Abstract

Research on corruption has made substantial progress in recent years. Yet, most studies still treat corruption as a homogenous phenomenon. This article argues that private-sector corruption can be distinguished conceptually from public-sector corruption, which has been in the spotlight of empirical research. We introduce the first indicator of private-sector corruption covering a large cross-section of countries. This new indicator is used to extend a recent empirical study on the cultural determinants of public-sector corruption (Kong and Volkema in Soc Indic Res 127(1):139–152, 2016). We find that self-serving leadership in high-income countries is associated with more corruption in both the public and the private sector. Furthermore, individualistic leadership in low-income countries is linked to reduced private-sector corruption. Next, we test a number of alternative cultural explanations for differences in private-sector corruption across countries. Overall, our results suggest that specific forms of corporate leadership culture matter for private-sector corruption, but also religious identity and trust play an important role.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Comparative research on corruption—that is, the abuse of entrusted power for private gain—has flourished over the past 15 years. Its primary driver has been the availability of more and better data on the global prevalence of corrupt behavior. Even though many questions about corruption remain unanswered (see, e.g., Jain 2001; Svensson 2005), we now understand at least some of the consequences of public-sector corruption. Among the most important effects are lower overall investment levels, less foreign direct investment, lower income and higher economic inequality, less government spending on education, higher military expenditure, lower environmental quality, and less trust in the political system. Lambsdorff (2006) offers a review of this literature and a more recent survey by Olken and Pande (2012) concentrates on corruption in developing countries. Although corruption has overall adverse effects, researchers are still trying to identify conditions under which corruption may actually “grease the wheels” of an economy (e.g., Dreher and Gassebner 2013).

Given these significant effects, it is not surprising that there has also been a lot of interest in the causes of corruption. Again, most of these studies focus exclusively on public-sector corruption, without explicitly distinguishing it from other forms of corruption (see Aidt 2003; Pellegrini and Gerlagh 2008; Treisman 2007, 2015 for insightful surveys). Nevertheless, some authors have started analyzing corruption in particular segments of the private or the public sector. Halim (2008), for example, investigates corruption in national bureaucracies, whereas Scott and Pyman (2008) compare levels of corruption in the military across different regions and countries. Voigt and Gutmann (2015) relate the organization of the judiciary to both judicial corruption and public-sector corruption more generally. Finally, Gutmann (2015) shows how the intensity of competition between religions and the degree to which they are regulated in different markets determine the corruption level in religious organizations.

Despite the fact that most researchers limit their attention to public-sector corruption, many of them still draw conclusions about corruption in general (Hodgson and Jiang 2007).Footnote 1 Consequently, they frequently define corruption as the abuse of public office for private gain—a phenomenon that, by definition, can only occur in the public sector. This definition is commonly used by academics, although it ignores that the major international conventions on corruption, for example by the Council of Europe and the United Nations, do not follow such a narrow delineation and explicitly include private-sector corruption (see OECD 2008). Even the World Bank (1997: 20), to whom the aforementioned narrow definition is usually attributed, clearly states that corruption is not confined to the public sector and it can be found in all forms of private-sector activities. The fact that firms are just as likely to pay bribes to other firms as they are to bribe public officials makes this negligence by academics even more worrisome (see Transparency International 2011).

In that context, it might be helpful to be more explicit about what exactly we have in mind when we refer to corruption. Conceptually, corruption takes place in the context of a principal-agent relationship where the agent accepts or requests compensation from a third party in return for acting against the principal’s interests (Shleifer and Vishny 1993). One can extend this transaction-based definition to include cases of misuse of one’s office for private gain in which no “third party” is involved (also referred to as fraud). Private-sector corruption can be distinguished from public-sector corruption in that the individual abusing a position of power holds a private, not a public office, which implies that the harmed principal is a private entity (Rose-Ackerman 2010). Examples of subjects potentially involved in private corruption are sales or purchasing agents who are privately remunerated by a contracting party for agreeing to favorable terms of contract, or union leaders who use their power to extort managers for their own benefit.Footnote 2 The relationship between private- and public-sector corruption can be considered as substitutive, for example, when privatization and procurement are used to take action against public corruption (Heywood 2015: 2). But it can also be complementary, as corruption is known to spill over across sectoral boundaries (Hodgson and Jiang 2007). Arguably, private corruption is more likely to occur in the face of a corrupt police force or judiciary.

One reason why economists might not have paid much attention to private-sector corruption is the idea derived from neoclassical economics that corrupt firms in competitive markets will be driven out of the market by their competitors who are not (or less) affected by corruption and are, thus, able to produce at a lower cost. This theoretical argument, however, does not hold water in the presence of significant transaction costs. If monitoring is costly, agents are able to extract rents for themselves, for example, by not working hard or by taking bribes. Coase (1937) explains the existence of firms as an attempt to lower transaction costs in repeated economic transactions. But monitoring in firms is costly as well and modern economic theory does, hence, not predict the absence or eradication of private-sector corruption (see, e.g., Myerson 2008 for an overview of mechanism design). Moreover, corruption in the private sector does not only redistribute resources between individuals, but it also negatively affects overall social welfare through the misallocation of resources. A corrupt employee is, for example, likely to purchase production inputs not from the cheapest producer, but from a competitor who pays a bribe. These socials costs can explain why law-makers in many countries seem eager to fight private-sector corruption.

The observation that legal regimes differ systematically in their treatment of private- and public-sector corruption (see, e.g., Argandoña 2003 or Rose-Ackerman 2010) highlights the policy relevance of studying both as distinct phenomena. The heterogeneity of legal approaches used to deal with private-sector corruption and the resulting information costs for transnationally operating businesses have motivated the Council of the European Union to harmonize the legal definition of private-sector corruption for all EU member states and to prescribe its implementation into national criminal law (decision 2003/568/JHA). In contrast, laws on private corruption in the US are still fragmented and differ between states (Green 2013). The overall situation has led some researchers to conclude that private-sector corruption “has been little studied, but ought to be the object of future work” (Rose-Ackerman 2008: 552). Limited availability of reliable data that could be used for this purpose is one of the main explanations for the shortage of such research.Footnote 3

In this article, we use principal factor analysis to demonstrate that private- and public-sector corruption can be distinguished empirically. From this factor analysis, we create a new indicator of private-sector corruption that covers 105 countries around the world in 2013. Our indicator is then used to extend a recent study (Kong and Volkema 2016) on the cultural origins of public-sector corruption. Our findings indicate that self-serving leadership in high-income countries is associated with more corruption in both the public and the private sector. Furthermore, individualistic leadership is linked to less private-sector corruption, but only in low-income countries. Beyond this empirical analysis, we also explore further cultural factors that might potentially be linked to private corruption. Thus, this article makes two contributions to the literature: First, we introduce a novel indicator of private-sector corruption and, second, we study the cultural determinants of private-sector corruption.

