Abstract

Considering the dearth of research on the impact of sustainability reporting practices on financial stability in the context of transition economies, this study aims to explore sustainability reporting practices of top oil and gas companies in Russia and investigate the effects of sustainability performance indicators on financial stability in the context of a given emerging economy. The study is based on panel data analysis of sustainability performance indicators and financial data of forty-five largest oil and gas companies listed on the Russian Trading Stock Exchange over the period 2012–2016. Data on sustainability performance were collected through analyzing sustainability reports and annual reports, while financial data were obtained from audited financial statements downloaded from company websites. The empirical results indicate that companies improve their sustainability performance indicators in order to manage risk and improve their financial stability. The results also show that firm-specific characteristics, such as financial capacity, leverage, firm size, and firm age, are important underlying factors affecting the degree of financial distress and financial stability. The findings of the study provide managers and practitioners with useful aspects of sustainability performance indicators to improve financial stability and mitigate financial distress. Additionally, investors and practitioners should consider other underlying factors, including financial capacity, leverage, firm size, and firm age, that may influence financial stability. Finally, the findings are useful for policymakers and regulators in promoting Global Reporting Initiative guidelines which will ultimately lead to sustainable development and financial stability in the context of emerging markets.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Recent corporate scandals, the world financial crisis, and global environmental issues have caused increasing demands from a diverse set of stakeholders for improved transparency and regular disclosure of non-financial performance indicators of business entities (Habek 2014). Therefore, considering the increasing global public awareness and sensitivity to economic, environmental, and social problems, modern business organizations demonstrate their commitment to sustainability performance and development (Ehnert et al. 2016). Companies inform their stakeholders about their economic, environmental, and social performance in order to meet the needs and expectations of the society and justify their business activities and operations (De Villiers et al. 2014; Dissanayake et al. 2016). In this context, sustainability initiatives as well as sustainability reporting (SR) practices enable business organizations to satisfy the interests of all stakeholders who want to make better investment choices and rational decisions. Business organizations provide sustainability disclosures with higher application levels to enhance transparency, improve corporate value and brand name, mitigate information asymmetry, motivate managers and employees, and ultimately gain competitive advantage over the competitors (Kılıç et al. 2015). Moreover, SR on economic, environmental, and social performance substantially contributes to corporate stability, continuous growth, and development (Lozano and Huisingh 2011). Therefore, it is not surprising that the concept of SR has been gaining prominence among policymakers, regulators, practitioners, and scholars for the last few years.

Since the collapse of the Soviet Union in 1991, the Russian economy has undergone significant reforms and restructuring changes through its transition from a central (i.e., socialist) economy to a free market economy. In this regard, sustainable development and social responsibility play a vital role in carrying out state reforms, implementing state-related strategic projects, improving an investment climate, and promoting long-term economic growth, especially in the case of developing countries and transition economies (World bank 2006). Consequently, the concept of sustainability development first appeared in Russia after the 1992 Rio Declaration on Environment and Development (Bobylev and Perelet 2013). The importance of introducing best practices of sustainability into the business community was recognized and supported by the Russian government. For example, in 1994, the government issued a presidential decree “On the State Strategy of the Russian Federation for Conservation and Ensuring Sustainable Development” (Bobylev and Perelet 2013). This strategic framework presents the main priorities of sustainable development, including ensuring environmental safety in industries, sustainable management of natural resources, ensuring a healthy environment for both urban and rural areas, improvement of waste management, environmental education, biodiversity and forest protection, and ecosystem recovery in damaged regions of Russia (Andreassen 2016). However, SR practices in Russia receive relatively less attention from scholars than SR practices in other emerging markets (Fifka and Pobizhan 2014). Thus, considering the dearth of research on SR in the emerging market of Russia, this study aims to explore SR practices of public companies operating in the Russian oil and gas industry and investigate the effects of sustainability performance indicators on financial stability in the context of a given emerging economy.

Although a number of previous studies have investigated the effects of corporate social responsibility (CSR) on financial stability in developed markets and well-established emerging economies (Gong and Ho 2017; Benlemlih and Girerd-Potin 2017; Qiu et al. 2016; Gupta and Krishnamurti 2016; Jiraporn et al. 2014; Sun and Cui 2014; Jo and Na 2012), the findings of those studies cannot be generalized to a market such as Russia, which has a distinctive capital market and unique institutional setting. Moreover, prior studies have focused on CSR activities to examine the impacts of CSR engagement on financial stability. Therefore, our study extends the current literature by assessing the extent of sustainability and sustainability reporting practices based on the guidelines of the Global Reporting Initiative (GRI) framework. Due to its comprehensiveness, visibility, and prestige, the GRI framework has been recognized as the widely accepted global standard for SR by top corporations worldwide (Sartori et al. 2017; Kuzey and Uyar 2017). Unlike other different reporting frameworks and guidelines, the GRI standards and guidelines are designed to present more transparent, informative, and detailed information on economic, social, and environmental performance aspects of sustainability (Fonseca et al. 2012). We assume that assessment of SR practices based on GRI would provide a more comprehensive scenario of SR practices and their impact on financial stability and risk management in the context of Russia which is almost non-existent in empirical studies.

