Abstract

This study uses unique hand-collected data from a televised entrepreneurial pitch competition to examine gender differences in obtaining angel financing. Results indicate that while the yield rates between male and female teams do not differ, a gender disparity in the amount of angel funding does in fact exist. Female teams receive less capital and provide more equity relative to their male counterparts, even when controlling for typical determinants of investment, such as industry and prior company success. Further, we find that female teams receive investments with lower valuations than their male counterparts largely because they initially offer higher equity stakes for less capital. Thus, this suggests that limitations to angel financing of female entrepreneurial ventures may be partly self-imposed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Barriers to accessing start-up capital present a significant challenge to female-owned businesses (Alsos et al. 2006; Brush et al. 2004a, b; Bursh et al. 2006; Harrison and Mason 2007; Robb et al. 2013; Azam Roomi et al. 2009), as external financing is a crucial ingredient to firm survival and growth for early stage companies (Amit et al. 1990; Berger and Udell 1998). This barrier is problematic for entrepreneurs as well as policymakers, as women-owned firms are the fastest growing sector of new venture ownership in the USA (Amatucci and Sohl 2004; Becker-Blease and Sohl 2007; Coleman and Robb 2009; U.S. Census Bureau 2007, 2012).Footnote 1 Further, revenue and employment growth among women-owned firms outperform that of all other firms, aside from large publicly traded corporations (U.S. Census Bureau 1997, 2002, 2007, 2012). This dichotomy suggests that conditional on being funded, women-owned firms are able to grow faster and perform better than companies owned by men. Thus, removing the gender gap in external financing may not only help female businesses succeed, but also further enhance economic growth.

One significant source of external financing for early stage ventures is angel investment. Angel financing, or financing from affluent individuals who provide equity capital for business start-ups (Wong et al. 2009), is a particularly important source of external funding for entrepreneurial ventures because angel investors are more likely to invest in the risky stages of early company development than banks and venture capitalists (Maxwell et al. 2011; Preston 2004). Furthermore, the total amount of capital available from high net worth angel investorsFootnote 2 is substantially larger than that of other private equity financing such as venture capital (Center for Venture Research, University of New Hampshire 2003; National Venture Capital Association 2000, 2003; Sohl 2011) and supplies most of the economic growth and job creation in the USA (Wiltbank 2005). Thus, angel investment represents a valuable potential resource for bridging the gender gap in external financing that early stage ventures face.

Given the potential significance of angel financing for economically important female-owned firms to overcome barriers to accessing capital, the main question underlying this investigation is: are women less likely to secure angel financing because of their gender alone? Thus, this study seeks to quantify if there is gender disparity in both the likelihood of angel investment as well as the amount of the investment. This paper aims to understand whether gender, outside of other characteristics that typically determine funding such as prior success and industry, plays a role in determining angel investment.

In order to answer the main question, this paper explores various determinants of financing given data on approximately 500 US entrepreneurial teams from a televised entrepreneurial pitch competition (“Shark Tank”). Our results indicate that women are no less likely to receive funding, the amount of funding differs significantly from male entrepreneurial teams. Our results are consistent with explicit considerations of an array of control variables including prior financial performance, age, and industry of the firm. Furthermore, we pay special attention to considerations of both internal and external validity, including a discussion of selection due to the fact that our data are from a televised show, patterns between seasons, alternative financing arrangements, and alternative characterization of a female team. Thus, while our setting presents several empirical challenges, we believe this setting also provides several important benefits that help inform the existing literature.

First, the television program shows both funded deals as well as those deals that failed to receive funding. Borrowing from the trade literature, we refer to this as the “intensive” margin of financing (how much capital entrepreneurs obtain) and the “extensive” margin (the likelihood of obtaining finance altogether). As our setting allows us to measure both, we believe it provides a more comprehensive picture of the funding process than either one alone can provide. Furthermore, as most databases on angel- and venture-backed companies have information only on funded companies (Becker-Blease and Sohl 2015; Kerr et al. 2011 are notable exceptions), the extant work can only examine companies that are successful in obtaining investment, limiting external validity.

Second, the setting allows us to capture deal-level data, including entrepreneur- and company-level variables such as prior financial success. Very few prior papers in the empirical angel financing literature incorporate deal-level data. Including these additional variables as covariates allows us to better understand whether gender is related to funding alone, or whether other characteristics of female-owned firms are determining external funding.

More generally, this paper makes a contribution by empirically examining on the micro-level a market that operates in almost total obscurity (Prowse 1998). Angel investors have a preference for anonymity, often work independently of others, and in general function in a far more informal way relative to other forms of private equity finance such as venture capital (Benjamin and Margulis 2001). Thus, while our setting admittedly presents many challenges, the ability to observe failed investments using deal-level data presents an opportunity to help shed light on a fairly opaque relationship.

This paper builds on prior work examining whether gender disparities in access to capital exist (Alsos et al. 2006; Brush et al. 2006; Azam Roomi et al. 2009; Coleman and Robb 2009; Greene et al. 2001; Coleman 2000). The literature focuses on access to financing across different sources (Carter and Rosa 1998a, b; Robb et al. 2013; Constantinidis et al. 2006), with a focus on bank financing in particular (Buttner and Rosen 1989; Hisrich and O’Brien 1982; Haines et al. 1999; Fay and Williams 1993; Riding and Swift 1990). The majority of these papers find that women-owned businesses exhibit disparities in capital structure relative to male-owned firms, in the sense of operating with much less capital. Women are also less likely to receive bank loans, and when they do, receive less attractive terms. Women-owned companies typically receive bank loans for lower amounts, with higher collateral requirements (Bellucci et al. 2010; Stefani and Vacca 2013; Orhan 2001). Similarly, several papers find that a lower proportion of women receive venture capital relative to men (Brush et al. 2004a, b; Orser et al. 2006; Greene et al. 2001).

Perhaps closest in spirit to this paper, Becker-Blease and Sohl (2007) also empirically examine whether women-owned business have equal access to angel capital relative to men but do not have access to deal-level information. Thus, while no empirical approach is perfect, including our own, we believe that statistically analyzing deal-level information for both funded and unfunded projects helps build the literature analyzing gender disparity in angel financing.

Altogether, this study aims to answer several fundamental questions regarding whether a gender disparity in obtaining angel financing exists. The results from our analysis indicate that female teams are no less likely to neither obtain angel financing nor receive any less financing, except when industry is included as a moderating variable. This is consistent with several prior papers that find differences in capitalization amounts, yet not yield rates between female- and male-owned businesses in angel financing (Becker-Blease and Sohl 2007). Further, we present evidence that the disparity in capital is largely due to the fact that teams ask for less capital, ceteris paribus. This suggests that limitations to angel financing by female entrepreneurs may be self-imposed. A variety of conceptual and empirical tests support this claim.

Understanding the reasons behind differences in funding between male- and female-led companies is important for several stakeholders including entrepreneurs, investors, and policymakers. For female entrepreneurs seeking capital to sustain early stage companies, the results suggest that given a chosen industry, gender alone will not impede investment likelihood but may result in less investment for more equity. This implies that female entrepreneurs may be well-advised to take special care in determining their valuations and investment requests, especially since start-up capital is important for early firm success. For investors, this paper suggests that women-owned companies may represent better investments, as financing for all else equal women-owned companies can be for a larger equity stake, with lower capital outlay. Finally, these results help inform policy as disentangling the reasons why women receive less can help unlock a potentially significant impediment to economic growth.

This paper proceeds as follows. The next section discusses the conceptual background regarding gender disparity in entrepreneurial funding. Section 3 describes our empirical setting and provides details regarding the television show Shark Tank. Section 4 discusses the summary statistics and highlights important differences between female- and male-led teams. Section 5 examines the results of our analyses. Section 6 discusses the robustness of our results, including the threats to both external validity and internal validity that using a televised entrepreneurial pitch competition engenders, as well as other sensitivity tests. Section 7 concludes.

