Abstract

We examine the role of extreme positive returns in the cross-section of stock returns in seven countries. While Bali et al. (J Financ Econ 99:427–446, 2011) find a significantly negative relation between the maximum daily returns over the past month (MAX) and the expected returns in the following month, we find that this relation disappears and even often reverses. The positive relation is found in Canada, the UK and the US, while the pattern in China is more in line with the previous findings, and for Germany, France and Japan the effect is not statistically significant. Further evidence using the US data suggests that the positive effect of MAX is largely a proxy for the idiosyncratic volatility. Moreover, we find that the MAX effect is mainly concentrated on periods before 1990’s given the same dataset as Bali et al. (2011). Collectively, our results indicate that the MAX effect is not stable over time. We conjecture the changing proportion of MAX-seeking investors is a crucial determinant of the MAX-return relation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

THOSE who occasionally bet on horse races like the Kentucky Derby or the Grand National have a tendency to favor 100-1 outsiders. Their motivation may be the desire for a big win to justify the act of gambling at all.Footnote 1

The above quote describes a phenomena so called “favorite-longshot bias”, which is a widely documented empirical fact. For example, favorite-longshot bias literature is surveyed in Hausch et al. (1994), where they find that the favorite-longshot bias exists in other gambling markets such as sports betting. Analogically, what is true for horse betting seems to be true for stock investments, too: many people prefer invest in lottery-like stocks (Harvey and Siddique 2000; Ang et al. 2006, 2009; Barberis and Huang 2008). In betting markets, the expected return on longshot bets tends to be systematically lower than on favorite bets.This is not compatible with the assumption of rational, risk averse investors and moreover it raises the question: If so many investors like to hold many of these stocks in their portfolios, would this eventually affect the equilibrium asset prices on average? Such anomalies have been found in the literature, e.g. regarding volatility and skewness.

In a study Bali et al. (2011) find a new anomaly, which they call MAX: extremely positive daily returns predict subsequent stock returns. More precisely, they find empirical evidence for a statistically and economically significant negative relation between the maximum daily return over the previous month (MAX) and the cross-section of expected stock returns in the following month. These results are robust to controls for well-know factors. More interestingly, including extreme positive returns reverses the puzzling relation between idiosyncratic volatility and future returns as recently found by Ang et al. (2006, 2009). The motivation is that investors frequently hold underdiversified portfolios and more often have a preference for lottery-like assets that usually have a small probability of large payoffs, e.g. low-priced stocks with high idiosyncratic volatility.Footnote 2 The result is interpreted as consistent with cumulative prospect theory (Tversky and Kahneman 1992; Barberis and Huang 2008) as well as the optimal beliefs framework of Brunnermeier et al. (2007).

Centered on this topic, which is also referred as the MAX effect, a number of studies following Bali et al. (2011) not only have been conducted broadly in settings both inside and outside the US, but also beginning to connect MAX with other factors influencing the significance of the MAX effect. For instance, Annaert et al. (2013) verify the US results that stocks with extreme positive returns have systematically lower future average returns in the European stock market. Walkshäusl (2014) also provides evidence in Europe and moreover, finds that the negative MAX-return relation is stronger among firms with high cash flow volatility and weaker among firms with high profitability. Cheon and Lee (2018) find evidence that the MAX effect and the degree of pricing of preference for lottery-type stocks varies across countries with the level of aggregate uncertainty avoidance measured by the Uncertainty Avoidance Index (UAI). Zhong and Gray (2016) confirm the presence of a strong MAX-effect with Australian equities and show that the MAX effect is strongly dependent on investor sentiment and is mainly due to the poor performance of high MAX stocks rather than high returns of low MAX stocks. Nartea et al. (2017) provide evidence in the Chinese stock market. Moreover, the results of the above mentioned studies are robust after controlling for a variety of these and other firm-level variables and anomalies. Particularly it is shown that controlling for MAX reduces the significance of the negative relation between idiosyncratic volatility and future returns as reported in Ang et al. (2006, 2009)

In this paper, we follow Bali et al. (2011) to reexamine and clarify the existence and significance of the relation between extremely positive returns and expected returns. We expand the scope with data on stock markets from Thomson DataStream across different seven countries (Germany, the U.K., China, Canada, France, Japan and the U.S.) concentrating on a more recent period from January 1990 to December 2009. Given a relatively larger sample in the U.S. market and its conflicting result with Bali et al. (2011), we also look at idiosyncratic volatility of stocks, a property that cannot be easily disentangled from features of lottery-like stocks. To further explore the robustness for the recent period findings in the U.S. stock market, additionally, we continue to investigate the issue using a sample of NYSE, AMEX and NASDAQ stocks from the CRSP. However, instead of using the full sample period from July 1962 to December 2017,Footnote 3 we divide it into two subperiods, namely, from July 1962 to December 1989 and from January 1990 to December 2017. We choose 1990 as splitting point, since the data points in both split samples are then of similar size and due to comparability with the Datastream data mentioned above. All variables are defined the same as in Bali et al. (2011).

