Int J Tour Res 15:595–610. https://doi.org/10.1002/jtr.1900

Chen Y, Wang Z, Zhong Z (2019) CO2 emissions, economic growth, renewable and non-renewable energy production and foreign trade in China. Renew Energy 131:208–216. https://doi.org/10.1016/j.renene.2018.07.047

Cohen J, Cohen P, West SG, Aiken LS (2014) Applied multiple regression/correlation analysis for the behavioral sciences. Psychology Press

Creane S, Goyal R, Mobarak AM, Sab R (2007) Measuring financial development in the Middle East and North Africa: a new database. Imf Staff Pap 53:479–511. https://doi.org/10.2307/30035923

De Gregorio J, Guidotti PE (1995) Financial development and economic growth. World Dev 23:433–448. https://doi.org/10.1016/0305-750X(94)00132-I

Destek MA, Sarkodie SA (2019) Investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Sci Total Environ 650:2483–2489. https://doi.org/10.1016/j.scitotenv.2018.10.017

Dong B, Wang F, Guo Y (2016) The global EKCs. Int Rev Econ Financ 43:210–221. https://doi.org/10.1016/j.iref.2016.02.010

Dong K, Sun R, Jiang H, Zeng X (2018) CO 2 emissions, economic growth, and the environmental Kuznets curve in China: what roles can nuclear energy and renewable energy play? J Clean Prod 196:51–63. https://doi.org/10.1016/j.jclepro.2018.05.271

Engle RG, Granger CWJ (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica 55:251–276. https://doi.org/10.2307/1913236

Esmaeilpour Moghadam H, Dehbashi V (2018) The impact of financial development and trade on environmental quality in Iran. Empir Econ 54:1777–1799. https://doi.org/10.1007/s00181-017-1266-x

Farhani S, Solarin SA (2017) Financial development and energy demand in the United States: new evidence from combined cointegration and asymmetric causality tests. Energy 134:1029–1037. https://doi.org/10.1016/j.energy.2017.06.121

Feridun M, Sezgin S (2008) Regional underdevelopment and terrorism: the case of south eastern Turkey. Def Peace Econ 19:225–233. https://doi.org/10.1080/10242690801972196

Ganda F (2019) The environmental impacts of financial development in OECD countries: a panel GMM approach. Environ Sci Pollut Res 26:6758–6772. https://doi.org/10.1007/s11356-019-04143-z

GCR-Index (2018) Global climate risk index | Germanwatch e.V. https://www.germanwatch.org/en/cri. Accessed 16 Apr 2019

Gill AR, Viswanathan KK, Hassan S (2018) A test of environmental Kuznets curve (EKC) for carbon emission and potential of renewable energy to reduce green house gases (GHG) in Malaysia. Environ Dev Sustain 20:1103–1114. https://doi.org/10.1007/s10668-017-9929-5

Granger CWJ (1988) Some recent developments in a concept of causality. J Econ 39:199–211

Guo M, Hu Y, Yu J (2019) The role of financial development in the process of climate change: evidence from different panel models in China. Atmos Pollut Res. https://doi.org/10.1016/j.apr.2019.03.006

Hair JF (2006) Multivariate data analysis. Pearson Education India, p 2006

Hanif I, Faraz Raza SM, Gago-de-Santos P, Abbas Q (2019) Fossil fuels, foreign direct investment, and economic growth have triggered CO2 emissions in emerging Asian economies: some empirical evidence. Energy 171:493–501. https://doi.org/10.1016/j.energy.2019.01.011

Hao Y, Zhang Z-Y, Liao H et al (2016) Is CO2 emission a side effect of financial development? An empirical analysis for China. Environ Sci Pollut Res 23:21041–21057. https://doi.org/10.1007/s11356-016-7315-8

Haseeb M, Azam M (2015) Energy consumption, economic growth and CO2 emission nexus in Pakistan. Asian J Appl Sci 8:27–36. https://doi.org/10.3923/ajaps.2015

Haseeb A, Xia E, Danish, et al (2018) Financial development, globalization, and CO2 emission in the presence of EKC: evidence from BRICS countries. Environ Sci Pollut Res 25:31283–31296. doi: https://doi.org/10.1007/s11356-018-3034-7

Islam F, Shahbaz M, Ahmed AU, Alam MM (2013) Financial development and energy consumption nexus in Malaysia: a multivariate time series analysis. Econ Model 30:435–441. https://doi.org/10.1016/j.econmod.2012.09.033