The article proceeds as follows: Sect. 2 deals with the measurement of private-sector corruption. In Sect. 3.1, we replicate the study by Kong and Volkema (2016) on leadership prototypes and public-sector corruption. Then we use our new indicator for private-sector corruption to examine the effect of the promotion of specific leadership prototypes identified by Kong and Volkema, but this time on the level of private-sector corruption. In Sect. 3.2, we study further potential cultural determinants of private-sector corruption. Section 4 summarizes our findings and offers suggestions for future research.

2 A New Indicator of Private-Sector Corruption

2.1 Factor Analysis of the Global Corruption Barometer 2013

Most empirical studies of corruption rely on either expert evaluations in the International Country Risk Guide or a composite indicator of corruption—predominantly the World Bank’s governance indicator “Control of Corruption” or Transparency International’s “Corruption Perceptions Index” (CPI). All three of these indicators contain information on only public-sector corruption. To create a new indicator of private-sector corruption, we use instead the most recent and largest global survey on corruption, the Global Corruption Barometer (GCB) by Transparency International (2013). The GCB asks citizens of over 100 countries: “To what extent do you see the following categories in this country affected by corruption?”Footnote 4 The twelve categories are: political parties, the legislature, the police, businesses, the media, the civil service, the judiciary, health services, NGOs, religious bodies, the military, and the education system.Footnote 5 If corruption levels in the private and the public sector are empirically distinguishable phenomena, this should be reflected in the different segments of the private and the public sphere covered by the GCB-data. Ex ante, we would expect that most of the twelve categories of the GCB are attributable to either the private or the public sector. Political parties, the legislature, the police, civil service, the judiciary, and the military are clearly integral parts of every country’s public sector. The delineation is less clear for health services and the education system, even though both are in most countries highly regulated and in large parts owned by the state. In contrast, businesses, NGOs, and religious bodies are predominantly private entities. Although the government frequently seeks to exercise control over the media, they are privately run in most countries. In fact, our data provides only very limited country coverage for Africa and the MENA region where state-owned media are particularly prevalent (Djankov et al. 2003).

Based on the above argumentation, we could manually classify the twelve corruption categories in the GCB as (1) public-sector corruption indicators, (2) private-sector corruption indicators, and, if one wishes to be conservative, (3) some ambiguous candidates. Aggregating the indicators in the private-sector-corruption-category, for example by calculating their mean score, would give us a measure of private-sector corruption. The idea behind aggregating the different indicators into one category, and not just choosing one of them, is twofold: We aim to improve the reliability of our new indicator by decreasing random measurement error, and to enhance its validity by using more encompassing measures of private-sector corruption.

Instead of relying only on arguments and common sense to form our corruption indicator, we suggest here to let the data speak. A factor analysis (see, e.g., Brown 2015 for an introduction to the method) can be employed to understand (1) the dimensionality of the data in the GCB, and (2) which categories of the GCB together represent a specific latent variable. The goal of this factor analysis is to provide empirical support for our theoretical prediction that private- and public-sector corruption are not sufficiently aligned to treat them as parts of the same phenomenon. If we find that private-sector corruption can be distinguished empirically from public-sector corruption, we can calculate factor scores as the best possible approximation of the identified latent constructs. The use of factor analysis has another advantage over the manual aggregation of sector-specific corruption indicators. Factor analysis decomposes the variance of each variable into common variance shared by other variables and variance that is unique to a particular variable. Factor analysis then analyzes only the common variance. This means that factors will not be biased by measurement error that is unique to one of the variables. In other words, if, for example, corruption in the media gives a distorted picture of private-sector corruption, this will not bias a factor score for private-sector corruption, as long as the other indicators reflective of private-sector corruption are not subject to the same distortion. Even more, if one of the indicators is reflective of both private- and public-sector corruption, factor analysis extracts only the variance that is shared by, respectively, the other indicators measuring private- and public-sector corruption. Again, the resulting factor scores will be unbiased.Footnote 6 However, if all indicators would be equally reflective of private- and public-sector corruption, we could obtain only one common factor and it would be impossible to empirically distinguish the two phenomena of interest.

A factor analysis identifies q common factors (labeled k = 1,…, q) that linearly reconstruct the p = 12 original GCB indicators. Equation (1) is the underlying estimation equation:

where y m,n is the mth observation on the nth variable, z m,k is the mth observation on the kth common factor, and β k,n is the set of factor loadings. ε m,n is the nth variable’s unique factor (which is similar to an error term). In this equation, only the GCB-corruption indicators (y) are observed. The goal of the factor analysis is to estimate the q < p common factors (z), which convey the essential information in the original set of variables. After estimating the factors and their loadings, it is necessary to interpret what latent variable is represented by each estimated factor. The factor loadings are helpful in this process. Note that, in contrast to principal component analysis, the principal factor analysis employed here does not require the latent variables to be orthogonal to each other. This is important, as private- and public-sector corruption can be expected to be positively correlated with each other. This is also why we draw on oblique (promax) rotation of the factor loadings, which produces clearer results if the factors are substantially correlated with each other (Afifi et al. 2012: 393). Kaiser (1958) warns that the different weighting of rows in rotating the axes introduces a bias, as rows with high communalities are given more influence. Thus, we follow his suggestion to apply equal weights in the sense that the common parts of the test vectors have equal length.

