Abstract

Olivera, in “Changes in Inequality and Generalized Trust in Europe” argues that the relationship between economic inequality and generalized trust becomes insignificant in his time series analyses when regression fixed effects are added to a basic model . I argue that the rationale for his analyses is problematic since neither trust nor inequality change much over time, that he includes former Communist nations inappropriately, and that a full model of trust and inequality must include countries outside Europe.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Uslaner (2002; see also Uslaner and Brown 2005) showed that the strongest predictor of generalized trust is the level of economic equality in a society–across countries without a legacy of Communism, in the United States over time, and across the American states. Uslaner argues that inequality leads people to view their fates as disconnected from people who are different from themselves. The rich and poor do not see each other as part of the same moral community, What happens to one group does not happen to others. Trusting other people—especially unknown people who are likely to be different from yourself—depends upon a social psychological foundation of optimism and control: The world is a good place, it is going to get better, and you can make it better. In highly unequal societies, people are unlikely to accept any of these arguments.

Generalized trust (used interchangeably with “trust” below) is not fragile as is what Uslaner (2002) calls “strategic trust.” It largely does not change much over a person’s life span and is not affected by most adult experiences. Bauer (2014), Becker (1996), Giddens (1991), Jones (1996), Uslaner (2002), and Wrightsman (1991) all argue that trust is learned at an early age and is not shaped by experiences in one’s later years. There is one major exception—growing economic inequality. Greater inequality leads to lower levels of trust (Uslaner 2002, 186–188).

However, trust and inequality levels persist over long periods of time (Uslaner 2008, 26).

Neither is immovable: Inequality rose in both the United States (since the 1970s) and in the transition countries of Central and Eastern Europe (after the fall of Communism)–and both were accompanied by declines in generalized trust (Uslaner 2002, 186–188; Uslaner 2008, 135). But these results are anomalous. This is why studying changes in inequality and trust is not terribly revealing. Ttrust is so stable over the lifespan is that inequality mostly doesn’t vary much.

Changes in inequality may shape levels of trust over extended periods of time, perhaps generations. But we lack historical data on both trust and inequality to test the dynamics of this relationship.

Olivera (2014) seems to accept the theoretical argument connecting inequality and trust, but is convinced that there are “unobserved effects” that may account for this relationship. He examines inequality and trust in Europe using the six-wave European Social Survey (ESS) and seeks to show that changes in inequality do not shape trust once fixed effects (country specific dummy variables) are taken into account.

Olivera is not offering an explanation for the foundations of generalized trust. Rather, he is simply attacking the linkage between inequality and trust. I challenge Olivera’s argument. He does not offer an alternative account for what shapes trust. So I focus instead about problems with his analysis of the linkage between trust and inequality. I do not replicate his analysis–since my argument is that the rationale for his analyses is misplaced.

Olivera’s empirical strategy is to examine changes in trust attributable to changes in inequality. The theoretical and empirical linkages in the literature are almost entirely cross-sectional, so it is unclear which studies Olivera is attacking. He is taking aim at the wrong question, especially since neither trust nor inequality change much over the 2002–2012 time period of his data.

Olivera’s focus on Europe is misplaced. The trust-inequality linkage cannot be tested if the data set excludes countries with the greatest inequality and the least trust. Olivera includes former Communist countries: Their historical levels of inequality are low, but measurement is often in question–and Communism likely led to lower levels independent of the income distribution.

Two major problems in his analysis are the means of testing the relationship (using fixed effects) and the nature of his sample. I consider each of these. I do not consider his individual level analysis of the survey data—except in his measure of trust. I discuss the problems with this measure in the “Appendix”, but I concentrate on the two issues with his aggregate analysis.

1 Olivera’s Analysis and Its Problems

Olivera constructs a panel for the 32 countries and six time periods to investigate how trust changes over time as inequality varies. Fewer than half of the countries administered the ESS are in all six waves, so the sample size for the aggregate analysis is 152 cases rather than 192 (32 × 6). He employs fixed effects to “take away the individual unobserved effects” attributable to unobserved variations at the country level. Fixed effects “will allow the unobserved effect… to be arbitrarily correlated with the time-varying explanatory variables.”

The aggregate trust measures across waves are almost perfectly correlated. Of the 15 zero-order correlations between the trust measures for 2002–2012, the lowest is .941 (for the 2004–2012 comparison). The average correlation is .967. And the associations do not atrophy over time. The average of the five correlations with the 2002 measure is .975, The variations in the correlations are due less to changes in the survey responses than in the countries included in the ESS at each wave.

The stability of the Gini indices (from 2002 to 2008) is somewhat lower, but still very strong. The correlations range from .850 (for 2002 compared to 2008) to .968 (2002/2004), with an average of .916. Excluding transition countries leads to much higher correlations–ranging form .957 (2004/2008) to .993 (2002/2004), with an average of .979.

