Abstract

The Limpopo Province is one of the poorer provinces in South Africa, facing the challenges of poverty, inequality and unemployment. To address these challenges the national government of South Africa has embarked on a massive infrastructure program. Our literature review confirmed a positive link between infrastructure development and economic growth. One of the key infrastructure projects that will be implemented in the Limpopo province is the building of a railway line to link the mining belt in the province to the Richards Bay harbour. The coal in the Limpopo province is also a strategic resource that is needed to fuel the coal fired power stations in the neighbouring Mpumalanga province. The short run and long run impacts of the proposed railway line have been simulated using the TERM CGE model.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Limpopo is one of the nine provinces in South Africa and has a population of 5.5 million. In terms of the sectoral contributions to the economy, the provincial economy is largely dependent on mining and quarrying, which contributed one third of the Gross Domestic Product (GDP) of Limpopo in 2011. (Statistics South Africa 2011). However, the expansion of mining activity is hampered by a lack of basic road, rail and water infrastructure. The Limpopo provincial economy is also characterized by severe poverty and inequality. The Gini coefficient for the income distribution is 0.67 (Rex 2012). The unemployment rate was 20.2 % at the end of 2011, while the province also had three million discouraged workers (about 10 % of the work force).

To address these challenges, the South African national government has announced a 400 billion RandFootnote 1 infrastructure project for Limpopo and Mpumalanga, two neighbouring provinces. The intended focus of the project will be the expansion of the rail and road links to the Richards Bay coal harbour in the northeast corner of South Africa, in the province of KwaZulu-Natal. The links should improve the quality of bulk transport services and enable the mines in the two provinces to produce more coal for export purposes and for internal use in the generation of electricity. Most of South Africa’s electricity is generated in coal fired power stations.

The objective of the paper is to evaluate the impacts of the infrastructure initiative on the Limpopo economy. The paper is structured as follows: we start with an overview of the first Strategic Integrated Plan (SIP1) that was released by the South African national government. The rail infrastructure that would be improved as part of SIP1 is the specific focus of this study. In the second part of the paper the link between infrastructure and economic growth is discussed, a link that has clearly been established in the literature (Fedderke and Garlick 2008:4).

The simulations for the study were done on the South African version of the TERMFootnote 2 at the University of Pretoria. The original TERM was developed by the Centre for Policy Studies at Monash University in Australia with the aim to perform regional studies for Australia, such as the one we are conducting (Centre for Policy Studies 2012). The last part of the paper provides an overview of the TERM model and simulation results.

Overview of the First Strategic Integrated Plan

The South African government identified a job creation target of five million jobs to be created by 2020 to address the stubborn high level of long term unemployment that is experienced in South Africa (Presidential Infrastructure Coordinating Committee (PICC) 2012:4). One of the key structural constraints that is hampering job creation in South Africa is the current status of its infrastructure.

The government’s “Infrastructure Plan” is a long term (20-year) centrally planned program aimed at improving and expanding the infrastructure in South Africa. An infrastructure plan has been developed with 645 infrastructure projects currently taking place in South Africa. After the completion of a spatial analysis exercise, 17 strategically integrated projects were identified, of which the project in Limpopo (SIP1) is our focus. SIP1 will try to unlock the untapped mineral resources in the Waterberg districtFootnote 3 of Limpopo. According to PICC (2012:14) the Limpopo province still has the following reserves:

-

18 billion tons of coal

-

6323 tons of platinum

-

5.5 billion tons of chromite

One key project to unleash these mining opportunities is the building of a railway line linking the coal mines to the Richards Bay coal harbour in KwaZulu-Natal. The majority of South Africa’s coal fired power stations are currently located in the Mpumalanga province, which borders the Limpopo province. The railway line will also be used to provide coal to these power stations. In the process the transportation of coal will switch from road to rail, with resultant savings in terms of cost and road maintenance.

The Railway Line to be Constructed

Since actual numbers are not yet available, we use government estimates as well as figures obtained from similar projects to estimate what the size of the investment in the planned railway line will be. The expected capital cost for the section of the railway line that will fall in the Limpopo province is R5.5 billion, which includes the capitalization of future operational costs.Footnote 4 The impact of this investment will be simulated in the short run using the Computable General Equilibrium (CGE) model. We estimate that the total increase in the capital stock with regards to the railway line alone would be about R950 million, using standard cost estimates obtained from the industry. The calculations are given in Table 1.