Consistent with our expectations, the empirical results of this study indicate that companies improve their sustainability performance indicators to manage risk and improve their financial stability, thus supporting the theoretical framework of the study. A panel data analysis of the association between the aggregate quality of sustainability and financial stability shows that companies with better sustainability performance are less risky and, therefore, more financially stable. The findings also indicate that firm-specific characteristics, including financial capacity, leverage, firm size, and firm age, are significant factors affecting the degree of financial stability. The results are robust to the use of an alternative measure for financial stability and for endogeneity.

Our study contributes to the growing body of literature related to sustainability and SR practices in a number of ways. First, it extends the current literature by exploring sustainability practices of top oil and gas companies in the Commonwealth of Independent States (CIS) context, i.e., more specifically in Russia. Second, in contrast with prior studies on SR that mostly analyze underlying factors influencing the extent and quality of sustainability information, our study assesses the linkage between sustainability performance indicators and financial stability. Third, the present study extends the current literature by analyzing economic, environmental, and social performance indicators of sustainability in the Russian oil and gas industry based on the latest version of the GRI framework—GRI4 standards. Furthermore, the present study is unique in examining the differential and aggregate impacts of sustainability performance on financial stability.

The remainder of the paper is organized as follows. The “Research context: the oil and gas industry of Russia and the need for sustainable development and SR practices” section provides a brief description of the research context. The “Literature review and hypothesis development” section presents the theoretical framework of the study, reviews the relevant literature related to the concept of SR, and develops the hypotheses. The “Data and methodology” section introduces data and variables followed by the research methodology. The “Findings and analysis” section provides the empirical findings of the study, and the “Conclusion and policy implications” section summarizes and concludes.

Research context: the oil and gas industry of Russia and the need for sustainable development and SR practices

The oil and gas sector accounts for approximately 20% of the Russia’s GDP and represents more than 50% of the total export revenue (Simola and Solanko 2017). The largest oil and gas companies in Russia represent more than 50% of the Russian stock market index. Therefore, the Russian oil and gas industry has been significantly contributing to the development of the national economy for the last few years. However, since oil and fuel markets worldwide were severely affected by the global financial crisis of 2008–2009 (Jobbágy and Bai 2012), the country had to promote energy resources, including production and export of natural resources. Moreover, Western sanctions against Russia over the crisis in Ukraine and the recent decline in world prices of oil and other commodities led the Russian economy to economic recession (Tuzova and Qayum 2016). Therefore, economic challenges, political crisis, frozen capital markets, and industrial recession are the main factors that have necessitated the development of the sustainability idea as one of the pillars of economic growth, environmental development, and social well-being of the country, especially in the oil and gas industry, which is an integral part of the economy. As the energy sector plays a distinguishing role in the country’s security, its long-term sustainability and economic development as well as sustainability priorities, in the strategic context, accompany development phenomena in the Russian economy (Andreassen 2016).

In 1996, the Russian government adopted the presidential decree “On the Concept for the Russian Federation’s Transition to Sustainable Development” with an objective to promote the sustainable development of the economy (Andreassen 2016). However, due to inefficient reforms during the transition period, both the 1994 and 1996 legal documents failed to introduce the concept of sustainable development to Russian companies and, therefore, had no real influences on corporate policies (Andreassen 2016; Bobylev and Perelet 2013). In 2002, the Russian government approved the country’s official Environmental Doctrine that highlights sustainability-related priorities, including sustainable use of natural resources, biodiversity, ensuring environmental safety in emergency, reduction of environmental pollution, and improving social well-being of the population. Later, in 2002, the government of 12 countries from Eastern Europe, Caucasus, and Central Asia regions adopted the Environmental Strategy to promote sustainable development and global CSR through environmental reforms, policies, and partnerships.

The priorities of the 2002 Environmental Doctrine and the 2002 Environmental strategy have initiated the first steps toward corporate disclosure of sustainability and CSR information on company websites and in corporate reports about general sustainability performance and CSR policies using key labels, such as “Sustainability Development,” “CSR,” “Environmental Performance,” and “Social Responsibility” (Andreassen 2016). As a result, CSR engagement slightly improved in the first decade of the twenty-first century. According to the official report of the Russian Union of Industrialists and Entrepreneurs, there has been a relatively good progress in non-financial reporting practices among Russian companies and most companies that publish their sustainability reports mainly operate in energy, oil and gas, and mining industries (Russian Union of Industrialists and Entrepreneurs 2017). However, recent political issues and economic recession have hampered progress in CSR and sustainability development (Simola and Solanko 2017). Since Russia is a post-communist country, CSR activities and expectations are still low and business organizations operate in a highly regulated environment. Although many large companies started actively implementing CSR in the early of 2000s, the state of CSR including sustainability development in Russia is still in a transitional stage (Fifka and Pobizhan 2014). Given the fact that non-financial disclosures, including CSR and sustainability information, are mostly voluntary in nature, improving social and environmental responsibility standards and transparency in the oil and gas industry of Russia is one of the critical tasks for the Russian business community (Shvarts et al. 2016).