Overall, we find that the influence of the MAX factor in stock pricing is not the same across countries. First of all, we fail to find any statistically significant relation between extremely positive returns and the subsequent average returns in the French, Japanese and German stock markets. While the Chinese stock market shows a similar pattern to that observed by Bali et al. (2011), in which high exposure to stocks with extremely positive returns tends to produce low expected returns, our results in Canada, the U.K. and the U.S. indicate a statistically positive cross-sectional relation between extreme positive returns and average returns, as contrary to the results of Bali et al. (2011). In fact, the positive MAX-return relation in the U.S. market disappears once we control for idiosyncratic volatility. The bivariate sorts and cross-sectional regressions reveal a robustly significant positive relation between idiosyncratic volatility and expected stock returns. Based on the dataset from the CRSP, we find that the result is similar to the finding of Bali et al. (2011) for the period from July 1963 to December 1989, however, there is no evidence of a significantly negative relation between the maximum daily return of the previous month and the cross-section of expected returns for the period from January 1990 to December 2017. In other words, the MAX effect is mainly concentrated on periods before 1990’s, but disappears in recent decades.

Given the results on the selected countries in recent time periods, our results suggest that the negative relation between the maximum daily return over the previous month and expected stock returns reported by Bali et al. (2011) is not as consistent as previous studies seemed to suggest, but that it might instead change over time or due to other factors. Therefore, it is conceivable that macroeconomic conditions or changes in the structure of ownership of the investor population might have played a critical role in determining the average returns affected by the performance of lottery-type stocks. Investors who tend to significantly overestimate the probability of a big reward of the lottery-like stocks are attracted towards those stocks. Thus, ultimately, the aggregate investors’ preferences for those stocks with high MAX properties could influence the cross-sectional expected stock returns. Inspired by this interpretation, we conjecture that the quantity or proportion of MAX-seeking investors, as typically represented by retail investors, in the overall market may relate to the effect that extremely positive stock returns have on expected returns. More explicitly, the MAX effect should be more pronounced in a market where market participants with strong preferences for lottery-like assets dominate, and the magnitude of this effect could change from time to time with respect to the constitution of investors’ structure. In particular, this might explain why the MAX effect seemed to have disappeared in the US in recent times.

Furthermore, there exists a strand of literature exploring several potential explanations that would connect our findings associated with MAX in the recent decades with the hypothesis above. Han and Kumar (2008) confirm that stocks with high proportion of retail investors tend to earn lower future returns, especially if they are speculative stocks. The lottery-type stocks, i.e. stocks with high MAX, contain exactly those features that could be attractive to retail investors, which supports the conclusion in Kumar (2009). Annaert et al. (2013) argue that stocks with lottery-like characteristics are more likely attractive to individual investors, of which the impact on pricing is larger. Han and Kumar (2013) examine the characteristics and pricing of stocks that are actively traded by speculative retail investors, and conclude that speculative retail trading affects stock prices. Baker and Wurgler (2006) present evidence that investor sentiment has significantly effects on the cross-section of stock prices. Lining up with this assumption Fong and Toh (2014) relate investor sentiment to the demand for high and low MAX stocks by showing that investor sentiment influences the strength of the MAX effect and this effect is amplified by environment factors such as high investor sentiment and religious beliefs which are more tolerant of gambling. An et al. (2015) document pricing anomalies associated with lottery features including maximum daily returns are state-dependent. More specifically, the previous underperformance of lottery-like assets is significantly stronger among firms with capital losses, lower institutional ownership, and periods with high investor sentiment, whereas the evidence is weak or even reversed among other stocks. Zhong and Gray (2016) show that the MAX effect concentrates amongst the most-overpriced stocks, but actually reverses amongst the most-underpriced stocks. Hur and Singh (2017)’s results suggest the MAX effect is related to investor attention and risk preferences.

Collectively, given the empirical evidence and alternative explanations above we reconcile our findings on the inconsistency of the MAX effect in different countries to the time-varying pattern of retail investors’ proportion and their tradings by fundamentally affecting the preference for lottery-like stocks during various time periods. We presume that stocks in a relatively younger stock market, such as China or earlier time periods in the U.S., are dominated by retail investors, hence exhibit a stronger negative MAX premium, while in well-developed markets where participants tend to be more rational and well-diversified, such as the U.S. nowadays, and market efficiency is generally higher, the magnitude of the MAX effect declines, resulting in the mispricing negative premium being substantially weaker, hence this relation evaporates (and even reverses, given the relation to idiosyncratic volatility).

The remainder of this paper is organized as follows: Sect. 2 describes the data and construction of variables. Section 3 presents the main empirical results in the seven countries, and discusses in detail the MAX effect using the U.S. data. Section 4 discusses robustness of the original results on two subperiods. Section 5 concludes.

2 Data and variables

The data sample comprises data on firms from seven markets for the period from January 1994 to December 2009. All the data sets are obtained from Thomson DataStream. Specifically, the individual stock returns we select are the S&P/TSX Composite for Canada, the FTSE-All shares for the U.K. market, the HDAX for Germany, Shanghai A-Shares for China, the Datastream data for France, the U.S., and Japan.