We anticipate that it will be more efficient and therefore less costly if coal is transported via rail instead of road. In terms of the transportation of manganese it was indicated that the cost could be up to 50 % lower (Bird 2012). Van Der Meulen (2012), however, is sceptical about the efficiency gains that we should expect, due to the historical inefficiency of Transnet, the public institution that provides rail services in South Africa. He found that in some cases it was even more expensive to transport minerals via rail than via road.

In our simulations we assume that the efficiency gain of transporting coal will be 30 %, excluding the savings with regards to road maintenance resulting from less road traffic. The impact of the efficiency gain will also be evaluated in the long run.

The Link Between Infrastructure Expenditure and Economic Growth

A positive link between infrastructure expenditure and economic growth has been highlighted extensively in the literature (World Bank 1994; Development Bank of Southern Africa (DBSA) 1998; Bogetic and Fedderke 2005). The DBSA is mainly responsible for infrastructure development in South Africa and sub-Saharan Africa. According to the DBSA (2006:22) infrastructure expenditure reduces the cost of production and consumption. In the process the expenditure on infrastructure improves the efficiency of the economy. Over time this will lead to higher levels of economic growth. The DBSA also argues that since infrastructure is located in a specific district or region, investment in infrastructure would lead to agglomeration advantages there (DBSA 2006:22).

According to the DBSA, investment in infrastructure could also lead to economic development (DBSA 2006:26). For example, the provisioning of electricity would directly improve the living conditions of households, and allow firms to become more productive, while the provisioning of roads and rail would provide access to markets and other services. Fedderke and Garlick (2008) completed a literature survey on the link between the investment in infrastructure and economic growth. The paper established the following four links between infrastructure and economic growth:

-

Infrastructure may simply be regarded as a direct input into the production process. An increase in infrastructure would boost output and in the process induce economic growth.

-

Infrastructure could be seen as a complement to other factors of production. Better infrastructure would lead to lower cost and higher productivity in the economy. In terms of the specific project that we are evaluating in this study, the establishment of the railway line will enable the mines in the area to increase the production of coal by 23 million tons per annum.

-

Higher expenditure during infrastructure projects can stimulate aggregate demand. While the first two links between infrastructure and the economy are related to the supply side, this factor influences the economy from the demand side.

-

Government can also use infrastructure expenditure as a tool for industrial policy to drive and direct private sector investment.

From the discussion it is clear that a positive link between economic growth and infrastructure is well established.

Description of the TERM Model

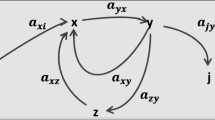

We are using a CGEFootnote 5 model of the South African economy to model the expansion of railway infrastructure in the Limpopo Province, namely the South African TERM (SA-TERM) model. SA-TERM is regional CGE model of all nine provinces in South Africa. SA-TERM is not an econometric or statistical model where the relationships between economic variables are estimated using statistical techniques, such as time-series or cross-sectional regression analysis. It is a typical CGE model that consists of a very large system of equations which describe relationships between economic variables, derived directly from micro economic theory. The said theory mostly assumes that all players in the economy search for optimal solutions, which are found through the maximisation or minimisation of some variables, subject to one or more constraints. The parameters of the equations are either found through econometric estimation techniques, or assumed.

SA-TERM models the interactions of individual or different groups of role players in the economy, such as household groups, industries, labourers, investors, foreign buyers and sellers, and the government. Each provincial economy is modelled separately, in such a way that each province could also be considered as a group, interacting with all the other provinces. The model consists of thousands of equations with endogenous and exogenous variables. The number of endogenous variables must be the same as the number of equations for the system to be solvable, but most equations have exogenous variables also, these values are known or assumed. The endogenous variable values are the solutions to the system of equations found by the computer by using a search algorithm.

The typical approach in our research would be to start with an economy in equilibrium (all markets are at the point where supply is equal to demand), and then change one or more exogenous variables, or we would say, shock one or more exogenous variables, and let the economy converge to a new equilibrium. We would then study the difference between the two states of equilibrium (comparative static analysis).

