Abstract

We add to the literature on the association of financial knowledge and financial attitudes with financial outcomes by focusing on predominantly low-income Hispanic families. We examine (i) saving for emergencies, for college, and in 401(k) plans, and (ii) ownership of a home, land or rental property, and an investment account. We find that financial knowledge is strongly related to our savings measures and to owning an investment account. Financial attitudes play less of a role, but assume some importance when interacted with financial knowledge. Self-reported financial knowledge in addition to factual financial knowledge is associated with favorable financial outcomes. Our results are important for the upward economic mobility of a demographic group that has received less attention in the literature.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

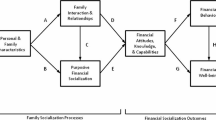

The increasing complexity of financial markets has put an increased research emphasis on the importance of the cognitive financial and numeracy skills necessary to make sound financial decisions about such activities as taking on debt, saving, and planning for retirement. Numerous studies have explored the link between financial literacy and a variety of financial outcomes. Behrman et al. (2010), for example, reported strong evidence that financial literacy is positively associated with wealth accumulation. Hilgert et al. (2003) found that individuals who scored higher on a financial questions quiz had better financial practices. Van Rooij et al. (2011) establish a positive association of financial literacy with stock ownership. Clark et al. (2014) showed that risk-adjusted returns on stock portfolios were higher for those with more financial knowledge, and Grinstein-Weiss et al. (2015) gave compelling evidence of a link between the intensity or “dosage” of financial literacy education and savings outcomes.

The growing literature has also explored the relationship between attitudes and personality traits and a wide range of financial behaviors and outcomes. Attitudes toward delaying gratification, for example, have been shown to affect pension contributions and savings (Hastings and Mitchell 2011) and credit card indebtedness (Meier and Sprenger 2010). Dohmen et al. (2012) showed that an increased willingness to take on risk was associated with an increased probability of holding stocks. Van Campenhout (2015), citing the strong link between attitudes and financial outcomes, made the case that financial literacy interventions and education should include an emphasis on financial attitudes.

Whereas the focus of the research discussed above has primarily been the association of financial literacy or financial attitudes with financial outcomes, our paper takes the discussion further and asks whether financial attitudes affect financial outcomes differently at various levels of financial literacy. Whereas Letkiewicz and Fox (2014) examined whether financial literacy can moderate the effects of conscientiousness on asset accumulation of young adults, our paper examines three financial attitudes: attitudes toward saving, taking risk, and delaying gratification. Of these, delaying gratification is comparable to self-control or conscientiousness. Additionally, the focus of our paper is on low-income Hispanic families. Such research is important because Hispanic families are less likely to use formal financial advice compared to their non-Hispanic white counterparts and also have lower levels of financial literacy relative to non-Hispanic whites, as noted by Olsen and Whitman (2012). This gap in literacy may have important implications for saving, investing, and retirement planning of low-income Hispanic families, but has received less attention in the literature.

Our work is an outgrowth of our ongoing collaboration with a major bank in conducting a five-year investigation of the effects of Individual Development Accounts (IDAs), i.e., incentivized savings accounts, on increasing access to post-secondary education among low-income, primarily Hispanic youth.Footnote 1 The program has led to the development of detailed survey data on financial literacy, attitudes toward delaying gratification, risk aversion and savings, and a wide range of financial outcomes for families from three participating local Title I middle-schools.Footnote 2 Using these data, we examine the association between multiple measures of financial knowledge and financial attitudes with several financial outcomes.