The mean change from 2002 to 2012 across his sample on the 11-point trust measure is .17. Only in Hungary and Slovenia are there positive changes greater than 10 % in trust and only Portugal shows a decline of more than 10 %. In only five countries–Bulgaria, Denmark, Estonia, Lithuania, and Slovakia–are there changes in the net Gini measures greater than two percent. Only in Bulgaria was there a considerable change in inequality, as the net Gini increased from 25 to 33.5 (or 34 %). However, trust levels in Bulgaria were virtually identical in 2006 (the first year it was included in the ESS) and 2012 at 3.34 and 3.32 on the 11-point scale.

Olivera is trying to explain change in one variable that is largely constant with another that doesn’t change much either.

The other major problem is, that he includes formerly Communist countries (Bulgaria, Croatia, the Czech Republic, Estonia, Hungary, Lithuania, Poland, Russia, Slovakia, Slovenia, and Ukraine). As Uslaner (2002. 228–232) argued, historical levels of inequality and trust are lower in these countries, which are attributable to the legacy of Communism. The rationale behind the argument that inequality leads to lower levels of trust does not hold for these countries. The inequality-trust linkage is much stronger with the transition countries removed from the sample.

We see the danger of including transition countries with other Western nations when we compare the correlations of trust with inequality across the six waves. The simple correlations between trust and inequality are modest: The strongest zero-order correlation is −.603, for trust in 2008 and the Gini (net worth) in 2004. The Ginis are the same measures Olivera used from the same data set. The contemporaneous correlation for 2004 is weaker at −.456. The lowest correlation is −.173 for the 2002 Gni and trust in 2012. The mean correlation between inequality and trust for contemporaneous years is −.432 (I used the 2008 Gini for trust in 2010 and 2012.)

When we restrict the sample to exclude transition countries, the correlations are much stronger. The contemporaneous correlations average −.682; the highest is for 2002 (−.765), the lowest for 2006 (–.605).

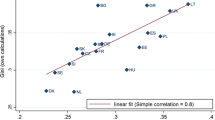

By focusing only on Europe, Olivera omits most of the countries with the highest levels of trust and the lowest inequality. These are countries in Latin America and Africa. I present graphs showing how sample selection maters in Figs. 1 and 2. In Fig. 1 I present a graph of trust and inequality using Olivera’s sample of countries (Europe with transition nations included). In Fig. 2 I present a graph of trust and inequality using Uslaner’s (2002) sample–including countries in Latin America and Africa, as well as Asia (where inequality is not as uniformly high).

Without the full range of cases, Olivera’s results are not generalizable. You can’t do a study of obesity with a sample comprised mostly of anorexics–or of all the societies with low inequality and high trust (the Nordic countries, the Netherlands, and Canada)–but few nations at the other extreme. The problem is exacerbated by the country-years available in the ESS. The countries with the lowest levels of inequality and the greatest trust–Denmark, Finland, Norway, and Sweden and the Netherlands–are overrepresented in the panel: Turkey and Russia are the only countries with high inequality and low trust, but they are only surveyed twice (Turkey) or three times (Russia). So Olivera’s sample is biased against finding a strong impact of inequality on trust.

A more comprehensive data base is necessary to estimate the effect of inequality on trust–and to see if Olivera’s results hold. I can’t use the ESS, so I rely upon the World Values Survey (WVS). Because of some anomalies in the WVS especially on trust since 2000 (cf. Muller et al. 2012), I use data from 1995 and earlier to fill in when data are not available for that year (see Uslaner 2002, 225, n. 6 for the full description of the WVS data employed). I use Uslaner’s sample, which excludes former Communist countries.

As with the simple correlations above, the graphs in Figs. 1 and 2 show that Olivera’s sample greatly underestimates the strength of the relationship between trust and inequality. For his restricted sample, the relationship is weak: R2 = .17, while for the larger sample Uslaner employs, the relationship is much stronger (R2 = − .44). At the lower right hand part of Fig. 2, we find countries from Latin America and Africa–which are absent from Olivera’s sample.

There is clearly a sample selection bias in Olivera’s data–and this leads to inefficient and biased estimates of the effects of inequality on trust (Heckman 1979).

This problem is not simply a question of methodology. The inequality-trust linkage stems from comparing wealthy Western welfare states with universalistic social policies (the Nordic countries) with countries that have long experienced an unequal distribution of resources and have also been marked by strong conflicts between a tiny economic elite such as African, Asian, and Latin American nations. The theoretical argument makes more sense comparing Sweden and Denmark with the large cluster of countries with high levels of inequality outside Europe than with the two outliers in Europe (Russia and Turkey) covered by the ESS.

Finally, Olivera’s attempt to challenge the inequality-trust relationship by employing fixed effects is itself problematic. I replicate fixed-effects static models in Table 1. First I estimate a model for all of the countries in the ESS sample for 2002–2008. Then I present models for countries with and without legacies of Communism (as argued above). For the full sample, the coefficient of the Gini index on trust is insignificant (t = .27). The same result holds for the formerly Communist countries (t = −.83). But for the remaining countries, there is an anomalous result: More inequality seemingly leads to higher levels of trust–and for a two-tailed test it is barely significant (t = 1.92, p < .10). How can we explain the curious positive relationship between inequality and trust?