In accordance with Bali et al. (2011) we measure extremely positive returns (MAX) as the maximum daily stock returns over one month.

where \(R_{i,d}\) is the return on stock i on day d and \(D_{t}\) is the number of trading days in month t. Meanwhile we also take other economic explanatory components into consideration. We measure the systematic risk with the market beta in line with the CAPM, which is estimated as the slope in the regression of individual stocks’ return on the value-weighted index market returns. For each month, we calculate the monthly market beta using daily returns within the month, and run time-series regression within the month on excess market returns. The estimated slope coefficient is the market beta for each month. Moreover, we take market capitalization and book-to-market ratio at the end of each month from DataStream. We use monthly returns to calculate proxies for intermediate-term momentum and short-term reversals, as a control for the effects of past returns following Bali et al. (2011). Specifically, momentum is defined as the cumulative return over the previous 11 months from \(t-12\) to \(t-2\). The reversal variable is the stock return over the previous month. Additionally, Amihud (2002) suggests a positive relation between illiquidity and cross-sectional returns. Following this idea, we measure the illiquidity by the ratio of the absolute monthly return and its trading volume in value. We ignore missing values, so that a firm is eliminated if the relevant information is missing for a particular variable.

3 Results

In this section, we discuss the results of the analyses across the seven countries. We start with a portfolio-level analysis, then we move on to cross-sectional regressions at the firm level.

Table 1 shows an overview of statistics for the stock returns and other firm characteristic data across the pooled samples. We use data from January 1994 to December 2009, in total 192 months. We present the time-series and cross-stocks averages of the monthly values for monthly return, monthly maximum daily return, market capitalization and book-to-market ratio. Firm size is the market value of equity and is measured by the natural logarithm.

3.1 Portfolio analysis

Before we check the characteristics of extremely positive returns on the individual country’s level, we first examine it in a global way. We form decile portfolios including all 4028 monthly stock returns across countries ranked on MAX, rebalanced every month. Portfolio 1 (low MAX) contains stocks with the lowest MAX in the previous month and Portfolio 10 (high MAX) includes stocks with the highest MAX in the previous month. Table 2 presents the equally weighted returns of the decile portfolios. As we compare the ten equally weighted portfolios, a striking feature different from the results of Bali et al. (2011) is that a high MAX stocks portfolio (decile 10) tends to generate higher returns (\(2.53\%\) per month on average) compared to other percentile portfolios, particularly compared to a low MAX stocks portfolio (decile 1). The average return difference is \(1.50\%\) with a significant t-statistic of 2.63 (not reported in the Table). Moreover, the high MAX portfolio exhibits substantially higher monthly volatility, at \(8.18\%\), than that of the low MAX portfolio at \(3.13\%\). We also find that portfolio 9 and 10 with relatively higher MAX stocks present positive skewness, while the other 8 portfolios show negative skewness.

In addition, in Fig. 1 we plot the time-series average portfolio returns across the seven countries by comparing the high MAX (top \(10\%\) MAX percentile) and the low MAX (bottom \(10\%\) MAX percentile) portfolios. It is clearly visible that the high MAX portfolio is more volatile than the low MAX portfolio across the seven countries.

Next, we move to a univariate sorting method to test the performance of the stocks that earned the highest daily return over one month at the country level. Due to relatively small data samples on some countries like Germany and France, in each month, we sort stocks based on the maximum daily return within the previous month into quintile portfolios for individual countries respectively. That is, stocks for each country are allocated into five portfolios based on MAX over the past month. Portfolio 1 is the portfolio of stocks with the lowest \(20\%\) MAX, and portfolio 5 is the portfolio of stocks with the highest \(20\%\) MAX. The time-series average MAX, monthly returns of equal-weighted, value-weighted and FF-3 alpha portfolios are reported in Table 3.

Our results show there is no universal relation between MAX and the returns in the following month. For stocks from the U.S. and Canada, both the value-weighted and equal-weighted quintile portfolios show that the average return of quintile 5 is statistically significant larger than that of quintile 1. While for China we observe the opposite for equal-weighted average and no significant effect for the value-weighted average. There is no evidence for a significant link between MAX and expected returns for stocks in France, Germany or Japan. In panel C we see that the alpha differences are less robust for UK, Canada and China, especially the numbers correspond to the US indicate a positive MAX effect in both equal- and value-weighted portfolios. We test this using cross-sectional regressions by adding other potentially influencing factors in the next section.

3.2 Cross-sectional Fama–MacBeth regressions

As a further test of the relation between MAX and returns we implement the Fama and MacBeth (1973) regressionsFootnote 4

The basic equation that we estimate is:

where \(R_{i,t+1}\) is the realized return on stock i in month \(t+1\). The predictive cross-sectional regressions are run on the one-month lagged values of maximum daily return (MAX), market beta (BETA), log market capitalization (SIZE), log book-to-market ratio (BM), momentum (MOM), short-term reversal (REV) and illiquidity (ILLIQ). Monthly cross-sectional regressions are run as the above econometric specification for all of the stocks in the seven markets individually. We then calculate the premium estimates \(\lambda _{1}\), \(\lambda _{2}\), \(\lambda _{3}\), \(\lambda _{4}\), \(\lambda _{5}\), \(\lambda _{6}\), \(\lambda _{7}\), respectively, as the time-series average of the 191-month (from January 1994 to December 2009) slope coefficients. Statistical significance is determined by the Newey and West (1987) adjusted t-statistics.

