Abstract

Although the role that renewable energy consumption plays on economic growth and emissions has been widely studied, there are relatively few papers focusing on the determinants of renewable energy consumption, and only one study focuses on the factors related to the share of renewables in the energy consumption in Africa. This paper contributes to the literature by filling the gap in knowledge by exploring the nexus between the share of renewables in energy consumption and social and economic variables, for a panel consisting of 21 African countries for the period between 1990 and 2013, extending the set of variables and the time span used by a previous study. Estimating a random-effects generalized least squares regression, we find that countries with a higher Human Development Index and a higher gross domestic product per capita have a lower share of renewable energy in the national grid. On the other hand, an increase in foreign direct investment has been found to be related to higher renewable energy integration. The level of democracy, measured by the Freedom House political rights and civil liberties ratings, does not directly affect the integration level of renewable energy sources. The negative relationship between gross domestic product per capita and the share of renewables contradicts previous findings for developed countries. This contradiction and policy implications are discussed in the light of the review of the energy mix of the selected countries.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

There is a consensus among researchers that a minimum level of energy consumption is key for a nation to achieve economic and social development (Wu and Chen 2017). Even though poverty is still a genuine and pressing issue in today’s world, lately, several nations have improved in development terms. For this trend to continue, and more nations to improve their living standards, increasing amounts of energy will be needed. Arto et al. (2016), using energy footprint,Footnote 1 confirmed that for developing countries to achieve the living standards of the developed ones, the rates of global energy use should increase substantially.

The world’s growing need for energy to support and improve living conditions (Wu and Chen 2017) coupled with the increase in population (with an annual population growth of 1.16% in 2017, WDI 2017) lead to an increase in fossil fuel consumption and hence brought with itself several challenges such as depletion of fossil fuel reserves, global warming, and climate change due to greenhouse gas emissions, geopolitical and military conflicts, continual fuel price fluctuations, and the increased occurrence of some health conditions (cardiovascular diseases, etc.) associated with emissions (Edenhofer et al. 2011; Kaygusuz 2012; Abbasi and Abbasi 2011; Wuebbles and Jain 2001).

Global warming and climate change are the consequences of mainly anthropogenic activities and the combustion of fossil fuels which releases greenhouse gases into the atmosphere (IPCC 2014). With increasing temperatures and extreme weather events, the effects on the environment can be seen in the loss of ecosystems and biodiversity, loss of land and changes in agricultural production (Bouwer 2019). Eighty percent of the increase in greenhouse gas emissions is due to the combustion of fossil fuels and industrial activities. The negative effects of these emissions will be more strongly felt in low-income countries (IPCC 2014).

Even though fossil energy has improved humanity’s standard of living, reflected by a high positive correlation between the total primary energy supply and national GDP per-capita averages and the fact that fossil fuels make up a very large portion of the total energy supply (Smil 2005), the need to find other alternative sources of energy became essential considering the above-mentioned concerns.

As pointed out by Arto et al. (2016), several studies have shown that fossil fuel depletion and uranium scarcity imply that energy will no longer be cheap and abundant, suggesting that renewable energies should be encouraged. Moreover, as Akizu-Gardoki et al. (2018) posit, there is agreement among scholars that the use of renewable energies is not only fundamental for the environment but it would also be positive in economic and social terms.

This gave rise to various researches and the implementation of policies that lead to the return to renewable energy resources, which are sustainable sources of energy. “Return” because humankind was using bio-energy (for cooking and warming) before the discovery of fossil energy.

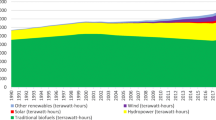

Renewable energy sources (RES) in this paper are considered as sources of energy “which naturally replenish themselves” (Future Energy Africa 2018, p. 7). Since energy from nature is in persistent flow, these sources of energy can be reliable, provided its technologies are well developed. Edenhofer et al. (2011) and Tiwari and Mishra (2012) present evidence that renewable sources of energy can help address the challenges we are encountered with. There is continuous research to improve them and make them more efficient and reliable. Renewable energy consumption has been increasing for the past decade. By the end of 2015, renewable energy made up 19.3% of global final energy consumption (REN21 2017). The renewables can be categorized as modern renewables (MRs) and traditional biomass, their share being 10.2 and 9.1% respectively. The MR can further be sub-categorized as biomass/geothermal/solar heat (4.2%), hydropower (3.6%), wind/solar/biomass/geothermal power (1.6%), and biofuel for transport (0.8%) (REN21 2017). In 2016, the power-generating capacity from renewable sources saw its highest annual increase (161 GW estimated capacity added to the previous capacity of 1856 GW) (REN21 2017). Nonetheless, there are challenges that tend to hinder the sustainability of renewable energy sources such as “market failures, lack of information, access to raw materials for future renewable resource deployment, and most importantly our (humans) way of utilizing energy in an inefficient way” (Owusu and Asumadu-Sarkodie 2016).

Kraft and Kraft’s (1978) empirical study on the nexus between gross energy consumption and gross national product, and the inferences from their analysis showing a bi-directional causality, spearheaded various studies in this field. Research involving the study of energy consumption (both renewable and non-renewable), trade, carbon dioxide emissions, and economic growth relationship has been growing for the past decades using different models with sometimes-conflicting findings for different time periods and/or regions.

Most studies, several of them reviewed in the “Literature review” section, have focused on the relationship between energy consumption (renewable and non-renewable) and economic growth; however, the social aspects of sustainability have received relatively little attention in Africa.

Against the backdrop, this paper attempts to investigate the major drivers of renewable energy consumption in Africa, to understand the effects of some social and economic variables using econometric methods and to propose policy recommendations. This paper makes several contributions to the existing literature (which is reviewed in the “Literature review” section): Firstly, the use of the share of the renewable energy sources as a percentage of the total energy consumption—instead of using the absolute value of the consumption—as the explained variable. As far as we know, it has only been used by very few researchers, and only by Attiaoui et al. (2017) for Africa. We use a larger and different set of variables than Attiaoui et al. (2017).

