Abstract

This paper focuses on the impact of financial fragmentation on small and medium enterprises’ (SMEs) access to finance. We combine country-level data on financial fragmentation and the ECB’s SAFE (Survey on the Access to Finance of Enterprises) data for 12 European Union (EU) countries over 2009–2016. Our findings indicate that an increase in financial fragmentation not only raises the probability of all firms to be rationed but also to be charged higher loan rates; in addition, it increases the likelihood of borrower discouragement and it impairs firms’ perceptions of the future availability of bank funds. Less creditworthy firms are even more likely to become credit rationed, suggesting a flight to quality effect in lending. However, our study also documents a potential adverse effect of increasing bank market power resulting from greater integration. This suggests that financial integration could impair firms’ financing, if not accompanied by policy initiatives aimed at maintaining an optimal level of competition in the banking sector.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Integrated capital markets provide a wider source of financing and lower funding costs for households and firms and ultimately support innovation and the efficient allocation of capital.

Victor Costâncio, Vice-President of the ECB,

Frankfurt am Main, 3 May 2018

1 Introduction

In this study, we explore the impact of financial fragmentation on small businesses’ access to finance. SMEs account for 99.8% of enterprises, 56.8% of the value added generated by the non-financial sector and 66.6% of total employment in EU-28, and their most relevant financing sources are bank-based instruments.Footnote 1 Therefore, divergences in loan interest rates across countries, coupled with difficulties in accessing bank products, can ultimately hinder economic growth.

In Europe, differences in average lending rates to non-financial companies tend to persist, and even increase significantly, and this was evident in the wake of the Eurozone debt crisis. Dispersion across interest rates is a crude measure of fragmentation because it reflects structural differences in demand, such as firms’ creditworthiness, employment expectations and rates, as well as supply side factors, including banks’ default frequencies, capital and asset ratios and competition for banking products (ECB 2013). Yet, in a fully financially integrated area, interest rates on loans do not depend on the country of residence of the firm but only on the factors related to the riskiness of the borrower (Zaghini 2016).

The increase in financial fragmentation has attracted considerable research interest on the effects on interest rate pass-through (Mayordomo et al. 2015; Zaghini 2016; Horvarth et al. 2018) and cross-border bank retrenchment (Emter et al. 2018; Bremus and Neugebauer 2018). These studies tend to agree on the possible negative effects of imperfect pass-through and retrenchment on firms’ access to finance. However, to the best of our knowledge, these assertions have not been tested in the empirical literature.

This paper attempts to fill this gap by addressing the following main research question: to what extent does financial fragmentation impair SMEs’ access to bank finance? We focus on the European case because after a long process of harmonisation and economic integration as part of the creation of a single market, the crisis inevitably brought about great instability and financial fragmentation and this latter has not yet been restored (Enria 2018). In this study, we conjecture that higher financial fragmentation affects the real economy because it increases frictions in the credit market. We look at both formal (quantity and price) and informal (discouragement) financing constraints and examine potential changes in bank behaviour and in firms’ expectations. Therefore, our sub-questions are further specifications of the main research question that this paper sets out to explore. This allows us on one hand to corroborate our conjecture, and on the other to provide a more detailed understanding of the underlying mechanisms at work. Specifically, we develop our research sub-questions as follows: does credit rationing occur through quantity or price rationing? What type of strategies do banks adopt to reallocate their lending portfolio after an increase in financial fragmentation? Specifically, is there a flight to quality in lending to riskier firms? Does financial fragmentation impair SMEs’ perceptions of future bank funds’ availability?

We contribute to the academic literature in several ways. First, we construct four measures of financial fragmentation of sovereign bond and credit markets with different maturities using a principal component technique. Our paper fills a gap in the literature as, to our knowledge, existing studies using a similar approach focus primarily on financial market integration and create a global index without capturing country-specific trends (Volosovych 2011; 2013; Donadelli and Paradiso 2014; Billio et al. 2017). Second, we create a unique dataset by matching country-level measures of financial fragmentation with firm-level restricted data drawn from the ECB’s SAFE questionnaire. This data source offers three main advantages for our analysis as it allows to (i) generate comprehensive measures of both formal and informal credit constraints that are not available with credit register dataFootnote 2; (ii) include in the model a large set of fixed effects that accounts for common demand shocks that could significantly affect our results (see Section 4); and (iii) analyse a relatively long period (8 years) spanning from the first to the fifteenth wave of the SAFE questionnaire (2009 to 2016) with an extensive cross-country coverage of eleven euro area countries and the UK.

We find that financial fragmentation has a significant impact on both quantity and price dimensions of credit constraints and on informal credit constraints—i.e. firms that are discouraged from applying because of fear of being rejected. The reduction in credit access shows evidence of a ‘flight to quality’ response, in which banks reduce lending to less creditworthy firms. Finally, we observe also that an increase in financial fragmentation reduces firms’ perceptions on the availability of future bank financing. These findings are robust to a battery of additional analyses including a Heckman selection model.

Our evidence contributes to the general understanding of the functioning of the market for small business financing after an increase in financial fragmentation. This allows us to offer important policy insights in the context of the recent European regulatory post-crisis agenda that successfully dealt with banking sector fragilities but struggled to restore financial integration. There is no doubt that there are costs from financial fragmentation for SMEs as it reduces their ability to access bank-based financing. Further integration via a more harmonised regulatory and supervisory setting and a Capital Markets Union (CMU)Footnote 3 is expected to reduce the SMEs’ dependency on the banking sector. This is because one of the key aims of CMU is to make it easier for small businesses to access financing through public markets and providing them with a wide choice of funding at a lower cost. However, there may be some unintended drawbacks as well that could derive, for example, from excessive bank size and concentration. Financial integration might allow for cross-border bank mergers with a result of excessively increasing bank size. The empirical literature (Beck et al. 2004; Carbo et al. 2009; and Ryan et al. 2014) shows that bank market power leads to higher credit constraints for SMEs. This unintended effect might ultimately neutralize or even reverse the lower credit constraints that result from reducing financial fragmentation.

The paper is organised as follows: Section 2 presents the literature review and the main hypotheses. Section 3 discusses different measures of financial fragmentation, the data and model specifications as well as the main results from the principal component analysis. Section 4 describes firm-level data and the econometric design adopted to analyse the impact of financial fragmentation on SMEs’ access to finance. Section 5 presents the empirical findings and the additional analyses. Section 6 concludes.

2 Literature review and hypothesis development

Neoclassical theory asserts that financial integration has potential benefits in terms of growth resulting from a more efficient capital allocation from rich countries to emerging economies. Recent theoretical papers quantify the benefits of financial integration in the EU by demonstrating that lower integration impairs firms’ access to capital, which in turn generates lower economic output and lower risk sharing (Fecht et al. 2012; Chakraborty et al. 2017). Other authors highlight the costs of an inefficient financial integration. In particular, for the EU context, Bolton and Jeanne (2011) and Farhi and Tirole (2018) warn that financial integration without fiscal integration results in an inefficient equilibrium that generates ex-post contagion across countries and between sovereign and banks.

The empirical literature on financial integration is mostly focused on stock markets and emphasises the potential benefits for listed firms in terms of reduction in their cost of equity (Bekaert et al. 2005; Mitton 2006; among others). To our knowledge, for non-listed firms, the literature is scarce and focused mostly on the effect of foreign bank entry for SMEs’ access to finance and performance. Giannetti and Ongena (2009, 2012) and Beck et al. (2004) suggest that foreign bank entry increases availability of external financing for smaller firms through the removal of obstacles derived from banking sector concentration. Similar results are obtained in Popov and Ongena (2011), where increased interbank market integration resulted in less stringent borrowing constraints and lower loan rates for borrowers. Focusing on the cost of bank financing, Bremus and Neugebauer (2018) find that a decline in cross-border lending activities leads to an increase in funding costs for SMEs.

