Abstract

This study investigates the long-run equilibrium relationship among carbon dioxide (CO2) emissions, income growth, energy consumption, and agriculture, thus testing the existence of what we call the agriculture-induced environmental Kuznets’ curve (EKC) hypothesis in the case of Pakistan for the period of 1971–2014. The long-run equilibrium relationship among the variables in the conducted model is confirmed by Maki’s (EM 29(5), 2011–2015, 2012) co-integration test under multiple structural breaks. Toda-Yamamoto’s (JE 66(1):225–250, 1995) causality test results reveal bidirectional causal relationships among gross domestic product (GDP), energy use, agriculture, and CO2 emissions. Fully modified ordinary least squares (FMOLS) results suggest that GDP has elastic positive impacts on CO2 emissions, and energy use and agricultural value added have inelastic positive impacts on CO2 emissions, whereas squared GDP has an inelastic and negative effect on CO2 emissions. This finding confirms the existence of the agriculture-induced EKC hypothesis in Pakistan and can be a guideline for other agrarian developing countries for the creation of effective policies around environmental degradation.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

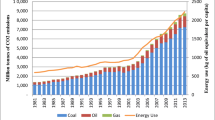

The history of industrialization can be characterized by the intense use of fossil fuels, mainly petroleum, natural gas, and coal. Fossil fuels have enabled humankind to reach an unprecedented pace of economic growth and level of prosperity, but these developments have come at a cost to the environment. Factors beyond fossil fuel use that accompany economic progress, such as high population growth, advanced transportation, new lifestyles, higher demands and expectations among citizens, and international trade, have further aggravated environmental problems (Alcántara and Padilla 2005; Intergovernmental Panel on Climate Change (IPCC) 2013). The recognition of the high environmental costs of these developments brought the concept of sustainable development onto the agenda, and, since sustainable development was first emphasized in detail in the World Development Report of 1992 (World Bank 1992), the relationship between economic growth and environmental problems has become one of the most investigated and discussed topics among researchers, policymakers, and international organizations (Boluk and Mert 2015).

The economic model known as Kuznets’ curve, developed by Simon Kuznets in the 1950s, demonstrates an inverted U-shaped relationship between economic development and income inequality (Kuznets 1955). Kuznets claimed that at the first stage of a nation’s economic development, income inequality at first rises then reaches a peak point and, after a threshold point of economic development, then tends to become less severe. Due to the increasing intensity of environmental problems, the well-known Kuznets’ curve was modified in the 1990s to describe the relationship between income level and environmental quality.

Following the original idea of Kuznets, Grossman and Krueger (1991, 1993), and Shafik and Bandyopadhyay (1992) independently claimed that there is an approximate inverted U-shaped relationship between income level and environmental quality. This relationship describes how, in the first stage of a nation’s economic development, environmental degradation increases (due to inferior production technologies); while as income levels go up, there is a structural change toward environmentally friendly production processes, at which point environmental degradation begins to diminish. This inverted U-shaped relationship between income and environmental degradation was first named the environmental Kuznets’ curve (EKC) by Panayotou (1993). The concept attracted significant interest in the academic world. Following the seminal papers of Shafik and Bandyopadhyay (1992) and Grossman and Krueger (1993), a literature began to emerge and evidence for the validity of EKC hypothesis began to mount (Roberts and Grimes 1997). For the past two decades, a large number of papers have investigated the applicability of the EKC in different countries and in different sample periods, using a variety of empirical approaches.Footnote 1 Many researchers have acknowledged its validity.

Agriculture is one of the most important segments of any nation’s economy. Although its role as a main driver of economic growth has been acknowledged for several centuries, the information age and globalization have significantly enhanced its importance. Research and development (R&D) in the agricultural sector has a very high rate of return (World Bank 2007), and agriculture is still very important contributor to increases in the total productivity of national economies (Fuglie 2010; Fuglie and Nin-Pratt 2012). Hence, agricultural know-how enables a country to increase its economic growth rate by enhancing its competitiveness. It is well documented that in developing nations, the poverty reduction effect of agricultural growth is greater than that of growth in others sectors (Timmer 2009).

These characteristics of the agricultural sector make it an important tool for developing countries (World Trade Organization (WTO) 2014a). On the other hand, developments over the last two decades in the global food market, including a significant increase in investment interests in agriculture (Deininger et al. 2011), surging R&D attempts, high levels of foreign direct investment (FDI), and higher food standards (Maertens and Swinnen 2014), have brought new challenges and opportunities for developing countries. Increasing volumes of exported agricultural products (The Food and Agriculture Organization (FAO) 2009; WTO 2014b) and greater export shares of developing countries in high value-added product segments motivate developing countries to increase agricultural production. However, more agricultural production leads to greater energy consumption, especially of fossil fuel (United States Census Bureau-USCB 2004–2005; Pimentel 2006; Tabar et al. 2010), and thus to higher levels of carbon emission (Intergovernmental Panel on Climate Change (IPCC) 2006), environmental pollution, deforestation, and poor water quality. The sustainability of agriculture-driven growth has become a vital concern.