Secondly, to the best of our knowledge, the Human Development Index as a variable has not been used in any econometric analysis for Africa, although a modified version of it was used by Gürlük (2009) in an analysis for the Mediterranean region. Using this variable is important because many researchers have found a strong connection between energy use and living standards in developing countries and a weaker correlation in developed nations, which can be seen by looking at the correlation between total primary energy demand per capita and HDI. Arto et al. (2016) found a correlation between total primary energy demand and HDI of 0.70 in countries with an HDI below 0.8, and a correlation of 0.57 in countries with an HDI above 0.8. Thirdly, this paper attempts to find ample representation from the five regions of the continent with the available data.

This paper is organized as follows. The next section presents some background information on Africa and describes briefly the current energy mix and renewable energy potentials. The section that follows reviews the recent literature related to our study. Subsequent sections describe the data and methodology used, present the empirical analysis and results, discuss the main findings, and the last section presents the conclusions and policy recommendations.

Brief background information on Africa and the continent’s energy mix

Africa consists of five regions: North, West, East, Central, and South. It consists of 54 self-governing countries. Economically, while many countries in the continent are developing, others are still among the least developed countries in the world.

Several papers (see for instance Barrios et al. 2006, Challinor et al. 2007, and Collier et al. 2008) have pointed out that climate change is already present in Africa. This can be observed in a drop in crop productivity (Challinor et al. 2007), migration from rural areas to urban areas in sub-Saharan Africa due to changes in the rainfall pattern (Barrios et al. 2006), and temperatures rising faster than the global average (Collier et al. 2008). These changes can be associated with the increase in pollution due to the increased use of fossil energy (Shahbaz et al. 2016) and due to deforestation (Aleman et al. 2018). While trying to develop the countries, the ways used to attain this goal might destroy the environment, reducing the economic growth and development they are trying to achieve. Hence, with the abundance of renewable energy resources, most countries in Africa are trying to develop policies and plans that will develop them in a sustainable manner (Bugaje 2006).

Analyzing the 21 countriesFootnote 2 considered in the empirical analysis that follows, we can observe that the energy mix in these countries comprises of fossil energy, hydropower, and “traditional” biomass.Footnote 3 On the other hand, many of these countries have considerable renewable energy harnessing potential from different sources such as solar energy, hydropower, bio-energy (wood, biogas, and biofuel), wind energy, and geothermal sources (Owusu 2018).

Most African countries lack full access to electricity, especially in the rural areas of the sub-Sahara region with only 37.4% of the population having access in 2015. With the increasing population (annual growth of 2.7% in the sub-Sahara region and 1.8% in the Northern region in 2016),Footnote 4 fuel price fluctuations, and lack of financial resources in most countries in Africa, renewable energy is a potential way out. Africa as a continent is endowed with various sources of renewable energy. This potential has not been fully harnessed mainly due to the lack of economic capital (research and development cost) and the institutional framework of the countries (Bugaje 2006). The percentage of renewable energy consumption in this continent is averaging around 62% of the total final energy consumption, with the majority coming from hydropower and traditional combustion of biomass (WDI 2017).

Literature review

The discussion and analysis of the relationships between economic and energy variables using econometric methods began with the study by Kraft and Kraft (1978). The early studies were mostly centered on developed countries because data was easier to obtain compared to developing and underdeveloped countries. These studies’ aim was to establish both the short- and long-run relationship between the environment and the economy. The most established hypothesis in this area of study is the Environmental Kuznets Curve (EKC), first tested by Grossman and Krueger (1991) and named by Panayotou (1993). This hypothesis tells us that an increase in gross domestic product (GDP) per capita leads to an increase in environmental pollution in the developing stages of an economy, but pollution decreases over time as the country’s economy grows further. This is also known as the inverted U-shaped relation. As the importance of renewable energy for the sustainability of our environment became more evident, studies on the EKC hypothesis began to include renewable energy consumption as part of their variables.

In this section, we first review studies on the EKC hypothesis in Africa that control for renewable energy consumption. Then, we summarize findings on the impact of renewable energy consumption on economic growth. Finally, we focus on studies that aim to explain the factors that affect renewable energy consumption as our study does.

Studies on the EKC hypothesis using renewable energy consumption for Africa

Ben Jebli et al. (2015) studied the role of renewable energy consumption and trade on the Environmental Kuznets Curve hypothesis for the sub-Saharan region. The study was conducted for 24 countries for the period 1980–2010. They used a panel cointegration model for the following variables: carbon dioxide (CO2) emissions per capita, GDP per capita, renewable energy consumption per capita, exports per capita, and imports per capita. They found that the EKC hypothesis is not validated. On the other hand, they found that a unidirectional causality exists from both exports and imports towards per-capita renewable energy consumption.

Testing the same hypothesis, Zoundi (2017) used a panel cointegration model for 25 African countries for the period 1980–2012. He controlled for per-capita renewable energy consumption (REC), per-capita primary energy consumption, and population growth. The results did not verify the EKC hypothesis. On the other hand, he found that an increase in per-capita renewable energy usage leads to a reduction in CO2 emissions.

Focusing on Algeria, Amri (2017) tested the EKC hypothesis from 1980 to 2011 controlling for renewable and non-renewable energy consumption and using the autoregressive distribution lags approach (ARDL). The empirical results proved the existence of an EKC. He found the effect of using renewable energy on CO2 emissions to be insignificant which he argues is most likely due to the very low share that renewable energy sources have in the total energy consumption. Solarin et al. (2017) verified the EKC hypothesis for Ghana, but differently from Amri (2017), they found that higher per capita REC leads to more CO2 emissions. Table 1 summarizes the literature review presented above.

