Abstract

Sustainability assessment can be used as a basic managerial analysis to evaluate the capability of water resources in supplying associated demands. Alteration of management policies in order to improve the systems’ performance and sustainability can lead to additional costs of system operation. In this study a novel framework is proposed for assessing economic life cycle costs of dams considering system’s performance from sustainability aspect. For convenience, the term Life Cycle Costs (LCC) is used instead of Economic LCC throughout this paper. First, a fuzzy model is proposed to discount and estimate the LCC of dams in different time intervals of their life span including: Construction, Operation and Maintenance (M&O), and Disposal periods. The model is capable of reflecting uncertainties caused by estimation and previsions of different costs because of fuzzy theory application. Then, sustainability of dam performance in operation period is evaluated through triple criteria of Reliability, Reversibility, and Vulnerability (R-R-V). To provide more realistic results, different system performance levels are defined based on the system’s capability to supply demands and the importance of each level is evaluated by weighting them. Furthermore, it is studied how changes in reservoirs operation strategies can reduce the LCC because of higher performance. The proposed methodology is applied to assess the LCC and performance of a dam located at North Eastern part of Iran. The results show that the system’s performance is remarkably enhanced when the operating rules are revised and this change will intangibly reduce the economic benefits.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Life Cycle Cost Assessment (LCCA) is an organized analysis of entire costs of a project or property. From a technical perspective Life Cycle Cost (LCC) is an economic model for pricing equipment and the process over life span of a production plant (Ong et al. 2012). Two important terms are in the definition of LCC. The first term is the life span of a project in which different phases can be defined. Although various phases can be defined for life span of a project (Laura and Vicente 2014), the traditional categorization consists three periods of construction, maintenance and operation, and disposal as the main phases (Taylor 1981). Cost is the second term that can be evaluated from various aspects. It should be noted the linguistic term “cost elements” carries two meanings of cost and profit elements throughout this paper. Based on the time intervals mentioned above, cost components can be ordered in four prime elements: research and development, production and construction, operation and maintenance, and retirement and disposal costs (Dhillon 1981). From the economic point of view each of these ordered costs can be classified into direct and indirect costs. Direct costs are imposed on project directly while indirect costs relate to effects of project (Love et al. 2006) such as agriculture development.

There are various models that have been developed in order to evaluate or optimize the LCC of a product or project. The most general methods for estimating LCC of projects is the Harvey method (Woodward 1997) in which the LCC of an asset or project is evaluated by defining the cost elements of interests, cost structure, cost estimating relationship, and establishing the method of formulation such as Kaufman formulation (Woodward 1997). One of the structures which is derived from Harvey method and mainly developed in order to compare the alternatives of a given project is Fabrycky and Blanchard (1991) structure. This framework is organized based on identification of alternatives for a project, development of Cost Breakdown Structure (CBS) (Cople and Brick 2010), selection of the cost model for analysis, and sensitivity analysis of cost factors (Zhu et al. 2012). Another structure which attempts to optimize the ownership costs by gathering and systematizing cost factors of products or assets is Woodward (1997) structure. This process is done by establishing of operation profiles of an asset, identifying all cost elements incurred during the assets’ operation life, and discounting the costs according to an assumed inflation rate. Activity based costing (ABC) model is the other model which minimizes the costs through an optimization algorithm considering hierarchy of activities and relation between different cost drivers (Cobas et al. 1996). The last model which aims to assess the trade-off between costs and performance of a system is called design to cost (DTS) model (Durairaj et al. 2002) which mainly focuses on the design procedures that can lead to reduction of final cost of a given product.

All the reviewed LCC structures need a mathematical model for calculation of Net Present Value (NPV). NPV is the sum of the present values of all net incomes earned during the exploitation period of a project (Hanafizadeh and Latif 2011). The developed models for computing NPV can be categorized into two groups. The first group contains those models which cannot reflect the uncertainties such as those used in researches of Bromilow and Pawsey (1987), and Al-Hajj and Horner (1998). The major advantage of these models is their simplicity but they are highly dependent on data availability which makes their application in real cases difficult. In infrastructure development projects like dam construction with a life span of more than a decade, the engineering judgments for cost estimation will be involved in LCC computations as well as the gaps or unavailability of economic data. Hence, the errors due to incomplete data and inaccurate judgments can cause considerable bias in calculations. Using fuzzy approaches in discounting calculations is one of the solutions for taking into account the uncertainties and provides more reliable results. Based on Ross (2009), the first cost estimation fuzzy model has been proposed in 1991 in which cost elements are considered as different linguistic variables. The proposed fuzzy model by Sobanjo (1999) is another cost estimation fuzzy model in which cost elements are considered as fuzzy functions, and inflation rate and time are non-fuzzy variables. The more comprehensive model which considers all input variables as fuzzy functions is the Kishk and Al-Hajj (2000) model. This model does not have the restrictions of previous models. In other words, extending the use of fuzzy functions to all the input variables lets the modeler to take account of the other variables’ uncertainties.

