Abstract

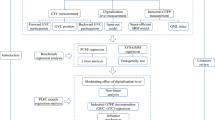

This study examined the stimulative effects of Chinese enterprises’ participation in the global value chain (GVC) on the progress of their green technologies. Using difference-in-difference panel models with big data of Chinese enterprises, we measured influencing factors such as enterprise participation degree, enterprise scale, corporate ownership, and research and development (R&D) investment. The results revealed that participation in the GVC can considerably improve the green technology levels in all enterprises, except state-owned ones. However, the older an enterprise, the higher the sluggishness is likely to be in its R&D activities; this is particularly true for state-owned enterprises. The findings provide insights into the strategy of actively addressing Chinese enterprises’ predicament of being restricted to the lower end of the GVC.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The development of global economic integration and communication/information technologies has expanded and refined the global value chain (GVC) and gradually formed a new system of international labor reallocation and trade (Humphrey and Schmitz 2000). In particular, the manufacturing sector has largely globalized, and enterprises across countries are gradually transitioning from trading in goods to trading in tasks (Escaith and Inomata 2011). This has considerably changed the approach of international trade theory toward enterprise internationalization. Each enterprise in the GVC serves as a link aiming to realize benefit maximization through the import of intermediate products, processing, and exports. In the GVC, the research and development (R&D) link benefits upstream enterprises the most, as they obtain considerable added value at low costs. The marketing link benefits downstream enterprises the most through further value addition amid increasingly fierce competition with related channels. These two links are generally dominated by developed countries. By contrast, the middle link, production, and manufacturing benefit the least because production factors are easily accessible, and most industries have reached maturity. Most Chinese enterprises can be categorized as a production and manufacturing link in the GVC that earn only slender processing fees.

As the second largest economic entity and a country with high emission, China’s economy is rapidly growing with an extensive product model characterized by high input, energy consumption, and emission. Over the past 30 years, that is, since the reform and opening up of the economy, this growth model has reached a bottleneck with problems such as excess capacity, resource shortage, and environmental pollution. The Fifth Plenary Session of the 18th Communist Party of China (CPC) Central Committee in 2015 specially proposed that China works toward green and sustainable development and sets up a safe and efficient modern energy system. In addition, today, a growing number of citizens are focusing on coordinated development between the environment and economic growth and playing increasingly important roles in making decisions on environmental treatment (do Paço et al. 2009; Glucker et al. 2013). Numerous scholars have reached a consensus that technological progress is a key factor in stimulating economic growth and improving environmental quality (Aghion et al. 2012). However, with the recent deterioration of the “demographic dividend” in China, the advantage of labor cost no longer exists. Developed countries have moved their businesses to Southeast Asian countries that have lower labor costs. This compelled Chinese enterprises to retreat from the GVC, which further aggravated the slowdown of the economy. In 2012, China entered the state of “new normal.”

Ever since Acemoglu (2002, 2003, 2007); Acemoglu et al. (2015) proposed endogenized theories of technological progress and the existence of biased technological progress, numerous related studies have emerged in the literature. This can be attributed to the ability of biased technological progress to explain crucial phenomena such as the labor employment structure (Song and Wang 2016), income gaps among countries (Acemoglu et al. 2015), and changes in environmental technology (Aghion et al. 2012). In addition to improvements in living standards, there is a growing concern among people regarding environmental influences on living quality. For example, better personal relationships can improve international trade (Macchiavello and Morjaria 2015), and higher fuel standards can improve the efficiency and direction of technological applications (Klier and Linn 2016). Thus, recent studies have extended the theory of biased technological progress to the environment and proposed the concept of green technology progress, that is, technological progress that can stimulate energy saving and emission reduction (Acemoglu et al. 2012). Some scholars believe that economic transition and structural adjustments in China’s new normal have become the main measures for improving economic situations. Industrial upgrading significantly depends on biased technological progress (Guvenen and Kuruscu 2006), and the development of green technologies can well improve environmental pollution and resource shortage in China. Moreover, Feichtinger et al. (2016) believe that the relationship between R&D and green technologies is represented by an inverted U-shaped curve. Thus, if China takes part in GVC, it should restructure industries and develop new growth strategies. Against the background of China’s economy embedded in the GVC, this study focuses on whether environment-biased technological progress in the manufacturing industry can be stimulated to optimize or upgrade the industrial structure.

Drawing on the approach of international trade theory toward green technology, this study explores whether the participation of the Chinese manufacturing industry in the GVC (1) stimulates the progress of green technologies in enterprises in the host countries, (2) optimizes their industrial structures, or (3) further flattens the U-shaped profit curve to acquire higher profits. We attempt to prove that following Chinese enterprises’ entry into the GVC, there are significant differences in the progress of green technologies, which gradually increase with an increase in participation. This study has the following three objectives. First, we conduct a detailed estimation of the participation degrees of enterprises in the GVC. Then, using customs data for enterprises and an industrial enterprise database, we calculate the rate of foreign value addition of exported goods. Second, we appropriately and effectively measure the progress of green technologies. With most empirical analyses adopting the index substitution method, whose conclusions tend to be unstable, it is necessary to propose a universal measure. Thus, we use big data of enterprises to ensure more stable conclusions. Third, we select appropriate enterprises in the experimental and control groups to compare changes in the progress of green technologies before and after the enterprises’ participation in the GVC to clarify its effects.

The remainder of this paper is structured as follows: “Literature review” section provides Global value chain and heterogeneous enterprises, Theory and demonstration of green technology progress, and New research and theory of big data. “Theoretical model” section presents Fundamental assumption, Influence of labor transfer on green technology gap, Influences of technology spillovers on green technology gap between enterprises, and Combined influences of two effects on green technology gap. “Model setting and index” section describes Preliminary estimation model for influences of GVC participation on green technologies and Retesting model for relationship between GVC participation and green technology progress. “Empirical analysis” section provides Preliminary regression analysis and Retesting influences of participation degree on green technology progress and “Conclusions”section provides ending and final statements of the study.