Studies analyzing the impact of renewable energy consumption on growth

The nexus between energy consumption and economic growth is one of the most studied issues in energy economics. As reviewed in detail by Bekun et al. (2019b), there are several well-established hypotheses regarding the causality between these two variables. Recently, there is also a growing research analyzing the relationship between REC and economic growth. Focusing on 16 EU countries, Bekun et al. (2019a) found a feedback mechanism, i.e., bi-directional causality between GDP per capita and the share of renewables in energy consumption. Wesseh and Lin’s (2016) study employed the translog production model with data for the period 1980–2011 for 34 African countries to investigate the impact of total renewable electric power consumption, total non-renewable electric power consumption, labor, and capital on real GDP. They found that renewable energy consumption is a stronger drive for growth as compared to the non-renewable energy. However, they point several challenges of using more renewable energy such as issues of scale, the large capital investment required, and some sitting problems.

Alabi et al. (2017) investigated the causality between renewable energy consumption per capita and economic growth for three African OPEC countries (Angola, Algeria, and Nigeria) for the period 1971–2011. Their findings revealed a bi-directional causality between REC and GDP per capita for both the short and long run. On the other hand, using data for 11 African countries, Ben Aissa et al. (2014) failed to find any short-run causality between REC and GDP. However, they found that in the LR, REC has a significant positive effect on GDP. Focusing on Tunisia, Ben Mbarek et al. (2018) found a unidirectional causality from GDP per capita to REC. For 20 OECD countries, Apergis and Payne (2010) found a bi-directional causality between REC and GDP. The same finding was also obtained for six Central American countries (Apergis and Payne 2011). On the other hand, analyzing 24 European countries, Marques and Fuinhas (2012) found that an increase in the share of renewable sources in the energy supply leads actually to a fall in the growth rate. Table 2 summarizes the literature on the relationship between economic growth and renewable energy consumption.

Studies analyzing determinants of renewable energy consumption

While the above-mentioned studies focused on the impact REC has on pollution or economic growth, others, like our study, investigated factors affecting REC. Attiaoui et al. (2017) studied the impact of CO2 emissions per capita, GDP per capita, and non-renewable energy consumption (NREC) per capita on renewable energy consumption (REC) which is measured using the combustible renewable ratio of total energy in 22 African countries for the period 1990–2011 using the autoregressive distribution lags-pooled mean group. They found that GDP has no significant impact on REC while CO2 emissions have a negative and NREC per capita a positive significant impact on REC.

Sadorsky (2009a), on the other hand, found that higher real GDP per capita leads to higher REC per capita in the G7 countries. While CO2 emissions have also a positive effect, the effect of an increase in oil prices was less important but negative. He also found the same positive effect of real GDP per capita on REC per capita for 18 emerging economies in another study (Sadorsky 2009b). The same effect of real GDP per capita on REC per capita was also confirmed by Omri et al. (2015) for a panel of 64 countries. They also found that trade openness is a driver of REC per capita, while Ben Aissa et al. (2014) failed to find any short- or long-run causality between trade and REC. Similarly, Salim and Rafiq (2012) found that REC is significantly and positively determined by income for six emerging economies, while like Sadorsky (2009b), they failed to find a significant impact of oil prices on REC. Besides real GDP per capita, Rasoulinezhad and Saboori (2018) found that financial openness and trade openness affect positively REC. Table 3 summarizes the papers presented above.

Considering the studies that have been done on Africa, various methods, different time periods, and different variables were employed. The conclusions vary depending on the country(ies), time frame, methodology, and the type of data used. Also, Marques and Fuinhas (2012) observed that the relationship between renewable energy consumption and economic growth seems to vary across countries and study periods. They argue that this could possibly be a result of omitted variable bias due to the non-inclusion of simultaneous consumption of fossil energy in the analysis. For this reason, the major oil-producing and exporting countries (Nigeria, Angola, and Algeria) in Africa are not included in this study.

Data and methodology of the study

Data and countries selection

The empirical analysis of this study comprises of 6 variables (see Table 4), namely, share of renewables in energy consumption (RNEW%), GDP per capita (GDPpc), trade openness (TO), foreign direct investment inflows (FDI), from the World Bank Development Indicators (WDI 2017); Human Development Index (HDI) from the Human Development Report (UNDP 2016) and democracy (DEM) from Freedom House as a measure of democratic freedom (mean score of Political Rights and Civil Liberties rating) (Freedomhouse.org 2017). These variables were selected to establish the nexus between the share of renewables in energy consumption and social and economic variables in Africa. Twenty-one countries were selected based on the availability of data spanning from 1990 to 2013 excluding the major oil-producing and exporting countries, i.e., Nigeria, Angola, and Algeria (see Table 5).

The independent variable (RNEW%), which measures the share of renewable energy in the total final energy consumption, includes the various RES usage from all sectors (industrial and household) (WDI 2017). We use energy consumption, which includes the total energy consumed within a country, i.e., indirect energy embodied in products and services is not taken into account (Arto et al. 2016).

The impact of foreign direct investment (FDI) on the environment could go in one of two directions. On the one hand, FDI contributes to biodiversity loss, deforestation, and greenhouse gas emissions and on the other, it contributes to economic growth. FDI’s “negative” effect on the environment is reflected by the “Pollution Haven” hypothesis (see for instance Jensen 1996; Xing and Kolstad 1996), while the concept of FDI’s “positive” effect on the environment and society is known as the “Pollution Halo” hypothesis (Eskeland and Harrison 2003; Birdsall and Wheeler 1993; Zarsky 1999).

Another independent variable used in this research is trade openness. There are different indices for the measurement of trade openness (see Yanikkaya 2003). The most common one, trade as a percentage of GDP, is the measure for trade openness used in this paper. Mostly, trade openness is studied to understand the dynamic effect it brings to the environment and the economy. As reviewed by Harrison (1996), most studies showed that it has a positive relationship with growth. Our paper seeks to study the contribution of trade openness to renewable energy consumption in Africa. If trade openness is a driver for renewable energy consumption, policies leading to greater trade openness would not only contribute to growth but to the environment as well.