Financial fragmentation of credit markets is transmitted from banks to borrowers through at least two channels. First, financial fragmentation can lead to a decline in credit flows across countries that ultimately reduces the availability of funds (Emter et al. 2018) and increases the cost of lending (Bremus and Neugebauer 2018) for SMEs. Second, credit market fragmentation can reduce also domestic lending if the funding conditions of domestic banks deteriorate (De Haan et al. 2017) as cross-border interbank credit becomes scarce (Fecht et al. 2012).

Changes in loan supply by individual banks would not matter much if SMEs could easily compensate by switching to alternative sources of credit, such as for example trade credit. However, as noted in Andrieu et al. (2018, among others), trade credit and bank financing are complementary rather than substitutes. The same difficulties in substituting bank-related products with market-based instruments and other sources of finance following credit supply shocks are also noted in Iyer et al. (2014) with Portuguese loan level data. As SMEs are mostly financed through banking products and represent most of the non-financial firms in the EU, their limited access to bank credit plays a crucial role for employment, investment, innovation and growth of the Euro area.

According to the two transmission channels, supply shocks resulting from higher financial fragmentation might lead to different types of credit constraints for SMEs. The seminal work of Stiglitz and Weiss (1981) suggests imperfections in credit markets lead to credit rationing materialized in three different main categories: quantity, price rationing and informal credit constraints. Specifically, following loan applications, (1) quantity rationing might occur in two forms: some firms receive a smaller part of the requested loan and some are credit denied in full; (2) price rationing occurs when firms are unable to get a loan due to the high costsFootnote 4; and finally, (3) informal credit constraints appear when some firms do not apply because of fear of being rejected. The first two categories are supply side measures of credit constraints, while the third is a demand side measure. According to the theory (Kon and Storey 2003) and the empirical evidence (Freel et al. 2012; Ferrando et al. 2015, 2017; Popov 2016; Han et al. 2009), it is important to separate firms that do not apply for credit because they do not need it from those that do not apply for credit because they are discouraged. Han et al. (2009) argue that in the case of uncreditworthy firm, discouragement is not problematic as it is part of the efficient functioning of the credit market. However, following Kon and Storey’s (2003) definition, discouraged borrowers are credit eligible firms that choose to not apply because of fear of rejection. Therefore, in general, the level of discouragement increases the inefficiencies in the credit markets and leads to sub-optimal levels of investment.

The alternative to fragmentation is integration that, despite holding substantial benefits for the real economy, might also trigger unintended consequences. For example, integration can lead to cross-border merger and acquisitions across banks with the result of an overall increase in relative bank size and a reduction of competition in banking markets. Theoretical literature on the relationship between banking sector concentration and firm financing proposes two contrasting findings. The market power hypothesis predicts that increased banking concentration results in increased financing constraints for SMEs. Empirical findings by Carbo et al. (2009) and Ryan et al. (2014) strongly support this hypothesis on a sample of SMEs headquartered in European countries. In contrast to this view, Petersen and Rajan’s (1995) information hypothesis suggests that higher banking market concentration enables banks to forgo interest rate premiums that they charge to opaque and risky enterprises because of the information rents earned in subsequent periods. Conversely, banks operating in competitive markets break even by charging higher interest rates when borrowers’ returns exhibit higher uncertainty. In competitive environments, banks cannot capitalize the informational advantage contained in bank-firm relationships and so the incentive to build these relationships is negated. Market power is therefore predicted to result in better borrower-firm relationships that reduce information asymmetries and agency costs and ultimately improve borrowers’ access to finance. As far as we know, there is no convincing empirical evidence that proves this hypothesis.

We conjecture that financial fragmentation triggers imperfect access to bank financing; i.e. it leads to credit supply shocks that are further transmitted to borrowers. Therefore, our first hypothesis, H1, can be formulated as follows:

H1: Financial fragmentation leads to an increase in both formal and informal credit constraints.

In our research setting, this first hypothesis is set out to help corroborate our main conjecture that higher financial fragmentation affects the real economy because it increases frictions in the credit markets.

According to the financial accelerator theory, in the presence of an adverse macroeconomic shock, banks reduce credit mostly to risky firms (Bernanke et al. 1996). The key underlying reason of this portfolio mechanism can be explained through information asymmetries and agency costs related to the credit markets. Imperfections in credit markets are reflected in the external finance premium. When a crisis breaks out, the premium increases due to the higher uncertainty in financial markets. In this context, smaller and riskier firms suffer most by the capital tightening (credit crunch, collateral or savings squeeze), because of the higher agency costs (Holmstrom and Tirole 1997) related to the financing of their investment projects. On the contrary, less risky borrowers have greater incentives to make well-informed investment choices and take actions to ensure good financial outcomes, reducing the need for lenders of an intensive evaluation and monitoring of their projects. One version of this phenomenon, called ‘flight to quality in lending’, is similar to the ‘flight to home’ effect and relates to the higher retrenchment of bank loans from foreign markets after a credit shock of different forms (De Haas and Van Horen 2013; Popov and Van Horen 2015). We empirically test the reallocation of credit after an increase in financial fragmentation in our second research hypothesis as follows:

H2: Financial fragmentation leads to a reallocation of bank loan portfolios toward less-risky borrowers—i.e. flight to quality in lending.

Evidence against the flight to quality effect has been contemplated in a theoretical model by Freixas et al. (2003). The authors demonstrate that emergency liquidity assistance from central banks creates moral hazard incentives for financially distressed banks who then increase lending to risky borrowers to secure short-term profits. This lending portfolio reallocation strategy called ‘gambling for resurrection’ might apply to banks in trouble due to weaknesses in the financial regulation framework.

It is also possible for financial integration to trigger growth effects which improve firms’ confidence in the future business environment. The benefits from financial integration in terms of a country’s growth prospects are still debated in the literature. Some contributions on financial integration reveal a positive association (Schnabel and Seckinger 2015; Giannetti and Ongena 2009; Beck et al. 2004), while others point to a limited effect (Coeurdacier et al. 2019; Detragiache et al. 2008). Understanding this relationship is important because if financial integration has a significant impact on future growth potential, then it may affect firms’ expectations of receiving external bank financing. In turn, if firms perceive that external financing will be limited, they might give up valuable investment opportunities.

We explicitly study the perceptions of external bank financing availability to check if financial fragmentation has an impact on future investment projects. We conjecture that for SMEs, an increase in financial fragmentation will worsen their perception of availability of future bank financing, due to the increased cost and reduced availability of bank debt. Therefore, our third hypothesis can be formulated as follows:

H3: An increase in financial fragmentation leads to a perception of lower availability of future external funds for SMEs.

3 Financial fragmentation: measure, data and country-level results

The first step in our methodological framework is to construct the country-level measures of financial fragmentation that we then use in the second stage of our analysis (Section 4.3) to examine the impact of financial fragmentation on SMEs’ access to finance in Europe. Section 3.1 provides a description of the methodology and data sources used to measure fragmentation; in Section 3.2, we discuss the country-level results.

3.1 Measuring fragmentation in credit and sovereign bond markets

Financial integration indicators can be classified in three main categories: price-based indicators, volume-based indicators and regulatory measures (Billio et al. 2017). Among the three categories, price-based indicators are the most common due to their easier interpretation. Price-based indicators invoke the law of one price, according to which two or more markets are integrated when identical assets are priced equally across borders. For these reasons, several works have focused on the co-movement between prices across markets, using different methodological frameworks: vector autoregression, error correction models and cointegration (Jayasuriya 2011; Gupta and Guidi 2012; Horvath et al. 2018); cross-country correlations (Goetzmann et al. 2005; among others), principal component analysis (Volosovych 2011; 2013; Donadelli and Paradiso 2014), factor analysis (Wagenvoort et al. 2011) and panel convergence methodologies (Rughoo and Sarantis 2012).

