Abstract

Motivated by an interest in investigating factors associated with poverty risks in Italy, our study provides insight into the relationship between various socio-economic, demographic, and behavioural variables and a new measure of the economic inadequacy of households. We propose that a household is in a condition of economic inadequacy when it simultaneously has difficulty making ends meet and is in arrears with payments of commitments for more than 90 days. To analyse the determinants of economic inadequacy, we use cross-sectional microdata collected through a structured questionnaire from a 2012 survey of household income and wealth conducted by the Bank of Italy. The results of the analysis show that the probability of economic inadequacy for Italian households is higher when the household is located in regions in southern Italy, has a low equivalent income, registers a decrease in income compared with that of a normal year, has a low liquidity ratio, pays rent for the house of residence, is over-indebted, is indebted to friends and relatives, and has an unhappy and impatient household head. We also propose constructing a composite indicator at the regional level that combines the percentage of households in relative poverty, as measured by the Italian National Institute of Statistics, and the percentage of households that we identify as existing in a condition of economic inadequacy. The composite indicator allows us to take into account some aspects of household living conditions that are not included in the measure of relative poverty.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The depth and duration of the economic downturn that has affected Italy in recent years has contributed to an increase in the percentage of households in poor economic conditions. Official statistics released by the Italian National Institute of Statistics (ISTAT) reveal that the percentage of Italian households existing in a condition of economic deprivation has increased from 14.8 % in 2007 to 24.9 % in 2012, while the percentage of household existing in a condition of relative poverty has increased from 11.1 % in 2007 to 12.7 % in 2012 (Istat 2014). These statistics should ‘raise the alarm’ for policymakers who are responsible for Italy’s welfare system and growth.

A mixture of macroeconomic and microeconomic factors may contribute to the compromise of a household’s budget. As a non-exhaustive list, we cite economic, political, and policy factors, as well as poor individual income management, family history, discrimination, high living costs, limited opportunities, disabilities, low income levels, and insufficient future planning, among other factors (Nandori 2014). Understanding the factors associated with households’ economic inadequacy represents a core task for policymakers who are interested in planning effective action strategies to eradicate the problem, to increase national well-being, and to achieve the Europe 2020 target in terms of poverty reduction (http://ec.europa.eu/europe2020/index/en.htm).

In this study, we use the concept of economic inadequacy and poverty (risk) interchangeably. Household poverty is a sophisticated concept that still does not have a universally shared definition. Studies conducted in various countries worldwide have addressed the issue of poverty (risk) with different approaches, ranging from comparing and proposing different measures of poverty to investigating factors that can help describe poverty, including its persistence over time (e.g., Litwin and Sapir 2009; Anderloni et al. 2012; Giarda 2013; Kaya 2014; Hick 2014). Relative poverty is a traditional measure employed by several international institutions (e.g., the Organisation for Economic Co-operation and Development, Eurostat) to identify a household in a condition of economic inadequacy. The poverty threshold may vary annually.Footnote 1 In Italy, the relative poverty line for a two-member household was equal to 972.52 Euro in 2013 (Istat 2014). Thus, if a household’s income is below the poverty line, the household is considered poor or in a condition of economic inadequacy. In contrast, if the household’s income is at or above the poverty line, the household is not considered to be in a condition of economic inadequacy. Thus, if a large and growing number of people in a population are living below the poverty line, the nation’s welfare policies are likely insufficient. However, using the poverty line as the sole criterion for a household’s eligibility for inclusion in social programmes might lead policymakers to neglect some aspects associated with the living conditions of households. For example, two households may be characterised by the same income level and family structure but may survive financially in a different manner based on their specific family needs and their ability to manage available resources.

In studying the phenomenon of household or individual poverty (or economic inadequacy), numerous scholars have suggested increasing the range of indicators to consider for measuring a household’s living conditions. These variables include the household’s inability to pay utility bills, debts, and rent (an objective measure) and its inability to make ends meet (a subjective measure). A household that cannot pay the arrears of financial commitments for more than 90 days is usually assumed to be in a severe economic condition, as the inability to pay the arrears of commitments should reflect the household’s monetary inability to fulfil its commitments (e.g., Duygan and Grant 2009). However, we must remember that some households may be able to fulfil their commitments but may decide not to pay for some services for other, sometimes unknown, reasons (see also, Dominy and Kempson 2003). A household’s ability to make ends meet instead represents a variable that can help control for both the income and the spending sides of its finances (e.g., Litwin and Sapir 2009; Kaya 2014). A possible criticism of using such a measure is that factors associated with individuals’ personal traits may affect responses of a subjective nature. Thus, in considering only subjective measures of poverty, a policymaker might incur paradoxes of eligibility for social policies (e.g., orienting social programmes to the false poor).

In following the line of research of an integrated view of subjective and objective indicators, we seek to analyse the economic inadequacy of households in Italy as follows:

-

First, using information from a sample survey, we argue that a household is in a condition of economic inadequacy when it is simultaneously unable to make ends meet (a subjective variable) and is in arrears with the payment of utility bills, debts, and/or rent (an objective variable).

-

Second, we investigate the characteristics of Italian families who are likely to be in a condition of economic inadequacy based on this new indicator. Within this framework of analysis, we also investigate the probability that a household is in a condition of economic fragility (i.e., the household is experiencing difficulty to making ends meet, but it is able to pay commitments) and the probability that a household is able to regularly pay commitments but will not pay or tends to delay payments (i.e., the household is unable to pay the arrears of commitments but does not experience difficulty in making ends meet). To the best of our knowledge, this is the first application that provides evidence in this regard.

-

Third, we provide a composite indicator of household poverty at a regional level by combining the percentage of households in relative poverty measured by ISTAT with the percentage of households in economic inadequacy determined using the measure proposed in the first point.

The first two points of analysis are addressed using Italian microeconomic data collected through a structured questionnaire from a 2012 survey of household income and wealth (SHIW) by the Bank of Italy. In this phase of analysis, our aim is to investigate the effect of a number of Italian household characteristics on the probability of economic inadequacy (i.e., when a family is simultaneously unable to make ends meet and is in arrears with the payment of utility bills, debts, and/or rent). Two separate univariate probit or logit models could be used to estimate the joint effects of a number of covariates (e.g., regarding household characteristics, region of residence, equivalent income, household income level compared with that of a normal year, liquidity ratio, debt-income ratio, and indebtedness to friends and relatives; regarding household head characteristics, age, education, high time preferences (or impatience), and happiness) on the outcome. However, the use of a univariate probit or logit model would likely lead to biased estimates if some unobserved factors affect both outcomes. To address this problem, we study this phenomenon by employing a bivariate probit model (BPM; e.g., Greene 2012). Such an approach involves estimating a simultaneous system of two binary regressions by modelling the equations’ dependence.

A possible concern in using such modelling framework is that we are unable to control for the suspected endogeneity issue with regard to the household head’s time preference and happiness and the household’s indebtedness to friends and relatives (see also Becker and Mulligan 1997; Weiss et al. 2008; Voicu 2014; Georgarakos et al. 2014). For example, it is likely that a number of unobservable confounders (e.g., the persistence of economic difficulty, an individual’s ability) will affect both the ability to make ends meet and the impatience (time preference) of the household head. A similar issue can arise in the relationship between a household head’s time preference and the inability to pay the arrears of commitments. Because we are not able to directly account for the aforementioned unobservable characteristics, we should expect biased parameter estimates and thus biased interpretations of the effects of interest on the outcome. To control for possible endogeneity issues, we employ instrumental variable (IV) methods. Specifically, a recursive bivariate probit model (RBP; e.g., Greene 2012) is used to control for the possible endogeneity of household head’s impatience and indebtedness to friends and relatives, while a two-stage stage least square model (2SLS; Baltagi 2002; Zanin et al. 2014) is used to control for the suspected endogeneity of happiness. The endogeneity issue may also arise for other reasons. For instance, the household head’s impatience may be affected by measurement errors or the problem of reverse causality, as (persistent) economic inadequacy in its various forms may affect household heads’ time preferences. Here, we treat only the first case of endogeneity (i.e., the presence of unobservable confounders) because we lack the longitudinal data necessary to investigate potential measurement errors and reverse causality. The same endogeneity issue for potential reverse causality may also arise with indebtedness to friends and relatives and with happiness. In any case, the issue of reverse causality for these variables is not among the aims of our analysis.