Literature review and hypothesis development

Since most business organizations are still unaware of the importance of voluntary disclosures, including SR, information asymmetry is high in transition economies and emerging markets (Mahmood and Orazalin 2017). Therefore, the present study forms a theoretical framework, including the agency and the legitimacy theories, to justify the association between sustainability performance and financial stability in the context of the emerging market of Russia. The agency theory postulates that moral managers undertake socially responsible activities which may improve transparency, reduce information asymmetry, promote strategies and philanthropy, and, eventually, minimize financial risk (Jensen and Meckling 1976). According to the principle of managerial discretion, managers are moral actors who should be involved in socially responsible undertakings (Wood 1991). Companies with greater social responsibility performance are more likely to report their CSR activities and, consequently, improve transparency and the quality of reporting (Dhaliwal et al. 2011). Rajgopal and Venkatachalam (2011) argue that higher levels of transparency and corporate reporting reduce information asymmetry and mitigate perceived financial risk. From the CSR point of view, information asymmetry is more severe among companies with weak CSR ratings (Cho et al. 2013). This is consistent with Kim et al. (2012) who conclude that companies with better CSR performance are less likely to engage in earnings management, thus confirming that CSR involvement improves corporate disclosure and reduces information asymmetry.

From the legitimacy theory perspective, companies with better social ratings are likely to act in an ethical and socially responsible manner and provide more informative, detailed, and transparent information voluntarily in order to comply with applicable laws, regulations, and ethical standards (Cheung et al. 2010). Companies with better social performance benefit from a low likelihood of financial penalties and lawsuits, have less strict regulatory controls, and gain a higher degree of customer loyalty and employee support (Benlemlih and Girerd-Potin 2017). This definitely reduces a company’s risk of facing financial distress, and, therefore, socially responsible companies enjoy higher credit rating, have less financial risk, and exhibit better performance (Goss and Roberts 2011; Godfrey 2005).

Since sustainability, cost efficiency, and reliability of supply are important competitive priorities for modern business organization (Torjai et al. 2015), it is expected that improved sustainability performance helps firms reduce information asymmetry, gain a higher degree of customer loyalty and employee support, build customer loyalty, and maintain stable relations with all stakeholders in times of financial instabilities. In other words, sustainability undoubtedly reduces a company’s risk of financial distress and bankruptcy. Therefore, it is assumed that higher economic, environmental, and social ratings and better sustainability reporting practices lead to a better financial stability.

Individual performance indicators of sustainability and financial stability

Orlitzky and Benjamin (2001) provide an extensive overview of research articles that examine the relationship between social performance and financial risk in the US market between 1978 and 1995. Through their meta-analysis, the authors support the theoretical argument that there is a negative relationship between these two variables and conclude that better CSR practices are associated with lower financial risk. Using data of US companies from the three-digit zip code areas, Jiraporn et al. (2014) provide evidence that companies with better social performance enjoy more favorable credit ratings. Bouslah et al. (2016) conclude that the aggregated measure of social performance reduces volatility significantly during the financial crisis based on a sample of US firms. Within the FTSE350 index, Qiu et al. (2016) find that companies with higher levels of social disclosures have higher market values. Oláh et al. (2017) conclude that the level of social trust established in organizations with employees and co-workers has a positive impact on financial performance and flexibility in the case of Hungarian logistics enterprises. There is general consensus in the existing literature that companies from environmentally sensitive sectors are likely to disclose more informative and transparent environmental and social disclosures (Guidry and Patten 2012; Clarkson et al. 2011; Brammer and Pavelin 2008). To avoid pollution-related penalties and lawsuits, companies act in favor of the environment, which can lead to improved corporate image, less strict regulatory controls, and greater levels of trust and loyalty in the society (Sharfman and Fernando 2008). Focusing on environmental risk management practices by US firms, Sharfman and Fernando (2008) report that improved environmental risk management is negatively related to cost of capital. El Ghoul et al. (2011) provide empirical evidence that investment in improving CSR substantially improves credit rating and reduces cost of capital based on data of US firms. Based on the theoretical framework and the findings of most prior studies, we, thus, expect that better performance in all three dimensions of sustainability—economic, environmental, and social performance—would reduce firm risk and, therefore, improve financial stability. Therefore, the following hypotheses are formulated:

-

H1: Better performance in every dimension of sustainability development improves financial stability of top oil and gas companies in Russia.

-

H1a: Economic sustainability performance is positively associated with financial stability of top oil and gas companies in Russia.

-

H1b: Environmental sustainability performance is positively associated with financial stability of top oil and gas companies in Russia.

-

H1c: Social sustainability performance is positively associated with financial stability of top oil and gas companies in Russia.

Sustainability performance and financial stability

While the relationship between voluntary disclosure and firm performance has been widely investigated in prior literature (Cheng et al. 2016), there is a paucity of research on the association between voluntary disclosure and financial performance from the perspective of financial stability. As reported by Goss and Roberts (2011), lenders are likely to offer attractive loan terms to more sustainability responsible companies because socially responsible activities improve corporate image, build good relationships with all stakeholders, and attract and retain key people, which will lead to lower risk and better financial performance over time (Chen and Wang 2011). Within the context of China, Gong and Ho (2017) provide evidence that stronger CSR performance improves corporate stability. Similarly, Benlemlih and Girerd-Potin (2017) find a negative association between CSR and financial risk based on samples from 25 countries. Several prior studies also support the notion that CSR engagement can reduce cost of capital (Goss and Roberts 2011; Dhaliwal et al. 2011; Chava 2014). Czarnitzki and Kraft (2007) analyze a large sample of Western Germany manufacturing companies and conclude that an interest rate increases to compensate for a possible default if the company has a weak and worse credit rating. Existing literature on the association between CSR engagement and financial stability is not limited to conventional measures of financial risk. For example, Dilling (2010) argues that companies issuing higher quality disclosures obtain better credit ratings which improve their financial success and lead to higher profits in the future. Similarly, Goss (2009) concludes that CSR engagement is an important determinant of firm distress and finds a negative association between CSR activities and the probability of default using a sample of US firms. Based on the theoretical framework of this study and the discussion of prior studies, it is assumed that sustainability performance indicators reduce the perceived risk of financial distress and, therefore, improve financial stability. Therefore, the following hypothesis is constructed:

-

H2: Sustainability performance is positively associated with financial stability of top oil and gas companies in Russia.

Data and methodology

Sample selection

The study analyzes data of largest public companies operating in the Russian oil and gas industry over the period 2012–2016. The research population is based on fifty-eight largest oil and gas companies listed on the Russian Trading Stock Exchange as of December 31, 2016. However, companies with insufficient data on sustainability and financial indicators are eliminated from the initial sample. This selection approach leaves us with a sample of forty-five companies, which still represents the majority of the oil and gas industry. After dropping potential outliers from both tails and removing year observations with net loss amounts and negative equity values, the final sample consists of 181 year observations for the period 2012 to 2016. The study of SR practices is particularly interesting in this time period as petroleum companies in Russia have been recently exposed to several economic crises and financial challenges (Tuzova and Qayum 2016; Orazalin and Mahmood 2018). Data on sustainability performance were collected through analyzing sustainability reports and annual reports, while financial data were obtained from audited financial statements downloaded from company websites.

Dependent variables

Since our main objective is to examine the impacts of sustainability performance on financial stability, we apply the Z score as a dependent variable. Recent studies by Gong and Ho (2017), Kuranchie-Pong et al. (2016), and Laeven and Levine (2009) have used the Z score as a measure of financial stability which assesses the distance from insolvency and the likelihood of bankruptcy. The Z score is measured as follows:

where, ROA is a return on total assets, measured as the ratio of net earnings to total assets; CAR is a capital adequacy ratio calculated as the ratio of equity capital to total assets; and σ (ROA) is a standard deviation of ROA. In accordance with Gong and Ho (2017), we determine the mean and standard deviation values of ROA for each 5-year period to incorporate the Z score value as a panel variable. A higher Z indicates that the company is less risky and, therefore, more financially stable.

Independent variables

In line with prior research, this study focuses on sustainability performance indicators reported by the companies in their annual reports and sustainability disclosures. Bear et al. (2010) and Jo and Harjoto (2011) argue that information contained in self-reported disclosures is under much control of board of directors and managers and, therefore, is more relevant and reliable than information provided by commercial agencies and interest groups.

The globally recognized GRI framework provides applicable reporting guidelines to assess economic (ECON), environmental (ENVN), and social (SOCL) aspects of SR practices of modern business organizations (Brown et al. 2009). Therefore, we measure individual dimensions of SR, including economic (9 items), environmental (34 items), and social (48 items) performance indicators, using the GRI G4 standards. Following prior studies, we apply a content analysis method to measure the extent of sustainability performance indicators. In particular, we analyze the presence or absence of sustainability performance indicators in annual reports and stand-alone sustainability reports based on the GRI standards and guidelines. A dichotomous approach is applied by assigning a value of one in case if an item is reported and zero if it is not reported. All assigned items are summed to calculate a total score within each individual SR dimension for each company. The individual score for each dimension is, then, calculated as the ratio of total items reported to the total number of items available and, therefore, is expressed in percentage terms. To measure the overall quality of sustainability disclosure, we construct a composite SR index for each company. The composite SR index for each company is calculated as follows:

where, rj = 1 if the item is reported and 0 if the item is not reported; n = the total number of 91 items reported in economic, environmental, and social performance dimensions based on the GR4 standards.

Control variables

Firm-specific characteristics, including financial capacity, leverage, firm age, and firm size, are incorporated as controls, since these variables may affect financial stability, as indicated by prior studies. Financial capacity is measured as free cash flows to total assets and indicates a level of available cash resources from operating activities after accounting all capital expenditures. Leverage ratio is calculated as total debts to total assets and measures a firm’s degree of leverage. Firm age is the number of years since the foundation of the business entity. Firm size is the natural logarithm of total assets of the company. Detailed description and measurement of all variables are presented in Table 1.

The research model of the study

Since our study is based on panel data analysis, we use duration dependence techniques to control omitted variables that change over time, thus controlling for unobserved time-constant heterogeneity. Therefore, the following panel regression model is employed:

where, FSTBit is financial stability of the company i at time t; SUSTAINABILITY REPORTINGit is the quality of sustainability information, including economic, environmental, social, and composite SR performance indicators; FCFTAit is a free cash flows to total assets ratio; LEVit is a leverage ratio; SIZEit is firm size; AGEit is firm age; ŋi is the unobserved heterogeneity or the unobservable individual firm effects; and εit is the specific error term.