Literature review

Global value chain and heterogeneous enterprises

The development of the GVC has attracted much scholarly attention and triggered multiple theoretical explorations. These theories can be divided into two types. The first type includes theories that divide the GVC into homogeneous decision-making units and exogenously preset the property of each outsourced task. Related studies include Grossman and Rossi-Hansberg (2008); Costinot et al. (2013); Baldwin and Yan (2014), who emphasize industrial distribution and production among different countries rather than the participation degree of enterprises in the GVC. The other type treats GVC as a transnational corporation and the “trade in tasks” in the industrial chain as a form of corporate contract. Thus, a key focus of this study is the design of an optimal contract form. For example, Antràs and Chor (2013) studied how to improve the control power of contractual relationships in a value chain to obtain optimal benefits. Antràs and Helpman (2004) stated that enterprises’ participation in the GVC was determined by enterprises’ efficiency; that is, if efficiency is high, enterprises are generally inclined toward participating in the GVC, and if not, they choose not to participate. Melitz (2003); Bernard et al. (2003) presented similar opinions. However, these studies simplified their analyses by assuming that enterprises only undertook simple and easy tasks. Moreover, they did not differentiate between heterogeneous enterprises. In reality, when engaging in production and processing tasks, enterprises are in a far more complex situation than modeled in the literature. Therefore, these models cannot simulate the present conditions, and thus there remains research scope for the participation degrees of enterprises in the GVC.

Recently, Upward et al. (2013) studied the heterogeneity of enterprises: he calculated the domestic value added of Chinese industrial exports to reflect the degree of enterprises’ participation in the GVC and found a correlation among domestic value added, enterprise scale, trade model, and ownership type. This indicated that participation degree was not devoid of change but mutually interacted with multiple of the aforementioned variables. Further, Chor et al. (2014) found a strong correlation among enterprises’ positions in the GVC, capital intensity, and technology intensity. This supported the findings of Antràs and Helpman (2004), who indicated that the degree of capital and technology intensity had strong decisive functions in GVC enterprises and the higher the intensity degree, the greater the possibility of enterprises occupying higher positions in the GVC. Although these scholars conducted groundbreaking studies on enterprises’ participation in the GVC, there remain gaps in the literature. For example, Antràs and Helpman (2004); Melitz (2003) adopted a theoretical model to explain the relationship between enterprise efficiency and degree of participation in the GVC, and thus, the conclusions greatly depended on the models’ assumptions. To ensure that our findings are conclusive, we attempt to find practical evidence of heterogeneous enterprises’ participation in the GVC under the state of new normal.

Most studies on heterogeneity, particularly those on the efficiency evaluation of heterogeneous enterprises, have been conducted at a theoretical level. Theoretical modeling depends on assumptions that cannot guide practices in China. At present, the most efficient way of evaluating efficiency is the data envelopment analysis (DEA). The issue of non-homogeneity has also received increasing attention and emphases by scholars (Fizel and Nunnikhoven 1992, 1993; Sexton et al. 1994); however, it was only after 2001 that “non-homogeneity” appeared as a single keyword (Haas and Murphy 2003; Saen 2007) in mainstream journals such as the European Journal of Operational Research. Drawing on these studies, we include heterogeneous enterprises in our GVC models to more comprehensively and objectively reflect GVC practices in China.

Theory and demonstration of green technology progress

Biased technological progress can be traced back to Hicks’ theory of wages (1932). In his book, Hicks pointed out that the objective of technological innovation is to save increasingly scarce production factors. Subsequently, Kennedy and Thirlwall (1972) proposed the “innovation possibility frontier” from a technology supply viewpoint and stated that a “frontier” determines a bias in technological progress. However, due to the lack of a micro foundation, the progress of theoretical studies on biased technological progress remains limited. Recent studies on biased technological progress have adopted Solow’s model as a micro foundation and relaxed the assumption of neutral technological progress in Solow’s residual values, considering that technological progress is generally not Hicks neutral but bias. This redeveloped the theory of biased technological progress (Aghion and Howitt 1992). Acemoglu (2003) claimed that biased technological progress comprised labor- and capital-intensive technological progress. The former refers to technological progress that causes the isoquant curve to move outward in the same direction as the capital axis, indicating that the same labor can be combined with higher production capital. The latter refers to technological progress that causes the isoquant curve to move outward and along the direction of the labor axis. According to Acemoglu’s (2003) definition, biased technological progress caused by adding different rates of technological progress to both the capital and labor side in Solow’s production function would be the quotient of the capital–labor marginal income ratio and technological progress ratio. If the quotient exceeded zero, technology would be more inclined toward capital; otherwise, it would be inclined toward labor. Given the increasing public concern regarding environmental problems, recent studies on biased technological progress are accounting for environmental factors that reflect living quality. Theoretical models on green technology progress generally adopt an output or input viewpoint. For example, Mannea and Richels (2004); Popp (2004) examined climate change and the welfare cost of optimal carbon tax based on output. Acemoglu et al. (2012), on the other hand, adopted an input approach. However, to conduct a comprehensive assessment of resource saving and emission reduction, it is important to account for both output and input aspects.

Some recent scholars have attempted to quantify the progress of green technology and most of them adopted DEA, which is generally considered better than the stochastic frontier analysis (SFA) because of its non-parametric estimation feature (Kou et al. 2016). Chambers et al. (1996); Chung et al. (1997); Oh (2010); Sarkis and Cordeiro (2012); Zografidou et al. (2016) suggested ways to measure green technology progress; however, given their theoretical approach, their findings on “total factor productivity with consideration of energy input and pollution emission factors” do not reflect the true connotation of biased technological progress (Ji and Wang 2014). A study relatively close to the theoretical assumption is Lovell’s (2003), who divided Malmquist index into technological change (TECH) and efficiency change (EFFCH). The TECH index was further divided into a MATECH, OBTECH, and IBTECH indexes that respectively measure neutral technological progress, the promoting effects of varying technological progress on output, and bias in technological progress. This method is being widely used to measure the features of biased technological progress across nations (Chen and Yu 2014), industries (Managi and Karemera 2004), and micro subjects (Walden et al. 2012). However, it can only qualitatively assess the direction of biased technological progress based on the “rotation” and “radial deflection” of the production frontier. Song and Wang (2016) proposed a new DEA-based method to measure green technology progress and examined its relationship with the labor employment structure, although their method can only measure two input factors and one output and not multiple inputs and outputs. Song et al. (2016); Cao and Wang (2016) also tried to evaluate the environment-biased technological progress in different ways; however, there was no consensus in these studies either.