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33:284–291. https://doi.org/10.1016/j.eneco.2010.10.003

Jalil A, Feridun M, Ma Y (2010) Finance-growth nexus in China revisited: new evidence from principal components and ARDL bounds tests. Int Rev Econ Financ 19:189–195. https://doi.org/10.1016/j.iref.2009.10.005

Javid M, Sharif F (2016) Environmental Kuznets curve and financial development in Pakistan. Renew Sustain Energy Rev 54:406–414. https://doi.org/10.1016/j.rser.2015.10.019

Jenkıns HP, Katırcıoglu ST (2010) The bounds test approach for cointegration and causality between financial development, international trade and economic growth: the case of Cyprus. Appl Econ 42:1699–1707. https://doi.org/10.1080/00036840701721661

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration- with applications to the demand for money. Oxf Bull Econ Stat 2:169–210

Jula D, Dumitrescu C-I, Lie I-R, Dobrescu R-M (2015) Environmental Kuznets curve. Evidence from Romania. Theor Appl Econ XXII:85–96

Kahouli B (2017) The short and long run causality relationship among economic growth, energy consumption and financial development: evidence from South Mediterranean Countries (SMCs). Energy Econ 68:19–30. https://doi.org/10.1016/j.eneco.2017.09.013

Katircioğlu ST (2010) International tourism, higher education and economic growth: the case of North Cyprus. World Econ 33:1955–1972. https://doi.org/10.1111/j.1467-9701.2010.01304.x

Katircioğlu ST, Taşpinar N (2017) Testing the moderating role of financial development in an environmental Kuznets curve: empirical evidence from Turkey. Renew Sustain Energy Rev 68:572–586. https://doi.org/10.1016/j.rser.2016.09.127

Khan MTI, Ali Q, Ashfaq M (2018) The nexus between greenhouse gas emission, electricity production, renewable energy and agriculture in Pakistan. Renew Energy 118:437–451. https://doi.org/10.1016/j.renene.2017.11.043

King RG, Levine R (1993) Finance and growth: Schumpeter might be right. Q J Econ 108:717–737. https://doi.org/10.2307/2118406

Komal R, Abbas F (2015) Linking financial development, economic growth and energy consumption in Pakistan. Renew Sustain Energy Rev 44:211–220. https://doi.org/10.1016/j.rser.2014.12.015

Kremers JJM, Ericsson NR, Dolado JJ (1992) The power of cointegration tests. Oxf Bull Econ Stat 54:325–348. https://doi.org/10.1111/j.1468-0084.1992.tb00005.x

Levine R, Loayza N, Beck T (2000) Financial intermediation and growth: causality and causes. J Monet Econ 46:31–77. https://doi.org/10.1016/S0304-3932(00)00017-9

Liu X, Zhang S, Bae J (2017) The impact of renewable energy and agriculture on carbon dioxide emissions: investigating the environmental Kuznets curve in four selected ASEAN countries. J Clean Prod 164:1239–1247. https://doi.org/10.1016/j.jclepro.2017.07.086

Mahalik MK, Babu MS, Loganathan N, Shahbaz M (2017) Does financial development intensify energy consumption in Saudi Arabia? Renew Sustain Energy Rev 75:1022–1034. https://doi.org/10.1016/j.rser.2016.11.081

Mirza FM, Kanwal A (2017) Energy consumption, carbon emissions and economic growth in Pakistan: dynamic causality analysis. Renew Sustain Energy Rev 72:1233–1240. https://doi.org/10.1016/j.rser.2016.10.081

Narayan PK (2005) The saving and investment nexus for China: evidence from cointegration tests. Appl Econ 37:1979–1990. https://doi.org/10.1080/00036840500278103

Narayan PK, Smyth R (2006) What Determines migration flows from low-income to high-income countries? an empirical investigation of Fiji-U.S. Migration 1972-2001. Contemp Econ Policy 24:332–342. https://doi.org/10.1093/cep/byj019

Nasir M, Rehman FU (2011) Environmental Kuznets curve for carbon emissions in Pakistan: an empirical investigation. Energy Policy 39:1857–1864. https://doi.org/10.1016/j.enpol.2011.01.025