For the last two decades, as a result of factors including rising and more volatile energy prices, technological advancements, and changes to environmental policies that govern the relationship between the agriculture and energy sectors, the relationship between the agricultural sector and environmental degradation has transformed. Energy prices rose and were more volatile during 2001–2012. Farmers witnessed an upward trend in the price of energy-related production inputs in this period. On the one hand, this price increase affected the profitability of the agricultural sector and caused changes to the energy usage patterns of the sector (Tokgoz et al. 2008). On the other hand, higher energy prices created incentives for other sectors to find alternative energy sources and the energy sector’s use of agricultural products, such as feed stock, as renewable fuel sources increased substantially. Other factors such as domestic energy security, rural economic growth, and environmental awareness accelerated growth in biofuel markets. These processes reinforced linkages between the agricultural and energy sectors, but the traditional one-way relationship between them, in which agriculture uses energy as an input and has been a net energy consumer, has become a two-way, reciprocal relationship. The fact that the agricultural sector has become a supplier of energy inputs, as well as a consumer, makes the agriculture-energy relationship more complicated and important to analyze (Hochman et al. 2010). Technological development has also changed the relationship between agricultural production and energy-environment issues. Both higher fossil fuel prices and the growing sensitivity of the international community to environmental degradation have led to the adoption of alternative technologies and production practices that conserve energy and other inputs. Enhanced energy efficiency not only helps to improve competitiveness through cost reduction, but also reduces greenhouse gas (GHG) emissions and environmental impacts (Alluvione et al. 2011).

Transformations in the agriculture-environment relationship is worth investigating empirically and in the energy use patterns of agricultural systems make agriculture an important candidate for enhancing the conventional EKC model. To the best of the authors’ knowledge, there is only one study (DOGAN 2016) in the relevant literature that explores the relationship between changes in the agricultural sector and environmental degradation in terms of the EKC framework. Given the importance of the agricultural sector and its changing relationship to energy-environment issues, augmenting the EKC hypothesis by incorporating the agricultural sector for the case of Pakistan (what we call the agriculture-induced EKC hypothesis) will make an important contribution to the existing empirical literature.

The existing literature discusses both the theory of and the robustness or sensitivity of the estimated EKC models (Tutulmaz 2015). Choosing the appropriate econometric approach is vital for the validity of the findings. Previous studies reported mixed results by adopting cross-sectional or panel data analyses to test the EKC hypothesis (Baek 2015). However, Baek and Kim (2011) claim that these mixed results are likely to be results of aggregation bias, which means that an insignificant (significant) income effect with one country could be more than offset by significant (insignificant) income effects with other countries. Furthermore, De Bruyn et al. (1998, p.173) argued “the EKC, as estimated from panel data, does not capture dynamic processes well enough to justify the claim that economic growth is de-linked from environmental pressure in individual countries.” To overcome this problem, many researchers prefer to use time series data to investigate individual countries (some recent studies, Aslan et al. 2018; Balaguer and Cantavella 2018; Farhani et al. 2014; Katircioglu and Katircioglu 2017; Lau et al. 2014; Robalino-López et al. 2014). We here use the time series method following the recommendation of Stern et al. (1996) to address the crucial question of the evolution of the income-environment relationship in a specific country and to avoid the issues of cross-sectional dependence (Wagner 2008) and heterogeneity (Dijkgraaf and Vollebergh 2005). We fully address the integration and co-integration properties of the data using more robust and superior econometric techniques than standard econometric procedures. Structural breaks in the series cause errors in the integration and co-integration properties of the series in standard econometric techniques (Perron 1990). In this context, Zivot’s and Andrews’ (1992) unit root test and Maki’s (2012) co-integration test took into account any possible structural break. On the other hand, Toda-Yamamoto’s (1995) causality test is employed instead of the standard Granger causality test. One advantage of Toda-Yamamoto’s causality test is that it can be applied regardless of the integration and co-integration features of variables in the model (Abu-Bader and Abu-Qarn 2008).

In this study, Pakistan is a case in which the agriculture-induced EKC hypothesis is to be tested. The environmental performance index (EPI), which is a joint project of the Yale Center for Environmental Law & Policy (YCELP) and Columbia University, in collaboration with the World Economic Forum, ranked Pakistan 148th out of 178 countries for environmental performance, indicating serious problems in the environmental policies of the country (2014). Pakistan has an agriculture-based economy, in which the agricultural sector contributed 25.1% of GDP in 2014 and in which 45% of the labor force of the country is engaged with the agricultural sector (World Bank development indicators 2015). Therefore, growth in Pakistan’s agriculture sector may accelerate economic growth overall, which could lead to higher energy consumption and hence could be a source of increased CO2 emissions. In 2050, a threefold increase in energy demand is expected as Pakistan has one of the fastest growing economies in the world (Rafique and Rehman 2017). According to Kyoto protocol agreements on climate change, the Government of Pakistan focuses on the ways of reducing air pollution and ensuring energy efficiency in the country while trying to accelerate economic growth (Mirza and Kanwal 2017). These circumstances make Pakistan an interesting case in which the relationship between CO2 emissions, economic growth, energy consumption, and agriculture as a test of the agriculture-induced EKC hypothesis is to be investigated, with the ultimate goal of informing effective environmental policy. The results of this study may also help other developing countries to create comprehensive policies to control environmental degradation.