The Human Development Index (HDI) is also included in the analysis as an independent variable. HDI was developed to reduce the reliance on economic growth as a measure of development. It measures the level of development of a country in three dimensions: education, life expectancy (which reflects the achievements in the health sector), and per-capita income. In this paper, HDI is included as a variable to analyze the role it plays in the option of using renewable energy sources.

Lastly, democracy (DEM), one of the social variables included in the paper, comprises of the aggregated weights of political rights (PR) and civil liberties (CL) ratings. The PR rating is based on “functioning of government, political diversity and participation, and electoral process”. The CL rating is centered on “rule of law, freedom of expression and belief, personal autonomy and individual rights, and associational and organizational rights” (Freedomhouse.org 2017). Democracy is known as an important “tool” in growth and development, and Torras and Boyce (1998) point out that civil liberties and political rights are strong factors affecting the environmental quality in low-income countries.

Methodology

This paper uses panel data analysis for the econometric model. The details of the models are explained in subsequent sections, while a brief description follows. Firstly, a descriptive analysis of the variables is done to understand the characteristics of the data, in order to make informed decisions on data pre-processing and the selection of an estimation method. Secondly, unit root tests are applied to examine the stationarity of the data series. It is expected that the variables will be integrated of order one, before proceeding to test cointegration among the variables. For this purpose, the study employs seven panel unit root tests. Thirdly, the panel causality test is used to investigate the direction of causality in a bivariate relationship. The results can be unidirectional, bi-directional, or no causality at all. Lastly, fixed- and random-effects estimators are used to estimate the long-run equilibrium relationships between the treatment variables (GDPpc, TO, FDI, HDI, DEM) and RNEW%, the dependent variable. Subsequently, the Hausman’s test is employed as a post-estimation method after the application of the fixed- and random-effects estimators to choose the appropriate method.

The following sub-sections give a detailed description of the methods and models used in the estimation process.

Causality test for panel data

Instead of the well-known Granger causality tests by Granger (1969), we employ an augmented version of it by Dumitrescu and Hurlin (2012) which is modeled in Eq. (1). This is because, in the presence of cross-sectional dependence, the standardized panel statistics have good small sample properties.

where the lag order of K in the element of N∗ (cross-sectional units) is the same for all the individual groups for the panel analysis. βi equal to (βi(1), βi(2), βi(3), … , βi(k))′ denotes the coefficients at a constant time, and it can differ across individual countries in the panel. The null hypothesis for this augmented version is H0 : βi = 0, ∀i = 1, 2, 3, … , N which states that there is no causality, against the alternative,\( {H}_1:\left\{\begin{array}{c}{\beta}_i=0,{\forall}_i=1,2,3,\dots, {N}_1\\ {}{\beta}_i\ne 0,{\forall}_i={N}_1+1,{N}_1+2,\dots, N\end{array}\right. \) where the known N1 is conditioned as\( 0\le \frac{N_1}{N}\le 1 \). If H0 is rejected, then causality exists among at least one panel form (Dumitrescu and Hurlin 2012). The interpretation of the test results includes an average Wald statistic across the individual groups in the panel and the probability value (P value) of the \( \overline{Z} \) (Z-bar). This bivariate analysis is conducted between share of renewables in energy consumption and the other variables considered if they are integrated of order one. The results are presented in “Panel causality estimation”.

Fixed-effects estimators and variance components model (random-effects)

The specification test is essential in econometric studies but it has one major challenge: the alternative hypothesis is not stated specifically (Hausman 1978). Fixed-effects (FE) and random-effects (RE) methods are used to mitigate the individual group (countries) effects in the presence of cross-section and period-specific effect terms. The specification test of FE uses orthogonal projections or first differences while that of RE assumes that the individual cross-section effects δi and the period specific effects γi are realizations of independent random variables with zero mean and finite variance. Essentially, RE assumes that the effect is uncorrelated with the idiosyncratic residual of the error term for the individual groups and time (Baltagi 2008; Davis 2002; Wansbeek and Kapteyn 1989).

Three different models are estimated using the share of renewables in energy consumption as the dependent variable. The first model is used to check the effects of social variables (HDI and DEM) on the consumption of renewable energy. The second model checks the effect of economic variables (GDPpc, FDI, and TO) on renewable energy consumption, and the third model is a combination of the first two models as a robustness check of the results. The random-effects and fixedeffects estimators in this paper follow the expression of the standard panel data model:

where RNEW%is the dependent variable (share of renewables in energy consumption), α represents the time-invariant nuisance parameter, GDPpc and FDIconsFootnote 5 are in logarithmic transformations, while HDI, TO, and DEM are not (see Table 4); ε represents the independent and identical error term distributed across the cross-sectional units i (countries) in time t. The null hypothesis is [H0 : pi, j = pj, i = cor(εi, t, εj, t) = 0 for i ≠ j] and the alternative hypothesis is [H1 : pi, j = pj, i ≠ 0 for i ≠ j] where pi, j is the “product moment of the correlation coefficient of the disturbances”.

The Hausman’s specification test is used to compare the random- and fixed-effects estimators:

The Hausman’s test statistic (Eq. (5)) follows a chi-square (x2) distribution under the null hypothesis that the difference in coefficients is not systematic. βFE and βRE are the fixed- and random-effects estimator’s coefficient vectors respectively, and VFE and VRE are the fixed- and random-effects estimator’s covariance matrices (Hausman 1978). Rejecting the null hypothesis implies that the random-effects estimator is preferred. The results are presented in the “Estimation of fixed and random effects” section.

Empirical analysis and results

Descriptive analysis of data

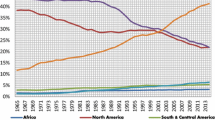

Studying the raw data series through descriptive statistics provides relevant information about the characteristics of the data such as distribution, tendency, frequency, etc. The average of RNEW% for the 21 countries for the span of 24 years (1990–2013) is 62.7% of the final energy consumption, which is much higher than not only the world average of 17.8% but other regions of the world for the same time span, as Table 6 shows.

