Abstract

The literature on racial differences in mortgage interest rates is mixed depending on samples, sample period, and product types. Mortgage loans that originated during the period between 2011 and 2019 from the 2013, 2016 and 2019 waves of the Survey of Consumer Finance were examined using weighted regressions with the repeated imputation inference method. During the whole sample period, Hispanics and Blacks paid 40 and 22 basis points (bp) higher rates than Whites at the one percent and ten percent statistical significance levels, respectively, after loan characteristics, such as term and adjustable rate, and borrower credentials, like net worth and debt to income, were controlled for. An analysis with time trend shows that Blacks paid higher rates by 56 bp in the base year but the gap decreased by 6.6 bp per year. The loan pricing gap disappeared by the end of sample period. However, Hispanics did not experience a reduction in rate differentials over time.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Ethnic/racial discrimination in credit markets is a critical issue that affects the wealth distribution among consumer groups. Black et al. (1978; p.186) defined discrimination in the mortgage lending decision as “a differential action taken by one party which affects a second party based on the personal characteristics of the second party.” Either application, denial or approval with unfavorable terms, constitutes discrimination. Discrimination happens in three dimensions (Haughwout et al., 2009). First, lenders may refuse to offer credit through outright rejection or maintain an unfavorable atmosphere towards minorities, who give up applying for credit due to the fear of denial. Second, lenders may steer accepted applicants into more costly products. Third, they may price a given product differently.

This paper examines the third dimension of credit overcharge: Are minorities charged more for the same loan product? Previous studies are divided depending on loan types, sample period, lender sample and methodology. This study analyzes the Survey of Consumer Finance (SCF) dataset (Board of Governors of the Federal Reserve System 2013; 2016; 2019) because it is a nationally representative sample and provides information on income, assets, liabilities, credit experience and demographic characteristics. Regarding the methodology, weighted regressions with the repeated-imputation inference (RII) method by Rubin (1987) were performed to properly incorporate the oversampling and multiple implicate techniques employed in the SCF. Among the mortgage loans originated during the years 2011 to 2019 sampled from the 2013, 2016 and 2019 waves of the SCF, Black borrowers on average contracted for mortgage rates 0.56 percent (or 56 basis points (bp)) higher than Whites in year 2011. However, the gap decreased by 6.6 bp per year, practically eliminating the gap by the end of the sample period.Footnote 1

Literature Review

Empirical literature on racial differences in mortgage interest rates is diverse in sample with respect to sample period, loan product type, lender, and country (Table 1 provides a summary of the previous literature). Boehm et al. (2006) expanded previous research by examining the biennial American Housing Survey (AHS) during the years from 1991 to 2001 for mortgages originated between 1989 and 2001. They reported that Blacks paid a 94 to 77 bp higher annual percentage rate (APR) than Whites when refinancing loans, and 20 to 24 bp higher for purchase loans.Footnote 2 Bocian et al. (2008) reported that Black and Latino borrowers were more likely to receive higher rates than White borrowers with a similar risk profile. Odds ratios for having a higher rate were higher for purchases, fixed rates, and loans with a prepayment penalty than refinances, variable rates, and loans with no penalty, respectively. Ghent et al. (2014) found evidence of adverse pricing for Blacks (no higher than 29 bp) and Hispanics in the subprime mortgage market, which was stronger for purchases and those originated by non-depository institutions. Bayer et al. (2018) reported that African American and Hispanic borrowers were 103% and 78% more likely to receive high-cost mortgages for home purchases. Higher odds were attributable to sorting across lenders (55–65%), and the remaining within-lender differences were concentrated in high-risk lenders.

These studies did not use samples representative of the whole United States (U.S.) mortgage markets in terms of geographic areas, specific lenders, and loan types. For example, Bocian et al. (2008) analyzed a large proprietary dataset for subprime mortgages along with 2004 Home Mortgage Disclosure Act (HMDA) data.Footnote 3 Ghent et al. (2014) analyzed subprime mortgages in California and Florida during 2005. Bayer et al. (2018) analyzed a proprietary dataset for subprime mortgages during the 2004–2007 period. Particularly the sub-prime mortgage sample was more likely to have an over-representation of minority borrowers compared to a sample of conforming loans and prone to a biased result.