We performed the Hausman’s specification test to determine whether the fixed-effects (FE) model or the random-effects (RE) model is appropriate for our study. The estimated statistics from the Hausman’s test shows that the difference between the FE and RE coefficients is statistically significant, thus indicating that the FE model is more appropriate compared to the RE model. The regression results from the FE models are reported in Table 5.

Findings and analysis

Descriptive statistics

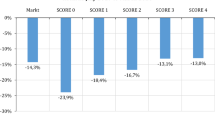

Table 2 presents descriptive results for all variables for the period 2012–2016. The mean value of economic, environmental, and social performance indicators is 31.86, 20.83, and 15.81%, respectively. The composite SR index has a mean value of 19.28%, with a standard deviation of 24.87%, and it ranges from 1.10 to 96.70%. The mean value of leverage is 20.03%, with a relatively wide range from 0.00 to 90.85%. The reported results for AGE show that the average age of oil and gas companies in Russia is about 28 years and varies between 1 and 80 years.

Correlation analysis

Table 3 presents the Pearson’s correlation analysis. It shows that the variations in FSTB are positively correlated with variations in all SR variables. The reported results also show that FSTB is positively correlated with FCFTA, SIZE, and AGE and negatively correlated with LEV. The matrix shows that the correlation between ECON and SIZE is the highest at 0.598 among all independent variables. As suggested by Pallant (2007), multicollinearity is present if the correlation coefficient between independent variables is above 0.700. The reported coefficients indicate that multicollinearity is not an issue in our analysis. Since FSTB is regressed separately on ECON, ENVN, SOCL, and SRIND variables, high correlations among SR variables are not an issue.

Regression results

Table 4 reports FE regressions of financial stability on SR variables and controls. The estimated coefficients for ECON and SOCL are positively and statistically significant with FSTB at the 10 and 5%, respectively. These results support Hypotheses 1 and 3, thus indicating that companies that disclose more informative, extensive, and transparent information on economic and social performance indicators are more financially stable. However, the variable ENVN is not statistically significant for explaining the variance in FSTB. This weak association indicates that reporting more information on environmental performance does not lead to better financial stability. Thus, Hypothesis 2 is not confirmed. The estimated coefficient for SRIND shows that the overall SR index is positively related to FSTB at the 5%, thus supporting Hypothesis 4, which posits that a higher quality of sustainability disclosure tends to minimize corporate risk and improve financial stability. This finding supports the findings by Benlemlih and Girerd-Potin (2017), Gong and Ho (2017), Qiu et al. (2016), and Goss and Roberts (2011). Of all sustainability performance measures, economic and social performance indicators appear to be the most important ones in terms of their risk implications. Overall, our empirical results indicate that companies are likely to improve their sustainability disclosure in order to manage risk and improve their financial stability in general.

With regard to control variables, FCFTA is positively related to the Z score at the 1% significance level. This positive association supports the notion that companies with higher levels of financial resources are less risky. This finding is in line with those of Qiu et al. (2016) that financial capacity reduces the apparent risk of financial distress and, therefore, has a positive effect on financial stability. The estimated coefficients of LEV show that leverage has a statistically significant and negative relationship with the Z score, implying that highly indebted companies are more risky and, therefore, face higher probability of bankruptcy. This finding supports the results by Nahar et al. (2016) and Jo and Na (2012). The estimated coefficients of SIZE are statistically significant and negative with the FSBT variable at the 5% level, thus indicating that firm size has a negative impact on financial stability. This association indicates that larger companies are more risky and less financially stable than smaller companies. The results also indicate that firm age is positively related to financial stability at the 5% significance level. This finding suggests that firm age is relevant in influencing firm solvency and financial stability. Overall, our empirical findings indicate that financial capacity, leverage, firm size, and firm age are important underlying factors influencing the degree of financial distress and financial stability.

Additional analyses and robustness check

We perform an additional analysis to examine whether our results are robust to an alternative measure of financial stability. Prior studies suggest that a risk-adjusted profit (RAR) is a good measure of financial stability (Gong and Ho 2017; Fazio et al. 2015) Therefore, we use the returns-related component of the Z score to proxy for financial stability to further investigate the association between sustainability performance and financial stability and confirm the results in the main analysis.

The estimated coefficients in Table 5 show that the ECON, SOCL, and SRIND variables are positively related to RAR, thus indicating that the main results in Table 4 are not affected by the use of the alternative measure for financial stability.

Prior studies address endogeneity issues in the association between CSR performance and financial stability (Gong and Ho 2017; Gong and Ho 2017; Michelon et al. 2015). To alleviate the endogeneity issue to further examine the effects of sustainability performance on financial stability, we use one year lagged values of ECON, ENVN, SOCL, and SRIND as instrumental variables employing two-stage least squares in a panel-data context (using the xtivreg command of STATA). Because of lagged values created for sustainability performance variables, the sample is reduced to 40 companies with a total number of 126 firm-year observations. Table 6 shows that the estimated coefficients of SOCL and SRIND are statistically significant and remain qualitatively similar to those reported in Table 4. However, the estimated coefficient of ECON is statistically insignificant, probably due to reduced sample size. Based on the estimated coefficients of SOCL and SRIND using the instrumental variables and two-stage least squares for panel-data models, we may conclude that endogeneity is not an issue in our analysis.