2 Conceptual background

In general, the amount of funding an entrepreneur receives is dependent upon their firm’s valuation (Collewaert and Manigart 2016). Thus, the valuation an angel investor prescribes to a firm determines the amount of equity the entrepreneurs can maintain in return for the angel capital based on the perceived riskiness of the investment (Vance 2005). This is important because if women are simply receiving less funding because their companies tend to be poorer performing, and thus higher risk, then the barriers to financing represent an efficient market outcome. However, if female-led ventures of equal risk profiles to male-led ventures are assigned lower net present values, and thus obtain less capital from investors, this would suggest that angel investors hold higher internal rate of return hurdles for female-led ventures. This would suggest a market imperfection with potentially irrational investment hurdles based on gender. The dichotomy suggested earlier, in which female firms receive less start-up capital and yet are faster growing, suggests this may be the case.

Few papers in the extant literature examine the relationship between entrepreneur gender and access to angel financing in particular (Amatucci and Sohl 2004; Becker-Blease and Sohl 2007; Carter et al. 2003; Gundry and Welsch 2001). Similar to the other more well-studied sources of capital, these papers find that angel funding of entrepreneurial ventures differs in terms of gender in certain respects. Brush et al. and Becker-Blease and Sohl (2007) suggest that women seek out angel financing less than men, with some divergence in results as to whether women are equally likely to obtain angel financing when they seek it out (Becker-Blease and Sohl 2007) or not (Amatucci and Sohl 2004; Carter et al. 2003). Gundry and Welsch (2001) show that women-owned high growth companies are much more likely to use angel financing than venture capital.

The difficulty in obtaining data on angel financing presents several areas of opportunity to build on prior work. For instance, several studies of gender in angel financing examine female-owned firms exclusively without access to data on firms owned by men (Gundry and Welsch 2001; Carter et al. 2003; Amatucci and Sohl 2004). Thus, it is difficult in these cases to measure the angel funding differences between men and women.

Furthermore, while other papers provide valuable in-depth discussions of the challenges women face in securing angel financing through interviews, the qualitative data puts limitations on analysis because it cannot be analyzed using statistical techniques (Amatucci and Sohl 2004). Additional studies use self-reported surveys to analyze gender differences in financing (Carter et al. 2003). While self-reported surveys may provide valuable tacit information that would not otherwise be observable to the researcher, answers may be more opinion than fact based (Podsakoff and Organ 1986). Thus while surveys are helpful in capturing otherwise tacit information, we believe not using surveys also conveys benefits.

The existing literature provides several possible reasons for differences in the funding of female entrepreneurs across sources of financing. One set of reasons for differences in funding of female and male entrepreneurs is that women enter less profitable industries, or more generally have less valuable firms (Coleman and Robb 2009; Stefani and Vacca 2013). In these papers, the assumption is that investors have equal access to information for both female and male entrepreneurs, and have no taste-based bias or discrimination (Bellucci et al. 2010; Piras et al. 2013). In these particular scenarios, therefore, less funding for women-owned firms represents an efficient outcome in the angel investment market.

Differences in funding may also arise due to inefficiencies in the market for angel investment. For one, there may be a disparity in angel financing of female firms because of differential information availability. Venture capital funding, for instance, is largely supported by social networks (Baron and Markman 2000; Batjargal and Liu 2004; Boisot and Child 1996; Mesquita and Lazzarini 2010; Shane and Cable 2002; Stam and Elfring 2008; Tsai and Ghoshal 1998). Given that social networks in venture capital are male-dominated (Brush et al. 2004a, b), investors may simply have more information regarding male-owned firms than female-owned firms through these social networks. Alternatively, investors may exercise underlying taste-based discrimination that leads them to underfund female firms (Bellucci et al. 2010). In either case, this causes the under-provision of angel investment from an efficiency standpoint.

The demand for capital also plays a role. Women may seek out formal external financing less frequently and instead rely even more on informal sources of external financing or alternatively, fund activity internally (Bennett and Dann 2000; Coleman and Robb 2009; Stefani and Vacca 2013; Brush et al. 2004a, b; Greene et al. 2001). Indeed, the literature finds some evidence that women-owned firms tend to fund their early stage companies more with internal funds than men (Constantinidis et al. 2006). Thus, funding differences between male- and female-owned firms may simply reflect differences in demand, not supply, which has very different policy implications.

We suggest another reason. Women may receive less because they ask for less, ceteris paribus. Several reasons for this difference may exist. For instance, women may be strategic in asking for less. From a sociological perspective, women may be aware of the potential for gender role injunctions in negotiations and adjust their valuations to respond to potential backlash (Amanatullah and Morris 2010; Amanatullah and Tinsley 2013; Moss-Racusin and Rudman 2010). Female gender roles are centered on the expectation that women behave communally, and not self-interestedly (Broverman et al. 1972; Eagly and Kite 1987). Thus, observers generally disapprove of behaviors that deviate from these norms, leading to backlash towards women in the form of negative evaluation and treatment (Heilman and Okimoto 2007; Rudman 1998; Rudman and Glick 1999). If in negotiations for start-up funding, investors expect women to act within these gender roles, and high valuations are considered outside of the norm, women fearing this backlash may therefore ask for lower valuations.

Or, women may actually undervalue their companies relative to men, and not be responding strategically to perceived threats of backlash. While untangling the reasons why women ask for less is beyond the scope of this work, the possibility of this additional determinant of gender disparity in capitalization suggests that gender disparity in angel financing may be at least partly self-imposed.

3 Setting and data

This paper explores the relationship between gender and angel investment using hand-collected data from the television pitch competition Shark Tank. Beginning in 2009, this program features a panel of five angel investors who consider investing in companies following presentations from entrepreneurs. Entrepreneurs or teams make presentations one company at a time during the show. Filming of the show actually happens in large blocks; the investors are presented with roughly nine hours’ worth of company presentations chosen by producers (Business Insider Feloni 2015). Then, producers assemble four or five of these presentations together to form one episode.Footnote 3

Each presentation (or “pitch”) has essentially three sequential parts. The first part involves the entrepreneur(s) presenting a brief, uninterrupted description of their company, the amount of investment they are seeking to obtain, and the amount of equity they are offering in exchange. A question and answer period follows, during which the investors ask questions related to the company, product, entrepreneur(s), etc. This may include, for instance, information regarding the entrepreneur’s education, the age of the company, etc. Finally, a negotiation stage ensues, during which the investors may make offers to invest in the company for a certain equity stake, and the entrepreneurs have an opportunity to negotiate, with a deal between the entrepreneur(s) and one or more angel investors potentially resulting.Footnote 4 If the entrepreneurs receive more than one offer from the panel of investors, the entrepreneurs then decide which offer they would like to accept, if any. The entrepreneurs and investors may not be able to come to an agreement if the presented company valuations are significantly lower than the entrepreneurs’ minimum valuation threshold. If a deal results, the investors then proceed with more due diligence after the televised pitch to ensure the entrepreneurs honestly represented their companies (Business Insider Feloni 2015). The investor then begins to work with the entrepreneur/firm after the show.

While the prior literature contains some variation (Brush et al. 2012; Carpentier and Suret 2015; Maxwell et al. 2011), most accounts of the traditional angel investment process also include three general steps. The pre-investment period involves activities related to the identification, screening, and evaluation of the firm (Paul et al. 2007; Prowse 1998). During this period, investors learn details about the entrepreneur, which typically includes a presentation by the entrepreneurs of the investment prospect including valuation of the company, followed by an informal question and answer period (Kerr et al. 2011). Due to the early stage of the companies, there are typically few comparable companies for angel investors to analyze, and angel investors thus look at few business plans before making their final decision (Benjamin and Margulis 2001). As a result, angel investors rarely use very formal models that project the company’s value, and rely instead on their own experience and intuition (Prowse 1998; Mason and Harrison 1996, 2000, 2003).