After the introduction of the single currency and the European Monetary Union over 20 years ago, the EU experienced substantial increases in market integration (Baele et al. 2004; Rughoo and Sarantis 2012; Wagenvoort et al. 2011). This process brought considerable benefits to both lenders and borrowers and offering opportunities to diversify idiosyncratic risks away from domestic economies. The global financial crisis in 2007–2009 and the more recent euro area sovereign debt crisis exposed many weaknesses of integrated markets particularly in relation to the transmission of shocks and volatility (Zaghini 2016; Mayordomo et al. 2015). In this study, we focus on financial fragmentation rather than integration not only because there is a potential trade-off with stability, but also because there is a need for research in this area that can help identify causes, consequences and effective policy actions. In a comprehensive review, Claessens (2019) notes that fragmentationFootnote 5 might occur for many different reasons, including a range natural barriers and frictions as well as differences in financial regulation and supervision.

We develop four measures of financial fragmentation using the principal component analysis (PCA). The choice is motivated by at least three reasons: (i) PCA is based on a clear theory-based interpretation (Volosovych 2011; 2013, Donadelli and Paradiso 2014; Billio et al. 2012, 2017); (ii) it accounts for several dimensions of integration including co-movement and segmentation; (iii) it is robust to outliers and avoids the selection of a benchmark country.Footnote 6 In addition, as emphasised in Ellul and Yerramilli (2013), the most important advantage of employing PCA is that no categories have to be subjectively eliminated and no subjective judgements has to be made regarding the relative importance of each category. The limitation of the PCA technique is related to the fact that the choice of the number of countries included in the analysis may influence the results obtained (Billio et al. 2017). For instance, in this study, we extract the first component from twelve countries, whereas including all EU countries and countries outside the EU might lead to different results.

According to Volosovych (2011) and Billio et al. (2012, 2017), commonality across asset returns can be detected by the proportion of total variation explained by the 1st principal component, dynamically extracted using a rolling window approach. PCA yields a decomposition of the variance-covariance matrix of returns of a country set into the orthonormal matrix of eigenvectors L. The first subset of eigenvalues captures a larger portion of the total volatility when the majority of returns tend to move together. Therefore, periods when the first principal component explains more of the total variation are indicative of increased integration across countries.

We employ the PCA on a 6-month rolling window for the monthly time series of interest rates for twelve selected EU countries. To allow the interpretation of commonalities between returns, we create a measure of dispersion across the first matrix of eigenvectors L as the ratio of the absolute value of the difference between the eigenvectors of a country and the mean of the eigenvectors over the mean of the eigenvectors:

where Li, t is the eigenvector of country i at time t, and E(Lt) is the mean of the eigenvectors of the selected countries at time t. At this point, the interpretation is quite intuitive: the higher the value of the ratio, the higher the financial fragmentation in country i at time t.

Our PCA technique is applied on monthly interest rates for eleven Euro area countries (Austria, Belgium, Germany, Finland, France, Greece, Ireland, Italy, the Netherlands, Portugal and Spain) and the UK. The ECB reports interest rates of Monetary Financial Institutions (MFIs) in the EU, both for new business and for outstanding amounts. We gather data on the 10-year bond rates of sovereign countries and loan interest rates on euro area non-financial corporations with the following maturities: up to 1 year (hereafter STL = short-term loans), over 1 year and up to 5 years (hereafter MTL = medium-term loans) and over 5 years (hereafter LTL = long-term loans).Footnote 7 It should be noted that short-term loans include long-term variable rate loans but exclude overdrafts.Footnote 8

Table A.1 in Appendix A illustrates the basic descriptive statistics of the interest rates series by country between January 2009 and December 2016. For short-term loans, there is a clear evidence of short- and long-run convergence until 2011 as differences across interest rates are lower in these periods. This partly reflects the similar economic conditions and inflation expectations among the selected countries. After 2011, we observe a deviation of short-term interest rates for sovereign stressed countries (Greece, Ireland, Italy, Portugal and Spain). For sovereign bond markets, the process of fragmentation is less evident and occurs only during the peak of the sovereign debt crisis, then the convergence of interest rates appears to rebound.

Moving to longer maturities, we document a similar pattern of convergence before the EU sovereign debt crisis in 2010–2012. After that period, the process of fragmentation is less pronounced in comparison to that observed for short-term maturities. Short-term loan rates are generally higher for Greece, Italy, Portugal and Spain, while medium- and long-term loan rates are usually higher in UK, Portugal and Greece. Part of these cross-country differences can be explained by macroeconomic conditions, inflation and the structure of the banking sector.

By comparing the evolution of sovereign bond yields and interest rates on loans, we can observe that unconventional monetary policy actions are not passed immediately to lending rates. This is in line with the results shown by Ritz and Walther (2015),Footnote 9 De Haan et al. (2017) and BIS (2011) on the effect of wholesale funding shocks due to the sovereign crisis on lending rates and volumes.

3.2 Results of principal component analysis

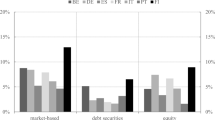

An increase in financial integration should be associated with commonality in asset returns across countries. In this paper, we attempt to measure commonality through PCA technique as described in Section 3.1. We apply the PCA technique on sovereign and credit market interest rates on a semi-annual time window, over the whole sample period considered (2009–2016). The results of our financial fragmentation measure, derived from the application of Eq. (1) on eigenvalues, are presented in Table 1 that provides country-level summary statistics of our financial fragmentation measures. Table A.2 in Appendix A reports the information on the proportion of variance explained by the first principal component.

Our measures of financial fragmentation show considerable variation over the period under analysis. During the Eurozone sovereign debt crisis, we observe a peak in the trend of financial fragmentation for both sovereign and credit markets. Following 2011, the sovereign market experienced a rebound in financial integration, while credit markets’ fragmentation increased during 2012 and 2013. Overall, we document that the short-term loan market is much more fragmented than other markets with longer maturities. The results are consistent with those observed in ECB (2013) and Horvath et al. (2018) who find a lower pass-through of loan interest rates with longer maturities.

Table A.2 in the Appendix displays the percentage of variance explained by the first principal component that is higher for the sovereign market as compared to the credit market. This corroborates our findings reported in Table 1. Moreover, the percentage of variance explained is lower for shorter-term loans, thereby further confirming our contention on the behaviour of short-term markets described above. Finally, since the eigenvalues of the second and the third components are lower, we can confirm that the first component captures most of the variation and can be proxied as a measure of financial fragmentation.Footnote 10 This is in line with other previous studies that used a similar approach (Billio et al. 2017; Volosovich 2011) using stock market returns.

For our main analysis, we use the measure of fragmentation on sovereign markets since it is more reactive in comparison to loan interest rate measures that exhibit a different pass-through of monetary policy and other market events. We use financial fragmentation measures of loan interest rates of different maturities in the additional analysis (Section 5.4) to provide further evidence of consistency of our results.

4 Firm-level data, dependent variables and empirical methodology

To investigate our three hypotheses, we combine micro-level data from the SAFE Survey with our country-level measures of financial fragmentation. In this section, first we briefly explain the purpose of the SAFE Survey, then we describe the key dependent variables that capture access to bank financing; finally, we present the econometric methodology.