As last point of analysis, we use principal component analysis to construct a composite indicator of poverty at the regional level.

This article is organised as follows: Sect. 2 presents the data and defines the variables for the empirical analysis. Section 3 introduces the proposed models, and Sect. 4 presents the main empirical findings.

2 Data

The empirical analysis is based on Italian microeconomic data collected through a structured questionnaire from a 2012 SHIW conducted in 2013 by the Bank of Italy. The survey consisted of a sample of 8151 Italian households and 20,022 individuals. The interviews were mainly conducted using computer-assisted personal interviewing. The household questionnaire was addressed to the person of reference (typically the household head; i.e., the person who was identified as responsible for the family’s economy), who responded on behalf of all household members. The survey concerns socio-demographic characteristics regarding the households’ members, wealth composition, income sources, and debts, among others.

2.1 Economic Inadequacy

We investigate Italian households’ economic inadequacy by considering the following two variables: (a) the inability to pay the arrears of commitments for a period of 3 months or more (an objective variable) and (b) the inability to make ends meet (a subjective variable).

The inability to pay the arrears of commitments (henceforth arrears): This variable aims to capture the existence of adverse events that hinder a household from fulfilling payments for contractual services (e.g., Stamp 2009). A section of the questionnaire was reserved to collect such information with the following three questions:

-

In 2012, have there been prolonged periods (at least 90 days) during which your family has been unable to pay the arrears of utility bills (e.g., gas, electricity, water)?

-

In 2012, have there been periods (at least 90 days) during which your family has been unable to pay the arrears of the rent for your house of residence?

-

Given each type of debt (mortgage and consumer credit), in 2012, have there been periods (of at least 90 days) during which your family has been unable to pay the arrears of an instalment payment?

The possible answers for each question were ‘yes’ or ‘no’. For ’yes’ responses, no further information was collected to determine whether the delay in payment was a ‘once–off’ event or a reoccurring event. In either case, this variable reflects a household’s difficulty in managing payments during the years in question. We construct a binary variable that takes a value of 1 if the household answers ‘yes’ to at least one of the three aforementioned questions regarding the inability to pay the arrears of commitments and 0 otherwise. The descriptive analysis has highlighted that approximately 10 % of the households reported being unable to pay the arrears of at least one of the aforementioned commitments (Table 4 in Appendix).

The inability to make ends meet (henceforth, economic difficulty): In consumer science, households are known to be characterised by heterogeneity in terms of lifestyle, consumer preferences (which reflect tastes and, in turn, influence the relationship between the acquisition of goods and the meeting of needs that are specific to each individual), social comparison behaviour, aspirational levels, etc. (Karlsson et al. 2004; Bryant and Zick 2006). Such differences influence consumers’ decision-making processes and expenditure behaviours. For instance, two households with equivalent incomes may have different characteristics; consequently, they may manifest different abilities in terms of staying within a budget. A household’s ability to stay within a budget is captured by the following question: On the basis of your total monthly income, is your household able to make ends meet? Possible answers are as follows: ‘with great difficulty’, ‘with difficulty’, ‘with some difficulty’, ‘fairly easily’, ‘easily’, and ‘very easily’. We construct a binary variable that takes a value of 1 when the household’s answer is ‘with great difficulty’ or ‘with difficulty’ and 0 otherwise. The descriptive statistics show that 35 % of the households report having difficulty making ends meet (Table 4 in Appendix). The percentage of households experiencing economic difficulty is consistent with that reported by ISTAT using the Eu-Silc (the Statistics on Income and Living Conditions) survey (http://dati.istat.it/).

2.2 Explanatory Variables

Household Characteristics

-

Region of residence: The use of spatial covariates in an economic analysis is important because they allow us to account for the possible differences in outcomes based on the geographical location of households. In this regard, studies at the microeconomic level relative to Italy include the region of residence of individuals/households to capture the dichotomy between the north and south of the country (e.g., Anderloni et al. 2012; Fabrizi et al. 2014; Celidoni 2015). The standard of living of households will likely be affected by labour market characteristics, cultural aspects, and spatial welfare policies, to name a few. We identify each region as a binary variable that takes a value of 1 when the ith household lives in the region considered and 0 otherwise.

-

Equivalent income: Income stream is an important economic resource that allows households to purchase goods and services to meet their individual needs (Bryant and Zick 2006). Thus, the resources of all household members (e.g., from dependent workers, retirement schemes, and self-employment) are assumed to be combined and redistributed among the members (Zanin and Marra 2012). However, if we compare the consumption of a one-person household with that of a four-person household, we do not necessarily expect the latter to require four times the amount of resources needed by the former, as there are economies of scale. To accurately compare income among different households, a solution suggested in the literature is to use an equivalence scale that accounts for the different sizes and compositions (the number of children and adults) of households (Nelson 1993; Banks and Johnson 1994; Hagenaars et al. 1994). Here, we employ the widely accepted OECD modified scale (Hagenaars et al. 1994; De Vos and Zaidi 1997). Specifically, equivalent income is calculated as follows:

$$\begin{aligned} {\text {Equivalent}} \, {\text {income}}= \frac{{\text {Net}} \, {\text{Annual}} \, {\text{Household}} \, {\text{Income}}} {1+ 0.5 \times ( {\text {no}}. \, {\text{adults}} -1) + 0.3 \times ({\text {no}}. \, {\text {child }} \, {\text {under}} \, 14)}. \end{aligned}$$(1)We construct a categorical variable based on the quartiles of the equivalent income distribution (income without imputed rents).

-

Household income level compared with that of a normal year: A section of the questionnaire was devoted to collecting qualitative information on income variations. Specifically, one question asked whether the household income for 2012 was ‘unusually high’, ‘unusually low’, or ‘at the mean’ compared with the income that the family expected to receive in a ‘normal year’. We observe that 20 % of the households reported an income reduction. Of these households, 5 % are characterised as having one or more unemployed members who are not looking for a first job. A decrease in available income, especially when such a decrease results from unemployment, can be reasonably assumed to contribute to an increase in the probability of a household’s economic inadequacy.

-

Debt-to-income ratio: The ratio of the amount of debt (consumer credit and/or loans) paid in 2012 to the net annual income indicates the share of income that is committed to debt repayment and that is not available for household consumption or savings (De Vaney 1994). The households are classified as follows: not indebted, indebted (a ratio of less than 30 %), and over-indebted (a ratio of more than 30 %). In line with the literature in this field, we set the threshold of household vulnerability at 30 % (see, De Vaney and Lytton 1995; ECB 2005). We observe that only 6 % of the households in the sample have debt repayment expenditures that total more than 30 % of the household’s income.

-

Indebtedness to friends and relatives: This variable takes a value of 1 if the household is indebted to friends and relatives and 0 otherwise. The descriptive statistics show that approximately 4 % of the households are indebted to friends and relatives (7800 Euro on average), and approximately 70 % of these households do not have debt with a bank or financial institution.

-

Liquidity ratio: The number of months that a household could meet its expenses/consumptions after a loss of income is measured with the ratio between household liquid assetsFootnote 2 and net annual income (e.g., De Vaney 1994). We expect that greater preparation for financial emergencies (such as income loss) will be associated with a lower probability of economic inadequacy. We define three thresholds for the liquidity ratio: lower than 0.25 (i.e., in the absence of income, the household is able to maintain the same standard of living and cover its expenses for fewer than 3 months), between 0.25 and 0.5 (i.e., the household can cover its expenses for 3–6 months), and greater than 0.5 (i.e., the household can cover its expenses for more than 6 months).

-

House rent: We construct a binary variable that takes a value of 1 if the household pays rent for the house of residence and 0 otherwise. We observe that approximately 20 % of Italian households do not own the house in which they live.

-

Number of members who are younger than 18: We consider the number of children present in the household who are younger than 18 years of age (i.e., minors). We account for the presence of adolescent children because some empirical evidence shows that there is a positive and significant association between the number of children present and the household’s financial vulnerability in Italy (Anderloni et al. 2012).