New research and theory of big data

Research on environment-biased technological progress in the field of environmental economies remains stagnant at the theoretical level with no empirical support given the lack of methods to effectively and continuously measure such progress, which has also led to mixed evaluation results. However, the increasing rate of pollution emission during production processes urgently demands a standardized method to measure bias in technological progress. In recent years, the fast development and wide application of big data have offered a new perspective to measuring environment-biased technological progress. The Environmental Protection Agency (EPA), together with the Energy Information Administration (EIA), sets up the Emissions and Generation Resource Integrated Database (eGRID) using big data to acquire and provide data on carbon emission from electricity generation in America.Footnote 1 The National Science Foundation (NSF) has also collected data on key technologies and processes that promote the science and engineering of big data and applied them to five important industries: service, manufacturing, architecture, agriculture, and mining (Tien 2013). Hence, many developing countries have increased their efforts on big data research (Wu et al. 2014). However, research on the use of big data remains rare, especially to measure biased technological progress. Moreover, factors such as volume, velocity, and variety increase the complexity of the analysis (Özdemir et al. 2013). However, once hidden information in big data is successfully extracted, the veracity and validation of research conclusions will be strengthened, which in turn would increase people’s enthusiasm toward big data analysis. Aronova et al. (2010), therefore, proposed the concept of big science based on big data and long-term ecologic research network to store sufficiently large quantities of data using database systems established by governments and financial groups to handle various problems that may occur during scientific research. Next, the selection of appropriate tools becomes a key element in the development of actual big data value, especially large-scale and multi-dimensional data streams in the field of environmental science that are on higher temporal and spatial levels. Although the United States Department of Agriculture (USDA) and EPA have established a data exchange and share platforms, because big data research in the field of environmental science still holds the status of the long tail of science, real-time handling of data and resource sharing still lag behind (Ellison 2010). Russom (2011) deemed that the combined application of management science, data mining, statistical inference, artificial intelligence, and natural language handling can effectively solve difficulties caused by the five V (volume, velocity, variety, veracity, and valorization) features of big data. Steed et al. (2013) designed the visual analysis system of an exploratory data analysis environment (EDEN) to solve the problem of complex mass data; however, the computed quantity by such methods was enormous and conclusions could not be acquired. Schnase et al. (2014) believed that computing stimulative to technological transfers and innovations could be applied to big data mining. Pijanowski et al. (2014) proposed that neural network and geological information system could be combined to analyze big data. Nevertheless, further verification of these methods in terms of credibility and reliability is needed.

In this study, we account for heterogeneity in the degree of participation in the GVC to examine the extent and direction of the correlation between enterprises’ participation and green technology progress in the host countries. We treat labor force as a carrier of green technology and indirectly expresses its movement through labor force flow. We adopt large-scale data as our research sample to demonstrate that the wage gap widens following enterprises’ participation in the GVC, indicating significant influences of the participation on green technology progress. The findings can serve as a practical basis for the relationship between Chinese enterprises’ engagement in global production and environmental protection.

Theoretical model

Fundamental assumption

We divide enterprises in the host country into two types: enterprises in the GVC and those that are not (non-GVC enterprises). We assume that all conditions, except the abovementioned one, apply equally across enterprises; in doing so, the deviation of results caused by other conditions can be avoided. From the differences between GVC and non-GVC enterprises, we indirectly infer the influence of GVC on green technology progress.

Assume that an enterprise becomes a link in the GVC production chain post-participation. Then, the enterprise’s import can be seen as intermediate product input and its exports are intermediate product output. After an enterprise enters the GVC, it provides higher wages than those not in the GVC to attract more talents, especially innovative talent, to satisfy the upstream and downstream requirements for technological progress. This results in a technological gap between both types of enterprises in the labor market. The extent and changes in this gap are related to the absolute wage difference between the two types of enterprises and the ratio of labor force of GVC enterprises to the total labor force. This is known as the labor force transfer effect.

GVC enterprises will affect product quality, technological level, and management system of non-GVC enterprises through imports and exports, technology transfers, and grafting. In this case, non-GVC enterprises can learn from and more conveniently imitate the green technologies of GVC enterprises, thus reducing the gap between the two enterprise types. This is also known as a technology spillover by GVC enterprises. To better describe the influences of GVC participation on enterprises’ technological progress, we establish a two-sector model based on Acemoglu’s (1998) work and make the following assumptions:

-

Assumption 1.

Assume that there are two production enterprises in the host country, a non-GVC enterprise (d) and GVC enterprise (f). Gross social output Y is composed of outputs Y d and Y f of the two enterprises and satisfies the constant elasticity of substitution (CES) production function:

where γ refers to the degree of importance of product Y f produced by the GVC enterprise to the gross social output Y.

-

Assumption 2.

Production of both Y d and Y f satisfies the Cobb–Douglas production function:

where A is the level of green technology, K is capital, L is labor force, and E is energy. Assume that green technology progress always has a functional relationship with labor and energy, but energy is an exogenous variable. In the short term, labor force can flow freely between enterprises and gross labor force is \( \overline{L} \). Since the proportion of labor force in the GVC enterprise is η, that of labor force in non-GVC ones will be 1 − η.

-

Assumption 3.

Average social wage is (1 − η)w d + ηw f , in which w d is the average wage in a non-GVC enterprise and w f is the average wage in a GVC enterprise. The wage levels of the two enterprises are increasing functions of technological progress. As the technological level in a GVC enterprise is higher than that in a non-GVC one, the technological gap between the two enterprises will be a = a f /a d > 1.

-

Assumption 4.

Internal income distribution in each enterprise is equalized, that is, there is no technological gap within each enterprise.

Influence of labor transfer on green technology gap

To avoid the influence of a technology spillover on labor transfer, we make the following assumption:

-

Assumption 5.

There is no technology spillover between the two enterprises; therefore, the gap in green technology level between the enterprises is constant.