4.1 Firm-level data: presentation of the SAFE survey

Firm-level data comes from the ‘Survey on the Access to Finance of Enterprises’ (SAFE). The SAFE questionnaire started in 2009 and is run jointly by the ECB and the European Commission every 6 months. Firms in the survey are randomly selected from the Dun & Bradstreet business register and are stratified by country, enterprise size class and economic activity. The sample size is different across countries in order to be sufficiently representative for the bigger economies. Firms from Germany, Spain, France and Italy account for roughly 15–20% of the total firms in the sample.Footnote 11

As regards the stratifications by firm size classes, the sample includes micro (1–9 employees), small (10–49 employees) and medium-sized (50–249 employees) enterprises. The firms are split into four major economic activities based on the one-digit level of NACE classification.Footnote 12 Economic activities include the four largest industries: manufacturing, construction, trade and services.Footnote 13 In terms of sectoral breakdown, 10% of firms are in the construction, 25% are in the service sector (business service, transport and real estate), 30% in manufacturing while the remaining 35% are in retail and trade. The same firms were re-surveyed across countries where possible. However, only a limited portion of firms were re-surveyed limiting the possibility of constructing a large panel data sample of enterprises.

We use 15 waves for the 11 most representative euro area countries: Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Netherlands, Spain, Portugal, plus the UK, for a total of 106,576 observations. We focus on these countries because coverage for smaller euro area countries is more limited. Section 4.2 explains the key dependent variables and Section 4.3 provides the details of the empirical methodology and firm-level explanatory variables. All variable definitions and sources can be found in Table B.1 in the Appendix.

4.2 Key dependent variables

Our main target is to evaluate how financial fragmentation affects SMEs’ access to finance and the underlying mechanisms at work (H1 and H2). To do so, we construct two key dependent variables using the responses to two specific survey questions which ask firms about their bank loan applications, as well as the outcome of these applications in the prior 6 months.

In particular, the first question is aimed at detecting whether a firm applied for a bank loan, as well as the reasons why it did not: ‘With regards to bank loans, could you please indicate whether you: (1) applied for them over the past 6 months [Applied]; (2) did not apply because you though you would be rejected [Discouraged]; (3) did not apply because you had sufficient internal funds [Sufficient internal funds]; (4) or did not apply for other reasons [Did not apply for other reasons]’. With this question, we model a dependent variable labelled bank loan application that takes value 1 if a firm applied for credit, a value of 2 if a firm is discouraged to apply, a value of 3 if a firm did not apply because of sufficient internal funds and 4 if did not apply for other reasons.

The second question is addressed only to firms who have applied for a bank loan and is intended to get information about the result of the application process: ‘If you applied for a bank loan over the past 6 months, did you: (1) receive almost all the financing you requested [Applied and got almost everything]; (2) receive only part of the financing you requested [Loan scaled]; (3) refuse to proceed because of unacceptable costs of terms and conditions [Refused]; (4) or have you not received anything at all’ [Denied]. With this second question, we construct the second dependent variable named bank loan result that takes value 1 if a firm applied and got almost everything, 2 if a firm is loan scaled, 3 if a firm refused the loan offer due to high costs and a value of 4 if a firm is credit denied.

Figure A.1 in Appendix A offers a simple visual representation of the key dependent variables.

Table 2 presents the observations’ frequency and shows that over 65% of the survey respondents do not apply for a bank loan either because of sufficient internal funds (43.97%) or because of other (undisclosed) reasons (21.74%), while roughly 6.5% of the survey respondents (corresponding to 6810 observations) declare to be discouraged borrowers. Discouraged firms represent a subsample of non-applicant firms that desire bank credit for financing their activities but do not apply because of fear of possible rejection. In terms of number of observations, there are more discouraged borrowers in this sample than firms that applied for credit and got their application denied (2690 observations) or scaled (2217 observations). These preliminary statistics highlight the importance of considering discouraged borrowers in the study as these are not necessary less creditworthy than applicant firms. The higher level of discouragement represents foregone investment opportunities for firms and missed lending opportunities on the part of banks. Interestingly, only a limited portion of applicant firms refused the loan offer due to high costs (561 observations); this accounts for roughly 2.10% of the respondents that applied for bank financing.

To test our third hypothesis (H3), we take advantage of a specific question that asks firms if they perceive that bank financing will improve, deteriorate or remain unchanged over the next 6 months. With this information, we create a dummy variable equal to 1 if firms perceive that bank financing will increase in the next 6 months (Perception of future funds). Table 3 reports the summary statistics and reveals that 20.26% of surveyed firms perceive that bank financing will increase in the next 6 months. By examining the evolution of this variable across the waves of the questionnaire (not reported), it is evident that the perception of availability of future funds increases during credit expansion periods.

4.3 Empirical methodology and firm-level explanatory variables

As discussed above, we examine three related hypotheses. The first is whether financial fragmentation affects both formal and informal credit constraints (H1). The second is whether risky firms are more sensitive to the increase in financial fragmentation due to the higher information asymmetries faced in their lending-borrower relationships (H2). Third, we investigate the expectations of firms about future bank financing after an increase in financial fragmentation (H3). Since survey questions on loan application demand and loan application results take more than two outcomes, we investigate H1 using a multinomial logit model of the following form:

where Prob(yi, s, c, t) are both bank loan – application and bank loan – results; Financial fragmentationc, t − 1 are country-level measures of financial fragmentation (see Section 3); Xi, s, c, t is a set of firm-level covariates to control for firm-level heterogeneity, Macroc, t − 1 is a vector of macroeconomic controls. In addition, we add a bi-dimensional set of fixed effects that allow us to net out common demand side effects.Footnote 14 Specifically, we include country-time fixed effects (ϑc, t) to control for shocks that are common to all firms in a country in a specific wave of the questionnaire, such as for example the sovereign debt crisis; industry-time fixed effects (γi, t) to net out unobserved shocks on demand factors common to all firms in a specific industry at a specific wave; and country-industry fixed effects (θc, i) to remove shocks common to all firms in the same sector in the same country, for example shocks related to demand of housing in Spain.

The main coefficient of interest, β1, captures the changes in access to finance given the level of financial fragmentation. A positive sign implies that all else equal, access to finance deteriorated more for firms in countries with higher financial fragmentation of sovereign bond or credit markets.

Based on the literature, we control for firm characteristics (Xi, s, c, t) using information on firm size, age, ownership structure, self-assessment of capital strength, outlook and credit history. In the following lines, we justify our selection of control variables more closely. First, firm size and age are important for banks’ financing. Larger firms are seen as less risky by lenders, because of their lower opaqueness and/or because of greater availability of collateral (Berger and Udell 1998, 2006). Investing in smaller firms, in most cases, introduces higher transaction costs associated with banks’ screening. This often results in higher loan rates and credit rationing for smaller firms (Cowling et al. 2012; Van Caneghem and Van Campenhout 2012). Older firms tend to have established banking relationships, and this facilitates their access to external financing in comparison with new established firms (Berger and Udell 1995; Cowling et al. 2012; Ferrando et al. 2017; among others). We model firms’ Size as a categorical variable equal to one for micro firms (1–9 employees), two for small (10–49 employees) and three for medium sized (50–249 employees), while Age is a dummy variable equal to 1 if a firm has been in business for less than 2 years. Table 3 shows that the average firm size is relatively small (2.07) and has been in existence for more than 5 years.

Bank credit rating scoring models are based on historical and behavioural information on firm’s ability to repay a loan. In these models, leverage, performance and credit history are important inputs for assessing firms’ credit risk. In particular, the probability of repaying debt is higher for firms that improve their profitability and reduced their leverage. However, this is also the case for firms with superior historical performance that build up their capital reserve within their businesses and which are likely to reduce their probability of default (Cowling 2010). Moreover, credit history is an element of soft information that banks use in their risk assessment and an improvement in bank-firm relationship increases the probability of firms to repay their debts. To capture information on profitability, capital and credit history, we take advantage of the questions which ask firms if their profitability (Positive outlook), capital (Capital improvements) and credit quality (Better credit history) improved in the past 6 months. Table 3 shows that 23% of the respondents declare an improvement in their credit history, 25% in their sales and profitability and 26% declare an improvement in capital.