Characteristics of the Household Head

-

Gender: We create a binary variable that takes a value of 1 if the household head is male and 0 otherwise. Scholars who have included the household head’s gender in studies of poverty in Italy have found conflicting evidence of the statistical significance of this variable. For example, Anderloni et al. (2012) did not find empirical evidence in this regard, while Addabbo and Baldini (2000) observed the opposite.

-

Age: We categorise the age of the household’s reference person using seven age groups (18–30, 31–40, 41–50, 51–60, 61–70, 71–80, >80). Age is a variable that plays a crucial role in many socio-demographic and economic analyses, as it can capture aspects that are linked to an individual’s lifecycle (e.g., retirement; see also Lusardi et al. 2011; Kaya 2014).

-

Education: Human capital is a set of heterogeneous intangible skills that contribute to improving individuals’ quality of work and living conditions. For the purpose of our analysis, we classify the educational level achieved by the household head as follows: 1 = illiterate or primary school education; 2 = first-stage secondary education; 3 = secondary school education; and 4 = university degree. One limitation of this variable is that it does not measure the performance, curriculum content, and other qualitative aspects of education (Zanin and Marra 2012). We have chosen to consider individuals who are illiterate and those who have achieved a primary school education as a unique category because the former represent only a small proportion of household heads (approximately 4 %). This choice is widely applied in studies of Italian households. However, if we were to extend our analysis to a developing country, we would treat illiterate individuals and those who have achieved a primary education as two separate categories, as whether an individual is illiterate or has a primary education may be a discriminating factor for the degree of poverty (e.g., Griggs et al. 2013).

-

Professional status: We categorise the professional status of the household head into five groups: employed, employed with a temporary job, self-employed, unemployed, and other.

-

Happiness: It is usually interpreted as a state of mind that is characterised by contentment, pleasure, and/or joy (e.g., Wu 2010; Zanin 2013). Observational studies have suggested that unhappy individuals are likely be pessimistic in evaluating their lives, including their financial situation (see also Strassle et al. 1999; Busseri 2012; Busseri et al. 2013). This correlation exists because happiness may include evaluations of the past and expectations for the future. In our case study, as a broad concept, happiness is useful to control for the personality traits of the household head and his or her effects on the outcomes of interest (e.g., Weiss et al. 2008). We construct a categorical variable of happiness as follows: 1 = score between 1 and 5 (unhappy); 2 = score between 6 and 7 (not unhappy but not completely happy); and 3 = score between 8 and 10 (happy).

-

(High) time preference: Measures of inter-temporal choices have attracted growing attention in behavioural economics research that aims to understand the role of utility functions in peoples’ lives. Empirical and experimental studies have confirmed the importance of inter-temporal preferences in explaining outcomes in a large number of life domains, such as income (e.g., Festerer and Winter-Ebmer 2000; Lawrence 1991), education (e.g., Festerer and Winter-Ebmer 2000; Lawrence 1991), health (e.g., Komlos et al. 2003), and parental divorce (Booth and Amato 2001; Compton 2009). The time preference is measured as the rate at which an individual discounts future utility. For this variable, information on the time preferences of household heads is collected using the following question:

-

(Q)

Imagine receiving an unexpected inheritance equal to the amount of income that your family earns in a year. Now, imagine that the inheritance is only available after one year. Would you be willing to sacrifice 10 % of that amount to have immediate access to the remaining 90 %?

-

yes \(\rightarrow \) go to question (Qa)

-

no \(\rightarrow \) go to question (Qb)

-

-

(Qa)

Would you sacrifice 20 %?

-

yes \(\rightarrow \) go to question (Qc)

-

no \(\rightarrow \) go to question (Qd)

-

-

(Qb)

Would you sacrifice 4 %?

-

yes \(\rightarrow \) go to question (Qe)

-

no \(\rightarrow \) go to question (Qf)

-

-

(Qc)

Would you sacrifice 30 %?

-

yes

-

no

-

-

(Qd)

Would you sacrifice 15 %?

-

yes

-

no

-

-

(Qe)

(Qe) Would you sacrifice 7 %?

-

yes

-

no

-

-

(Qf)

(Qf) Would you sacrifice 2 %?

-

yes

-

no

-

Based on the responses to these questions, we construct a binary variable that takes a value of 1 if the household head accepts a high discount rate (20 % or more) and 0 otherwise. The question investigates individuals’ time preferences in relation to speeding up gains and considers the devaluation of rewards as a function of delay (see also Frederick et al. 2002; Tu 2004; Borghans et al. 2008). The willingness to accept a high discount rate is based on a fixed time period, i.e., one year, and a fixed amount of money, i.e., the family’s annual income. Thus, we are unable to investigate potential changes in time preferences depending on the amount of money and/or the time horizon, which is a limitation of this study. Based on the relevant literature, we expect household heads with a high time preference (or impatience; henceforth, time preference) to be focused on their present well-being and those with a low time preference (or patience) to be focused on their future well-being. Impatience can influence an individual’s investment and consumption decisions and, in turn, a household’s economic conditions. Specifically, highly impatient individuals are less sensitive to the negative effects of their choices (e.g., Holden et al. 1998; Franken et al. 2008; Anderloni et al. 2012). Accordingly, we expect that an impatient household head will likely be associated with household economic inadequacy.

3 Modelling Strategy

In this section, we describe the methodological approach used to investigate the characteristics of households’ economic inadequacy.

3.1 The Bivariate Probit Model

The bivariate probit model involves estimating a simultaneous system of two binary regressions. The model can be written as follows:

where \({\texttt{arrears} }^*_{i}\) and \({\texttt{economic}}\, {\texttt{difficulty }}^*_{i}\) are continuous latent variables that determine the observed binary outcomes \({\texttt{arrears} }_{i}\) and \({\texttt{economic}} \, {\texttt{difficulty} }_{i}\) using the rules \(1({\texttt{arrears}}_{i} > 0)\) and \(1({\texttt{economic}} \, {\texttt{difficulty} }_{i} > 0)\), respectively. \({x}_{i1}\) and \({x}_{i2}\) are the ith row vectors containing the parametric model components described in Sect. 2.2, with corresponding parameter vectors \({\beta }_{1}\) and \({\beta }_{2}\). The errors \(\left( \varepsilon _{1i}, \varepsilon _{2i}\right) \) are assumed to follow the following bivariate distribution:

If \(\rho \) (the correlation coefficient) is equal to 0, then the two probit models are independent of one another. By contrast, if \(\rho \ne 0\), then we have the following:

The errors in each model have a unique term \((u_{i})\) and another term \((\gamma _{i})\) that is common to both models. In this way, the error terms are correlated, and the probability of one outcome will be dependent on the probability of the other. Hence, when \(\rho \ne 0\), estimating the equations jointly is more efficient than estimating the equations as two separate probit models.

The estimated coefficients and associated confidence intervals (CIs) are useful in determining the sign and the statistical significance of the explanatory variable included in the model. The covariates’ impacts on the outcome are instead provided as average marginal effects that are obtained from the joint probabilities (e.g., Greene 2012).

The predicted joint probabilities describe four primary economic conditions of the households:

-

\(Pr({\texttt{arrears }}_{i}=1,{\texttt{economic}}\,{\texttt{difficulty}}_{i}=1)\) The household simultaneously has difficulty making ends meet and is in arrears with payments of commitments for more than 90 days. This combination of conditions suggests that the household is in a condition of economic inadequacy \((P_{11})\) The higher the \(P_{11}\), the higher the probability that the household is at risk of poverty and social exclusion.

-

\(Pr({\texttt{arrears }}_{i}=0,{\texttt{economic}}\, {\texttt{difficulty }}_{i}=1)\) Despite experiencing difficulty making ends meet, the household is able to pay its commitments. A higher probability of this combination of conditions should be associated with a higher probability that the household is economically fragile \((P_{01})\).

-

\(Pr({\texttt{arrears }}_{i}=1,{\texttt{economic}}\, {\texttt{difficulty }}_{i}=0)\) The household is unable to pay the arrears of commitments but does not experience difficulty making ends meet. Such a household likely decides to pay when creditors commence actions for debt recovery. The household can pay but will not pay \((P_{10})\) or tends to delay payments because it is not receiving satisfactory services.