A reason underlying labor force flow is wage gaps. A Theil index is generally used to measure such a gap:

where I i is the sum of wages of individuals in group i, I is total wage, and N i is the number of individuals in group i and the overall number of people. Assume a functional relationship between wage and green technology. In this case, we extend the Theil index to the Theil green technology index (TTI) to measure the green technology gap. For simplicity, we set the average social green technology level to \( \overline{A}=\left(1-\eta \right){a}_d+\eta {a}_f \), where a d = f(A d ) and a f = f(A f ). Then, according to above assumption, the formula can be expressed as

This gives us

Because the level of green technology is higher in GVC than in non-GVC enterprises, the wage level in the former will be higher than that in the latter. This wage gap can cause the transfer of labor force from a non-GVC enterprise to a GVC enterprise. To observe the influence of the labor transfer effect on the green technology gap, we solve formula (2) for the first-order derivative of η and set it to zero. Then, we can obtain

This yields an optimal solution for the labor transfer effect:

where 0 < η < η* and ∂TTI/∂η > 0. This indicates that in the initial stage of GVC participation, with the transfer of labor force, the technological gap between the enterprises continuously widens. When labor transfer exceeds η*, η * < η < 1, and ∂TTI/∂η < 0. This means that with the transfer of labor force, the technological gap between the enterprises begins to decrease. In sum, under the condition that the green technology level in a GVC enterprise is higher than that in a non-GVC one, the labor transfer effect from the enterprise’s participation in the GVC will widen the green technology gap at first but reduce it in an inverted U shape.

To better measure the features of change to TTI, we seek the second derivative of η and set it to zero. Then, we obtain

From the above analysis, we see that the labor transfer effect influences a green technology gap between enterprises in three phases. Assume that the green technology gap is formed in three phases. The influence of a labor transfer on green technology is illustrated in Fig. 1. In phase A, labor force transfers from a non-GVC to GVC enterprise, causing the gap to increase albeit gradually. In phase B, the labor transfer reduces the green technology gap with a gradual rate of reduction, and in phase C, the speed of shrinkage caused by a labor transfer gradually decreases.

Influences of technology spillovers on green technology gap between enterprises

In this section, we include a technology spillover effect to examine the influences of foreign direct investment (FDI) on a technology gap between enterprises. Before doing so, we make the following assumption:

-

Assumption 6.

A GVC enterprise affects the innovation efficiency of green technology in a non-GVC enterprise through a technological spillover, that is,

where ξ is the coefficient of a spillover from a GVC enterprise to the innovation efficiency of green technology in a non-GVC enterprise, δ is the extent of influence a technology spillover from a GVC enterprise has on a non-GVC one, that is, the coefficient of a technology spillover effect, and ∂K/∂δ > 0 and ∂η/∂δ > 0.

According to assumption 1, on the premise of benefit maximization, the relative demand of a non-GVC and GVC enterprise is

Then, a green technology spillover from a GVC enterprise to non-GVC ones will be

To observe a change in the green technology gap caused by that in δ, we insert formula (7) in formula (2) and perform a derivation of δ. For simplicity, we set

Then, we obtain

As ∂T/∂δ < 0, an increase in a technology spillover from a GVC to a non-GVC enterprise will reduce the green technology gap between enterprises, which is consistent with reality. Similarly, to better observe the influence on a technology gap, we conduct a two-stage derivation of TTI and set it to zero. Then, we obtain

Therefore,

In the formula, A 0 is a function of η. When δ < δ*, ∂2 TTI/∂δ 2 > 0 and when δ > δ*, ∂2 TTI/∂δ 2 < 0. Thus, a technology gap between the enterprises is a decreasing function of the technology spillover effect coefficient δ, which means a technology spillover from a GVC to a non-GVC enterprise can shrink the technology gap. Assume that the technology gap between the GVC and non-GVC enterprises is formed in three phases, and the ratio of the quantity of GVC enterprises to that of non-GVC enterprises is 5:1. The influences of a technology spillover on green technology progress are drawn in Fig. 2. When δ < δ*, the shrinkage of a technology gap accelerates, and when δ > δ*, the shrinkage of a technology gap slows down gradually.

Combined influences of two effects on green technology gap

Given the existence of both labor transfer and technology spillover, we deem that a change in the technology gap between enterprises after GVC participation is a result of a synergy between the two effects. If there is no system barrier in the host country, wages and social benefits in GVC enterprises will improve since local high-quality labor force will transfer from non-GVC to GVC enterprises. Thus, the labor transfer effect will be the first to play its role. After a production period, the technology and management levels in non-GVC enterprises will improve by studying and imitating advanced technologies and mature management experiences in GVC enterprises. Only at this time does the function of a technology spillover effect appear. This shows that a technology spillover effect generally lags behind a labor transfer effect and the lag degree is decided by technical barriers, patent systems, and the enterprises’ ability to absorb.

We discuss the lag in the technology spillover effect under two conditions. First, the technology spillover effect occurs before the labor transfer effect and reaches a turning point. This indicates that a technology spillover effect appears when a technology gap caused by a labor transfer effect continues to increase, which will result in two conditions: the speed of the increase in the green technology gap begins to decline and the highest value for a green technology gap caused by a labor transfer effect lowers and appears in advance. In general, the inverted U-shaped curve of a green technology gap will be much lower and the turning point of the curve will move toward the left. Second, a technology spillover effect appears after the turning point of the curve. In this case, the position of the turning point will not be affected, and the shrinkage of the technology gap will be accelerated.

Model setting and index

Since we attempt to compare influences of participation and non-participation in the GVC on enterprises’ green technology progress, it is important to examine the progress of similar enterprises prior to their participation in the GVC. Thus, we use the data from China’s industrial enterprise database and customs import and export trade database and combine them using Upward et al. (2013) method. First, we match the names of enterprises with particular years. Because some enterprises may have changed their names, years and name variables are used at the same time to avoid repeated or omitted calculations. Second, for enterprises that have not been identified, zip codes of their locations and the final five telephone numbers are included as variables. We assume that enterprises with the same zip code use the same telephone number. We selected the final five telephone numbers because some cities may add new digits to the original telephone numbers, and the added digits are generally at the first or second position.

