Abstract

Prior literature on the role that firm heterogeneity plays in corruption finds that larger firms pay smaller bribes and are less likely to pay bribes than smaller firms. These studies, however, often overlook the plausible reverse causality between firm growth or firm size and corruption. Utilizing an innovative identification strategy that accounts for this source of endogeneity, this study finds that increased firm size actually causes greater corruption and bureaucratic burdens on a typical firm and provides evidence against the argument for a uniform corruption burden regardless of size. It was determined that a one standard deviation increase in sales leads to 0.33 standard deviation increase in bribes, and to 0.36 standard deviation increase in management time spent dealing with public officials. Moreover, although corruption burden increases with increasing firm size, we find that this relationship is non-linear and diminishes in magnitude as firm size approaches to medium and large. We conclude with implications and policy considerations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Corruption can be considered as a localized practice that creates distortions to local firms (Bertrand et al. 2007), empirically examined to have detrimental impacts on economic growth and private investments at macro-level (Mauro 1995). A growing body of micro-level evidence has accumulated suggesting that firm heterogeneity plays a major role in explaining corruption. Prior studies have linked firm size to corruption, while providing mixed results (Schiffer and Weder 2001; Clarke and Xu 2004; Martin et al. 2007; Wu 2009). For instance, using the Business Environment and Enterprise Performance Surveys (BEEPS) 1999 data, Clarke and Xu (2004) found that large enterprises were less likely to pay bribes than small enterprises and also paid lower amounts of bribes. Martin et al. (2007) used the World Business Environment Surveys (WBES) 2000 data from 80 countries and found contrasting effects of firm size on the engagement of firms in bribery activity depending on which measure of firm size was used. Using the WBES 2000, Schiffer and Weder (2001) showed that firm size is negatively associated with corruption.

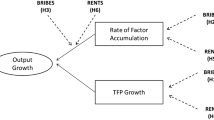

One key missing factor from these studies is the endogeneity of firm size and performance, leading the previous works to lack a rigorous research design capable of providing robust estimates. The main econometric challenge to examination of the link between firm size and corruption is addressing their plausible reverse causality. Corruption might reduce the size of firms through adversely affecting their performance and growth, which is known as the “sand the wheels” view on corruption. Particularly, corruption might act as a tax on business; however, it is more costly than taxation because of its uncertain and secretive in nature (Wei 1997). For instance, Beck et al. (2005) used firm-level data in 54 countries and found that corruption affects firm growth adversely. Fisman and Svensson (2007) found that a one percentage point increase in the amount of bribes reduces firm growth by three percentage points. In addition, rampant corruption and red tape might distort the firm size distribution because of “threshold effects.” Numerous statutory and regulatory exemptions exist for small businesses (Bradford 2004), a small firm thereby bears more burdensome regulations as it begins to expand its operations. As a result, some more productive firms choose to remain below the statutory threshold in order to avoid this burden (Garicano et al. 2016). To the contrary, corruption might bring about better economic outcomes such as receiving a public contract, getting a license, and saving on taxes (Tonoyan et al. 2010), the concept known as the “grease the wheels” view on corruption.

The current paper applies an innovative identification strategy combined with the instrumental variable method which allows for examination into the impact of exogenous changes in firm size on corruption to answer the following questions: Does firm size increase corruption burden, and if so, is this a non-linear relationship? Three types of corruption burden are investigated: bribery burden, as a firm’s reported bribe payments to public officials as percentage of sales to get things done; kickbacks, as informal payments to secure government contracts; and time burden, as management time wasted on interactions with bureaucrats. The pooled nationally representative surveys of firms mainly in Eastern Europe and Central Asia between 2002 and 2005, the BEEPS, are the primary dataset of this study. The BEEPS are widely acknowledged to have important design merits.

Endogenous firm size is instrumented by price shocks in international markets. World price of a particular commodity or manufactured product is estimated by its world exports value and net weight which are collected from the UN Comtrade database. The trade data of more than 5700 products are mapped to 32 industrial groups by using a concordance, which is available in Hoekman et al. (2002). Plausibly, world price of products is exogenous to corruption activities of this study’s sample because the included firms are primarily small and medium firms in transition economies. The identification strategy together with the richness of the BEEPS database allows this paper to become the first cross-country study to provide rigorous evidence on the causal link between firm size and corruption.

This study contributes to the existing empirical literature in several ways. First, departing from prior literature which usually treats firm size as exogenous, this paper addresses the plausible endogeneity bias by use of a strong instrumental variable strategy based on price shocks in international markets. World price of a particular product might cause changes in a firm’s sales and its performance, for firms whose main product line is that product. In contrast, Clarke and Xu (2004), Martin et al. (2007), Schiffer and Weder (2001), and Wu (2009) only provide the association between firm size and corruption based on their ordinary least squared (OLS) estimations. Svensson (2003) is the only peer-reviewed study addressing the endogeneity concern in a within-country study design. Second, this paper differs from earlier work (particularly, Svensson 2003) in two additional aspects. This current paper becomes the first cross-country study to provide rigorous evidence on the causal link between firm size and corruption. In a within-country research design, Svensson (2003) utilized a survey of bribe payers in Uganda in order to examine his proposed bargaining power hypothesis between profitability and corruption. This current study analyzes the link between firm size and three types of corruption burdens using cross-country micro data of 28 countries, mainly in Eastern Europe and Central Asia. The cross-country micro data allow us to investigate corruption burdens at different levels, including self-reported behavior data of firms and country-level institutional characteristics. Furthermore, relaxing the assumed linear relationship in Svensson (2003), this current work examines the hypothesis of a non-linear relationship between firm size and corruption. The robust IV approach allows this study to provide evidence on the pattern of the causal link between firm size and corruption. A diminishing effect of firm size on corruption is supported by the data. The positive effect of firm size on corruption burden is highest at the lowest levels of firm size such as micro and small firms, and remains positive but becomes diminished as firm size increases to medium and large.

The remainder of this paper is organized as follows. Section 2 briefly discusses relevant literature and develops the hypotheses. Section 3 presents the key data acquired for use in this study. Section 4 discusses the empirical strategy, methodology, and specifications utilized. In Sections 5, the results are reported. Section 6 provides discussion on the estimated effects and their implications.