Table 4 reports the results of regressions. The results of the regressions also manifest similar predictive patterns of MAX as those we obtain from the portfolio analysis. Looking individually at the univariate regressions in Panel A, we find that MAX in China is negatively and significantly related to the cross-section of expected returns with an average slope coefficient of \({-}\,0.175\) (\(t = -\,4.684\)), which indicates that average firm returns decrease as MAX becomes large. For countries like France and Germany, the coefficient on MAX is statistically insignificant. In contrast, the results for Canada, the U.K. and the U.S. suggest that high maximum daily return stocks tend to generate high expected returns.

In order to control for other potential economic explanations, we include various firm characteristics as well as other risk components in the regressions, as shown in Panel B. The MAX effect in China is even stronger in terms of magnitude when all other variables are included in the regressions. The coefficient of MAX in France is negative and becomes statistically significant. Furthermore, the positive relation between MAX and expected returns is robust for Canada, U.K. and U.S., while it is still insignificant for Germany and Japan.

In summary, unlike the findings in Bali et al. (2011), we do not find uniformly strong evidence for an economically and statistically significant negative relation between extremely positive returns and expected returns. In fact for our data sample from January 1994 to December 2009 we find this relation only in China, and we even find contradicting results in Canada, U.K. and U.S.. In these countries the coefficients on MAX are all positive and statistically significant.

3.3 A more detailed look at the U.S. market

Our most surprising finding so far is that MAX is strongly positively associated with future stock returns in the U.S. (Table 4). This seems to direct contradict the findings of Bali et al. (2011), which demonstrated a negative and significant relation between MAX and expected returns in the US. Therefore in this section, we take a detailed look at the effect of MAX within the U.S. data, where a relatively large number of firms allows for greater power for investigating the cross-sectional determinants of the MAX effect.

The full specification with MAX and other control variables shows that MAX has a positive impact on the cross-section of expected returns. One may argue that the MAX’s predictive ability on subsequent returns is due to its proxy for some other well-known effects. Given the characteristics of the high MAX stocks, our first conjecture is that the MAX effect could be closely associated with the size effect (e.g. Banz 1961; Fama and French 1992). As the size effect indicates, small firms have higher expected returns than large firms. Naturally, high MAX stocks are likely to be small stocks, which would potentially dominate the positive relation between MAX and future returns in our sample on the U.S. data. The size effect, however, is already mostly controlled for in the Fama–MacBeth regressions in the previous section.

Another possible explanation is the following: numerous studies have demonstrated that idiosyncratic risk is positively related to the cross-sectional expected returns (Levy 1978; Merton 1987; Malkiel and Xu 2002; Jiang and Lee 2006; Fu 2009). Idiosyncratic risk is the risk that is unique to an individual firm and is independent from the aggregate market. Special events of certain firms, like record-breaking events, achieving extremely positive daily returns, are intuitively and firmly linked to stocks’ idiosyncratic volatility. Investors, therefore, would demand a premium for holding stocks with high idiosyncratic risk. Following Bali et al. (2011), to estimate idiosyncratic volatility for an individual stock, we assume a single factor generating process and measure the firm-level idiosyncratic volatility using the following model:

where \(\varepsilon _{i,d}\) is the idiosyncratic return on day d. The idiosyncratic volatility of stock i in month t is then determined as the standard deviation of the residuals:

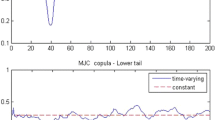

In particular, the correlation between cross-sectional average of MAX and idiosyncratic volatility is remarkably high with the correlation coefficient of \(93\%\), as one can see visually in Fig. 2. Obviously, stocks with high (low) MAX are frequently those stocks with high (low) idiosyncratic volatility (henceforth IVOL). Thus as a robustness check we control the potential proxy variables IVOL while examining the MAX effect.

In order to control for the two possible explanations of the MAX phenomenon, size and idiosyncratic volatility, we firstly conduct bivariate portfolio sorts. Specifically, we create quintile portfolios each month from January 1994 to December 2009 ranked on firm size and idiosyncratic volatility of the previous month respectively, and then within each quintile we sort stocks on their maximum daily returns. For the sake of saving space, we do not report all \(5\times 5\) portfolios, but present average returns across the spectrum of the control variables for the 5 quintile portfolios with dispersion in MAX. As a result, quintile 1 (5) consists of the \(20\%\) lowest (highest) MAX stocks, and each quintile is formed with variation in MAX, but with similar levels of control variables (size and IVOL). The return difference is the time-series average returns between the high MAX portfolios and the low MAX portfolios. Table 5 reports the average equal-weighted and value-weighted returns over control of size and IVOL respectively, and their associated Newey-West adjusted t-statistics. The value-weighted quintile portfolio is value weighted using market capitalization at the end of the preceding month.

