Abstract

This paper studies the interaction between savagean uncertainty and time preferences. We introduce a variation of the discounted subjective expected utility model, where time preferences are state dependent. Before uncertainty is resolved, the individual is unsure about the discount factor that will be used, even when evaluating certain payoffs. The model can account for the present bias and diminishing impatience, even if the future is discounted geometrically. The present bias disappears when the immediate payoff becomes uncertain. Although preferences are not stationary, choices may be time consistent.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Individuals are impatient. The utility of a reward decreases as the time before its experience increases. Impatience is typically modelled using a constant discount factor (Koopmans 1960). Experimental evidence,Footnote 1 however, suggests that actual discount factors are not constant, but they decline over time: the further away is a payoff, the higher is individual’s patience. Such phenomenon is called Diminishing Impatience (DI), it may be a source of dynamic inconsistency and it is not compatible with the standard exponential discounting. In this work, we propose a possible explanation for DI stemming from the interaction of savagean uncertainty and intertemporal choice. Intuitively, uncertainty about the true state of the world may affect the time preferences of the individual, in particular, the discount factor used to evaluate future utility attached to the state. For example, the value of a sure payment at time t may depend on the result of a diagnostic test conducted before t, even though the utility of the payment remains the same. What affects the present value of the payment is the possibility of being more or less impatient, conditional on the result of the test.Footnote 2 Before uncertainty is resolved, the individual is unsure about the discount factor she will use, even when evaluating risk-free future payoffs. In turn, linear aggregation of state-dependent discount factors generates diminishing impatience. When uncertainty is resolved, the individual discounts the future utility exponentially, according to the discount factor attached to the realized state. Formally, the Uncertain Discount Expected Utility (UDEU) model evaluates an uncertain consumption plan \(c:\varOmega \rightarrow X^ \infty \) (a map from states of nature \(\varOmega \) to consumption streams \((c_0(\omega ),c_1(\omega ),c_2(\omega ),\ldots )\) and \(X\subset {\mathbb {R}}\)) by

where \(\omega \in \varOmega \) is a Savage state of the world and p is a subjective probability. The model can be interpreted in the following way: the individual fixes a state \(\omega \), she calculates the present value of the consumption stream in \(\omega \), \((c_0(\omega ),c_1(\omega ),\ldots )\) according to the utility u over payoffs and the discount factor \(\delta (\omega )\). She repeats the same procedure for all states and she aggregates the present values using the subjective probability p. When evaluating consumption plans that do not depend on the state of the world, the actual discount factor is the subjective expected value of the discount factors \(E_p[\delta (\omega )^t]\). Diminishing impatience occurs since, as the delay increases, the more patient factors decrease more slowly than the less patient ones, lowering the overall impatience (Theorem 1). Therefore, diminishing impatience arises naturally as the result of state-dependent time preferences. Violations of stationarity (diminishing impatience) are often identified with time inconsistency, i.e., dynamic preference reversal. However, the two properties are logically independent: stationarity restricts preferences at a given point in time, whereas dynamic consistency restricts preferences at different points in time. Halevy (2015) clarified the relation between the two, showing that non-stationary preferences are time inconsistent only if they are stable over time, a property called time invariance. We generalize the result to infinite consumption streams and we give a sufficient condition to observe a UDEU utility that is non-stationary but time consistent. The condition restricts the time evolution of subjective probabilities. This extends to the Savage’s setting the approaches of Sozou (1998), Azfar (1999), Halevy (2005), who proposed non-stationary but time consistent models of choice assuming objective uncertainty (risk). Differently from these, in our model, Bayesian updating of subjective probabilities may be at odds with time consistency (see Example 1).

The contribution of the paper is twofold: first, we show how diminishing impatience arises naturally in a setting where time preferences may depend on the realization of the state of nature. Our approach is less artificial than alternative approaches assuming uncertainty about the discount rates from the outset. Indeed, our model provides a foundation for the Implicit Risk Approach.Footnote 3 According to such theory, a subjective risk is attached to any future outcome: for example, the mortality risk or the possibility that a promise may be breached. In our model, uncertainty about the future is due to uncertainty about time preferences and it is completely subjective. Our model extends those assuming uncertainty coming from mortality rates. Indeed, the UDEU can be interpreted as a model of uncertain lifetime, if \(\delta (\omega )^t\) is interpreted as the probability of “reaching” time t. But it is not restricted to such interpretation, since state-dependent time preferences may follow from alternative explanations. For example, uncertainty about future wealth, education, self-control. Fisher (1930) proposed six “personal factors” that may influence impatience: foresight, self-control, habit, expectation of life, concerns for the lives of other persons, fashion. If uncertainty affects one of the factors, impatience is random. Second, we show that also in the subjective uncertainty setting, we can explain a variety of behavioral patterns related to non-stationarity and time consistency. The UDEU may exhibit non-stationary and time inconsistent choices (if we retain time invariance). Alternatively, the UDEU can accommodate non-stationary but time consistent choices (if we drop time invariance). Lastly, the UDEU can also reproduce a discounting behavior that resembles the quasi-hyperbolic discounting model of Laibson (1997), although the nature is different. It corresponds to the UDEU with only two distinct discount factors, one of which is extremely impatient (see Sect. 3.1); for example, evaluating future payments before a dangerous surgery. In this case, the discount functions are equivalent to the \(\beta \)–\(\delta \) model, where \(\beta \) is the probability of the extremely impatient rate (die during the surgery).

The interaction between time and uncertainty as a possible explanation for diminishing impatience has been proposed, under various forms, in the literature. Halevy (2008), Epper and Fehr-Duda (2015), Baucells and Heukamp (2012), and Saito (2015) identify delayed payments with objective lotteries, since any future payoff is intrinsically uncertain, for example, due to mortality risk. In the objective risk domain, this identification establishes a one-to-one relation between violations of expected utility (non-linear weighting of probabilities) and violations of stationarity.Footnote 4 Such identification is supported experimentally (see Keren and Roelofsma 1995; Baucells and Heukamp 2010). Our approach differs from this, since in the Savage’s setting there is no objective risk and the relation between violations of expected utility and non-stationarity breaks down. We can have non-stationary discount with subjective expected utility (see Theorem 1) and stationary discount with non-linear subjective expected utility (see Sect. 7). Alternative models such as Azfar (1999), Farmer and Geanakoplos (2009), explained DI assuming uncertainty in the discount factor and retaining expected utility. However, the assumption that subjective discount factors are uncertain per se is difficult to support outside the realm of finance. Our approach offers a possible rationale for uncertainty in the discount factors: state-dependent time preferences. All the results in our setting depend on the effect of uncertainty, therefore, our explanation of diminishing impatience does not substitute those proposed in deterministic settings (for example lack of self-control). What we want to highlight is that with Savage’s uncertainty, diminishing impatience may be natural and not related to lack of self-control or uncertainty in the experience of future payoffs.

While state-dependent preferences are natural, the exponential discounting form of conditional preferences \(\delta (\omega )^tu(c_t(\omega ))\) may be questioned. Firstly, the current work contributes to a literature who explains diminishing impatience exploiting the interaction between time preferences and uncertainty. Since we are assuming that uncertainty is the only driving force behind diminishing impatience, it is natural to posit that absence of uncertainty or the knowledge of the true state of the world should make preferences stationary. This is true in the UDEU, due to exponential discounting of conditional preferences. If the individual knows the true state of the world \(\hat{\omega }\), she will evaluate future consumption using \(\delta (\hat{\omega })^tu(c_t(\hat{\omega }))\), a stationary preference. In other words, if the state of the world affects the individual’s tastes about future consumption, when knowing the true state she can anticipate her future tastes and behave rationally. This prediction is peculiar to our model since, it is the unique model studying the interaction between discount and subjective uncertainty. Indeed, if we introduce a precise form of subjective uncertainty in the immediate payoffs (see Fact 1), diminishing impatience should disappear. This is a testable restriction that can be used to validate or falsify the model.