In contradiction to LCC, sustainability has various aspects because a system can be evaluated from different perspectives. Sustainability can be defined as a decision making process leading to reduction of failure probability (Shamir 1996), or coordinating the social, economic and environmental goals (Raskin et al. 1996), or even as improving the quality of human life (Kundzewicz 1999). From managerial perspective, sustainability is a practice for improving decision making process (Gibson 2006). Considering this definition as the base, two main goals can be inferred: boosting a system’s sustainability by revision of decision making process (Morrison-Saunders and Pope 2013) and reflecting the social aspects (Slootweg and Jones 2011) which makes the evaluations more dynamic and realistic. This evaluation can be performed through indicators (McLaren and Simonovic 1999), guidelines (Makoni et al. 2001) or criteria (Takeuchi et al. 1998). In this study, the sustainability of dams operation is assessed based on triple criteria of Reliability-Resilience-Vulnerability (R-R-V) which are the most used and useful criteria in evaluating and measuring a system’s sustainability (Duckstein and Parent 1994; Loucks 1997).

In this paper, a new framework is proposed for assessing the LCC of dam projects based on Harvey method (Woodward 1997). The structure of the proposed framework is organized by applying the cost breakdown in three periods of Construction, M&O and Disposal which constitute the life span of dam projects. Two novel approaches are introduced for assessing economic profits of M&O period considering study scope which allows one to estimate the costs of this period based on data availability. In other part of the present study, a classical method of evaluating systems’ performance as a measure of system sustainability is revised by using two techniques of defining and weighting different performance levels and water demands. The flexibility and yielding more realistic results are two most important features of this revised model of system performance evaluation.

2 Methodology

Dam construction pursues various aims in environmental, economic, and social aspects. Since this study focuses on the economic aspects of the dams through their lifespans, the economic considerations mainly determine the borders of study scope. Whereas the direct costs and data availability specify the primary boundaries, the indirect costs which stem from exporting electricity and/or water as economic goods, industrial and agricultural development of the region can result in more widespread boundaries.

Based on the goal of this paper, methodology section is divided into two parts. The first part details the cost structure of LCC evaluation and explains the fuzzy model of discounting through which the total cost is estimated. In the second part, the proposed sustainability assessment process using R-R-V criteria is explained. These two parts relate together through operating policies where the performance of the system affect the economic costs and vice versa. Hence, the LCC of dam projects can be connected to their performance throughout their life span based on changing operating policies and monitoring the consequent changes in system’s performance and economic costs.

2.1 LCC Framework

Cost structure which is the main component of the framework may be developed based on the different processes or the time intervals in the projects life-span. Since services are provided for a long-term period in infrastructures development, classifying costs according to different periods of system operation would be an efficient approach. The mathematical model for discounting costs is the second component of this framework. The proposed model in this paper is a fuzzy model which is capable of reflecting the uncertainties of different cost elements.

2.1.1 Construction Period

Although this period is known as the first phase of the project costs, there may be some unseen costs before the start of construction. In dam construction projects, feasibility studies and the initial experiments result in considerable costs which may occur in an interval longer than construction period. Thus, these costs constitute a part of LCC. In addition to preconstruction costs, construction costs accrue to construction period. Four basic cost elements constitute these types of cost as shown in Fig. 1. However, the whole required information may not be available for all activities. To evaluate the construction costs when there are no detailed data about activities is the analysis of capital investments which are actually the big budgets allocated to infrastructure projects. This process is indicated by dotted lines in Fig. 1. Using dotted lines implies that this method is not imperative but it would be necessary if the detailed data is not available. These investments may be made at different intervals of construction or preconstruction periods. So, it is necessary to take into account the discounting calculations for these costs.

2.1.2 Maintenance and Operation (M&O) Period

Such as the most projects, this period is the most important interval in the dams’ lifespan economy. The key point about economic interactions of this period is the variation of discount rate and the financial profits that the project makes. Unlike the construction period, the M&O period may last for many decades. The discount rate varies according to economic changes throughout this time interval and unawareness about the exact values of discount rate in this period creates uncertainties in discounting calculations. The application of fuzzy approach for computing the costs helps to reflect these uncertainties.

As previously mentioned, the scope of study determines the constraints on evaluation. The more the scope spreads, the more cost elements engage in calculations and therefore uncertainties increase. In this paper, two new approaches are proposed for estimating M&O profits of dam projects based on the boundaries of study scope. The first proposed approach which is Profit Estimation based on Basic Data Availability (PEBDA) approach limits the profitable elements to the direct profits. Only the profits which are economically related to the project and directly affect it are taken into account. Solid bubbles in Fig. 2 illustrate the cost elements of the PEBDA approach throughout the M&O period. Using PEBDA approach, the dam project’s profitable elements are confined to selling and/or exporting water, generating electricity, flood control, fishery, and recreation plans which benefit the project directly. Furthermore, since the costs on maintenance and operation are practically not as vast as construction costs, they can be categorized into two groups of manpower and replacement-procurement costs. To facilitate the calculations, these costs are converted into annual costs.