-

\(Pr({\texttt{arrears }}_{i}=0,{\texttt{economic}} \,{\texttt{difficulty }}_{i}=0)\) The household is able to survive without facing (major) economic difficulties. A higher probability of this economic situation should be associated with a higher probability that the household is in a condition of economic adequacy \((P_{00})\).

For each discrete variable, the marginal effect computed from the joint distribution of the arrears and economic difficulty measures the change (the increase or decrease) in the probability of the outcome, given a one-unit change in the explanatory variable.

3.2 On the Investigation of Endogeneity Issues

In model (2), we have assumed that the household head’s impatience and happiness as well as indebtedness to friends and relatives have an effect on the household’s economic inadequacy. However, we suspect that in the relationship between each of these covariates and the outcomes of interest (economic difficulty and arrears), there is an endogeneity issue that we are unable to take into account. Given such an endogeneity issue, we may produce a biased measurement of the effect of each covariate on the outcome. Therefore, we suggest controlling for the potential endogeneity of the household head’s impatience and indebtedness to friends and relatives (both binary variables) using an RBP model (Sect. 3.2.1), while a 2SLS model is used to control for the potential endogeneity of happiness (Sect. 3.2.2).

3.2.1 Recursive Bivariate Probit Model

In this section, we introduce the structure of the RBP model with a practical example illustrating the investigation of endogeneity of household heads’ time preferences. The model is written as follows:

where \({y}^*_{i}\) represents an observed binary outcome (see Sect. 2.1). \({x}_{i1}\) and \({x}_{i2}\) are the ith row vectors containing the parametric model components described in Sect. 2.2, with corresponding parameter vectors \({\beta }_{1}\) and \({\beta }_{2}\). In (4), the error terms \(\left( \varepsilon _{i1},\varepsilon _{i2}\right) \) are assumed to be identically distributed as a bivariate normal with zero means, unit variances and the correlation coefficient \(\rho \) (e.g., Greene 2012). The error variances are normalised to unity, to identify the parameters in the model. The parameter of interest is \(\delta \), through which we can estimate the effect of household heads’ time preferences on the outcome variable in terms of the average treatment effect on the treated (ATT).Footnote 3

To identify this parameter, the exclusion restriction (ER) on the covariates is typically assumed to hold (e.g., Maddala 1983, p. 122). That is, the set of regressors in the first equation of (4) contains at least one or more regressors more than those included in the second equation. These regressors are regarded as IVs, which are associated with household heads’ time preferences, independent of \({\texttt{y}}^*_{i}\), conditional on the observed and unobserved confounders and independent of the unobserved confounders [and hence independent of the errors \((\varepsilon _{i1},\varepsilon _{i2})\) (e.g., Chib et al. 2009; Radice et al. 2013)]. However, as demonstrated in Wilde (2000), in RBP models, identification can be achieved even if the same regressors appear in both equations. As explained in Little (1985), theoretical identification may be tenuous when the distribution of the error terms is skewed or multimodal. In such cases, the inclusion of an instrument can help obtain better parameter estimates (Radice et al. 2013).

The chosen IV is a binary variable that equals 1 if the household head is married and 0 otherwise. As discussed by Compton (2009), marriage (which is supposed to be for life) can be viewed as an investment or as a repeated prisoner’s dilemma game. Household heads who are married are likely to be cooperative with the aim of maintaining a stable marriage for the long term. In other words, married household heads are expected to be more patient than their single, widowed, or divorced counterparts because they have an interest in placing a relatively high weight on future utility. We expect the chosen IV to have a negative and significant impact on a household head’s propensity to have a high time preference. As mentioned previously, theoretical identification does not require the availability of an IV, although an IV may help achieve better empirical identification. For this reason, we also estimate the RBP model (4) without the ER (RBP-noER). In controlling for the potential endogeneity of indebtedness to friends and relatives, we are unable to include a valid IV in the model. Therefore, only a RBP-noER is carried out in this case.

3.2.2 Two-Stage Least Square Model

To control for the potential endogeneity of \({\texttt{happiness} }={\mathbf{X }}_{e}\), we use a 2SLS model (e.g., Baltagi 2002; Zanin et al. 2014). Specifically, the first-stage regression is as follows:

where \({\mathbf{X }}_o\) is the matrix of observed confounders described in Sect. 2.2, and \({\mathbf{X} }_{IV}= {\texttt{married}}\) is a binary variable that takes a value of 1 if the household head is married and 0 otherwise. This IV is considered valid because some empirical evidence has shown that married individuals are more likely to be happy than their single, widowed, or divorced counterparts (e.g., Helliwell and Grover 2014 and the references therein). Furthermore, it is reasonable to assume that marriage does not have an effect on the outcomes of interest, given the confounders in the model; in addition, it is unlikely that marriage is associated with unobservable confounders, such as the persistence economic difficulty.

Based on Eq. (5), we compute \(\hat{\mathbf{X }}_e\) = \( \hat{{\mathbb {E}}}({\mathbf{X }}_e | {\mathbf{X} }_o, {\mathbf{X }}_{IV})\), which will be included in the second-stage model and is written as follows:

where \({\texttt{y }}\) represents the outcomes of interest. The 2SLS model (6) is implemented using STATA software (StataCorp. 2011).

4 Results

The analysis aims to investigate the probability of economic inadequacy for Italian households. To this end, we employ a bivariate probit model (2), which is estimated using STATA statistical software (StataCorp. 2011). Before describing the marginal effects of each covariate on the probability of economic inadequacy, we provide some evidence supporting the dependence of the equations in model (2). Table 5 in the Appendix reports the results for the parametric estimates. We note that the signs and statistical significance of the parameters are consistent with economic theory. We highlight that \(\widehat{\rho }\) is statistically significant and equal to 0.35 (CI 0.28;0.41). This result suggests that the two probit models are not independent of one another; thus, the use of a bivariate probit model framework is preferable. Although we are interested in the factors influencing the probability of households’ economic inadequacy (\(P_{11}\)), we also provide a description of the marginal effects measured for the remaining combinations of outcomes (\(P_{10}\), \(P_{01}\), \(P_{00}\); see Sect. 3).

4.1 Economic Inadequacy Versus Economic Adequacy

Table 1 reports the marginal effects computed from each covariate and obtained from the joint distribution of economic difficulty and the inability to pay the arrears of commitments. We begin by comparing two opposing economic situations for households: economic inadequacy \((P_{11})\) and economic adequacy \((P_{00})\). We observe that 10.5 % of the households are likely in a condition of economic inadequacy because they simultaneously have difficulty making ends meet and are unable to pay the arrears of one or more commitments (e.g., utility bills, rent, and debts). Conversely, a situation of economic adequacy is observed for 60.8 % of the households. Note that a condition of economic adequacy does not mean that a household has a high standard of living; it instead indicates that the household has the economic resources and/or ability to manage its budget to at least sufficiently satisfy the household’s needs. A number of variables both at the household level and in relation to the household head may help explain the condition of a household’s budget.

We begin by discussing the effect of the household head’s personality traits on the probability of the household’s economic (in)adequacy. We observe that a household head who is unhappy and highly impatient has a higher probability (6 and 3 %, respectively) of being in a condition of economic inadequacy compared with a household head who is happy and less impatient. Conversely, the probability that a household is in a condition of economic adequacy is 17 % lower if the household head is unhappy and 7 % lower if the household head has a high time preference. The positive and significant effect of the household head’s impulsivity on the household’s economic inadequacy confirms the assumptions discussed in Sect. 2.2 and agrees with evidence found in Anderloni et al. (2012) on the existence of a relationship between impulsivity and the vulnerability of households. We also found that household head’s gender does not have an impact on the probability of economic inadequacy, while it was found to have a significant effect on the probability of economic adequacy. As discussed in Sect. 2.2, our finding is in line Anderloni et al. (2012), while Addabbo and Baldini (2000) highlighted the opposite result. These discrepancies might be linked not only to sampling but also to differences in the observation period. Staying in the context of demographic factors, we found that the household head’s age shows an inverted-U shape effect on the probability of economic inadequacy, while the opposite result was observed in the case of economic adequacy (see also Addabbo and Baldini 2000). Regarding human capital, we confirm the findings of studies available in the literature that show that the household head’s low educational level is associated with a higher probability that a family is in a condition of economic inadequacy (see, e.g., Addabbo and Baldini 2000). The knowledge accumulated through schooling represents a useful tool that enhance an individual’s talents, job opportunities, and ability to make decisions, to name a few. Therefore, a higher education is likely to reduce the probability of a household being in a poor economic condition. In contrast with the findings of Addabbo and Baldini (2000), we have not found evidence that the household head’s employment in a temporary job will increase the probability that the household is in a condition of economic inadequacy (see also Muffels 2008).