On the other hand, several studies found no significant rate differentials against Black borrowers. From regressions with control variables such as Federal Housing Administration (FHA) /Veterans Affairs (VA), refinance vs purchase, year, income, conventional, loan purpose, occupancy, sex, regions, loan amount and loan to value (LTV), Courchane and Nickerson (1997) found Black/Hispanic borrowers from one bank paid only 0.176 bp higher than Whites. For the other bank they analyzed, both Black and Hispanic borrowers paid less in overage. Crawford and Rosenblatt (1999) found no differential loan yield pricing among conventional loan borrowers.Footnote 4 In FHA and VA lending, Black borrowers paid just 3.6 bp more, which is economically insignificant. Black et al. (2003) also found Black borrowers were not likely to pay overage. Hispanic borrowers were paying just 0.5 bp higher in purchases and 1.15 bp higher in refinances. Overage was not economically significant. They concluded that rate overage had more to do with market power and differential bargaining skills and less to do with race. Haughwout et al. (2009) found no evidence of adverse pricing in initial interest rate over the six-month London Interbank Offered Rate (LIBOR) against minority borrowers among 2/28 adjusted rate mortgages (ARM).

These four studies did not use samples representative of the whole U.S. mortgage market, either. Courchane and Nickerson (1997) analyzed loan data from two anonymous banks during the 1992–1993 period. Crawford and Rosenblatt (1999) examined the loans from a large lender during the 1988–1989 period. Black et al. (2003) examined a major lender’s loans originated in 1996. Their study may be further biased since the lender did not permit overage on certain products marketed to low-income borrowers. Haughwout et al. (2009) analyzed 2/28 ARM subprime mortgages issued in August 2005, the peak month for originations of subprime loans. They did not include loans handled by servicers that do not report to LoanPerformance.com either.

More recently, Cheng et al. (2015) analyzed the 2001, 2004 and 2007 waves of the SCF, and reported that Black borrowers on average paid about 29 bp more than White borrowers. Apparently, their sample of three SCF waves included more loans originated in early years than recently originated ones, and failed to pick up recent pricing in the mortgage markets. They also did not apply weights or the RII method in regressions, which are necessary to control for the oversampling and multiple implicates in the SCF, respectively.

Mortgage pricing across race using the SCF dataset was examined because it represents the whole U.S. population. Specifically, mortgage loans originated during the years 2011–2019 from the 2013, 2016 and 2019 waves of the SCF datasets were examined. In addition, the correct method of weighted regressions with the RII (Rubin 1987) was used.

Hypothesis

Courchane and Nickerson (1997) listed three theories on price discrimination in mortgage loans. 1) Asymmetric information: lenders have less information than borrowers on the default risk of the latter. The higher the information asymmetry is, the higher the interest rate charged to lenders as a compensation for taking the risk. Rate overage not explained by this information asymmetry between lender and borrower can represent loan officers’ personal preference or cultural affinities. 2) Search cost: borrowers’ excessive cost of searching among potential lenders allows a lender to raise the price of a mortgage loan contract for less informed borrowers such as minority borrowers. 3) Collateral valuation: when lenders cannot accurately value the collateralized home due to infrequent sales or various home conditions in the area, they tend to underestimate the collateral value and upwardly adjust the mortgage rate. A key argument put forth by the current study is that the aforementioned reasons for pricing differentiation may become less relevant as information technology advances in the mortgage industry. As Lyons (2003) suggested, financial innovation has lessened credit constraints for minorities, technological advances improve the speed of information diffusion and the quality of information in the financial sector. Hence, the lenders’ information asymmetry and borrowers’ information search costs decline, and collateral valuation becomes more accurate at a lower cost. The current study hypothesizes that mortgage rate differences across race diminished over time.

Research Methods

Sample

The SCF, conducted by the Federal Reserve Board with the Department of the Treasury, contains detailed data on the finances of the U.S. primary economic units. The SCF provides information on income, assets, liabilities, credit experience, and demographic characteristics and creates a national representative sample. It has been widely used in the literature (Lyons 2003; Straight 2002). While the HMDA data have omitted-variable bias (Delis & Papadopoulos, 2019), SCF does not suffer from a similar bias.