The likely culprit for sign reversal is multicollinearity. And this is indeed the problem.

The VIF (variance inflation factor) for the Gini coefficient is 87.04, which is far above the conventional level of 10 indicating severe collinearity. The VIF for the country dummies for Greece, Italy, Portugal, Turkey, and Great Britain range between 10.63 and 26.53. Each of these countries except Great Britain are Southern European (or Eurasian in the case of Turkey).

Excluding Britain, the average Gini for the countries with high VIFs is 35 compared to 27 for the other Western countries. The R2 for these country dummies with the Gini index is .76 with Britain included and .62 with Britain excluded. Either way, there is substantial collinearity between the fixed effects and the Gini index.

Fixed effects don’t clarify the linkage between inequality and trust. They obscure it.

Plümper et al. (2005, 331,334) argue that fixed effects distort the relationship between variables that do not change much over time and “completely absorb differences in the level of the independent variables across the units….If a theory predicts level effects, one should not include unit dummies. In these cases, allowing for a mild bias resulting from omitted variables is less harmful than running a fixed effects specification.” More simply stated: (1) fixed effects may distort the relationship between variables that do not change much over time (such as inequality and trust); and (2) are largely atheoretical. Fixed effects might be useful if the dependent and independent variables varied substantially over time. But they don’t. For the countries without a legacy of Communism, the R2 within countries (over time) is .079, compared to .338 across countries.

2 Reprise

Olivera claims to have found problems with the linkage between inequality and generalized trust. His models are not up to the task of challenging this connection. It is not so much that Olivera made mistakes in estimation. Rather, the rationale behind his critique is problematic.

References

Bauer, P. C. (2014). Negative experiences and trust: a causal analysis of the effects of victimization on generalized trust. European Sociological Review, 2014, 1–21.

Becker, L. C. (1996). Trust as noncognitive security about motives. Ethics, 107, 43–61.

Giddens, A. (1991). Modernity and Self-identity. Camebridge: Polity Press.

Heckman, J. J. (1979). Sample selection bias as a specification error. Econometrica, 47(1), 153–161.

Hooghe, M., & Reeskens, T. (2008). Cross-cultural measurement equivalence of generalized trust. Evidence from the European Social Survey (2002 and 2004). Social Indicators Research, 85(3), 515–532.

Jones, K. (1996). Trust as an affective attitude. Ethics, 107, 4–25.

Muller, D., Torgler, B., & Uslaner, E. M. (2012). A comment on ‘inherited trust and growth’. Economics Bulletin, 32(2012), 1481–1488.

Plümper, T., Troeger, V. E., & Manow, P. (2005). Panel data analysis in comparative politics: Linking method to theory. European Journal of Political Research, 44, 327–354.

Uslaner, E. M. (2002). The moral foundations of trust. New York: Cambridge University Press.

Uslaner, E. M. (2008). Corruption, inequality, and the rule of law. New York: Cambridge University Press.

Uslaner, E. M., & Brown, M. (2005). Inequality, trust, and civic engagement. American Politics Research, 31(4), 868–894.

Wrightsman, L. S. (1991). Interpersonal trust and attitudes toward human nature. In J. Robinson et al. (Eds.), Measures of personality and psychological attitudes. San Diego: Academic Press.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

As many others do–he cites Hooghe and Reeskens (2008)–Olivera’s measure of trust includes not only the generalized trust question (“Generally speaking, do you believe that most people can be trusted or can’t you be too careful in dealing with people?”) but also measures of fairness and helpfulness.. Olivera, as many others do, call this composite index “trust.” Yet, trust, helpfulness, and fairness are not the same thing. In the American General Social Survey from 1972 to 2010, the three measures do not scale well. A factor analysis gives a seeming one-dimensional solution, indicating that the three indicators do cluster together. However, the eigenvalue is only .67 and the three measures have a scalability coefficient (alpha) of only .49.

Moreover, the three indicators don’t track each other well over time. In the time series from 1960 to 2012 (employing both the ANES and the General Social Survey in the United States), the aggregate measures of trust and fairness are strongly (r = 79) and helpfulness is correlated with fairness (r = .66). However, helpfulness is only modestly related to trust (r = .269) and barely declines over time (r = .334), while trust has fallen strongly over time (r = –.877).

While the three measures are all correlated in the ESS, the relationships are not universally strong. For half of the 32 countries, the correlations between helpfulness and both trust and fairness are below .5. For 11 countries, the trust-helpfulness correlations are below .4. It is thus a leap to consider the three measures as part of the same syndrome of trust.

Rights and permissions

About this article

Cite this article

Uslaner, E.M. A Reconsideration of Olivera’s “Changes in Inequality and Generalized Trust in Europe”. Soc Indic Res 128, 723–729 (2016). https://doi.org/10.1007/s11205-015-1053-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-015-1053-z