The Sample and the Surveys

We collected data from 137 parents of eighth-grade students in two waves. Wave I was collected during the academic year 2011–2012 and Wave II was collected during the academic year 2012–2013. For the three Title I schools represented in our sample, the proportions of students that were eligible for reduced-price or free lunch in 2012 were 92.2%, 79.9%, and 70.9%, relative to the statewide average of 57.5%.Footnote 3 The proportions of Hispanic students in these schools in 2012 were 90.9%, 64.6%, and 81.7%, compared to the statewide average of 52% (California Department of Education DataQuest 2017). The households that feed into our sample of three schools match more closely the predominantly Hispanic, economically disadvantaged population that feeds into 100 similar state-wide schools that we seek to represent.Footnote 4 With a median household income of $32,500 that is statistically significantly lower than the corresponding value of $45,855 for Hispanics in California, these descriptive statistics verify that our sample is low-income.Footnote 5

Econometric Specification

Our econometric model is set up to assess the association of financial literacy and financial attitudes with financial outcomes, such as whether a family has money set aside in savings for emergency.

where Si * is a latent variable representing a respondent’s perceived difference between the marginal benefit and the marginal cost of setting aside funds for emergencies, which, in turn, depends on financial literacy, financial attitudes, and a vector of control variables such as family income, education, and the number of dependents in the household given by Xi.

In a second model, described in Eq. 2 below, we expand the baseline expression by including an interaction between financial literacy and financial attitudes. For example, it may be that attitudes towards savings elicit different responses on the probability of setting aside emergency funds based on one’s level of financial literacy.

We use binary probit methods to obtain the parameter estimates and report marginal effects for the explanatory variables in our baseline and expanded models.

Description of the Data

Dependent Variables

We analyze the determinants of six financial outcomes in the empirical work that follows: (1) saving for emergencies; (2) saving for children’s college education; (3) saving in a 401(k) or Individual Retirement Account (IRA); (4) home ownership; (5) ownership of land or rental property; and (6) ownership of investment accounts such as stocks and bonds. For the first three savings measures, we used specific questions from the survey to create binary indicators equal to 1 for each instance where a respondent reported that he or she engaged in a particular savings activity. The questions used to elicit the savings information were (1) Have you or your spouse set aside emergency funds that would cover your expenses in case of sickness, job loss, economic downturn, or other emergencies? (2) Are you or your spouse setting aside any money for your children’s college education? (3) Do you or your spouse contribute to a retirement account like a 401(k) or IRA? For the remaining financial outcome measures, we created binary indicators equal to 1 for each case when an individual responded in the affirmative to the following questions: (1) Is the house, apartment, or mobile home where you reside owned by you or someone in the family with a mortgage or loan or owned by you or someone in the family free and clear? (2) Do you or your spouse own other real estate (land, rental property) in the United States or elsewhere? (3) Do you or your spouse have investment accounts (stocks and/or bonds)?Footnote 6

In 2012, while 45% of California households and 40% of U.S. households have set aside “rainy day” funds, only 26% of our respondents had savings set aside for emergencies. Only 20% of our sample had started saving for their children’s college compared to 34% of all U.S. households and 37% of Hispanic households in the U.S. In our sample, 43% had savings in a 401(k) or IRA, compared to 54% of all U.S. households. While 35% of U.S. households own investment accounts, only 11% of households in our sample own investment accounts and 10% of our sample owns land or rental property.Footnote 7 Only 29% of our sample owns their home compared to homeownership rates of 66% for all U.S. households, 46% for Hispanic households in the U.S. and 42% of Hispanic households in California.Footnote 8 , Footnote 9 The null hypotheses that our sample proportions are equal to available corresponding population counterparts are all rejected, indicating low rates of saving and asset ownership in our sample. In conjunction with the low median household income of our sample and the representativeness of our schools with the predominantly Hispanic economically disadvantaged population in similar schools state wide, these low outcome measures reinforce that our underlying population is low-income Hispanic families.

Explanatory Variables

Financial Attitudes

We use three financial attitudes measures as explanatory variables in our empirical work explaining financial outcomes: attitudes towards savings, attitudes toward taking on risk, and attitudes toward delaying gratification, or its converse, present bias. The first set of financial attitudes variables correspond to two queries about attitudes toward saving: (i) what would the respondent do with an extra $200?, where the categories of choices were: spend all now, spend most now, spend half, save most, or save all; and (ii) we asked respondents to express the strength of their agreement with the statement, “I try not to spend all of the money that I have saved.” Responses were based on a Likert-scale. Response options were strongly agree, agree, neutral, disagree, and strongly disagree. We created the savings attitude index by using factor analysis to arrive at a summary measure of savings attitudes based on the above two queries.