Lastly, in Sect. 7, we relax the expected utility assumption allowing for a different attitude toward the uncertainty coming from the states of the world and the “future”, in the spirit of Nau (2006), Ergin and Gul (2009). Relaxing linearity in probability, we can observe stationary preferences also in the presence of state-dependent time preference. Therefore, the result linking diminishing impatience and uncertain discount factors is peculiar to the (state-dependent) expected utility form of the UDEU.

2 An introductory example

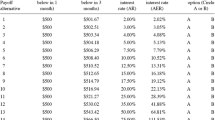

Suppose an individual has to choose between two different payments. One smaller but immediate r, the other R larger but in 7 days. The choice is between (r, 0) and (R, 7). The individual, however, is uncertain about the possibility of receiving an offer for a permanent job position. The states of the world are \(\varOmega =\{o, \lnot o \}\) and each one occurs with subjective probability \(p=0.5\). We assume that the job offer does not affect the utility of each payment, but it affects the impatience of the individual, intuitively, if the offer occurs the patience is higher (for example, the individual is more relaxed or less impatient because she expects higher income in the future).Footnote 5 In case of offer, \(\delta (o)=0.99\), whereas \(\delta (\lnot o)=0.3\). Suppose we want to know the current preference \(\succ \) of the individual for the two payments and before knowing if the job offer will arrive or not. Next table sums up the information about probability and the discount factors attached to each state.

|

Assuming that the value of each payment is \(u(r)=4\) and \(u(R)=7\), the individual is asked today to rank the following pairs: (r, 0) and (R, 7). Then, according to the UDEU,Footnote 6 \((r,0)\succ (R,7)\). Suppose now that both payments are delayed by one week. The choice now is between (r, 7) and (R, 14). Assuming again \(u(r)=4\) and \(u(R)=7\), simple calculations show that \((R,14)\succ (r,7)\). Today, the individual prefers the earlier/sooner payment, but she reverses her preferences when both are equally postponed. This is the preference reversal often ascribed to diminishing impatience. However, it follows from uncertainty about impatience, rather than lack of self control. In addition, uncertainty about the job offer is the only reason for exhibiting diminishing impatience. If the individual knew the true state of the world, her preference would be stationary. Indeed, suppose “o” is the true state and it is known to the individual, it follows that \((R,7)\succ (r,0)\) and \((R,14)\succ (r,7)\), the preference of an individual who discounts the future geometrically. In our model, uncertainty is the unique driver of diminishing impatience.

2.1 Related literature

The present work contributes to a strand of literature which exploits the interaction between time preferences and uncertainty to explain diminishing impatience. The consideration that any future payoff is intrinsically uncertain dates back to Fisher (1930) and Yaari (1965). Mortality risk, for example, invariably affects any future payoff. This intuition is supported experimentally (Keren and Roelofsma 1995; Weber and Chapman 2005; Myerson et al. 2003; Baucells and Heukamp 2010). The paper is closely related to a class of models that jointly accommodate diminishing impatience and time consistent choices. In the models of Sozou (1998), Azfar (1999), and Halevy (2005), Bayesian updating of mortality risk leads to time-consistent choices, while maintaining diminishing impatience. Our model is different in two dimensions: first, we consider subjective uncertainty. Indeed, Sozou (1998) and Halevy (2005) assume the existence of an uncertain hazard rate governing the probability of experiencing future utility, whereas Azfar (1999) and Farmer and Geanakoplos (2009) rationalize diminishing impatience directly assuming uncertainty in the discount rate. Second, in our model Bayesian updating of beliefs may not be sufficient to give time consistency (see Example 1). Along the same lines, Dasgupta and Maskin (2005) assume a known hazard rate coupled with uncertainty about the timing at which payoffs are realized, to rationalize dynamic preference reversal. To the best of our knowledge, Higashi et al. (2009) is the only work with an axiomatization of subjectively random discount factors; however, their primitive is a preference over menus of objective lotteries. The alternative explanations proposed by Halevy (2008), Saito (2015), Baucells and Heukamp (2012) and Epper and Fehr-Duda (2015) were discussed in the introduction. Alternative explanations of diminishing impatience rely on non-geometric discounting such as the hyperbolic discounting model of Loewenstein and Prelec (1992), whereas the more parsimonious model of Laibson (1997) accounts for the present bias. Axiomatic foundations of the latter are provided by Hayashi (2003) and Montiel Olea and Strzalecki (2014). Bleichrodt et al. (2009) introduced two flexible classes of discount functions that generalize hyperbolic discounting allowing for different degrees of relative and absolute DI. Hyperbolic, quasi-hyperbolic discounting and the classes of Bleichrodt et al. (2009) do not cope with uncertainty. Harris and Laibson (2013) introduced the present–future model, a stochastic extension of the subjective discount model of Luttmer and Mariotti (2003), in which uncertainty concerns the duration of the “present” and the Instantaneous Gratification model, a limiting case of the present–future model. However, they do not provide any behavioral foundation. In a different domain, Jackson and Yariv (2014) and Millner and Heal (2016) obtain results, similar to Theorems 1 and 3, as a consequence of aggregating preferences of individuals with heterogeneous discount factors.

3 Uncertain discount expected utility and diminishing impatience

In this section, we introduce our model and we show how preferences represented by the UDEU can exhibit diminishing impatience. Time is discrete and infinite, \(t\in {\mathbb {N}}\) and \({\mathbb {N}}=\{0,1,2\ldots \}\). We assume the existence of a finite set \(\varOmega \), containing the states of the world with \(|\varOmega |>2\). We denote \(\varDelta (\varOmega )\), the simplex over \(\varOmega \). The set of consequences is a bounded interval of \(X\subset {\mathbb {R}}\) we can normalize to be equal to [0, 1]. An act is a function \(h:\varOmega \rightarrow X^\infty \), associating with each state of the world \(\omega \in \varOmega \), a consumption stream \(h(\omega )=\{h_0(\omega ),h_1(\omega ),\ldots \}\in X^\infty \), where \(h_t(\omega )\) denotes the element of X associated with the act h at time t and state \(\omega \). The set of all acts is denoted \({\mathscr {H}}\). The individual has a preference \(\succcurlyeq \) over acts. We assume that uncertainty resolves after a choice is made but before time 0; hence, consumption at time zero may be uncertain but it is not discounted. We do not assume any preference for early or late resolution of uncertainty. If an act is independent of the state, i.e., \(h_t(\omega )=h_t(\omega ')\) for all \(\omega ,\omega '\in \varOmega \), we call it a state-independent act and we, sometimes, write \(x=(x_0,x_1,\ldots )\). We denote \(X^\infty \), the set of all state-independent acts. If an act is also independent of time, i.e., \(h_t(\omega )=z\), for all \(\omega \in \varOmega \), \(t\in {\mathbb {N}}\) and some \(z\in X\), we call it a constant act. We can now introduce our UDEU representation:

Definition 1

A UDEU representation of \(\succcurlyeq \) is a tuple \((V,u,\{\delta (\omega )\}_{\omega \in \varOmega },p)\) with \(u:X\rightarrow {\mathbb {R}}\), \(\delta (\omega )\in (0,1]\) for all \(\omega \in \varOmega \), \(p\in \varDelta (\varOmega )\), \(V:{\mathscr {H}}\rightarrow {\mathbb {R}}\), such that, \(V(h)\ge V(h')\), if and only if, \(h\succcurlyeq h'\) and

The UDEU generalizes the discounted (subjective) expected utility model allowing for state-dependent time preferences. In the case of a state-independent act \(h=(x_0,x_1,\ldots )\), UDEU becomes

the actual discount factor \(E_p[\delta (\omega )^t]\) is a weighted average of the state-dependent discount factors \(\delta (\omega )\), where weights are given by the subjective probabilities. Therefore, although state-independent acts are not affected by uncertainty, the actual discount factor depends on the belief and the time preference. We now show how the UDEU can account for diminishing impatience (or hyperbolic preferences) and, in particular, the present bias.