In addition to the Pearson’s correlation analysis, we also performed the variance inflation factor (VIF) which measures the impact of collinearity among independent variables. Serious multicollinearity issues are present in the regression analysis if a VIF value is greater than 10 (Chatterjee et al. 2000). In our analysis, the estimated VIF values (due to space limitation not reported but available upon request) for all independent variables are much lower than 10, thus implying the absence of potential multicollinearity.

Conclusion and policy implications

The aim of this study is to explore the extent of SR practices of oil and gas companies in Russia and investigate the effects of sustainability performance indicators on financial stability. The study is based on panel data analysis of SR practices and financial data of top oil and gas companies in Russia for the period 2012–2016. Data on sustainability performance were collected through analyzing sustainability reports and annual reports, while financial data were obtained from audited financial statements downloaded from company websites. The empirical results indicate that companies improve their sustainability disclosures in order to manage risk and improve their financial stability in general, thus supporting the agency theory and the legitimacy theory. The findings also indicate that financial capacity, leverage, firm size, and firm age are important underlying factors influencing the degree of financial distress and financial stability.

The study has important practical implications for policymakers, regulators, managers, practitioners, and investors. As the findings reveal that improved sustainability performance indicators leads to better financial stability, managers should enhance their sustainability reporting practices and disclose sustainability performance indicators in a more informative, extensive, and transparent manner to different stakeholders. With the increasing importance of sustainability disclosures, it is essential that companies operating in the Russian oil and gas industry adopt and implement new G4 standards of the GRI framework as part of their corporate disclosure practices in order to provide more informative and transparent information, control firm risks, and improve financial stability as these standards have more acceptance and recognition than other traditional reporting practices. Thus, the findings provide managers and practitioners with some useful aspects of sustainability performance indicators relating to the extent of SR information, which in turn lead to improved financial stability. The findings also suggest that financial capacity, leverage, age, and size are important underlying factors that influence financial stability. More specifically, older companies with higher levels of financial resources are better equipped to improve financial stability and mitigate financial distress. On the other hand, larger and highly indebted companies are more risky and less financially stable. Therefore, investors and practitioners should consider these factors when evaluating the level of corporate financial stability. The findings also have important implications for policymakers and regulators in their continuous efforts to encourage business organizations to disclose sustainability information in accordance with GRI guidelines, which will ultimately lead to sustainable development and financial stability in the long run. Overall, the results provide policymakers and regulators with some direction in terms of reforming and improving corporate reporting practices in oil and gas industries of emerging markets, such as Russia, and identifying the important dimensions of sustainability performance indicators for improved financial stability.

Our findings are subject to several limitations which provide new avenues for future research. First, our analysis is based on data from top 45 companies operating in the Russian oil and gas industry as we are unable to get access to sustainability data of the other 13 companies. Therefore, extending a sample size beyond 2016 and including data of other companies would provide a better understanding of the relationship between sustainability information and financial stability in the future. Second, the study focuses on companies operating only in the oil and gas industry. Therefore, further studies with a focus on other industries need to be conducted to provide new insights on the association between sustainability reporting and financial stability. Although the Russian Federation is one of the leading economies in the Eurasian Union as well as in the CIS region, future comparative studies, including samples from other CIS emerging markets, would provide new knowledge on the importance of SR practices in financial healthiness and stability in different markets. Despite these limitations, we believe that the study makes important contributions to the current literature in the context of emerging markets from the CIS region.

References

Andreassen N (2016) Arctic energy development in Russia—how “sustainability” can fit? Energy Res Soc Sci 16:78–88. https://doi.org/10.1016/j.erss.2016.03.015

Benlemlih M, Girerd-Potin I (2017) Corporate social responsibility and firm financial risk reduction: on the moderating role of the legal environment. J Bus Financ Account 44:1137–1166. https://doi.org/10.1111/jbfa.12251

Bear S, Rahman N, Post C (2010) The Impact of Board Diversity and Gender Composition on Corporate Social Responsibility and Firm Reputation. J Bus Ethics 97:207–221. https://doi.org/10.1007/s10551-010-0505-2

Bobylev S, Perelet R (2013) Sustainable development in Russia. Russian–German Environmental Information Bureau, Berlin–St. Petersburg

Bouslah K, Kryzanowski L, M’Zali B (2016) Social performance and firm risk: impact of the financial crisis. J Bus Ethics 149:643–669. https://doi.org/10.1007/s10551-016-3017-x

Brammer S, Pavelin S (2008) Factors influencing the quality of corporate environmental disclosure. Bus Strateg Environ 17:120–136. https://doi.org/10.1002/bse.506

Brown HS, de Jong M, Lessidrenska T (2009) The rise of the global reporting initiative: a case of institutional entrepreneurship. Environ Polit 18:182–200. https://doi.org/10.1080/09644010802682551

Chatterjee S, Hadi A, Price B (2000) Regression analysis by example, third edit edn. John Wiley and Sons, Inc., New York

Chava S (2014) Environmental externalities and cost of capital. Manag Sci 60:2223–2247. https://doi.org/10.1287/mnsc.2013.1863

Chen H, Wang X (2011) Corporate social responsibility and corporate financial performance in China: an empirical research from Chinese firms. Corp Gov 11:361–370. https://doi.org/10.1108/14720701111159217