We also used three measures of risk-taking behavior. First, we obtained responses to two different gambles. In the first gamble, we asked respondents if they would prefer a 100% chance of winning $30, an 80% chance of winning $45, or a 20% chance of winning nothing. Note that the question was worded so that the expected value of the gamble was greater than the certainty equivalent. Therefore, individuals preferring the certainty equivalent demonstrate rather strong risk aversion. In a second question, we asked respondents to select from the following choices assuming that they had won $1000 in a game show: (1) keep the $1000; (2) flip a coin for a one-half chance to win $2000 and a one-half chance to obtain nothing; or (3) they would take either one. In this scenario, the expected value of the gamble is equal to the certainty equivalent of the prize, and respondents who selected to keep the $1000 exhibit risk aversion. In a final measure of risk aversion, we asked respondents to indicate the strength of their agreement to the following statement: If I had an investment, I would prefer it to offer a high return and risk instead of a guaranteed return. The Likert-scale responses for this statement were: strongly agree, agree, neutral, disagree, and strongly disagree. We again extract a single factor from factor analysis to explain respondents’ risk-taking behavior. We note that we used the original scaled variables, with larger values indicating more willingness to take on risk, in the factor analysis.

A final measure of attitudes was constructed in an effort to assess impatience or present bias. Respondents were asked if they would prefer the $1000 now or some larger amount in 1 year, where we adjusted the larger dollar figures to correspond to simple annual interest rates of 2%, 5%, and 10%. For purposes of the present study, we define a binary indicator for high present bias as a respondent who preferred $1000 today to $1100 a year from today, or an implied discount rate greater than 10%.Footnote 10

In our sample, 64.24% of respondents save most or all of an extra $200 and about 78.84% agree or strongly agree that they try not to spend all of the money they have saved. A large proportion (78.83%) of respondents is risk averse when evaluating gambles, and 24.82% would prefer high risk and return over a guaranteed return. With regard to present bias, 37.96% of respondents would prefer to receive $1000 now rather than $1100 a year from now. To mitigate the possibility that responses may be biased toward what the respondents believe is socially desirable, we assured survey takers that their responses were confidential.

Financial Literacy

Financial Literacy Index

Our survey contained the five widely-used and basic questions that test financial literacy developed by Lusardi and Mitchell (2009). These questions pertain to compound interest, inflation, the relationship between bond prices and interest rates, the impact on total interest payments of a 15-year versus 30-year mortgage, and whether a single stock or a mutual fund was a safer investment. The proportions of our sample that correctly answered the compound interest, inflation, bond price-interest rate relationship, mortgage payment, and stock diversification questions were 60.58%, 48.91%, 13.87%, 60.58%, and 32.15%, respectively, which were each lower than the 75%, 61%, 28%, 75%, and 48% scored by respondents in National Financial Capability Study (2012b, p. 27). This indicates a lower level of financial literacy of our sample. Following the lead of Lusardi and Mitchell (2009) we extract a single financial literacy index using factor analysis where our factor loads for the five questions were 0.53, 0.71, 0.68, 0.79 and 0.86, respectively. Since there is no objective method of deciding on the appropriate procedure to calculate the financial literacy index, we also developed an alternative measure of the financial literacy index using PRIDIT scores that have precedence in this literature (e.g., Letkiewicz and Fox 2014). The PRIDIT scores procedure gives more weight to a correct answer provided to a difficult question. In the interest of space, these computations are available on request.

Self-Reported Scale of Financial Knowledge

Our survey also contained two questions where we asked respondents to assess their own financial knowledge based on a scale from 1 to 7, where the respondent was told that “1” indicated “I don’t know anything” and “7” indicated “I know a lot”, to the questions: (1) How would you rate how much you know about managing money (such as paying bills, balancing the checkbook, etc.)? (2) How would you assess your knowledge of the stock market? We created a binary variable equal to 1 if respondents rated how much they knew about managing money as either 6 or 7. We also created a binary variable equal to 1 if the respondent rated their knowledge of the stock market as 5, 6, or 7, where the cut off included scale 5 in the stock market case on account of the very few responses of 6 or 7.