Table 7 shows the descriptive analysis for all the 21 countries together. The average FDIFootnote 6 for all countries under study is US$− 500,000,000 echoed in all the sub-regions of Africa, which means that the disinvestment of foreign investors was more than the investments, which translates into limited technology spillover and limited transfer of labor and managerial skills.

The descriptive statistics for the countries in the Northern African region from 1990 to 2013 are shown in Table 8. The average GDPpc of the region, US$2482.72 (constant 2010) is relatively high compared to the continent, with Tunisia having a maximum of US$4196.75Footnote 7 which is the highest in the region. Egypt has the lowest average GDPpc in the region. This region’s average HDI is the highest (0.61) in the continent. Also, the region’s average renewable energy consumption (12.76%) is low for the period under study compared to the other regions. The level of democracy of the region averaging 5.2 means that the region is partly free in their PR and CL, which does not foster free will and development of its populace. Considering the p value of the Jarque-Bera test, the null hypothesis of normal distribution is rejected although some variables in some regions are normally distributed. Thus, overall, the variables under consideration are not normally distributed.

Table 9 shows the descriptive statistics for the Western African region. The average annual GDPpc at constant 2010 US$ and HDI of this region are the lowest in the continent, US$650.64 and 0.39, respectively. The RNEW% of this region for the period of study (74%) is higher on average than that of the continent (63%), and the level of democracy indicates that the countries are free and partly free.

In Eastern Africa, Mauritius’ average GDPpc is the second (US$5926.68) in the continent to South Africa (US$6425.37). The country with the lowest GDPpc in the continent is Burundi with US$250.39. The highest average renewable energy consumption as percentage of the total energy consumption in the continent is observed in Burundi (95.63%). See Table 10 for a detailed descriptive analysis of all the variables for Eastern Africa.

Cameroon’s average GDPpc at constant 2010 US$ is 1140.44 for the period of study (Table 11). The country is considered as not free with regard to their average ratings of PR and CL (5.98), and it has above average RNEW%.

The Southern African region descriptive analysis is shown in Table 12. South Africa has the highest GDPpc (US$6425.37) on the continent and their HDI (0.63) is second to Tunisia.

Unit root test

For robust statistical analysis, we use seven different panel unit root tests. Breitung and Das (2005), Phillips and Perron (1988) (PP), augmented Dickey-Fuller (ADF), (Dickey and Fuller 1979), Im et al. (2003) (IPS), Harris and Tzavalis (1999) (HT), and Levin et al. (2002) (LLC) unit root tests have their null hypothesis that panels contain a unit root against the alternative that panels are stationary. The null hypothesis of the seventh test, Hadri (2000), states that all panels are stationary, and the alternative states that some panels contain unit roots. Therefore, rejecting the null hypothesis in the first six tests implies that the panel is stationary, while in the seventh test rejecting the null implies that some panels contain a unit root.

Table 13 shows the results of the unit root tests. The majority of the unit root tests fail to reject the null hypothesis at level but reject the null hypothesis at first difference, at 10% significance level. Thus, the results show that RNEW%, FDI, GDPpc, HDI, DEM, and TO are stationary at their first difference. Therefore, the above variables are integrated of order one (I (1)) and meet the statistical requirement for the Westerlund cointegration analysis.

Panel causality estimation

Table 14 shows the results of the Granger causality test (augmented version) where the null hypothesis is that the independent variable does not Granger-cause the dependent variable. The findings show that renewable energy consumption has a bi-directional causality with GDPpc, TO, HDI, and DEM, for at least one country. For the period under study, the causality of FDI with RNEW% is unidirectional; thus, renewable energy consumption Granger-causes FDI in at least one of the countries under study.

Estimation of fixed and random effects

Having satisfied the precondition that the variables under investigation are integrated of order one (see Table 13), the study proceeds with the estimation method using the fixed- and random-effects estimators. The fixed-and random-effects models are estimated with RNEW% as the dependent variable and lnFDIcons, lnGDPpc, TO, DEMrev, and HDI as the independent variables. The DEM values are reversed to ease the interpretation of results in the variable DEMrev. Now, a higher average rating means more freedom. There are three estimations in this section (see the “Fixed-effect estimators and variance components model (random effects)” section). The first one (Eq. (2)) seeks to understand the relationship between social factors (HDI and DEM) and renewable energy consumption. The second model (Eq. (3)) focuses on the relationship of economic variables (GDPpc, FDI, and TO) with renewable energy consumption. The last estimation (Eq. (4)) is run as a check by bringing all the independent variables together except for HDI because it is highly correlated with GDPpc (0.81 Pearson’s correlation coefficient).Footnote 8 Figure 1 below depicts the GDPpc and HDI for all the countries and years under consideration. It can be seen that the relationship between these two variables is positive and strong. The relationship is mostly linear, except for Botswana, South Africa, and Swaziland where GDPpc and HDI have a U-shaped relationship: Even though at the beginning the relation is negative, it eventually turns to be positive as GDPpc increases. Analyzing all the countries and years together, it can be observed that a small change in GDPpc has a very strong effect on HDI until a GDPpc circa $1400 (that corresponds to an HDI circa 0.55). Above this value, an increase in GDPpc has a smaller—although still important—effect on HDI. This is in line with Arto et al. (2016) results: HDI increases when GDP increases in countries with low levels of GDPpc; but in countries with higher levels of GDPpc, the relation is weaker. All the countries included in this study have low levels of GDPpc, explaining why the correlation between HDI and GDP is so strong (0.81 Pearson’s correlation coefficient).

Tables 15, 16, and 17 show the estimation results which are interpreted at 10% significance level. The Hausman’s specification test was used as a post-estimation method to compare the fixed- and random-effects estimates. According to the Hausman’s test (Tables 15, 16, and 17), the null hypothesis of “difference in coefficients is not systematic” cannot be rejected. Hence, the random-effects model estimate is deemed appropriate in interpreting the results.