The second proposed approach is Profit Estimation based on Detailed Data Availability (PEDDA) approach. This approach considers both direct and indirect profits. In this way, the profits include the broader range of economic revenues such as incomes from agricultural and industrial development. In Fig. 2, the dotted bubbles signify the complementary components of PEDDA approach process. PEDDA approach helps to estimate the indirect incomes of agricultural and industrial development which are connected by dotted lines to profits bubble (Fig. 2) as extra economic benefits. The annual incomes from development of a region can be related to the amount of water provided for agricultural and industrial demands. As for the flood control section which seems to be a quit complicated part to calculate, the profitability of the project can be measured by the damage severity of the floods that are mitigated. Finally, after calculation and estimation of all cost elements, the discount rate is applied. The PEDDA approach requires more elaborate structure for computing the final profits in M&O period and as a result, more uncertainties are created by this procedure.

It is obvious that a comprehensive economic analysis of M&O period needs an extensive collection of information about cost elements. In unconstructed dam projects, the data is limited to historical records of region’s rivers and the value of farmlands. In such conditions, the cost elements are estimated with high level of uncertainties and complexity. Figuge 3 shows the estimation process of profits earned by released water. The procedure is founded on determining reservoir’s storage and amount of released water based on continuity equation, Standard Operation Policy (SOP), and regional demands. Eq. 1 represents the continuity equation in which reservoir’s storage at each time step is determined through the equation variables at the previous time step.

where the S, I, P, R, E, and Se are the amount of reservoir storage, river discharge (reservoir input), precipitation, released water, evaporation, and sediment, respectively. The index t represents the time step. There are two constraints which limit the reservoir’s storage to be between maximum capacity (Smax) and minimum capacity (Smin) of the reservoir. The first constraint (Eq. 2) says that if the storage is higher than maximum capacity then overflow volume (S O ) equals the difference between storage and maximum capacity, and so the modified amount of storage is considered as S. The second constraint (Eq. 3) shows that if the reservoir’s storage is lower than minimum capacity, then the amount of released water should be decreased to its modified amount (R tr ) in order to satisfy the constraint. To solve this problem, the variables at the right side of the Eq. 1 should be determined. The river discharge, precipitation, and evaporation are obtained from hydrology and meteorology studies. The amount of sediment is estimated by sedimentology studies.

However, the key variable in the equation is the released water which is usually specified by SOP, management policies, and the region demands. Using the mentioned information and storage level of reservoir at each time step, the reservoir’s storage at next step is determined. The lower loop in Fig. 3 illustrates this process. The dashed connection in this figure, states that the obtained value for reservoir storage with values of the other variables of continuity equation at each time step are used as the input variables in Eq. 1 for the next time step. After determining the reservoir’s storage and consequently amount of released water, the profits can be estimated using one of the PEBDA or PEDDA approaches. The upper part of flowchart in Fig. 3 shows the calculation process for profits according to PEBDA approach (with just solid bubbles) and PEDDA approach (with both solid and dotted bubbles). Considering PEBDA approach, after determining the quantity of released water, dependent profit elements which emerge from generating electricity, water allocation, and fishery are calculated. Simultaneously, the independent elements such as flood control and incomes from recreational plans are estimated. After determining the profit elements at each time step of M&O period, discount rate can be applied to finalize the estimation of profit elements.

2.1.3 Disposal Period

This period is the last period of the dams’ life span. When the effectiveness of dam operation considerably decreases, the dam is disused. This period is the most insignificant period from economic point of view and is the shortest period compared with other two periods. Hence, the discount rate change is too small and can be neglected. Figure 4 demonstrates the cost elements for this period. As shown, resale or salvage value of equipment can be considered as the only profitable element of this period. Also the disposal cost consists of machinery and equipment cost, energy cost, and manpower cost. Such as the two other periods evaluating the costs of this period is highly dependent on data availability. The data unavailability and the fact that this period has the farthest distance from beginning time, increase the uncertainties in discounting costs of this period.

2.1.4 Fuzzy Discounting Model

After specifying the cost elements for different periods, in order to perform economic analysis and obtain LCC, the model of discounting is developed. Since the uncertainty is one of the impartible components of costs elements, the proposed model must be capable of reflecting uncertainties appropriately. Fuzzy models as a flexible tool in reflecting uncertainties can be used for such calculations. The Eq. 4 represents the fuzzy form of the present value model (Kishk and Al-Hajj 2000).

where NPV is the net present value, C0 is investment costs, PWA is present worth factor of annual recurring cost, A j is the j th undiscounted annual recurring cost, C k and PWN k are the k th undiscounted recurring non-annual cost and discounting factor for k th non-annual recurring cost, PWS and S are the present worth factor for a single future cost and whole salvage value of project at the end of the analysis period, and nar and nnr are the number of annual recurring costs and number of non-annual recurring costs, respectively. The tilde mark over the terms indicates the fuzzy forms of the variables. In supplementary Eq. 5 to 7, r, T, n, and t are the discount rate, length of analysis period, number of recurrences of a non-annual recurring cost, and frequencies of non-annual recurring costs.