First, take an arbitrary \(o\in X\) and set \(u(o)=0\). We denote \((x,t)\in X^\infty \), the state-independent act h defined as: \(h(\omega )=(o,o,\ldots ,x,o,\ldots )\) for all \(\omega \in \varOmega \) and x is payed at time t. Clearly, \(V(x,t)=u(x)E_p[\delta (\omega )^t]\), hence (x, t) can be interpreted as a payment x at time t. We use the following definitions:

Definition 2

-

DI.

\(\succcurlyeq \) exhibits diminishing impatience, if for any \(y>x>0\) and \(0<t\),

$$\begin{aligned} (x,t)\sim (y,t+1)\ \ \ \text{ implies }\ \ \ (x,t-1)\succ (y,t) \end{aligned}$$ -

PB.

\(\succcurlyeq \) exhibits the present bias, if for any \(y>x>0\) and \(0<t\)

$$\begin{aligned} (x,t)\sim (y,t+1)\ \ \ \text{ implies }\ \ \ (x,0)\succ (y,1) \end{aligned}$$

According to DI, as the payments are delayed the bigger payoff becomes more attractive than the smaller one. The present bias is the particular case of diminishing impatience at 0. When discounting is hyperbolic, as in Loewenstein and Prelec (1992), and the utility and the discount function are separated, the preference exhibits diminishing impatience. The quasi-hyperbolic discounting of Laibson (1997) exhibits the PB but not DI. We can equivalently define DI and the PB in terms of an impatience index (see Halevy 2008). Assuming \(V(x_0,x_1\ldots )=\sum _{t=0}^\infty d(t)u(x_t)\), with \(d(0)=1\). Let \(I(t)=\frac{d(t)}{d(t+1)}\) then,

-

1.

DI is equivalent to \(I(t)>I(t+1)\) for all \(t\ge 0\)

-

2.

PB is equivalent to \(I(0)>I(t)\) for all \(t>0\)

The next result shows that the UDEU exhibits DI:

Theorem 1

Let \(I(t)=\frac{E_p[\delta (\omega )^t]}{E_p[\delta (\omega )^{t+1}]}\), there exists \(\delta (\omega )\ne \delta (\omega ')\) with \(p(\omega )>0,p(\omega ')>0\), if and only if, \(\succcurlyeq \) exhibits diminishing impatience.

As the time horizon increases, the more patient discount factors decline more slowly than the less patient ones, lowering the overall impatience. Therefore, diminishing impatience and the present bias arise naturally when time preferences depend on the state of the world and preferences are aggregated linearly.

As a side note, the UDEU model is related to the discount of “far future” introduced by Weitzman (1998, 2001). He claims that, under uncertainty of the discount rates, the evaluation of very long-term projects, as climate change policies, mineral depletion, radioactive waste disposal, should be made using the average of discount factors, i.e., \(E[\tilde{\delta }^t]\) rather than discount ratesFootnote 7 \(E[\tilde{\delta }]^t\). Our model and its axiomatic foundation in Sect. 5 offer a rationalization of Weitzman’s approach, since the UDEU can be interpreted as the utility of a planner that evaluates the present value of very-long term policies under uncertainty of the discount rates. Our results show that the Weitzman approach implies diminishing impatience (of the planner) but may be time consistent, as we will see in the Sect. 4. In addition, we discuss in Sect. 7 the consequences of relaxing the linear aggregation of discount factors. Diminishing impatience may disappear if discount factors are aggregated non-linearly, showing that Theorem 1 and the result of Weitzman strongly depend on the linearity of the aggregation rule.

3.1 The UDEU and quasi-hyperbolic discounting

A particular case of the UDEU generates a discounting behavior that resembles the quasi-hyperbolic discounting model of Laibson (1997). In the quasi-hyperbolic discounting model, the discount factor is equal to 1 at time \(t=0\) and to \(\beta \delta ^t\) at time \(t>0\) for some \(\beta \in [0,1]\). Consider the UDEU model with only two distinct discount factors, call them \(\delta \) and \(\epsilon \), with the second very close to zero (or even equal to zero if we define \(0^0=1\)). In that case, when evaluating a state-independent act, we have \(E_p[\delta (\omega )^t]=p\delta ^t+(1-p)\epsilon ^t\). It corresponds to

For \(t>0\), \(E_p[\delta (\omega )^t]\approx p\delta ^t\), since for \(\epsilon \) small enough the second term is negligible or equal to zero if \(0^0=1\). Such an extreme case of the UDEU, where the individual is completely impatient in a given state (or event) and has the same discount factor in all the remaining states (or events), can generate the same discount of a quasi-hyperbolic function; however, our \(\beta \)–\(\delta \) discounting is actually a p–\(\delta \). To be more concrete, consider the case of an individual evaluating a future sure payment before a dangerous surgery. With probability p, she will survive and discount a future payment according to \(\delta \). In the worst case of not surviving, the value of any future payment is zero, equivalent to complete discount. In this case, it is natural to observe a “present biased” attitude toward the future. Clearly, the nature of the two is extremely different and we are not considering our approach as a foundation for quasi-hyperbolic discounting. We are only considering an extreme case of our model that can generate similar predictions.

4 Time consistency and time invariance

In this section, we extend the UDEU model to repeated choices over time and we discuss the relation between time consistency and non-stationarity. Violations of stationarity are often identified with violations of time consistency; however, the two notions are independent. Stationarity is a static property, it restricts preferences at a given point in time. Time consistency is a dynamic property, it relates preferences at different points in time. As elegantly proved by Halevy (2015), non-stationarity and time inconsistency are equivalent only if preferences do not change over time, a property called time invariance.Footnote 8 We extend the result of Halevy (2015) relating stationarity, time consistency and time invariance to our setting and we show how the UDEU model can accommodate non-stationary but time consistent choices. We provide a sufficient condition restricting the evolution of beliefs over time: if subjective probabilities exactly counterbalance the impact of higher discount factors on the overall patience, the individual exhibits diminishing impatience but time consistent choices. Such result extends to the subjective uncertainty setting the results of Sozou (1998), Azfar (1999), Halevy (2005). Differently from them, Bayesian updating of beliefs may not guarantee time consistent choices (see Example 1). We consider a family of preferences \(\{\succcurlyeq _\tau \}_{\tau =0}^\infty \), each of which is represented by a UDEU. The assumption we make in the first part of this section is the following: at each decision time \(\tau \) the individual faces the same choice problem, that is, information about the realization of the state of the world in the previous dates is irrelevant (uncertainty is i.i.d). We may also interpret such setting as if, each \(\succcurlyeq _\tau \) represents the preferences of a “self” facing the same choice problem of the other selves. Notice that i.i.d. uncertainty is a property of the underlying stochastic environment and not of preferences. We use such setting since it allows a direct comparison with the definitions of Halevy (2015) and because the results we develop here are useful to understand what happens in our model when learning takes place. We will relax such an assumption in the next section.

First, we introduce the definitions of stationarity, time invariance and time consistency adapted from Halevy (2015) to our setting (similar definitions are proposed in Millner and Heal 2016). To offer a direct comparison with the setting of Halevy (2015), all of our definitions consider state-independent acts only. For a given state-independent act \(x\in X^\infty \) and a given \(z\in X\), we denote (z, x) the shift-forward of x, i.e., \((z,x)=(z,x_0,x_1,\ldots )\). The following is the standard definition of stationarity:

-

(Stationarity). \(\succcurlyeq _\tau \) is stationary if for all \(x,y\in X^\infty \) and \(z\in X\)

$$\begin{aligned} x\sim _\tau y \Longleftrightarrow (z,x)\sim _\tau (z,y) \end{aligned}$$

Preferences over deterministic consumption streams are not reversed when consumption is shifted. As anticipated, stationarity is a “static” property: it restricts preferences at time \(\tau \) only. In the previous section, we showed that the UDEU violates stationarity. The following property, time invariance, imposes consistency between preferences at different points in time:

-

(Time invariance). \(\{\succcurlyeq _{\tau }\}_{\tau =0}^\infty \) are time invariant if for all \(x,y\in X^\infty \) and all \(\tau ,\tau '\in {\mathbb {N}}\),

$$\begin{aligned} x\sim _\tau y \Longleftrightarrow x\sim _{\tau '}y \end{aligned}$$

The ranking of state-independent acts does not depend on the decision date.Footnote 9 Lastly, we introduce the notion of time consistent preferences:

-

(Time consistency). \(\{\succcurlyeq _{\tau }\}_{\tau =0}^\infty \) are time consistent if for all \(x,y\in X^\infty \) and \(z\in X\) and \(\tau \in {\mathbb {N}}\),

$$\begin{aligned} (z,x)\sim _\tau (z,y) \Longleftrightarrow x\sim _{\tau +1}y \end{aligned}$$

Preferences are time consistent if the ranking of state-independent acts does not change after a common history.Footnote 10 It precludes ex-post (tomorrow) deviations from an ex-ante (today) plan. The following theorem relates the preceding properties and it is a direct generalization of Proposition 4 in Halevy (2015).