The robust statistical analysis results from the random-effects model in Table 15 show that an increase in HDI by 0.1 points reduces renewable energy consumption by 5.1 percentage points (pp). The nexus between RNEW% and the level of democracy is not statistically significant.

The results from the random-effects model in Table 16 show that a 1% increase in GDPpc reduces RNEW% by 0.2 pp. A 1% increase in FDI increases RNEW% by 0.002 pp. Trade openness does not have a statistically significant effect on RNEW%. The results of Table 17 concur with those from Tables 15 and 16.

Discussion

This article analyzed the relationship between the share of renewables in energy consumption and social (HDI and DEM) and economic (GDPpc, FDI, and TO) variables. Regarding HDI, a higher HDI implies higher life expectancy, better education, and higher income (GDP per capita). Therefore, if a country has a higher HDI, its populace, on average, would be provided with better living standards that could drive their decisions to protect their environment. Thus, one might expect to observe a larger share of renewables in a country’s energy consumption if the country has a higher HDI.

However, our econometric results and Fig. A.2 in the appendix show otherwise.Footnote 9 We find that a higher HDI in Africa reduces renewable energy consumption. This finding can be explained by the review of the 21 countries which shows that most of the renewable energy consumed is obtained through “traditional” methods such as burning wood for cooking (see the “Brief background information on Africa and the continent’s energy miX” section and Owusu 2018). Therefore, with a higher HDI, the traditional methods of renewable energy consumption will decline and an increase will be observed in the use of modern methods utilizing fossil fuels (e.g., LPG for cooking). It will also increase the number of automobiles that run on fossil fuel, and industries will be developed. Considering the economic status across the continent and the low electrification rates, traditional energy usage is a relatively cheaper option compared to advanced renewable energy technologies, hence the observed reduction in renewable energy consumption with an increase in HDI.

Regarding the economic variables, it is observed that economic growth reduces renewable energy consumption. This can be discussed from two viewpoints: first, one of the goals of most developing and underdeveloped countries is to grow economically. As energy drives economic growth and fossil energy is a cheaper option, its consumption will be increased to promote income growth. Secondly, growth in income (GDP) can prompt the populace to seek more efficient options and reduce the use of traditional methods of renewable energy. The shift is capital intensive; hence, the percentage of renewable energy consumption declines. Our findings contradict those of Sadorsky (2009a) for the G7 countries who obtains that GDP per capita is a driver of renewable energy usage. As can be seen in Fig. A.1 in the appendix, the relationship between GDPpc and RNEW% is negative for all the countries except Rwanda, where the relationship is positive but weak. The difference with Sadorsky (2009a)’s finding can be explained by the fact that the G7 countries are developed while most African countries are still developing. Therefore, after some point, with increased income (GDP growth) on the African continent, an increase in the use of “modern” renewable energy can be expected.

On the other hand, Salim and Rafiq (2012) obtain the same finding as Sadorsky (2009a) for emerging countries. However, it should be noticed that while those papers focus on renewable energy consumption per se (in absolute values), we consider the share of renewable sources in total energy consumption. An increase in renewable energy consumption does not imply an increase in its share as long as the consumption of non-renewable energy increases at a higher rate.

The above-mentioned negative relationships between HDI and RNEW% and between GDPpc and RNEW% explain why we observe that the average share of renewables in energy consumption in the continent is much higher than the world average (see Table 6). The fact that Africa contains many low-income level countries, as reflected in Table A.1 in the Appendix, makes it a continent which consumes energy produced mainly from traditional renewable energy sources.

The relationship between renewable energy consumption and foreign direct investment inflows is positive. As such, foreign direct investment can be considered as a factor affecting renewable energy consumption. Foreign direct investment can lead to an improvement in renewable energy technologies in Africa. Therefore, sustained growth in foreign direct investment inflows might assist the region in the achievement of a long-term reduction in climate change-related outcomes while promoting sustainable development.

Conclusions and policy recommendations

This paper examined factors affecting renewable energy consumption in Africa by considering the nexus between renewable energy consumption and some social and economic factors. The main empirical findings are that the share of renewables in the energy mix is negatively correlated to GDPpc and HDI, and positively related to FDI. The causality tests show that there is bi-directional causality between GDPpc, FDI, HDI, trade openness, the level of democracy in a country, and the share of renewables in energy consumption, except for foreign direct investment that shows a unidirectional causality.

Although renewable energy consumption has a positive effect on the environment, most of the renewable energy consumed in Africa is through “traditional” methods which is being replaced by “modern” but fossil-fuel-based energy. Considering our empirical findings, it is recommended that policymakers improve their efforts in educating their populace on the use of “clean” renewable energy and energy efficiency.

Secondly, development cooperation (such as World Bank partnership with recipient governments) should research into clean and modern renewable energy alternatives that are affordable and reliable in Africa. Such cooperation is important since, as pointed out by Marques and Fuinhas (2012), the switch to modern renewable sources is lengthy and needs very large investments, which most of the African countries cannot afford by themselves.

Thirdly, African countries should also accelerate the implementation of policies and incentives to increase the supply of energy from modern renewable sources, to stimulate the switch from traditional renewable energy to modern renewable energy. As Sadorsky (2009b) points out, countries that have stronger policies implemented to encourage renewable energy consumption are the ones that enjoy higher growth rates of consumption of such sources.

Finally, economic policies that can promote income growth to a level where it may actually foster modern renewable energy consumption and policies to attract foreign direct investment are recommended, since we found that FDI is positively related to renewable energy consumption.

Notes

Arto et al. (2016) define energy footprint as “the energy consumed worldwide to satisfy the domestic final demand of a country, including both the direct energy consumption of households and the global energy requirements to produce the goods and services demanded by final users” (Arto et al. 2016, p. 3).