We also consider owners’ characteristics that capture important aspects of the firm owners’ human capital and the creditworthiness of the enterprise. Family-owned business have better access to credit because they face less moral hazard problems and undertake more conservative investment strategies (Bopaiah 1998; Psillaki and Eleftheriou 2015). Moreover, family firms usually have more durable banking relationships in comparison to non-family firms and this attenuates the effects of a credit shocks to this type of firms. On the contrary, Ferrando and Griesshaber (2011) suggests that family firms are more credit constrained because ownership structure is connected to firm size as smaller firms are more likely to be owned by a family or single person in comparison to larger firms. Information on the variable Family owner is captured by a dummy variable that takes value one for firms that are family owned, which represent 50.49% of the respondents of the survey.

The second owner characteristic controls for the fact that firms can be part of a group or stand-alone firms. The rationale is that firms that are part of groups are less financially constrained in comparison to stand-alone firms due to access to internal group funds (Bremus and Neugebauer 2018). This information is captured through a dummy variable that takes value one if a firm is an autonomous profit-oriented firm (Stand Alone).

In terms of macroeconomic control variables (Macroc, t − 1), we include information on gross domestic product (GDP) growth, unemployment and the structure of the banking sector. We expect a lower probability of credit constraints in countries with higher GDP growth and lower unemployment rates as macroeconomic expansion increases loan demand and improves firms’ credit risk conditions. To account for the heterogeneity of the EU banking sector, we include the concentration ratios calculated on the top 5 financial institutions in a specific country. In line with the recent findings of Carbo et al. (2009) and Ryan et al. (2014), we expect that increased banking concentration results in increased financing constraints for SMEs.

To test hypothesis 2 (H2), we extend Eq. (2) by interacting firm-specific proxies of credit risk with our preferred measure of financial fragmentation. More specifically, we modify Eq. (2) as follows:

where Credit riski, s, c, t is proxied by five firm-specific variables that we present so far: positive outlook, capital improvements and better credit history, size and age. As discussed before, firms’ leverage, performance, credit history, size and age are important inputs for assessing firms’ credit risk. All control variables remain the same as in Eq. (2). In this regression, the coefficients of the interaction terms capture the increasing effect of financial fragmentation on risky firms.

Hypothesis 3 (H3) is tested using a probit model in which the dependent variable measures firms’ perceptions about the availability of future bank financing—as explained in the previous subsection—and the set of independent variables used in Eq. (2).

Finally, our empirical investigations are not free from limitations. The first one is related to the fact that surveys contain subjective responses to interviewers’ questions. This is particularly important in our dataset for those concerning the self-assessment of the risk variables related to capital, credit history and outlook improvement as they may not be supported by balance sheet information. Another limitation concerns the use of cross-sectional data instead of panel data. With cross-sectional data, the exact timing of the responses is unknown, so we cannot incorporate additional firm-level information regarding bank-firm relationships. For example, we do not know if firms that improve their capital were or not credit constrained in the past.

5 Results

5.1 Financial fragmentation and firms’ access to finance

In this section, we present the empirical results of our estimations of the effects of financial fragmentation of sovereign bond markets on bank loan application and its related outcome (H1). In Table 4, we start with the demand side, where we analyse the effects of financial fragmentation on discouraged borrowers. In this table, we report the empirical results of the multinomial logit model with bank loan application as the dependent variable. To estimate a multinomial logit model, one needs to select a base or reference category to which the coefficient estimates relate. While theoretically it does not matter which of the alternative outcomes of bank loan application demand we use, we select the category of firms that did not apply for credit for other reasons. In the additional analysis section, we show that our results are robust even when we change the base category.

Panel A of Table 4 presents the estimates. We find that financial fragmentation decreases the probability of applying for credit (column 1) and increases the probability of being discouraged from applying (column 2). This means that financial fragmentation has a significant impact on informal credit constraints. The marginal effects evaluated at the mean (panel B of Table 4) are highly significant and indicate that the economic magnitude of financial fragmentation is significant. For a 1% increase in financial fragmentation, we find a 1.5% increase in the likelihood of observing discouraged borrowers.

The scale of discouraged firms in an economy depends on three main factors: screening errors of banks, application costs and the spread between interest rates charged on firms and those charged by money lenders on banks (Kon and Storey 2003). Although not directly tested, it is plausible that the uncertainty related to a higher level of financial fragmentation affects screening errors because of higher information asymmetries between borrowers and lenders. In this context, banks might face difficulties in evaluating high-quality SMEs’ projects. Moreover, it also possible that financial fragmentation refrained some borrowers from applying for credit due to the increased cost of bank financing.Footnote 15

Further, we observe a few interesting results in the control variables. It is not unusual that firms that are discouraged from applying (column 2 of Table 4) declare negative self-assessment of their capital and credit history. These two variables have a prominent role in banks’ credit scoring systems; therefore, due to the deterioration of these two characteristics, firms do not apply for a loan because of fear of being credit rejected. Moreover, in line with Freel et al. (2012) and Han et al. (2009), we observe that discouraged borrowers tend to be newly born firms with less experience in the credit market. In other words, the level of discouragement increases for firms with less established banking relationship and with more opaque projects in time of higher financial fragmentation. This could possibly be related to a large extent of screening errors made by banks, given the higher uncertainty related to financial fragmentation, or because some borrowers may have indeed refrained from asking for credit in order to avoid generating negative credit history.

Banking market concentration seems very relevant in explaining discouraged borrowers where we find a relatively large, positive and statistically significant coefficient. This is consistent with findings linking concentration in banking markets with firms’ credit constraints (Carbo et al. 2009; Ryan et al. 2014). Han et al. (2009) pointed out that self-rationing mechanism is more efficient in concentrated banking markets because banks have higher incentives in investing in relationship lending with the consequence that risky borrowers are more likely to be discouraged. Therefore, based on their findings, discouragement can benefit banks to avoid the problem of screening errors in loan applications. However, since we do not know the portion of discouraged creditworthy firms and the length of the relationships between banks and borrowers, we cannot speculate more about the effects of this coefficient.

In Table 5, we present the empirical results on the effects of financial fragmentation of sovereign bond markets on the outcomes of the applications for bank loans. For all of the outcome variables, the estimated coefficients of financial fragmentation are always positive and significant. The marginal effects evaluated at the mean (panel B of Table 5) reveal that an increase in financial fragmentation increases the probability of being loan scaled by 2.5%, refusing a loan due to high costs by 2.1% and roughly 0.6% of being credit denied. The positive sign and significance of the main coefficients of interest could also be related to an amplification effect not driven by firm demand side factors experienced during and after the sovereign debt crisis. Altavilla et al. (2017) and Popov and Van Horen (2015) observe that banks with large sovereign exposures reduced lending of their foreign subsidiaries, even though their subsidiaries are based in core EU countries.

Moving to the specific coefficients of interest, in Table 5, we observe that financial fragmentation has a similar effect on credit scaling (column 1 of Table 5) and on the amount of loans refused due to high costs (column 2 of Table 5). This suggests that a shock on banks’ balance sheets following an increase in financial fragmentation is passed on firms through both quantity and price adjustments, as increased financial fragmentation triggers more severe information asymmetry problems. This may also occur because banks encounter difficulties in monitoring firms’ behaviour once the loan is granted. However, even though statistically significant, the coefficient of financial fragmentation has a smaller effect on credit denial (column 3 of Table 5) suggesting that banks do not tighten too much their credit standards after an increase in financial fragmentation of sovereign bond markets. In other words, this lower coefficient suggests that banks do not modify their screening mechanisms after an increase in financial fragmentation.

With regard to the firm-specific control variables, estimates suggest that firms reporting improvements in terms of capital and credit history are less likely to be loan scaled or denied. Moreover, new firms tend to be loan scaled and loan denied. This latter result can be related to their greater opaqueness or because they typically have less availability of collateral than older firms (Berger and Udell 1998, 2006). Also, firms that refuse a loan (column 2 of Table 5) due to the high costs appear to be typically smaller in size and report an improvement in their credit history.