Financial Knowledge Index

Financial knowledge has been viewed as comprising not just factual knowledge of financial matters, but also confidence in having such knowledge (Asaad 2015; and Allgood and Walstad 2016). In order to capture this measure of financial knowledge, we combine our three measures of financial literacy discussed above, the financial literacy index and the two self-reported Likert-scale measures of financial knowledge, to create a financial knowledge index using factor analysis, and we extracted a single factor to represent the financial knowledge index.

Control Variables

We use a set of respondent characteristics as control variables in our tests. Annual income was set equal to one for respondents with income greater than $45,000 per year. The reference category is families with incomes of $45,000 or less.Footnote 11 Based on responses to the education question, we created a binary indicator if the respondent or her spouse had a BA degree or higher. The reference category holds those cases where both the respondent and the spouse had less than a BA degree. In terms of educational attainment, 30.9% of the U. S. population and 14.5% of the Hispanic population have a BA or more, compared to 15.3% in our sample.Footnote 12 We also control for the number of dependent children and the number of dependent adults in a household. We created a binary indicator for families with 1 to 2 dependent children and a binary indicator for families with 3 to 4 dependent children. The reference category is families with 5 or more dependent children. Analogous binary indicators were created for the number of dependent adults in the household. For 2012, while 43.8% of our sample has 1–2 dependent children, for all U.S. households, this share is 34.8% and for all Hispanic households in the U.S., this share is 44.6%.Footnote 13 The null hypotheses that our measures of educational attainment and presence of 1–2 dependent children in our sample were each equal to the corresponding counterparts for Hispanics in U.S. were not rejected.

Empirical Results

The average marginal effects of the financial knowledge index and financial attitudes on financial outcomes estimated using the binary probit baseline specification in Eq. 1, which do not consider the interaction of financial attitudes and financial knowledge, are reported in Table 1. We consider three savings outcomes: saving for emergency, saving for college, and saving in a 401(k) or IRA, and ownership of three types of assets: a home, land or rental property, and investment accounts. Financial knowledge is strongly related to each of our three savings measures. A one-standard-deviation increase in the financial knowledge index is associated with an increase in the probability of savings for emergencies, saving for college, and saving in a 401(k) or IRA by 11.8, 12.0, and 10.2 percentage points, respectively. To put these estimates in perspective, a 12-percentage-point increase in saving for college associated with a one-standard deviation increase in financial knowledge corresponds to a 61% increase in saving for college. This finding is important in the context of the low educational attainment of Hispanic youth as noted by Song and Elliott (2012) who find that parents’ saving for college is strongly associated with increased attendance at a 4-year college by Hispanic youth. As far as asset ownership is concerned, financial knowledge is related only to ownership of investment accounts. One standard deviation in the index is associated with an 11.7-percentage-point increase in the probability of owing investment accounts.Footnote 14

The dummy variable representing the cohort in Wave II is statistically significant at the 10% level in Column 3. As noted earlier, this cohort was drawn a year later from the same schools as the Wave I cohort. We tested across these samples for differences in demographic characteristics. The notable difference between these two cohorts is that Wave II participants have a much larger percentage of five or more dependent children. Chi-squared tests returned p-values of 0.0011 for the full sample and 0.0079 for the sample restricted to valid observations for the regressions performed. Of the remaining characteristics, only differences in family income warrant further discussion. Based on our binary indicator for higher income families, the descriptive statistics reveal that the Wave I cohort had a higher percentage of higher-income families, though the differences were not statistically significant. The tests returned p-values of 0.1202 for the full sample and 0.1192 for the restricted sample. However, additional analysis of the categorical income measure underlying our binary indicator revealed that the cohort in Wave II had smaller percentages at the very high income and larger percentages at the very low income. Given the binary nature of our income variable, which delineates only those families with incomes of $45,000 or higher, this makes the negative sign for the Wave II variable plausible in the equation explaining savings in 401(k) or IRAs.