Somewhat surprisingly, it is shown in Table 5 that the positive effect of MAX disappears for both screening processes. Instead, the 5-1 differences for equal- and value-weighted portfolios are negative (but insignificant). When controlling for IVOL, the equal-weighted and value-weighted spreads between the high MAX and the low MAX quintile are not statistically significantly different. Hence, the bivariate sorts screening for size and IVOL reduce the cross-sectional variation in MAX, implying that both firm size and IVOL largely interact with MAX. Therefore, we conclude that the positive MAX effect within the U.S. data is not robust, and controlling for other risk factors such as size and IVOL is critical to the significance of the result.

Furthermore, Table 6 presents the raw value-weighted and equal-weighted returns of univariate sorts and bivariate sorts of IVOL after controlling for firm size and MAX. Applying a similar procedure to that as in Table 5, for the bivariate sorts, we first form 5 portfolios by sorting stocks each month on size or MAX, and then we again sort stocks based on IVOL into 5 quintile portfolios within each control quintile, which results in \(5\times 5\) IVOL portfolios conditioned on size or MAX. For brevity, we report the average portfolio returns with dispersion of IVOL across the control variables.

We find that while both raw value-weighted and equal-weighted return differences between the high IVOL portfolio and the low IVOL portfolio are positive, only the difference in equal-weighted portfolios is statistically significant. This is not surprising though: quintile 5 contains the highest \(20\%\) of the stocks sorted by IVOL, yet on the other hand, it also represents a smaller proportion of the market capitalization. Since we know that small stocks have higher average returns than large stocks, this is the reason why the value-weighted return of quintile 5 is much lower than the equal-weighted return of the same quintile.

After controlling for the size in the 4th and 5th column, the equal-weighted and value-weighted return differences between the high IVOL and the low IVOL quintile are highly significant. When we look at the last two columns, where portfolios are controlled by MAX, the positive effect of IVOL persists. These results are definitely more substantive and robust than those sorts based on MAX. Particularly noteworthy is the finding that using the bivariate sorts does not dramatically reduce the higher returns of quintile 5 based on idiosyncratic volatility.

Merton (1987) underlines that, in an information-segmented market, stocks with larger firm-specific variances require high average returns to compensate investors for holding imperfectly diversified portfolios. Barberis and Huang (2001) point out that stocks with higher idiosyncratic volatility have higher expected returns. It is intuitively clear that high MAX stocks also have a propensity for higher idiosyncratic volatility.

Next we investigate the relation between average returns and IVOL by applying the Fama and MacBeth (1973) cross-sectional regressions. We extend Eq. 2 to incorporate idiosyncratic volatility. Table 7 reports the time-series averages of estimated coefficients from various specifications. In addition to the variables mentioned before, we include the dummy variables high MAX and low MAX in the regressions. High (low) MAX takes the value one if a stock appears in the highest (lowest) MAX quintile over the previous month and zero otherwise. The idea is that if a stock’s previous MAX is relatively high (low), this phenomenon would potentially persist over the next month.

Among models 1, 2, 3, and 5 shown in Table 7, where MAX is included in the regression in the absence of IVOL, the coefficient estimate is significant and positive, which suggests that stocks with higher MAX earn higher returns in the following month. Both dummy high MAX and low MAX have little influence on the results. Augmenting the regression with firm’s size does not help: the positive relation between MAX and expected returns remains. When IVOL is added to the regression in model 4, the average slope coefficient on MAX reverses its sign to negative, but not significant. In contrast, the average slope coefficient on IVOL is statistically significant on the \(1\%\) level, which is in line with the result from the portfolio analysis: once IVOL is controlled for, the positive effect of MAX vanishes. Moreover, when we consider MAX, size and IVOL in one regression (model 8), while the power of the IVOL and size is significant and consistent with the former results, the MAX coefficient is small and has an insignificant t-statistic. Similarly, model 9 and 10 further show that the coefficient of IVOL is robust after controlling for other well-known economic explanations, whereas the explanatory power of MAX is marginal and statistically insignificant.

In summary, the result is intriguing: based on the double-sorting of portfolios and the cross-sectional regressions, we see that idiosyncratic volatility wins against MAX in explaining the cross-sectional variation of average returns. Although MAX alone exhibits significantly positive explanatory power in forecasting the subsequent monthly returns, this cross-sectional relation is insignificant and even negative (albeit not significantly) in the presence of idiosyncratic volatility. Hence these findings indicate that the positive relation between MAX and future stock returns in the U.S. market is explained by idiosyncratic volatility as estimated by daily stock returns in the previous month. The positive relation between IVOL and expected returns is large in magnitude and statistically significant in various regression specifications. This evidence implies that MAX seems to be a proxy for IVOL, and it is the IVOL which drives the positive relation in determining the cross-section of expected returns.