If the process proceeds, the investment event occurs including contract negotiation. Finally, in the post-investment period, the relationship between the entrepreneurs/firms and angels further develops, as angel investors help firms with their expertise on business issues, connections to distributors, customers, and other important stakeholders. Additional rounds of financing may also occur.

The process on the television show shows several similarities as well as significant differences to the actual angel financing process. On the one hand, the sequential nature of the steps and the steps themselves generally follow a similar pattern of identification and learning, investment, and post-investment. On the other, one main difference is how investors traditionally come across investment opportunities. Well-known investors come across new investment opportunities outside of the show in several ways: the informal social networks of traditional angel financing, angel investment portals such as AngelList,Footnote 5 as well as from “cold-call” emails sent directly from entrepreneurs through their publicly available emails.Footnote 6 This is different from the process during the television show, as the set of pitches the investors are exposed to is chosen by the producers of the show.

Another difference between our setting and the traditional angel financing process is that angel investors typically do not directly influence or compete with one another on a deal. On the show, however, there are situations in which the investors compete against one another to invest in a desirable company. Finally, another difference is that the more intensive due diligence process on the television show is done after the deal is agreed upon. This suggests that the angel investor may agree to a deal on the television show with less information relative to reality.

The similarities and differences in the characteristics of the angel investors on the show and the typical angel investor are also of note. Angel investors are typically well-educated, middle-aged (45–65 years old) individuals who are of considerable net worth and likely to have been entrepreneurs themselves (Aram 1989; Morrissette 2007; Freear et al. 1994).

The investors in this data share a great deal of similarities to typical investors based on these characteristics. All of the investors on the show are of considerable net worth, with their net worth ranging from an estimated $50 million to $3.4 billion.Footnote 7 Of the 11 investors and guest investors on the show, each had been, or is, an entrepreneur themselves. The majority were middle-aged while on the show (8 out of 11), and only three are not university graduates. Thus, based on these standard characteristics of angel investors, most of the investors on the show resemble typical investors. A main difference from our investors to typical investors is that participation on the television show subsequently made these investors also entertainers, potentially changing their investment patterns. We discuss how this change impacts our analysis in the robustness section, Section 6.

While we discuss the implications of these differences to generalizability more in Section 6, it is also important to keep in mind the similarities that the investors must use their own funds to invest and these are actual angel investors who invest outside of the show as well. Because of this, they also have no obligation to invest. Thus, on the most basic level, the show represents a private equity funding process for entrepreneurs with investors using similar investment metrics to the traditional angel financing market.

To capture the information from these pitches, a team of research assistants hand-collected and double-keyed each available presentation, from each episode, from seasons 1 to 6 of the television show. A third party then reconciled any discrepancies found between the two sets of input data in order to improve data accuracy and minimize the potential for human error.

Several variables were collected to capture angel financing. First, we consider whether entrepreneurial teams received an offer from an investor(s), or the extensive margin. This variable, “offer,” is an indicator equal to one for those pitches that received at least one offer and zero if the team received no offers. The intensive margin, or the amount of financing contingent upon receiving an offer, is also captured, as well as the equity stake traded for this investment. Final company valuation is the quotient of the accepted dollar amount and the accepted equity amount. Given the final company valuation, the difference between accepted final company valuation with the investors and the initial company valuation the entrepreneurs presented (“bid-ask spread”) is also calculated. This is an important metric to consider as it allows the final valuations to be viewed in reference to initial valuations. With this difference, we are able to analyze the number of female teams that received final valuations either equal, less, or greater to their initial valuations, as compared to male teams, and the magnitude of this differential.

The independent variable of interest is the gender composition of entrepreneurial teams. In addition to capturing team size, several characterizations of what is considered a “female” team are used. First, we consider the starkest measure, in which a team is considered “female” if it is entirely composed of women. This may include teams of individuals that are women or a single female entrepreneur.Footnote 8 Thus, our variable “all-female” is an indicator equal to one for those teams that are all female and zero for those teams with 100% male composition (“all-male”). Also, we examine the gender-funding relationship using a “female-mixed” team variable, which is an indicator equal to one for those teams that have at least one female, and equal to zero if the team is all male.

Additionally, we carefully consider and record other characteristics that capture entrepreneur/team and firm characteristics that may be correlated with gender and help determine funding. If not included as control variables, the estimates may suffer from omitted variables bias. For instance, the financial background of the firm may be correlated with both gender composition and financing outcomes. Thus, the analysis includes prior sales to date, production costs and selling prices, as well as the amount personal capital invested into the business as control variables. Similarly, if female-led companies are likely to be younger firms, which may be correlated with funding, then firms age is also an important control variable. While we cannot ensure that all possible omitted variables are accounted for, by including these variables as control variables, we are able to somewhat mitigate this issue.

In addition to the control variables, we also pay special attention to the role of firm industry. As prior literature suggests that women are more likely to enter highly competitive, and therefore less profitable industries such as service and retail (Loscocco et al. 1991; Du Rietz and Henrekson 2000; Fairlie and Robb 2009), it may be the case that industry, and not gender, is driving financing outcomes. Thus, we include industry as a control variable.

Further, as the relationship between gender and financing outcome may differ depending on the industry of the firm, the moderating effect of industry is also considered. This allows the relationship between gender and financing to vary based on industry to take into account that the different industries women choose to enter may be have different funding outcomes. This study quantifies industry using the Global Industry Classification Standard (GICS) classification (De Bhojraj et al. 2003). To be even more descriptive, we create 28 unique industry codes, by taking into account that companies may span across industries. We believe this approach represents a reasonable quantification of industry, particularly as many papers in the existing literature operationalize industry with broader measures (Bhattacharya and Bloch 2004; Davis and Henrekson 1999; Degryse et al. 2012; Sato 1989).

4 Summary statistics

In total, the sample consists of 495 entrepreneurial pitches. Table 1 provides descriptive statistics regarding the gender composition of entrepreneurial teams and other variables. Of the total number of pitches, approximately 60% are from male teams. Interestingly, very few of the pitches are from teams with mixed gender composition. While 26% of the pitches are from all-female teams, only 14% are from mixed teams. Table 1 also shows that the differences in a large set of company characteristics do not differ between all-female and all-male teams. t tests in the difference in means between all-female and all-male companies do not differ significantly when comparing company age, entrepreneurial team size, personal capital invested, production cost, selling price per unit, or total prior company sales. Thus, on average, the descriptive statistics indicate that teams do not differ in fundamental company characteristics that typically determine investment.

The gender composition of our sample shows several helpful similarities to the outside angel financing in the USA. First, on the firm level in our sample, 40% of teams in the sample have at least one female entrepreneur; 26% of teams contain only females, and 14% are mixed gender teams. Out of the mixed teams, the majority is two-person mixed gender teams. As a comparison, in the USA in 2012, 36% of all businesses were women-owned (U.S. Census Bureau 2012). Thus, the representative proportion of women-owned firms in the sample is similar to the proportion in the USA, and both are well below majority. Second, on the entrepreneur level, the gender composition of our sample is also similar to that in the USA. In our sample, 35% of all of entrepreneurs are female, which is very similar to the 37% of new female entrepreneurs in the USA in 2014 (Fairlie et al. 2015).