Since the Cheng et al. (2015) analysis of the 2001, 2004 and 2007 waves of the SCF is outdated, the three most recent SCF waves in 2013, 2016 and 2019 were examined in this study. From each wave, the loans originated within three years from the survey year were collected to avoid oversampling of older loans. SCF assigns a weight to each observation for a given year to best represent the population composition. The sum of the weights is increasing over years, which matches the number of households published by the U.S. Census Bureau. The number of observations stays almost the same over the survey waves. The weights growing over the waves will solve the problem of the observations from older waves being over-represented. Analyses without weighting would fail to recognize the time effects. In addition, SCF intentionally oversampled high net-worth households to capture a meaningful number of such households. Any unweighted analysis would yield biased results. For example, the unweighted mean net worth of households in 2001 was $6,882,747, while the weighted mean was $395,837. To cope with the oversampling technique of the SCF, the survey weights (X42001) were used in all analyses. Observations were excluded if the mortgage rate was lower than the average 10-year Treasury yield during the loan origination year.Footnote 5

Repeated-Imputation Inference

The SCF uses the multiple imputation technique to replace missing values. Researchers should ideally use all five imputation replicates (i.e., implicates) with the RII method (Rubin 1987). When Lindamood et al. (2007) replicated the logit analyses of Bi and Montalto (2004), the simple averaging method produced lower p-values and more significant results than the correct RII method. Hence, weighted regression analyses with the RII method were performed, following Baek and Cho (2021).

Variables

Analyzed are the potential factors for the mortgage interest rates: borrower’s demographic and financial variables, and loan product terms. Rate denotes the mortgage interest rates in basis points. Year was set to zero if the loan origination year was 2011, one if 2012, and so on. Hence, the Year variable ranges from zero to eight. ARM is an indicator variable for adjusted rate mortgage. TYld denotes the average 10-year Treasury yield of the origination year. Term denotes the mortgage loan term in years. Refi indicates whether the loan was for refinancing a loan instead of for a home purchase.

Black and Hispanic races were separately coded while White and others are the default race. Age_Orig denotes the respondent’s age in the year of loan origination. Male and Married are indicator variables, while Edcl denotes the level of education (1 other, 2 high school or GED, 3 some college, 4 bachelor’s degree or higher).

LnNWT denotes the natural log of net worth, and LnIncome the natural log of total income received from all sources before taxes and other deductions. LnLiq denotes the natural log of liquid assets, which include assets in checking, savings, money market accounts (MMA), cash or call money, and prepaid debit accounts. Debt2Inc denotes the debt-to-income ratio. Unemployed indicates that the respondent is not employed and BnkrupLast5 indicates whether the respondent filed for bankruptcy in the past five years from the time of survey. TurnDown takes the value of one if a lender or creditor has turned down any credit request in the past 12 months. These two variables were used to control for the respondent’s credit worthiness.

Empirical Results

Previous studies report mixed results depending on sample and methodology. To get a snapshot of mortgage pricing across race and to compare with previous studies, first just the most recent wave of SCF conducted in 2019 was examined. Table 2 lists the simple average mortgage rates in basis points by race and year among all observations from the 2019 wave. Loan origination years range across 30 years from 1990 to 2019. On average, Blacks paid 63.6 bp higher than Whites, while Hispanics paid 48.4 bp more. In sum, raw interest rates for Blacks and Hispanics were higher than for Whites for most origination years. Compared to the average 10-year T-yield of the origination year, the rate spread for Blacks and Hispanics was 32.8 bp and 41.1 bp higher, respectively, than for Whites in the same origination year.