Naz S, Sultan R, Zaman K et al (2019) Moderating and mediating role of renewable energy consumption, FDI inflows, and economic growth on carbon dioxide emissions: evidence from robust least square estimator. Environ Sci Pollut Res 26:2806–2819. https://doi.org/10.1007/s11356-018-3837-6

Ng S, Perron P (2001) LAG length selection and the construction of unit root tests with good size and power. Econometrica 69:1519–1554. https://doi.org/10.1111/1468-0262.00256

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267. https://doi.org/10.1016/j.eneco.2012.08.025

Pesaran MH, Shin Y (1997) An autoregressive distributed lag modelling approach to cointegration analysis. Econom Soc Monogr 31:371–413

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16:289–326. https://doi.org/10.1002/jae.616

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38:2528–2535. https://doi.org/10.1016/j.enpol.2009.12.048

Saidi K, Ben MM (2017) The impact of income, trade, urbanization, and financial development on CO2 emissions in 19 emerging economies. Environ Sci Pollut Res 24:12748–12757. https://doi.org/10.1007/s11356-016-6303-3

Samargandi N, Fidrmuc J, Ghosh S (2015) Is the relationship between financial development and economic growth monotonic? Evidence from a sample of middle-income countries. World Dev 68:66–81. https://doi.org/10.1016/j.worlddev.2014.11.010

Sarkodie SA (2018) The invisible hand and EKC hypothesis: what are the drivers of environmental degradation and pollution in Africa? Environ Sci Pollut Res 25:21993–22022. https://doi.org/10.1007/s11356-018-2347-x

Saud S, Chen S, Danish HA (2019) Impact of financial development and economic growth on environmental quality: an empirical analysis from Belt and Road Initiative (BRI) countries. Environ Sci Pollut Res 26:2253–2269. https://doi.org/10.1007/s11356-018-3688-1

Seetanah B, Sannassee RV, Fauzel S et al (2019) Impact of economic and financial development on environmental degradation: evidence from small island developing states (SIDS). Emerg Mark Financ Trade 55:308–322. https://doi.org/10.1080/1540496X.2018.1519696

Shahbaz M, Lean HH, Shabbir MS (2012) Environmental Kuznets curve hypothesis in Pakistan: cointegration and Granger causality. Renew Sustain Energy Rev 16:2947–2953. https://doi.org/10.1016/j.rser.2012.02.015

Shahbaz M, Hye QMA, Tiwari AK, Leitão NC (2013) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sustain Energy Rev 25:109–121. https://doi.org/10.1016/j.rser.2013.04.009

Shahbaz M, Shahzad SJH, Ahmad N, Alam S (2016) Financial development and environmental quality: the way forward. Energy Policy 98:353–364. https://doi.org/10.1016/j.enpol.2016.09.002

Shahbaz M, Van HTH, Mahalik MK, Roubaud D (2017) Energy consumption, financial development and economic growth in India: new evidence from a nonlinear and asymmetric analysis. Energy Econ 63:199–212. https://doi.org/10.1016/j.eneco.2017.01.023

Shahzad SJH, Kumar RR, Zakaria M, Hurr M (2017) Carbon emission, energy consumption, trade openness and financial development in Pakistan: a revisit. Renew Sustain Energy Rev 70:185–192. https://doi.org/10.1016/j.rser.2016.11.042

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37:246–253. https://doi.org/10.1016/j.enpol.2008.08.025

Wolde-Rufael Y (2009) Energy consumption and economic growth: the experience of African countries revisited. Energy Econ 31:217–224. https://doi.org/10.1016/j.eneco.2008.11.005

Zafar MW, Saud S, Hou F (2019) The impact of globalization and financial development on environmental quality: evidence from selected countries in the Organization for Economic Co-operation and Development (OECD). Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-04761-7

Zaidi SHA (2017) Modelling and forecasting energy intensity , energy efficiency and CO 2 emissions for Pakistan. University of Leicester

Zivot E, Andrews DWK (2002) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J Bus Econ Stat 20:25–44. https://doi.org/10.1198/073500102753410372

Funding

This empirical work was financially supported by the National Natural Science Foundation of China under the project number of (NSFC-71672009.71372016).

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Shujah-ur-Rahman, Chen, S., Saleem, N. et al. Financial development and its moderating role in environmental Kuznets curve: evidence from Pakistan. Environ Sci Pollut Res 26, 19305–19319 (2019). https://doi.org/10.1007/s11356-019-05290-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-019-05290-z