Abstract

The energy sector has become the largest contributor to greenhouse gas (GHG) emissions. Among these GHG emissions, most threatening is CO2 emission which comes from the consumption of fossil fuels. This empirical work analyzes the roles of renewable energy consumption and non-renewable energy consumption in CO2 emissions in Pakistan. The empirical evidence is based on an auto-regressive distributive lag (ARDL) model of data from 1970 to 2016. The disaggregate analysis reveals that renewable energy consumption has an insignificant impact on CO2 emission in Pakistan and that, in the non-renewable energy model, natural gas and coal are the main contributors to the level of pollution in Pakistan. Economic growth positively contributes to CO2 emission in the renewable energy model but not in the non-renewable energy model. Policies that emphasize the contribution of renewable energy to economic growth and that add more clean energy into the energy mix are suggested.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Energy sector is responsible for 75% of the global GHG emissions (International Energy Association 2015). Carbon dioxide (CO2) emissions have increased over the years due to continuous rise in the global energy demand and have severe implications for the environment and a significant contributor to global climate change. In an effort to address the increasing concerns about climate change, the Conference of Parties (COP) of the United Nations Framework Convention for Climate Change (UNFCCC) agreed to limit the increase in the global temperature to 2 °C above pre-industrial levels by 2020 in 2015 (UNFCCC 2015). Since this target cannot be achieved until the pattern of energy consumption is changed, therefore, combating climate change with sustainable development has become an essential global agenda in planning for energy production and consumption. An economy may turn to a sustainable track if it uses a mixture of renewable and non-renewable energy resources (Dogan 2016). Therefore, policymakers must know the individual contributions of energy sources (renewable and non-renewable) on economic growth and CO2 emissions.

Numerous studies concerned with energy consumption, economic growth, and environmental degradation such as Shahbaz et al. (2012); Alkhathlan and Javid (2015); and Ibrahiem (2015) concluded that high levels of energy consumption are central to economic growth while at the same time, they have a tendency to deteriorate the environment in developing and developed economies (Azad et al. 2015).

There has been a continuous increase in energy use for developing countries during recent years to achieve higher levels of living standards and economic development (Shahbaz et al. 2012). Attaining higher ladders of economic development at the cost of natural environment is never desirable. Therefore, examining the role of renewable and non-renewable energy consumption in CO2 emissions has remained debatable in empirical literature due to differences in data sets, regions, and research methodologies employed (Mirza and Kanwal 2017). Our study attempts to find more evidence on causal relationships between renewable and non-renewable energy consumption, CO2 emissions, and economic growth concurrently in a single study for the case of Pakistan.

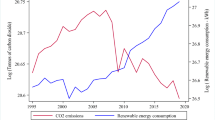

Pakistan is an interesting case study for this empirical work as its share of energy-led emissions is increasing. As per the Global Climate Risk Index (2018), Pakistan has been one of the most affected countries due to climate during the last two decades. The impact of climate change compared to the country’s diminutive per capita GHG emissions has been very high in Pakistan (Abas et al. 2017). Moreover, Pakistan has faced acute energy shortages from 2007 and onwards that have adversely affected its economic growth (Komal and Abbas 2015). To address these energy shortages, Pakistan has resorted primarily to non-renewable energy-producing sources, which are the main contributors to the country’s CO2 emissionsFootnote 1 (Nasir and Ur Rehman 2011). During the last three years, Pakistan has initiated seven energy projects that are based on coal consumption and will further add to GHG emissions in the country. Although the country has set numerous goals and strategies to encourage consumption from renewable resources, the energy sector is ill-managed and the share of renewable energy consumption is very small. Despite the initiation of renewable energy policy in 2006 and the existence of huge potentialFootnote 2 for renewable energy production, no time path is available to achieve sustainable energy development in Pakistan.

Therefore, having a large population and being one of the major contributors to GHG emissions among the developing countries, Pakistan is an ideal candidate for an exclusive study that examines the environmental and growth effects of any possible fuel substitutions in the coming years. In this paper, we attempt to carry out a disaggregated analysis to test for the existence of long-run and short-run relationship between individual energy consumption sources, CO2 emissions, and economic growth. We also implement causality tests to study the direction of causality between these variables to suggest optimal policies. Analysis of renewable and non-renewable energy consumption by source at disaggregate levels facilitates the examination of the relationships among each source of energy consumption, economic growth, and CO2 emissions. In addition, research at disaggregate level is essential for examining the barriers to replacing traditional energy resources with newer ones, along the lines of Greiner et al. (2018) who investigated whether natural gas consumption can mitigate CO2 emissions produced from coal consumption.

Novelty of our study relative to the existing literature lies mainly in the difference in analytical perspective. Previous studies on Pakistan have investigated aggregate relationships among selected variables; however, this study examines the role of different renewable and non-renewable energy sources in CO2 emissions. With disaggregated level analysis, we are able to compare the individual impact of renewable and non-renewable energy consumption on CO2 emissions and economic growth. Our contribution also includes a comparative assessment of renewable and non-renewable consumption in a holistic manner to suggest a comprehensive policy framework towards CO2 emission reduction. The analysis provides valuable information for policymakers to construct an optimal combination of renewable and non-renewable sources in order to meet the national demand.