When we apply factor analysis to the twelve indicators from the GCB, we obtain a principal-factor solution with two factors that fulfill the Kaiser criterion (i.e., their eigenvalues of 6.2 and 2.0 are larger than unity). The promax rotated factor loadings are displayed in Table 1 and absolute factor loadings larger than 0.3 are in bold. These are often referred to as “moderate” or even as “high” loadings, in case they exceed 0.6. The low level of uniqueness of the variables, that is, the share of variance of each of them that is not explained by the two common factors, indicates that the twelve variables can be explained quite well by only two factors. The corresponding Kaiser–Meyer–Olkin measure of sampling adequacy equals 0.84, which is considered “meritorious” according to Kaiser’s (1974) classification. The interpretation of the two factors is straightforward. Factor 1 evidently depicts public-sector corruption and it is not associated with any of the private-sector indicators. In contrast, Factor 2 is strongly associated with the four indicators of private-sector corruption and only modestly related to some of the public-sector corruption indicators. These results clearly indicate that we can use the second factor as a general indicator of private-sector corruption.Footnote 7 We use the regression method suggested by Thompson (1950) to score the two factors. Our indicator of private-sector corruption is significantly positively correlated with the first factor, which represents public-sector corruption (Pearson correlation coefficient r = 0.42).Footnote 8

2.2 Properties of Our New Private-Sector Corruption Indicator

One possible concern about the data in the Global Corruption Barometer is the interpretation of the questions by survey respondents. It could be argued that laymen do not draw on a consistent model of corruption when answering the questions. They may attribute corruption to private businesses even when business people bribe public officials. This would, of course, constitute public-sector corruption according to our definition as only the public official is abusing entrusted power. This reasonable skepticism is, however, not supported by the data. In the factor analysis we find two clearly distinct latent variables that are associated with private- and public-sector corruption, respectively. This should not be the case if survey respondents were to interpret corruption affected businesses as yet another manifestation of public-sector corruption. To strengthen our argument, we also correlate our indicator of private-sector corruption with an indicator based on the World Bank’s (2015) Enterprise Surveys, which captures the share of firms that identify public-sector corruption as a major obstacle to their current operations. The measured correlation is close to zero (r = 0.10), which suggests to us that the GCB’s survey respondents are not misinterpreting the questions about private-sector corruption.

Finally, to improve our understanding of the second latent variable identified in our factor analysis, we can study the inter-item correlations of the different pairs of variables. Cronbach’s (1951) alpha can help us to assess the reliability of a scale composed of the four private-sector corruption indicators, which measure corruption in NGOs, media, religious bodies, and businesses. Alpha, that is, the squared correlation between the measured scale and the underlying factor, takes the value 0.87 in our case. It can be interpreted as an estimate of the correlation between two variables that are randomly drawn from a population of variables like those in our set of corruption indicators. Alpha can take values between 0 and 1, and higher values reflect a higher reliability of a scale constructed from the respective indicators. If we construct our scale only based on any three of the four indicators, alpha drops to a value between 0.82 and 0.86, indicating that all four variables contribute to our measurement of latent private-sector corruption. Respectively, alpha drops if we add one of the remaining eight corruption indicators from the GCB to our scale. The analysis of Cronbach’s alpha coefficient lends additional support to our reading of the identified second latent variable as representing private-sector corruption.

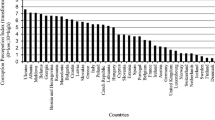

To see if there are regional differences in private-sector corruption, we calculate average private-sector corruption scores in five world regions (Asia, SSA, MENA, Europe, and the Americas). The regional distribution of our new indicator shows some interesting features.Footnote 9 The top private-sector corruption scores in each region are comparable in size, but Asia and especially Sub-Saharan Africa exhibit some of the lowest corruption scores. Correspondingly, we find that these two regions have lower mean private-sector corruption levels than the other world regions. Sub-Saharan Africa is also clearly the region with the largest differences between countries in terms of private-sector corruption. Rwanda has the lowest corruption score in our sample, whereas Sudan ranks among the top countries. Two explanations for these observations come to mind: First, differences in cultural characteristics might be responsible. If private-sector organizations in Sub-Saharan Africa and Asia are, for example, organized based on kinship, and employees are more accepting of social control and monitoring, this might allow some countries to limit corruption in the private sector. Second, some of these countries might exhibit an economic structure that is less susceptible to private-sector corruption. Small firm sizes and a large share of self-employed, such as in rather agrarian societies, avoid the principal-agent problems that may lead to private-sector corruption. Rose-Ackerman (2007), for example, argues that with private sectors in developing and emerging economies beginning to thrive, opportunities for corruption in the private sector will also increase. In the next section, we take a closer look at some potential cultural explanations of differences in private-sector corruption.

3 Cultural Determinants of Private-Sector Corruption

3.1 Replicating Kong and Volkema

In this section, we examine the impact of culture on private-sector corruption. We start by replicating and extending the empirical analysis of Kong and Volkema (2016) in this subsection. The next subsection, then, uses the same empirical framework to look at some of the most plausible alternative cultural explanations that were not considered in the original study. Kong and Volkema study the impact of culture on public-sector corruption. They derive indicators for three cultural dimensions from a factor analysis of data on six leadership styles contained in the GLOBE project (see House et al. 2002; Javidan et al. 2006a, b). This project collected data from more than 17,000 middle managers in almost 1000 organizations that are located in 62 countries. While the GLOBE project aspires to inquire into societal culture, the data produced in this study primarily reflects (nationally prevalent) organizational culture. Van Lange (1999) discusses the three social value orientations measured by Kong and Volkema in more detail and analyzes how they can affect behavior in a prisoner’s dilemma situation. Kong and Volkema (2016) describe “self-serving leadership” as being focused on personal benefits at the expense of others. In contrast, “prosocial leadership” aims at increasing collective welfare. These two cultural traits can be considered diametric opposites. Finally, “individualistic leadership” is according to Hofstede et al. (2010: 119) characterized by a management of individuals, where performance is evaluated openly and on an individual level. In individualistic societies preferential treatment of one customer or business partner over another is seen as unethical or unprofessional, whereas the opposite is true in collectivist societies. In the latter, a relationship of trust needs to be established before business can be done. Hofstede et al. emphasize that this trust and loyalty only extends to natural persons, but not to impersonal legal entities, such as firms.