Next, the three most recent SCF waves in 2013, 2016 and 2019 were examined. From each wave, the loans originated within 3 years from the survey year were collected to avoid oversampling older loans. The final dataset has a total of 12,830 observations with all implicates (#1: 2573, #2: 2567, #3: 2561, #4: 2567, #5: 2562). Average descriptive statistics over five implicates are reported in Table 3. Mortgage interest rates have an average of 4.08% and range from 0.32% to 23%. Black and Hispanic respondents represent 8.3% and 6.7% of the sample, respectively. Their representations are lower than the total population weights because the sample only includes the respondents who had mortgages and owned a home. The average age at origination was 45.8 with the range of 18 to 92. Eighty-five percent of respondents were male, and 75.7% were married. Only 5.8% of mortgages were adjusted rate mortgages, and most loans had 30-year terms. Slightly more than half of the mortgages were refinance loans. Average net worth was only $44,583, while the median value was $179,854. Average annual income was $95,121 and average value of liquid assets was $8,904. The debt to income ratio ranged from 0.0078 to 142 with an average of 2.7 times. Two percent of respondents were unemployed, and 2.5 percent filed for bankruptcy in the five years from the time of survey. Surprisingly, 13.2% of mortgage holders had a credit application turned down in the past 12 months.

To examine the effects of weights and the RII method in regressions, three different regressions were performed: A. An unweighted regression using first implicates only; B. a weighted regression using first implicates only; and C. a weighted RII regression using all five implicates. The regression model is as follows:

The results are reported in three columns of Table 4. From columns A and B, some changes in coefficients and their statistical significance can be observed. ARM was weakly significant in a raw regression but became insignificant in the weighted regression. Loan terms did not seem to affect the interest rates, while refinance mortgages enjoyed about a 30 bp decrease in rates. As expected, the general market interest rate affects mortgage rates. Net worth is associated with a decrease in interest rates, while the effect of income or the debt to income ratio is not clear. Liquid assets decrease the interest rates, while bankruptcy history sharply increases the rate by about 100 bp.Footnote 6 Younger and more educated borrowers pay lower interest rates. In addition, borrowers with high income and liquidity pay lower rates.

Column C presents the result of the weighted regression with the RII method and shows the difference in race variables from the first two regressions in columns A and B. The race variables are significant in the first two regressions without the RII method. Blacks and Hispanics seem to pay 18–19 bp and 40–48 bp higher than Whites, respectively. Compared to the first and second regressions, the Black variable is now weakly significant (10% level). Married, ARM, LnNWT, Debt2Inc and TurnDown are no longer statistically significant. Blacks (Hispanics) pay 21.7 (40.4) bp higher rates than Whites when controlling for age, education, ARM vs fixed, mortgage term, purchase/refinance, credit history and 10-year Treasury yield, among others.

Did Rate Differences Disappear in Recent Years?

The study hypothesis was that racial differences in mortgage rates diminish in recent years. Separate regressions using loans originated during early (2011–2015) and late (2016–2019) years were performed. As shown in Table 5, Blacks paid 38.9 bp more than Whites during the 2011–2015 period but the coefficient became economically and statistically insignificant in more recent years (2016–2019). On the other hand, Hispanics kept paying higher rates by about 40 bp consistently during the entire period. The effects of education, net worth and employment status became stronger in the recent period, but sex, marital status, income, the debt to income ratio and bankruptcy history became irrelevant in recent years.

Rate overage changes due to technological advances may have been gradual instead of being structural. To further examine the time trend in the rate differences across races, interaction variables were added between Black and Year and between Hispanic and Year as follows:

The results of the weighted RII regression are reported in Table 6. In the 2011 base year, Black borrowers paid 56 bp higher than Whites but their rate difference decreased by 6.6 bp per year (losing 52.8 bp during the next 8-year period). With this trend, mortgage rate differences between Black and White almost disappear after 8 years. On the other hand, one cannot conclude that Hispanics pay higher rates in 2011 or that their rate difference changes over time due to weak statistical significance.

Conclusion and Discussions

This study analyzed mortgage loans that originated during the years 2011–2019 from the 2013, 2016 and 2019 waves of the SCF, which is a nationally representative sample rich with information on income, assets, liabilities, credit experience and demographic characteristics. Weighted regressions with the RII method were utilized in order to properly incorporate the oversampling and multiple implicate techniques employed in the SCF. We hypothesized that faster information diffusion, lower information search cost and more accurate collateral valuation due to advances in information technology would alleviate mortgage-pricing differences across races. Black borrowers on average contracted for mortgage rates 56 bp higher than Whites in the base year, but the gap decreased by 6.6 bp per year, practically eliminating the gap by the end of the sample period. Diminishing differences in rate overage across time may have alternative explanations: low interest rates during the sample period, rising home prices, and different market timing ability across race.