Theorem 2

Any two of the three properties: stationarity, time consistency and time invariance, imply the third.

As in the setting of Halevy (2015), non-stationarity implies time inconsistency only if preferences are stable over time, i.e., they are time invariant. In Sect. 3, we proved that the UDEU model exhibits non-stationary preferences. According to Theorem 2, if a preference represented by the UDEU is time consistent, it must violate time invariance. Alternatively, if a preference represented by the UDEU is time invariant, it must violate time consistency.

The first step is to understand what are the consequences of assuming time invariance for a family of UDEUs preferences \(\{\succcurlyeq _\tau \}_{\tau =0}^\infty \). Since each \(\succcurlyeq _\tau \) is represented by a tuple \((V_\tau ,u_\tau ,\{\delta _\tau (\omega )\}_{\omega \in \varOmega },p_\tau )\), there are many elements that may vary from time to time: pure tastes over outcomes \(u_\tau \), subjective probabilities \(p_\tau \) and time preferences \(\{\delta _\tau (\omega )\}_{\omega \in \varOmega }\). Before going to the result, we need some notation: we write \(u_\tau \equiv u_{\tau '}\), if \(u_{\tau '}\) is a positive affine transformation of \(u_\tau \). In the following proposition we restrict our attention to the case of time invariant tastes, i.e., the utility of final outcomes does not change across decision times.

Proposition 1

Suppose that \(u_\tau \equiv u_{\tau '}\) for all \(\tau ,\tau '\in {\mathbb {N}}\) then, \(\{\succcurlyeq _\tau \}_{\tau =0}^\infty \) satisfy time invariance, if and only if, \(E_{p_\tau }[\delta _\tau (\omega )^{t}]=E_{p_{\tau '}}[\delta _{\tau '}(\omega )^{t}]\), for all \(t> 0\).

Time invariance is equivalent to equality of the “actual discount factor” across decision times. It is clearly different from saying that discount factors \(\delta _\tau (\omega )=\delta _{\tau '}(\omega )\) are equal across decision times. It follows that a family of time invariant UDEU preferences that agree on the ranking of final outcomes, is represented by

where \(d(t-\tau )=E_{p_\tau }[\delta _\tau (\omega )^{t-\tau }]\) and d is independent of \(\tau \).

Differently, if a family of UDEUs is time consistent, it has to violate time invariance and, by Proposition 1, discount factors cannot be stable across decision times. The next theorem gives a sufficient condition for time consistency of a family of UDEUs in terms of time evolution of beliefs.

Theorem 3

Suppose that \(\delta _\tau (\omega )=\delta _{\tau '}(\omega )=\delta (\omega )\) for all \(\tau ,\tau '\in {\mathbb {N}}\) and all \(\omega \in \varOmega \) and \(u_\tau \equiv u_{\tau '}\) for all \(\tau ,\tau '\in {\mathbb {N}}\), if

then, \(\{\succcurlyeq _\tau \}_{\tau =0}^\infty \) satisfy time consistency.

As discussed after Theorem 1, diminishing impatience occurs because the more patient discount factors decline more slowly than the less patient ones. The condition on the subjective probabilities in Theorem 3 guarantees time consistency since, it is exactly sufficient to counterbalance such phenomenon.Footnote 11 As the decision time increases, the individual has to lower the weight attached to the more patient factors. To see this point, consider the impatience index \(I_\tau (t)\) of Theorem 1 at decision time \(\tau \),

for all \(t\ge \tau \) and at time \(\tau +1\),

for all \(s\ge \tau +1\). By the condition on Theorem 3, the two are equal for all periods after \(\tau \). For example, for \(t=s=\tau +1\), we have \(I_\tau (\tau +1)=\frac{E_{p_\tau }[\delta (\omega )]}{E_{p_\tau }[\delta (\omega )^{2}]}\) and \(I_{\tau +1}(\tau +1)=\frac{1}{E_{p_{\tau +1}}[\delta (\omega )]}\), by the condition of Theorem 3, \(I_{\tau +1}(\tau +1)=\frac{1}{E_{p_{\tau }}[\delta (\omega )^2][E_{p_{\tau }}[\delta (\omega )]]^{-1}}=I_\tau (\tau +1)\). Intuitively, the relative impatience between two subsequent future periods as seen from today coincides with the same measure as seen from tomorrow. Clearly, if discount factors are equal across states, the condition in Theorem 3 reduces to \(p_{\tau +1}(\omega )=p_\tau (\omega )\), and by Proposition 1, preferences become time invariant and then stationary. To sum up, in a setting where uncertainty is identical at each decision time, time consistency may coexist with non-stationary preferences, if beliefs are updated in a way that counterbalance the increasing patience of the individual. As noted above, identical uncertainty at each decision time is a property of the underlying stochastic framework and not of preferences. Therefore, the fact of observing time varying subjective beliefs is not precluded in this setting.

4.1 Bayesian updating and time consistency

In this section, we study the problem of having time consistency when beliefs are updated after the acquisition of new information. Let \(\varSigma \) be an algebra of events defined on \(\varOmega \). For each event \(E\in \varSigma \), let \(f_Eg\) the act delivering \(f(\omega )\in X^\infty \) if \(\omega \in E\) and g otherwise. Suppose that for each event \(E\in \varSigma \), the individual has conditional preference \(\succcurlyeq _E\), representing her behavior if E occurs. Time consistency in the static setting imposes consistency between conditional preferences \(\succcurlyeq _E\) and the unconditional preference \(\succcurlyeq \). The following definition is due to Ghirardato (2002) in a static setting: \(f_Eg\succcurlyeq g\) if and only if \(f\succcurlyeq _E g\), for all \(E\in \varSigma \). Conditional preferences \(\succcurlyeq _E\) can be defined through ex-ante preferences \(\succcurlyeq \). Such condition, plus additional standard axioms, guarantees that in a state-independent expected utility setting, ex-post preferences are represented by the Bayesian updating of the subjective probability representing \(\succcurlyeq \). Suppose that there exists a filtration \(\{{\mathscr {F}}_\tau \}_{\tau \in {\mathbb {N}}}\) defined on \(\varOmega \) and generated by a finite partition. At time \(\tau \), the individual knows that the true state of the world \(\omega \) belongs to an event \(E\in {\mathscr {F}}_\tau (\omega )\), where \({\mathscr {F}}_\tau (\omega )\) is the cell of the partition containing \(\omega \). For each event \(E\in {\mathscr {F}}_\tau (\omega )\) containing \(\omega \), let \(\succcurlyeq _{\tau +1,E}\) represents preference at time \(\tau \) conditional on the occurrence of E. We assume that each \(\succcurlyeq _{\tau +1,E}\) is represented by a UDEU, \((V_{\tau +1,E},u_{\tau +1,E},\{\delta _{\tau +1,E}(\omega )\}_{\omega \in \varOmega },p_{\tau +1,E})\), hence:

It is important to notice that \(p_{\tau +1,E}\) is a probability distribution that is not necessarily the Bayesian updating of \(p_\tau \). Karni (2007, Th. 3) axiomatized such representation in a static setting. Consider the following contingent version of time consistency that is comparable with the one proposed earlier:

-

(Contingent time consistency). \(\{\succcurlyeq _{\tau }\}_{\tau =0}^\infty \) are contingently time consistent if for all \(x,y\in X^\infty \) and \(z\in X\), \(E\in {\mathscr {F}}_\tau (\omega )\) and \(\tau \in {\mathbb {N}}\),

$$\begin{aligned} (z,x)_E(z,y)\sim _\tau (z,y) \Longleftrightarrow x\sim _{\tau +1,E}y \end{aligned}$$

The condition generalizes time consistency (the two coincide for \(E=\varOmega \)) imposing consistency between ex-ante conditional preferences and ex-post choices, but only for state-independent acts.