Kong and Volkema (2016) hypothesize that the endorsement of self-serving and prosocial leadership prototypes should be relevant for corruption levels in the public sector. On the one hand, a society which condones self-serving leadership is likely to tolerate, if not endorse, corrupt behavior among its leaders. On the other hand, one that endorses prosocial leadership can be expected to punish corrupt behavior, as there is a stronger focus on equity and fairness considerations in such a society. Regarding individualistic leadership, Kong and Volkema hesitate to predict an effect on public-sector corruption because corruption is supposedly only “an issue related to socioeconomic interdependence” (Kong and Volkema 2016: 143). In line with the arguments of Kong and Volkema, we also predict that private-sector corruption is positively related to self-serving leadership and negatively associated with the endorsement of prosocial leadership in a society. Because prosocial individuals assign a positive value to outcomes for others, they are less likely to tolerate socially harmful actions, including corruption. Self-serving individuals, however, assign no or even a negative value to outcomes for others and should thus be willing to participate in corruption or to look the other way.

In contrast to Kong and Volkema (2016), we expect also individualism to be important for corruption, and particularly for private-sector corruption. Individualism emphasizes dissent, personal freedom, and achievement, rather than conformity, loyalty, and respect for one’s superior (Gorodnichenko and Roland 2016). These traits make it more difficult to conceal corruption in large organizations. Licht (2008), for example, argues that individualism is linked to law-abidingness and Licht et al. (2007) provide empirical evidence that individualism has a causal negative effect on public-sector corruption. Tabellini (2010) shows, more generally, that appreciation of an individualistic education of children is associated with higher quality legal institutions. This effect should be even more pronounced for private-sector corruption, as Licht et al. (2005) show a positive effect of individualism on corporate governance laws, specifically regarding investor protection. Van Hoorn (2014) provides a detailed survey of the literature regarding how individualism is associated across countries with different management practices in firms. Van Hoorn conjectures that “individualism has a positive effect on management quality, raising the level of sophistication of the practices that firms use to manage their operations” (p. 55). He provides extensive and robust empirical evidence that individualism is a main determinant of good management practices. Wated and Sanchez (2005) and Sanchez et al. (2008) argue that managers in individualistic societies are less likely to tolerate corruption among their employees, which survey evidence supports. Zheng et al. (2013) show that bank lending corruption is perceived to be higher among firms in collectivist countries. Accordingly, we expect private corruption to be negatively related to individualism. Our hypotheses can be easily summarized: Countries with more prosocial or individualistic leadership are expected to suffer less from private-sector corruption, whereas the opposite is expected of societies that endorse self-serving leadership.

Consistent with Kong and Volkema (2016), we expect that these relationships differ between high- and low-income countries. The idea that the causes of corruption differ systematically between the developed and the developing world has become prevalent in the corruption literature in recent years, but it has not been formally tested very often (e.g., Graeff and Mehlkop 2003; Jetter et al. 2015; Olken and Pande 2012). Kong and Volkema argue that the effect of leadership culture should be more pronounced in countries with higher income, whereas we expect the opposite. Here we offer two exemplary reasons for this expectation. First, high-income countries can afford high-quality formal institutions, such as anti-corruption legislation, judicial independence, etc. The legislature in these countries is more likely to enact laws that constrain socially inefficient behavior (like corruption in the private or the public sector) and the executive has the means to actually enforce these laws. Experimental evidence suggests that the existence of such formal institutions will undermine the relevance of (or “crowd out”) informal institutions and norms, which could have regulated the same behavior (see, e.g., Ostrom 2000: 147). Hence, we expect that the effect of cultural traits should be relatively more important in low-income countries, where societies are, to a larger degree, organized by informal rules than by formal rules. Second, firms and labor market participants in high-income countries tend to be exposed to higher levels of competition, among other things due to higher factor mobility. This implies that the reality of markets in high-income countries is closer to the neoclassical model of competitive markets we referred to in the introduction and principal-agent-problems should therefore be reduced, as inefficiently operating firms and employees can be replaced more easily. Consequently, cultural traits are expected to play a more important role in low-income countries, where transaction costs are higher and market imperfections are pervasive.

To test these hypotheses, we use exactly the same data and empirical model as Kong and Volkema (2016), but we replace the dependent variable with our newly constructed indicator for private-sector corruption. More precisely, we estimate the following equation:

where CORR is an indicator of corruption in up to 53 countries i. M is a vector of standard control variables, which is comprised of indicators for democracy and ethnic fractionalization, as in Kong and Volkema (2016). INC stands for a country’s log-income per capita. CULT is a vector of three variables for the cultural endorsement of specific leadership styles. Finally, we add in some model specifications three multiplicative interaction terms between a country’s income and each one of the culture indicators. All indicators (here and in the following) are standardized to have a mean of zero and a standard deviation of one to facilitate interpretation of the results. The data sources are described in “Appendix 3”.

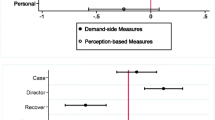

Table 2 provides our estimation results. For comparison, Columns 1 and 2 show the replicated results of Kong and Volkema (2016). It should be noted that concerns about the potential endogeneity of income per capita seem unwarranted in light of the results of Gundlach and Paldam (2009), who demonstrate that long-run causality appears to run entirely from income to corruption (and not the other way around). As the hypotheses to be tested are conditional, we also calculate marginal effects and their standard errors (see Brambor et al. 2006 for details on how to interpret such linear-interactive models). Figure 1 shows the marginal effect of the different leadership prototypes on public-sector corruption at different levels of income per capita. The 95%-confidence interval indicates the range of income at which a leadership type is statistically significantly associated with the level of corruption (i.e., when the value zero is not enclosed in the confidence interval). A rug plot and a histogram show the distribution of countries in our sample according to their level of income.