The remainder of the paper is distributed as follows. The “Literature review” section reviews related work in the literature. The “Methodology and data” section describes the study’s data collection and econometric approach. The results and discussion are presented in the “Empirical analysis and discussion of results” section, while the “Conclusion” section provides a conclusion.

Literature review

The relationships among renewable and non-renewable energy sources, economic growth, and CO2 emissions have been investigated in many studies. Many have used panel country data to investigate these relationships. For example, Apergis and Payne (2011a) conducted a study of 80 countries and found bidirectional causality between renewable energy consumption and economic growth and between non-renewable energy consumption and economic growth. The same results were reported by Tugcu et al. (2012), who used the auto-regressive distributive lag (ARDL) approach to assess the classical production function in the G-7 countries. Using fully modified ordinary least square (FMOLS), Sadorsky (2009) found a positive relationship between renewable energy consumption and real income per capita in 18 countries. By employing similar methods to a group of 69 countries, Ben Jebli and Ben Youssef (2015) validated the growth hypothesis for both renewable and non-renewable energy consumption. These results were later supported by Wesseh and Lin (2016a), who estimated a translog model for 34 African countries. Kahia et al. (2016) explored an energy-growth nexus for Middle East and North African (MENA) countries using data from 1980 to 2012. Applying a panel cointegration technique, they reported bidirectional causality between renewable and non-renewable energy consumption, found significant but negative short-run coefficients, and specified substitutability of renewable and non-renewable energy resources. Similarly, Bhattacharya et al. (2016) applied a heterogeneous panel Granger causality test to multiple countries and found no causality between renewable energy consumption and GDP. Ito (2017) applied a GMM model to 42 developing countries and argued that renewable consumption reduces CO2 emissions and has a positive influence on economic growth in the long run.

Other studies have used single-country data sets. For instance, Dogan (2016) investigated the case of Turkey by applying a vector error correction model (VECM) Granger causality test with a structural break and found bidirectional long-run and short-run causality between non-renewable energy consumption and GDP. They also reported one-way short-run causality from GDP towards renewable energy consumption, while in long run they found bidirectional causality. Using the Toda-Yamamoto causality method for Italy, Vaona (2012) supported the feedback hypothesis for non-renewable energy consumption and growth while neutrality hypothesis for the relationship between renewable energy consumption and economic growth. Apergis and Payne (2014) used the Toda-Yamamoto causality technique and found no relation among renewable, non-renewable energy consumption and economic growth in the USA. Table 6 shown in the Annexure lists the literature on renewable and non-renewable energy consumption, CO2 emissions, and economic growth.

Some studies on Pakistan have assessed the role of renewable and non-renewable energy consumption on economic growth and CO2 emissions by applying various econometric models. Studies on Pakistan’s economy have focused only on aggregate analysis, while the relationships at the disaggregated level have not been explored for the case of Pakistan. For example, Mirza and Kanwal (2017) carried out an analysis on aggregate data of total energy consumption and found bidirectional long-run causalities between total energy consumption, economic growth, and CO2 emissions. Danish et al. (2017) conducted an aggregate study on renewable and non-renewable energy consumption and observed bidirectional causality between renewable energy consumption and CO2 emissions in Pakistan. Shahzad et al. (2017) used Granger causality to report that energy consumption is positively related to CO2 emissions. Muhammad et al. (2014) examined the nexus between renewable and non-renewable energy consumption, real GDP, and CO2 emissions for Pakistan by applying structural VAR technique. But they also used aggregate data for analysis. One common conclusion from the studies in this area is the support for renewable energy resources. Table 7 shown in the Annexure lists the literature on disaggregated studies that have been conducted in various countries. We cannot ignore the analysis at disaggregated levels because Pakistan’s energy is a mixture of renewable and non-renewable energy resources. The current study addresses this research gap by considering each source of energy with its related CO2 emissions and economic growth.

Methodology and data

Methodology

This study explores the relationships among renewable and non-renewable energy consumption, economic growth, and CO2 emissions in Pakistan. The disaggregated analysis examines the corresponding effects of energy consumption on economic growth and CO2 emissions. We use a standard linear-log function to test the per capita relationship between CO2 emissions, renewable energy consumption, non-renewable energy consumption, and GDP. To discuss disaggregate contributions to CO2 emissions, we employ the following linear-log model for analytical purposes:

where CO2t reflects carbon emissions, GDP denotes gross domestic products, Hydro reflects hydroelectricity, Nuc implies Nuclear energy, and εt is the disturbance term. In order to measure different contribution of renewable energy consumption and non-renewable energy consumption to CO2 emissions, we have divided the above-mentioned model into two sub-models which can be described as below:

Model 1: renewable energy consumption, GDP, and CO2 emissions

Model 2: non-renewable energy consumption, GDP, and CO2 emissions

Model 1 shows the relationship between renewable energy consumption (hydroelectricity and nuclear energy), GDP, and CO2 emissions while Model 2 shows non-renewable energy consumption (through oil, coal, and natural gas) GDP, and CO2 emissions. For this study, we collected time series data from 1970 to 2016 from two major sources: World Development Indicators (WDI) (World Bank 2017) and BP Statistics (2017). The data for GDP per capita was obtained from WDI, while data on CO2 emissions, oil, coal, natural gas, hydroelectricity, and nuclear consumption were collected from BP Statistics.