Theoretical framework

The results of empirical analyses that seek to investigate the validity of the EKC hypothesis are dependent on several factors, such as the selection of the dependent variable, independent variables, country and sample period, econometric model, and empirical methods. We assert that choices about the influence granted to these variables in various models are the main sources of conflicting findings on the validity of the EKC hypothesis. Hence, in order to obtain robust and reliable results, it is imperative that one is clear about the decisions made regarding the role and weight of these variables in EKC models.

The EKC describes a relationship between income growth and environmental pollution. Environmental pollution is the dependent variable of the model and can be proxied by several other variables, from changes in biological diversity (Dietz and Adger 2003) to toxic intensity (Seppälä et al. 2001) and to the most commonly used proxy variable (because of its availability), pollutants. Pollutants can be classified in two broad groups: those with local effects and those with global effects. CO2 is considered a global emission and is one of the most applied emissions in EKC models (Acaravcı and Ozturk 2010; Carson 2010; Cetin 2018; Zilio and Recalde 2011; Osabuohien et al. 2014; Sinha and Shahbaz 2018; Yang and Chen 2014; Yavuz 2014; Al-Mulali et al. 2015a; Zoundi 2017). There are several reasons for this choice. First, carbon emission is a useful variable for policy discussion and recommendation. According to the IPCC (2006), CO2 represents 76.7% of greenhouse gas (GHG) emissions, which is a vital statistic for decision-makers, for economic planning, and for environmental protection.

Carbon dioxide is directly related to important sustainability problems such as global warming, greenhouse effects, and climate change. Given that a key concern of current international development efforts is the mitigation of global climate change, it is crucial that variables that have an impact on CO2 emissions be identified (Villanueva 2012). As a global emission, the costs of carbon dioxide extend beyond the time and place in which emissions are generated. This causes so-called free rider problems, in which countries can emit CO2 without bearing the whole cost of those emissions. The global nature of CO2 effects often makes it difficult to investigate the relationship between economic growth and pollution in specific contexts, which leads to a lack of consensus in both economics and policy decisions. These challenges make the research interesting. Because of the abovementioned reasons, per capita carbon dioxide emission is used as the dependent variable in our agriculture-induced EKC model.

The EKC represents a reduced form relationship (Grossman and Krueger 1995) that intends to evaluate the “net” or total effect of income growth on environmental quality. Adding nonstructural variables into the EKC model can capture the effect of other variables on the relationship between income growth and environmental degradation depicted by the main reduced model (De Bruyn and Heintz 1999). With the help of nonstructural variables, it might be possible to see a pattern that is masked by the estimation of the reduced form model. Furthermore, the use of nonstructural variables can improve econometric properties and improve the residual quality of the estimations (Tutulmaz 2015). Hence, if it is argued that a variable has a significant influence on environmental quality, then adding this variable to the conventional EKC model will provide better results and enable us to have a better understanding of the relationship under investigation. To this aim, several different variables have been added to the original EKC model in various studies, including labor and capital (Apergis and Payne 2009a, b; Ghali 2004), trade (Jalil and Feridun 2011; Nasir and Rehman 2011; Shahbaz et al. 2014; Zambrano-Monserrate et al. 2018; Zhang 2018), energy consumption (Lean and Smyth 2010; Saboori and Sulaiman 2013; Shahbaz et al. 2015; Ozokcu and Ozdemir 2017), indicators that proxy the use of pollutant energies (Apergis and Ozturk 2015), and the evolution of energy prices (Katircioglu 2017; Richmond and Kaufman 2006). Following recent studies that investigated the relationship between income growth and environmental pollution by incorporating a particular segment of the economy into the EKC model (Katırcıoglu 2014), this study, for the first time, augments the conventional EKC model by including the agricultural sector as an independent variable. This is the main novelty of the paper that we believe will lead to a better understanding of the relationship described by the EKC hypothesis. We further incorporate energy use into the model, as disregarding the role of energy use would generate estimation bias in the results (Balaguer and Cantavella 2016).

The EKC hypothesis has attracted the attention of researchers who have sought to investigate its validity. One reason for this interest is what Tutulmaz (2015) has called the “atomic structure of the model that is suitable to different modeling techniques” (74). Following the seminal paper of Shafik and Bandyopadhyay (1992), researchers have used several different model specifications to investigate the EKC hypothesis. As introduced above, the EKC hypothesis represents an inverted U-shaped relationship between income growth and environmental quality. The inverted U-shaped relationship between income growth and environmental quality is expressed by the quadratic model of the conventional EKC in the relevant literature (Al-Mulali et al. 2015b; Ang 2007; Apergis and Ozturk 2015; Jalil and Mahmud 2009; Jalil and Feridun 2011; Katircioglu 2014; Katircioglu and Celebi 2018; Pata 2017; Shahbaz et al. 2013; Yavuz 2014) as follows:

Where CO2 is carbon dioxide emissions (kt), GDP is real income at constant 2010 U.S.$, GDP2 is squared real income and E is energy consumption.

The agriculture-induced EKC hypothesis can be formulated by adding agriculture as a regressor to the conventional EKC model as follows:

where A represents the agriculture value-added constant, per US$ 2010.