The main result of Kong and Volkema (displayed numerically in Column 2 of Table 2) is illustrated lucidly by the top-left diagram in Fig. 1. In high-income countries public-sector corruption is positively associated with self-serving leadership, whereas in low-income countries the relationship is not significantly different from zero. Figure 1 also pictures the insignificant effects of individualistic and prosocial leadership on public-sector corruption at any income level, just as it is reported by Kong and Volkema. Our replication, thus, clearly reconfirms their empirical results: Only cultural endorsement of self-serving leadership is significantly related to public-sector corruption and only in high-income countries.

Next, we show the marginal effect of each of the three indicators of leadership culture on private-sector corruption, as described numerically in Column 4 of Table 2. A comparison of Columns 2 and 4 shows that at the sample mean of income per capita self-serving leadership exerts the same effect on private- as on public-sector corruption. A one-standard deviation increase in self-serving leadership increases public- and private-sector corruption by one-third of a standard deviation. The top-left diagram in Fig. 2 shows the marginal effect of self-serving leadership on private-sector corruption at different levels of income per capita. We find the same positive association as for public-sector corruption. Endorsing self-serving leadership, thus, seems to promote corruption both in the public and in the private sector. However, in contrast to our expectation, this result holds again only for high-income countries. The latter finding deserves further scrutiny, as we would expect culture and informal institutions to matter more in poor societies, which often lack effective formal institutions and competitive markets.

Marginal effect of leadership style on private-sector corruption. Note: see Fig. 1

The top-right diagram in Fig. 2 illustrates the marginal effect of prosocial leadership on private corruption. Against our theoretical expectation, but in line with the findings of Kong and Volkema (2016) for public-sector corruption, we find no statistically significant effect. This is visualized by the value zero always being enclosed in the confidence interval. Finally, the bottom diagram in Fig. 2 shows the marginal effect of individualistic leadership prototypes on private-sector corruption. Individualism is indeed linked to less private-sector corruption and this relationship is only statistically significant in low-income countries. This result supports the findings by Licht et al. (2007) that individualism can constrain corruption and that it is linked to better corporate governance laws, which might be particularly relevant for explaining the significant result with respect to corruption in the private sector. The effect is not statistically significant at the sample mean of income per capita, but if income is one standard deviation below the sample mean, a one standard deviation increase in individualistic leadership would lower private-sector corruption by 40% of a standard deviation. Overall, the effect of individualistic leadership seems to be similar in absolute size to that of self-serving leadership, but of course it operates in the opposite direction and at different levels of income.

A major concern with our empirical analysis could be the small sample size of 40 observations. It does not allow us to include a large battery of control variables. Consequently, endogeneity due to omitted variable bias becomes a possibility (as it is in the study by Kong and Volkema 2016 who can also use only few control variables). We would, however, argue that the endogeneity problem is more limited here than in most other regression analyses of corruption, as our explanatory variables of interest are cultural factors, which according to Williamson (2000) operate on the most exogenous level of social analysis. Also Hofstede et al. (2010) argue that these factors change only over very long periods of time, which is why most social scientists who study institutions consider culture to be exogenously given. Here we use the same assumption, but future empirical studies might challenge the validity of this assumption, given appropriate instruments, such as those recently discussed by Maseland (2013) or Gorodnichenko and Roland (2016).

Aside from heightened endogeneity concerns, the small sample size may also lead to problems with influential observations or unstable parameter estimates. To address the latter concern at least to some degree, we have estimated all models without controlling for ethnic fractionalization, democracy, or both (results available on request). The estimated coefficients and standard errors remain virtually identical. To deal with potentially influential observations, we estimate robust regression models that are able to deal with both the presence of outliers and heteroscedasticity. These are more efficient estimators than OLS when the error term is not normally distributed, and they are robust to data contamination. The estimated models are shown in “Appendix 4”. The coefficient estimates become larger and are, if anything, different from zero at even more conservative levels of statistical significance. We interpret this as clear evidence that influential observations do not bias our OLS estimates and t test statistics. These robustness tests confirm that in spite of a small sample size, our empirical results appear to be quite reliable.

To sum up, our results on the relationship between leadership culture and private-sector corruption are very similar to those of Kong and Volkema (2016). Yet, there are also some differences. Self-serving leadership is related to more corruption in the private and the public sectors of high-income countries. Prosocial leadership has no statistically significant effect on public or private corruption. However, the endorsement of individualistic leadership prototypes is linked to less corruption in the private sectors of low-income countries, while it has no effect on public-sector corruption. We did expect that individualistic leadership is most important for constraining corruption in low-income countries, but it remains unclear why self-serving leadership hurts only high-income countries in terms of increased private- and public-sector corruption.

3.2 Exploring Additional Cultural Determinants of Private-Sector Corruption

In this subsection, we broaden our view of corruption beyond the narrow set of cultural aspects studied by Kong and Volkema (2016). To that end, we measure the association between these alternative cultural traits and our indicator of private-sector corruption. This constitutes a purely exploratory exercise and serves to inform the reader about potentially interesting avenues for future research on the cultural determinants of corruption. In other words, we do not set out to test concrete theories regarding the link between these factors and private corruption. As in the previous section, we control for ethnic fractionalization and the level of democracy while testing the association between a cultural country characteristic of interest and the country’s level of private corruption at different levels of income per capita. We test three groups of cultural characteristics: religious adherence, trust, and cultural dimensions measured by Hofstede et al. (2010). “Appendix 5” shows the regression results and Figs. 3 and 4 display plotted marginal effects based on these results. When analyzing the role of the population shares of Catholics, Protestants, and Muslims, we find no significant association with private-sector corruption, independent of a country’s level of income. These results change as soon as we operationalize religion by majority-religion dummies (see Fig. 3). Islam is still not linked to private-sector corruption, but countries with Protestant-majority populations tend to suffer from less corruption. The result for Protestantism is in line with extant research that finds a similar effect on public-sector corruption (see, e.g., Treisman 2000). Also Catholic-majority countries with low income are relatively less affected by private-sector corruption; but, at the same, time high-income Catholic-majority countries experience increased private sector-corruption. We come back to this result below.