Estimation technique

This study applies the ARDL bound testing technique to capture the short-run and long-run dynamics at disaggregate levels. The ARDL methodology was introduced by Pesaran et al. (2001) to test for cointegration among variables. This methodology has several benefits and can be applied if variables are integrated at level I(0) or first difference I(1). It provides robust results regardless of sample size, adjusts the lags in the model, and delivers unbiased estimates with valid t-statistics of the long-run model (Harris and Sollis 2003). Moreover, with the help of a simple linear transformation, ARDL derives a dynamic unrestricted error correction model (UECM). The UECM joins long-run equilibrium with short-run dynamics while keeping long-run information intact. ARDL is a suitable model in the presence of endogeneity and serial correlation in time series data (Pesaran et al. 2001).

Based on the objective of this study, we employed ARDL twice for two different models, i.e., Model 1 for renewable energy consumption, GDP, and CO2 emissions and Model 2 for non-renewable energy consumption, GDP, and CO2 emissions. Both models are specified as follows:

ARDL Model 1: renewable energy consumption, GDP, and CO2 emissions

where Δ is the first difference operator and p denotes the lag length. We derived two hypotheses from Eq. (4) for the long relationships. The first is null hypothesis of no cointegration (H0:λ1 = λ2 = λ3 = λ4 = 0) which tested against the second one, i.e., the alternative hypothesis (H1:λ1 ≠ λ2 ≠ λ3 ≠ λ4 ≠ 0).

ARDL Model 2: non-renewable energy consumption, GDP, and CO2 emissions

where Δ is the first difference operator and q denotes the lag length. The null hypothesis of no cointegration is (H0:γ1 = γ2 = γ3 = γ4 = γ5 = 0) tested against the alternative hypothesis of cointegration (H1:γ1 ≠ γ2 ≠ γ3 ≠ γ4 ≠ γ5 ≠ 0).

Empirical analysis and discussion of results

As a first step, we check the unit root in each series using the Augmented Dicky Fuller (ADF) and Phillips Pearson (PP) tests. Table 1 presents the results of the unit root tests, which reveal that the variables are stationary at I(1). As no variable is integrated at 2nd difference, we reject the null hypotheses of no stationary at I(1) for all of the series.

In order to check structural break in the data, we also employed Zivot and Andrews structural break unit root test. Table 2 reveals that structural breaks exist and all variables are integrated at first difference except Coal which is integrated at level. These breaks may occur due to changes in government and economic condition or due to the introduction of new regulations. For example, structure break of 2008 recalls the global financial crises when most of countries were affected economically. GDP rates in many countries declined in the comparison of CO2 emissions. The problem of structural break can be overcome by adding additional variable or dummy variable from the period of structural change in dependence variable. We have also considered dummy variable to improve the long-run stability of the results. All the unit root tests allowed us to use ARDL technique as all variables are integrated at I(0) and I(I).

After checking the unit root, we move to ARDL bound testing to test for cointegration among variables. Table 3 depicts the results of bound testing for Model 1 and Model 2. The results show a long-run relationship among all of the selected variables. The calculated F-statistics are greater than the appropriate critical values of upper-bound. Hence, the null hypothesis of no cointegration is rejected. Diagnostic tests for serial correlation (the Breusch-Godfrey test) and heteroscedasticity (the Arch Test) support the conclusion that the error term is white noise. The Ramsey RESET test also indicates that the model is well-specified.

We also used the Johansen Cointegration technique to check the robustness of our findings. This technique provides two types of values: trace statistics and maximum eigenvalue statistics. Table 8, presented in the Annexure, indicates that there is at least one cointegration relationship present between renewable and non-renewable energy consumption, economic growth, and CO2 emissions.

After confirmation of cointegration through the ARDL technique, we check for the long-run and short-run dynamics of Model 1 and Model 2. Results are shown in Table 4 for both models.

In Model 1, the coefficient of GDP is positive and significant (β = 1.665411), which means that economic growth accelerates the CO2 emissions in the long-run path when energy is consumed from renewable resources. This result is similar to those of Danish et al. (2017) and Mirza and Kanwal (2017) for Pakistan and Zoundi (2017) for 25 African countries. This relationship indicates that an increase in economic growth enhances the demand for energy and so indirectly adds to CO2 emissions (Shahbaz et al. 2012). The results reflect the increasing population, urbanization, and industrialization in Pakistan, where energy demand is increasing in parallel. Energy use in Pakistan is based primarily on a combination of fossil fuels, so the share of renewable resources is minor. Therefore, energy consumption increases the GDP parallel to an increase in CO2 emissions, as in the case of Algeria that Bélaïd and Youssef (2017) discussed. Some authors have found that renewable energy consumption causes a decline in CO2 emissions when GDP increases, as Dogan and Ozturk (2017) found for the USA. However, this finding does not hold for Pakistan because of the seismic differences between the two economies. Shahzad et al. (2017) argued that Pakistan is operating below the threshold level of economic activities, so until it achieves the threshold level, CO2 emissions are likely to rise in Pakistan. If energy consumption is below the threshold level, then the technology effect remains meager and the effects of scale and composition dominate. In the short run, there is a negative—albeit insignificant—relationship between GDP and CO2 emissions. The relationship between GDP and CO2 emissions has been studied many times for different data sets. Many authors (for example, Danish et al. 2017; Sinha and Shahbaz 2018) formulated their studies using the hypothesis of environmental Kuznets curve (EKC). The EKC hypothesis suggests that there might be an inverted U-shape or a U-type nexus between environmental quality and GDP per capita which implies that in the early stages of economic development, economic growth will sooner or later undo the environmental impact. Thus, we can say that a positive or negative relationship between GDP and CO2 emissions is not obvious.