In the next step, the computational method is specified. Vertex method (Dubois et al. 2004) as an approximate method of extension for performing computation in fuzzy models is used for carrying out the calculations of NPW function in this paper. The simplicity and adjustable accuracy are the most considerable advantages of this method. The basis of the method is partitioning the membership functions into crisp sets by the cuts known as λ-cut. A cut of fuzzy set B at λ level is a crisp set which is defined by:

where x, X, and μ are argument, domain, and membership. By increasing the number of cuts or decreasing the distance between λ cut levels, the accuracy of results for output membership function increases. Assuming that the NPW function is a continuous function, the values of NPW membership function at each level of λ is computed through vertex method as follows:

where f is discounting function (Eq. 4). The C0λ, A jλ, C kλ, r λ, Tλ, t kλ, n kλ, and Sλ are the values of C0 (investment costs), A j (the j th undiscounted annual recurring cost), C k (k th undiscounted recurring non-annual cost), r (discount rate), T (length of analysis period), t k (frequencies of non-annual recurring costs), and S (salvage value of project) at the λ level. Although some terms of Eq. 4 have fractional parts, none of them has discontinuity and therefore the NPW is a continuous function. The proposed method, in addition to discounting costs, can be used for other economic evaluations such as cost-benefit analysis. For this purpose, the costs and benefits must be calculated separately.

2.2 System’s Performance

Although the economic profitability may be of paramount importance, there is no doubt that the supply of regional water demand in M&O period is of high priority. As previously mentioned, the main goal of this paper is assessing the economic aspect of dams considering their performance. To this intent, system performance is monitored through the proposed sustainability assessment method. The flexible structure of this method helps researcher to obtain a more realistic image of system status. Reliability, Resilience, and Vulnerability (R-R-V) are three criteria of this method for assessing the system sustainability. Defining different levels of system performance besides weighting of demands and the levels are two techniques which are employed to make the assessment more flexible. The components of the proposed methods are explained in the following sections in detail.

2.2.1 R-R-V Criteria

The R-R-V criteria are the most widely used criteria for assessing the system performance in water resource management. The first criterion, reliability, is generally defined as the probability of non-failure state of system (Hashimoto et al. 1982). The failure of a system is an unsatisfactory state which is defined according to system tasks. For dams, the deficiency in supply of demands is usually considered as failure state. Four practical forms can be derived from this general definition: occurrence reliability, volumetric reliability, temporal reliability, and annual reliability (Kundzewicz and Kindler 1995). The volumetric reliability is used in this study for reservoir reliability assessment because of its capability for including water deficit which reflects the socio-economic aspects of reservoir operation (Klemeš et al. 1981). The volumetric form of reliability is formulated as follows:

where Rel v , D, and Y, and t correspond to volumetric reliability, water demand, supplied water and time step, respectively. T is the length of the system performance assessment period. The second criterion, resilience, is defined as likelihood of return to normal operation after a failure. Assuming that the probability of failure in all circumstances is constant, the mathematical form of resilience would be as follows:

where Res 1 , d (j), and M are average system resilience, duration of the j th failure event, and total number of failure events, respectively. The advantage of using average resilience is that all failure events participate in calculations. Resilience can also be defined as the maximum consecutive duration that the system spends in an unsatisfactory state (Moy et al. 1986). In this way the mathematical form of resilience would be:

where R 2 and d (j) are resilience based on maximum value and duration of the j th failure event. Kundzewicz and Chalupka (1995) argued that the definition based on maximum value better reflects the system’s behavior, but it must be noted that this definition ignores the other failure events. The first definition is more appropriate for long term analysis and the second one can be used for short term analysis of extreme events. Therefore, the first approach is used in this study.

The last criterion, vulnerability, which relates to the failure periods such as resilience, is defined as damage probability of a failure event. The damage is explained by the water deficit in a given period. Such as resilience, two forms can be considered for vulnerability. Assuming that the probabilities of all damage occurrences are equal, the Eq. 13 is obtained for mean vulnerability. Furthermore, Eq. 14 can be used for vulnerability estimation based on maximum value.

where Vul 1 , Vul 2 , and v (j) are vulnerability based on mean value, vulnerability based on maximum value, and deficit volume of j th failure event respectively. D t and Y t are the water demand and supplied water. As can be seen, the outcomes of Eq. 13 and 14 may be bigger than 1. For comparability purpose with two other system performance criteria, the vulnerability values are normalized. Hence, the Eq. 13 and 14 are divided by the maximum value of vulnerability and the relative vulnerability is defined as (Kjeldsen and Rosbjerg 2001):

where rVul (j) and Vul (j) are the relative and absolute vulnerability of j th failure event. The denominator shows the maximum vulnerability of all failure events. In this paper the average resilience and vulnerability are used in assessment of dam performance.