4 Robustness test of Bali et al. (2011) on two subperiods

Given the puzzling results from the U.S. market revealed above, we continue to investigate the issue using a sample of NYSE, AMEX and NASDAQ stocks from the CRSP. However, instead of using the full sample period from July 1962 to December 2017, we divide it into two subperiods, namely, from July 1962 to December 1989 and from January 1990 to December 2017, while all variables are defined the same as in Bali et al. (2011). More specifically, our data include daily and monthly returns of NYSE, AMEX, and NASDAQ financial and nonfinancial firms from July 1962 to December 2017. Additionally, we use data from Compustat for the book value of individual firms. The purpose is to complement the Bali et al. (2011)’s original study and clarify the existence and significance of a relation between MAX and the cross-section of expected stock returns on a more recent period, which is perhaps the most relevant period.

Similarly, we firstly examine returns of portfolios formed on the sorting of MAX. The procedure of the portfolio-based approach is easy to implement and produces a straightforward result. For each month in the two subperiods, we sort stocks based on the maximum daily return over the preceding month to form 10 portfolios with an equal number of stocks. Portfolio 1 contains the lowest \(10\%\) stocks of MAX and portfolio 10 consists of the \(10\%\) stocks that have the highest MAX. Table 8 presents the value-weighted and equal-weighted returns of percentile portfolios in the following month. It also presents the magnitude and statistical significance of the intercepts (Fama–French five-factor alphas) from the regressions of the value-weighted and equal-weighted portfolio returns on a constant, the excess market return, the SMB, the HML, the RMW and the CMA. SMB, HML, RMW and CMA refer to small minus big, high minus low, robust minus weak, and conservative minus aggressive, respectively [see Fama and French (2015)]. Factors are described in details in Kenneth French’s data library.

As shown in Panel A of Table 8, where we compose portfolios each month during the post-1990 period, the average maximum daily return of stocks within a month increases sharply from less than \(2\%\) in the lowest decile to \(27\%\) in the highest decile. Especially, the MAX is \(12.24\%\) in decile 9, while it soars to \(26.79\%\) in decile 10, in the last column. More importantly, we do not find significant indications of a negative MAX effect. The portfolio return differences display a strikingly different picture that is by no means in support of the results revealed in Bali et al. (2011). The value-weighted portfolio return differences between decile 10 and 1 is \(-\,0.35\%\) per month with an insignificant Newey-West t-statistic of \(-\,0.72\). The intercept of the time-series regressions of value-weighted excess returns on the five-factor in the column of five-factor-alpha is \(-\,0.01\%\) for the lowest MAX decile and \(0.17\%\) for the highest MAX decile. A hedging portfolio longing decile 10 and shorting decile 1 yields a monthly return of \(-\,0.18\%\), yet not strongly statistically significant. Portfolio returns from decile 1 to decile 10 are flat with no clear trend. The return spread between the highest MAX and lowest MAX is small in magnitude at \(-\,0.03\%\) per month, though statistically distinguished from zero. The five-factor alphas also exhibit even a positive alpha difference of \(0.18\%\) with little statistical significance.

As a comparison we provide the portfolio analysis on the pre-1990 period back to July 1962 in Panel B. It is clear that, despite the insignificant results in Panel A, the overall pattern in Panel B coincides with Table 1 of Bali et al. (2011). More explicitly, in their paper deciles 1–8 (including decile 9 more or less) have approximately the same levels of return, whereas the returns of deciles 10 are distinctively lower. The same holds in our results. Furthermore, all the results are conceivable and expected, with highly statistical significance. The average value-weighted portfolio difference between decile 10 and 1 is \(-\,0.70\%\) per month with a t-statistic of \(-\,2.17\). It is worth noting that in Table 1 of the original paper, the value-weighted high MAX portfolio has abysmally low return (\(-\,0.02\%\) per month), whereas the counterpart in our result is remarkably higher (\(0.08\%\)). As with the equal-weighted portfolios, the monthly difference for decile returns and alpha is \(-\,0.72\%\) and \(-\,0.98\%\), respectively, both of which are highly significant.

The above results indicate that the average raw and risk-adjusted return differences between stocks in the lowest and highest MAX deciles are much less impressive and weaker than that documented in Bali et al. (2011), once we rely on a sample period from January 1990 to December 2017. Nevertheless, the negative average return differentials, in any case, are notably stronger in the pre-1990 period than in the post-1990 period. Our conjecture is that if the main finding of Bali et al. (2011) exists, it is the strong negative relation in the early decades that dominates.

To assure the findings from the portfolio analysis, we further examine the cross-sectional relation between MAX and expected returns at the firm level by using Fama–MacBeth regressions. Firstly, the cross-section of one-month-ahead returns are regressed against only MAX. Furthermore, we include idiosyncratic volatility along with the same set of controls into the regressions, as introducing MAX sheds light on the puzzle of idiosyncratic volatility according to Bali et al. (2011).Footnote 5

Table 9 presents results of the cross-sectional regressions with MAX, IVOL and other six independent control variables. Idiosyncratic volatility is estimated within-month daily returns following Ang et al. (2006, 2009) with respect to the three-factor Fama and French (1993) regression:

The idiosyncratic volatility for stock i is measured as the standard deviation of the residuals \(\varepsilon _{i}\). The other variables are calculated as described in previous sections.