Our results show a positive but insignificant relationship between hydroelectricity use and CO2 emissions. A 1% change in the use of hydroelectricity leads to a unit change in CO2 emissions of only 0.11. Nuclear consumption and CO2 emissions also have a positive but insignificant relationship, as a 1% change in nuclear consumption brings a unit change of 0.013 in CO2 emissions. In the short run, then, hydroelectricity and nuclear energy have positive but insignificant relationships with CO2 emissions.

In the nexus among non-renewable energy consumption, GDP, and emissions (Model 2) is a negative but insignificant long-run relationship between GDP and CO2 emissions such that GDP is negatively related to CO2 emissions. However, such is not always the case; for example, Martínez-Zarzoso and Bengochea-Morancho (2004) stated that CO2 emissions’ declining as a result of increased income sustains to a certain level, after which CO2 emissions increase with additional increases in income. This finding is an indication for Pakistan’s economy that, as income rises, at some point will come an increase in CO2 emissions such that this relationship becomes positive. The mediator in this relationship is non-renewable energy consumption. The use of fossil fuels increases the CO2 emissions in Pakistan, which reduces the economy’s energy efficiency and deteriorates the environment (Muhammad et al. 2014; Danish et al. 2018). Moreover, excessive CO2 emissions result in the long run in economic benefits’ being outweighed by the economic cost associated with the use of non-renewable resources (Apergis et al. 2010). Pakistan must pursue smart policies on the use of fossil fuels to prevent GDP’s decreasing as a result of inefficient and excessive use of non-renewable energy resources (Soytas et al. 2007).

In the long run, coal consumption bears a positive and statistically significant relationship with CO2 emissions. Our results match Shahbaz et al.’s (2015) results for China, Ahmad et al.’s (2016) results for India, and Mohiuddin et al.’s (2016) results for Pakistan that coal consumption can increase economic development, but its environmental cost is high. Chandran Govindaraju and Tang (2013) also examined a disaggregate link between coal consumption and CO2 for India and China and found a strong long-run influence of coal consumption on growth and CO2 emissions for China. China’s policy of reducing coal consumption could cut CO2 emissions but at the cost of economic growth, as is the case for Pakistan. Although coal consumption increases CO2 emissions, technology can reduce its environmental effects. Policymakers must plan to decrease the share of coal consumption in Pakistan’s overall energy mix.

In the long run, natural gas consumption has a positive relationship with CO2 emissions. Natural gas has the largest share of Pakistan’s total energy mix. Alkhathlan and Javid (2015) concluded that natural gas in Saudi Arabia is friendlier to the environment than other energy sources are, but in Pakistan, natural gas is the least environmentally friendly source of energy, so Alkhathlan and Javid’s (2015) results contrast ours. The reason for difference may be the difference in economies and the level of reliance on natural gas for energy. This outcome is consistent with Shahzad et al.’s (2017) findings for Pakistan. Where there is heavy dependence on natural gas in the overall energy mix, the sustainability of native sources becomes questionable. Per the estimates of the Planning Commission of Pakistan (2017), at the current speed of consumption, the country’s native natural gas resources will be depleted within seventeen years. Therefore, Pakistan must shift its consumption from natural gas to coal or, preferably, more renewable energy sources.

Oil, as the second-largest source of energy consumption in Pakistan, also contributes to the country’s CO2 emissions, although the positive relationship between oil and CO2 in the country is insignificant. Dependence on oil in Pakistan has increased because of a severe energy crises and a reduction in natural gas resources but besides oil supply, risk has also increased (Mohsin et al. 2018). Exploration of sustainable ways to produce energy in Pakistan is vital. In the short run, as Model 2 indicates, GDP is negatively associated with CO2 emissions, while all non-renewable energy sources have positive and significant relationships with CO2 emissions. Therefore, per capita CO2 emissions are largely affected by the non-renewable energy consumption. This result makes sense since Pakistan’s primary sources of energy are mainly non-renewable (natural gas, oil, and coal).

We also performed diagnostic tests to examine the models’ stability. Table 4 shows that, on disaggregate levels, there is no serial correlation, heteroscedasticity, or model misspecification. The cumulative sum (CUSUM) and CUSUM of squared recursive residual (CUSUMSQ) plots are executed to ratify that long-run and short-run links are stable. The results are shown in Figs. 1 and 2 for renewable and non-renewable energy sources, respectively.

Model I: renewable energy consumption, GDP, and CO2 emissions

Model 2: non-renewable energy consumption, GDP, and CO2 emissions

The CUSUM and CUSUMQ values fall between the upper and lower critical bounds at the 5% levels, indicating the stability and reliability of long-run and short-run dynamics.

Cointegration results indicate the presence of long-run relationships among the variables. We apply the VECM to find the direction of causal relationships. Toda and Philips (1993) indicated that if a long-term relationship exists, then an error correction model can be applied to determine the direction of causality. An error correction model also allows us to differentiate between long-term and short-term Granger causality. VECM Granger causality is determined by using the Wald statistic for all independent variables to determine the difference and lag difference coefficients. Table 5 depicts the causality results for Models 1 and 2, along with the growth and CO2 emissions.