Marginal effect of other cultural traits on private-sector corruption. Note: see Fig. 1

Linking trust to corruption at different levels of per capita income, we find that high trust levels are associated with reduced private-sector corruption levels (see Fig. 4). This result is in line with a recent study that finds trust to be a root cause of differences in education levels and institutional quality across countries (see Bjørnskov and Méon 2013). Finally, we take a look at five additional key cultural traits of civilizations as measured by Hofstede et al. (2010). These are power distance (i.e., the degree to which the less powerful accept and expect that power is distributed unequally); masculinity (i.e., a preference for achievement, heroism, assertiveness competitiveness, and material rewards for success); uncertainty avoidance (i.e., the degree to which people feel uncomfortable with uncertainty and ambiguity); long-term orientation (i.e., encouragement of thrift and efforts in modern education as a way to prepare for the future); and, finally, indulgence (i.e., relatively unconstraint gratification of basic and natural human drives). First of all, we find that long-term orientation and indulgence are not related to private-sector corruption levels. For uncertainty avoidance, we find increased levels of private-sector corruption. We would speculate that this has to do with more regulation of businesses in these uncertainty avoiding societies, which limits competition and creates opportunities for private corruption. Also masculinity is linked to more private-corruption in countries with a particularly high income. This would be in line with previous literature that links women to reduced public-sector corruption (Dollar et al. 2001; Swamy et al. 2001).

Finally, for power distance, we find a negative effect on private-sector corruption in low-income countries, and the opposite in countries with high income. In low-income countries, acceptance of hierarchies is, thus, linked to less private-sector corruption, but in high-income countries acceptance of hierarchies is linked to more private-sector corruption. This finding is comparable to what we reported above for Catholic-majority countries. This parallel does not come as a surprise, as Putnam (1993) and La Porta et al. (1997) have argued that Catholicism is an exceptionally hierarchical religion and therefore discourages the formation of trust in society. Interestingly, when we test the income-dependent effects of power distance and trust simultaneously, none of them are statistically significant. It remains an open question why power distance and Catholic majorities are associated with less private corruption in low-income countries. It should be noted that it is not possible to test the different cultural dimensions of Hofstede against each other or against the leadership styles studied in Sect. 3.1, due to limited degrees of freedom. In this sense, some of the observed correlations might in future research turn out to be spurious.

4 Conclusion

Despite recent advances in research on corruption, there is still need for more contributions dealing with private-sector corruption. Our study aims to take a step towards filling this gap by introducing a new indicator of private-sector corruption. This indicator is currently available for 105 countries and, as country coverage of the underlying Global Corruption Barometer by Transparency International expands, that number should increase over the coming years.

We use our new indicator in a first model application to replicate and extend a recent study by Kong and Volkema (2016), which examines for the first time the effect of leadership culture on the level of public-sector corruption in different countries. Testing the effect of different leadership prototypes on private-sector corruption, we find that self-serving leadership in high-income countries is associated with more corruption, not only in the public, but also in the private sector. Furthermore, individualistic leadership is linked to reduced private-sector corruption, but only in low-income countries. This empirical analysis serves as a first demonstration of the usefulness of our new indicator. Clearly, future studies will need to use more rigorous identification strategies to shed light on the exact causal mechanisms that lead to different levels of private-sector corruption across countries. This also requires taking alternative explanations seriously. Potrafke (2012) has, for example, demonstrated that public-sector corruption is strongly and negatively associated with a country’s average IQ level (r = −0.63). The correlation between IQ and private-sector corruption, however, is only weak and positive (r = 0.31). Potrafke argues that public-sector corruption is lower in countries where people discount future rewards less than inhabitants of other countries. It is then not surprising that we find no similar effect on private-sector corruption, as we also did not find a significant relationship between long-term orientation, as measured by Hofstede et al. (2010), and private-sector corruption.

A shortcoming of our indicator is its still limited country coverage and it will take a while until the number of survey waves is sufficiently large to use it in a cross-country time-series setting. Another limitation is our exclusive reliance on subjective corruption indicators, which constitutes a common problem in the empirical corruption literature, particularly when cross-country studies are conducted. Recent research has demonstrated that perceptions of corruption diverge systematically from reported experiences (Gutmann et al. 2014). Once data on experience with private-sector corruption becomes available, it would be worthwhile to repeat our factor analysis based on experience-based data.

Future empirical work drawing on our new corruption indicator could extend our knowledge regarding the causes of variation in private-sector corruption levels across countries. The exact consequences of private-sector corruption are also largely unexplored, although there are several important questions for researchers to answer: How do (especially multinational, but also domestic) firms adjust their business practices when faced with the existence of private-sector corruption in an economy? Are market prices higher when private corruption is pervasive? What is the effect of private-sector corruption on market entry, competition between firms, and innovation? And how effectively do law-makers respond to adverse effects of private-sector corruption? The high policy relevance of finding answers to these questions is evident.

Notes

Although Jordan and the Solomon Islands are part of the GCB, that question is not covered for Jordan, and for the Solomon Islands data specifically on corruption in the military is not available.

Answers were possible on a five-point Likert scale ranging from 1 (not at all corrupt) to 5 (extremely corrupt). We use the mean scores for each country, effectively interpreting the survey item according to a linear scale.

These traits of factor analysis are not shared by principal component analysis, which tries to maximize the variance that is explained by the principal components.

The results are virtually identical to those we obtain when we use instead the data from the 2010/11 wave of the GCB, which was the first wave to cover 100 countries and corruption in 11 segments of the private and the public sector. Earlier waves covered only significantly less countries and sectors.

Correlations with the latest public-sector corruption indicators by Transparency International (CPI) and the World Bank (Control of Corruption) are even lower (at around r = 0.15) and insignificant. The even lower correlations are not surprising, as the timing and method of measurement differs from the GCB.

References

Acemoglu, D., & Johnson, S. (2005). Unbundling institutions. Journal of Political Economy, 113(5), 949–995.

Afifi, A., May, S., & Clark, V. A. (2012). Practical multivariate analysis (5th ed.). Boca Raton: CRC Press.

Aidt, T. S. (2003). Economic analysis of corruption: A survey. The Economic Journal, 113(491), F632–F652.