The agriculture-induced EKC model in Eq. (2) can be converted to logarithmic form in order to capture growth effects in the long-run as follows:

where lnCO2t, lnGDPt, \( {\mathrm{lnGDP}}_t^2 \), lnEt, and lnAt are logarithmic forms of carbon dioxide emissions, real income, squared real income, energy consumption, and agriculture value-added constant, respectively.

Data and methodology

This study adopts annual data covering the period of 1971–2014. Carbon dioxide emissions (kt), gross domestic product per capita constant 2010 US$, energy use (kg of oil equivalent per capita) and agriculture value-added constant 2010 US$ data are collected from World Bank Development Indicators (2017).

Unit root test

The Zivot-Andrews (Zivot and Andrews 1992) unit root test is applied by taking a single structural break in the variables into consideration. The Zivot-Andrews unit root test has three aspects which are applied in the current study. Model I suggests a break in the intercept, model T indicates a break in trend, and model B suggests a break both in intercept and trend. Three models can be represented as follows;

where DUt = 1 and DTt = t − Tb if t > Tb and 0 otherwise. Tb and m stand for a possible break point and upper limit of the chosen lag length for the dependent variable, respectively.

Co-integration test

Standard co-integration tests do not take into account structural breaks and have errors in estimating long-run relationships among economic variables (Westerlund and Edgerton 2007). There are several co-integration tests that allow only one structural break in the series (Gregory and Hansen 1996; Carron-i-Silvestre and Sanso 2006; Westerlund and Edgerton 2007; Hatemi-j 2008). On the other hand, the number of structural breaks in economic variables is unpredictable especially for emerging economies and considering only one structural break in the economic variables causes misspecifications about estimating long-run relationships between them. Therefore, the Maki (2012) co-integration test considers multiple structural breaks in the series up to five. All of the series should be stationary at their first differences in order to apply the Maki (2012) co-integration test. Maki (2012) proposed four alternative models as follows:

Model 1: with break in intercept and without trend

Model 2: with break in intercept and coefficients and without trend

Model 3: with break in intercept and coefficients and with trend

Model 4: with break in intercept, coefficients, and trend

where Di indicates dummy variables as Di = 1 when t > Tb and Di = 0 otherwise and Tb and k stand for a possible break point and upper limit of the chosen lag length, respectively.

Estimation of long-run coefficients

If co-integration test indicates a long-run relationship among variables under investigation, then long-run coefficients have to be estimated to reveal the long run relationship between them. To this aim, fully modified ordinary least squares (FMOLS) approach, which is developed by Phillips and Hansen (1990), will be adopted. The advantage of adopting FMOLS approach is that it corrects endogeneity and serial correlation effects and it eliminates the sample bias error (Narayan and Narayan 2005).

FMOLS model can be estimated as follows:

where Xt is an I(1) variable and Yt is a (k × 1) vector of I(1) independent variables which are not co-integrated between them.

Causality test

Existence and direction of causal interactions among variables is estimated by the Toda-Yamamoto (1995) causality test. The Toda-Yamamoto (1995) test has more advantageous characteristics. One of the most important advantages of the Toda-Yamamoto causality test is that it is conducted regardless of the integration of the series and co-integration features of models. In order to test the causal interactions among variables, Toda and Yamamoto (1995) suggest the modified Wald stat (MWALD). This method suggests estimating the vector autoregression (VAR) (k + dmax). In this model, k is the ideal order and the maximum order of integration is represented as dmax. In this study, bootstrap test is carried out with endogenous lag order which is suggested by Hacker and Hatemi-J (2012) and 10,000 simulations are carried out to calculate bootstrapped critical values. The Hacker and Hatemi-J (2012) information criteria are adopted for the ideal lag selection in the models.

VAR (k + dmax) model can be represented as follows:

Empirical results

Table 1 reports the integration order of variables by adopting Zivot and Andrews’ (1992) unit root test. The unit root test results reveal that the variables used in the study are not stationary at their level forms under one single structural break. Therefore, first differences of the variables are taken and the series becomes stationary. That is to say that all variables are integrated of order one under the existence of a single structural break: I(1). Also, the augmented Dickey-Fuller (ADF) and Phillips-Perron (PP) unit root tests are applied as a robustness check for the unit root analysis (see Appendix).

The long-run equilibrium relationship among CO2 emissions, GDP, the square of GDP, energy use, and agricultural value added was investigated by Maki’s (2012) co-integration test under multiple structural breaks. Results of the co-integration test confirm the existence of a long-run equilibrium relationship among variables under multiple structural breaks. Computed test statistics, critical values, and obtained break points under four models of Maki’s (2012) co-integration test are reported in Table 2. The null hypothesis, in which there would be no co-integration relationship, is rejected when adopting the four models of Maki (2012) under various multiple structural breaks up to five. Furthermore, the Johansen co-integration and bounds test under autoregressive distributed lag (ARDL) model is applied as a robustness check for confirming the long-run equilibrium relationship among variables (see Appendix).