Short-run causality is determined based on the F-statistic calculated through the Wald test, while long-run causality is calculated with the help of the error correction term (ECT). An ECTt−1 that is statistically significant and that has a negative sign is sign of long-run causality (Danish et al. 2018). The econometric equations for Models 1 and 2 are as follows:

The results ratify the presence of long-run causality among hydroelectricity, nuclear, GDP, and CO2 emissions. ECTt−1 is significant in the long run for CO2 emissions, hydroelectricity, and nuclear. Bidirectional causality is present between, nuclear and CO2 emissions, which suggests that any change in hydroelectricity or nuclear will cause a change in CO2 emissions and vice versa. Moreover, we observe unidirectional causality from GDP to hydroelectricity, GDP to nuclear, and GDP to CO2 emissions. However, the short-run results of Model 1 reveal that causality runs in one direction, from GDP to CO2 emissions, from CO2 emissions to nuclear, from GDP to nuclear, and from hydroelectricity to nuclear. In the short run, there is no causality between hydroelectricity and CO2 emissions, between hydroelectricity and GDP, or between hydroelectricity and nuclear. Numerous studies, such as Al-Mulali et al. (2015), Apergis and Payne (2014), Farhani and Shahbaz (2014), Ohler and Fetters (2014), and Yuan et al. (2008), have also confirmed the relationships among renewable energy consumption, economic growth, and CO2 emissions. Short-run values are shown in the chi-square coefficient and p values, while long-run values are shown through t-statistics and p values.

For Model 2, the long-run results reveal a bidirectional relationship between GDP and coal and between GDP and oil. This result is consistent with Zhang and Yang (2013) and Lim et al. (2014), who examined the disaggregated nexus of energy-emissions growth for China and the Philippines, respectively. There is evidence that CO2 Granger-causes GDP, as Lim et al. (2014) found that growth can continue without increasing CO2 emissions. A unidirectional causality runs from CO2 to coal, so growing CO2 emissions per capital increase coal consumption. Neutral causality is observed between oil and CO2 emissions, between natural gas and CO2 emissions, between natural gas and GDP, and between natural gas and oil. We endorse the policy of Shahbaz and Lean (2012) that government can protect its GDP rate if it explores alternate energy sources to cater the energy needs of Pakistan. In the short run, CO2 emissions and oil Granger-cause GDP. CO2 and natural gas consumption Granger-cause coal consumption in the short run.

Conclusion

This study examines the roles of renewable and non-renewable energy consumption in economic growth and CO2 emissions at disaggregate levels for Pakistan. The study confirms that energy consumption is central to a country’s economic development, but some energy resources are harmful to the environment. For Pakistan, our results indicate that consumption of renewable energy (hydroelectricity and nuclear) produces less CO2 emissions than non-renewable energy consumption (oil, coal, and natural gas) does. At the disaggregated level, natural gas consumption is a major source of energy production and the main driver of CO2 emissions, followed by oil and coal consumption.

Pakistan’s economy is growing fast, but its growth depends heavily on energy consumption. Increased amounts of energy are needed to cater to the increasing demand from the production, household, and transport sectors, but more energy consumption will add more CO2 emissions to the air if Pakistan’s existing energy mix remains as it is. To achieve the desired growth rate without harming the environmental quality, policymakers should analyze the country’s energy mix at disaggregated levels. A polluted environment not only has a negative effect on human health but also deteriorates water quality and agricultural production. Pakistan’s government can limit CO2 emissions by shifting from natural gas energy to other alternatives to lower the environmental burden. As Solarin et al. (2018) suggested, the government should encourage hydropower activities and more projects should be started to expand the hydropower production. Our results show that consumption of natural gas generates more CO2 pollution than the other energy resources in the country’s energy mix. Even so, natural gas reserves are inadequate, whereas coal reserves are ample, so coal is expected to remain the primary source of energy in Pakistan in the future.

The results of this study provide valuable information for policymakers to construct an optimal combination of renewable and non-renewable sources in order to meet the national demand. We put forward a policy such as there is need to plan a strategic mix of all available energy resources in Pakistan to meet the growing economy’s energy demands while also reducing CO2 emissions. The government should also encourage the industrial infrastructure to use high-level technologies for energy conversion. For example, natural gas-to-liquid technologies and coal-bed methane techniques are useful in converting energy to increase efficiency. Similarly, the government should construct more hydroelectricity plants, as hydroelectricity is more environmentally friendly and economical than coal-fired electricity or natural gas.

Moreover, Pakistan’s government should use awareness campaigns to encourage and motivate consumers and producers to use energy-efficient technologies to improve the environmental quality. Nuclear power and hydroelectricity are the best alternatives to fossil fuels for helping economic development and reducing CO2 emissions. Therefore, there is a strong need to increase investment in renewable energy sources like solar power, hydroelectricity, wind, and biofuels to stimulate sustainable development in Pakistan.

Notes

Eighty-six percent of Pakistan’s energy requirements are met through consumption of non-renewable energy sources.