Cheng S, Lin KZ, Wong W (2016) Corporate social responsibility reporting and firm performance: evidence from China. J Manag Gov 20:503–523. https://doi.org/10.1007/s10997-015-9309-1

Cheung YL, Jiang P, Tan W (2010) A transparency disclosure index measuring disclosures: Chinese listed companies. J Account Public Policy 29:259–280. https://doi.org/10.1016/j.jaccpubpol.2010.02.001

Cho SY, Lee C, Pfeiffer RJ (2013) Corporate social responsibility performance and information asymmetry. J Account Public Policy 32:71–83. https://doi.org/10.1016/j.jaccpubpol.2012.10.005

Clarkson PM, Li Y, Richardson GD, Vasvari FP (2011) Does it really pay to be green? Determinants and consequences of proactive environmental strategies. J Account Public Policy 30:122–144. https://doi.org/10.1016/j.jaccpubpol.2010.09.013

Czarnitzki D, Kraft K (2007) Are credit ratings valuable information? Appl Financ Econ 17:1061–1070. https://doi.org/10.1080/09603100600749220

De Villiers C, Low M, Samkin G (2014) The institutionalisation of mining company sustainability disclosures. J Clean Prod 84:51–58. https://doi.org/10.1016/j.jclepro.2014.01.089

Dhaliwal DS, Li OZ, Tsang A, Yang YG (2011) Voluntary nonfinancial disclosure and the cost of equity capital: the initiation of corporate social responsibility reporting. Account Rev 86:59–100. https://doi.org/10.2308/accr.00000005

Dilling PFA (2010) Sustainability reporting in a global context: what are the characteristics of corporations that provide high quality sustainability reports—an empirical analysis. Int Bus Econ Res J 9:19–30. https://doi.org/10.19030/iber.v9i1.505

Dissanayake D, Tilt C, Xydias-Lobo M (2016) Sustainability reporting by publicly listed companies in Sri Lanka. J Clean Prod 129:169–182. https://doi.org/10.1016/j.jclepro.2016.04.086

Ehnert I, Parsa S, Roper I, Wagner M, Muller-Camen M (2016) Reporting on sustainability and HRM: a comparative study of sustainability reporting practices by the world’s largest companies. Int J Hum Resour Manag 27:88–108. https://doi.org/10.1080/09585192.2015.1024157

El Ghoul S, Guedhami O, Kwok CCY et al (2011) Does corporate social responsibility affect the cost of capital? J Bank Financ 35:2388–2406. https://doi.org/10.1016/j.jbankfin.2011.02.007

Fazio DM, Tabak BM, Cajueiro DO (2015) Inflation targeting: is IT to blame for banking system instability? J Bank Financ 59:76–97. https://doi.org/10.1016/j.jbankfin.2015.05.016

Fifka MS, Pobizhan M (2014) An institutional approach to corporate social responsibility in Russia. J Clean Prod 82:192–201. https://doi.org/10.1016/j.jclepro.2014.06.091

Fonseca A, McAllister ML, Fitzpatrick P (2012) Sustainability reporting among mining corporations: a constructive critique of the GRI approach. J Clean Prod 84:70–83. https://doi.org/10.1016/j.jclepro.2012.11.050

Godfrey PC (2005) The relationship between corporate philanthropy and shareholder wealth: a risk management perspective. Acad Manag Rev 30:777–798

Gong Y, Ho K-C (2017) Does corporate social responsibility matter for corporate stability? Evidence from China. Qual Quant 52:2291–2319. https://doi.org/10.1007/s11135-017-0665-6

Goss A (2009) Corporate social responsibility and financial distress. ASAC 30:

Goss A, Roberts GS (2011) The impact of corporate social responsibility on the cost of bank loans. J Bank Financ 35:1794–1810. https://doi.org/10.1016/j.jbankfin.2010.12.002

Guidry RP, Patten DM (2012) Voluntary disclosure theory and financial control variables: an assessment of recent environmental disclosure research. Account Forum 36:81–90. https://doi.org/10.1016/j.accfor.2012.03.002

Gupta K, Krishnamurti C (2016) Does corporate social responsibility engagement benefit distressed firms? The role of moral and exchange capital. Pacific Basin Financ. J

Habek P (2014) Evaluation of sustainability reporting practices in Poland. Qual Quant 48:1739–1752. https://doi.org/10.1007/s11135-013-9871-z

Jensen MC, Meckling WH (1976) Theory of the firm: managerial behavior, agency costs and ownership structure. J Financ Econ 3:305–360

Jiraporn P, Jiraporn N, Boeprasert A, Chang K (2014) Does corporate social responsibility (CSR) improve credit ratings? Evidence from geographic identification. Financ Manag 43:505–531. https://doi.org/10.1111/fima.12044

Jo H, Harjoto MA (2011) Corporate Governance and Firm Value: The Impact of Corporate Social Responsibility. J Bus Ethics 103:351–383. https://doi.org/10.1007/s10551-011-0869-y

Jo H, Na H (2012) Does CSR reduce firm risk? Evidence from controversial industry sectors. J Bus Ethics 110:441–456. https://doi.org/10.1007/s10551-012-1492-2

Jobbágy P, Bai A (2012) The effects of global real economic crisis on the markets for fossil and renewable fuels. Appl Stud Agribus Commer—APSTRACT 6:51–56