After revealing the long-run equilibrium relationship among the model’s variables, long-run coefficients were obtained by the FMOLS estimation technique. The results of the FMOLS estimation are indicated in Table 3. According to our empirical findings, GDP has elastic positive effect on CO2 emissions, and energy use and agricultural value added have inelastic positive effects on CO2 emissions, which means income growth and energy use and agricultural development have significant positive effects on air pollution in the case of Pakistan. By contrast, squared GDP has an inelastic and negative impact on CO2 emissions in the long run. This finding evidences the existence of the agriculture-induced EKC hypothesis in the case of Pakistan.

Figure 1 plots the relationship between (a) actual CO2 emissions and GDP; (b) estimated CO2 emissions and actual GDP with energy consumption; and (c) estimated CO2 emissions with energy consumption and agriculture. Panel a indicates that there is no evidence of an inverted U-shaped relationship between actual CO2 emissions and GDP. Therefore, the role of energy consumption and agriculture should be taken into account. Panels b and c indicate that the contribution of energy consumption and agriculture to the inverted U-shaped relationship between CO2 emissions and GDP is not clear. Thus, Fig. 1 suggests that per capita GDP in Pakistan has not reached the level of turning point yet.

The directionality of the long-run relationship among these variables is clarified by Toda-Yamamoto’s (1995) causality test. These findings are reported in Table 4. Toda-Yamamoto’s causality test results reveal bidirectional causal relationships among GDP, energy use, agriculture, and CO2 emissions, which indicates that a change in income growth and related changes in energy use and agriculture cause air pollution in Pakistan. Causality test results also reveal that there is a bidirectional relationship between GDP and energy use, which means changes in income growth cause a change in energy use and a change in energy use causes a change in income growth.

Table 5 indicates variance decomposition of CO2 emissions, where high levels of error forecasts are explained by exogenous shocks to GDP and by increases over time. Error forecast variance of CO2 emissions by a shock to the GDP is 26.72% in period 10 which means exogenous shocks to the GDP variable explain 26.72% of error forecasts in CO2 emissions. On the other hand, exogenous shocks to energy consumption explain lower levels of error forecasts in CO2 emissions rather than exogenous shocks to agriculture. When there is an exogenous shock to agriculture, error forecasts increase in the initial periods but, after some time, error forecasts start to decline. As it can be seen from Table 5, error forecast variance of CO2 emissions by a shock to the agriculture is at its peak value (6.47%) in the fourth period and it declined to 5.09% in period 10.

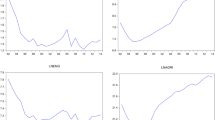

Figure 2 plots the impulse responses between CO2 emissions and its determinants. Impulse responses indicate reactions of the series to exogenous shocks. It is important to use structural information to identify relevant shocks (Lütkepohl 2008). Figure 2 indicates that the response of CO2 emissions to shocks in the GDP is positive, whereas it is negative when the GDP doubles. Moreover, the response of CO2 emissions to shocks in energy consumption is very low and decreases over time. Finally, when there is a shock in the agricultural sector, the response of CO2 emissions is positive in the initial periods but starts to decline over time. These findings support the EKC hypothesis in the case of Pakistan and are consistent with the results of estimated long-run coefficients in Table 3.

Conclusion

This study investigates the validity of the agriculture-induced EKC hypothesis and the long-run equilibrium relationship among CO2 emissions, income growth, energy consumption, and agriculture in the case of Pakistan for the period of 1971–2014. To the best of our knowledge, this is the only study in the current literature that tests the validity of the EKC hypothesis by adding agriculture to the conventional EKC model for the case of Pakistan. The long-run equilibrium relationship is investigated by adopting Maki’s (2012) co-integration test under multiple structural breaks. The results of Maki’s (2012) co-integration test confirm the long-run equilibrium relationship under various significant structural breaks up to five among the variables included in the current study.

The validity of the EKC hypothesis can be investigated by comparing estimated long-run coefficients of GDP and squared GDP in the conducted model. If the estimated coefficient of GDP is positive, while the estimated coefficient of squared GDP is negative, the validity of the EKC hypothesis is confirmed for the host country. According to FMOLS regression results, income growth has elastic and positive effects on CO2 emissions, and energy consumption and agricultural development have inelastic and positive effects on CO2 emissions which are used as a proxy for air pollution. On the other hand, squared GDP has an inelastic and negative impact on CO2 emissions in the long run. The results of FMOLS regression suggest the validity of the EKC hypothesis for the case of Pakistan.

Policy makers should be aware not only of the importance of agriculture to the economy of Pakistan but also its effect on environmental degradation. The main cause of air pollution by agriculture sector is burning fossil fuel in the production phase. To reduce the level of pollution, farmers’ awareness should be raised to use fossil fuel mode of energy efficiently by investing more in research and development (R&D) activities. Moreover, it is important to invest in clean agriculture while promoting higher income growth and to simultaneously replace polluting forms of energy consumption with renewable energy. By adopting alternative energy resources, coal-fired power stations and emissions from these stations can be reduced. Government also can encourage farmers to use innovative, environmental friendly technologies by adopting a reward mechanism. In other words, farmers who use environmental and innovative techniques in production should be rewarded to decrease the usage of polluting technologies in the sector. In addition, excess usage of fertilizers is one of the main causes of pollution. Government should control the amount of fertilizers used in the production of crops by educating farmers to use fertilizers efficiently. The results of this study can be a guideline for other agrarian developing countries for the creation of effective policies around environmental degradation.