We first must prove whether participation in the GVC will generate notable differences in enterprises’ green technology. However, a simple comparison of technological changes before and after participation in the GVC will not reflect actual conditions. This is because first, the technological levels across years may have systematic differences that cannot be completely attributed to the participation in the GVC, and second, green technology progress may be affected by the enterprises themselves or technology spillover effects from other enterprises. Given these considerations, we use difference-in-difference (DID) models to identify the influences of GVC participation. Enterprises in the western areas significantly differ from those in the eastern areas, which makes a comparison difficult. Thus, we use data for 35,248 enterprises in six provinces in central China (Henan, Hubei, Shanxi, Hunan, Anhui, and Jiangxi). To build an experimental environment favorable to the DID model, we select non-GVC enterprises in Henan, Hubei, and Shanxi provinces as the control group and GVC enterprises in Hunan, Anhui, and Jiangxi provinces as the experimental group. As the economic and policy conditions in these six provinces are similar, other variables are controlled for, except whether an enterprise participates in the GVC. Moreover, provincial borders serve as natural barriers in restricting the influences of a technological spillover on enterprises.

Preliminary estimation model for influences of GVC participation on green technologies

In this research, we develop a DID model by deducting changes in the green technology progress of enterprises in the control group from those of enterprises in the experimental group before and after participating in the GVC. First, we consider a simple measurement model:

where GTP is green technology progress and T is a dummy variable for time. If enterprises are in the GVC, the value of T will be one and zero otherwise. A is a state dummy variable, whose value for the control group is zero and that for the experimental group is one. Z is a control variable, including enterprise scale, enterprise age, comparative advantages of enterprises’ industry, and R&D ability. i refers to enterprise and j to period.

Green technology progress (GTP)

We use the DEA method to measure green technology progress. Since green technology progress comprises energy-saving and emission-reducing products, the literature still lacks a mature and comprehensive measurement method. According to Acemoglu et al. (2012) definition, the production frontier contains deflections owing to the influences of biased technological progress. Accordingly, we use the slacked-based measurement method to simulate the deflection progress of the production frontier. Assume production input X and energy input E in base period S and end period T. Then, the position of the production envelopment surface moves in the direction of X, and that of the euclidean center A also changes on the envelopment surface. During measurement, we must consider the deflection of decision-making unit A’s position on the production envelopment surface.

Under the same undesirable output, if both input and output in period T increase compared with those in period S, or under the same input, if output increased while undesirable output decreased and in the meantime, the production envelopment surface moved toward X, and this condition is termed emission-reducing technological progress. In this case, we calculate production technology efficiencies in periods S and T by keeping constant the original production technology, that is, the production frontier S. Thus, we get \( {\rho}_x^s\left({x}_s,{y}_s\right) \) and \( {\rho}_x^s\left({x}_T,{y}_T\right) \). By keeping the production frontier T unchanged and calculating the production technology efficiencies of A in periods S and T, we get \( {\rho}_x^T\left({x}_s,{y}_s\right) \) and \( {\rho}_x^T\left({x}_T,{y}_T\right) \). Considering that the changes in the production frontier are mainly caused by those in technology and production efficiencies, if the factors of production efficiency change can be eliminated, then we can derive the change in only production technology efficiency.

Thus, the rate of change in production technology efficiency is

Similarly, the rate of change in emission-reducing technology efficiency is

Thus, we can set up the Malmquist index of emission-reducing technological progress (ErBP) as

If ErBP > 1, emission-reducing technology progress is likely to exist, that is, the larger the value of ErBP, the more significant the emission-reducing technological progress. Similarly, the Malmquist index of energy-saving technology progress (EsBP) is

If EsBP > 1, energy-saving technological progress is likely to occur, that is, the larger the value of EsBP, the more significant the energy-saving technology progress. As improvements in environmental quality simultaneously require energy saving and emission reduction, we define a comprehensive green technology progress index as

In addition to the proportion of foreign value added, we need to control for other indexes that may influence green technology progress.

Enterprise scale

According to Schumpeter, large-scale enterprises with a low competition degree have higher innovation potential because they have large quantities of internal resources, such as capital, technology, and talents. Internal funds in large-scale enterprises can better support multiple R&D activities, control new product prices, and undertake R&D risks. In addition, large-scale enterprises face less market uncertainty and can raise funds more easily. Hence, we select large-, medium-, and small-scale enterprises as our explanatory variables that are included as dummy variables.

Enterprise age

It is commonly considered that the longer the operation of an enterprise, the more capable it is in dominating a market trend and the higher its R&D motives. We use the differences between the current year and enterprises’ registration year as the age variable, whose coefficient is preliminarily judged as positive.

Comparative advantage of enterprises (RCA)

We reference the Balassa index, used to measure price ratio advantages, to construct a measurement index for RCA as follows:

where X ijt is the amount of exports of enterprise j, in industry i, in year t, and \( {X}_{it}^w \) is the gross global export in industry i, in year t. If RCA < 1, the amount of enterprise j’s export in year t is smaller than the average amount for industry i in that year. In this case, the enterprise has a comparative advantage. As for the enterprises in this study, since they have similar economic and policy conditions, having comparative advantages in the whole industry means more advanced technology and greater productivity than other enterprises. Thus, we preliminarily judge the regression coefficient of this variable as positive.

Research and development capability (RD)

Since R&D activities are conducted to add value to an enterprise, an increase in R&D investments does not necessarily mean the strengthening of R&D capability. From the calculated rate of foreign value added in the above context, we see that the participation degrees of enterprises producing polluting and technology-intensive products in the GVC are higher. Hence, R&D in an enterprise has two directions: green technology that stimulates energy saving and emission reduction (RD1), and production technology that simulates improvements in technology intensity (RD2). In addition, the demand for technological progress tends to differ by industry. For example, the papermaking and communication industries have higher demands for progress in its green technology than production technology. Therefore, we use the ratio of the production value of new products to total corporate profit to replace RD2; the higher the ratio, the stronger the R&D of the enterprise’s production. Production efficiency that accounts for environmental factors is used to replace RD1; the higher the production efficiency, the stronger the R&D for green technology. Using Tone’s (2001) method to improve the model, we derive a computational formula for green technology R&D as follows:

\( {\displaystyle \sum_{j=1}^n{\lambda}_jpf{t}_j}-{s}_r^{+}=pf{t}_0, \),

where ρ is green technology R&D; E, np, and pft are energy consumption, production value of a new product, and total corporate profit, respectively; \( {s}_i^{-},\kern0.5em {s}_r^{-},\kern0.5em {s}_r^{+} \) are slack variables and λ is a parameter.