Kılıç M, Kuzey C, Uyar A (2015) The impact of ownership and board structure on corporate social responsibility in the Turkish banking industry. Corp Gov Int J Bus Soc 15:357–374

Kim Y, Park MS, Wier B (2012) Is earnings quality associated with corporate social responsibility? Account Rev 87:761–796. https://doi.org/10.2308/accr-10209

Kuranchie-Pong L, Bokpin GA, Andoh C (2016) Empirical evidence on disclosure and risk-taking of banks in Ghana. J Financ Regul Compliance 24:197–212. https://doi.org/10.1108/JFRC-05-2015-0025

Kuzey C, Uyar A (2017) Determinants of sustainability reporting and its impact on firm value: evidence from the emerging market of Turkey. J Clean Prod 143:27–39. https://doi.org/10.1016/j.jclepro.2016.12.153

Laeven L, Levine R (2009) Bank governance, regulation and risk taking. J Financ Econ 93:259–275. https://doi.org/10.1016/j.jfineco.2008.09.003

Lozano R, Huisingh D (2011) Inter-linking issues and dimensions in sustainability reporting. J Clean Prod 19:99–107. https://doi.org/10.1016/j.jclepro.2010.01.004

Mahmood M, Orazalin N (2017) Green governance and sustainability reporting in Kazakhstan’s oil, gas, and mining sector: evidence from a former USSR emerging economy. J Clean Prod 164:389–397. https://doi.org/10.1016/j.jclepro.2017.06.203

Michelon G, Pilonato S, Ricceri F (2015) CSR reporting practices and the quality of disclosure: an empirical analysis. Crit Perspect Account 33:59–78. https://doi.org/10.1016/j.cpa.2014.10.003

Nahar S, Azim M, Anne Jubb C (2016) Risk disclosure, cost of capital and bank performance. Int J Account Inf Manag 24:476–494. https://doi.org/10.1108/IJAIM-02-2016-0016

Oláh J, Bai A, Karmazin G, Balogh P, Popp J (2017) The role played by trust and its effect on the competiveness of logistics service providers in Hungary. Sustainability 9:2303. https://doi.org/10.3390/su9122303

Orazalin N, Mahmood M (2018) Economic, environmental, and social performance indicators of sustainability reporting: evidence from the Russian oil and gas industry. Energy Policy 121:70–79. https://doi.org/10.1016/j.enpol.2018.06.015

Orlitzky M, Benjamin JD (2001) Corporate social performance and firm risk: a meta-analytic review. Bus Soc 40:369–396. https://doi.org/10.1177/000765030104000402

Pallant J (2007) SPSS survival manual: a step by step guide to data analysis using SPSS for Windows (version 15), Version 15. Open University Press, McGraw Hill, New York, NY

Qiu Y, Shaukat A, Tharyan R (2016) Environmental and social disclosures: link with corporate financial performance. Br Account Rev 48:102–116. https://doi.org/10.1016/j.bar.2014.10.007

Rajgopal S, Venkatachalam M (2011) Financial reporting quality and idiosyncratic return volatility. J Account Econ 51:1–20. https://doi.org/10.1016/j.jacceco.2010.06.001

Russian Union of Industrialists and Entrepreneurs (2017) Business Practice in the mirror of reporting: present and future

Sartori S, Witjes S, Campos LMS (2017) Sustainability performance for Brazilian electricity power industry: an assessment integrating social, economic and environmental issues. Energy Policy 111:41–51. https://doi.org/10.1016/j.enpol.2017.08.054

Sharfman MP, Fernando CS (2008) Environmental risk management and the cost of capital. Strateg Manag J 29:569–592. https://doi.org/10.1002/smj.678

Shvarts EA, Pakhalov AM, Knizhnikov AY (2016) Assessment of environmental responsibility of oil and gas companies in Russia: the rating method. J Clean Prod 127:143–151. https://doi.org/10.1016/j.jclepro.2016.04.021

Simola H, Solanko L (2017) Overview of Russia’s oil and gas sector. 3–30

Sun W, Cui K (2014) Linking corporate social responsibility to firm default risk. Eur Manag J 32:275–287. https://doi.org/10.1016/j.emj.2013.04.003

Torjai L, Nagy J, Bai A (2015) Decision hierarchy, competitive priorities and indicators in large-scale “herbaceous biomass to energy” supply chains. Biomass Bioenergy 80:321–329. https://doi.org/10.1016/j.biombioe.2015.06.013

Tuzova Y, Qayum F (2016) Global oil glut and sanctions: the impact on Putin’s Russia. Energy Policy 90:140–151. https://doi.org/10.1016/j.enpol.2015.12.008

Wood DJ (1991) Corporate social performance revisited. Acad Manag Rev 16:691–718. https://doi.org/10.5465/AMR.1991.4279616

World Bank (2006) World development report. The World Bank and Oxford University Press, New York

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Philippe Garrigues

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Orazalin, N., Mahmood, M. & Narbaev, T. The impact of sustainability performance indicators on financial stability: evidence from the Russian oil and gas industry. Environ Sci Pollut Res 26, 8157–8168 (2019). https://doi.org/10.1007/s11356-019-04325-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-019-04325-9