2 Literature

There have been two strands of prior literature on the role of firm size and profitability in corruption. Prior to one of the most influential models of corruption, Shleifer and Vishny (1993), most economic studies of corruption focused on the principal-agent model and assumed homogeneous clients from private sectors such as Banfield (1985), Becker and Stigler (1974), and Klitgaard (1988). This strand of studies suggests a uniform bribe rate regardless of size, or in other words, suggests that firm size is not a determinant of bribery.

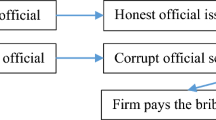

Shleifer and Vishny (1993) take the principal-agent problem as given and provide an industrial organization perspective of corruption in which market forces such as competition between buyers of government services are taken into account. In the same vein, Bliss and Di Tella (1997) studied the relationship between corruption and competition in which firms differ in cost structures and bureaucrats have the power to extract money from firms and drive the most inefficient firms out of business. Svensson (2002, 2003) develops a stylized bargaining model in which public officials make different bribe demands across firms based on those firms’ ability to pay and the costs of reallocating their business elsewhere. Through a survey of bribe-payers in Uganda, Svensson (2003) estimated that firms spent about 8% of their total costs for bribe payments which were largely explained by their “ability to pay” and “refusal power.” In particular, Svensson (2003) explicitly addressed the endogeneity concern in the assumed linear relationship between profitability and corruption and showed the evidence that the higher a Uganda firm’s current and future profits, the more it must pay. Hence, this study hypothesizes:

H1 Increased firm size causes greater corruption and bureaucratic burdens on a typical firm (micro and small firms).

Similar to Svensson (2003), this paper empirically tests the bargaining power hypothesis that larger firms may be more vulnerable and exposed to extortion by corrupt officials because of their higher “ability to pay.” In addition, smaller firms can more easily slip into informal arrangements in order to avoid taxes, regulations, and interactions with bureaucrats (Schiffer and Weder 2001). This current study further hypothesizes that the relationship between firm size and corruption is non-linear. In other words, the positive impact of firm size on corruption burden might be diminishing as firm size increases from micro and small to medium and larger firms. Larger firms tend to possess stronger refusal power, political influence, and economies of scale. These factors of resiliency may moderate additional exposure to demands from corrupt officials due to increasing revenue capacity. A large firm might possess some political powers and other means to resist predatory bureaucrats (Schiffer and Weder 2001). Also, informal payments to bureaucrats might be fixed costs on firms; consequently, a large firm can absorb these costs more easily. Therefore, this study proposes:

H2 The positive effect of firm size on corruption burdens declines as firm size increases from micro and small to medium and large firms.

3 Data

The BEEPS, a nationally representative survey of firms mainly in Eastern Europe and Central Asia, is the main dataset of this study. The data were pooled from 10,762 observations of the BEEPS in 2005 and 6678 observations of the BEEPS in 2002 (only 1500 firms were interviewed in both rounds). The list of 28 covered countries in the BEEPS sample is presented in Table 4 (appendix) along with their aggregate corruption burden on firms and firm size. In the analysis sample, a typical firm reported paying 1.02% of their revenue for informal payments to public officials and 1.39% of contract value as kickbacks, as well as spending 4.88% of management time to deal with public officials. On average, an Azerbaijan firm paid the largest rate of bribes among observed countries, 3.07% of revenue, while a half of Azerbaijani firms reported paying bribes. Despite consisting of mostly transition and developing economies, the sample covers several high-income countries such as Ireland and Spain. Irish and Spanish firms, the most sizable companies regarding their sales, tend to pay modest bribes compared to their peers in other countries in the sample.

The BEEPS asked firm managers about their experiences and assessments of corruption and other business environment issues. Its center piece of information on corruption issues is bribery burden on a firm, defined as a firm’s reported bribe payments to public officials as percentage of sales. The question about bribes was phrased benignly to preserve firm anonymity and encourage candid response. Questions in the BEEPS placed a greater emphasis on experience, and less on perceptions of firm managers, who may be discerned as a special category of “well-informed persons” (Knack 2007). Therefore, firm-reported data from the BEEPS might be considered as a firm’s experience about corruption. In addition, the BEEPS was designed for firm-level analyses, with numerous characteristics of the responding firms being tracked, and for taking care to preserve firm anonymity. Another merit of the BEEPS is that firm information tends to be independent from corruption judgments of others. The BEEPS data collection utilized random sampling, region-wide collection, and compatible survey methodology across countries. The survey sample was also designed to be representative of the population of firms in terms of their economic significance, sector, size, and geographical location within each country. In addition, Kaufmann et al. (2000) evaluated the extent of potential systematic bias and found little evidence of country perception bias in the BEEPS. The BEEPS 2002 and 2005 yielded a survey completion rate of 36.93% and 37.71% of all contacts, respectively. These response rates are deemed acceptable for data collected from organizations, particularly in the context that the BEEPS guarantee their representativeness of the population of firms. Baruch and Holtom (2008) analyzed 1607 studies published between 2000 and 2005 and found that the average response rate for studies that employed data collected from organizations was 35.7%. In addition, Cook et al. (2000) argue that response representativeness is more important than response rate in survey research.

Despite of the aforementioned merits of the BEEPS, there were changes in the questionnaire and methodology in the latest rounds of the BEEPS (2008–2009 and 2011–2014). These changes allow the latest BEEPS to become compatible with the Enterprise Surveys implemented by the World Bank in other regions of the world since 2006. Nevertheless, the BEEPS dropped significant information about corruption. For example, the latest rounds dropped questions about the uncertainty of a corrupt transaction and a firm’s ability to walk away from a corrupt official. In addition, the respondent rates to the question on the bribe rate in the recent rounds were considerably smaller than those of the BEEPS 2002 and 2005. Particularly, in the 2002 and 2005 surveys, 90% of respondent firms answered to the bribe-related question and 37.7% among them reported positive bribes. In the World Bank’s Enterprise Surveys 2006–2014 (including the BEEPS in 2008–2009 and 2011–2014), 64% respondent firms answered the same question and 18% among them reported positive bribes. Thus, two compatible rounds of BEEPS, the 2002 and 2005 surveys, were selected for use in this study due to their richer information on corruption and firm performance than the later BEEPS and other enterprise surveys.