As mentioned earlier, the analysis explicitly takes into account that the relationship between gender and funding may vary based on industry using the GICS code. The GICS consists of 10 different industry sectors, ranging from consumer discretionary to information technology to utilities. Table 1 shows the distribution of companies across industries. Most firms are in the consumer discretionary and consumer staples industry, with a combined 78% of the companies coming from one of these two industries. The former includes automobiles and components, consumer durables and apparel, consumer services, media, and retailing, while the latter includes food and staples retailing, food, beverage and tobacco, and household and personal products (MSCI 2016). However, companies in this context may span across multiple industries. For instance, a company producing teddy bears with MP3 players that record and transmit messages globally is considered both consumer discretionary for the teddy bear element, as well as telecommunications, given the more technological features. Thus, we also assign companies in multiple industries a unique industry code, modifying the initial 10 GICS industry codes to include 28 possible variations.

The data reveals several similarities as well as differences in the industry composition by gender. As shown in Table 1, most firms in the sample (78%) are consumer discretionary and consumer staples firms. Further, the majority of both all-female and all-male teams fall into consumer discretionary and consumer staples. However, all-female teams come from a smaller range of industries than all-male teams. Male teams span across almost all 28 classifications, while female teams cover approximately half of the sectors. Moreover, the industry distribution for mixed teams more closely mirrors that of all-female teams. Not surprisingly, a Kolmogorov-Smirnov test suggests that the distribution of industries between all-female and all-male pitches differs only slightly.

Where all-female and all-male teams begin to differ significantly is in the asking valuations. The descriptive statistics suggest that all-female teams tend to ask for less capital and release higher equity stakes in their firms. As shown in Table 1, the average company valuation across all teams is approximately $2.2 million; yet, for all-male teams, the average asking valuation is closer to $3 million, while all-female team valuations are closer to $1 million, and this difference is statistically significant. On average, all-female teams ask for half the dollar amount than of that all male teams and are also initially willing to exchange, 2% more equity stake in their company. Interestingly, despite the significantly lower valuations of all-female companies, the descriptive statistics in Table 1 suggest that all-male companies are poorer performers with lower total sales than all-female teams, and more than twice the amount of personal capital invested, although these differences are not statistically significant.

Table 1 also shows several measures of the extensive margin, or yield rates. The data indicate that 63% of all entrepreneurial pitches result in at least one offer by the investors. Further, this yield rate does not statistically differ between all-female and all-male teams. Sixty-four percent of the pitches by all-female teams receive at least one offer by the investors, compared to 63% of the all-male teams, and this difference is also not statistically significant. Furthermore, about half of the pitches receive multiple offers. Specifically, 30% of total entrepreneurial pitches result in multiple offers; 26% of all-female teams receive multiple offers and 30% of all-male teams, yet these percentages are not statistically different from one another. Of the 310 pitches that received offers, 18% could not come to an agreement with the investor(s). Of the total number of teams, all-female teams had a 9% rejection rate, while all-male teams had a 14% reject rate, yet this was not statistically different. Altogether, no statistical difference between the yield rates for all-female teams versus all-male teams was found.

Table 1 provides descriptive statistics on the intensive margin as well. Investments are on average $272,000 for a 32% equity stake. This is similar to the amount discussed as the baseline investment in the traditional angel financing process (Benjamin and Margulis 2001). The average accepted valuation for all teams here is approximately $1.3 million,Footnote 9 with the majority of companies accepting lower than their asking valuations (as the negative bid-ask spread in Table 1 suggests). Regardless of gender composition, teams accept offers at around 63% of their initial asking valuation.

In order to understand the contextual background for these magnitudes, the final company valuations and bid-ask spreads are also measured as percentages of the initial company valuations (“normalized”).Footnote 10 Thus, we divide the final company valuations and bid-ask spreads by the initial company valuations to see how much smaller (or larger) the final company valuations are in relation to the initial request. Out of all the measures composing the final valuation, only the average equity amount accepted statistically differs between all-female and all-male teams. Namely, all-female teams, on average, accept offers giving a larger equity stake in the company to the investors, relative to their all-male counterparts.

Table 2 shows the correlation between the variables used in the analysis. Here, we observe preliminary indications of the negative correlation between gender of teams and investment, and the positive correlation to equity traded. Similarly, female teams are negatively correlated with both final and initial company valuation, and initial dollar amount presented.

5 Results

We use ordinary least squares regression to measure the relationship between gender and angel financing. The main dependent variables include whether the team received an offer, the final company valuation, and the bid-ask spread. Several control variables that may influence investment and potentially be correlated with gender, including team size, age of the company, and total firm sales to date, are also included. As the final angel investment can be affected by the entrepreneur’s initial company valuation, the asking dollar amount and asking equity percentage are also included as determinants of final valuation.

Table 3 indicates the results of the analysis examining the differences in whether the team received an offer, the final company valuation, and the bid-ask spread between all-female and all-male teams. Model 1 examines the relationship between the gender composition of the team and the likelihood of receiving an offer. Similar to Buttner and Rosen (1989) and Becker-Blease and Sohl (2007), we fail to find significant differences in the likelihood of receiving funding for all-female versus all-male teams.

The remaining models examine final company valuation and bid-ask spread, respectively. If it were the case that asking valuation completely determined final valuation, other variables such as gender would not be significant in their relationship to the final valuations. Model 2 shows however, that all-female teams have a $1.2 million higher final company valuation than all-male teams, while including asking valuation as a control variable. Thus, at equivalent levels of initial valuation, sales, age, etc., female teams have higher final valuations, without considering additional covariates. Similarly, model 3 shows that a positive relationship exists between the gender composition of the team and the bid-ask spread. The average bid-ask spread for all-female teams is $982,000 larger than for all-male teams due to the increased final company valuation. Results also show that as expected, asking equity is correlated with final valuation.

Table 4 indicates the results of the main analysis of Table 3, with an additional interaction effect between gender and the industry variable to allow the relationship between gender and financing to vary based on industry. Model 1 shows that even when including the interaction effect, there is no evidence that all-female teams are more or less likely to receive offers than all-male teams. However, it is evident from model 2 that the differential impact of industry matters in this setting. Both the direct relationship of an all-female team and the interaction effect are significant, suggesting that not only is team gender related to final company valuation, but that this relationship depends on industry. When the coefficients of the direct effect and the interaction effect are added together, the combined result is that gender influences final company valuation by $685,000. In other words, all-female teams receive lower final company valuations than all male teams by this magnitude, holding all else constant.

Model 3 echoes the result of model 2, showing that when the direct effect and interaction effect for bid-ask spreads are combined, the net result is that all-female teams have bid-ask spreads that are $581,000 less than all-male teams. The bid-ask spreads for all-female teams are smaller than for all-male teams as female teams ask for less and are more likely to be provided with final valuations closer to their initial ask.

In order to further understand the determinants of the differences in funding, Table 5 shows the relationship between the three initial financial variables (asking dollar amount, asking equity amount, and initial company valuation) and the gender composition of the team. Next, the differences in the initial asking dollar amount, asking equity percentage, and initial company valuation between all-female and all-male teams are analyzed, as initial valuation is likely a strong predictor of final valuation. If no gender differences exist in initial valuation, it would be the case that gender is not significant in predicting initial valuation when controlling for sales, company age, industry, etc. However, model 1 indicates that even when considering similar industries, sales, company age, etc., the gender of the team is correlated with initial valuation. An all-female team, on average, has an asking dollar amount that is $130,000 less than all-male teams. Model 2 shows that all-female teams initially offer 2.5% more equity in their company, therefore lowering average company valuations to $1.4 million below that of all-male teams, as shown in model 3.

Further, we separately examine the two industries in which teams are heavily concentrated, in order to determine if firms in the two industries vary significantly in their initial company valuations. Table 6 examines the same initial financial variables as in Table 5, looking at only those firms in consumer discretionary. Similarly, Table 7 displays the results for only those firms in consumer staples.