Financial attitudes, on the whole, do not show a strong association with savings outcomes and asset ownership, except for the positive impact of the savings attitude index on savings for emergencies and the negative impact of high present bias on owing land or rental property. Table 1 also shows that higher-income households are 16.4 percentage points more likely to save for college, 28.7 percentage points more likely to have savings in a 401(k) or IRA, and are 20.7, 10.1, and 12.7 percentage points more likely to own a home, own land or rental property, or investment accounts respectively. A positive relationship between income and saving is expected since the ability to save is impeded at low income levels where families without savings tend to pay more for basic financial services, as noted by authors such as Caskey (1994). Households with at least one spouse with a BA degree or higher, were 27.7 percentage points more likely to own a house and 14.3 percentage points more likely to own an investment account. Families with 1 to 2 or 3 to 4 dependent children are more likely than larger families with 5 or more dependent children to have savings for emergency and savings for college. Overall, our findings match those of Keister (2000), who compares asset ownership among black and white households and finds that income and education are each important in explaining asset ownership and that an increase in siblings can strain resources of a household, thereby adversely affecting savings.Footnote 15

Table 2 presents the results for the expanded model described in Eq. 2 where we interact financial attitudes with financial knowledge. We report the average marginal effect for each financial attitude evaluated at the 25th, 75th, and 95th percentiles of the financial knowledge index. Our theoretical underpinning for Table 2 is that having a certain financial attitude may not be important to financial outcomes if one does not have the financial knowledge, encompassing both factual and self-reported knowledge components, which are needed to act on those attitudes. This pattern is borne out for owning land or rental property and its association with the savings attitude index (Row 3, Column 5) as well as with the risk-taking index (Row 6, Column 5). A one-standard- deviation increase in the savings attitude index raises the probability of land or rental property ownership by 13.7 percentage points at the 95th percentile of financial knowledge. A one-standard-deviation increase in willingness to take on risk raises the probability of land or rental property ownership by 11.9 percentage points (Row 6, Column 5) at the 95th percentile of the financial knowledge distribution and by 5.1 percentage points (Row 5, Column 5) at the 75th percentile of the financial knowledge distribution.

Elsewhere in Table 2, our results may appear to be against the grain of our theoretical underpinning, but the existence of complicated substitutions among methods of saving and asset ownership make some of our results unintuitive. For instance, risk-taking individuals at the 95th percentile of financial knowledge, relative to non-risk-taking individuals at the same percentile of financial knowledge, are less likely to save in 40lK or IRA (Row 6, Column 3), which are usually safer assets relative to land or rental property. Another such case is when those who have a stronger savings attitude are less likely to hold investment accounts when evaluated at 95th percentile of the knowledge (Row 3, Columns 6a and 6b).Footnote 16 We note that the same marginal effect is positive and significant (and of similar magnitude) in the outcome of owning land or rental property (Row 3, Column 5). Our small sample size limits the conclusions that we can draw from Table 2, but our framework presented here is useful to test whether high levels of financial knowledge when interacted with financial attitudes fetches favorable financial outcomes.

In a final analysis reported in Table 3, we separate out our three components of the financial knowledge index: financial literacy scores and the self-reported measures of stock market knowledge and money management to assess which measure or combination of measures may be more important in explaining our financial outcomes. Panel A uses the financial literacy index in isolation; Panel B; includes only the two self-reported measures of financial knowledge; and Panel C; uses the financial literacy index and both the self-reported financial knowledge measures.

Overall, the results from Table 3 indicate that high financial literacy is associated with ownership of investment accounts. A one standard deviation increase in the financial literacy index is associated with an increase in ownership of investment account by 13.7 percentage points in Panel A and by 10.9 percentage points when self-reported financial knowledge is included in Panel C. Panels B and C indicate that self-reported knowledge of managing money is related with saving in a 401(k) or IRA and saving for college, and self-reported knowledge of the stock market has a strong association with ownership of investment accounts, saving for college, and savings for emergencies. This result on the importance of self-reported knowledge for our sample consisting of predominantly low-income, Hispanic families corroborates the findings of authors such as Asaad (2015) and Allgood and Walstad (2016) who used data from the National Financial Capability Study obtained from extensive surveys conducted in 2012 and 2009. These authors conclude that confidence as measured by self-reported knowledge is needed to convert financial literacy into action and therefore influences financial behaviors.