Theorem 4

Suppose that \(\delta _\tau (\omega )=\delta _{\tau +1,E}(\omega )=\delta (\omega )\) for all \(\tau \in {\mathbb {N}}\) and all \(\omega \in \varOmega \) and \(u_\tau \equiv u_{\tau +1,E}\) for all \(\tau \in {\mathbb {N}}\), if

then, \(\{\succcurlyeq _{\tau }\}_{\tau =0}^\infty \) satisfy contingent time consistency.

The condition \(\delta _\tau (\omega )=\delta _{\tau +1}(\omega )\) implies that time preferences are stable across decision dates, what changes is the subjective probability of each state. If \(E=\varOmega \), we are back to the case of Theorem 3. Clearly, if discount factors are all constant, the condition in Theorem 4 corresponds to Bayesian updating of beliefs. However, the presence of state-dependent time preferences requires a correction of updated probability to restore time consistency. Indeed, the following example shows that Bayesian updating of probabilities, i.e., \(p_{\tau +1,E}(\omega )=p_{\tau +1}(\omega |E)= \frac{p_\tau (\omega )}{\sum _{\omega '\in E}p_\tau (\omega ')}\), may not guarantee contingent time consistency in the presence of state-dependent time preferences.

Example 1

(Time inconsistency with Bayesian updating) Assume \(\varOmega =\{\omega _1,\omega _2,\omega _3\}\) and \(p(\omega _i)=\frac{1}{3}\). Discount factors are \(\delta (\omega _1)=\frac{10}{12}\), \(\delta (\omega _2)=0\) and \(\delta (\omega _3)=\frac{9}{10}\). Let \((z,x_0,x_1)=(z,1,0)\) and \((z,y_0,y_1)=(z,0,1.2)\) and \(E=\{\omega _1,\omega _2\}\). Suppose that we have a UDEU representation of the unconditional preference \(\succcurlyeq _0\) given by \((V_0,u,\{\delta (\omega )\}_{\omega \in \varOmega },p_0)\). And a representation of conditional preferences \(\succcurlyeq _{1,E}\) given by \((V_{1,E},u,\{\delta (\omega )\}_{\omega \in \varOmega },p_1(\cdot |E))\). So, preference over final outcomes and time preferences are identical and the subjective probability is updated with the Bayes’ rule. Assume that \(u(x)=x\), then

Indeed, \((z,x_0,x_1)_E(z,y_0,y_1)\sim _0(z,y_0,y_1)\) since, \(z+\frac{1}{3}\cdot \frac{10}{12}+\frac{1}{3}\cdot 0.9^2=z+1.2\cdot \frac{1}{3}(\frac{10}{12}^2+0.9^2)\) which is true. However, \((x_0,x_1)\not \sim _{1,E} (y_0,y_1)\) since, \(1\ne 1.2\cdot 0.5\cdot \frac{10}{12}\).

Contingent time consistency and Bayesian updating of beliefs may be at odds in the presence of state-dependent time preferences. Our suspicion is that the two can hold simultaneously only if discount factors are state-independent (i.e., the standard discounted expected utility). Therefore, the dynamic consistency definition of Karni (2007) (A.2 Ordinal Coherence) that generates Bayesian updating of subjective probabilities may be too strong to coexist with state-dependent time preferences.

In the case of Bayesian updating of beliefs, the assumption of time invariance is very strong. Indeed, consider the following definition:

-

(Contingent time invariance). \(\{\succcurlyeq _{\tau }\}_{\tau =0}^\infty \) are contingently time invariant if for all \(x,y\in X^\infty \), \(E\in {\mathscr {F}}_\tau (\omega )\) and \(\tau \in {\mathbb {N}}\),

$$\begin{aligned} x\sim _\tau y \Longleftrightarrow x\sim _{\tau +1,E}y \end{aligned}$$

Contingent preferences are equivalent to unconditional ones. It means that preferences (over state constant acts) are invariant to the arrival of new information. While this is often the case in modeling dynamic choice under ambiguity (e.g., Epstein and Schneider 2003; Maccheroni et al. 2006), in our setting this would imply, by the same argument of Proposition 1, that: \(E_{p_\tau }[\delta _\tau (\omega )^t]=E_{p_{\tau +1,E}}[\delta _{\tau +1,E}(\omega )^t]\). Such condition is clearly violated when subjective probabilities are updated by Bayes’ rule, i.e., \(p_{\tau +1,E}(\omega )=p_{\tau +1}(\omega |E)\), unless discount rates are all equal across states (i.e., discounted expected utility). Therefore, there is a tension between time invariance and information acquisition over time. This is consistent with the models of Sozou (1998), Azfar (1999), Halevy (2008), where Bayesian updating of mortality risk leads to time consistency, violating time invariance.

5 Axiomatic foundation of the UDEU

In this section, we propose an axiomatic foundation of the UDEU. The UDEU is a simple generalization of the discounted subjective expected that allows for state-dependent time preferences. Therefore, the axiomatic exercise is devoted to identify the testable restrictions characterizing state-dependent time preferences.

The first axiom simply states that preferences are represented by a state-dependent subjective expected utility. Since the main focus of the paper is on the intertemporal behavior, we omit the axiomatic foundation of a state-dependent utility, that is provided by Karni (2007, Th. 3). The most important point to note is that in Karni (2007, Th. 3), the subjective probability is unique and the state-dependent utilities are unique up to positive affine transformations.Footnote 12

Axiom 1

(Utility) \(\succcurlyeq \) is represented by a state-dependent subjective expected utility: \(h\mapsto \sum _{\omega \in \varOmega }p(\omega ) v_\omega (h(\omega ))\). Where p is unique and \(\{v_\omega :X^\infty \rightarrow {\mathbb {R}}\}_{\omega \in \varOmega }\) are unique up to positive affine transformations.

The representation in axiom utility corresponds to Theorem 3 in Karni (2007) with \(E=\varOmega \). Given the state-dependent utility representation, we want to transform each state-dependent utility \(v_\omega (\cdot )\) into a stationary utility. Given \(\omega \in \varOmega \), we denote \(f_{\omega }g\), the act giving f in state \(\omega \) and g otherwise. We now define a family of preferences \(\{\succcurlyeq _\omega \}_{\omega \in \varOmega }\) and we write \(f\succcurlyeq _\omega g\), if and only if, \(f_\omega h\succcurlyeq g_\omega h\) for some h. By additive separability of the representation, the definition is independent of the h. Each \(\succcurlyeq _\omega \) represents preferences of the individual in the case she knows that the true state of the world is \(\omega \). The next axiom involves conditional preferences only and it imposes standard geometric discounting conditionally on each state in \(\varOmega \).

Axiom 2

(Conditional temporal axiom)

-

(Cond. stationarity). For all state-independent acts \(x,y\in X^\infty \), \(z\in X\) and \(\omega \in \varOmega \),

$$\begin{aligned} (z,x)\sim _\omega (z,y) \Longleftrightarrow x\sim _\omega y \end{aligned}$$ -

(Cond. impatience). For all constant acts \(x,y\in X^\infty \), \(z\in X\) and \(\omega \in \varOmega \),

$$\begin{aligned} (x,x,\ldots )\succ _\omega (y,y,\ldots ) \Longleftrightarrow (x,y,z,z,\ldots )\succ _\omega (y,x,z,z,\ldots ) \end{aligned}$$

Conditional preferences are stationary and impatient in the Koopmans sense. This is the axiom that discriminates the UDEU from the discounted expected utility. If uncertainty of the future is the only force driving diminishing impatience, once uncertainty is resolved or if there is no uncertainty at all, the individual should behave rationally. The next axiom implies that the utility of the final outcomes is not state-dependent.