Model 1 from Tables 6 and 7 indicates that all-female teams in both industries ask for lower dollar amounts than all-male teams, but this difference is larger in consumer staples. Further, all-female teams in consumer staples offer more equity in their companies than teams in consumer discretionary, as shown in model 2 of Tables 6 and 7. Thus, model 3 in Table 7 indicates that all-female teams in consumer staples have initial company valuations that are $2 million below that of all-male teams, while in consumer discretionary, all-female teams value themselves at $1.2 million below that of all-males, on average, as shown in model 3 of Table 6. Overall, female teams remain substantially undervalued in regards to their initial asks in the main industries.

6 Robustness

6.1 Lower valuation as an optimal strategy

Thus far, while the results indicate that female teams ask for lower capitalization at higher equity amounts, we have remained agnostic as to the reason. While examining all of the potential reasons is beyond the scope of this paper, one potential reason is that women asking for less is the optimal equilibrium response given they believe asking for more will lower their likelihood of obtaining investment altogether. If lower valuations by women are optimal, it should be the outcome that, all else equal, female teams with higher valuations are less likely to receive funding (Amanatullah and Morris 2010; Amanatullah and Tinsley 2013; Moss-Racusin and Rudman 2010).

Two analyses provide evidence that female teams with higher valuations are not less likely to receive investment. First, the main results already suggest that this is not the case. If women who ask for higher valuation are less likely to obtain investment, then controlling for initial company valuation, the results should show differences in the likelihood of receiving an offer. Since on average, female valuations are much lower, this suggests women could ask for more without compromising the likelihood of receiving an offer.

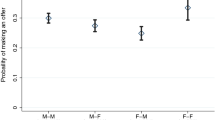

To further eliminate this possibility, we analyze the probabilities of receiving an offer within quartiles of initial company valuation, by splitting the sample into quartiles based on initial company valuation and examining whether differences exist in the likelihood of receiving an offer between male and female teams within each quartile. If it is the case that women strategically value their companies with lower capitalization to prevent deal failure, funding probabilities for female versus male teams should be significantly lower in the higher quartiles.

Table 8 shows that in fact, this is not the case. Models 1–4 show the regression results for the subsequent quartiles of initial company valuations. All models indicate that the likelihood of receiving an offer from investors is not statistically different between all-female and all-male teams regardless of the magnitude of the initial company valuation. Thus, results provide preliminary evidence that lower initial company valuations are not an optimal strategy to prevent pitch failure.

6.2 Selection bias and generalizability

As mentioned earlier, several elements of the setting create selection issues. For clarity, we separately discuss the threats to external and internal validity that these issues present. The former consists of the set of issues that pose threats to the generalizability of the results to the angel investment environment outside of the show. The latter are the issues that compromise the relationship measure here between gender and funding. While we do not have a solution for each issue, we discuss the threats each pose as comprehensively as possible.

6.2.1 External validity

Some of the limits to generalizability arise from how the entrepreneurial pitch competition is different from the traditional angel financing process. As discussed in Section 3, there are several important differences in the process itself. First, angel investors typically come across investment opportunities through social connections, cold-calls, and now increasingly through online portals, and then choose which projects to move forward with. This is in contrast to the television show, in which producers chose the pitches to present to the investors.

Compared to the actual set of pitches angel investors are meeting with, however, it is doubtful that the likelihood of investment for the set of pitches producers choose would be higher. If investors are more likely to invest in the set of pitches producers choose, this would suggest that somehow producers have a better understanding of the projects investors would like to fund then the investors themselves. So, given this consideration, it is likely that the yield rates for a particular investor outside of the show are higher.

Issues regarding generalizability also arise as producers ostensibly choose pitches based on entertainment value. In terms of external validity, this is problematic if the set of pitches chosen by producers are markedly different from the outside environment of companies typically seeking angel investment.

Several elements are important to consider when considering this. As mentioned earlier, perhaps the most important element to keep in mind is that the investors use their own funds. Thus, even if the producers are choosing the set of pitches the investors observe, the willingness to invest and investment amounts reflect the actual willingness to pay of the investors and this is likely to echo their willingness to pay outside of the show, albeit with some noise. Furthermore, in Section 4, several comparisons of the sample to the outside population of angel investment show similarities that reasonably suggest the results provide preliminary evidence for generalizability to the outside environment in the USA.

Entertainment value may also be determined by the industry of these firms. Producers may choose firms from certain industries because they are some combination of the following: (1) more inherently entertaining, or (2) easier to explain to audiences. This is problematic if these companies are in industries that are different than the companies seeking angel financing outside of the show.

The sample here shows that 78% of the pitches are from firms in two industries—consumer discretionary and consumer staples. As mentioned earlier, this includes a fairly wide range of industries. While a more narrow classification system may be beneficial, our industry composition is relatively similar to several accounts of angel financing in the USA (Shane 2012). Business angels are generally much less industry-specialized than venture capitalists (Van Osnabrugge 2000). According to the Kauffman Index of Growth Entrepreneurship (2016), new high growth ventures are in a wide range of industries that fall into our categorization of consumer discretionary or consumer staples industries, such as retail, food and beverage, and advertising and marketing (Morelix et al. 2016). Furthermore, based on a 2015 study of the most desirable industries for starting a high growth business, five out of the top eight industries, or 63%, fall into either the consumer discretionary or consumer staples sectors (Winfrey 2015). Therefore, the industry classifications of the firms on the show are not inconsistent with the high growth firms seeking angel financing outside of the show.

Several other elements may contribute to inflated valuations and yield rates relative to the outside environment. As mentioned earlier, the competitive nature of the show may artificially inflate valuations for those companies with interest from multiple investors. It is important to recognize, however, that while competition on the show is more direct, competition among angel investors outside of the show also exists (Arrington 2010; MacLeod 2010). Thus, the claim that this competition is completely unlike reality is not entirely accurate.

Another artifact that may inflate valuations and yield rates is that a large part of the due diligence process is done after the deal is reached. Thus, investors may invest in deals they may not have otherwise relative to the outside angel investment process. While more due diligence is conducted after the investment event for the television show, investors are able to cancel deals given that they believe the pitches on the show misrepresented the actual company. While we do not have the actual statistics, anecdotal evidence suggests that approximately 15% of deals fall through after the due diligence is conducted (Business Insider Feloni 2015). This suggests that while this problem exists, at least it is not a majority of the deals. While we do not have a way of addressing those deals that fail or change after the show, we do know at the very least that the investors did agree to the deal on the show under the specific terms we capture. So while we do acknowledge that this it is far from ideal that deals may change after the show, at the very least what we measure are deals that the investors agree to in the first place. Furthermore, it is not clear that this due diligence process is any less rigorous than it would be outside the show as investors are using their own funds.

In addition, the due diligence process in angel financing in general is much more informal and less tenuous, with investors relying much more on intuition relative to other investment processes such as venture capital that involve investors acting on behalf of a fund (Prowse 1998). As a result, anecdotal evidence suggests that angel funding reaches the investment event within one or two meetings (Business Insider Horowitz 2010). Thus, while more of the due diligence is conducted after the investment process, the above discussion suggests not only that it may be the same process, but that the angel investment process itself is expedient relative to other sources of capital.

The generalizability may be hindered by the fact that the investors may alter their typical behavior because the show is televised. For instance, investors may invest in female-owned firms only because they want to ensure they are not perceived as prejudiced by the audience. This is essentially a version of the Hawthorne effect (Roethlisberger et al. 1939), in which participants in a study alter their behavior because they are being observed. It is also important to remember again, however, that investors are investing their own funds. Thus, while their behavior may be different for television, it is unlikely that they would invest in companies that they would not invest in normally, limiting the upward bias that the Hawthorne effect may cause.