Moving on to variables at the household level, in model (2), the inclusion of a measure of household equivalent income is useful to control for the consistent association between the flow of income received by the household during the year and the probability of economic (in)adequacy. Consistent with our expectations, we find that a household with an annual equivalent income in the first quartile has a 10 % higher probability of being in a condition of economic inadequacy and a 35 % lower probability of being in a condition of economic adequacy compared with richer households. The measures of the liquidity ratio and the debt-to-income ratio (see Sect. 2.2 for details) provide additional insight into the probability of households’ economic (in)adequacy. Specifically, a household with a liquidity ratio lower than 0.25 and a debt-to-income ratio higher than 30 % has a 5 % and 4 % higher probability, respectively, of being in a condition of economic inadequacy compared with a household in the reference categories (i.e., a liquidity ratio >0.5 and without debt). Indebtedness to friends and relatives is another interesting economic variable that we have found to be associated with a condition of economic inadequacy. A household that is indebted to friends and relatives is 19 % less likely to be in condition of economic adequacy than a household that is not indebted to friends and relatives. Households with low incomes may request economic support from friends and relatives because banks have refused them loans or because they feel that they cannot gain access to credit. However, data constraints prevent us from investigating this issue; therefore, further studies are required to better understand households’ decision-making processes and the channels through which they gain access to credit when they are in a poor economic condition. Another factor that contributes to reducing households’ economic adequacy (by 11 %) is rent payments for the house of residence. Paying rent likely reduces households’ economic adequacy because rent, as well as a debt, depletes economic resources that could be allocated towards expenditures that improve family well-being, thus magnifying the household’s economic inadequacy.

As suggested by Okun’s law (e.g., Zanin and Marra 2012; Zanin 2014b), recession periods contribute to increases in the unemployment rate and, consequently, in the number of households at risk of economic inadequacy because the presence of one or more unemployed persons in a household can destabilise a household’s budget (the uncertainty effect). This finding is empirically documented in several studies in the literature and is confirmed in our analysis (e.g., Kaya 2014 and the references therein). Specifically, we find that households reporting a reduction in income due to the unemployment of one or more household members have a 6 % higher probability of being in a condition of economic inadequacy, while households reporting a reduction in income that is not linked to unemployment factors (e.g., one member moves from a full-time job to a part-time job or retires from the labour market) have a 4 % higher probability of being in a condition of economic inadequacy. This finding is of crucial interest to policymakers because economic insecurity can harm investment decisions and consumption choices, which are important drivers of economic recovery (see e.g., Zanin 2015).

4.2 Economic Fragility

The households that are likely to have difficulty making ends meet but that are nevertheless able to fulfil all their commitments (e.g., utility bills, rent, and debts) have been classified as being in a condition of economic fragility \((P_{01})\). This classification characterises 26.8 % of Italian households. The households that reside in Basilicata, Calabria, Sicily, Campania, and Puglia have a higher probability of being economically fragile than households that reside in other areas of the country. One reason for this result might relate to the higher unemployment rates in these areas, which ranged between 15 and 19 % (compared with the national level of 10.7 %) in 2012. This finding is also confirmed in other studies related to poverty in Italy (e.g., Anderloni et al. 2012; Gallie and Paugam 2002). In line with our expectations, the equivalent income represents an important indicator of the household’s economic condition. Specifically, we observe that households with low equivalent incomes have a 26 % higher probability of being in an economic fragile condition compared with the richest households. This evidence is important because it supports the hypothesis that the quali-quantitative indicator proposed is consistent with the flow of financial resources available to the family. Another important indicator of the risk of economic fragility is a reduced income due to the loss of employment of one or more household members. We found that such an event increases the probability of economic fragility by 6 % compared with a household whose income level remains stable (or unusually high compared with a normal year). Paying rent is another factor that can affect a household’s probability of entering into a condition of economic fragility (4 %; see also Anderloni et al. 2012) for the same discussed in the case of economic inadequacy. In general, we observe that the factors that may distinguish a household’s risk of economic inadequacy compared with its risk of economic fragility are the debt-to-income ratio, rent payments, the presence of minors, and the household head age.

4.3 Can Pay but Will Not Pay

A household that does not have (severe) difficulty making ends meet may nevertheless be unable to pay the arrears of utility bills, rent, and/or debt. In other words, a household that can pay may not be willing to pay (\(P_{10}\)). Based on available microdata, this combination of events appears to affect only a marginal percentage of Italian households (1.9 %). However, this finding is important because it highlights how delaying the payment of commitments might not always be attributable to monetary difficulties; it may instead be attributable to behavioural factors that reflect an unwillingness to pay commitments. This finding suggests that a household that delays the payment of commitments is not always experiencing economic difficulties, although such cases represent only a small percentage of households. It is interesting to note that \(P_{10}\) is a behaviour that characterises the household heads ranging in age from 41 to 50 years old. The reasons for this behaviour are not clear but represent a potential direction for future research. Duygan and Grant (2006) observed, for example, that the phenomenon of household arrears varies across countries in terms of the effect of institutional factors (e.g., the cost of defaults).

4.4 Empirical Evidence of Endogeneity Issues

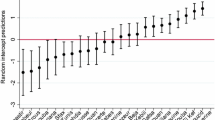

In this section, we present the results of the analysis to control for the potential endogeneity of time preference, indebtedness to friends and relatives, and happiness. Table 2 reports the results of the analysis that controls for the endogeneity of household heads’ time preference in relation to each outcome of interest using the RBP model (4). We begin by checking that \(H_0:\rho =0\) and \(H_1:\rho \ne 0\), where \(H_0\) corresponds to the absence of endogeneity.

The estimated correlation coefficients and the associated confidence intervals (CIs) can be used to test \(H_0\) (see also Monfardini and Radice 2008). We note that the estimated correlation coefficient (\(\widehat{\rho }\)) is statistically significant and negative in the time preference-economic difficulty relationship, while a non-significant coefficient is found for the time preference-arrears relationship. This result suggests that endogeneity may only be a concern for the first relationship cited and that unobservable confounders affecting household heads’ time preferences and households’ economic difficulties are negatively correlated. The estimated ATT is 8.4 %. This result indicates that an impatient household head is 8.4 % more likely than a less impatient household head to live in a household experiencing economic difficulties. We observe that the ATT estimated with both the SRBP-ER and the SRBP-noER models is similar. This empirical evidence supports the claim that the possible lack of a valid IV does not prevent us from reliably estimating the ATT. In line with the expectations discussed in Sect. 3.2.1, we also observe that the chosen IV is negative and statistically significant, which supports the assumption that married household heads are likely to be more patient than their single, widowed, and divorced counterparts.

For practitioners, this analysis offers two important findings. First, the impatience of the household head has a stronger effect on the probability that a household faces economic difficulties (8.4 %) than on the probability that a household is unable to pay arrears (5.4 %); second, the endogeneity of household heads’ time preferences affects only one dimension of the measure of economic inadequacy, and the effect of 3 % reported in Table 1 might be only slightly underestimated.

The control for the possible endogeneity of indebtedness to friends and relatives has been carried out by estimating an RBP (4) without exclusion restrictions due to the lack of a valid IV. The estimated correlation coefficients and the associated CIs suggest that the assumption of endogeneity is not supported by empirical evidence (see Table 3). Hence, the presence of an endogeneity issue is excluded for indebtedness to friends and relatives.