Axiom 3

(Certainty consistency). For all \(\omega ,\omega '\in \varOmega \) and all constant acts \(x,y\in X^\infty \),

Turning to the representation theorem, standard arguments lead to the following result:

Theorem 5

Axioms utility, conditional temporal axiom and certainty consistency are satisfied, if and only if, there exists a utility V representing \(\succcurlyeq \) of the form

where p is a unique probability, \(\delta (\omega )\in (0,1]\) for all \(\omega \in \varOmega \) and u is a strictly increasing and cardinally unique utility function.

The UDEU is a minimal generalization of subjective discounted expected utility taking into account the possibility that uncertainty affects pure time preferences.

6 Testing the UDEU

As hinted in the introduction, the structure of the UDEU allows us to perform a thought experiment that resembles the experiment of Keren and Roelofsma (1995). They show, in an objective risk setting, that the present bias decreases drastically when the immediate reward becomes risky. The UDEU can capture a similar behavioral pattern in our Savage’s uncertainty setting. Indeed, if we introduce a particular form of uncertainty in the immediate payoff, the present bias and diminishing impatience disappear. The prediction is peculiar to our model and it can be used to falsify or validate the model in a laboratory or field experiment. Let denote \((x,\omega ,t)\) the following act (assuming \(u(o)=0\)):

It is an act paying x at time t and state \(\omega \) and zero otherwise, alternatively it can be written in the previous notation as \((o,o,o,\ldots ,x,o,o,\ldots )_\omega (o,o,o,\ldots )\). It is the counterpart of Keren and Roelofsma (1995)’s lotteries in our setting. Now, suppose that an individual is indifferent between \((x,\omega ,t)\) and \((y,\omega ,t+1)\) for some \(y,x\in X\) and \(t\in {\mathbb {N}}\). Then we have the following:

Fact 1

For all \(x,y\in X\) and \(t,t'\in {\mathbb {N}}\).

Taking \(t=0\) gives the desired result. Therefore, introducing a precise form of uncertainty eliminates DI and the present bias. Since uncertainty resolves immediately, Fact 1 can be compared to the results of Keren and Roelofsma (1995). The explanation is similar, although its nature is completely different. The main difference between the present and the future is the intrinsic uncertainty of the latter. In the UDEU, the uncertainty of the future comes from uncertainty of the discount factor, since the present payoff is not discounted, it is certain (when state-independent). Differently, future payoffs, even the state-independent ones, are invariably “uncertain”. The additional impatience at certainty is captured by the inequality \(I(0)>I(t)\) for all t (when there are at least two different discount factors with strictly positive probability) or equivalently

When we introduce uncertainty in the immediate payoff, the present loses its certainty and the preference is, conditionally to the state of nature, stationary.

The parallelism with Keren and Roelofsma (1995) is only intuitive, since they used objective risk setting. They offered to subjects the typical choices over sooner/smaller or later/larger rewards, 100 now or 110 in 4 weeks and 100 in 26 weeks or 110 in 30 weeks. An individual who chooses 100 now in Choice 1. and for 110 in Choice 2. exhibits the present bias. In the experiment of Keren and Roelofsma (1995), 82% of the subjects opt for 100 now and 63% for $110 in 30 weeks. Subsequently, Keren and Roelofsma (1995) proposed the following choices (in all cases the lotteries pay zero with the residual probability): 100 now with probability 0.9 or 110 in 4 weeks with probability 0.9 and 100 in 26 weeks with probability 0.9 or 110 in 30 weeks with probability 0.9. They found that the percentage of individuals choosing the immediate reward drops to 54% and it is further reduced to 39% in a version of the experiment with a lower probability of 0.5, whereas the percentage of subjects choosing 110 in 30 weeks remains quite stable regardless of the probabilities. The result supports the intuition that the main difference between the future and the present is an intrinsic uncertainty of the former. If subjects attach more value to certainty (the present), the present bias occurs. When the present becomes uncertain, this distinction is no longer valid. The UDEU can account for a similar behavior in the subjective risk setting, i.e., when probabilities are not fixed exogenously and without assuming additional value of certainty.

7 Relaxing expected utility

The assumption of linearity in probability in the UDEU is clearly strong. Violations of expected utility in the Savage’s setting are well known, for example the Ellsberg’s paradox (Ellsberg 1961). Our setting of state-dependent consumption streams is particularly suitable to be interpreted as a product state-space. Each factor, \(\varOmega \) and \({\mathbb {N}}\), has its “uncertainty”, \(\varOmega \) as a state of the world, \({\mathbb {N}}\) as the possibility of not experiencing time t. Hence, each payment \(h_t(\omega )\in X\) depends on the resolution of two “sources of uncertainty”. Various models allow for different “sources of uncertainty” toward which the individual may have a different attitude. For example, Nau (2006), Ergin and Gul (2009). In our UDEU model, we implicitly assumed that the individual has the same attitude toward both “sources”, \(\varOmega \) and \({\mathbb {N}}\). Consider the following generalization of the UDEU that allows for differential attitude toward one source of uncertainty:

The utility of an act h is calculated in a two-stage procedure. For a given state of the world \(\omega \), the discounted value of the consumption stream attached to it, \(\sum _{t=0}^\infty \delta (\omega )^t u(h_t(\omega ))\), is calculated. The total value of h is calculated distorting the value of consumption streams by a function \(\phi :{\mathbb {R}}\rightarrow {\mathbb {R}}\) and aggregating them linearly. As in Nau (2006), Ergin and Gul (2009), a non-linear \(\phi \) can be interpreted as a different attitude toward the uncertainty coming from the “source” \({\mathbb {N}}\). The question is: are the results of Sect. 3 robust to this relaxation? The following example provides a negative answer.

Example 2

Let \(\phi (r)=\ln (r)\) and consider the acts \(h=(x,t)\), \(h'=(y,t+1)\) and \(g=(x,0)\), \(g'=(y,1)\). Then, we have

i.e., \(V_S(h)=V_S(h')\), if and only if, \(V_S(g)=V_S(g')\).

So the preference represented by \(V_S\) is stationary. The proof is in Appendix. Relaxing expected utility within the framework of the UDEU allows for a variety of behaviors related to the interplay between uncertainty and time preferences. Both stationarity and diminishing impatience are possible, even if discount factors are state-dependent. Concerning applications, Example 2 highlights the dependence of the Weitzman’s result to the linear aggregation of discount factors.

8 Conclusion

We introduced a model of intertemporal choice that takes into account the intrinsic uncertainty of the future through uncertainty in the discount factor. The model is a simple generalization of the discounted expected utility that allows for state-dependent time preferences. Its behavioral foundation is straightforward. The model can account for diminishing impatience and the present bias. In the dynamic extension, we give a sufficient condition to guarantee non-stationary but time consistent choices. Surprisingly, Bayesian updating of beliefs does not guarantee time consistency.

Notes

Section 2 contains an alternative example.

See Halevy (2005) for references.

The positive relation between income and patience dates back to Fisher (1930): “The degree of his impatience depends on his entire income stream, beginning at the present instant and stretching indefinitely into the future.”

\(4(0.5\times 0.99^0+0.5\times 0.3^0)>7(0.5\times 0.3^7+0.5\times 0.99^7)\).

In his experiment, up to 20% of the subjects made non-stationary but time consistent choices.

The meaning of invariance is the following (see Halevy 2015): \((x',x'',x''',\ldots )\sim _\tau (y',y'',y''',\ldots )\), if and only if \((x',x'',x''',\ldots )\sim _{\tau +1} (y',y'',y''',\ldots )\).