In addition to BEEPS data, the world prices of various products were estimated by their world exports value and net weight, which are from the UN Comtrade database. In order to map the world price estimates into the BEEPS, two concordant systems were utilized. The first, linking the Harmonized Commodity Description and Coding Systems (HS) and ISIC rev.2 (International Standard Industrial Classification) classifications, is developed by Jerzy Rozanski (the World Bank). The file is available in the CDROM that accompanies the book edited by B. Hoekman, A. Mattoo, and P. English, “Development, Trade and the WTO: a Handbook” (Hoekman et al. 2002). The second system comes from the correspondence table of the United Nations Statistics Division. The country-level control variable data necessary for the present analyses were acquired from QoG Standard Data (version January 2016) which consists of approximately 2500 variables from more than 100 data sources. Particularly, constant GDP per capita and imports of goods and services come from the World Development Indicator (WDI). The dichotomous democracy measure comes from Boix-Miller-Rosato Dichotomous Coding of Democracy, 1800–2010 Dataverse. The alternative democracy index is from Vanhanen (2014). The United Nations Human Development Index (HDI) was used to capture skill endowments in one sensitivity analysis. The Human Development Index is published by the United Nation Development Programme in their Human Development Reports.

4 Empirical strategy

4.1 Identification and instrumental variable

The key econometric challenge in examining the link between firm size and corruption is addressing the possible reverse causality between these variables, distinctly plausible in the context that many firm characteristics may directly link to corruption. Corruption might reduce the size of firms through adversely affecting their performance and growth as well as discouraging productive firms from initiating growth. For instance, Beck et al. (2005) used firm-level data in 54 countries and found that corruption affects firm growth adversely. Fisman and Svensson (2007) found that a one percentage point increase in the amount of bribes reduces firm growth by three percentage points. Additionally, some more productive firms, that would have been larger without threshold level regulatory burdens, choose to remain below the statutory threshold to avoid the relevant costs of its expansion (Garicano et al. 2016). Conversely, corruption might bring about economically advantageous outcomes such as receiving a public contract, getting a license, and saving on taxes (Tonoyan et al. 2010). The instrumental variable method, a potential approach to address endogeneity issues (Angrist and Pischke 2008), was employed in this current study to examine the causal link between firm growth (firm size) and corruption burdens.

This paper uses price shocks in international markets to instrument the endogenous independent variable, firm size. To be a valid instrumental variable, an instrument must meet both the relevance and exclusion restriction assumptions. The rationale of the relevance assumption that using price shocks as an instrument is assumed to be robustly associated with the endogenous variable is as follows. Variations in the world price of a particular product might cause changes in a firm’s sales and its performance, for firms whose main product line consists of that product. Particularly, world price of a product may strongly and positively link to its domestic price—the market price of a firm’s output. A decline in the world price of a product might reduce the domestic price of a firm’s output. If the demand of that product is price elastic, the price shock leads to the firm’s increasing sales revenue as windfall gains. Conceptually, therefore, price shock in international markets is an important predictor of firm size, which supports the relevance assumption in the IV approach. This testable assumption has been verified by testing the significance of the instrument in the first-stage regression.

The latter assumption, exclusion restriction assumption, is that valid instruments do not have any direct effect on the dependent variable or any effect running through omitted variables. Formally stated, international price shock should be independent of firm-level corruption burden given firm growth or firm size. Plausibly, world price of products is independent of corruption activities of this study’s sample because the included firms are primarily small and medium firms in transition economies. First, it is reasonable to eliminate the direct link between domestic corruption burden on these small and medium firms and international prices. In particular, if individual firms pay less informal payments to public officials in their country in order to overcome bureaucratic barriers of their business, this might lead to the changes in these firms’ production and management costs. The variation in these firms’ pricing behavior may play a trivial role in predicting the world prices because of their lacking international market power. In addition, this study found more robust results in analyses when excluding large firms, which reinforces this argument. Second, it is also plausible that international price shocks are not linked to any potentially omitted predictors of firm-level corruption burdens. In order to meet this assumption, this study selected three sets of exogenous determinants of corruption burden based on the prior literature. Particularly, the time-variant country-level determinants of corruption (economic development, economic openness, and democracy), the firm-level characteristics (exporting capacity, under 5 years of operation, state sales capacity, ownership types, and its located city size), and two dimensions of a corruption environment (corruption structure and the degree of certainty) were controlled. Therefore, world price of a firm’s main product line might be a valid instrument which satisfies the exclusion restriction assumption. Ultimately, this identification strategy allows this paper to examine the impact of the exogenous changes in sales revenues (firm size), the aforementioned windfall gains, on corruption burden through use of the instrumental variable approach.

Total sales, the primary measure of firm size, is instrumented by the one-year lagged world price of a firm’s main product line. World price of a particular product is approximately estimated by its world exports value and net weight. The world exports value and net weight of 5121 products, all 6-digit 1996 HS commodities and manufactured products in 2000, 2001, 2003, and 2004, were collected from the UN Comtrade database. More than 1.4 million country-year-product observations of export flows of all countries (167 countries) were acquired in order to estimate the worldwide trade value, net weight, and world price for each product. The analysis excludes 665,017 observations due to missing HS codes. The concordance between the 6-digit HS and 4-digit ISIC rev.2 is used to map the price data to 96 ISIC rev.2 industrial groups. Subsequently, the price data were merged to 152 ISIC rev.3.1 (4 digit) industrial groups by using the correspondence table linking between the classes (4-digit level) in ISIC Rev.2 and ISIC Rev.3.1. Finally, the price data were aggregated to 32 ISIC rev.3.1 (2 digit) industrial groups and merged into the pooled BEEPS 2002 and 2005 data which consisted of 45 aggregate ISIC rev.3.1 industrial groups. The sample of analyses consists of 5465 observations of firms which have completed data on all variables and have been previously assigned into four major industrial sectors: mining and quarrying, manufacturing, retail trade, and real estate. Firms in service sectors such as wholesales trade, transportation, hotels, and restaurants were dropped from the analysis due to non-availability of service quantity data in the trade database.