Finally, it is important to note that there are 11 investors over the course of six seasons in total. This is a small sample of the total population of angel investors. This is a limitation of our data that we cannot change. In particular, these investors are likely skewed to the more wealthy and powerful of angel investors, as only relatively well-known investors are likely to be cast. However, while not all angel investors are as wealthy and powerful, these are very attractive qualities of the investors to entrepreneurs. Thus, while our data is limited in this sense, at least the results apply somewhat to a subset of angel investors that are important to entrepreneurs.

6.2.2 Internal validity

Several of the selection issues above may not only affect external validity, but also the internal validity. The main condition directing our analysis is that bias in measurement only occurs if something about the selection process is correlated with gender as well as funding, and our results echo the differences. Vestiges of the selection process that are not correlated with gender and funding do not affect the results. Further, it would need to be the case that the results of the selection issues that are infiltrating internal validity cause the same differences in industry choice and funding that the results show (disparity in funding based on gender). Thus, we discuss each potential issue in light of this requirement.

For instance, it may be the case that the entertainment value of pitches is correlated with gender and funding. As mentioned earlier, producers choose pitches likely due to their entertainment value. For this to truly be an issue here, it would need to be the case that the disparity in funding is not because of gender per se, but because female pitches are more/less entertaining, and entertaining pitches are more/less likely to receive funding.

However, the composition of gender in the data provides evidence that this is not the case. If gender determined entertainment value, the show would be entirely one gender, given that producers ostensibly only care about entertainment value. Further, if entertainment value of a pitch and success in angel financing are correlated, close to all (or none) of the pitches should be funded, if producers choose those companies for the show with the highest entertainment value. However, the rate of receiving at least one offer from the investors is 63%, providing evidence that entertainment value is not perfectly determinative of success. Thus, we have preliminary evidence that entertainment value alone is not driving the gender disparity in funding observed.

Furthermore, we do not know if the producers control the content. We do know, however, that the entrepreneurs are not paid actors and therefore are not reading from a script. Most essential to the analysis is that these are real companies, and the investments made are also real. Thus, statements about the company shown to be untrue, regardless of the potential entertainment value provided, would render the deals void subject to the investors discretion. So, while producers may influence the content of the deals, it can only be on matters tangential to the investment. Further, if there were particular words that increased entertainment value, all pitches would contain those words given that producers want to increase entertainment value, but this does not hold true.

Industry selection similarly compromises our internal validity if and only if industry is correlated with gender as well as funding. If this were the case, then the results may be measuring the effect of industry alone, and not gender. However, results show that conditional on being a female team, the likelihood of being in one of these two industries is almost the same for both genders. Thus, if the selection into industry based on gender was compromising the results, the data could not generate the disparity in funding that is observed. Furthermore, being in this industry alone does not guarantee success/failure in funding, as approximately 47% of the pitches in these two industries do not get funded. This suggests that industry is not the underlying variable driving gender disparity in funding outcomes.

6.3 Characterization of a “female” team

In the context of the main regression analyses, a female team is a team in which all of the members are female. For robustness, the definition of a female team is expanded to include all teams that have at least one woman. Table 9 shows that the results from the main regression with the new characterization of a female team do not substantially differ from the prior results. Model 1 shows that, on average, the team asks for $110,000 less than all-male teams. The initial equity percentage the team is willing to give up is 1.2% greater than all-male teams, and initial company valuations are $1.2 million lower than for all-male teams, as shown in models 2 and 3. This suggests that as long as one female is present, the team still initially asks for significantly less than all-male teams.

6.4 Alternative financing arrangements

In the main analysis, only teams whose final company valuations consisted of a standard trade of equity for capital are examined. Alternative investments, such as royalty arrangements, are not included due to the difficulty in assigning company valuations based on these arrangements. Further, we did not group the deals with alternative valuations with those with standard valuation, therefore, as this would have created inconsistencies both in terms of measurement as well as generalizability.

The largest category of the alternative investment is royalty arrangements; approximately 10% of teams received investments consisting of royalties. Royalties are typically valued using the present value of the projected royalty stream, and the value of the company is then calculated using either a discounted cash flow or multiple to arrive at the current value (Liberman et al. 2011). Given the provided information in our environment, however, proper discount rates and multiples for each company cannot be determined, and thus we cannot accurately forecast future sales in order to calculate the fair company valuation. Therefore, this cohort of pitches remains excluded, yet given that this population is small in comparison to the sample size, this should not significantly affect our results.

6.5 Regression to the mean and learning over seasons

The sequential nature of the seasons also brings up two additional points in terms of robustness. First, it may be the case that the results reflect a regression to a mean valuation from one season to another. Regression to the mean here would imply that each observation (pitch) has two components; the mean of the sample plus a random component. For example, an individual pitch valuation may be high, but this may be partly due to some average characteristic of the pitch plus a random component, such as a very telegenic entrepreneur. Regression to the mean suggests that even though one pitch may obtain a high valuation, the next valuation will be closer to the mean (lower). This would suggest that, on average, the mean of pitches for each season would be the same. However, we find that the mean valuation is not the same in each season, but in fact rises in most seasons.Footnote 11

An additional concern is that entrepreneurs learn to increase their valuations over time. It is important to remember that what would influence the measurement of the relationship between gender and funding is if learning over seasons is correlated with gender and also affected funding. If the entrepreneurs learn from one season to next and this is determining both the funding and is correlated with gender, then the main effect should change when including a variable reflecting the season of a pitch. Results in Table 10 with variables taking into account the season of the pitch provide evidence that this is not the case. Thus, even if learning is happening from one season to the next in terms of changing valuations, this does not eliminate the significance of the relationship between gender and financing.

6.6 Additional covariates

Several other additional covariates were added to the regression analysis that may be correlated with funding, such as the production cost and unit selling price, yet none were correlated with funding nor changed the results regarding gender. Perhaps the most interesting of these is the education levels of the entrepreneurs. Unfortunately, we do not know the education level of every entrepreneur, as not every entrepreneur reveals his or her education. We do, however, have data on whether the entrepreneur revealed their education altogether. As Table 11 shows, including this covariate, like the other additional covariates we examined, does not change our results nor is this covariate significant.

7 Discussion and conclusions

This paper investigates the relationship between success rates in angel financing and the gender composition of teams using unique hand-collected data from nearly 500 US entrepreneurial pitches. The results show that there is no gender disparity in the likelihood of receiving angel funding, regardless of the magnitude of initial company valuations. Rather, this analysis finds that the disparities lie in the magnitude of final capital received, as women-owned firms receive less funding from angel investors than their male counterparts and that this depends on industry. Women-owned firms, depending on industry, receive company valuations that are, on average, $685,000 less than those of all-male firms, controlling for numerous firm and entrepreneurial characteristics. These differences remain statistically significant even if only one female is present on the team, suggesting that even a non-zero amount of women on entrepreneurial teams is associated with lower company valuations. These analysis also shows that gender disparities in angel financing in this setting is a result of all-female teams asking for less, rather than being based on the actual attributes of the company itself, suggesting that limitations to funding may be partly self-imposed. Women-owned companies may obtain less funding because they ask for less.

We also find evidence that seeking out lower valuations by female teams is not an optimal strategy to ensure funding is received. It is important to make this distinction, given that whether or not this strategy is optimal informs our implications for female entrepreneurs. If a lower asking valuation is optimal for female teams due to gender roles for instance, then the resulting question is why investors penalize female-owned firms for asking for more. If undervaluation is not an optimal strategy however, then the prescription for obtaining more capital lies in the hands of the female entrepreneurs themselves.

Our evidence shows that in fact, women are not at risk of losing an offer if their valuations are higher in this setting. Altogether, this suggests that not only are the limitations to angel financing faced by female teams at least party self-imposed in this context but also presenting lower valuations to investors in this competition is not an optimal strategy. We perceive this as an encouraging finding for female entrepreneurs. In this environment, asking for more does not decrease one’s chances of being funded. Thus, the possibility exists that increased capitalization may come simply from asking for a higher initial valuation.