Potential of 2,900,000 MW of solar, 2000 MW of small hydropower, 346,000 MW of wind, 3000 MW of biogas, and 1000 MW of waste-to-energy is available in Pakistan but the total renewable energy installed capacity is less than 1% of the existing potential (Wakeel et al. 2016).

References

Abas N, Kalair A, Khan N, Kalair AR (2017) Review of GHG emissions in Pakistan compared to SAARC countries. Renew Sust Energ Rev 80:990–1016. https://doi.org/10.1016/j.rser.2017.04.022

Ahmad A, Zhao Y, Shahbaz M, Bano S, Zhang Z, Wang S, Liu Y (2016) Carbon emissions, energy consumption and economic growth: an aggregate and disaggregate analysis of the Indian economy. Energy Policy 96:131–143. https://doi.org/10.1016/j.enpol.2016.05.032

Akhmat G, Zaman K (2013) Nuclear energy consumption, commercial energy consumption and economic growth in South Asia: bootstrap panel causality test. Renew Sust Energ Rev 25:552–559. https://doi.org/10.1016/j.rser.2013.05.019

Al-Mulali U, Ozturk I, Lean HH (2015) The influence of economic growth, urbanization, trade openness, financial development, and renewable energy on pollution in Europe. Nat Hazards 79:621–644. https://doi.org/10.1007/s11069-015-1865-9

Alkhathlan K, Javid M (2015) Carbon emissions and oil consumption in Saudi Arabia. Renew Sust Energ Rev 48:105–111

Alkhathlan K, Javid M (2013) Energy consumption, carbon emissions and economic growth in Saudi Arabia: an aggregate and disaggregate analysis. Energy Policy 62:1525–1532. https://doi.org/10.1016/j.enpol.2013.07.068

Apergis N, Payne JE (2011a) On the causal dynamics between renewable and non-renewable energy consumption and economic growth in developed and developing countries. Energy Syst 2:299–312. https://doi.org/10.1007/s12667-011-0037-6

Apergis N, Payne JE (2011b) Renewable and non-renewable electricity consumption–growth nexus: evidence from emerging market economies. Appl Energy 88:5226–5230. https://doi.org/10.1016/j.apenergy.2011.06.041

Apergis N, Payne JE (2014) Renewable energy, output, CO2 emissions, and fossil fuel prices in Central America: evidence from a nonlinear panel smooth transition vector error correction model. Energy Econ 42:226–232. https://doi.org/10.1016/j.eneco.2014.01.003

Apergis N, Payne JE (2012) Renewable and non-renewable energy consumption-growth nexus: evidence from a panel error correction model. Energy Econ 34:733–738. https://doi.org/10.1016/j.eneco.2011.04.007

Apergis N, Payne JE, Menyah K, Wolde-Rufael Y (2010) On the causal dynamics between emissions, nuclear energy, renewable energy, and economic growth. Ecol Econ 69:2255–2260. https://doi.org/10.1016/j.ecolecon.2010.06.014

Azad AK, Rasul MG, Khan MMK, Sharma SC, Bhuiya MMK (2015) Study on Australian energy policy, socio-economic, and environment issues. J Renew Sustain Energy 7. https://doi.org/10.1063/1.4938227

Bélaïd F, Youssef M (2017) Environmental degradation, renewable and non-renewable electricity consumption, and economic growth: assessing the evidence from Algeria. Energy Policy 102:277–287. https://doi.org/10.1016/j.enpol.2016.12.012

Ben Jebli M, Ben Youssef S (2015) Economic growth, combustible renewables and waste consumption, and CO2 emissions in North Africa. Environ Sci Pollut Res 22:16022–16030. https://doi.org/10.1007/s11356-015-4792-0

Bhattacharya M, Paramati SR, Ozturk I, Bhattacharya S (2016) The effect of renewable energy consumption on economic growth: evidence from top 38 countries. Appl Energy 162:733–741. https://doi.org/10.1016/j.apenergy.2015.10.104

Bildirici EM, Bakirtas T (2016) The relationship among oil and coal consumption, carbon dioxide emissions, and economic growth in BRICTS countries. J Renew Sustain Energy 8:045903. https://doi.org/10.1063/1.4955090

BP Statistics (2017) BP Statistics. www.bp.com

Chandran Govindaraju VGR, Tang CF (2013) The dynamic links between CO2 emissions, economic growth and coal consumption in China and India. Appl Energy 104:310–318. https://doi.org/10.1016/j.apenergy.2012.10.042

Danish, Zhang B, Wang B, Wang Z (2017) Role of renewable energy and non-renewable energy consumption on EKC: evidence from Pakistan. J Clean Prod 156:855–864. https://doi.org/10.1016/j.jclepro.2017.03.203

Danish, Zhang B, Wang Z, Bo W (2018) Energy production, economic growth and CO2 emission: evidence from Pakistan. Nat Hazards 90:27–50. https://doi.org/10.1007/s11069-017-3031-z

Dogan E (2016) Analyzing the linkage between renewable and non-renewable energy consumption and economic growth by considering structural break in time-series data. Renew Energy 99:1126–1136. https://doi.org/10.1016/j.renene.2016.07.078

Dogan E, Ozturk I (2017) The influence of renewable and non-renewable energy consumption and real income on CO2 emissions in the USA: evidence from structural break tests. Environ Sci Pollut Res 24:10846–10854. https://doi.org/10.1007/s11356-017-8786-y