4.2 Specifications and variables

The bribe rate, defined as the share of revenues to a corrupt official that a firm informally pays in order to “get things done” (Clarke and Xu 2004; Wu 2009), was used to reflect the level of bribery burden on a firm. Bribe rate is proxied by the firm-reported data under the BEEPS survey question “On average, what percent of total annual sales do firms like yours typically pay in unofficial payments or gifts to public officials?” Two additional types of corruption burden are kickbacks and time burden. Kickbacks in public procurement are payments made to secure procurement contracts, known as one type of the misuse of public office for private gain, a form of government corruption (Hellman et al. 2002; Svensson 2005). The question of kickbacks is phrased as “When firms in your industry do business with the government, how much of the contract value would be typically paid in additional or unofficial payments/gifts to secure the contract?” Time burden, management time dealing with bureaucrats, is measured by the percent of senior management time spent in dealing with officials, as reported in the BEEPS survey question “What percent of senior management’s time over the last 12 months was spent in dealing with public officials about the application and interpretation of laws and regulations and to get or to maintain access to public services?”

The Bribe rateijkt of firm i in sector j of country k at time t is a function of Sizeijkt, firm-level characteristics Fijkt, one-year lagged country-level characteristics Ck, t − 1, time period fixed effects θt, country-sector fixed-effects θjk, and a normally distributed unobserved error term uijkt, as the following:

This study utilized two common indicators of firm size: dollar value of sales and number of full-time employees (Martin et al. 2007). Table 5 (appendix) summarizes definitions and descriptive statistics of the variables. The correlation matrix of the key variables is presented in Table 6 (appendix) as an exploratory tool, which illustrates the negative associations between firm size (employment and sales) and bribery burden as well the negative associations between firm size and the IV.

The selection of exogenous determinants of corruption burden was based on the previous studies. The key time-variant country-level determinants of corruption were controlled for, including one-year-lagged economic development, economic openness, and democracy in the baseline specification (La Porta et al. 1999; Treisman 2000). Economic development is measured by per capita income, measured as constant GDP per capita using international currency from the WDI. Economic openness is measured by imports of goods and services as a share of GDP, from the WDI. Democracy is measured by the Boix-Miller-Rosato dichotomous democracy measure. The authors define a country as democratic if it satisfies conditions for both contestation and participation in the political sphere. In an alternative specification, democracy is measured by the index of democratization. The index of democratization constructed by Vanhanen (2014) portrays the electoral success of smaller parties and the voting turnout in each election.

Two different dimensions of a corruption environment, corruption structure and the degree of certainty, were controlled for in one specification. Shleifer and Vishny (1993) emphasize the roles of different structures of corruption markets in their industrial organization model in which a firm tends to pay less for bribes in a more competitive network of officials. Another important aspect of corruption regimes is the degree of certainty of a corruption transaction, which is highlighted by the two-dimensional framework of corruption illustrated by Rodriguez et al. (2005). Corruption structure is proxied by the firm-reported data from the question of how often a firm can walk away from the corrupt official and go to another official for the same service. The degree of certainty of corruption is reflected by the extent to which a firm knows in advance about amounts of informal payments. These firm-reported data were aggregated to four major industrial sectors (mining and quarrying, manufacturing, retail trade, and real estate) by country. In all specifications, country-by-sector fixed-effects are also utilized instead of separate country and sector fixed-effects because corruption environment in the same sector may vary across countries.

The firm-level control variables include exporting capacity, under 5 years of operation, state sales capacity, ownership types, and its located city size. In particular, dummy variables indicating whether a firm exports, sells to the government, operates under 5 years, is owned by a private foreign company, is owned by government/state, has an individual as the largest shareholder, and has a family as the largest shareholder are also controlled for. Dummy variables of these control variables are used instead of continuous or discrete variables in order to capture exogenous and important firm-level determinants of corruption, thus avoiding potential endogeneity bias on their coefficients. For instance, foreign ownership as percentage owned by some private foreign company or organization tends to be endogenous. A more intensive foreign ownership may change corruption activities of a firm; however, corruption activities may reduce the percentage owned by the private foreign partner.

The IV/two-stage least squares regressions are implemented by the xtivreg2 package in Stata, which was developed by Schaffer (2015). Country-by-sector fixed-effects estimations were conducted instead of firm-level fixed-effects estimations because only 10% of the whole sample was surveyed repeatedly in the two survey rounds utilized. The standard errors are corrected for heteroscedasticity and clustered within-country sector groups. The first-stage and second-stage regression equations are as follows, respectively:

where eijkt is a normally distributed unobserved error term and world prices, t − 1 is the one-year lagged world price of a product line s (an ISIC rev.3.1 industrial group aggregated at 2 digit level).

where \( {\widehat{\mathrm{Size}}}_{ijkt} \) is the fitted value from Eq. 2.

In order to examine the plausible non-linear link between firm size and bribe rate, Sizeijkt2 is added to Eq. 2 as a second endogenous variable. As suggested in Wooldridge (2010, p. 237), \( {{\widehat{\mathrm{Size}}}_{ijkt}}^2 \) is used as a single IV for Sizeijkt2 in order to address endogeneity concerns. In addition, \( {\widehat{\mathrm{Size}}}_{ijkt}\times \mathrm{Size}\ \mathrm{category} \) is used to instrument Sizeijkt × Size category.

Spending more management time to deal with bureaucrats has a potential detrimental feedback effect on sales; therefore, time cost is treated as an endogenous variable in the estimations in the same manner with bribe rateijkt. For instance, when a firm’s senior managers spend more time to deal with public officials, they consequently have less time available to deal with production, innovation, and other general management. As a result of wasted management time, it might limit sales and negatively affect performance of a firm. Therefore, the similar identification strategy and baseline specification in the IV regressions of bribe rateijkt were applied to time costijkt.

5 Results

Figure 1 portrays an interesting reverse U-shaped relation between firm size and bribe rate. Small firms with employment between 10 and 50 employees tend to bear significantly higher bribery burden than micro firms. Both micro firms and small firms bear substantial higher bribery burden than medium and large firms. In contrast, medium and large firms tend to spend more management time to negotiate and interact with public officials than smaller peers.