Retesting model for relationship between GVC participation and green technology progress

In this section, we continue to test the influences of GVC participation on green technology progress. Given the discussion thus far, we build the following measurement model:

where FVAR is the proportion of the foreign value added of an enterprise’s exports, which expresses the participation degree in the GVC, and Z is a control variable. To eliminate the interference of industrial characteristics, regional development disparity, and economic fluctuations in the regression results, we add fixed effects of industry ϕ i , province ϕ p , and time ϕ t to the model.

We adopt Upward et al.’s (2013) method to calculate the proportion of the foreign value added of an enterprise’s exports. The method assumes that enterprises are complete links in the GVC, and all processing trade imports of the enterprises are intermediate inputs to process trade exports and intermediate inputs of general trade imports are used for domestic sales and general trade exports. Hence, the proportion of foreign value added of an enterprise’s export is

where M and X are the enterprise’s imports and exports, D is domestic sales, superscript P is processing trade, and O is general trade. The data are obtained from the customs statistics and census database of industrial enterprises. As for the condition that foreign value added exceeds total export during computation, we set the foreign value added such that it equals total exports.

Using this method, we derive the FVAR index after computation to replace the participation degree index. As shown in Fig. 3, the proportions of foreign value added in the papermaking and paper product, waste resources, and materials recycling, and chemical fiber manufacturing industries are high. In addition, the proportions of foreign value added in communication equipment manufacturing and computer and other electronic equipment manufacturing, which account for 42 % of China’s total export volume, are also relatively high. This indicates that intermediate products are polluting, and capital intensive can acquire higher earnings in industries with export advantages in China, and these industries have significant degrees of participation in the GVC.

Empirical results

Preliminary regression analysis

To verify whether the participation of an enterprise in the GVC affects its green technology progress, we conduct a regression analysis on model (10), the results of which are shown in Table 1. In the table, columns (1)–(3), respectively, are the regression results for the large-, medium-, and small-scale enterprises’ green technology progress when controlling for production technology input. Columns (4)–(6), respectively, show the regression results for large-, medium-, and small-scale enterprises’ green technology progress when controlling for green technology input. The results indicate that green technology progress will be stimulated irrespective of the direction of R&D input (production or green technology). However, the fixed effects of these enterprises on green technology progress significantly vary. That is, the larger the enterprise scale, the greater the emphasis on green technology progress. This is in line with Chiara and Ivete (2011) findings on the relationship between enterprise scale and R&D input. In this study, we focus on the regression coefficients of time dummy variable, state dummy variable, and cross terms. From Table 1, we know that the time dummy variables are notably positive when other variables are under control, which indicates that green technology progress has a self-improvement trend and the smaller the enterprise scale the more significant the trend. The regression coefficients of the state dummy variables are non-significant, indicating no significant difference between the control and experimental groups. Only when there is no difference between the two groups will the post-participation changes be our desired results. We also find that the regression coefficients of the cross terms are notably positive, indicating that the enterprises’ participation in the GVC does have stimulative effects on green technology progress and such effects are expressed more obviously in large-scale enterprises. This may be because large-scale enterprises are able to better absorb technology spillovers from developed countries and undertake R&D costs. Enterprise age is notably negative, which is contradictory to our previous judgment. The larger the enterprise scale, the more obvious the negative relationship between age and green technology progress. This can be attributed to enterprises’ sluggishness in R&D and management and the larger the enterprise scale, the higher its sluggishness given the lack of competitive pressure.

Retesting influences of participation degree on green technology progress

The preliminary regression analysis already proved that enterprises’ participation in the GVC influences their green technology progress. In this retest, we attempt to demonstrate the relationship between the participation degree and green technology progress. In this section, we treat FVAR, an index for enterprises’ participation degree in the GVC, as the kernel variable. Table 2 shows the estimation results obtained using formula (18). Columns (1)–(3), respectively, show the influences of state-owned, foreign, and Hong Kong, Macau, and Taiwan enterprises on green technology progress in the case of large-scale enterprises. We find that the correlation between the participation of large-scale state-owned enterprises in the GVC and green technology progress is not significant, while that of foreign enterprises and Hong Kong, Macau, and Taiwan enterprises are notable. From the regression coefficients for ownership type, all the three enterprises focus on improving green technology, but the stimulative effects on state-owned enterprises are not as significant as in the case of the other two types. From the two findings above, we know that although state-owned enterprises try to improve green technology, they may still miss the opportunity for self-improvement because of their slow response to technological factors. Columns (4)–(6) present the influences of the three types on green technology progress in the case of medium-scale enterprises. Similarly, the FVAR index is non-significant during the regression progress of state-owned enterprises, but the participation degrees of foreign enterprises and Hong Kong, Macau, and Taiwan enterprises stimulate improvements in green technology. In fact, their degree of stimulation is higher than that of large-scale enterprises in green technology progress, indicating that enterprise scale and ownership structure are important factors in determining green technology progress. Similar to the preliminary test results, the enterprises’ comparative advantages are all positive, and foreign enterprises are more capable of improving green technology regardless of scale. As for enterprise scale, we find that large-scale enterprises pay more attention to improvements in green technology than medium-scale ones.