References

Abu-Bader S, Abu-Qarn AS (2008) Financial development and economic growth: empirical evidence from six MENA countries. Rev Dev Econ 12(4):803–817

Acaravci A, Ozturk I (2010) On the relationship between energy consumption, CO2 emissions and economic growth in Europe. Energy 35:5412–5420

Alcántara V, & Padilla E (2005) Analysis of CO2 and its explanatory factors in the different areas of the world. Technical report Universidad Autonoma de Barcelona, Department of Economics Applied, Spain

Alluvione F, Moretti B, Sacco D, Grignani C (2011) EUE (energy use efficiency) of cropping systems for a sustainable agriculture. Energy 36(7):4468–4481

Al-Mulali U, Saboori B, Ozturk I (2015a) Investigating the Environmental Kuznets Curve hypothesis in Vietnam. Energy Policy 76:123–131

Al-Mulali U, Weng-Wai C, Sheau-Ting L, Mohammed AH (2015b) Investigating the environmental Kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecol Indic 48:315–323

Ang JB (2007) CO2 emissions, energy consumption, and output in France. Energy Policy 35:4772–4778

Apergis N, Payne JE (2009a) CO2 emissions, energy usage, and output in Central America. Energy Policy 37:3282–3286

Apergis N, Payne JE (2009b) Energy consumption and economic growth in Central America: evidence from a panel cointegration and error correction model. Energy Econ 31:211–216

Apergis N, Ozturk I (2015) Testing Environmental Kuznets Curve hypothesis in Asian countries. Ecol Indic 52:16–22

Aslan A, Destek MA, Okumus I (2018) Bootstrap rolling window estimation approach to analysis of the Environment Kuznets Curve hypothesis: evidence from the USA. Environ Sci Pollut Res 25(3):2402–2408

Baek J (2015) Environmental Kuznets curve for CO2 emissions: the case of Arctic countries. Energy Econ 50:13–17

Baek J, Kim HS (2011) Trade liberalization, economic growth, energy consumption and the environment: time series evidence from G-20 countries. J East Asian Econ Integr 15(1):3–32

Balaguer J, Cantavella M (2018) The role of education in the Environmental Kuznets Curve. Evidence from Australian data. Energy Econ 70:289–296

Balaguer J, Cantavella M (2016) Estimating the environmental Kuznets curve for Spain by considering fuel oil prices (1874–2011). Ecol Indic 60:853–859

Bölük G, Mert M (2015) The renewable energy, growth and environmental Kuznets curve in Turkey: an ARDL approach. Renew Sust Energ Rev 52:587–595

Carson RT (2010) The environmental Kuznets curve: seeking empirical regularity and theoretical structure. Rev Environ Econ Policy 4(1):3–23

Cetin MA (2018) Investigating the environmental Kuznets Curve and the role of green energy: emerging and developed markets. Int J Green Energy 15(1):37–44

Carrion-i-Silvestre JL, Sansó A (2006) Testing the null of cointegration with structural breaks. Oxf Bull Econ Stat 68(5):623–646

De Bruyn S, van den Bergh C, Opschoor J (1998) Economic growth and emissions: reconsidering the empirical basis of environmental Kuznets curves. Ecol Econ 25:161–175

De Bruyn SM, Heintz RJ (1999) Handbook of environmental and resource economics. Edward Elgar, Cheltenham, UK

Deininger K, Byerlee D, Lindsay J, Norton A, Selod H, Stickler M (2011) Rising global interest in farmland. World Bank, Washington, DC

Dietz S, Adger WN (2003) Economic growth, biodiversity loss and conservation effort. J Environ Manag 68(1):23–35

Dijkgraaf E, Vollebergh H (2005) A test for parameter homogeneity in CO2panel EKC estimations. Environ Resour Econ 32:229–239

Dogan N (2016) Agriculture and Environmental Kuznets Curves in the case of Turkey: evidence from the ARDL and bounds test. Agric Econ 62(12):566–574

Farhani S, Chaibi A, Rault C (2014) CO2 emissions, output, energy consumption, and trade in Tunisia. Econ Model 38:426–434

Food and Agriculture Organization of the United Nations (FAO) (2009) How to feed the world in 2050. High Level Expert Forum, Rome Retrieved from: www.fao.org

Fuglie K (2010) Total factor productivity in the global agricultural economy: evidence from FAO data. In: Alston JM, Babcock BA, Pardey PG (eds) The shifting patterns of agricultural production and productivity worldwide. The Midwest Agribusiness Trade Research and Information Center Iowa State University, Ames, Iowa

Fuglie K, Nin-Pratt A (2012) Global food policy report: a changing global harvest. The International Food Policy Research Institute, Washington, DC

Ghali KH (2004) Energy use and output growth in Canada: a multivariate cointegration analysis. Energy Econ 26(2):225–238

Gregory AW, Hansen BE (1996) Residual-based tests for cointegration in models with regime shifts. J Econ 70(1):99–126

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free trade agreement. National Bureau of Economic Research, New York