The SA-TERM model has:

-

27 commodities and 27 industries

-

9 regions representing the nine provinces in South Africa (Limpopo, North West, Mpumalanga, Gauteng, Free State, Northern Cape, Western Cape, Eastern Cape, and KwaZulu-Natal)

-

11 labour types

-

12 household types.

For data it uses the regional social accounting matrices that were developed by Coningarth Economists.

Methodology

The study reports on two sets of simulations. We first look at the short run results of large sums of funds spent in the construction phase of the infrastructure project. In this phase, the new railway line is being constructed and the economies of the provinces are affected through more employment and activity in the construction industry. During the second phase of the project the railway line becomes operational and all the industries that are making use of the new infrastructure benefit through improved productivity through lower transport costs.

Closure and Shocks for the Construction Phase

In typical neo-classical microeconomic terms we assume that the capital stock remains fixed in the short run because there is not enough time for it to adjust to new levels. The only two factors of production that could adjust are labour and material inputs into the production process. Since we typically only keep either the price or the quantity of any variable constant, we allow the rental price of capital to vary, while we keep the national real wage constant in the short run.

In the standard short run closure, total national investment is kept constant to match the short run capital stock assumption, but in this simulation we have to allow total investment to change. This is what the construction phase is all about: exogenously increasing investment in the construction industry. Since the labour market serves as primary driver of much of the economic activity in the regions, we make regional consumption follow regional wage income. However, even though wage income might differ between the regions, we assume that the behaviour of all households will be similar and therefore fix the national propensity to consume. The short run shocks are 50 % increases in investment expenditure in three industries, namely, construction, metal machinery and transport equipment.

Simulation Results for the Construction Phase

In the short run, it is assumed that Limpopo has an upward sloping labour supply curve. The construction of the railway line increases the demand for labour in the province, since capital is fixed and more labour will be hired to increase production. The labour market adjusts via a combination of rising real wages and increased employment (Horridge and Wittwer 2007:6).

Since capital is fixed, the expansion in the said industries increases the marginal product of capital and hence the real return on capital or capital rentals will increase (Horridge and Wittwer 2007:6). We find the expected result in Limpopo, that the capital/labour ratio decreases, while the inverse price ratio, namely the real producer wage/rate of return on capital, also decreases (see Table 2).

We also find that the stimulus of the construction project causes household consumption and investment to increase more than provincial domestic product in Limpopo, which implies that exports must be decreasing. This is due to a real appreciation in the region as the price of (non-traded) construction goods rises relative to other goods and services.

Closure and Shocks for the Operational Phase

In the long run there is enough time for the capital stock to adjust to restore pre-simulation rates of return in each industry. In the labour market we keep the national aggregate level of employment unchanged, while regional labour is imperfectly mobile as in the short run. (Horridge and Wittwer 2007:8). All the capital stocks, except for the transport services industry, are determined endogenously, driven by industry rates of return. A typical long run assumption in CGE models is that we do not expect the balance of trade to move towards an increasing deficit or surplus in the long run, so we assume that the balance remains a constant proportion of GDP. Regional consumption is still following regional wage income, as in the short run, and we also expect government consumption to grow at the same rate as private consumption.

Three sets of shocks are applied in the long run: The first shock is to determine the impact of the increased capital stock on the railway sector in Limpopo, which we increase (shock) by 25 %. The second shock is to improve the productivity of rail freight services between Limpopo and all other provinces by 10 %, while the third set of shocks are on the productivity of all factors of production in three mining industries that will benefit directly from the new railway line, namely, coal mining, other mining, and petrochemicals. We shock the productivity of all factors of production in these industries to improve by five percent.

Simulation Results for the Operational Phase

The results of the long run simulations are given in Table 3. It is clear that the project will have a bigger impact in the long run than in the short run. In the long run the building of the railway line will lead to a 4.46 % increase in Limpopo GDP, while aggregate employment in Limpopo will increase by 1.97 %. Since by assumption, the project does not increase national employment in the long run, Table 3 shows that employment in other provinces will decrease to allow for the increase in employment in Limpopo. In practice, however, it is very likely that much of the increase will come from the unemployed in the Province. In June 2012 the total number of workers in Limpopo was 1,018,000 according to the quarterly labour force survey of Statistics South Africa (2012), so that the building of the new railway line could create up to an additional twenty thousand jobs in Limpopo.