The five questions used in our study to construct the financial literacy index are the same as the ones used by Assad (2015) and by Allgood and Walstad (2016), but our methodology in calculating the financial literacy index from these five questions differs from the approach used by these authors. Whereas we use the Lusardi (2009) factor analysis and the PRIDIT methods to obtain the financial literacy index, Assad (2015) and Allgood and Walstad (2016) use the number of correct answers to the five financial literacy questions as a measure of financial literacy. With regard to measuring self-assessed knowledge, our question is similar to that asked by these authors, but we separate out the participant’s self-assessed knowledge of money management issues and investing in the stock market by asking them to rate their knowledge on each of these two issues.Footnote 17 It is important to note that our finding of an association of self-reported knowledge with financial decision-making for low-income Hispanic families matches the conclusions of the above-mentioned authors who use large samples that cover the entire United States. Our results suggest that policy measures that focus on increasing both financial literacy and confidence pertaining to financial knowledge will improve financial outcomes for the demographic group that is the focus of our study.

We do not take our findings to necessarily imply causality since it is possible that there is reverse causation from financial outcomes to financial attitudes and financial knowledge. We explored several candidates for instrumental variables for financial knowledge and financial attitudes. However, we could not make a strong case that these potential instruments were exogenous, thus precluding our ability to correct for such potential endogeneity.

Conclusion

Our contribution lies in focusing on financial outcomes that are germane to the upward economic mobility of low-income Hispanic families, a demographic group that has received less attention in literature. Our key results suggest a positive association of financial knowledge with saving for emergencies, saving for children’s college education and 401(k) plans, and for ownership of investment accounts. Income is an important determinant of saving for college, saving in a 401(k) or IRA, and in owning a home, land or rental property, and investment accounts. The presence of up to four dependent children relative to five or more dependent children is associated with saving for emergencies and for college.

Financial attitudes show a much weaker association with financial outcomes, controlling for financial knowledge and other household and personal characteristics. However, we uncover salient relationships of attitudes with outcomes when financial attitudes are interacted with financial knowledge. The small scale of our study limits the generalizability of our results, but the richness of our data arising from our detailed survey provides valuable insights to questions not adequately addressed in the literature for the demographic group of our focus.

Our findings point to the need for policy initiatives to improve financial literacy and thereby enable the low-income Hispanic community to participate in the financial mainstream. Such financial inclusion of low-income populations is important in reducing poverty and income inequality as noted by authors such as Demirguc-Kunt (2014). Furthermore, our finding on the importance of self-reported financial knowledge in attaining favorable financial outcomes highlights the need to promote such confidence in financial knowledge to enable low-income families to attain higher levels of wealth. Future research in this field will benefit from applying our estimation framework to a larger scale data set to explore further the interactive effects of financial knowledge with financial attitudes and how this interaction influences saving and asset ownership patterns for the low-income Hispanic community.

Notes

Details of our IDA program can be found in Bhattacharya et al. (2016).

Title I schools receive special U.S. Department of Education funding based on their high percentage of students from low-income families.

Reduced-price or free-lunch income eligibility is 200% of the poverty-level income stipulated by the federal government (U.S. Department of Health and Human Services 2012 ).

Similar characteristics across the 100 schools include socioeconomic status and ethnicity of pupils. Across our sample of three schools, the weighted averages of the percentage of students eligible for reduced price free lunch and percentage of Hispanics in each school, lie within 95% confidence intervals created by the authors from the data on 100 “similar” schools published by the California Department of Education (2000).

Median household income for Hispanics in California is obtained from Table B19113I Median family income in the past 12 months: Hispanic or Latino householder 2013 American Community Survey 1-year estimates (U.S. Census Bureau 2012a).