Grossman GM, Krueger AB (1993) Environmental impacts of a North American free trade agreement. MIT press, Cambridge

Grossman G, Krueger A (1995) Economic environment and the economic growth. Q J Econ 110(2):353–377

Hacker S, Hatemi-J A (2012) A bootstrap test for causality with endogenous lag length choice: theory and application in finance. J Econ Stud 39(2):144–160

Hatemi-j A (2008) Tests for cointegration with two unknown regime shifts with an application to financial market integration. Empir Econ 35(3):497–505

Hochman G, Rajagopal D, Zilberman D (2010) The effect of biofuels on crude oil markets. Agbio Forum 13(2):112–118

Intergovernmental Panel on Climate Change (IPCC) (2006) 2006 IPCC guidelines for national greenhouse gas inventories. Retrieved from: https://www.ipcc-nggip.iges.or . jp./public/2006gl/index.html

Intergovernmental Panel on Climate Change (IPCC). (2013). Fifth assessment report (AR5). Retrieved from: https://www.ipcc.ch/report/ar5/IPCC, Intergovernmental Panel on Climate Change. (2006). IPCC guidelines for national greenhouse gas inventories, prepared by the National Greenhouse gas Inventories Programme. Retrieved from: https://www.ipcc.ch/report/ar5/

Jalil A, Mahmud SF (2009) Environment Kuznets curve for CO2 emissions: a cointegration analysis for China. Energy Policy 37(12):5167–5172

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33:284–291

Katircioglu ST (2014) Testing the tourism-induced EKC hypothesis: the case of Singapore. Econ Model 41:383–391

Katircioglu S (2017) Investigating the role of oil prices in the conventional EKC model: evidence from Turkey. Asian Econ Financ Rev 7(5):498–508

Katircioğlu S, Katircioğlu S (2017) Testing the role of urban development in the conventional environmental Kuznets curve: evidence from Turkey. Appl Econ Lett:1–6

Katircioglu S, Celebi A (2018) Testing the role of external debt in environmental degradation: empirical evidence from Turkey. Environ Sci Pollut Res:1–10

Kijima M, Nishide K, Ohyama A (2010) Economic models for the environmental Kuznets curve: a survey. J Econ Dyn Control 34:1187–1201

Kuznets S (1955) Economic growth and income inequality. Am Econ Rev 45(1):1–28

Lau LS, Choong CK, Eng YK (2014) Investigation of the environmental Kuznets curve for carbon emissions in Malaysia: do foreign direct investment and trade matter? Energy Policy 68:490–497

Lean HH, Smyth R (2010) CO2 emissions, electricity consumption and output in ASEAN. Appl Energy 87(6):1858–1864

Lütkepohl H (2008) Impulse response function. In: The new Palgrave dictionary of economics. Palgrave Macmillan, London, pp 1–5

Maertens M & Swinnen JF (2014) Agricultural trade and development: a supply chain perspective, geneva: World Trade Organization (WTO), forthcoming Working Paper

Maki D (2012) Tests for cointegration allowing for an unknown number of breaks. Econ Model 29(5):2011–2015

Mirza FM, Kanwal A (2017) Energy consumption, carbon emissions and economic growth in Pakistan: dynamic causality analysis. Renew Sust Energ Rev 72:1233–1240

Narayan PK, Narayan S (2005) Estimating income and price elasticities of imports for Fiji in a cointegration framework. Econ Model 22(3):423–438

Nasir M, Rehman FU (2011) Environmental Kuznets curve for carbon emissions in Pakistan: an empirical investigation. Energy Policy 39(3):1857–1864

Osabuohien ES, Efobi UR, Gitau CMW (2014) Beyond the environmental Kuznets curve in Africa: evidence from panel cointegration. J Environ Policy Plan 16(4):517–538

Özokcu S, Özdemir Ö (2017) Economic growth, energy, and environmental Kuznets curve. Renew Sust Energ Rev 72:639–647

Panayotou, T. (1993). Empirical test and policy analysis of environmental degradation at different stages of economic development(Working Paper, P238). Technology and employment programme, International Labour Office, Geneva

Pasten R, Figueroa BE (2012) The environmental Kuznets curve: a survey of the theoretical literature. Int Rev Environ Resource Econ 6(3):195–224

Pata UK (2017) The effect of urbanization and industrialization on carbon emissions in Turkey: evidence from ARDL bounds testing procedure. Environ Sci Pollut Res:1–8

Perron P (1990) Testing for a unit root in a time series with a changing mean. J Bus Econ Stat 8(2):153–162

Phillips PC, Hansen BE (1990) Statistical inference in instrumental variables regression with I (1) processes. Rev Econ Stud 57(1):99–125

Pimentel D (2006) Impacts of organic farming on the efficiency of energy use in agriculture. An organic center state of science review, Ithaca, NY

Rafique MM, Rehman S (2017) National energy scenario of Pakistan—current status, future alternatives, and institutional infrastructure: an overview. Renew Sust Energ Rev 69:156–167

Richmond AK, Kaufmann RK (2006) Energy prices and turning points: the relationship between income and energy use/carbon emissions. Energy J 27(4):157–180