Farhani S, Shahbaz M (2014) What role of renewable and non-renewable electricity consumption and output is needed to initially mitigate CO2emissions in MENA region? Renew Sust Energ Rev 40:80–90. https://doi.org/10.1016/j.rser.2014.07.170

Global Climate Risk Index (2018) Who suffers most from extreme weather events? Weather-related Loss Events in 2016 and 1997 to 2016. Report available in English for download at: https://germanwatch.org/en/14638

Greiner PT, York R, McGee JA (2018) Snakes in The Greenhouse: does increased natural gas use reduce carbon dioxide emissions from coal consumption? Energy Res Soc Sci 38:53–57. https://doi.org/10.1016/j.erss.2018.02.001

Harris R, Sollis R (2003) Applied time series modelling and forecasting. Wiley and Sons Inc., West, Sussex. Book available online at https://www.wiley.com/en-us/Applied+Time+Series+Modelling+and+Forecasting-p-9780470844434

Ibrahiem DM (2015) Renewable electricity consumption, foreign direct investment and economic growth in Egypt: an ARDL approach. Procedia Economics and Finance 30:313–323. https://doi.org/10.1016/S2212-5671(15)01299-X

International Energy Association (2015) Energy and Climate Change, World Energy Outlook special report (page # 18). Available at https://www.iea.org/publications/freepublications/publication/WEO2015SpecialReportonEnergyandClimateChange.pdf

Ito K (2017) CO2 emissions, renewable and non-renewable energy consumption, and economic growth: evidence from panel data for developing countries. Int Econ 151:1–6. https://doi.org/10.1016/j.inteco.2017.02.001

Kahia M, Ben Aïssa MS, Charfeddine L (2016) Impact of renewable and non-renewable energy consumption on economic growth: new evidence from the MENA Net Oil Exporting Countries (NOECs). Energy 116:102–115. https://doi.org/10.1016/j.energy.2016.07.126

Komal R, Abbas F (2015) Linking financial development, economic growth and energy consumption in Pakistan. Renew Sust Energ Rev 44:211–220. https://doi.org/10.1016/j.rser.2014.12.015

Lach Ł (2015) Oil usage, gas consumption and economic growth: evidence from Poland. Energy Sources, Part B Econ Planning, Policy 10:223–232. https://doi.org/10.1080/15567249.2010.543946

Lean HH, Smyth R (2010) CO2 emissions, electricity consumption and output in ASEAN. Appl Energy 87:1858–1864. https://doi.org/10.1016/j.apenergy.2010.02.003

Lim K-M, Lim S-Y, Yoo S-H (2014) Oil consumption, CO2 emission, and economic growth: evidence from the Philippines. Sustainability 6:967–979. https://doi.org/10.3390/su6020967

Long X, Naminse EY, Du J, Zhuang J (2015) Nonrenewable energy, renewable energy, carbon dioxide emissions and economic growth in China from 1952 to 2012. Renew Sust Energ Rev 52:680–688

Lotfalipour MR, Falahi MA, Ashena M (2010) Economic growth, CO2 emissions, and fossil fuels consumption in Iran. Energy 35:5115–5120. https://doi.org/10.1016/j.energy.2010.08.004

Martínez-Zarzoso I, Bengochea-Morancho A (2004) Pooled mean group estimation of an environmental Kuznets curve for CO2. Econ Lett 82:121–126. https://doi.org/10.1016/j.econlet.2003.07.008

Marvão Pereira A, Marvão Pereira RM (2010) Is fuel-switching a no-regrets environmental policy? VAR evidence on carbon dioxide emissions, energy consumption and economic performance in Portugal. Energy Econ 32:227–242. https://doi.org/10.1016/j.eneco.2009.08.002

Mirza FM, Kanwal A (2017) Energy consumption, carbon emissions and economic growth in Pakistan: dynamic causality analysis. Renew Sust Energ Rev 72:1233–1240

Mohiuddin O, Asumadu-Sarkodie S, Obaidullah M (2016) The relationship between carbon dioxide emissions, energy consumption, and GDP: a recent evidence from Pakistan. Cogent Eng 3. https://doi.org/10.1080/23311916.2016.1210491

Mohsin M, Zhou P, Iqbal N, Shah SAA (2018) Assessing oil supply security of South Asia. Energy 155:438–447. https://doi.org/10.1016/j.energy.2018.04.116

Muhammad SS, Muhammad Z, Muhammad S (2014) Renewable and nonrenewable energy consumption, real GDP and CO2 emissions nexus: a structural VAR approach in Pakistan. Bull Energy Econ 2:91–105. https://doi.org/10.5897/JAERD12.088

Nasir M, Ur Rehman F (2011) Environmental Kuznets curve for carbon emissions in Pakistan: an empirical investigation. Energy Policy 39:1857–1864. https://doi.org/10.1016/j.enpol.2011.01.025

Ohler A, Fetters I (2014) The causal relationship between renewable electricity generation and GDP growth: a study of energy sources. Energy Econ 43:125–139

Pao H-T, Tsai C-M (2010) CO2 emissions, energy consumption and economic growth in BRIC countries. Energy Policy 38:7850–7860. https://doi.org/10.1016/j.enpol.2010.08.045

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16:289–326. https://doi.org/10.1002/jae.616