The investigation for the potential endogeneity of happiness has been performed using the 2SLS model presented in Sect. 3.2.2. To obtain consistent estimates, the chosen IV (married) must be strongly associated with the endogenous variable (happiness). Here, we found the IV included in the first-stage regression (5) to be strongly significant at the 5 % level. After the estimation of model (6), we use the Hausmann test to assess for the presence of endogeneity. The result of this test gives p values equal to 0.31 and 0.65 in the happiness-economic difficulty and happiness-arrears relationship, respectively. These findings suggest that, in both of the 2SLS models estimated, the null hypothesis of happiness’s exogeneity is not rejected. Therefore, in our case, we have not found empirical evidence confirming that happiness is affected by an endogeneity issue.

4.5 Some Evidence of the Spatial Differences Influencing Households’ Economic Inadequacy in Italy

Figure 1 aims to represent poverty at a spatial level using two different measures of (risk) poverty. Map (a) displays the distribution of poverty when the measure of relative poverty (our elaboration of data from ISTAT) is taken into account, while map (b) displays the distribution of poverty when we consider the measure of economic inadequacy presented in the previous sections. Before plotting these indicators on the maps, we rescaled the values of these two measures in the range 0–100 using the max-min approach, where 0 represents the minimum percentage of households in poor conditions and 100 represents the maximum percentage.

In comparing the two maps, we first note that poverty is strongly associated with location. Specifically, we observe some overlap in the distribution of poverty risks, with higher values in southern Italy than in northern Italy. The southern areas are characterised by the highest unemployment risk, the lowest gross domestic product (GDP) per capita, the lowest ratio of enterprises per inhabitant, the lowest municipal expenditures on social assistance, and the lowest allotment of public services for children (e.g., the nursery schools that represent an important service in the implementation of policies aimed at the reconciliation of home and work commitments), to name a few (e.g., D’Antonio and Scarlato 2008; Cracolici et al. 2009; Fabrizi et al. 2014; Istat 2015). These factors also explain why foreign citizens who enter in the country choose to locate their residence in northern Italy rather than in southern Italy (see Marra et al. 2012).

Our analysis suggests that economic inadequacy is a concern not only for historical areas of southern Italy but also for households located in some regions in northern Italy, such as Veneto (located in the northeast) and Piedmont (located in the northwest). Based on our descriptive analysis, compared with other regions in northern Italy, Veneto shows a concentration of families who have manifested a decrease in their income (including reasons linked to unemployment) and are indebted to friends and relatives. In Piedmont, we instead observe a concentration of families who pay rent, and have a low liquidity ratio. As discussed in Sect. 4.1, these factors are among the main drivers of households’ economic inadequacy. From a macroeconomic point of view, Veneto and Piedmont are also characterised by a contraction of GDP per capita in real terms of approximately 2000 Euro (the difference between the mean values of GDP per capita for the 2003–2007 period with those for the 2008–2012 period), compared with other northern regions, whose contraction was approximately 1000 Euro (the effect of the Great Recession). This evidence further strengthens the fact that households residing in these regions are likely experiencing deteriorating living conditions that contribute to an increase in behaviours and perceptions that are associated with a condition of economic inadequacy (see also Chen 2015).

In central Italy, we note an issue of economic inadequacy in Lazio, which is not highlighted by the relative poverty indicator. In this region, we highlight a concentration of families who manifest a decreased income and have a low liquidity ratio. In Lazio, as in Veneto and Piedmont, we observe a contraction of the GDP per capita in real terms of approximately 2000 Euro when comparing the 2003–2007 period with the 2008–2012 period.

In the southern regions where the economic inadequacy of households becomes a more widespread phenomenon than that observed in northern Italy, we note, for instance, that the regions of Molise and Basilicata show a conflicting trend. Although we register a high prevalence of families with low equivalent incomes in both regions, we have observed that a high percentage of households have not manifested decreased incomes, as is the case in neighbouring regions. In addition, we note that a low percentage of households in Molise and Basilicata declare that they are indebted to friends and relatives or that they are over-indebted. This evidence suggests that, even in the presence of limited resources, households in these regions are likely to manage their available resources differently than households located in others regions of southern Italy.

a Map of the relative poverty of households (our elaboration using data from ISTAT); b Map of the economic inadequacy of households based on the proposed indicator (see Sect. 3.2.1). The values of the respective indicators were rescaled using a min-max approach. The values used to colour the map range from 0 to 100, where 0 represents the minimum percentage of households in poor conditions and 100 represents the maximum percentage

Map of the composite poverty indicator obtained by combining the percentage of households in a condition of relative poverty and the percentage of households in economic inadequacy. Combining these two indicators was carried out using a principal component analysis. The values used to colour the map range from 0 to 100, where 0 and 100 represent the areas with the best and worst well-being conditions of households, respectively

Differences between valid indicators aiming to describe a same or similar phenomena are not unique in the literature (Hick 2014 and reference therein). Poverty is, however, a multidimensional phenomenon that can be better measured using a combination of indicators.

Using the principal component analysis technique, we propose a composite poverty indicator, which is obtained by combining the percentage of households in relative poverty and the percentage of households in economic inadequacy. The construction of a composite indicator allows us to moderate the possible limitations associated with indicators of relative poverty and economic inadequacy, as discussed in previous sections. The results of the composite indicator are displayed in the map of Fig. 2. The values used to colour the map range between 0 and 100, where 0 and 100 represent the areas with the best and worst levels of economic well-being, respectively. This indicator confirms the dualism between areas in northern and southern Italy (see also Helliwell and Putnam 1995); it also does not overlook the poverty risks observed in some areas of northern Italy, as captured by the indicator of economic inadequacy. Therefore, the composite indicator proposed allows policymakers to assess poverty (risk) taking into account not only income but also the management of available resources and how these factors may vary across regions.

5 Concluding Remarks

Motivated by an interest in understanding poverty-related issues in Italy, we employ Italian microeconomic data collected using a structured questionnaire from a 2012 SHIW conducted by the Bank of Italy and examine factors associated with the probability of Italian households’ economic inadequacy (i.e., the inability to make ends meet and the inability to pay the arrears of commitments (e.g., utility bills, house rent, debts) for more than 90 days). Accordingly, using the bivariate probit model (2), we employ both objective and subjective measures to study the economic well-being of households. Based on the available data, we observe that 10.5 % of the households were in a condition of economic inadequacy in 2012. The factors influencing the probability that a household will be in a condition of economic inadequacy are as follows:

-

Quantitative factors: a low equivalent income, a low liquidity ratio (i.e., in the absence of income, the household could maintain the same standard of living and meet its expenses for fewer than 3 months), and over-indebtedness (debt-to-income ratio \(>\)30 %).

-

Quali-quantitative factors: indebtedness to friends and relatives, a decrease in income at the household level, rent payments, and an unhappy, highly impatient household head.

-

Unobserved factors: poor money management, the persistence of economic difficulty, and the individual’s ability. These factors are likely associated with both outcomes (the inability to pay arrears and economic difficulty).

Within our framework of analysis, we also show that a (small) proportion of households have been in arrears with the payment of utility bills, debts, and/or rent for more than 90 days, even though they do not have major difficulties making ends meet. This finding is important because evidence that being in arrears with payments of commitments might not be a sufficiently reliable indicator of a household’s economic inadequacy. We also observed that approximately 27 % of households are in a fragile economic condition. Therefore, approximately a quarter of Italian households have difficulty making ends meet; however, they are able to manage the family budget and to avoid falling into arrears with payments of commitments. It is likely that households in such economic conditions forgo satisfying some needs that might be useful in improving the family’s well-being.

Through a sensitivity analysis, we have also estimated model (2) within a semiparametric specification that allows us to flexibly model the effect of continuous covariates without making a priori assumptions using penalised regression splines (e.g., Wood 2006; Zanin 2014a). The results are similar to those obtained using the classic bivariate probit model specification. This finding suggests that the fully parametric specification is able to accurately describe the phenomenon investigated.