IRB procedures were followed. We pilot-tested our questions through cognitive interviews conducted by the university’s social science research center to ensure that the survey takers understood the questions as intended. The surveys were administered in both English and Spanish.

The home ownership rate for the U.S. in 2012 is obtained from Table 14. Homeownership Rates for the US and Regions: 1964 to Present (U.S. Census Bureau 2012b).

Home ownership rates for U.S. Hispanics and California Hispanics are obtained from Table B25003I. Tenure (Hispanic or Latino householder) Universe: Occupied housing units with a householder who is Hispanic or Latino 2012 American Community Survey 1-Year Estimates (U.S. Census Bureau 2012c).

The binary indicators represent what one might consider a positive financial attitude, but we are cognizant that there are no right or wrong answers.

As noted earlier, the state-wide median household income for Hispanics in 2012 was $45,855.

Share of Hispanic and U.S. households with 1–2 dependent children obtained from Table F1. Family Households, by Type, Age of Own Children, Age of Family Members, and Age, Race and Hispanic Origin of Householder: 2012 (U.S. Census Bureau 2012e).

Obstacles to home ownership faced by minority communities is noted by Keister (2000)

Our paper differs from Keister (2000) in methodology and estimation techniques.

Column 6b uses PRIDIT financial literacy scores in the Financial Knowledge Index. Two questions, on the inverse relationship between bonds and interest rate and on which investment was safer (individual stock versus mutual fund), are conceptually most relevant to knowledge of investment accounts, and had the highest weights at 86.13% and 67.85% respectively.

Assad uses a total of three questions to measure self-assessed knowledge, one of which is similar to ours.

References

Allgood, S., & Walstad, W. (2016). The effects of perceived and actual financial literacy on financial behaviors. Economic Inquiry, 54(1), 675–697.

Asaad, C. (2015). Financial literacy and financial behavior: Assessing knowledge and confidence. Financial Services Review, 24(2), 101–117.

Behrman, J., Mitchell, O., Soo, C., & Bravo, D. (2010). Financial literacy, schooling, and wealth accumulation. PARC Working Papers, University of Pennsylvania Scholarly Commons. http://repository.upenn.edu/parc_working_papers/32. Accessed 14 Oct 2015.

Bhattacharya, R., Gill, A., & Stanley, D. (2016). The effectiveness of financial literacy instruction: The role of individual development accounts participation and the intensity of instruction. Journal of Financial Counseling and Planning, 27(1), 20–35.

California Department of Education (2000). Construction of California’s School Characteristics Index and Similar Schools Ranks. http://www.cde.ca.gov/ta/ac/ap/documents/tdgreport0400.pdf. Accessed 17 March 2017.

California Department of Education DataQuest (2017). http://data1.cde.ca.gov/dataquest/. Accessed 17 June 2017.

Caskey, R. (1994). Fringe Banking: Check-Cashing Outlets, Pawnshops, and the Poor. New York: Russel Sage Foundation.

Clark, R. L., Lusardi, A., & Mitchell, O. S. (2014). Financial knowledge and 401(k) investment performance. National Bureau of Economic Research, Working Paper 20137. http://www.nber.org/papers/w20137. Accessed 14 Oct 2015.

Demirguc-Kunt, A. (2014). Presidential address: Financial inclusion. Atlantic Economic Journal, 42(4), 349–356.

Dohmen, T., Falk, A., Huffman, D., & Sunde, U. (2012). The intergenerational transmission of risk and trust attitudes. Review of Economic Studies, 79(2), 645–677.

Grinstein-Weiss, M., Guo, S., Reinertson, V., & Russell, B. (2015). Financial education and savings outcomes for low-income IDA participants: does age make a difference? The Journal of Consumer Affairs, 49(1), 156–185.

Hastings, J. S., & Mitchell, O. S. (2011). How financial literacy and impatience shape retirement wealth and investment behaviors. National Bureau of Economic Research, Working Paper 16740. http://www.nber.org/papers/w16740.pdf. Accessed 1 March 2017.