Robalino-López A, García-Ramos JE, Golpe AA, Mena-Nieto Á (2014) System dynamics modelling and the environmental Kuznets curve in Ecuador (1980–2025). Energy Policy 67:923–931

Roberts J, Grimes P (1997) Carbon intensity and economic development 1962–91: a brief exploration of the environmental Kuznets curve. World Dev 25:191–198

Saboori B, Sulaiman J (2013) CO2 emissions, energy consumption and economic growth in Association of Southeast Asian Nations (ASEAN) countries: a cointegration approach. Energy 55:813–822

Seppälä T, Haukioja T, Kaivo-oja J (2001) The EKC hypothesis does not hold for direct material flows: environmental Kuznets curve hypothesis tests for direct material flows in five industrial countries. Popul Environ 23(2):217–238

Shafik N, & Bandyopadhyay S (1992) Economic growth and environmental quality: time-series and cross-country evidence (Vol. 904). World Bank Publications

Shahbaz M, Ozturk I, Afza T, Ali A (2013) Revisiting the environmental Kuznets curve in a global economy. Renew Sust Energ Rev 25:494–502

Shahbaz M, Khraief N, Uddin GS, Ozturk I (2014) Environmental Kuznets curve in an open economy: a bounds testing and causality analysis for Tunisia. Renew Sust Energ Rev 34:325–336

Shahbaz M, Mallick H, Mahalik MK, Loganathan N (2015) Does globalization impede environmental quality in India? Ecol Indic 52:379–393

Sinha A, Shahbaz M (2018) Estimation of environmental Kuznets curve for CO2 emission: role of renewable energy generation in India. Renew Energy 119:703–711

Stern D, Common M, Barbier E (1996) Economic growth and environmental degradation: the environmental Kuznets curve and sustainable development. World Dev 24:1151–1160

Tabar IB, Keyhani A, Rafiee S (2010) Energy balance in Iran’s agronomy (1990–2006). Renew Sust Energ Rev 14(2):849–855

Timmer P (2009) The evolving structure of world agricultural trade. FAO, Rome

Toda HY, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econ 66(1):225–250

Tokgoz S, Elobeid A, Fabiosa J, Hayes DJ, Babcock BA, Yu THE et al (2008) Bottlenecks, drought, and oil price spikes: impact on US ethanol and agricultural sectors. Appl Econ Perspect Policy 30(4):604–622

Tutulmaz O (2015) Environmental Kuznets curve time series application for Turkey: why controversial results exist for similar models? Renew Sust Energ Rev 50:73–81

USCB. 2004–2005. Statistical abstract of the U.S. Washington, DC:U.S. Government Printing Office

Villanueva IA (2012) Introducing institutional variables in the environmental Kuznets curve (EKC): a Latin American study. Annals-Economy Series 1:71–81

Wagner M (2008) The carbon Kuznets curve: a cloudy picture emitted by bad econometrics? Resour Energy Econ 30(3):388–408

Westerlund J, Edgerton DL (2007) New improved tests for cointegration with structural breaks. J Time Ser Anal 28(2):188–224

World Bank (2007) World development report 2008: agriculture for development. World Bank, Washington, DC

World Trade Organization (WTO) (2014a) World trade report 2014:market access for products and services of export interest for least-developed countries. World Trade Organization, Geneva

World Trade Organization (WTO) (2014b) World trade report 2014 trade and development: recent trends and the role of the WTO. World Trade Organization, Geneva

Yang J, Chen B (2014) Carbon footprint estimation of Chinese economic sectors based on a three-tier model. Renew Sust Energ Rev 29:499–507

Yavuz NC (2014) CO2 emission, energy consumption, and economic growth for Turkey: evidence from a cointegration test with a structural break. Energy Sources, Part B: Econ Plan Policy 9(3):229–235

World Bank Development Indicators (2015). Retrieved from:http://databank.worldbank.org

World Bank Development Indicators (2017). Retrieved from: http://databank.worldbank.org

World Bank (1992) World development report 1992: development and the environment. In: New York: Oxford university press. World Bank. Retrieved from https://openknowledge.worldbank.org/handle/10986/5975

Zambrano-Monserrate MA, Carvajal-Lara C, Urgiles-Sanchez R (2018) Is there an inverted U-shaped curve? Empirical analysis of the environmental Kuznets curve in Singapore. Asia-Pac J Account Econ 25(1–2):145–162

Zhang S (2018) Is trade openness good for environment in South Korea? The role of non-fossil electricity consumption. Environ Sci Pollut Res:1–13

Zilio M, Recalde M (2011) GDP and environment pressure: the role of energy in Latin America and the Caribbean. Energy Policy 39(12):7941–7949

Zivot E, Andrews DWK (1992) Further evidence on the great crash, the oil price shock and the unit root hypothesis. J Bus Econ Stat 10:251–270

Zoundi Z (2017) CO2 emissions, renewable energy and the environmental Kuznets curve, a panel cointegration approach. Renew Sust Energ Rev 72:1067–1075

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Philippe Garrigues

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Gokmenoglu, K.K., Taspinar, N. Testing the agriculture-induced EKC hypothesis: the case of Pakistan. Environ Sci Pollut Res 25, 22829–22841 (2018). https://doi.org/10.1007/s11356-018-2330-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-018-2330-6