2.2.2 Sustainability

The reliability, resiliency and vulnerability are the main components by which the system performance is measured. Increase in reliability and/or resilience leads to a more sustainable performance; conversely, increase in vulnerability shows a more unsustainable performance of a system. Since sustainability has direct relation with reliability and resilience, and an inverse relation with vulnerability, it can be mathematically defined as Eq. 16 (Kjeldsen and Rosbjerg 2001).

where Sus and i are the sustainability and the number of time step.

2.2.3 Defining Performance Level and Weighting

The offered method for assessing performance of water resource is a classic method. The main disadvantage of this method is that a single threshold is considered as a boundary between the failure and non-failure states. Supplying all the water demands in all time steps is impractical due to dam inflow variability. So, a fixed threshold for desired system performance may lead to an unrealistic evaluation of system status. Or in cases with small water supply deficiency for a long period such as application of hedging rules, resilience value would be much smaller than one according to Eq. 11. In these cases, in spite of close-to-one values of reliability and vulnerability and the fact that the system performance is acceptable, sustainability would be close to 0.

In order to overcome this problem, performance levels are defined in which a certain percentage of each demand can be supplied. For instance, L1, L2, and L3 may be performance levels of system at which the first 40, 70, and 100 % of demands are supplied, respectively. Due to supplying the critical portion of demands, L1 is the most important level; accordingly L2 and L3 are second and third important levels, respectively. It should be noted that the importance of supplying each category of demands is different. Usually, domestic water demand takes the first priority. Therefore, depending on the priority of various demands, their supply percentages differ at a certain level; e.g. the percentages of supplying at L1 are 90, 80, 50, and 30 % for domestic, environmental, industrial, and agricultural water demands, respectively.

In the first step, the weights of each category of water demand and performance level are determined. Since the first performance level represents the critical status of a system, it is better to formulate the weights demands according to amounts of water demands at this level. Hence, the weight of each water demand category is calculated at the first performance level by Eq. 17.

where w d (k), P k , and D k are the normalized weight of water demand, percentage of supply of water demand at first level, and amount of water demand in k th category, respectively. nd is the number of demand categories. Using the demand categories weights in different performance levels, the weight of each system performance level is defined as follows:

where w l(m) and nl are the initial weight of m th performance level and the number of defined performance levels, respectively. D j is the amount of water demand in j th category and w dj is the weight of j th water demand category. For a given demand, P is the percentage of supply and the first lower index in P shows the level number at which the demand is supplied and the second lower index is the category number. The weights are normalized as follows:

where w ln(m) and w l (i) are the normalized weight of m th performance level and initial weight of the i th performance level. It should be noted that water deficit which is the main component of reliability and vulnerability criteria is substituted into the equations in weighted form. The related weights are calculated by Eq. 17 and 19. Taking a closer look at presented equations for R-R-V criteria reveals that the only criterion which is not a function of water deficit is resilience. For this criterion, the failure state can be redefined based on the levels of performance. In means that the threshold of complete supply of all demands (the highest level) can be shifted to lower levels; e.g. if the highest level is level 5, the failure level can be lowered from level 5 to level 4 or 3. Consequently, the new failure level is used as the threshold of supplying demands for reliability and vulnerability criterion.

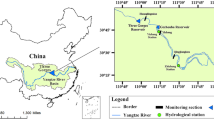

3 Case Study

A real dam located in north eastern part of Iran which is being constructed is considered as the case study of this paper. There are varieties of domestic, environmental, industrial, and agricultural water demands which are supposed to be supplied by this reservoir. The monthly demands for each of these groups are given in Table 1. Downstream of this reservoir, an irrigation and drainage network with an area of 2.1 km2 is being developed and its water demand is supplied through this reservoir. All of the costs and benefits of this side project are a part of the dam project. The useful life of the reservoir and irrigation and drainage network are estimated to be 50 and 30 years, respectively.

4 Results

4.1 Cost Elements of Construction Period

The cost elements for construction period have been derived from second phase of economic studies of this dam. The whole construction cost has been estimated to be about $12.7 million. The land costs have been estimated based on the cost of farmlands areas, cost of defunct facilities, and access roads which will be drown after reservoir inundation. The area of inundated lands is 100 acres which half of it is arable and the other half is arid. The land cost is $4 thousand for an acre of farmland. The economic cost of whole damages and the costs of resettlements are estimated to be about $100 thousand. Thus, the final cost for this section is approximately $300 thousand. The initial studies costs which are a part of preconstruction costs have been estimated to be at least $690 thousand. The irrigation network project costs about 20 % of the dam construction cost. The cost elements have been estimated based on Rial equivalent value in year 2006. Due to the short span of these periods, the discount rate was neglected in cost calculations.

4.2 Cost Elements of M&O Period

The useful life or the M&O span of project is considered to be 50 years. The approximations of costs in this period including manpower costs and replacement-procurement costs show that the annual expenses for dam project and irrigation network are 0.6 and 1.3 % of their construction costs, respectively. Also, since the useful life of irrigation system is 30 years, the renewal costs of this system which is equal to its construction cost, should be taken into account for the second time at end of the year 30. Since the dam is not a hydroelectric dam and there are no facilities for recreational plans, the cost elements related to these sections are eliminated in calculations. Also the allocated water to environmental demand is considered as an obligation for the project and supply of this demand has no economic value and should not be involved in calculations. There is no export of water in the project scheme and it is also eliminated from calculations.