Did Lower Interest Rates Suppress Overage Opportunities?

When interest rates rise in the market, the deposit-lending spread increases and the rate overage opportunity may also grow. However, the sample period of 2011–2019 enjoyed historically low interest rates. The 10-year T-yield averaged 2.31% and ranged within a narrow band of 1.80–2.91%. Accordingly, 30-year fixed-rate mortgage interest rates during the same period stayed within the small range of 3.31–5.05% with a low average of 4.03% (Fig. 1). Low interest rates throughout the sample period do not seem to be related to the changes in the rate overage.

30-year Mortgage Interest Rates during 2011–2019. Source: freddiemac.com (2022)

Did Rising Home Price Asymmetrically Benefit Minority Borrowers?

Nationally, the S&P/Case-Shiller Home Price Index increased by 53% from 139.05 in January 2011 to 212.35 in December 2019 (Fig. 2).Footnote 7 The index went up every year during the period except 2011. Lenders’ overage needs protection from default decreases as home values had an upward trend. In addition, their inability to adjust rates with respect to collateral became less relevant when collateral values had an upward trend. Hence, rising home prices during the sample period may have alleviated the lenders’ motivation for rate overcharges, and partly contributed to the diminishing rate overage. However, home price appreciation alone cannot explain the rate overage disappearance only among the Black borrowers, as long as the appreciation is applicable to the borrowers of all race and ethnicity.

Source: St. Louis Fed (2022)

S&P/Case-Shiller U.S. National Home Price Index 2010–2020.

Did Whites Better Time The Mortgage Market?

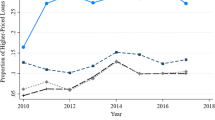

To examine whether the rate differential resulted from the White’s ability to better time the mortgage market, the borrower race distribution across time was examined. Figure 3 shows the racial distribution of borrowers across mortgage origination years. Although the improvement in minority home ownership is noticeable, the racial compositions do not seem to change across years and market timing is not a likely reason for the diminishing rate overage.

In all, the alternative explanations cannot explain the diminishing rate overage among the Black borrowers. Advances in information technologies in the mortgage market seem to cause the reduction in the previous rate overcharges among Black borrowers. The reason for the lack of similar effects among Hispanic borrowers is uncertain and a topic for future studies. Policy makers will be able to finetune the regulation and policies on minority home ownership and mortgage loan support across different sets of minority Americans.

This study focused on the third dimension of racial discrimination-credit overcharge. Further studies on the first two dimensions are also suggested: outright rejection and product steering. Specifically, minority borrowers may be more likely to become victims to predatory lending like the ARM loans with a low introductory rate followed by a big jump. A sample with detailed information on ARM terms would enable such a study.

Data Availability

The SCF does not provide the data such as introductory rate, spread changes, etc.

Notes

A basis point is a standard measure for interest rates and other percentages in finance. One basis point equals 1/100th of 1%, or 0.01%.

Boehm et al. (2006) were not able to control for borrower credit history or net worth, which were not reported by the American Housing Survey.

Bocian et al. (2008) provided no measure of the overage difference and their sample was restricted to first mortgages on owner-occupied homes. In addition, loans were excluded if they were for manufactured housing units, backed by private mortgage insurance, with non-standard amortization schedules or jumbo loans (origination amount greater than $333,700 in most states).

They converted 1 discount point to .15% or .25% in interest rate.

The respondents may have refinanced but answered the origination year of the original mortgage and reported the current rate. It is also possible that these borrowers used very high origination/discount points to lower the rate. Without the origination points, one cannot determine if the mortgage interest rate disclosed by the survey respondent is accurate. Regressions without this exclusion, however, produced qualitatively the same results.

Other things being equal, a mortgage for a newly purchased home charges a lower rate than a refinance loan, but refinance loans in the SCF sample represent selection bias among the borrowers who took advantage of lower interest rates in the market by refinancing. High-rate loans are more likely to be refinanced at a lower rate, and the SCF suffers from this selection bias.

The index value in January 2000 was 100.