The focus of this study is on the IV regressions, and thus, all results in tables and figures are in regard to the IV regression results unless otherwise directly noted. Table 1 presents OLS and IV results from Eqs. 1, 2, and 3, where the dependent variable is the percentage of total sales typically paid in unofficial payments by a firm. The OLS results are reported for comparison purposes. Controlling country-level and firm-level time-invariant characteristics and country-by-sector fixed-effects, the OLS regression results indicate a negative association between firm size (measured by sales and employment) and the bribe rate (columns 2 and 4, p < 0.05 and p < 0.01 respectively). Using the Davidson-Mackinnon test for consistency of OLS estimates after the baseline IV fixed-effect regressions, the OLS consistency can be rejected (< 0.001 and 0.003 as p values for regressions of sales and employment respectively). In contrast, the IV regressions show that either firm size, as either sales or employment had a statistically significant and positive impact on the bribe rate (columns 1 and 3 respectively). Models 1 and 3 include 5459 observations due to automatically dropping 6 singletons (a single observation for a country-sector group in the fixed-effects regressions). Column 1 of Table 1 shows the baseline specification which uses the one-year lagged world price as the IV. The coefficient on log(sales) implies that a 10% increase in sales brings the bribe rate up by 0.041% of sales (4.02% of average bribe rate, p < 0.01). Equivalently, a one standard deviation increase in sales is linked to 0.83 additional percent of sales paid in bribes which equals 0.33 standard deviation increase in bribe rate. Results in column 3 suggest that an increase in employment by one standard deviation increases the bribe rate by 1.01% points (0.40 standard deviation, p < 0.01).

The coefficients on the control variables in the baseline IV regressions (columns 1 and 3) are generally statistically significant with signs consistent with theories and previous analyses. Most firm-level determinants of bribe rate are statistically significant, including firms under 5 years of operations, export capacity (trade), business with government (for firm size based on employment only), ownership, largest shareholders, and located city size. Firms under 5 years of operation bear more corruption burden than others in regard to the amount of bribes. Older firms might have more know-how and experience to deal best with corruption (Schiffer and Weder 2001). In addition, export firms tend to pay a lower rate of bribery than non-export firms do. Foreign-owned firms also pay a lower rate of bribery compared to domestic firms. For firms whose customers are government agencies, the bribe rate is higher than their peers. With an advantage of state ownership, a state-owned firm bears a lower bribery burden from public officials. Firms with either individual or family as its largest shareholder might pay a higher bribe rate than might a firm with a corporate or governmental largest shareholder. In addition, firms located in a country’s capital tend to pay higher amounts in bribes than other locations. The coefficients on the country-level time-variant control variables are less significant despite their expected signs. The dichotomous democracy measure is significantly and negatively associated with the rate of bribery. The result implies that firms in a democratic country pay less bribes than their counterparts in a non-democratic country. A firm operating in a country with a lower level of economic development might face more bribery burden from public officials, although this macro-economic variable is not statistically significant.

Estimating the local average treatment effects of firm size on bribery by the IV method involves several assumptions. The Cragg-Donald Wald F-statistic (F-statistic 1) and the Kleibergen-Paap rk Wald F-statistics (F-statistic 2) are reported and used to test the relevance of the IV, the one-year lagged world price of products. Referring to the Stock-Yogo critical values for the relevance test, the F-statistic exceeds 10 in the baseline estimation, which confirms the relevance of the IV in capturing exogenous variations in firm size. The first-stage regressions of the IV/2SLS estimations in Table 1 provide additional evidence on the relevance of the IV. The results indicate that sales and employment of a firm are negatively associated with world price of that firm’s product line.

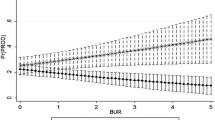

Figure 2 visualizes the IV estimates using the full sample and several sub-samples including micro firms, small firms, and medium-large firms. Micro firms (2–10 employees) which accounted for 39% of the sample tend to bear the largest bribery burden rise from bureaucrats (p < 0.05), followed by small firms (p < 0.1), and lastly medium and large firms (p > 0.1). Small firms with 11–49 employees, accounting for 30% of the whole sample, yields a positive coefficient on log(sales) which is insignificant. The estimate using the sample of medium and large firms is positive and smaller than the coefficient of the whole sample, but it is statistically insignificant.

Effects of firm size on reported bribery payments in different sub-samples. This figure presents the adjusted difference (bar) and its 95% confidence interval (in error bars) in bribery rate attributable to firm sales. The dataset represents one observation per firm per year, over the period of 2002–2005. All models are restricted to all firms which have completed data on dependent variables, independent variable, instrument variables, and control variables (5465 firms).

Table 2 reports the IV estimated effects of exogenous changes in firm size on bribe rate using several sub-samples and the non-linear specification regarding firm size. The estimated interaction terms between firm size and size classification (column 1) suggest diminishing positive effects of firm size on bribery rate, which reinforces the aforementioned results in sub-samples. Micro firms tend to face the largest bribery burden associated to their sales (or employment), followed by small firms, then medium and large firms (p < 0.01). For medium and large firms, the positive effect of firm size on bribery rate is substantially smaller than others. Alternatively, the quadratic term of firm size was treated as an additional endogenous variable included to the IV baseline regression (column 5). The quadratic term on employment is negative and significant (p < 0.05). For firm size based on sales, the coefficient is positive and insignificant.

Table 3 fully reports the estimated effects of firm size on the proportion of management time spent dealing with public officials using the full sample and several sub-samples. On average, a 10% increase in sales (or employment) leads a typical firm to spend an additional 0.17% of management time (or 0.33% for employment), which is statistically significant (p < 0.01, column 1). Equivalently, a one standard deviation increase in sales causes 3.42 additional percent of management time (0.36-standard deviation increase). The estimated interaction terms between firm size and size classification (column 2) suggest diminishing positive effects of firm size on time cost of interacting with public officials. Columns 3–5 show significantly differential positive effects of firm size on time burden regarding size classification. Similar to bribery burden, micro and small firms tend to face the larger time burden associated to their sales than medium and large firms, which reinforces the estimated interaction terms. The quadratic term of firm size is negative and statistically significant using either sales or employment as a measure of firm size (p < 0.05 for sales and p < 0.05 for employment).