Real private consumption follows labour income in the model, so that the trends in the first row of Table 3 confirm what happens to aggregate employment. Real government expenditure is modelled to follow private consumption, so that we also see the same trend in row three of the table. We exogenously shock the capital stock of transport services to increase in Limpopo, but all other industries’ capital stocks are free to change optimally. The tenth row in Table 3 shows that the aggregate capital stock in Limpopo increases, while it mostly decreases in other provinces. The explanation for this comes from the assumption that the real rate of return of capital, and hence the marginal product of capital (to which it is equal), is fixed in the long run. We increase the productivity of capital in our simulation, but keep aggregate labour constant, so that from a simple production function it is imperative that the capital stock should increase to keep the marginal product of capital fixed. Exports increase from Limpopo because it becomes more productive and therefore less costly. Imports increase because GDP grows and household (labour) income increases.

Conclusion

The new railway line to Lephalale in the Limpopo Province in South Africa will have major economic benefits for the region in terms of increased GDP, resulting from all the expenditure side variables, namely, private and government consumption, private and government investment, and exports. From the simulation results it is clear that it will add significantly to the provincial economy in terms of economic growth and job creation. Although the model is set up such that the increases in labour demand would be supplied from other provinces, we would assume that 20,000 new jobs would be created in the Limpopo province alone.

Notes

Ten South African Rand is approximately equal to one US dollar.

The Enormous Regional Model.

In South Africa the Limpopo province comprises of five districts, one of which is Waterberg.

We estimate that their calculations include operational costs for 20 years into the future.

CGE models are economy-wide models, like Input–output (IO) models, but the structure is more flexible. IO models typically have fixed structures of production with fixed relationships with the elements of final demand. CGE models are able to let households maximise utility subject to budget constraints, while industries minimise costs given certain production technologies and final demand. Cost-benefit models need not be economy-wide, but could study specific sectors of the economy separately.

References

Bird I (2012) Personal Interview on 24 August 2012 in Lephalale, South Africa.

Bogetic, Z., & Fedderke, J. W. (2005). International benchmarking of South Africa’s infrastructure performance Policy Paper no 7 (pp. 1–25). Cape Town: Economic Research Southern Africa.

Centre for Policy Studies (2012) The TERM model Available WWW: http://www.monash.edu.au/policy/term.htm. Accessed 30 Apr 2012.

Development Bank of Southern Africa. (1998). Infrastructure: A foundation for development. Development report. Midrand: Development Bank of Southern Africa.

Development Bank of Southern Africa. (2006). Infrastructure barometer. Midrand: Development Bank of Southern Africa.

Fedderke, J., & Garlick, R. (2008). Infrastructure development and economic growth in South Africa: A review of the accumulated evidence. Working Paper no 12 (pp. 1–29). Pretoria: Economic Research Southern Africa.

Horridge JM, Wittwer G (2007) The economic impacts of a construction project, using SinoTERM, a multi-regional CGE model of China, General Working Paper No. G-164 COPS, Melbourne, pp 1–15.

Presidential Infrastructure Coordinating Committee. (2012). Provincial and local government conference A summary of the Infrastructure plan (pp. 1–34). Pretoria: Presidential Infrastructure Coordinating Committee.

Rex. (2012). Regional explorer database. Pretoria: Global Insight.

Statistics South Africa. (2011). Gross domestic product release. Pretoria: Number P04413 Statistics South Africa.

Statistics South Africa. (2012). 2nd quarterly labour force survey. Pretoria: Number P20112 Statistics South Africa.

Van Der Meulen D (2012) Telephonic interview on 12 April 2012.

World Bank. (1994). World Development Report 1994. Infrastructure for development. New York: Oxford University Press.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Mostert, J.W., Van Heerden, J.H. A Computable General Equilibrium (CGE) Analysis of the Expenditure on Infrastructure in the Limpopo Economy in South Africa. Int Adv Econ Res 21, 227–236 (2015). https://doi.org/10.1007/s11294-015-9524-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11294-015-9524-1