Interestingly, in line with the empirical findings of Carbo et al. (2009) and Ryan et al. (2014) the probability of facing (some type of) reduced credit access increases in countries with more concentrated banking sectors. Finally, macroeconomic control variables, when significant, have the expected signs in all models and overall results suggest that a deteriorating macroeconomic environment increases the probability for firms to be credit denied.

The important takeaway in this context is that an increase in financial fragmentation is passed on through price adjustments (loan refused) and non-price dimensions (credit rationing) of lending. Moreover, the effect is visible and relevant also for firms that are discouraged from applying, which represent a relatively important share of firms in our sample. In comparison to more severe shocks to the banking sector, such as the sovereign debt crisis, financial fragmentation has a smaller impact on loan application denial. As pointed out in Ferrando et al. (2017), the sovereign debt crisis increased loan application denial and loan scale without having a larger effect on price dimensions and on firms that are discouraged from applying.

5.2 Is there a ‘flight to quality’ in lending?

In this section, we exploit firms’ heterogeneity in order to analyse which type of firms suffer most from an increase in financial fragmentation. As discussed in Section 2, after a negative shock, banks might adjust their lending portfolios away from risky borrowers—i.e. flight to quality in lending. Results of the estimations of Eq. (3) that explicitly tests our second hypothesis, H2, are reported in Table 6.

We observe different coefficients depending on the outcome. It appears that firms that report an improvement in capital and credit history are less likely to be loan scaled (column 1 of Table 6) or credit denied (column 3 of Table 6). This result is in line with our expectations and suggests that banks reduced credit to less creditworthy firms when financial fragmentation increases. Moreover, it appears that new firms are more likely to be credit denied. This suggest that banks prefer to deny credit to firms with less established lending relationship when financial fragmentation increases. In column 2 of Table 6, we look at firms that refused the loan due to high costs and notice that those firms are new and smaller in size. This result suggests that banks tend to increase loans’ interest rates (price rationing) to firms with less established lending relationships and with a smaller size.

Overall, results in Table 6 imply that information asymmetries problems become more severe in some lender-borrower relationships due to an increased borrower opacity, leading to price (refused) and non-price adjustments (rationing). According to these findings, we can argue that banks become more cautious when making lending decisions after an increase in financial fragmentation. Hence, we can document a “flight to quality” effect in lending after an increase in financial fragmentation with banks adjusting their portfolios away from more opaque and risky borrowers. This finding corroborates theoretical arguments that after a supply shock of different forms, it is likely to observe a reallocation of credit from low-net worth to high-net worth borrowers.

5.3 Perception of availability of future external funds

In this section, we evaluate the impact of financial fragmentation on firms’ expectations about future availability of bank financing (H3). To do so, we run Eq. (2) using the perceived availability of future bank funds as a dependent variable. Results of the estimation are reported in Table 7.

We find that financial fragmentation of bond markets has a negative effect on firms’ perceptions of future external debt financing. Our evidence suggests that firms’ expectations of the availability of future bank funds diminished significantly in times of financial fragmentation. This result indicates that financial fragmentation might possibly reduce the amount of valuable investment opportunities that firms can set up in the next period.

Regarding firm-specific covariates, we find that firms that improve their risk indicators in terms of capital, credit history and outlook perceive an increase in the availability of future bank financing funds. The result is in line with Ferrando and Mulier (2015) that find that less creditworthy firms tend to be more concerned about future availability of bank financing.

5.4 Additional analyses

In this section, we address four non-trivial concerns about our empirical results. Since we consider a long-time period that comprises also the sovereign debt crisis, one might be concerned that our results may be impacted significantly. To rule out this concern, we run our estimates without considering the sovereign crisis period when financial fragmentation of both credit and sovereign markets was consistently higher. We run Eq. (2) using the data gathered by the SAFE survey after the crisis period from wave 8 (February and March 2013) to wave 16 (September and October 2016). If the coefficients of financial fragmentation measures are similar to those estimated above, we can conclude that our results are not driven by the crisis periods.

Panel A of Table 8 reports the estimates of the main coefficients of the multinomial probit model which confirm that financial fragmentation has an effect also in the rebounding period after the crisis that allow us to confirm the validity of the results in Tables 4 and 5 in which we claim that financial fragmentation is important for firms’ access to finance. Interestingly, the higher magnitude and significance of the main coefficient of interest suggest that financial fragmentation is important for SMEs’ access to finance even during periods of economic expansion.

We also remove the peripheral countries affected by the sovereign debt crisis: Greece, Ireland, Italy, Portugal and Spain (GIIPS). This test also allows us to verify whether countries with similar characteristics suffered more than others from financial fragmentation. In contrast to core countries that benefited from higher integration levels over the period especially during the crisis, GIIPS experienced higher levels of financial fragmentation. Results in panel B of Table 8 further confirm our assertions on the impact of financial fragmentation on SMEs’ access to finance. The coefficient estimates of interest remain positive and significant in all specifications and confirm that fragmentation impairs firms’ access to finance also in these countries.

In this study, we use a measure of fragmentation that reflects conditions of the sovereign bond market. This is because the underlying mechanism is easier to interpret—i.e. an increase in the repricing in the sovereign bond markets is transmitted on funding costs of banks—while the pass-through on loan rates of banking markets depends on a series of factors: purpose of the loan, structure of the banking market products. We also repeat the estimations with our measures of financial fragmentation on banking markets of different maturities: short (STL), medium (MTL) and long term (LTL).Footnote 16

Results are displayed in Table 9 and further confirms our main results. As we discussed in Section 3, fragmentation in credit markets is higher than fragmentation on sovereign bond markets. Moreover, the pass-through of financial fragmentation in loan market segments with longer maturities takes longer time as banks gradually transmit funding shocks into lending interest rates. Despite this different pass-through, financial fragmentation of banking markets has a positive and significant effect on SMEs’ access to finance. The magnitude of the coefficients remains roughly the same, suggesting that the estimated economic impact of fragmentation on banking markets on SMEs’ financing constraints is similar to that observed when considering fragmentation on sovereign bond markets.

We address also two potential concerns related to sample selection and firm loan demand. Our main model fails to account for the fact that firms that apply for credit are not a random sample of the population of firms. In order to take this potential bias in consideration, we use a simple probit model with Heckman selection procedure, i.e. a two-step probit estimator that controls for sample selection. In the selection equation, we incorporate information on firms that do not apply for credit because of sufficient internal funds or for other reasonsFootnote 17 as well as two additional control variables that account for firms’ demand for credit. The exclusion restriction requires that the selection equation should be estimated on a set of variables that is larger by at least one variable than the set of variables in the outcome equation (Popov and Udell 2012; Ongena et al. 2013; Heckman 1979). Credible identification rests on including at least one variable that has a non-zero effect on the selection variable (firms that do not apply because of sufficient internal funds or for other reasons) and a zero effect on the outcomes (denied, refused, scaled and discouraged).

The first additional control variable in our selection equation equals one if a firm report that its main problem is product competition and zero otherwise. The underlying idea is that stronger or increasing competitive pressure can reduce firm’s expectation about its future growth (Popov and Udell 2012). The second variable excluded in the outcome equation takes value one if a firm declare that is most pressing problem is costs of production, and zero otherwise. If product costs increase, it becomes difficult for a firm targeting the desired level of profitability and expand their activities. Based on the theoretical model of demand for credit lines of Martin and Santomero (1997) and the empirical evidence in Bremus and Neugebauer (2018), firms with lower growth perspective have lower credit demand. For computational reasons and because of difficulties in the estimation, we run the Heckman model with country, time and industry fixed effects, without taking in consideration the interactions between fixed effects that are more likely to absorb common demand shocks. Results are reported in panel A of Table 10.