Conclusions

The formation of a new international labor division and trade system under the GVC has provided a new perspective for empirical analyses on new trade theories. However, whether GVC participation can help enterprises improve their green technology progress under the condition of global labor division remains an open question. Drawing on Upward et al. (2013), we derive the foreign value-added index and treat it as a kernel variable to measure the degree of enterprises’ participation in the GVC. Then, by analyzing the differences in enterprise ownership, enterprise scale, and R&D inputs, we observed the effects of various enterprises’ participation in the GVC on green technology. Our conclusions are as follows:

-

a)

An enterprise’s participation in the GVC is beneficial to improvements in green technologies. Although China has the highest volume of import and export trade in the world, Chinese enterprises remain at the lower end of the GVC, dependent on others for core technologies, and lack competitiveness. Even though some enterprises can absorb advanced foreign technologies, expected R&D objectives are yet to be satisfied owing to the limitations of an enterprise’s scale. In addition, although enterprises being able to improve their green technologies without GVC participation, the scope for such improvement is far less than that brought about by technology spillovers and labor transfer effects through enterprises’ participation in the GVC. Therefore, improvements in production efficiency and core competitiveness through the transformation of the growth model and adjustments to the trade structure are prerequisites to enterprise value maximization and green technology progress.

-

b)

The higher the participation degree in the GVC, the stronger will be the effects on green technology improvement. Foreign and HMT enterprises can absorb advanced technologies more quickly than state-owned ones. At present, the Chinese economy is facing structural adjustments and shifts in growth speed. Factor conditions that support industrial development are changing and instability is increasing. These conditions render market sensitivity and control ability as crucial factors. Therefore, it is important to propel reforms for state-owned enterprises and seek effective ways to realize green technology progress in enterprises based on their participation degree in the GVC.

-

c)

Larger enterprise scale and improved production efficiency are beneficial to green technology progress. However, from the empirical analysis, the older the enterprise, the more sluggish it becomes. A fundamental solution in this case is establishing reasonable development from a long-term perspective. Therefore, given the slowing down of China’s economic growth, it is important to increase R&D input to improve the quality and technological content of exported products and establish national brands abroad to obtain R&D input and sales profits that can improve international competitiveness. Such competitiveness can, in turn, positively affect green technology progress, implying a virtuous circle for enterprises.

In comparison to developed countries, China lags behind in technological development. However, it can still exploit the late-mover advantage to realize rapid development through learning and imitation during GVC participation. Undoubtedly, pure dependence on technological introductions has significant negative effects. It is important that enterprises implement self-innovation. At present, with China increasingly integrating in globalized systems, trade influences should be given sufficient emphasis. Import from advanced countries should be encouraged to simulate clean production and green technology innovations. In addition, advanced environmental protection concepts and technologies in developed countries can be imitated and further developed, fully exploiting the technology spillover effects of trade.

Notes

These include emission quantities and rates of oxynitride, sulfur dioxide, carbon dioxide, methane, and nitrous oxide. Please see http://www.epa.gov/cleanenergy/energy-resources/egrid/index.html; accessed on March 5, 2014.

References

Acemoglu D (1998) Why do new technologies complement skills? Directed technical change and wage inequality. Q J Econ 113:1055–1089

Acemoglu D (2002) Directed technical change. Review of Economic Studies 69:781–781

Acemoglu D (2003) Labor and capital-augmenting technical change. J Eur Econ Assoc 1:1–37

Acemoglu D (2007) Equilibrium bias of technology. Econometrica 75:1371–1410

Acemoglu D, Aghion P, Bursztyn L, Hemous D (2012) The environment and directed technical change. Am Econ Rev 102:131–166

Acemoglu D, Gancia G, Zilibotti F (2015) Offshoring and directed technical change. American Economic Journal–Macroeconomics 7:84–122

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60:323–351

Aghion P, Dechezleprêtre A, Hemous D, Martin R, Van Reenen J (2012) Carbon taxes, path dependency and directed technical change: evidence from the auto industry. NBER Working Paper 18596

Antràs P, Chor D (2013) Organizing the global value chain. Econometrica 81:2127–2204

Antràs P, Helpman E (2004) Global sourcing. J Polit Econ 112:552–580

Aronova E, Baker KS, Oreskes N (2010) Big science and big data in biology: from the international geophysical year through the international biological program to the long term ecological research (LTER) network, 1957–present. Hist Stud Nat Sci 40:183–224

Baldwin J, Yan B (2014) Global value chains and the productivity of Canadian manufacturing firms. Mimeo, Statistics Canada, Analytical Studies Branch

Bernard AB, Eaton J, Jensen JB, Kortum S (2003) Plants and productivity in international trade. Am Econ Rev 93:1268–1290

Cao BR, Wang SH (2016) Opening up, international trade, and green technology progress in China. J Clean Prod. doi:10.1016/j.jclepro. 2016.08.145

Chambers RG, Färe R, Grosskopf S (1996) Productivity growth in APEC countries. Pac Econ Rev 1:181–190

Chen P, Yu M (2014) Total factor productivity growth and directions of technical change bias: evidence from 99 OECD and non-OECD countries. Ann Oper Res 214:143–165

Chiara P, Ivete SGF (2011) Competition and innovation in Luxembourg. Journal of Industry Competition and Trade 12:93–117

Chor D, Manova K, Yu Z, (2014) The global production line position of Chinese firms. Mimeo, Standard University

Chung YH, Färe R, Grosskopf S (1997) Productivity and undesirable outputs: a directional distance function approach. Journal of Environment Management 51:229–240

Costinot A, Vogel J, Wang S (2013) An elementary theory of global supply chains. Rev Econ Stud 80:109–144

do Paço AMF, Raposo MLB, Leal Filho W (2009) Identifying the green consumer: a segmentation study. J Target Meas Anal Mark 17:17–25

Ellison AM (2010) Repeatability and transparency in ecological research. Ecology 91:2536–2539

Escaith H, Inomata S (2011) Trade patterns and global value chains in East Asia: from trade in goods to trade in tasks. IDE JETRO and World Trade Organization, Geneva

Feichtinger G, Lambertini L, Leitmann G, Wrzaczek S (2016) R&D for green technologies in a dynamic oligopoly: Schumpeter, arrow and inverted-U’s. Eur J Oper Res 249:1131–1138

Fizel JL, Nunnikhoven TS (1992) Technical efficiency of for-profit and non-profit nursing homes. Manag Decis Econ 13:429–439

Fizel JL, Nunnikhoven TS (1993) The efficiency of nursing home chains. Appl Econ 25:49–55