The countries are Benin, Botswana, Burundi, Cameroon, Egypt, Ghana, Guinea, Kenya, Malawi, Mali, Mauritius, Morocco, Rwanda, Senegal, Sierra Leone, South Africa, Swaziland, Tanzania, Togo, Tunisia, and Uganda. The country choice is discussed in “Data and countries selection”.

See Owusu (2018) for a detailed analysis of the energy mix and potential of those 21 countries.

World Development Indicators (WDI) 2017.

As FDI takes a negative value for some observations, the same constant has been added to all values to obtain a positive value and to be able to perform its logarithmic transformation.

The countries Egypt, Senegal, Sierra Leone, Togo, Burundi, Malawi, Cameroon, Mauritius, Botswana, South Africa, and Swaziland have a positive FDI for at least one year in the period of study.

The country level descriptive analysis is presented in the appendix.

A table with the correlation coefficients is presented in the appendix.

Figure A.2 in the appendix shows the relationship between HDI and RNEW% for all the countries and years under study. It shows a negative relationship between these two variables for all the countries except Rwanda and Swaziland where the relationship is positive, and Burundi and South Africa where the relationship is extremely weak.

References

Abbasi T, Abbasi S (2011) Renewable energy sources: their impact on global warming and pollution. PHI Learning Private Limited, New Delhi

Akizu-Gardoki O, Bueno G, Wiedmann T, Lopez-Guede JM, Arto I, Hernandez P, Moran D (2018) Decoupling between human development and energy consumption within footprint accounts. J Clean Prod 202:1145–1157

Alabi O, Ackah I, Lartey A (2017) Re-visiting the renewable energy–economic growth nexus: empirical evidence from African OPEC countries. Int J Energy Sect Manage 11:387–403

Aleman JC, Jarzyna MA, Staver AC (2018) Forest extent and deforestation in tropical Africa since 1900. Nat Ecol Evol 2(1):26–33

Amri F (2017) Carbon dioxide emissions, output, and energy consumption categories in Algeria. Environ Sci Pollut Res 24(17):14567–14578

Apergis N, Payne JE (2010) Renewable energy consumption and economic growth: evidence from a panel of OECD countries. Energy Policy 38(1):656–660

Apergis N, Payne JE (2011) The renewable energy consumption—growth nexus in Central America. Appl Energy 88(1):343–347

Arto I, Capellán-Pérez I, Lago R, Bueno G, Bermejo R (2016) The energy requirements of a developed world. Energy Sustain Dev 33:1–13

Attiaoui I, Toumi H, Ammouri B, Gargouri I (2017) Causality links among renewable energy consumption, CO2 emissions, and economic growth in Africa: evidence from a panel ARDL-PMG approach. Environ Sci Pollut Res 24:13036–13048

Baltagi B (2008) Econometric analysis of panel data. John Wiley & Sons, Inc., Hoboken

Barrios S, Bertinelli L, Strobl E (2006) Climatic change and rural–urban migration: the case of sub-Saharan Africa. J Urban Econ 60:357–371

Ben Aïssa MS, Jebli MB, Youssef SB (2014) Output, renewable energy consumption and trade in Africa. Energy Policy, 66:11-18.

Bekun FV, Alola AA, Sarkodie SA (2019a) Toward a sustainable environment: Nexus between CO2 emissions, resource rent, renewable and nonrenewable energy in 16-EU countries. Sci Total Environ 657:1023–1029

Bekun FV, Emir F, Sarkodie SA (2019b) Another look at the relationship between energy consumption, carbon dioxide emissions, and economic growth in South Africa. Sci Total Environ 655:759–765

Ben Jebli M, Ben Youssef S, Ozturk I (2015) The role of renewable energy consumption and trade: environmental Kuznets curve analysis for sub-Saharan Africa countries. Afr Dev Rev 27:288–300

Ben Mbarek M, Saidi K, Rahman MM (2018) Renewable and non-renewable energy consumption, environmental degradation and economic growth in Tunisia. Qual Quant 52(3):1105–1119

Birdsall N, Wheeler D (1993) Trade policy and industrial pollution in Latin America: where are the pollution havens? J Environ Dev 2:137–149

Bouwer LM (2019) Observed and projected impacts from extreme weather events: implications for loss and damage. In: Mechler R, Bouwer L, Schinko T, Surminski S, Linnerooth-Bayer J (eds) Loss and Damage from Climate Change. Climate Risk Management, Policy and Governance. Springer, Cham

Breitung J, Das S (2005) Panel unit root tests under cross-sectional dependence. Statistica Neerlandica 59:414–433

Bugaje I (2006) Renewable energy for sustainable development in Africa: a review. Renew Sust Energ Rev 10:603–612

Challinor A, Wheeler T, Garforth C, Craufurd P, Kassam A (2007) Assessing the vulnerability of food crop systems in Africa to climate change. Clim Chang 83:381–399

Collier P, Conway G, Venables T (2008) Climate change and Africa. Oxf Rev Econ Policy 24:337–353

Davis P (2002) Estimating multi-way error components models with unbalanced data structures. J Econ 106:67–95

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431

Dumitrescu EI, Hurlin C (2012) Testing for Granger non-causality in heterogeneous panels. Econ Model 29:1450–1460

Edenhofer O, Pichs-Madruga R, Sokona Y, Seyboth K, Matschoss P, Kadner S, Zwickel T, Eickemeier P, Hansen G, Schlömer S, von Stechow C (eds) (2011) IPCC special report on renewable Energy sources and climate change mitigation. Cambridge University press, Cambridge

Eskeland GS, Harrison AE (2003) Moving to greener pastures? Multinationals and the pollution haven hypothesis. J Dev Econ 70:1–23

FreedomHouse.org (2017) Freedom in the world 2017. Retrieved from https://freedomhouse.org/report/freedom-world/freedom-world-2017. Accessed 26 Aug 2017