Alesina, A., Devleeschauwer, A., Easterly, W., Kurlat, S., & Wacziarg, R. (2003). Fractionalization. Journal of Economic Growth, 8(2), 155–194.

Argandoña, A. (2003). Private-to-private corruption. Journal of Business Ethics, 47(3), 253–267.

Bjørnskov, C., & Méon, P.-G. (2013). Is trust the missing root of institutions, education, and development? Public Choice, 157(3), 641–669.

Borghesi, R. (2008). Widespread corruption in sports gambling: Fact or fiction? Southern Economic Journal, 74(4), 1063–1069.

Brambor, T., Clark, W. R., & Golder, M. (2006). Understanding interaction models: Improving empirical analyses. Political Analysis, 14(1), 63–82.

Brown, T. A. (2015). Confirmatory factor analysis for applied research (2nd ed.). New York: Guilford Press.

Coase, R. H. (1937). The nature of the firm. Economica, 4(16), 386–405.

Coase, R. H. (1979). Payola in radio and television broadcasting. Journal of Law and Economics, 22(2), 269–328.

Cronbach, L. J. (1951). Coefficient alpha and the internal structure of tests. Psychometrika, 16(3), 297–334.

Deutscher, C, Dimant, E., & Humphreys, B. R. (2017). Match fixing and sports betting in football: Empirical evidence from the German Bundesliga. PPE working paper no. 8, University of Pennsylvania.

Djankov, S., McLiesh, C., Nenova, T., & Shleifer, A. (2003). Who owns the media? Journal of Law and Economics, 46(2), 341–382.

Dollar, D., Fisman, R., & Gatti, R. (2001). Are women really the “fairer” sex? Corruption and women in government. Journal of Economic Behavior & Organization, 46(4), 423–429.

Dreher, A., & Gassebner, M. (2013). Greasing the wheels? The impact of regulations and corruption on firm entry. Public Choice, 155(3–4), 413–432.

Duggan, M., & Levitt, S. D. (2002). Winning isn’t everything: Corruption in sumo wrestling. The American Economic Review, 92(5), 1594–1605.

Gorodnichenko, Y., & Roland, G. (2016). Culture, institutions and the wealth of nations. Forthcoming: Review of Economics and Statistics. doi:10.1162/REST_a_00599.

Graeff, P., & Mehlkop, G. (2003). The impact of economic freedom on corruption: Different patterns for rich and poor countries. European Journal of Political Economy, 19(3), 605–620.

Green, S. P. (2013). Official and commercial bribery: Should they be distinguished? In J. Horder & P. Alldridge (Eds.), Modern bribery law: Comparative perspectives (pp. 39–65). New York: Cambridge University Press.

Gundlach, E., & Paldam, M. (2009). The transition of corruption: From poverty to honesty. Economics Letters, 103(3), 146–148.

Gutmann, J. (2015). Believe, but verify? The effect of market structure on corruption in religious organizations. Kyklos, 68(2), 153–164.

Gutmann, J., Padovano, F., & Voigt, S. (2014). Perception vs. experience: How to explain differences in corruption measures using microdata?. In Paper presented at the EPCS meeting, Cambridge.

Halim, N. (2008). Testing alternative theories of bureaucratic corruption in less developed countries. Social Science Quarterly, 89(1), 236–257.

Heywood, P. M. (2015). Introduction. In P. M. Heywood (Ed.), Routledge handbook of political corruption (pp. 1–13). London: Routledge.

Hodgson, G. M., & Jiang, S. (2007). The economics of corruption and the corruption of economics: An institutionalist perspective. Journal of Economic Issues, 41(4), 1043–1061.

Hofstede, G., Hofstede, G. J., & Minkov, M. (2010). Cultures and organizations: Software of the mind. New York: McGraw-Hill.

House, R., Javidan, M., Hanges, P., & Dorfman, P. (2002). Understanding cultures and implicit leadership theories across the globe: An introduction to project GLOBE. Journal of World Business, 37(1), 3–10.

Jain, A. K. (2001). Corruption: A review. Journal of Economic Surveys, 15(1), 71–121.

Javidan, M., Dorfman, P. W., de Luque, M. S., & House, R. J. (2006a). In the eye of the beholder: Cross cultural lessons in leadership from project GLOBE. Academy of Management Perspectives, 20(1), 67–90.

Javidan, M., House, R. J., Dorfman, P. W., Hanges, P. J., & de Luque, M. S. (2006b). Conceptualizing and measuring cultures and their consequences: A comparative review of GLOBE’s and hofstede’s approaches. Journal of International Business Studies, 37(6), 897–914.

Jetter, M., Agudelo, A. M., & Hassan, A. R. (2015). The effect of democracy on corruption: Income is key. World Development, 74, 286–304.

Kaiser, H. F. (1958). The varimax criterion for analytic rotation in factor analysis. Psychometrika, 23(3), 187–200.

Kaiser, H. F. (1974). An index of factorial simplicity. Psychometrika, 39(1), 31–36.

Kong, D. T., & Volkema, R. (2016). Cultural endorsement of broad leadership prototypes and wealth as predictors of corruption. Social Indicators Research, 127(1), 139–152.

Lambsdorff, J. G. (2006). Causes and consequences of corruption: What do we know from a cross-section of countries? In S. Rose-Ackerman (Ed.), International handbook on the economics of corruption (pp. 3–51). Cheltenham: Elgar.

Li, G. (1985). Robust regression. In D. C. Hoaglin, F. Mosteller, & J. W. Tukey (Eds.), Exploring data tables, trends, and shapes (pp. 281–343). New York: Wiley.

Licht, A. N. (2008). Social norms and the law: Why peoples obey the law. Review of Law and Economics, 4(3), 715–750.

Licht, A. N., Goldschmidt, C., & Schwartz, S. H. (2005). Culture, law, and corporate governance. International Review of Law and Economics, 25(2), 229–255.

Licht, A. N., Goldschmidt, C., & Schwartz, S. H. (2007). Culture rules: The foundations of the rule of law and other norms of governance. Journal of Comparative Economics, 35(4), 659–688.

Maoz, Z., & Henderson, E. A. (2013). The world religion dataset, 1945–2010: Logic, estimates, and trends. International Interactions, 39(3), 265–291.