The results of the estimations with the Heckman model further confirm our main results shown in Tables 4 and 5. The main variable of interest (financial fragmentation) remains positive and significant with a similar coefficient. The fact that the results are fairly similar (although slightly weaker for some firm control variables; not displayed for reasons of brevity) indicates that selection bias is not a main concern in our main estimations.

Then we control for firm demand side effects. Our results suggest that an increase in financial fragmentation has a statistically significant impact on SMEs’ access to finance. Specifically, it might be a demand-driven transmission mechanism that works through firms’ balance sheets independent from financial fragmentation paths. If loan demand for firm i increases and this is not controlled for, the probability of being credit constrained increases as well; thus, our estimates are biased upward. By contrast, if loan demand declines, our estimates are biased downward. We address this point formally with two different solutions. In the first check, we run Eq. (2) on a subset of firms that declare in the survey wave that their most pressing problem was selling their products. While in the second check, we run the same equation on a subset of firms that declare an increase in product competition and difficulties in selling their products. Results of these additional tests are reported in panels B and C of Table 10 and further confirm our main estimates, as the coefficients of the main variables of interest remain broadly the same. This removes our concern on an upward or downward bias of the main coefficient capturing the effect of financial fragmentation on firms’ access to bank financing.

The last concern relates to the categories identified in the survey. In the bank loan application, the survey offers firms four options: (1) applying for credit, (2) did not apply because of fear of possible rejection, (3) did not apply because of sufficient internal funds and (4) did not apply for other reasons. Firm observations in categories 3 and 4 can be grouped since both categories contain observations related to firms that do not desire bank funding. Results of the estimates are shown in panel A of Table 11 and remain qualitatively similar than those shown in Table 4.

Moreover, firms that refused the loan due to high costs might be high-quality borrowers that perceive that given their creditworthiness, the cost of bank financing is too high and thus refused the loan offer. So, these firms are not rationed by the bank as in the case of firms partially or totally rationed. Thus, in this last check, we repeat our estimation grouping the category of firms that refused the loan due to high costs into the category of firms that applied and received almost the full amount and we repeat the estimations of Eq. 2. In this estimation, an increase of financial fragmentation again impacts firm access to finance.

6 Conclusions

This paper investigates the effect of financial fragmentation on SMEs’ access to finance. So far, to our knowledge, the related literature has not devoted much attention to how financial fragmentation of sovereign and credit markets impacts on SMEs’ availability of bank credit. This paper tries to fill this gap by combining country-level measures of financial fragmentation with the ECB’s SAFE survey on access to finance.

Three main findings emerge from this study. First, we find robust evidence that financial fragmentation impairs the availability of bank financing through both quantity and price dimension of credit. Moreover, financial fragmentation also influences the latent demand for credit as it increases the share of discouraged borrowers. Secondly, we find that an increase in financial fragmentation has a larger impact on less creditworthy enterprises. This evidence is consistent with the flight to quality hypothesis in lending and the theoretical arguments that claim that information asymmetry problems become more severe in some lender-borrower relationships due to greater borrower opacity. Thirdly, we show that financial fragmentation reduces firms’ expectations about the availability of future bank funds. Interestingly, our results also suggest that different types of firms seem to experience different types of credit constraints. For example, newly born and smaller firms exhibit more formal credit constraints (loan scaled and loan denial), while informal credit constraints appear more evident for newly born firms independently from their size.

Our findings provide important policy implications for current events and policy responses to increased financial sector fragmentation. Based on our results, financial fragmentation leads to higher credit constraints for SMEs. Given the importance of bank credit for the growth of SMEs (Beck and Demirguc-Kunt 2006), credit constraints might lead to real effects such as lower investments and employment levels that finally reduced the output of the EU. Therefore, concerns on the ongoing fragmentation path in the EU’s financial sector, rebounded after the Brexit referendum, seem to be legitimate. Further developments on the process of the banking union and the capital market union may improve the integration path across the EU countries with an ultimate result of enhanced risk sharing across countries and greater availability of funds for SMEs.

Naturally, other mechanisms could neutralize or even reverse the benefits of financial integration for firms’ access to finance. For example, integration facilitates cross-border mergers and acquisitions in the banking sector that will likely to increase the lenders’ relative size. According to our results and in line with the empirical works by Ryan et al. (2014) and Carbo et al. (2009), excessive concentration in banking markets can significantly impair SMEs’ access to finance. This suggests that financial integration could impair firm financing, if not accompanied by policy initiatives aimed at maintaining an optimal level of competition in the banking sector. Our results should, therefore, be treated with some caution in terms of policy implications and more research should be done to better understand the effects of financial fragmentation on SMEs’ access to finance. In our opinion, it would be interesting to analyse the effect of financial fragmentation on firms’ financing decisions, for example, analysing the substitution of bank credit with trade credit and/or other funding sources (equity, retained earnings) after an increase in financial fragmentation/integration.

Notes

EU-28 includes all European Union member states at the time of writing (2019). In this paper, we refer to an SME by the standard European Commission definition (http://ec.europa.eu/growth/smes/business-friendly-environment/sme-definition_en). Data are drawn from the European Commission (2017) Annual Report on European SMEs 2016/2017.

Credit register data contains only information on loan applications. However, applicant firms are a sub-sample of all firms: some firms do not apply because they do not need credit, while others do not apply because of fear of possible rejection. As suggested by Popov and Udell (2012), Ferrando et al. (2015, 2017) and Freel et al. (2012), among others, not accounting for these informal credit constraints could bias the results of the analysis.

The capital markets union aims to provide new sources of funding for businesses, especially for small and medium-sized enterprises; reduce the cost of raising capital; increase options for savers across the EU; facilitate cross-border investing and attract more foreign investment into the EU; support long-term projects; and make the EU financial system more stable, resilient and competitive (European Council https://www.consilium.europa.eu/en/policies/capital-markets-union/). See also Zachariadis (2019).

According to Stiglitz and Weiss (1981), banks’ best strategy is to ration credit whenever demand increase interest rates above the optimal level.

There are many definitions of fragmentation in the literature; however, the term is typically used to refer to some forms of imperfect financial markets integration based on the idea that in the absence of fragmentation, the ‘law of one price’ should hold. Earlier studies that document that financial integration was achieved in the euro area (see for example: Baele et al. 2004; Rughoo and Sarantis 2012) used measures of integration; however, recent studies document a fragmentation pattern after the eruption of the global and the sovereign debt crisis (Horvarth et al. 2018; Mayordomo et al. 2015; Zaghini 2016) and started to implement new measures of fragmentation—i.e. for example dispersion across interest rates.

Other studies use (i) convergence of loans and deposit rates (Baele et al. 2004; Rughoo and Sarantis 2012) and (ii) the extent of cross-border activities, in terms of retail operations (Gual 2004; Perez et al. 2005), deals and foreign loans (Schnabel and Seckinger 2015; Emter et al. 2018). Both measures have drawbacks because interest rates could be different across countries due to differences in both banking products and characteristics of domestic borrowers. Equally, relying on cross-border activities ignores the fact that banks reduce lending operations less if, for example, the market is near; if they were present with a subsidiary, and/or if they acted in cooperation with a domestic lender (De Haas and Van Horen 2013; Popov and Van Horen 2015).

Unfortunately, data on new business loans is missing for some countries (for example Belgium and UK).

We do not distinguish between interest rates on small/large volumes (below/above EUR 1 million) of loans because the data is missing for Belgian, Greek and Portuguese rates both at the ECB and at the national central banks.

Ritz and Walther (2015) do not analyse empirically the effect of the wholesale funding shocks after the sovereign debt crisis. They develop a theoretical model to explain the effect of wholesale uncertainty on lending.

These results are not reported for the sake of brevity, but they are available with the authors upon request.