Hilgert, M. A., Hogarth, J. M., & Beverly, S. G. (2003). Household financial management: the connection between knowledge and behavior. Federal Reserve Bulletin, 89(7), 309–322.

Keister. (2000). Race and wealth inequality: The impact of racial differences in asset ownership on the distribution of household wealth. Social Science Research, 29, 477–502.

Letkiewicz, J. C., & Fox, J. J. (2014). Conscientiousness, financial literacy, and asset accumulation of young adults. Journal of Consumer Affairs, 48(2), 274–300.

Lusardi, A., & Mitchell, O. (2009). How ordinary consumers make complex economic decisions: Financial literacy and retirement readiness. IDEAS Working Paper Series from RePEc.

Meier, S., & Sprenger, C. (2010). Present-biased preferences and credit card borrowing. American Economic Journal: Applied Economics, 2(1), 193–210.

National Financial Capability Study (2012a). FINRA Foundation. http://www.usfinancialcapability.org/results.php?region=CA. Accessed 1 March 2017.

National Financial Capability Study (2012b). FINRA Foundation. http://www.usfinancialcapability.org/downloads/NFCS_2012_Report_Natl_Findings.pdf. Accessed 1 March 2017.

Olsen, A., & Whitman, K. (2012). An Overview of Contemporary Financial Education Initiatives Aimed at Minority Populations. In D. J. Lamdin (Ed.), Consumer Knowledge and Financial Decisions: Lifespan Perspectives (pp. 77–97). International Series on Consumer Science. New York and Heidelberg: Springer.

Song, H., & Elliott, W. (2012). The effects of parents’ college savings on college expectations and hispanic youth's four-year college attendance. Children and Youth Services Review, 34(9), 1845–1852.

U.S. Census Bureau. (2012a). Table B19113I, Median family income for California for past 12 months universe: families with a householder who is Hispanic or Latino. 2013 American Community Survey 1-Year Estimates. https://factfinder.census.gov/faces/tableservices/jsf/pages/productview.xhtml?pid=ACS_12_1YR_B19113I&prodType=table. Accessed 17 June 2017.

U.S. Census Bureau. (2012b). Table 14, Home ownership rates for the U.S. Homeownership Rates for the U.S. and Regions: 1964 to Present. https://www.census.gov/housing/hvs/data/histtabs.html. Accessed 10 June 2017.

U.S. Census Bureau. (2012c). Table B25003I, Home ownership rates for U.S. Hispanics and California Hispanics. https://factfinder.census.gov/faces/tableservices/jsf/pages/productview.xhtml?pid=ACS_12_1YR_B25003I&prodType=table. Accessed 17 June 2017.

U.S. Census Bureau. (2012d). Current Population Survey, 2012 Annual Social and Economic Supplement.

U.S. Census Bureau.(2012e). Table F1. Family Households, by Type, Age of Own Children, Age of Family Members, and Age, Race and Hispanic Origin of Householder: 2012 https://www.census.gov/data/tables/2012/demo/families/cps-2012.html. Accessed 17 June 2017.

U.S. Department of Health and Human Services (2012) https://aspe.hhs.gov/2012-hhs-poverty-guidelines. Accessed June 6 2017.

Van Campenhout, G. (2015). Revaluing the role of parents as financial socialization agents in youth financial literacy programs. The Journal of Consumer Affairs, 49(1), 186–222.

Van Rooij, M., Lusardi, A., & Alessie, R. (2011). Financial literacy and stock market participation. Journal of Financial Economics, 101(2), 449–472.

Acknowledgements

The research conducted in this paper is part of the U.S. Bank Economic Empowerment Program with the Center for Economic Education at California State University at Fullerton. The authors acknowledge research assistance from Joshua Mitton and thank anonymous referees for their suggestions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Gill, A., Bhattacharya, R. The Interaction of Financial Attitudes and Financial Knowledge: Evidence for Low-Income Hispanic Families. Atl Econ J 45, 497–510 (2017). https://doi.org/10.1007/s11293-017-9556-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11293-017-9556-4