There are 3 cost elements remained in water allocation section: domestic, industrial, and agricultural demands. The profit of these elements has been calculated according to the amount of supplied water for each demand in each month. The water tariff has been applied in linear form and water rate is $0.2 per m3. Based on the available data, the indirect incomes of water allocation are just calculated for agricultural development section. Table 2 represents the cropping pattern for farmlands and economic parameters of crops. The detailed calculations have been performed based on the annual crop yields (Ghahraman and Sepaskhah 2004).

As a result of agricultural development in the region, livestock industry would flourish. The investigations show that the annual net income would grow to $400 thousand. These profits are also taken into account as a part of agricultural development profit. Fishery is another project scheme which has been planned to develop by using the dam’s lake. Based on the available information, the annual income of fishery section would be around $97 thousand.

The last remaining cost element relates to flood control benefits. Since the dam protects the downstream lands from flooding, the economic benefits would be earned through this way. The cost estimation is based on the flooding inundated area and the damages that flood could cause. According to the hydrological studies in this region, the probability of the flood occurrence and flood peak discharge are 0.2 and 60.5 m3/s, respectively. So, the calculation of profits must be performed for 5-year time steps. The downstream lands which are inundated during design flood have an area of 12 acres and all are farmlands. Since the gross income of one acre of farmland is $1,130, the net income from flood damages mitigation would be approximately $200 thousand.

4.3 Cost Elements of Disposal Period

In this study, there is no information about disposal period. Basically, disposal period of dams usually is not taken into consideration and most of projects are not analyzed from this point of view in Iran. Therefore, in the absence of information of similar projects, the estimation of costs in this period is difficult. In a comprehensive study by Otto (2000), 25 dams have been studied where eighteen of them are small dams. For 10 of these 25 dams, actual disposal costs were only 37 % on average of the estimated repair costs. In this case study, because of lack of information, the disposal costs is considered to be 37 % of the life span repair costs.

4.4 Discounting Model and Economic Analysis

To develop the fuzzy model of discounting, after determining the cost elements, the membership of variables are specified. Figure 5 shows the typical form of membership function used for variables of NPW function (Eq. 4) in this study. Owing to high level of uncertainty in all variables, the effective domain of MFs has been extended to very high and low values. As previously mentioned, the discount rate may change during the life span of the project and this change is assumed to be linear over the M&O period. The initial value in the first year and final value in the year 50 for discount rate are assumed to be 0.05 and 0.3, respectively. In the fuzzy model calculations, the increment of λ in calculation steps is considered to be 0.10. Running the NPW fuzzy model, the MF of the output variable is yielded. Figure 6 illustrates the LCC membership of the project in two parts of cost and profits. Having a closer look at the output membership function, reveals that the general form of output function has remained trapezoidal although its properties have slightly changed in comparison with input membership functions. This shows that the Vertex method maintains the properties of membership functions of input variables.

In order to perform a more comprehensive economic analysis on costs, the benefit-cost analysis has been carried out. Figure 7 shows the derived membership functions of benefit-cost (B/C) for 10-year time steps and whole life span of the project. These functions have been obtained based on dividing the profit membership functions by the cost membership functions through the Vertex method. Reduction in values of B/C in consecutive 10-year steps shows that project efficiency decrease as time elapses. This decrease stems from the fact that costs of maintenance and operation increase while the capability of the project to supply different demands reduces during the project life span.

4.5 System Performance

In the first step of assessing the dam performance sustainability, the levels of system performance are defined. Table 3 represents the features of defined levels for system performance. In this study 5 levels of system performance are considered. The first level corresponds to the most critical conditions of system where the minimum demands are supplied. The fifth level shows the most satisfactory conditions where all the demands are completely supplied. According to their importance, the demands have been arranged into domestic, environmental, industrial, and agricultural demands. At all levels, the minimum percentage of demand supply increases based on its priority. After specifying the levels, the weights of demands and levels are calculated. Tables 4 and 5 present the calculated normal weights of demands and system performance levels in each month, respectively.

In the next step, the monthly reservoir release is determined using the SOP method. The released water is allocated to demands based on the demands weights. Figure 8 illustrates the results at level 1 and 5 on 1-year time steps. As can be seen, the complete supply of all demands, at level 5, is impossible. According to Fig. 8, at level 1, the system performance collapses in the year 30 and cannot recover. Further assessments show that a drought period starts in the year 30. Furthermore, the main cause of the system weakness in recovering in the next years is the reduction of useful volume of the reservoir because of sediment accumulation in dam reservoir.