Applying the same empirical strategy for bribe rate, the regression results of kickback rates portrayed in Fig. 3 (appendix) are less significant. The coefficients on log(sales) and log(sales)2 are positive and negative respectively in the IV estimations; however, they are not significant at the 95% confidence level.

Although IV estimations are considered to be dependent on the data at hand, the IV estimates are robust across different specifications (Table 7, appendix). In order to address a concern that the baseline regressions could have omitted variables, columns 2 and 5 provide regressions which additionally control for 2 important determinants of corruption: macro-level human capital and firm-level innovative activities. The United Nations Human Development Index (HDI) was utilized to capture skill endowments (human capital) at country-level. A binary indicator of spending on R&D, which equals 1 if the firm reported positive spending on R&D, was also added in this sensitivity check. This measure is constructed based on the answers to the following survey questions for each round: (i) BEEPS 2002: Spending as % of annual sales on R&D, average 1998–2001 and (ii) BEEPS 2005: Spending on research and development in 2004, in thousands of USD. The results are highly similar to the baseline regression results. HDI significantly reduces the bribe rate. The coefficient on the innovative measure is negative and insignificant. Columns 3 and 6 show the IV regression which substituted the dichotomous democracy measure by the democracy index. This alternative estimation yields results highly similar to those reported in the baseline specification. Columns 4 and 8 present the IV estimates with a different specification, which additionally controlled for the two variables of corruption structures: corruption structure and degree of certainty. This alternative estimation only marginally modified the results of the baseline specification. These newly added control variables are not statistically significant.

The IV estimates are also robust using alternative identification strategies with different IVs (Table 8, appendix). Using the annual change in world price as an alternative IV, the estimations reported in columns 2 and 5 provide evidence on positive effects of firm size on bribery rate (p < 0.1) and on time burden (p < 0.05). The coefficient on log(sales) implies that a 10% increase in sales brings the bribe rate up by 0.02% of sales despite this effect being marginally statistically significant (p < 0.1). Following Svensson’s (2003) approach, the country-sector average of sales or employment (subtracting ith observation from the average) is also used as an alternative IV and is reported in columns 3 and 6. We obtained similar results (positive and significant coefficients) when estimating the impacts of sales or employment on time cost. When estimating the impacts of firm growth on the bribe rate, the estimated coefficients are positive, however, no longer significant.

6 Discussion

In recent decades, the availability of cross-country firm surveys with firms’ experience on corruption allows scholars to explore the magnitude, determinants, and consequences of corruption at the micro-level. Given the context of the increasingly important roles of micro and small enterprises, it is important to provide rigorous evidence on the link between firm heterogeneity and government corruption. This paper primarily examines whether increases in sales (or employment) lead to greater corruption burdens on firms. Data from pooled nationally representative firm surveys, mostly in Eastern Europe and Central Asia between 2002 and 2005, were analyzed by implementing the instrumental variable method. A credible instrumental variable design has been implemented to address reverse causality between firm size and corruption, the instrumental variable strategy based on price shocks in international markets. The non-linear relationship between firm size and corruption has also been investigated.

The comparison between IV and OLS estimates as well as the Davidson-Mackinnon test confirms the plausible two-way causation between firm size and corruption and the potential bias of the OLS results, which has been usually ignored in the previous works. The direction of this bias depends upon whether the effect of corruption on sales is dominated by either detrimental or advantageous feedback effects (“sand the wheels” or “grease the wheels”, respectively). Therefore, the OLS estimates might be downwardly biased, when compared to the IV estimates. This downward bias might be a result of the potential detrimental feedback effect from corruption burdens on sales which dominates the “grease the wheels” effect of corruption on sales. In the same vein, numerous macro-level studies such as Dutta and Sobel (2016), and Fisman and Svensson (2007), La Porta et al. (1999), Mauro (1995), and Treisman (2000). Additionally, Wei (1997) and Fisman and Svensson (2007) provide firm-level evidence for the “sand the wheels” effect of corruption; that is government corruption is harmful for economic growth. Furthermore, in many transition economies, where corruption and red tape are rampant, burdensome regulatory thresholds, triggered by larger firms as they grow, might discourage productive firms from growing.

The first key finding is that an exogenous increase in sales (firm size), as windfall gains thanks to price shocks in international markets, leads firms to pay a larger proportion of their revenues as bribes to public officials.

Using a different measure for corruption-related burdens, the data showed that that an exogenous increase in firm size not only increases the amount of informal payments paid to corrupt officials but also causes firms to spend more, not less, management time to deal with public officials. Therefore, the findings provide evidence which supports hypothesis H1 while providing evidence against the argument for a uniform bribe rate regardless of size. In other words, larger firms may be more vulnerable and exposed to extortion by corrupt officials because of their higher “ability to pay.” In addition, smaller firms can more easily slip into informal arrangements in order to avoid taxes, regulations, and interactions with bureaucrats (Schiffer and Weder 2001). Thereby, informality might help smaller firms avoid corruption burden.

The IV results of this study are contrary to the OLS results presented by Clarke and Xu (2004), Rand et al. (2012), and Wu (2009). Clarke and Xu (2004) found that large firms paid lower amounts as share of revenues than small counterparts in the BEEPS 1999 data, which is similar to this study’s OLS results. Using Asia firm surveys, Wu (2009) provides a positive OLS coefficient on the dummy variable for small firms (less than 500 employees), but it is statistically insignificant. Firm size, measured by log(employment), is found to have a negative and statistically insignificant association with the magnitude of bribe payments in Rand et al. (2012).