Glucker AN, Driessen PP, Kolhoff A, Runhaar HA (2013) Public participation in environmental impact assessment: why, who and how? Environ Impact Assess Rev 43:104–111

Grossman GM, Rossi-Hansberg E (2008) Trading tasks: a simple theory of offshoring. Am Econ Rev 98:1978–1997

Guvenen F, Kuruscu B (2006) Ben-Porath meets skill-biased technical change: a theoretical analysis of rising inequality. Discussion Paper No. 144

Haas DA, Murphy FH (2003) Compensating for non-homogeneity in decision-making units in data envelopment analysis. Eur J Oper Res 144:530–544

Humphrey J, Schmitz H (2000) Governance and upgrading: linking industrial cluster and global value chain research. IDS Working Paper, No. 120, Institute of Development Studies, University of Sussex, Brighton

Ji YB, Wang YP (2014) Some comments on Antonelli and Quatraro’s paper of measuring effect of biased technology on TFP. J Technol Transf 39:276–280

Kennedy C, Thirlwall AP (1972) Surveys in applied economics: technical progress. Econ J 82:11–72

Klier T, Linn J (2016) The effect of vehicle fuel economy standards on technology adoption. J Public Econ 133:41–63

Kou MT, Chen HH, Wang SY, Shao YM (2016) Measuring efficiencies of multi-period and multi-division systems associated with DEA: an application to OECD countries’ national innovation systems. Expert Syst Appl 46:494–510

Lovell K (2003) The decomposition of Malmquist productivity indexes. J Prod Anal 20:437–458

Macchiavello R, Morjaria A (2015) The value of relationships: evidence from a supply shock to Kenyan rose exports. Am Econ Rev 105:2911–2945

Managi S, Karemera D (2004) Input and output biased technological change in US agriculture. Applied Economic Letter 11:283–286

Mannea A, Richels R (2004) The impact of learning-by-doing on the timing and costs of CO2 abatement. Energy Econ 26:603–619

Melitz MJ (2003) The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71:1695–1725

Oh D-H (2010) A global Malmquist of efficiency in data envelopment analysis. European Journal of Operation Research 130:498–509

Özdemir V, Badr KF, Dove ES, Endrenyi L, Geraci CJ, Hotez PJ, Milius D, Neves-Pereira M, Pang T, Rotimi CN, Sabra R, Sarkissian CN, Srivastava S, Tims H, Zgheib NK, Kickbusch I (2013) Crowd-funded micro-grants for genomics and “big data”: an actionable idea connecting small (artisan) science, infrastructure science, and citizen philanthropy. Omics: A Journal of Integrative Biology 17:161–172

Pijanowski BC, Tayyebi A, Doucette J, Pekin BK, Braun D, Plourde J (2014) A big data urban growth simulation at a national scale: configuring the GIS and neural network based land transformation model to run in a high performance computing (HPC) environment. Environ Model Softw 51:250–268

Popp D (2004) ENTICE: endogenous technological change in the DICE model of global warming. J Environ Econ Manag 48:742–768

Russom P (2011) Big data analytics. TDWI Best Practices Report, Fourth Quarter

Saen RF (2007) A new mathematical approach for suppliers selection: accounting for non-homogeneous is important. Appl Math Comput 185:84–95

Sarkis J, Cordeiro JJ (2012) Ecological modernization in the electrical utility industry: an application of a bads-goods DEA model of ecological and technical efficiency. Eur J Oper Res 219:386–395

Schnase JL, Duffy DQ, Tamkin GS, Nadeau D, Thompson JH, Grieg CM, McInerney MA, Webster WP (2014) MERRA analytic services: meeting the big data challenges of climate science through cloud-enabled climate analytics-as-a-service. Comput Environ Urban Syst. doi:10.1016/j.compenvurbsys Accessed 2013.12.003.

Sexton TR, Sleeper S, Taggart RE (1994) Improving pupil transportation in North Carolina. Interfaces 24:87–103

Song ML, Wang SH (2016) Can employment structure promotes environment-biased technical progress? Technological Forecasting & Social Change. doi:10.1016/j.techfore. Accessed 2016.02.16

Song ML, Wang SH, Wu KY (2016) Environment-biased technological progress and industrial land use efficiency in China’s new normal. Annuals of Operations Research. doi:10.1007/s10479-016-2307-0

Steed CA, Ricciuto DM, Shipman G, Smith B, Thornton PE, Wang D, Shi X, Williams DN (2013) Big data visual analytics for exploratory earth system simulation analysis. Comput Geosci 61:71–82

Tien JM (2013) Big data: unleashing information. J Syst Sci Syst Eng 22:127–151

Tone K (2001) A slacks-based measure of efficiency in data envelopment analysis. Eur J Oper Res 130:498–509

Upward R, Wang Z, Zheng J (2013) Weighing China’s export basket: the domestic content and technology intensity of Chinese exports. J Comp Econ 41:527–543

Walden JB, Kirkley JE, Fare R (2012) Productivity change under and individual transferable quota management system. Am J Agric Econ 94:913–928

Wu X, Zhu X, Wu GQ, Ding W (2014) Data mining with big data. Knowledge and data engineering. IEEE Trans Knowl Data Eng 26:97–107

Zografidou E, Prtridis K, Arabatzis G, Dey PK (2016) Optimal design of the renewable energy map of Greece using weighted goal-programming and data envelopment analysis. Comput Oper Res 66:313–326

Acknowledgments

This work was supported by the National Natural Science Foundation of China under [Grant No. 71601170], the Projects in Philosophy and Social Science Research of the Ministry of Education of China [Grant No. 16YJC630123], the China Postdoctoral Science Foundation [Grant No. 2015 M570613], the Special Project of Postdoctoral Innovation Projects of Shandong [Grant No. 201503013], and the Natural Science Foundation of Shandong, China [Grant No. ZR2015PG003].

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Philippe Garrigues

Rights and permissions

About this article

Cite this article

Song, M., Wang, S. Participation in global value chain and green technology progress: evidence from big data of Chinese enterprises. Environ Sci Pollut Res 24, 1648–1661 (2017). https://doi.org/10.1007/s11356-016-7925-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-016-7925-1