The meaning of consistency is the following (see Halevy 2015): \((z,x',x'',\ldots )\sim _\tau (z,y',y'',\ldots )\), if and only if \((x',x'',\ldots )\sim _{\tau +1} (y',y'',\ldots )\).

A similar condition has been proposed by Millner and Heal (2016) in a different choice problem: time consistency of a social planner that aggregates preferences of individuals with heterogeneous discount rates.

As noted in Karni (2007, Footnote 7) his results hold for any product of connected, separable, topological spaces. Our outcome space \(X^\infty \) satisfies the previous properties. Few conditions characterize the model: \(\succcurlyeq \) is a continuous weak order, there exist a best and a worst outcome (A.0 in Karni 2007) and cardinal coherence (A.1 in Karni 2007).

References

Andreoni, J., & Sprenger, C. (2012). Estimating time preferences from convex budgets. The American Economic Review, 102(7), 3333–3356.

Azfar, O. (1999). Rationalizing hyperbolic discounting. Journal of Economic Behavior & Organization, 38(2), 245–252.

Baucells, M., & Heukamp, F. H. (2010). Common ratio using delay. Theory and Decision, 68(1), 149–158.

Baucells, M., & Heukamp, F. H. (2012). Probability and time trade-off. Management Science, 58(4), 831–842.

Benzion, U., Rapoport, A., & Yagil, J. (1989). Discount rates inferred from decisions: An experimental study. Management Science, 35(3), 270–284.

Bleichrodt, H., Rohde, K. I. M., & Wakker, P. P. (2009). Non-hyperbolic time inconsistency. Games and Economic Behavior, 66(1), 27–38.

Chakraborty, A., & Halevy, Y. (2016). Strotz meets Allais: remarks on the relation between present bias and the certainty effect. Unpublished Manuscript

Dasgupta, P., & Maskin, E. (2005). Uncertainty and hyperbolic discounting. American Economic Review, 95, 1290–1299.

Ellsberg, D. (1961). Risk, ambiguity, and the savage axioms. The Quarterly Journal of Economics, 75(4), 643–669.

Epper, T., & Fehr-Duda, H. (2015). The missing link: Unifying risk taking and time discounting. Unpublished manuscript

Epper, T., Fehr-Duda, H., & Bruhin, A. (2011). Viewing the future through a warped lens: Why uncertainty generates hyperbolic discounting. Journal of Risk and Uncertainty, 43(3), 169–203.

Epstein, L., & Schneider, M. (2003). Recursive multiple-priors. Journal of Economic Theory, 113(1), 1–31.

Ergin, H., & Gul, F. (2009). A theory of subjective compound lotteries. Journal of Economic Theory, 144, 899–929.

Farmer, J. D., & Geanakoplos, J. (2009). Hyperbolic discounting is rational: Valuing the far future with uncertain discount rates. Tech. Rep. 1719, Cowles Foundation for Research in Economics, Yale University.

Fisher, I. (1930). The theory of interest. New York: Macmillan.

Ghirardato, P. (2002). Revisiting savage in a conditional world. Economic Theory, 20(1), 83–92.

Gollier, C. (2004). Maximizing the expected net future value as an alternative strategy to gamma discounting. Finance Research Letters, 1(2), 85–89.

Gollier, C., & Weitzman, M. L. (2010). How should the distant future be discounted when discount rates are uncertain? Economics Letters, 107(3), 350–353.

Halevy, Y. (2005). Diminishing impatience: Disentangling time preference from uncertain lifetime. Unpublished manuscript.

Halevy, Y. (2008). Strotz meets Allais: Diminishing impatience and the certainty effect. American Economic Review, 98(3), 1145–62.

Halevy, Y. (2015). Time consistency: Stationarity and time invariance. Econometrica, 83(1), 335–352.

Harris, C., & Laibson, D. (2013). Instantaneous gratification. The Quarterly Journal of Economics, 128(1), 205–248.

Hayashi, T. (2003). Quasi-stationary cardinal utility and present bias. Journal of Economic Theory, 112(2), 343–352.

Higashi, Y., Hyogo, K., & Takeoka, N. (2009). Subjective random discounting and intertemporal choice. Journal of Economic Theory, 144(3), 1015–1053.

Jackson, M. O., & Yariv, L. (2014). Present bias and collective dynamic choice in the lab. American Economic Review, 104(12), 4184–4204.

Karni, E. (2007). Foundations of Bayesian theory. Journal of Economic Theory, 132(1), 167–188.

Keren, G., & Roelofsma, P. (1995). Immediacy and certainty in intertemporal choice. Organizational Behavior and Human Decision Processes, 63(3), 287–297.

Koopmans, T. C. (1960). Stationary ordinal utility and impatience. Econometrica, 28, 287.

Laibson, D. (1997). Golden eggs and hyperbolic discounting. The Quarterly Journal of Economics, 112(2), 443–77.

Loewenstein, G., & Prelec, D. (1992). Anomalies in intertemporal choice: Evidence and an interpretation. The Quarterly Journal of Economics, 107(2), 573–597.

Luttmer, E. G. J., & Mariotti, T. (2003). Subjective discounting in an exchange economy. Journal of Political Economy, 111(5), 959–989.

Maccheroni, F., Marinacci, M., & Rustichini, A. (2006). Dynamic variational preferences. Journal of Economic Theory, 128(1), 4–44.

Millner, A., & Heal, G. (2016). Collective intertemporal choice: The possibility of time consistency. Working Paper 22524, National Bureau of Economic Research. doi:10.3386/w22524.

Montiel Olea, J. L., & Strzalecki, T. (2014). Axiomatization and measurement of quasi-hyperbolic discounting. The Quarterly Journal of Economics, 129, 1449–1499.

Myerson, J., Green, L., Scott Hanson, J., Holt, D. D., & Estle, S. J. (2003). Discounting delayed and probabilistic rewards: Processes and traits. Journal of Economic Psychology, 24(5), 619–635.

Nau, R. (2006). Uncertainty aversion with second-order utilities and probabilities. Management Science, 52(1), 136–145.

Saito, K. (2011). Strotz meets allais: Diminishing impatience and the certainty effect: Comment. American Economic Review, 101(5), 2271–2275.

Saito, K. (2015). A relationship between risk and time preferences. Unpublished manuscript.

Sozou, P. D. (1998). On hyperbolic discounting and uncertain hazard rates. Proceedings of the Royal Society of London Series B: Biological Sciences, 265(1409), 2015–2020.

Thaler, R. (1981). Some empirical evidence on dynamic inconsistency. Economics Letters, 8(3), 201–207.

Weber, J. B., & Chapman, G. B. (2005). The combined effects of risk and time on choice: Does uncertainty eliminate the immediacy effect? Does delay eliminate the certainty effect? Organizational Behavior and Human Decision Processes, 96(2), 104–118.

Weitzman, M. L. (1998). Why the far-distant future should be discounted at its lowest possible rate. Journal of Environmental Economics and Management, 36(3), 201–208.

Weitzman, M. L. (2001). Gamma discounting. American Economic Review, 91(1), 260–271. doi:10.1257/aer.91.1.260.

Yaari, M. E. (1965). Uncertain lifetime, life insurance, and the theory of the consumer. The Review of Economic Studies, 32(2), 137–150.

Author information

Authors and Affiliations

Corresponding author

Appendix: Proofs

Appendix: Proofs

Proof of Theorem 1

We derive I(t) with respect to t (assuming I(t) as function from \({\mathbb {R}}_+\rightarrow {\mathbb {R}}_+\)) and we show its derivative is negative.

Since \(\delta (\omega )\) are all smaller or equal than one, \(E_p[\delta (\omega )^t]\ge E_p[\delta (\omega )^{t+1}]\), hence

the left-hand side of the previous inequality is equal to

Since \((1-\delta (\omega ))\ge 0\) and \(\ln \delta (\omega )\le 0\), the sign of the expression is negative. \(\square \)

Proof of Theorem 2

Time invariance and time consistency imply stationarity. By time consistency \((z,x)\sim _\tau (z,y)\), if and only if, \(x\sim _{\tau +1}y\). By time invariance \(x\sim _{\tau +1}y\), if and only if, \(x\sim _{\tau }y\).