4.6 The System Performance Improvement

As demonstrated in previous section, the system performance declines even at level 1 in the last 20 years of its life span. It means that the system is not even able to supply the demands critical conditions. Two major problems which leads to this decline are: reduction of reservoir’s useful volume and water shortage. A solution that can partly overcome this problem is the revision of SOP of the reservoir. In this study, the SOP has been modified so that the system supplies the less water from the year 25 until the year 50. Although this change leads to reduction in water supply at all-time steps in the second half of M&O life span, it would help to store more water in non-dry intervals to be used in less or no inflow periods. In other words, this approach would distribute the severe water shortages of a dry interval among the consecutive intervals which may be non-dry.

Figure 9 illustrates the sustainability of the system at the critical level before and after applying the revised SOP. This figure reveals that the system performance has considerably increased. The average improvement of the system sustainability is about 20 %. In addition, the standard deviation of sustainability values after applying the revised SOP has decreased slightly which means the oscillations of systems performance has lowered. This increases the water supply security which is of high importance especially from social point of view. In order to find out how much this revision has affected the economic costs of the system, the cost elements related to allocated water have been recalculated. Figure 10 demonstrates the profits of the project only for the affected cost elements before and after applying the revised SOP. As can be inferred, the profit has decreased slightly and since this profit constitutes a small portion of total profit, its decrease is almost ineffective in whole LCC.

5 Summary and Conclusion

This paper introduced a method for assessing the LCC of dam projects regarding their performance. The proposed structure for assessing the projects LCC is capable of considering various cost elements. The simplicity and flexibility are the two main advantages of this structure. The structure has been organized based on splitting the life span up to three periods. For the M&O period which is the longest and most important period in dams life span, two new approaches of PEBDA and PEDDA have been introduced by which the incomes and benefits of this period can be estimated depending the data availability and boundaries of study scope. In the proposed structure, the fuzzy discounting model has been proposed in order to reflect the uncertainties in cost estimations. Evaluating the system performance is the other part of this study. In this section, a classical model of reservoir sustainability assessment has been revised based on two techniques of defining performance levels and weighting the different water demands and the levels. Using multiple levels, this revised model helps the modeler to perform a more comprehensive and realistic analysis. The assessment of costs of the system according to its performance is a novel managerial perspective which has been addressed in this study. This perspective has been assessed based on improving the system’s performance and evaluating the new costs which are imposed to system due to the improvement.

Results have been analyzed for a dam project located in north eastern part of Iran. As shown in the case study, the B/C factor decreases during the M&O period which testifies this fact that the project efficiency reduces as time elapses. The assessment of performance of the dam based on classical method demonstrates that the system’s performance is unsustainable in the most time intervals of M&O period because the system is unable to meet all the demands completely. However, assessing the system’s performance based on the revised method shows that although the project is unable to fully supply all the water demands, it does not mean the system could not supply any proportion of the demands. Indeed, the system could have better performance when the lower levels are considered as the base. This realistic perspective on system’s performance lets projectors to revise the operating plan on lower levels which are more critical and easy to improve. Consequently, this change, improvement of systems’ performance at lower levels, can impose some costs on the system. The re-evaluation of the system’s LCC after improving system’s performance illustrates that revising operating policy in order to make the system more sustainable at lower level, does not cost so much and the additional costs are intangible.

References

Al-Hajj A, Horner MW (1998) Modelling the running cost of buildings. Constr Manag Econ 16(4):459–470

Bromilow FJ, Pawsey MR (1987) Life cycle cost of university buildings. Constr Manag Econ. doi:10.1080/01446193.1987.10462089

Cobas E, Hendrickson C, Lave L, McMichael F (1996) Life cycle analysis of batteries using economic input output Analysis. In: Proceedings of IEEE International Symposium on Electronics and Environment, Texas

Cople DG, Brick ES (2010) A simulation framework for technical systems life cycle cost analysis. Simul Model Pract Theory. doi:10.1016/j.simpat.2009.08.009

Dhillon BS (1981) Life cycle cost: a survey. Microelectron Reliab. doi:10.1016/0026-2714(81)90241-9

Dubois D, Fargier H, Fortin J (2004) A generalized vertex method for computing with fuzzy intervals. 2004. IEEE Int Conf Fuzzy Syst. doi:10.1109/FUZZY.2004.1375793

Duckstein L, Parent E (1994) System engineering of natural resources under changing physical conditions: a framework for reliability and risk. In: Duckstein L, Parent E (eds) Engineering risk in natural resources management. Kluwer Academic Publishers, Netherlands

Durairaj SK, Ong SK, Nee AYC, Tan RBH (2002) Evaluation of life cycle cost analysis methodologies. Corp Environ Strateg. doi:10.1016/S1066-7938(01)00141-5

Fabrycky WJ, Blanchard BS (1991) Life-cycle cost and economic analysis. Prentice Hall, New Jersey

Ghahraman B, Sepaskhah AR (2004) Linear and non-linear optimization models for allocation of a limited water supply. Irrig Drain 53(1):39–54

Gibson RB (2006) Sustainability assessment: basic components of a practical approach. Impact Assess Proj Apprais. doi:10.3152/147154606781765147

Hanafizadeh P, Latif V (2011) Robust net present value. Math Comput Model. doi:10.1016/j.mcm.2011.02.005