Saboori B, Sulaiman J (2013) Environmental degradation, economic growth and energy consumption: evidence of the environmental Kuznets curve in Malaysia. Energy Policy 60:892–905. https://doi.org/10.1016/j.enpol.2013.05.099

Sadorsky P (2009) Renewable energy consumption and income in emerging economies. Energy Policy 37:4021–4028. https://doi.org/10.1016/j.enpol.2009.05.003

Salim RA, Hassan K, Shafiei S (2014) Renewable and non-renewable energy consumption and economic activities: further evidence from OECD countries. Energy Econ 44:350–360. https://doi.org/10.1016/j.eneco.2014.05.001

Shafiei S, Salim RA (2014) Non-renewable and renewable energy consumption and CO2 emissions in OECD countries: a comparative analysis. Energy Policy 66:547–556. https://doi.org/10.1016/j.enpol.2013.10.064

Shahbaz M, Farhani S, Ozturk I (2015) Do coal consumption and industrial development increase environmental degradation in China and India? Environ Sci Pollut Res 22:3895–3907. https://doi.org/10.1007/s11356-014-3613-1

Shahbaz M, Lean HH (2012) The dynamics of electricity consumption and economic growth: a revisit study of their causality in Pakistan. Energy 39:146–153. https://doi.org/10.1016/j.energy.2012.01.048

Shahbaz M, Zeshan M, Afza T (2012) Is energy consumption effective to spur economic growth in Pakistan? New evidence from bounds test to level relationships and Granger causality tests. Econ Model 29:2310–2319. https://doi.org/10.1016/j.econmod.2012.06.027

Shahzad SJH, Kumar RR, Zakaria M, Hurr M (2017) Carbon emission, energy consumption, trade openness and financial development in Pakistan: a revisit. Renew Sust Energ Rev 70:185–192. https://doi.org/10.1016/j.rser.2016.11.042

Sinha A, Shahbaz M (2018) Estimation of environmental Kuznets curve for CO2 emission: role of renewable energy generation in India. Renew Energy 119:703–711. https://doi.org/10.1016/j.renene.2017.12.058

Solarin SA, Al-Mulali U, Gan GGG, Shahbaz M (2018) The impact of biomass energy consumption on pollution: evidence from 80 developed and developing countries. Environ Sci Pollut Res 25:22641–22657. https://doi.org/10.1007/s11356-018-2392-5

Soytas U, Sari R, Ewing BT (2007) Energy consumption, income, and carbon emissions in the United States. Ecol Econ 62:482–489. https://doi.org/10.1016/j.ecolecon.2006.07.009

Toda HY, Phillips PCB (1993) Vector autoregressions and causality. Econometrica 61:1367–1393

Tugcu CT, Ozturk I, Aslan A (2012) Renewable and non-renewable energy consumption and economic growth relationship revisited: evidence from G7 countries. Energy Econ 34:1942–1950. https://doi.org/10.1016/j.eneco.2012.08.021

UNFCCC (2015) Conference of Parties (COP) of the United Nations Framework Convention for Climate Change

Vaona A (2012) Granger non-causality tests between (non)renewable energy consumption and output in Italy since 1861: the (ir)relevance of structural breaks. Energy Policy 45:226–236. https://doi.org/10.1016/j.enpol.2012.02.023

Wakeel M, Chen B, Jahangir S (2016) Overview of energy portfolio in Pakistan. Energy Procedia 88:71–75. https://doi.org/10.1016/j.egypro.2016.06.024

Wesseh PK, Lin B (2016a) Can African countries efficiently build their economies on renewable energy? Renew Sust Energ Rev 54:161–173. https://doi.org/10.1016/j.rser.2015.09.082

Wesseh PK, Lin B (2016b) Output and substitution elasticities of energy and implications for renewable energy expansion in the ECOWAS region. Energy Policy 89:125–137. https://doi.org/10.1016/j.enpol.2015.11.007

World Bank (2017) World Development Indicators. http://www.wdi.org/. Accessed 5 Feb 2018

Yuan JH, Kang JG, Zhao CH, Hu ZG (2008) Energy consumption and economic growth: evidence from China at both aggregated and disaggregated levels. Energy Econ 30:3077–3094. https://doi.org/10.1016/j.eneco.2008.03.007

Zhang W, Yang S (2013) The influence of energy consumption of China on its real GDP from aggregated and disaggregated viewpoints. Energy Policy 57:76–81. https://doi.org/10.1016/j.enpol.2012.10.023

Ziramba E (2009) Disaggregate energy consumption and industrial production in South Africa. Energy Policy 37:2214–2220. https://doi.org/10.1016/j.enpol.2009.01.048

Zoundi Z (2017) CO2 emissions, renewable energy and the environmental Kuznets curve, a panel cointegration approach. Renew Sust Energ Rev 72:1067–1075

Funding

We are grateful to the National Natural Science Foundation of China (No. 71571019) for supporting and sponsoring this study.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Muhammad Shahbaz

Annexure

Annexure

Rights and permissions

About this article

Cite this article

Zaidi, S.A.H., Danish, Hou, F. et al. The role of renewable and non-renewable energy consumption in CO2 emissions: a disaggregate analysis of Pakistan. Environ Sci Pollut Res 25, 31616–31629 (2018). https://doi.org/10.1007/s11356-018-3059-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-018-3059-y