Stationarity and time consistency imply time invariance. Without loss of generality, let \(\tau '>\tau \). By stationarity, \(x\sim _\tau y\), if and only if, \((z,x)\sim _{\tau }(z,y)\). By time consistency, \((z,x)\sim _{\tau }(z,y)\), if and only if, \(x\sim _{\tau +1}y\). Repeating the same argument until \(\tau '\) gives the result.

Time invariance and stationarity imply time consistency. By stationarity \((z,x)\sim _\tau (z,y)\), if and only if, \(x\sim _{\tau }y\). By time invariance, \(x\sim _{\tau }y\), if and only if, \(x\sim _{\tau +1}y\).

\(\square \)

Proof of Proposition 1

If \(u_\tau \equiv u_{\tau '}\) and \(E_{p_\tau }[\delta _\tau (\omega )^{t-\tau }]=E_{p_{\tau '}}[\delta _{\tau '}(\omega )^{t-\tau '}]\), for all \(\tau ,\tau '\in {\mathbb {N}}\) time invariance follows immediately. To see the opposite implication, consider the following state-independent acts \(h=(x_0,x_1,z,z,z,\ldots )\) and \(h'=(y_0,y_1,z,z,z,\ldots )\), who differs in the firs two periods only and assume that \(h\sim _\tau h'\). Then by time invariance, \(h\sim _\tau h'\), if and only if, \(h\sim _{\tau '}h'\). Since \(u_\tau \equiv u_{\tau '}\), rescale the utilities to be equal. Then, \(u(x_0)+u(x_{1})E_{p_\tau }[\delta _\tau (\omega )]= u(y_0)+u(y_{1})E_{p_\tau }[\delta _\tau (\omega )]\), if and only if, \(u(x_0)+u(x_{1})E_{p_{\tau '}}[\delta _\tau (\omega )]= u(y_0)+u(y_{1})E_{p_{\tau '}}[\delta _{\tau '}(\omega )]\), or \(u(x_0)-u(y_0)+E_{p_\tau }[\delta _\tau (\omega )](u(x_1)-u(y_1))=u(x_0)-u(y_0)+E_{p_{\tau '}}[\delta _{\tau '}(\omega )](u(x_1)-u(y_1))\) and it follows that \(E_{p_{\tau }}[\delta _{\tau }(\omega )]=E_{p_{\tau '}}[\delta _{\tau '}(\omega )]\). \(\square \)

Proof of Theorem 3

Suppose that \(\delta _\tau (\omega )=\delta _{\tau '}(\omega )=\delta (\omega )\) for all \(\tau ,\tau '\) and all \(\omega \in \varOmega \) and \(u_\tau \equiv u_{\tau '}\) for all \(\tau ,\tau '\), and we normalize the utilities to be all equal. Then, time consistency holds if

or

is equivalent to:

or

The left-hand side of Eq. (2) is equal to \(u(x_{\tau +1})E_{p_\tau }[\delta (\omega )]+u(x_{\tau +2})E_{p_\tau }[\delta ^2_\omega ]+\cdots \) where the left-hand side of Eq. (3) is equal to \(u(x_{\tau +1})+u(x_{\tau +2})E_{p_{\tau +1}}[\delta (\omega )]+\cdots \) Let

then equality (3) becomes

that corresponds to \(u(x_{\tau +1})+u(x_{\tau +2})E_{p_\tau }[\delta (\omega )^{2}]\cdot M+\ldots =u(y_{\tau +1})+u(y_{\tau +2})E_{p_\tau }[\delta (\omega )^{2}]\cdot M+\ldots \), where \(M=[E_{p_\tau }[\delta (\omega )]]^{-1}\). Multiplying both sides by \(M^{-1}\), we have \(u(x_{\tau +1})E_{p_\tau }[\delta (\omega )]+u(x_{\tau +2})E_{p_\tau }[\delta (\omega )^{2}]+\ldots =u(y_{\tau +1})E_{p_\tau }[\delta (\omega )]+u(y_{\tau +2})E_{p_\tau }[\delta (\omega )^{2}]+\ldots \) which is equality (2). \(\square \)

Proof of Theorem 4

Suppose that \(\delta _\tau (\omega )=\delta _{\tau '}(\omega )=\delta (\omega )\) for all \(\tau ,\tau '\) and all \(\omega \in \varOmega \) and \(u_\tau \equiv u_{\tau '}\) for all \(\tau ,\tau '\), and we normalize the utilities to be all equal. Then, conditional time consistency holds if

or

is equivalent to:

or

The left-hand side of Eq. (4) is equal to \(u(x_{\tau +1})E_{p_\tau }[\delta (\omega )]+u(x_{\tau +2})E_{p_\tau }[\delta ^2_\omega ]+\cdots \) where the left-hand side of Eq. (5) is equal to \(u(x_{\tau +1})+u(x_{\tau +2})E_{p_{\tau +1,E}}[\delta (\omega )]+\cdots \) Let

if \(\omega \in E\) and 0 otherwise. Then equality (5) becomes

that corresponds to \(u(x_{\tau +1})+u(x_{\tau +2})[\sum _{\omega \in E}p_\tau (\omega )\delta (\omega )^{2}]\cdot M_E+\ldots =u(y_{\tau +1})+u(y_{\tau +2})[\sum _{\omega \in E}p_\tau (\omega )\delta (\omega )^{2}]\cdot M_E+\cdots \), where \(M_E=[\sum _{\omega \in E}p_\tau (\omega )\delta (\omega )]^{-1}\). Multiplying both sides by \(M_E^{-1}\), we have \(u(x_{\tau +1})[\sum _{\omega \in E}p_\tau (\omega )\delta (\omega )]+u(x_{\tau +2})[\sum _{\omega \in E}p_\tau (\omega )\delta (\omega )^2]+\cdots =u(y_{\tau +1})[\sum _{\omega \in E}p_\tau (\omega )\delta (\omega )]+u(y_{\tau +2})[\sum _{\omega \in E}p_\tau (\omega )\delta (\omega )^2]+\cdots \) which is equality (4). \(\square \)

Proof of Theorem 1

By standard arguments and the cardinal uniqueness of each \(v_\omega (\cdot )\), the Conditional Temporal axiom implies that each conditional preference is represented by a geometrically discounted utility, hence

for some \(\delta (\omega )\in (0,1]\) and \(u_\omega (\cdot ):[0,1]\rightarrow {\mathbb {R}}\). Now take two constant act x, y with \(x\succcurlyeq _\omega y\), by Certainty consistency, \(x\succcurlyeq _{\omega '} y\) for all \(\omega '\in \varOmega \). Then, \(u_\omega (x)\frac{1}{1-\delta (\omega )}\ge u_\omega (y)\frac{1}{1-\delta (\omega )}\), if and only if, \(u_{\omega '}(x)\frac{1}{1-\delta (\omega ')}\ge u_{\omega '}(y)\frac{1}{1-\delta (\omega ')}\), or \(u_{\omega }(x)\ge u_{\omega }(y)\), if and only if, \(u_{\omega '}(x)\ge u_{\omega '}(y)\). Since it holds for any x, y, \(u_{\omega }(\cdot )\) and \(u_{\omega '}(\cdot )\) represent the same preferences over X, by uniqueness up to positive affine transformation of both we can equate all the \(u_{\omega }(\cdot )=u(\cdot )\). \(\square \)

Proof of the Example 2 in Sect. 7. Suppose that \((x,t)\sim (y,t+1)\), then

equivalently

I would like to thank the editor and two anonymous referees for helpful comments.

Rights and permissions

About this article

Cite this article

Pennesi, D. Uncertain discount and hyperbolic preferences. Theory Decis 83, 315–336 (2017). https://doi.org/10.1007/s11238-017-9603-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-017-9603-2