In addition, the questionnaire provides weights to restore the proportions of the economic weight (in terms of number of employees) of each size class, economic activity and country. All regressions use these weights.

See https://www.ecb.europa.eu/stats/pdf/surveys/sme/methodological_information_survey_and_user_guide.pdf for methodological information about the SAFE survey.

The abbreviation NACE is the classification of economic activities in the European Union (EU); the term NACE is derived from the French Nomenclature statistique des activités économiques dans la Communauté européenne.

Firms in agriculture, public administration and financial services are excluded from the questionnaire.

Simple fixed effects—i.e. country, time and industry—do not allow us to carefully separate common demand side shocks. For that reason, we use the interaction between fixed effects—i.e. country-time, industry-time and country-industry fixed effects.

This assertion is partially proven with the result in column 3 of Table 5, where we observe that financial fragmentation increases the number of firms that refused a loan due to the higher interest rates.

In a not displayed test (for reasons of brevity), we also control our results using alternative measures of financial fragmentation.

Firms that do not apply because of fear of rejection are included in the output equation of the Heckman correction procedure.

References

Altavilla, C., Pagano, M., & Simonelli, S. (2017). Bank exposures and sovereign stress transmission. Review of Finance, 2103–2139. https://doi.org/10.1093/rof/rfx038.

Andrieu, G., Staglianò, R., & van der Zwan, P. (2018). Bank debt and trade credit for SMEs in Europe: firm-, industry-, and country-level determinants. Small Business Economics, 51, 245–264. https://doi.org/10.1007/s11187-017-9926-y.

Baele, L., Ferrando, A., Hördahl, P., Krylova, E., Monnet, C., 2004. Measuring financial integration in the Euro Area. ECB Occasional Papers Series, 14. Retrieved from: https://www.ecb.europa.eu/pub/pdf/scpops/ecbocp14.pdf

Beck, T., & Demirguc-Kunt, A. (2006). Small and medium-size enterprises: access to finance as a growth constraint. Journal of Banking & Finance, 30, 2931–2943. https://doi.org/10.1016/j.jbankfin.2006.05.009.

Beck, T., Demirguc-Kunt, A., & Makksimovic, V. (2004). Bank competition and access to finance: International evidence. Journal of Money, Credit and Banking, 36(3), 627–648 Retrieved from http://www.jstor.org/stable/3838958.

Bekaert, G., Harvey, C., & Lundblad, C. (2005). Did financial liberalization spur economic growth? Journal of Financial Economics, 77, 3–35. https://doi.org/10.1016/j.jfineco.2004.05.007.

Berger, A., & Udell, G. (1995). Relationship lending and line of credit in small firm finance. The Journal of Business, 68(3), 351–381 Retrieved from: https://www.jstor.org/stable/2353332.

Berger, A., & Udell, G. (1998). The economics of small business finance: the role of private equity and debt market in the financial growth cycle. Journal of Banking and Finance, 22, 613–673. https://doi.org/10.1016/S0378-4266(98)00038-7.

Berger, A., & Udell, G. (2006). A more complete conceptual framework for SME finance. Journal of Banking and Finance, 30, 2945–2966. https://doi.org/10.1016/j.jbankfin.2006.05.008.

Bernanke, B., Gertler, M., & Gilchrist, S. (1996). The financial accelerator and the flight to quality. The Review of Economics and Statistics, 78(1), 1–15. https://doi.org/10.2307/2109844.

Billio, M., Getmansky, M., Lo, A. W., & Pelizzon, L. (2012). Econometric measures of connectedness and systemic risk in the finance and insurance sectors. Journal of Financial Economics, 104, 535–559. https://doi.org/10.1016/j.jfineco.2011.12.010.

Billio, M., Donadelli, M., Paradiso, A., & Riedel, M. (2017). Which market integration measure? Journal of Banking and Finance, 76, 150–174. https://doi.org/10.1016/j.jbankfin.2016.12.002.

BIS, (2011). The impact of Sovereign credit risk on bank funding conditions, CGFS Papers, No. 43, Basel Committee on the Global Financial System. Retrieved from: https://www.bis.org/publ/cgfs43.pdf

Bolton, P., & Jeanne, O. (2011). Sovereign default risk and bank fragility. IMF Economic Review, 59(2), 162–194. https://doi.org/10.1057/imfer.2011.5.

Bopaiah, C. (1998). Availability of credit to family businesses. Small Business Economics, 11(1), 75–86 Retrieved from http://www.jstor.org/stable/40217614.

Bremus, F., & Neugebauer, K. (2018). Reduced cross-border lending and financing costs of SMEs. Journal of International Money and Finance, 80, 35–58. https://doi.org/10.1016/j.jimonfin.2017.09.006.

Carbo, S., Rodriguez-Fernandez, F., & Udell, G. (2009). Bank market power and SME financing constraints. Review of Finance, 13(2), 309–340. https://doi.org/10.1093/rof/rfp003.

Chakraborty, I., Hai, R., Holter, H. A., & Stepanchuk, S. (2017). The real effects of financial (dis)integration: a multi-country equilibrium analysis of Europe. Journal of Monetary Economics, 85, 28–45. https://doi.org/10.1016/j.jmoneco.2016.11.003.

Claessens, S. (2019). Fragmentation in global financial markets: good or bad for financial stability? Bank for International Settlement Working Papers, 815 https://www.bis.org/publ/work815.pdf.

Coeurdacier, N., Rey, H., & Winant, P. (2019). Financial integration and growth in a risky world. Journal of Monetary Economics. In press. Doi. https://doi.org/10.1016/j.jmoneco.2019.01.022.

Cowling, M. (2010). The role of loan guarantee schemes in alleviating credit rationing. Journal of Financial Stability, 6(1), 36–44. https://doi.org/10.1016/j.jfs.2009.05.007.

Cowling, M., Liu, W., & Ledger, A. (2012). Small business financing in the UK before and during the current financial crisis. International Small Business Journal, 30(7), 778–800. https://doi.org/10.1177/0266242611435516.

De Haan, L., van den End, J., & Vermeulen, P. (2017). Lenders on the storm of wholesale funding shocks: saved by central bank? Applied Economics, 49, 4679–4703. https://doi.org/10.1080/00036846.2017.1287868.

De Haas, R., & Van Horen, N. (2013). Running for the exit? International bank lending during a financial crisis. The Review of Financial Studies, 26(1), 244–285. https://doi.org/10.1093/rfs/hhs113.

Detragiache, E., Tressel, T., & Gupta, P. (2008). Foreign banks in poor countries: theory and evidence. Journal of Finance, 63(5), 2123–2160. https://doi.org/10.1111/j.1540-6261.2008.01392.x.

Donadelli, M., & Paradiso, A. (2014). Is there heterogeneity in financial integration dynamics? Evidence from country and industry emerging market equity indexes. Journal of International Financial Markets, Institutions & Money, 32, 184–218. https://doi.org/10.1016/j.intfin.2014.06.003.

ECB, 2013. Assessing the retail bank interest rate pass-through in the Euro Area at times of financial fragmentation. Monthly Bulletin, August, European Central Bank. Retrieved from: https://www.ecb.europa.eu/pub/pdf/other/art1_mb201308en_pp75-91en.pdf

Ellul, A., Yerramilli, V. 2013. Stronger risk controls, lower risk: evidence from US bank holding companies, The Journal of Finance, Vol. LXVIII, No. 5, October. https://doi.org/10.1111/jofi.12057.

Emter, L., Schmitz, M., & Tirpak, M. (2018). Cross-border banking in the EU since the crisis: what is driving the great retrenchment? In ECB working paper No. 2130. Retrieved from: https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2130.en.pdf.

Enria, A. (2018). Fragmentation in banking markets: crisis legacy and the challenge of Brexit. BCBS-FSI High Level Meeting for Europe on Banking Supervision, (17 September 2018).