Hashimoto T, Stedinger JR, Loucks DP (1982) Reliability, resiliency, and vulnerability criteria for water resource system performance evaluation. Water Resour Res 18(1):14–20

Kishk M, Al-Hajj A (2000) A fuzzy model and algorithm to handle subjectivity in life cycle costing based decision-making. J Financ Manag Prop Constr 5(1–2):93–104

Kjeldsen TR, Rosbjerg D (2001) A framework for assessing the sustainability of a water resources system. In: Schumann AH, Acreman MC, Davis R, et al. (eds) Regional Management of Water Resources. IHAS Publications, Publ. No. 268, 107–114

Klemeš V, Srikanthan R, McMahon TA (1981) Long memory flow models in reservoir analysis: what is their practical value? Water Resour Res 17(3):737–751

Kundzewicz ZW (1999) Flood protection—sustainability issues. Hydrol Sci J. doi:10.1080/02626669909492252

Kundzewicz Z, Chalupka M (1995) Low flows of the River Warta, Poland- risk and uncertainty aspects. IAHS Publications. http://ks360352.kimsufi.com/redbooks/a231/iahs_231_0319.pdf. Accessed 14 May 2013

Kundzewicz Z, & Kindler J (1995). Multiple criteria for evaluation of reliability aspects of water resource systems. IAHS Publications. http://ks360352.kimsufi.com/redbooks/a231/iahs_231_0217.pdf. Accessed 22 December 2013

Laura CS, Vicente DC (2014) Life-cycle cost analysis of floating offshore wind farms. Renew Energy. doi:10.1016/j.renene.2013.12.002

Loucks DP (1997) Quantifying trends in system sustainability. Hydrol Sci J. doi:10.1080/02626669709492051

Love PED, Irani Z, Ghoneim A, Themistocleous M (2006) An exploratory study of indirect ICT costs using the structured case method. Int J Inf Manag. doi:10.1016/j.ijinfomgt.2005.11.001

Makoni ST, Kjeldsen TR, Rosbjerg D (2001) Sustainable reservoir development-a case study from Zimbabwe. In: Schumann AH, Acreman MC, Davis R, et al. (eds) Regional Management of Water Resources. IHAS Publications, Publ. No. 268, 17–24

McLaren RA, Simonovic SP (1999) Evaluating sustainability criteria for water resource decision making: a case study from the Assiniboine delta aquifer region. Can Water Resour J. doi:10.4296/cwrj2402147

Morrison-Saunders A, Pope J (2013) Conceptualising and managing trade-offs in sustainability assessment. Environ Impact Assess Rev. doi:10.1016/j.eiar.2012.06.003

Moy WS, Cohon JL, ReVelle CS (1986) A programming model for analysis of the reliability, resilience, and vulnerability of a water supply reservoir. Water Resour Res 22(4):489–498

Ong HC, Mahlia TMI, Masjuki HH, Honnery D (2012) Life cycle cost and sensitivity analysis of palm biodiesel production. Fuel. doi:10.1016/j.fuel.2012.03.031

Otto B (2000) Payin for dam removel: a guide to select funding sources. American Rivers, Washington DC

Raskin PD, Mansen E, Margolis RM (1996) Water and sustainability global patterns and long-range problems. Nat Resour Forum 20(1):1–15

Ross TJ (2009) Fuzzy logic with engineering applications, 3rd edn. Wiley, New York

Shamir U (1996) Sustainable management of water resources. Proc Int Conf Water Resour Environ Res, Kyoto, Jpn 2:15–29

Slootweg R, Jones M (2011) Resilience thinking improves SEA: discussion paper. Impact Assess Proj Apprais. doi:10.3152/146155111X12959673795886

Sobanjo JO (1999) Facility life-cycle cost analysis based on fuzzy sets theory. In: Proceedings of 8th International Conference on Durability of Building Materials and Components, Vancouver, Canada, pp. 1798–1809

Takeuchi K, Hamlin M, Kundzewicz ZW, Rosbjerg D, Simonovic SP (1998) Sustainable reservoir development and management. IHAS Publications, Wallingford, Publ. No 251

Taylor W (1981) The use of life cycle costing in acquiring physical assets. Long Range Plan 14(6):32–43

Woodward DG (1997) Life cycle costing—theory, information acquisition and application. Int J Proj Manag. doi:10.1016/S0263-7863(96)00089-0

Zhu Y, Tao Y, Rayegan R (2012) A comparison of deterministic and probabilistic life cycle cost analyses of ground source heat pump (GSHP) applications in hot and humid climate. Energy Build. doi:10.1016/j.enbuild.2012.08.039

Acknowledgments

The authors wish to thank Mr. S. Yari due to his ideas for improving this paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Vahdat–Aboueshagh, H., Nazif, S. & Shahghasemi, E. Development of an Algorithm for Sustainability Based Assessment of Reservoir Life Cycle Cost Using Fuzzy Theory. Water Resour Manage 28, 5389–5409 (2014). https://doi.org/10.1007/s11269-014-0808-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11269-014-0808-7