Utilizing cross-country firm surveys in Eastern Europe and Central Asia and a different instrument, this current study confirms findings in Svensson (2003). Using the instrumental variable approach, Svensson (2003) treats firm-level profits as endogenous and uses several firm-specific variables including qualifications and experience of the owner/manager, firm age, and foreign ownership, cost of security per employee, as well as by industry-location averages of profits. Some of these excluded instrumental variables might not meet the exclusive restriction assumption that valid instruments do not have any direct effect on the dependent variable or any effect running through omitted variables. For example, the owner/manager’s previous experience from working abroad might directly link to his firm’s corruption activity, leading to biased estimates. Additionally, corruption has been analyzed as a catalyst to organized crime and may explain crime dynamics in some countries such as Colombia and Russia as well as within-country regions such as Sicily in Italy (Kugler et al. 2005). Hence, cost of security per employee, a proxy for the cost of risk management rising from crime, may not be plausibly exogenous. Last, the industry-location averages of profits might not be exogenous, as Svensson (2003) argued that the industrial and regional dummies are uncorrelated with the reported level of bribe payments. In contrast, Donadelli et al. (2014) found that the negative relationship between corruption and financial performance is stronger in specific industries such as consumer services, financials, oil and gas, and technology, which they defined as “corruption sensitive.” Departing from Svensson’s approach (2003), this current paper employs price shocks in international markets to instrument the endogenous independent variable, firm size. Variations in the world price of a particular product might cause changes in a firm’s sales and its performance, for firms whose main product line consists of that product. Plausibly, world price of products is exogenous to corruption activities of this study’s sample because the included firms are primarily small and medium firms in transition economies.

The second key finding is the diminishing positive effects of firm size on corruption burdens which supports hypothesis H2. In particular, the positive effect of firm size on corruption burden is highest at the lowest levels of firm size such as micro and small firms, and becomes diminished as firm size increases to medium and large. In the analysis sample, a typical firm is either a micro firm or a small firm. Micro firms with 2–10 employees accounted for 39% of the analysis sample while small firms with 11–49 employees comprised of 30 of the sample. The smallest positive effects of firm size on corruption burdens being among large firms might be a result of stronger refusal power, political influence, and economies of scale. These factors of resiliency may moderate additional exposure to demands from corrupt officials due to increasing revenue capacity. Particularly, a large firm might possess some political powers and other means to resist predatory bureaucrats (Schiffer and Weder 2001). Also, informal payments to bureaucrats might be fixed costs on firms; consequently, a large firm can absorb these costs more easily.

This paper has several important policy implications in the context of the increasingly important roles of small- and medium-sized enterprise development across the globe (Aquilina et al. 2006). The findings indicate that the smallest firms in Eastern Europe and Central Asia might face the most bureaucratic harassment during their growth. Accordingly, burdensome corruption and red tape, government-made obstacles, tend to weaken micro- and small-sized enterprises’ positions and opportunities in the playing field with larger firms. In addition, paying more bribes to public officials may not help a typical firm to circumvent the rigidity of bureaucracy. This paper provides evidence confirming the need to relax both formal and informal bureaucratic and regulatory constraints on micro and small enterprises, especially in rampant corruption countries.

Furthermore, this research identifies an endogeneity issue when examining the link between firm size and corruption. The study also develops a new identification strategy based on price shocks in international markets. The innovative identification strategy of this paper may help to advance future research, contributing to the growing literature on micro-level evidence of corruption with emphasis on explaining the interaction between firms and public officials.

Though innovative in its approach, this study has several limitations. It should be acknowledged that the narrow scope of the BEEPS 2002 and 2005 utilized in this study, which cover primarily transition economies in Eastern Europe and Central Asia, may limit the generalizability of the study to other regions or types of economies. The study generalizability is also limited by the absence of available data for a number of service sectors in the trade database. Last, the less robust positive effect of firm size on kickback payments might be attributable to the differences between the two forms of corruption: informal payments to get things done and rent-seeking kickbacks for government contracts. These observed differences are unclear in the current study; however, they are an interesting avenue for future research.

In conclusion, given some windfall gains, a firm with an exogenous increase in sales (or employment) not only tends to pay a higher amount of bribes paid to public officials but so spend more management time to interact with public officials. This positive effect of firm size on corruption burden is, however, diminishing as firm size increases; the burden being highest at the lowest levels of firm size such as micro and small firms then becoming lessened as firm size increases to medium and large.

References

Angrist, J. D., & Pischke, J.-S. (2008). Mostly harmless econometrics: an empiricist’s companion. Princeton, NJ: Princeton University Press.

Aquilina, M., Klump, R., & Pietrobelli, C. (2006). Factor substitution, average firm size and economic growth. Small Business Economics. Springer, 26(3), 203–214. https://doi.org/10.1007/s11187-005-4715-4.

Banfield, E. C. (1985) Corruption as a feature of governmental organization. In Here the People Rule. Boston: Springer, pp. 147–170. https://doi.org/10.1007/978-1-4613-2481-2_8.

Baruch, Y., & Holtom, B. C. (2008). Survey response rate levels and trends in organizational research. Human Relations. Sage Publications, 61(8), 1139–1160. https://doi.org/10.1177/0018726708094863.

Beck, T., Demirgüç-Kunt, A., & Maksimovic, V. (2005). Financial and legal constraints to growth: Does firm size matter? The Journal of Finance. Wiley Online Library, 60(1), 137–177. https://doi.org/10.1111/j.1540-6261.2005.00727.x.

Becker, G. S., & Stigler, G. J. (1974). Law enforcement, malfeasance, and compensation of enforcers. The Journal of Legal Studies. JSTOR, 3(1), 1–18.

Bertrand, M., et al. (2007). Obtaining a driver’s license in India: an experimental approach to studying corruption. The Quarterly Journal of Economics. JSTOR, 122(4), 1639–1676. https://doi.org/10.1162/qjec.2007.122.4.1639.

Bliss, C., & Di Tella, R. (1997). Does competition kill corruption? Journal of Political Economy. JSTOR, 105(5), 1001–1023. https://doi.org/10.1086/262102.

Bradford, C. S. (2004). Does size matter-an economic analysis of small business exemptions from regulation. J. Small & Emerging Bus. L. HeinOnline, 8, 1. Available at: https://heinonline.org/HOL/P?h=hein.journals/jsebl8&i=9. Accessed 20 Oct 2016.

Clarke, G. R. G., & Xu, L. C. (2004). Privatization, competition, and corruption: how characteristics of bribe takers and payers affect bribes to utilities. Journal of Public Economics. Elsevier, 88(9), 2067–2097. https://doi.org/10.1016/j.jpubeco.2003.07.002.

Cook, C., Heath, F., & Thompson, R. L. (2000). A meta-analysis of response rates in web-or internet-based surveys. Educational and psychological measurement Sage Publications, 60(6), 821–836. https://doi.org/10.1177/00131640021970934.