While we are careful to keep in mind that there are limitations to the generalizability of our results outside of the show, our results provide preliminary insights for entrepreneurs and policy makers for overcoming the general funding differences between male- and female-led companies that the prior literature has documented. The findings here reinforce the importance of research by female entrepreneurs into both comparable company valuation and forecasting of their future business in order to ensure proper company valuation.

For policymakers, the results suggest that educating female entrepreneurs regarding their valuation process may be an important element of decreasing the gender disparity in financing of entrepreneurial ventures. For instance, while the U.S. Small Business Administration sponsors local women’s business centers that help female entrepreneurs access capital, our results suggest that the inclusion of training to help female entrepreneurs assess their valuations may be a valuable element of such programs.

While educating women on their valuations may be important based on our preliminary evidence, it is unclear what this difference necessarily arises from outside of the characteristics of the company. While we eliminate the possibility that this is an equilibrium response to maximize the likelihood of investment for female teams, and we control for company characteristics, further reasons why female teams ask for less is beyond the scope of this work. Future research should therefore explore the antecedents to this difference in order to hone in on the gender disparity in funding that potentially is impeding further economic growth.

Notes

The statistics we provide do not exactly match Coleman and Robb 2009 because we extended the timeframe and calculated overall growth rates that include statistics from the U.S. Census Bureau Survey of Business Owners from 2007 and 2012, as well as 1997 and 2002.

Angel investors invest in small, private firms using their private funds (Wong et al. 2009).

Eight episodes in Season 1 consisted of five separate pitches, as opposed to the standard four pitches.

More details on the selection process for the television program can be found in Appendix A.

This information was taken from publicly available information across several sources on the internet, including LinkedIn reports, as well as Forbes’ list of the wealthiest Americans.

Seventeen percent of the individual teams are women.

This value does not represent the quotient of the accepted dollar amount and the accepted equity amount. This is because the average accepted valuation for each company uses corresponding dollar and equity amounts for each company, while average dollar and average equity are calculated within each separate variable.

The normalized final company valuation and normalized bid-ask spread are equal to the final company valuation divided by the initial company valuation and the bid-ask spread divided by the initial company valuation, respectively.

Results here excluded for brevity and available upon request from corresponding author.

References

ABC. (2016). Apply to Shark Tank—casting. ABC Television Network. Retrieved from http://abc.go.com/shows/shark-tank/apply.

Alsos, G. A., Isaksen, E. J., & Ljunggren, E. (2006). New venture financing and subsequent business growth in men- and women-led businesses. Entrepreneurship Theory and Practice, 30, 667–686. doi:10.1111/j.1540-6520.2006.00141.x.

Amanatullah, E. T., & Morris, M. W. (2010). Negotiating gender roles: gender differences in assertive negotiating are mediated by women’s fear of backlash and attenuated when negotiating on behalf of others. Journal of Personality and Social Psychology, 98(2), 256. doi:10.1037/a0017094.

Amanatullah, E. T., & Tinsley, C. H. (2013). Ask and ye shall receive? How gender and status moderate negotiation success. Negotiation and Conflict Management Research, 6(4), 253–272. doi:10.1111/ncmr.12014.

Amatucci, F. M., & Sohl, J. E. (2004). Women entrepreneurs securing business angel financing: tales from the field. Venture Capital, 6(2–3), 181–196. doi:10.1080/1369106042000223579.

Amit, R., Glosten, L., & Muller, E. (1990). Entrepreneurial ability, venture investments, and risk sharing. Management Science, 36, 1233–1246. doi:10.1287/mnsc.36.10.1233.

Aram, J. D. (1989). Attitudes and behaviors of informal investors toward early-stage investments, technology-based ventures, and coinvestors. Journal of Business Venturing, 4(5), 333–347. doi:10.1016/0883-9026(89)90005-0.

Arrington, M. (2010). VCs and super angels: the war for the entrepreneur. TechCrunch by AOL, Inc. Retrieved from https://techcrunch.com/2010/08/15/venture-capital-super-angel-war-entrepreneur/

Azam Roomi, M., Harrison, P., & Beaumont-Kerridge, J. (2009). Women-owned small and medium enterprises in England: analysis of factors influencing the growth process. Journal of Small Business and Enterprise Development, 16(2), 270–288. doi:10.1108/14626000910956056.

Baron, R. A., & Markman, G. D. (2000). Beyond social capital: how social skills can enhance entrepreneurs’ success. The Academy of Management Executive, 14(1), 106–116. doi:10.5465/AME.2000.2909843.

Batjargal, B., & Liu, M. (2004). Entrepreneurs’ access to private equity in China: the role of social capital. Organization Science, 15(2), 159–172. doi:10.1287/orsc.1030.0044.

Becker-Blease, J. R., & Sohl, J. E. (2007). Do women-owned businesses have equal access to angel capital? Journal of Business Venturing, 22, 503–521. doi:10.1016/j.jbusvent.2006.06.003.

Becker-Blease, J. R., & Sohl, J. E. (2015). New venture legitimacy: the conditions for angel investors. Small Business Economics, 45(4), 735–749. doi:10.1007/s11187-015-9668-7.

Bellucci, A., Borisov, A., & Zazzaro, A. (2010). Does gender matter in bank–firm relationships? Evidence from small business lending. Journal of Banking & Finance, 34(12), 2968–2984. doi:10.1016/j.jbankfin.2010.07.008.

Benjamin, G. A., & Margulis, J. (2001). The angel investor’s handbook. Bloomberg: Princeton.

Bennett, R., & Dann, S. (2000). The changing experience of Australian female entrepreneurs. Gender, work & organization, 7(2), 75–83. doi:10.1111/1468-0432.00095.

Berger, A. N., & Udell, G. F. (1998). The economics of small business finance: the roles of private equity and debt markets in the financial growth cycle. Journal of Banking & Finance, 22, 613–673. doi:10.1016/S0378-4266(98)00038-7.

Bhattacharya, M., & Bloch, H. (2004). Determinants of innovation. Small Business Economics, 22(2), 155–162. doi:10.1023/B:SBEJ.0000014453.94445.

Boisot, M., & Child, J. (1996). From fiefs to clans and network capitalism: explaining China’s emerging economic order. Administrative Science Quarterly, 600–628. doi:10.2307/2393869.

Broverman, I. K., Vogel, S. R., Broverman, D. M., Clarkson, F. E., & Rosenkrantz, P. S. (1972). Sex-role stereotypes: a current appraisal. Journal of Social Issues, 28(2), 59–78. doi:10.1111/j.1540-4560.1972.tb00018.x.

Brush, C., Carter, N., Gatewood, E., Greene, P., & Hart, M. (2004a). Clearing the hurdles: women building high-growth businesses. FT Press. ISBN:0131112015.

Brush, C., Carter, N., Gatewood, E., Greene, P., & Hart, M. (2004b). Gatekeepers of venture growth: a Diana Project report on the role and participation of women in the venture capital industry. Available at SSRN 1260385. doi:10.2139/ssrn.1260385.

Brush, C. G., Edelman, L. F., & Manolova, T. S. (2012). Ready for funding? Entrepreneurial ventures and the pursuit of angel financing. Venture Capital, 14(2–3), 111–129. doi:10.1080/13691066.2012.654604.

Buttner, E. H., & Rosen, B. (1989). Funding new business ventures: are decision makers biased against women entrepreneurs? Journal of Business Venturing, 4, 249–261. doi:10.1016/0883-9026(89)90015-3.

Carpentier, C., & Suret, J. M. (2015). Angel group members’ decision process and rejection criteria: a longitudinal analysis. Journal of Business Venturing, 30(6), 808–821. doi:10.1016/j.jbusvent.2015.04.002.