Future Energy Africa (2018) An African Energy Industry Report: 2018. Industry survey, market intelligence, and forecasts series. ispypublishing ltd, Bolton

Granger CW (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37:424–438

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free trade agreement, National Bureau of Economic Research Working Paper No. 3194

Gürlük S (2009) Economic growth, industrial pollution and human development in the Mediterranean region. Ecol Econ 68:2327–2335

Hadri K (2000) Testing for stationarity in heterogeneous panel data. Econ J 3:148–161

Harris RD, Tzavalis E (1999) Inference for unit roots in dynamic panels where the time dimension is fixed. J Econ 91:201–226

Harrison A (1996) Openness and growth: a time-series, cross-country analysis for developing countries. J Dev Econ 48:419–447

Hausman JA (1978) Specification tests in econometrics. Econometrica 46:1251–1271

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econ 115:53–74

IPCC (2014) Climate change 2014: synthesis report. In: Core Writing Team, Pachauri RK and Meyer LA (eds.) Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. IPCC, Geneva, 151 pp.

Jensen V (1996) The pollution haven hypothesis and the industrial flight hypothesis: some perspectives on theory and empirics. Centre for Development and the Environment (Working Paper 1996.5), University of Oslo, Oslo

Kaygusuz K (2012) Energy for sustainable development: a case of developing countries. Renew Sust Energ Rev 16:1116–1126

Kraft J, Kraft A (1978) On the relationship between energy and GNP. J Energy Devel 3:401–403

Levin A, Lin C-F, Chu C-SJ (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econ 108:1–24

Marques AC, Fuinhas JA (2012) Is renewable energy effective in promoting growth? Energy Policy 46:434–442

Omri A, Daly S, Nguyen DK (2015) A robust analysis of the relationship between renewable energy consumption and its main drivers. Appl Econ 47:2913–2923

Owusu PA (2018) The nexus between renewable energy consumption, environmental pollution, and socio-economic variables in Africa: an econometric approach. Master Thesis

Owusu PA, Asumadu-Sarkodie S (2016) A review of renewable energy sources, sustainability issues and climate change mitigation. Cogent Eng 3:1167990

Panayotou T (1993) Empirical tests and policy analysis of environmental degradation at different stages of economic development. World Employment Programme Research Working Paper No. 238

Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346

Rasoulinezhad E, Saboori B (2018) Panel estimation for renewable and non-renewable energy consumption, economic growth, CO2 emissions, the composite trade intensity, and financial openness of the commonwealth of independent states. Environ Sci Pollut Res 25:17354–17370

REN21 (2017) Renewables 2017 Global Status Report. REN21 secretariat, Paris

Sadorsky P (2009a) Renewable energy consumption, CO2 emissions and oil prices in the G7 countries. Energy Econ 31:456–462

Sadorsky P (2009b) Renewable energy consumption and income in emerging economies. Energy Policy 37:4021–4028

Salim RA, Rafiq S (2012) Why do some emerging economies proactively accelerate the adoption of renewable energy? Energy Econ 34(4):1051–1057

Shahbaz M, Solarin SA, Ozturk I (2016) Environmental Kuznets curve hypothesis and the role of globalization in selected African countries. Ecol Indic 67:623–636

Smil V (2005) Energy at the crossroads: global perspectives and uncertainties. MIT Press, Cambridge

Solarin SA, Al-Mulali U, Musah I, Ozturk I (2017) Investigating the pollution haven hypothesis in Ghana: an empirical investigation. Energy 124:706–719

Tiwari GN, Mishra RK (2012) Advanced renewable energy sources. Royal Society of Chemistry Publishing, Cambridge

Torras M, Boyce JK (1998) Income, inequality and pollution: a reassessment of the environmental Kuznets curve. Ecol Econ 25:147–160

United Nations Development Programme (2016) Human Development Report. Retrieved from http://hdr.undp.org/en/data. Accessed August 2017

Wansbeek T, Kapteyn A (1989) Estimation of the error-components model with incomplete panels. J Econ 41:341–361

Wesseh PK, Lin B (2016) Can African countries efficiently build their economies on renewable energy? Renew Sust Energ Rev 54:161–173

World Bank (2017) World development indicators 2017. Washington, D.C. https://data.worldbank.org/data-catalog/world-development-indicators. Accessed July 2017

Wu XF, Chen GQ (2017) Global primary energy use associated with production, consumption and international trade. Energy Policy 111:85–94

Wuebbles DJ, Jain AK (2001) Concerns about climate change and the role of fossil fuel use. Fuel Process Technol 71:99–119

Xing Y, Kolstad C (1996) Environment and trade: a review of theory and issues. MPRA Paper No. 27694

Yanikkaya H (2003) Trade openness and economic growth: a cross-country empirical investigation. J Dev Econ 72:57–89

Zarsky L (1999) Havens, halos and spaghetti: untangling the evidence about foreign direct investment and the environment. In: Foreign direct investment and the environment. OECD Publishing, Paris, pp 47–74. https://doi.org/10.1787/9789264266315-en

Zoundi Z (2017) CO2 emissions, renewable energy and the environmental Kuznets curve, a panel cointegration approach. Renew Sust Energ Rev 72:1067–1075

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Philippe Garrigues

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This article is derived from Phebe Asantewaa Owusu’s Master’s thesis (Owusu 2018) titled “The Nexus Between Renewable Energy Consumption and Socio-Economic Variables in Africa: An Econometric Approach”. The authors are ordered alphabetically.

Electronic supplementary material

ESM 1

(DOCX 488 kb)

Rights and permissions

About this article

Cite this article

Ergun, S.J., Owusu, P.A. & Rivas, M.F. Determinants of renewable energy consumption in Africa. Environ Sci Pollut Res 26, 15390–15405 (2019). https://doi.org/10.1007/s11356-019-04567-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-019-04567-7

Keywords

- Renewable energy consumption

- Human development index

- Democracy

- Gross domestic product per capita

- Foreign direct investment

- Trade openness

- Africa