The models 1–4 in panel A are regression results conducted in the period from January 1990 to December 2017. Consistent with the results of our portfolio analysis, we do not find a robust negative relation between MAX and stock expected returns. The average coefficient of MAX in a univariate regression (model 1) is almost zero, \(-\,0.0078\), with a t-statistic of \(-\,0.64\). When we run the regression with only IVOL as in model 2, the average slope of IVOL is \(-\,0.022\), and it is not statistically significant (\(t=-0.44\)). Model 3 generates a negative coefficient (\(-\,0.0055\)) for both MAX and IVOL \(-\,0.0046\), both of which are statistically insignificant. Moreover, neither a significant effect of MAX nor IVOL shows up when we run the multivariate regression with full specification in model 4. The MAX coefficient is \(-\,0.006\) with a t-steatitic of \(-\,0.176\) and the coefficient on idiosyncratic volatility is 0.068 with a t-statistic of 0.81.

Compared to the results in panel A, the models 5, 6, 7 in panel B are qualitatively similar to those in Table 10 of Bali et al. (2011): MAX is negatively and significantly related to the cross-section of expected returns with an average slope coefficient of \(-\,0.053\) (\(t = -2.79\)) in model 5. The coefficient of IVOL is \(-\,0.11\) (\(t = -1.45\)). In the presence of MAX and IVOL at the same time, the IVOL coefficient is 0.28 with a t-statistic of 2.61 in model 7, and the coefficient shows similar results after extending the regression to include the six other control variables in model 8. The estimate of MAX is \(-\,0.14\) with an extreme t-statistic (\(t=-7.68\)) in model 7, and it changes to \(-\,0.176\) in model 8 with a strongly significant t-statistic (\(t=-8.38\)).

The results from the portfolio-level and firm-level analysis suggest that the MAX factor has not been able to produce an economically or statistically significant effect in the recent decades. On the other hand, MAX is far more important in explaining the variation of cross-sectional stock returns in early periods, for example, until 1989. Therefore, our conclusion is that the MAX effect along the lines of Bali et al. (2011), if anything, is driven mostly by its strong impact in early periods. This risk factor deteriorates and tends to diminish over time.

5 Conclusion

In this paper, we have investigated the impact of extreme positive returns and examined the cross-sectional relation between maximum daily return and expected stock returns across different countries. We also extend the original study of Bali et al. (2011) by testing the robustness of their results on two sample subperiods.

The results suggest that the original findings can not be easily generalized. In China both portfolio- and firm-level analysis indicate the highest daily returns in the previous month are negatively related to the expected returns in the following month, which is consistent with the original results (and the recent results of Nartea et al. (2017)) and implies that investors are likely to pay more for those stocks and accept for a lower return. In contrast, we find that in recent time periods extreme positive returns are followed by high returns in Canadian, the U.K. and the U.S. markets. In addition, we test the contradicting results in the U.S. market by examining its interaction with idiosyncratic volatility. The inclusion of idiosyncratic volatility in bivariate portfolio analysis and the cross-sectional regression makes the positive relation between MAX and expected returns vanishing. On the other hand, the effect of idiosyncratic volatility is robust after controlling for MAX, which suggests that the positive MAX-return relation is simply a proxy for idiosyncratic volatility. Moreover, the robustness test with the CRSP dataset on two subperiods show that the relation between high MAX and low returns is not stable over time. The original pattern can be replicated for the period of July 1962 to December 1989, whereas it is not robustly negative for the period from January 1990 to December 2017.

This makes it challenging to interpret the MAX anomaly in pricing the cross-sectional expected returns. The above analysis among seven countries shows that only the result of the Chinese stock and the early U.S. stock market reveals a similar pattern to the one found by Bali et al. (2011), while the other markets show a different picture. Given the empirical evidence provide by Han and Kumar (2008), Kumar (2009), Han and Kumar (2013) and Hur and Singh (2017) etc., we posit that the MAX-return relation depends largely on the extent of MAX-seeking behavior among investors. By a dominant proportion of MAX-seeking investors in the aggregate market, the negative premium of MAX is stronger and more significant, such as China, while in a more mature and rational market with more sophisticated participants such as the recent U.S. stock market, the negative MAX-premium is mitigated and even can be reversed. Therefore, stock returns as well as the overall pattern of the aggregate market can be potentially affected, which may cast doubt on the robustness of relevant risk factors in the empirical performance with asset-pricing models. In a nutshell, our results suggest that market-specific explanations are likely to play a crucial role in determining whether a MAX effect exists for different time periods. The relation between MAX and expected returns is not stable over time, which makes it worth further investigating the time-varying aspect of the MAX-premium, given the development of the market and the fundamental root that causes retail investors to overweigh lottery-like assets and the reason why time-series return premiums of MAX fades in the recent time period.

Notes

Reported in The Economist (May 31, 2011). Liquidity and lottery tickets—Why investors overpay for certain assets.

The main analysis in Bali et al. (2011) was based on a sample from 1962 to 2005, although they also had robustness tests with data starting in 1926.