We also investigated for the possible endogeneity of the household head’s high impatience and happiness and the household’s indebtedness to friend and relatives. The suspicion is that there might be unobserved confounders (e.g., the persistence of economic difficulty and individuals’ abilities) that affect each of the aforementioned covariates and the outcomes of interest. The results obtained from this analysis have shown that an endogeneity issue is present only in the relationship between the household head’s time preference and the household’s economic difficulty. In any case, based on the empirical evidence (Table 2), the endogeneity of time preference in relation to economic inadequacy appears to not be a serious concern, as expected.

At a spatial level, we note that economic inadequacy mainly affects households in southern regions rather than households in northern regions of Italy. However, the dichotomy between the two macro-areas of the country is not as strong as displayed by the relative poverty measure provided by ISTAT. In fact, we observe some evidence of non-negligible poverty risks in some regions of northern Italy (e.g., Veneto and Piedmont). If the relative poverty measure is unable to take into account aspects related to household members’ needs and their ability to manage the available resources, the use of subjective measures can help fill these information gaps but simultaneously introduce some distortions related to individuals’ personality traits. To moderate such issues, we propose the construction of a composite indicator that combines the percentage of households in relative poverty and the percentage of households in a condition of economic inadequacy. This composite indicator confirms that higher poverty risks are mainly located in the regions of southern Italy compared with those in northern Italy, even though some signals of poverty risk are highlighted in some areas in northern Italy. The proposed composite indicator allows policymakers to assess poverty (risk) by taking into account not only income but also the management of available resources and how these factors may vary across regions.

Future extensions of the present study may include the following: (a) an analysis of the (reverse) causal effects of each covariate on households’ economic inadequacy based on longitudinal data; (b) the collection of information through proxy variables that may elucidate the household’s ability to manage its budget (for example, an experimental study may investigate household behaviours with respect to economic choices, as well as how such behaviours relate to households’ economic conditions); and (c) inspired by the study of De Oliveira et al. (2014), an investigation of the potential effects/behaviours associated with solidarity among households in conditions of economic inadequacy.

Notes

The poverty line is derived considering the distribution of income within the population (e.g., 60 % of the median income in Eurostat’s at-risk-of-poverty measure).

This measure is given by the sum of bank deposits, postal deposits, government securities, bonds, equity in companies (traded or not traded on the stock market), investment trusts, and so forth, valued on the 31 December 2012.

Following Rosenbaum and Rubin (1983), we employ the counterfactual framework to define the effect of the treatment (for example, household heads’ time preference) on the outcome variable (for example, economic difficulty). Each individual in the population has two potential values for the outcome: \({\texttt{economic}}\, {\texttt{difficulty} }_{{\texttt{time}}\, {\texttt{preference}}=1} \) and \({\texttt{economic}}\, {\texttt{difficulty} }_{{\texttt{time}} \, {\texttt{preference}}=0} \). Obviously, we are able to observe only one of these values for each individual; the other outcome is the counterfactual. The treatment effect is therefore defined as

$${\mathbb{E}}({\texttt{economic}} \, {\texttt{difficulty}}_{{\texttt{time}} \, {\texttt{preference}}=1})-{\mathbb{E}} ({\texttt{economic}} \, {\texttt{difficulty}}_{{\texttt{time}}\, {\texttt{preference}}=0} ), $$where effect is for the entire population. However, we are interested in the effect calculated considering only individuals who received the treatment (in our case, an individual with a high time preference); hence, we are interested in the so-called ATT (Wooldridge 2010). Let \({\mathbb{E}} ({\texttt{economic}} \, {\texttt{difficulty}} _{{\texttt{time}} \, {\texttt{preference}}=1} |{\texttt{time}} \,{\texttt{preference}}=1)\) be the average outcome of individuals when they actually manifest a high time preference, and let \({\mathbb {E}}({\texttt{economic}} \,{\texttt{difficulty} }_{{\texttt{time}} \,{\texttt{preference}} =0} |{\texttt{time}} \,{\texttt{preference }}=1)\) be the average outcome of individuals with a high time preference who are assumed not to have a high time preference. Thus, the ATT is defined as

$$\begin{aligned} {\text{ATT}} &= {\mathbb{E}} ({\texttt{economic}} \,{\texttt{difficulty}}_{{\texttt{time}}\,{\texttt{preference}}=1} |{\texttt{time}} \,{\texttt{preference }}=1)\\ &-{\mathbb{E}} ({\texttt{economic}}\, {\texttt{difficulty}}_{{\texttt{time}}\, {\texttt{preference}}=0} | {\texttt{time}}\, {\texttt{preference}}=1). \end{aligned}$$Since \({\texttt{economic}}\, {\texttt{difficulty} }_{{\texttt{time}}\,{\texttt{preference=}}0 }\) is not observed for individuals with a high time preference, the quantity \({\mathbb {E}}({\texttt{economic}} \, {\texttt{difficulty}}_{{\texttt{time}}\, {\texttt{preference}}=0} |{\texttt{time}} \,{\texttt{preference }}=1)\) must be estimated by using the proposed RBP model (4). For further methodological details, see also Radice et al. (2013) and Zanin (2014a, b).

References

Addabbo, T., & Baldini, M. (2000). Poverty dynamics and social transfers in Italy in the early 1990s. International Journal of Manpower, 21, 291–321.

Anderloni, L., Bacchiocchi, E., & Vandone, D. (2012). Household financial vulnerability: An empirical analysis. Research in Economics, 66, 284–296.

Baltagi, B. H. (2002). Econometrics. New York: Springer.

Banks, J., & Johnson, P. (1994). Equivalence scale relativities revisited. The Economic Journal, 104, 883–890.

Becker, G. S., & Mulligan, C. B. (1997). The endogenous determination of time preference. The Quarterly Journal of Economics, 3, 729–758.

Borghans, L., Duckworth, A. L., Heckman, J. J., & Weel, B. (2008). The economics and psychology of personality traits. The Journal of Human Resources, 43, 972–1059.

Booth, A., & Amato, P. R. (2001). Parental pre-divorce relations an offspring post-divorce well-being. Journal of Marriage and Family, 3, 197–212.

Bryant, W. K., & Zick, C. D. (2006). The economic organization of the household. New York: Cambridge University Press.

Busseri, M. A. (2012). How dispositional optimists and pessimists evaluate their past, present, and anticipated future life satisfaction: A lifespan approach. European Journal of Personality, 27, 185–199.

Busseri, M. A., Malinowski, A., & Choma, B. L. (2013). Are optimists oriented uniquely toward the future? Investigating dispositional optimism from a temporally-expanded perspective. Journal of Research in Personality, 47, 533–538.

Celidoni, M. (2015). Decomposing vulnerability to poverty. The Review of Income and Wealth, 61, 59–74.

Chen, X. (2015). Relative deprivation and individual well-being. IZA World of Labor. http://wol.iza.org/articles/relative-deprivation-and-individual-well-being-1.

Chib, S., Greenberg, E., & Jeliazkov, I. (2009). Estimation of semiparametric models in the presence of endogeneity and sample selection. Journal of Computational and Graphical Statistics, 18, 321–348.

Compton, J. (2009). Why do smokers divorce? Time preference and marital stability. Working Paper, Department of Economics, University of Manitoba, Manitoba.

Cracolici, M. F., Cuffaro, M., & Nijkamp, P. (2009). A spatial analysis on Italian unemployment differences. Statistical Methods & Application, 18, 275–291.

D’Antonio, M., & Scarlato, M. (2008). Centre and periphery in development policy for the south. Review of Economics Conditions in Italy, 2, 213–243.

De Oliveira, A. C. M., Eckel, C. C., & Croson, R. T. A. (2014). Solidarity among the poor. Economics Letters, 123, 144–148.

De Vos, K., & Zaidi, M. A. (1997). Equivalence scale sensitivity of poverty statistics for the member states of the European community. Review of Income and Wealth, 43, 319–333.

De Vaney, S. A. (1994). The usefulness of financial ratios as predictors of household insolvency: Two perspectives. Financial Counseling and Planning, 5, 5–26.

De Vaney, S. A., & Lytton, R. (1995). Household insolvency: A review of household debt repayment, delinquency, and bankruptcy. Financial Services Review, 4, 137–156.

Dominy, N., & Kempson, E. (2003). Can’t pay or won’t pay? A review of creditor and debtor approaches to the non-payment of bills. Working paper no. 4/03, Personal Finance Research Centre, University of Bristol.