References

Baek, H. Y., & Cho, D. D. (2021). Are there racial differences in loan approvals? Applied Economics Letters, 28(4), 260–263.

Bayer, P., Ferreira, F., & Ross, S. (2018). What drives racial and ethnic differences in high-cost mortgages? The role of high-risk lenders. The Review of Financial Studies, 31(1), 175–205.

Bi, L., & Montalto, C. P. (2004). Emergency funds and alternative forms of saving. Financial Services Review, 13(2), 93–109.

Black, H., Boehm, T., & DeGennaro, R. (2003). Is there discrimination in mortgage pricing? The case of overages. Journal of Banking and Finance, 27, 1139–1165.

Black, H., Schweitzer, R., & Mandell, L. (1978). Discrimination in mortgage lending. American Economic Review, 68(2), 186–191.

Board of Governors of the Federal Reserve System (2013). Survey of Consumer Finances, data downloaded on December 8, 2022 from https://www.federalreserve.gov/econres/scfindex.htm.

Board of Governors of the Federal Reserve System (2016). Survey of Consumer Finances, data downloaded on December 8, 2022 from https://www.federalreserve.gov/econres/scfindex.htm.

Board of Governors of the Federal Reserve System (2019). Survey of Consumer Finances, data downloaded on December 8, 2022 from https://www.federalreserve.gov/econres/scfindex.htm.

Bocian, D. G., Ernst, K. S., & Li, W. (2008). Race, ethnicity and subprime home loan pricing. Journal of Economics and Business, 60, 110–124.

Boehm, T. P., Thistle, P. D., & Schlottmann, A. (2006). Rates and race: An analysis of racial disparities in mortgage rates. Housing Policy Debate, 17(1), 109–149.

Cheng, P., Lin, Z., & Liu, Y. (2015). Racial discrepancy in mortgage interest rates. Journal of Real Estate Finance and Economics, 51, 101–120.

Courchane, M., & Nickerson, D. (1997). Discrimination resulting from overage practices. Journal of Financial Services Research, 11, 133–151.

Crawford, G. W., & Rosenblatt, E. (1999). Differences in the cost of mortgage credit implications for discrimination. Journal of Real Estate Finance and Economics, 19(2), 147–159.

Delis, M. D., & Papadopoulos, P. (2019). Mortgage lending discrimination across the U.S.: New methodology and new evidence. Journal of Financial Service Research, 56, 341–368.

Freddie Mac (2022). 30-Year Fixed-Rate Mortgages Since 1971, data downloaded on December 8, 2022 from https://www.freddiemac.com/pmms/pmms30.

Ghent, A. C., Hernandez-Murillo, R., & Owyang, M. T. (2014). Differences in subprime loan pricing across races and neighborhoods. Regional Science and Urban Economics, 48, 199–215.

Haughwout, A., Mayer, C. and Tracy, J. (2009). Subprime mortgage pricing: The impact of race, ethnicity, and gender on the cost of borrowing, Brookings-Wharton Papers on Urban Affairs, 33–63, downloaded on December 8, 2022 from https://www0.gsb.columbia.edu/mygsb/faculty/research/pubfiles/4662/2009%20haughwout%20mayer.pdf.

Lindamood, S., Hanna, S. D., & Bi, L. (2007). Using the Survey of Consumer Finances: Some methodological considerations and issues. Journal of Consumer Affairs, 41(2), 195–214.

Lyons, A. C. (2003). How credit access has changed over time for U.S. households. Journal of Consumer Affairs, 37(2), 231–255.

Rubin, D. B. (1987). Multiple Imputation for Nonresponse in Surveys. New York, NY: John Wiley & Sons.

St. Louis Fed (2022). S&P/Case-Shiller U.S. National Home Price Index, data downloaded on December 8, 2022 from https://fred.stlouisfed.org/series/CSUSHPINSA.

Straight, R. L. (2002). Wealth: Asset-accumulation differences by race-SCF data, 1995 and 1998. American Economic Review, 92(2), 330–334.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Baek, H.Y., Cho, D.D. Are Minorities Still Paying Higher Mortgage Interest Rates?. Int Adv Econ Res 29, 31–47 (2023). https://doi.org/10.1007/s11294-022-09864-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11294-022-09864-5