In the original paper, their results show that inclusion of MAX variable reverses the anomalous negative relation between idiosyncratic volatility and returns in Ang et al. (2006).

References

Amihud Y (2002) Illiquidity and stock returns: cross-section and time-series effects. J Financ Mark 5:31–56

An L, Wang H, Wang J, Yu J (2015) Lottery-related anamolies: the role of reference-dependent preferences. Working paper

Ang A, Hodrick RJ, Xing Y, Zhang X (2006) The cross-section of volatility and expected returns. J Finance 61:259–299

Ang A, Hodrick RJ, Xing Y, Zhang X (2009) High idiosyncratic volatility and low returns: international and further U.S. evidence. J Financ Econ 91:1–23

Annaert J, Ceuster MD, Verstegen K (2013) Are extreme returns priced in the stock market? European evidence. J Bank Finance 37:3401–3411

Baker M, Wurgler J (2006) Investor sentiment and the cross-section of stock returns. J Finance 61:1645–1680

Bali TG, Cakici N, Whitelaw RF (2011) Maxing out: stocks as lotteries and the cross-section of expected returns. J Financ Econ 99:427–446

Banz RW (1961) The relation between return and market value of common stocks. J Financ Econ 9:3–18

Barberis N, Huang M (2001) Mental accounting, loss aversion and individual stock returns. J Finance 56:1247–1292

Barberis N, Huang M (2008) Stocks as lotteries: the implications of probability weighting for security prices. Am Econ Rev 98:2066–2100

Brunnermeier M, Gollier C, Parker J (2007) Optimal beliefs, asset prices and the preference for skewed returns. Am Econ Rev 97:159–165

Campbell JY, Lettau M, Malkiel BG, Xu Y (2001) Have individual stocks become more volatile? An empirical exploration of idiosyncratic risk. J Finance 56:1–43

Cheon Y-H, Lee K-H (2018) Maxing out globally: individualism, investor attention, and the cross section of expected stock returns. Manag Sci 64:5807–5831

Fama E, MacBeth J (1973) Risk, return and equilibrium: empirical tests. J Polit Econ 71:607–636

Fama EF, French KR (1992) The cross section of expected returns. J Finance 46:427–465

Fama EF, French KR (1993) Common risk factors in the returns on stocks and bonds. J Financ Econ 33:3–56

Fama EF, French KR (2015) A five-factor asset pricing model. J Financ Econ 116:1–22

Fong WM, Toh B (2014) Investor sentiment and the max effect. J Bank Finance 46:190–201

Fu F (2009) Idiosyncratic risk and the cross-section of expected stock returns. J Financ Econ 91:24–37

Goetzmann WN, Kumar A (2007) Why do individual investors hold under-diversified portfolios. Working paper

Han B, Kumar A (2008) Retail clienteles and the idiosyncratic volatility puzzle. Unpublished working paper

Han B, Kumar A (2013) Speculative retail trading and asset prices. J Financ Quant Anal 48:377–404

Harvey CR, Siddique A (2000) Conditional skewness in asset pricing tests. J Finance 55:1263–1295

Hausch D, Lo V, Ziemba WT (1994) Efficiency of racetrack betting markets. Academic Press, San Diego

Hur J, Singh V (2017) Cross section of expected returns and extreme returns: the role of investor attention and risk preferences. Financ Manag 46:409–431

Jiang X, Lee B-S (2006) The dynamic relation between returns and idiosyncratic volatility. Financ Manag 35:43–65

Kumar A (2009) Who gambles in the stock market? J Finance 64:1889–1933

Levy H (1978) Equilibrium in an imperfect market: a constraint on the number of securities in the portfolio. Am Econ Rev 68:643–658

Lo A, Mackinlay A (1990) Data-snooping biaes in tests of financial asset pricing models. Rev Financ Stud 3:431–468

Malkiel B, Xu Y (2002) Idiosyncratic risk and security returns. Working paper

Merton R (1987) A simple model of capital market equilibrium with incomplete information. J Finance 42:483–510

Mitton T, Vorkink K (2007) Equilibrium underdiversification and the preference for skewness. Rev Financ Stud 20:1255–1288

Nartea GV, Kong D, Wu J (2017) Do extreme returns matter in emerging markets? Evidence from the Chineses stock market. J Bank Finance 76:189–197

Newey W, West K (1987) A simple, positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica 55:703–708

Odean T (1999) Do investors trade too much? Am Econ Rev 89:1279–1298

Tversky A, Kahneman D (1992) Advance in prospect theory: cumulative representation of uncertianty. J Risk Uncertain 5:297–323

Walkshäusl C (2014) The max effect: European evidence. J Bank Finance 42:1–10

Zhong A, Gray P (2016) The max effect: an exploration of risk and mispricing explanations. J Bank Finance 65:76–90

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Yuan, S., Rieger, M.O. & Caliskan, N. Maxing out: the puzzling influence of past maximum returns on future asset prices in a cross-country analysis. Manag Rev Q 70, 567–589 (2020). https://doi.org/10.1007/s11301-019-00176-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11301-019-00176-3