Duygan, B., & Grant, C. (2006). Household arrears: What role do institutions play? Working paper.

Duygan, B., & Grant, C. (2009). Household debt repayment behaviour: What role do institutions play? Economic Policy, 24, 10–140.

European Central Bank (ECB) (2005). Assessing the financial vulnerability of mortgage-indebted Euro area household using micro-level data. Financial Stability Review.

Fabrizi, E., Ferrante, M. R., & Pacei, S. (2014). A micro-econometric analysis of the antipoverty effect of social cash transfer in Italy. Review of Income and Wealth, 60, 323–348.

Festerer, J. & Winter-Ebmer, R. (2000). Smoking, discount rates and returns to education. IZA working paper no 126.

Franken, I. H., Van Strien, J. W., Nijs, I., & Muris, P. (2008). Impulsivity is associated with behavioral decision-making deficits. Psychiatry Research, 158, 155–163.

Frederick, S., Loewenstein, G., & O’donoghue, T. (2002). Time discounting and time preference: A critical review. Journal of Economic Literature, 40, 351–401.

Gallie, D., & Paugam, S. (2002). Welfare regimes and the experience of unemployment in Europe. New York: Oxford University Press.

Georgarakos, D., Haliassos, M., & Pasini, G. (2014). Household debt and social interactions. The Review of Financial Studies, 27, 1404–1433.

Giarda, E. (2013). Persistency of financial distress amongst Italian households: Evidence from dynamic models for binary panel data. Journal of Banking & Finance, 37, 3425–3434.

Greene, W. H. (2012). Econometric analysis. New York: Prentice Hall.

Griggs, D., Stafford-Smith, M., Gaffney, O., Rockstrm, J., hmanMC, Shyam-sundar, P., et al. (2013). Policy: Sustainable development goals for people and planet. Nature, 495, 305–307.

Hagenaars, A. J. M., De Vos, K., & Zaidi, M. A. (1994). Poverty statistics in the late 1980s: Research based on micro-data. Technical report, Office for Official Publications of the European Communities, Luxembourg.

Helliwell, J. F., & Putnam, R. D. (1995). Economic growth and social capital in Italy. Eastern Economic Journal, 21, 295–307.

Helliwell, J. F. & Grover, S. (2014). How’s life at home? New evidence on marriage and the set point for happiness. NBER working paper no 20794

Hick, R. (2014). On ‘consistent’ poverty. Social Indicators Research, 118, 1087–1102.

Holden, S. T., Shiferaw, B., & Wik, M. (1998). Poverty, market imperfections and time preferences: Of relevance for environmental policy? Environment and Development Economics, 3, 105–130.

Istat (2014). Poverty in Italy. http://www.istat.it/en/archive/128451. Accessed 26 Apr 2015.

Istat (2015). Noi Italia. http://noi-italia.istat.it/index.php?id=82. Accessed 4 May 2015.

Lawrence, E. C. (1991). Poverty and the rate of time preference: Evidence from panel data. The Journal of Political Economy, 99, 54–77.

Little, R. (1985). A note about models for selectivity bias. Econometrica, 53, 14691474.

Litwin, H., & Sapir, E. V. (2009). Perceived income adequacy among older adults in 12 countries: Findings from the survey of health, ageing and retirement in Europe. The Gerontologist, 49, 1–10.

Lusardi, A., Schneider, D., & Tufano, P. (2011). Financially fragile household: Evidence and implications. NBER working paper no 17072.

Marra, G., Miller, D. L., & Zanin, L. (2012). Modelling the spatiotemporal distribution of the incidence of resident foreign population. Statistica Neerlandica, 66, 133–160.

Maddala, G. S. (1983). Limited dependent and qualitative variables in econometrics. Cambridge: Cambridge University Press.

Monfardini, C., & Radice, R. (2008). Testing exogeneity in the bivariate probit model: A Monte Carlo study. Oxford Bulletin of Economics and Statistics, 70, 271–282.

Muffels, R. J. A. (2008). Flexibly and employment security in Europe: Labour market in transition. USA: Edward Elgar Pubblishing Limited.

Nandori, E. S. (2014). Interpretation of poverty in St. Louis County, Minnesota. Applied Research in Quality of Life, 9, 479–503.

Nelson, J. A. (1993). Household equivalence scales: Theory versus policy? Journal of Labor Economics, 11, 471–493.

Kaya, O. (2014). Is perceived financial inadequacy persistent? Review of Income and Wealth, 60, 636–654.

Karlsson, N., Dellgran, P., Klingander, B., & Garling, T. (2004). Household consumption: Influences of aspiration level, social comparison, and money management. Journal of Economic Psychology, 25, 753–769.

Komlos, J., Smith, P. K., & Barry, B. (2003). Obesity and the rate of time preference: Is there a connection? University of Munch, Discussion paper 2003-16

Radice, R., Zanin, L., & Marra, G. (2013). On the effect of obesity on employment in the presence of observed and unobserved confounders. Statistica Neerlandica, 67, 436–455.

Rosenbaum, P., & Rubin, D. (1983). The central role of the propensity score in observational studies for causal effects. Biometrika, 70, 41–55.

Stamp, S. (2009). An exploratory analysis of financial difficulties among those living below the poverty line in Ireland. http://www.combatpoverty.ie/publications/workingpapers/2009-02_WP_FinancialDifficultiesAmongThoseLivingBelowThePovertyLine.

StataCorp. (2011). Stata statistical software: Release 12. College Station, TX: StataCorp LP.

Strassle, C. G., McKee, E. A., & Plant, D. D. (1999). Optimism as an indicator of psychological health: Using psychological assessment wisely. Journal of Personality Assessment, 72, 265–276.

Tu, Q. (2004). Reference points and loss aversion in intertemporal choice. Institute of World Economics and Politics, Chinese Academy of Social Sciences, Wageningen University. doi:10.2139/ssrn.644142.

Voicu, B. (2014). Priming effects in measuring life satisfaction. Social Indicators Research. doi:10.1007/s11205-014-0818-0.

Weiss, A., Bates, T. C., & Luciano, M. (2008). Happiness is a personal(ity) thing: The genetics of personality and well-being in a representative sample. Psychological Science, 19, 205–210.

Wilde, J. (2000). Identification of multiple equation probit models with endogenous dummy regressors. Economics Letters, 69, 309–312.

Winger, B. J., & Frasca, R. R. (1993). Personal finance: An integrated planning approach (3rd ed.). New York: Macmillan Publishing Company.

Wood, S. N. (2006). Generalized additive models: An introduction with R. London: Chapman & Hall.

Wooldridge, J. M. (2010). Econometric analysis of cross section and panel data. Cambridge: MIT Press.

Wu, J. (2010). Pleasure and meaning: The two foundations of happiness. Applied Research in Quality of Life, 5, 79–80.

Zanin, L., & Marra, G. (2012). A comparative study of the use of generalized additive model and generalized linear models in tourism research. International Journal of Tourism Research, 14, 451–468.

Zanin, L. (2013). Detecting unobserved heterogeneity in the relationship between subjective well-being and satisfaction in various domains of life using the REBUS-PLS path modelling approach: A case study. Social Indicators Research, 110, 281–304.

Zanin, L., Radice, R., & Marra, G. (2014). A comparison of approaches for estimating the effect of Women’s education on the probability of using modern contraceptive methods in Malawi. The Social Science Journal, 51, 361–367.

Zanin, L. (2014a). Exploring the effect of participation in sports on the risk of overweight. Applied Research in Quality of Life. doi:10.1007/s11482-014-9317-3.

Zanin, L. (2014b). On Okun’s law in OECD countries: An analysis by age cohorts. Economics Letters, 125, 243–248.

Zanin, L. (2015). The response of Italian households to a large transitory income shock during an economic crisis: An experimental study on the intention to increase consumption levels. Working paper available at SSRN: http://ssrn.com/abstract=2605746.

Acknowledgments

We would like to thank three anonymous reviewers for numerous suggestions that encouraged us to conduct further analyses and helped us improve the article’s presentation and quality. The opinions expressed herein are those of the author and do not reflect those of the institution of affiliation.

Author information