Maseland, R. (2013). Parasitical cultures? The cultural origins of institutions and development. Journal of Economic Growth, 18(2), 109–136.

Myerson, R. B. (2008). Perspectives on mechanism design in economic theory. The American Economic Review, 98(3), 586–603.

OECD. (2008). Corruption—A glossary of international standards in criminal law. Paris: OECD Publishing.

Olken, B. A., & Pande, R. (2012). Corruption in developing countries. Annual Review of Economics, 4, 479–509.

Ostrom, E. (2000). Collective action and the evolution of social norms. Journal of Economic Perspectives, 14(3), 137–158.

Pellegrini, L., & Gerlagh, R. (2008). Causes of corruption: A survey of cross-country analyses and extended results. Economics of Governance, 9(3), 245–263.

Pemstein, D., Meserve, S. A., & Melton, J. (2010). Democratic compromise: A latent variable analysis of ten measures of regime type. Political Analysis, 18(4), 426–449.

Porta, L., Rafael, F L.-d., Shleifer, A., & Vishny, R. W. (1997). Trust in large organizations. The American Economic Review, 87(2), 333–338.

Potrafke, N. (2012). Intelligence and corruption. Economics Letters, 114(1), 109–112.

Putnam, R. D. (1993). Making democracy work: Civic traditions in modern Italy. Princeton: Princeton University Press.

Rose-Ackerman, S. (1975). The economics of corruption. Journal of Public Economics, 4(2), 187–203.

Rose-Ackerman, S. (2007). Measuring private sector corruption. U4Brief 2007-5, Chr. Michelsen Institute.

Rose-Ackerman, S. (2008). Corruption. In C. K. Rowley & F. G. Schneider (Eds.), Readings in public choice and constitutional political economy (pp. 551–566). New York: Springer.

Rose-Ackerman, S. (2010). The law and economics of bribery and extortion. Annual Review of Law and Social Science, 6, 217–238.

Sanchez, J. I., Gomez, C., & Wated, G. (2008). A value-based framework for understanding managerial tolerance of bribery in Latin America. Journal of Business Ethics, 83(2), 341–352.

Scott, D., & Pyman, M. (2008). Public perceptions of corruption in the military in europe and the rest of the world. European Security, 17(4), 495–515.

Shleifer, A., & Vishny, R. W. (1993). Corruption. Quarterly Journal of Economics, 108(3), 599–617.

Svensson, J. (2005). Eight questions about corruption. Journal of Economic Perspectives, 19(3), 19–42.

Swamy, A., Knack, S., Lee, Y., & Azfar, O. (2001). Gender and corruption. Journal of Development Economics, 64(1), 25–55.

Tabellini, G. (2010). Culture and institutions: Economic development in the regions of Europe. Journal of the European Economic Association, 8(4), 677–716.

Thompson, G. (1950). The factorial analysis of human ability. London: University of London Press.

Transparency International. (2011). Bribe payers index 2011. http://www.transparency.org/research/bpi.

Transparency International. (2013). Global corruption barometer 2013. http://www.transparency.org/gcb2013.

Treisman, D. (2000). The causes of corruption: A cross-national study. Journal of Public Economics, 76(3), 399–457.

Treisman, D. (2007). What have we learned about the causes of corruption from ten years of cross-national empirical research. Annual Review of Political Science, 10, 211–244.

Treisman, D. (2015). What does cross-national empirical research reveal about the causes of corruption? In P. M. Heywood (Ed.), Routledge handbook of political corruption (pp. 95–109). London: Routledge.

Van Hoorn, A. (2014). Individualism and the cultural roots of management practices. Journal of Economic Behavior & Organization, 99, 53–68.

Van Lange, P. A. (1999). The pursuit of joint outcomes and equality in outcomes: An integrative model of social value orientation. Journal of Personality and Social Psychology, 77(2), 337–349.

Voigt, S. (2013). How (not) to measure institutions. Journal of Institutional Economics, 9(1), 1–26.

Voigt, S., & Gutmann, J. (2015). On the wrong side of the law: Causes and consequences of a corrupt judiciary. International Review of Law and Economics, 43, 156–166.

Wated, G., & Sanchez, J. I. (2005). The effects of attitudes, subjective norms, attributions, and individualism-collectivism on managers’ responses to bribery in organizations: Evidence from a developing nation. Journal of Business Ethics, 61(2), 111–127.

Williamson, O. E. (2000). The new institutional economics: Taking stock, looking ahead. Journal of Economic Literature, 38(3), 595–613.

Wolfers, J. (2006). Point shaving: Corruption in NCAA basketball. The American Economic Review, 96(2), 279–283.

World Bank. (1997). Helping countries combat corruption: The role of the World Bank. http://www1.worldbank.org/publicsector/anticorrupt/corruptn/corrptn.pdf.

World Bank. (2015). Enterprise surveys. http://www.enterprisesurveys.org.

Yohai, V. J. (1987). High breakdown-point and high efficiency robust estimates for regression. The Annals of Statistics, 15(2), 642–656.

Zheng, X., El Ghoul, S., Guedhami, O., & Kwok, C. C. Y. (2013). Collectivism and corruption in bank lending. Journal of International Business Studies, 44(4), 363–390.

Acknowledgements

The authors thank Dejun Tony Kong and Roger Volkema for sharing their data as well as Agnes Strauß, Anna Sunik, Cornelius Haasnoot, Erich Gundlach, Julia Grauvogel, Karsten Mau, Michael Stoffel, Nora ElBialy, Sabrina Maaß, Sönke Häseler, Stanley Winer, Stefan Voigt, Stephan Michel, the GIGA’s “Non-Democratic Regimes” research team, and participants of the European Political Science Association Conference for helpful comments and suggestions on earlier drafts of this paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Replication files and data will be made available at www.jerg-gutmann.de.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

Rights and permissions

About this article

Cite this article

Gutmann, J., Lucas, V. Private-Sector Corruption: Measurement and Cultural Origins. Soc Indic Res 138, 747–770 (2018). https://doi.org/10.1007/s11205-017-1684-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-017-1684-3