Carter, S., & Rosa, P. (1998a). Indigenous rural firms: farm enterprises in the UK. International Small Business Journal, 16(4), 15–27.

Carter, S., & Rosa, P. (1998b). The financing of male- and female-owned businesses. Entrepreneurship & Regional Development, 10(3), 225–242. doi:10.1080/08985629800000013.

Carter, N., Brush, C., Greene, P., Gatewood, E., & Hart, M. (2003). Women entrepreneurs who break through to equity financing: the influence of human, social and financial capital. Venture Capital: An International Journal of Entrepreneurial Finance, 5, 1–28. http://dx.doi.org/10.1080/1369106032000082586.

Center for Venture Research. (2003). 2003 Angel Group Survey. The University of New Hampshire.

Coleman, S. (2000). Access to capital and terms of credit: a comparison of men-and women-owned small businesses. Journal of Small Business Management, 38(3), 37.

Coleman, S., & Robb, A. (2009). A comparison of new firm financing by gender: evidence from the Kauffman Firm Survey data. Small Business Economics, 33, 397–411. doi:10.1007/s11187-009-9205-7.

Collewaert, V., & Manigart, S. (2016). Valuation of angel-backed companies: the role of investor human capital. Journal of Small Business Management, 54(1), 356–372. doi:10.1111/jsbm.12150.

Constantinidis, C., Cornet, A., & Asandei, S. (2006). Financing of women-owned ventures: the impact of gender and other owner-and firm-related variables. Venture Capital, 8(02), 133–157. doi:10.1080/13691060600572557.

Davis, S. J., & Henrekson, M. (1999). Explaining national differences in the size and industry distribution employment. Small Business Economics, 12(1), 59–83. doi:10.1023/A:1008078130748.

De Bhojraj, S., Lee, C. M. C., & Oler, D. (2003). What’s my line? A comparison of industry classification schemes for capital market research. Journal of Accounting and Economics, 41, 745–769. doi:10.1046/j.1475-679X.2003.00122.x.

Degryse, H., de Goeij, P., & Kappert, P. (2012). The impact of firm and industry characteristics on small firms’ capital structure. Small Business Economics, 38(4), 431–447. doi:10.1007/s11187-010-9281-8.

Du Rietz, A., & Henrekson, M. (2000). Testing the female underperformance hypothesis. Small Business Economics, 14(1), 1–10. doi:10.1023/A:1008106215480.

Eagly, A. H., & Kite, M. E. (1987). Are stereotypes of nationalities applied to both women and men? Journal of Personality and Social Psychology, 53(3), 451. doi:10.1037/0022-3514.53.3.451.

Fairlie, R. W., & Robb, A. M. (2009). Gender differences in business performance: evidence from the Characteristics of Business Owners survey. Small Business Economics, 33, 375–395. doi:10.1007/s11187-009-9207-5.

Fairlie, R. W., Morelix, A., Reedy, E. J., & Russell, J. (2015). The Kauffman Index 2015: Startup Activity| National Trends. doi:10.2139/ssrn.2613479.

Fay, M., & Williams, L. (1993). Gender bias and the availability of business loans. Journal of Business Venturing, 8(4), 363–376. doi:10.1016/0883-9026(93)90005-P.

Feloni, R. (2015). Mark Cuban explains what happens after a deal is made on ‘Shark Tank’. Business Insider –Strategy. Retrieved from http://www.businessinsider.com/what-happens-after-closing-shark-tank-deal-2015-10

Freear, J., Sohl, J. E., & Wetzel, W. E. (1994). Angels and non-angels: are there differences? Journal of Business Venturing, 9(2), 109–123. doi:10.1016/0883-9026(94)90004-3.

Greene, P. G., Brush, C. G., Hart, M. M., & Saparito, P. (2001). Patterns of venture capital funding: is gender a factor? Venture Capital: An international Journal of Entrepreneurial Finance, 3, 63–83. doi:10.1080/13691060118175.

Gundry, L. K., & Welsch, H. P. (2001). The ambitious entrepreneur: high growth strategies of women-owned enterprises. Journal of Business Venturing, 16(5), 453–470. doi:10.1016/S0883-9026(99)00059-2.

Haines, G. H., Orser, B. J., & Riding, A. L. (1999). Myths and realities: an empirical study of banks and the gender of small business clients. Canadian Journal of Administrative Sciences/Revue Canadienne des Sciences de l'Administration, 16(4), 291–307. doi:10.1111/j.1936-4490.1999.tb00690.x.

Harrison, R. T., & Mason, C. M. (2007). Does gender matter? Women business angels and the supply of entrepreneurial finance. Entrepreneurship Theory and Practice, 31(3), 445–472. doi:10.1111/j.1540-6520.2007.00182.x.

Heilman, M. E., & Okimoto, T. G. (2007). Why are women penalized for success at male tasks?: the implied communality deficit. Journal of Applied Psychology, 92(1), 81. doi:10.1037/0021-9010.92.1.81.

Hisrich, R. D., & O'Brien, M. (1982). The woman entrepreneur as a reflection of the type of business. In K. Vesper (Ed.), Frontiers of entrepreneurship research (pp. 54–67). Wellesly: Bason College.

Horowitz, B. (2010). How angel investing is different than venture capital. Business Insider Strategy. Retrieved from http://www.businessinsider.com/how-angel-investing-is-different-than-venture-capital-2010-3

Kerr, W., Lerner, J., & Schoar, A. (2011). The consequences of entrepreneurial finance: evidence from angel financings, SSRN. NBER WP, 15831, 10–086. doi:10.1093/rfs/hhr098.

Liberman, A., Chrocziel, P., & Levine, R. (2011). International licensing and technology transfer: practice and the law. Wolters Kluwer Law & Business.

Loscocco, K. A., Robinson, J., Hall, R. H., & Allen, J. K. (1991). Gender and small business success: an inquiry into women’s relative disadvantage. Social Forces, 70(1), 65–85. doi:10.1093/sf/70.1.65.

MacLeod, M. (2010). How pervasive is collusion amongst angel investors. Quora.com. Retrieved from https://www.quora.com/How-pervasive-is-collusion-amongst-angel-investors

Mason, C. M., & Harrison, R. T. (1996). Informal venture capital: a study of the investment process, the post-investment experience and investment performance. Entrepreneurship & Regional Development, 8(2), 105–126. doi:10.1080/08985629600000007.

Mason, C. M., & Harrison, R. T. (2000). Investing in technology ventures: what do business angels look for at the initial screening stage? In P. Reynolds, E. Autio, C. Brush, W. Bygrave, S. Manigart, H. Sapienza, & K. Shaver (Eds.), Frontiers of entrepreneurship research (pp. 293–304). Babson Park: Babson College.

Mason, C. M., & Harrison, R. T. (2003). “Auditioning for money” what do technology investors look for at the initial screening stage? The Journal of Private Equity, 6(2), 29–42. doi:10.3905/jpe.2003.320037.

Maxwell, A. L., Jeffrey, S. A., & Lévesque, M. (2011). Business angel early stage decision making. Journal of Business Venturing, 26(2), 212–225. doi:10.1016/j.jbusvent.2009.09.002.

Mesquita, L. F., & Lazzarini, S. G. (2010). Horizon and vertical relationships in developing economies: implications for sme access to global markets. New Frontiers in Entrepreneurship. Recognizing, Seizing, and Executing Opportunities, 31–66. doi: 10.1007/978-1-4419-0058-6_3.

Morelix, A., Reedy, E. J., & Russell, J. (2016). The Kauffman Index 2016: Growth Entrepreneurship | National Trends. Retrieved from http://www.kauffman.org/microsites/kauffman-index/reports/growth-entrepreneurship