Donadelli, M., Fasan, M., & Magnanelli, B. S. (2014). The agency problem, financial performance and corruption: country, industry and firm level perspectives. European Management Review, 11(3–4), 259–272. https://doi.org/10.1111/emre.12038.

Dutta, N., & Sobel, R. (2016). Does corruption ever help entrepreneurship? Small Business Economics. Springer Science & Business Media, 47(1), 179. https://doi.org/10.1007/s11187-016-9728-7.

Fisman, R., & Svensson, J. (2007). Are corruption and taxation really harmful to growth? Firm level evidence. Journal of Development Economics. Elsevier, 83(1), 63–75. https://doi.org/10.1016/j.jdeveco.2005.09.009.

Garicano, L., Lelarge, C., & Van Reenen, J. (2016). Firm size distortions and the productivity distribution: evidence from France. The American Economic Review. American Economic Association, 106(11), 3439–3479. https://doi.org/10.1257/aer.20130232.

Hellman, J. S., Jones, G. & Kaufmann, D. (2002). Far from home: do foreign investors import higher standards of governance in transition economies? Available at SSRN 386900. https://doi.org/10.2139/ssrn.386900.

Hoekman, B. M., Mattoo, A. & English, P. (2002). Development, trade, and the WTO: a handbook. World Bank Publications. https://doi.org/10.1596/978-0-8213-4997-7.

Kaufmann, D. et al. (2000). Measuring governance, corruption, and state capture: how firms and bureaucrats shape the business environment in transition economies. World Bank Policy Research Working Paper, (2312). https://doi.org/10.1596/1813-9450-2312.

Klitgaard, R. (1988). Controlling corruption. Berkeley and Los Angeles, CA: University of California Press.

Knack, S. (2007). Measuring corruption: a critique of indicators in Eastern Europe and Central Asia. Journal of Public Policy. Cambridge Univ Press, 27(03), 255–291. https://doi.org/10.1017/S0143814X07000748.

Kugler, M., Verdier, T., & Zenou, Y. (2005). Organized crime, corruption and punishment. Journal of Public Economics. Elsevier, 89(9–10), 1639–1663. https://doi.org/10.1016/j.jpubeco.2004.05.005.

Martin, K. D., et al. (2007). Deciding to bribe: a cross-level analysis of firm and home country influences on bribery activity. Academy of Management Journal, 50(6), 1401–1422. https://doi.org/10.5465/amj.2007.28179462.

Mauro, P. (1995). Corruption and growth. The Quarterly Journal of Economics, 110(3), 681–712. https://doi.org/10.2307/2946696.

La Porta, R., et al. (1999). The quality of government. Journal of Law, Economics, and Organization. Oxford University Press, 15(1), 222–279. https://doi.org/10.1093/jleo/15.1.222.

Rand, J., et al. (2012). Firm-level corruption in Vietnam. Economic Development and Cultural Change. JSTOR, 60(3), 571–595. https://doi.org/10.1086/664022.

Rodriguez, P., Uhlenbruck, K., & Eden, L. (2005). Government corruption and the entry strategies of multinationals. Academy of Management Review, 30(2), 383–396. https://doi.org/10.1086/664022.

Schaffer, M. (2015). ‘xtivreg2: Stata module to perform extended IV/2SLS, GMM and AC/HAC, LIML and k-class regression for panel data models’, Statistical Software Components. Boston College Department of economics. Available at: https://econpapers.repec.org/RePEc:boc:bocode:s456501. Accessed 10 Oct 2016.

Schiffer, M. and Weder, B. (2001) Firm size and the business environment: worldwide survey results. World Bank Publications. https://doi.org/10.1596/978-0-8213-5003-4.

Shleifer, A., & Vishny, R. W. (1993). Corruption. The Quarterly Journal of Economics, 108(3), 599–617.

Svensson, J. (2002). Who must pay bribes and how much? Available at: www.jstor.org/stable/25053902. Accessed 15 Jan 2015.

Svensson, J. (2003). Who must pay bribes and how much? Evidence from a cross section of firms. The Quarterly Journal of Economics, 118(1), 207–230.

Svensson, J. (2005). Eight questions about corruption. The Journal of Economic Perspectives. American Economic Association, 19(3), 19–42. https://doi.org/10.1257/089533005774357860.

Tonoyan, V., et al. (2010). Corruption and entrepreneurship: how formal and informal institutions shape small firm behavior in transition and mature market economies. Entrepreneurship theory and practice. Wiley Online Library, 34(5), 803–831. https://doi.org/10.1111/j.1540-6520.2010.00394.x.

Treisman, D. (2000). The causes of corruption: a cross-national study. Journal of public Economics, 76(3), 399–457. https://doi.org/10.1016/S0047-2727(99)00092-4.

Vanhanen, T. (2014). ‘Measures of democracy 1810-2014’, Finnish Social Science Data Archive. Available at: http://urn.fi/urn:nbn:fi:fsd:T-FSD1289. Accessed 10 Sept 2016.

Wei, S.-J. (1997). Why is corruption so much more taxing than tax? Arbitrariness kills. https://doi.org/10.3386/w6255.

Wooldridge, J. M. (2010). Econometric analysis of cross section and panel data. Cambridge: MIT Press.

Wu, X. (2009). Determinants of bribery in Asian firms: evidence from the world business environment survey. Journal of Business Ethics. Springer, 87(1), 75–88. https://doi.org/10.1007/s10551-008-9871-4.

Funding

Dr. Nguyen has been received a United Nations University UNU-MERIT Ph.D Fellowship and Indiana University’s postdoctoral fellowship funded by the Searle Freedom Trust when conducting this work.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendices

Effects of firm size on kickback rate. This figure presents the adjusted difference (bar) and its 95% confidence interval (in error bars) in kickback rate attributable to firm size. The dataset represents one observation per firm per year, over the period of 2002–2005. All models are restricted to all firms which have completed data on dependent variables, independent variable, instrument variables, and control variables (5465 firms)

Rights and permissions

About this article

Cite this article

Nguyen, T.D. Does firm growth increase corruption? Evidence from an instrumental variable approach. Small Bus Econ 55, 237–256 (2020). https://doi.org/10.1007/s11187-019-00160-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-019-00160-x